Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - POPULAR, INC. | d287559d8k.htm |

Financial

Results Financial Results

Fourth Quarter 2011

Fourth Quarter 2011

Exhibit 99.1 |

Forward Looking

Statements The information contained in this presentation includes forward-looking

statements within the meaning of the Private Securities Litigation Reform Act of 1995.

These forward-looking statements are based on management’s current expectations

and

involve

risks

and

uncertainties

that

may

cause

the

Company's

actual

results

to

differ

materially

from

any

future

results

expressed or implied by such forward-looking statements. Factors that may cause such a

difference include, but are not limited to (i) the rate of growth in the economy and

employment levels, as well as general business and economic conditions; (ii)

changes in

interest

rates,

as

well

as

the

magnitude

of

such

changes;

(iii)

the

fiscal

and

monetary

policies

of

the

federal

government and its agencies; (iv) changes in federal bank regulatory and supervisory policies,

including required levels of capital; (v) the relative strength or weakness of the

consumer and commercial credit sectors and of the real estate markets in Puerto Rico

and the other markets in which borrowers are located; (vi) the performance of the stock and bond markets; (vii)

competition in the financial services industry; (viii) possible legislative, tax or regulatory

changes; (ix) the impact of the Dodd- Frank Act on our businesses, business practice

and cost of operations; and (x) additional Federal Deposit Insurance Corporation

assessments. Other than to the extent required by applicable law, the Company undertakes no obligation to

publicly update or revise any forward-looking statement. Please refer to our Annual Report

on Form 10-K for the year ended December 31, 2010 and other SEC reports for a

discussion of those factors that could impact our future results. The financial

information included in this presentation for the quarter ended December 31, 2011 is based on

preliminary unaudited data and is subject to change.

1 |

2011

Highlights •

Net Income for the year amounted to $151 million

•

Net income of $3 million in Q4; fourth consecutive profitable quarter

–

Provision for non-covered loans fell $26.8 million to $123.9 million on

linked-quarter basis

–

PR commercial/construction NPL inflows declined 52% in Q4; credit review of the

portfolio was completed

–

Net charge offs of non-covered loans in Q4 were down 7% to $126 million

•

Ended the year with strong capital and well positioned for improved results in 2012

2

Strong NIM of 4.34%

Provision for loan losses down 43% from prior year

Results include a one-time expense of $15.6 million due to employee retirement

window

Improved credit quality trends |

Financial

Results 3

¹

Unaudited

Q4 2011

Q3 2011

Variance

Net interest income

$344,780

$369,311

($24,531)

Service fees & other oper. income

113,848

106,696

7,152

Gain on sale of investments, loans & trading profits

18,064

21,055

(2,991)

FDIC loss-share income (expense)

17,447

(5,361)

22,808

Gross revenues

2,438

Provision for loan losses

(excluding covered loans)

(123,908)

(150,703)

26,795

Provision for loan losses (covered WB loans)

(55,900)

(25,573)

(30,327)

Total provision BPOP

(179,808)

(176,276)

(3,532)

Net revenues

314,331

315,425

(1,094)

Personnel costs

124,547

111,724

12,823

Other operating expenses

186,546

170,631

15,915

Total operating expenses

311,093

282,355

28,738

Income before Tax

3,238

33,070

(29,832)

Income Tax

(263)

(5,537)

5,274

Net income

$2,975

$27,533

($24,558)

Financial Ratios

EPS

$0.00

$0.03

($0.03)

NIM

4.30%

4.45%

-0.15%

$ in thousands (except per share data)

1

1

494,139

491,701 |

Q4 vs. Q3 2011

Adjusted Variances (in millions) 4

($In millions)

Q4 vs. Q3 variance as reported

(30)

$

Adjustments

Gain on sale of securites Q3

8

Gain on sale of securites Q4

3

Variance

5

Retirement window Q4

16

Adjusted negative variance

(9)

$

Covered loans

(17)

$

Mortgage loans

(8)

(25)

FDIC loss share increase:

Accretion of indemnification asset

2

ASC 310-20 and provision-mirror acct.

