Attached files

| file | filename |

|---|---|

| 8-K - SUNTRUST BANKS INC | kwb8-kmarch2012.htm |

Boston, MA March 1, 2012 Mark Chancy Head of Wholesale Banking Keefe, Bruyette & Woods Bank Conference

2 Important Cautionary Statement About Forward-Looking Statements The following should be read in conjunction with the financial statements, notes and other information contained in the Company’s 2011 Annual Report on Form 10-K, Quarterly Reports on Form10-Q, and Current Reports on Form 8-K. This presentation includes non-GAAP financial measures to describe SunTrust’s performance. The reconciliations of those measures to GAAP measures are provided within or in the appendix of this presentation. In this presentation, net interest income and net interest margin are presented on a fully taxable-equivalent (“FTE”) basis, and ratios are presented on an annualized basis. The FTE basis adjusts for the tax-favored status of income from certain loans and investments. The Company believes this measure to be the preferred industry measurement of net interest income and provides relevant comparison between taxable and non-taxable amounts. This presentation contains forward-looking statements. Statements regarding our business objectives including expected cost savings are forward-looking statements. Also, any statement that does not describe historical or current facts, is a forward-looking statement. These statements often include the words “believes,” “expects,” “anticipates,” “estimates,” “intends,” “plans,” “goals,” “targets,” “initiatives,” “objectives,” “potentially,” “probably,” “projects,” “outlook” or similar expressions or future conditional verbs such as “may,” “will,” “should,” “would,” and “could.” Forward-looking statements are based upon the current beliefs and expectations of management and on information currently available to management. Our statements speak as of the date hereof, and we do not assume any obligation to update these statements or to update the reasons why actual results could differ from those contained in such statements in light of new information or future events. Forward-looking statements are subject to significant risks and uncertainties. Investors are cautioned against placing undue reliance on such statements. Actual results may differ materially from those set forth in the forward-looking statements. Factors that could cause actual results to differ materially from those described in the forward-looking statements can be found in Item 1A of Part I of our 10-K and in other periodic reports that we file with the SEC. Those factors include: as one of the largest lenders in the Southeast and Mid-Atlantic U.S. and a provider of financial products and services to consumers and businesses across the U.S., our financial results have been, and may continue to be, materially affected by general economic conditions, particularly unemployment levels and home prices in the U.S., and a deterioration of economic conditions or of the financial markets may materially adversely affect our lending and other businesses and our financial results and condition; legislation and regulation, including the Dodd-Frank Act, as well as future legislation and/or regulation, could require us to change certain of our business practices, reduce our revenue, impose additional costs on us or otherwise adversely affect our business operations and/or competitive position; we are subject to capital adequacy and liquidity guidelines and, if we fail to meet these guidelines, our financial condition would be adversely affected; loss of customer deposits and market illiquidity could increase our funding costs; we rely on the mortgage secondary market and GSEs for some of our liquidity; we are subject to credit risk; our ALLL may not be adequate to cover our eventual losses; we may have more credit risk and higher credit losses to the extent our loans are concentrated by loan type, industry segment, borrower type, or location of the borrower or collateral; we will realize future losses if the proceeds we receive upon liquidation of nonperforming assets are less than the carrying value of such assets; a downgrade in the U.S. government's sovereign credit rating, or in the credit ratings of instruments issued, insured or guaranteed by related institutions, agencies or instrumentalities, could result in risks to us and general economic conditions that we are not able to predict; the failure of the European Union to stabilize the fiscal condition and creditworthiness of its weaker member economies, such as Greece, Portugal, Spain, Hungary, Ireland, and Italy, could have international implications potentially impacting global financial institutions, the financial markets, and the economic recovery underway in the U.S.; weakness in the real estate market, including the secondary residential mortgage loan markets, has adversely affected us and may continue to adversely affect us; we are subject to certain risks related to originating and selling mortgages, and may be required to repurchase mortgage loans or indemnify mortgage loan purchasers as a result of breaches of representations and warranties, borrower fraud, or as a result of certain breaches of our servicing agreements, and this could harm our liquidity, results of operations, and financial condition; financial difficulties or credit downgrades of mortgage and bond insurers may adversely affect our servicing and investment portfolios; we may be terminated as a servicer or master servicer, be required to repurchase a mortgage loan or reimburse investors for credit losses on a mortgage loan, or incur costs, liabilities, fines and other sanctions if we fail to satisfy our servicing obligations, including our obligations with respect to mortgage loan foreclosure actions; we are subject to risks related to delays in the foreclosure process; we may continue to suffer increased losses in our loan portfolio despite enhancement of our underwriting policies and practices; our mortgage production and servicing revenue can be volatile; as a financial services company, adverse changes in general business or economic conditions could have a material adverse effect on our financial condition and results of operations; changes in market interest rates or capital markets could adversely affect our revenue and expense, the value of assets and obligations, and the availability and cost of capital and liquidity; changes in interest rates could also reduce the value of our MSRs and mortgages held for sale, reducing our earnings; the fiscal and monetary policies of the federal government and its agencies could have a material adverse effect on our earnings; depressed market values for our stock may require us to write down goodwill; clients could pursue alternatives to bank deposits, causing us to lose a relatively inexpensive source of funding; consumers may decide not to use banks to complete their financial transactions, which could affect net income; we have businesses other than banking which subject us to a variety of risks; hurricanes and other disasters may adversely affect loan portfolios and operations and increase the cost of doing business; negative public opinion could damage our reputation and adversely impact business and revenues; a failure in or breach of our operational or security systems or infrastructure, or those of our third party vendors and other service providers, including as a result of cyber attacks, could disrupt our businesses, result in the disclosure or misuse of confidential or proprietary information, damage our reputation, increase our costs and cause losses; we rely on other companies to provide key components of our business infrastructure; the soundness of other financial institutions could adversely affect us; we depend on the accuracy and completeness of information about clients and counterparties; regulation by federal and state agencies could adversely affect the business, revenue, and profit margins; competition in the financial services industry is intense and could result in losing business or margin declines; maintaining or increasing market share depends on market acceptance and regulatory approval of new products and services; we might not pay dividends on your common stock; our ability to receive dividends from our subsidiaries could affect our liquidity and ability to pay dividends; disruptions in our ability to access global capital markets may adversely affect our capital resources and liquidity; any reduction in our credit rating could increase the cost of our funding from the capital markets; we have in the past and may in the future pursue acquisitions, which could affect costs and from which we may not be able to realize anticipated benefits; we are subject to certain litigation, and our expenses related to this litigation may adversely affect our results; we may incur fines, penalties and other negative consequences from regulatory violations, possibly even inadvertent or unintentional violations; we depend on the expertise of key personnel, and if these individuals leave or change their roles without effective replacements, operations may suffer; we may not be able to hire or retain additional qualified personnel and recruiting and compensation costs may increase as a result of turnover, both of which may increase costs and reduce profitability and may adversely impact our ability to implement our business strategies; our accounting policies and processes are critical to how we report our financial condition and results of operations, and they require management to make estimates about matters that are uncertain; changes in our accounting policies or in accounting standards could materially affect how we report our financial results and condition; our stock price can be volatile; our framework for managing risks may not be effective in mitigating risk and loss to us; our disclosure controls and procedures may not prevent or detect all errors or acts of fraud; our financial instruments carried at fair value expose us to certain market risks; our revenues derived from our investment securities may be volatile and subject to a variety of risks; and we may enter into transactions with off-balance sheet affiliates or our subsidiaries.

