Attached files

| file | filename |

|---|---|

| 8-K - UIL HOLDINGS CORPORATION 8-K 02-22-2012 - UIL HOLDINGS CORP | form8k.htm |

| EX-99.1 - EXHIBIT 99.1 - UIL HOLDINGS CORP | ex99_1.htm |

4Q & FY ‘11 Earnings

4Q & FY 2011 Earnings Presentation

February 23, 2012

Exhibit 99.1

4Q & FY ‘11 Earnings

2

Note to Investors

Certain statements contained herein, regarding matters that are not historical facts, are forward-looking statements (as defined in the

Private Securities Litigation Reform Act of 1995). These include statements regarding management’s intentions, plans, beliefs,

expectations or forecasts for the future. Such forward-looking statements are based on UIL Holdings’ expectations and involve risks and

uncertainties; consequently, actual results may differ materially from those expressed or implied in the statements. Such risks and

uncertainties include, but are not limited to, general economic conditions, legislative and regulatory changes, changes in demand for

electricity, gas and other products and services, unanticipated weather conditions, changes in accounting principles, policies or

guidelines, and other economic, competitive, governmental, and technological factors affecting the operations, markets, products and

services of UIL Holdings’ subsidiaries, The United Illuminating Company, The Southern Connecticut Gas Company, Connecticut

Natural Gas Corporation and The Berkshire Gas Company. Such risks and uncertainties with respect to UIL Holdings’ recent

acquisition of The Southern Connecticut Gas Company, Connecticut Natural Gas Corporation and The Berkshire Gas Company

include, but are not limited to, the possibility that the expected benefits will not be realized, or will not be realized within the expected

time period. The foregoing and other factors are discussed and should be reviewed in UIL Holdings’ most recent Annual Report on

Form 10-K and other subsequent periodic filings with the Securities and Exchange Commission. Forward-looking statements included

herein speak only as of the date hereof and UIL Holdings undertakes no obligation to revise or update such statements to reflect events

or circumstances after the date hereof or to reflect the occurrence of unanticipated events or circumstances.

