Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Standard AVB Financial Corp. | d305692d8k.htm |

Annual Meeting

February 21, 2012

S

T

A

N

D

A

R

D

Exhibit 99.1 |

Forward-Looking Statements

3

2

This

presentation

contains

forward-looking

statements,

which

can

be

identified

by

the

use

of

words

such

as

“estimate,”

“project,”

“believe,”

“intend,”

“anticipate,”

“plan,”

“seek,”

“expect,”

“will,”

“may”

and words of similar meaning. These forward-looking statements

include, but are not limited to:

•

statements of our goals, intentions and expectations;

•

statements regarding our business plans, prospects, growth and operating

strategies; •

statements regarding the asset quality of our loan and investment

portfolios; and •

estimates of our risks and future costs and benefits.

These forward-looking statements are based on our current beliefs and

expectations and are inherently subject to significant business,

economic and competitive uncertainties and contingencies, many of which

are beyond our control. In addition, these forward-looking

statements are subject to assumptions with respect to future business

strategies and decisions that are subject to change. We are under no

duty to and unless required under the federal securities laws, we do not

undertake any obligation to update any forward-looking

statements after the date of this report.

The following factors, among others, could cause actual results to differ

materially from the anticipated results or other expectations

expressed in the forward-looking statements:

•

general

economic

conditions,

either

nationally

or

in

our

market

areas,

that

are

worse

than

expected;

•

competition among depository and other financial institutions;

•

inflation and changes in the interest rate environment that reduce our

margins or reduce the fair value of financial instruments;

•

adverse changes in the securities markets;

•

changes

in

laws

or

government

regulations

or

policies

affecting

financial

institutions,

including

changes

in

regulatory

fees

and

capital requirements;

•

our

ability

to

enter

new

markets

successfully

and

capitalize

on

growth

opportunities;

•

our ability to successfully integrate acquired entities, if any;

•

changes in consumer spending, borrowing and savings habits;

•

changes

in

accounting

policies

and

practices,

as

may

be

adopted

by

the

bank

regulatory

agencies,

the

Financial

Accounting

Standards Board, the Securities and Exchange Commission and the Public

Company Accounting Oversight Board; •

changes in our organization, compensation and benefit plans;

•

changes in our financial condition or results of operations that reduce

capital available to pay dividends; and •

changes in the financial condition or future prospects of issuers of

securities that we own. Because of these and other uncertainties,

our actual future results may be materially different from the results indicated by these forward-

looking statements. |

Company Overview

M

A

L

V

E

R

N

S

T

A

N

D

A

R

D |

19

Overview of Standard Financial Corp.

4

Standard Bank, a Pennsylvania chartered savings bank organized in

1913, is the wholly owned subsidiary of Standard Financial Corp.

On October 6, 2010, Standard Financial Corp. completed its

mutual-to- stock conversion raising $34.8 million in gross

proceeds. Standard Financial Corp. trades on the NASDAQ Capital

Market under the symbol STND.

Standard Financial Corp. conducts its business from ten community

banking offices located in the Pennsylvania counties of Allegheny,

Westmoreland and Bedford and Allegany County, Maryland.

As of December 31, 2011, we had $437.3 million in total assets, $290.7

million in net loans, $324.4 million in deposits and $78.4 million

in stockholders’

equity. |

6

Community Banking Office Locations

4785 Old William Penn Hwy.

Murrysville, PA

Executive Offices

2640 Monroeville Blvd.

Monroeville, PA

211 W. Main Street

Ligonier, PA

5

Headquarters

3945 Center Street

Hyndman, PA

200 N. Mechanic Street

Cumberland, MD

1275 National Hwy.

LaVale, MD

Banking Offices

659 W. Main Street

Mt. Pleasant, PA

2100 Summit Ridge Plaza

Mt. Pleasant, PA

100 Pittsburgh Street

Scottdale, PA

5150 Route 30

Greensburg, PA |

12

Deposit Market Share

6

The population change

from 2000-2010 for

Westmoreland and

Allegheny Counties was

-2.04% and -4.75%,

respectively, compared

to 2.39% for

Pennsylvania and

10.59% for the United

States.

Median household

income for 2010 for

Westmoreland and

Allegheny Counties was

$48,485 and $51,369,

respectively, compared

to $52,723 for

Pennsylvania and

$54,442 for the United

States.

