Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - PROSPERITY BANCSHARES INC | d307356d8k.htm |

| EX-2.1 - AGREEMENT AND PLAN OF REORGANIZATION - PROSPERITY BANCSHARES INC | d307356dex21.htm |

| EX-99.2 - PRESS RELEASE - PROSPERITY BANCSHARES INC | d307356dex992.htm |

Exhibit 99.1

Merger with American State Financial Corp

February 27,

2012 |

2

“Safe Harbor”

Statement

“Safe Harbor”

Statement

under the Private Securities Litigation Reform Act of 1995

Statements contained in this presentation which are not

historical facts and which pertain to future operating results

of

Prosperity

Bancshares

®

and

its

subsidiaries

constitute

“forward-looking

statements”

within

the

meaning

of

the

Private Securities Litigation reform Act of 1995. These

forward-looking statements involve significant risks and

uncertainties. Actual results may differ materially from the

results discussed in these forward-looking statements. Factors

that might cause such a difference include, but are not limited

to, those discussed in the company’s periodic filings with the

SEC.

Copies

of

the

SEC

filings

for

Prosperity

Bancshares

®

may be downloaded from the Internet at no charge from

www.prosperitybanktx.com. |

3

Strategic Rationale

Strategic Rationale

•

American State merger marks Prosperity’s entry into West Texas in a

significant way:

–

Expands Prosperity west of I-35 and creates a presence in 18 new

counties, for a total of 78 counties of operation upon

completion –

American State is ranked in the top three by deposit market share in

each of the following attractive markets: Lubbock, Abilene and

Odessa –

Creates ample opportunities for in-market consolidation in new

markets across Texas •

Creates the second largest bank focused solely on Texas with

approximately $14 billion in assets:

–

Improves Texas deposit market share ranking to the seventh position

from number nine –

Significantly increases the C&I loan portfolio, increasing from

approximately $440 million to over $740 million

–

Complementary balance sheets as American State brings high quality,

low cost deposits and pristine asset quality

•

Following

the

merger,

Prosperity

will

be

the

51st

largest

U.S.

headquartered

banking

institution |

4

Assumptions & Impact

Assumptions & Impact

•

Expected to be approximately 8% accretive to earnings per share

•

The tangible common equity ratio is restored in approximately one

year •

Preliminary loan mark is approximately equal to American State’s

current loan loss reserve

•

Non-deposit fee revenue is enhanced through the merger

•

Through the merger Prosperity will acquire a trust department with $850

million in assets under management |

5

Pro Forma Branch Franchise

Pro Forma Branch Franchise

(1) PB pro forma for pending and recently completed

acquisitions: Texas Bankers, East Texas Financial Services and Bank Arlington

(2) ASFC excludes one drive thru branch in Odessa and eight

mobile deposit services for nursing homes that do not retain deposits

PB

(1)

(178)

ASFC

(2)

(37)

Texas Deposit Market Share

Source: SNL Financial and Microsoft MapPoint; Deposit data as of June 30, 2011 |

6

Merger Summary

Merger Summary

Merger Partner:

American State Financial Corporation

(“American State”

or “ASFC”)

Aggregate Value:

$529.2 million

(1)

Termination Fee:

$20.0 million (3.8% of transaction value)

Due Diligence:

Completed

(1) Based on PB closing price of $41.14 on

2/24/2012 Consideration:

66.3% stock / 33.7% cash

Each share of American State common stock will be

converted into the right to receive the pro-rata share

of $178.5 million in cash and 8,525,000 shares of PB

common stock |

7

Transaction Highlights

Transaction Highlights

(1)

Based on PB closing price of $41.14 on 2/24/2012

(2)

ASFC balance sheet and income statement data as of 12/31/2012; earnings

estimates per PB management (3)

Calculated as the premium paid to tangible book value as a percentage

of total deposits Source: SNL Financial

Anticipated Closing:

Third Quarter 2012

Pre-tax Cost Savings:

20.0%

Transaction Multiples:

Merger Price to:

(1),(2)

Book Value:

