Attached files

| file | filename |

|---|---|

| 8-K - BANCORPSOUTH, INC. - BANCORPSOUTH INC | d298599d8k.htm |

BancorpSouth, Inc.

Investor Presentation

February 2012

Exhibit 99.1 |

Forward Looking Information

2

Certain statements contained in this presentation and the accompanying slides may not be based on

historical facts and are “forward-looking statements” within the meaning of

Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-

looking statements may be identified by reference to a future period or by the use of

forward-looking terminology, such as “anticipate,” “believe,” “estimate,”

“expect,” “foresee,” “may,” “might,” “will,”

“intend,” “could,” “would” or “plan,” or future or conditional verb tenses, and variations or negatives of such terms. These

forward-looking statements include, without limitation, statements about the use of non-GAAP

financial measures, maturities of our CDs, pro forma capital ratios, our strategic focus,

results of operations and financial condition. We caution you not to place undue reliance on the forward-looking statements contained in this

presentation, in that actual results could differ materially from those indicated in such

forward-looking statements as a result of a variety of factors. These factors include, but

are not limited to, conditions in the financial markets and economic conditions generally, the adequacy of the Company’s provision and allowance for

credit losses to cover actual credit losses, the credit risk associated with real estate construction,

acquisition and development loans, the impact of legal or administrative proceedings, the

availability of capital on favorable terms if and when needed, liquidity risk, the Company’s ability to improve its internal controls

adequately, governmental regulation, including the Dodd Frank Act, and supervision of the

Company’s operations, the impact of regulations on service charges on the Company’s

core deposit accounts, the susceptibility of the Company’s business to local economic conditions, the soundness of other financial institutions,

changes in interest rates, the impact of monetary policies and economic factors on the Company’s

ability to attract deposits or make loans, volatility in capital and credit markets,

reputational risk, the impact of hurricanes or other adverse weather events, any requirement that the Company write down goodwill or other

intangible assets, diversification in the types of financial services the Company offers, competition

with other financial services companies, risks in connection with completed or potential

acquisitions, the Company’s growth strategy, interruptions or breaches in security of the Company’s information systems, the failure of

certain third party vendors to perform, limitations on the Company’s ability to declare and pay

dividends, dilution caused by the Company’s issuance of any additional shares of its

common stock to raise capital or acquire other banks, bank holding companies, financial holding companies and insurance agencies, other

factors generally understood to affect the financial results of financial services companies and other

factors detailed from time to time in the Company’s press releases and filings with the

Securities and Exchange Commission. Forward-looking statements speak only as of the date they were made, and, except as

required by law, we do not undertake any obligation to update or revise forward-looking statements

to reflect events or circumstances after the date of this presentation. Certain tabular

presentations may not reconcile because of rounding. Unless otherwise noted, any quotes in this presentation can be attributed to

company management.

|

Non-GAAP Financial Disclaimer

3

This presentation contains financial information determined by methods other than those prescribed by

accounting principles generally accepted in the United States ("GAAP'). Management uses

these "non-GAAP" financial measures in its analysis of the Company's capital and

performance. Management believes that the ratio of tangible shareholders’ equity to tangible

assets is important to investors who are interested in evaluating the adequacy of the Company's

capital levels. Management believes that tangible book value per share is important to

investors who are interested in changes from period to period in book value per share exclusive of changes in tangible assets.

Management believes that pre-tax, pre-provision earnings is important to investors as it shows

earnings trends without giving effect to provision for credit losses.

You should not view these disclosures as a substitute for results determined in accordance with GAAP,

and they are not necessarily comparable to non-GAAP measures used by other companies. The

limitations associated with these measures are the risks that persons might disagree as to the

appropriateness of items comprising these measures and that different companies might calculate these measures

differently. Information provided in the Appendix of this presentation reconciles these non-GAAP

measures with comparable measures calculated in accordance with GAAP. |

Strong core capital base

Overview of BancorpSouth, Inc.

$13.0 billion in assets

287 locations with reach throughout a 9-state footprint

Customer-focused business model with comprehensive line of financial products

and banking services for individuals and small to mid-size businesses

Nation’s 26

th

largest insurance agency / brokerage operation

Strong

mortgage

operations

with

production

totaling

$1.2

billion

for

2011

Consistent core earnings with pre-tax, pre-provision earnings of $186.1

million (excluding MSR impairment)

4

Data as of and for the year ended December 31, 2011

Insurance ranking from Business Insurance Magazine as of December 31, 2010 Common equity: $1.3 billion

Tangible shareholders’ equity / tangible assets: 7.67% Total risk-based capital ratio: 13.03% |

5

Regional Management Structure |

6

Balance Sheet Summary

Dollars in millions, except per share

12/31/11

9/30/11

12/31/10

Total assets

$12,996

$13,199

$13,615

(4.5)

