Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Expedia Group, Inc. | d287929d8k.htm |

SUPPLEMENTAL HISTORICAL

FINANCIAL INFORMATION

January 2012

Exhibit 99.1 |

2

Introduction

TripAdvisor Spin-Off

Following

the

close

of

trading

on

the

Nasdaq

Stock

Market

on

December

20,

2011,

Expedia,

Inc.

(“Expedia”

or the “Company”), a

Delaware corporation, completed the spin-off (the “Spin-Off”) of

TripAdvisor, Inc., a Delaware corporation (“TripAdvisor”) to Expedia

stockholders. TripAdvisor consists of the domestic and international operations

previously associated with Expedia’s TripAdvisor Media Group

(the

“TripAdvisor

Businesses”)

and

is

now

a

separately

traded

public

company,

trading

under

the

symbol

“TRIP”

on The

Nasdaq Global Select Market. Expedia continues to own and operate its remaining

businesses—the domestic and international operations

of

its

travel

transaction

brands—as

a

separately

traded

public

company,

trading

under

the

symbol

“EXPE”

on The Nasdaq

Global Select Market. Prior to the Spin-Off, TripAdvisor was a wholly-owned

subsidiary of Expedia, with Expedia as its sole stockholder. Expedia effected

the Spin-Off by means of a reclassification of its capital stock that resulted in the holders of Expedia capital stock

immediately prior to the time of effectiveness of the reclassification having the

right to receive a proportionate amount of TripAdvisor capital stock. A

one-for-two reverse stock split of outstanding Expedia capital stock occurred immediately prior to the Spin-Off, with

cash paid in lieu of fractional shares.

Basis of Presentation

The unaudited quarterly consolidated financial information presented within this

presentation is based on historical results, after giving effect to the

TripAdvisor Businesses as discontinued operations and the reverse stock split for the periods presented.

Non-GAAP Measures

The Appendices to this presentation also include certain financial measures that are

supplemental measures to GAAP and are defined by the Securities and Exchange

Commission as non-GAAP financial measures. Following the Spin-Off, the Company

introduced Adjusted EBITDA, a new non-GAAP financial measure. Going forward, the

Company plans to regularly report Adjusted EBITDA and will no longer report

Operating Income Before Amortization. Reconciliations

to

GAAP

measures

of

non-GAAP

measures

set

forth

in

this

presentation

are

included

in

the

Appendices.

These non-

GAAP measures are subject to certain limitations and are intended to supplement, not

substitute for, comparable GAAP measures.