21

23

Other Income:

Serv charges & other fees

(3)

Gain on sale & indemnity reserves

2

Other operating income

10

9

43

Covered loans

(30)

US

(16)

(3)

Other Expenses

(13)

Detailed variances

(9)

$

Provision:

Provision BPPR - non-covered

Lower net interest income:

Explanation

Variance in pre-tax income |

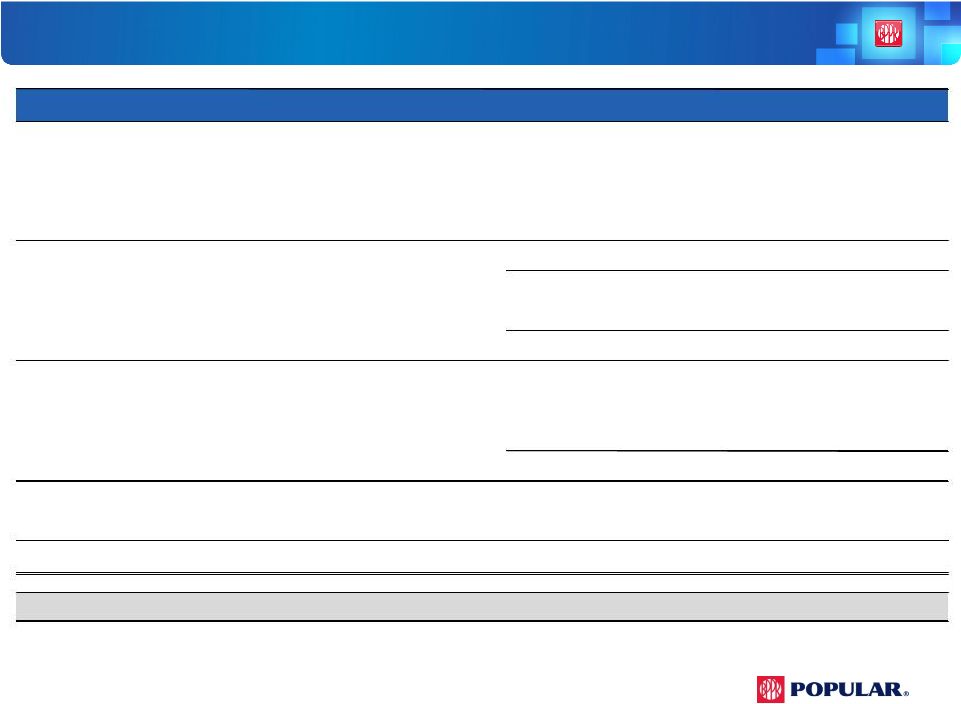

10.94%

14.52%

15.79%

7.99%

12.10%

15.97%

17.25%

8.62%

Tier 1 Common

Tier 1 Capital

Total Capital

Tangible Common Equity

Capital Ratios

5

1

See the earnings press release for reconciliation of Common Stockholders

Equity (GAAP) to Tier 1 Common Equity (Non-GAAP).

2

Minimum Regulatory Requirements for Well Capitalized

Q3

2011

Q2

2011

Q3

2010

1

•

There is no specific plan at this time for TARP repayment nor any obligation to accelerate a

total or partial payment

•

Any repayment of TARP will be done in a manner that protects shareholder value and will be

subject to regulatory approval

•

As of year end, the unamortized TARP discount amounted to $466 million

•

Including the discount amortization, the effective cost of TARP capital in Q4 was 16% of the

accreting book value, or 7.8% of the par amount of $935 million

•

Interest expense for 2011: $72.5 million

coupon $46.8 million

discount amortization $25.7 million

•

Strong capital ratios

Q4

2010

Q4

2011

Q4

2010

Q4

2011

Q4

2011

Q4

2010

5%

2

6%

2

10%

2

Q4

2011

Q4

2010 |

6

Consolidated Credit Summary

•

NPAs

have decreased since Q4 10 principally driven by the sale of non-performing loans