%

Cash and equivalents

499

500

272

83.5

Securities

2,514

2,482

2,709

(7.2)

Loans, net of unearned income

8,870

9,056

9,333

(5.0)

Allowance for credit losses

(195)

(200)

(197)

(1.0)

Total deposits

10,955

11,063

11,490

(4.7)

Short-term borrowings

375

451

443

(15.3)

Shareholders' equity

1,263

1,267

1,222

3.4

Book value per share

15.13

15.17

14.64

3.3

Tangible book value per share

11.68

11.71

11.17

4.6

12/31/11 vs 12/31/10

% Change |

Common

Stock Offering Pro forma capital ratios assume $109 million of net

proceeds. Closed $115 million common stock

offering on January 24, 2012

Improves capitalization at the

Holding Company and maintains

flexibility at the Bank

Increases Holding Company

liquidity

Enhances strategic flexibility

Positioned for recovery

Ability to invest

Opportunistic M&A

Holding Company Capital Ratios

7

TCE / TA

Tier 1 Common

Ratio

Tier 1 Ratio

12/31/11

12/31/11 Pro Forma

7.67%

10.15%

11.77%

8.46%

11.28%

12.90%

6.00%

8.00%

10.00%

12.00%

14.00% |

8

Recent Operating Results

12/31/11

9/30/11

6/30/11

3/31/11

12/31/10

Net interest revenue

$107.5

$108.1

$109.9

$109.4

$110.2

Provision for credit losses

19.3

25.1

32.2

53.5

43.3

Noninterest revenue

65.3

62.1

75.1

68.3

74.0

Noninterest expense

135.9

130.7

137.1

130.0

123.5

Income (loss) before income taxes

17.7

14.3

15.7

(5.8)

17.4

Income tax provision (benefit)

4.4

2.4

2.9

(5.3)

1.6

Net income (loss)

$13.3

$11.9

$12.8

($0.5)

$15.8

Net income (loss) per share: diluted

$0.16

$0.14

$0.15

($0.01)

$0.19

Nonrecurring/Noncash Items*

MSR valuation adjustment

($1.0)

($11.7)

($3.8)

$2.5

$8.9

Security gains (losses), net

-

2.0

10.0

-

(0.5)

Prepayment penalty on FHLB borrowings

-

-

(9.8)

-

-

Branch closure expense

-

(3.1)

-

-

-

Total nonrecurring/noncash items

($1.0)

($12.8)

($3.6)