Source: SNL Financial.

Westmoreland, PA

2011

Rank

Institution (ST)

Type

Number

of

Branches

6/30/11 Total

Deposits in

Market ($000)

6/30/11 Total

Market

Share (%)

1

PNC Financial Services Group (PA)

Bank

22

1,804,063

26.59

2

First Commonwealth Financial (PA)

Bank

17

957,807

14.11

3

S&T Bancorp Inc. (PA)

Bank

11

766,958

11.30

4

RBS

Bank

18

740,482

10.91

5

F.N.B. Corp. (PA)

Bank

23

689,534

10.16

6

First Niagara Finl Group (NY)

Bank

9

382,344

5.63

7

Commercial National Financial (PA)

Bank

10

290,467

4.28

8

Dollar Bank FSB (PA)

Savings Inst

4

216,489

3.19

9

Standard Financial Corp (PA)

Thrift

6

201,718

2.97

10

Westmoreland FS&LA (PA)

Savings Inst

1

132,778

1.96

Total For Institutions In Market

143

6,785,788

Allegheny, PA

2011

Rank

Institution (ST)

Type

Number

of

Branches

6/30/11 Total

Deposits in

Market ($000)

6/30/11 Total

Market

Share (%)

1

PNC Financial Services Group (PA)

Bank

104

34,030,720

55.31

2

Bank of New York Mellon Corp. (NY)

Bank

2

8,575,399

13.94

3

RBS

Bank

78

4,262,827

6.93

4

Dollar Bank FSB (PA)

Savings Inst

28

2,772,554

4.51

5

First Niagara Finl Group (NY)

Bank

40

2,045,876

3.33

6

F.N.B. Corp. (PA)

Bank

50

1,674,370

2.72

7

TriState Capital Holdings Inc. (PA)

Bank HC

2

1,560,691

2.54

8

Huntington Bancshares Inc. (OH)

Bank

18

1,269,736

2.06

9

First Commonwealth Financial (PA)

Bank

34

1,118,452

1.82

10

Northwest Bancshares, Inc. (PA)

Thrift

17

680,589

1.11

25

Standard Financial Corp (PA)

Thrift

3

43,990

0.07

Total For Institutions In Market

461

61,523,048 |

12

Deposit Market Share

7

The population change

from

2000-2010

for

Bedford

County, PA was -2.60%

and Allegany County, MD was

-0.42%, compared to

2.39%

for

Pennsylvania,

8.20% for Maryland and

10.59% for the United

States.

Median household income

for 2010 for Bedford

County, PA was $39,728

and Allegany County, MD was

$37,162 compared to $52,723

for Pennsylvania, $66,983 for

Maryland and $54,442 for the

United States.

Allegany, MD

2011

Rank

Institution (ST)

Type

Number

of

Branches

6/30/11 Total

Deposits in

Market ($000)

6/30/11 Total

Market

Share (%)

1

Susquehanna Bancshares Inc. (PA)

Bank

5

296,570

43.98

2

M&T Bank Corp. (NY)

Bank

6

158,563

23.52

3

First United Corp. (MD)

Bank

4

124,309

18.44

4

PNC Financial Services Group (PA)

Bank

3

50,338

7.47

5

Standard Financial Corp (PA)

Thrift

2

44,515

6.60

Total For Institutions In Market

20

674,295

Source: SNL Financial.

Bedford, PA

2011

Rank

Institution (ST)

Type

Number

of

Branches

6/30/11 Total

Deposits in

Market ($000)

6/30/11 Total

Market

Share (%)

1

Susquehanna Bancshares Inc. (PA)

Bank

5

170,599

23.72

2

F.N.B. Corp. (PA)

Bank

5

136,381

18.96

3

M&T Bank Corp. (NY)

Bank

3

103,182

14.35

4

First Commonwealth Financial (PA)

Bank

3

97,870

13.61

5

Hometown Bank of Pennsylvania (PA)

Comm'l Bank

2

90,743

12.62

6

Altoona First Savings Bank (PA)

Savings Bank

2

59,882

8.33

7

Standard Financial Corp (PA)

Thrift

1

24,618

3.42

8

Orbisonia Community Bncp Inc. (PA)

Bank HC

1

21,820

3.03

9

CBT Financial Corp. (PA)

Bank

1

14,033

1.95

10

Somerset Trust Holding Company (PA)

Bank

1

0

0.00

Total For Institutions In Market

24

719,128 |

19

Fiscal 2011 Review

8

Through the stock offering we established the Standard Charitable

Foundation by making a one time contribution of $1.4

million. Donations from the foundation will benefit the

Bank’s communities for many years. We expect annual contributions to

approximate $90,000.