1.89x

Tang. Book Value:

2.06x

LTM Earnings:

12.6x

2012 Earnings Estimate:

13.6x

Deposit Premium:

(3)

11.1%

|

8

Management Retention

Management Retention

The following members of American State’s management will join

Prosperity’s executive team:

Management

Current Role

Prosperity Position

W. R. Collier

Chairman & CEO

-

Holding Company Board Member

-

Senior Chairman –

West Texas Area

Michael F. Epps

Vice Chairman & President

-

Chairman –

West Texas Area

-

Prosperity Management Committee

Tony Whitehead

President –

Lubbock

Division

-

President –

West Texas Area

-

Prosperity Management Committee

Additionally, four Prosperity Bank

board seats will be offered to the

following American State Bank

Directors:

Directors

Industry

Scott Collier

Construction

Mark Kirkpatrick

Ranching / Oil & Gas

Van May

Agribusiness

Don Pickering

Manufacturing |

9

American State

Financial Highlights

American State

Financial Highlights

•

Founded in 1948 in

Lubbock, TX

•

Consistent growth and

profitability through

recession

•

Operates 37 locations

across 18 counties

•

Established presence in

core markets of operation

Source: SNL Financial

($mm)

At or for the year ended December 31,

'08 -

'11

2008

2009

2010

2011

CAGR

Balance Sheet

Total Assets

$2,203.4

$2,406.7

$2,690.8

$3,081.7

11.8%

Total Net Loans

979.7

1,036.5

1,073.7

1,174.3

6.2%

Securities

1,000.9

1,149.5

1,225.1

1,587.8

16.6%

Deposits

1,766.1

1,931.8

2,157.1

2,459.5

11.7%

Total Equity

229.5

231.8

250.9

279.7

6.8%

Balance Sheet Ratios

Loans / Deposits (%)

56.5

54.9

51.0

49.3

TCE / TA (%)

9.45

8.75

8.53

8.38

Leverage Ratio (%)

9.49

8.79

8.82

8.15

Tier 1 Ratio (%)

15.71

15.30

16.37

15.03

Total Capital Ratio (%)

16.79

16.45

17.62

16.29

Profitability Ratios

ROAA (%)

1.28

1.27

1.44

1.48

ROAE (%)

11.54

12.75

14.70

15.85

Net Interest Margin (%)

3.58

3.89

3.85

3.62

Efficiency Ratio (%)

57.5

55.0

55.1

53.3

Fee Inc / Operating Rev (%)

32.6

29.5

29.1

29.4

Asset Quality

NPAs / Loans + OREO (%)

1.62

2.38

0.98

0.76

NCOs / Avg Loans (%)

0.55

1.12

0.32

0.01

Reserves / Loans (%)

1.40

1.46

1.68

2.02

Texas Ratio (%)

7.37

13.37

4.42

3.61 |

10

Established Presence in

Core Markets of Operation

Established Presence in

Core Markets of Operation

American State has significant deposit market share in its markets,

including top three rankings in the attractive Lubbock, Abilene

and Odessa markets Note:

ASFC excludes one drive thru branch in Odessa, eight mobile deposit

services for nursing homes that do not retain deposits (seven in Lubbock and one in Abilene) and six branches not defined

by an MSA representing $199 million in deposits

Represents a top 5 market share

Source: SNL Financial and Microsoft MapPoint; Deposit data as of June

30, 2011 American State Deposit Market

Share by Texas MSA MSA

Market

Rank

Branch

Count

Deposits

in Market

($mm)

Market

Share

(%)

Population

2010

(Actual)

Proj. HH

Income

2010-15

(%)

