Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - Xinde Technology Co | Financial_Report.xls |

| EX-21 - EXHIBIT 21 - Xinde Technology Co | v301349_ex21.htm |

| EX-32.2 - CERTIFICATION - Xinde Technology Co | v301349_ex32-2.htm |

| EX-32.1 - CERTIFICATION - Xinde Technology Co | v301349_ex32-1.htm |

| EX-31.2 - CERTIFICATION - Xinde Technology Co | v301349_ex31-2.htm |

| EX-31.1 - CERTIFICATION - Xinde Technology Co | v301349_ex31-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

S QUARTERLY REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended December 31, 2011

OR

£ TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE EXCHANGE ACT

For the transition period from __________ to __________

COMMISSION FILE NUMBER: 000-53672

XINDE TECHNOLOGY COMPANY

(Exact name of registrant as specified in its charter)

| Nevada | 20-812712 | |

|

(State or other jurisdiction of incorporation or organization) |

(IRS Employer Identification No.) |

Number 363, Sheng Li West Street, Weifang, Shandong Province,

The People’s Republic of China

(Address of principal executive offices)

(011) 86-536-8322068

(Registrant’s Telephone Number, Including Area Code)

Check whether the issuer (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the issuer was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes S No £

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes S No £

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company filer (Check one):

| Large Accelerated Filer £ | Accelerated Filer £ | Non-Accelerated Filer £ | Smaller Reporting Company S |

Indicate by check mark whether the registrant is a shell company as defined in Rule 12b-2 of the Exchange Act. Yes £ No S

State the number of shares outstanding of each of the issuer’s classes of common equity, as of the latest practicable date: As of February 13, 2012, the registrant had 240,000,000 shares of common stock, par value $0.001 per share, issued and outstanding.

| -1- |

TABLE OF CONTENTS

| PAGE | ||

| PART I FINANCIAL INFORMATION | 3 | |

| ITEM 1. FINANCIAL STATEMENTS | 3 | |

| ITEM 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OR PLAN OF OPERATION | 4 | |

| ITEM 3. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK | 20 | |

| ITEM 4. CONTROLS AND PROCEDURES | 20 | |

| PART II OTHER INFORMATION | 21 | |

| ITEM 1. LEGAL PROCEEDINGS | 21 | |

| ITEM 1A. RISK FACTORS | 21 | |

| ITEM 2. UNREGISTERED SALES OF EQUITY SECURITIES AND USE OF PROCEEDS | 21 | |

| ITEM 3. DEFAULTS UPON SENIOR SECURITIES | 21 | |

| ITEM 4. MINE SAFETY DISCLOSURES. | 21 | |

| ITEM 5. OTHER INFORMATION | 21 | |

| ITEM 6. EXHIBITS | 21 | |

| SIGNATURES | 23 | |

| EXHIBIT 31.1 | ||

| EXHIBIT 31.2 | ||

| EXHIBIT 32.1 | ||

| EXHIBIT 32.2 |

| -2- |

PART I FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS

XINDE TECHNOLOGY COMPANY

AND SUBSIDIARIES

CONTENTS

| PAGES | F-1–F-2 | CONDENSED CONSOLIDATED BALANCE SHEETS AS OF DECEMBER 31, 2011 AND JUNE 30, 2011 (UNAUDITED) | ||

| PAGES | F-3 | CONDENSED CONSOLIDATED STATEMENTS OF INCOME AND COMPREHENSIVE INCOME FOR THE THREE AND SIX MONTHS ENDED DECEMBER 31, 2011 AND 2010 (UNAUDITED) | ||

| PAGES | F-4–F-5 | CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS FOR THE SIX MONTHS ENDED DECEMBER 31, 2011 AND 2010 (UNAUDITED) | ||

| PAGES | F-6–F-25 | NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS FOR THE THREE AND SIX MONTHS ENDED DECEMBER 31, 2011 AND 2010 (UNAUDITED) |

| -3- |

XINDE TECHNOLOGY COMPANY

AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

(UNAUDITED)

ASSETS

| December 31, | June 30, | |||||||

| 2011 | 2011 | |||||||

| CURRENT ASSETS | ||||||||

| Cash and cash equivalents | $ | 2,632,447 | $ | 4,292,507 | ||||

| Restricted cash | 220,393 | - | ||||||

| Accounts receivable, net of allowance for doubtful accounts of $1,304,186 and $794,850 at December 31, 2011 and June 30, 2011, respectively | 93,756,956 | 97,785,036 | ||||||

| Inventories | 18,799,104 | 10,430,199 | ||||||

| Notes receivable, including bank acceptance notes | 17,636,954 | 7,214,395 | ||||||

| Prepayments for goods | 6,643,966 | 5,710,029 | ||||||

| Prepaid expenses and other receivables | 31,448 | 40,362 | ||||||

| Due from employees | 108,056 | 39,206 | ||||||

| Due from related party | 4,133 | - | ||||||

| Total Current Assets | 139,833,457 | 125,511,734 | ||||||

| LONG-TERM ASSETS | ||||||||

| Plant and equipment, net | 3,673,625 | 3,081,362 | ||||||

| Land use rights, net | 2,362,262 | 925,240 | ||||||

| Construction in progress | 179,728 | 889,839 | ||||||

| Deposit for land use right | - | 1,326,605 | ||||||

| Deferred taxes | 155,226 | 136,992 | ||||||

| Total Long-Term Assets | 6,370,841 | 6,360,038 | ||||||

| TOTAL ASSETS | $ | 146,204,298 | $ | 131,871,772 | ||||

See accompanying notes to the condensed consolidated financial statements

| F-1 |

XINDE TECHNOLOGY COMPANY

AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

(UNAUDITED)

LIABILITIES AND SHAREHOLDERS’ EQUITY

| December 31, | June 30, | |||||||

| 2011 | 2011 | |||||||

| CURRENT LIABILITIES | ||||||||

| Accounts payable | $ | 6,090,239 | $ | 6,576,118 | ||||

| Short-term bank loans | 2,676,196 | 2,630,154 | ||||||

| Customer deposits | 429,474 | 219,819 | ||||||

| Notes payable, including related parties | 1,095,698 | 1,313,909 | ||||||

| Current portion of long-term notes payable to related parties | 95,959 | 90,864 | ||||||

| Income tax payable | 11,749,856 | 9,723,497 | ||||||

| Other payables | 1,267,045 | 1,199,764 | ||||||

| Value added tax payable | 32,322,638 | 26,331,151 | ||||||

| Due to employees | 113,722 | 78,953 | ||||||

| Due to related parties | 410,529 | 132,599 | ||||||

| Accrued expenses | 955,543 | 829,115 | ||||||

| Deferred taxes | 595,673 | 937,880 | ||||||

| Total Current Liabilities | 57,802,572 | 50,063,823 | ||||||

| LONG-TERM LIABILITIES | ||||||||

| Long-term portion of notes payable to related parties | 176,677 | 221,667 | ||||||

| Total Long-Term Liabilities | 176,677 | 221,667 | ||||||

| TOTAL LIABILITIES | 57,979,249 | 50,285,490 | ||||||

| COMMITMENT AND CONTINGENCY | ||||||||

| SHAREHOLDERS’ EQUITY | ||||||||

| Common stock, $0.001 par value; 350,000,000 shares authorized; 240,000,000 shares issued and outstanding at December 31, 2011 and June 30, 2011 | 240,000 | 240,000 | ||||||

| Additional paid-in capital | 892,334 | 892,334 | ||||||

| Retained earnings (the restricted portion is $204,069 at December 31, 2011 and June 30, 2011) | 77,813,803 | 72,613,580 | ||||||

| Accumulated other comprehensive income | 9,278,912 | 7,840,368 | ||||||

| TOTAL SHAREHOLDERS’ EQUITY | 88,225,049 | 81,586,282 | ||||||

| TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY | $ | 146,204,298 | $ | 131,871,772 | ||||

