Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - FEDERAL NATIONAL MORTGAGE ASSOCIATION FANNIE MAE | d307690d8k.htm |

| EX-99.2 - EXHIBIT 99.2 - FEDERAL NATIONAL MORTGAGE ASSOCIATION FANNIE MAE | d307690dex992.htm |

Exhibit 99.1

Resource Center: 1-800-732-6643

| Contact: |

Pete Bakel 202-752-2034 |

|||||||||||||||||

| Date: |

February 29, 2012 | |||||||||||||||||

Fannie Mae Reports Fourth-Quarter and Full-Year 2011 Results

Fannie Mae Maintains a Clear Focus on Building Profitable, High-Quality New Book of Business and

Providing Liquidity for the Mortgage Market

Company Enables Millions of Americans to Benefit from Financing Solutions that Promote Homeownership and Quality Rental Housing

WASHINGTON, DC – Fannie Mae (FNMA/OTC) today reported a net loss of $2.4 billion in the fourth quarter of 2011, compared with a net loss of $5.1 billion in the third quarter of the year. The company’s net loss in the fourth quarter reflected $5.5 billion in credit-related expenses, the substantial majority of which were related to its legacy (pre-2009) book of business and due largely to a decline in home prices. These charges were partially offset by a growing percentage of net revenues from the company’s high-quality new book of business.

For the full year of 2011, Fannie Mae reported a net loss of $16.9 billion, compared with a loss of $14.0 billion for 2010. The increase in the net loss for the year was due primarily to a $6.1 billion increase in net fair value losses in 2011. This resulted from losses in the company’s risk management derivatives in 2011 caused by a significant decline in interest rates during the year. These fair value losses on the company’s derivatives were offset by fair value gains during 2011 related to its mortgage investments; however, only a portion of these investments is recorded at fair value in its financial statements.

“While economic factors such as falling home prices and high unemployment produced strong headwinds for our business again in 2011, we continued to grow a very strong new book of business as we have since 2009. During the year, Fannie Mae funded the market with more than $650 billion in liquidity and maintained its focus on strengthening Fannie Mae’s ability to support and improve the housing industry,” said Michael J. Williams, president and chief executive officer. “For example, since 2009, we have set industry standards for underwriting that promote sustainable homeownership and affordable rental housing. Families across America also have benefited from efforts by Fannie Mae to enable homeowners to refinance 6.6 million mortgages, 1.9 million households to purchase a home, and provided financing for over 1.1 million units of quality rental housing.”

“We continue to build a high-quality new book of business for both single-family and multifamily. Our new single-family book now accounts for more than half of our overall single-family guaranty book of business,” said Susan McFarland, executive vice president and chief financial officer. “Fannie Mae remains focused on reducing losses on the legacy book and we estimate that we have reserved for the substantial majority of the remaining losses on these loans. We are seeing positive outcomes from

| Fourth-Quarter and Full-Year 2011 Results | 1 |

our actions, such as our investments to build the industry’s most effective credit operation, which completed more than one million workout solutions since 2009 to help homeowners retain their homes or avoid foreclosure.”

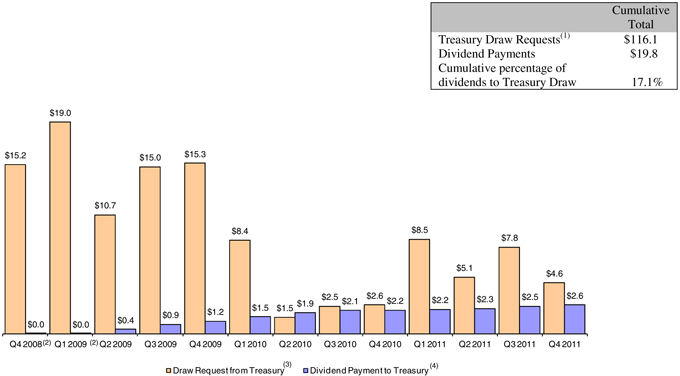

The company’s net worth deficit of $4.6 billion as of December 31, 2011, reflects the recognition of its total comprehensive loss of $1.9 billion and its payment to Treasury of $2.6 billion in senior preferred stock dividends during the fourth quarter of 2011. The Acting Director of the Federal Housing Finance Agency (“FHFA”) will submit a request to Treasury on Fannie Mae’s behalf for $4.571 billion to eliminate the company’s net worth deficit. Upon receipt of those funds, the company’s total obligation to Treasury for its senior preferred stock, which will require an annualized dividend payment of $11.7 billion, will be $117.1 billion. The table below shows the amount of Fannie Mae’s requested draws from Treasury and dividend payments to Treasury since entering into conservatorship on September 6, 2008.

Treasury Draw Requests and Dividend Payments

$ in Billions

| (1) | Treasury draw requests do not include the initial $1.0 billion liquidation preference of Fannie Mae’s senior preferred stock, for which Fannie Mae did not receive any cash proceeds. |

| (2) | Fannie Mae paid dividends to Treasury of $31 million in the fourth quarter of 2008 and $25 million in the first quarter of 2009. |

| (3) | Represents the draw required and requested based on Fannie Mae’s net worth deficit for the quarters presented. Draw requests were funded in the quarter following each quarterly net worth deficit. |

| (4) | Represents quarterly cash dividends paid during the quarters presented by Fannie Mae to Treasury, based on an annual rate of 10% per year on the aggregate liquidation preference of the senior preferred stock. |

| Fourth-Quarter and Full-Year 2011 Results | 2 |

PROVIDING LIQUIDITY AND SUPPORT TO THE MARKET

Fannie Mae has continued to provide liquidity and support to the U.S. mortgage market in a number of important ways:

The company has served as a stable source of liquidity for purchases of homes and financing of multifamily rental housing, as well as for refinancing existing mortgages. Fannie Mae provided approximately $2.3 trillion in liquidity to the mortgage market from 2009 through 2011 by its purchases and guarantees of mortgage loans, including more than 8.5 million single-family mortgage loans, which enabled borrowers to purchase homes or refinance mortgages, and multifamily loans that financed over 1.1 million units of multifamily housing.

| • | Fannie Mae has been a consistent market presence as it continued to provide liquidity to the mortgage market even when other sources of capital exited the market, as has been shown repeatedly over the last few years. The company estimates Fannie Mae, Freddie Mac, and Ginnie Mae have collectively guaranteed more than 99 percent of new single-family mortgage-related securities issuances in 2009 through 2011, which accounted for more than 85 percent of single-family first-lien mortgages the company currently estimates were originated in the United States from 2009 through 2011. Because the company’s estimate of mortgage originations is subject to change as additional data become available, the company’s estimated share of single-family first-lien mortgages for prior periods may change in the future, perhaps materially. |

| • | The company has strengthened its underwriting and eligibility standards to support sustainable homeownership, enabling borrowers to have access to a variety of conforming mortgage products, including long-term, fixed-rate mortgages, such as the prepayable 30-year fixed-rate mortgage that protects homeowners from interest rate swings. |

| • | The company helped more than 900,000 homeowners retain their homes or otherwise avoid foreclosure from 2009 through 2011, which helped support neighborhoods, home prices, and the housing market. Moreover, borrowers’ ability to pay their modified loans has improved in recent periods as the company has enhanced the structure of its modifications. For loans modified outside of the Administration’s Home Affordable Modification Program (“HAMP”), one year after modification, 67 percent of modifications that the company made in the fourth quarter of 2010 were performing, compared with 50 percent of modifications in the fourth quarter of 2009. For loans modified under HAMP, one year after modification, 74 percent of its HAMP modifications made in the fourth quarter of 2010 were performing, compared with 73 percent of its HAMP modifications in the fourth quarter of 2009. |

| • | The company helped borrowers refinance loans through its Refi Plus™ initiative, which provides expanded refinance opportunities for eligible Fannie Mae borrowers. The company acquired approximately 732,000 loans refinanced under its Refi Plus initiative in 2011. Some borrowers may have increased their monthly payments as they took advantage of lower interest rates to reduce the terms of their loans, to switch from adjustable rates to fixed rates, or to switch from interest-only mortgages to fully amortizing mortgages. Even taking these refinancings into account, the company’s acquisitions under Refi Plus reduced its borrowers’ monthly mortgage payments by an average of $166. |

| Fourth-Quarter and Full-Year 2011 Results | 3 |

| • | The company continued to support affordability in the multifamily rental market. More than 85 percent of the multifamily units it financed from 2009 through 2011 were affordable to families earning at or below the median income in their area. |

| • | The company remained the largest single issuer of mortgage-related securities in the secondary market in the fourth quarter of 2011, with an estimated market share of new single-family mortgage-related securities issuances of 54 percent, compared with 43 percent in the third quarter of 2011 and 49 percent in the fourth quarter of 2010. Fannie Mae also remained a constant source of liquidity in the multifamily market. As of September 30, 2011 (the latest date for which information was available), the company owned or guaranteed approximately 21 percent of the outstanding debt on multifamily properties. |

