Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - VAPORIN, INC. | Financial_Report.xls |

| EX-31.1 - EXHIBIT 31.1 - VAPORIN, INC. | v300454_ex31-1.htm |

| EX-32.1 - EXHIBIT 32.1 - VAPORIN, INC. | v300454_ex32-1.htm |

| EX-31.2 - EXHIBIT 31.2 - VAPORIN, INC. | v300454_ex31-2.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-K

| þ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2011

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 333-148346

FELAFEL CORP.

(Exact name of registrant as specified in charter)

| Delaware | 80-0546288 | |

| (State or Other Jurisdiction of | (I.R.S. Employer Identification No.) | |

| Incorporation or Organization) |

| c/o Idan Karako | ||

|

27 Bet Hillel Street, Unit 18, Tel Aviv, Israel |

67017 | |

| (Address of Principal Executive Offices) | (Zip Code) |

011-972-54-6419419

(Issuer’s Telephone Number)

Securities registered pursuant to Section 12(b) of the Act: None

| Name of Each Exchange | ||

| Title Of Each Class | on Which Registered |

Securities registered under Section 12(g) of the Exchange Act:

Common Stock, $0.0001 par value per share

Title of Class

Indicate by check mark whether the registrant is a well-known seasoned issuer as defined in Rule 405 of the Securities Act. Yes ¨ No þ

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. þ

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer ¨ Accelerated filer ¨ Non-accelerated filer ¨

Smaller Reporting Company þ

Indicate by check mark whether the registrant is a shell company (as defined by Rule 12b-2 of the Exchange Act) Yes o No þ

The aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the last sale price of such common equity as of January 30, 2012, was $1,666,667.

Number of shares of common stock outstanding as of January 30, 2012 was 10,333,334.

DOCUMENTS INCORPORATED BY REFERENCE – None

PART I

Item 1. Description of Business.

As used in this annual report, references to “Felafel,” “Felafel Corp,” the “Company,” “we,” “our,” or “us” refer to Felafel Corp., unless the context otherwise indicates.

Forward-Looking Statements

This annual report contains forward-looking statements which relate to future events or our future financial performance. In some cases, such forward-looking statements may be identified by terminology such as “may,” “should,” “expects,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” “potential” or “continue” or the negative of these terms or other comparable terminology. These statements are only predictions and involve known and unknown risks, uncertainties and other factors, including the risks in the section entitled “Risk Factors,” that may cause our or our industry’s actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements.

While these forward-looking statements, and any assumptions upon which they are based, are made in good faith and reflect our current judgment regarding the direction of our business, actual results will almost always vary, sometimes materially, from any estimates, predictions, projections, assumptions or other future performance suggested herein. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements to actual results.

Corporate Background

Felafel Corp. was incorporated under the laws of the State of Delaware on June 2, 2009. We intend to establish in Riga, Latvia, a fast-food outlet serving felafel meals and related vegetarian offerings with nutritional value that capitalize on a growing fast food trend towards eating healthier meals. Our menu will include reasonably priced meals, including “to-go” pita sandwiches, plates of salads and felafels, and side dishes. In October 2011, the Company entered into an agreement in principle with Kinsolin Ltd., a Latvian corporation pursuant to which Kinsolin has purchased from the Company for $85,000 (the “Franchise Fee”) the right to become the Company’s country master franchisor for the Republic of Estonia. The Company received the Franchise Fee in October and November 2011.

Over the course of the first quarter of 2012, the Company and Kinsolin hope to enter into a definitive master franchise agreement, pursuant to which it is anticipated that Kinsolin will be the Company’s exclusive franchisor in Latvia for a period of five years beginning on January 1, 2012, subject to renewal. In addition, Kinsolin will pay annual royalties to the Company in an amount equal to 3% of gross sales. The minimum annual royalty will be $50,000 for calendar years beginning on and after January 1, 2013. We will have the right to cancel the agreement in the event that Kinsolin does not open any restaurants by June 30, 2012.

Our Business

We are focused on establishing and operating a felafel ‘to go’ restaurant in Riga, Latvia. If that restaurant is successful, we hope to use it as a starting point for the establishment of multiple franchised felafel ‘to go’ outlets in major cities across Estonia, Latvia and Lithuania. On June 3, 2009, Mr. Idan Karako joined our company as President and Director. Mr. Karako has been working in the food industry starting in his father’s catering business since a very young age. Since 2009 to present he has been managing food service event for 101 Tapasim and Tznoberim Traveling Chef’s, which are both companies in Israel. Mr. Karako earned a B.A. from the Interdisciplinary Center (IDC) in Herzliya, Israel in 2009, where he studied at the Lauder School of Government. During his studies, Mr. Karako worked within the food service industry including managing events at the Mool Hasade restaurant, where he was responsible for all aspects of the events including employee management, sales, and food service. In addition, Mr. Karako handled the same responsibilities at the Pri Haaretz Catering Group in 2006-2007. Between 2004-2005 Mr. Karako worked in the logistics department at Joe-Bar, a company that offered its on-site bar-services at several locations for parties such as weddings and graduations. We have no employment agreement with Mr. Karako.

We have chosen to locate our pilot restaurant in Riga, Latvia. The actual location has not yet been chosen; Mr. Karako will choose the specific location based upon its foot traffic, accessibility, cost and layout. Mr. Karako anticipates using the services of a local real estate brokerage firm to choose a location. We chose to locate the pilot restaurant in Latvia because management is familiar with the city and is comfortable establishing operations there. Riga is Latvia’s capital and largest city, with a population of approximately 717,000 as of 2008 according to the city’s official website, www.riga.lv. The city of Riga and its surrounding areas are home to approximately 1.1 million people, who constitute approximately 48% of Latvia’s total population (source: http://acre.socsci.uva.nl/case-studies/riga.html).

| 1 |

In October 2011, the Company entered into an agreement in principle with Kinsolin Ltd., a Latvian corporation pursuant to which Kinsolin has purchased from the Company for $85,000 (the “Franchise Fee”) the right to become the Company’s country master franchisor for the Republic of Estonia. The Company received the Franchise Fee in October and November 2011.

Over the course of the first quarter of 2012, the Company and Kinsolin hope to enter into a definitive master franchise agreement, pursuant to which it is anticipated that Kinsolin will be the Company’s exclusive franchisor in Latvia for a period of five years beginning on January 1, 2012, subject to renewal. In addition, Kinsolin will pay annual royalties to the Company in an amount equal to 3% of gross sales. The minimum annual royalty will be $50,000 for calendar years beginning on and after January 1, 2013. We will have the right to cancel the agreement in the event that Kinsolin does not open any restaurants by June 30, 2012.

We do not currently have sufficient capital to operate our business, and we will require additional funding in the future to sustain our operations. Additionally, since we only raised $40,000 in our Offering, we will have to seek additional funding in order to fund our pilot restaurant. There is no assurance that we will have revenue in the future or that we will be able to secure the necessary funding to develop our business. There is no assurance that we will ever be able to raise financing.

Our offices are currently located in Israel, which is where Mr. Karako permanently resides. Assuming that we obtain financing to open and operate our pilot restaurant, we anticipate that Mr. Karako will move to Riga for a period of approximately six months to serve as the restaurant’s initial manager. After that time, we hope to be able to hire professional, on site management from the local population.