See accompanying notes to the condensed consolidated financial statements

| F-2 |

XINDE TECHNOLOGY COMPANY

AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF INCOME AND

COMPREHENSIVE INCOME

(UNAUDITED)

| Three Months Ended | Six Months Ended | |||||||||||||||

| December 31, 2011 | December 31, 2010 | December 31, 2011 | December 31, 2010 | |||||||||||||

| REVENUES, NET | $ | 19,595,521 | $ | 32,387,892 | $ | 42,456,804 | $ | 62,686,928 | ||||||||

| COST OF GOODS SOLD | (15,503,846 | ) | (25,859,579 | ) | (34,537,473 | ) | (51,648,735 | ) | ||||||||

| GROSS PROFIT | 4,091,675 | 6,528,313 | 7,919,331 | 11,038,193 | ||||||||||||

| Selling and marketing | (386,073 | ) | (658,789 | ) | (849,956 | ) | (1,743,953 | ) | ||||||||

| General and administrative | (847,776 | ) | (260,016 | ) | (1,130,892 | ) | (773,331 | ) | ||||||||

| Bad debt recoveries | - | 480,454 | 107,197 | 662,974 | ||||||||||||

| INCOME FROM OPERATIONS | 2,857,826 | 6,089,962 | 6,045,680 | 9,183,883 | ||||||||||||

| Interest expense, net | (22,360 | ) | (62,140 | ) | (66,061 | ) | (203,895 | ) | ||||||||

| Other income, net | 39,198 | 122,565 | 51,887 | 238,102 | ||||||||||||

| Exempted value added tax | 659,521 | - | 656,946 | 3,258,380 | ||||||||||||

| INCOME BEFORE INCOME TAXES | 3,534,185 | 6,150,387 | 6,688,452 | 12,476,470 | ||||||||||||

| INCOME TAXES | (710,255 | ) | (773,934 | ) | (1,488,229 | ) | (1,643,137 | ) | ||||||||

| NET INCOME | 2,823,930 | 5,376,453 | 5,200,223 | 10,833,333 | ||||||||||||

| OTHER COMPREHENSIVE INCOME (LOSS) | ||||||||||||||||

| Foreign currency translation gain | 482,090 | 846,213 | 1,438,546 | 1,820,017 | ||||||||||||

| OTHER COMPREHENSIVE INCOME (LOSS) | 482,090 | 846,213 | 1,438,546 | 1,820,017 | ||||||||||||

| COMPREHENSIVE INCOME | $ | 3,306,020 | $ | 6,222,666 | $ | 6,638,769 | $ | 12,653,350 | ||||||||

| WEIGHTED AVERAGE SHARES OUTSTANDING BASIC AND DILUTED | 240,000,000 | 240,000,000 | 240,000,000 | 240,000,000 | ||||||||||||

| NET INCOME PER COMMON SHARE, BASIC AND DILUTED | $ | 0.01 | $ | 0.02 | $ | 0.02 | $ | 0.05 | ||||||||

See accompanying notes to condensed consolidated financial statements

| F-3 |

XINDE TECHNOLOGY COMPANY

AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(UNAUDITED)

| Six Months Ended | ||||||||

| December 31, 2011 | December 31, 2010 | |||||||

| CASH FLOWS FROM OPERATING ACTIVITIES: | ||||||||

| Net income | $ | 5,200,223 | $ | 10,833,333 | ||||

| Adjustments to reconcile net income to net cash provided by operating activities: | ||||||||

| Depreciation and amortization | 209,677 | 141,449 | ||||||

| Provision for doubtful accounts | 600,591 | 188,804 | ||||||

| Bad debt recoveries | (107,197 | ) | (662,974 | ) | ||||

| Exempted value added tax | (656,946 | ) | (3,258,380 | ) | ||||

| Deferred taxes | (360,442 | ) | 343,742 | |||||

| Net (gain) loss on settlement of accounts receivable and accounts payable for fixed assets | (13,372 | ) | (7,590 | ) | ||||

| Net gain on disposal of fixed assets | (24,543 | ) | - | |||||

| Changes in operating assets and liabilities | ||||||||

| (Increase) Decrease In: | ||||||||

| Accounts receivable | 3,518,745 | (7,973,154 | ) | |||||

| Inventories | (8,368,905 | ) | (8,866,033 | ) | ||||

| Prepayments for goods | (933,937 | ) | (1,348,151 | ) | ||||

| Prepaid expenses and other receivables | 8,911 | (6,398 | ) | |||||

| Due from employees | (68,849 | ) | 94,643 | |||||

| Due from related parties | (4,133 | ) | - | |||||

| Increase (Decrease) In: | ||||||||

| Accounts payable | (460,106 | ) | 286,040 | |||||

| Value added tax payable | 6,648,434 | 10,052,818 | ||||||

| Other payables | 67,281 | 21,462 | ||||||

| Taxes payable | 2,026,359 | 1,459,542 | ||||||

| Customer deposits | 209,656 | 282,770 | ||||||

| Due to employees | 34,768 | (38,135 | ) | |||||

| Due to related parties | 277,929 | (110,689 | ) | |||||

| Accrued expenses | 126,430 | 257,372 | ||||||

| Net cash provided by operating activities | 7,930,574 | 1,690,471 | ||||||

| CASH FLOWS FROM INVESTING ACTIVITIES: | ||||||||

| Purchases of plant and equipment | (72,612 | ) | (108,891 | ) | ||||

| Purchases of construction in progress | (12,748 | ) | (22,920 | ) | ||||

| Proceeds from sale of fixed assets | 101,224 | - | ||||||

| Payment for land use right | (137,217 | ) | - | |||||

| Repayment of notes receivable | 24,155,881 | 44,414,853 | ||||||

| Issuance of notes receivable | (34,410,018 | ) | (47,738,078 | ) | ||||

| Net cash used in investing activities | (10,375,490 | ) | (3,455,036 | ) | ||||

See accompanying notes to condensed consolidated financial statements

| F-4 |

XINDE TECHNOLOGY COMPANY

AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(UNAUDITED)

| Six Months Ended | ||||||||

| December 31, 2011 | December 31, 2010 | |||||||

| CASH FLOWS FROM FINANCING ACTIVITIES: | ||||||||

| Restricted cash | $ | (220,393 | ) | $ | - | |||

| Proceeds from short-term loans | 940,675 | 743,641 | ||||||

| Repayments of short-term loans | (940,675 | ) | (1,725,248 | ) | ||||

| Repayments of notes payable | (1,588,634 | ) | (137,201 | ) | ||||

| Proceeds from notes payable | 1,303,228 | 654,601 | ||||||

| Net cash used in financing activities | (505,799 | ) | (464,207 | ) | ||||

| NET DECREASE IN CASH AND CASH EQUIVALENTS | (2,950,715 | ) | (2,228,772 | ) | ||||

| Effect of exchange rate changes on cash | 1,290,655 | 1,740,813 | ||||||

| Cash and cash equivalents at beginning of period | 4,292,507 | 3,399,360 | ||||||

| CASH AND CASH EQUIVALENTS AT END OF PERIOD | $ | 2,632,447 | $ | 2,911,401 | ||||

| SUPPLEMENTARY CASH FLOW INFORMATION | ||||||||

| Income taxes paid | $ | 12,610 | $ | 10,752 | ||||

| Interest paid | $ | 100,814 | $ | 155,489 | ||||

SUPPLEMENTAL NON-CASH DISCLOSURES:

1. During the six months ended December 31, 2011, accounts payable with an aggregate carrying amount of $25,773 was settled by two fixed assets with a fair value of $12,401, resulting in a gain of $13,372.

2. During the six months ended December 31, 2010, accounts payable with an aggregate carrying amount of $14,873 was settled by two fixed assets with a fair value of $7,283, resulting in a gain of $7,590.

3. During the six months ended December 31, 2011, fixed assets with a net book value of $76,681 were sold for cash $101,224, resulting in a $24,543 gain.

4. During the six months ended December 31, 2011, $735,467 was transferred from construction in progress to plant and equipment.

5. During the six months ended December 31, 2011, $1,463,822 was transferred from deposit to land use right.

See accompanying notes to the condensed consolidated financial statements

| F-5 |

XINDE TECHNOLOGY COMPANY

AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

for the three and six MONTHS ENDED DECember 31, 2011 and 2010

(UNAUDITED)

NOTE 1 – ORGANIZATION AND PRINCIPAL ACTIVITIES

Wasatch Food Services, Inc., (“Wasatch”) was incorporated under the laws of the State of Nevada on December 20, 2006. On April 22, 2010, Wasatch Food Services, Inc. changed its name to Xinde Technology Company (“Xinde”). The principal activities of Xinde and subsidiaries (the “Company”) are the design, development, manufacture, and commercialization of fuel injection pumps, injectors, multi-cylinder diesel engines and small generator units in the People’s Republic of China (the “PRC”) and overseas markets.

On April 14, 2011, the Company (i) effected a 4-for-1 forward stock split of the Company's common stock; (ii) increased the number of authorized shares of common stock from 150,000,000 shares to 350,000,000 shares. As a result, all the amounts in the accompanying condensed consolidated financial statements have been restated to give effect to the 4-for-1 forward stock split.

