Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - PLAINS EXPLORATION & PRODUCTION CO | d294466d8k.htm |

| EX-99.1 - PRESS RELEASE - PLAINS EXPLORATION & PRODUCTION CO | d294466dex991.htm |

Credit

Suisse 2012 Energy Summit

February 2012

Exhibit 99.2 |

1

Corporate Headquarters

Contacts

Plains Exploration & Production Company

700 Milam, Suite 3100

Houston, Texas 77002

Forward-Looking Statements

This presentation is not for reproduction or distribution to others without PXP’s

consent. Corporate Information

James C. Flores –

Chairman, President & CEO

Winston M. Talbert –

Exec. Vice President & CFO

Hance V. Myers, III –

Vice President

Joanna Pankey –

Manager, Shareholder Services

Phone: 713-579-6000

Toll Free: 800-934-6083

Email:

investor@pxp.com

Web Site: www.pxp.com

Except for the historical information contained herein, the matters discussed in

this

presentation

are

“forward-looking

statements”

as

defined

by

the

Securities

and Exchange Commission. These statements involve certain assumptions

PXP made based on its experience and perception of historical trends, current

conditions, expected future developments and other factors it believes are

appropriate under the circumstances.

The forward-looking statements are subject to a number of known and

unknown risks, uncertainties and other factors that could cause our actual

results to differ materially. These risks and uncertainties include, among other

things, uncertainties inherent in the exploration for and development and

production

of

oil

and

gas

and

in

estimating

reserves,

the

timing

and

closing

of

acquisitions and divestments, unexpected future capital expenditures, general

economic conditions, oil and gas price volatility, the success of our risk

management

activities,

competition,

regulatory

changes

and

other

factors

discussed in PXP’s filings with the SEC.

References to quantities of oil or natural gas may include amounts that the

Company believes will ultimately be produced, but that are not yet classified as

"proved reserves" under SEC definitions.

Corporate

Information

Director |

2

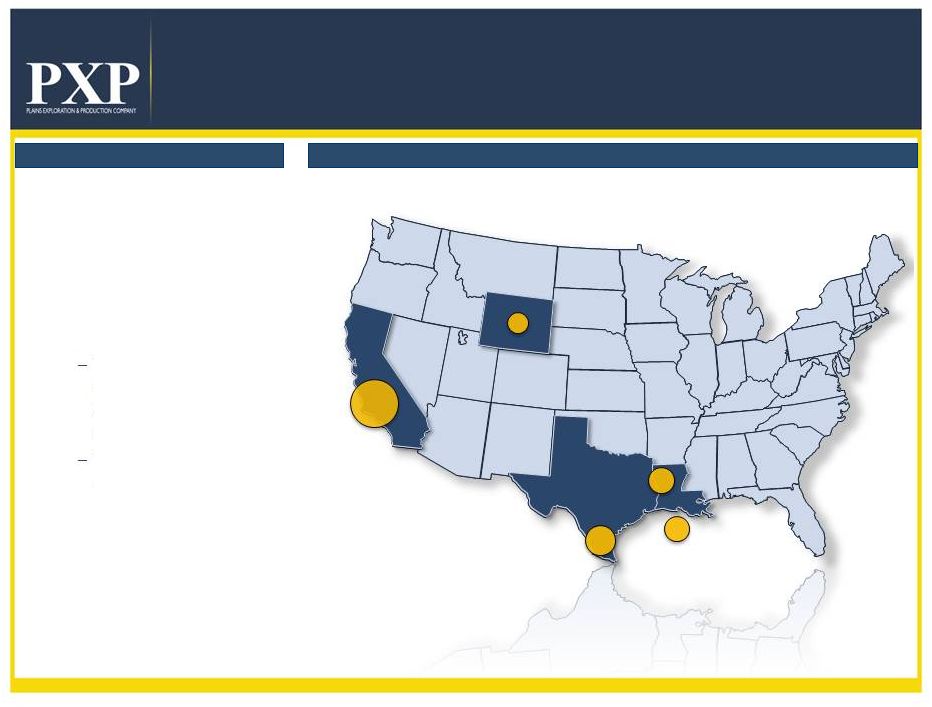

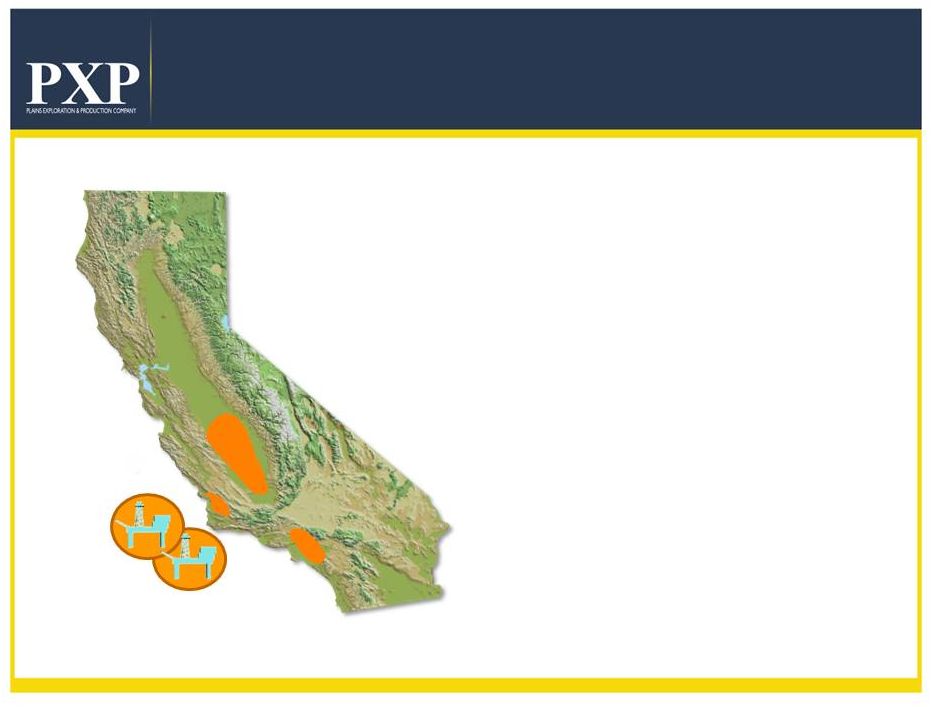

Core Asset Areas

Overview and Background

•

PXP is an independent oil and gas

company primarily engaged in

acquiring, developing, exploring and

producing oil and gas properties

•

Assets in PXP’s principal focus

areas include:

Mature properties with

long-lived reserves and

significant development

opportunities

Newer properties with

development and

exploration potential

•

PXP is headquartered in Houston,

TX with operations located in the

continental United States

Overview

Background and Operations

Madden

Haynesville

Gulf of Mexico

San Joaquin Valley

Arroyo Grande

Santa Maria Basin

Los Angeles Basin

Eagle Ford |

3

2011 Highlights

•

Consistently Strong Quarterly Operating Results

•

Exceptional Eagle Ford Development Results

•

Improved Eagle Ford and California Pricing Mechanisms

•

Improved Hedge Position Volumes and Pricing

•

GOM Financing and Lucius Sanctioning

•

Divested South Texas and Texas Panhandle Assets

•

Issued $600MM 6 5/8% Senior Notes Due 2021

•

Issued $1,000MM 6 3/4% Senior Notes Due 2022

•

Retired $1,324MM in Higher Cost Senior Notes |

4

2011 Operational Results

•

411 MMBOE Proved Reserves YE 2011

•

Reserve Replacement Ratio of 222%

•

16% Reserve Growth year-over-year pro forma for

asset sales

•

18% Reserve Growth in oil/liquids pro forma for asset

sales

•

Oil/Liquids 59% of total proved, up from 54% in 2010

•

12.2 Year Proved R/P

(1)

