Attached files

| file | filename |

|---|---|

| EX-99.4 - EX-99.4 - EASTMAN CHEMICAL CO | d290397dex994.htm |

| 8-K - FORM 8-K - EASTMAN CHEMICAL CO | d290397d8k.htm |

| EX-99.7 - EX-99.7 - EASTMAN CHEMICAL CO | d290397dex997.htm |

| EX-99.1 - EX-99.1 - EASTMAN CHEMICAL CO | d290397dex991.htm |

| EX-99.3 - EX-99.3 - EASTMAN CHEMICAL CO | d290397dex993.htm |

| EX-99.5 - EX-99.5 - EASTMAN CHEMICAL CO | d290397dex995.htm |

| EX-99.6 - EX-99.6 - EASTMAN CHEMICAL CO | d290397dex996.htm |

Eastman’s Acquisition of Solutia:

Strengthening a Top-Tier Specialty

Chemical Company

January 27, 2012

Exhibit 99.2 |

Forward-Looking Statements

This communication includes forward-looking statements subject to the safe

harbor provisions of the federal securities laws. Forward-looking

statements include, but are not limited to, statements regarding Eastman’s current expectations regarding

the timing of completion of the proposed acquisition, the expected benefits of the

proposed acquisition, integration plans and expected synergies therefrom,

and Eastman’s anticipated future financial and operating performance and results, including

estimates for general economic conditions and growth. Such expectations are based

upon certain preliminary information, internal estimates, and management

assumptions, expectations, and plans, and are subject to a number of risks and

uncertainties inherent in projecting future conditions, events, and results.

Actual results could differ materially from expectations expressed in the

forward-looking statements if one or more of the underlying assumptions or expectations

prove to be inaccurate or are unrealized. Important factors that could cause

actual results to differ materially from such expectations are and will be

detailed in the company’s filings with the Securities and Exchange Commission (“SEC”),

including

the

Quarterly

Report

on

Form

10-Q

for

the

quarter

ended

September

30,

2011

that

has

been

filed

with

the

SEC,

as

well as the Annual Report on Form 10-K for the fiscal year ended December 31,

2011 and the proxy statement/prospectus that will be included in the

Registration Statement on Form S-4 that Eastman will file with the SEC in connection with the

proposed

acquisition.

Filings

made

by

Eastman

are

available

when

filed

with

the

SEC,

on

the

Eastman

web

site

at

www.eastman.com in the Investors, SEC Information section.

Additional Information and Where to Find it

Eastman will file with the SEC a registration statement on Form S-4 that will

include a proxy statement of Solutia and a prospectus of Eastman relating to

Eastman’s proposed acquisition of Solutia. WE URGE INVESTORS AND SECURITY

HOLDERS TO READ THE REGISTRATION STATEMENT AND PROXY STATEMENT/PROSPECTUS AND ANY

OTHER RELEVANT

DOCUMENTS

WHEN

THEY

BECOME

AVAILABLE,

BECAUSE

THEY

WILL

CONTAIN

IMPORTANT

INFORMATION about Eastman, Solutia, and the proposed acquisition. Investors and

security holders will be able to obtain these materials (when they are

available) and other documents filed with the SEC free of charge at the SEC’s website,

www.sec.gov. In addition, copies of the registration statement and proxy

statement/prospectus (when they become available) may be obtained free of

charge by accessing Eastman’s website at www.eastman.com by clicking on the

“Investors”

link

and

then

clicking

on

the

“SEC

Information”

link

or

by

writing

Eastman

at

P.O.

Box

431,

Kingsport,

Tennessee

37662, Attention: Investor Relations. Security holders may also read and copy any

reports, statements and other information filed by Eastman with the SEC, at

the SEC public reference room at 100 F Street, N.E., Washington D.C. 20549. Please call

the SEC at 1-800-SEC-0330 or visit the SEC’s website for further

information on its public reference room. 2 |

3

Non-GAAP Financial Measures

Certain Eastman financial measures referenced in this presentation are non-GAAP

financial measures (earnings per share, operating earnings, and

cash-flow from operating activities) that exclude asset impairments and

restructuring charges and early debt extinguishment costs. A reconciliation to the most

directly comparable

GAAP

financial

measures

and

other

associated

disclosures,

including

a

description

of

the

asset impairments and restructuring charges and early debt extinguishment costs are

available in our fourth- quarter and full-year financial results news

release and the tables accompanying the news release available at

www.investors.eastman.com.

