Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - EL PASO ELECTRIC CO /TX/ | form8-ker.htm |

| EX-99.01 - PRESS RELEASE - EL PASO ELECTRIC CO /TX/ | exh9901.htm |

El Paso Electric Company 4th Quarter 2011 Earnings Conference Call February 22, 2012 Exhibit 99.02

El Paso Electric R February 22, 2012 Investor Relations 2 Statements in this presentation, other than statements of historical information, are forward-looking statements that are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 (the “act”). Such statements are intended to be made as of the date of this presentation, and the company does not undertake to update any such forward-looking statement. Forward-looking statements involve known and unknown risks and other factors that may cause actual results to differ materially from those expressed in this presentation. In connection with the safe-harbor provisions of the act, the company has set forth below a number of important risks and factors that could cause actual results to differ materially from forward-looking information. Factors that could cause or contribute to such differences include, but are not limited to: Our rates in Texas following the rate case filed on February 1, 2012 pursuant to the El Paso City Council’s resolution ordering El Paso Electric (EE) to show cause why our base rates for El Paso customers should not be lower Increased prices for fuel and purchased power and the possibility that regulators may not permit EE to pass through all such increased costs to customers or to recover previously incurred fuel costs in rates Recovery of capital investments and operating costs through rates in Texas and New Mexico Uncertainties and instability in the general economy and the resulting impact on EE’s sales and profitability Unanticipated increased costs associated with scheduled and unscheduled outages The size of our construction program and our ability to complete construction on budget and on time Costs at Palo Verde (PV) Deregulation and competition in the electric utility industry Possible increased costs of compliance with environmental or other laws, regulations and policies Possible income tax and interest payments as a result of audit adjustments proposed by the IRS Uncertainties and instability in the financial markets and the resulting impact on EE’s ability to access the capital and credit markets Other factors detailed by EE in its public filings with the Securities and Exchange Commission. Please refer to EE’s 2010 Form 10K and other 1934 Act Filings Safe Harbor Statement

El Paso Electric R On March 2, 2012 David Stevens will resign his position as CEO of El Paso Electric in order to pursue another job opportunity Board of Directors appointed Thomas V. Shockley to assume the responsibilities of the CEO on an interim basis – Thomas V. Shockley • EE Director since May 26, 2010 • Former Vice Chairman and COO of AEP • Former President and COO of CSW, which is now part of AEP • Several executive and management positions in the utility and energy industries Search for successor will consider both internal and external candidates CEO Transition Update February 22, 2012 Investor Relations 3

El Paso Electric R February 22, 2012 Investor Relations 4 Solid 4th Quarter results due to a 2.5 percent increase in retail kWh sales Repurchased approximately 280,389 shares at a total cost of $9.2mm during the 4th quarter of 2011 4th quarter dividend of $0.22 per share or $8.8mm Highlights for the 4th Quarter 2011

El Paso Electric R Financial and Regulatory – Earnings per share (Basic) increased from $2.08 in 2010 (before extraordinary gain) to $2.49 in 2011 – Paid first common stock dividend since 1989 – Repurchased 2,782,455 shares of common stock for $86.5mm which enhanced shareholder value and balanced the Company’s capital structure – Refinanced the revolving credit facility, extending the term and lowering interest costs – Settled a long-standing dispute with Tucson Electric Power over transmission rights on EE’s transmission system – Obtained all necessary regulatory approvals to construct Rio Grande Unit 9 Operational – Completed construction and began commercial operation of the steam generator completing the Combined Cycle Newman Power Plant Unit 5 2011 Accomplishments February 22, 2012 Investor Relations 5

El Paso Electric R February 22, 2012 Investor Relations 6 4th Quarter 2011 (Basic) EPS - $0.14, compared to 4th Quarter 2010 (Basic) EPS of $0.18 YTD 2011 (Basic) EPS - $2.49, compared to YTD 2010 (Basic) EPS of $2.08, before extraordinary item 4th Quarter and YTD 2011 Financial Results

El Paso Electric R Primary positive drivers: – Increase in retail non-fuel base revenues due to a 2.5% increase in kWh sales and 1.3% growth in the average number of retail customers served - $0.03/share Primary negative drivers: – Increased planned maintenance outages and freeze protection upgrades at our local generating plants – ($0.06)/share – Decreased AFUDC primarily due to lower balances of construction work in progress subject to AFUDC – ($0.05)/share – Increased customer care expenses due to an increase in uncollectible customer accounts and costs for customer related activities – ($0.02)/share 4th Quarter Key Earnings Drivers February 22, 2012 Investor Relations 7

