Attached files

| file | filename |

|---|---|

| EX-99.2 - EXHIBIT 99.2 - IEC ELECTRONICS CORP | v300886_ex99-2.htm |

| 8-K - FORM 8-K - IEC ELECTRONICS CORP | v300886_8k.htm |

Exhibit 99.1

SLIDES TO BE PRESENTED AT ANNUAL MEETING OF STOCKHOLDERS HELD FEBRUARY 1, 2012

2 Agenda ▪ Review 2011 ▪ Financial Results ▪ Sales and Marketing Activities ▪ Future Outlook

3 Forward Looking Statements This presentation, including any discussion regarding the Company's future prospects, contains certain forward - looking statements that involve risks and uncertainties, including uncertainties associated with economic conditions in the electronics industry, particularly in the principal industry sectors served by the Company, changes in customer requirements and in the volume of sales to principal customers, competition and technological change, the ability of the Company to control manufacturing and operating costs, and satisfactory relationships with vendors. The Company's actual results of operations may differ significantly from those contemplated by any forward - looking statements as a result of these and other factors, including factors set forth in the Company's 2011 Annual Report on Form 10 - K and in other filings with the Securities and Exchange Commission.

4 Opening Remarks ▪ 2011 Summary: – Some of the strongest financial returns in the entire industry ▪ Sales increased 38% ▪ Operating income increased 35% ▪ EBITDA increased 61% ▪ Net gain of 8 customers in our target markets – Numerous new projects from existing customers

5 Opening Remarks (continued) ▪ Acquired Southern California Braiding in December, 2010 ▪ Since the acquisition we reduced our debt from $47 million to $35 million in 9.5 months ▪ #3 on the Forbes list of Top 100 Best Small Companies ▪ The Newark facility received its second manufacturing honor in two years - AME award

We have had some success this past year !

7 The 2011 Economy and Our Customers ▪ Patchy economy – Industrial market - some customers were struggling while others experienced outstanding growth – The Medical equipment market as a whole is growing ▪ Other markets were under different pressure – Military/Aerospace ▪ Postponement of program funding emerged during the 2 nd half of our fiscal year ▪ Well managed – diversified group of customers

8 Well Managed Customers

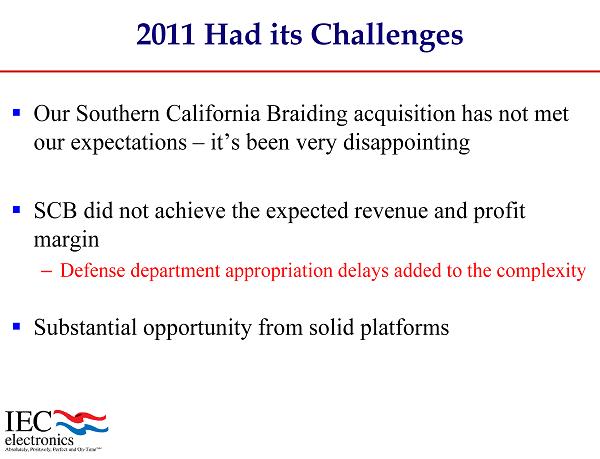

2011 Had its Challenges ▪ Our Southern California Braiding acquisition has not met our expectations – it’s been very disappointing ▪ SCB did not achieve the expected revenue and profit margin – Defense department appropriation delays added to the complexity ▪ Substantial opportunity from solid platforms

10 Introductions and Shareholder Vote ▪ Board of Directors ▪ Management Team ▪ Public Accountant and Legal Counsel ▪ Shareholder Vote

