Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - OLD NATIONAL BANCORP /IN/ | d299397d8k.htm |

Exhibit 99.1

| Filed by Old National Bancorp Pursuant to Rule 425 under the Securities Act of 1933 Subject Company: Indiana Community Bancorp Commission File No.: 000-18847 Old National Bancorp Sterne Agee Financial Institutions Investor Conference February 13, 2012 |

| Bob Jones President and CEO Jim Ryan Executive Vice President and Director of Corporate Development |

| Additional Information for Shareholders In connection with the proposed merger, Old National Bancorp will file with the Securities and Exchange Commission a Registration Statement on Form S-4 that will include a Proxy Statement of Indiana Community Bancorp and a Prospectus of Old National Bancorp, as well as other relevant documents concerning the proposed transaction. Shareholders are urged to read the Registration Statement and the Proxy Statement/Prospectus regarding the merger when it becomes available and any other relevant documents filed with the SEC, as well as any amendments or supplements to those documents, because they will contain important information. A free copy of the Proxy Statement/Prospectus, as well as other filings containing information about Old National Bancorp and Indiana Community Bancorp, may be obtained at the SEC's Internet site (http://www.sec.gov). You will also be able to obtain these documents, free of charge, from Old National Bancorp at www.oldnational.com under the tab"Investor Relations" and then under the heading "Financial Information" or from Indiana Community Bancorp by accessing Indiana Community Bancorp's website at www.myindianabank.com under the tab "Shareholder Relations" and then under the heading "Documents." Old National Bancorp and Indiana Community Bancorp and certain of their directors and executive officers may be deemed to be participants in the solicitation of proxies from the shareholders of Indiana Community Bancorp in connection with the proposed merger. Information about the directors and executive officers of Old National Bancorp is set forth in the proxy statement for Old National's 2011 annual meeting of shareholders, as filed with the SEC on a Schedule 14A on March 25, 2011. Information about the directors and executive officers of Indiana Community Bancorp is set forth in the proxy statement for Indiana Community Bancorp's 2011 annual meeting of shareholders, as filed with the SEC on a Schedule 14A on March 22, 2011. Additional information regarding the interests of those participants and other persons who may be deemed participants in the transaction may be obtained by reading the Proxy Statement/Prospectus regarding the proposed merger when it becomes available. Free copies of this document may be obtained as described in the preceding paragraph. |

| Forward-Looking Statement This presentation contains certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements include, but are not limited to, descriptions of Old National's financial condition, results of operations, asset and credit quality trends and profitability. Forward-looking statements can be identified by the use of the words "anticipate," "believe," "expect," "intend," "could" and "should," and other words of similar meaning. These forward-looking statements express management's current expectations or forecasts of future events and, by their nature, are subject to risks and uncertainties and there are a number of factors that could cause actual results to differ materially from those in such statements. Factors that might cause such a difference include, but are not limited to; market, economic, operational, liquidity, credit and interest rate risks associated with Old National's business, competition, government legislation and policies (including the impact of the Dodd-Frank Wall Street Reform and Consumer Protection Act and its related regulations), ability of Old National to execute its business plan (including the proposed acquisition of Indiana Community Bancorp), changes in the economy which could materially impact credit quality trends and the ability to generate loans and gather deposits, failure or circumvention of Old National's internal controls, failure or disruption of our information systems, significant changes in accounting, tax or regulatory practices or requirements, new legal obligations or liabilities or unfavorable resolutions of litigations, other matters discussed in this presentation and other factors identified in the Company's Annual Report on Form 10-K and other periodic filings with the Securities and Exchange Commission. These forward-looking statements are made only as of the date of this presentation, and Old National undertakes no obligation to release revisions to these forward-looking statements to reflect events or conditions after the date of this presentation. |

| Non-GAAP Financial Measures These slides contain non-GAAP financial measures. For purposes of Regulation G, a non-GAAP financial measure is a numerical measure of the registrant's historical or future financial performance, financial position or cash flows that excludes amounts, or is subject to adjustments that have the effect of excluding amounts, that are included in the most directly comparable measure calculated and presented in accordance with GAAP in the statement of income, balance sheet or statement of cash flows (or equivalent statements) of the issuer; or includes amounts, or is subject to adjustments that have the effect of including amounts, that are excluded from the most directly comparable measure so calculated and presented. In this regard, GAAP refers to generally accepted accounting principles in the United States. Pursuant to the requirements of Regulation G, Old National Bancorp has provided reconciliations within the slides, as necessary, of the non-GAAP financial measure to the most directly comparable GAAP financial measure. |