Details of the Company as of December 31, 2011 are as follows:

| Name | Place and Date of Establishment/ Incorporation |

Relationship | Principal Activities | |||

| Xinde Industrial Limited (“XIL”), formerly Jolly Promise Ltd. (“JPL”) |

British Virgin Island July 2, 2008 |

Wholly-owned subsidiary of Xinde | Investment holding company | |||

| H.K. Sindhi Fuel Injection Co., Ltd (“HKSIND”) |

Hong Kong, PRC, June 7, 2004 |

Wholly-owned subsidiary of XIL | Investment holding company |

On December 30, 2011, Jolly Promise Ltd. changed its name to Xinde Industrial Limited. (“XIL”).

| F-6 |

XINDE TECHNOLOGY COMPANY

AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

for the three and six MONTHS ENDED DECember 31, 2011 and 2010

(UNAUDITED)

NOTE 1 - ORGANIZATION AND PRINCIPAL ACTIVITIES (CONTINUED)

| Name |

Place and Date of Establishment/ Incorporation |

Relationship | Principal Activities | |||

|

Weifang Huajie Fuel Injection Co., Ltd. (“Huajie”) |

Shandong, PRC October 24, 2009 |

Wholly-owned subsidiary of HKSIND | Investment holding company | |||

|

Weifang Xinde Fuel Injection System Co., Ltd. (“Weifang Xinde”) |

Shandong, PRC October 29, 2007 |

Wholly-owned subsidiary of Huajie | Investment holding company | |||

|

Weifang Hengyuan Oil Pump & Oil Fitting Co., Ltd. ("Hengyuan") |

Shandong, PRC, December 21, 2001 |

Wholly-owned subsidiary of Weifang Xinde | Design, development, manufacture, and commercializing of fuel injection pump, diesel fuel injection systems and injectors | |||

| Weifang Jinma Diesel Engine Co., Ltd. (“Jinma”) |

Shandong, PRC December 19, 2003 |

Wholly-owned subsidiary of Weifang Xinde | Manufacture and sale of multi-cylinder diesel engine and small generating units | |||

| Weifang Huaxin Diesel Engine Co., Ltd. (“Huaxin”) |

Shandong, PRC October 20, 2003 |

Wholly-owned subsidiary of Weifang Xinde | Manufacture and sale of multi-cylinder diesel engine and small generating units |

Inter-company accounts and transactions have been eliminated in consolidation.

| F-7 |

XINDE TECHNOLOGY COMPANY

AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

for the three and six MONTHS ENDED DECember 31, 2011 and 2010

(UNAUDITED)

NOTE 2 – BASIS OF PRESENTATION

The Company’s unaudited condensed consolidated financial statements as of December 31, 2011 and for the three and six months ended December 31, 2011 and 2010 have been prepared in accordance with generally accepted accounting principles for interim financial information and pursuant to the requirements for reporting on Rule 8-03 of Regulation S-X. Accordingly, they do not include all the information and footnotes required by accounting principles generally accepted in the United States of America for complete financial statements.

However, such information reflects all adjustments (consisting solely of normal recurring adjustments), which are, in the opinion of management, necessary for the fair presentation of the consolidated financial position and the consolidated results of operations. Results shown for interim periods are not necessarily indicative of the results to be obtained for a full year. The condensed consolidated balance sheet information as of June 30, 2011 was derived from the audited consolidated financial statements included in the Form 10-K. These interim condensed consolidated financial statements should be read in conjunction with that report.

NOTE 3 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

| (a) | Use of Estimates |

The preparation of financial statements in conformity with generally accepted accounting principles in the United States requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the consolidated financial statements, and the reported amounts of revenue and expenses during the reporting period. Management makes these estimates using the best information available at the time the estimates are made; however actual results when ultimately realized could differ from those estimates.

| (b) | Economic and Political Risks |

The Company’s operations in the PRC are subject to special considerations and significant risks not typically associated with companies in North America and Western Europe. These include risks associated with, among others, the political, economic and legal environment and foreign currency exchange. The Company’s results may be adversely affected by changes in the political and social conditions in the PRC, and by changes in governmental policies with respect to laws and regulations, anti-inflationary measures, currency conversion, remittances abroad, and rates and methods of taxation, among other things.

| F-8 |

XINDE TECHNOLOGY COMPANY

AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

for the three and six MONTHS ENDED DECember 31, 2011 and 2010

(UNAUDITED)

NOTE 3 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

| (c) | Fair Value of Financial Instruments |

ASC 820-10, Fair Value Measurements, establishes a three-tier fair value hierarchy, which prioritizes the inputs used in measuring fair value. The hierarchy prioritizes the inputs into three levels based on the extent to which inputs used in measuring fair value are observable in the market.

These tiers include:

· Level 1—defined as observable inputs such as quoted prices in active markets;

· Level 2—defined as inputs other than quoted prices in active markets that are either directly or indirectly observable; and

· Level 3—defined as unobservable inputs in which little or no market data exists, therefore requiring an entity to develop its own assumptions.

The assets measured at fair value on a recurring basis subject to the disclosure requirements of ASC 820-10 as of December 31, 2011 are as follows:

| Fair Value Measurements at Reporting Date Using | ||||||||||||||||

| Carrying Value as of December 31, 2011 | Quoted Prices in Active Markets for Identical Assets (Level 1) | Significant Other Observable Inputs (Level 2) | Significant Unobservable Inputs (Level 3) | |||||||||||||

| Long-term notes payable | $ | 272,635 | - | $ | 272,635 | $ | - | |||||||||

The carrying amounts of financial assets and liabilities, such as cash and cash equivalents, accounts receivable, notes receivable, prepayments for goods, short-term bank loans, accounts payable, customer deposits, short-term notes payable, due to employee, due to related parties and other payables, approximate their fair values because of the short maturity of these instruments. The fair value of the Company’s long-term notes payable is estimated based on the current rates offered to the Company for debt of similar terms and maturities. Under this method, the Company’s fair value of long-term notes payable was not significantly different from the carrying value at December 31, 2011.

| (d) | Cash and Cash Equivalents |

For financial reporting purposes, the Company considers highly liquid investments purchased with original maturity of three months or less to be cash equivalents. Restricted cash represents time deposits to guarantee bank acceptance notes. Also see Note 11.

| F-9 |

XINDE TECHNOLOGY COMPANY

AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

for the three and six MONTHS ENDED DECember 31, 2011 and 2010

(UNAUDITED)

NOTE 3 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

| (e) | Inventories |

Inventories are stated at the lower of cost or net realizable value. The cost of raw materials is determined on the basis of weighted average. The cost of finished goods is determined on the weighted average basis and comprises direct materials, direct labor and an appropriate proportion of overhead.

Net realizable value is based on estimated selling prices less any further costs expected to be incurred for completion and disposal.

| (f) | Prepayments |

Prepayments represent cash paid in advance to suppliers for purchases of raw materials.

| (g) | Plant and Equipment |

Plant and equipment are carried at cost less accumulated depreciation and amortization. Depreciation is provided over their estimated useful lives, using the straight-line method. Leasehold improvements are amortized over the life of the asset or the term of the lease, whichever is shorter. Estimated useful lives are as follows:

| Buildings | 30 years | |

| Machinery | 10 years | |

| Motor vehicles | 5 years | |

| Office equipment | 5 years |

The cost and related accumulated depreciation of assets sold or otherwise retired are eliminated from the accounts and any gain or loss is included in the statement of income. The cost of maintenance and repairs is charged to expense as incurred, whereas significant renewals and betterments are capitalized.

| (h) | Construction in Progress |

Construction in progress represents direct costs of construction or the acquisition cost of buildings or machinery and design fees. Capitalization of these costs ceases and the construction in progress is transferred to plant and equipment when substantially all the activities necessary to prepare the assets for their intended use are completed. No depreciation is provided until the assets are completed and ready for their intended use.

| (i) | Land Use Rights |

According to the laws of China, land in the PRC is owned by the government and cannot be sold to an individual or company. However, the government grants the user a “land use right” to use the land. The land use rights granted to the Company are being amortized using the straight-line method over the lease term of fifty years.

| F-10 |

XINDE TECHNOLOGY COMPANY

AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

for the three and six MONTHS ENDED DECember 31, 2011 and 2010

(UNAUDITED)

NOTE 3 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

| (j) | Impairment of Long-Term Assets |

Long-term assets of the Company are reviewed annually as to whether their carrying value has become impaired, pursuant to the guidelines established in ASC 360-10. The Company considers assets to be impaired if the carrying value exceeds the future projected cash flows from the related operations. The Company also re-evaluates the periods of amortization to determine whether subsequent events and circumstances warrant revised estimates of useful lives. There was no impairment for the six months ended December 31, 2011.

| (k) | Revenue Recognition |

Revenue represents the invoiced value of goods sold, recognized upon the shipment of goods to customers. Revenue is recognized when all of the following criteria are met:

-Persuasive evidence of an arrangement exists,

-Delivery has occurred or services have been rendered,

-The seller's price to the buyer is fixed or determinable, and

-Collectability is reasonably assured.

The majority of the Company’s revenue results from sales contracts with distributors and revenue are recorded upon the shipment of goods. Management conducts credit background checks for new customers as a means to reduce the subjectivity of collectability.

