Attached files

| file | filename |

|---|---|

| EX-99.2 - EXHIBIT 99.2 - IDEX CORP /DE/ | d297295dex992.htm |

| 8-K - FORM 8-K - IDEX CORP /DE/ | d297295d8k.htm |

Fourth Quarter 2011 Earnings Release

February 7, 2012 |

Agenda

2

IDEX Outlook

2011 Summary

Segment Realignment

2011 Segment Performance

Fluid & Metering

Health & Science

Dispensing Equipment

Fire & Safety

2012 Guidance

Q&A |

IDEX Proprietary & Confidential

Replay Information

Dial toll–free: 855.859.2056

International: 404.537.3406

Conference ID: #40912918

Log on to: www.idexcorp.com

3 |

IDEX Proprietary & Confidential

Cautionary Statement

Under the Private Securities

Litigation Reform Act

This presentation and discussion will include forward-looking statements.

Our actual performance may differ materially from that indicated

or suggested

by any such statements. There are a number of factors that could cause those

differences, including those presented in our most recent annual

report and

other company filings with the SEC.

4 |

IDEX Proprietary & Confidential

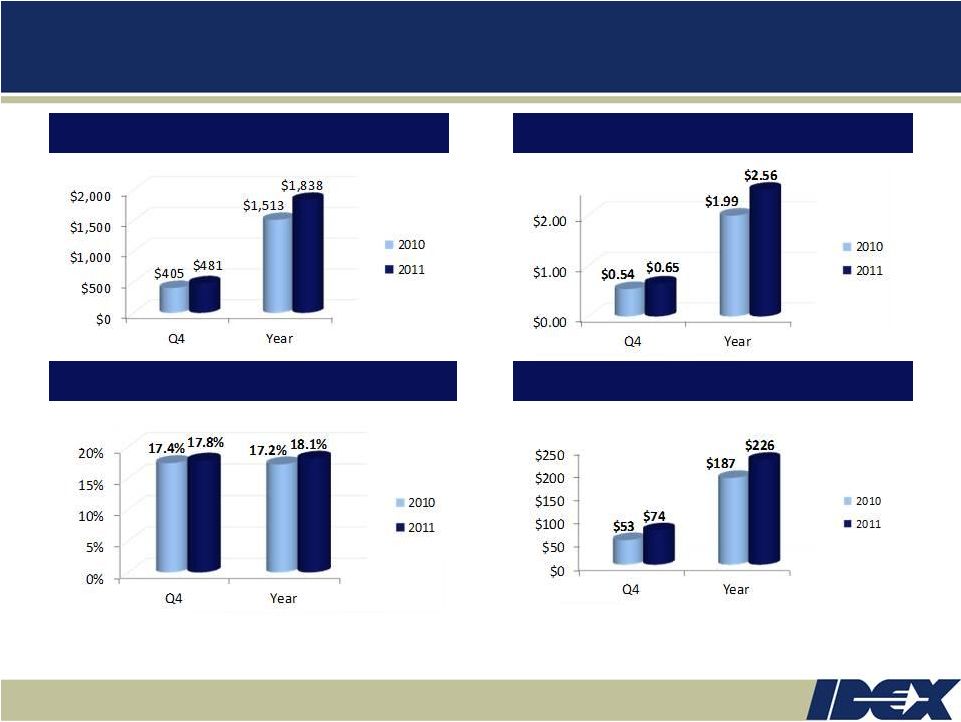

Total Revenue

Operating Margin*

Free Cash Flow **

EPS*

IDEX 2011 Financial Performance

Outstanding free cash flow, continued top-line growth and margin

expansion 5

Organic: 9%

29% Growth

Organic: 7%

20% Growth

* EPS / Op Margin data was adjusted for $9.4M and $12.3M of restructuring expenses

in Q411 and FY2011, respectively. Restructuring expenses were $4.7M and $11.1M in

Q4 2010 and FY2010, respectively. Additionally, EPS and Op Margin was adjusted for the CVI Melles Griot fair value inventory charge of $15.8M in FY2011.

