Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - EL PASO CORP/DE | d291731d8k.htm |

| EX-8.1 - OPINION OF WACHTELL, LIPTON, ROSEN & KATZ AS TO CERTAIN TAX MATTERS - EL PASO CORP/DE | d291731dex81.htm |

| EX-99.2 - FORM OF ELECTION FORM FOR HOLDERS OF EQUITY AWARDS - EL PASO CORP/DE | d291731dex992.htm |

Exhibit 99.1

TIME IS CRITICAL. PLEASE COMPLETE AND RETURN PROMPTLY.

ELECTION FORM AND LETTER OF TRANSMITTAL

To accompany certificates of common stock, par value $3.00 per share, of

EI Paso Corporation (“New EI Paso” f/k/a Sirius Holdings Merger Corporation)

ELECTION DEADLINE IS 5:00 P.M., NEW YORK TIME, ON [ ]

This Election Form and Letter of Transmittal may be used to make an election only with respect to certain shares of New EI Paso common stock you hold. You may receive additional Election Forms and/or Letters of Transmittal with respect to shares of New EI Paso common stock held by you in another manner or in another name or with respect to equity awards you hold (if any).

Your EI Paso Corporation Stock Certificates:

Locate the listed certificates.

| Certificate Numbers | Shares | Certificate Numbers | Shares | |||

| XXXX12345678 |

12345678901234 | XXXX12345678 | 12345678901234 | |||

| XXXX12345678 |

12345678901234 | XXXX12345678 | 12345678901234 | |||

| XXXX12345678 |

12345678901234 | XXXX12345678 | 12345678901234 | |||

| XXXX12345678 |

12345678901234 | XXXX12345678 | 12345678901234 | |||

| XXXX12345678 |

12345678901234 | XXXX12345678 | 12345678901234 | |||

You hold more than 10 certificates, not all certificates can be listed on this form.

| Other Certificate Total | Total Certificated Shares | Shares Held By Us | Total Shares | |||

| 12345678901234 | 12345678901234 | 12345678901234 | 12345678901234 |

Complete the box(es) on the reverse side to make an election to receive (i) 0.9635 of a share of Kinder Morgan Class P common stock and 0.640 of a warrant to purchase one share of Kinder Morgan Class P common stock (the “Stock Election”), (ii) $25.91 in cash without interest and 0.640 of a warrant to purchase one share of Kinder Morgan Class P common stock (the “Cash Election”) or (iii) 0.4187 of a share of Kinder Morgan Class P common stock, $14.65 in cash without interest and 0.640 of a warrant to purchase one share of Kinder Morgan Class P common stock (the “Mixed Election”), each of which is subject to proration, adjustment and certain limitations as set forth in the Merger Agreement. If no box is checked or you elect to make “No Election,” you will be deemed to have made a “Mixed Election” for your shares of New EI Paso common stock, upon the terms of and subject to the conditions of Merger Agreement.

ELECTION CHOICES

+

I hereby elect to receive the following as consideration for my shares of New EI Paso common stock held in this account:

STOCK ELECTION (0.9635 of a share of Kinder Morgan Class P common stock and 0.640 of a warrant to purchase one share of Kinder Morgan Class P common stock)

| ¨ | Mark this box to elect to make a stock election with respect to ALL of your New EI Paso shares. |

| ||

| ¨ | Mark this box to elect to make a stock election with respect to the following number of your New EI Paso shares. Please fill in the number of shares for which you would like to make a stock election. | |||

|

CASH ELECTION ($25.91 in cash without interest and 0.640 of a warrant to purchase one share of Kinder Morgan Class P common stock) |

||||

|

¨ |

Mark this box to elect to make a cash election with respect to ALL of your New EI Paso shares |

| ||

| ¨ | Mark this box to elect to make a cash election with respect to the following number of your New EI Paso shares. Please fill in the number of shares for which you would like to make a cash election. | |||

|

MIXED ELECTION (0.4187 of a share of Kinder Morgan Class P common stock, $14.65 in cash without interest and 0.640 of a warrant to purchase one share of Kinder Morgan Class P common stock) | ||||

|

¨ |

Mark this box to elect to make a mixed election with respect to ALL of your New EI Paso shares |

| ||

| ¨ | Mark this box to elect to make a mixed election with respect to the following number of your New EI Paso shares. Please fill in the number of shares for which you would like to make a mixed election. | |||

|

NO ELECTION |

||||

|

¨ |

Mark this box to make no election with respect to ALL of your New EI Paso shares. |

|||

You will be deemed to have made a “MIXED ELECTION” if:

