Attached files

| file | filename |

|---|---|

| 8-K - 8-K - WCA WASTE CORP | d303606d8k.htm |

Change

2010 vs 2011E

2010

2011E

$

%

Volume

(0.7%)

Price

3.0%

Revenue

Collection

$123.1

$153.4

$30.3

24.6%

Disposal

98.8

102.9

4.1

4.1%

Transfer

35.0

40.9

5.9

16.9%

Other

12.5

19.7

7.2

57.6%

Eliminations

(39.9)

(43.1)

(3.2)

8.0%

Total revenue

$229.5

$273.8

$44.3

19.3%

Internalization

71.6%

68.1%

(3.5%)

EBITDA

53.1

57.7

4.6

8.7%

% margin

23.1%

21.1%

(2.0%)

Adj. EBITDA

$56.2

$62.7

$6.5

11.6%

% margin

24.5%

22.9%

(1.6%)

Capex

$31.3

$31.8

$0.5

1.6%

2011Estimated Results

2011 Estimated Results Commentary

Revenue was up 19.3% year-over-year, driven by

acquisitions and pricing growth

Completed 3 acquisitions in Q1 2011 that accounted for

$36 million of revenue increase

Largest was Emerald Waste acquisition (Central Florida)

Lower operating margins year-over-year can be partially

attributed to higher fuel and rail costs, a change in the mix

of revenue and M&A related costs

Cost of diesel as a percentage of revenue was 8.2% for

2011E, up from 6.3% in the prior year, resulting in lower

margins

Mix of revenue included more residential services

following the acquisition of Emerald Waste Services

$1.8 million of M&A costs during 2011E; majority related

to Macquarie acquisition

Comparative Results

($ in millions)

Note:

2011E represents unaudited actual results.

2011E not

pro forma for North Carolina and South Carolina asset sales.

–

–

–

–

–

Exhibit 99.1 |

Reconcilliation of Adjusted EBITDA

($ in millions)

2011E

Net income (loss)

($2.4)

Add: Depreciation and amortization

33.5

Add: Interest expense

20.2

Add: Taxes

0.5

Add: Write-off of deferred financing costs

0.2

Add: Loss on early extinguishment of debt

5.8

EBITDA

$57.7

Add: One-time merger & acquisition related expenses

1.8

Add: Accretion expense for closure and post-closure obligations

1.0

Add: Non-cash stock-based compensation

2.2

Adj. EBITDA

$62.7

Pro forma adjustments:

Add: Public company costs

1.4

Add: Reduced senior management costs

1.7

Add: Stoughton and Emerald Waste run-rate adjustments

1.3

Less: EBITDA from North and South Carolina assets

(3.5)

Other

1.2

Total pro forma Adj. EBITDA

$64.7

Includes cost savings related to audit fees, legal fees, tax

preparation

fees,

investor

relations

and

directors’

fees

and

shares

Includes run-rate adjustments for the full year impact of the

acquisitions completed during 2011

Cost savings from realignment of management team and new

employment contracts

Removes the EBITDA impact for the assets that are being sold to

Waste Industries

Includes $0.3 million related to termination of a host Ohio landfill

fee

(terminated

effective

July

1,

2011)

and

$0.8

million

related

to

the City of Ada contract awarded in October 2011

Includes

fees

related

to

M&A

activity;

majority

of

costs

related

to

proposed acquisition by MIP II |

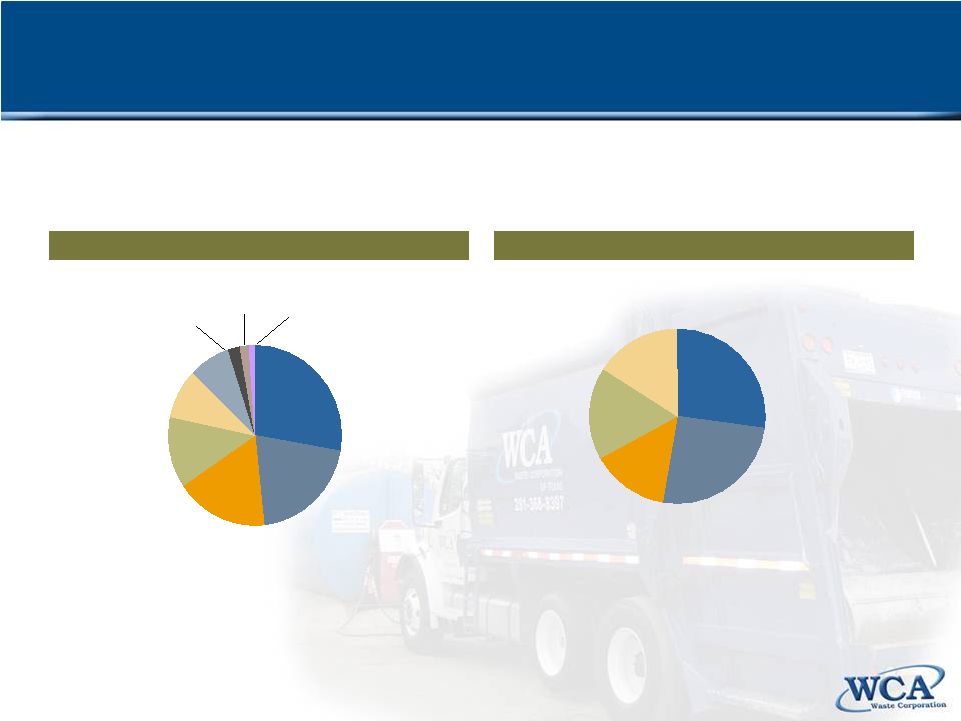

Residential

$66.0

Roll-off

$37.8

Commercial

$41.3

Disposal

$71.0

Transfer & other

$44.8

27.2%

17.2%

15.8%

25.3%

14.5%

2011 Estimated Revenue by Geography

2011 Estimated Revenue by Business Type

1.6%

27.8%

2.4%

8.9%

1.0%

17.1%

20.6%

Arkansas

$23.1

Texas

$72.6

Missouri / Kansas

$53.7

Tennesse

$2.7

Alabama

$6.3

Florida

$33.4

Colorado /

New Mexico $4.3

7.7%

12.8%

Ohio / Massachusetts

$44.7

Oklahoma

$20.0

($ in millions)

Note:

Pro forma for the North and South Carolina asset sale.

(1)

Defined

as

ratio

of

intercompany

disposal

expense

to

total

gross

disposal

expense.

Company Overview

($ in millions) |

Company Overview (Continued)

Residential

46%

Commercial

28%

Roll-off

26%

2011 Estimated Collection Revenue by Service |

Historical Change in Volume and Pricing

Volume change

Pricing change

(3.1%)

(2.0%)

(4.8%)

(3.0%)

(9.8%)

(6.9%)

(5.3%)

(10.3%)

(5.6%)

(0.5%)

(3.5%)

2.0%

(2.4%)

(2.8%)

3.0%

(0.4%)

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

2008

2009

2010

2011

Note:

Reflects year-on-year volume and pricing change.

5.4%

4.0%

4.0%

5.3%

5.7%

2.2%

(0.1%)

(1.8%)

(2.3%)

(2.1%)

1.1%

0.2%

3.8%

3.5%

1.7%

2.3%

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

2008

2009

2010

2011

C&D proportion

of revenue:

43%

36%

35%

25% |