Investors are urged to consider carefully the comparable GAAP measures and

reconciliations. Trademarks and logos are the property of their respective

owners. ©

2012 Expedia, Inc. All rights reserved. CST: 2029030-50

|

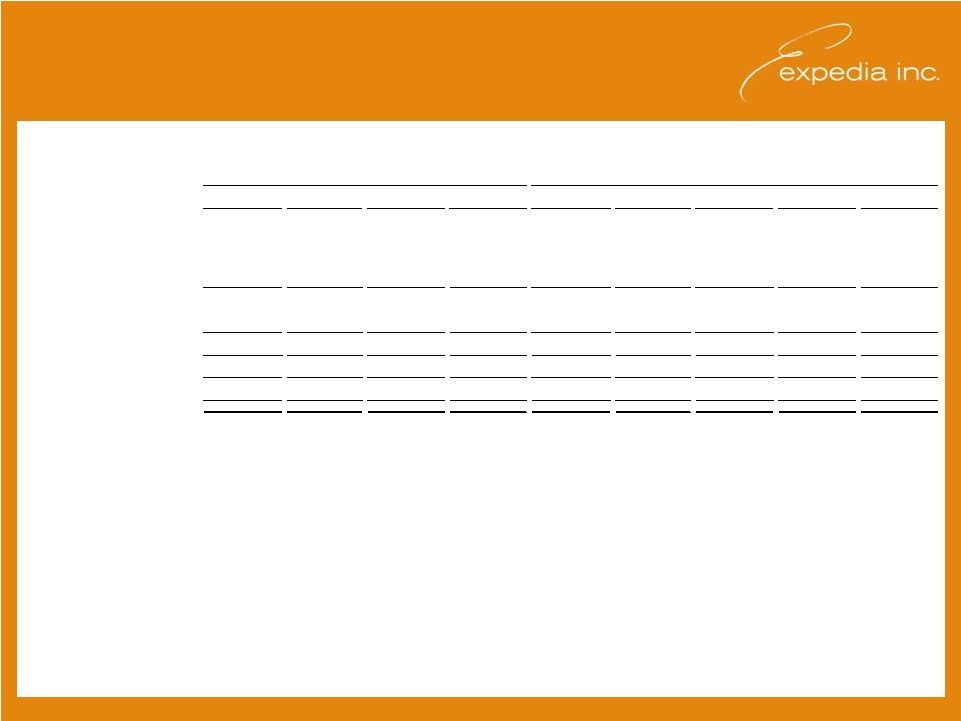

3

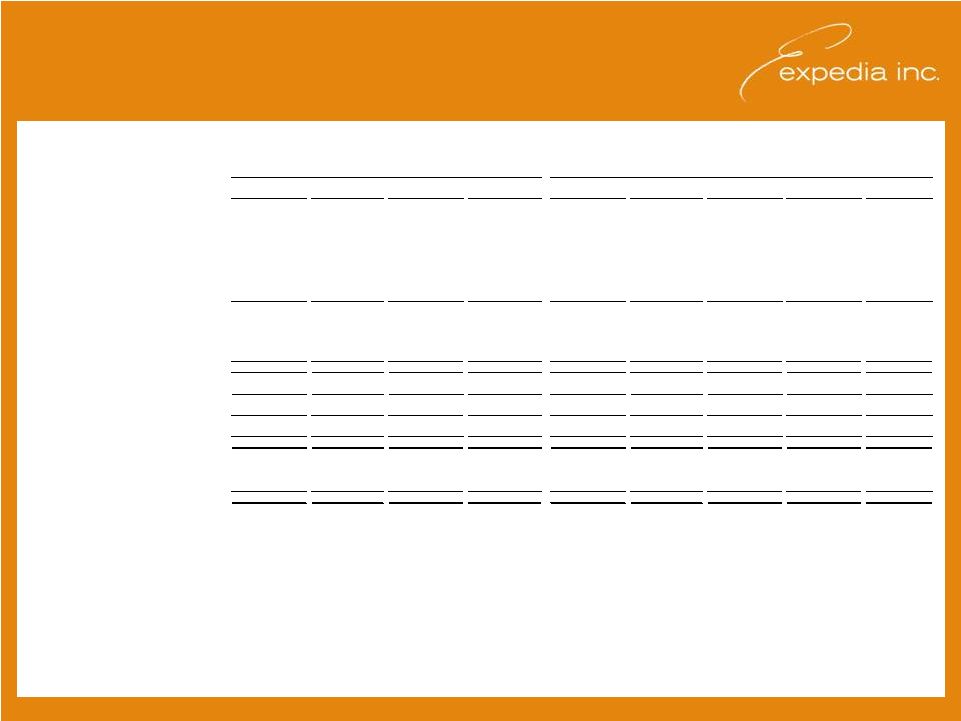

Statements of Operations

Three months ended

March 31

Three months ended

June 30

Three months ended

September 30

Nine months ended

September 30

Three months ended

March 31

Three months ended

June 30

Three months ended

September 30

Three months ended

December 31

Year ended

December 31

Revenue

727,835

$

913,591

$

1,020,450

$

2,661,876

$

646,418

$

751,537

$

898,099

$

737,591

$

3,033,645

$

Costs and expenses:

Cost of revenue (1)

175,610

195,810

206,451

577,871

156,483

166,836

187,977

174,191

685,487

Selling and marketing (1)

350,908

400,483

408,169

1,159,560

291,999

308,425

351,130

283,227

1,234,781

Technology and content (1)

86,807

93,101

98,472

278,380

75,218

74,406

79,761

79,395

308,780

General and administrative (1)