Industry Background

The Baltic States are comprised of Lithuania, Estonia and Latvia. With a combined total population of over 7 million people and a turbulent past, the Baltics have finally begun to settle down as independent, stable countries with Estonia entering the Euro zone in January 2011. The recent economic recession has negatively affected the entire region, but according to Latvia's Finance Ministry, the economy had begun to recover by the end of 2010 (source: http://baltic-review.com/2010/09/04/finance-ministry-latvian-economy-back-on-track/). Of course, there is no guarantee that economic conditions in Latvia will continue to improve.

Fast food is a relatively recent arrival to the Baltic States. The industry started to take off with the arrival of McDonald’s (whose franchise in the Baltics is owned by Premier Capital of Malta) in 1994. There are currently three major fast food chains operating in the region. In addition to McDonald’s, there is Cili, which is pronounced as Chili in English, which claims to be the largest restaurant and café chain in Lithuania, and there is Hesburger, a Finnish company that also operates fast food restaurants in the Baltic states.

All three of these chains are considerably larger and have more resources than we have.

The Product

Felafel is a popular meal in the Middle East and is gaining favor around the world for its taste and healthy ingredients. A felafel is a deep-fried ball of ground chick-pea with added herbs and spices. The balls are normally a little smaller than a golf ball and a regular felafel take out (or ‘to-go’) meal includes 4 – 5 balls served in a pita bread, with an assortment of tasty salad toppings and spicy sauces.

There is at present no fast-food chain or outlet anywhere in the Baltics that offers the simple ‘felafel’ meal. The fast food meals presently offered are traditionally American, and include the items like hamburger and pizza. Although the fast food industry is fairly young in the region, and carries the reputation of being unhealthy, its success and growing sales prove that the local populations are more than ready to adopt the fast food tradition of tasty, quickly prepared meals.

The Baltic market is following the Western fast food tradition, while simultaneously watching and being made aware of the cost that many westerners are paying for excessive consumption of fast food. This scenario explains why many of the fast food chains have begun to combat the reputation as unhealthy by offering token, healthy items as well as calorie indicators, on their menus and websites.

| 2 |

In an average felafel serving there about 500 calories, 58.2 grams of carbohydrates, 17.3 grams of protein and 20.7 grams of monounsaturated fat.1

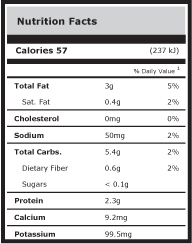

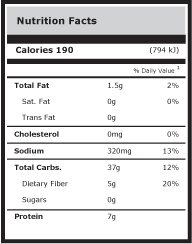

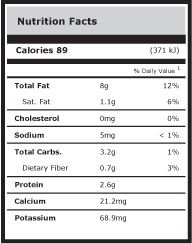

A “felafel serving” means a pita sandwich which includes four felafel balls, a vegetable salad, and tahini sauce. Based on the nutrition facts that are presented on www.calorieking.com, as shown in the charts below, we calculated that a felafel serving will have about 500 calories, 20.7 grams of fat, 58.2 grams of carbohydrates and 17.3 grams of protein. Based on the tables below, one pita bread contains 165 calories, four felafel balls contain a collective total of 228 calories, and one tablespoon of tahini sauce contains 100 calories. The vegetables have no countable calories. The price for a felafel serving will be 3.50 Euros.

| Vegetarian Foods: Falafel | Breads: Pita | Tahini | ||

|

|

|

Felafel is made from chickpeas, which are high in protein and Vitamin B, and from herbs (like parsley and coriander), which have fibers. Felafel is usually served with yogurt-tahini sauce, which is a good source of iron, calcium and additional protein, and with a fresh salad, which is a good source of vitamins and fibers.

Although felafel is deep fried, by frying it in fresh, zero trans fat canola oil, and using the ideal temperature of 350-375 Fahrenheit, the oil will not penetrate into the felafel mix. Therefore, we believe that our offerings will appeal to vegetarians who will appreciate the change of pace from eating other kinds of salads. Everything on offer in our pilot restaurant will be vegetarian, apart from the soft drinks.

Because the felafel balls are prepared as a mix in advance, there is an opportunity to create an entire range of unique tasting felafel that could include local ingredients and spices to make them even more appealing the local consumers. Once the product is launched with the original flavor, the felafel meal can be introduced in different varieties to suit local tastes and flavors which may further increase sales. With this in mind, variations such as ‘Mexican Felafel’ with added beans and corn, or a ‘Gourmet Felafel’ comprised of felafel balls mixed with various cheeses, or an ‘English Felafel’ can be introduced together with chips (French fries).

The felafel has been successful as a fast food in the Middle East, where it continues to challenge the major fast food chains like McDonalds, due to its value for money and nutritional value. We believe that these advantages that felafel holds over ‘traditional’ fast foods auger well for the success of a branded chain of fast food outlets across the Baltic States offering a cheap and healthier alternative to the regular hamburgers and pizzas. Our restaurant will offer fresh, fast and healthy food along with quality service — from cooking to eating.

We anticipate that a felafel will cost approximately 3.50 euro per serving. Beverages, which we currently anticipate to include Coca Cola, Nestea Iced Tea, Coke Zero, Fanta, soda water and mineral water, will cost approximately 1.00 euro each.

| 1 | http://nutritiondata.self.com/facts/legumes-and-legume-products/4404/2 |

| 3 |

Principal Markets and Marketing Strategy

If our pilot restaurant is successful, the target market for our restaurants may yet span three countries—Latvia, Lithuania and Estonia — and a range of tastes. While there are apparently very different tastes in each of these countries, traditional western fast foods are selling very well, indicating that there is generally, a growing level of acceptance of new tastes and flavors. For example, according to a reporter in the Baltic Times reporting on the introduction of pizza to the region; ‘The Lithuanians love it, the Estonians hate it (relatively) and the Latvians will put up with it, provided it has a Latvian flavor of course’(2). 2

Initially, we plan to open and operate one pilot restaurant outlet in Riga, Latvia. Riga is the largest city in Latvia and the second largest city within the Baltic States. If the first site is successful, we hope to engage franchisors for each of the three Baltic States, who will establish franchised outlets in their respective states. The current plan, which may be subject to change, is to start with Latvia, then Estonia and then Lithuania. We may retain the restaurant in Riga as company-owned, or we may sell it to the Latvian franchisor. We do not currently plan to open additional restaurants on our own.

We have also chosen to locate our pilot restaurant in Riga because our management is familiar with Riga and believes it can successfully operate a restaurant in that city.

In October 2011, the Company entered into an agreement in principle with Kinsolin Ltd., a Latvian corporation pursuant to which Kinsolin has purchased from the Company for $85,000 (the “Franchise Fee”) the right to become the Company’s country master franchisor for the Republic of Estonia. The Company received the Franchise Fee in October and November 2011.

Over the course of the first quarter of 2012, the Company and Kinsolin hope to enter into a definitive master franchise agreement, pursuant to which it is anticipated that Kinsolin will be the Company’s exclusive franchisor in Latvia for a period of five years beginning on January 1, 2012, subject to renewal. In addition, Kinsolin will pay annual royalties to the Company in an amount equal to 3% of gross sales. The minimum annual royalty will be $50,000 for calendar years beginning on and after January 1, 2013. We will have the right to cancel the agreement in the event that Kinsolin does not open any restaurants by June 30, 2012. Kinsolin may open restaurants in Estonia before we open our pilot restaurant in Riga.

We plan to establish our own brand and to condition the public to relate to it through images and emotive references to the Chain of Freedom. The Chain of Freedom was a peaceful political demonstration that occurred on August 23, 1989. Nearly two million people joined hands to form a human chain over 600 km’s long across Estonia, Latvia, and Lithuania, which at the time were republics of the Soviet Union. The company plans to include an image as part of its overall brand strategy which would represent this historic event. By drawing on the positive emotional connection that many people in the Baltic region have to the Chain of Freedom, hope to increase our product’s appeal as a brand and to improve the brand’s ability to penetrate the market.