(1) Pro forma for 2011 asset sales. |

5

2011 Production & Revenue Analysis

•

98.9 MBOE per day Production in 2011, a 12% increase over

2010 and 23% pro forma for asset sales

•

82.2 MBOE per day pro forma Production in 2011, reflects

16.7 MBOE per day impact of fourth-quarter asset sales

•

Expect approximate 30% increase in 2012(E) oil/liquids revenue

compared to 2011(E) oil/liquids revenue

•

Increase reflects impact of higher estimated oil/liquids

volumes and stronger pricing associated with new

marketing contracts

•

Oil/Liquids sales as a percentage of total revenue

2012(E) 90%±

2011(E) 78%

2010 74%

•

98% estimated Brent pricing for crude oil in 2012 |

6

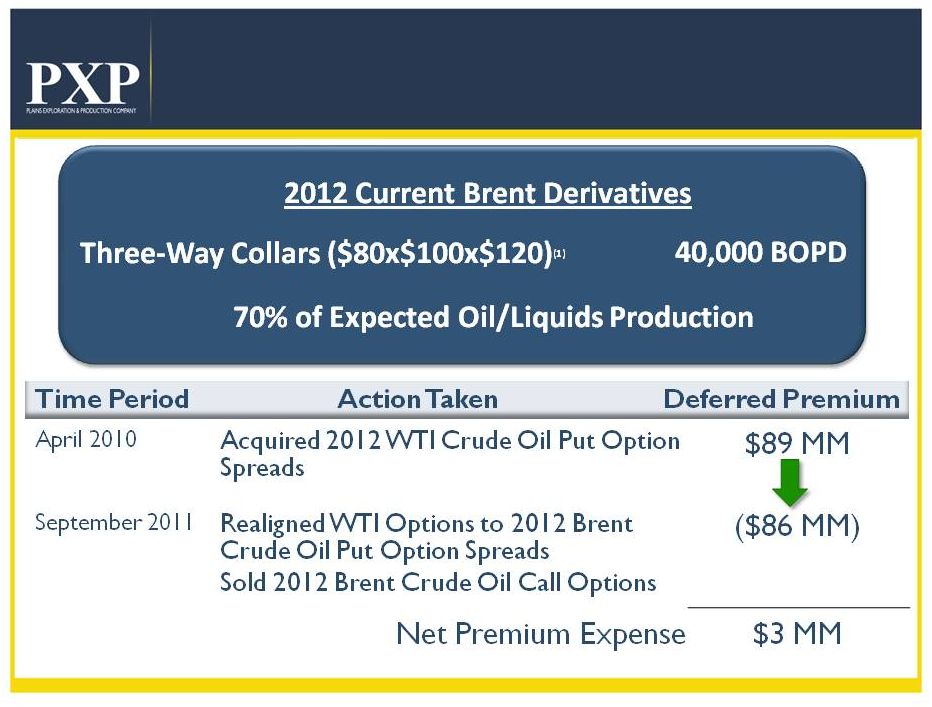

2012 Oil Hedge Program

“Costless Deferred Premium Strategy”

(1) Weighted average price, see detailed pricing in addendum.

|

7

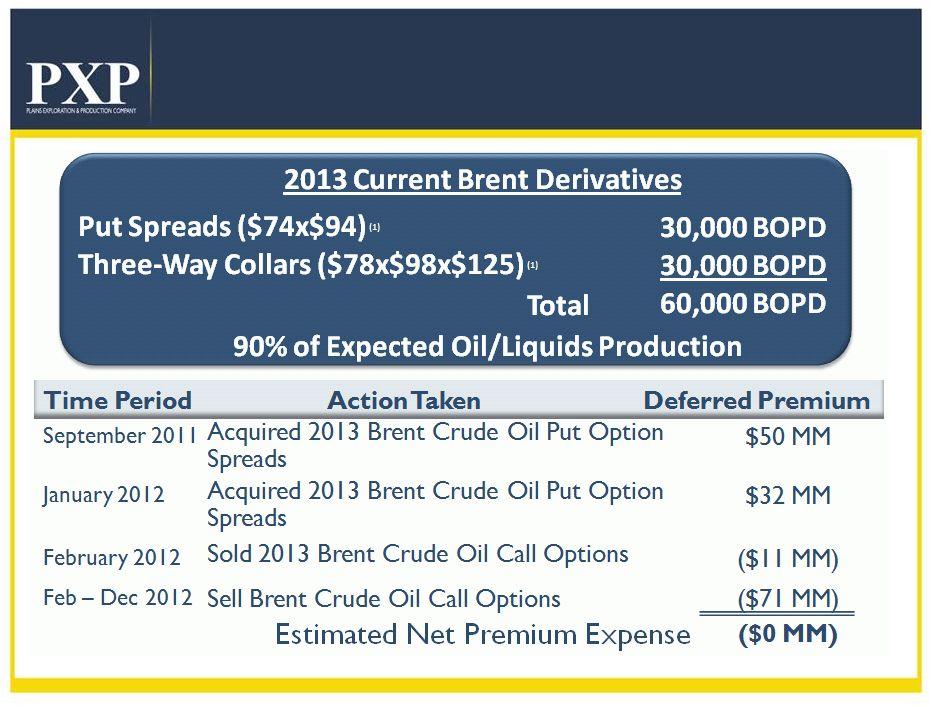

2013 Oil Hedge Program

“Costless Deferred Premium Strategy”

(1) Weighted average price, see detailed pricing in addendum.

|

8

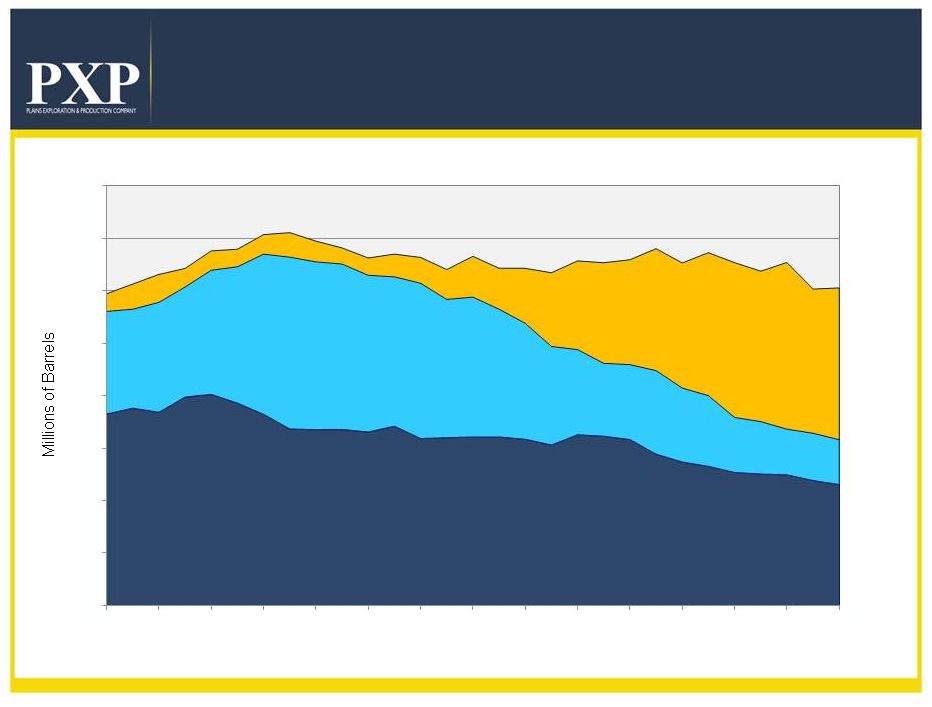

California Oil Supply Sources

Source: The California Energy Commission.

