Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - STERLING FINANCIAL CORP /WA/ | d303108d8k.htm |

Management Update

For the Year Ended December 31, 2011

Ticker: STSA

Spokane, Washington

www.sterlingfinancialcorporation-spokane.com

February 17, 2012

Exhibit 99.1 |

Safe Harbor

(1) The Reform Act defines the term "forward-looking statements"

to include: statements of management plans and objectives, statements regarding the future economic performance, and projections of revenues and

other financial data, among others. The Reform Act precludes liability for

oral or written forward-looking statements if the statement is identified as such and accompanied by "meaningful cautionary statements

identifying important factors that could cause actual results to

differ materially from those made in the forward-looking

statements." 2

In the course of our presentation, we may discuss matters that are

deemed to be forward-looking statements, which are intended to be

covered by the safe harbor for “forward-looking statements”

provided by the Private Securities Litigation Reform Act of 1995 (the

“Reform Act”) (1)

.

Forward-looking statements involve substantial risks and uncertainties,

many of which are difficult to predict and are generally beyond our

control. Actual results may differ materially and adversely from

projected results. We assume no obligation to update any

forward-looking statements (including any projections) to reflect

any changes or events occurring after the date hereof. Additional

information about risks of achieving results suggested by any

forward-looking statements may be found in Sterling’s

10-K, 10-Q and other SEC filings, including under the

headings “Risk Factors” and “Management’s Discussion and

Analysis of Financial Condition and Results of Operations.” |

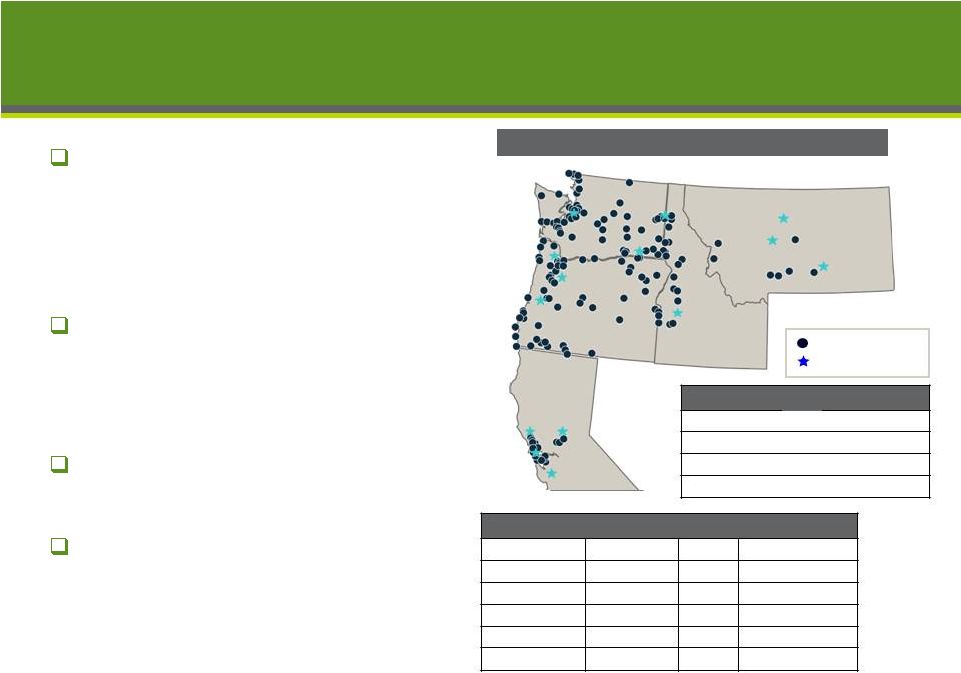

Franchise at a Glance

3

Based in Spokane, Wash.,

Sterling is one of the largest

commercial banks

headquartered in the Pacific

Northwest

(1)

More than 45,000

commercial transaction

accounts and 255,000 retail

transaction accounts

$6.5 billion of deposits with

an average cost of 0.80%

(2)

$730 million recapitalization

completed in August 2010

175 branches in 5 states

Source: SNL Financial, Company filings

Note: Financial data as of December 31, 2011.

MONTANA

IDAHO

OREGON

WASHINGTON

San Jose

San

Francisco

Sacramento

Santa

Rosa

Eugene

Salem

Portland

Seattle

Spokane

Great Falls

Helena

Billings

Boise

Major cities

Sterling branches

Key Statistics as of 12/31/2011

(billions)

Total assets:

$9.2

Total deposits

$6.5

Net loans

$5.3

Deposit Market Share

(3)

State

Branches

Rank

Market Share

Washington

71

8

2.93%

Oregon

67

7

3.16%

California

13

54

0.11%

Idaho

18

11

2.55%

Montana

7

16

1.09%

(1)

Pacific Northwest defined as Idaho, Oregon and Washington.

(2)

For the quarter ended December 31, 2011.