3 SunTrust’s Wholesale Business

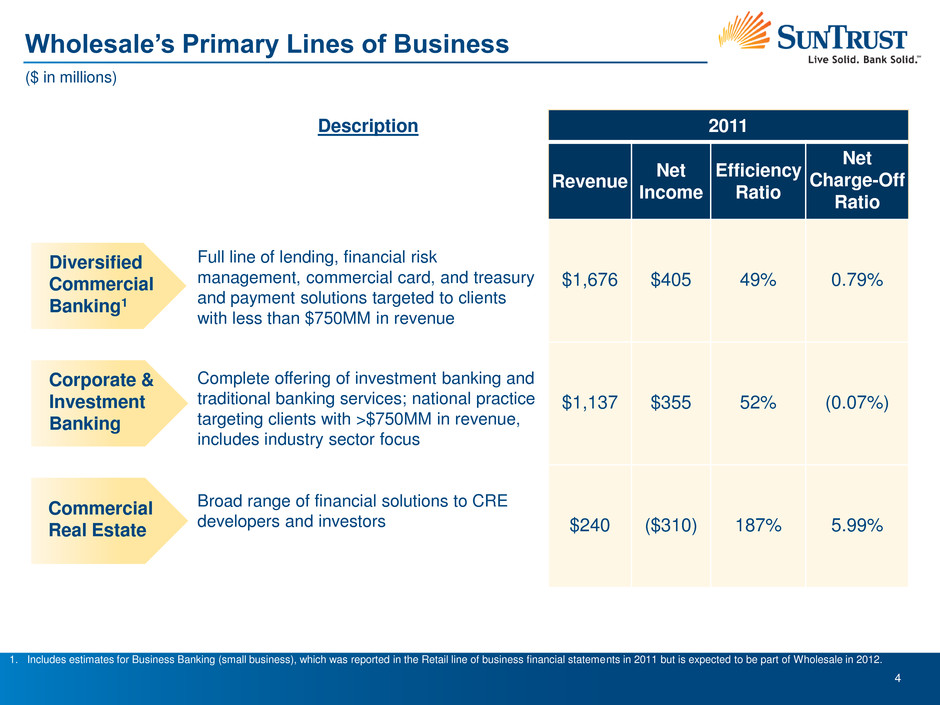

4 Wholesale’s Primary Lines of Business Diversified Commercial Banking1 Commercial Real Estate Corporate & Investment Banking ($ in millions) Description 2011 Revenue Net Income Efficiency Ratio Net Charge-Off Ratio Full line of lending, financial risk management, commercial card, and treasury and payment solutions targeted to clients with less than $750MM in revenue $1,676 $405 49% 0.79% Complete offering of investment banking and traditional banking services; national practice targeting clients with >$750MM in revenue, includes industry sector focus $1,137 $355 52% (0.07%) Broad range of financial solutions to CRE developers and investors $240 ($310) 187% 5.99% 1. Includes estimates for Business Banking (small business), which was reported in the Retail line of business financial statements in 2011 but is expected to be part of Wholesale in 2012.

