Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - Wendy's Co | d307528d8k.htm |

Fourth

Quarter 2011

Earnings Call

March 1, 2012

©2012 Oldemark LLC

Exhibit 99.1 |

JOHN

BARKER

CHIEF COMMUNICATIONS OFFICER |

TODAY’S AGENDA

The Wendy’s Company

Financial Update

Steve Hare

CEO Overview

Emil Brolick

Q&A Session

3 |

Forward-Looking

Statements and

Non-GAAP Financial Measures

This presentation, and certain information that management may discuss in connection

with this presentation, contains certain statements that are not historical

facts, including information concerning possible or assumed future results of our

operations.

Those

statements

constitute

“forward-looking

statements”

within the meaning of the Private Securities Litigation Reform

Act of 1995 (The “Reform Act”). For all forward-looking statements, we

claim the protection of the safe harbor for forward-looking statements

contained in the Reform Act. Many

important

factors

could

affect

our

future

results

and

could

cause

those

results

to

differ

materially

from

those

expressed

in

or

implied by our forward-looking statements. Such factors, all of which are difficult

or impossible to predict accurately, and many of which

are

beyond

our

control,

include

but

are

not

limited

to

those

identified

under

the

caption

“Forward-Looking

Statements”

in our

news

release

issued

on

March

1,

2012

and

in

the

“Special

Note

Regarding

Forward-Looking

Statements

and

Projections”

and “Risk

Factors”

sections of our most recent Form 10-K / Form 10-Qs.

In addition, this presentation and certain information management may discuss in

connection with this presentation reference non- GAAP financial measures,

such as adjusted earnings before interest, taxes, depreciation and amortization, or adjusted EBITDA, and

adjusted earnings per share. Adjusted EBITDA and adjusted earnings per share exclude

certain expenses, net of certain benefits. Reconciliations of non-GAAP

financial measures to the most directly comparable GAAP financial measures are provided in the

Appendix to this presentation, and are included in our news release issued on March 1,

2012 and posted on www.aboutwendys.com. The Wendy’s Company

4 |

STEVE

HARE

CHIEF FINANCIAL OFFICER |

Q4 2011

Financial Highlights Q4 2011 N.A. Same-

Store Sales

Company-owned +5.1%

Franchise

+4.2%

Systemwide +4.4%

Company Restaurant

Margin

Q4 2011 15.0%

Q4 2010

14.0%

+100 bps

Q4 2011 Adjusted EBITDA*

* See reconciliation of Adjusted EBITDA (earnings before interest, taxes,

depreciation and amortization) in the appendix. Q4

2011 $80.9 million Q4

2010 $73.2 million |

2011

Full-Year Highlights ($ in Millions)

2011

2010

Better/

(Worse)

Sales

2,126.6

$

2,079.1

$

47.5

$

Franchise revenues

304.8

296.3

8.5

Total revenues

2,431.4

$

2,375.4

$

56.0

$

Adjusted EBITDA*

331.1

$

341.9

$

(10.8)

$

(Less) plus:

Transaction related and other costs

(45.7)

-

(45.7)

Arby's indirect corporate overhead in general and administrative (G&A)

(14.6)

(32.7)

18.1

SSG purchasing cooperative expenses in G&A

2.2

(5.2)

7.4

Integration costs in G&A

-

(5.5)

5.5

Reversal of pension withdrawal expense in cost of sales

-

5.0

(5.0)

Depreciation and amortization

(123.0)

(126.8)

3.8

Impairment of long-lived assets

(12.9)

(26.3)

13.4

Operating profit

137.1

$

150.4

$

(13.3)

$

* See reconciliation of Adjusted EBITDA (earnings before interest, taxes,

depreciation and amortization) in the appendix. |

2011 Income

from Continuing Operations and Special Items

($ in Millions, except per share amounts)

per share

per share

Adjusted income from continuing operations and adjusted earnings per share*

62.1

$

0.15

$

71.7

$

0.17

$

(Less) plus:

Arby's transaction related and other costs

(28.5)

(0.07)

-

-

Impairment of long-lived assets

(7.9)

(0.02)

(16.3)

(0.04)