11 2011 Year in Review Vince Leo, Acting Chief Financial Officer

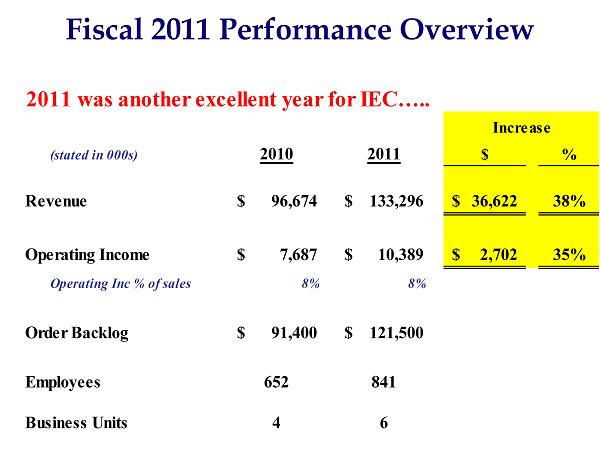

Fiscal 2011 Performance Overview 2011 was another excellent year for IEC….. (stated in 000s) 2010 2011 $ % Revenue 96,674$ 133,296$ 36,622$ 38% Operating Income 7,687$ 10,389$ 2,702$ 35% Operating Inc % of sales 8% 8% Order Backlog 91,400$ 121,500$ Employees 652 841 Business Units 4 6 Increase

40,914 51,092 67,811 96,674 133,296 0 20,000 40,000 60,000 80,000 100,000 120,000 140,000 2007 2008 2009 2010 2011 D o l l a r s i n T h o u s a n d s Net Sales Annual Sales Trends 33% 43% 25% The Company continues to deliver strong, year over year revenue growth… 38%

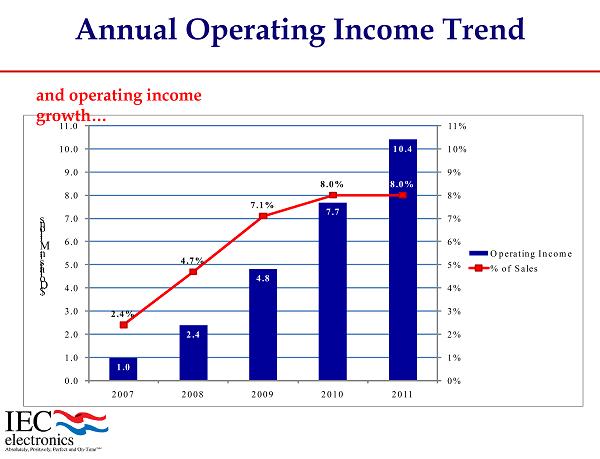

Annual Operating Income Trend 1.0 2.4 4.8 7.7 10.4 2.4% 4.7% 7.1% 8.0% 8.0% 0% 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 11% 0.0 1.0 2.0 3.0 4.0 5.0 6.0 7.0 8.0 9.0 10.0 11.0 2007 2008 2009 2010 2011 $ D o l l a r s i n M i l l i o n s Operating Income % of Sales and operating income growth…

Financial Results: Comparative P&L (stated in 000s except EPS) 2010 2011 Increase Total Revenue 96,674$ 133,296$ 38% Cost of Revenue 80,411 109,039 Gross Profit 16,263 24,257 49% Gross Profit as % of Revenue 17% 18% Selling and Administrative 8,576 13,868 Operating Income 7,687 10,389 35% Operating Income as % of Revenue 8% 8% Other (Income)Expense, Net (182) (1,028) Interest Expense 814 1,601 Income before Tax 7,055 9,816 39% Income Tax Expense 2,400 3,056 Net Income 4,655$ 6,760$ 45% EPS - Diluted $0.48 $0.68 42%

Financial Results: Comparative Cash Flows (stated in 000s) 2010 2011 $ % EBITDA 9,093$ 14,674$ 5,581$ 61% Cash Flow from Operations 7,830$ 14,035$ 6,205$ 79% Increase over 2010 Increased earnings & cash flow growth…

40,914 51,092 67,811 96,674 133,296 0 10,000 20,000 30,000 40,000 50,000 60,000 70,000 80,000 90,000 100,000 110,000 120,000 130,000 140,000 150,000 160,000 2007 2008 2009 2010 2011 2012 D o l l a r s i n T h o u s a n d s Net Sales Annual Sales Trends 33% 43% 25% IEC remains focused on delivering year over year growth… 38% 9% - 14% Estimate

18 Jeff Schlarbaum, President, IEC Electronics Corp.

Sales & Marketing Review ▪ How we created a more comprehensive service offering in 2011 ▪ Delivering a one - stop - shop experience for our customers ▪ Leveraging our brand to expand into new markets ▪ Market sector trends