Participants in the Solicitation

Eastman, Solutia, and certain of their respective directors, executive officers and

other persons may be deemed to be participants in the solicitation of

proxies in respect of the proposed acquisition. Information regarding

Eastman’s directors and executive officers is available in Eastman’s proxy statement filed with

the SEC on March 24, 2011 in connection with its 2011 annual meeting of

stockholders, and information regarding Solutia’s directors and

executive officers is available in Solutia’s proxy statement filed with the

SEC on March 4, 2011 in connection with its 2011 annual meeting of stockholders.

Other information regarding persons who may be deemed participants in the

proxy solicitation and a description of their direct and indirect interests,

by security holdings or otherwise, will be contained in the registration statement and

proxy statement/prospectus and other relevant materials to be filed with the SEC

when they become available.

Non-Solicitation

This communication does not constitute an offer to sell or the solicitation of an

offer to buy any securities, nor

shall

there

be

any

sale

of

securities

in

any

jurisdiction

in

which

such

offer,

solicitation,

or

sale

would be

unlawful prior to registration or qualification under the securities laws of any

such jurisdiction. |

Agenda

Review of 4Q / FY 2011 Eastman results

Transaction overview

Strategic rationale

Solutia overview and strategic fit

Financial summary and EPS forecast update

Summary

4 |

4Q11

financial results – Corporate

($ in millions, except EPS)

4Q11

4Q10

Change

Sales revenue

$1,723

$1,463

18 %

Volume effect

5 %

Price effect

11 %

Product mix effect

2 %

Exchange rate effect

--

%

Operating earnings

$163

$187

EPS from continuing operations

$0.71

$0.70

Sales revenue increased due to:

•

Selling prices

11%

•

Sales volume

5%

Operating earnings declined primarily in the Specialty Plastics and PCI

segments 5

5

in response to higher raw material and energy costs

primarily in PCI |

Full-year 2011 financial results –

Corporate

6

($ in millions, except EPS)

FY11

FY10

Change

Sales revenue

$7,178

$5,842

23 %

Volume effect

7 %

Price effect

14 %

Product mix effect

2 %

Exchange rate effect

--

%

Operating earnings

$1,013

$891

EPS from continuing operations

$4.56

$3.48

Sales revenue increased due to:

•

Selling prices

14%

•

Sales volume

7%

of a previously idled olefins cracking unit, and strengthened end-use demand

primarily for CASPI segment products

in response to higher raw material and energy costs

primarily due to growth in PCI plasticizer product lines, the restart

Operating earnings increased primarily due to higher selling prices more than

offsetting higher raw material and energy costs and higher sales

volume |

Eastman to acquire Solutia

Transaction overview

7

Purchase

price and

transaction

value

Each Solutia share exchanged for $22.00 in cash and 0.12 share of Eastman

stock ~80% cash and ~20% stock consideration

$4.7 billion Total Enterprise Value

•

Includes

$3.4

billion

equity

value

plus

net

assumed

Solutia

debt

of

$1.3 billion

Value of $27.65 for each Solutia share

•

42% premium to the January 26, 2012 closing price of Solutia’s common

stock 9.0

times

2011

EBITDA

(1)

Financial

impact

Expected to be immediately accretive to Eastman earnings, excluding

acquisition-related costs and charges

Cost synergies of approximately $100 million identified and expected to be

achieved by year-end 2013

Significant tax benefit from utilization of Solutia NOLs

Eastman

free

cash

flow

(2)

over

next

2

years

expected

to

be

~$1

billion

Attractive return on capital

Closing

conditions

Solutia stockholder approval

Receipt of regulatory approvals

Other customary closing conditions

Timing

Closing expected in mid-2012

(1)

Solutia EBITDA defined as net income attributable to Solutia plus loss from

discontinued operations, income tax expense, interest expense, loss on debt extinguishment

or modification, depreciation and amortization, events affecting comparability,

non-cash share-based compensation expense and Primary Accelerators and Nylon

cost overhang all as reported by Solutia.

(2) Free cash flow defined as expected cash from operations minus expected

capital expenditures and dividends. |

Eastman’s strategic focus

Solutia acquisition consistent with all criteria

8

Growing core businesses

Bias toward emerging markets

Focus on sustainable businesses

Use JVA to execute our strategy

•

Complementary and adjacent key end markets (auto, architectural,

etc.)