$2.5

$8.4

Three Months Ended

Dollars in millions, except per share data *Represents

both nonrecurring and noncash items that are included in income before

taxes but are not considered to be a component of core operating earnings |

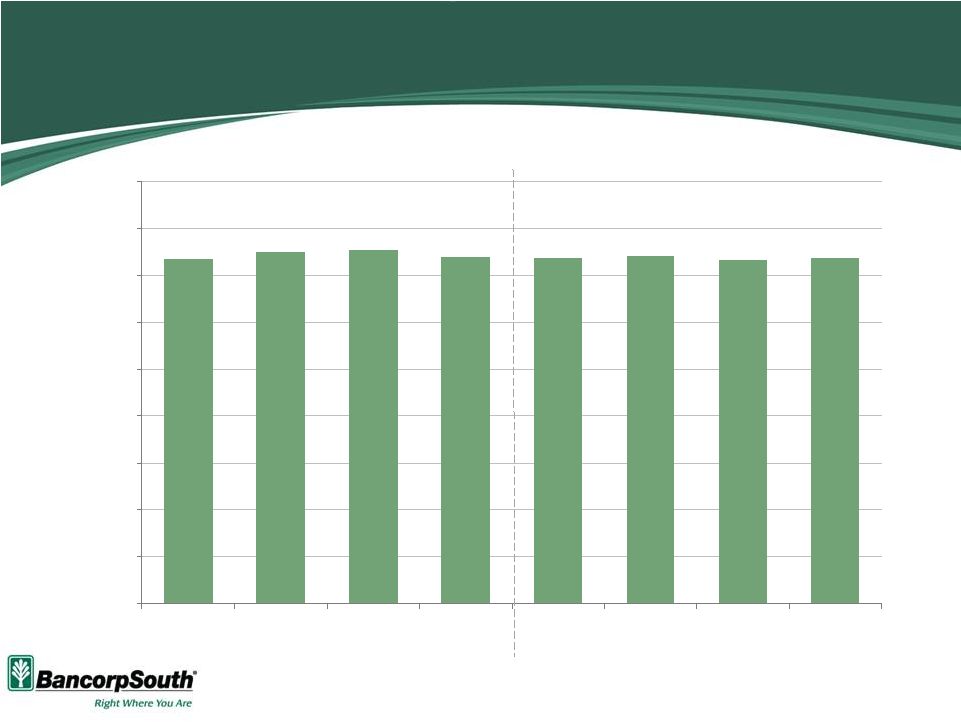

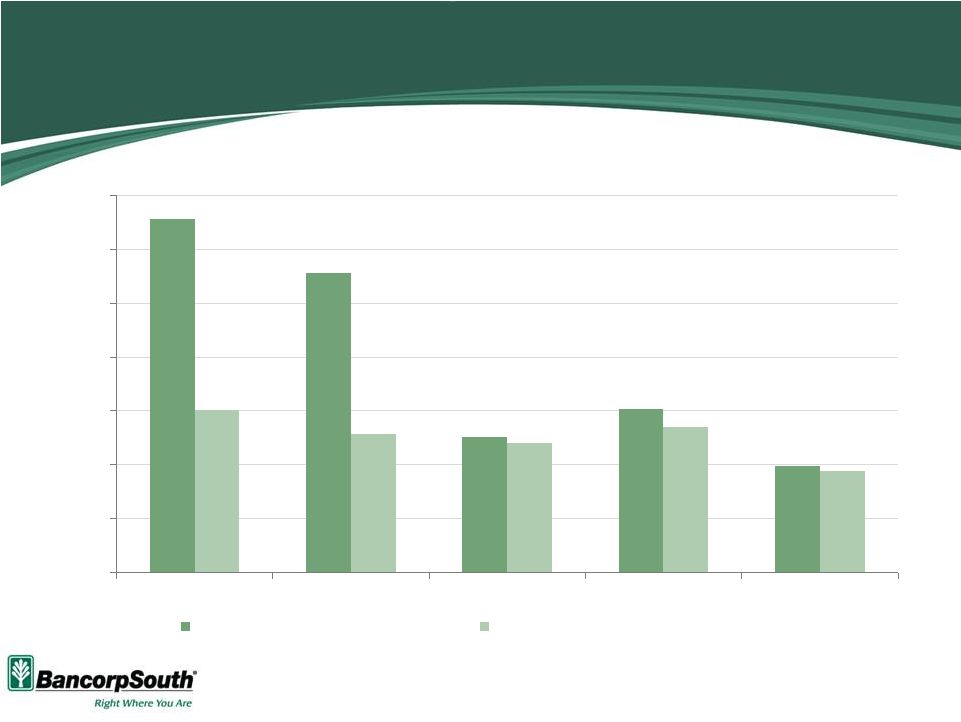

$55

$46

$56

$61

$48

$48

$39

$37

$55

$55

$61

$52

$45

$52

$51

$38

$0

$10

$20

$30

$40

$50

$60

$70

3/31/10

6/30/10

9/30/10

12/31/10

3/31/11

6/30/11

9/30/11

12/31/11

Pre-tax, Pre-provision Earnings

Pre-tax, Pre-provision Earnings (excl. MSR impairment)