100

200

300

400

500

600

700

800

1982

1984

1986

1988

1990

1992

1994

1996

1998

2000

2002

2004

2006

2008

2010

California

Alaska

Foreign |

9

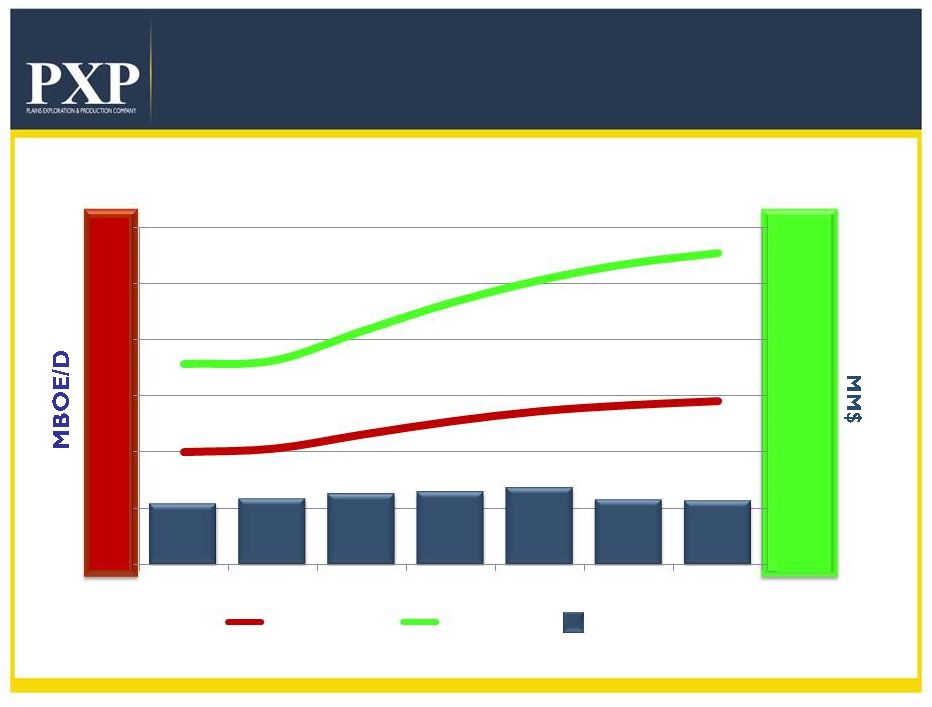

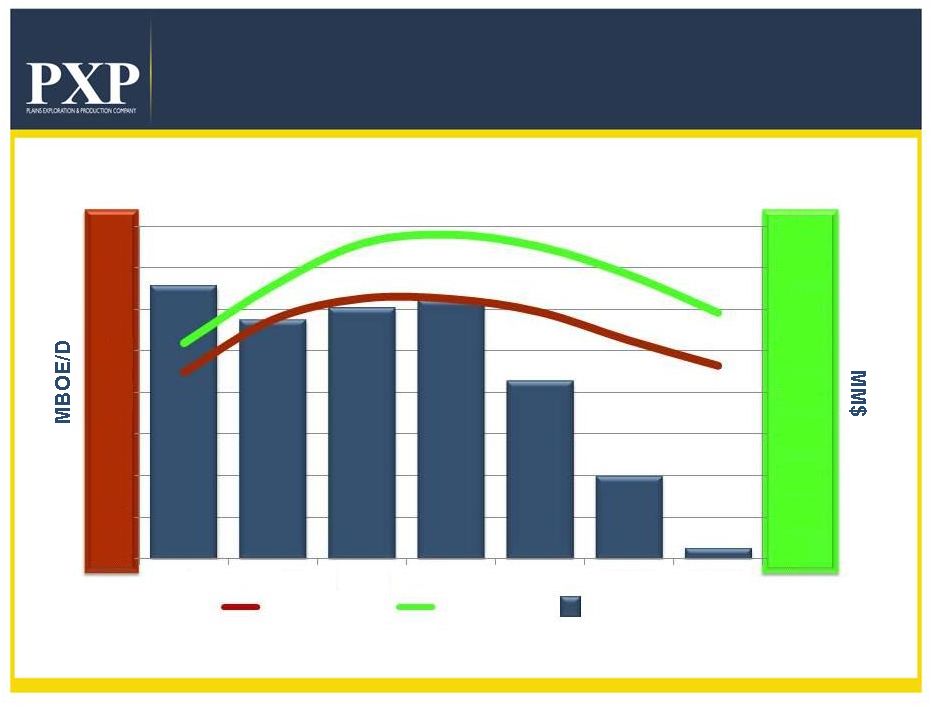

PXP

Operational Plan at $110 Brent Oil

Oil & Gas Capital

Cash Flow

Production

GOM Capital

PXP Net Production

Oil & Gas Cash Flow

(1)(2)

GOM Oil Production

Starts 2014

Eagle Ford

Oil Growth

(1) Oil and Gas revenues minus lease expenses.

(2) Assumes $108/Bbl Brent based oil pricing and natural gas pricing of $3.70/MMBtu in

2012 and $110/Bbl Brent based oil pricing and natural gas pricing of $4.00/MMBtu

2013 and beyond.