| A. | You fail to follow the instructions on the “Election Form and Letter of Transmittal” or otherwise fail properly to make an election; |

| B. | A properly completed “Election Form and Letter of Transmittal,” together with your stock certificate(s), confirmation of book-entry transfer or a properly completed Notice of Guaranteed Delivery, is not actually received by the Exchange Agent at or before the Election Deadline; |

| C. | You properly and timely revoke a prior election without making a new election; or |

| D. | You check the “No Election” box above. |

These elections will be subject to proration based on (i) a proration adjustment if cash consideration is oversubscribed, (ii) a proration adjustment if cash consideration is undersubscribed and (iii) a proration adjustment to preserve the intended treatment of the transactions as a reorganization within the meaning of Section 368(a) of the Internal Revenue Code of 1986, as amended.

No guarantee can be made that you will receive the amount of cash consideration or stock consideration that you elect. No guarantee can be made as to the value of the consideration received relative to the value of the shares of New EI Paso common stock being exchanged. You are encouraged to obtain current market quotations for Kinder Morgan Class P common stock when making your election.

To be effective, this Election Form and Letter of Transmittal must be properly completed, signed and delivered to the Exchange Agent at one of the addresses listed in the Election Form and Letter of Transmittal, together with your stock certificate(s), confirmation of book-entry transfer or a properly completed Notice of Guaranteed Delivery, by the Election Deadline, which will be 5:00 p.m., New York City time, on[ ], 2012, unless delayed to a subsequent date. Do not send your election materials to New El Paso, Old El Paso, Kinder Morgan or the Information Agent.

SIGNATURE(S) REQUIRED. Signature of Registered Holder(s) or Agent

Must be signed by the registered holder(s) EXACTLY as name(s) appear(s) on stock certificate(s). If signature is by a trustee, executor, administrator, guardian, attorney-in-fact, officer for a corporation in a fiduciary or representative capacity, or other person, please set forth full title. See Instructions 5, 6, 7 and 8.

By signing below, I represent and warrant as follows:

(1) I have full power and authority to surrender the New EI Paso shares represented by the stock certificate(s) surrendered herewith or transferred in book-entry form, or covered by a guarantee of delivery, free and clear of all liens, claims and encumbrances. I will, upon request, execute and deliver any additional documents reasonably deemed by the Exchange Agent to be appropriate or necessary to complete the surrender and exchange of my New EI Paso shares.

(2) I understand that neither surrender nor an election is made in acceptable form until receipt by the Exchange Agent of this Election Form and Letter of Transmittal, duly completed and manually signed, together with any stock certificate(s) representing New EI Paso shares and all accompanying evidences of authority. I agree that all questions as to validity, form and eligibility of any surrender of the New EI Paso shares will be determined by the Exchange Agent.

(3) I understand that, pending the completion of the second merger, I may not and shall not sell or otherwise transfer the New EI Paso shares subject to this Election Form unless the Merger Agreement is terminated or I properly revoke this election prior to the Election Deadline.

(4) I acknowledge that, until I properly surrender the certificate(s) representing the New EI Paso shares to which this Election Form and Letter of Transmittal relates or properly transfer such New EI Paso shares in book-entry form, I will not receive any consideration issuable or payable in connection with the second merger. Delivery of such certificate(s) will be effected, and risk of loss and title to such certificate(s) will pass, only upon proper delivery thereof to the Exchange Agent in the appropriate manner to one of the addresses shown above.

Sign and provide your tax ID number on the IRS Form W-9 provided herein (or the appropriate IRS Form W-8 if you are a non-U.S. stockholder, a copy of which can be obtained at www.irs.gov). See Instruction 8.

| Signature of owner

|

Signature of co-owner, if any

|

Area Code/Phone Number

| ||||||

|

|

SIGNATURE(S) GUARANTEED (IF REQUIRED) See Instruction 6.

Unless the shares were tendered by the registered holder(s) of the common stock, or for the account of a member of a Eligible Institution, your signature(s) must be guaranteed by an Eligible Institution.

| Authorized Signature

|

Name of Firm

|

|||||||

|

|

Address of Firm – Please Print

INSTRUCTIONS

(Please read carefully all of the instructions below)

1. Delivery; Election Deadline: For any election contained herein to be considered, the Election Form and Letter of Transmittal, properly completed in accordance with these instructions and signed, together with either your stock certificate(s) or evidence of shares in book-entry form, as applicable, or a properly completed Notice of Guaranteed Delivery, and any other documentation reasonably required by the Exchange Agent, to the Exchange Agent at one of the addresses set forth below so that it is actually received by the Exchange Agent at or prior to the Election Deadline. Do not send such materials to New El Paso, Old El Paso, Kinder Morgan or the Information Agent because they will not be forwarded to the Exchange Agent and your election will be invalid. The method of delivery is at the option and risk of the surrendering stockholder. Registered mail, appropriately insured, with return receipt requested, is suggested. A return envelope is enclosed for your convenience. Delivery shall be effected, and risk of loss and title will pass, only upon proper delivery of the certificate(s) or book-entry shares to the Exchange Agent.