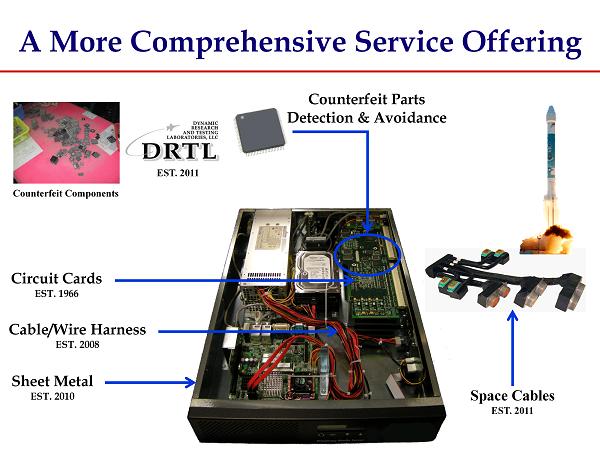

Sheet Metal EST. 2010 Cable/Wire Harness EST. 2008 Circuit Cards EST. 1966 Counterfeit Parts Detection & Avoidance EST. 2011 Counterfeit Components Space Cables EST. 2011 A More Comprehensive Service Offering

Counterfeit Detection & Avoidance Missile Defense Agency found 800 fake parts on one missile interceptor system alone, and paid over $2 million to replace them. (1) (1) Missile Defense Agency (MDA) chief Lt. Patrick O’Reilly; The Hill, Counterfeit military parts from China a ‘clear and present danger’ , 11/08/11 What’s the Significance? ▪ Weakens secure systems (National Defense) ▪ Negatively affects product performance ▪ Compromises product reliability

Delivering A One - Stop - Shop Experience Serving a broader collection of customer requirements Customer Newark, NY Victor, NY Albuquerque, NM Rochester, NY Bell Gardens, CA

Enhancing Our One - Stop - Shop Platform Customer

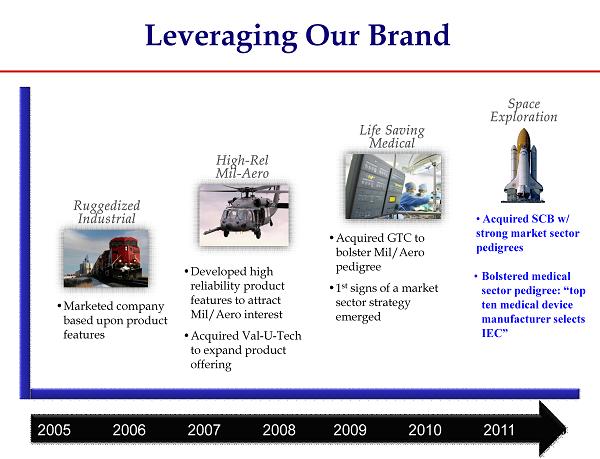

24 of 16 • Marketed company based upon product features • Developed high reliability product features to attract Mil/Aero interest • Acquired Val - U - Tech to expand product offering • Acquired SCB w/ strong market sector pedigrees • Acquired GTC to bolster Mil/Aero pedigree • 1 st signs of a market sector strategy emerged 2005 2006 2007 2008 2009 2010 2011 Leveraging Our Brand • Bolstered medical sector pedigree: “top ten medical device manufacturer selects IEC”

0 5,000 10,000 15,000 20,000 25,000 30,000 35,000 2007 2008 2009 2010 2011 Industrial Medical/Other Revenue Trends By Sector Medical & Industrial 140% YoY Increase 8% YoY Decline ▪ The broad economic slowdown continued to negatively affect large capital equipment purchases. In 2012, we see a return to growth ▪ Organic growth driven by maturing programs and volume increases Sales in $ 000’s