James Torgerson

President and Chief Executive Officer

Richard Nicholas

Executive Vice President and Chief Financial Officer

4Q & FY ‘11 Earnings

2011 Accomplishments/Milestones

ü Successful integration of gas companies, electric company and UIL

ü Implemented growth strategy for natural gas heating conversions

§ Converted approximately 8,300 customers in 2011 - 22% above the 2010 level

ü GenConn Middletown became operational

§ GenConn Devon & GenConn Middletown are now fully operational and

operating in the ISO-New England markets

operating in the ISO-New England markets

ü Invested in Connecticut portion of New England East West Solution

projects

projects

§ $10.9 million through February 2012

q Remaining deposits expected over a period of three to five years

ü Continued success in executing on 10-year capital expenditure plan -

driving long-term earnings growth

driving long-term earnings growth

ü Settled all pending issues with the Connecticut Public Utilities Regulatory

Authority relating to the Connecticut gas companies’ rate case appeals

Authority relating to the Connecticut gas companies’ rate case appeals

3

4Q & FY ‘11 Earnings

UIL Integration

q Substantially exited Transitional Services Agreement in Fall of 2011

q In the process of converting Connecticut gas companies’ customer

information systems to a single UIL platform

information systems to a single UIL platform

4

Realizing savings of $11.6M in 2012,

compared to Iberdrola USA’s (IUSA) $23M

of allocated corporate overheads, support

costs and shared services in 2009

compared to Iberdrola USA’s (IUSA) $23M

of allocated corporate overheads, support

costs and shared services in 2009

$M

4Q & FY ‘11 Earnings

4Q & FY 2011 Earnings Highlights

q Consolidated net income in 2011 of $99.7M, an increase of $44.8M

compared to 2010

compared to 2010

§ Full year of net income from gas operations

§ Earnings from UI’s equity investment in GenConn

§ Absence of after-tax acquisition related costs, which occurred in 2010

§ Includes $0.07 per share negative impact on earnings from bonus depreciation

q 4Q ‘11 consolidated earnings of $21.3M, a $10.8M increase compared to

4Q ‘10

4Q ‘10

§ Full quarter of earnings from gas operations compared to 6 weeks of earnings

in 2010

in 2010

§ Earnings from UI’s equity investment in GenConn

§ Absence of after-tax acquisition related costs, which occurred in 2010

5

4Q & FY ‘11 Earnings

Gas Conversions

q 2011 conversions - 22% increase over 2010 levels

§ Converted approximately 8,300 in 2011 compared to 6,800 additions in 2010

q Consumer interest in converting remains strong

§ Financing options have been expanded to assist customers with up-front

conversion costs

conversion costs

§ Natural gas supply prices are low and projected to remain low for the

foreseeable future

foreseeable future

§ Delivered natural gas price for heating customers is approximately half the

cost of heating oil on an equivalent basis

cost of heating oil on an equivalent basis

q 2012 goal is to convert approximately 10,200 customers to natural gas

heat, a 50% increase over 2010 levels of 6,800 additions

heat, a 50% increase over 2010 levels of 6,800 additions

§ Target is to convert 30,000-35,000 gas heating customers for the period 2011-

2013

2013

q Each new residential customer is anticipated to generate approximately

$280-$315 of distribution net operating income annually

$280-$315 of distribution net operating income annually

6

4Q & FY ‘11 Earnings

State Regulatory Update

7

GenConn 2012 Revenue Requirement

Utility Company Storm Response

q Investigation of Public Service Companies’

response to 2011 Storms (DN 11-09-09)

response to 2011 Storms (DN 11-09-09)

§ Hearings for Electric - April 23rd through May

4th

4th

§ Draft decision expected 6/12/12, final decision

expected 6/27/12

expected 6/27/12

q Final decision on 12/21/11 approved 2012

revenue requirement of $76.6M (DN 11-07-12)

revenue requirement of $76.6M (DN 11-07-12)

Renewable Energy

q On 1/18/12, UI filed proposal with PURA

outlining framework for approval of UI’s

renewable connections program under which

UI would develop up to 10MW of renewable

generation for recovery on a cost of service

basis

outlining framework for approval of UI’s

renewable connections program under which

UI would develop up to 10MW of renewable

generation for recovery on a cost of service

basis

UI Electric Distribution Rate Case

q Evaluating timing of distribution rate case to

reflect significant investments in distribution

infrastructure

reflect significant investments in distribution

infrastructure

Berkshire Gas Rate Plan

q 10-yr rate plan expired on 1/31/12

q Evaluating options

Other

q Anna Ficeto, current director of PURA, was

nominated by Governor Malloy to serve as a

judge on the CT Superior Court

nominated by Governor Malloy to serve as a

judge on the CT Superior Court

4Q & FY ‘11 Earnings

Legislative Update

q Post-Storm Investigations

§ A panel formed by CT Governor Malloy issued its report on 1/9/12; areas of focus:

q Utility preparedness, tree trimming and infrastructure hardening

q Communications and information sharing

q Municipal matters such as preparedness, road safety and shelter operations

q Legislative session began February 8th (ends May 8th)

§ Governor’s Bill No. 23 referred to the Committee on Energy & Technology - An Act

Enhancing Emergency Preparedness and Response

Enhancing Emergency Preparedness and Response

q Seeks to establish minimum standards of performance for utilities in emergency preparation &

restoration

restoration

q Requires an RFP for micro-grid pilots

§ Expansion of gas infrastructure and conversions is a UIL strategic legislative priority

8

4Q & FY ‘11 Earnings

FERC-Related Developments

FERC Order 1000:

q Issued by FERC on July 21, 2011. Includes

provisions related to:

provisions related to:

§ Incorporating public policy into transmission planning

§ Transmission cost allocation

§ Limitation on right of first refusal

§ Inter-regional transmission coordination

Potentially enhances UIL’s ability to

participate in renewable transmission

participate in renewable transmission

q Initial review indicates that New England is

already compliant with many of the

requirements …

already compliant with many of the

requirements …

§ But, stakeholders will need to reach consensus on

some, e.g. incorporation of public policy

some, e.g. incorporation of public policy

§ Initial stakeholder discussions have begun

9

Challenge to Regional Base ROE:

q “206” Complaint filed by multiple

state governmental parties on

September 30, 2011

state governmental parties on

September 30, 2011

§ Claimed that New England TO’s base

ROE is too high

ROE is too high

q Multiple New England TOs

(including UI) filed a response on

October 20, 2011

(including UI) filed a response on

October 20, 2011

§ Demonstrates that ROE is at an

appropriate level

appropriate level

q Multiple responses to responses

filed through remainder of 2011

filed through remainder of 2011

q FERC will decide, but date of

decision uncertain

decision uncertain

4Q & FY ‘11 Earnings

Economic Update

q Connecticut gained 600 jobs in December - recovering slowly(1)

q Seasonally adjusted unemployment rates as of December 2011(2)

§ CT - 8.2%

§ MA - 6.8%

§ National - 8.3% (as of January 2012)

q Unemployment rates in the largest cities in our service areas(2)

§ Bridgeport - 7.8%

§ New Haven - 8.7%

§ Hartford - 8.4%

(1) Data Core Partners LLC

(2) U.S. Bureau of Labor Statistics

10

4Q & FY ‘11 Earnings

11

4Q ‘11 vs. 4Q ‘10

FY ‘11 vs. FY ‘10

4Q & FY ‘11 Earnings

12

4Q & FY 2011 Financial Results - Details

Electric distribution, CTA, GenConn & Other

q 6% increase in ‘11 net income over ‘10; $1.6M increase in net income quarter-over-quarter

§ GenConn contributed to UIL pre-tax earnings of $11.3M & $3.1M for the full-year and 4Q ‘11, respectively

q Average D & CTA ROE as of 12/31/11: 8.74%

Electric transmission

q 11% increase in ‘11 net income over ’10; 8% decrease in net income quarter-over-quarter

§ Both the full year & 4Q ‘11 were favorably impacted by an increase in the allowance for funds used during

construction due to an increased CWIP balance and earnings on deposits made in NEEWS

construction due to an increased CWIP balance and earnings on deposits made in NEEWS

§ The absence of effective income tax rate adjustments, which occurred in the 4Q ’10, more than offset the

earnings increase in 4Q ‘11

earnings increase in 4Q ‘11

q 2011 weighted average ROE of 12.4%

Gas distribution

q 2011 income of $43.8M, 4Q ’11 net income of $14.1M, compared to $12.9M for the 6 weeks

following the acquisition in mid-November ‘10

following the acquisition in mid-November ‘10

§ The negative impact of warmer than normal weather for the full-year & 4Q ’11 was partially offset by

weather insurance

weather insurance

§ Heating degree days were less than normal by an average of 6.9% & 16.7% for the full-year & 4Q ‘11,

respectively

respectively

q Recovered pre-tax earnings of $2.2M of carrying charges related to the settlement of the gas

companies’ rate cases

companies’ rate cases

q Preliminary average ROEs as of 12/31/11: SCG 6.70% -6.90%, CNG 9.20% -9.40%

Corporate

q 2011 after-tax costs of $13M compared to $21.8M in ‘10; 4Q ‘11 after-tax costs of $3.6M compared

to $12.3M in 4Q ‘10

to $12.3M in 4Q ‘10

q Decrease for the year and the quarter was primarily due to the absence in 2011 of after-tax

acquisition related costs incurred in 2010, partially offset by the interest expense related to the

October ‘10 issuance of $450M of public debt

acquisition related costs incurred in 2010, partially offset by the interest expense related to the