We plan to use outdoor advertising campaigns to promote our pilot restaurant. Posters mounted on poles and select billboards will be used. It is intended that a large billboard be leased close to the outlet’s location with a punchy message reinforcing the brand and the health aspect of the arrival of the new meal on the go. This message will be used on smaller posters dotted strategically to lead the public to the outlet. Costs of billboards and posters are generally lower than other forms of advertising.

We may also employ students to personally approach and engage passing pedestrians, handing out flyers plus a free sample of one felafel ball. The flyers will initially offer a promotion such as ‘buy one, get one free’. This personal approach may also be used on the surrounding offices to introduce the new outlet along with menus and prices, and possibly a delivery service.

As noted above, tastes vary in the Baltic States. Therefore, localization will be a part of the marketing strategy. Changes and adjustments to the ingredients and menu offerings may be made to suit local tastes. We have never operated a restaurant in Latvia before. We may have to make adjustments in our menu to satisfy local customer preferences and dislikes.

We also plan to promote felafel as a health food. With vegetarianism being a fairly new concept in the Baltics, we believe that it is important that we make this claim in our advertising and on our packaging. We believe that Baltic customers will come to appreciate economical meals that are also relatively healthy.

Despite the recent recession, there are signs that the economic situation in Latvia has stabilized. Latvia’s credit rating outlook at Standard & Poor’s was raised recently after government austerity measures that have exacerbated the European Union’s deepest recession paid off, leaving state finances in better shape. S&P raised the outlook on Latvia’s BB rating, two notches below investment grade, to “stable” from “negative.” Exports are recovering. The government of Valdis Dombrovskis has raised taxes and cut spending to reduce the budget deficit and meet the terms of its 7.5 billion euro ($10.2 billion) loan from a group led by the European Union and the International Monetary Fund. The economy, which contracted 17.7 percent in the fourth quarter of 2009, has undergone a severe adjustment led by wage declines, making exports more competitive. Gross domestic product fell only 0.2% in 20103, after contracting 18 percent in 2009, according to S&P4. Of course, there is no guarantee that Latvia's economy will continue to improve.

2 http://www.baltictimes.com/news/articles/20102

3 http://www.news2biz.com/article/2011/2/10/latvia_gdp_down_by_0_2_in_2010

4 http://www.bloomberg.com/apps/news?pid=newsarchive&sid=aKdjVHSYeS.w

| 4 |

Operations in 2011

In October 2011, the Company entered into an agreement in principle with Kinsolin Ltd., a Latvian corporation pursuant to which Kinsolin has purchased from the Company for $85,000 (the “Franchise Fee”) the right to become the Company’s country master franchisor for the Republic of Estonia. The Company received the Franchise Fee in October and November 2011.

Over the course of the first quarter of 2012, the Company and Kinsolin hope to enter into a definitive master franchise agreement, pursuant to which it is anticipated that Kinsolin will be the Company’s exclusive franchisor in Latvia for a period of five years beginning on January 1, 2012, subject to renewal. In addition, Kinsolin will pay annual royalties to the Company in an amount equal to 3% of gross sales. The minimum annual royalty will be $50,000 for calendar years beginning on and after January 1, 2013. We will have the right to cancel the agreement in the event that Kinsolin does not open any restaurants by June 30, 2012.

During the last quarter of 2011, we began to look for restaurant space in Latvia, and met with brokers, insurance agents and local counsel for that purpose. As of the date hereof, we have not yet entered into any agreements with respect to our pilot restaurant.

Competition

So long as we only have one restaurant, our competition will be every fast food restaurant that is located near that restaurant, i.e. in Riga, Latvia, Ultimately, we hope to engage franchisors who will branch out into the rest of Latvia, Lithuania and Estonia. As such, we view our competition as being the three largest fast food chains that are already present in those countries: Cili Pica, Hesburger and McDonald’s. Cili Pica is a chain of pizza stores, which also serve pasta and meat dishes and deliver to one’s home. Hesburger is the biggest competitor in the fast food arena. They have been an established chain of hamburger outlets since 2002 with a dedicated following. McDonald’s outlets offer the same menus as their US counterparts. Based on our directors’ observations, all three chains follow the same high standards of hygiene and service. All of these chains are much larger than we are and have significantly greater resources than we have.

Employees

We presently have no employees. All functions, including development, strategy, negotiations and clerical functions are currently being provided by our executive officers on a voluntary basis. Until we open the pilot restaurant, we plan to use independent contractors and not have any employees. Once the pilot restaurant opens, we hope to hire a cleaner, a cook and a manager out of our revenues.

Risk Factors

An investment in our common stock involves a high degree of risk. A potential investor should carefully consider the following factors and other information in this Form 10-K before deciding to invest in our company. If any of the following risks actually occur, our business, financial condition, results of operations and prospects for growth would likely suffer. As a result, our investors could lose all or part of their investment in our Company.

Risk Factors Relating to Our Company

1. We are a development stage company and may never be able to effectuate our business plan or achieve any revenues or profitability. Therefore, at this stage of our business, potential investors have a high probability of losing their entire investment.

We were established on June 2, 2009 and have no operating history. We are in the development stage and are subject to all of the risks inherent in the establishment of a new business enterprise. We have had no revenue from or customers of our planned operations to date. Our operations to date have been focused on organizational, start-up, and fund raising activities. As a development stage company, we are a highly speculative venture involving significant financial risk. It is uncertain as to when we will become profitable, if ever.

There is nothing at this time on which to base an assumption that our business operations will prove to be successful or that we will ever be able to operate profitably. We may not be able to successfully effectuate our business. There can be no assurance that we will ever achieve any revenues or profitability. The revenue and income potential of our proposed business and operations is unproven as the lack of operating history makes it difficult to evaluate the future prospects of our business.

| 5 |

2. We expect losses in the future because we have no consistent revenue.

We expect losses over the next twelve months because we do not yet have any consistent revenues to offset the expenses associated with the initial costs of establishing our pilot restaurant in Riga, Latvia. These losses may be offset in whole or in part by revenues from our pilot restaurant later in the year if we succeed in opening our pilot restaurant, and it generates revenue. We cannot guarantee that we will ever be successful in generating consistent revenues in the future. We recognize that if we are unable to generate consistent revenues, we will not be able to earn profits or continue operations. There is no history upon which to base any assumption as to the likelihood that we will prove successful, and we can provide investors with no assurance that we will generate consistent revenues or ever achieve profitable operations.

3. If our business strategy is not successful, we may not be able to continue operations as a going concern and our stockholders may lose their entire investment in us.

As discussed in the Notes to Financial Statements included in this Annual Report, as of December 31, 2011 we had no revenue from our planned operations other than a one-time franchise fee and a consulting fee, and incurred a net loss of approximately $134,425 for the period from June 2, 2009 (inception) to December 31, 2011. These factors raise substantial doubt that we will be able to continue operations as a going concern, and our independent auditors included an explanatory paragraph regarding this uncertainty in their report on our financial statements for the period from June 2, 2009 (inception) to December 31, 2011. Our ability to continue as a going concern is dependent upon our generating cash flow sufficient to fund operations. Our business strategy may not be successful in addressing these issues. If we cannot continue as a going concern, our stockholders may lose their entire investment in us.