(3)

Deposit market share data as of June 30, 2011. |

Q4 2011 Performance Highlights

Improving quarterly results

Reported Q4 net income of $14.8 million

Four consecutive quarters of earnings growth

Net interest margin (FTE) of 3.26%, up 46 bps from Q4 2010

Average cost of deposits declined by 33 bps from Q4 2010

Reduced credit provisioning

Provision for Q4 credit losses of $4.0 million

Compares to $30.0 million provision for Q4 2010

Declining levels of non-performing assets (NPAs)

NPAs of $369.1 million at 12/31/11, reflecting a 55% decline

compared to $816.3 million of NPAs at 12/31/10

Focus on liquidating OREO, note sales, short sales and other workouts

Robust loan originations

Portfolio originations (excluding HFS) were $332.0 million, up 84%

over Q4 2010

4 |

Formula

for

Success

–

“Back

to

Basics”

Banking

Focus on customers

Delivering value proposition to customers

o

Fair pricing

o

Competitive products and services

Resolving credit challenges

Improving credit metrics throughout the loan portfolio

Reducing non-performing loans and OREO

Strategic expansion in key markets and lines of business

Increased emphasis on sales and business development

Intelligent market segmentation

Expense control and emphasis on organizational efficiency

Managing through emerging regulatory changes

Cost-

effective

Funding

Improved

Asset

Quality

High Quality,

Relationship

Based Asset

Generation

Expense

Control

Profitable

Growth

5 |

Rank

Institution

Deposits

Deposit

Market

Share

1

Bank of America

$8,552

23.2

%

2

U.S. Bancorp

7,589

20.6

3

Wells Fargo

6,241

16.9

4

JPMorgan Chase

3,105

8.4

5

KeyCorp

2,488

6.7

6

Umpqua

1,617

4.4

PF 7

Sterling Pro Forma

1,102

3.0

7

BNP Paribas / BancWest

912

2.5

8

West Coast Bancorp

842

2.3

9

First Independent Bank

695

1.9

10

Riverview Bancorp

619

1.7

11

Washington Federal

441

1.2

12

Sterling

407

1.1

13

HomeStreet

300

0.8

14

First Federal S&LA of McMinnville

285

0.8

15

Banner

266

0.7

Recently Announced Acquisition of

First Independent Bank

6

Improves Sterling’s deposit market share in the Portland-Vancouver

MSA to #7 from #12 (largest market in Oregon) Enhances

Sterling’s

business

mix

–

addition

of

low

cost

core

deposit

base

Expands Wealth Management platform and adds Trust Services to product

offering ($452 million AUM at 12/31/11) All Regulatory approvals

received in January; Expected close February 29, 2012 6

Source: SNL Financial. Deposit market share data as of June 30, 2011.

Deposit Market Share: Portland-Vancouver MSA

Pro Forma Branch Map

Portland

Eugene

Spokane

Seattle

WA

84

90

5

OR

Washington

Columbia

Multnomah

Clackamas

Hood River

Clark

Skamania

Sterling

First Independent

Bank

Major Cities

Portland

($ in millions)

($ in millions)