|

10

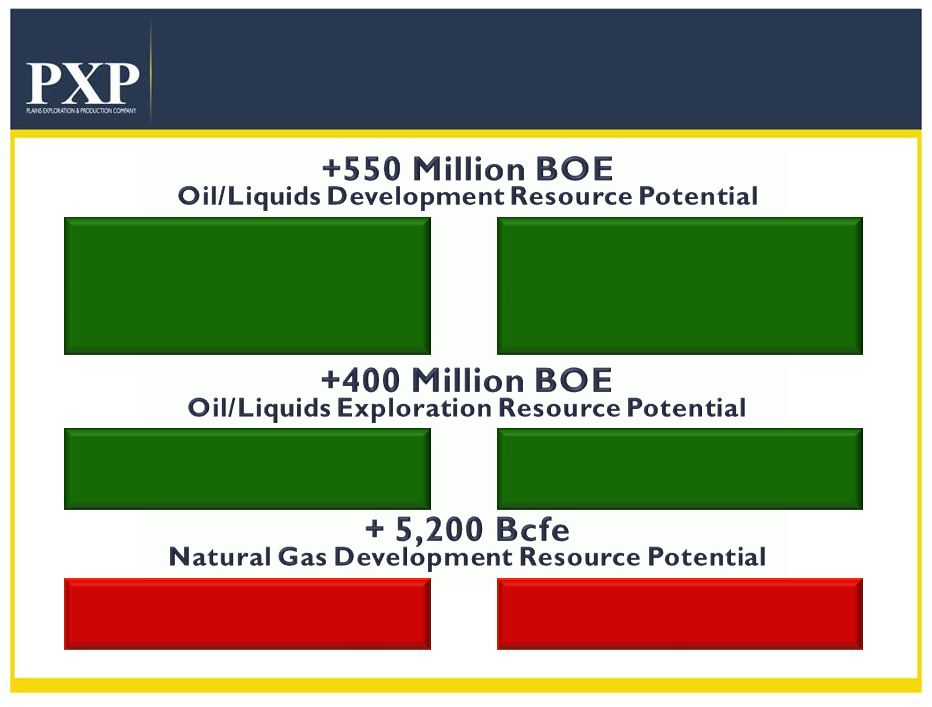

+1.8 Billion BOE

Undeveloped Resource Potential

Potential Reserves

283 MMBOE

162 MMBOE

106 MMBOE

Region

California

Eagle Ford

Gulf of Mexico

Potential Reserves

409 MMBOE

Region

Gulf of Mexico

5,200 Bcfe

40 Bcfe

Haynesville/Bossier

Madden |

11

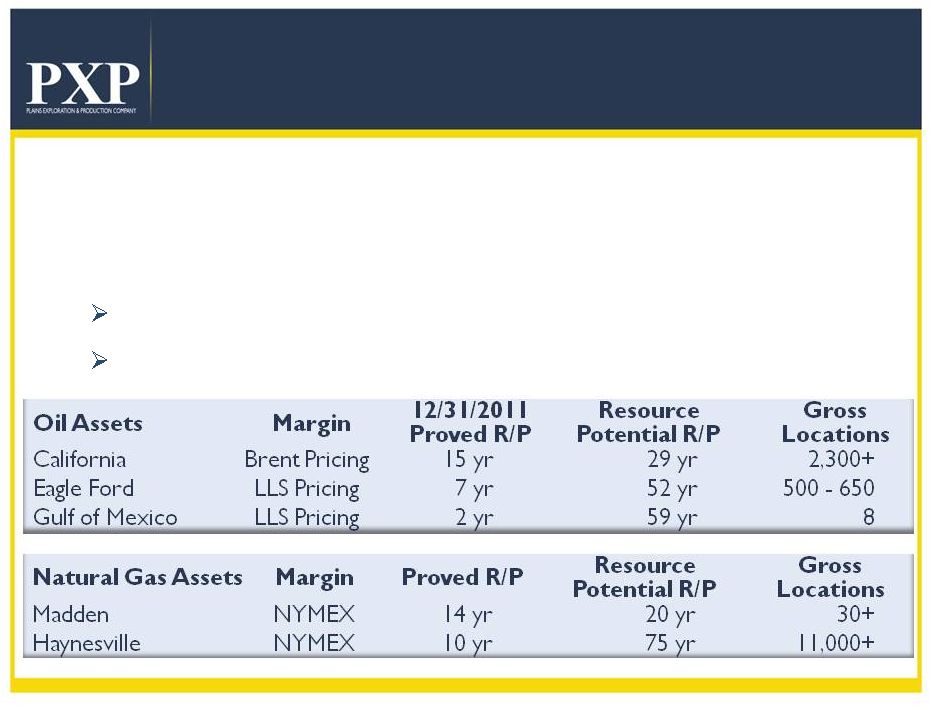

Strong Asset Intensity

11

Asset Intensity

•

High Margins

•

Durability

Proved Reserves R/P 12.2 years

(1)

Resource R/P 62 years

(1)

(1) Pro forma for 2011 asset sales. |

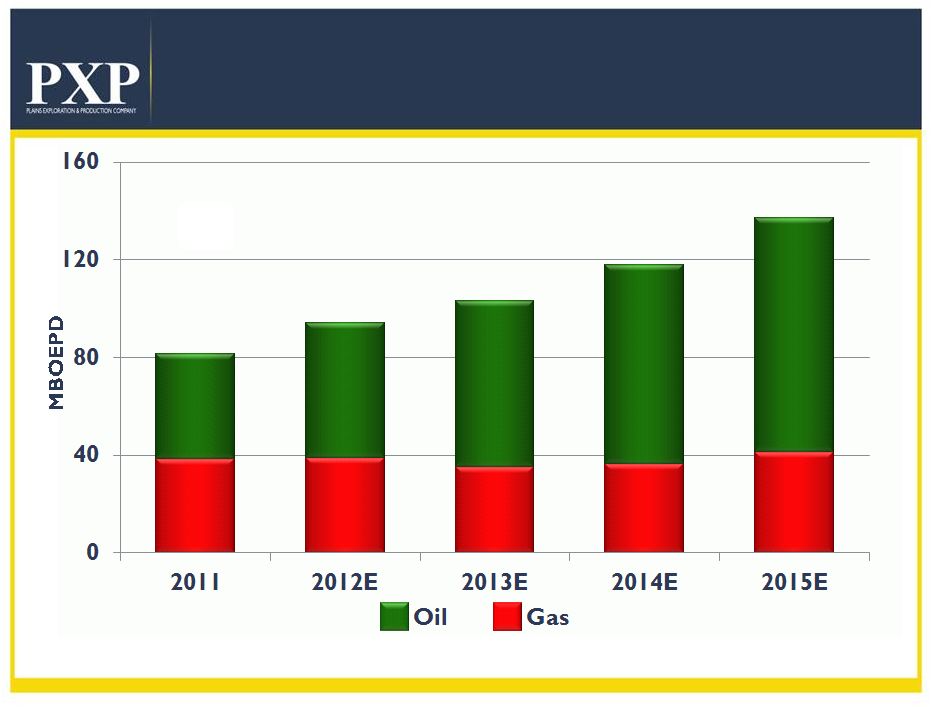

12

Multi Year Oil Growth

Production Growth Targets

42%

42%

58%

58%

34%

34%

66%

66%

30%

30%

70%

70%

31%

31%

69%

69%

47%

47%

53%

53%

94

(2)

103

(2)

118

(2)

137

(2)

82

(1)

(1)

Pro forma for asset sales.

(2) Assumes

$108/Bbl

Brent

based

oil

pricing

and

natural

gas

pricing

of

$3.70/MMBtu

in

2012

and

$110/Bbl

Brent

based

oil

pricing

and

natural

gas

pricing of $4.00/MMBtu 2013 and beyond. |

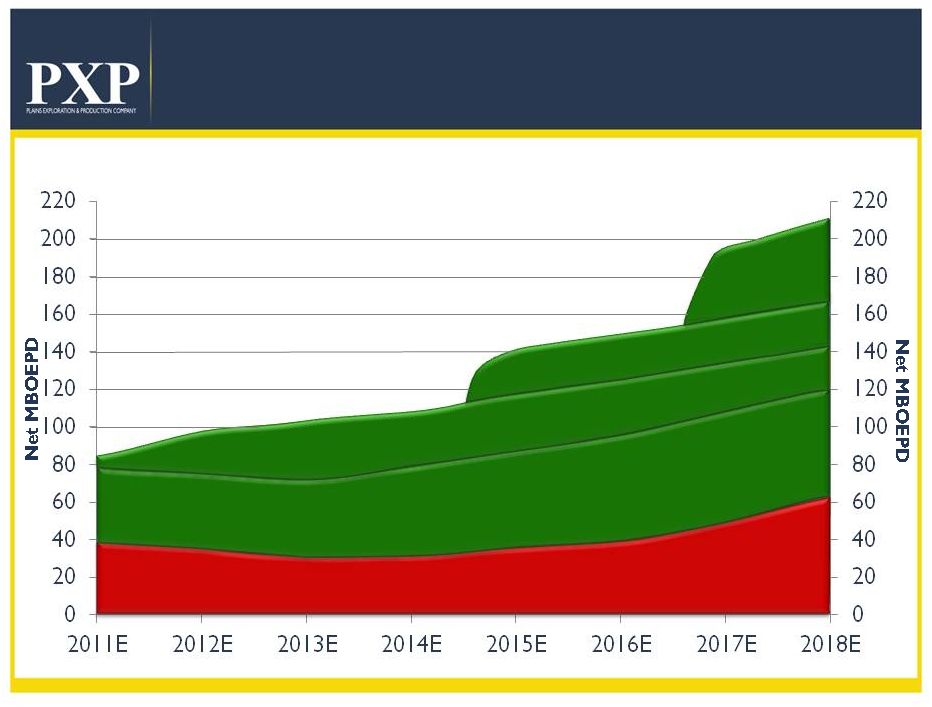

13

Asset Production Target Profile

Haynesville/Madden

Haynesville/Madden

California

California

Eagle Ford

Eagle Ford

GOM-Lucius

GOM-Lucius

GOM Risked

GOM Risked

Exploration

Exploration

Success

Success |

14

Capital Allocation

2012 Capital Program

(1)

Includes

development,

exploitation,

real

estate,

capitalized

interest

and

G&A

costs

but

does

not

include

additional

capital

for

exploratory

successes.