71,160

72,045

78,680

221,885

64,540

63,945

63,624

66,495

258,604

Amortization of intangible assets

5,834

5,914

5,564

17,312

5,650

5,479

5,550

5,835

22,514

Legal reserves, occupancy tax and

other 2,358

2,531

14,015

18,904

366

5,910

903

15,513

22,692

Operating income

35,158

143,707

209,099

387,964

52,162

126,536

209,154

112,935

500,787

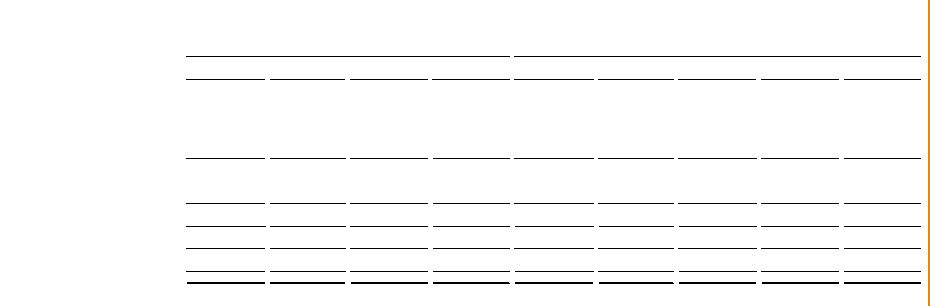

Other income (expense):

Interest income

3,335

5,451

5,784

14,570

594

1,210

2,426

2,822

7,052

Interest expense

(22,522)

(22,489)

(23,234)

(68,245)

(12,500)

(11,501)

(18,279)

(24,148)

(66,428)

Other, net

(7,182)

(5,404)

10,790

(1,796)

1,883

2,177

(15,292)

(4,340)

(15,572)

Total other expense, net

(26,369)

(22,442)

(6,660)

(55,471)

(10,023)

(8,114)

(31,145)

(25,666)

(74,948)

Income from continuing operations before

income taxes 8,789

121,265

202,439

332,493

42,139

118,422

178,009

87,269

425,839

Provision for income taxes

(2,886)

(33,132)

(30,599)

(66,617)

(15,228)

(40,091)

(41,339)

(23,684)

(120,342)

Income from continuing operations

5,903

88,133

171,840

265,876

26,911

78,331

136,670

63,585

305,497

Discontinued operations, net of taxes (a)

46,306

52,757

38,566

137,629

33,688

37,022

41,354

7,999

120,063

Net income

52,209

140,890

210,406

403,505

60,599

115,353

178,024

71,584

425,560

Net income attributable to noncontrolling

interests (170)

(497)

(872)

(1,539)

(1,204)

(1,091)

(1,474)

(291)

(4,060)

Net income attributable to Expedia,

Inc. 52,039

$

140,393

$

209,534

$

401,966

$

59,395

$

114,262

$

176,550

$

71,293

$

421,500

$

Amounts attribuable to Expedia, Inc.:

Income from continuing operations

5,826

$

87,682

$

170,947

$

264,455

$

25,748

$

77,253

$

135,223

$

63,391

$

301,615

$

Discontinued operations, net of taxes

46,213

52,711

38,587

137,511

33,647

37,009

41,327

7,902

119,885

Net income

52,039

$

140,393

$

209,534

$

401,966

$

59,395

$

114,262

$

176,550

$

71,293

$

421,500

$

Earnings per share from continuing operations (b)

Basic

0.04

$

0.64

$

1.26

$

1.94

$

0.18

$

0.54

$

0.96

$

0.46

$

2.14

$

Diluted

0.04

0.63

1.22

1.90

0.17

0.53

0.94

0.45

2.09

Shared used in

computing earning per share from continuing operations (b)

Basic

136,930

136,796

136,176

136,632

144,301

142,044

140,608

138,052

141,233

Diluted

139,084

139,053

139,684

139,271

147,251

144,488

143,142

141,251

144,014

Dividends declared per common share

0.07

$

0.07

$

0.07

$

0.21

$

0.07

$

0.07

$

0.07

$

0.07

$

0.28

$

(1) Includes

stock-based compensation as follows: Cost of revenue

810

$

581

$

584

$

1,975

$

789

$

487

$

549

$

576

$

2,401

$

Selling and marketing

3,509

2,279

2,423

8,211

3,662

2,684

2,521

2,899

11,766

Technology and content

3,863

2,690

2,982

9,535

3,604

2,648

2,569

2,844

11,665

General and administrative

6,616

5,963

7,034

19,613

8,670

7,278

5,652

5,075

26,675

EXPEDIA, INC.