During 2011, Fannie Mae purchased or guaranteed approximately $653 billion in loans, measured by unpaid principal balance, which included approximately $67 billion in delinquent loans purchased from its single-family mortgage-backed securities (“MBS”) trusts. Fannie Mae’s purchases and guarantees during 2011 enabled its lender customers to finance approximately 2,680,000 single-family conventional loans and loans for approximately 423,000 units in multifamily properties.

CREDIT QUALITY

New Single-Family Book of Business: Fifty-three percent of Fannie Mae’s single-family guaranty book of business as of December 31, 2011 consisted of loans it had purchased or guaranteed since the beginning of 2009. The company’s new single-family book of business has a strong overall credit profile and is performing well. The company expects that these loans will be profitable over their lifetime, meaning the company’s fee income on these loans will exceed the company’s credit losses and administrative costs for them. If future macroeconomic conditions turn out to be more adverse than the company’s expectations, these loans could become unprofitable.

Single-family conventional loans added to Fannie Mae’s book of business since January 1, 2009, have a weighted average loan-to-value ratio at origination of 68 percent, and a weighted average credit score at origination of 762.

For more information on the expected lifetime profitability of the company’s new single-family book of business, please refer to the discussion following Table 3 in the company’s annual report on Form 10-K for the year ended December 31, 2011.

2005 to 2008 Single-Family Book of Business: The single-family credit losses the company realized from 2009 through 2011, combined with the amounts the company had reserved for single-family credit losses as of December 31, 2011, total approximately $140 billion. The substantial majority of these losses were attributable to single-family loans the company purchased or guaranteed from 2005 through 2008. The company expects its loss reserves will remain significantly elevated relative to historical levels for an extended period because: (1) it expects future defaults on loans in its legacy book of business and the resulting charge-offs will occur over a period of years; and (2) a significant portion of its reserves represents concessions granted to borrowers upon modification of their loans and will remain in its reserves until the loans are fully repaid or default.

| Fourth-Quarter and Full-Year 2011 Results | 4 |

The 2005 to 2008 acquisitions are becoming a smaller percentage of the company’s single-family guaranty book of business, having decreased from 39 percent of its single-family guaranty book of business as of December 31, 2010, to 31 percent as of December 31, 2011.

Fannie Mae’s single-family serious delinquency rate has decreased each quarter since the first quarter of 2010. This decrease is the result of home retention solutions, as well as foreclosure alternatives and completed foreclosures. The decrease also is attributable to the company’s acquisition of loans with a stronger credit profile since the beginning of 2009, as these loans are now more than 50 percent of the single-family guaranty book of business, resulting in a smaller percentage of the company’s loans becoming seriously delinquent. The company expects serious delinquency rates will continue to be affected in the future by home price changes, changes in other macroeconomic conditions, the length of the foreclosure process, the volume of loan modifications, and the extent to which borrowers with modified loans continue to make timely payments. In addition, due to circumstances in the foreclosure environment, foreclosures are proceeding at a slow pace, which has resulted in loans remaining seriously delinquent in the company’s book of business for a longer time.

STRATEGIES TO REDUCE CREDIT LOSSES ON THE LEGACY BOOK

To reduce the credit losses Fannie Mae ultimately incurs on its legacy book of business, the company has been focusing its efforts on several strategies, including reducing defaults by offering home retention solutions, such as loan modifications. Successful modifications allow borrowers who were having problems making their pre-modification mortgage payments to remain in their homes. While loan modifications contribute to higher credit-related expenses in the near term, the company believes that successful modifications will ultimately reduce the company’s credit losses over the long term from what they otherwise would have been if the company had foreclosed on the loans. Fannie Mae completed approximately 213,000 loan modifications during 2011, bringing the total number of loan modifications the company has completed since January 2009 to more than 715,000. The substantial majority of these modifications involved deferring or lowering borrowers’ monthly mortgage payments, which the company believes increases the likelihood borrowers will be able to remain current on their modified loans. Borrowers’ ability to pay their modified loans has improved in recent periods as the company has enhanced the structure of its modifications. The ultimate long-term success of the company’s current modification efforts is uncertain and will be highly dependent on economic factors, such as unemployment rates, household wealth and income, and home prices, as well as borrowers’ willingness to pay their loans.

As the company works to reduce credit losses, it also seeks to assist struggling borrowers, help stabilize communities, and support the housing market. In dealing with struggling borrowers, Fannie Mae first seeks home retention solutions that enable them to keep their homes before turning to foreclosure alternatives. If the company is unable to provide a viable home retention solution for a struggling borrower, the company seeks to offer a foreclosure alternative and complete it in a timely manner. From 2009 through 2011, the company completed approximately 195,000 preforeclosure sales (also known as short sales) and deeds-in-lieu of foreclosure. When there is no viable home retention solution or foreclosure alternative that can be applied, the company seeks to move to foreclosure expeditiously. The goal of these efforts is to help minimize delinquencies that can adversely impact local home values and destabilize communities, as well as lower costs to Fannie Mae.

Improving servicing standards and execution is another key aspect of the company’s strategy to reduce its credit losses. The performance of the company’s mortgage servicers is critical to its success in

| Fourth-Quarter and Full-Year 2011 Results | 5 |

reducing defaults, completing foreclosure alternatives, and managing workout and foreclosure timelines efficiently, because servicers are the primary point of contact with borrowers. Fannie Mae is taking a number of steps to improve the servicing of its delinquent loans.

| • | In June 2011, the company issued new standards for mortgage servicers under FHFA’s Servicing Alignment Initiative (“Initiative”). The Initiative is aimed at establishing consistency in the servicing of delinquent loans owned or guaranteed by Fannie Mae and Freddie Mac. Among other things, the new servicing standards, which became effective October 1, 2011, are designed to result in earlier, more frequent, and more effective contact with borrowers, and to improve servicer performance by providing servicers monetary incentives for exceeding loan workout benchmarks and by imposing fees on servicers for failing to meet loan workout benchmarks or foreclosure timelines. |

| • | In some cases, Fannie Mae transfers servicing on loan populations that include loans with higher-risk characteristics to special servicers with whom the company has worked to develop high-touch protocols for servicing these loans. These protocols include lowering the ratio of loans per servicer employee, prescribing borrower outreach strategies to be used at early stages of delinquency, and providing struggling borrowers a single point of contact to resolve issues. Transferring servicing on higher-risk loans enables the borrowers (and loans) to benefit from these high-touch protocols while increasing the original servicer’s capacity to service the remaining loans, creating an opportunity to improve service to the remaining borrowers. |

| • | In September 2011, Fannie Mae issued its first ratings of servicers’ performance under its Servicer Total Achievement and Rewards (“STAR”) program. The STAR program is designed to encourage improvements in customer service and foreclosure prevention outcomes for homeowners by rating servicers on their performance in these areas. |

While Fannie Mae believes these steps will improve the servicing on its loans, ultimately the company is dependent on servicers’ willingness, efficiency, and ability to implement its home retention solutions and foreclosure alternatives, and to manage timelines for workouts and foreclosures. For more information on the company’s strategies to reduce credit losses on its legacy book, please refer to the company’s annual report on Form 10-K for the year ended December 31, 2011.