The Company offers warranties on its products for periods between six and twelve months after the sale. The Company estimates the warranty reserves based on historical records and identical or similar types on the market. Warranty expenses related to product sales are charged to the condensed consolidated statements of income and comprehensive income in the period in which sales are recognized. For the six months ended December 31, 2011 and 2010, warranty expense was $227,226 and $281,144, respectively, and is included in cost of goods sold in the accompanying condensed consolidated statements of income and comprehensive income.

| (l) | Retirement Benefits |

Retirement benefits in the form of contributions under defined contribution retirement plans to the relevant authorities are charged to expense as incurred. The retirement benefits expense for the six months ended December 31, 2011 and 2010 are $176,338 and $75,105, respectively. The retirement benefits expenses are included in cost of sales, selling expenses, and general and administrative expenses.

| F-11 |

XINDE TECHNOLOGY COMPANY

AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

for the three and six MONTHS ENDED DECember 31, 2011 and 2010

(UNAUDITED)

NOTE 3 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

| (m) | Foreign Currency Translation |

The accompanying consolidated financial statements are presented in United States dollars. The functional currency of the Company is the Renminbi (RMB). Capital accounts of the consolidated financial statements are translated into United States dollars from RMB at their historical exchange rates when the capital transactions occurred. Assets and liabilities are translated at the exchange rates as of balance sheet date. Income and expenditures are translated at the average exchange rate of the quarter.

| December 31, 2011 | June 30, 2010 | December 31, 2010 | ||||||||||

| Period ended RMB: US$ exchange rate | 6.3523 | 6.4635 | 6.6118 | |||||||||

| Average RMB: US$ exchange rate for three months ended | 6.3535 | - | 6.6670 | |||||||||

| Average RMB: US$ exchange rate for six months ended | 6.3784 | - | 6.7237 | |||||||||

The RMB is not freely convertible into foreign currency and all foreign exchange transactions must take place through authorized institutions. No representation is made that the RMB amounts could have been, or could be, converted into US dollars at the rates used in translation.

| (n) | Comprehensive Income |

Comprehensive income is defined to include all changes in equity except those resulting from investments by owners and distributions to owners. Among other disclosures, all items that are required to be recognized under current accounting standards as components of comprehensive income are required to be reported in a financial statement that is presented with the same prominence as other financial statements. Comprehensive income includes net income and the foreign currency translation gain.

| (o) | Earnings Per Share |

Basic earnings per share are computed by dividing income available to common shareholders by the weighted-average number of common shares outstanding during the period. Diluted earnings per share is computed similar to basic earnings per share except that the denominator is increased to include the number of additional common shares that would have been outstanding if the potential common shares had been issued and if the additional common shares were dilutive. There were no potentially dilutive securities for the six months ended December 31, 2011 and 2010.

| (p) | Segment and Geographic Reporting |

The Company operates in one business segment, the design, development, manufacture, and commercialization of fuel injection pumps, injectors, multi-cylinder diesel engines and small generator units mainly in the PRC. The sales of the Company outside of the PRC were insignificant for the six months ended December 31, 2011 and 2010.

| F-12 |

XINDE TECHNOLOGY COMPANY

AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

for the three and six MONTHS ENDED DECember 31, 2011 and 2010

(UNAUDITED)

NOTE 3 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

| (q) | Recent Accounting Pronouncements |

In May 2011, the FASB issued ASU No. 2011-04, Fair Value Measurement (Topic 820): Amendments to Achieve Common Fair Value Measurement and Disclosure Requirements in U.S. GAAP and IFRSs. The guidance in ASU 2011-04 changes the wording used to describe the requirements in U.S. GAAP for measuring fair value and for disclosing information about fair value measurements, including clarification of the FASB's intent about the application of existing fair value and disclosure requirements and changing a particular principle or requirement for measuring fair value or for disclosing information about fair value measurements. The amendments in this ASU should be applied prospectively and are effective for interim and annual periods beginning after December 15, 2011. Early adoption by public entities is not permitted. The adoption of this guidance is not expected to have a material impact on the Company’s financial position or results of operations.

In June 2011, the FASB issued ASU No. 2011-05, Comprehensive Income (Topic 220): Presentation of Comprehensive Income. The guidance in ASU 2011-05 applies to both annual and interim financial statements and eliminates the option for reporting entities to present the components of other comprehensive income as part of the statement of changes in stockholders' equity. This ASU also requires consecutive presentation of the statement of net income and other comprehensive income. Finally, this ASU requires an entity to present reclassification adjustments on the face of the financial statements from other comprehensive income to net income. The amendments in this ASU should be applied retrospectively and are effective for fiscal year, and interim periods within those years, beginning after December 15, 2011. Early adoption is permitted. The adoption of this guidance is not expected to have a material impact on the Company’s financial position or results of operations.

In September 2011, the FASB issued ASU No. 2011-08, Intangibles – Goodwill and Other (Topic 350): Testing Goodwill for Impairment. The guidance in ASU 2011-08 is intended to reduce complexity and costs by allowing an entity the option to make a qualitative evaluation about the likelihood of goodwill impairment to determine whether it should calculate the fair value of a reporting unit. The amendments also improve previous guidance by expanding upon the examples of events and circumstances that an entity should consider between annual impairment tests in determining whether it is more likely than not that the fair value of a reporting unit is less than its carrying amount. Also, the amendments improve the examples of events and circumstances that an entity having a reporting unit with a zero or negative carrying amount should consider in determining whether to measure an impairment loss, if any, under the second step of the goodwill impairment test. The amendments in this ASU are effective for annual and interim goodwill impairment tests performed for fiscal years beginning after December 15, 2011. Early adoption is permitted, including for annual and interim goodwill impairment tests performed as of a date before September 15, 2011, if an entity’s financial statements for the most recent annual or interim period have not yet been issued. The adoption of this guidance is not expected to have a material impact on the Company’s financial position or results of operations.

| F-13 |

XINDE TECHNOLOGY COMPANY

AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

for the three and six MONTHS ENDED DECember 31, 2011 and 2010

(UNAUDITED)

NOTE 4 – CONCENTRATIONS

| (a) | Customers |

The Company’s major customers accounted for the following percentages of total sales and accounts receivable as follows:

| Sales Six Months Ended | Accounts Receivable | |||||||||||||||

| December 31, | December 31, | June 30, | ||||||||||||||

| Major Customers | 2011 | 2010 | 2011 | 2011 | ||||||||||||

| Company A | 2.2 | % | 3.4 | % | 0.7 | % | 2.6 | % | ||||||||

| Company B | 2.1 | % | 3.1 | % | 1.0 | % | 2.8 | % | ||||||||

| Company C | 2.0 | % | 3.0 | % | 0.6 | % | 2.8 | % | ||||||||

| Company D | 1.9 | % | 2.9 | % | 1.3 | % | 3.0 | % | ||||||||

| Company E | 1.7 | % | 2.9 | % | 1.5 | % | 3.0 | % | ||||||||

| (b) | Suppliers |

The Company’s major suppliers accounted for the following percentages of total purchases and accounts payable as follows:

| Purchases Six Months Ended | Accounts Payable | |||||||||||||||

| December 31, | December 31, | June 30, | ||||||||||||||

| Major Suppliers | 2011 | 2010 | 2011 | 2011 | ||||||||||||

| Company F | 6.2 | % | 10.1 | % | 0.7 | % | 0.9 | % | ||||||||

| Company G | 5.2 | % | 5.4 | % | - | 1.1 | % | |||||||||

| Company H | 4.0 | % | 3.8 | % | 0.2 | % | 0.0 | % | ||||||||

| Company I | 3.7 | % | 3.4 | % | 0.5 | % | 0.9 | % | ||||||||

| Company J | 3.4 | % | 3.1 | % | 0.0 | % | 0.3 | % | ||||||||

NOTE 5 – INVENTORIES

Inventories are summarized as follows:

| December 31, 2011 | June 30, 2011 | |||||||

| Raw materials | $ | 12,020,174 | $ | 7,503,324 | ||||

| Work-in-progress | 6,017,135 | 1,325,905 | ||||||

| Finished goods | 761,795 | 1,600,970 | ||||||

| Total inventories | $ | 18,799,104 | $ | 10,430,199 | ||||

| F-14 |

XINDE TECHNOLOGY COMPANY

AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

for the three and six MONTHS ENDED DECember 31, 2011 and 2010

(UNAUDITED)

NOTE 6 – NOTES RECEIVABLE

Notes receivable consist of the following:

| December 31, 2011 | June 30, 2011 | |||||||||

| Notes receivable from unrelated parties: | ||||||||||

| Due December 13, 2011, interest at 12% per annum (Settled on due date) | $ | - | $ | 1,547,149 | ||||||

| Due December 13, 2011, interest free (Settled on due date) | - | 9,283 | ||||||||

| Due June 13, 2012, interest at 12% per annum | (a) | 1,574,233 | - | |||||||

| Due June 13, 2012, interest free | 103,899 | - | ||||||||

| Due December 24, 2011, interest at 10% per annum (Settled on due date) | - | 25,741 | ||||||||

| Due December 24, 2011, interest free (Settled on due date) | - | 2,661 | ||||||||

| Due March 24, 2012, interest at 10% per annum | 23,613 | - | ||||||||

| Due March 24, 2012, interest free | 3,568 | - | ||||||||

| Due January 10, 2012, interest free (Settled on due date) | 128,562 | 61,370 | ||||||||

| Due January 10, 2012, interest at 12% per annum (Settled on due date) | 1,101,963 | 1,083,005 | ||||||||

| Subtotal | $ | 2,935,838 | $ | 2,729,209 | ||||||

| Bank acceptance notes (aggregated by month of maturity): | ||||||||||

| Due July, 2011 (Settled on its due date) | - | 1,547 | ||||||||

| Due August, 2011 (Settled on its due date) | - | 77,357 | ||||||||

| Due September, 2011 (Settled on its due date) | - | 416,476 | ||||||||

| Due October, 2011 (Settled on its due date) | - | 909,254 | ||||||||

| Due November, 2011 (Settled on its due date) | - | 1,724,762 | ||||||||

| Due December, 2011 (Settled on its due date) | - | 1,355,790 | ||||||||

| Due January, 2012 (Settled on its due date) | 2,397,165 | - | ||||||||

| Due February, 2012 (Settled on its due date) | 3,942,112 | - | ||||||||

| Due March, 2012 | 3,598,093 | - | ||||||||

| Due April, 2012 | 1,844,558 | - | ||||||||

| Due May, 2012 | 1,602,369 | - | ||||||||

| Due June, 2012 | 1,316,819 | - | ||||||||

| Subtotal | 14,701,116 | 4,485,186 | ||||||||

| Total | $ | 17,636,954 | $ | 7,214,395 | ||||||

(a) The notes are secured by the total assets of the borrower.

