Attached files

| file | filename |

|---|---|

| 8-K - SUNOCO LOGISTICS PARTNERS LP--FORM 8-K - Energy Transfer Operating, L.P. | d290216d8k.htm |

Fourth Quarter 2011

Earnings Conference Call

January 26, 2012

Sunoco Logistics Partners L.P.

Exhibit 99.1 |

Forward-Looking Statements

2

You should review this slide presentation in conjunction with the fourth

quarter 2011 earnings conference call for Sunoco Logistics

Partners L.P., held on January 26 at 4:30 p.m. ET. You may listen to

free) 888-790-3592. International callers should dial

517-308-9379. Please enter Conference ID “Sunoco

Logistics.” Audio replays of the conference call will be

available for two weeks after the conference call beginning

approximately two hours following the completion of the call. To access the replay, dial 888-282-

0036. International callers should dial

203-369-3022. During the

call, those statements we make that are not historical facts are forward-looking statements.

These forward-looking statements are not guarantees of future

performance. Although we believe the assumptions underlying these

statements are reasonable, investors are cautioned that such forward-looking

statements involve risks and uncertainties that may affect our business

and cause actual results to differ materially from those discussed

during the conference call. Such risks and uncertainties include economic,

business, competitive and/or regulatory factors affecting our business,

as well as uncertainties related to the outcomes of pending or

future litigation. Sunoco Logistics Partners L.P. has included in its Annual Report

on Form 10-K for the year ended December 31, 2010, and in its

subsequent SEC filings, cautionary language identifying important

factors (though not necessarily all such factors) that could cause future outcomes to

differ materially from those set forth in the forward-looking

statements. For more information about these any obligation to update or alter these forward-looking statements,

whether as a result of new information, future events or

otherwise. This presentation includes certain non-GAAP financial measures

intended to supplement, not substitute for, comparable GAAP

measures. Reconciliations of non-GAAP financial measures to GAAP

financial measures are provided in the slides at the end of the

presentation. You should consider carefully the comparable

GAAP measures and the reconciliations to those measures provided in this presentation.

the

audio

portion

of

the

conference

call

on

our

website

at

www.sunocologistics.com

or

by

dialing

(USA

toll-

factors,

see

our

SEC

filings,

available

on

our

website

at

www.sunocologistics.com.

We

expressly

disclaim |

Highlights

Record quarterly performance:

•

$165 million Adjusted EBITDA

•

$110 million Distributable Cash Flow (DCF)

Record full year performance:

•

$544 million Adjusted EBITDA

•

$388 million Distributable Cash Flow

•

$665 million of Expansion Capital Spending

3

Note: Fourth quarter and full year Adjusted EBITDA and DCF

include an $11million charge for regulatory obligations

recognized in

connection with the Partnership’s impairment assessment of certain assets affected by Sunoco, Inc.’s

announcement to exit

its refining operations |

Highlights

Grew ratable business 14% year over year

Completed

a

three-for-one

unit

split

(1)

on

December

2

nd

Increased

distribution

for

27

th

consecutive

quarter

2012 Guidance:

•

Increase the cash distribution by 7 %

•

Approximately $300 million of organic expansion capital

•

Approximately $50 million of maintenance capital

(1)