Arby's indirect corporate overhead in G&A

(9.2)

(0.02)

(20.5)

(0.05)

SSG purchasing cooperative expenses in G&A

1.4

-

(3.2)

(0.01)

Integration costs in G&A

-

-

(3.5)

(0.01)

Reversal of pension withdrawal expense in cost of sales

-

-

3.1

0.01

Loss on early extinguishment of debt

-

-

(16.3)

(0.04)

Gain on collection of note receivable

-

-

3.1

0.01

(44.2)

(0.11)

(53.6)

(0.13)

Income from continuing operations and earnings per share

17.9

$

0.04

$

18.1

$

0.04

$

2011

2010

* See reconciliation of Adjusted Income from Continuing Operations and

Adjusted Earnings Per Share in the appendix. |

2011 Cash

Flow ($ in Millions)

2011

Cash flow from operations

246.7

$

Capital expenditures

(146.8)

Restaurant acquisitions

(11.2)

Proceeds from dispositions, net

104.9

Repurchases of common stock

(157.6)

Dividends paid

(32.4)

Other financing / investing activities

(2.2)

Net cash flow before debt payments

1.4

Repayments of long-term debt

(38.7)

Net decrease in cash after debt payments

(37.3)

Beginning cash balance

512.5

Ending cash balance

475.2

$

9 |

2011

Consolidated Debt ($ in Millions)

Senior Debt

1,327.9

$

Capital Leases and Other Debt

29.1

Total Debt

1,357.0

Less: Cash and Cash Equivalents

475.2

Net Debt

881.8

$

2011 Adjusted EBITDA*

331.1

$

Total Debt / 2011 Adjusted EBITDA*

4.1x

Net Debt / 2011 Adjusted EBITDA*

2.7x

Y/E 2011

* See reconciliation of Adjusted EBITDA (earnings before interest, taxes,

depreciation and amortization) in the appendix. |

Stock

Repurchases and Dividends (In Millions, except per share amounts)

2009-2011

2011

Total

Shares purchased

31

83

Average price per share

$5.07

$4.83

Repurchase amount

$157

$402

Authorization expired at 2011 year end.

Quarterly Cash Dividend

•

$0.02 per share

•

Payable on March 15, 2012 to stockholders of

record as of March 1, 2012

Quarterly Cash Dividend

•

$0.02 per share

•

Payable on March 15, 2012 to stockholders of

record as of March 1, 2012

11 |

2012

OUTLOOK The Wendy’s Company

Company-Operated Same-Store Sales

2 to 3%

Company-Operated Restaurant Margin

Flat to +50 bps

Commodity Basket Increase

115 to 145 bps

Adjusted EBITDA

$335 to $345

million |

2012

Capital Expenditures The Wendy’s Company

Investing to increase long-term shareholder value

New Units

$40

Remodels

40

Restaurant Equipment/Maintenance

65

Product Development

20

Technology

30

Other

30

Total Estimated Capex

$225

$ IN MILLIONS |

The Wendy’s Company

* International Growth (outside of North America)