The Election Deadline will be 5:00 p.m., New York City time, on [ ], 2012, unless delayed to a subsequent date (the “Election Deadline”). In the event that the expected effective time of the second merger and the Election Deadline change, we will announce the revised dates in a press release, on our web sites at www.kindermorgan.com and www.elpaso.com and in a filing with the SEC. You may also obtain up-to-date information regarding the Election Deadline by calling the Information Agent at (800) 322-2885. If you hold your shares of New El Paso common stock in “street name” or in another manner, you may be subject to an earlier deadline. You bear the risk of ensuring proper and timely delivery. Therefore, we encourage you to submit your election materials promptly.

The Exchange Agent, in its sole discretion, will determine whether any Election Form and Letter of Transmittal is received on a timely basis and whether an Election Form and Letter of Transmittal has been properly completed.

2. Revocation or Change of Election Form: Any Election Form and Letter of Transmittal may be revoked or changed by written notice from the person submitting such form to the Exchange Agent, but to be effective such notice must be received by the Exchange Agent at or prior to the Election Deadline. The Exchange Agent will have discretion to determine whether any revocation or change is received on a timely basis and whether any such revocation or change has been properly made. No election may be revoked or changed after the Election Deadline unless and until the Merger Agreement is terminated. See Instruction 4.

3. Surrender of Original Certificate(s); Lost, Stolen or Destroyed Certificate(s): For any election contained herein to be effective, this Election Form and Letter of Transmittal must be accompanied by the original certificate(s) evidencing your shares of New El Paso common stock and any required accompanying evidences of authority. From and after the effective time of the first merger, each share of Old El Paso common stock was deemed to represent a share of New El Paso common stock, without any action on the part of the holder of such share. Therefore, original certificate(s) evidencing your shares of New El Paso common stock will be those original certificate(s) previously evidencing your shares of Old El Paso common stock. If your certificate(s) has been lost, stolen or destroyed, contact the Exchange Agent at (877) 453-1503 prior to submitting the Election Form and Letter of Transmittal.

4. Termination of Merger Agreement: In the event of termination of the Merger Agreement, the Exchange Agent will promptly return stock certificate(s) representing shares of New El Paso common stock via registered mail or through a book-entry transfer for shares held in street name. The Exchange Agent and New El Paso will use their commercially reasonable efforts to facilitate return of such stock certificate(s) in the event of termination of the Merger Agreement, but return of certificate(s) other than by registered mail will only be made at the expense, written direction and risk of the requesting New El Paso stockholder, accompanied by a pre-paid, pre-addressed return courier envelope sent to the Exchange Agent.

5. Signatures: If the Election Form and Letter of Transmittal is signed by the registered holder(s) of the shares surrendered, the signature(s) must correspond exactly with the name(s) as written on the face of the certificate(s) surrendered or on the assignment authorizing transfer, without alteration, enlargement or any change

whatsoever. Do not sign the certificate(s) because signatures are not required if the certificate(s) surrendered herewith are submitted by the registered owner of such shares who has not completed the section entitled “Special Payment and Issuance Instructions” or are for the account of an Eligible Institution (as defined below). If any of the shares surrendered hereby are owned by two or more joint owners, all such owners must sign the Election Form and Letter of Transmittal exactly as written on the face of the certificate(s). If any shares are registered in different names on several certificates, it will be necessary to complete, sign and submit as many separate Election Forms and Letters of Transmittal as there are different registrations. Election Forms and Letters of Transmittal executed by trustees, executors, administrators, guardians, attorneys-in-fact, officers of corporations or others acting in a fiduciary capacity who are not identified as such to the registration must be accompanied by proper evidence of the signatory’s authority to act.