| Old National Bancorp (NYSE: ONB) $8.6 billion in total assets at Dec. 31, 2011 Largest financial services holding company headquartered in Indiana Operates one of the largest independent insurance agencies headquartered in Indiana 183 financial centers1 throughout Indiana, Western Kentucky and Southern Illinois 1As of December 31, 2011 |

| Strong 4Q11 Earnings Performance Net income of $22.2 million, or $.23 per share Results include $5.2 million in acquisition costs $5.7 million, or $.07 per share, in 4Q10 Revenues, net of securities gains, increased 32.9% over 4Q10 Capital and liquidity remain strong Credit quality well controlled |

| Strong Full-Year 2011 Earnings Performance Net income of $72.5 million, or $.76 per share $38.2 million, or $.44 per share, in 2010 Earnings driven by Reduced credit costs Benefits of Integra and Monroe acquisitions Continued focus on reducing noninterest expenses |

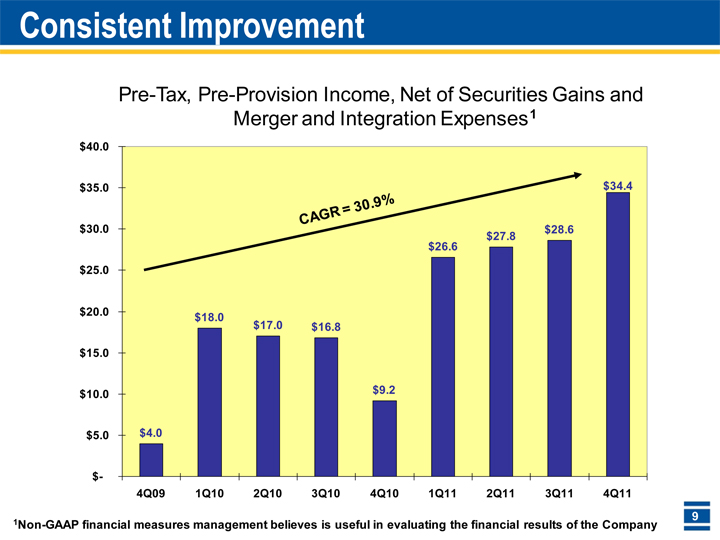

| Consistent Improvement 4Q09 1Q10 2Q10 3Q10 4Q10 1Q11 2Q11 3Q11 4Q11 Pre-Tax, Pre-Provision Income, Net of Securities Gains and Merger and Integration Expenses 4 18 17 16.8 9.2 26.6 27.8 28.6 34.4 1Non-GAAP financial measures management believes is useful in evaluating the financial results of the Company 1 CAGR = 30.9% Pre-Tax, Pre-Provision Income, Net of Securities Gains and Merger and Integration Expenses |

| Old National Bancorp (NYSE: ONB) Questions you might be asking Why Indiana Community Bancorp? What is Old National doing to grow net income in this slow growth, low interest rate environment? What is Old National's capital strategy? What is Old National's perspective on credit? |

| Questions you might be asking Why Indiana Community Bancorp? |

| Why Indiana Community Bancorp? Strong strategic and cultural fit Advances objective of being Indiana's bank Provides entry into attractive I-65 corridor markets Columbus, Indiana - one of the strongest markets in the state Lower unemployment and higher HH income than Indiana and national averages Same cultural values and strong management team Financially compelling acquisition EPS accretion of $.06 to $.08 per share in first full year Over 35% cost saves expected Exceeds internal IRR hurdle |

| Evansville Strategic fill-in of attractive I-65 corridor in South Eastern Indiana Area is home to Cummins Inc. and Honda Manufacturing of Indiana Old National Bancorp Indiana Community Bancorp Why Indiana Community Bancorp? Headquartered in Columbus, Indiana NASDAQ: INCB |

| Questions you might be asking What is Old National doing to grow net income in this slow growth, low interest rate environment? |

| Slow Growth, Low Rate Environment Adapting and reshaping our business to grow revenue Capitalizing on M&A opportunities Making tough decisions Reducing noninterest expense Reducing investment portfolio and wholesale funding |