UNAUDITED CONSOLIDATED STATEMENTS OF OPERATIONS

(In thousands, except for per share data)

2010

2011 |

4

(a)

Represents

the

elimination

of

the

assets

and

liabilities

as

well

as

the

results

of

operations

of

TripAdvisor,

including

(i)

the

reclassification of expense Expedia paid to TripAdvisor related to sales and

marketing expense (previously eliminated in

consolidation)

to

third-party

expense

as

the

relationship

will

continue

after

the

Spin-Off,

(ii)

the

reclassification

of

expense related to the obligation to fund a charitable foundation that was assumed by

TripAdvisor in conjunction with

the

Spin-Off,

(iii)

non-recurring

expenses

incurred

to

effect

the

spin-off

of

TripAdvisor

during

the

nine

months

ended

September

30,

2011

of

$6.5

million

and

(iv)

interest

expense

and

amortization

of

debt

issuance

costs

and

discount, related to the redemption of Expedia’s 8.5% senior notes due 2016 in

connection with the Spin-Off, was attributed to discontinued operations in

all periods presented. (b)

Reflects

changes

in

Expedia’s

stockholders’

equity to affect the spin-off after giving effect to the one-for-two

reverse stock split of Expedia that occurred in connection with the

Spin-Off. Statements of Operations (cont’d)

|

5

Appendix A: Non-GAAP Measures

Definitions of Non-GAAP Measures

Expedia, Inc. reports Adjusted EBITDA, Adjusted Net Income and Adjusted EPS, all of

which are supplemental measures to GAAP and are defined by the SEC as

non-GAAP financial measures. These measures are among the primary metrics by which management evaluates the

performance of the business and on which internal budgets are based. Management

believes that investors should have access to the same set of tools that

management uses to analyze our results. These non-GAAP measures should be

considered in addition to results prepared in accordance with GAAP, but should not be considered a

substitute for or superior to GAAP. Adjusted EBITDA, Adjusted Net Income and Adjusted

EPS have certain limitations in that they do not take into account the impact

of certain expenses to our consolidated statements of operations. We endeavor to compensate for the limitation of the

non-GAAP measures presented by also providing the most directly comparable GAAP

measures and descriptions of the reconciling items and adjustments to derive

the non-GAAP measures. Adjusted EBITDA, Adjusted Net Income and Adjusted EPS also exclude certain items related to

occupancy tax matters, which may ultimately be settled in cash, and we urge investors

to review the detailed disclosure regarding these matters

in

the

Management

Discussion

and

Analysis,

Legal

Proceedings

sections,

as

well

as

the

notes

to

the

financial

statements,

included in

the Company’s annual and quarterly reports filed with the Securities and

Exchange Commission. The non-GAAP financial measures used by the Company

may be calculated differently from, and therefore may not be comparable to, similarly titled measures used by other companies.

The definition of Adjusted Net Income was revised in fourth quarter of 2010 and

fourth quarter of 2011. Adjusted

EBITDA

is

defined

as

operating

income

plus:

(1)

stock-based

compensation

expense,

including compensation expense related to

certain

subsidiary

equity

plans;

(2)

acquisition-related

impacts,

including

(i)

amortization

of

intangible

assets

and

goodwill

and

intangible

asset

impairment,

and

(ii)

gains

(losses)

recognized

on

changes

in

the

value

of

contingent

consideration

arrangements;

(3)

certain infrequently

occurring

items,

including

restructuring;

(4)

items

included

in

Legal

reserves,

occupancy

tax

and

other,

which

includes

reserves

for potential

settlement of issues related to hotel occupancy taxes, related court decisions and

final settlements, and charges incurred, if any, for monies that

may

be

required

to

be

paid

in

advance

of

litigation

in

certain

occupancy

tax

proceedings;

(5)

gains

(losses)

realized

on

revenue

hedging

activities that are included in other, net; and (6) depreciation.

The above items are excluded from our Adjusted EBITDA measure because these items are

noncash in nature, or because the amount and timing of these items is

unpredictable, not driven by core operating results and renders comparisons with prior periods and competitors less

meaningful. We believe Adjusted EBITDA is a useful measure for analysts and

investors to evaluate our future on-going performance as this measure

allows a more meaningful comparison of our performance and projected cash earnings with our historical results from prior periods

and to the results of our competitors. Moreover, our management uses this measure

internally to evaluate the performance of our business as a whole and our

individual business segments. In addition, we believe that by excluding certain items, such as stock-based compensation and

acquisition-related

impacts,

Adjusted

EBITDA

corresponds

more

closely

to

the cash operating income generated from our business and allows

investors to gain an understanding of the factors and trends affecting the ongoing

cash earnings capabilities of our business, from which capital investments are

made and debt is serviced. |

6

Appendix A: Non-GAAP Measures (cont’d)