4. Since our officers can work or consult for other companies, their activities could slow down our operations.

Our officers are also members of our board of directors, and they are not required to work exclusively for us. They do not devote all of their time to our operations. Therefore, it is possible that a conflict of interest with regard to their time may arise based on their employment for other companies. Their other activities may prevent them from devoting full-time to our operations which could slow our operations and may reduce our financial results because of the slow down in operations. It is expected that our directors will devote between five and ten hours per week to our operations on an ongoing basis, and will devote whole days and even multiple days at a stretch when required until the pilot restaurant is opened. Once the pilot restaurant is opened, and until such time as we are able to hire a professional restaurant manager, we expect that Mr. Karako will manage our pilot restaurant and Ms. Eglinskaite-Dijokiene will assist him, and that each will devote approximately 30 hours per week to our operations.

5. We are heavily dependent upon our officers and directors. The loss of either Idan Karako or Viktorija Eglinskaite-Dijokiene, upon whose knowledge, leadership and technical expertise we rely, would harm our ability to execute our business plan.

We are dependent on the continued contributions of Idan Karako, our President, Chief Executive Officer, Treasurer and Director, and Viktorija Eglinskaite-Dijokiene, our Secretary and Director, whose knowledge and leadership would be difficult to replace. If we were to lose either of their services, or if either of them is not available to us when we need them, our ability to execute our business plan would be harmed and we may be forced to cease operations until such time as we could hire a suitable replacement.

6. Our executive officers are not currently receiving any compensation.

Our executive officers are currently working for us without any compensation. In the future, our executive officers may draw salaries of up to $5,000 per month, subject to the availability of funds.

We do not currently have the funds available to offer our executive officers competitive salaries, nor do we have the funds available to hire additional management or employees.

We do not expect to have the funds available to offer our executive officers competitive salaries or to hire additional management or employees unless and until our pilot restaurant begins operations and produces cash flow.

7. We operate in a competitive market with limited personnel resources and a failure to attract and retain qualified employees could harm our ability to execute our business plan.

Our future success depends in part on our ability to identify, attract and retain qualified personnel. Competition for employees in our industry is intense and turnover is high, and we may not be successful in attracting and retaining such personnel. We will be competing with other food services companies that have many more resources than we have. Other food services companies may choose to enter our market and may have greater resources and experience than we have in facilitating the necessary sales channels. We will also be competing directly with larger restaurant chains, which carry a wider range of offerings than we intend to offer, at a lower cost.

Because our directors will manage our pilot restaurant until such time as we can afford to hire a professional manager, we do not expect to have to hire any other key employees until such time as we have sufficient funding to do so.

8. Management has limited experience in restaurant operations.

Although Idan Karako has managed a restaurant in his home country, Israel, none of our management team has ever operated or managed a restaurant in Latvia or in any other country in the Baltic region.

| 6 |

9. Risks related to opening a restaurant during an economic recession.

As noted under “Description of Business — Industry Background,” Latvia has recently undergone an economic recession. While the Latvian Ministry of Finance believes that the recession is over as of September 20105, we cannot be sure that this is correct.

If the recession continues, we could face difficulties in raising capital to operate our pilot restaurant, and in attracting customers to our pilot restaurant at prices at which we can operate profitably.

10. Risks related to the fast food restaurant industry.

Our performance is subject to a number of factors that affect the restaurant industry generally and the fast food segment of the industry in particular.

Adverse changes in any one or more of these factors could reduce customer transactions at our restaurants, impose limits on pricing or cause us to incur additional expenditure in modifying our concepts or restaurants, any or all of which could adversely affect our business and the results of our operations.

Competition with large and better-financed restaurant chains

Felafel Corp. plans to operate in the informal eating-out market (IEO), more specifically in the fast food restaurant market (FFR), and will face competition in each of them. The inability to compete successfully in any of these markets could adversely affect our business and the results of our operations. Many of our competitors are much larger than we are, have much greater resources than we have, and have significant operations in Riga, and in the Baltic states market generally. Among the competitors who have significant presence in Riga and the Baltic states are McDonald’s (whose franchise in the Baltic states is owned by Premier Capital, PLC of Malta), Hesburger, which has some 300 restaurants in Finland and the Baltic states, and Cili, whose Cili Pica restaurants are a significant presence in Lithuania, Latvia and Russia. All of these competitors have significantly greater financial resources than we have.

Difficulty in obtaining and maintaining required licenses and approvals

Felafel Corp.’s pilot restaurant, and any other restaurant our franchisees might open, will be subject to various laws and regulations affecting its business. Difficulties or failure in obtaining any required licenses or approvals, or the loss thereof, could adversely affect Felafel Corp.’s business and the results of its operations. Each restaurant opened by us or by one of our franchisees will be subject to licensing and regulation by a number of governmental authorities, which may include alcoholic beverage controls, smoking laws, health and safety measures, disability access requirements and fire safety requirements. Difficulties in obtaining, or any failure to obtain, the required licenses or approvals, or the loss thereof, could adversely affect our business and the results of our operations. Various bodies have the power to conduct inspections of our restaurants and to close down any restaurant that fails to comply with any relevant regulations.

Potential litigation relating to food quality and product healthiness

In view of the nature of its business, Felafel Corp. may be the subject of complaints or claims from customers alleging food-related illness, injuries suffered on Felafel Corp.’s premises, or other food quality, health or operational concerns. Adverse publicity resulting from such allegations may materially affect sales revenues generated by Felafel Corp. restaurants, regardless of whether such allegations are true or whether Felafel Corp. is ultimately held liable or whether the player in the market which has given rise to the claim is Felafel Corp. or a direct competitor. We may also be liable under relevant legislation for any damage caused through serving food of inappropriate quality, even if the restaurant in question is owned and operated by one of our franchisees. No assurance can be given that we will not incur significant liabilities under such laws in the future.

In addition, we may be subject to a type of litigation which is particular to the nature of our business. “Fast-food” restaurant chains in the United States, for instance, have been the subject of class action suits concerning obesity, and while we believe that our food is healthier and therefore we should not be subject to such lawsuits, there can be no assurance that Felafel Corp. will not be subject to similar claims in Latvia and in the other Baltic countries, if we should seek to penetrate them in the future. Regardless of its results, all litigation is expensive and time consuming, and may divert management’s attention away from the operation of the business. In addition, we cannot be certain that any insurance coverage that we maintain will be sufficient to cover one or more substantial claims.

We do not currently maintain any insurance coverage, and we have not included funding for such coverage in our initial budget. We hope to purchase such coverage if funds are available once our pilot restaurant is up and running. However, there can be no assurance that adequate insurance coverage will be available to us at a reasonable price.

11. If we are unable to obtain funding, our business operations may be harmed.

In order to open and operate our pilot restaurant in Riga we will need to obtain additional funding or reduce our budget by cutting back on certain items and employing used equipment. Additionally, in the event that we seek to locate master franchisors or franchisees, or to expand in the future, the inability to raise the required capital will restrict our ability to do so, and may impair our ability to continue to conduct business operations. If we are unable to obtain necessary financing, we will likely be required to curtail our development plans, which could cause the Company to become dormant, or to leave it as a one-restaurant company. Currently, we do not have any arrangements or agreements to raise additional capital.

