Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - PMI GROUP INC | d290777d8k.htm |

Exhibit 99.1

UNITED STATES BANKRUPTCY COURT

DISTRICT OF DELAWARE

| In re The PMI Group, Inc. |

Case No. 11-13730 (BLS) | |

| Reporting Period: 11/23/11-12/31/11 |

MONTHLY OPERATING REPORT

File with Court and submit copy to United States Trustee within 20 days after end of month

Submit copy of report to any official committee appointed in the case

| REQUIRED DOCUMENTS |

Form No. |

Document Attached |

Explanation Attached |

Debtor’s Statement | ||||

| Schedule of Cash Receipts and Disbursements |

MOR-1 | X | ||||||

| Bank Account Reconciliations, Bank Statements and Cash Disbursements Journal |

MOR-l(a) | X | ||||||

| Schedule of Professional Fees Paid |

MOR-1(b) | X | ||||||

| Statement of Operations |

MOR-2 | X | ||||||

| Balance Sheet |

MOR-3 | X | ||||||

| Status of Postpetition Taxes |

MOR-4 | X | ||||||

| Summary of Unpaid Postpetition Accounts Payable |

MOR-4(a) | X | ||||||

| Debtor Questionnaire |

MOR-5 | X |

I declare under penalty of perjury (28 U.S.C. Section 1746) that this report and the attached documents are true and correct to the best of my knowledge and belief.

|

|

| |

| Signature of Debtor |

Date | |

|

|

| |

| Signature of Joint Debtor |

Date | |

|

|

| |

| Signature of Authorized Individual* |

Date | |

| Donald P. Lofe, Jr. |

Executive Vice President, Chief Financial Officer and Chief Administrative Officer | |

| Printed Name of Authorized Individual |

Title of Authorized Individual | |

| * | Authorized individual must be an officer, director or shareholder if debtor is a corporation; a partner if debtor is a partnership; a manager or member if debtor is a limited liability company. |

NOTES TO MONTHLY OPERATING REPORT

The PMI Group, Inc., a debtor and debtor in possession (the “Company” or “Debtor”), hereby submits its Monthly Operating Report (the “MOR”).

1. Description of the Cases. On November 23, 2011 (the “Petition Date”), the Debtor filed a voluntary petition with the Bankruptcy Court for reorganization under Chapter 11 of the Bankruptcy Code. The Debtor is operating its business as a debtor-in-possession pursuant to sections 1107(a) and 1108 of the Bankruptcy Code.

2. Basis of Presentation. The MOR is limited in scope, covers a limited time period and has been prepared solely for the purpose of complying with the monthly reporting requirements to the United States Bankruptcy Court. The financial information in the MOR is preliminary and unaudited and does not purport to show the financial statements of the Debtor in accordance with Generally Accepted Accounting Principles (“GAAP”) and, therefore, may exclude items required by GAAP, such as certain reclassifications, eliminations, accruals, valuations and disclosure items. We caution readers not to place undue reliance upon the MOR. There can be no assurance that such information is complete and the MOR may be subject to revision.

The information contained in the MOR has been derived from the Debtor’s books and records in conjunction with information available from non-debtor affiliates. This information, however, has not been subject to procedures that would typically be applied to financial information presented in accordance with GAAP, and upon the application of such procedures, we believe that the financial information could be subject to changes and these changes could be material. The information furnished in this MOR includes primarily normal recurring adjustments but does not include all of the adjustments that would typically be made for financial statements prepared in accordance with GAAP. In addition, certain information and footnote disclosures normally included in financial statements prepared in accordance with GAAP have been condensed or omitted.

3. Recoveries and Causes of Action. The MOR, the Debtor’s Schedules of Assets and Liabilities and Statements of Financial Affairs may not include a complete list of causes of action it possesses as of the Petition Date or at any point thereafter. Regardless of the recoveries and causes of action listed, the Debtor reserves all of its rights with respect to any and all causes of action they may possess, including, but not limited to, avoidance actions or to assert any defenses, and nothing in this MOR shall be deemed a waiver or limitation of any of the Debtor’s rights to pursue any such causes of action or recovery or assert any defenses.