Notes receivable from unrelated parties are unsecured except for (a).

| F-15 |

XINDE TECHNOLOGY COMPANY

AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

for the three and six MONTHS ENDED DECember 31, 2011 and 2010

(UNAUDITED)

NOTE 7 – DUE FROM/TO RELATED PARTIES

| (I) | Due To Related Parties |

| December 31, 2011 | June 30, 2011 | |||||||||||

| Jin Xin | (a) | $ | - | $ | 373 | |||||||

| Liu Dianjun | (b) | 333,221 | 53,154 | |||||||||

| Li Zengshan | (c) | 77,308 | 79,072 | |||||||||

| Total due to related parties | $ | 410,529 | $ | 132,599 | ||||||||

| (II) | Due From Related Party |

| December 31, 2011 | June 30, 2011 | |||||||||||

| Jin Xin | (a) | $ | 4,133 | $ | - | |||||||

| Total due from related party | $ | 4,133 | $ | - | ||||||||

| (III) | Due From Employees |

| December 31, 2011 | June 30, 2011 | |||||||||||

| Current | $ | 108,056 | $ | 39,206 | ||||||||

| Total due from employees | (d) | $ | 108,056 | $ | 39,206 | |||||||

| (IV) | Due To Employees |

| December 31, 2011 | June 30, 2011 | |||||||||||

| Current | $ | 113,722 | $ | 78,953 | ||||||||

| Total due to employees | (e) | $ | 113,722 | $ | 78,953 | |||||||

| (a) | Jin Xin is a shareholder of the Company and the chairman of Jinma, a subsidiary of the Company. The receivable balance represents traveling advances, which are unsecured, interest-free and collectible on demand. The payable balance represented business related expenses paid by Jinxin on behalf of the Company, which was unsecured, interest-free and had no fixed repayment term. |

| (b) | Liu Dianjun is a shareholder of the Company and the chairman of Hengyuan, a subsidiary of the Company. The balances represent amounts advanced from Liu Dianjun, which are interest-free, unsecured and have no fixed repayment terms. |

| (c) | Li Zengshan is a shareholder of the Company and the chairman of Huaxin, a subsidiary of the Company. The balances represent business related expenses paid by Li Zengshan on behalf of the Company. The balances are interest-free, unsecured and have no fixed repayment terms. |

| F-16 |

XINDE TECHNOLOGY COMPANY

AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

for the three and six MONTHS ENDED DECember 31, 2011 and 2010

(UNAUDITED)

NOTE 7 – DUE FROM/TO RELATED PARTIES (CONTINUED)

| (d) | Due from employees are interest-free, unsecured and have no fixed repayment terms. The Company provides these advances for business-related purposes only, including for the purchases of raw materials and business-related travel in the ordinary course of business. |

| (e) | Due to employees are interest-free, unsecured and have no fixed repayment terms. The amounts primarily represent business and traveling related expenses paid by sales personnel on behalf of the Company. |

NOTE 8 – LAND USE RIGHTS, NET

Land use rights consist of the following:

| December 31, 2011 | June 30, 2011 | |||||||

| Cost of land use rights | $ | 2,551,760 | $ | 1,087,939 | ||||

| Less: Accumulated amortization | (189,498 | ) | (162,699 | ) | ||||

| Land use rights, net | $ | 2,362,262 | $ | 925,240 | ||||

Amortization expense for the six months ended December 31, 2011 and 2010 was $26,799 and $11,466, respectively.

Amortization expense for the next five years and thereafter is as follows:

| 2012 (six months) | $ | 26,799 | ||

| 2013 | 53,598 | |||

| 2014 | 53,598 | |||

| 2015 | 53,598 | |||

| 2016 | 53,598 | |||

| Thereafter | 2,121,071 | |||

| Total | $ | 2,362,262 |

Two land use rights with an aggregate net book value of $53,080 and $52,995 at December 31, 2011 and June 30, 2011, respectively, were registered in the names of two members of management of the Company. The Company’s legal counsel has confirmed the ownership of these two land use rights by the Company. The Company estimates that the application for the transfer of the certificates of these two land use rights will be completed by the end of June 2012. One of the land use rights has been pledged as collateral for bank loans borrowed by Li Zengshan (shareholder and officer of the Company) in the amount of $272,636. Also see Note 14.

| F-17 |

XINDE TECHNOLOGY COMPANY

AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

for the three and six MONTHS ENDED DECember 31, 2011 and 2010

(UNAUDITED)

NOTE 9 – PLANT AND EQUIPMENT, NET

Plant and equipment consist of the following:

| December 31, 2011 | June 30, 2011 | |||||||

| Buildings | $ | 3,022,473 | $ | 2,970,474 | ||||

| Machinery and equipment | 1,962,367 | 1,176,778 | ||||||

| Office equipment | 62,504 | 60,458 | ||||||

| Motor vehicles | 457,152 | 553,238 | ||||||

| 5,504,496 | 4,760,948 | |||||||

| Less : Accumulated depreciation | ||||||||

| Buildings | (611,067 | ) | (551,032 | ) | ||||

| Machinery and equipment | (867,750 | ) | (759,902 | ) | ||||

| Office equipment | (47,139 | ) | (43,336 | ) | ||||

| Motor vehicles | (304,915 | ) | (325,316 | ) | ||||

| (1,830,871 | ) | (1,679,586 | ) | |||||

| Plant and equipment, net | $ | 3,673,625 | $ | 3,081,362 | ||||

Depreciation expense for the six months ended December 31, 2011 and 2010 was $182,878 and $129,983 respectively.

At December 31, 2011, the legal title to three motor vehicles with a total net book value of $60,391, were registered in the names of management members of the Company. The Company’s legal counsel has confirmed the ownership of the motor vehicles and office buildings by the Company. The Company estimates the transfer of the legal titles of the three motor vehicles will be completed by the end of June 2012.

One office building was pledged as collateral for bank loans borrowed by Li Zengshan (a shareholder and officer of the Company) in the amount of $272,636. Also see Note 14.

Application for ownership certificates of eleven buildings with an aggregate net book value of $1,300,971 is in progress. The Company’s legal counsel has confirmed the ownership of the eleven buildings by the Company. The application for the certificates of the buildings is expected to be completed by the end of June 2012.

| F-18 |

XINDE TECHNOLOGY COMPANY

AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

for the three and six MONTHS ENDED DECember 31, 2011 and 2010

(UNAUDITED)

NOTE 10 – SHORT-TERM BANK LOANS

Short-term bank loans consist of the following:

| December 31, 2011 | June 30, 2011 | |||||||

| Weifang Bank: | ||||||||

| Monthly interest only payments at 9.88% per annum, due January 24, 2012, guaranteed by Weifang Huaxin Diesel Engine Co., Ltd. (Repaid on its due date) | $ | 314,846 | $ | 309,430 | ||||

| Monthly interest only payments at 7.43% per annum, due July 22, 2011, guaranteed by Weifang Hengyuan Oil Pump & Oil fitting Co., Ltd. (Repaid on its due date) | - | 618,860 | ||||||

| Monthly interest only payments at 8.83% per annum, due February 27, 2012, guaranteed by Weifang Hengyuan Oil Pump & Oil fitting Co., Ltd. | 314,847 | 309,430 | ||||||

| Monthly interest only payments at 9.18% per annum, due July 22, 2012, guaranteed by Weifang Hengyuan Oil Pump & Oil fitting Co., Ltd. | 629,693 | - | ||||||

| China Construction Bank: | ||||||||

| Monthly interest only payments at 5.84% per annum, due July 29, 2011, collateralized by land use rights. (Repaid on its due date) | - | 309,430 | ||||||

| Monthly interest only payments at 6.39% per annum, due January 9, 2012, guaranteed by Weifang Jinma Diesel Engine Co.,Ltd. and Weifang Hengyuan Oil Pump & Oil fitting Co., Ltd. | 1,101,963 | 1,083,004 | ||||||

| Bank of China: | ||||||||

| Monthly interest only payments at 7.87% per annum, due July 14, 2012, guaranteed by Weifang Hengyuan Oil Pump & Oil fitting Co., Ltd. | 314,847 | - | ||||||

| Total | $ | 2,676,196 | $ | 2,630,154 | ||||

Interest expense for short-term bank loans for the six months ended December 31, 2011 and 2010 was $194,896 and $191,911, respectively.

| F-19 |

XINDE TECHNOLOGY COMPANY

AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

for the three and six MONTHS ENDED DECember 31, 2011 and 2010

(UNAUDITED)