5 See http://baltic-review.com/2010/09/04/finance-ministry-latvian-economy-back-on-track/

| 7 |

To date, we have raised $700 from our Directors, $40,000 from a group of investors and $40,000 in our initial public offering. Additionally, we have collected a franchise fee of $85,000 from Kinsolin in exchange for our granting them a franchise in Estonia. Much of that money has been spent on expenses for our initial public offering and as of January 30, 2012, we have $5,934 remaining in the bank. We will still need an additional amount of approximately $50,000 in order to open and operate the pilot restaurant for the first year in the best possible way. But in the event that our pilot restaurant is successful, we will still need additional funding for finding a country master franchisor to take the lead in expanding operations in Latvia, and to find a country master franchisor who will take the lead in expanding to Lithuania. We hope to obtain additional funding from any or all of operations, fees paid by persons whom we may engage as country master franchisors, proceeds of future equity issuances, loans from our directors, or if available, loans from commercial banks, but we do not know whether we will be able to obtain that funding. Any additional funding from equity issuances may result in your proportionate share in the Company being diluted.

Additionally, while we hope to fund the pilot restaurant’s operations from cash flow after the first year, there can be no assurance that this will be possible. Moreover, even if we do raise sufficient capital and generate revenues to support our operating expenses, there can be no assurances that the revenue will be sufficient to enable us to develop our business to a level where it will generate profits and cash flows from operations that are sufficient to sustain us.

These matters raise substantial doubt about our ability to continue as a going concern. Our independent auditors have included an explanatory paragraph in their report on our financial statements regarding concerns about our ability to continue as a going concern. Accordingly, our failure to generate sufficient revenues or to generate adequate capital could result in the failure of our business and the loss of your entire investment.

Although they have not undertaken to do so, our directors may loan the company money from time to time on terms that are customary for directors and officers lending money to their companies.

12. Because we do not have an audit or compensation committee, shareholders will have to rely on our directors, who are not independent, to perform these functions.

We do not have an audit or compensation committee comprised of independent directors. Indeed, we do not have any audit or compensation committee. These functions are performed by our two directors, who are also our sole officers. Thus, there is a potential conflict of interest in that our directors have the authority to determine issues concerning management compensation and audit issues that may affect management decisions.

Under the Sarbanes Oxley Act of 2002 and the related rules and regulations of the Securities and Exchange Commission, or SEC, we will be required to implement additional corporate governance practices and adhere to a variety of reporting requirements and complex accounting rules. Compliance with these obligations requires significant management time, places significant additional demands on our finance and accounting staff (which, as noted, currently consists of our two officers and directors), and on our financial, accounting and information systems, and increases our insurance, legal and financial compliance costs.

13. Currency exchange rate fluctuations could result in higher costs and decreased margins.

We anticipate that all of our products will be sold outside of the United States initially in the Republic of Latvia, and later, if we are successful, in the Republics of Estonia and Lithuania. As a result, we will conduct transactions and report our revenues and expenses in various currencies, initially the Latvian lat, and later, if we succeed in establishing franchises in those countries, in the Euro, since Estonia joined the European Monetary Union on January 1, 2011, and in the Lithuanian litas, respectively. Conducting transactions in foreign currencies, while reporting our financial results in dollars, will increase our exposure to fluctuations in foreign currency exchange rates relative to the U.S. dollar. Foreign currency fluctuations could have an adverse effect on our results of operations and financial condition.

We do not plan to engage in any hedging activities.

14. We cannot be assured that Latvians, or other residents of the Baltic states will like felafel.

We are not aware of any attempt to introduce felafel on any kind of scale in Latvia or in the Baltic states generally. Felafel is a favorite in Middle Eastern countries, but we cannot guarantee that it will appeal to Latvians in Riga or elsewhere, or even if it does appeal to them, that such appeal will be retained over the longer term. We have done no market research to determine whether anyone has attempted to introduce felafel to the Latvian market, and if so, whether they were successful. We have done no market research to determine whether the taste of felafel appeals to the Latvian public.

No assurance may be given that our pilot restaurant or any further endeavors will be successful. Even if our pilot restaurant is successful, there can be no assurances that success will be capable of replication elsewhere.

| 8 |

RISKS RELATING TO OUR SHARES OF COMMON STOCK

15. We may issue additional shares of common stock in the future, which would reduce our current investors’ percentage of ownership and which may dilute our share value.

Our Certificate of Incorporation authorizes the issuance of 200,000,000 shares of common stock, of which 10,333,334 shares are issued and outstanding. The future issuance of additional shares of common stock which we are currently authorized to issue may result in substantial dilution in the percentage of our common stock held by our then existing shareholders. We may value any common stock issued in the future on an arbitrary basis. The issuance of common stock for future services or acquisitions or other corporate actions may have the effect of diluting the value of the shares held by our investors, and might have an adverse effect on any trading market for our common stock.

16. FINRA sales practice requirements may limit a stockholder’s ability to buy and sell our stock.

In addition to the “penny stock” rules described below, the FINRA has adopted rules that require that in recommending an investment to a customer, a broker-dealer must have reasonable grounds for believing that the investment is suitable for that customer. Prior to recommending speculative low priced securities to their non-institutional customers, broker-dealers must make reasonable efforts to obtain information about the customer’s financial status, tax status, investment objectives and other information. Under interpretations of these rules, the FINRA believes that there is a high probability that speculative low priced securities will not be suitable for at least some customers. The FINRA requirements make it more difficult for broker-dealers to recommend that their customers buy our common stock, which may have the effect of reducing the level of trading activity in our common stock. As a result, fewer broker-dealers may be willing to make a market in our common stock, reducing a stockholder’s ability to resell shares of our common stock.

17. Our common shares will be subject to the “Penny Stock” Rules of the SEC and the trading market in our securities will be limited, which will make transactions in our stock cumbersome, which may reduce the value of an investment in our stock.

The Securities and Exchange Commission has adopted Rule 15g-9 which establishes the definition of a “penny stock” for the purposes relevant to us, as any equity security that has a market price of less than $5.00 per share or with an exercise price of less than $5.00 per share, subject to certain exceptions. For any transaction involving a penny stock, unless exempt, the rules require:

| • | that a broker or dealer approve a person’s account for transactions in penny stocks; and |

| • | that the broker or dealer receive from the investor a written agreement to the transaction, setting forth the identity and quantity of the penny stock to be purchased. |

In order to approve a person’s account for transactions in penny stocks, the broker or dealer must:

| • | obtain financial information and investment experience objectives of the person; and |

The broker or dealer must also deliver, prior to any transaction in a penny stock, a disclosure schedule prescribed by the Commission relating to the penny stock market, which, in highlight form:

| • | sets forth the basis on which the broker or dealer made the suitability determination; and |

| • | confirms that the broker or dealer received a signed, written agreement from the investor prior to the transaction. |

Generally, brokers may be less willing to execute transactions in securities subject to the “penny stock” rules. This may make it more difficult for investors to dispose of our common shares thus causing a decline in the market value of our stock.

Disclosure also has to be made about the risks of investing in penny stocks in both public offerings and in secondary trading and about the commissions payable to both the broker-dealer and the registered representative, current quotations for the securities and the rights and remedies available to an investor in cases of fraud in penny stock transactions. Finally, monthly statements have to be sent disclosing recent price information for the penny stock held in the account and information on the limited market in penny stocks.

18. There is no current trading market for our securities and if a trading market does not develop, purchasers of our securities may have difficulty selling their shares.

Although we do have a market maker, and our shares are currently quoted on the FINRA Over the Counter Bulletin Board, there is currently no active public trading market for our securities and an active trading market in our securities may not develop or, if developed, may not be sustained. If for any reason an active public trading market does not otherwise develop, purchasers of the shares may have difficulty selling their common stock should they desire to do so.

19. The price of our shares in our initial public offering was arbitrarily determined by us and subsequent prices for our shares may not reflect the actual market price for the securities.