All unit and per unit information presented herein is on a

post-split basis. 4 |

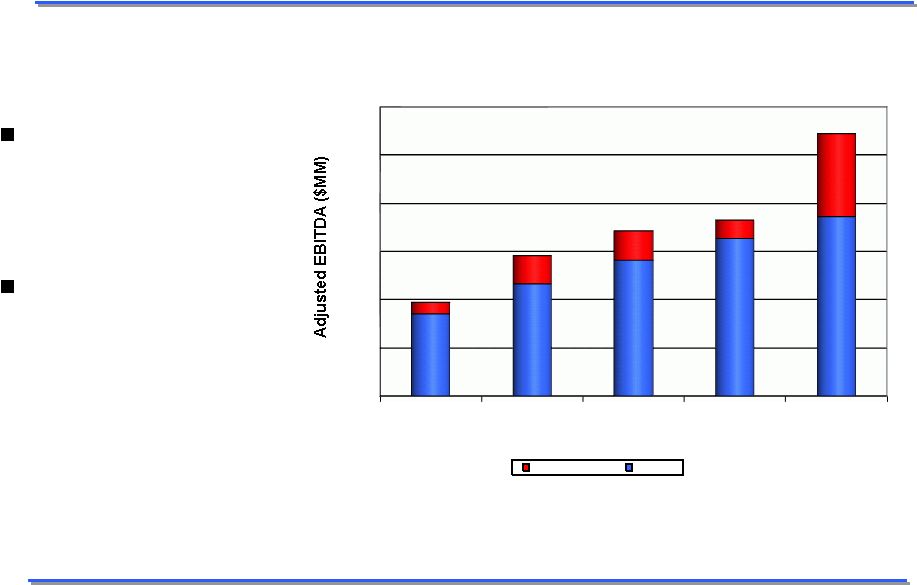

Segment EBITDA:

Segment Change 2007-2011YTD Adjusted EBITDA: Ratable and Market

Related Maximize asset base by

taking advantage of

market opportunities

Distributions based on

ratable cash

•

Market related cash

flow increases

coverage ratio

193

291

343

366

544

0

100

200

300

400

500

600

2007

2008

2009

2010

2011

Year

Market Related

Ratable

5 |

Record Expansion Capital Growth

2011 expansion capital of $665 million included record organic

and acquisition growth.

(1)

Includes inventory.

(amounts in millions)

Full Year Ended

December 31,

2011

Calculation of Expansion Capital:

Organic Expansion Capital

171

$

Major Acquisitions

(1)

494

Total Expansion Capital

665

$

6

|

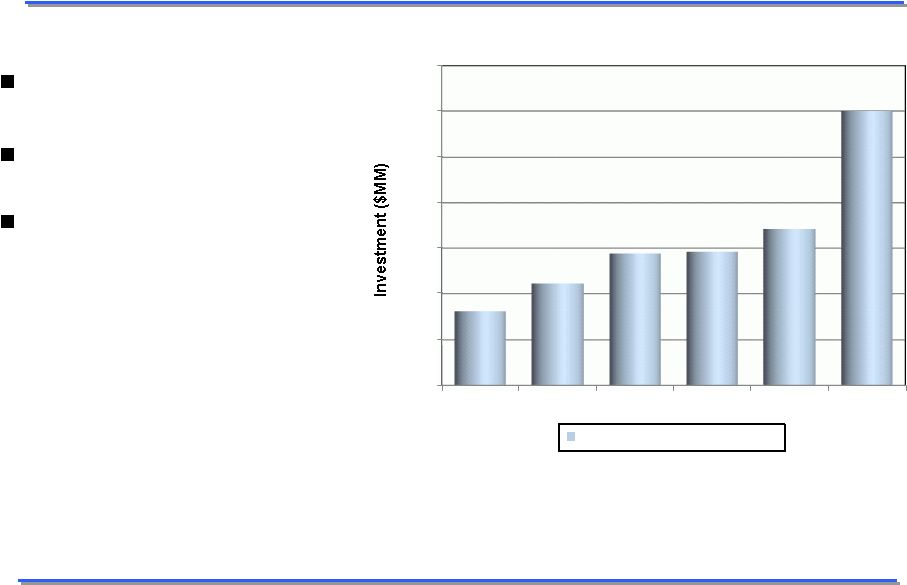

Organic Expansion Capital

7

Optimize current asset base

Invest in organic extensions

•

Butane blending

•

Nederland

•

Eagle Point

•

Mariner West

•

West Texas Crude Expansion

2012 Organic investment

projected to be approximately

$300 million including:

0

50

100

150

200

250

300

350

2007

2008

2009

2010

2011

2012P

Organic Expansion Capital |

2011 Acquisitions

Texon Crude Business w/exposure to shales in:

Bakken, Granite Wash, Permian & Eagleford

Eagle Point Tank Farm

Inland Pipeline (84% interest)