Adjusted

Net

Income

generally captures all items on the statements of operations that occur in normal

course operations and have been, or ultimately will be, settled in cash and is

defined as net income/(loss) attributable to Expedia, Inc. plus net of tax: (1) stock-based compensation

expense, including compensation expense related to certain subsidiary equity plans;

(2) acquisition-related impacts, including (i) amortization of intangible

assets, including as part of equity-method investments, and goodwill and intangible asset impairment, (ii) gains (losses) recognized

on changes in the value of contingent consideration arrangements, and (iii) gains

(losses) recognized on noncontrolling investment basis adjustments when we

acquire controlling interests; (3) mark to market gains and losses on derivative instruments assumed at the time of

Expedia’s spin-off from IAC/Interactive Corp.; (4) currency gains or losses

on U.S. dollar denominated cash or investments held by majority- owned

eLong, Inc.; (5) certain other infrequently occurring items, including restructuring charges; (6) items included in Legal reserves,

occupancy tax and other, which includes reserves for potential settlement of issues

related to hotel occupancy taxes, related court decisions and final

settlements, and charges incurred, if any, for monies that may be required to be paid in advance of litigation in certain occupancy

tax proceedings; (7) discontinued operations; (8) the noncontrolling interest impact

of the aforementioned adjustment items and (9) unrealized gains (losses) on

revenue hedging activities that are included in other, net. We believe

Adjusted Net Income is useful to investors because it represents Expedia, Inc.’s combined results, excluding the impact of certain

expenses, infrequently occurring items and items not directly tied to the core

operations of our businesses. We believe

Adjusted EPS is useful to investors because it represents, on a per share basis, Expedia’s consolidated results, taking into account items

which are not allocated to the operating businesses such as interest expense, taxes,

foreign exchange gains or losses, and minority interest, but excluding the

effects of certain expenses not directly tied to the core operations of our businesses.

Adjusted Net Income does not include all items that affect our net income/(loss) and

net income/(loss) per share for the period. Therefore, we think it is

important to evaluate these measures along with our consolidated statements of operations.

Adjusted EPS is defined as Adjusted Net Income divided by adjusted weighted average

shares outstanding, which include dilution from options and warrants per

the treasury stock method and include all shares relating to restricted stock units (“RSUs”) in shares outstanding for Adjusted EPS.

This differs from the GAAP method for including RSUs, which treats them on a treasury

