Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - STANCORP FINANCIAL GROUP INC | d290662d8k.htm |

| EX-99.2 - STATISTICAL SUPPLEMENT - STANCORP FINANCIAL GROUP INC | d290662dex992.htm |

| EX-99.1 - PRESS RELEASE - STANCORP FINANCIAL GROUP INC | d290662dex991.htm |

©

2010 Standard Insurance Company

2012 Annual Guidance

January 30, 2012

Exhibit 99.3 |

©

2010 Standard Insurance Company

Forward-Looking Statements

2

This presentation should be read in conjunction with StanCorp’s

most recent earnings release and most recent Form 10-Q.

Information in this presentation includes certain statements related

to projected growth and future events. These statements are

“forward-looking”

statements as that term is defined in the Private

Securities Litigation Reform Act of 1995. Because such statements

are subject to risks and uncertainties, actual results in future

periods may differ materially from those expressed or implied by

such forward-looking statements. See StanCorp’s latest annual

report on Form 10-K and most recent Form 10-Q filed with the

Securities and Exchange Commission for a description of the types

of uncertainties and risks that may affect actual results.

|

©

2010 Standard Insurance Company

2012 Annual Guidance

3

Earnings Guidance

Challenges

•

Net income per diluted share,

excluding after-tax net capital

gains and losses, to be in the

range of $3.60 to $3.90.

•

Return on average equity,

excluding after-tax net capital

gains and losses from net income

and AOCI from equity, to be in the

range of 9% to 10%.

•

Sustained low interest rate

environment.

•

Declining wage and employment

levels.

•

Competitive pricing environment. |

©

2010 Standard Insurance Company

2012 Annual Guidance

4

•

Given pricing actions and a continued challenging economic environment,

we expect group insurance premium growth to be relatively flat.

•

We expect our group insurance annual benefit ratio to be in the range of

80% to 82%.

•

If the current interest rate environment persists, we estimate the discount

rate would be lowered 25 to 50 basis points.

•

We expect share repurchases to be in the range of $40 to $80 million.

•

Our estimated 2012 effective income tax rate will be 26% to 27%.

•

We estimate that implementing ASU 2010-26 will increase pre-tax

expenses by approximately $3 to $4 million.

Factors Affecting 2012 Guidance |

©

2010 Standard Insurance Company

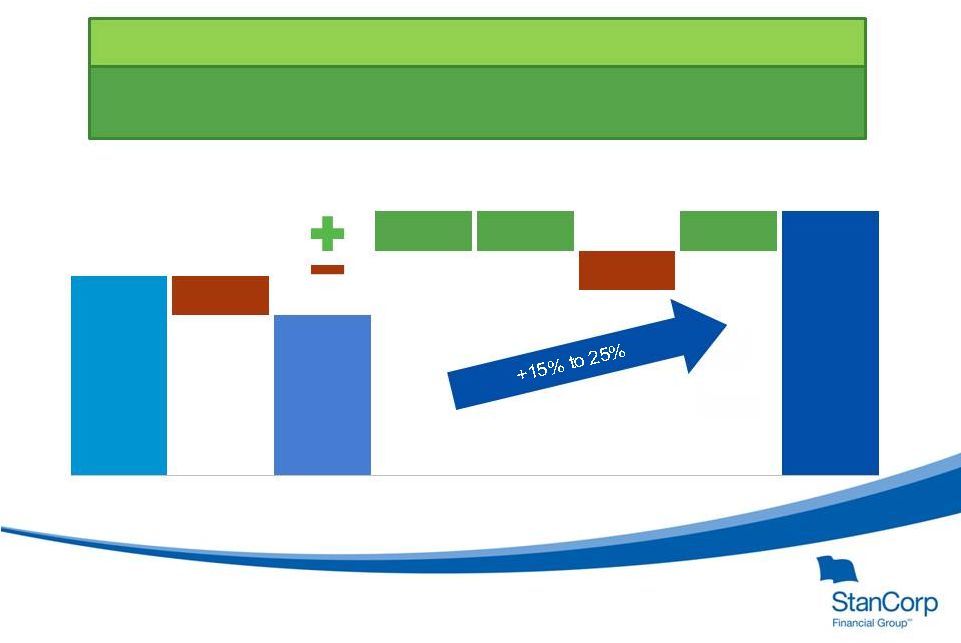

Earnings per Share

5

*Excluding after-tax net capital gains and losses

For

illustrative

purposes,

factors

are

not

shown

to

scale

2011 EPS*

2012 EPS Guidance

Net income per diluted share, excluding after-tax net capital gains and

losses, to be in the range of $3.60 to $3.90.

ASU 2010-26

DAC Impact

$0.05 to $0.06

2011 EPS*

Including

Annual

ASU 2010-26

DAC Impact

$3.13 to $3.14

$3.60 to $3.90

Group

Benefit Ratio

Interest

Rates

Premium

Growth

Other

2012 EPS*

Guidance

$3.19 |

©

2010 Standard Insurance Company

6

Non-GAAP Financial Measures

($ millions –

except per share data)

2011

Reconciliation of Non-GAAP financial measures:

Net income

139.3

$

After-tax net capital losses

(4.5)

Net income excluding after-tax net capital losses

143.8

$

Net capital losses

(6.9)

$

Tax benefit on net capital losses

(2.4)

After-tax net capital losses

(4.5)

$

Diluted earnings per common share:

Net income

3.09

$

After-tax net capital losses

(0.10)

Net income excluding after-tax net capital losses

3.19

$

Share data:

Basic weighted-average

44,876,650

Diluted weighted-average

45,016,070

At period end

44,268,859

Shareholders' equity

2,010.5

$

Accumulated other comprehensive income

235.1

Shareholders' equity excluding accumulated other

comprehensive income

1,775.4

$

Net income return on average equity

7.1%

Net income return on average equity

(excluding after-tax net capital losses and

accumulated other comprehensive income)

8.2

Book value per common share:

Including accumulated other comprehensive income

45.42

$

Accumulated other comprehensive income

5.32

Excluding accumulated other comprehensive income

40.10

$ |