The offering price of our common stock was determined by us arbitrarily and because our shares are not yet actively traded, the current market price may not reflect the fair market value of our common shares. The market price of our shares may decline below the offering price. The stock market has experienced extreme price and volume fluctuations. In the past, securities class action litigation has often been instituted against various companies following periods of volatility in the market price of their securities. If instituted against us, regardless of the outcome, such litigation would result in substantial costs and a diversion of management’s attention and resources, which would increase our operating expenses and affect our financial condition and business operations.

| 9 |

20. The requirements of being a public company may strain our resources and distract our management.

As a public company, we will be subject to the reporting requirements of the Securities Exchange Act of 1934, as amended, or the Exchange Act, and the Sarbanes-Oxley Act of 2002, or the Sarbanes-Oxley Act. These requirements may place a strain on our systems and resources. The Exchange Act requires that we file annual, quarterly and current reports with respect to our business and financial condition. The Sarbanes-Oxley Act requires that we maintain effective disclosure controls and procedures and internal controls for financial reporting. We will be required to document and test our internal control procedures in order to satisfy the requirements of Section 404 of the Sarbanes-Oxley Act, which requires annual management assessments of the effectiveness of our internal controls over financial reporting and a report by our independent registered public accountants addressing these assessments. During the course of our testing, we may identify deficiencies which we may not be able to remediate in time to meet the deadline imposed by the Sarbanes-Oxley Act for compliance with the requirements of Section 404. In addition, if we fail to achieve and maintain the adequacy of our internal controls, as such standards are modified, supplemented or amended from time to time, we may not be able to ensure that we can conclude on an ongoing basis that we have effective internal controls over financial reporting in accordance with Section 404 of the Sarbanes-Oxley Act.

In order to maintain and improve the effectiveness of our disclosure controls and procedures and internal control over financial reporting, significant resources and management oversight will be required. This may divert management’s attention from other business concerns, which could have a material adverse effect on our business, financial condition, results of operations and cash flows. In addition, we may need to hire additional accounting and financial staff with appropriate public company experience and technical accounting knowledge, and we cannot assure you that we will be able to do so in a timely fashion.

We currently estimate that compliance with these obligations will cost us approximately $10,000 per year in legal and accounting fees, in addition to the management time required for compliance. However, if we find that we need to hire additional accounting and financial staff with appropriate public company experience and technical accounting knowledge in order to comply, those costs could materially increase.

21. Because we do not intend to pay any cash dividends on our common stock, our stockholders will not be able to receive a return on their shares unless they sell them.

We intend to retain any future earnings to finance the development and expansion of our business. We do not anticipate paying any cash dividends on our common stock in the foreseeable future. Unless we pay dividends, our stockholders will not be able to receive a return on their shares unless the value of such shares appreciates and they sell them. There is no assurance that stockholders will be able to sell shares when desired.

22. Because all of our officers and directors are located in non-U.S. jurisdictions, you may have no effective recourse against the management for misconduct and may not be able to obtain service of process or enforce judgment and civil liabilities against our officers, directors, experts and agents.

All of our directors and officers are nationals and/or residents of countries other than the United States, and all or a substantial portion of such persons’ assets are located outside the United States. As a result, it may be difficult for investors to obtain service of process against our officers and directors, and to enforce within the United States any judgments obtained against our officers or directors, including judgments predicated upon the civil liability provisions of the securities laws of the United States or any state thereof.

23. Because our shares are quoted on the over-the-counter bulletin board, we are required to remain current in our filings with the SEC and our securities will not be eligible for quotation if we are not current in our filings with the SEC.

Because our shares are quoted on the over-the-counter bulletin board, we are required to remain current in our filings with the SEC in order for shares of our Common Stock to remain eligible for quotation on the over-the-counter bulletin board. In the event that we become delinquent in our required filings with the SEC, quotation of our Common Stock will be terminated following a 30 day grace period if we do not make our required filing during that time. If our shares are not eligible for quotation on the over-the-counter bulletin board, investors in our Common Stock may find it difficult to sell their shares.

| 10 |

24. Any trading market that may develop may be restricted by virtue of state securities laws to the extent they prohibit trading absent compliance with individual state laws.

These restrictions may make it difficult or impossible to sell shares in those states. There can be no assurance that any active public market for our Common Stock will develop in the foreseeable future. Transfer of our Common Stock may also be restricted under the securities or securities regulations laws promulgated by various states and foreign jurisdictions, commonly referred to as “Blue Sky” laws. Absent compliance with such individual state laws, our Common Stock may not be traded in such jurisdictions. Because the securities registered hereunder have not been registered for resale under the “Blue Sky” laws of any state, the holders of such shares and persons who desire to purchase them in any trading market that might develop in the future, should be aware that there may be significant state “Blue Sky” law restrictions upon the ability of investors to sell the securities and of purchasers to purchase the securities. These restrictions prohibit the secondary trading of our Common Stock. Thirty-three states have what is commonly referred to as a “manual exemption” for secondary trading of securities such as those to be resold by selling stockholders under this registration statement. In these states, so long as the issuer obtains and maintains a listing in Mergent, Inc.’s or Standard and Poor’s Corporate Manual, secondary trading of common stock can occur without any filing, review or approval by state regulatory authorities in these states. These states are: Alaska, Arizona. Arkansas, Colorado, Connecticut, District of Columbia, Florida, Hawaii, Idaho, Indiana, Iowa, Kansas, Maine, Maryland, Massachusetts, Michigan, Mississippi, Missouri, Nebraska, New Jersey, New Mexico, North Carolina, North Dakota, Ohio, Oklahoma, Oregon, Rhode Island, South Carolina, Texas, Utah, Washington, West Virginia, and Wyoming. Ten states provide for an exemption for non-issuer transactions in outstanding securities effected through a registered broker-dealer when the securities are subject to registration under Section 12 of the Securities Exchange Act of 1934 for at least 90 days (180 days in Alabama). These states are: Alabama, Colorado, District of Columbia, Illinois, Kansas, Missouri, New Jersey, New Mexico, Oklahoma, and Rhode Island. However, in other states, investors may not be able to purchase and sell our securities. Accordingly, investors should consider the secondary market for our securities to be a limited one.

25. Delaware law and our charter may inhibit a takeover

Provisions of Delaware law, such as its business combination statute, may have the effect of delaying, deferring or preventing a change in control of our company, even if such transactions would have significant benefits to our stockholders. As a result, these provisions could limit the price some investors might be willing to pay in the future for shares of our Common Stock. We are subject to the provisions of Section 203 of the Delaware General Corporation Law, which restricts certain business combinations with interested stockholders. The combination of these provisions effectively inhibits a non-negotiated merger or other business combination.

26. Voting control of our common stock is possessed by Idan Karako and Viktorija Eglinskaite-Dijokiene. This concentration of ownership could discourage or prevent a potential takeover of Felafel Corp. that might otherwise result in your receiving a premium over the market price for your common stock.

The voting control of our common stock is possessed by Idan Karako, our President, Chief Executive Officer, Treasurer and Director, who was issued 5,000,000 shares of our common stock for $500, and by Viktorija Eglinskaite-Dijokiene, our Secretary and Director, who was issued 2,000,000 shares of our common stock for $200. Holders of our common stock are entitled to one non-cumulative vote on all matters submitted to our stockholders. The result of this concentration of ownership and voting control is that Idan Karako and Viktorija Eglinskaite-Dijokiene have the ability to control all matters submitted to our stockholders for approval and to control our management and affairs, including extraordinary transactions such as mergers and other changes of corporate control, and going private transactions. Additionally, this concentration of voting power could discourage or prevent a potential takeover of the Company that might otherwise result in your receiving a premium over the market price for your common stock.