El Paso Electric R Primary positive earnings drivers (net of tax): – Higher retail non-fuel base revenues due to a 3.1% increase in kWh sales to retail customers reflecting higher non-fuel summer base rates and a 1.4% increase in the average number of retail customers served – $0.51/share – Decreased income tax expense due to no comparable activity in 2011 relating to the one-time charge to income tax expense in 2010 recognizing the elimination Medicare Part D tax benefits – $0.11/share – Decreased weighted average number of shares outstanding resulting from the common stock repurchase program – $0.10/share – Increased transmission revenue $5.1mm (pre-tax) due to the settlement agreement with Tucson Electric Power that resulted in one-time income of $3.9 million (pre-tax) – $0.08/share YTD Key Earnings Drivers February 22, 2012 Investor Relations 8

El Paso Electric R Negative earnings drivers (net of tax): – Decreased retained margins on off-system sales due to lower average market prices and increased margin sharing with customers – ($0.10)/share – Decreased AFUDC primarily due to lower balances of CWIP subject to AFUDC – ($0.09)/share – Increased maintenance expense due to weather-related damage and freeze protection upgrades at our local generating plants – ($0.09)/share – Increased customer care expenses due to increased costs for customer- related activities and an increase in uncollectible customer accounts – ($0.05)/share – Increased transmission and distribution O&M expense due to higher wheeling expense, a reliability study for the NERC, and payroll costs – ($0.05)/share YTD Key Earnings Drivers February 22, 2012 Investor Relations 9

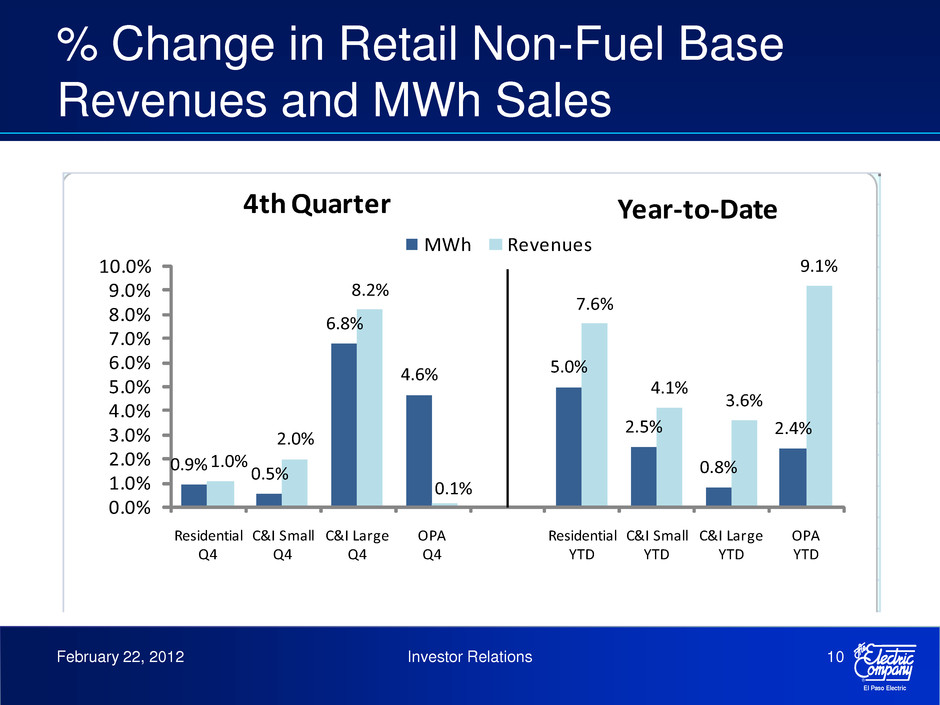

El Paso Electric R February 22, 2012 Investor Relations 10 % Change in Retail Non-Fuel Base Revenues and MWh Sales % Change in Retail Non-Fuel Base Revenues and MWh Sales Residential Q4 C&I Small Q4 C&I Large Q4 0.9% 0.5% 6.8% 4.6% 5.0% 2.5% 0.8% 2.4% 1.0% 2.0% 8.2% 0.1% 7.6% 4.1% 3.6% 9.1% 0.0% 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0% 8.0% 9.0% 10.0% Residential Q4 C&I Small Q4 C&I Large Q4 OPA Q4 Residential YTD C&I Small YTD C&I Large YTD OPA YTD Year-to-Date MWh Revenues 4th Quarter

El Paso Electric R Summary of 2012 Texas Rate Case February 22, 2012 Investor Relations 11 On October 4, 2011, El Paso City Council adopted a resolution requiring EE to show cause why base rates for customers in El Paso should not be reduced On February 1, 2012, EE filed a rate case with Public Utility Commission of Texas (PUCT), the City of El Paso (City), and other incorporated cities in Texas – Historical test year ended September 30, 2011 (adjusted for known and measurable items) – Return on equity of 10.6% with 53.4% equity Requested non-fuel base rate increase of $26.3mm – Base rate, interruptible and other revenue increases - $17.6mm – Requesting surcharge of $8.7mm over 12 months for rate case expenses