| But what about organic Revenue Growth? Entire company focused on important client acquisition from competitors - committed to taking market share Strategic cross-selling - marketing insurance and wealth management products to commercial relationships Streamlining processes to make it simpler, easier and faster for clients to do business with Old National Increased distribution and cross-sell opportunities from acquisition partners |

| Consistent Improvement 4Q09 1Q10 2Q10 3Q10 4Q10 1Q11 2Q11 3Q11 4Q11 Noninterest expense, less merger and integration costs 90.8 77.1 77.9 76.1 83.3 76.4 77.6 88.4 88.5 Total Revenues 91.6 98.1 98.1 96.1 96.2 104.2 105.9 119.9 125.7 1Non-GAAP financial measures management believes is useful in evaluating the financial results of the Company 1 CAGR = 4.0% |

| Questions you might be asking What is Old National's capital strategy? |

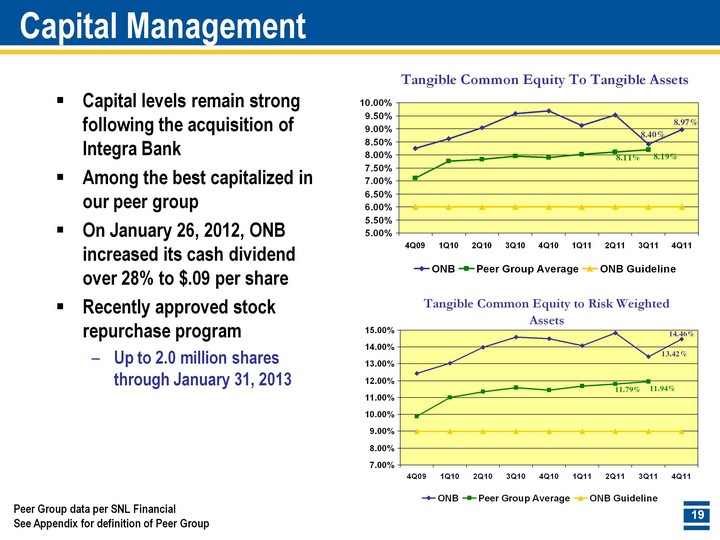

| Capital Management 4Q09 1Q10 2Q10 3Q10 4Q10 1Q11 2Q11 3Q11 4Q11 ONB 0.1244 0.1304 0.1398 0.1458 0.145 0.1408 0.1482 0.1342 0.1446 Peer Group Average 0.0989 0.11 0.1133 0.1158 0.1144 0.1169 0.1179 0.1194 ONB Guideline 0.09 0.09 0.09 0.09 0.09 0.09 0.09 0.09 0.09 Capital levels remain strong following the acquisition of Integra Bank Among the best capitalized in our peer group On January 26, 2012, ONB increased its cash dividend over 28% to $.09 per share Recently approved stock repurchase program Up to 2.0 million shares through January 31, 2013 4Q09 1Q10 2Q10 3Q10 4Q10 1Q11 2Q11 3Q11 4Q11 ONB 0.0825 0.0862 0.0903 0.0958 0.0968 0.0912 0.0952 0.084 0.0897 Peer Group Average 0.071 0.0775 0.0783 0.0795 0.0789 0.0802 0.0811 0.0819 ONB Guideline 0.06 0.06 0.06 0.06 0.06 0.06 0.06 0.06 0.06 Peer Group data per SNL Financial See Appendix for definition of Peer Group |

| Questions you might be asking What is Old National's perspective on credit? |

| Credit Comments Good quarter in terms of reduction in criticized / classified Generally, the environment seems to be less pessimistic Good share of our borrowers have diminished balance sheets and weaker cash flow as a result of the prolonged downturn Timing of a recovery is key The longer the recovery takes to gain momentum the more likelihood we will see downgrades continue - especially CRE Integra continues to perform as expected |

