Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Mastercard Inc | d287778d8k.htm |

| EX-99.1 - PRESS RELEASE - Mastercard Inc | d287778dex991.htm |

Exhibit 99.2

Exhibit 99.2

MasterCard Incorporated

Fourth-Quarter and Full-Year 2011 Financial Results Conference Call

February 2, 2012

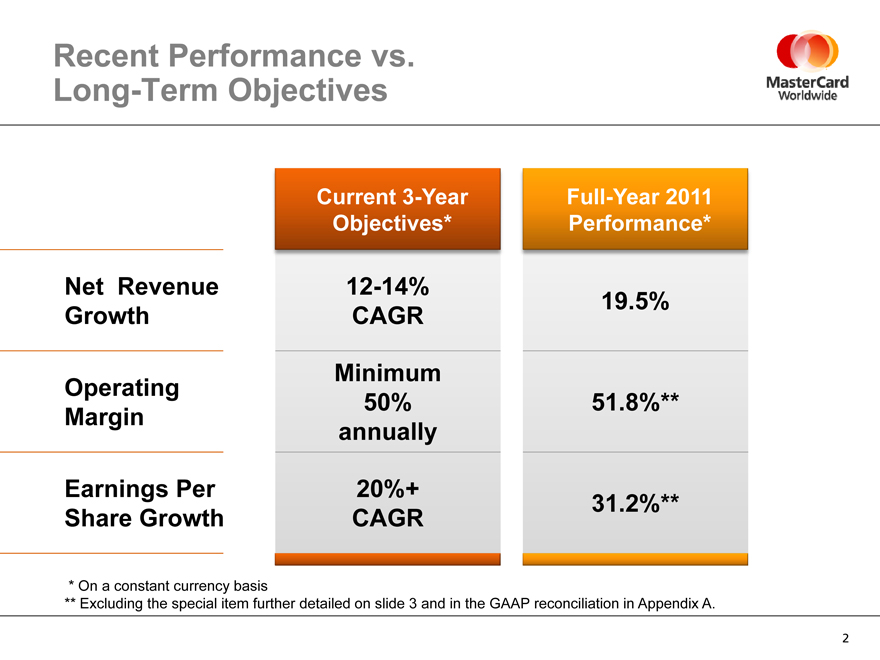

Recent Performance vs. Long-Term Objectives

Net Revenue Growth

Operating Margin

Earnings Per Share Growth

Current 3-Year Full-Year 2011

Objectives* Performance*

12-14% 19.5%

CAGR

Minimum

50% 51.8%**

annually

20%+

CAGR 31.2%**

| * |

|

On a constant currency basis |

** Excluding the special item further detailed on slide 3 and in the GAAP reconciliation in Appendix A.

| 2 |

|

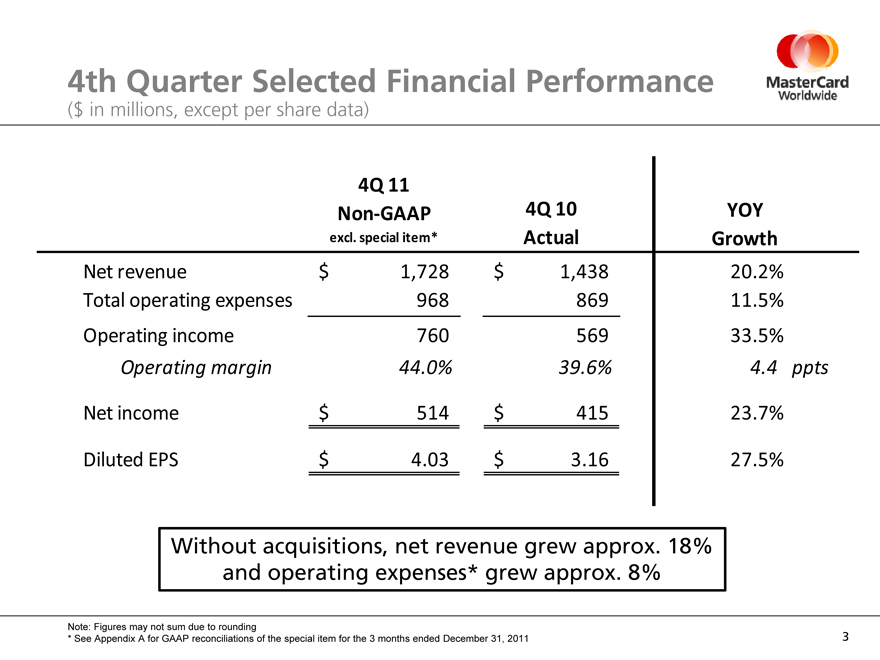

4th Quarter Selected Financial Performance

($ in millions, except per share data)