4. Reorganization Items. American Institute of Certified Public Accountant Statement of Position 90-7, “Financial Reporting by Entities in reorganization under the Bankruptcy Code” (“SOP 90-7”) requires separate disclosure of reorganization items such as realized gains and losses from the settlement of pre-petition liabilities, provisions for losses resulting from the reorganization and restructuring of the business as well as professional fees directly related to the process or reorganizing the Debtor under Chapter 11. Such items are reflected in the MOR as Bankruptcy Related Expenses.

5. Liabilities Subject to Compromise. As a result of the Chapter 11 filing, most pre-petition indebtedness is subject to compromise or other treatment under a plan of reorganization. Generally, actions to enforce or otherwise effect payment of pre-petition 11 liabilities are stayed. The Debtor has been paying and intends to continue to pay undisputed post-petition claims in the ordinary course of business. In addition, the Debtor may reject pre-petition executory contracts with respect to the Debtor’s operations with the approval of the Bankruptcy Court. Damages resulting from rejection of executory contracts are generally treated as general unsecured claims and will be classified as liabilities subject to compromise. The pre-petition liabilities that are subject to compromise are reported herein at the amounts expected to be allowed, although they may be settled for lesser amounts. The amounts currently classified as liabilities subject to compromise may be subject to future adjustments depending on Bankruptcy Court actions, further developments with respect to disputed claims, determinations of the secured status of certain claims, the values of any collateral securing such claims or other events. While GAAP requires fair market adjustments to certain obligations, including funded debt, this MOR states such obligations at notional value, including pre-petition accrued interest.

6. Post-petition Accounts Payable. To the best of the Debtor’s knowledge, all undisputed post-petition accounts payable have been and are being paid under agreed-upon payment terms.

7. Investments in Subsidiaries. Financial information related to any of the Debtor’s investments in its subsidiaries has been derived from the Debtor’s books and records in conjunction with the information available from non-debtor affiliates. Any information contained in this report pertaining to the Debtor’s investments in its subsidiaries should be viewed as preliminary and subject to revision. Given the timing of this filing, final loss provision and other expenses may not be reflected in the period in which they occur.

8. Non-Cash Compensation Expense. Prior to the Petition Date, certain employees of the Debtor and its subsidiaries were granted stock-based compensation (including options). The Debtor has not expensed or accrued post-petition expense for outstanding stock-based grants.

9. Notes Receivable. The Other Assets balance reported on the balance sheet of this report includes notes receivable that relate to investments made prior to 2002 to fund programs instituted, or to be instituted, by the Company or its subsidiaries. These programs are no longer in place and the Debtor is currently attempting to monetize these assets. The value assigned to these notes has been derived from the Debtor’s books and records in conjunction with the information available from non-debtor affiliates. The Debtor has not independently confirmed the outstanding balance on these notes receivable. These amounts may not represent fair market value and may be subject to significant revision.

The Debtor holds a Note Receivable of approximately $285 million plus accrued interest from an operating subsidiary. That subsidiary has been placed into receivership on an interim basis by its regulator due to a deficiency in regulatory capital; accordingly, the Debtor has provided a full valuation allowance against this note. The fair market value of this note and the amount that may ultimately be received in satisfaction thereof cannot be determined at this time.

2

10. Deferred Assets and Liabilities and Other Accruals. The Debtor has reversed certain accruals for pre-petition non-cash assets and liabilities, such as unamortized debt issuance expenses. There is significant uncertainty respecting the Debtor’s ability to utilize its deferred tax attributes; accordingly, a full valuation allowance has been applied to the deferred tax asset and no tax benefit or provision has been recognized.

3

The PMI Group, Inc.