Exploration

capital

is

defined

as

discovery

and

dry

hole

costs.

2012E

$1.6 Billion

(1)

20%

14%

9%

16%

California

Eagle Ford

GOM

Haynesville

Other

41% |

15

California Oil

Onshore/Offshore

Los

Angeles

Basin

San Joaquin

Valley

Arroyo

Grande

Pt Pedernales

Pt Arguello

•

217 MMBOE Proved Reserves

•

431 MMBOE Total Resource

Potential

•

68% Proved Developed

•

14.6

yr

Proved

R/P,

28.9

yr

Potential

R/P

•

2,300+ Future Well Locations

The shaded areas are for illustrative purposes only and do not reflect actual leasehold

acreage. Resource |

16

California Oil

Operational Plan

PXP Net Production

Oil & Gas Cash Flow

(1)(2)

Capital

Cash Flow

Production

$321 MM

$349 MM

$371 MM

$381 MM

$405 MM

$341 MM

$334 MM

$0

$300

$600

$900

$1,200

$1,500

$1,800

0

20

40

60

80

100

120

2012E

2013E

2014E

2015E

2016E

2017E

2018E

(1) Oil and Gas revenues minus lease expenses.

(2) Assumes $108/Bbl Brent based oil pricing and natural gas pricing of $3.70/MMBtu in

2012 and $110/Bbl Brent based oil pricing and natural gas pricing of $4.00/MMBtu

2013 and beyond.

|

17

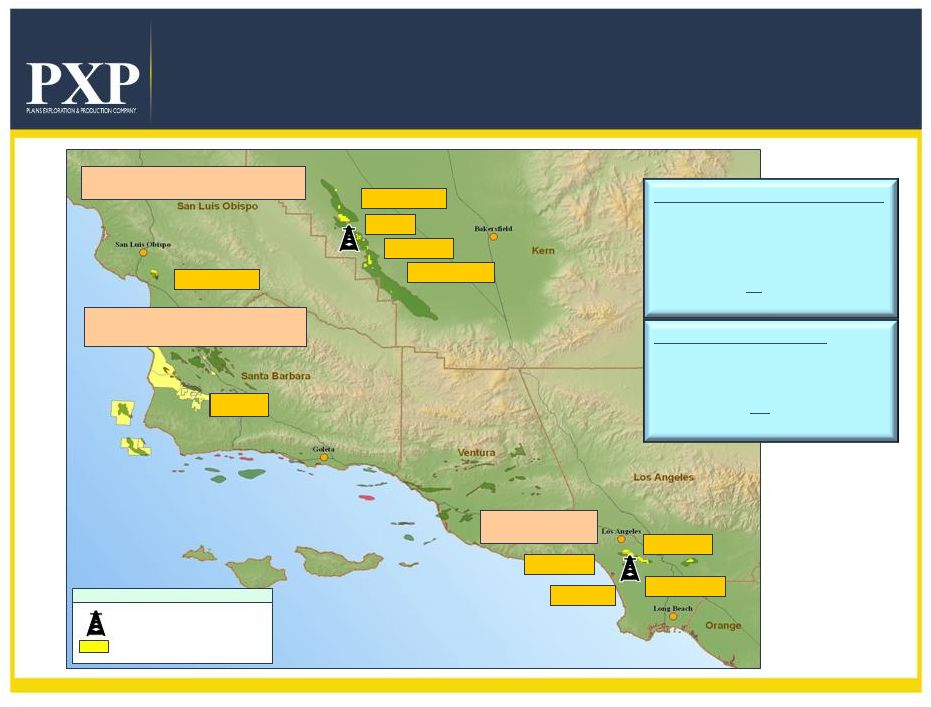

San Joaquin Valley

Legend

PXP LEASES

Santa

Maria

Basin

LA Basin

Arroyo Grande

Midway Sunset

Cymric

South Belridge

McKittrick

Montebello

Inglewood

Urban Area

Las Cienegas

Onshore California

Lompoc

2012 Activity Map

PXP

2012

Gross

Well

Activity

•

82

Planned Wells

•

3 Planned Wells

•

LAB

30

Planned Wells

•

SMB

5

Planned Wells

Total 120 Planned

Wells PXP ACTIVE DRILLS

Total Future Locations

•

SJV 1900

•

LAB

400

•

SMB

10

Total

2310

SJV

SJV Explor |

18

Eagle Ford Horizontal Oil Play

Operational Plan

PXP Net Production

Oil & Gas Cash Flow

(1)(2)

(1) Oil and Gas revenues minus lease expenses.

(2) Assumes

$108/Bbl

Brent

based

oil

pricing

and

natural

gas

pricing

of

$3.70/MMBtu

in

2012

and

$110/Bbl

Brent

based

oil

pricing

and

natural

gas

pricing of $4.00/MMBtu 2013 and beyond.

Capital

Cash Flow

Production

$0

$100

$200

$300

$400

$500

$600

$700

$800

0

5

10

15

20

25

30

35

40

2012E

2013E

2014E

2015E

2016E

2017E

2018E

$655 MM

$575 MM

$602 MM

$623 MM

$427 MM

$200 MM

$27 MM |

19

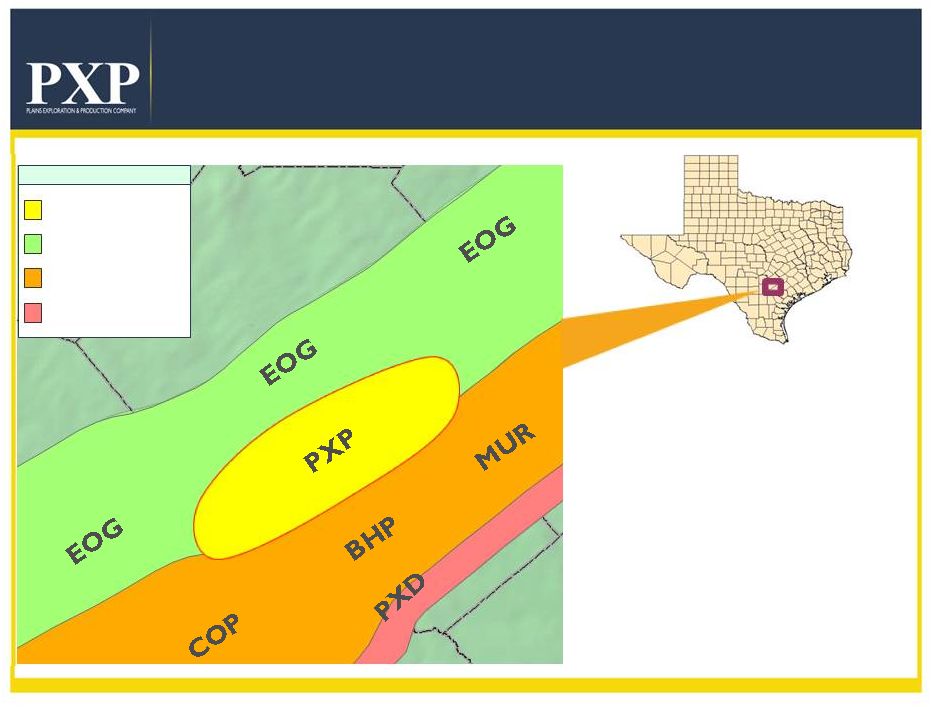

Eagle Ford Horizontal Oil Play

WILSON

ATASCOSA

Legend

PXP ACREAGE

OIL WINDOW

GAS CONDENSATE

WINDOW

DRY GAS WINDOW

The shaded area is for illustrative purposes only and does not reflect actual leasehold