4Q 11

Non-GAAP 4Q 10 YOY

excl. special item* Actual Growth

Net revenue $ 1,728 $ 1,438 20.2%

Total operating expenses 968 869 11.5%

Operating income 760 569 33.5%

Operating margin 44.0% 39.6% 4.4 ppts

Net income $ 514 $ 415 23.7%

Diluted EPS $ 4.03 $ 3.16 27.5%

Without acquisitions, net revenue grew approx. 18% and operating expenses* grew approx. 8%

Note: Figures may not sum due to rounding

| * |

|

See Appendix A for GAAP reconciliations of the special item for the 3 months ended December 31, 2011 |

| 3 |

|

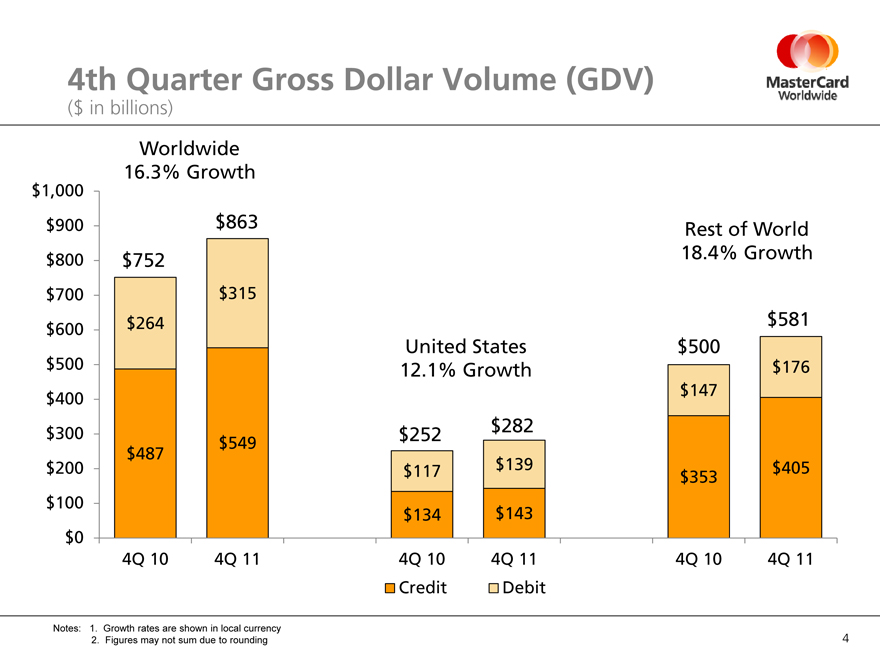

4th Quarter Gross Dollar Volume (GDV)

($ in billions)