Lubbock

3

9

737.5

12.2

276,354

15.2

Abilene

2

6

316.5

13.9

161,179

15.6

Odessa

2

4

282.2

12.6

134,891

14.5

Midland

8

2

228.3

4.9

133,025

10.9

Plainview

2

1

125.0

23.5

35,071

12.9

Levelland

3

1

87.4

17.4

22,344

14.9

Snyder

4

1

86.5

22.1

16,060

14.2

Big Spring

5

1

40.2

8.0

33,702

14.8

Brownwood

5

2

29.0

5.5

38,784

14.3

Granbury

8

2

26.3

2.9

61,010

8.4

San Angelo

13

1

19.5

1.1

109,521

14.5

Dallas-Fort Worth

157

1

18.3

0.0

6,540,927

11.5

MSA Totals

31

1,996.7

7,562,868 |

11

West Texas Markets

Economies at a Glance

West Texas Markets

Economies at a Glance

Lubbock MSA

Abilene MSA

Midland-Odessa “Petroplex”

(1) Midland-Odessa combined unemployment rate

calculated as a weighted average of Midland and Odessa MSA unemployment rates

Source: 2010 Census Bureau, Unemployment rates per Bureau of Labor

Statistics as of December 2011 •

Population: approximately 275,000; unemployment rate: 5.3%

•

Serves as the economic, education and health care hub of the South

Plains region •

Home to Texas Tech University (30,000+ students) and Lubbock Christian

University (1,500+)

•

Largest contiguous cotton-growing region in the world

•

Population: approximately 160,000; unemployment rate: 6.0%

•

Home to Dyess Air Force Base, a 6,000 acre military facility home to

13,000 military and civilian people with an annual economic

impact of $310 million •

Diverse economy, including wind, medical, oil and high tech

industries, has stabilized the region and weathered the

recession’s regional impact •

Combined

population:

approximately

274,000;

unemployment

rate:

4.5%

(1)

•

Located on the Permian Basin, a petroleum rich area of West Texas, and

home to the New York Mercantile Exchange’s benchmark West

Texas Intermediate Crude •

Combined economies grew 13.5% in 2011 as high crude prices have driven

record consumer spending and a strong housing market

|

12

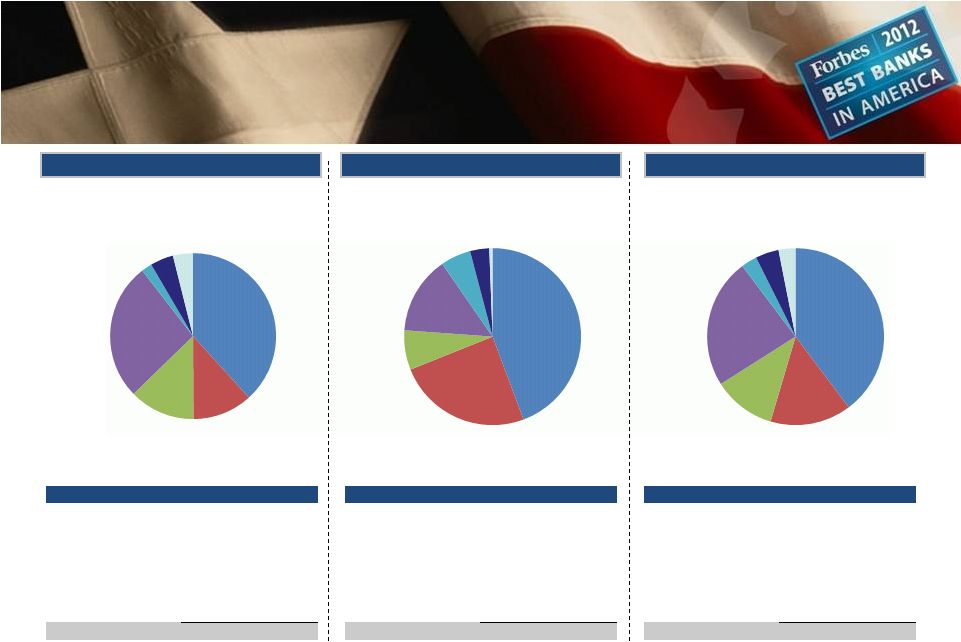

Pro Forma Loan Composition

Pro Forma Loan Composition

Prosperity Bancshares, Inc.

American State Financial Corporation

Pro Forma

Loan Portfolio ($000)

% of Total

Commercial R.E.