NOTE 11 – NOTES PAYABLE, INCLUDING RELATED PARTIES

Notes payable consist of the following:

| December 31, 2011 | June 30, 2011 | |||||||||

| Bank acceptance notes: | ||||||||||

| Due February 5, 2012 (Repaid on its due date) | $ | 314,847 | $ | - | ||||||

| Subtotal | (a) | 314,847 | - | |||||||

| Notes payable to an unrelated individual: | ||||||||||

| Due August 4, 2011, interest at 14.40% per annum with the principal payable at the due date. (Repaid on its due date) | - | 456,409 | ||||||||

| Due October 1, 2011, interest free with the principal payable at the due date. (Repaid on its due date) | - | 6,568 | ||||||||

| Due November 27, 2011, interest at 12% per annum with the principal payable at the due date. (Repaid on its due date) | - | 154,715 | ||||||||

| Due May 4, 2012, interest at 14.36% per annum with the principal payable at the due date. | 398,785 | 392,976 | ||||||||

| Due May 4, 2012, interest at 12% per annum with the principal payable at the due date. | 103,899 | 148,526 | ||||||||

| Due June 30, 2012, interest at 12% per annum with the principal payable at the due date. | 157,423 | - | ||||||||

| Due September 18, 2012, interest at 36% per annum with the principal payable at the due date. | 31,485 | - | ||||||||

| Subtotal | 691,592 | 1,159,194 | ||||||||

| Notes payable to related individuals: | ||||||||||

| Due December 24, 2011, interest at 10% per annum with the principal payable at the due date | (b) | - | 100,565 | |||||||

| Due June 28, 2012, interest at 10% per annum with the principal payable at the due date | (b) | 89,259 | 54,150 | |||||||

| Subtotal | 89,259 | 154,715 | ||||||||

| Total | $ | 1,095,698 | $ | 1,313,909 | ||||||

| (a) | The bank acceptance notes are secured by $220,393 of restricted cash at December 31, 2011. |

| (b) | The notes were due to Mr. Li Zengshan, a shareholder and officer of the Company. The current balances represent loans to the Company which are unsecured. |

Notes payable to an unrelated individual are unsecured.

| F-20 |

XINDE TECHNOLOGY COMPANY

AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

for the three and six MONTHS ENDED DECember 31, 2011 and 2010

(UNAUDITED)

NOTE 12 – LONG -TERM NOTES PAYABLE TO RELATED PARTIES

Long-term notes payable to related parties consist of the following:

| December 31, 2011 | June 30, 2011 | |||||||||||

| Notes payable to related individuals: | ||||||||||||

| Due August 4, 2014, monthly interest payment at 7.46% per annum. Principal is repaid every month in 60 equal installments from August 4, 2009. | (a) | $ | 272,636 | $ | 312,531 | |||||||

| Total long-term notes payable | 272,636 | 312,531 | ||||||||||

| Less: Current portion | (95,959 | ) | (90,864 | ) | ||||||||

| Long-term portion | $ | 176,677 | $ | 221,667 | ||||||||

The repayment schedule for long-term notes payable is as follows:

| Years Ended December 31, | Amount | |||

| 2012 | $ | 95,959 | ||

| 2013 | 103,372 | |||

| 2014 | 73,305 | |||

| Total | $ | 272,636 | ||

| (a) | This note is due to Mr. Li Zengshan, who is a shareholder of the Company. The balance represents a loan to the Company to support business operations. |

| F-21 |

XINDE TECHNOLOGY COMPANY

AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

for the three and six MONTHS ENDED DECember 31, 2011 and 2010

(UNAUDITED)

NOTE 13 – TAXES

| (a) | Corporation Income Tax (“CIT”) |

On March 16, 2007, the National People’s Congress of China approved the Corporate Income Tax Law of the People’s Republic of China (the “new CIT law”), which went into effective on January 1, 2008. In accordance with the relevant tax laws and regulations of PRC, the applicable corporate income tax rate for Hengyuan, Jinma and Huaxin is 25%. However, prior to January 2011, Jinma and Huaxin were defined by the local tax bureau as tax payers subject to the “Verification Collection” method, according to which the amount of income taxes paid is determined by the local tax bureau based on certain criteria instead of applying the CIT rate of 25%. Therefore, the amount of income tax assessed for Jinma and Huaxin under this Verification Collection method differed from the normal computation by applying the CIT rate of 25%.

The Company received written authorization from the local Chinese government to extend the payment of its current income tax due of approximately $11.7 million.

Effective January 1, 2007, the Company adopted ASC 740-10, Accounting for Uncertainty in Income Taxes. The interpretation addresses the determination of whether tax benefits claimed or expected to be claimed on a tax return should be recorded in the financial statements.

Under ASC 740-10, the Company may recognize the tax benefit from an uncertain tax position only if it is more likely than not that the tax position will be sustained on examination by the taxing authorities, based on the technical merits of the position. The tax benefits recognized in the financial statements from such a position should be measured based on the largest benefit that has a greater than fifty percent likelihood of being realized upon ultimate settlement. ASC 740-10 also provides guidance on de-recognition, classification, interest and penalties on income taxes, accounting in interim periods and requires increased disclosures. As of December 31, 2011, the Company does not have a liability for unrecognized tax benefits.

The Company’s income tax expense for the six months ended December 31, 2011 and 2010 are summarized as follows:

| December 31, 2011 | December 31, 2010 | |||||||

| Current: | ||||||||

| Provision for CIT | $ | 1,848,671 | $ | 1,299,395 | ||||

| Deferred: | ||||||||

| Provision for CIT | (360,442 | ) | 343,742 | |||||

| Income tax expense | $ | 1,488,229 | $ | 1,643,137 | ||||

| F-22 |

XINDE TECHNOLOGY COMPANY

AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

for the three and six MONTHS ENDED DECember 31, 2011 and 2010

(UNAUDITED)

NOTE 13 – TAXES (CONTINUED)

The Company’s income tax expense differs from the “expected” tax expense for the six months ended December 31, 2011 and 2010 (computed by applying the CIT rate of 25% percent to income before income taxes) is as follows:

| December 31, 2011 | December 31, 2010 | |||||||

| Computed “expected” expense | $ | 1,672,113 | $ | 3,119,117 | ||||

| Permanent differences | (183,884 | ) | (832,142 | ) | ||||

| Favourable tax rates | - | (643,838 | ) | |||||

| Income tax expense | $ | 1,488,229 | $ | 1,643,137 | ||||

The tax effects of temporary differences that give rise to the Company’s net deferred tax assets and liabilities as of December 31, 2011 and June 30, 2011 is as follows:

| December 31, 2011 | June 30, 2011 | |||||||

| Deferred tax assets: | ||||||||

| Current portion: | ||||||||

| Sales | $ | 471 | $ | 462 | ||||

| Bad debt provision | 139,971 | 164,010 | ||||||

| Other expenses | 298,207 | 231,700 | ||||||

| Subtotal | 438,649 | 396,172 | ||||||

| Deferred tax liabilities: | ||||||||

| Current portion: | ||||||||

| Sales cut-off | (914,224 | ) | (1,256,924 | ) | ||||

| Other | (120,098 | ) | (77,128 | ) | ||||

| Subtotal | (1,034,322 | ) | (1,334,052 | ) | ||||

| Net deferred tax liabilities- current portion | (595,673 | ) | (937,880 | ) | ||||

| Deferred tax assets: | ||||||||

| Non-current portion: | ||||||||

| Depreciation | 154,717 | 132,055 | ||||||

| Amortization | 509 | 4,937 | ||||||

| Subtotal | 155,226 | 136,992 | ||||||

| Net deferred tax assets - non-current portion | 155,226 | 136,992 | ||||||

| Total net deferred tax liabilities | $ | (440,447 | ) | $ | (800,888 | ) | ||

| F-23 |

XINDE TECHNOLOGY COMPANY

AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

for the three and six MONTHS ENDED DECember 31, 2011 and 2010

(UNAUDITED)

NOTE 13 – TAXES (CONTINUED)

| (b) | Tax Holiday Effect |

For the six months ended December 31, 2011 and 2010 the PRC corporate income tax rate was 25%. Certain subsidiaries of the Company are entitled to favorable tax rates for the periods ended December 31, 2011 and 2010.

The pro forma combined effects of the favorable tax rates available to the Company for the six months ended December 31, 2011 and 2010 are as follows:

| For the Six Months Ended December 31, | ||||||||

| 2011 | 2010 | |||||||

| Tax holiday effect | $ | - | $ | 643,838 | ||||

| Basic net income per share effect | $ | - | $ | 0.01 | ||||

| (c) | Value Added Tax (“VAT”) |

Enterprises or individuals, who sell commodities, engage in repair and maintenance or import or export goods in the PRC are subject to a value added tax in accordance with Chinese Laws. The value added tax standard rate is 17% of the gross sale price, and the Company records its revenue net of VAT. A credit is available whereby VAT paid on the purchases of semi-finished products or raw materials used in the production of the Company’s finished products can be used to offset the VAT due on the sales of the finished products.

In the six months ended December 31, 2011 and 2010, output VAT payable of $656,946 and $3,258,380, respectively, was exempted by the local tax bureau to honor the Company’s continuous contribution to the local economy and its achievement of becoming a United States public reporting company, resulting in income of $656,946 and $3,258,380, respectively, which was reflected in the accompanying condensed consolidated statements of income and comprehensive income for the six months ended December 31, 2011 and 2010.