•

Combination of technology and business capabilities drive significant

opportunities

•

~25% of Eastman pro forma 2011 revenue was in Asia Pacific (>$2 billion)

•

Leverages trend of growing middle class buying premium products

•

Building more manufacturing capacity in Asia Pacific to meet growth

•

Focus includes renewable resources and product safety

•

Expands

portfolio

of

sustainable

products

(energy

efficiency

and

safety) |

Solutia: Global leader in Specialty

Chemicals and Performance Materials

9

Headquartered in St. Louis, MO

3,400 employees

24 manufacturing

facilities,

>30 technical centers and sales

offices worldwide

Operates three business

segments:

•

Advanced Interlayers

Market leader in Saflex™

•

Performance Films

Market leader in Llumar™

•

Technical Specialties

Market leader in Crystex™

NYSE: SOA

2011 revenue of $2.1 billion and

EBITDA of $0.5 billion

Attractive 2011 EBITDA margin of

~25%

(1) Source: Solutia public filings and December 2011 Investor Day presentation

|

10

Solutia

Eastman

Exited Commodity and

Non-Core Businesses

Key Investments in

High Margin, Specialty

Focused Businesses

2001

2012

Beaumont, TX

Gasification

Project

CASPI Under-

performing

Lines

Polyethylene

PET

Nylon

Acrylic Fibers

Feed

Ingredients

Pharma

Dequest

UK & Korea

Filter Tow

Expansion

Hercules

Adhesives

Sterling

Chemicals

Genovique

Specialties

Southwall

Flexsys

EVA / Solar

Saflex

Expansion

Suzhou &

Kuantan

Investments

Strategic Improvement

Tritan™

Copolyester

Expansion

Strategic

actions

improved

portfolios

Market-

leading,

competitive

positions in

key products

Focus on

superior

financial

performance

Combining two strong companies |

Solutia acquisition accelerates

Eastman’s growth investment in

Asia Pacific

11

Source: Eastman and Solutia

Growing Presence in Asia-Pacific

% of Total Revenue

Eastman Asia Pacific revenue expected to grow from ~$1.7 billion

in 2011 to

>$3 billion in 2015 and higher than corporate EBITDA margins

Eastman Site

Solutia Site

19%

23%

28%

2008

2011

2015E post acquisition |

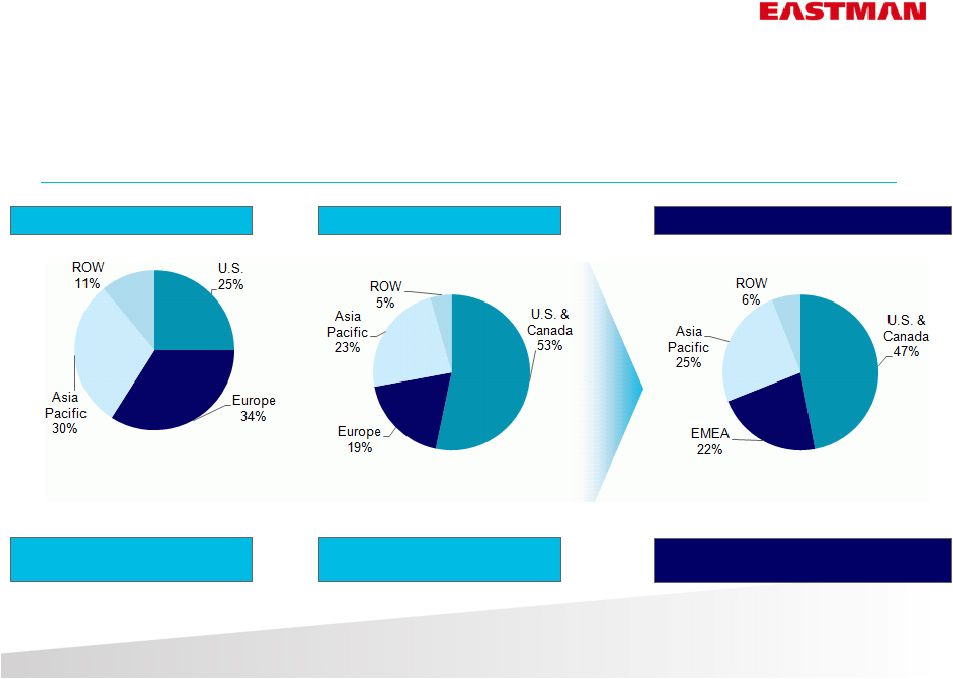

Eastman pro forma 2011

revenue by geography

Geographic diversity remains a source of strength

12

Solutia

Eastman pro forma

Eastman

Solutia 2011 revenue:

$2 billion

Eastman 2011 revenue:

$7 billion

Eastman pro forma 2011

revenue: $9 billion

2011 revenue by geography

Source: Eastman public filings and Solutia’s December 2011

Investor Day presentation |

Eastman pro forma 2011 revenue

by end-market

End-market diversity remains a source of strength

13

Solutia

Eastman pro forma

Eastman

Solutia 2011 revenue:

$2 billion

Eastman 2011 revenue:

$7 billion

Eastman pro forma 2011 revenue:

$9 billion

2011 revenue by end-market

Source: Eastman public filings and Solutia’s December 2011

Investor Day presentation |

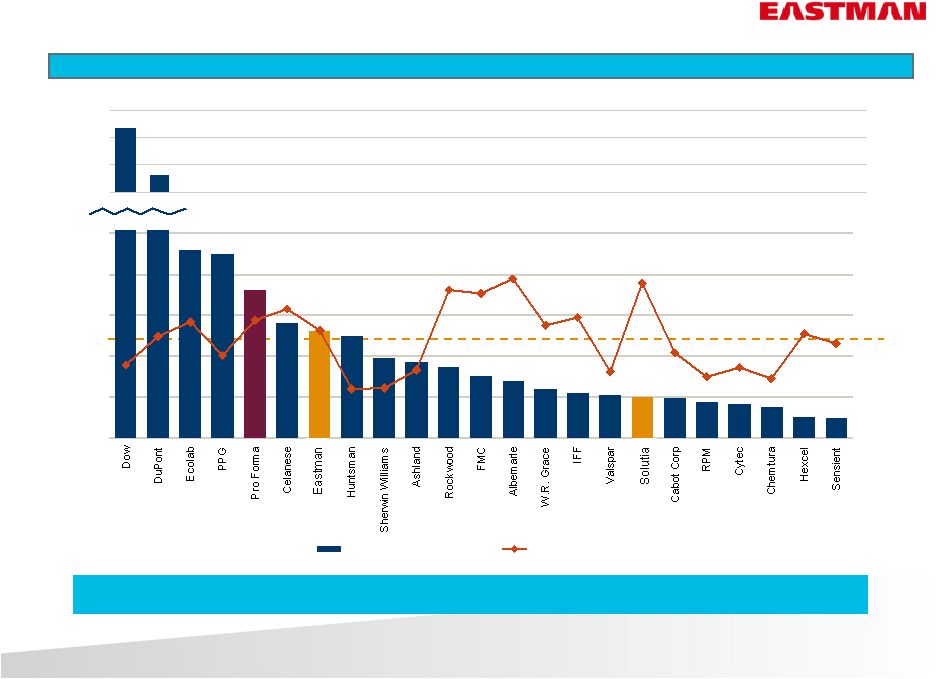

$6,000

$7,000

$8,000

$9,000

EBITDA

2011E EBITDA Margin

Top-tier Specialty Chemical Company

14

Source: IBES consensus estimates, for all other than Eastman, Solutia, and

Pro Forma; Eastman and Solutia from public filings Mean

peer

Margin

17.1%

2011 EBITDA and EBITDA Margins

2011 Eastman pro forma EBITDA $1.8 billion with ~20% EBITDA margin

$0

$500

$1,000

$1,500

$2,000

$2,500

5%

10%

15%

20%

25%

30%

EBITDA

EBITDA Margin |

Attractive capital structure

Benefits from low cost interest environment

15

Expect new debt financing will be composed of low-interest term loan and public

debt Bridge facility financing commitments in place from Citi and

Barclays Eastman pro forma Debt / EBITDA ratio expected at closing of

~2.8 Eastman pro forma expected to generate ~$1 billion of free cash flow

over next two years •

Expected cash flows and synergies to allow Eastman to delever quickly

Revolving facility of $750 million to remain undrawn at closing

Committed to maintaining current annual dividend rate of $1.04 per share

Eastman is committed to maintaining an investment grade credit rating

Cash from Solutia and Eastman

$ 600

New debt financing

$3,500

Eastman equity issued to Solutia stockholders

$ 700

$ in millions |

16

Achievable cost and tax synergies as

well as potential revenue opportunities

Track record from previous acquisitions and divestitures

gives us confidence in ability to realize synergies

~$100 million identified

•

Reduction of corporate

costs

•

Raw material and

procurement savings

•

Improved manufacturing

and supply chain

processes