Sterling

First

Independent

Sterling

Pro Forma

Branches

176

14

190

Total Deposits per Branch

$37.1

$49.6

$38.0 |

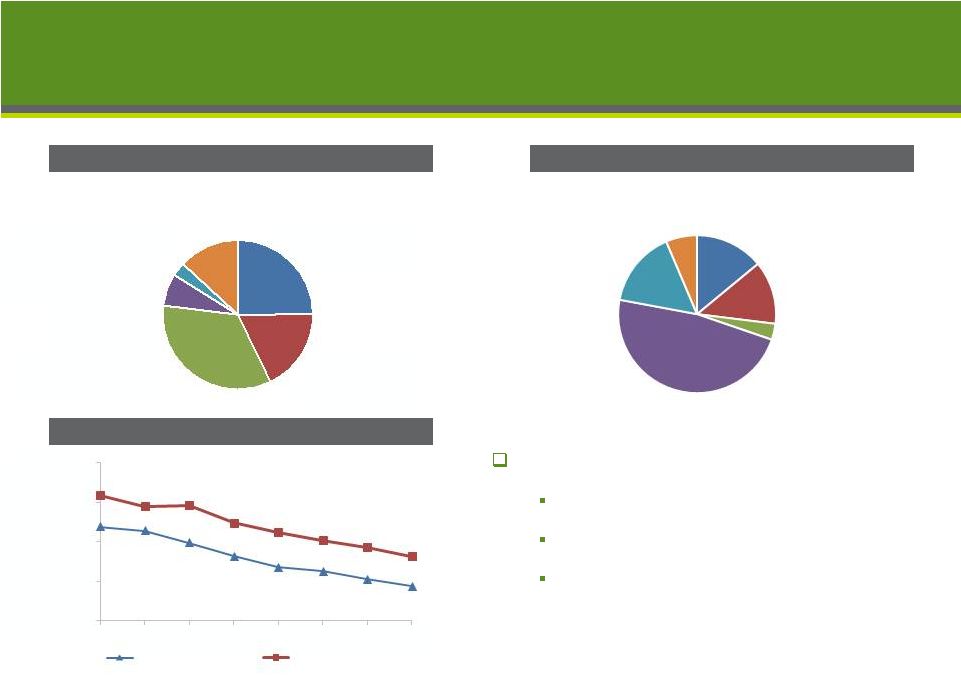

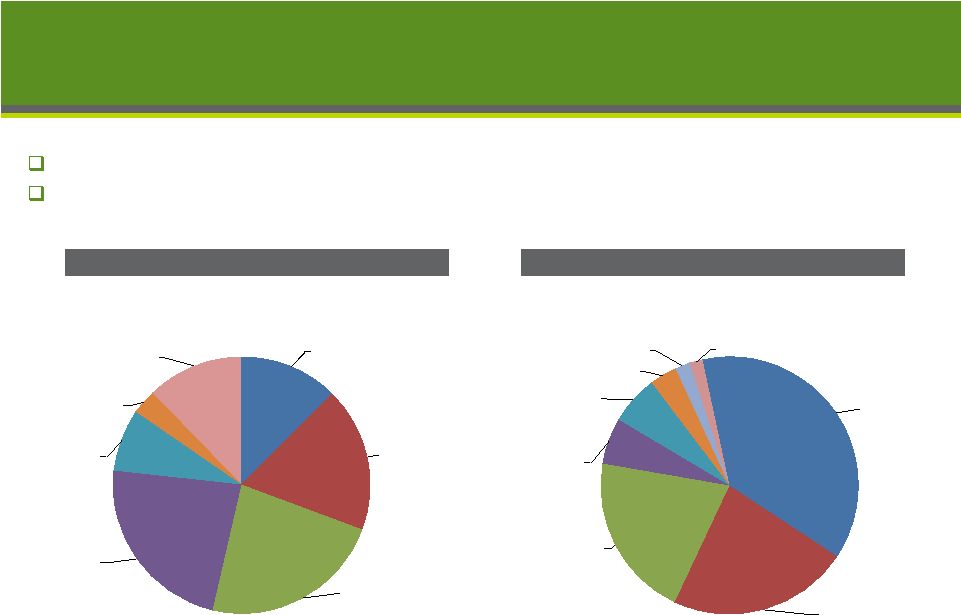

First Independent Deposit and Loan Composition

7

7

Loan Portfolio Composition

Cost of Interest-Bearing Deposits

Source: SNL Financial.

(1)

Peers defined as banks in Washington and Oregon with asset size greater than

$500 million and less than $5 billion. (1)

Deposit Composition

Balance of $680mm as of Dec. 31, 2011

Gross Balance of $453mm as of Dec. 31, 2011

Seller retaining $49mm of loans

Impaired and other loans

Overlapping and related credit exposure

Estimated gross credit mark of 9.5% or

$40mm on remaining $425mm of gross loans

o

Net credit mark of 6.1%, or $26mm

0.95%

0.91%

0.79%

0.65%

0.54%

0.50%

0.42%

0.35%

1.27%

1.16%

1.17%

0.99%

0.89%

0.81%

0.74%

0.65%

0.00%

0.40%

0.80%

1.20%

1.60%

Q1'10

Q2'10

Q3'10

Q4'10

Q1'11

Q2'11

Q3'11

Q4'11

First Independent

Peer Median

IRA

Accounts

3%

CD

Accounts

13%

Non-

Interest

Bearing DDA

25%

Savings

Accounts

7%

Money

Market

Demand

Accounts

34%

Interest

Bearing DDA

18%

C&D

14%

1-4 Family

13%

Multifamily

3%

CRE

48%

C&I

16%

Consumer &

Other

6% |

Improving Trends Summary (Q4 2011 vs. Q4 2010)

8

Increased margins and improved expense management

Net interest margin

Funding costs

Non-interest expense

46

bps

32 bps

20%

61%

55%

Provision for loan losses

Non-performing assets

Classified assets

87%

Improved asset quality and reduced credit provisioning

|

Deposit Composition

Source: SNL Financial and company filings.

Peers include: BANR, CATY, CYN, CVBF, GBCI, PACW, SIVB, UMPQ, and WABC.

Figures based on median of peers. Overall improvement in deposit mix

leading to lower cost of deposits

Decreased brokered deposits by

$651mm since year end 2009, to $429mm

$1.2 billion of CDs re-pricing during 2012

with a current average rate of 1.31%

Deposit composition

Deposit balances

Reducing

avg.

cost

of

deposits

(%)

(1)

9

Non-interest

bearing transaction:

$1,212 / 19%

Time deposits-retail

& public:

$2,232 / 34%

Time deposits-

brokered:

$429 / 7%

Savings and money

market demand:

$2,092 / 32%

Interest-bearing

transaction:

$521 / 8%

Balance of $6,486 million as of December 31, 2011

(in millions)

(in millions)

12/31/2010

12/31/2011

Annual

% change

Retail deposits:

Transaction

$1,490

$1,733

16%

Savings and MMDA

1,567

1,902

21%

Time deposits

2,809

1,993

-29%

Total retail

5,866

5,628

-4%

Public:

796

429

-46%

Brokered:

249

429

72%

Total deposits

$6,911

$6,486

-6%

BPs Change

Depost funding costs

1.13%

0.80%

-33

Gross loans to deposit

81%

85%

3.68%

3.26%

2.88%

2.82%

2.72%

2.31%

2.08%

1.98%

1.77%

1.45%

1.36%

1.27%

1.13%

1.01%

0.91%

0.86%

0.80%

2.18%

1.50%

1.10%

1.13%

1.33%

1.10%

0.90%

0.85%

0.73%

0.67%

0.66%

0.56%

0.50%

0.51%

0.48%

0.45%

0.00%

0.50%

1.00%

1.50%

2.00%

2.50%

3.00%

3.50%

4.00%

4.50%

Q4

07

Q1

08

Q2

08

Q3

08

Q4

08

Q1

09

Q2

09

Q3

09

Q4

09

Q1

10

Q2

10

Q3

10

Q4

10

Q1

11

Q2

11

Q3

11

Q4

11

4Q 2011 Y-o-Y Improvement (33 bps)

