Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Behringer Harvard Short-Term Liquidating Trust | v301033_8k.htm |

© 2012 Behringer Harvard For Fund Investors and Their Financial Advisors Only February 1, 2012 Estimated Per Unit Valuation

© 2012 Behringer Harvard For Fund Investors and Their Financial Advisors Only 2 Notices • Material on these pages is intended for educational or informational purposes only. Behringer Harvard does not provide tax, legal or specific investment advice. Investors should always seek the advice of their tax, legal, and/or financial advisors regarding their specific situation. • The information herein may contain notional investment concepts and/or return assumptions. None of such concepts or assumptions should be considered to be a prediction of any results that an investor in a Behringer Harvard program should expect. • This presentation is not an offer to sell or a solicitation of an offer to buy any securities. Such an offering is made only by means of an applicable prospectus. • NEITHER THE ATTORNEY GENERAL OF THE STATE OF NEW YORK NOR ANY OTHER STATE SECURITIES REGULATOR HAS PASSED ON OR ENDORSED THE MERITS OF ANY OFFERING OF BEHRINGER HARVARD INVESTMENT PROGRAM SECURITIES. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE. • The information from third party sources contained herein is believed to be reliable, but we do not guarantee its accuracy or completeness. Such third party information is intended for the private use of the viewers of this presentation and is for informational purposes only. Unauthorized distribution or use of such information is strictly prohibited as all rights to the material are reserved to the party that generated the information. We undertake no obligation to update or supplement this information at any time or in any way.

© 2012 Behringer Harvard For Fund Investors and Their Financial Advisors Only 3 Notices and Risk Factors • the possibility that sale or redemption may be for less than the original amount invested, • the absence of a public market for these securities, • limited transferability and lack of liquidity, • the possibility of substantial delay in making distributions, • reliance on affiliated sponsors, advisors, and general partners, • payment of significant fees to affiliated sponsors, advisors, and general partners, • payment of distributions from sources other than cash flow from operating activities, • risks associated with mezzanine financing, • risks associated with foreign properties, • no assurance that the stated objectives will be met, and • special risks associated with investing in real estate such as: – the possibility of declining real estate values – the possibility of declining economic conditions – the possible lack of availability of credit – overbuilding – changes in interest rates – extended vacancies of properties – potential development risks and construction delays • Investments in non - listed REITs, limited partnerships, and other real estate program securities are subject to substantial risks. These risks include, but are not limited to, the following:

© 2012 Behringer Harvard For Fund Investors and Their Financial Advisors Only 4 Forward - Looking Statements This presentation contains forward - looking statements relating to the business and financial outlook of certain Behringer Harvard programs that are based on our current expectations, estimates, forecasts, and projections and are not guarantees of future performance. Forward - looking statements can generally be identified by the use of forward - looking terminology, such as “may,” “anticipate,” “expect,” “intend,” “plan,” “believe,” “seek,” “estimate,” “would,” “could,” “should,” and variations of these words and similar expressions. Actual results may differ materially from those expressed in these forward - looking statements, and you should not place undue reliance on any such statements. Risks that could cause actual results to vary materially from those expressed in forward - looking statements include Forward - looking statements in this presentation speak only as of the date on which such statements were made, and we undertake no obligation to update any such statements that may become untrue because of subsequent events. We claim the safe harbor protection for forward - looking statements contained in the Private Securities Litigation Reform Act of 1995. • absence of a public market for these securities • limited operating history • absence of properties identified for acquisition limited transferability and lack of liquidity • possibility of substantial delay before distributions are made • risks associated with lending activities • no assurance that distributions will continue to be made or that any particular rate of distribution will be maintained • until the proceeds from an offering are invested and generating cash flow from operating activities, some or all of the distributions will be paid from other sources, which may be deemed a return of capital, such as from the proceeds of an offering, cash advances by the advisor, cash resulting from a waiver of asset management fees, proceeds from the sales of assets, and borrowings in anticipation of future cash flow from operating activities, which could result in less proceeds to make investments in real estate • reliance on the program’s advisor or general partner • payment of significant fees to the advisor or general partner and their affiliates • potential conflicts of interest • lack of diversification in property holdings until significant funds have been raised • potential development risks and construction delays • the potential inability to retain current tenants and attract new tenants due to a competitive real estate market • risk that a program’s operating results will be affected by economic and regulatory changes that have an adverse impact on a program’s investments • risk that the program will not achieve all of its objectives if it does not complete its securities offerings • risks related to investments in distressed properties or debt include possible default under the original loan • inability of tenants to pay their leases • unforeseen increases in operating and capital expenses • possibility of continuing decline in real estate values • lack of availability of due diligence information and • inability to adequately value distressed assets. These risks may impact a program’s financial condition, operating results, returns to its shareholders, and ability to make distributions as stated in the applicable prospectus. Investment in securities of Behringer Harvard real estate programs is subject to substantial risks and may result in the loss of principal invested. Real Estate programs are not suitable for all investors. Please refer to the prospectus for a more detailed discussion of risks and suitability standards in your state.