acreage. •

PXP acreage position

•

~60,000 net acres

•

7 to 9 rigs running in 2012

•

Depth to Eagle Ford Top

•

~9,500' -

11,500' TVD

•

172 MMBOE Total Resource

Potential, 51.7 yr R/P

•

14 MBOE/D current rate

•

50+% 2011-2015 CAGR

•

500+ future locations |

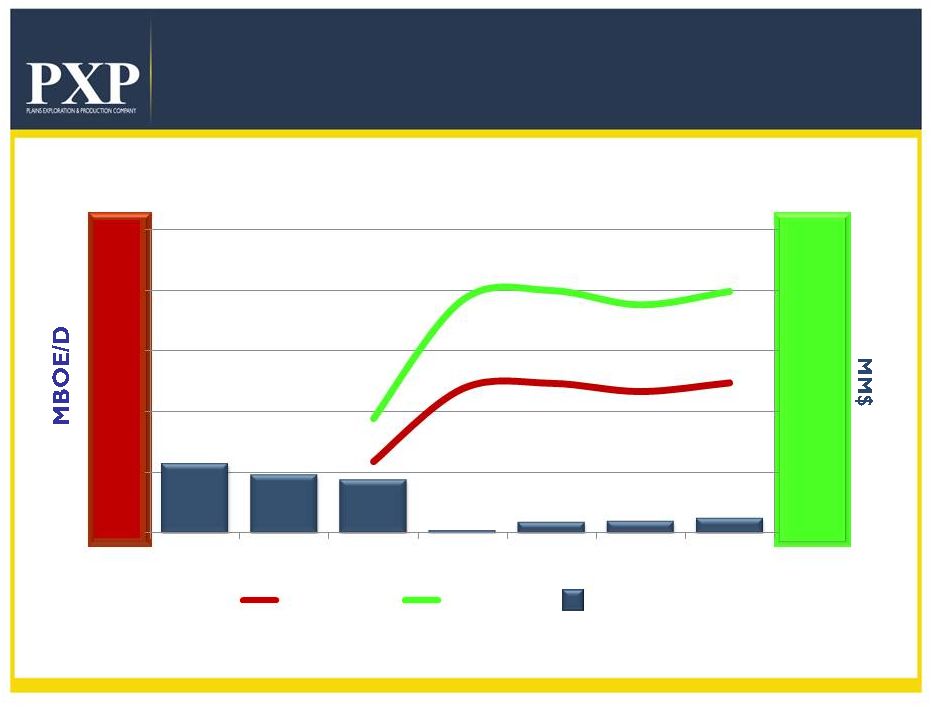

20

Gulf of Mexico

Operational Plan

Net Production

Oil & Gas Cash Flow

(1)(2)

Capital

Cash Flow

Production

$230 MM

$191 MM

$177 MM

$10 MM

$35 MM

$40 MM

$49 MM

$0

$200

$400

$600

$800

$1,000

0

10

20

30

40

50

2012E

2013E

2014E

2015E

2016E

2017E

2018E

(1) Oil and Gas revenues minus lease expenses.

(2) Assumes $108/Bbl Brent based oil pricing and natural gas pricing of $3.70/MMBtu in

2012 and $110/Bbl Brent based oil pricing and natural gas pricing of $4.00/MMBtu

2013 and beyond.

|

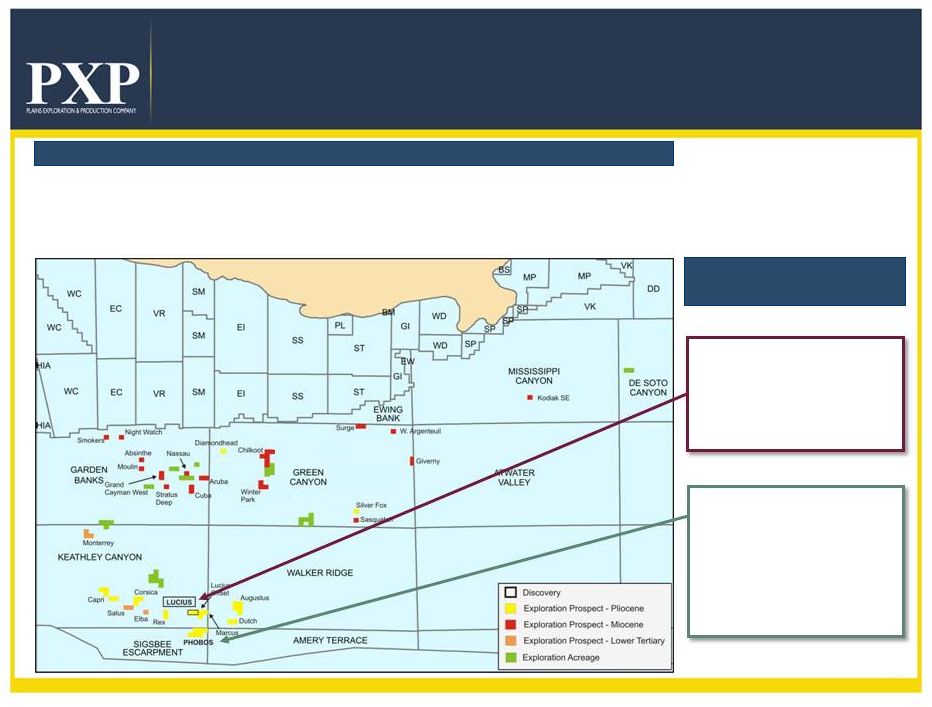

21

Gulf of Mexico Portfolio

•

1 Discovery

•

29 Exploration Prospects

•

37 blocks of Exploration Acreage

•

Interest in 102 blocks

•

570,000 gross acres / 191,000 net acres

Deepwater Leasehold

High-Quality Deepwater

GOM Assets

•

Lucius discovery made PXP an

early mover in Pliocene play

–

Acquisition of substantial

additional acreage at

favorable terms in the March

2010 lease sale

•

Phobos prospect located in the

same Pliocene hydrocarbon

complex as the Lucius

discovery

–

Analogous characteristics

to Lucius discovery well

–

Additional upside potential

in the Lower Tertiary play |

22

Lucius Oil Development

•

Lucius oil project commercial sanction announced in 2011

with additional production targeted for 2nd half 2014

•

“Gross resource potential in the Lucius field is approximately

300+ MMBOE”

(1)

•

The Hadrian 5 (KC 919-3) well, that is part of the Lucius

unitization agreement, initially “encountered 475 feet of net oil

pay”

and “drilling ahead to deeper objectives, encountered an

additional 250 feet of net oil pay”

(2)

•

600+ MMBOE net resource potential from Phobos and

additional Pliocene, Miocene and Lower Tertiary prospects

(1) Source: Anadarko Petroleum Corporation (APC).