East Boston Products Terminal

8 |

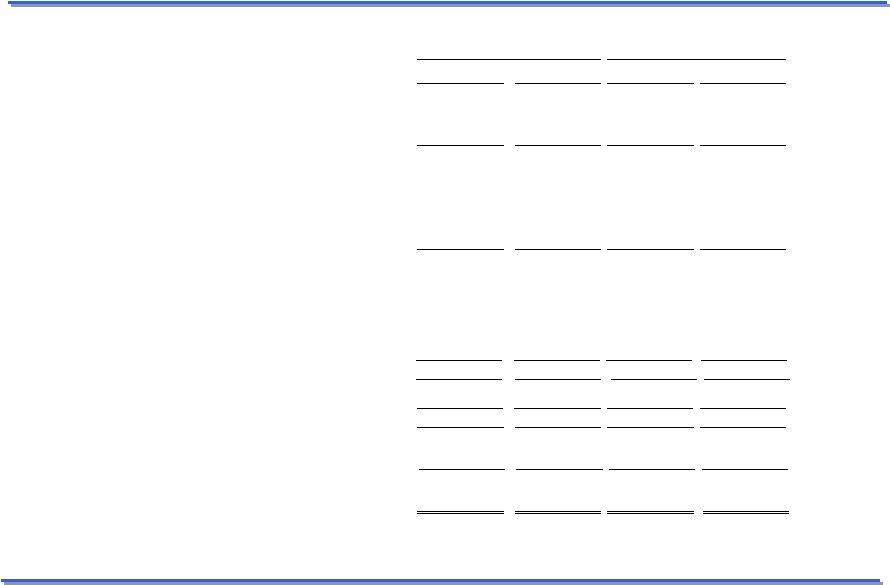

Q4 2011 Financial Highlights

(amounts in millions)

9

Three Months Ended

Full Year Ended

December 31,

December 31,

2011

2010

2011

2010

Sales and other operating revenue

3,376

$

2,223

$

10,905

$

7,808

$

Other income

4

5

13

30

Total revenues

3,380

2,228

10,918

7,838

Cost of products sold and operating expenses

3,178

2,103

10,264

7,398

Depreciation and amortization

25

19

86

64

Impairment charge and related matters

42

3

42

3

Selling, general and administrative expenses

23

20

90

72

Total costs and expenses

3,268

2,145

10,482

7,537

Operating income

112

83

436

301

Interest cost and debt expense

28

21

96

78

Capitalized interest

(2)

(2)

(7)

(5)

Gain on investments in affiliates

-

-

-

128

Income before provision for income taxes

86

64

347

356

Provision for income taxes

7

4

25

8

Net Income

79

60

$

322

348

$

Net income attributable to noncontrolling

interests

3

1

9

2

Net Income attributable to Sunoco Logistics

Partners L.P.

76

$

59

$

313

$

346

$

|

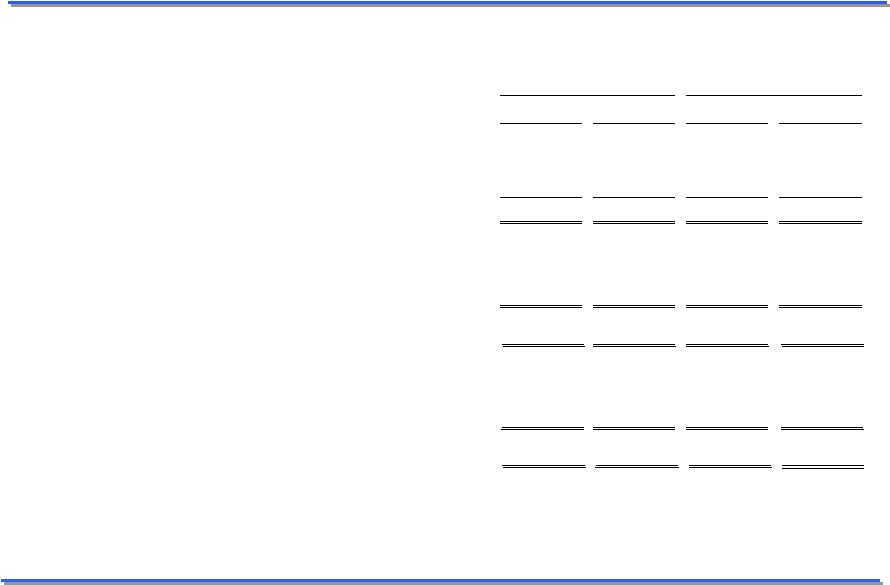

Q4 2011 Financial Highlights

(amounts in millions, except per unit amounts)

10

Three Months Ended

Full Year Ended

December 31,

December 31,

2011

2010

2011

2010

Calculation of Limited Partners' interest:

Net Income attributable to Sunoco Logistics Partners L.P.