© 2012 Behringer Harvard For Fund Investors and Their Financial Advisors Only 5 Questions? During the call, please e - mail questions to: bhreit@behringerharvard.com

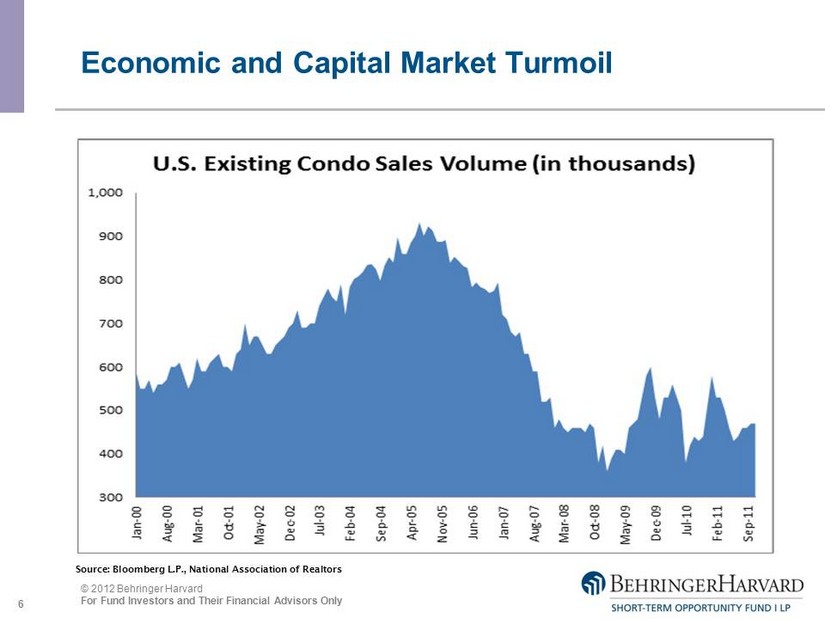

© 2012 Behringer Harvard For Fund Investors and Their Financial Advisors Only 6 Economic and Capital Market Turmoil Source: Bloomberg L.P., National Association of Realtors

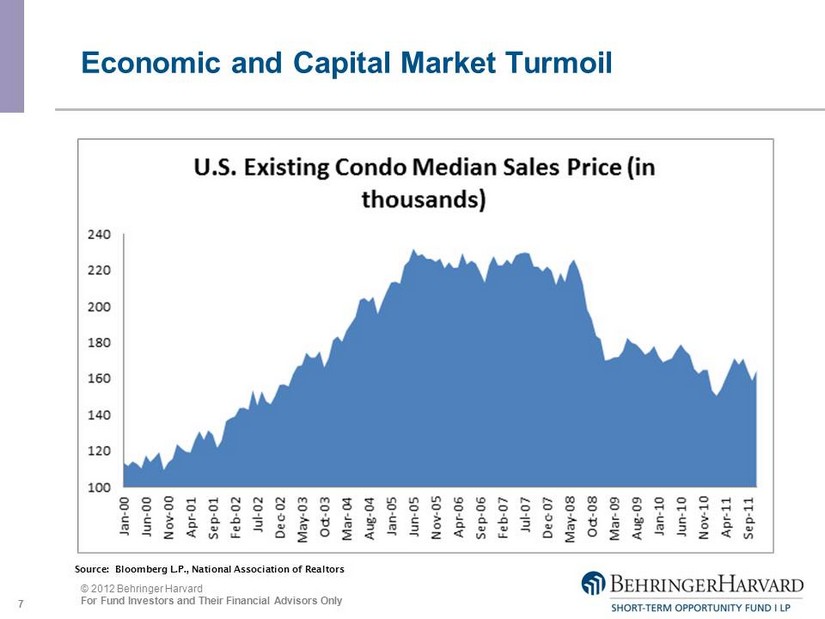

© 2012 Behringer Harvard For Fund Investors and Their Financial Advisors Only 7 Economic and Capital Market Turmoil Source: Bloomberg L.P., National Association of Realtors