•

NCOs

slightly declined in the fourth quarter, although experiencing

variability within the portfolios

•

Provision for loan losses

for 2011 was down 43% vs 2010

•

Allowance & allowance to loans

coverage ratio remained relatively flat

Excluding covered loans

$ in millions

Q4 11

Q3 11

Q4 11 vs

Q3 11

Q4 10

Q4 11 vs

Q4 10

Loans Held to Maturity (HTM)

$20,602

$20,674

-0.35%

$20,728

-0.61%

Loans Held for Sale

363

369

-1.63%

894

-59.40%

Total Non Covered Loans

$20,965

$21,043

-0.37%

$21,622

-3.04%

Non-performing assets (inc OREO)

$2,173

$2,158

0.70%

$2,405

-9.65%

NPLs HTM to loans HTM

8.44%

8.38%

0.06%

7.58%

0.86%

Net charge-offs

$126

$135

-6.67%

$478

-73.64%

Net charge-offs to average loans HTM

2.46%

2.64%

-0.18%

8.82%

-6.36%

Provision for loan losses

$124

$151

-17.88%

$354

-64.97%

Provision to total loans HTM

2.41%

2.92%

-0.51%

6.83%

-4.42%

Provision for loan losses to net charge-offs

0.98x

1.11x

-0.13x

0.74x

0.24x

Allowance for loan losses

$690

$693

-0.43%

$793

-12.99%

Allowance for loan losses to loans (excl. LHFS)