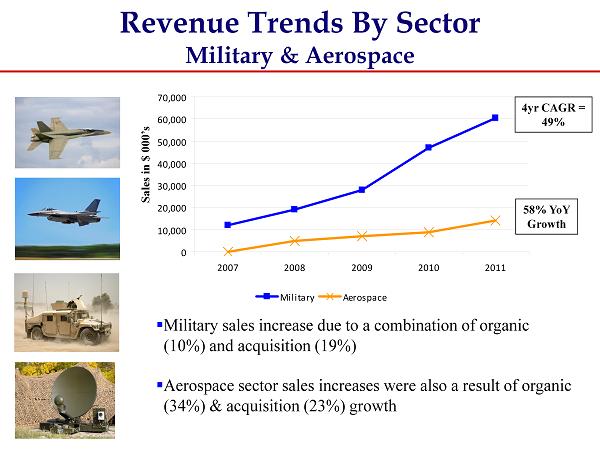

0 10,000 20,000 30,000 40,000 50,000 60,000 70,000 2007 2008 2009 2010 2011 Military Aerospace Revenue Trends By Sector Military & Aerospace 4yr CAGR = 49% 58% YoY Growth ▪ Military sales increase due to a combination of organic (10%) and acquisition (19%) ▪ Aerospace sector sales increases were also a result of organic (34%) & acquisition (23%) growth Sales in $ 000’s

27 Looking Ahead – Fiscal, 2012 ▪ Our long term organic growth goal is 17% per year ▪ This year we expect our organic sales to increase 9 - 14% ▪ Why 9 - 14%? – Weak global economy, muddled U.S. economy ▪ Medical market to continue growing ▪ Industrial market growth to be more modest ▪ Military/Aerospace market – patchy for most of next year – Program releases and timing is less predictable

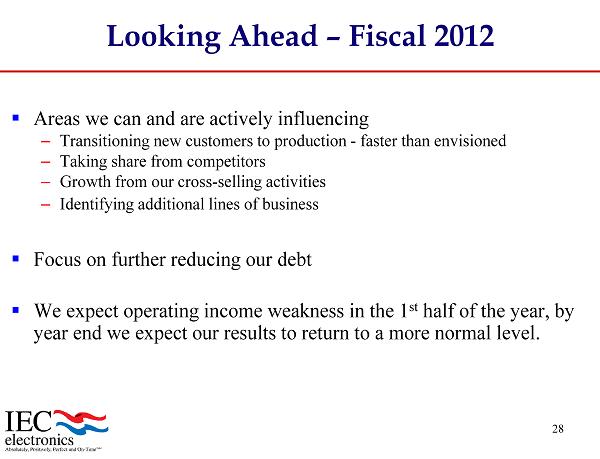

28 Looking Ahead – Fiscal 2012 ▪ Areas we can and are actively influencing – Transitioning new customers to production - faster than envisioned – Taking share from competitors – Growth from our cross - selling activities – Identifying additional lines of business ▪ Focus on further reducing our debt ▪ We expect operating income weakness in the 1 st half of the year, by year end we expect our results to return to a more normal level.

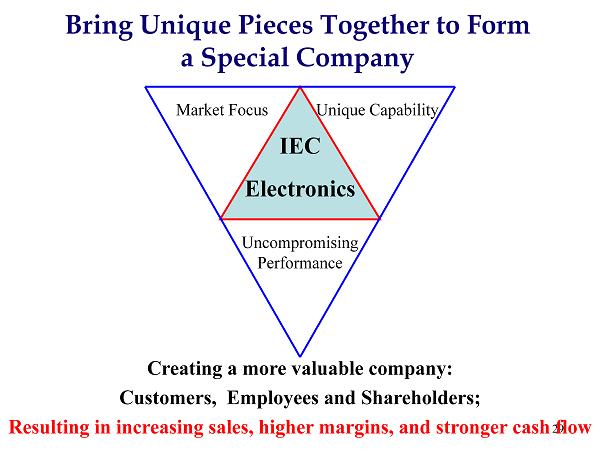

29 Market Focus Unique Capability IEC Electronics Uncompromising Performance Creating a more valuable company: Customers, Employees and Shareholders; Resulting in increasing sales, higher margins, and stronger cash flow Bring Unique Pieces Together to Form a Special Company

30 Conclusion ▪ In executing our strategy, our focus will be: – Drive organic growth – Invest in new internal businesses, customers and people – Expand within our chosen market sectors – Continue to review acquisition opportunities

We are growing your company!

32 IEC Electronics Corp. 2011 Annual Meeting February 1, 2012 Questions “Absolutely, Positively Perfect and On - Time (SM) ”