method basis. Shares outstanding for Adjusted EPS purposes are therefore

higher than shares outstanding for GAAP EPS purposes. |

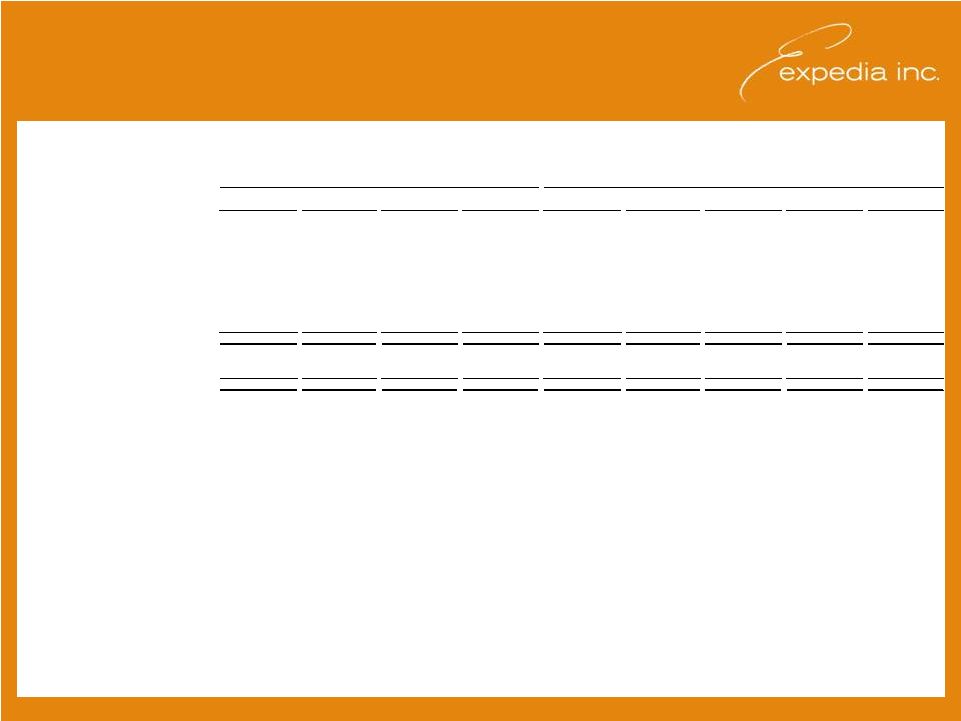

7

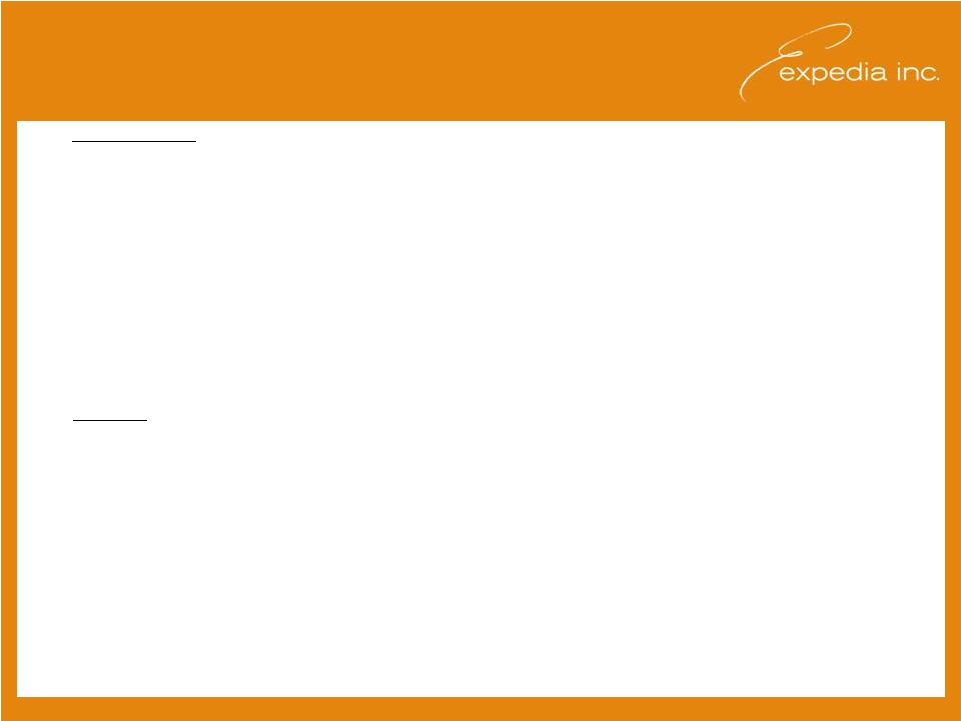

Appendix B: Adjusted EBITDA

Reconciliation

Three months ended

March 31

Three months ended

June 30

Three months ended

September 30

Nine months ended

September 30

Three months ended

March 31

Three months ended

June 30

Three months ended

September 30

Three months ended

December 31

Year ended

December 31

Adjusted EBITDA

82,027

$

188,996

$

277,677

$

548,700

$

100,379

$

181,035

$

249,868

$

169,200

$

700,482

$

Depreciation

(29,185)

(31,651)

(36,791)

(97,627)

(23,026)

(27,226)

(27,271)

(28,008)

(105,531)

Amortization of intangible

assets (5,834)

(5,914)

(5,564)

(17,312)

(5,650)

(5,479)

(5,550)

(5,835)

(22,514)

Stock-based

compensation (14,798)

(11,513)

(13,023)

(39,334)

(16,725)

(13,097)

(11,291)

(11,394)

(52,507)

Legal reserves,

occupancy tax and other (2,358)

(2,531)

(14,015)

(18,904)

(366)

(5,910)

(903)

(15,513)

(22,692)

Realized (gain) loss on

revenue hedges 5,306

6,320

815

12,441

(2,450)

(2,787)

4,301

4,485

3,549

Operating income

35,158

143,707

209,099

387,964

52,162

126,536

209,154

112,935

500,787

Interest expense,

net (19,187)

(17,038)

(17,450)

(53,675)

(11,906)

(10,291)

(15,853)

(21,326)

(59,376)

Other, net

(7,182)

(5,404)

10,790

(1,796)

1,883

2,177

(15,292)

(4,340)

(15,572)