The VAT payable was $32,322,638 and $26,331,151 at December 31, 2011 and June 30, 2011, respectively. The Company received written authorization from the local tax authorities to defer the payment of its current VAT payable in anticipation of additional future exemptions from the local tax bureau.

| F-24 |

XINDE TECHNOLOGY COMPANY

AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

for the three and six MONTHS ENDED DECember 31, 2011 and 2010

(UNAUDITED)

NOTE 14 – COMMITMENT AND CONTINGENCY

On August 4, 2009, Hengyuan entered into a guarantee contract to serve as guarantor for bank loans borrowed by Mr. Li Zengshan, a shareholder and officer of the Company, from the Industrial and Commercial Bank of China with a guarantee amount of $272,636. Under this guarantee contract, a land use right and an office building of Hengyuan were pledged as collateral for the bank loans. (Also see Notes 8 and Note 9)

A default by Mr. Li Zengshan is considered remote by management. No liability for the guarantor’s obligation under the guarantee contract was recognized as of December 31, 2011.

| F-25 |

ITEM 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OR PLAN OF OPERATION

Forward Looking Statements

The following discussion of the financial condition and results of operations of Xinde Technology Company, a Nevada corporation and its subsidiaries (the “Company” or “Xinde”) is based upon and should be read in conjunction with our unaudited condensed consolidated financial statements and their related notes included in this quarterly report. This report may contain forward-looking statements. Generally, the words “believes”, “anticipates”, “may”, “will”, “should”, “expect”, “intend”, “estimate”, “continue” and similar expressions or the negative thereof or comparable terminology are intended to identify forward-looking statements. Such statements are subject to certain risks and uncertainties, including the matters set forth in this report or other reports or documents we file with the SEC from time to time, which could cause actual results or outcomes to differ materially from those projected. Undue reliance should not be placed on these forward-looking statements which speak only as of the date hereof. We undertake no obligation to update these forward-looking statements.

Notable Corporate Action

On April 7, 2011 the Company held a special meeting of its stockholders. At the special meeting, the Company’s stockholders approved, by the requisite member of votes, to increase the amount of the Company’s authorized common stock from 150,000,000 to 350,000,000 shares and to effect a 4-for-1 forward split of the Company’s outstanding common stock, resulting in 240,000,000 shares outstanding (effective as of April 14, 2011). As a result, each reference herein to shares of common stock as well as the financial information included herein is presented as giving effect to the 4-for-1 forward stock split.

Summary of the Company’s Current Business

The Company operates in one business segment, the design, development, manufacturing and commercialization of fuel injection pumps, injectors, multi-cylinder diesel engines and small generator units mainly in the People’s Republic of China. However, our products compete in three primary product segments, namely (1) fuel injection system products, (2) diesel engine products and (3) generator products. We believe our broad range of products (including non-vehicle diesel engines, diesel generators, injection pumps, injectors and three-coupling components and agricultural machinery and construction machinery) increases our competitiveness.

The Company is based in China’s Shandong Province in the city of Weifang where many large and medium-sized diesel engine enterprises and related products and components manufacturers are located. Weifang is also an important traffic center on the east coast in northern China. We believe our location makes the purchase of raw materials and sales of our products very convenient and reduces the costs associated with sales while reducing freight costs.

We have developed fuel injection system products that already meet the Euro III Emissions Standard, which is most relevant in light of China’s implementation of the Euro III Emissions Standard in 2010. Furthermore, we believe that we are China’s only company with exclusive intellectual property rights for fuel injection systems meeting such Euro III Emissions Standard which could lead to broad market appeal. Due to our strict technical standards and quality control in production process, our products have become well-known brands in their markets throughout China. Our Company has always placed quality control first and we received our ISO9001 certification in 2005.

Our products feature a cost and price advantage arising from our independently owned intellectual property. For example, our integrated electromechanical electronically-controlled high-pressure fuel injection system with common rail sells for RMB7,000 (US$1,029) per set as compared with products produced by some of our largest competitors (BOSCH and DENSO) which offer comparable products for RMB15,000 (US$2,011) per set. As a result, we believe such products will gain market share and be instrumental in improving our competitive position and brand influence.

We also have a long-term relationship with Tianjin University’s Combustion Laboratory of Combustion Engines, a national key laboratory located in Tianjin, China, which contributes to our growing expertise and reputation in the field of integrated electromechanical electronically-controlled high-pressure fuel injection systems with common rail in China. In addition, we have an experienced team of in-house technicians which contributes to our product’s technical content and ultimately, our core competitiveness.

| -4- |

Through independent development, cooperation and introduction, we have developed a variety of diesel engine injector assemblies for Sitair, 170, 190 and 105 models as well as multi-cylinder No. 1, BX, BXD, IIW and DT12/24-10X (electronic regulator) injection pump assemblies and oil transfer pumps. In addition, we have fully acquired the production process and technology for EGR (Exhaust Gas Recirculation) diesel engines and gas power generators that are in growing demand in the marketplace.

We have established nationwide marketing and after-sale service networks in China. We have established more than 20 branches throughout China, including branches in Fu’an, Guangzhou, Dongguan, Jiangdu, Chengdu, Chongqing, Kunming, Taiyuan, Shenyang, Changsha and Urumchi. The Company employs agents throughout China, who receive commissions on the amount of products that they help the Company to sell. Agreements with such agents are generally formed during national trade fairs or other types of trade exhibitions. We pay for transportation expenses and the products are generally delivered via road vehicles. Mobile technicians operate our after-sales network. Each is assigned to a different geographical area.

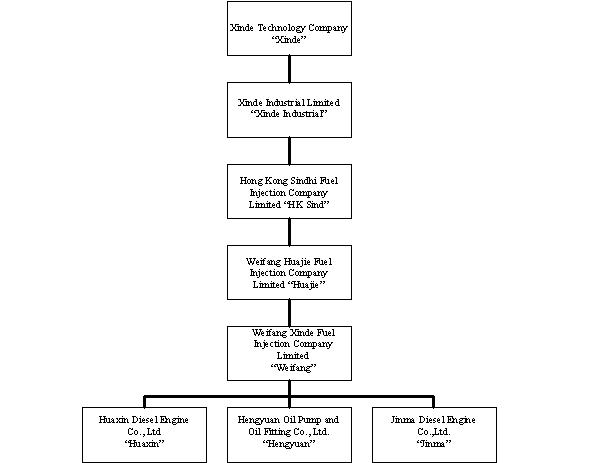

The above described corporate structure of the Company and our subsidiaries is illustrated below:

| -5- |

Each of our subsidiaries has its own marketing network. The Company’s goal is to utilize each of such networks to create a countrywide network. The Company has made its after-sales service a priority, setting up a special after-sales service management department to provide users with after-sales services.

Our principal offices are located at Number 363, Sheng Li West Street, Weifang, Shandong Province, The People’s Republic of China, Telephone: (86) 536-8322068, Facsimile: (86) 852-28450504. The Company website in English is www.chinaxinde.cn. The Company’s common stock is currently quoted on the OTCQB under the symbol “WTFS.OB”.

Critical Accounting Policies, Estimates and Assumptions

The SEC defines critical accounting policies as those that are, in management’s view, most important to the portrayal of our financial condition and results of operations and those that require significant judgments and estimates.

The discussion and analysis of our financial condition and results of operations is based upon our financial statements which have been prepared in accordance with accounting principles generally accepted in the United States. The preparation of these financial statements requires us to make estimates and judgments that affect the reported amounts of assets and liabilities. On an on-going basis, we evaluate our estimates including the allowance for doubtful accounts, the salability and recoverability of inventory, income taxes and contingencies. We base our estimates on historical experience and on other assumptions that we believe to be reasonable under the circumstances, the results of which form our basis for making judgments about the carrying values of assets and liabilities that are not readily apparent from other sources. Actual results may differ from these estimates under different assumptions or conditions.

We cannot predict what future laws and regulations might be passed that could have a material effect on our results of operations. We assess the impact of significant changes in laws and regulations on a regular basis and update the assumptions and estimates used to prepare our financial statements when we deem it necessary.

Fair Value of Financial Instruments

ASC 820-10 (formerly SFAS No. 157, Fair Value Measurements) establishes a three-tier fair value hierarchy, which prioritizes the inputs used in measuring fair value. The hierarchy prioritizes the inputs into three levels based on the extent to which inputs used in measuring fair value are observable in the market.

These tiers include:

• Level 1—defined as observable inputs such as quoted prices in active markets;

• Level 2—defined as inputs other than quoted prices in active markets that are either directly or indirectly observable; and

• Level 3—defined as unobservable inputs in which little or no market data exists, therefore requiring an entity to develop its own assumptions.