STSA

Peer

(1) |

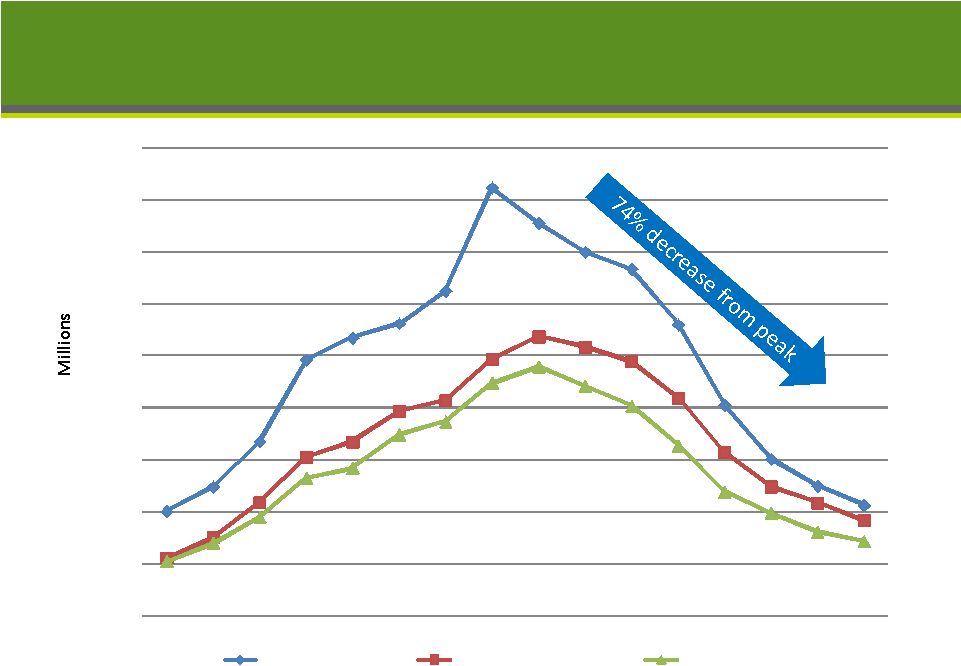

10

$-

$200

$400

$600

$800

$1,000

$1,200

$1,400

$1,600

$1,800

Q1 08

Q2 08

Q3 08

Q4 08

Q1 09

Q2 09

Q3 09

Q4 09

Q1 10

Q2 10

Q3 10

Q4 10

Q1 11

Q2 11

Q3 11

Q4 11

Classified Assets

Non

-perfoming Assets

Non

-performing Loans

$426

12/31/09: $1,648

Improving Trend in Classified & Non-Performing Assets |

(in millions)

12/31/2010

3/31/2011

6/30/2011

9/30/2011

12/31/2011

NPLs beginning-of-period

$809.0

$654.6

$477.1

$396.1

$323.1

Additions/increases

62.5

47.0

65.1

66.6

33.0

Return to accruing status

(11.1)

(77.3)

(13.7)

(6.8)

-

Charge-offs

(31.4)

(24.1)

(33.4)

(29.9)

(10.7)

Transfer to OREO

(58.6)

(67.3)

(33.5)

(58.7)

(18.5)

Payments/sales

(115.8)

(55.8)

(65.5)

(44.2)

(39.7)

NPLs end of period

$654.6

$477.1

$396.1

$323.1

$287.2

NPLs/Loans

11.6%

8.6%

7.1%

5.8%

5.2%

% decline ($) since Q4 2010:

56%

For the quarter ended

Non-performing Loan (NPL) Flow Analysis

11 |

OREO Flow Analysis

12

(dollars in millions)

Amount

Properties

Amount

Properties

OREO:

Beginning balance

$83

203

$162

439

Additions

265

821

178

463

Valuation adjustments

(37)

-

(22)

-

Sales

(155)

(584)

(241)

(758)

Other changes

6

(1)

5

(1)

Ending balance

$162

439

$82

143

2010

2011

For the year ended December 31, |

Washington:

$2,073 / 37%

Oregon:

$1,254 / 23%

N. California:

$1,148 / 21%

Idaho:

$318 / 6%

S. California:

$340 / 6%

Arizona: $191 / 3%

Montana:

$101 / 2%

Other: $95 / 2%

Outstanding balance of $5.5 billion as of Dec. 31, 2011

(2)

(in millions)

Loan Portfolio Summary

Reducing Construction Loan Exposure and Focusing on Relationship-Based

Lending Gross loans were $5.5 billion at December 31, 2011

2011

portfolio

loan

originations

increased

by

$897

million,

or

189%

over

2010

(1)

Source: Company filings.

(1)

Excluding residential mortgage loans held for sale.

(2)

Net of $124.1 million in FAS 114 writedowns.

Loan mix by geography

Loan mix by category

13

Residential RE:

$688 / 13%

Multi-family RE:

$1,001 / 18%

CRE, NOO:

$1,276 / 23%

CRE, OO:

$1,272 / 23%

C&I: $432 / 8%

Construction:

$175 / 3%

Consumer:

$675 / 12%

Outstanding balance of $5.5 billion as of Dec. 31, 2011

(2)