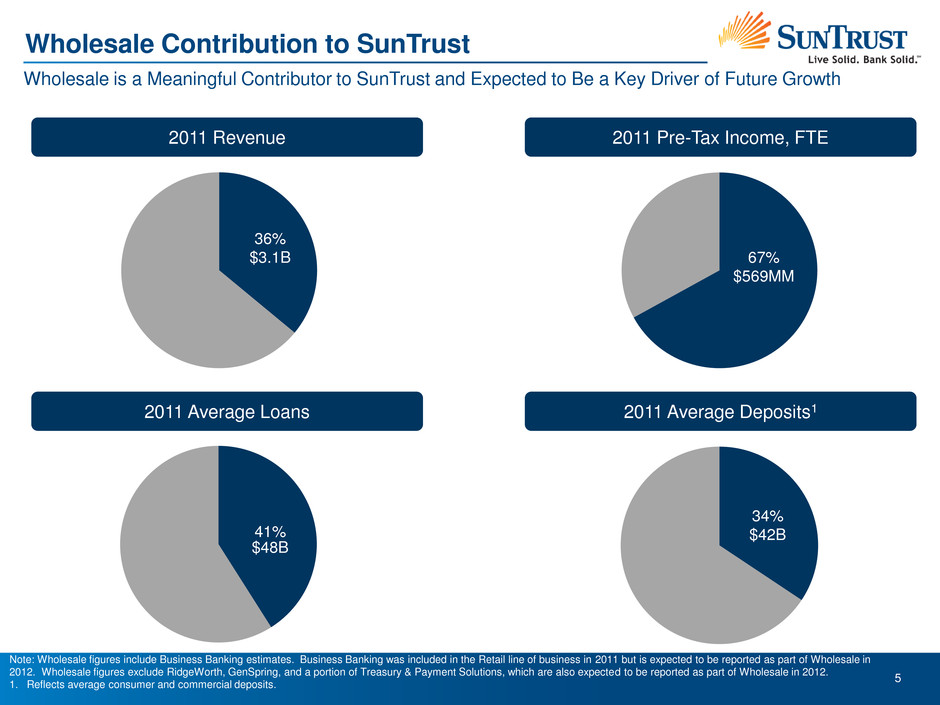

5 Wholesale Contribution to SunTrust Note: Wholesale figures include Business Banking estimates. Business Banking was included in the Retail line of business in 2011 but is expected to be reported as part of Wholesale in 2012. Wholesale figures exclude RidgeWorth, GenSpring, and a portion of Treasury & Payment Solutions, which are also expected to be reported as part of Wholesale in 2012. 1. Reflects average consumer and commercial deposits. 36% 2011 Revenue 2011 Pre-Tax Income, FTE 2011 Average Loans 2011 Average Deposits1 $3.1B 67% $569MM $48B 34% $42B Wholesale is a Meaningful Contributor to SunTrust and Expected to Be a Key Driver of Future Growth 41%