Net Income for fiscal 2011 was $2.4 million, or $3.3 million after

adjusting for the one

time

after

tax

impact

of

$0.9

million

to

fund

the

charitable

foundation,

which

was a 14% increase from fiscal 2010 of $2.9 million.

Solid Capital Base with Tangible Equity to Tangible Assets of 16.29% as

of 9/30/11. Asset

quality

continues

to

remain

strong

compared

to

peer

groups

and

industry

averages.

Despite difficult economic conditions and weak loan demand, we were able

to achieve both deposit and loan growth in fiscal 2011.

Reduction in borrowings of $9.8 million, or 23.8%, from $41.2 million at

fiscal year- end 2010 to $31.4 million at fiscal year-end

2011. On April 6, 2011, a new community banking office was

opened in Greensburg, PA. As of 9/30/11 deposits had grown

to approximately $2.0 million in a market which includes 29

offices of competing banks. |

19

2012 Business Strategy

9

Our primary objective is to operate as a profitable,

community-oriented financial institution

serving customers in our market areas. We have sought to

accomplish this objective by adopting a business strategy that is

designed to maintain strong capital and high asset quality.

Our business strategy includes the following elements:

Increasing commercial real estate

lending, focusing on small and medium

sized businesses, while maintaining our conservative loan

underwriting standards.

Emphasizing deposit relationships by attracting new customers and

enhancing existing customer relationships.

Pursuing

future

expansion

and

acquisition

opportunities

with

the

capital

raised in the conversion, although we have no current arrangements or

agreements with respect to any such acquisitions.

|

M

A

L

V

E

R

N

Financial Highlights

S

T

A

N

D

A

R

D |

9

Stable Asset Growth

11

Dollars in millions

CAGR = Compound Annual Growth Rate.

$342.9

$354.0

$382.4

$435.1

$434.6

$437.3

$0.0

$100.0

$200.0

$300.0

$400.0

$500.0

$600.0

9/30/07

9/30/08

9/30/09

9/30/10

09/30/11

12/31/11 |

12

Total Loan Portfolio Growth

12

Dollars in millions

48%

50%

49%

49%

49%

49%

25%

26%

28%

30%

30%

31%

17%

17%

17%

16%

16%

16%

5%

5%

5%

3%

4%

4%

$0.0

$25.0

$50.0

$75.0

$100.0

$125.0

$150.0

$175.0

$200.0

$225.0

$250.0

$275.0

$300.0

$325.0

9/30/07

9/30/08

9/30/09

9/30/10

09/30/11

12/31/11

Other

Construction

Commercial

Home Equity

Commercial RE

1-4 Family

Residential

$289.6

$246.1

$260.0

$290.1

$273.8

$295.0 |

12

Credit Quality Trends

13

Peer consists of public banks and thrifts located in the Mid-Atlantic

region with Assets between $300M and $600M . Excludes

MHCs and Merger Targets. Non-Performing Loans / Total Loans

STND at 12/31/11: 1.30%

At

2007

2008

2009

2010

2011

12/31/11

NPAs / Total Assets (%)

0.26

0.51

0.61

1.10

1.24

1.17

NCOs / Average Loans (%)

0.02

0.10

0.17

0.10

0.37

0.68

Allowance / NPLs (%)

294.43

150.12

233.01

101.71

97.73

88.95

Allowance / Total Loans (%)

0.97

0.93

1.12

1.38

1.56

1.47

At September 30,

0.63%

0.49%

1.37%

1.62%

0.44%

0.67%

1.62%

1.71%

1.78%

0.00%

0.50%

1.00%

1.50%

2.00%

2.50%

09/30/07

09/30/08

09/30/09

09/30/10

09/30/11

STND

Peer Median

0.33% |

15

Deposit Growth

14

Dollars in millions

47%

41%

38%

40%

42%

43%

29%

36%

42%

39%

35%

35%

24%

22%

20%

21%

23%

23%

$0.0

$50.0

$100.0

$150.0

$200.0

$250.0

$300.0

$350.0

$400.0

9/30/07

9/30/08

9/30/09

9/30/10

09/30/11

12/31/11

Certificates of Deposit

Savings

Demand, NOW and Money Market

$320.3

$264.0

$254.6

$316.2

$286.9

$324.4 |

15

Net Interest Margin

15

In this difficult interest rate environment, we have been able to maintain

our net interest margin.