The company believes that home retention solutions are most effective in preventing defaults when completed at an early stage of delinquency. Similarly, the company’s foreclosure alternatives are more likely to be successful in reducing its loss severity if they are executed expeditiously. Accordingly, providing potential home retention solutions to delinquent borrowers early in the delinquency and, where no home retention solutions or foreclosure alternatives are available, reducing delays in completing foreclosure is a fundamental component of the company’s strategy to reduce its credit losses and help stabilize the housing market.

HOME RETENTION SOLUTIONS AND FORECLOSURE ALTERNATIVES

Loan Workouts: During the fourth quarter of 2011, Fannie Mae completed more than 82,000 single-family loan workouts, including more than 60,000 home-retention solutions (modifications, repayment plans, and forbearances). For the year, the company completed 328,491 single-family loan workouts. Details of the company’s home-retention solutions and foreclosure alternatives include:

| Fourth-Quarter and Full-Year 2011 Results | 6 |

| • | Loan modifications, which consist of permanent modifications under HAMP and Fannie Mae’s own modification options, decreased in the fourth quarter of 2011 to 51,936 from 60,025 in the third quarter of 2011. For the year, the company completed 213,340 loan modifications, compared with 403,506 in 2010. The volume of workouts completed in 2011 decreased compared with 2010, primarily driven by a decline in the number of seriously delinquent loans in 2011, compared with 2010. In addition, the company began to require that all Fannie Mae non-HAMP modifications also must go through a trial period, which initially lowers the number of modifications that can become permanent in any particular period. |

| • | Repayment plans/forbearances of 8,517 in the fourth quarter of 2011, compared with 8,202 in the third quarter of 2011. For the year, the company completed 35,318 repayment plans/forbearances, compared with 31,579 in 2010. |

| • | Short sales and deeds-in-lieu of foreclosure of 22,231 in the fourth quarter of 2011, compared with 19,306 in the third quarter of 2011. For the year, the company completed 79,833 short sales and deeds-in-lieu of foreclosure, compared with 75,391 in 2010. |

Homeowner Initiatives: During 2011, Fannie Mae continued to develop programs and invest in initiatives designed to help keep people in homes, assist prospective homeowners, and support the mortgage and housing markets overall. As of December 31, 2011, Fannie Mae had established twelve Mortgage Help Centers across the nation to accelerate the response time for struggling borrowers with loans owned by Fannie Mae. During 2011, these centers helped borrowers obtain nearly 6,100 home retention plans. The company’s Mortgage Help Centers are complemented in their efforts by partnerships with 17 local non-profit organizations in 16 cities, collectively known as its Mortgage Help Network. The Mortgage Help Network represents a contractual relationship with select not-for-profit counseling agencies located in the company’s top delinquent mortgage markets to provide borrowers with loans owned by Fannie Mae foreclosure prevention counseling, documentation assistance, and assistance with pending loan workout solutions. The company also uses direct mail, phone calls, and some advertising to encourage homeowners to visit KnowYourOptions.com to pursue home retention solutions and foreclosure alternatives.

Refinancing Initiatives: Through the company’s Refi PlusTM initiative, which provides expanded refinance opportunities for eligible Fannie Mae borrowers, and includes The Administration’s Home Affordable Refinance Program (“HARP”) loans, the company acquired approximately 732,000 loans during 2011. Some borrowers may have increased their monthly payments as they took advantage of lower interest rates to reduce the terms of their loans, to switch from adjustable rates to fixed rates, or to switch from interest-only mortgages to fully amortizing mortgages. Even taking these refinancings into account, the company’s acquisitions under Refi Plus reduced its borrowers’ monthly mortgage payments by an average of $166.

FORECLOSURES AND REO

Fannie Mae acquired 47,256 single-family real-estate owned (“REO”) properties, primarily through foreclosure, in the fourth quarter of 2011, compared with 45,194 in the third quarter of 2011. Fannie Mae disposed of 51,344 single-family REO in the fourth quarter of 2011, compared with 58,297 in the third quarter of 2011. As of December 31, 2011, the company’s inventory of single-family REO properties was 118,528, compared with 122,616 as of September 30, 2011, and 162,489 as of December 31, 2010. The carrying value of the company’s single-family REO was $9.7 billion as of December 31, 2011, compared with $11.0 billion as of September 30, 2011, and $15.0 billion as of December 31, 2010.

| Fourth-Quarter and Full-Year 2011 Results | 7 |

The company’s single-family foreclosure rate was 1.13 percent on an annualized basis for 2011, compared with 1.15 percent in the first nine months of 2011 and 1.46 percent for 2010. This reflects the annualized number of single-family properties acquired through foreclosure as a percentage of the total number of loans in Fannie Mae’s single-family conventional guaranty book of business.

The changing foreclosure environment has significantly lengthened the time it takes to foreclose on a mortgage loan in many states, which has slowed the pace of Fannie Mae’s REO property acquisitions. The increase in foreclosure timelines also has increased Fannie Mae’s credit-related expenses and negatively affected its single-family serious delinquency rates. Moreover, Fannie Mae believes these changes in the foreclosure environment will delay the recovery of the housing market because it will take longer to clear the housing market’s supply of distressed homes, which typically sell at a discount to non-distressed homes and therefore negatively affect overall home prices.

SUMMARY OF FOURTH-QUARTER AND FULL-YEAR 2011 RESULTS

Fannie Mae reported a net loss of $2.4 billion for the fourth quarter of 2011, compared with a net loss of $5.1 billion in the third quarter of 2011. The company reported a net loss of $16.9 billion for 2011, compared with a loss of $14.0 billion for 2010. The net worth deficit of $4.6 billion as of December 31, 2011 takes into account dividends paid on senior preferred stock held by Treasury.

| Fourth-Quarter and Full-Year 2011 Results | 8 |

| (Dollars in millions)(1) |

4Q11 | 3Q11 | Variance | 2011 | 2010 | Variance | ||||||||||||||||||

| Net interest income |

$ | 4,163 | $ | 5,186 | $ | (1,023 | ) | $ | 19,281 | $ | 16,409 | $ | 2,872 | |||||||||||

| Fee and other income |

370 | 291 | 79 | 1,163 | 1,084 | 79 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net revenues |

4,533 | 5,477 | (944 | ) | 20,444 | 17,493 | 2,951 | |||||||||||||||||

| Investment gains, net |

187 | 73 | 114 | 506 | 346 | 160 | ||||||||||||||||||

| Net other-than-temporary impairments |

54 | (262 | ) | 316 | (308 | ) | (722 | ) | 414 | |||||||||||||||

| Fair value losses, net |

(751 | ) | (4,525 | ) | 3,774 | (6,621 | ) | (511 | ) | (6,110 | ) | |||||||||||||

| Administrative expenses |

(605 | ) | (591 | ) | (14 | ) | (2,370 | ) | (2,597 | ) | 227 | |||||||||||||

| Credit-related expenses(2) |

(5,513 | ) | (4,884 | ) | (629 | ) | (27,498 | ) | (26,614 | ) | (884 | ) | ||||||||||||

| Other non-interest expenses(3) |

(311 | ) | (373 | ) | 62 | (1,098 | ) | (1,495 | ) | 397 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net losses and expenses |

(6,939 | ) | (10,562 | ) | 3,623 | (37,389 | ) | (31,593 | ) | (5,796 | ) | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Loss before federal income taxes |

(2,406 | ) | (5,085 | ) | 2,679 | (16,945 | ) | (14,100 | ) | (2,845 | ) | |||||||||||||

| (Provision) benefit for federal income taxes |

(1 | ) | — | (1 | ) | 90 | 82 | 8 | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net loss |

(2,407 | ) | (5,085 | ) | 2,678 | (16,855 | ) | (14,018 | ) | (2,837 | ) | |||||||||||||

| Less: Net loss attributable to the noncontrolling interest |

1 | — | 1 | — | 4 | (4 | ) | |||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net loss attributable to Fannie Mae |

$ | (2,406 | ) | $ | (5,085 | ) | $ | 2,679 | $ | (16,855 | ) | $ | (14,014 | ) | $ | (2,841 | ) | |||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total comprehensive loss attributable to Fannie Mae |

$ | (1,945 | ) | $ | (5,282 | ) | $ | 3,337 | $ | (16,408 | ) | $ | (10,570 | ) | $ | (5,838 | ) | |||||||

| Preferred stock dividends |

$ | (2,622 | ) | $ | (2,494 | ) | $ | (128 | ) | $ | (9,614 | ) | $ | (7,704 | ) | $ | (1,910 | ) | ||||||

|

(1) Certain prior period amounts have been reclassified to conform to the current period presentation.