(in millions) |

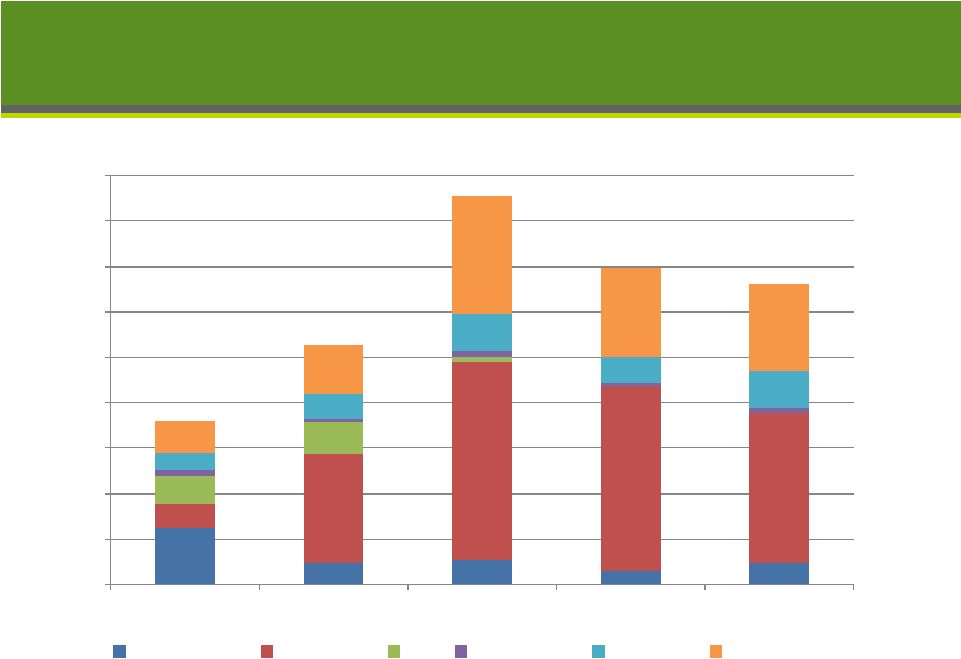

0

50

100

150

200

250

300

350

400

450

Q4 10

Q1 11

Q2 11

Q3 11

Q4 11

Residential RE

Multifamily

CRE

Construction

Consumer

Commercial

Loan

Portfolio

New

Originations

by

Quarter

(1)

($ in millions)

14

$265

$180

$332

$348

$426

Source: Company filings.

(1)

Excluding residential mortgage loans held for sale.

|

WA

30%

OR

10%

N Cal

31%

S Cal

29%

5 Yr Fixed

Hybrid

ARM

64%

3 Yr Fxd

H-ARM

19%

7 Yr Fxd

H-ARM

6%

Other

7%

Refi

75%

Purchase

25%

15

MF loan programs

MF geography

MF loan purpose

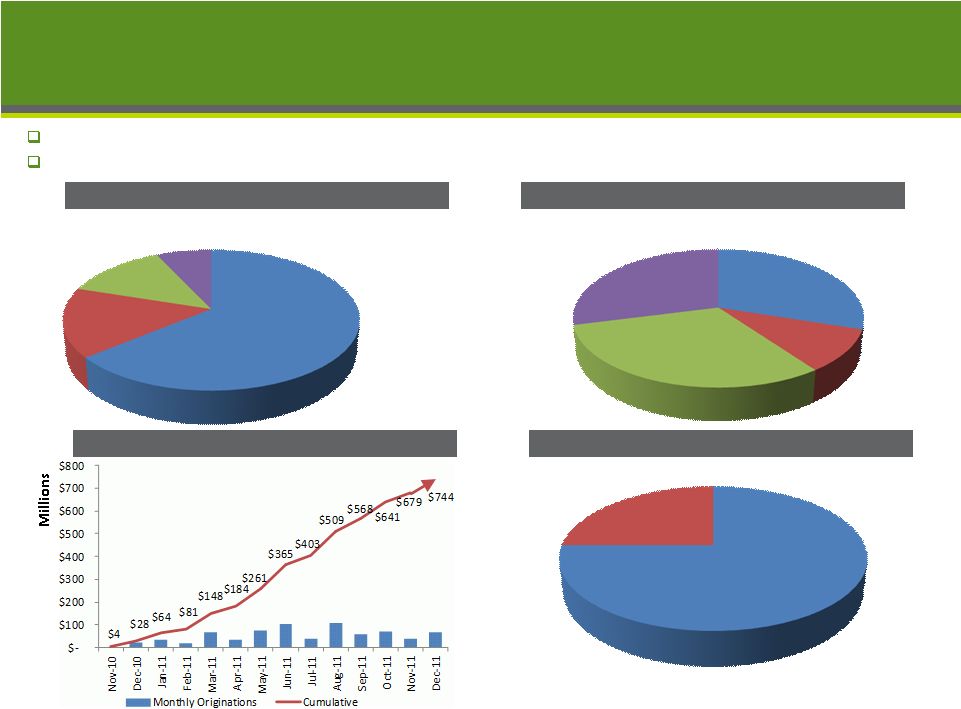

MF originations since program inception

Wtd Avg LTV: 67.0%; Wtd Avg DSC: 1.31:1; Wtd Avg Yield: 4.7%

$49 million sale completed in Q4 2011 for net gain of $1.3 million; expect

additional sales in 2012 Multifamily – Program to Date as of Q4

2011 |

Sterling Rebranding

16

Sterling Savings Bank to be rebranded to Sterling Bank

Initial launch in Q1 2012

First significant branding initiative since bank was founded over 30 years

ago Completes process of evolving from thrift roots to a

full-service commercial bank initiated in 2005 with charter

conversion CA will continue to operate as Sonoma Bank due to trademark

restrictions New website launch March 2012:

www.bankwithsterling.com Signage will be replaced over a two year

period with initial roll out in Spokane, Portland, Vancouver and

Seattle Expected financial impact of $3.5 million for 2012

At Sterling Bank, we improve lives and strengthen

communities. We are a bridge to the possible.