Leveraging

technology from

both companies

Leveraging

complementary

business

capabilities

Leveraging key end-

market overlap

Cost synergies

Tax synergies

Revenue synergies

~$1.5 billion of NOL benefits

Eastman expects to utilize

over next 15 years, half in

next 3 years

~$150 million Foreign Tax

Credits that Eastman expects

to utilize over next 10 years

Geographic profile and entity

structure expected to enable

Eastman to reduce effective

tax rate |

Clear

path to completion Solutia stockholder approval

Receipt of necessary regulatory approvals

Completion of standard and customary closing

conditions

•

No financing contingency

•

Termination fee of $102 million

17

Expected to close by mid-2012 |

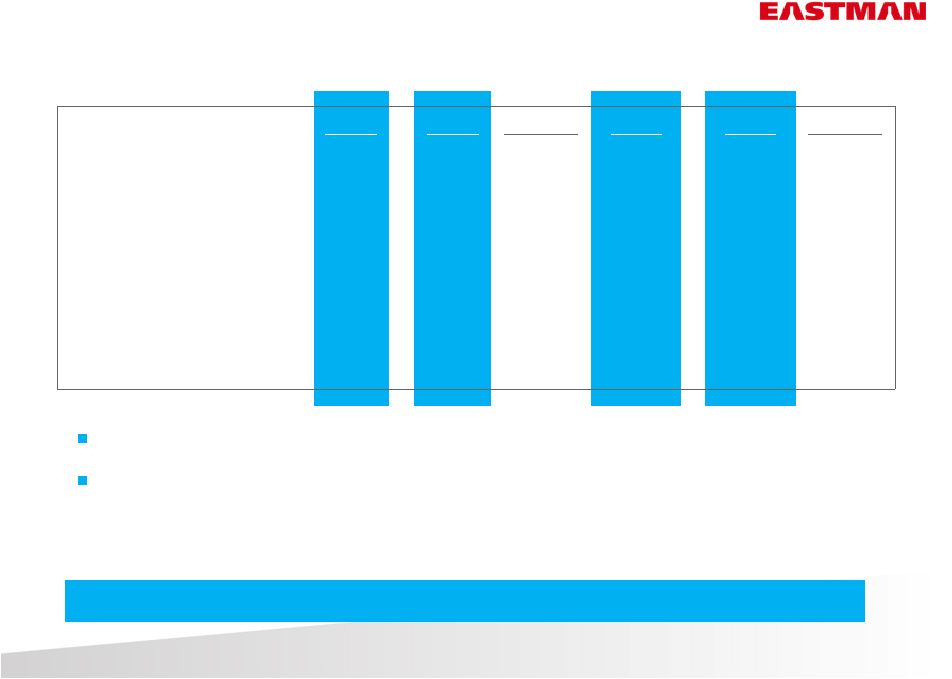

Acquisition expected to result in

strong 2013 EPS growth

Note: earnings per share estimates exclude acquisition related costs and

charges 2011

$/share

$4.56

~$5.00

>$6.00

2011

18

2012E

2013E |

Eastman + Solutia = A compelling value

Complementary and adjacent key end-markets

Combination of technology and business capabilities

drive significant opportunities

Expands presence in emerging markets, particularly

Asia Pacific

Clearly defined, executable cost and tax synergies

Committed to investment grade credit rating

Attractive return on capital

Expect significant EPS accretion

19 |

Appendix |

4

th

-Quarter

and

Full-Year

2011 Financial Results |

2011

accomplishments 22

Second consecutive year of increased earnings per share and

operating earnings for Eastman and for each of the four businesses

Sales revenue increased 23%

Continued progress on growth initiatives

•

Acquired Sterling Chemicals, Scandiflex, and Dynaloy

•

Completed

capacity

expansions

for

Regalite

TM

adhesives

and

first

phase of CHDM monomer for copolyesters

•

Broke ground on acetate tow joint venture with China National Tobacco

Corporation

Free cash flow $142 million

Returned cash to stockholders with dividend increases and share

repurchases

Note: Free cash flow is defined as cash from operations less capital

expenditures and dividends, excluding the tax payment for the gain on the

sale of the PET business completed first quarter 2011.