October ‘10 issuance of $450M of public debt

§ In 2011, interest expense on the $450M of public debt was $12.7M and $3.2M for the full-year and 4Q ‘11,

respectively, compared to acquisition related expenses of $19.3M and $10.9M for the full-year and 4Q’10,

respectively

respectively, compared to acquisition related expenses of $19.3M and $10.9M for the full-year and 4Q’10,

respectively

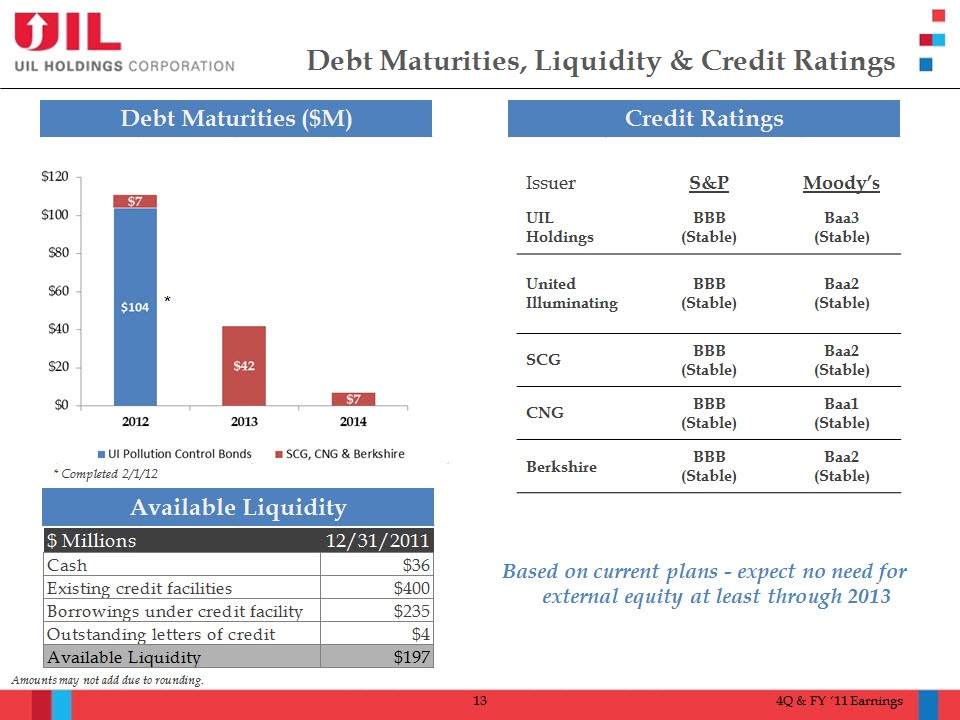

Credit Ratings

4Q & FY ‘11 Earnings

2012 CapEx Update ($M)

14

q Identified projects with clear need

q IT-related shared services projects are in UIL Corporate

Amounts may not add due to rounding.

4Q & FY ‘11 Earnings

2012 Earnings Expectations

15

Current Assumptions

q Regulated businesses are expected to earn the allowed return on an aggregate basis

q Integration savings of $11.6M in 2012, compared to Iberdrola USA’s (IUSA) $23M of allocated

corporate overheads, support costs and shared services in 2009

corporate overheads, support costs and shared services in 2009

q 2012 goal is to convert approximately 10,200 customers to natural gas heat, a 50% increase over 2010

levels of approximately 6,800 additions

levels of approximately 6,800 additions

q CTA earnings are expected to decline by $0.04 per diluted share, as rate base continues to be

amortized

amortized

q Bonus depreciation is expected to have a negative impact on earnings of $0.12 per share, an

additional $0.05 per share, compared to 2011

additional $0.05 per share, compared to 2011

q Execution of capital expenditure plan at each of our regulated businesses

q Continued focus on management of O&M expense at each of our regulated businesses