Income from continuing

operations before income taxes 8,789

121,265

202,439

332,493

42,139

118,422

178,009

87,269

425,839

Provision for income

taxes (2,886)

(33,132)

(30,599)

(66,617)

(15,228)

(40,091)

(41,339)

(23,684)

(120,342)

Income from continuing

operations 5,903

88,133

171,840

265,876

26,911

78,331

136,670

63,585

305,497

Discontinued

operations, net of taxes 46,306

52,757

38,566

137,629

33,688

37,022

41,354

7,999

120,063

Net income

52,209

140,890

210,406

403,505

60,599

115,353

178,024

71,584

425,560

Net income attributable

to noncontrolling interests (170)

(497)

(872)

(1,539)

(1,204)

(1,091)

(1,474)

(291)

(4,060)

Net income

attributable to Expedia, Inc. 52,039

$

140,393

$

209,534

$

401,966

$

59,395

$

114,262

$

176,550

$

71,293

$

421,500

$

2011

2010

EXPEDIA, INC.

ADJUSTED EBITDA RECONCILIATION

(In thousands) |

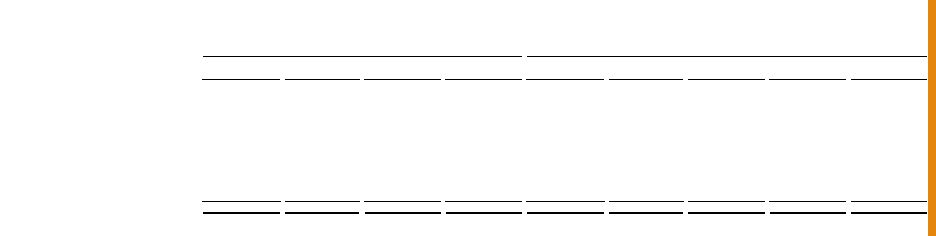

8

Appendix C: Adjusted Net Income and

Adjusted EPS Reconciliation

Three months ended

March 31

Three months ended

June 30

Three months ended

September 30

Nine months ended

September 30

Three months ended

March 31

Three months ended

June 30

Three months ended

September 30

Three months ended

December 31

Year ended

December 31

Net income attributable to Expedia, Inc.

52,039

$

140,393

$

209,534

$

401,966

$

59,395

$

114,262

$

176,550

$

71,293

$

421,500

$

Discontinued operations, net

of taxes (46,213)

(52,711)

(38,587)

(137,511)

(33,647)

(37,009)

(41,327)

(7,902)

(119,885)

Amortization of intangibles

5,834

5,914

5,564

17,312

5,650

5,479

5,550

5,835

22,514

Stock-based

compensation 14,798

11,513

13,023

39,334

16,725

13,097

11,291

11,394

52,507

Legal reserves,

occupancy tax and other 2,358

2,531

14,015

18,904

366

5,910

903

15,513

22,692

Foreign currency

loss on U.S. dollar cash balances held by eLong

377

1,182

558

2,117

(125)

873

1,358

606

2,711

Unrealized (gain) loss on revenue hedges

1,146

(1,983)

(10,612)

(11,449)

(718)

(903)

8,724

(2,205)

4,898

Noncontrolling interests

(674)

(1,050)

(815)

(2,539)

(436)

(783)

(954)

(704)

(2,877)

Provision

for income taxes (6,825)

(5,196)

(12,178)

(24,199)

(7,236)

(8,450)

(8,283)

(10,480)

(34,449)

Adjusted Net Income

22,840

100,593

180,502

303,935

39,974

92,477

153,812

83,350

369,612

GAAP diluted weighted

average shares outstanding 139,084

139,053

139,684

139,271

147,251

144,488

143,142

141,251

144,014

Additional restricted

stock units 1,572

1,333

1,218

1,374

2,270

1,979

1,735

1,569

1,889

Adjusted weighted average shares outstanding

140,656

140,386

140,902

140,645

149,521

146,467

144,877

142,820

145,903

Diluted earnings per

share from continuing operations 0.04

$

0.63

$

1.22

$

1.90

$

0.17

$

0.53

$

0.94

$

0.45

$

2.09

$

Adjusted earnings per share from continuing operations

0.16

0.72

1.28

2.16

0.27

0.63

1.06

0.58

2.53

2011

2010

EXPEDIA, INC.

ADJUSTED EPS

(In thousands, except for per share data) |