2012

Low-single

digit Adjusted

EBITDA

growth rate

2013 & Beyond

High-single to

low-double digit

Adjusted

EBITDA

growth rate

14

Breakfast

Image Activation: New

North America Business

Improvement

Financial

Strategies

Image Activation: Remodels

Int’l* |

EMIL

BROLICK

PRESIDENT & CHIEF EXECUTIVE OFFICER |

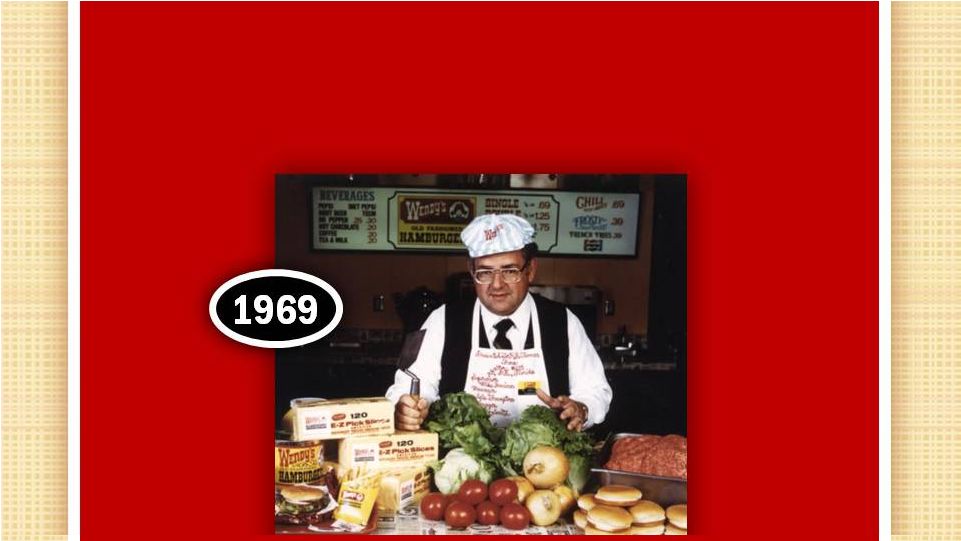

WENDY’S

RECIPE

TO WIN

The Wendy’s Company |

A CUT

ABOVE A CUT ABOVE

Foundation

of

Recipe

to

Win

BRAND VISION

Foundation

of

Recipe

to

Win

BRAND VISION |

A CUT

ABOVE Why it will work

Reimaging the Restaurants

Reimaging the People

Reimaging the Experience

Reimaging the Food

Reimaging the Brand Communications |

A CUT

ABOVE A Quick Casual Experience at a QSR Price! |

IMAGE

ACTIVATION Contemporizing Wendy’s

is key to growth

Moves us from a functional

to an emotional experience

Makes other Ps work better

P

LACE

The Wendy’s Company |

TRADITIONAL

ULTRA-MODERN

URBAN

CONTEMPORARY |

Image

Activation Strategy 22

2011

Initial 10 remodels

•

Customer feedback very positive

•

Sales exceeding expectations

2012

50 remodels

•

$750 to $850K investment

•

Targeting 15% ROI

•

Develop financing sources for franchisees

20 new restaurants

2013

and

beyond

Accelerate growth

•

Value-engineered investment / lower costs

•

Meet return target |

In

each Image Activation restaurant: The Wendy’s Company

P

EOPLE

Re-interview staff

Change leadership if needed

Focus on “Five-Stars”