Cash Receipts and Disbursements

November 23, 2011 to December 31, 2011

MOR—1

| Cash Receipts1 |

$ | 100,780 | ||

| Operating Disbursements |

||||

| Employee Compensation |

222,500 | |||

| Payroll Taxes |

8,664 | |||

| Employee Benefit Costs |

— | |||

| Consultants and Temporary Staff |

2,891 | |||

| Ordinary Course Professional Fees |

— | |||

| Intercompany Payments (non-employee) |

— | |||

| Travel |

— | |||

| Tax Payments |

36,000 | |||

| Board Compensation and Travel |

— | |||

| Other (misc. G&A and contingencies) |

82 | |||

|

|

|

|||

| Total Operating Disbursements |

270,137 | |||

| Bankruptcy Related Expenses |

||||

| Debtor Professionals |

— | |||

| UCC Professionals |

— | |||

| Claims Administrators |

— | |||

| US Trustee |

— | |||

|

|

|

|||

| Total Bankruptcy Disbursements |

— | |||

| Total Disbursements |

270,137 | |||

| Net Cash Flow |

(169,357 | ) | ||

| Beginning Cash Balance as of 11-23-2011 |

165,578,477 | |||

| Change in Cash |

(169,357 | ) | ||

|

|

|

|||

| Ending Cash Balance as of 12-31-2011 |

$ | 165,409,120 | ||

|

|

|

|||

| 1 | Primarily includes distributions from illiquid securities into BNY Mellon account |

The PMI Group, Inc.

Schedule of Bank Accounts and Balances

For the Month Ended December 31, 2011

MOR—1a

Note: All bank accounts have been reconciled for the period presented.

| Name of Bank |

Account Name |

Bank Account Number | Balance | |||||||

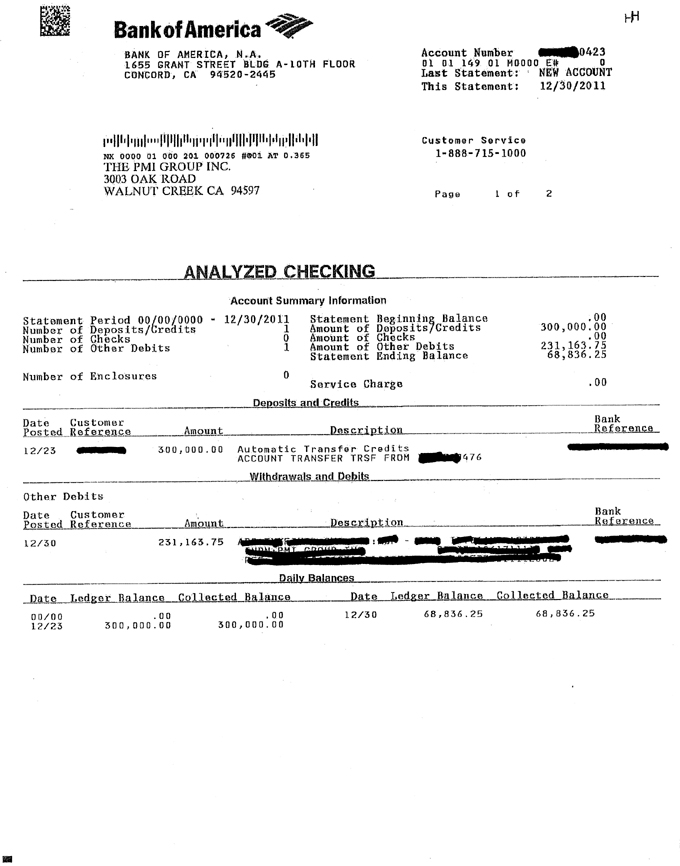

| Bank of America |

Main Account | xxxxxx0476 | $ | 165,011,449 | ||||||

| Bank of America |

Payroll Account | xxxxxx0423 | 68,836 | |||||||

| Bank of New York |

Cash Securities | xxx430 | 169,932 | |||||||

| Chemical Bank |

Gateway | xxxxxx1515 | 148,177 | |||||||

| First National Bank of Gordon |

Gateway | xxx251 | 10,726 | |||||||

|

|

|

|||||||||

| Total |

$ | 165,409,120 | ||||||||

|

|

|

|||||||||

The PMI Group, Inc.

Schedule of Professional Fees Paid

November 23, 2011 to December 31, 2011

MOR—1b

No Professional Fees were paid from November 23, 2011 through December 31, 2011.

STATEMENT OF OPERATIONS

THE PMI GROUP, INC.