6 SunTrust’s Strategic Priorities— Wholesale’s Role

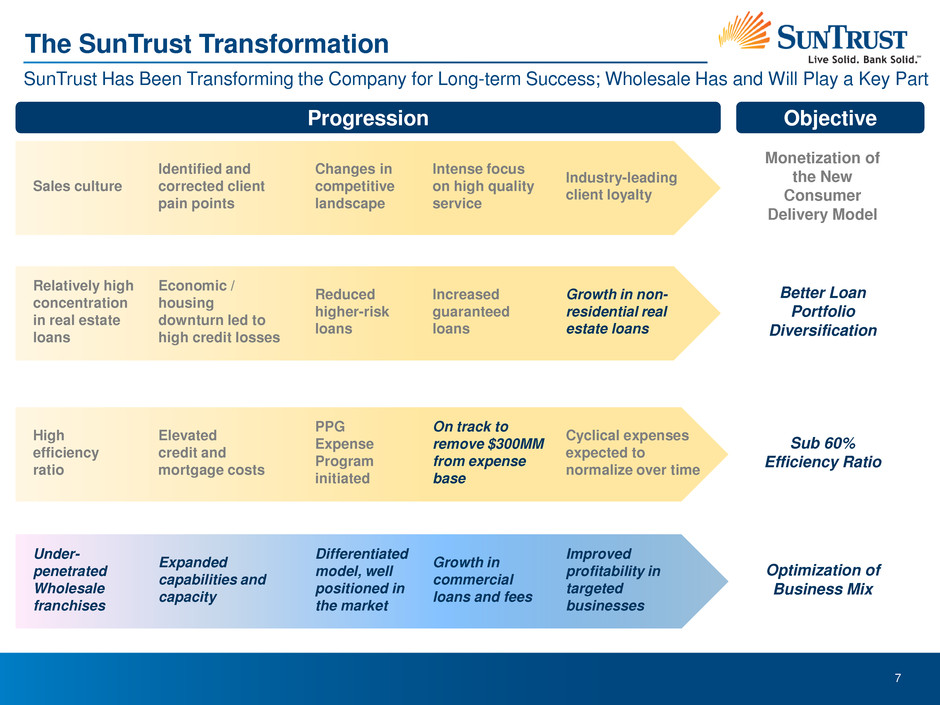

7 The SunTrust Transformation SunTrust Has Been Transforming the Company for Long-term Success; Wholesale Has and Will Play a Key Part Sales culture Intense focus on high quality service Industry-leading client loyalty Identified and corrected client pain points Changes in competitive landscape Monetization of the New Consumer Delivery Model Under- penetrated Wholesale franchises Growth in commercial loans and fees Expanded capabilities and capacity Differentiated model, well positioned in the market Improved profitability in targeted businesses High efficiency ratio On track to remove $300MM from expense base Elevated credit and mortgage costs PPG Expense Program initiated Progression Objective Cyclical expenses expected to normalize over time Relatively high concentration in real estate loans Increased guaranteed loans Reduced higher-risk loans Growth in non- residential real estate loans Economic / housing downturn led to high credit losses Better Loan Portfolio Diversification Optimization of Business Mix Sub 60% Efficiency Ratio

8 Construction³ 6% Diversifying the Loan Portfolio Targeted Portfolios Have Increased While the Real Estate Concentration Has Been Reduced 1. Consumer includes direct consumer loans (other than student guaranteed), consumer indirect loans, and consumer credit cards. 2. Guaranteed includes guaranteed student loans and guaranteed residential mortgages. 3. Construction includes both commercial and residential construction. NOTE: Numbers reflect period end balances and may not sum to 100% due to rounding. Loan Portfolio Composition – 12/31/11 Total Loans: $122.5B Loan Portfolio Composition – 12/31/09 Total Loans: $113.7B C&I 40% Consumer¹ 10% Guaranteed² 11% Resi Mtg. - Non Guar. 19% Home Equity 13% CRE 4% C&I 39% Consumer¹ 8% Guaranated² 3% Resi Mtg. - Non Guar. 23% Home Equity 15% CRE 6% C&I Loans – up 11% YOY $44.0 $44.8 $45.1 $45.9 $48.0 $49.5 4Q 09 4Q 10 1Q 11 2Q 11 3Q 11 4Q 11 Construction Loans—Down 68% in 2 Years Construction³ 2% $5.0 $2.6 $2.1 $1.7 $1.4 $1.2 $1.9 $1.3 $1.2 $1.1 $1.0 $1.0 4Q 09 4Q 10 1Q 11 2Q 11 3Q 11 4Q 11 Commercial Construction Residential Construction $6.9 $3.9 $3.3 $2.9 $2.4 $2.2 ($ in billions)

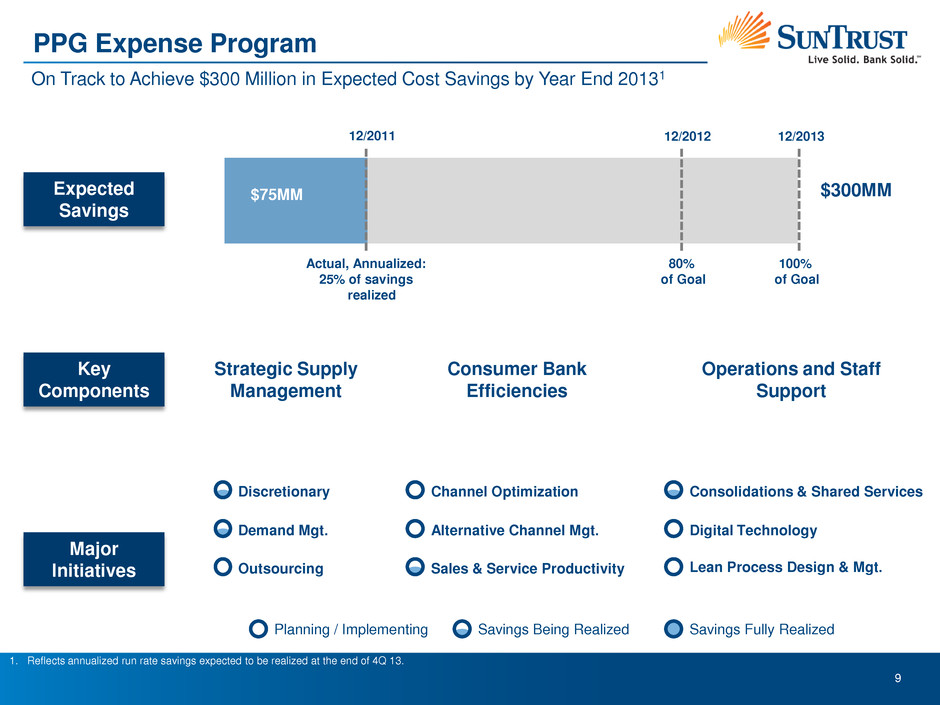

9 On Track to Achieve $300 Million in Expected Cost Savings by Year End 20131 Expected Savings Key Components Major Initiatives 1. Reflects annualized run rate savings expected to be realized at the end of 4Q 13. PPG Expense Program Consumer Bank Efficiencies Strategic Supply Management Planning / Implementing Savings Being Realized Savings Fully Realized Discretionary Outsourcing Demand Mgt. Channel Optimization Alternative Channel Mgt. Sales & Service Productivity Consolidations & Shared Services Digital Technology Lean Process Design & Mgt. 12/2013 12/2012 80% of Goal 100% of Goal $300MM Actual, Annualized: 25% of savings realized $75MM 12/2011 Operations and Staff Support