1,441,226

$

38.3%

Commercial

439,854

11.7%

Construction

482,140

12.8%

1-4 Family Residential

1,007,266

26.7%

Consumer

78,187

2.1%

Agriculture

170,234

4.5%

Home Equity

146,999

3.9%

Gross Loans

3,765,906

$

100.0%

Yield on Loans

5.70%

Loan Portfolio ($000)

% of Total

Commercial R.E.

537,051

$

44.3%

Commercial

298,219

24.6%

Construction

87,575

7.2%

1-4 Family Residential

172,364

14.2%

Consumer

66,944

5.5%

Agriculture

42,466

3.5%

Home Equity

7,271

0.6%

Gross Loans

1,211,890

$

100.0%

Yield on Loans

5.24%

Loan Portfolio ($000)

% of Total

Commercial R.E.

1,978,277

$

39.7%

Commercial

738,073

14.8%

Construction

569,715

11.4%

1-4 Family Residential

1,179,630

23.7%

Consumer

145,131

2.9%

Agriculture

212,700

4.3%

Home Equity

154,270

3.1%

Gross Loans

4,977,796

$

100.0%

Yield on Loans

5.59%

Source: PB’s 4 Quarter 2012 Earnings

Release and company documents for American State; Data as of December 31, 2011; Yield on loans as of quarter ended December 31, 2011

Commercial

R.E.

38.3%

Commercial

11.7%

Construction

12.8%

1-4 Family

Residential

26.7%

Consumer

2.1%

Agriculture

4.5%

Home

Equity

3.9%

Commercial

R.E.

44.3%

Commercial

24.6%

Construction

7.2%

1-4 Family

Residential

14.2%

Consumer

5.5%

Agriculture

3.5%

Home

Equity

0.6%

Commercial

R.E.

39.7%

Commercial

14.8%

Construction

11.4%

1-4 Family

Residential

23.7%

Consumer

2.9%

Agriculture

4.3%

Home

Equity

3.1%

th |

13

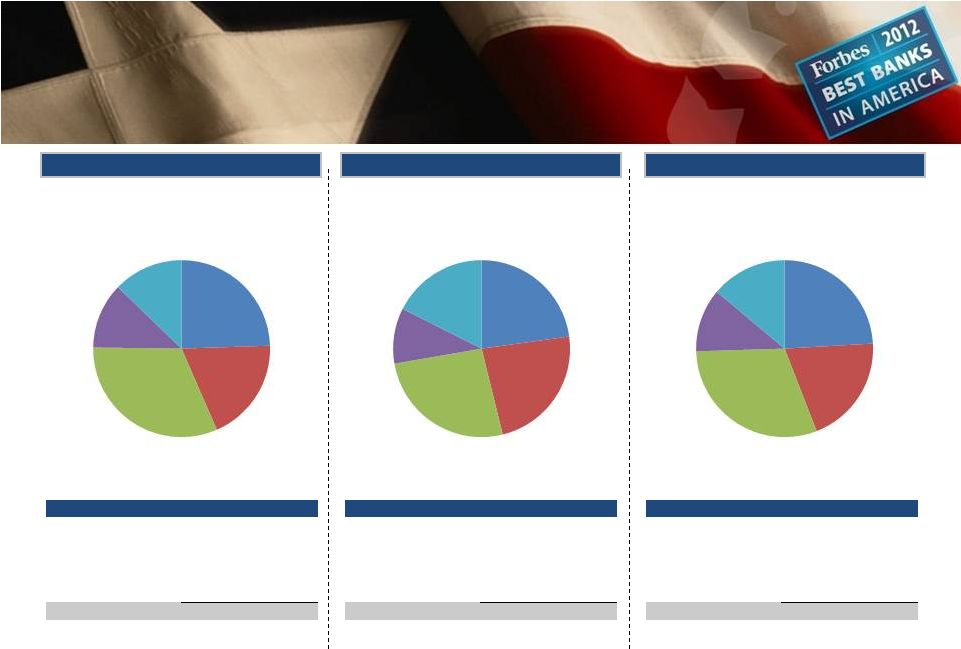

Pro Forma Deposit Composition

Pro Forma Deposit Composition

Prosperity Bancshares, Inc.