www.bankwithsterling.com |

Expense Control and Operating Efficiency Drivers

17

Comprehensive staff review completed which identified $15 million

in annualized staff savings

Substantially all staffing reductions will be achieved during Q1

‘12, with full year

2012 compensation impact of $12 million excluding severance

Reductions represent approximately 6% of FTEs and 8% of related compensation

expense (relative to 2011)

Severance related charge of approximately $3 million to be recognized in Q1

‘12 OREO Expense –

Expected decline with lower levels of OREO

Q4 2011 OREO Expense was only 12% of full year amount

Working to improve efficiency and effectiveness of operations

Additional reductions in FDIC insurance

Ongoing vendor assessment and procurement strategies

Review of branches and facilities

Management target: Efficiency ratio less than 60% by 2013

“Given the challenging interest rate environment and the uncertain

economic outlook, Sterling must position itself for continued

success, including lowering its operating expenses. Sterling has fewer assets today than it did just a few years

ago and, although this has been a difficult decision, the bank needs to

appropriately reflect that reality.”

-Greg Seibly, CEO

|

Summary

Executing on our strategic plan

Valuable, core-deposit franchise drives earnings power

Continued improvement in asset quality metrics

High-quality, relationship-driven asset generation

Ongoing expense management

Emphasizing increased earnings power

Focused on increasing pre-tax, pre-provision earnings

Fully

Reserved

Net

Deferred

Tax

Asset

of

$327

million

($5.27

per

share)

as of 12/31/11

Expect a portion of the DTA reserve may be released during the first half

of 2012 if performance trends continue

Regardless of reserve release amount, effective tax rate of 0% expected for

2012 Amount

of

DTA

that

can

be

included

in

regulatory

capital

will

be

subject

to

limitations

Capitalization

Significantly

exceeds

regulatory

levels

required

for

“well-capitalized”

status

Additional capital in place to support opportunistic growth

Will evaluate other capital management alternatives, including cash

dividends, with expected release of regulatory restrictions

Capital ratios have improved since recapitalization in August 2010:

o

Tier 1 leverage ratio:

11.4%

o

Tier 1 risk-based capital ratio:

17.8%

o

Total risk-based capital ratio:

19.1%

18 |

Ticker: STSA

Spokane, Washington

www.sterlingfinancialcorporation-spokane.com

19

Investor Contacts

Media Contact

Patrick Rusnak

Cara Coon

Chief Financial Officer

VP/Communications and Public Affairs Director

(509) 227-0961

(509) 626-5348

patrick.rusnak@sterlingsavings.com

cara.coon@sterlingsavings.com

Daniel Byrne

EVP/Corporate Development Director

(509) 458-3711

dan.byrne@sterlingsavings.com |

Appendix

20 |

12/31/2011

Peer median

(1)

TCE/TA

9.4%

8.8%

Tier 1 leverage

11.4%

9.5%

Tier 1 risk-based capital

17.8%

13.7%

Total risk-based capital

19.1%

15.5%

NPA/Tangible Capital + ALLL

35.4%

19.3%

Capital Compared to Peers

Source: SNL Financial and company filings. Sterling Financial data as of

December 31, 2011. Peer group data as of most recent quarter available.

(1) Peers include all public U.S. banking companies with between

$7 billion and $25 billion in assets.

21 |

Last Five Quarters Financial / Operating Highlights

22

(in millions)

12/31/2010

3/31/2011

6/30/2011

9/30/2011

12/31/2011

Asset Quality

NPAs

(1)

$816

$629

$498

$435

$369

Classified assets

$1,100

$812

$604

$500

$426

NPAs / assets

8.6%

6.7%

5.4%

4.7%

4.0%

ALLLs / NPLs

37.7%

48.8%

53.5%

57.6%

61.8%

ALLL / loans

4.4%

4.2%

3.8%

3.3%

3.2%

Net charge-offs (NCOs)

$31

$24

$33

$30

$11

NCOs / avg. loans

2.0%

1.6%

2.2%

2.0%

0.7%

Balance Sheet

Total assets

$9,493

$9,352

$9,242

$9,176

$9,193

Net loans

$5,379

$5,321

$5,388

$5,428

$5,341

Total construction loans

$526

$396

$308

$222

$175

Securities

$2,838

$2,821

$2,496

$2,448

$2,550

Core deposits

(2)

$6,662

$6,393

$6,124

$6,108

$6,057

Gross loans/total deposits

81%

83%

85%

87%

85%

Capital

$771

$774

$808

$859

$879

TCE/TA

8.0%

8.1%

8.6%

9.2%

9.4%

Tier 1 leverage

10.1%

10.6%

10.9%

11.1%

11.4%

Operating Highlights

Operating income (loss) before taxes

($38.1)

$5.4

$7.6

$11.3

$14.8

Provision for credit losses

$30.0

$10.0

$10.0

$6.0

$4.0

FTE net interest margin

2.80%

3.22%

3.31%

3.34%

3.26%

Adj. FTE net interest margin

3.43%

3.75%

3.73%

3.60%

3.53%

For the quarters ended

(3)

(1)

Net of cumulative confirmed losses on loans and OREO of $207.3 million for

Dec. 31, 2011, $299.7 million for Sept. 30, 2011, $375.7 million for June 30, 2011, $423.8 million for March 31, 2011, and

$516.3 million for Dec. 31, 2010.

(2)

Core deposits defined as total deposits less brokered CDs.