10 Optimization of Business Mix— The Wholesale Growth Plan

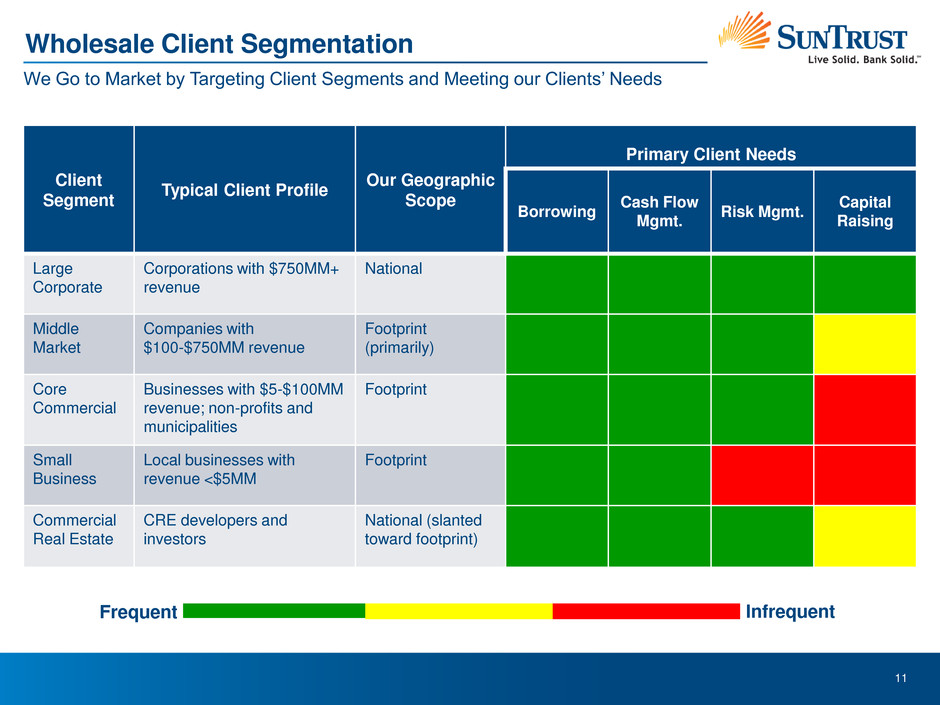

11 Wholesale Client Segmentation Client Segment Typical Client Profile Our Geographic Scope Primary Client Needs Borrowing Cash Flow Mgmt. Risk Mgmt. Capital Raising Large Corporate Corporations with $750MM+ revenue National Middle Market Companies with $100-$750MM revenue Footprint (primarily) Core Commercial Businesses with $5-$100MM revenue; non-profits and municipalities Footprint Small Business Local businesses with revenue <$5MM Footprint Commercial Real Estate CRE developers and investors National (slanted toward footprint) Frequent We Go to Market by Targeting Client Segments and Meeting our Clients’ Needs Infrequent

12 Large Corporate and Middle Market Acted Primarily as a Credit Provider – Offered Mostly Credit and Rate Risk Products and Expertise Expanded Product, Industry and Advisory Expertise– Established Premier Mid- Market Position Strong Growth and Profitability; Increasingly Relevant and Improved Market Share; Capital Markets Penetration Across the Entirety of Wholesale is Low OP P OR T U N IT IE S 1. Improve Deal Economics by Garnering More Lead Advisor Roles 2. Improve Sales Effectiveness and Productivity to Increase Profitability 3. Leverage Successful Platform to Cross- Sell to Other Wholesale Segments A C T ION S 1. Expanding Industry Specialties 2. Selectively Expanding Products and Capital Markets Expertise 3. Better Aligning Resources With Targeted Clients 4. Increasing Relationship Manager Sales Capacity by Shifting Non Sales Related Activities to Support Staff Progression Current State