The assets measured at fair value on a recurring basis subject to the disclosure requirements of ASC 820-10 as of December 31, 2011 are as follows:

| Fair Value Measurements at Reporting Date Using | ||||||||||||||||

| Carrying Value as of December 31, 2011 | Quoted Prices in Active Markets for Identical Assets (Level 1) | Significant Other Observable Inputs (Level 2) | Significant Unobservable Inputs (Level 3) | |||||||||||||

| Long-term notes payable | $ | 272,635 | $ | — | $ | 272,635 | $ | — | ||||||||

The carrying amounts of financial assets and liabilities, such as cash and cash equivalents, accounts receivable, notes receivable, prepayments for goods, short-term bank loans, accounts payable, customer deposits, short-term notes payable, due to employee, due to related parties and other payables, approximate their fair values because of the short maturity of these instruments. The fair value of the Company’s long-term notes payable is estimated based on the current rates offered to the Company for debt of similar terms and maturities. Under this method, the Company’s fair value of long-term notes payable was not significantly different from the carrying value at December 31, 2011.

| -6- |

Cash and Cash Equivalents

For financial reporting purposes, the Company considers highly liquid investments purchased with original maturity of three months or less to be cash equivalents.

Inventories

Inventories are stated at the lower of cost or net realizable value. The cost of raw materials is determined on the basis of weighted average. The cost of finished goods is determined on the weighted average basis and comprises direct materials, direct labor and an appropriate proportion of overhead.

Net realizable value is based on estimated selling prices less any further costs expected to be incurred for completion and disposal.

Plant and Equipment

Plant and equipment are carried at cost less accumulated depreciation and amortization. Depreciation is provided over their estimated useful lives, using the straight-line method. Leasehold improvements are amortized over the life of the asset or the term of the lease, whichever is shorter. Estimated useful lives are as follows:

| Buildings: | 30 years |

| Machinery: | 10 years |

| Motor vehicles: | 5 years |

| Office equipment: | 5 years |

The cost and related accumulated depreciation of assets sold or otherwise retired are eliminated from the accounts and any gain or loss is included in the statement of income. The cost of maintenance and repairs is charged to expense as incurred, whereas significant renewals and betterments are capitalized.

Land Use Rights

Under Chinese law land is owned by the state or rural collective economic organizations. The state issues to the land users the land use right certificate. Land use rights can be revoked and the land users forced to vacate at any time when redevelopment of the land is in the public interest. The public interest rationale is interpreted quite broadly and the process of land appropriation may be less than transparent. The land use rights granted to the Company are being amortized using the straight-line method over the lease term of fifty years.

Revenue Recognition

Revenue represents the invoiced value of goods sold, recognized upon the shipment of goods to customers. Revenue is recognized when all of the following criteria are met:

-Persuasive evidence of an arrangement exists,

-Delivery has occurred or services have been rendered,

-The seller's price to the buyer is fixed or determinable, and

-Collectability is reasonably assured.

The majority of the Company’s revenue results from sales contracts with distributors and revenue are recorded upon the shipment of goods. Management conducts credit background checks for new customers as a means to reduce the subjectivity of collectability.

| -7- |

The Company offers warranties on its products for periods between six and twelve months after the sale. The Company estimates the warranty reserves based on historical records and identical or similar types on the market. Warranty expenses related to product sales are charged to the consolidated statements of income and comprehensive income in the period in which sales is recognized. During the six months ended December 31, 2011 and 2010, warranty expense was $227,226 and $281,144, respectively, and is included in selling and marketing expenses in the accompanying consolidated statements of income and comprehensive income.

Foreign Currency Translation

The accompanying consolidated financial statements are presented in United States dollars. The functional currency of the Company is the Renminbi (RMB). Capital accounts of the consolidated financial statements are translated into United States dollars from RMB at their historical exchange rates when the capital transactions occurred. Assets and liabilities are translated at the exchange rates as of balance sheet date. Income and expenditures are translated at the average exchange rate of the quarter.

|

December 31, 2011 |

June 30, 2010 |

December 31, 2010 | ||||

| Period ended RMB: US$ exchange rate | 6.3523 | 6.4635 | 6.6118 | |||

| Average RMB: US$ exchange rate for three months ended | 6.3535 | - | 6.6670 | |||

| Average RMB: US$ exchange rate for six months ended | 6.3784 | - | 6.7237 |

The RMB is not freely convertible into foreign currency and all foreign exchange transactions must take place through authorized institutions. No representation is made that the RMB amounts could have been, or could be, converted into US dollars at the rates used in translation.

Segment

The Company operates in one business segment, the design, development, manufacture and commercialization of fuel injection pumps, injectors, multi-cylinder diesel engines and small generator units mainly in the PRC. Our sales made outside of the PRC were insignificant for the three months ended December 3, 2011 and 2010.

Results of Operations For the Three Months Ended December 31, 2011 Compared to the Three Months Ended December 31, 2010

The following table sets forth the amounts and the percentage relationship to revenues of certain items in our consolidated statements of income for the three months ended December 31, 2011 and 2010:

| For the Three Months Ended December 31, | ||||||||||||||||||||||||

| 2011 | 2010 | Comparisons | ||||||||||||||||||||||

| Amount |

% of Revenues |

Amount |

% of Revenues |

Change in Amount |

Change in % |

|||||||||||||||||||

| $ | $ | $ | ||||||||||||||||||||||

| REVENUES, NET | 19,595,521 | 100 | % | 32,387,892 | 100 | % | (12,792,371 | ) | (39 | )% | ||||||||||||||

| COST OF GOODS SOLD | (15,503,846 | ) | (79 | )% | (25,859,579 | ) | (80 | )% | 10,355,733 | (40 | )% | |||||||||||||

| GROSS PROFIT | 4,091,675 | 21 | % | 6,528,313 | 20 | % | (2,436,638 | ) | (37 | )% | ||||||||||||||

| Selling and marketing | (386,073 | ) | (2 | )% | (658,789 | ) | (2 | )% | 272,716 | (41 | )% | |||||||||||||

| General and administrative | (847,776 | ) | (4 | )% | (260,016 | ) | (1 | )% | (587,760 | ) | 226 | % | ||||||||||||

| Bad debt recoveries | - | - | 480,454 | 1 | % | (480,454 | ) | (100 | )% | |||||||||||||||

| INCOME FROM OPERATIONS | 2,857,826 | 15 | % | 6,089,962 | 19 | % | (3,232,136 | ) | (53 | )% | ||||||||||||||

| -8- |

| For the Three Months Ended December 31, | ||||||||||||||||||||||||

| 2011 | 2010 | Comparisons | ||||||||||||||||||||||

| Amount |

% of Revenues |

Amount |

% of Revenues |

Change in Amount |

Change in % |

|||||||||||||||||||

| $ | $ | $ | ||||||||||||||||||||||

| Interest expense, net | (22,360 | ) | (0.11 | )% | (62,140 | ) | (0.19 | )% | 39,780 | (64) | % | |||||||||||||

| Other income, net | 39,198 | 0.20 | % | 122,565 | 0.38 | % | (83,367 | ) | (68) | % | ||||||||||||||

| Exempted value added tax | (659,521 | ) | (3.37 | )% | - | - | (659,521 | ) | - | |||||||||||||||

| INCOME FROM OPERATIONS BEFORE INCOME TAXES | 3,534,185 | 18 | % | 6,150,387 | 19 | % | (2,616,202 | ) | (43) | % | ||||||||||||||

| INCOME TAXES | (710,255 | ) | (4 | )% | (773,934 | ) | (2 | )% | 63,679 | (8) | % | |||||||||||||

| NET INCOME | 2,823,930 | 14 | % | 5,376,453 | 17 | % | (2,552,523 | ) | (47) | % | ||||||||||||||

| OTHER COMPREHENSIVE INCOME | 482,090 | 2 | % | 846,213 | 3 | % | (364,123 | ) | (43) | % | ||||||||||||||

| Foreign currency translation gain | 482,090 | 2 | % | 846,213 | 3 | % | (364,123 | ) | (43) | % | ||||||||||||||

| COMPREHENSIVE INCOME | 3,306,020 | 17 | % | 6,222,666 | 19 | % | (2,916,646 | ) | (47) | % | ||||||||||||||

Revenues

Our revenues are derived from the design, development, manufacture, and commercialization of fuel injection pumps, injectors, multi-cylinder diesel engines and small generator units for the PRC and overseas markets. The table below sets forth a breakdown of our revenues by product for the three months indicated:

| For the Three Months Ended December 31, | ||||||||||||||||||||||||

| 2011 | 2010 | Comparisons | ||||||||||||||||||||||

| Amount |

% of Revenues |

Amount |

% of Revenues |

Change in Amount |

Change in % | |||||||||||||||||||

| $ | $ | $ | ||||||||||||||||||||||

| Revenues: | ||||||||||||||||||||||||

| Electric pumps | 2,063,767 | 11 | % | 2,176,933 | 6 | % | (113,166) | (5 | )% | |||||||||||||||

| Multi-cylinder pumps | 5,007,927 | 26 | % | 7,958,357 | 24 | % | (2,950,430) | (37 | )% | |||||||||||||||

| Single-cylinder pumps | 219,481 | 1 | % | 636,195 | 2 | % | (416,714) | (66 | )% | |||||||||||||||

| Fuel muzzles | 1,091,960 | 6 | % | 1,743,203 | 5 | % | (651,243) | (37 | )% | |||||||||||||||

| Parts | 137,203 | 1 | % | 203,467 | 1 | % | (66,264) | (33 | )% | |||||||||||||||

| Diesel engines | 8,322,714 | 43 | % | 14,097,204 | 44 | % | (5,774,490) | (41 | )% | |||||||||||||||