76

$

59

$

313

$

346

$

Less: General Partner's interest

(14)

(12)

(54)

(48)

Limited Partners' interest in Net Income

62

$

47

$

259

$

298

$

Net Income per Limited Partner unit:

Basic

0.60

$

0.47

$

2.56

$

3.13

$

Diluted

0.60

$

0.47

$

2.54

$

3.11

$

Weighted Average Limited Partners' units outstanding:

Basic

103.3

99.2

101.3

95.2

Diluted

103.8

99.7

101.8

95.7

(1)

Amounts reflect the three-for-one unit split in the fourth

quarter 2011. (1)

(1) |

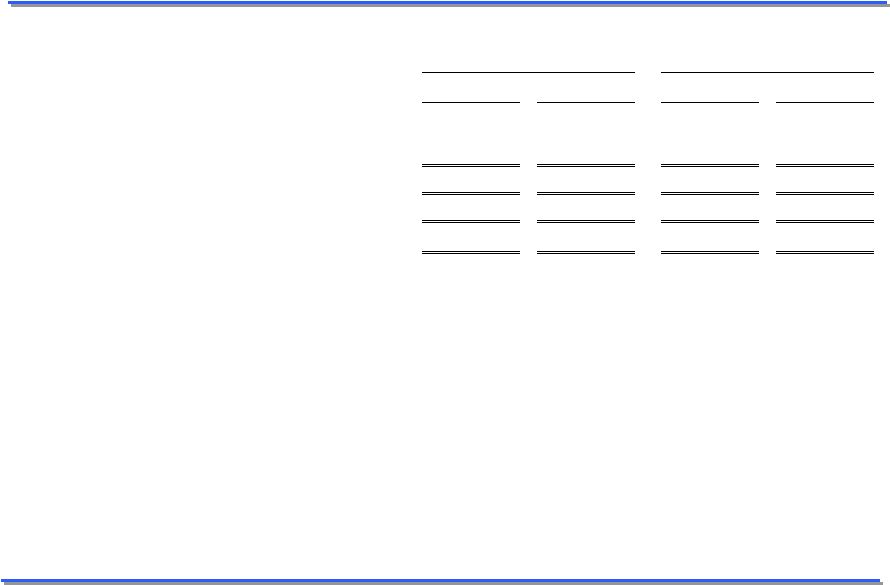

Refined Products Pipelines

(financial amounts in millions)

11

Three Months Ended

Full Year Ended

December 31,

December 31,

2011

2010

2011

2010

Financial Highlights

Sales and other operating revenue

37

$

29

$

130

$

120

$

Operating income

9

$

10

$

33

$

44

$

Depreciation and amortization expense

4

$

3

$

17

$

15

$

Adjusted EBITDA

(1)

12

$

13

$

49

$

59

$

Operating Highlights

(2)(3)

Pipeline throughput (thousands of bpd)

599

442

522

468

Pipeline revenue per barrel (cents)

67.5

71.7

68.3

70.0

(1)

(2)

(3)

Amounts exclude earnings attributable to noncontrolling interests.

Excludes amounts attributable to equity interests which are not

consolidated. In May 2011, the Partnership acquired a controlling

financial interest in the Inland refined products pipeline. As a result of this acquisition, the Partnership

accounted for this entity as a consolidated subsidiary from the

acquisition date. Volumes for the twelve months ended December 31, 2011 of 88 thousand bpd and

the related revenue per barrel, have been included in the consolidated

totals. From the date of acquisition, this pipeline had actual throughput of approximately

140

thousand

bpd

for

the

twelve

months

ended

December

31,

2011. |

Terminal Facilities

(financial amounts in millions)

12

Three Months Ended

Full Year Ended

December 31,

December 31,

2011

2010

2011

2010

Financial Highlights

Sales and other operating revenue

156

$

99

$

435

$

287

$

Operating income

(11)