| 1Q08 2Q08 3Q08 4Q08 1Q09 2Q09 3Q09 4Q09 1Q10 2Q10 3Q10 4Q10 1Q11 2Q11 3Q11 4Q11 Provision Expense 21.9 5.7 6.8 17 17.3 12 12.2 21.8 9.3 8 6.4 7.1 3.3 3.2 0 0.1 Quarterly Net Charge-Offs 6.1 15.9 5.5 13.4 12.6 13.6 12.7 21.8 6.7 8.2 6.1 6.9 2.9 5.8 4.9 8.2 2008 2009 2010 $40.8 $60.8 $28.0 $51.5 > $63.3 > $30.8 > $ in millions Long-term positive trends in credit quality resulted in decline in credit costs 1Q08 2Q08 3Q08 4Q08 1Q09 2Q09 3Q09 4Q09 1Q10 2Q10 3Q10 4Q10 1Q11 2Q11 3Q11 4Q11 ONB 0.0052 0.0135 0.0047 0.0114 0.0107 0.0119 0.0125 0.022 0.0072 0.009 0.0066 0.0074 0.0027 0.0056 0.005 0.0079 Peer Group Average 0.003 0.0041 0.005 0.0077 0.0078 0.0133 0.0118 0.0159 0.0107 0.0131 0.0119 0.0128 0.0088 0.0109 0.0088 Peer Group data per SNL Financial See Appendix for definition of Peer Group Credit Quality - Excluding Covered Loans 2011 $21.7 $6.5 < |

| Credit Quality - ALLL and Mark Summary Credit Quality - ALLL and Mark Summary $ in millions 1 Management believes this reconciliation to be useful to demonstrate that the day one fair value mark considers credit risk and should be included as part of total coverage |

| How is ONB handling the Integra loan portfolio? Separate division created to handle Reporting and accounting Loss share agreement Special assets Performing loans |

| Thank You Q&A |

| Old National Bancorp Appendix |

| Pre-Tax, Pre-Provision Income1 Pre-Tax, Pre-Provision Income1 1Non-GAAP financial measures management believes is useful in evaluating the financial results of the Company 20.3% 273.9% 30.7% 4.8% |

| M & A Strategy Must enhance Old National's mission of being a true "community bank" Must align strategically and culturally Must meet/exceed financial targets Must pass rigorous due diligence process Focus on in-market community banks where significant cost saves can be achieved |

| Non-GAAP Reconciliations Non-GAAP Reconciliations |

| Non-GAAP Reconciliations Non-GAAP Reconciliations |

| Credit Quality - Excluding Covered Loans 4Q08 1Q09 2Q09 3Q09 4Q09 1Q10 2Q10 3Q10 4Q10 1Q11 2Q11 3Q11 4Q11 ONB 0.0084 0.0073 0.0082 0.0094 0.0089 0.0055 0.0076 0.0076 0.0069 0.0058 0.0057 0.0062 0.0078 Peer Group Average 0.013 0.0142 0.0129 0.0144 0.0166 0.0158 0.0173 0.0164 0.016 0.0157 0.0144 0.0138 Peer Group data per SNL Financial See Appendix for definition of Peer Group 1As a % of end of period total loans 4Q08 1Q09 2Q09 3Q09 4Q09 1Q10 2Q10 3Q10 4Q10 1Q11 2Q11 3Q11 4Q11 ONB 0.0006 0.0005 0.0006 0.0007 0.0009 0.0004 0.0001 0.0004 0.0002 0.0002 0.0001 0.0003 0.0003 Peer Group Average 0.0022 0.0023 0.00256 0.0037 0.0044 0.0047 0.006 0.0059 0.0061 0.006 0.0057 0.0056 Better than peer group performance |

| 1Q10 2Q10 3Q10 4Q10 1Q11 2Q11 3Q11 4Q11 ONB Consolidated 0.9273 0.9477 0.9527 0.9448 0.5366 0.547 0.486 0.4615 ONB Excluding Monroe 0.84 0.83 0.68 0.65 Peer Group data per SNL Financial See Appendix for definition of Peer Group Credit Quality - Excluding Covered Loans 1 Does not reflect impact of $30.8 million loan mark on Monroe loan portfolio 1 |

| ONB's Peer Group Like-size, publicly-traded financial services companies, generally in the Midwest, serving comparable demographics with comparable services as ONB comparable demographics with comparable services as ONB comparable demographics with comparable services as ONB |

| Investor Contact Additional information can be found on the Investor Relations web pages at www.oldnational.com Investor Inquiries: Lynell J. Walton, CPA SVP - Director of Investor Relations 812-464-1366 lynell.walton@oldnational.com |