|

Update on 2011 outlook statements

23

4Q11 EPS expected to be higher than 4Q10 EPS of $0.70

Full-year 2011 EPS expected to be approximately $4.62

Expect

2011

free

cash

flow

to

be

between

$175

-

$200

million

Expect to make 2-3 acquisitions in 2011

Allocation of capital will continue to be disciplined

23 |

Financial results –

CASPI

($ in millions)

4Q11

4Q10

Change

FY11

FY10

Change

Sales revenue

$425

$379

12 %

$1,844

$1,574

17 %

Volume effect

3 %

5 %

Price effect

10 %

13 %

Product mix effect

--

%

(1 %)

Exchange rate effect

(1 %)

--

%

Operating earnings

$52

$53

$331

$299

4Q11 operating earnings relatively flat

FY11 operating earnings increased primarily due to higher selling prices, higher

sales volume, and the benefits from cracking propane, which more than

offset higher raw material and energy costs

Expect

2012

operating

earnings

to

be

approximately

$350

million

1

1

Does not include projected results from Solutia businesses

24 |

Financial results –

Fibers

($ in millions)

4Q11

4Q10

Change

FY11

FY10

Change

Sales revenue

$324

$300

8 %

$1,279

$1,142

12 %

Volume effect

1 %

3 %

Price effect

5 %

4 %

Product mix effect

2 %

5 %

Exchange rate effect

--

%

--

%

Operating earnings

$80

$78

$346

$326

4Q11 operating earnings increased primarily due to higher acetate tow sales

volume FY11 operating earnings increased primarily due to higher acetate tow

sales volume and higher selling prices more than offsetting higher raw

material and energy costs Expect

2012

operating

earnings

to

be

slightly

higher

than

2011

1

1

Does not include projected results from Solutia businesses

25 |

Financial results –

PCI

26

($ in millions)

4Q11

4Q10

Change

FY11

FY10

Change

Sales revenue

$697

$526

33 %

$2,860

$2,083

37 %

Volume effect

15 %

14 %

Price effect

14 %

19 %

Product mix effect

4 %

4 %

Exchange rate effect

--

%

--

%

Operating earnings

$42

$51

$296

$231

4Q11 operating earnings declined as higher selling prices were more than offset by

higher raw material and energy costs, particularly in Asia Pacific and

Europe FY11 operating earnings increased, particularly in North America,

primarily due to higher selling prices, higher sales volume, and the

increased benefits from cracking propane to produce low-cost propylene,

which more than offset higher raw material and energy costs Expect

2012

operating

earnings

to

be

approximately

$320

million

1

1

Does not include projected results from Solutia businesses

|

Financial results –

Specialty Plastics

27

($ in millions)

4Q11

4Q10

Change

FY11

FY10

Change

Sales revenue

$277

$258

7 %

$1,195

$1,043

15 %

Volume effect

(9 %)

(2 %)

Price effect

14 %

16 %

Product mix effect

2 %

1 %

Exchange rate effect

--

%

--

%

Operating earnings

$9

$24

$105

$93

4Q11 operating earnings declined due to lower sales volume and lower capacity

utilization due to weakened demand for copolyester product lines and

inventory management during and after planned maintenance shutdowns

FY11 operating earnings increased primarily due to higher selling prices more than

offsetting

higher

raw

material

and

energy

costs

and

the

positive

impact

of

Tritan™

copolyester growth initiative

Expect

2012

operating

earnings

to

be

approximately

$120

million

1

1

Does not include projected results from Solutia businesses

|

4

th

-Quarter and Full-Year

2011 Financial Results

Curt Espeland, Sr. VP and CFO |

Full-year 2011 financial highlights

29

Cash from operations of $625 million

•

$735 excluding impact of tax payment on the sale of the

PET business

•

Working capital increased by $280 million

Capital expenditures $457 million

Generated $142 million of free cash flow

Note: Free cash flow is defined as cash from operations less capital

expenditures and dividends, excluding the tax payment for the gain on the

sale of the PET business completed first quarter 2011.

|

Balanced capital allocation in 2011

30

Supporting earnings growth and returning cash to stockholders

Sterling Chemicals

Scandiflex

Dynaloy

Capital expenditures

Tritan™

copolyester

expansion

CHDM monomer expansion

CTA expansion

Regalite™

expansion

2-EH expansion

Share repurchases

U.S. pension contributions

$457 m

$316 m

$102 m

$136 m

$156 m |

4

th

-Quarter

and

Full-

Year 2011 Financial

Results

Jim Rogers, President and CEO

Curt Espeland, Senior Vice President and CFO

January 27, 2012 |