$

21

$

85

$

95

$

Depreciation and amortization expense

10

$

8

$

34

$

26

$

Adjusted EBITDA

(1)

30

$

32

$

150

$

124

$

Operating Highlights

Terminal throughput (thousands of bpd):

(2)

Refined products terminals

514

502

492

488

Nederland terminal

692

724

757

729

Refinery terminals

505

434

443

465

(1)

(2)

Amounts

include

an

$11

million

charge

for

regulatory

obligations

recognized

in

the

fourth

quarter

2011

in

connection

with

the

Partnership's

impairment

assessment

of

certain

assets

affected

by

Sunoco's

announcement

to

exit

its

refining

operations.

In

July

2011

and

August

2011,

the

Partnership

acquired

the

Eagle

Point

tank

farm

and

a

refined

products

terminal

located

in

East

Boston

Massachusetts,

respectively.

Volumes

for

these

acquisitions

are

included

from

their

acquisition

dates. |

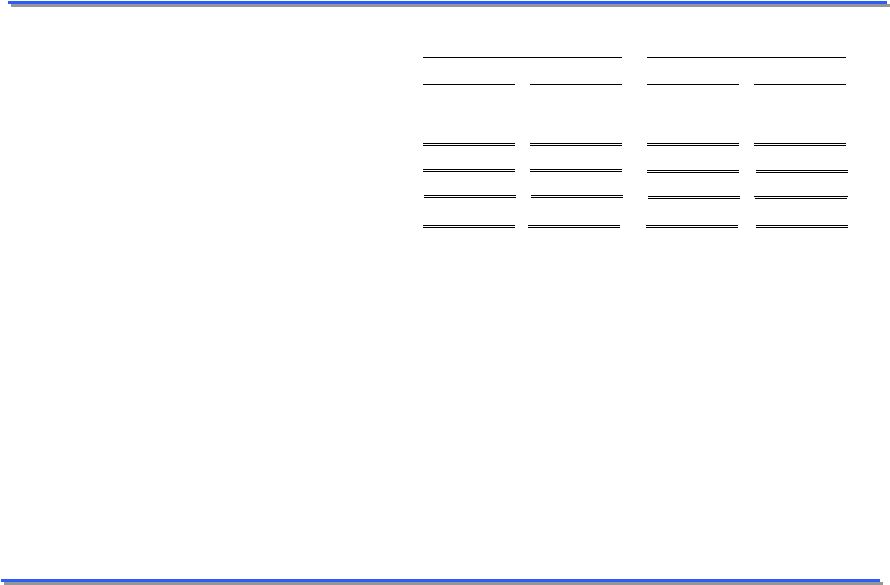

Crude Oil Pipelines

(financial amounts in millions)

13

Three Months Ended

Full Year Ended

December 31,

December 31,

2011

2010

2011

2010

Financial Highlights

Sales and other operating revenue

86

$

76

$

319

$

221

$

Operating income

52

$

36

$

181

$

126

$

Depreciation and amortization expense

6

$

7

$

25

$

21

$

Adjusted EBITDA

(1)

56

$

42

$

198

$

145

$

Operating Highlights

(2)(3)

Pipeline throughput (thousands of bpd)

1,577

1,592

1,587

1,183

Pipeline revenue per barrel (cents)

58.9

50.9

55.0

50.7

(1)

(2)

(3)

Amounts exclude earnings attributable to noncontrolling interests.

In July 2010, the Partnership acquired additional interests in

the Mid-Valley and West Texas Gulf crude oil pipelines, which previously

had been recorded as

equity investments. The Partnership obtained a controlling

financial interest as a result of these acquisitions and began accounting for these entities as

consolidated subsidiaries from their respective acquisition

dates. Volumes and the related revenues for the twelve months ended

December 31, 2010 of 278

thousand bpd have been included in the crude oil pipeline throughput

and revenue per barrel. From the date of acquisition, these pipelines had actual throughput

of approximately 696 thousand bpd for the three and twelve months ended

December 31, 2010. The amounts presented for the three and twelve month periods

ended December 31, 2011 include amounts attributable to these systems

for the entire period. Excludes amounts attributable to equity

interests which are not consolidated. |

Crude Oil Acquisition and Marketing

(financial amounts in millions)