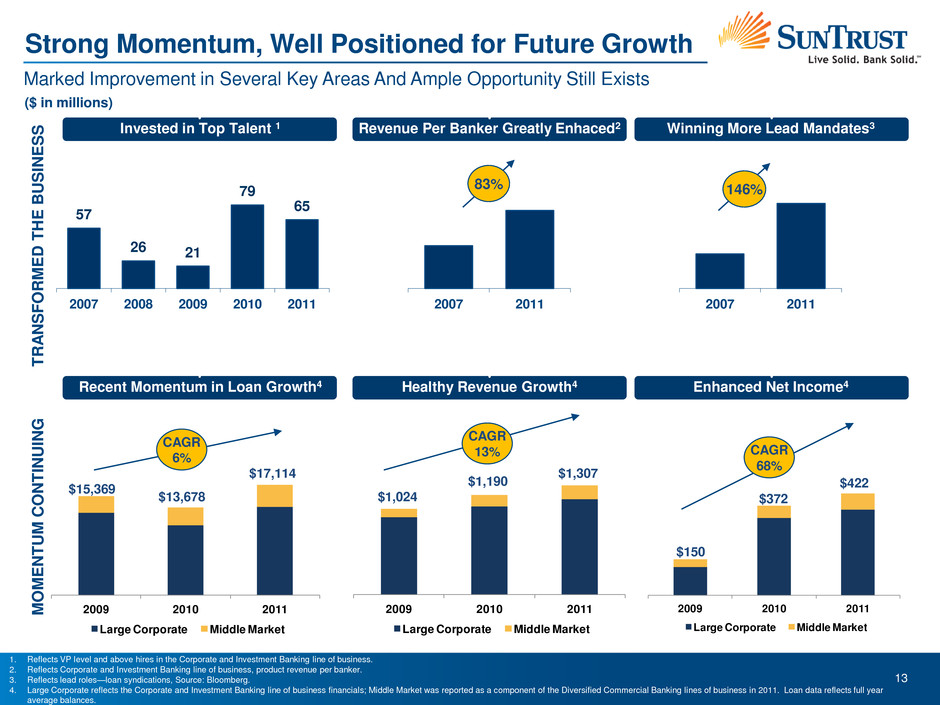

13 V V 2009 2010 2011 Large Corporate Middle Market 2009 2010 2011 Large Corporate Middle Market 2007 2011 Strong Momentum, Well Positioned for Future Growth Marked Improvement in Several Key Areas And Ample Opportunity Still Exists 146% 83% 1. Reflects VP level and above hires in the Corporate and Investment Banking line of business. 2. Reflects Corporate and Investment Banking line of business, product revenue per banker. 3. Reflects lead roles—loan syndications, Source: Bloomberg. 4. Large Corporate reflects the Corporate and Investment Banking line of business financials; Middle Market was reported as a component of the Diversified Commercial Banking lines of business in 2011. Loan data reflects full year average balances. CAGR 13% 2007 2011 TR A NSFOR M E D THE BUS INE S S M OMENT U M CONTIN U IN G 57 26 21 79 65 2007 2008 2009 2010 2011 V V Invested in Top Talent 1 Revenue Per Banker Greatly Enhaced2 Winning More Lead Mandates3 V V Recent Momentum in Loan Growth4 Healthy Revenue Growth4 Enhanced Net Income4 CAGR 6% $1,024 $1,190 $1,307 2009 2010 2011 La g Corporate Middle Market CAGR 68% $150 $372 $422 $15,369 $13,678 $17,114 ($ in millions)

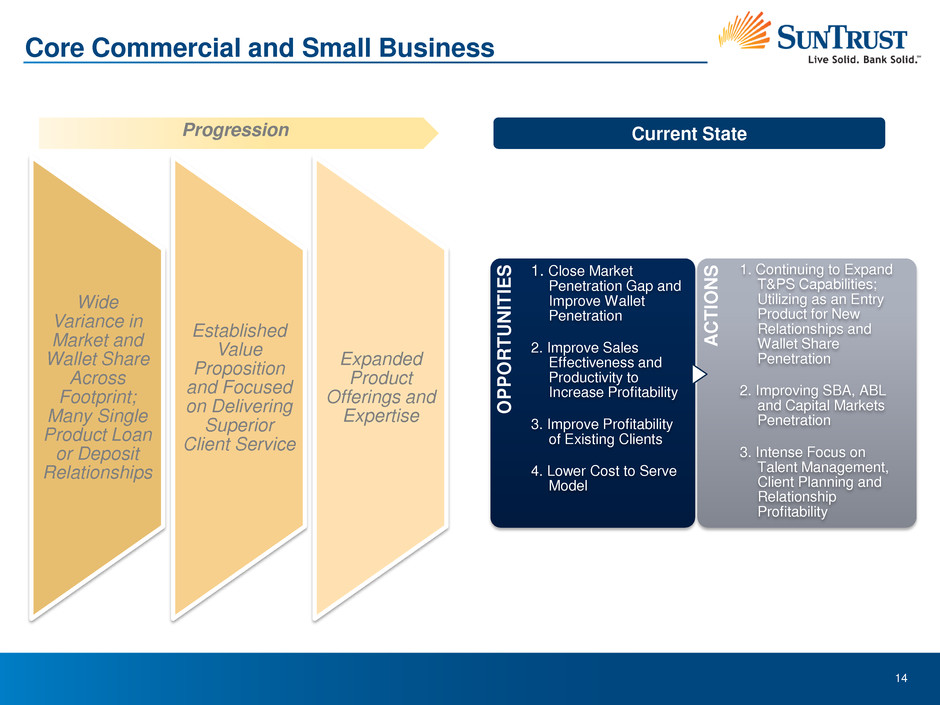

14 Core Commercial and Small Business Wide Variance in Market and Wallet Share Across Footprint; Many Single Product Loan or Deposit Relationships Established Value Proposition and Focused on Delivering Superior Client Service Expanded Product Offerings and Expertise OPPOR T U N IT IE S 1. Close Market Penetration Gap and Improve Wallet Penetration 2. Improve Sales Effectiveness and Productivity to Increase Profitability 3. Improve Profitability of Existing Clients 4. Lower Cost to Serve Model A C T ION S 1. Continuing to Expand T&PS Capabilities; Utilizing as an Entry Product for New Relationships and Wallet Share Penetration 2. Improving SBA, ABL and Capital Markets Penetration 3. Intense Focus on Talent Management, Client Planning and Relationship Profitability Progression Current State