9

Stable and Consistent Pre-tax, Pre-provision Earnings

Dollars in millions

Data for quarters ended as of dates shown

|

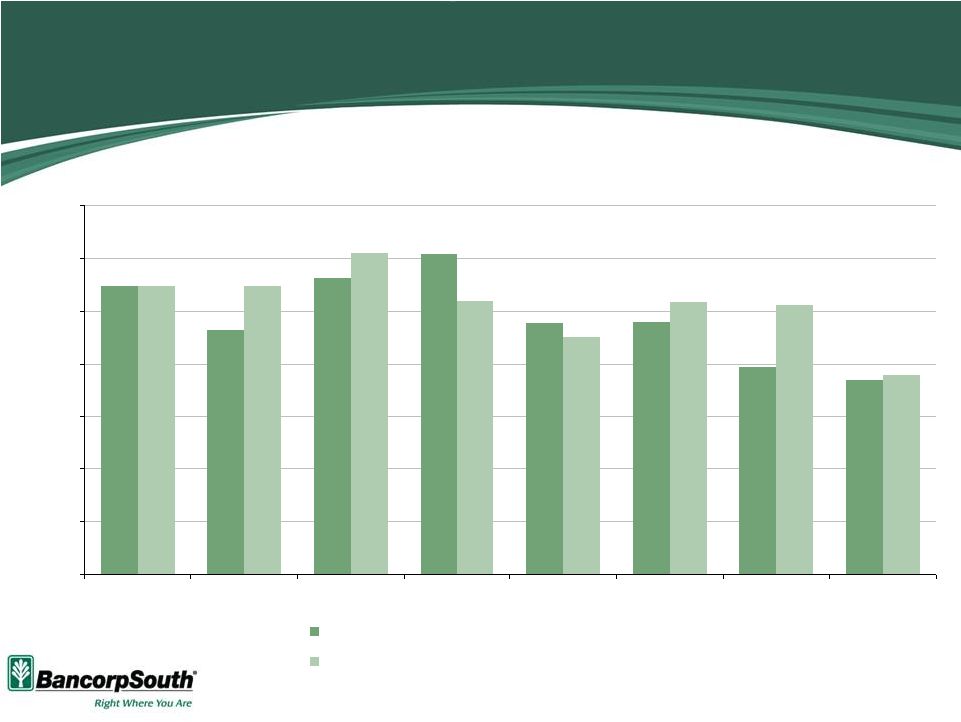

Stable Net Interest Margin

Fiscal Year

Quarter Ended

Shown on a fully taxable equivalent basis

10

3.68%

3.75%

3.77%

3.70%

3.69%

3.71%

3.66%

3.69%

0.00%

0.50%

1.00%

1.50%

2.00%

2.50%

3.00%

3.50%

4.00%

4.50%

2007

2008

2009

2010

3/31/11

6/30/11

9/30/11

12/31/11 |

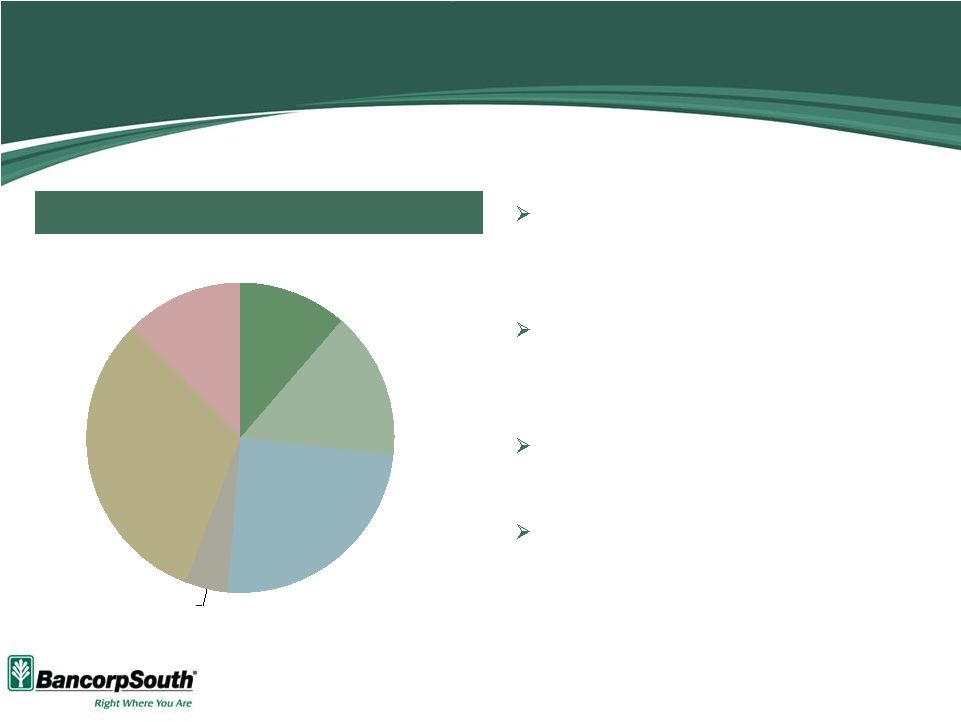

Mortgage

lending

11%

Card and

merchant fees

16%

Service

charges

25%

Trust income

4%

Insurance

commissions

32%

Other

12%

Diversified Revenue Stream

Noninterest Revenue Composition

Insurance and mortgage businesses

provide significant sources of noninterest

revenue

Historically, over 35% of total revenue

has been derived from noninterest

sources

Insurance commissions were up 6% for

2011 compared to 2010

Mortgage production volume totaled $1.2

billion for 2011

Total Noninterest Revenue of $272.4M*

11

Percentages and amounts based on data for the twelve months ended December 31, 2011

*Excludes net securities gains of $12.1 million and MSR impairment of $13.7 million