(2) Consists of provision for loan losses, provision for guaranty losses and foreclosed property expense (income).

(3) Consists of debt extinguishment losses, net and other expenses.

|

| |||||||||||||||||||||||

Net revenues were $4.5 billion in the fourth quarter of 2011, down 17 percent from $5.5 billion in the third quarter of 2011. Net interest income was $4.2 billion, down 20 percent from $5.2 billion in the third quarter of 2011. The decline in net interest income was due primarily to an out-of-period adjustment of $1.2 billion recorded in the fourth quarter of 2011 to correct the rate used to calculate interest income on mortgage-related securities. For the year, net revenues were $20.4 billion, up 17 percent from $17.5 billion in 2010.

Credit-related expenses, which consist of the provision for loan losses, provision for guaranty losses, and foreclosed property expense, were $5.5 billion in the fourth quarter of 2011, up from $4.9 billion in the third quarter of 2011. For the year, credit-related expenses were $27.5 billion, compared with $26.6 billion in 2010. The increase in the company’s credit-related expenses in the fourth quarter and full year of 2011 was driven largely by a decline in home prices.

Credit losses, which the company defines generally as net charge-offs plus foreclosed property expense, excluding the effect of certain fair-value losses, were $4.7 billion in the fourth quarter of 2011, compared with $4.5 billion in the third quarter of 2011. For the year, credit losses were $18.7 billion, compared with $23.6 billion in 2010. Credit losses were up in the fourth quarter of 2011

| Fourth-Quarter and Full-Year 2011 Results | 9 |

compared with the third quarter of 2011 due to a slight increase in foreclosure acquisitions. Credit losses were down year over year due to the slowdown in the processing of foreclosures and an increase in the amounts received related to outstanding repurchase requests.

Total loss reserves, which reflect an estimate of the probable losses the company has incurred in its guaranty book of business, including concessions it granted borrowers upon modification of their loans, increased to $76.9 billion as of December 31, 2011, compared with $75.6 billion as of September 30, 2011. The total loss reserve coverage to total nonperforming loans was 31 percent as of December 31, 2011, compared with 30 percent as of September 30, 2011, and 26 percent as of December 31, 2010. The continued stress on a broad segment of borrowers from persistent high levels of unemployment and underemployment, and the prolonged decline in home prices have caused the company’s total loss reserves to remain high for the past few years.

Net fair value losses were $751 million in the fourth quarter of 2011, compared with net fair value losses of $4.5 billion in the third quarter of 2011. For the year, net fair value losses were $6.6 billion, compared with $511 million in 2010. The fourth quarter decrease and full-year increase was driven primarily by fair value losses on Fannie Mae’s risk management derivatives due to a significant decline in interest rates during the third quarter of 2011.

NET WORTH AND U.S. TREASURY FUNDING

The Acting Director of FHFA will request $ 4.571 billion of funds from Treasury on the company’s behalf under the terms of the senior preferred stock purchase agreement between Fannie Mae and Treasury to eliminate the company’s net worth deficit as of December 31, 2011. Fannie Mae’s fourth-quarter dividend of $2.6 billion on its senior preferred stock held by Treasury was declared by FHFA and paid by the company on December 31, 2011.

In December 2011, Treasury provided the company $7.8 billion to cure its net worth deficit as of September 30, 2011. As a result of this draw, the aggregate liquidation preference of the senior preferred stock increased from $104.8 billion to $112.6 billion as of December 31, 2011. It will increase to $117.1 billion upon the receipt of funds from Treasury to eliminate the company’s fourth-quarter 2011 net worth deficit, which will require an annualized dividend payment of $11.7 billion. This amount exceeds the company’s reported annual net income for every year since its inception.

Through December 31, 2011, Fannie Mae has paid an aggregate of $19.8 billion to Treasury in dividends on the senior preferred stock.

OUTSTANDING BANK OF AMERICA REPURCHASE REQUESTS

Fannie Mae makes repurchase requests for lenders to repurchase loans or compensate Fannie Mae for losses sustained on loans that do not meet its underwriting or eligibility requirements, or for which the mortgage insurer has rescinded coverage. In the fourth quarter of 2011, Bank of America, the seller/servicer with which Fannie Mae has the most repurchase requests outstanding, slowed the pace of its repurchases. As a result of Bank of America’s failure to honor its contractual obligations in a timely manner, the already high volume of Fannie Mae’s outstanding repurchase requests with Bank of America increased substantially. Measured by unpaid principal balance, Bank of America accounted for approximately 52 percent of Fannie Mae’s outstanding repurchase requests as of December 31, 2011, compared with 45 percent as of September 30, 2011 and 41 percent as of December 31, 2010, shortly after entering into an

| Fourth-Quarter and Full-Year 2011 Results | 10 |

agreement with Fannie Mae to address its then outstanding repurchase requests. Similarly, Bank of America accounted for 59 percent of Fannie Mae’s repurchase requests that had been outstanding for more than 120 days as of December 31, 2011, compared with 48 percent as of September 30, 2011 and 37 percent as of December 31, 2010. Fannie Mae is taking steps to address Bank of America’s delays in honoring Fannie Mae’s repurchase requests. For example, Fannie Mae did not renew its existing loan delivery contract with Bank of America at the end of January, which significantly restricted the types of loans they can deliver to Fannie Mae. Bank of America can continue delivering loans to Fannie Mae under the company’s Refi Plus initiative, including HARP loans. Bank of America’s failure to honor repurchase obligations in a timely manner has not caused Fannie Mae to change its estimate of the amounts it expects to collect from them ultimately, and Fannie Mae continues to work with Bank of America to resolve these issues. If Fannie Mae collects less than the amount it expects from Bank of America, Fannie Mae may be required to seek additional funds from Treasury under its senior preferred stock purchase agreement. Table 55 in Fannie Mae’s annual report on Form 10-K for the year ended December 31, 2011 displays its top five mortgage seller/servicers by outstanding repurchase requests based on the unpaid principal balance of the loans underlying the repurchase requests issued as of December 31, 2011. Fannie Mae does not expect the change in its agreement with Bank of America to be material to Fannie Mae’s business or results of operations, as Bank of America represented less than 5 percent of Fannie Mae’s loan delivery volume in the quarter ended December 31, 2011.

BUSINESS SEGMENT RESULTS

Fannie Mae conducts its activities through three complementary businesses: its Single-Family business, its Multifamily business, and its Capital Markets group. The company’s Single-Family and Multifamily businesses work with Fannie Mae’s lender customers, who deliver mortgage loans that the company purchases and securitizes into Fannie Mae MBS. The Capital Markets group manages the company’s investment activity in mortgage-related assets and other interest-earning non-mortgage investments, funding investments in mortgage-related assets primarily with proceeds received from the issuance of Fannie Mae debt securities in the domestic and international capital markets. The Capital Markets group also provides liquidity to the mortgage market through short-term financing and other activities.