27. Our articles of incorporation provide for indemnification of officers and directors at our expense and limit their liability, which may result in a major cost to us and hurt the interests of our shareholders because corporate resources may be expended for the benefit of officers and/or directors.

Our articles of incorporation and applicable Delaware law provide for the indemnification of our directors, officers, employees, and agents, under certain circumstances, against attorney’s fees and other expenses incurred by them in any litigation to which they become a party arising from their association with or activities on our behalf. We will also bear the expenses of such litigation for any of our directors, officers, employees, or agents, upon such person’s promise to repay us if it is ultimately determined that any such person shall not have been entitled to indemnification. This indemnification policy could result in substantial expenditures by us, which we will be unable to recoup.

We have been advised that, in the opinion of the SEC, indemnification for liabilities arising under federal securities laws is against public policy as expressed in the Securities Act of 1933 and is, therefore, unenforceable. In the event that a claim for indemnification against these types of liabilities, other than the payment by us of expenses incurred or paid by a director, officer or controlling person in the successful defense of any action, suit or proceeding, is asserted by a director, officer or controlling person in connection with the securities being registered, we will (unless in the opinion of our counsel, the matter has been settled by controlling precedent) submit to a court of appropriate jurisdiction, the question whether indemnification by us is against public policy as expressed in the Securities Act and will be governed by the final adjudication of such issue. The legal process relating to this matter, if it were to occur, is likely to be very costly and may result in us receiving negative publicity, either of which factors is likely to materially reduce the market and price for our shares, if such a market ever develops.

| 11 |

28. If an active trading market develops for our shares, sales of our shares relying upon Rule 144 may depress prices in that market by a material amount.

All of the currently outstanding shares of our Common Stock, except for the 1,333,334 shares sold in our initial public offering, are “restricted securities” within the meaning of Rule 144 under the Securities Act of 1933, as amended. As restricted securities, these shares may be resold only pursuant to an effective registration statement or under the requirements of Rule 144 or other applicable exemptions from registration under the Act and as required under applicable state securities laws. Rule 144 provides in essence that a person who has held restricted securities for a prescribed period may, under certain conditions, sell every three months, in brokerage transactions, a number of shares that does not exceed 1.0% of a company’s outstanding Common Stock. The alternative average weekly trading volume during the four calendar weeks prior to the sale is not available to our shareholders being that the OTCBB is not an “automated quotation system” and, accordingly, market based volume limitations are not available for securities quoted only over the OTCBB. As a result of revisions to Rule 144 which became effective on or about February 15, 2008, there is no limit on the amount of restricted securities that may be sold by a non-affiliate (i.e., a stockholder who has not been an officer, director or control person for at least 90 consecutive days) after the restricted securities have been held by the owner for a period of one year provided that the securities were not issued by a shell company or that the issuer who issued the securities has not been a shell company for at least one year. We were a shell company as defined in the rules and regulations under the Securities Act of 1933 until October 2011. 9,000,000 of our currently outstanding shares of Common Stock have been held for one year or more, and 2,000,000 of those shares are held by non-affiliates. A sale under Rule 144 or under any other exemption from the Act, if available, or pursuant to registration of shares of Common Stock of present stockholders, may have a depressive effect upon the price of the Common Stock in any market that may develop.

RISKS RELATED TO OUR OPERATIONS IN THE REPUBLICS OF ESTONIA, LATVIA AND LITHUANIA

29. Risk of political instability with respect to foreign operations.

Our activities are planned to take place initially in the Republic of Latvia, which is located in Eastern Europe, and in the future, if our pilot restaurant is successful, we may seek to expand our operations by developing franchises in the Republic of Latvia and in the Republics of Estonia and Lithuania. Our operations will be subject to a number of conditions endemic to Eastern European countries, including political instability. The present governmental arrangements in Eastern Europe and countries of the former Soviet Union were established relatively recently, when they replaced Communist regimes. If they fail to maintain the support of their citizens, these governments could themselves be replaced by other institutions, including a possible reversion to totalitarian forms of government.

In addition, conducting and expanding our international operations subjects us to other risks that we would not generally face in the United States. These include:

| • | difficulties in managing the staffing of our international operations, including hiring and retaining qualified employees; | |

| • | increased expense related to localization of our products and services, including language translation and the creation of localized agreements; | |

| • | potentially adverse tax consequences, including the complexities of foreign value added tax systems, restrictions on the repatriation of earnings and changes in tax rates; | |

| • | increased expense to comply with U.S. laws that apply to foreign operations, including the Foreign Corrupt Practices Act and Office of Foreign Assets Control regulations; | |

| • | longer accounts receivable payment cycles and difficulties in collecting accounts receivable; | |

| • | increased financial accounting and reporting burdens and complexities; | |

| • | political, social and economic instability; | |

| • | terrorist attacks and security concerns in general; and | |

| • | reduced or varied protection for intellectual property rights and cultural norms in some geographies that are simply not respectful of intellectual property rights. |

The occurrence of one or more of these events could negatively affect our operations and, consequently, our operating results. Further, operating in international markets requires significant management attention and financial resources. We cannot be certain that the investment and additional resources required to establish, acquire or integrate operations in other countries will produce desired levels of revenue or profitability.

Item 2. Description of Property.

The Company uses office space owned by our President in Israel as our office space at no charge on a month to month basis. We do not intend to carry on any operations in Israel and are not subject to the risks of doing business in that country. The Company has not paid any rent since incorporation. We anticipate that we will have to pay rent for our pilot restaurant in Latvia from the date that we sign a contract for the restaurant’s space until operations commence. Once the Company opens its first restaurant in Latvia, we intend to move our headquarters to Latvia. When that happens, we hope to finance our headquarters’ rent and the pilot restaurant’s rent out of operations.

The first restaurant will be in an area in the city center with high foot traffic. Depending on rent costs we may choose to be in one of the malls in Riga.

Item 3. Legal Proceedings.

There are no pending legal proceedings to which we are a party or in which any of our Directors, officers or affiliates, any owner of record or beneficially of more than 5% of any class of our voting securities, or security holder is a party adverse to us or has a material interest adverse to ours. Our property is not the subject of any pending legal proceedings.

| 12 |

Item 4. Submission of Matters to a Vote of Security Holders

We did not submit any matters to a vote of security holders during the fourth quarter of the year ended December 31, 2011.

PART II

Item 5. Market for Common Equity and Related Stockholder Matters.

Market for our common stock

There is currently no market for our shares. We cannot give you any assurance that the shares will ever have a market or that if a market for our shares ever develops, that you will be able to sell your shares. In addition, even if a public market for our shares develops, there is no assurance that a secondary public market will be sustained.

The shares are quoted on the OTC Bulletin Board under the symbol OTC BB FLAL, but no active trading market has developed and we cannot assure you that an active trading market will ever develop.

Dividend Policy

We have not declared or paid dividends on our common stock since our formation, and we do not anticipate paying dividends in the foreseeable future. Declaration or payment of dividends, if any, in the future, will be at the discretion of our Board of Directors and will depend on our then current financial condition, results of operations, capital requirements and other factors deemed relevant by the Board of Directors. There are no contractual restrictions on our ability to declare or pay dividends.

Record Holders

As of January 30, 2012, we had outstanding 10,333,334 shares of common stock, which were held by 45 stockholders of record.