(3)

Adjusted FTE NIM includes interest reversal on non-performing

loans. |

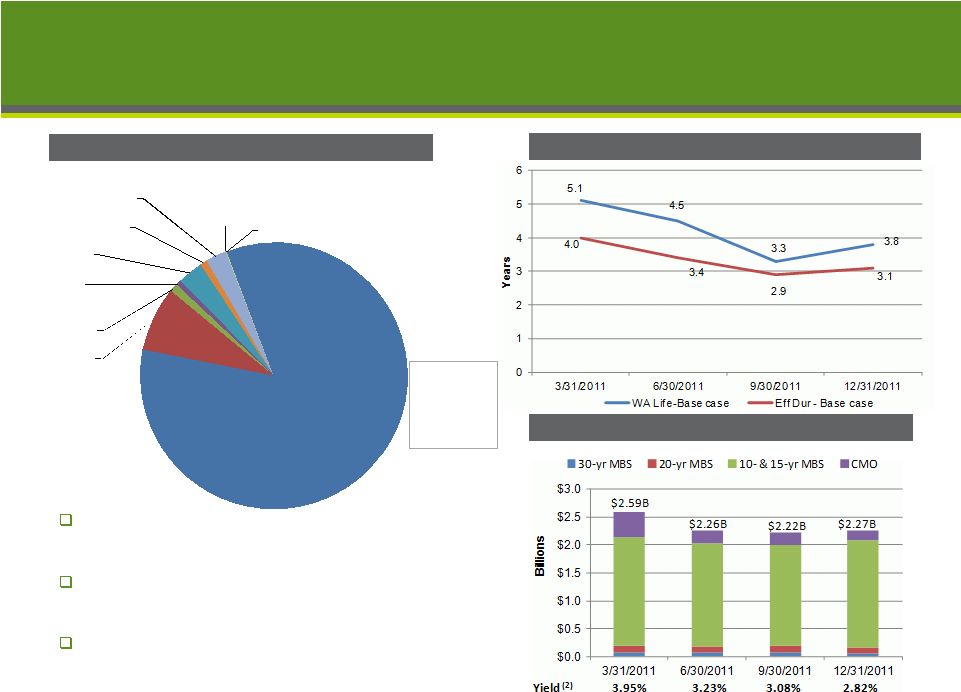

MBS:

$2,089 / 84%

Muni bonds:

$194 / 8%

Corp: $25 /1%

Non-agency:

$17 / 1%

Ginnie Mae:

$76 / 3%

Freddie Mac:

$23 / 1%

Fannie Mae:

$60 / 2%

Tax credit:

$2 / 0%

Other: $1 / 0%

$2.5 billion total portfolio

(in millions)

High Quality, Low Credit Risk Investment Portfolio

Three considerations in shaping investment

portfolio composition are safety, liquidity and

return

Strategy remains to reduce exposure to 30-yr

MBS and replace with 10-

and 15-year MBS

with good cash flows to fund loan growth

84% Agency MBS pass-throughs

Source: Company filings.

(1)

Durations and average life measures are base case, under current

market rates.

(2)

Yield at quarter end.

Investment portfolio

Weighted avg life and effective duration

MBS composition

23

2.95%

overall

portfolio

yield

(2) |

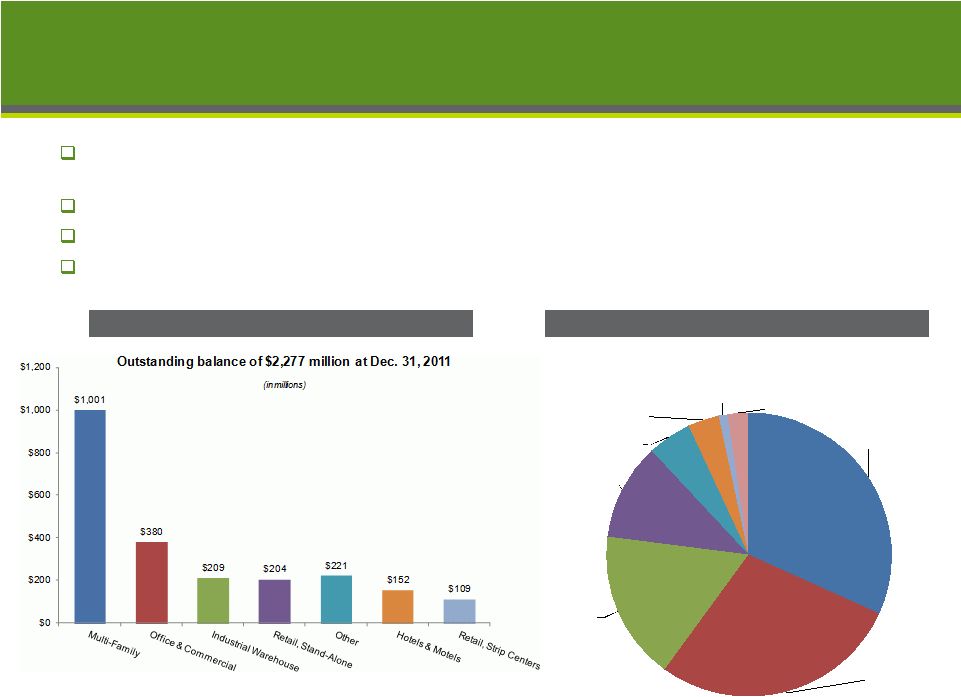

Includes Multifamily

Non-owner-occupied commercial real estate loans (including

multifamily) totaled $2.3 billion as of 12/31/2011

Increased by $445 million, or 24% since 12/31/2010

Represented 41% of gross loans as of 12/31/2011, up from 33% at

12/31/2010 3% of non-owner-occupied CRE loans were

non-performing as of 12/31/2011 Source: Company filings.