Single-Family guaranty book of business was $2.84 trillion as of both December 31, 2011 and September 30, 2011. Similarly, Single-Family guaranty fee income for both the third and fourth quarter 2011 was $1.9 billion. The Single-Family business lost $4.5 billion in the fourth quarter of 2011, compared with $3.7 billion in the third quarter of 2011, due primarily to credit-related expenses of $5.4 billion, the substantial majority of which were attributable to loans purchased or guaranteed prior to 2009. For the year, the Single-Family business lost $23.9 billion, compared with a loss of $26.7 billion in 2010.

Multifamily guaranty book of business was $195.2 billion as of December 31, 2011, compared with $193.3 billion as of September 30, 2011. Multifamily recorded credit-related expenses of $116 million in the fourth quarter of 2011, compared with credit-related expenses of $102 million in the third quarter of 2011. Multifamily earned $177 million in the fourth quarter of 2011, compared with $72 million in the third quarter of 2011. For the year, Multifamily earned $583 million, compared with earnings of $216 million in 2010.

Capital Markets’ net interest income for the fourth quarter of 2011 was $2.4 billion. Fair value losses were $637 million, compared with fair value losses of $4.7 billion in the third quarter of 2011. The Capital Markets mortgage investment portfolio balance decreased to $708.4 billion as of December 31,

| Fourth-Quarter and Full-Year 2011 Results | 11 |

2011, compared with $722.2 billion as of September 30, 2011, resulting from purchases of $55.9 billion, liquidations of $36.2 billion, and sales of $33.4 billion during the quarter. The Capital Markets group earned $2.6 billion in the fourth quarter of 2011, compared with $711 million lost in the third quarter of 2011. Capital Markets’ third-quarter losses were driven by losses on the company’s risk management derivatives in the third quarter of 2011. For the year, Capital Markets earned $9.0 billion, compared with $16.1 billion in 2010.

The company provides further discussion of its financial results and condition, credit performance, fair value balance sheets, and other matters in its annual report on Form 10-K for the year ended December 31, 2011, which was filed today with the Securities and Exchange Commission. Further information about the company’s credit performance, the characteristics of its guaranty book of business, the drivers of its credit losses, its foreclosure-prevention efforts, and other measures is contained in the “2011 Credit Supplement” on Fannie Mae’s Web site, www.fanniemae.com.

# # #

In this release, the company has presented a number of estimates, forecasts, expectations, and other forward-looking statements regarding the company’s future financial results; the profitability of its loans; the impact of successful loan modifications; FHFA’s future requests to Treasury on Fannie Mae’s behalf; Fannie Mae’s future serious delinquency rates, credit losses, credit-related expenses, defaults, and charge-offs; its draws from and dividends to be paid to Treasury; the performance, profitability and caliber of loans it is acquiring; the impact of the changing foreclosure environment; the impact of the company’s actions on its delinquencies, defaults, loss severities, costs and credit losses; the future performance of modifications and factors that could influence that performance; the impact of the company’s actions on the housing industry; the impact of the company’s actions to improve the servicing on its loans; the company’s expectations regarding its future loss reserves; the company’s expectations regarding the impact of the change in its agreement with Bank of America; the company’s expectations regarding amounts it will ultimately collect from Bank of America; and the potential impact on the company’s Treasury draws of the company’s future collections from Bank of America. These estimates, forecasts, expectations, and statements are forward-looking statements and are based on the company’s current assumptions regarding numerous factors, including assumptions about future home prices and the future performance of its loans. The company’s future estimates of these amounts, as well as the actual amounts, may differ materially from its current estimates as a result of home price changes, interest rate changes, unemployment, other macroeconomic variables, government policy matters, changes in generally accepted accounting principles, credit availability, social behaviors, the volume of loans it modifies, the effectiveness of its loss mitigation strategies, management of its real estate owned inventory and pursuit of contractual remedies, changes in the fair value of its assets and liabilities, impairments of its assets, the adequacy of its loss reserves, its ability to maintain a positive net worth, effects from activities the company takes to support the mortgage market and help homeowners, the conservatorship and its effect on the company’s business, the investment by Treasury and its effect on the company’s business, changes in the structure and regulation of the financial services industry, the company’s ability to access the debt markets, disruptions in the housing, credit, and stock markets, government investigations and litigation, the performance of the company’s servicers, conditions in the foreclosure environment, and many other factors. Changes in the company’s underlying assumptions and actual outcomes, which could be affected by the economic environment, government policy, and many other factors, including those discussed in the “Risk Factors” section of and elsewhere in the company’s annual report on Form 10-K for the year ended December 31, 2011, and elsewhere in this release, could result in actual results being materially different from what is set forth in the forward-looking statements.

Fannie Mae provides Web site addresses in its news releases solely for readers’ information. Other content or information appearing on these Web sites is not part of this release.

Fannie Mae exists to expand affordable housing and bring global capital to local communities in order to serve the U.S. housing market. Fannie Mae has a federal charter and operates in America’s secondary mortgage market to enhance the liquidity of the mortgage market by purchasing or guaranteeing mortgage loans originated by mortgage bankers and other lenders so that they may lend to home buyers. Our job is to help those who house America.

| Fourth-Quarter and Full-Year 2011 Results | 12 |

ANNEX I

(In conservatorship)

(Dollars in millions, except share amounts)

| As of December 31, | ||||||||

| 2011 | 2010 | |||||||

| ASSETS |

||||||||

| Cash and cash equivalents (includes $2 and $348, respectively, related to consolidated trusts) |

$ | 17,539 | $ | 17,297 | ||||

| Restricted cash (includes $45,900 and $59,619, respectively, related to consolidated trusts) |

50,797 | 63,678 | ||||||

| Federal funds sold and securities purchased under agreements to resell or similar arrangements |

46,000 | 11,751 | ||||||

| Investments in securities: |

||||||||

| Trading, at fair value (includes $8 and $21, respectively, related to consolidated trusts) |

74,198 | 56,856 | ||||||

| Available-for-sale, at fair value (includes $1,191 and $1,055, respectively, related to consolidated trusts) |

77,582 | 94,392 | ||||||

|

|

|

|

|

|||||

| Total investments in securities |

151,780 | 151,248 | ||||||

|

|

|

|

|

|||||

| Mortgage loans: |

||||||||

| Loans held for sale, at lower of cost or fair value (includes $66 and $661, respectively, related to consolidated trusts) |

311 | 915 | ||||||

| Loans held for investment, at amortized cost: |

||||||||

| Of Fannie Mae |

380,134 | 407,228 | ||||||

| Of consolidated trusts (includes $3,611 and $2,962, respectively, at fair value and loans pledged as collateral that may be sold or repledged of $798 and $2,522, respectively) |

2,590,332 | 2,577,133 | ||||||

|

|

|

|

|

|||||

| Total loans held for investment |

2,970,466 | 2,984,361 | ||||||

| Allowance for loan losses |

(72,156 | ) | (61,556 | ) | ||||

|

|

|

|

|

|||||

| Total loans held for investment, net of allowance |

2,898,310 | 2,922,805 | ||||||

|

|

|

|

|

|||||

| Total mortgage loans |

2,898,621 | 2,923,720 | ||||||

| Accrued interest receivable, net (includes $8,466 and $8,910, respectively, related to consolidated trusts) |

10,000 | 11,279 | ||||||

| Acquired property, net |

11,373 | 16,173 | ||||||

| Other assets (includes cash pledged as collateral of $1,109 and $884, respectively) |

25,374 | 26,826 | ||||||

|

|

|

|

|

|||||

| Total assets |

$ | 3,211,484 | $ | 3,221,972 | ||||

|

|

|

|

|

|||||

| LIABILITIES AND DEFICIT |

||||||||

| Liabilities: |

||||||||

| Accrued interest payable (includes $9,302 and $9,712, respectively, related to consolidated trusts) |