|

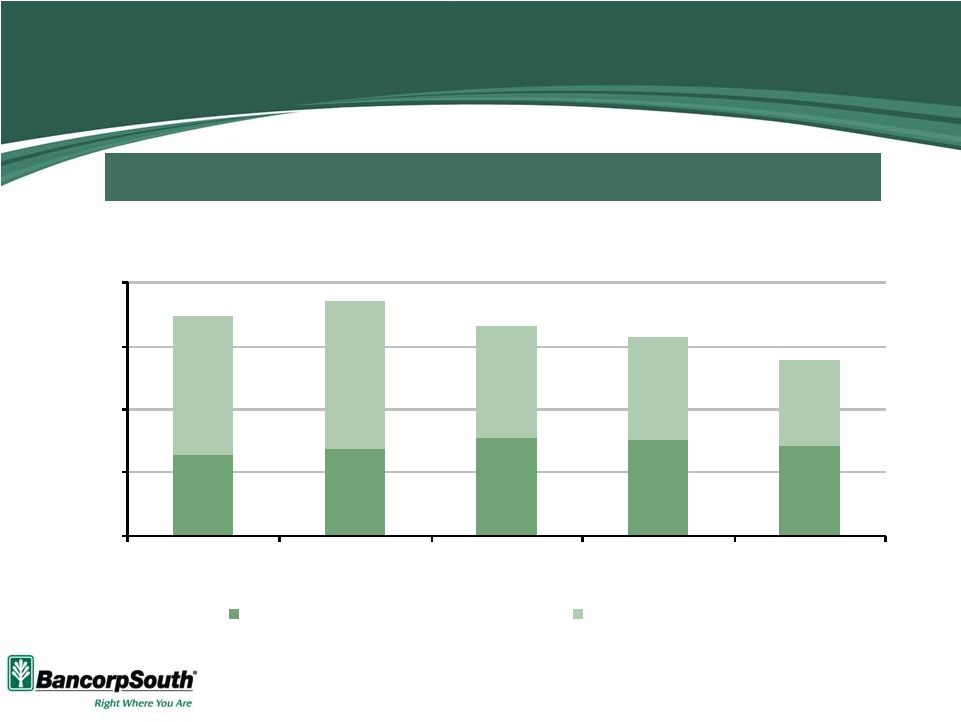

Noninterest Revenue

12

Excludes net securities gains and MSR impairment

Data for quarters ended as of dates shown

$22M

$22M

$21M

$18M

$23M

$23M

$22M

$19M

$0

$20

$40

$60

$80

3/31/10

6/30/10

9/30/10

12/31/10

3/31/11

6/30/11

9/30/11

12/31/11

Insurance Commissions

All Other Noninterest Revenue

$62M

$66M

$72M

$66M

$66M

$69M

$72M

$66M

Noninterest revenue continues to be a stable and significant source of revenue.

Insurance business continues to perform well and typically makes up approximately