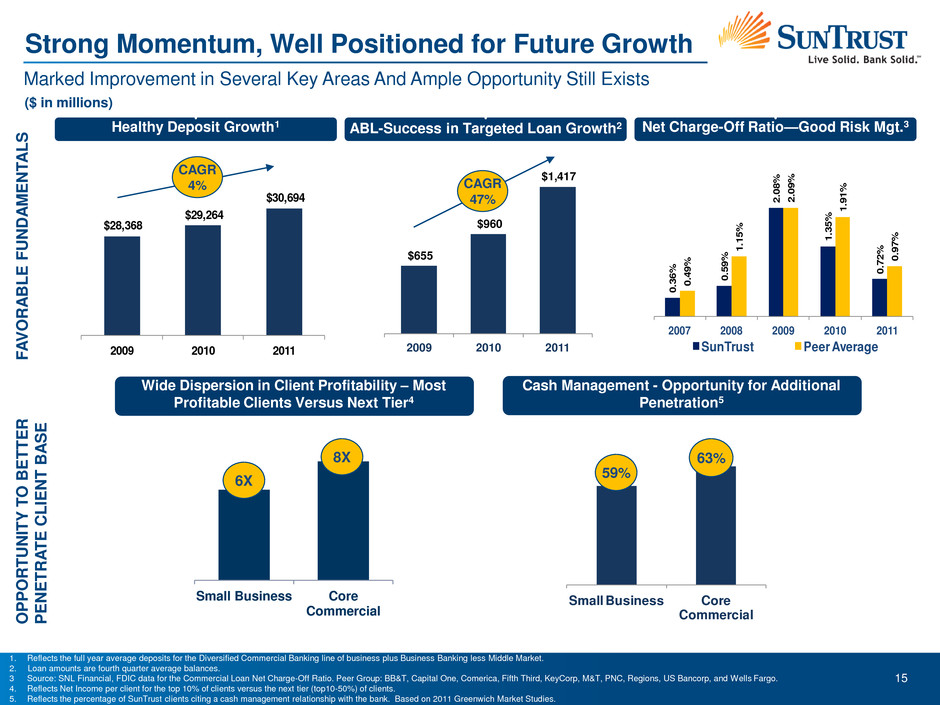

15 $655 $960 $1,417 2009 2010 2011 V Small Business Core Commercial Strong Momentum, Well Positioned for Future Growth Marked Improvement in Several Key Areas And Ample Opportunity Still Exists 1. Reflects the full year average deposits for the Diversified Commercial Banking line of business plus Business Banking less Middle Market. 2. Loan amounts are fourth quarter average balances. 3 Source: SNL Financial, FDIC data for the Commercial Loan Net Charge-Off Ratio. Peer Group: BB&T, Capital One, Comerica, Fifth Third, KeyCorp, M&T, PNC, Regions, US Bancorp, and Wells Fargo. 4. Reflects Net Income per client for the top 10% of clients versus the next tier (top10-50%) of clients. 5. Reflects the percentage of SunTrust clients citing a cash management relationship with the bank. Based on 2011 Greenwich Market Studies. F A V OR A BLE FU N D A M E N T A L S O P P ORT U NIT Y T O BETTER P E NETR A TE CLIENT B A S E V V Net Charge-Off Ratio—Good Risk Mgt.3 ABL-Success in Targeted Loan Growth2 Cash Management - Opportunity for Additional Penetration5 Small Business Core Commercial 6X 8X 63% 59% CAGR 47% ($ in millions) Healthy Deposit Growth1 $28,368 $29,264 $30,694 2009 2010 2011 CAGR 4% Wide Dispersion in Client Profitability – Most Profitable Clients Versus Next Tier4 0. 36 % 0. 59 % 2. 08 % 1. 35 % 0. 72 % 0. 49 % 1. 15 % 2. 09 % 1. 91 % 0. 97 % 2007 2008 2009 2010 2011 SunTrust Peer Average