2.66%

2.98%

2.99%

3.25%

3.31%

3.26%

0.0%

0.5%

1.0%

1.5%

2.0%

2.5%

3.0%

3.5%

4.0%

FY

09/30/07

FY

09/30/08

FY

09/30/09

FY

09/30/10

FY

09/30/11

QTR

12/31/11 |

15

Net Income

16

Dollars in thousands

*Without net impact of one time contribution of $908,000 to Standard

Charitable Foundation. $2,424

$2,060

$1,140

$2,144

$2,915

$831

$3,332*

$0

$500

$1,000

$1,500

$2,000

$2,500

$3,000

$3,500

$4,000

FY

09/30/07

FY

09/30/08

FY

09/30/09

FY

09/30/10

FY

09/30/11

QTR

12/31/11 |

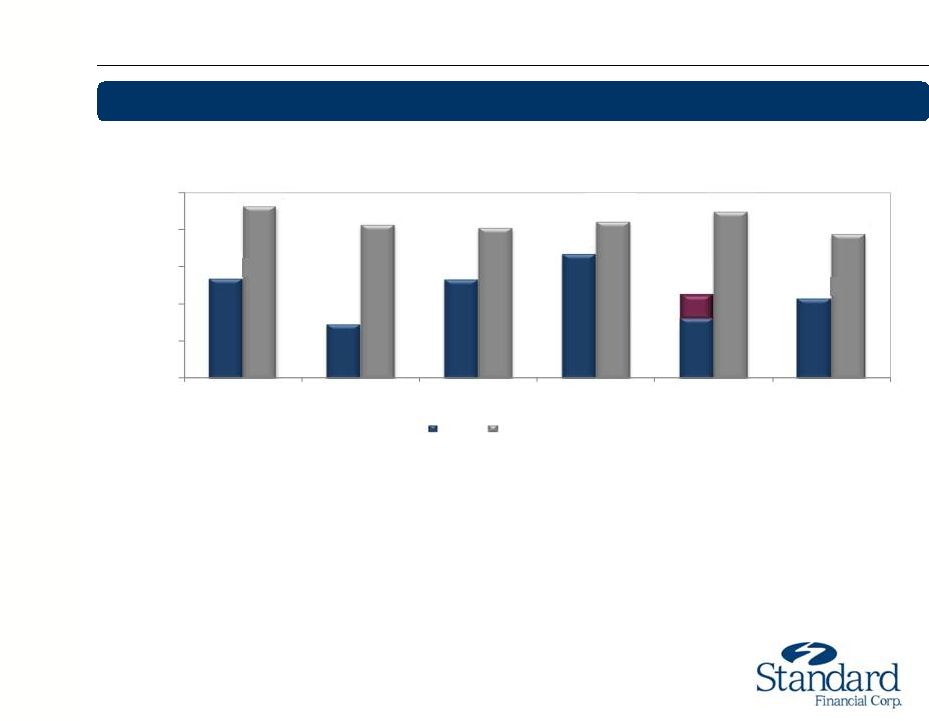

15

Performance Measures

17

Return on Average Assets

*Without net impact of one-time contribution to Standard Charitable

Foundation. Peer consists of public banks and thrifts located in

the Mid-Atlantic region with Assets between $300M and $600M. Excludes MHCs and

Merger Targets.

0.56%

0.62%

0.33%

0.58%

0.73%

0.76%*

0.76%

0.83%

0.69%

0.67%

0.75%

0.86%

0.80%

0.0%

0.3%

0.5%

0.8%

1.0%

FY

09/30/07

FY

09/30/08

FY

09/30/09

FY

09/30/10

FY

09/30/11

QTR

12/31/11

STND

Peer Median |

15

Performance Measures

18

Return on Average Equity

*Without net impact of one-time contribution to Standard Charitable

Foundation. Peer consists of public banks and thrifts located in

the Mid-Atlantic region with Assets between $300M and $600M. Excludes MHCs and

Merger Targets.