CRE NOO loan mix by geography

CRE NOO loan mix by property type

24

Washington:

$723 / 32%

N. California:

$644 / 28%

Oregon:

$387 / 17%

S. California:

$253 / 11%

Arizona: $111 / 5%

Idaho: $80 / 4%

Montana: $25 / 1%

Other: $54 / 2%

Outstanding balance of $2,277 million at Dec. 31, 2011

(in millions)

Loan Portfolio – CRE Non-Owner-Occupied |

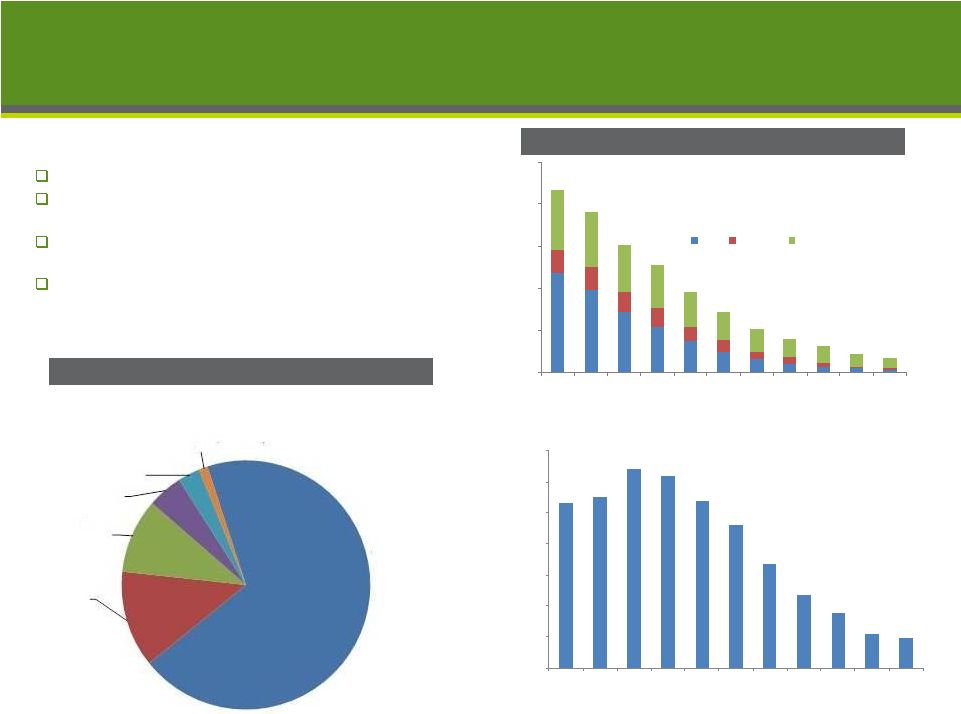

Includes SBA

Owner-occupied commercial real estate loans totaled $1.27 billion as of

12/31/2011 Represented 23% of gross loans at 12/31/2011

6% of owner-occupied CRE loans were non-performing at

12/31/2011 SBA loans were $98 million, or 8% of total

owner-occupied CRE loans at 12/31/2011 Source: Company

filings. CRE OO loan mix by geography

CRE OO loan mix by property type

25

Washington:

$411 / 32%

N. California:

$351 / 28%

Oregon:

$306 / 24%

Idaho: $74 / 6%

Arizona: $67 / 5%

S. California:

$36 / 3%

Montana:

$14 / 1%

Other: $12 / 1%

Outstanding balance of $1,272 million at Dec. 31, 2011

(in millions)

$332

$242

$224

$134

$129

$76

$49

$49

$38

$0

$50

$100

$150

$200

$250

$300

$350

Outstanding balance of $1,272 million at Dec. 31, 2011

(in millions)

Loan Portfolio – CRE Owner-Occupied |

Construction Loan Reductions

Aggressively shrinking construction portfolio

Construction balances have decreased $2.8

billion, or 94% since 2007

At 12/31/2011, construction loans had declined to

3% of total loans vs. 32% at 12/31/2007 (peak)

Construction non-performing loans totaled $95

million (33% of total NPLs) as of 12/31/2011

Total construction loans

Construction loan balances

26

$-

$500

$1,000

$1,500

$2,000

$2,500

2Q09

3Q09

4Q09

1Q10

2Q10

3Q10

4Q10

1Q11

2Q11

3Q11

4Q11

(in millions)

Res

Multifam

Comm'l

$534

$552

$640

$619

$540

$459

$336

$238

$176

$109

$95

$-

$100

$200

$300

$400

$500

$600

$700

2Q09

3Q09

4Q09

1Q10

2Q10

3Q10

4Q10

1Q11

2Q11

3Q11

4Q11

Non-performing construction loans

(in millions)

Commercial:

$121 / 69%

Multi-family:

$22 / 12%

Residential -

vertical: $17 / 10%

Lots: $8 / 5%

Raw land: $5 / 3%

A&D: $2 / 1%

Outstanding balance of $175 million as of Dec. 31, 2011

(in millions) |

Ticker: STSA

Spokane, Washington

www.sterlingfinancialcorporation-spokane.com

27

Investor Contacts

Media Contact

Patrick Rusnak

Cara Coon

Chief Financial Officer

VP/Communications and Public Affairs Director

(509) 227-0961

(509) 626-5348

patrick.rusnak@sterlingsavings.com

cara.coon@sterlingsavings.com

Daniel Byrne

EVP/Corporate Development Director

(509) 458-3711

dan.byrne@sterlingsavings.com |