/ hire exceptional

new employees

IMPROVING RELIABILITY AND PREDICTABILITY |

Win with “Five-Star Athletes” |

RESTAURANT OPERATING LEVELS

U.S. Company and Franchise Restaurants

The Wendy’s Company

2008

2011

2008

2011

A & B LEVEL

F LEVEL

P

ERFORMANCE

83.5%

32.5%

24.8%

0.6% |

|

P

ROMOTION

Message

Creative

Media

The Wendy’s Company |

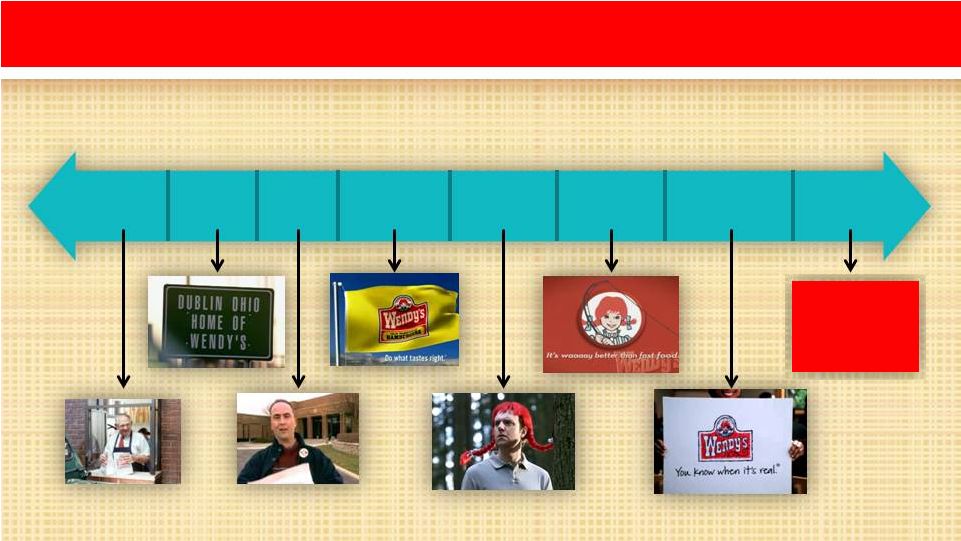

PROMOTION…Creative

Ad Campaign Chronology…There was Dave and then…

24 Ads

30 Ads

55 Ads

50 Ads

9 Ads

700+ Ads

1989-2002

2004

2005-2006

2007

2008-2009

2009-2011

2012

Dave

Mr.

Wendy

Do What

Tastes Right

Red Wig/

That’s Right

Waaaay

Better

You Know

When It’s Real

Code Name:

RED

The Wendy’s Company

2003

Town of

Dublin

15 Ads

2

nd

Qtr

New

Campaign

2

nd

Qtr

New

Campaign |

NEW

CAMPAIGN SUCCESS CRITERIA

GOAL

Win the Hearts and Minds of Consumers

Competing for share of mind, not just selling products

HOW

Tactically and Strategically Brilliant

Creates emotional connection to “Big Brand,”