14

Three Months Ended

Full Year Ended

December 31,

December 31,

2011

2010

2011

2010

Financial Highlights

Sales and other operating revenue

3,135

$

2,048

$

10,163

$

7,282

$

Operating income

62

$

16

$

137

$

36

$

Depreciation and amortization expense

5

$

1

$

10

$

2

$

Adjusted EBITDA

67

$

17

$

147

$

38

$

Operating Highlights

(1)

Crude oil purchases (thousands of bpd)

(2)

690

606

663

638

Gross margin per barrel purchased (cents)

(2)(3)

103.4

35.6

61.9

20.0

Average crude oil price (per barrel)

$94.02

$85.18

$95.14

$79.55

(1)

(2)

(3)

Represents total segment sales and other operating revenue minus

cost of products sold and operating expenses and depreciation and

amortization divided by total crude purchases.

The Crude Oil Acquisition and Marketing segment gathers, purchases,

markets and sells crude oil principally in Oklahoma and Texas. The segment consists of

approximately 140 crude oil transport trucks; and approximately 110

crude oil truck unloading facilities. Includes results from the

crude oil acquisition and marketing business acquired from Texon L.P. in August 2011 from the acquisition date. |

Q4 2011 Financial Highlights

(amounts in millions)

15

Three Months Ended

Full Year Ended

December 31,

December 31,

2011

2010

2011

2010

Capital Expenditure Data:

Maintenance capital expenditures

22

$

12

$

42

$

37

$

Expansion capital expenditures

69

58

171

137

Major Acquisitions

-

-

494

252

Total

91

$

70

$

707

$

426

$

December 31,

December 31,

2011

2010

Balance Sheet Data (at period end):

Cash and cash equivalents

5

$

2

$

Total debt

(2)(3)

1,698

$

1,229

$

Equity:

Sunoco Logistics Partners L.P. Equity

1,096

$

965

$

Noncontrolling interests

98

77

Total Equity

1,194

$

1,042

$

(1)

(2)

(3)

Total debt at December 31, 2010 includes the $100 million promissory

note to Sunoco, Inc. Includes July 2011 acquisition of Eagle

Point tank farm from Sunoco for $100 million, consisting of: Class A (deferred distribution)

units with a fair value of $98 million and $2 million in cash. This

related party transaction was recorded at Sunoco’s carrying value on

$22 million under generally accepted accounting principles.

As of December 31, 2011, the Partnership had available borrowing

capacity of $550 million under its revolving credit facilities.

(1) |

Non-GAAP Financial Measures

(amounts in millions)

(1)

Management of the Partnership believes Adjusted EBITDA and

distributable cash flow information enhances an investor's understanding of a business’

ability to generate

cash for payment of distributions and other purposes. Adjusted

EBITDA and distributable cash flow do not represent and should not be considered an alternative to net

income or cash flows from operating activities as determined under

United States generally accepted accounting principles (GAAP)

and may not be comparable to other

similarly titled measures of other businesses.

(2)

Amounts

exclude

earnings

attributable

to

noncontrolling

interests

and

include

an

$11

million

charge

for

regulatory

obligations

recognized

in

the

fourth

quarter

2011

in

connection with the Partnership's impairment assessment of certain

assets affected by Sunoco's announcement to exit its refining

operations.

16

Three Months Ended

Full Year Ended

December 31,

December 31,

2011

2010

2011

2010

Add: Interest expense, net

26

19

89

73

Add: Depreciation and amortization expense

25

19

86

64

Add: Impairment charge

31

3

31

3

Add: Provision for income taxes

7

4

25

8

Less: Gain on investments in affiliates

-

-

-

(128)

Adjusted EBITDA

(1)(2)

165

104

544

366

Less: Interest expense, net

(26)

(19)

(89)

(73)

Less: Maintenance capital expenditures

(22)

(12)

(42)

(37)

Less: Provision for income taxes

(7)

(4)

(25)

(8)

Distributable cash flow

(1)

110

$

69

$

388

$

248

$

313

$

346

$

59

$

76

$

Net Income attributable to Sunoco Logistics

Partners L.P. |