Securities Authorized for Issuance Under Equity Compensation Plans

As of December 31, 2011, none of our equity securities were authorized to be issued under any compensation plans (including individual compensation arrangements).

Recent Sales of Unregistered Securities

On June 3, 2009, we issued 5,000,000 shares of common stock to Mr. Idan Karako, our President, Chief Executive Officer, Treasurer and Director, for a $500 subscription receivable, which has since been paid.

On December 21, 2009, we issued 2,000,000 shares of common stock to Ms. Viktorija Eglinskaite-Dijokiene, our Secretary and Director, for a $200 subscription receivable, which has since been paid.

The shares that were issued to each of Mr. Karako and Ms. Eglinskaite-Dijokiene, were issued in a transaction that was exempt from the registration requirements of the Securities Act pursuant to Regulation S promulgated by the Securities and Exchange Commission.

Between April and August of 2010, we issued 2,000,000 shares of common stock to 41 investors in a private placement pursuant to the exemption from the registration requirements of the Securities Act provided by Regulation S, the 2010 Private Placement. The aggregate consideration paid for such shares was $40,000. All investors in such private placement were non-US persons (as defined under SEC Regulations). The Company provided all investors in the 2010 Private Placement with a subscription agreement and the shares were issued in transactions that were exempt from the registration requirements of the Securities Act pursuant to Regulation S promulgated by the Securities and Exchange Commission.

Purchases of Our Equity Securities By Us or Our Affiliates

Other than the purchases of our equity securities by Mr. Idan Karako and by Ms. Viktorija Eglinskaite-Dijokiene, respectively, described above, there have been no purchases of our securities by us or by our affiliates.

Item 6. Selected Financial Data

Not applicable.

| 13 |

Item 7. Managements's Discussion and Analysis or Plan of Operation

RESULTS OF OPERATIONS

For the years ended December 31, 2011 and December 31, 2010

We have not generated any revenues since inception, including for the year ended December 31, 2011, except for one-time revenues resulting from the sale of a master franchise for Estonia. Our operating activities during these periods consisted primarily of developing our business plan.

General and administrative expenses were $142,259 for the year ended December 31, 2011, compared to $12,166 for the year ended December 31, 2010. The increase in general and administrative expenses was due to an increase in our activity level, and expenses relating to our initial public offering. General and administrative expenses primarily consist of consulting fees, professional fees and filing fee expenses.

Our net loss for the year ended December 31, 2011, was $122,259 or $0.01 per share, compared to $12,166 or $0.00 per share for the year ended December 31, 2010. The weighted average number of shares outstanding was 9,657,534 at December 31, 2011, compared to 7,684,932 at December 31, 2010.

LIQUIDITY AND CAPITAL RESOURCES

As of December 31, 2011

As of December 31, 2011, our current assets were $10,959 and our current liabilities were $22,684, resulting in negative working capital of $11,725.

As of December 31, 2011, our total liabilities were $90,684, compared to total liabilities of $9,516 as of December 31, 2010,

Stockholders’ equity decreased from $28,534 at December 31, 2010, to a deficit of $79,724 at December 31, 2011. This was the result of the net loss for the year ended December 31, 2011.

For the year ended December 31, 2011, net cash used in operating activities was $25,775, compared to net cash used in operating activities of $21,650 for the year ended December 31, 2010. Net cash used in operating activities for the year ended December 31, 2011 was mainly the result of a net loss adjusted for changes in liabilities.

For the year ended December 31, 2011, net cash used in investing activities was $0, compared to net cash used in investing activities of $0 for the year ended December 31, 2010.

Net cash flows from financing activities for the year ended December 31, 2011 was $17,684, compared to net cash flows from financing activities of $40,700 for the year ended December 31, 2010.

Plan of Operation

We plan initially to open and operate one company-owned restaurant in Riga, Latvia, which will serve as our pilot restaurant. We have chosen to locate the pilot restaurant in Riga, because our management team knows the city of Riga well and feels that it is capable of operating our pilot restaurant there.

We have not yet opened our pilot restaurant in Riga. We anticipate doing so in mid-2012.

We anticipate that once the restaurant opens, it will start to generate cash.

In October 2011, we entered into an agreement in principle with Kinsolin Ltd., a Latvian corporation pursuant to which Kinsolin has purchased from the Company for $85,000 (the “Franchise Fee”) the right to become the Company’s country master franchisor for the Republic of Estonia. We received the Franchise Fee in October and November 2011.

| 14 |

Over the course of the first quarter of 2012, the Company and Kinsolin hope to enter into a definitive master franchise agreement, pursuant to which it is anticipated that Kinsolin will be the Company’s exclusive franchisor in Latvia for a period of five years beginning on January 1, 2012, subject to renewal. In addition, Kinsolin will pay annual royalties to the Company in an amount equal to 3% of gross sales. The minimum annual royalty will be $50,000 for calendar years beginning on and after January 1, 2013. We will have the right to cancel the agreement in the event that Kinsolin does not open any restaurants by June 30, 2012.

To date, Kinsolin has not opened any restaurants. We believe that once Kinsolin does open restaurants, they will generate cash, and we will receive royalties.

Of course, there can be no assurance that any of these predictions is accurate or will ever materialize.

In the first year of operation, costs will be directed to launching and operating the pilot restaurant. Between June and September 2011, we raised $40,000 in our initial public offering, which we have spent or anticipate spending approximately as follows:

| Design, Legal fee, Store construction and ventilation | $ | 13,000 | ||

| Signage | $ | 2,649 | ||

| Initial Marketing and inventory and working capital | $ | 6,000 | ||

| Display Unit | $ | 1,351 | ||

| Table counter | $ | 1,000 | ||

| Six chairs | $ | 200 | ||

| Counter | $ | 800 | ||

| Electronic till and stock level counter | $ | 530 | ||

| Two refrigerators | $ | 770 | ||

| Drinks fridge | $ | 583 | ||

| Store room shelving | $ | 100 | ||

| Automatic Felafel maker and fryer | $ | 1,060 | ||

| Mixer/blender | $ | 365 | ||

| Stainless Steel pans | $ | 583 | ||

| Heating | $ | 1,000 | ||

| Creation of web site | $ | 0 | ||

| Accounting costs | $ | 1,325 | ||

| Operating costs during pre-opening period (payroll, rent, utilities, etc) | $ | 6,431 | ||

| Advertising Costs | $ | 1,500 | ||

| Total Opening Costs | $ | 39,247 |

In the period following the offering, we expect to sign a one-year lease for the pilot restaurant location. We have already begun to investigate suitable locations for the pilot restaurant. The locations that we have thus far investigated as possibly being appropriate to establish our pilot restaurant have been more expensive than we originally anticipated. Therefore, the amounts in the budget chart may not cover the costs of finding the store location and the first year’s rent.

We anticipate spending between $5,000 and $20,000 to make the rental location suitable for our pilot restaurant. Because we raised less than the maximum amount in our initial public offering, we will reduce the amount that we spend on this item by using less expensive materials. We anticipate that this process will take approximately two months once we find a suitable location and that it will include the following steps:

| • | Assembling the interior and exterior décor | |

| • | Connecting the plumbing and the required electric wiring | |

| • | Installing the necessary kitchen appliances including refrigerator(s), a felafel maker, a mixer and a salad station | |

| • | Obtaining the required certificate of occupancy, regulatory licenses, and certifications | |

| • | Setting up the cash register and utilities |

| 15 |

| • | Hiring and training personnel | |

| • | Food testing and pre-opening trial runs |