Worldwide

16.3% Growth

$1,000

$900 $863 Rest of World

$800 $752 18.4% Growth

$700 $315

$600 $264 $581

United States $500

$500 12.1% Growth $176

$400 $147

$300 $252 $282

$549

$487

$200 $117 $139 $353 $405

$100

$134 $143

$0

4Q 10 4Q 11 4Q 10 4Q 11 4Q 10 4Q 11

Credit Debit

Notes: 1. Growth rates are shown in local currency

2. Figures may not sum due to rounding

| 4 |

|

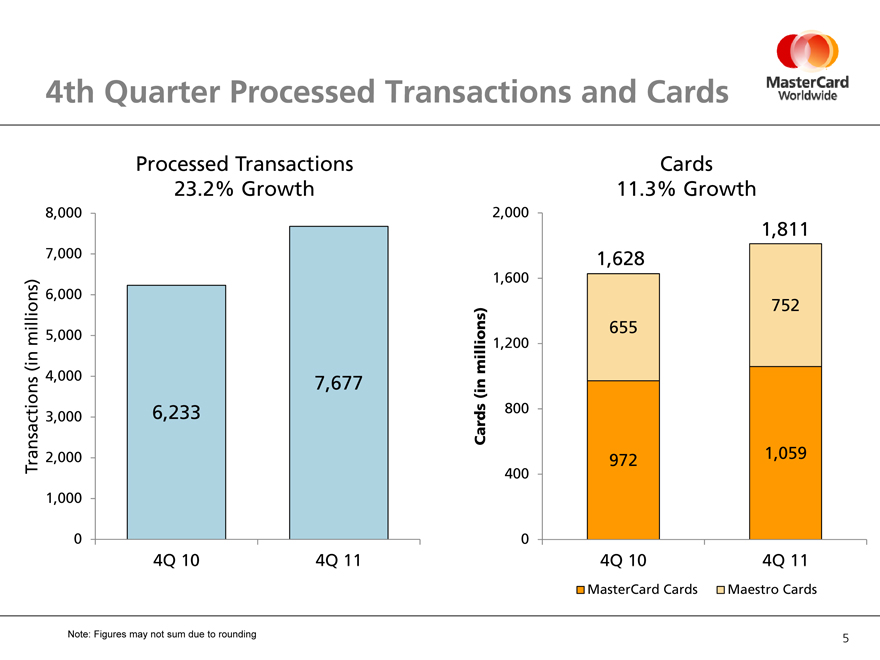

4th Quarter Processed Transactions and Cards

Processed Transactions

23.2% Growth

Cards

11.3% Growth

8,000 2,000

1,811

7,000 1,628

1,600

6,000

752

millions) 5,000 655

1,200

(in millions)

4,000

7,677 (in

3,000 6,233 Cards 800

transactions 2,000 972 1,059

T 400

1,000

0 0

4Q 10 4Q 11 4Q 10 4Q 11

MasterCard Cards Maestro Cards

Note: Figures may not sum due to rounding

| 5 |

|

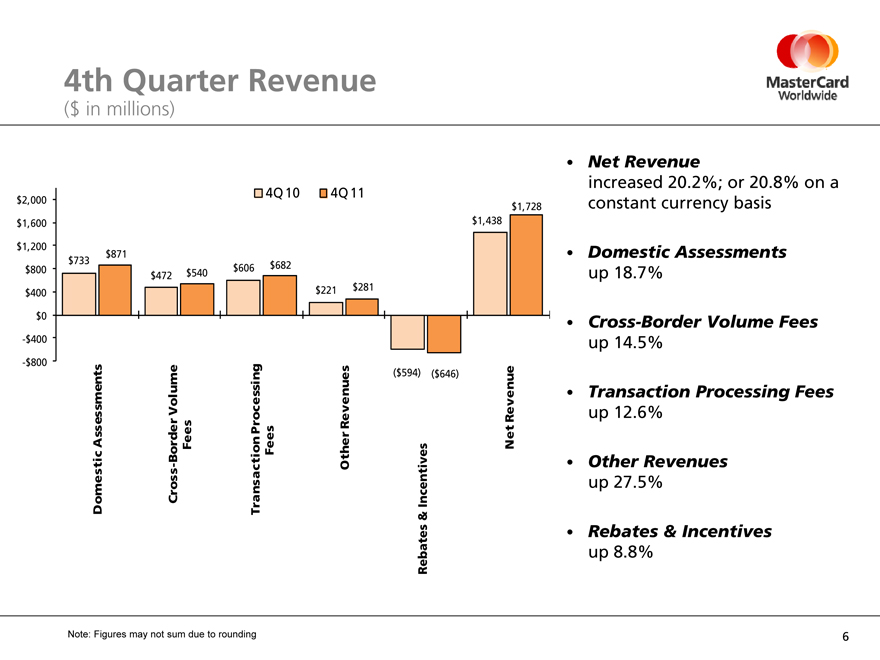

4th Quarter Revenue

($ in millions)

$2,000 $1,600 $1,200 $800 $400 $0

-$400

-$800

$871 $733 $540 $606 $682 $472 $221 $281

4Q 10 4Q 11

$1,728 $1,438

($594) ($646)