$ | 12,648 | $ | 13,764 | ||||

| Federal funds purchased and securities sold under agreements to repurchase |

— | 52 | ||||||

| Debt: |

||||||||

| Of Fannie Mae (includes $838 and $893, respectively, at fair value) |

732,444 | 780,044 | ||||||

| Of consolidated trusts (includes $3,939 and $2,271, respectively, at fair value) |

2,457,428 | 2,416,956 | ||||||

| Other liabilities (includes $629 and $893, respectively, related to consolidated trusts) |

13,535 | 13,673 | ||||||

|

|

|

|

|

|||||

| Total liabilities |

3,216,055 | 3,224,489 | ||||||

|

|

|

|

|

|||||

| Commitments and contingencies (Note 19) |

— | — | ||||||

| Fannie Mae stockholders’ equity (deficit): |

||||||||

| Senior preferred stock, 1,000,000 shares issued and outstanding |

112,578 | 88,600 | ||||||

| Preferred stock, 700,000,000 shares are authorized—555,374,922 and 576,868,139 shares issued and outstanding, respectively |

19,130 | 20,204 | ||||||

| Common stock, no par value, no maximum authorization—1,308,762,703 and 1,270,092,708 shares issued, respectively; 1,157,767,400 and 1,118,504,194 shares outstanding, respectively |

687 | 667 | ||||||

| Accumulated deficit |

(128,381 | ) | (102,986 | ) | ||||

| Accumulated other comprehensive loss |

(1,235 | ) | (1,682 | ) | ||||

| Treasury stock, at cost, 150,995,303 and 151,588,514 shares, respectively |

(7,403 | ) | (7,402 | ) | ||||

|

|

|

|

|

|||||

| Total Fannie Mae stockholders’ deficit |

(4,624 | ) | (2,599 | ) | ||||

|

|

|

|

|

|||||

| Noncontrolling interest |

53 | 82 | ||||||

|

|

|

|

|

|||||

| Total deficit |

(4,571 | ) | (2,517 | ) | ||||

|

|

|

|

|

|||||

| Total liabilities and deficit |

$ | 3,211,484 | $ | 3,221,972 | ||||

|

|

|

|

|

|||||

See Notes to Consolidated Financial Statements

| Fourth-Quarter and Full-Year 2011 Results | 13 |

(In conservatorship)

Consolidated Statements of Operations and Comprehensive Loss

(Dollars and shares in millions, except per share amounts)

| For the Year Ended December 31, |

||||||||||||

| 2011 | 2010 | 2009 | ||||||||||

| Interest income: |

||||||||||||

| Trading securities |

$ | 1,087 | $ | 1,251 | $ | 3,859 | ||||||

| Available-for-sale securities |

3,277 | 5,290 | 13,618 | |||||||||

| Mortgage loans (includes $123,633, $132,591, and $6,143, respectively, related to consolidated trusts) |

138,462 | 147,583 | 21,521 | |||||||||

| Other |

117 | 146 | 357 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total interest income |

142,943 | 154,270 | 39,355 | |||||||||

|

|

|

|

|

|

|

|||||||

| Interest expense: |

||||||||||||

| Short-term debt (includes $9, $12, and $- , respectively, related to consolidated trusts) |

310 | 631 | 2,306 | |||||||||

| Long-term debt (includes $108,641, $118,373, and $344, respectively, related to consolidated trusts) |

123,352 | 137,230 | 22,539 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total interest expense |

123,662 | 137,861 | 24,845 | |||||||||

|

|

|

|

|

|

|

|||||||

| Net interest income |

19,281 | 16,409 | 14,510 | |||||||||

| Provision for loan losses |

(25,914 | ) | (24,702 | ) | (9,569 | ) | ||||||

|

|

|

|

|

|

|

|||||||

| Net interest (loss) income after provision for loan losses |

(6,633 | ) | (8,293 | ) | 4,941 | |||||||

|

|

|

|

|

|

|

|||||||

| Investment gains, net |

506 | 346 | 1,458 | |||||||||

| Other-than-temporary impairments |

(614 | ) | (694 | ) | (9,057 | ) | ||||||

| Noncredit portion of other-than-temporary impairments recognized in other comprehensive income |

306 | (28 | ) | (804 | ) | |||||||

|

|

|

|

|

|

|

|||||||

| Net other-than-temporary impairments |

(308 | ) | (722 | ) | (9,861 | ) | ||||||

| Fair value losses, net |

(6,621 | ) | (511 | ) | (2,811 | ) | ||||||

| Debt extinguishment losses, net |

(232 | ) | (568 | ) | (325 | ) | ||||||

| Fee and other income |

1,163 | 1,084 | 7,984 | |||||||||

|

|

|

|

|

|

|

|||||||

| Non-interest loss |

(5,492 | ) | (371 | ) | (3,555 | ) | ||||||

|

|

|

|

|

|

|

|||||||

| Administrative expenses: |

||||||||||||

| Salaries and employee benefits |

1,236 | 1,277 | 1,133 | |||||||||

| Professional services |

736 | 942 | 684 | |||||||||

| Occupancy expenses |

179 | 170 | 205 | |||||||||

| Other administrative expenses |

219 | 208 | 185 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total administrative expenses |

2,370 | 2,597 | 2,207 | |||||||||

| Provision for guaranty losses |

804 | 194 | 63,057 | |||||||||

| Foreclosed property expense |

780 | 1,718 | 910 | |||||||||

| Other expenses |

866 | 927 | 8,219 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total expenses |

4,820 | 5,436 | 74,393 | |||||||||

|

|

|

|

|

|

|

|||||||

| Loss before federal income taxes |

(16,945 | ) | (14,100 | ) | (73,007 | ) | ||||||

| Benefit for federal income taxes |

(90 | ) | (82 | ) | (985 | ) | ||||||

|

|

|

|

|

|

|

|||||||

| Net loss |

(16,855 | ) | (14,018 | ) | (72,022 | ) | ||||||

| Other comprehensive income: |

||||||||||||

| Changes in unrealized losses on available-for-sale securities, net of reclassification adjustments and taxes |

622 | 3,504 | 11,136 | |||||||||

| Other |

(175 | ) | (60 | ) | 361 | |||||||

|

|

|

|

|

|

|

|||||||

| Total other comprehensive income |

447 | 3,444 | 11,497 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total comprehensive loss |

(16,408 | ) | (10,574 | ) | (60,525 | ) | ||||||

| Less: Comprehensive loss attributable to the noncontrolling interest |

— | 4 | 53 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total comprehensive loss attributable to Fannie Mae |

$ | (16,408 | ) | $ | (10,570 | ) | $ | (60,472 | ) | |||

|

|

|

|

|

|

|

|||||||

| Net loss |

$ | (16,855 | ) | $ | (14,018 | ) | $ | (72,022 | ) | |||

| Less: Net loss attributable to the noncontrolling interest |

— | 4 | 53 | |||||||||

|

|

|

|

|

|

|

|||||||

| Net loss attributable to Fannie Mae |

(16,855 | ) | (14,014 | ) | (71,969 | ) | ||||||

| Preferred stock dividends |

(9,614 | ) | (7,704 | ) | (2,474 | ) | ||||||

|

|

|

|

|

|

|

|||||||

| Net loss attributable to common stockholders |

$ | (26,469 | ) | $ | (21,718 | ) | $ | (74,443 | ) | |||

|

|

|

|

|

|

|

|||||||

| Loss per share—Basic and Diluted |

$ | (4.61 | ) | $ | (3.81 | ) | $ | (13.11 | ) | |||

| Weighted-average common shares outstanding—Basic and Diluted |

5,737 | 5,694 | 5,680 | |||||||||

See Notes to Consolidated Financial Statements

| Fourth-Quarter and Full-Year 2011 Results | 14 |

(In conservatorship)