(2) Exxon Mobil Corporation (XOM) Q2 2011 Earnings Call Transcript.

|

23

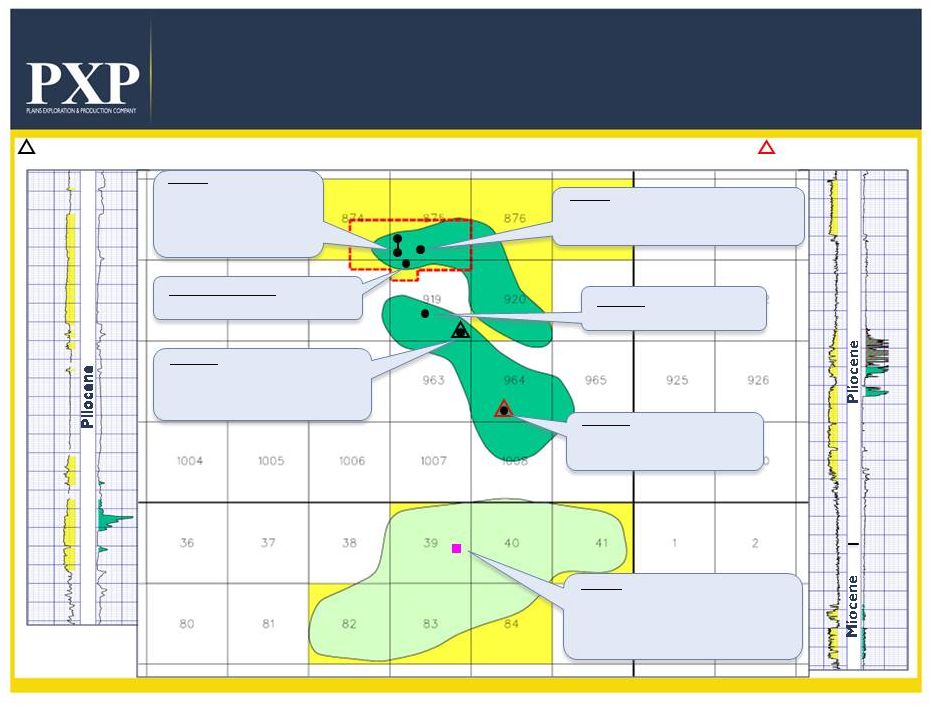

Lucius / Hadrian / Phobos Oil Complex

500 MMBOE of Discovered Resource;

1+ BBOE Exploration Upside

LUCIUS Discovery

PHOBOS Prospect

Lucius 1

Lucius 1ST

Lucius 2

Hadrian 3

Hadrian 1

Hadrian 2

Phobos 1

•

Potential 2012 drill

•

25,000 acres higher than oil pay at

Hadrian 2

•

Pliocene, Miocene and Wilcox potential

•

Structure mapped on seismic

Hadrian 2

•

Over 1,000 feet of net sand

with over 400 feet of net oil

and gas pay

Hadrian 1

Lucius 2

Lucius 1

Hadrian 3

•

Over 500 feet of net oil pay

Hadrian 5 (KC 919-3)

•

Over 700 feet of net oil pay

Hadrian 5

HADRIAN Discovery

ExxonMobil / Hadrian 2

KC 964 OCSG-21451 #1

Source: Wood Mackenzie,

Plains Offshore estimates,

ExxonMobil and BOEMRE

ExxonMobil / Hadrian 1

KC 919 OCSG-21447 #1

•

Over 600 feet of net high- quality oil pay

with further gas condensate pay

•

Successful flow test

complete

•

Over 900 feet of net sand with over 100 feet of net

oil and gas pay •

Kicked off additional delineation drilling in the

complex •

Over 600 feet of net oil pay in three primary oil

pays •

Deeper targets remaining to be drilled |

24

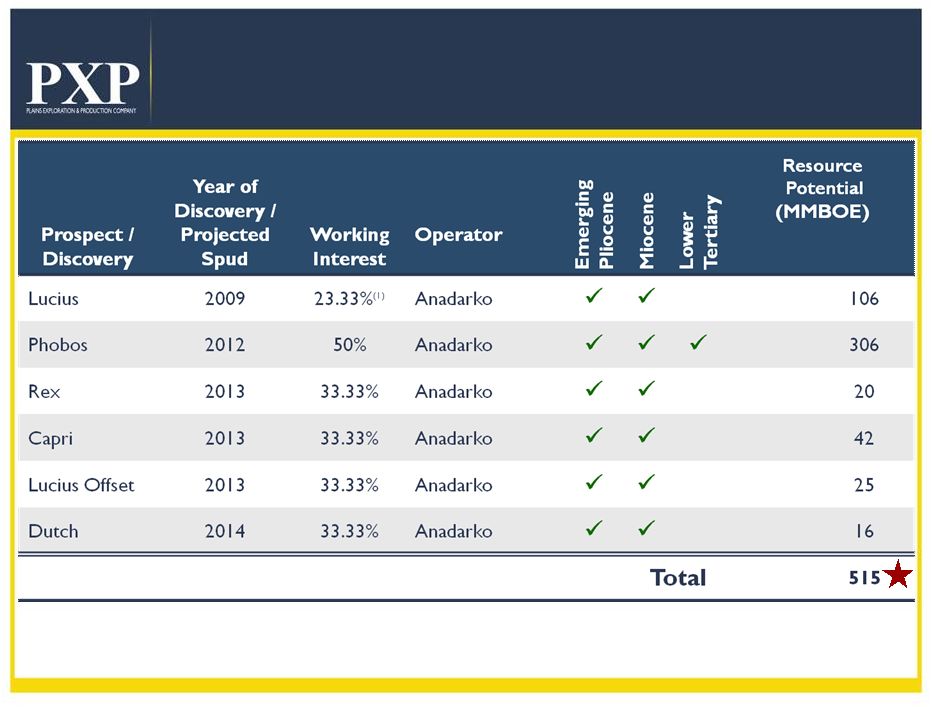

2012 –

2014 Operational Plan

Existing Discoveries and Near-Term Exploration

(1) Lucius working interest post unitization; remaining working interests reflective of