Domestic Assessments

Cross-Border Volume Fees

Transaction Processing Fees

Other Revenues

Rebates & Incentives

Net Revenue

Net Revenue increased 20.2%; or 20.8% on a constant currency basis

Domestic Assessments up 18.7%

Cross-Border Volume Fees up 14.5%

Transaction Processing Fees up 12.6%

Other Revenues up 27.5%

Rebates & Incentives up 8.8%

Note: Figures may not sum due to rounding

| 6 |

|

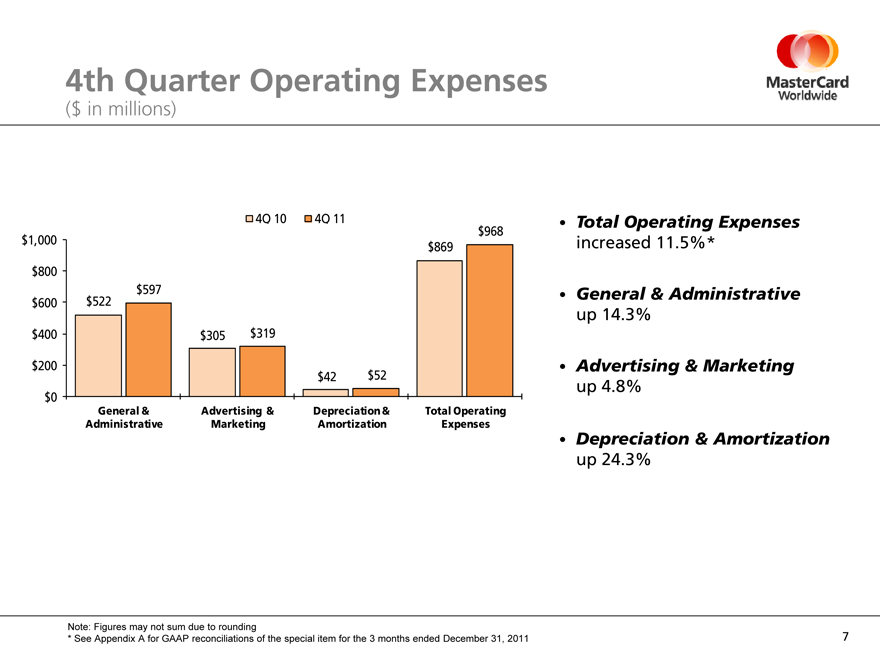

4th Quarter Operating Expenses

($ in millions)

$1,000 $800 $600 $400 $200 $0

$597 $522

$305 $319

$42 $52

$968 $869

4Q 10 4Q 11

General & Advertising & Depreciation & Total Operating Administrative Marketing Amortization Expenses

Total Operating Expenses increased 11.5%*

General & Administrative up 14.3%

Advertising & Marketing up 4.8%

Depreciation & Amortization up 24.3%

Note: Figures may not sum due to rounding

| * |

|

See Appendix A for GAAP reconciliations of the special item for the 3 months ended December 31, 2011 |

| 7 |

|

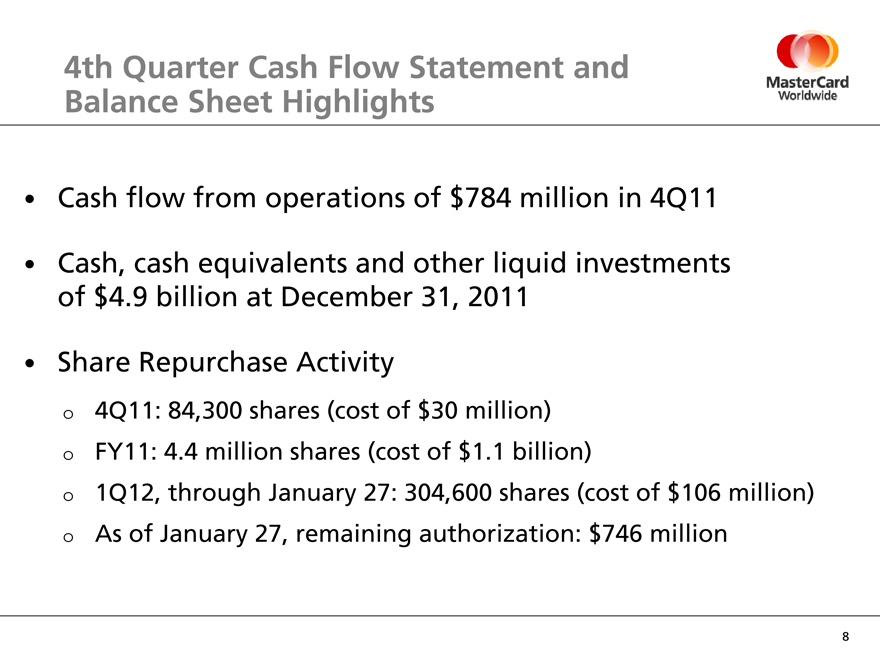

4th Quarter Cash Flow Statement and Balance Sheet Highlights

Cash flow from operations of $784 million in 4Q11

Cash, cash equivalents and other liquid investments of $4.9 billion at December 31, 2011