Consolidated Statements of Cash Flows

(Dollars in millions)

| For the Year Ended December 31, | ||||||||||||

| 2011 | 2010 | 2009 | ||||||||||

| Cash flows used in operating activities: |

||||||||||||

| Net loss |

$ | (16,855 | ) | $ | (14,018 | ) | $ | (72,022 | ) | |||

| Reconciliation of net loss to net cash used in operating activities: |

||||||||||||

| Amortization of cost basis adjustments |

(369 | ) | 126 | 2,568 | ||||||||

| Provisions for loan and guaranty losses |

26,718 | 24,896 | 72,626 | |||||||||

| Valuation (gains) losses |

(408 | ) | (1,289 | ) | 3,425 | |||||||

| (Gains) losses from partnership investments |

(82 | ) | 74 | 6,735 | ||||||||

| Current and deferred federal income taxes |

1,044 | 258 | (1,919 | ) | ||||||||

| Purchases of loans held for sale |

(737 | ) | (81 | ) | (109,684 | ) | ||||||

| Proceeds from repayments of loans held for sale |

68 | 88 | 2,413 | |||||||||

| Net change in trading securities, excluding non-cash transfers |

(17,048 | ) | (23,612 | ) | 11,976 | |||||||

| Payments to servicers for foreclosed property expense and servicer incentive fees |

(5,394 | ) | (5,658 | ) | (2,570 | ) | ||||||

| Other, net |

(2,175 | ) | (8,179 | ) | 543 | |||||||

|

|

|

|

|

|

|

|||||||

| Net cash used in operating activities |

(15,238 | ) | (27,395 | ) | (85,909 | ) | ||||||

| Cash flows provided by investing activities: |

||||||||||||

| Purchases of trading securities held for investment |

(2,951 | ) | (8,547 | ) | (48,659 | ) | ||||||

| Proceeds from maturities of trading securities held for investment |

2,591 | 2,638 | 12,918 | |||||||||

| Proceeds from sales of trading securities held for investment |

1,526 | 21,556 | 39,261 | |||||||||

| Purchases of available-for-sale securities |

(192 | ) | (413 | ) | (165,103 | ) | ||||||

| Proceeds from maturities of available-for-sale securities |

13,552 | 17,102 | 48,096 | |||||||||

| Proceeds from sales of available-for-sale securities |

3,192 | 7,867 | 306,598 | |||||||||

| Purchases of loans held for investment |

(78,099 | ) | (86,724 | ) | (52,148 | ) | ||||||

| Proceeds from repayments of loans held for investment of Fannie Mae |

25,190 | 20,715 | 30,958 | |||||||||

| Proceeds from repayments of loans held for investment of consolidated trusts |

544,145 | 574,740 | 26,184 | |||||||||

| Net change in restricted cash |

12,881 | (15,025 | ) | — | ||||||||

| Advances to lenders |

(70,914 | ) | (74,130 | ) | (79,163 | ) | ||||||

| Proceeds from disposition of acquired property and short sales |

47,248 | 39,682 | 22,667 | |||||||||

| Contributions to partnership investments |

(178 | ) | (351 | ) | (688 | ) | ||||||

| Proceeds from partnership investments |

283 | 129 | 87 | |||||||||

| Net change in federal funds sold and securities purchased under agreements to resell or similar agreements |

(34,249 | ) | 41,471 | 4,230 | ||||||||

| Other, net |

363 | (531 | ) | (27,503 | ) | |||||||

|

|

|

|

|

|

|

|||||||

| Net cash provided by investing activities |

464,388 | 540,179 | 117,735 | |||||||||

| Cash flows used in financing activities: |

||||||||||||

| Proceeds from the issuance of debt of Fannie Mae |

766,598 | 1,155,993 | 1,930,907 | |||||||||

| Payments to redeem debt of Fannie Mae |

(815,838 | ) | (1,146,363 | ) | (2,030,705 | ) | ||||||

| Proceeds from issuance of debt of consolidated trusts |

233,516 | 276,575 | 58 | |||||||||

| Payments to redeem debt of consolidated trusts |

(647,695 | ) | (808,502 | ) | (601 | ) | ||||||

| Payments of cash dividends on senior preferred stock to Treasury |

(9,613 | ) | (7,706 | ) | (2,470 | ) | ||||||

| Proceeds from senior preferred stock purchase agreement with Treasury |

23,978 | 27,700 | 59,900 | |||||||||

| Net change in federal funds purchased and securities sold under agreements to repurchase |

— | 49 | (54 | ) | ||||||||

| Other, net |

146 | (45 | ) | 18 | ||||||||

|

|

|

|

|

|

|

|||||||

| Net cash used in financing activities |

(448,908 | ) | (502,299 | ) | (42,947 | ) | ||||||

| Net increase (decrease) in cash and cash equivalents |

242 | 10,485 | (11,121 | ) | ||||||||

| Cash and cash equivalents at beginning of period |

17,297 | 6,812 | 17,933 | |||||||||

|

|

|

|

|

|

|

|||||||

| Cash and cash equivalents at end of period |

$ | 17,539 | $ | 17,297 | $ | 6,812 | ||||||

|

|

|

|

|

|

|

|||||||

| Cash paid during the period for: |

||||||||||||

| Interest |

$ | 128,806 | $ | 140,651 | $ | 26,344 | ||||||

| Income taxes |

— | — | 876 | |||||||||

| Non-cash activities (excluding impact of the transition to the consolidation accounting guidance): |

||||||||||||

| Net mortgage loans acquired by assuming debt |

$ | 448,437 | $ | 484,699 | $ | — | ||||||

| Net transfers from (to) mortgage loans held for investment of Fannie Mae to (from) mortgage loans held for investment of consolidated trusts |

33,859 | (121,852 | ) | — | ||||||||

| Transfers from advances to lenders to investments in securities |

— | — | 77,191 | |||||||||

| Transfers from advances to lenders to loans held for investment of consolidated trusts |

69,223 | 68,385 | — | |||||||||

| Net transfers from mortgage loans to acquired property |

56,517 | 66,081 | 5,707 | |||||||||

See Notes to Consolidated Financial Statements

| Fourth-Quarter and Full-Year 2011 Results | 15 |

(In conservatorship)

Consolidated Statements of Changes in Equity (Deficit)

(Dollars and shares in millions, except per share amounts)

| Fannie Mae Stockholders’ Equity (Deficit) | ||||||||||||||||||||||||||||||||||||||||||||||||

| Shares Outstanding | Senior Preferred |

Preferred Stock |

Common Stock |

Additional Paid-In Capital |

Retained Earnings (Accumulated Deficit) |

Accumulated Other Comprehensive Loss |

Treasury Stock |

Non Controlling Interest |

Total Equity (Deficit) |

|||||||||||||||||||||||||||||||||||||||

| Senior Preferred |

Preferred | Common | ||||||||||||||||||||||||||||||||||||||||||||||

| Balance as of December 31, 2008 |

1 | 597 | 1,085 | $ | 1,000 | $ | 21,222 | $ | 650 | $ | 3,621 | $ | (26,790 | ) | $ | (7,673 | ) | $ | (7,344 | ) | $ | 157 | $ | (15,157 | ) | |||||||||||||||||||||||

| Cumulative effect from the adoption of the accounting guidance on other-than-temporary impairments, net of tax |

— | — | — | — | — | — | — | 8,520 | (5,556 | ) | — | — | 2,964 | |||||||||||||||||||||||||||||||||||

| Change in investment in noncontrolling interest |

— | — | — | — | — | — | — | — | — | — | (13 | ) | (13 | ) | ||||||||||||||||||||||||||||||||||

| Comprehensive loss: |

||||||||||||||||||||||||||||||||||||||||||||||||

| Net loss |

— | — | — | — | — | — | — | (71,969 | ) | — | — | (53 | ) | (72,022 | ) | |||||||||||||||||||||||||||||||||

| Other comprehensive income, net of tax effect: |

||||||||||||||||||||||||||||||||||||||||||||||||

| Changes in net unrealized losses on available-for-sale securities (net of tax of $2,658) |