1/3 of noninterest revenue. |

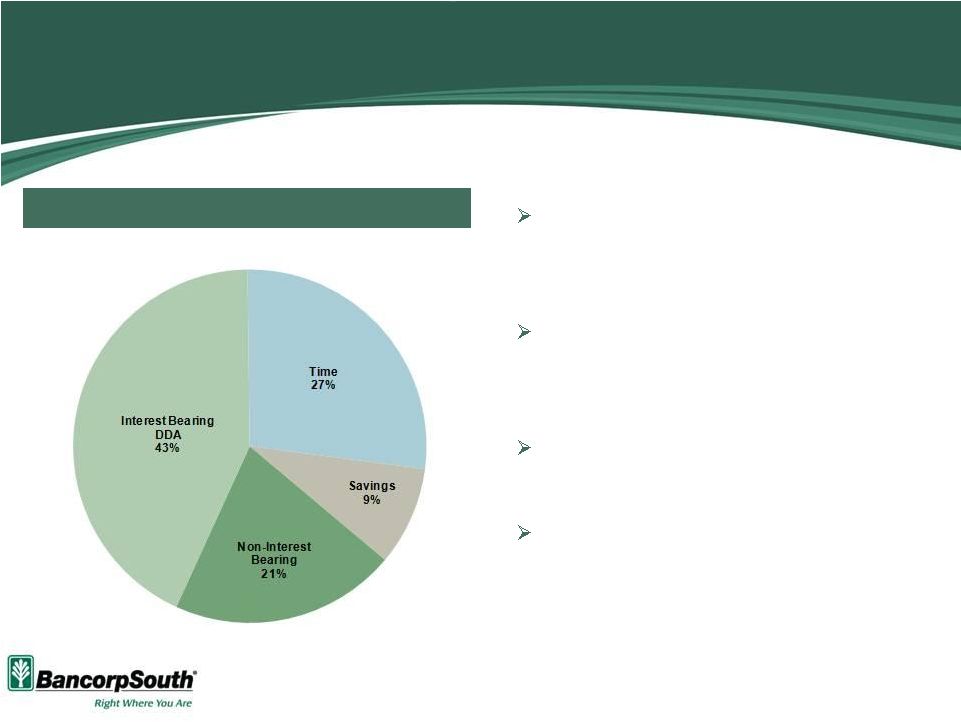

Core

Deposit Franchise As of and for the periods ended December 31,

2011 $11.0B Total

Deposit Composition

13

Approximately 87% of total deposits are

core, yielding a 92% loan / core deposit

ratio

Noninterest bearing deposits have grown

approximately 10% since December 31,

2010

Cost of total deposits for the quarter

ended December 31, 2011 was 0.67%

Over $1 billion in CDs are maturing over

the next two quarters at a weighted

average rate of approximately 1.26% |

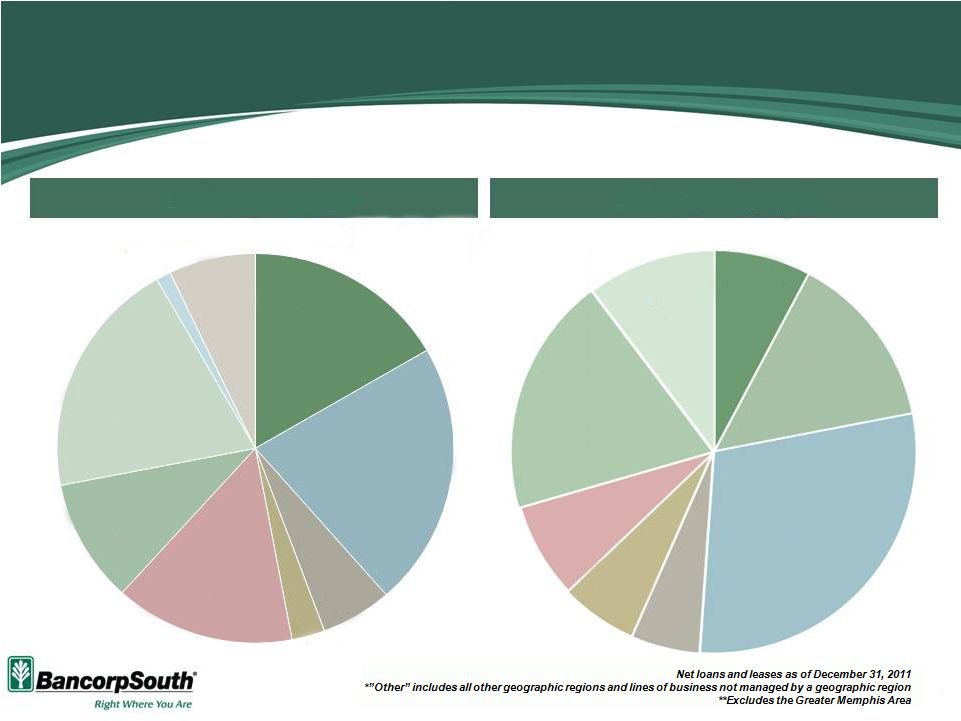

Diversified Loan Portfolio

$8.9B Portfolio

Loans By Category

Loans By Geography

14

Commercial &

Industrial

16%

Consumer Mortgages

22%

Home

Equity

6%

Agricultural

3%

C&I Owner-

15%

Construction,

Acquisition & Dev.

10%

Commercial Real

Estate

20%

Credit Cards

1%

Other

7%

AL & FL

Panhandle

8%

AR**

14%

MS**

29%

MO

6%

Greater

Memphis

6%

TN**

8%

TX & LA

19%

Other*

10%

Occupied |

% Change

As of

Linked

YOY

12/31/11

9/30/11

12/31/10

12/31/11 vs. 9/30/11

12/31/11 vs. 12/31/10

Commercial and industrial

1,474

$

1,503

$

1,491

$

(2.0%)

(1.2%)

Real estate:

Consumer mortgages

1,945

1,966

1,952

(1.1%)

(0.3%)

Home equity

514

523

543

(1.7%)

(5.3%)

Agricultural

239

250

252

(4.1%)

(5.1%)

Commercial and industrial-owner occupied

1,302

1,330

1,331

(2.1%)

(2.2%)

Construction, acquisition and development

908

977

1,175

(7.0%)

(22.7%)

Commercial

1,754

1,772

1,817

(1.0%)

(3.5%)

Credit Cards

106

103

106

3.0%

(0.1%)

Other

627

632

665

(0.8%)

(5.7%)

Total

8,870

$

9,056

$

9,333

$

(2.0%)

(5.0%)

Loan Portfolio

Continue to decrease exposure in the CAD portfolio

Excluding

the

impact

of

CAD

portfolio

-

total

loans

declined

2.4%

from

December

31, 2010

15

Dollars

in

millions

Net

loans

and

leases |

Credit Quality Improvement

Non-performing loans decreased 11.2% from the previous quarter

Non-performing assets decreased 5.6% from the previous quarter

Both NPLs and NPAs have declined for three consecutive quarters

51% of non-accrual loans paying as agreed

85% of non-accrual loans were impaired and carried at 68% of unpaid

principal balance (“UPB”)

Sales of OREO properties during the quarter totaled $16.7 million,

16

At and for the three months ended December 31, 2011

“Paying as agreed” includes loans < 30 days past due with payments occurring at least

quarterly

resulting in no material net gain/loss. OREO is carried at 54% of

aggregate loan balances at time of foreclosure |

4Q11

NPL Improvement 17

Dollars in millions

As of

12/31/11

9/30/11

Change

Non-accrual loans and leases

$276.8

$314.5

($37.7)

Loans and leases 90+ days past due, still accruing

3.4

7.3

(3.9)

Restructured loans and leases, still accruing

42.0

41.0

1.0

Total non-performing loans and leases

$322.3

$362.8

($40.5)