© 2012 Behringer Harvard For Fund Investors and Their Financial Advisors Only 8 Estimated Valuation During the call, please e - mail questions to: bhreit@behringerharvard.com

© 2012 Behringer Harvard For Fund Investors and Their Financial Advisors Only 9 5050 Quorum & Landmark I and II • Landmark was sold on June 30, 2011 for $16.25 million; 5050 Quorum was sold on December 16, 2011 for $6.8 million. The Fund negotiated $8 million in discounted pay - off and the removal of the recourse nature of the debt associated with each property. The proceeds from both sales were then used to fully satisfy the remaining debt. • The assets were sold to a buyer who has available capital necessary to complete the lease up of the assets and increase their values. In light of the current state of commercial lending and the Fund operating in its disposition phase, the Fund did not have sufficient liquidity to complete the lease ups itself. • In each case, because of restrictions in the Fund’s limited partnership agreement, the Fund could not enter into a joint venture agreement to co - own the property but, rather, had to sell the asset and retain a back - end promoted interest in connection with the disposition. • Promoted interests were ascribed no value in the current estimated valuation.

© 2012 Behringer Harvard For Fund Investors and Their Financial Advisors Only 10 250/290 John Carpenter • Part of our revolving credit agreement with Bank of America. The $9.7 million principal balance matures on December 21, 2012. • We are negotiating with a prospective tenant to lease a significant portion of this property. We are also in negotiations with a prospective purchaser that will simultaneously close the purchase of the property and sign the lease with the prospective tenant. • Sales proceeds would be used to pay off the $9.7 million debt plus a portion of the Hotel Palomar loan with the same lender.

© 2012 Behringer Harvard For Fund Investors and Their Financial Advisors Only 11 Estimated Valuation During the call, please e - mail questions to: bhreit@behringerharvard.com

© 2012 Behringer Harvard For Fund Investors and Their Financial Advisors Only 12 Hotel Palomar and Retail • The hotel is continuing to improve its operations as demonstrated by growth in occupancy, Average Daily Rate and Revenue Per Available Room. • Retail occupancy at this property was at 100% as of September 30, 2011. • The current $41.2 million balance on the loan matures on December 21, 2012. Fund plans to use the proceeds from the future sale of 250/290 John Carpenter to pay down a portion of the loan and receive additional time from the bank to accommodate more growth in the hotel’s net operating income with the intent of increasing the value above that which is included in this valuation. • We anticipate marketing this property for sale in late 2012.

© 2012 Behringer Harvard For Fund Investors and Their Financial Advisors Only 13 1221 Coit Road • The long - term, full - building lease to Internap Network Services Corp., the property’s conversion into a data center, and the completion of a new loan to pay off existing debt and finance tenant improvements positively affected the Fund’s estimated valuation. • The tenant has an option through June 2012 to purchase the property at a price significantly higher than the Fund’s current carrying value. • If the tenant does not exercise its purchase option, we plan to market the property for sale in mid - 2012.

© 2012 Behringer Harvard For Fund Investors and Their Financial Advisors Only 14 Palomar Condos/Telluride Condos • Palomar Condos completed in 2007, seven units initially sold. Converted to rental units in March 2009. Restarted sales program in June 2011. Six units sold in 2011. • Telluride Condos completed in summer of 2011, 23 units total. No condos sold to date. • In April 2011, Texans Credit Union, construction lender for both projects, placed into conservatorship by National Credit Union Association (NCUA). • Behringer Harvard Short - Term Opportunity Fund I has attracted outside capital and presented offers to acquire both loans at a discount, which would have resulted in the Fund having a promoted interest in the properties. • Initial indications were favorable for a note purchase, but final approval was denied by NCUA. • Recourse nature of loans and calculations of potential deficiency resulted in a negative value for each asset.

© 2012 Behringer Harvard For Fund Investors and Their Financial Advisors Only 15 Estimated Valuation During the call, please e - mail questions to: bhreit@behringerharvard.com

© 2012 Behringer Harvard For Fund Investors and Their Financial Advisors Only 16 Questions? During the call, please e - mail questions to: bhreit@behringerharvard.com