Share Repurchase Activity

4Q11: 84,300 shares (cost of $30 million) FY11: 4.4 million shares (cost of $1.1 billion)

1Q12, through January 27: 304,600 shares (cost of $106 million) As of January 27, remaining authorization: $746 million

| 8 |

|

Looking Ahead

Business update through January 28

Updated 2011-2013 performance objectives

For the period 2012-2013 (on a constant currency basis):

Net revenue growth: 12-14% CAGR Operating Margin: Minimum 50% annually EPS growth: 20%+ CAGR

Thoughts for 2012

9

Mastercard Worldwide

The Heart of CommerceTM

10

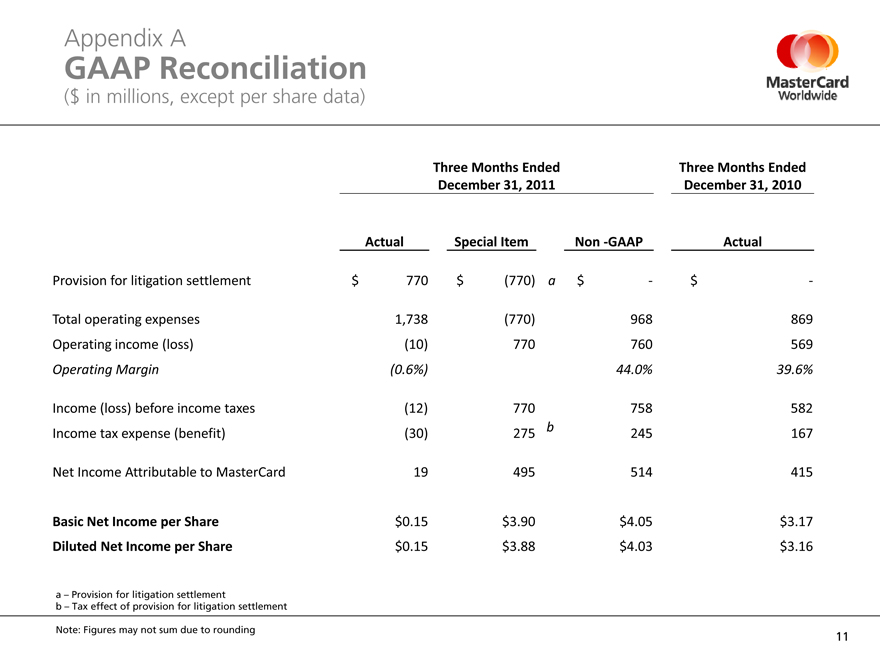

Appendix A

GAAP Reconciliation

($ in millions, except per share data)

Three Months Ended Three Months Ended

December 31, 2011 December 31, 2010

Actual Special Item Non -GAAP Actual

Provision for litigation settlement $ 770 $ (770) a $—$ —

Total operating expenses 1,738 (770) 968 869

Operating income (loss) (10) 770 760 569

Operating Margin (0.6%) 44.0% 39.6%

Income (loss) before income taxes (12) 770 758 582

Income tax expense (benefit) (30) 275 b 245 167

Net Income Attributable to MasterCard 19 495 514 415

Basic Net Income per Share $0.15 $3.90 $4.05 $3.17

Diluted Net Income per Share $0.15 $3.88 $4.03 $3.16

a – Provision for litigation settlement b – Tax effect of provision for litigation settlement