— | — | — | — | — | — | — | — | 4,936 | — | — | 4,936 | ||||||||||||||||||||||||||||||||||||

| Reclassification adjustment for other-than-temporary impairments recognized in net loss (net of tax of $3,441) |

— | — | — | — | — | — | — | — | 6,420 | — | — | 6,420 | ||||||||||||||||||||||||||||||||||||

| Reclassification adjustment for gains included in net loss (net of tax of $119) |

— | — | — | — | — | — | — | — | (220 | ) | — | — | (220 | ) | ||||||||||||||||||||||||||||||||||

| Unrealized gains on guaranty assets and guaranty fee buy-ups |

— | — | — | — | — | — | — | — | 245 | — | — | 245 | ||||||||||||||||||||||||||||||||||||

| Amortization of net cash flow hedging gains |

— | — | — | — | — | — | — | — | 9 | — | — | 9 | ||||||||||||||||||||||||||||||||||||

| Prior service cost and actuarial gains, net of amortization for defined benefit plans |

— | — | — | — | — | — | — | — | 107 | — | — | 107 | ||||||||||||||||||||||||||||||||||||

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||

| Total comprehensive loss |

(60,525 | ) | ||||||||||||||||||||||||||||||||||||||||||||||

| Senior preferred stock dividends |

— | — | — | — | — | — | (2,470 | ) | — | — | — | — | (2,470 | ) | ||||||||||||||||||||||||||||||||||

| Increase to senior preferred liquidation |

— | — | — | 59,900 | — | — | — | — | — | — | — | 59,900 | ||||||||||||||||||||||||||||||||||||

| Conversion of convertible preferred stock into common stock |

— | (17 | ) | 27 | — | (874 | ) | 14 | 860 | — | — | — | — | — | ||||||||||||||||||||||||||||||||||

| Other |

— | — | 1 | — | — | — | 72 | 2 | — | (54 | ) | — | 20 | |||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

| Balance as of December 31, 2009 |

1 | 580 | 1,113 | $ | 60,900 | $ | 20,348 | $ | 664 | $ | 2,083 | $ | (90,237 | ) | $ | (1,732 | ) | $ | (7,398 | ) | $ | 91 | $ | (15,281 | ) | |||||||||||||||||||||||

| Cumulative effect from the adoption of the accounting guidance on transfers of financial assets and consolidation |

— | — | — | — | — | — | — | 6,706 | (3,394 | ) | — | (14 | ) | 3,298 | ||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

| Balance as of January 1, 2010, adjusted |

1 | 580 | 1,113 | 60,900 | 20,348 | 664 | 2,083 | (83,531 | ) | (5,126 | ) | (7,398 | ) | 77 | (11,983 | ) | ||||||||||||||||||||||||||||||||

| Change in investment in noncontrolling interest |

— | — | — | — | — | — | — | — | — | — | 9 | 9 | ||||||||||||||||||||||||||||||||||||

| Comprehensive loss: |

||||||||||||||||||||||||||||||||||||||||||||||||

| Net loss |

— | — | — | — | — | — | — | (14,014 | ) | — | — | (4 | ) | (14,018 | ) | |||||||||||||||||||||||||||||||||

| Other comprehensive income, net of tax effect: |

||||||||||||||||||||||||||||||||||||||||||||||||

| Changes in net unrealized losses on available-for-sale securities (net of tax of $1,644) |

— | — | — | — | — | — | — | — | 3,054 | — | — | 3,054 | ||||||||||||||||||||||||||||||||||||

| Reclassification adjustment for other-than-temporary impairments recognized in net loss (net of tax of $253) |

— | — | — | — | — | — | — | — | 469 | — | — | 469 | ||||||||||||||||||||||||||||||||||||

| Reclassification adjustment for gains included in net loss (net of tax of $10) |

— | — | — | — | — | — | — | — | (19 | ) | — | — | (19 | ) | ||||||||||||||||||||||||||||||||||

| Unrealized gains on guaranty assets and guaranty fee buy-ups |

— | — | — | — | — | — | — | — | 1 | — | — | 1 | ||||||||||||||||||||||||||||||||||||

| Prior service cost and actuarial gains, net of amortization for defined benefit plans |

— | — | — | — | — | — | — | — | (61 | ) | — | — | (61 | ) | ||||||||||||||||||||||||||||||||||

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||

| Total comprehensive loss |

(10,574 | ) | ||||||||||||||||||||||||||||||||||||||||||||||

| Senior preferred stock dividends |

— | — | — | — | — | — | (2,265 | ) | (5,441 | ) | — | — | — | (7,706 | ) | |||||||||||||||||||||||||||||||||

| Increase to senior preferred liquidation |

— | — | — | 27,700 | — | — | — | — | — | — | — | 27,700 | ||||||||||||||||||||||||||||||||||||

| Conversion of convertible preferred stock into common stock |

— | (3 | ) | 5 | — | (144 | ) | 3 | 141 | — | — | — | — | — | ||||||||||||||||||||||||||||||||||

| Other |

— | — | 1 | — | — | — | 41 | — | — | (4 | ) | — | 37 | |||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

| Balance as of December 31, 2010 |

1 | 577 | 1,119 | 88,600 | 20,204 | 667 | — | (102,986 | ) | (1,682 | ) | (7,402 | ) | 82 | (2,517 | ) | ||||||||||||||||||||||||||||||||

| Change in investment in noncontrolling |

— | — | — | — | — | — | — | — | — | — | (29 | ) | (29 | ) | ||||||||||||||||||||||||||||||||||

| Comprehensive loss: |

||||||||||||||||||||||||||||||||||||||||||||||||

| Net loss |

— | — | — | — | — | — | — | (16,855 | ) | — | — | — | (16,855 | ) | ||||||||||||||||||||||||||||||||||

| Other comprehensive income, net of tax effect: |

||||||||||||||||||||||||||||||||||||||||||||||||

| Changes in net unrealized losses on available-for-sale securities (net of tax of $250) |

— | — | — | — | — | — | — | — | 465 | — | — | 465 | ||||||||||||||||||||||||||||||||||||

| Reclassification adjustment for other-than-temporary impairments recognized in net loss (net of tax of $99) |

— | — | — | — | — | — | — | — | 209 | — | — | 209 | ||||||||||||||||||||||||||||||||||||

| Reclassification adjustment for gains included in net loss (net of tax of $28) |

— | — | — | — | — | — | — | — | (52 | ) | — | — | (52 | ) | ||||||||||||||||||||||||||||||||||

| Prior service cost and actuarial gains, net of amortization for defined benefit plans |

— | — | — | — | — | — | — | — | (175 | ) | — | — | (175 | ) | ||||||||||||||||||||||||||||||||||

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||

| Total comprehensive loss |

(16,408 | ) | ||||||||||||||||||||||||||||||||||||||||||||||

| Senior preferred stock dividends |

— | — | — | — | — | — | (1,072 | ) | (8,541 | ) | — | — | — | (9,613 | ) | |||||||||||||||||||||||||||||||||

| Increase to senior preferred liquidation |

— | — | — | 23,978 | — | — | — | — | — | — | — | 23,978 | ||||||||||||||||||||||||||||||||||||

| Conversion of convertible preferred stock into common stock |

— | (21 | ) | 39 | — | (1,074 | ) | 20 | 1,054 | — | — | — | — | — | ||||||||||||||||||||||||||||||||||

| Other |

— | — | — | — | — | — | 18 | 1 | — | (1 | ) | — | 18 | |||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

| Balance as of December 31, 2011 |

1 | 556 | 1,158 | $ | 112,578 | $ | 19,130 | $ | 687 | $ | — | $ | (128,381 | ) | $ | (1,235 | ) | $ | (7,403 | ) | $ | 53 | $ | (4,571 | ) | |||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

See Notes to Consolidated Financial Statements

| Fourth-Quarter and Full-Year 2011 Results | 16 |