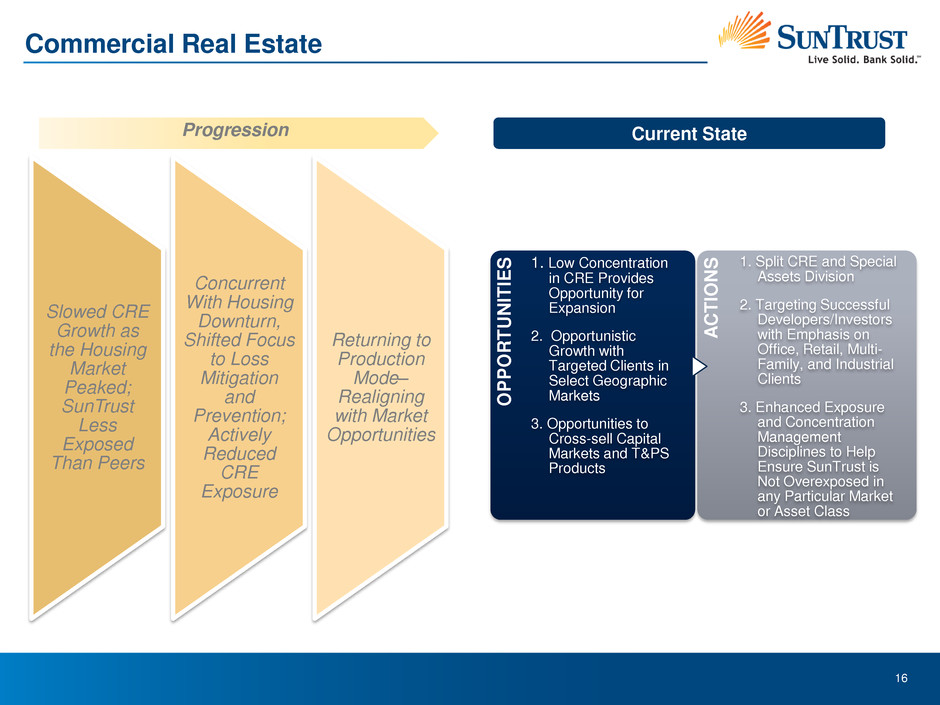

16 Commercial Real Estate Slowed CRE Growth as the Housing Market Peaked; SunTrust Less Exposed Than Peers Concurrent With Housing Downturn, Shifted Focus to Loss Mitigation and Prevention; Actively Reduced CRE Exposure Returning to Production Mode– Realigning with Market Opportunities O P P O R T U N IT IE S 1. Low Concentration in CRE Provides Opportunity for Expansion 2. Opportunistic Growth with Targeted Clients in Select Geographic Markets 3. Opportunities to Cross-sell Capital Markets and T&PS Products A C T IO N S 1. Split CRE and Special Assets Division 2. Targeting Successful Developers/Investors with Emphasis on Office, Retail, Multi- Family, and Industrial Clients 3. Enhanced Exposure and Concentration Management Disciplines to Help Ensure SunTrust is Not Overexposed in any Particular Market or Asset Class Progression Current State

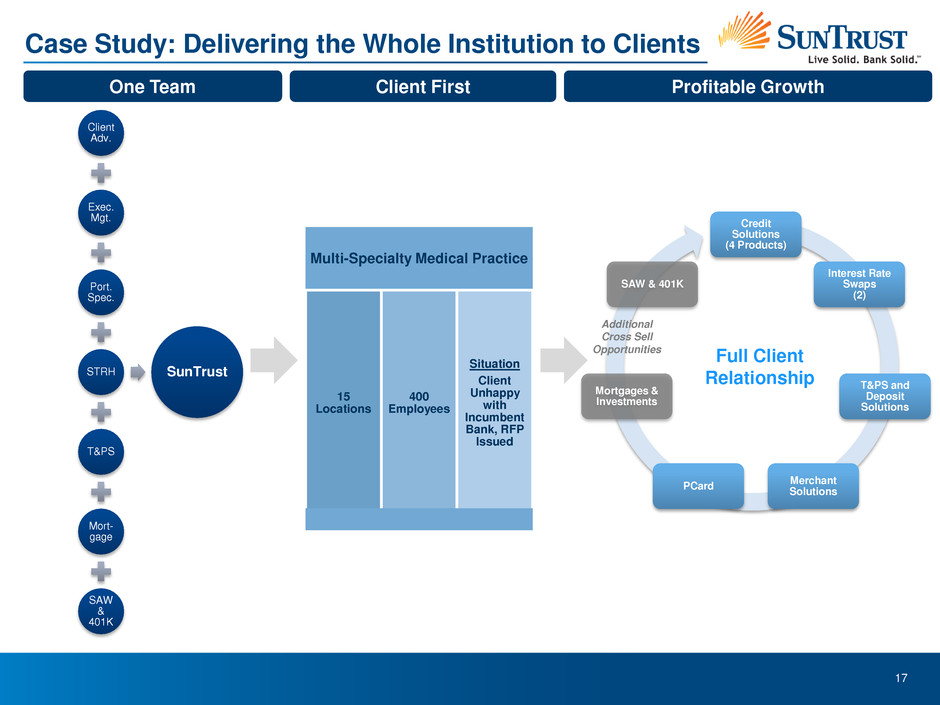

17 Case Study: Delivering the Whole Institution to Clients Client Adv. Exec. Mgt. Port. Spec. STRH T&PS Mort- gage SAW & 401K SunTrust One Team Client First Profitable Growth Credit Solutions (4 Products) Interest Rate Swaps (2) T&PS and Deposit Solutions Merchant Solutions PCard Mortgages & Investments SAW & 401K Full Client Relationship Additional Cross Sell Opportunities Multi-Specialty Medical Practice 15 Locations 400 Employees Situation Client Unhappy with Incumbent Bank, RFP Issued

18 Summary • Wholesale has long been a core strength of SunTrust • Our businesses are integrated and aligned to meet our clients’ needs • The bulk of the Wholesale businesses are strongly profitable today and have favorable momentum • Wholesale is expected to be a meaningful contributor to SunTrust’s future growth via: Focusing on the clients / businesses where we can be most relevant Leveraging our enhanced capabilities Capitalizing upon opportunities to deepen and expand client relationships

Boston, MA March 1, 2012 Mark Chancy Head of Wholesale Banking Keefe, Bruyette & Woods Bank Conference