For the Period of November 23, 2011 through December 31, 2011

MOR—2

| Total Revenues |

$ | — | ||

| Payroll |

222,500 | |||

| Other Recurring Expenses |

185,519 | |||

|

|

|

|||

| Total Recurring Expenses |

408,019 | |||

| Non-Recurring Expenses—Bankruptcy Related |

639,767 | |||

|

|

|

|||

| Total Expense |

1,047,787 | |||

| Interest and Dividends |

17,926 | |||

| Equity Earnings |

(3,488,570 | ) | ||

| Gain (Loss) on Investments |

(112 | ) | ||

|

|

|

|||

| Net Investment Income |

(3,470,756 | ) | ||

|

|

|

|||

| Income (Loss) before Tax |

(4,518,543 | ) | ||

|

|

|

|||

| Tax Provision |

— | |||

|

|

|

|||

| Net Income (Loss) |

$ | (4,518,543 | ) | |

|

|

|

|||

BALANCE SHEET

THE PMI GROUP, INC.

For the Month Ended December 31, 2011

MOR—3

| Assets |

||||

| Fixed Income Securities |

$ | 1,697,364 | ||

| Cash |

165,409,120 | |||

| Investments in Subsidiaries |

53,423,528 | |||

| Accounts Receivable—Affiliates |

2,030,425 | |||

| Pre-paid Assets |

10,279,503 | |||

| Other Assets |

697,645 | |||

|

|

|

|||

| Total Assets |

$ | 233,537,585 | ||

|

|

|

|||

| Liabilities Not Subject to Compromise |

||||

| Accrued Expenses |

$ | 796,510 | ||

| Accounts Payable |

24,107 | |||

| Accounts Payable—Intercompany |

64,112 | |||

| Other Liabilities |

71,999 | |||

|

|

|

|||

| Liabilities Not Subject to Compromise |

$ | 956,729 | ||

| Liabilities Subject to Compromise |

||||

| Pre-Petition Bond Debt |

$ | 744,074,292 | ||

| Gateway Liability |

262,000 | |||

| Accounts Payable |

49,197 | |||

| Accounts Payable—Intercompany |

21,579,113 | |||

|

|

|

|||

| Liabilities Subject To Compromise |

$ | 765,964,601 | ||

|

|

|

|||

| Total Liabilities |

$ | 766,921,330 | ||

|

|

|

|||

| Equity |

||||

| Common Stock |

$ | 1,970,788 | ||

| Additional Paid In Capital and Accumulated Deficit |

738,050,374 | |||

| Treasury Shares |

(1,273,404,907 | ) | ||

|

|

|

|||

| Total Shareholder Equity |

$ | (533,383,746 | ) | |

|

|

|

|||

| Total Liabilities & Equity |

$ | 233,537,585 | ||

|

|

|

|||

The PMI Group, Inc.

Summary of Post-Petition Taxes

For the Month Ended December 31, 2011

MOR—4

Representation: To the best of its knowledge, The PMI Group, Inc. has paid its taxes due as of 12-31-2011.

The PMI Group, Inc.

Summary of Post-Petition Debts

For the Month Ended December 31, 2011

MOR—4a

Unpaid Post-Petition Debts

| Current | 0-31 Days | 31-60 Days | 61-90 Days | Over 90 Days | Total | |||||||||||||||||||

| Total Operating Payables |

$ | 24,076 | $ | — | $ | — | $ | — | $ | — | $ | 24,076 | ||||||||||||

| Total Bankruptcy Related Payables |

$ | 31 | $ | — | $ | — | $ | — | $ | — | $ | 31 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total Post-Petition Payables |

$ | 24,107 | $ | — | $ | — | $ | — | $ | — | $ | 24,107 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

The PMI Group, Inc.

Debtor Questionnaire

For the Month Ended December 31, 2011

MOR—5

DEBTOR QUESTIONNAIRE

| Must be completed each month |

Yes |

No | ||

| 1. Have any assets been sold or transferred outside the normal course of business this reporting period? If yes, provide an explanation below. |

x | |||

| 2. Have any funds been disbursed from any account other than a debtor in possession account this reporting period? If yes, provide an explanation below. |

x | |||

| 3. Have all postpetition tax returns been timely filed? If no, provide an explanation below. |

x | |||

| 4. Are workers compensation, general liability and other necessary insurance coverages in effect? If no, provide an explanation below. |

x | |||

| 5. Has any bank account been opened during the reporting period? If yes, provide documentation identifying the opened account(s). If an investment account has been opened provide the required documentation pursuant to the Delaware Local Rule 4001-3. |

x |

Note: Documentation supporting the opening of a bank account to support payroll services is attached to this report.