* * Q4 and full year 2011 and 2010 Free Cash Flow was adjusted for $39M and $31M,

respectively, for the forward starting interest rate swap settlement. |

IDEX Proprietary & Confidential

Fluid & Metering

13% organic revenue growth in 2011…

margin expanded 140 bps in 2011

6

Q4 Sales Mix:

Organic

+8%

Acquisition

-

Fx

-

Total

+8%

Q4

Summary:

Strong top line growth; reinvigorated aftermarket sales

Energy, Chemical, Agriculture continue to drive results

Water/Waste Water markets are challenged due to US muni

spend

Total Orders

Total Revenue

Operating Margin*

* Op Margin data adjusted for restructuring expense

Organic: 9%

Organic: 13%

140 bps

Improvement

Organic: 8%

Organic: (1%)

80 bps

Improvement |

IDEX Proprietary & Confidential

Health & Science

IDEX Optics and Photonics platform integration is well underway

7

Q4 Sales Mix:

Organic

+7%

Acquisition

+44%

Fx

-

Total

+51%

Q4 Summary:

When adjusted for 2011 acquisitions operating margin is 24.6%

New products and increased content within the life science end

markets

Industrial, environmental, food and pharma markets remain

strong

HST M&A pipeline entering 2012 is robust.

Total Orders

Total Revenue

Operating Margin*

* Op Margin data adjusted for restructuring expense and the CVI Melles

Griot fair value inventory charge Organic: 9%

Organic: 9%

110 bps

Compression

280 bps

Compression

Organic: 2%

Organic: 7% |

IDEX Proprietary & Confidential

Dispensing

Operating margins will improve through structural actions taken

8

Q4 Sales Mix:

Organic

-%

Acquisition

-

Fx

-1%

Total

-1%

Q4

Summary:

Consolidation of European sales offices completed in Q4

Structural actions taken will continue to improve margins

Holding share in N.A.; wins on retrofits and spare parts

Total Orders

Total Revenue

Operating Margin*

* Op Margin data adjusted for restructuring expense

Organic: (9%)

Organic: (11%)

20 bps

Improvement

20 bps

Compression

Organic: flat

Organic: (16%) |

IDEX Proprietary & Confidential

Fire & Safety/

Diversified

Global penetration and continued margin improvement

9

Q4 Sales Mix:

Organic

+6%

Acquisition

-

Fx

-

Total

+6%

Q4

Summary:

Rescue’s growth driven by new product introduction and

emerging market expansion

BAND-IT continued growth through new applications in new

markets

North American Fire markets stable, penetration into

international and adjacent markets

Total Orders

Total Revenue

Operating Margin*

* Op Margin data adjusted for restructuring expense

Organic: 6%

140 bps

Improvement

Organic: 5%

Organic: 1%

150 bps

Improvement

Organic: 6% |

IDEX Proprietary & Confidential

Outlook: 2012 Guidance Detail

10

Mid Single Digit Organic Sales Growth…Double Digit EPS Growth

2012 Organic Growth Expectations

Mid single digits

Future acquisitions not contemplated in the growth below

Sales

EPS

FY 2011 Actuals

$ 1,838

$ 2.56

Interest Expense

(0.10)

FX

(20M)

(0.03)

Full Year Optics and Photonics

70M -

80M

0.10 -

0.12

Organic Growth

85M -

100M

0.22 -

0.28

Completed Restructuring Actions

0.04

Global Investments

( 0.05)

FY 2012 Forecast

~$2B

$2.74 -2.82 |

IDEX Proprietary & Confidential

Outlook: 2012 Guidance Summary

Q1 2012

Adjusted EPS estimate range: $0.62 –

$0.64

Organic revenue growth of 4%

Negative Fx impact of $4M to sales (at January

31 rates) FY 2012

Adjusted EPS estimate range: $2.74 –

$2.82

Organic revenue growth in the mid single digits

Operating margin of 19%

Negative Fx impact of

$20M to sales (at January 31 rates)

Positive impact of 5% from acquisitions

Other modeling items

Tax rate 30%

Interest expense of $41M

Cap Ex $40M

Free Cash Flow will exceed net income

EPS

estimate

excludes

future

restructuring,

acquisitions

and

acquisition–related

costs

11 |

IDEX Proprietary & Confidential

Q&A

12 |