Allowance for credit losses to net loans and leases

2.20%

2.21%

Allowance for credit losses to non-performing loans and leases

60.55%

55.04%

Non-performing loans and leases to net loans and leases

3.63%

4.01% |

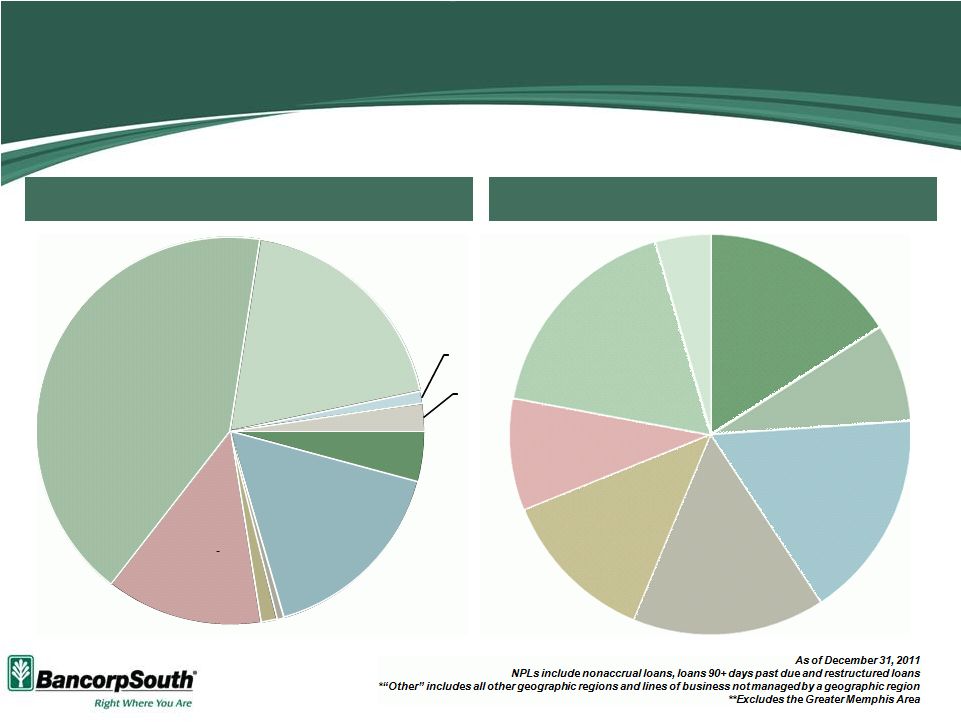

NPLs

By Type & Location NPLs By Category

NPLs By Geography

18

Commercial & Industrial

4%

Consumer Mortgages

16%

Home Equity

1%

Agricultural

1%

-

C&I Owner

Occupied

13%

Construction, Acquisition

& Development

42%

Commercial

Real Estate

19%

Credit Cards

1%

Other

2%

AL & FL

Panhandle

16%

AR**

8%

MS**

17%

MO

15%

Greater

Memphis

13%

TN**

9%

TX & LA

18%

Other*

4% |

19

Newly Identified Non-Accrual Loans

$131M

$111M

$50M

$61M

$39M

$60M

$52M

$48M

$54M

$38M

$0

$20

$40

$60

$80

$100

$120

$140

12/31/10

3/31/11

6/30/11

9/30/11

12/31/11

Newly Identified Non-Accrual Loans

Loans 30-89 Days Past Due, Still Accruing

Dollars in millions

Newly identified non-accrual loans for quarters ended as of dates shown

|

Non-Accrual Loans

20

51% of non-accrual loans were paying as agreed as of December 31, 2011

$0

$100

$200

$300

$400

12/31/10

3/31/11

6/30/11

9/30/11

12/31/11

Non-Accrual Lns Paying as Agreed

All Other Non-Accrual Lns

Dollars in millions

“Paying as Agreed” includes loans < 30 days past due with payments occurring at least