American State Financial Corporation

Pro Forma

Deposit Portfolio ($000)

% of Total

Non-interest Bearing DDA

1,972,226

$

24.5%

Interest Bearing DDA

1,532,701

19.0%

MMA & Savings

2,557,023

31.7%

CD's & IRA's<100m

968,806

12.0%

CD's & IRA's>100m

1,029,498

12.8%

Total Deposits

8,060,254

$

100.0%

Cost of Total Deposits

0.44%

Deposit Portfolio ($000)

% of Total

Non-interest Bearing DDA

561,065

$

22.8%

Interest Bearing DDA

574,094

23.3%

MMA & Savings

642,744

26.1%

CD's & IRA's<100m

249,553

10.1%

CD's & IRA's>100m

432,073

17.6%

Total Deposits

2,459,529

$

100.0%

Cost of Total Deposits

0.42%

Deposit Portfolio ($000)

% of Total

Non-interest Bearing DDA

2,533,291

$

24.1%

Interest Bearing DDA

2,106,795

20.0%

MMA & Savings

3,199,767

30.4%

CD's & IRA's<100m

1,218,359

11.6%

CD's & IRA's>100m

1,461,571

13.9%

Total Deposits

10,519,783

$

100.0%

Cost of Total Deposits

0.44%

Non-interest

Bearing

DDA

24.5%

Interest

Bearing

DDA

19.0%

MMA &

Savings

31.7%

CD's &

IRA's<100m

12.0%

CD's &

IRA's>100m

12.8%

Non-interest

Bearing

DDA

22.8%

Interest

Bearing

DDA

23.3%

MMA &

Savings

26.1%

CD's &

IRA's<100m

10.1%

CD's &

IRA's>100m

17.6%

Non-interest

Bearing

DDA

24.1%

Interest

Bearing

DDA

20.0%

MMA &

Savings

30.4%

CD's &

IRA's<100m

11.6%

CD's &

IRA's>100m

13.9%

Source: PB’s 4 Quarter 2012 Earnings

Release and company documents for American State; Data as of December 31, 2011; Cost of deposits as of quarter ended December 31, 2011

th |

14

Capital Ratio Analysis

Capital Ratio Analysis

(1)

(2)

($mm)

PB

ASFC

Pro Forma

12/31/11

12/31/11

9/30/12

Balance Sheet

Total Assets

9,823

$

3,082

$

13,969

$

Tangible Assets

8,877

3,058

12,743

Risk Weighted Assets

4,357

1,628

6,285

8,784

3,003

12,293

Deposits

8,060

2,460

11,055

Capital

Tangible Common Equity

622

256

808

Tier 1 Capital

693

245

880

Total Capital

745

265

933

Capital Ratios

TCE / TA

7.0%

8.4%

6.3%

Leverage

7.9%

8.1%

7.2%

Tier 1 Capital

15.9%

15.0%

14.0%

Total Capital

17.1%

16.3%

14.9%

Average Assets for Leverage Ratio

(1)

Estimated close is pro forma for pending and recently completed

acquisitions: Texas Bankers, East Texas Financial Services, Bank Arlington, and American State Financial Corporation

(2)

Calculated as average assets less non-allowable intangibles; per

regulatory guidance |

15

Contact Information

Contact Information

Corporate Headquarters

Investor Contacts

Prosperity Bank Plaza

David Zalman

4295 San Felipe

Chairman & Chief Executive Officer

Houston, Texas 77027

979.543.2200

david.zalman@prosperitybanktx.com

281.269.7199 Telephone

Dan Rollins

281.269-7222 Fax

President & Chief Operating Officer

www.prosperitybanktx.com

281.269.7199

dan.rollins@prosperitybanktx.com

David Hollaway

Chief Financial Officer

281.269.7199

david.hollaway@prosperitybanktx.com |

ASFC Merger

Presentation -

2/27/12 |