3.18%

5.33%

2.86%

5.27%

6.64%

4.38%*

4.25%

9.23%

8.20%

8.04%

8.39%

8.92%

7.70%

0.0%

2.0%

4.0%

6.0%

8.0%

10.0%

FY

09/30/07

FY

09/30/08

FY

09/30/09

FY

09/30/10

FY

09/30/11

QTR

12/31/11

STND

Peer Median |

15

Performance Measures –

cont.

19

Efficiency Ratio

Non Interest Expense / Average Assets

Peer consists of public banks and thrifts

located in the Mid-Atlantic region with

Assets between $300M and $600M.

Excludes MHCs and Merger Targets.

2.43%

2.37%

2.36%

2.20%

2.48%

2.21%

2.74%

2.76%

2.86%

2.79%

2.82%

2.91%

0.00%

0.50%

1.00%

1.50%

2.00%

2.50%

3.00%

3.50%

FY

09/30/07

FY

09/30/08

FY

09/30/09

FY

09/30/10

FY

09/30/11

QTR

12/31/11

STND

Peer Median

75%

79%

73%

62%

68%

62%

68%

66%

69%

66%

67%

71%

0.0%

10.0%

20.0%

30.0%

40.0%

50.0%

60.0%

70.0%

80.0%

90.0%

FY

09/30/07

FY

09/30/08

FY

09/30/09

FY

09/30/10

FY

09/30/11

QTR

12/31/11

STND

Peer Median |

15

Stockholders’

Equity

20

Stock Offering

10/6/10

Strong

Capital

Position

Total Equity ($000)

Tangible Equity / Tangible Assets

Dollars in millions

$39.4

$38.7

$42.2

$45.3

$78.7

$78.4

$0.0

$20.0

$40.0

$60.0

$80.0

$100.0

09/30/07

09/30/08

09/30/09

09/30/10

09/30/11

12/31/11

8.8%

8.4%

8.7%

8.4%

16.3%

16.1%

0.0%

3.0%

6.0%

9.0%

12.0%

15.0%

18.0%

21.0%

09/30/07

09/30/08

09/30/09

09/30/10

09/30/11

12/31/11 |

15

Building Shareholder Value

21

•

Announced our first

quarterly dividend

on 10/20/11 of

$0.045 per share.

•

Announced stock

repurchase program

of 10% in October

2011. As of

12/31/11, 55,000

shares had been

repurchased.

•

Since our IPO

(10/6/10) we have

increased our book

value by 6.7% and

our tangible book

value by 7.6%.

Book Value

Tangible Book Value

$21.46

$21.74

$22.25

$22.63

$22.89

$0.00

$4.00

$8.00

$12.00

$16.00

$20.00

$24.00

$28.00

12/31/10

03/31/11

06/30/11

09/30/11

12/31/11

$18.71

$18.99

$19.52

$19.91

$20.14

$0.00

$4.00

$8.00

$12.00

$16.00

$20.00

$24.00

$28.00

12/31/10

03/31/11

06/30/11

09/30/11

12/31/11 |

M

A

L

V

E

R

N

Market Statistics

S

T

A

N

D

A

R

D |

21

Dividend History

23

Data as of February 1, 2012

Source: SNL Financial

Current Div Yield

1.2%

Description:

Common stock, $0.01 par value

Announce Date

Ex-Dividend Date

Pay Date

Amount

Frequency

1/19/2012

1/31/2012

2/15/2012

$0.0450

Quarterly

10/20/2011

10/31/2011

11/15/2011

$0.0450

Quarterly

Common Equity Dividends |

21

STND Stock Price Performance

24

Since IPO –

October 6, 2010 at $10.00 Per Share

Data as of February 15, 2012

Source: SNL Financial

3.1%

15.8%

60.0%

0.80

0.90

1.00

1.10

1.20

1.30

1.40

1.50

1.60

1.70

STND

NASDAQ Bank

S&P 500

STND Price

on 2/15/12 –

$16.00 |

19

Fiscal 2012 Outlook

25

Emphasize relationship banking with our customers

Remain focused on asset quality

Prudent loan growth

Continue to manage the interest rate margin

Manage capital through dividends & repurchases

Continue to add value for Standard Shareholders

|

M

A

L

V

E

R

N

Questions? |