gains trial of promoted idea

Unique

look,

tone

and

feel

…

you

will

know

it

is

Wendy’s

The Wendy’s Company |

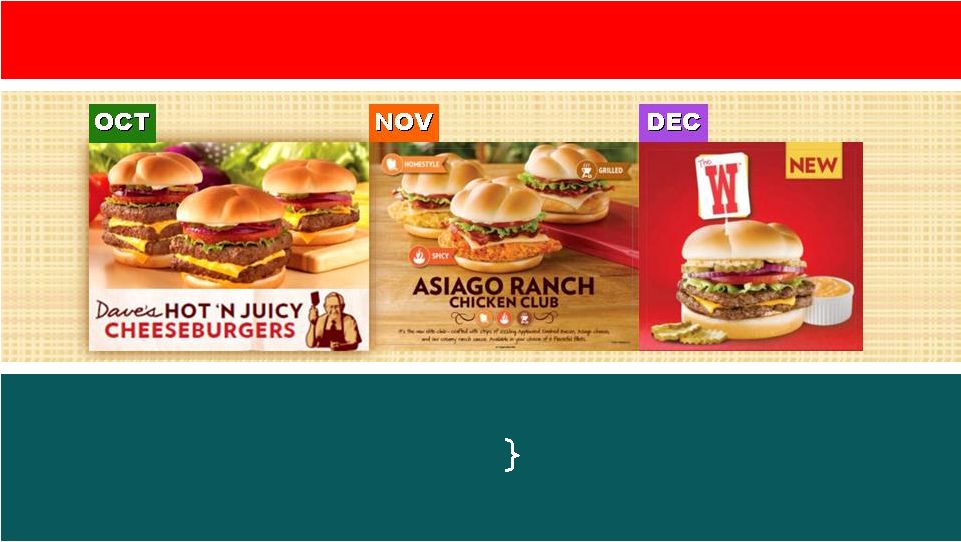

The Wendy’s Company

P

RODUCT

Successful launch of new

core product in 2011 |

The Wendy’s Company

PREMIUM

HAMBURGER

TASTES

PREMIUM

HAMBURGER

TASTES

PREMIUM

SEASONAL

SALAD

PREMIUM

SEASONAL

SALAD

NEW NEWS

ON A

CLASSIC

NEW NEWS

ON A

CLASSIC

NEW TWIST

ON NATURAL

CUT FRIES

NEW TWIST

ON NATURAL

CUT FRIES

P

RODUCT

2012 HIGHLIGHTS

2012 HIGHLIGHTS |

DIFFERENTIATED MENU OFFERINGS

FRESH INGREDIENTS AND FRESH PREPARATION

SANDWICHES

BEVERAGES

SIDES

The Wendy’s Company

Consumers rate Wendy’s breakfast products

notably higher than the competition’s

P

RODUCT

|

The Wendy’s Company

BREAKFAST

OPERATIONALLY SUCCESSFUL

breakfast business

Committed to earning our share of the

Able to execute at various volumes

among our best

Operational attribute scores at breakfast are

P

RODUCT

|

The Wendy’s Company

BREAKFAST EXPANSION –

2012

New market in Northeast

Adding breakfast to

select company remodels

and new builds

Focused on building

awareness and driving

sales growth |

OUR

COMPETITIVE ADVANTAGES The Wendy’s Company

35

Iconic brand, latent equities

Clear brand vision …

A CUT ABOVE

Well-defined growth platforms

We have the RECIPE TO WIN

Focused on EXECUTION |

Upcoming

Investor Calendar 36

March

7:

Bank

of

America

Merrill

Lynch

Conference

March 12:

Roth

Growth

Stock

Conference

March 15:

UBS

Global

Consumer

Conference

May 8:

1Q Earnings Release |

Q&A |

The Wendy’s Company

©2012 Oldemark LLC |

Appendix |

Reconciliation of Adjusted EBITDA to Income from

Continuing Operations

(Unaudited)

(In Millions)

2011

2010

2011

2010

Adjusted EBITDA

80.9

$

73.2

$

331.1

$

341.9

$

(Less) plus:

Transaction related and other costs

(15.0)

-

(45.7)

-

Arby's indirect corporate overhead in general and administrative (G&A)

-

(7.9)

(14.6)

(32.7)

SSG purchasing cooperative expenses in G&A

-

(0.3)

2.2

(5.2)

Integration costs in G&A

-

(1.2)

-

(5.5)

Reversal of pension withdrawal expense in cost of sales

-

5.0

-

5.0

Depreciation and amortization

(32.0)

(30.4)

(123.0)

(126.8)

Impairment of long-lived assets

(4.6)

(4.9)

(12.9)

(26.3)

Operating profit

29.3

33.5

137.1

150.4

Interest expense

(28.2)

(28.6)

(114.1)

(118.4)

Loss on early extinguishment of debt

-

-

-

(26.2)

Investment income, net

0.3

0.0

0.5

5.3

Other income, net

0.2

0.3

0.9

2.5

Income from continuing operations before income taxes

1.6

5.2

24.4

13.6

Benefit from (provision for) income taxes

2.7

0.9

(6.5)

4.5

Income from continuing operations

4.3

$

6.1

$

17.9

$

18.1

$

Fourth Quarter

Twelve Months |

Reconciliation of Adjusted Income from Continuing Operations

and Adjusted Earnings per Share to Income from Continuing

Operations and Earnings per Share

(Unaudited)

(in millions, except per share amounts)

per share

per share

per share

per share

Adjusted income from continuing operations and adjusted earnings per share

16.4

$

0.04

$

12.0

$

0.03

$

62.1

$

0.15

$

71.7

$

0.17

$

(Less) plus:

Arby's transaction related and other costs

(9.3)

(0.02)

-

-

(28.5)

(0.07)

-

-

Impairment of long-lived assets

(2.8)

(0.01)

(3.0)

(0.01)

(7.9)

(0.02)

(16.3)

(0.04)

Arby's indirect corporate overhead in G&A

-

-

(5.0)

(0.02)

(9.2)

(0.02)

(20.5)

(0.05)

SSG purchasing cooperative expenses in G&A

-

-

(0.2)

-

1.4

-

(3.2)

(0.01)

Integration costs in G&A

-

-

(0.8)

-

-

-

(3.5)

(0.01)

Reversal of pension withdrawal expense in cost of sales

-

-

3.1

0.01

-

-

3.1

0.01

Loss on early extinguishment of debt

-

-

-

-

-

-

(16.3)

(0.04)

Gain on collection of Deerfield Capital Corp. note receivable

-

-

-

-

-

-

3.1

0.01

(12.1)

(0.03)

(5.9)

(0.02)

(44.2)

(0.11)

(53.6)

(0.13)

Income from continuing operations and earnings per share

4.3

$

0.01

$

6.1

$

0.01

$

17.9

$

0.04

$

18.1

$

0.04

$

Fourth Quarter

Twelve Months

2011

2010

2011

2010 |