4Q & FY ‘11 Earnings

Closing Remarks

q Successful completion of integration of gas companies, electric company and

UIL

UIL

q Earn allowed returns

q Focus on natural gas conversions expansion

q Continue to manage O&M expenses

q Identified capital expenditures with a clear need

§ Executing on plan - realizing rate base growth

q Commitment to investment grade credit profile

q Consistent history of dividend payments

q Continue to seek out Transmission opportunities in our service territory and

beyond

beyond

q Based on current plans, expect no need for external equity at least through

2013

2013

16

4Q & FY ‘11 Earnings

Q&A

4Q & FY ‘11 Earnings

Appendix

4Q & FY ‘11 Earnings

2011 Financial Results - Details

19

This table has been presented for illustrative purposes only and is not necessarily indicative of results of operations that would

have been achieved had the acquisition not taken place.

have been achieved had the acquisition not taken place.

4Q & FY ‘11 Earnings

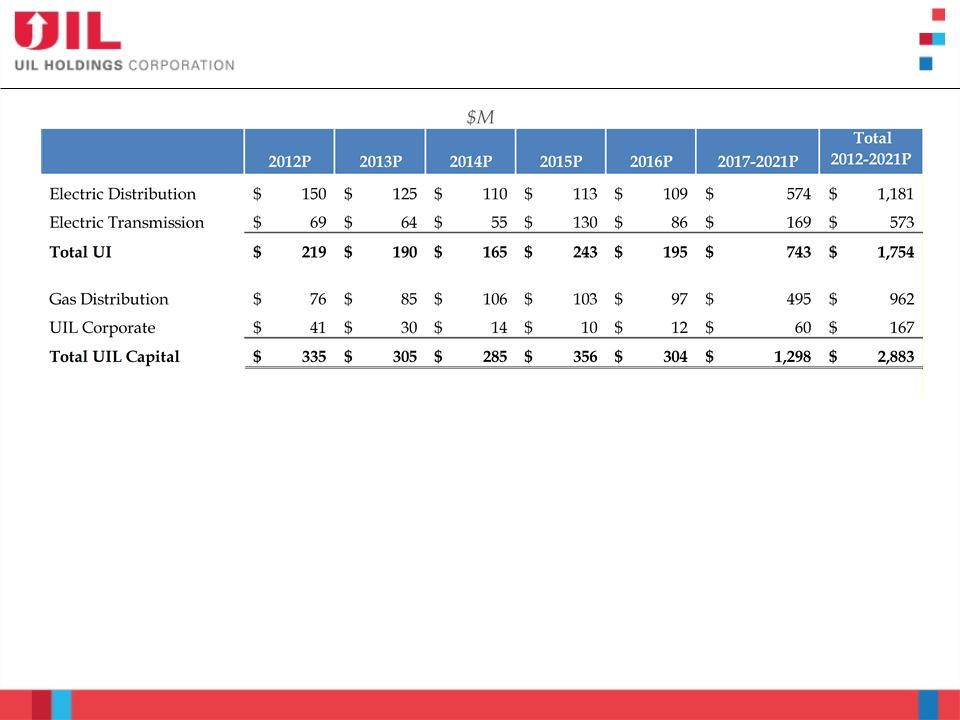

UIL 2012-2021 Capital Expenditure Forecast*

20

q Identified projects with clear need

q Full 10-yr forecast for Gas Distribution CapEx

q IT-related shared services projects are in UIL Corporate

* 10-yr Capex forecast will be updated in the Fall of 2012

Amounts may not add due to rounding.

4Q & FY ‘11 Earnings

2012-2016 Average Rate Base Forecast

GenConn Equity Investments:

Rate Base $M (Excluding GenConn Equity Investments):

$2,062

$2,235

$2,388

$2,535

$2,731

1%

41%

22%

36%

40%

22%

38%

40%

22%

38%

38%

24%

38%

Amounts may not add due to rounding.

21

CAGR 7.3%

Gas

Distribution:

4.1%

Electric

Transmission:

9.2%

Electric

Distribution:

11.6%

2%

43%

22%

33%