Note: Figures may not sum due to rounding

11

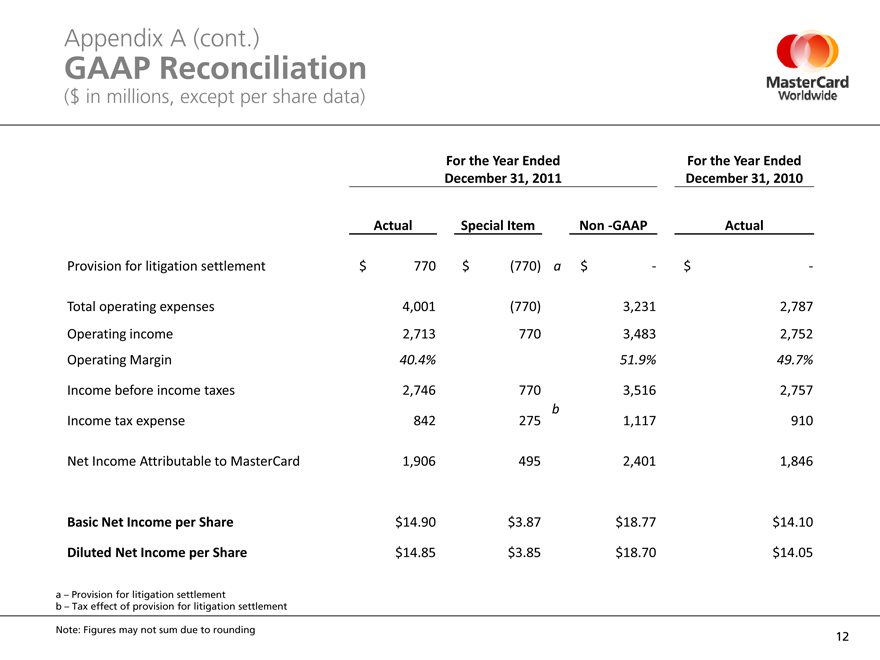

Appendix A (cont.)

GAAP Reconciliation

($ in millions, except per share data)

For the Year Ended For the Year Ended

December 31, 2011 December 31, 2010

Actual Special Item Non -GAAP Actual

Provision for litigation settlement $ 770 $ (770) a $—$—

Total operating expenses 4,001 (770) 3,231 2,787

Operating income 2,713 770 3,483 2,752

Operating Margin 40.4% 51.9% 49.7%

Income before income taxes 2,746 770 3,516 2,757

Income tax expense 842 275 b 1,117 910

Net Income Attributable to MasterCard 1,906 495 2,401 1,846

Basic Net Income per Share $14.90 $3.87 $18.77 $14.10

Diluted Net Income per Share $14.85 $3.85 $18.70 $14.05

a – Provision for litigation settlement

b – Tax effect of provision for litigation settlement

Note: Figures may not sum due to rounding

12

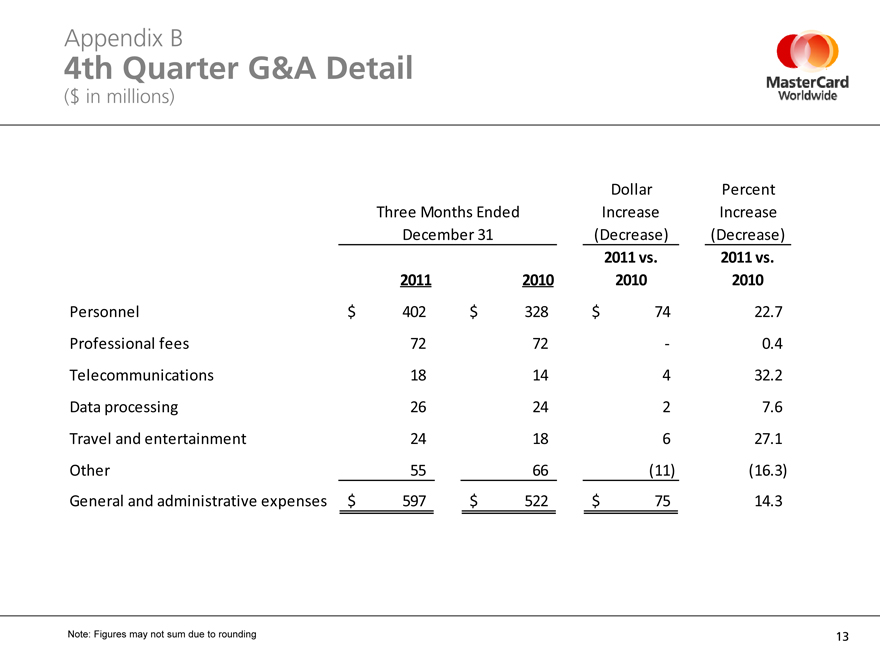

Appendix B

4th Quarter G&A Detail

($ in millions)

Dollar Percent

Three Months Ended Increase Increase

December 31 (Decrease) (Decrease)

2011 vs. 2011 vs.

2011 2010 2010 2010

Personnel $ 402 $ 328 $ 74 22.7

Professional fees 72 72 —0.4

Telecommunications 18 14 4 32.2

Data processing 26 24 2 7.6

Travel and entertainment 24 18 6 27.1

Other 55 66 (11) (16.3)

General and administrative expenses $ 597 $ 522 $ 75 14.3

Note: Figures may not sum due to rounding

13