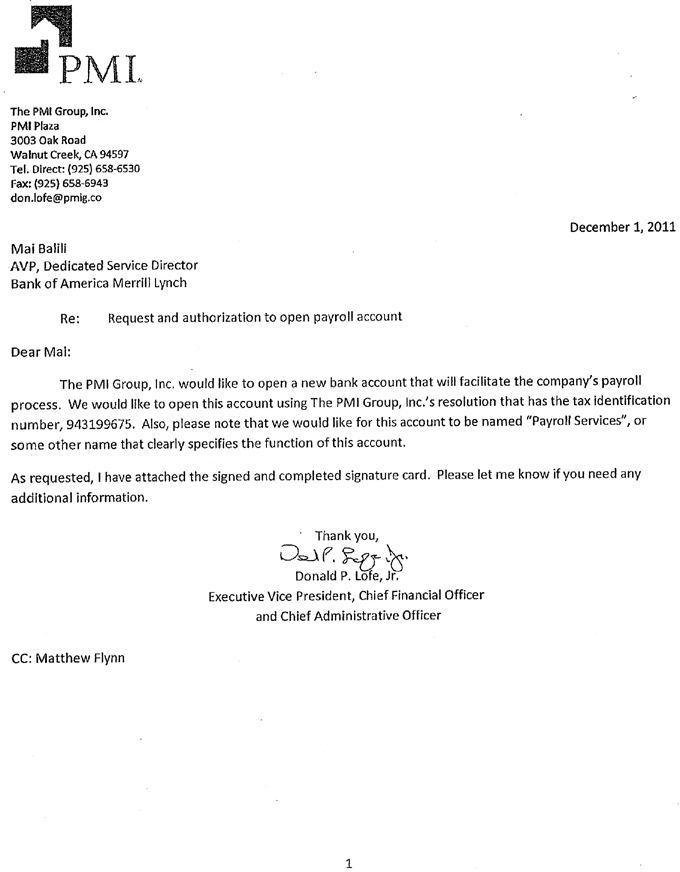

The PMI Group, Inc.

PMI Plaza

3003 Oak Road

Walnut Creek, CA 94597

Tel. Direct: (925) 658-6530

Fax: (925) 658-6943

don.lofe@pmig.co

December 1, 2011

Mai Balili

AVP, Dedicated Service Director

Bank of America Merrill Lynch

Re: Request and authorization to open payroll account

Dear Mai:

The PMI Group, Inc. would like to open a new bank account that will facilitate the company’s payroll process. We would like to open this account using The PMI Group, Inc.’s resolution that has the tax identification number, 943199675. Also, please note that we would like for this account to be named “Payroll Services”, or some other name that clearly specifies the function of this account.

As requested, I have attached the signed and completed signature card. Please let me know if you need any additional information.

‘Thank you,

Donald P. Lofe, Jr.

Executive Vice President, Chief Financial Officer

and Chief Administrative Officer

CC: Matthew Flynn

BANK OF AMERICA, N.A. 1655 GRANT STREET BLDG A-10TH FLOOR CONCORD, CA 9452- - 2445 Account Number 0423 01 01 149 01 M0000 E# 0 Last Statement: NEW ACCOUNT This Statement: 12/30/2011 NX 0000 01 000 301 000726 #@01 AT 0.365 THE PMI GROUP INC. 3003 OAK ROAD WALNUT CREEK CA 94597 Customer Service 1- 888-715-1000 Page 1 of 2 ANALYZED CHECKING Account Summary Information Statement Period 00/00/0000 Number of Deposits/Credits Number of Checks Number of Other Debits Number of Enclosures -12/30/2011 1 0 1 0 Statement Beginning Balance Amount of Deposit Credits Amount of Checks Amount of Other Debits Statement Ending Balance Service Charge .00 300,000,00 .00 231,163.75 68,836.25 .00 Deposits and Credits Date Customer Posted Reference Amount Description Bank Reference 300, 000 .00 AutomaticTransfer Credits ACCOUNT TRANSFER TRSF FROM476 Withdrawals and Debits 12/23 Other Debits

Date Customer Posted Reference Amount Description BanReference 12/30 23.1, 163.75 Dailv Balances Date Ledger Balance Collected Balance Ledger Collected Balance Balance 00/00 Date 12/23 .00 300,000.00 . 00 300,000.00 12/30 68,836 .25 68,836.25