quarterly 36%

37%

47%

48%

51% |

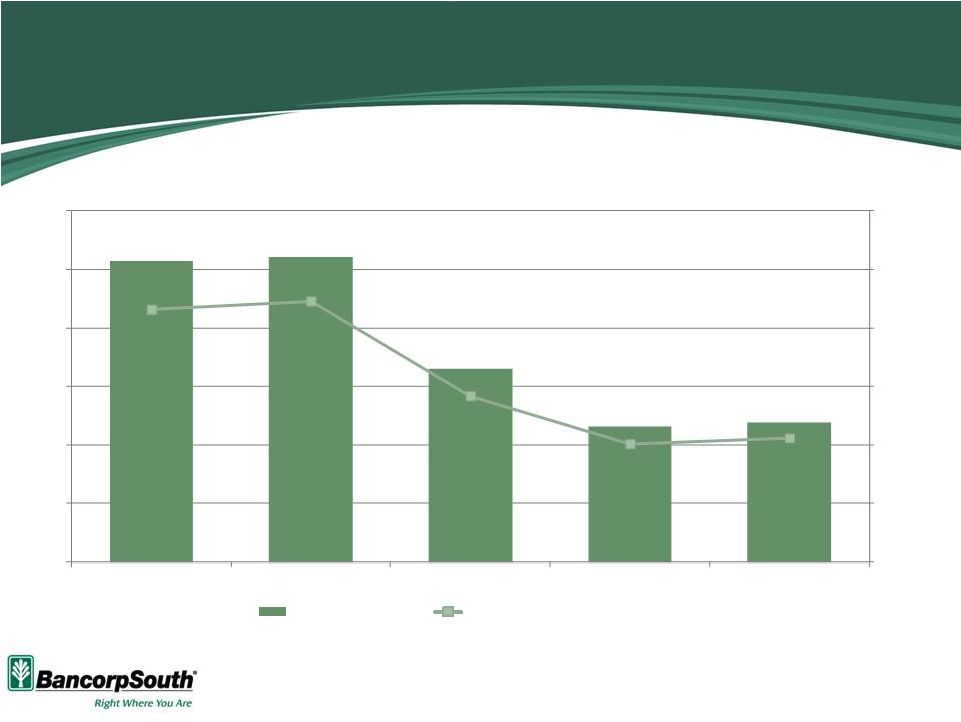

Net

Charge-offs are Stabilizing 21

Net Charge-Offs

Net Charge-offs / Average loans

$51

$52

$33

$23

$24

0.0%

0.5%

1.0%

1.5%

2.0%

2.5%

3.0%

$0

$10

$20

$30

$40

$50

$60

12/31/10

3/31/11

6/30/11

9/30/11

12/31/11

% Avg. Loans

Data for quarters ended as of dates shown

Dollars in millions |

Strategic Focus

Preserve strong capital and position the Company for economic recovery

Focus on asset quality

Pursue quality loan growth

Take advantage of market disruption

Grow core earnings through margin expansion and revenue growth

Expense control and reduction

22 |

Summary

Leading Mid-South Regional Bank Serving Our Communities for Over 100 Years

Stable net interest margin and historically over 35% of the revenue stream derived

from noninterest sources High Quality Deposit Franchise with a Stable Core

Deposit Base 87% core deposits*

Cost of total deposits of 0.67%

Positive Asset Quality Trends

11.2% decline in non-performing loans and 5.6% decline in non-performing

assets from Q3‘11 to Q4’11 NPLs and NPAs have declined for three

consecutive quarters 51% of nonaccrual loans paying as agreed

Consistent Pre-tax, Pre-Provision Earnings

23

Proven and Experienced Management Team

Diversified Revenue Stream

At and for the three months ended December 31, 2011 *Includes all deposits

except CDs>100K |

Appendix |

25

Non-GAAP Financial Reconciliation

Pre-Tax, Pre-Provision Earnings Reconciliation

Q4-11

Q3-11

Q2-11

Q1-11

Q4-10

Q3-10

Q2-10

Q1-10

(Dollars in Thousands)

Net Interest Income Before Provision --> A

$107,489

$108,075

$109,912

$109,437

$110,253

$109,678

$109,329

$111,882

Noninterest Income --> B

65,335

62,055

75,144

68,311

73,974

69,752

57,086

63,332

Noninterest Expense --> C

135,856

130,698

137,069

130,010

123,447

123,087

120,016

120,483

Pre-Tax Pre-Provision Earnings --> D=A+B-C

36,968

39,432

47,987

47,738

60,780

56,343

46,399

54,731

MSR Valuation Adjustment --> E

(991)

(11,676)

(3,839)

2,540

8,895

(4,609)

(8,323)

8

Pre-Tax Pre-Provision Earnings (Excluding MSR Adjustment) -->

F=D-E 37,959

51,108

51,826

45,198

51,885

60,952

54,722

54,723

Tangible Common Equity / Tangible Assets (TCE/TA) and Tangible Book Per Share

Pro Forma

As of

As of

As of

12/31/2011*

12/31/2011

9/30/2011

12/31/2010

(In Thousands, Except Percentages and Per Share Amounts)

Common Equity --> A

$1,371,912

$1,262,912

$1,266,753

$1,222,244

Assets --> B

13,104,851

12,995,851

13,198,518

13,615,010

Intangibles --> C

287,910

287,910

288,723

289,720

Tangible Common Equity --> D=A-C

1,084,002

975,002

978,030

932,524

Tangible Assets --> E=B-C

12,816,941

12,707,941

12,909,795

13,325,290

Tangible Common Equity / Tangible Assets (%) -- > F=D/E

8.46%

7.67%

7.58%

7.00%

Common Shares Outstanding -- > G

83,484

83,489

83,482

Tangible Book Value Per Share -- > D=D/G

11.68

11.71

11.17

*Assumes $109 million of net proceeds from common stock offering

|