existing leasehold ownership. Recent OCS Lease Sale High Bidder on Additional

Inventory 24 |

25

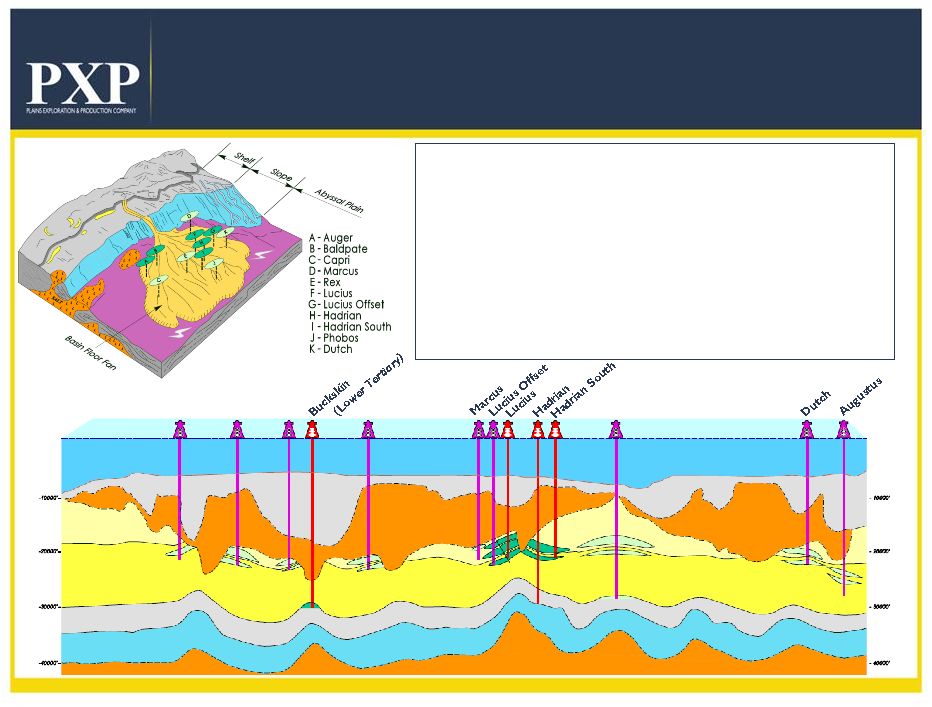

Premium Emerging Pliocene Position

Pleistocene

Pliocene

Miocene

Lower Tertiary

Cretaceous Jurassic

Louann Salt

Allochthonous

Salt

Allochthonous

Salt

Sea Floor

Capri

Elba

Rex

Phobos

Pliocene

**Figure not to scale**

Corsica

•

Lucius discovery and derisked drilling inventory makes Plains

Offshore a leader in Pliocene trend

•

Excellent reservoir characteristics in thick unrestricted turbidite fan

sandstones

•

Miocene and Wilcox provides upside

•

Lucius

•

•

Completed flow test

•

1 oil expected 2H2014

•

Significant exploration upside:

•

Phobos, Lucius offset, Capri, Rex, Dutch and Marcus

High-quality oil discovery

st |

26

Natural Gas Portfolio

Projected Dry Gas Scenario at $4.00 Mcf

•

Closely

align

Natural

Gas

focused

CapEx

with

Natural

Gas generated operating cash flow at $4.00/Mcf

2012 Projected Operating Cash Flow at $4.00/Mcf

Projected Dry Gas Cash Flow

$ 143 MM

2012 Projected Capital Allocation at $4.00/Mcf

Haynesville

$ 139 MM

Madden

$ 7 MM

$ 146 MM

($ 3) MM |

27

2012 Objectives

•

Strong Quarterly Operating Results

•

15%+ Production Growth

•

Eagle Ford Oil Development Growth Focus

•

Continue Lucius Oil Development Build

Out with Third Party Funding

•

Drill Phobos Exploration Well with 300+

MMBOE Net Potential |

28

Addendum |

29

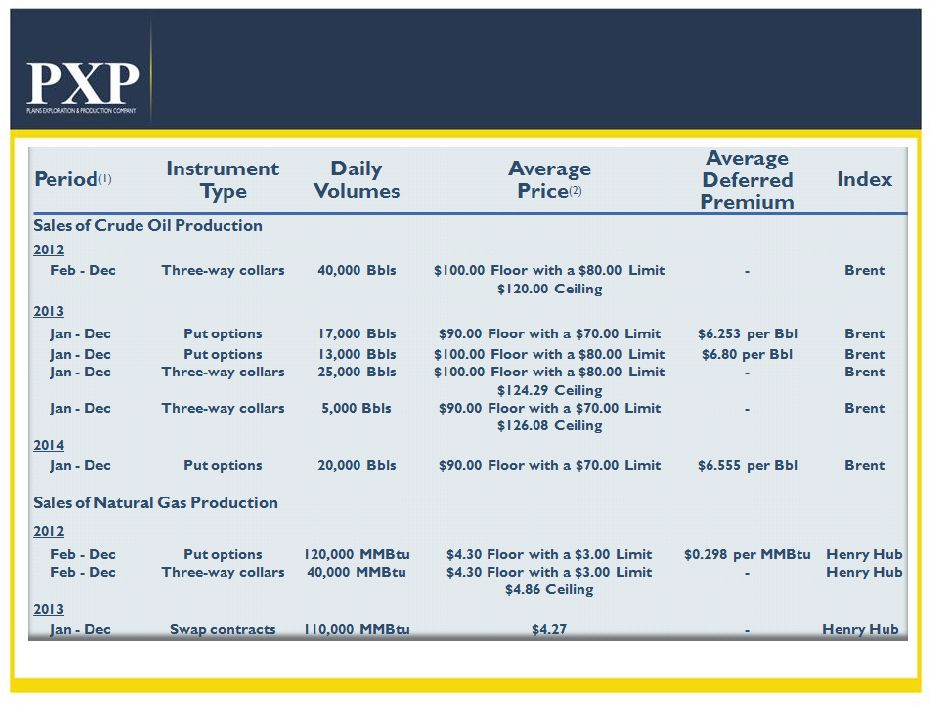

Updated Hedging Position

Derivative Instruments

(1)

All of our derivatives are settled monthly.

(2)

The average strike price does not reflect the cost to purchase the put options or

collars. |

30

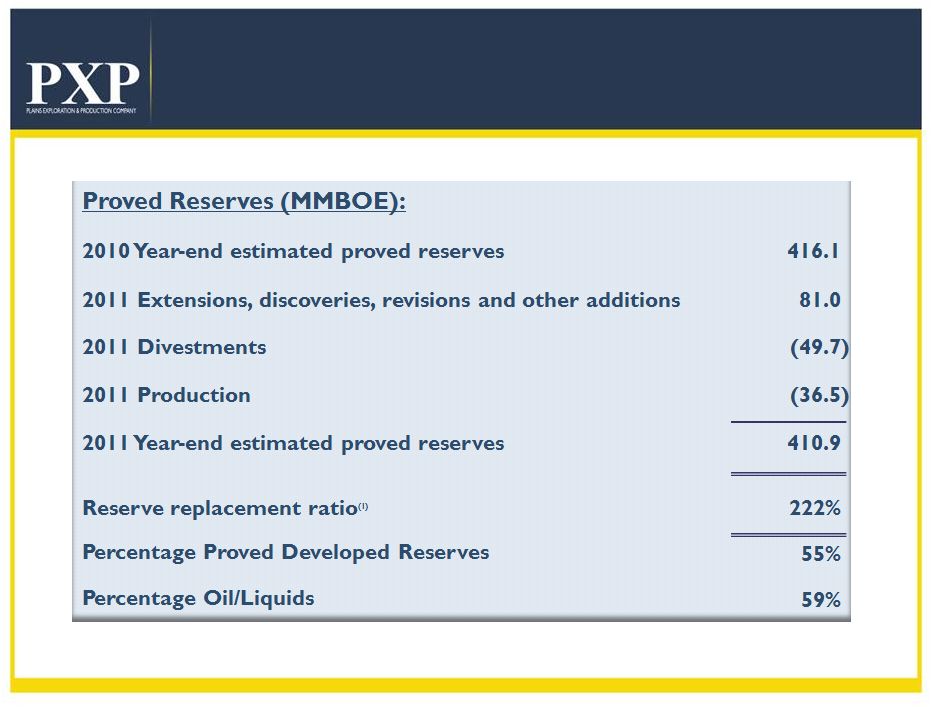

2011 Proved Reserves Reconciliation

(1) The Reserve Replacement Ratio is an indicator of our ability to replace annual

production volume and grow our reserves. It is important to economically find and develop new reserves that will

offset produced volumes and provide for future production given the inherent decline of

hydrocarbon reserves as they are produced. This statistical indicator has limitations, including its

predictive and comparative value. As such, this metric should not be considered in

isolation or as a substitute for an analysis of our performance as reported under GAAP. Furthermore, this

metric may not be comparable to similarly titled measurements used by other companies. |

“People building value together to find and produce

energy resources safely, reliably and efficiently”

|