Attached files

| file | filename |

|---|---|

| 8-K - LNB BANCORP, INC. 8-K - LNB BANCORP INC | a50164313.htm |

Exhibit 99.1

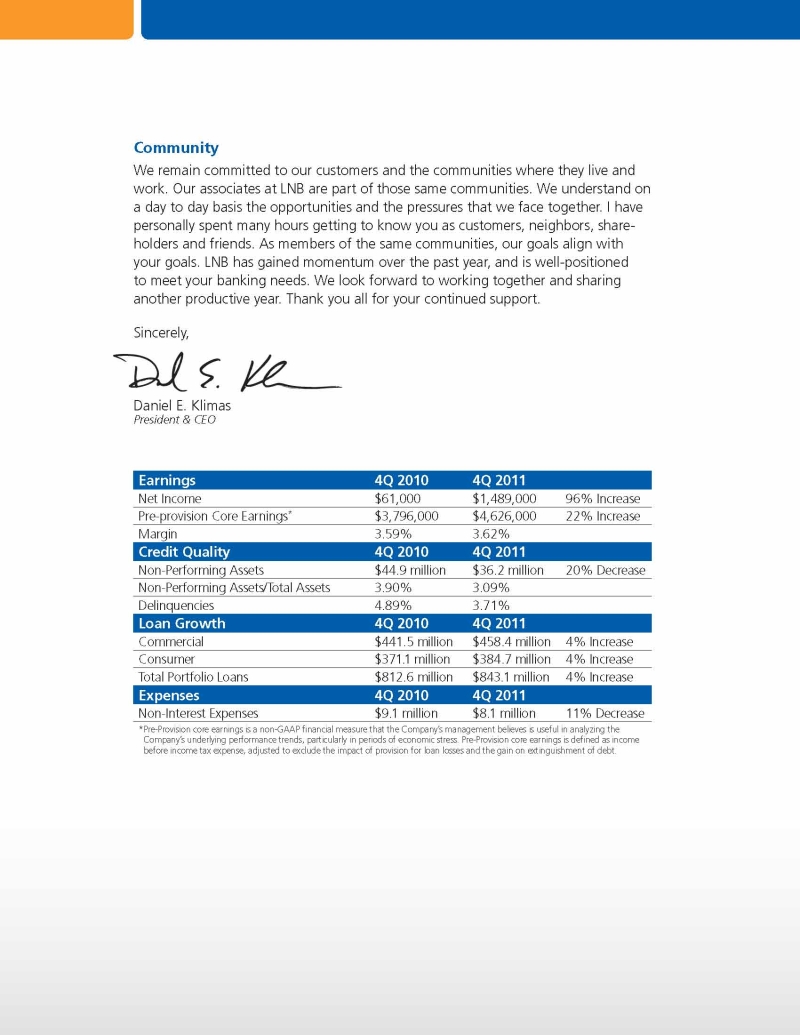

February, 2012 I am pleased to report a strong fourth quarter and another year of improved operating performance. We continue to make progress in essential areas of our business activities, and finished the year stronger and better positioned to serve our customers and communities in Northeast Ohio. Although our economy has not yet fully recovered, there are positive signs emerging throughout our markets. Financial Performance Net Income in the fourth quarter of 2011 was $1.49 million, up $1.43 million from the year-ago fourth quarter. Our revenue throughout the year was stable and welldiversified, while operating expenses continued their decline. Fourth quarter, in particular, reflects the significant progress we’ve made in nearly every expense category, reducing expenses over $1 million compared to the year-ago fourth quarter. Loans grew nearly 4% during 2011 in a market where growth remains a challenge. We have continued our solid performance in business lending; recently, Crain’s Cleveland Business cited Lorain National Bank as one of Northeast Ohio’s Top Ten Small Business Administration (SBA) lenders. Serving small businesses has been a core strength of LNB throughout our 107-year history. We continue to look for opportunities to lend to businesses throughout Northeast Ohio. We are finding that businesses are welcoming our higher level of personal service. On the consumer side, our auto loans grew by $30 million during 2011, both in local markets as well as working with auto dealers in other parts of the country. We believe our multi-state expansion of auto lending should enable us to sustain our loan growth. We have made steady progress reducing our problem loans. During 2011, we reduced nonperforming loans by nearly 20%, or $8 million. As a community bank, we are well-aware of the financial challenges our customers face. Although it may lead to a longer workout process, we are working with our customers to assist them through these difficult times. Community We remain committed to our customers and the communities where they live and work. Our associates at LNB are part of those same communities. We understand on a day to day basis the opportunities and the pressures that we face together. I have personally spent many hours getting to know you as customers, neighbors, shareholders and friends. As members of the same communities, our goals align with your goals. LNB has gained momentum over the past year, and is well-positioned to meet your banking needs. We look forward to working together and sharing another productive year. Thank you all for your continued support. Sincerely, Daniel E. Klimas President & CEO Earnings 4Q 2010 4Q 2011 Net Income $61,000 $1,489,000 96% Increase Pre-provision Core Earnings* $3,796,000 $4,626,000 22% Increase Margin 3.59% 3.62% Credit Quality 4Q 2010 4Q 2011 Non-Performing Assets $44.9 million $36.2 million 20% Decrease Non-Performing Assets/Total Assets 3.90% 3.09% Delinquencies 4.89% 3.71% Loan Growth 4Q 2010 4Q 2011 Commercial $441.5 million $458.4 million 4% Increase Consumer $371.1 million $384.7 million 4% Increase Total Portfolio Loans $812.6 million $843.1 million 4% Increase Expenses 4Q 2010 4Q 2011 Non-Interest Expenses $9.1 million $8.1 million 11% Decrease * Pre-Provision core earnings is a non-GAAP financial measure that the Company’s management believes is useful in analyzing the Company’s underlying performance trends, particularly in periods of economic stress. Pre-Provision core earnings is defined as income before income tax expense, adjusted to exclude the impact of provision for loan losses and the gain on extinguishment of debt.