El Paso Electric R On November 15, 2011, the El Paso City Council adopted a resolution which established current rates as temporary rates for customers of EE residing within the city limits of El Paso – Temporary rates will be effective from November 15, 2011 until a final determination in the rate case is rendered by the PUCT – Once rates are finalized at the conclusion of the rate proceeding, the PUCT or City : • Shall authorize EE to surcharge bills for the amounts under collected • May order a refund to customers for the amounts over collected • Based upon EE’s proposed rate changes, some customer classes would see refunds and some surcharges Temporary Rates February 22, 2012 Investor Relations 12

El Paso Electric R February 22, 2012 Investor Relations 13 2012 Earnings Guidance range of $2.15 to $2.55 per basic share (excludes impact of 2012 Texas Rate Case) Key variables: – Base revenue growth of (0.5%) to 1.5% – Increase between 1.0% to 2.0% in total O&M over 2011 amounts – Expected capital expenditures of approximately $242mm 2012 Earnings Guidance

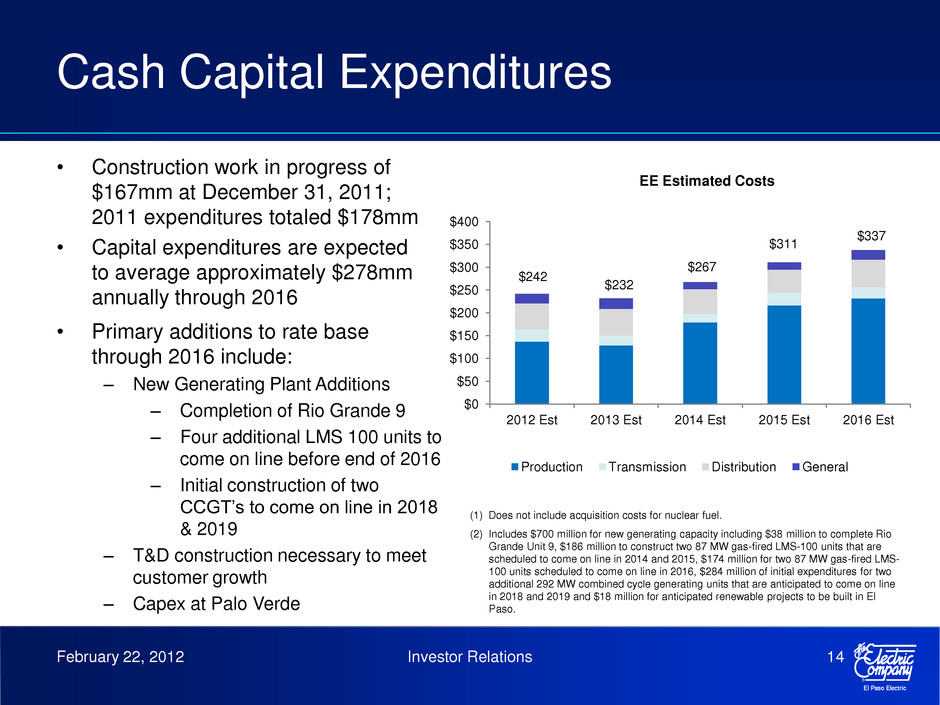

El Paso Electric R Cash Capital Expenditures February 22, 2012 Investor Relations 14 • Primary additions to rate base through 2016 include: – New Generating Plant Additions – Completion of Rio Grande 9 – Four additional LMS 100 units to come on line before end of 2016 – Initial construction of two CCGT’s to come on line in 2018 & 2019 – T&D construction necessary to meet customer growth – Capex at Palo Verde • Construction work in progress of $167mm at December 31, 2011; 2011 expenditures totaled $178mm • Capital expenditures are expected to average approximately $278mm annually through 2016 $0 $50 $100 $150 $200 $250 $300 $350 $400 2012 Est 2013 Est 2014 Est 2015 Est 2016 Est EE Estimated Costs Production Transmission Distribution General $242 $232 $267 $337 $311 (1) Does not include acquisition costs for nuclear fuel. (2) Includes $700 million for new generating capacity including $38 million to complete Rio Grande Unit 9, $186 million to construct two 87 MW gas-fired LMS-100 units that are scheduled to come on line in 2014 and 2015, $174 million for two 87 MW gas-fired LMS- 100 units scheduled to come on line in 2016, $284 million of initial expenditures for two additional 292 MW combined cycle generating units that are anticipated to come on line in 2018 and 2019 and $18 million for anticipated renewable projects to be built in El Paso.

El Paso Electric R February 22, 2012 Investor Relations 15 EE expended $178mm for additions to plant during 2011 EE dividend payments were $27.2mm in 2011 – EE is committed to enhancing long term value and cash returns to shareholders primarily through quarterly cash dividend payments and secondarily through share repurchases – Board will review the dividend policy annually in conjunction with the annual shareholders meeting • Anticipate moving toward a target 45% dividend payout ratio EE had a cash balance of $8.2mm at December 31, 2011 At December 31, 2011, EE had liquidity of $174.4mm including cash and the revolving credit facility Capital Requirements and Liquidity

February 22, 2012 Investor Relations 16 Questions and Answers