6. Guarantee of Signatures: No signature guarantee is required on the Election Form and Letter of Transmittal if (a)(i) the Election Form and Letter of Transmittal is signed by the registered holder(s) (including any participant in the Book-Entry Transfer Facility’s systems whose name appears on a security position listing as the owner of such shares) of shares surrendered with the Election Form and Letter of Transmittal and (ii) such registered holder has not completed either the box entitled “Special Delivery Instructions” or the box entitled “Special Payment and Issuance Instructions” on the Special Payment and Delivery Form; or (b) such shares are surrendered for the account of a firm that is a bank, broker, dealer, credit union, savings association or other entity which is a member in good standing of the Securities Transfer Agents’ Medallion Program (each, an “Eligible Institution”). In all other cases, all signatures on the Election Form and Letter of Transmittal must be guaranteed by an Eligible Institution.

7. Special Payment and Issuance Instructions: If the merger consideration is to be made payable to or registered in a name other than the name(s) that appear(s) on the surrendered certificate(s), indicate the name(s) and address in the box captioned “Special Payment and Issuance Instructions” on the Special Payment and Delivery Form and include such Form with your Election Form and Letter of Transmittal and any certificate(s) if applicable. The stockholder(s) named will be considered the record owner(s) and should complete the section entitled “Signatures Required” and the Substitute Form W-9 (or the appropriate IRS Form W-8 if you are a non-U.S. stockholder, a copy of which can be obtained at www.irs.gov). If the section entitled “Special Payment and Issuance Instructions” is completed, then signatures on the Election Form and Letter of Transmittal must be guaranteed by a firm that is an Eligible Institution. If the surrendered stock certificate(s) are registered in the name of a person other than the signer of the Election Form and Letter of Transmittal, or if issuance is to be made to a person other than the signer of the Election Form and Letter of Transmittal or if the issuance is to be made to a person other than the registered owner(s), then the surrendered certificate(s) must be endorsed or accompanied by duly executed stock powers, in each case signed exactly as the name(s) of the registered owner(s) appear on such certificate(s) or stock power(s), with the signatures on the certificate(s) or stock power(s) guaranteed by an Eligible Institution as provided herein.

8. Special Delivery Instructions: If the merger consideration is to be delivered to another address than that set forth on the Election Form and Letter of Transmittal, indicate the address in the box captioned “Special Delivery Instructions” on the Special Payment and Delivery Form and include such Form with your Election Form and Letter of Transmittal and any certificate(s) if applicable. If the section entitled “Special Delivery Instructions” is completed, then signatures on the Election Form and Letter of Transmittal must be guaranteed by a firm that is an Eligible Institution.

9. IRS Form W-9: Under U.S. Federal income tax law, a non-exempt stockholder is required to provide the Exchange Agent with such stockholder’s correct Taxpayer Identification Number (“TIN”) on the enclosed Internal Revenue Service (“IRS”) Form W-9. If the certificate(s) are in more than one name or are not in the name of the actual owner, consult the instructions included on the enclosed IRS Form W-9 for additional guidance on which number to report. Failure to provide the information on the form may subject the surrendering stockholder to U.S. federal income tax withholding (currently at a rate of 28% and scheduled to increase to 31% in 2013) on the payment of any cash. If a TIN has not been issued to a surrendering stockholder and such stockholder has applied for a number or intends to apply for a number in the near future, such stockholder must write “Applied For” in the space for the TIN on the enclosed IRS Form W-9. If a TIN has been applied for and the Exchange Agent is not provided with a TIN before payment is made, backup withholding (currently at a rate of 28% and scheduled to increase to 31% in 2013) will apply to all payments to such surrendering stockholders of any cash consideration due for their former shares. Please review the instructions included on the enclosed IRS Form W-9 for additional information.

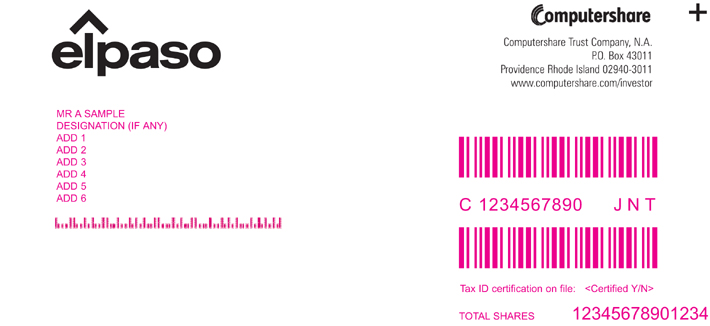

| If delivering by mail: | If delivering by courier: | |||

| Computershare Trust Company, N.A. c/o Voluntary Corporate Actions P.O. Box 43011 Providence, RI 02940-3011 |

Computershare Trust Company, N.A. c/o Voluntary Corporate Actions Suite V 250 Royall Street Canton, MA 02021 |

For Information Call MacKenzie Partners, Inc. at (800) 322-2885.