3.35%

3.35%

0.00%

3.83%

-0.48%

Allowance for loan losses to NPLs HTM

39.73%

39.99%

-0.26%

50.46%

-10.73% |

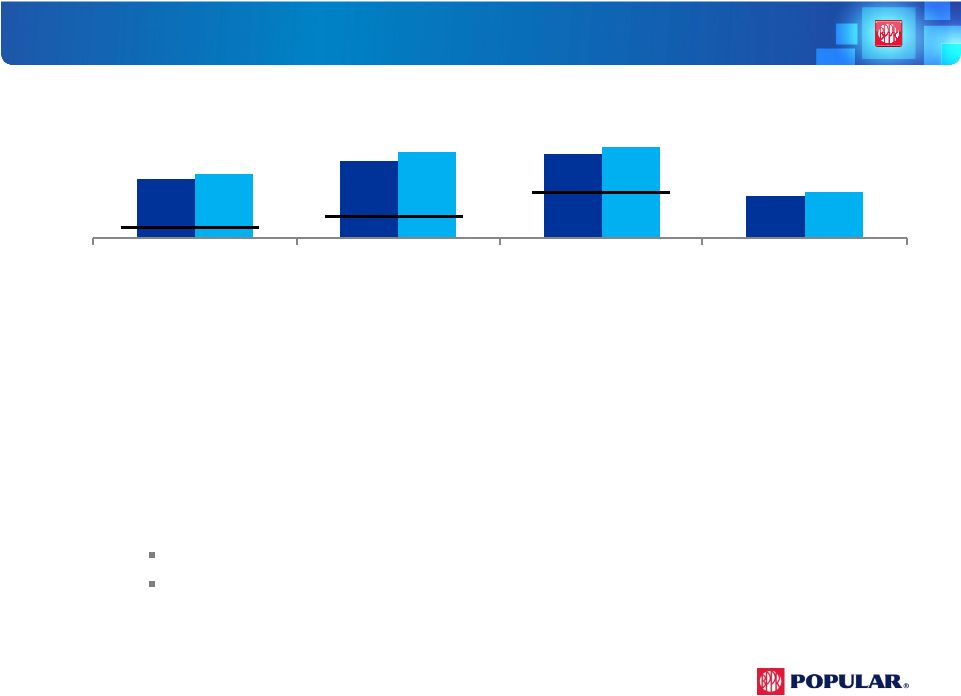

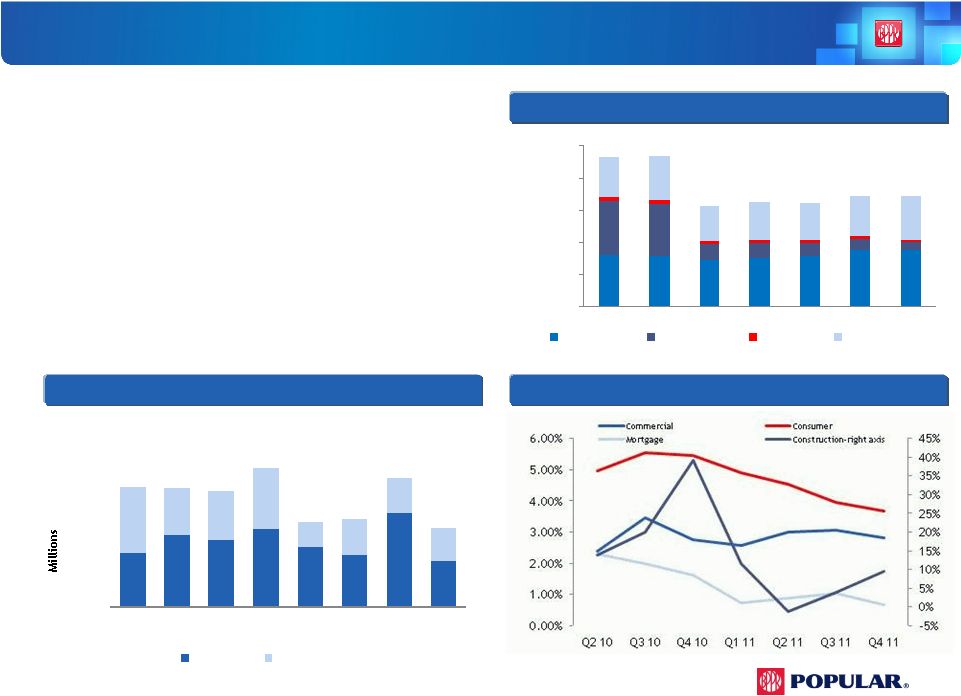

Non-Performing Loans-

Popular, Inc.

Commercial & Construction NPL Inflows

Credit Quality Overview-

•

NPLs increased by $6 million in Q4 driven by higher PR

mortgage offset by reductions in construction. The

increase in Q3 was $107 million.

•

NCO ratio for Q4 was 2.46% ($126 million) vs. 2.64%

($135 million) in Q3, driven by PR C&I and consumer

portfolio

•

Inflow of NPLs in the PR commercial & construction

portfolios are lower ($111 million) given completion of

the credit review

•

For the year total NPL inflows for the commercial &

construction portfolios are down 22%

7

Excludes Covered Loans & LHFS

In 000’s

Net Charge Offs-Popular, Inc.

1

1

Excludes net charge-offs of $210 million in commercial and construction loans as

a result of charging-off collateral dependent loans more promptly in Q4

10. 0

500,000

1,000,000

1,500,000

2,000,000

2,500,000

2Q10

3Q10

4Q10

1Q 11

2Q 11

3Q 11

4Q 11

Commercial

Construction

Consumer

Mortgage

$119

$161

$149

$174

$133

$116

$212

$101

$147

$104

$109

$136

$57

$79

$77

$77

$0

$50

$100

$150

$200

$250

$300

$350

1Q10

2Q10

3Q10

4Q10

1Q11

2Q11

3Q11

4Q11

Commercial & Construction

Inflows

PR Inflows

US Inflows |

2011

Highlights •

First year of operational profitability

since 2006

Further expanded strong margin

Reduced credit cost by 43% from

2010

Strengthened capital position

Executed on asset acquisitions

•

Improved credit profile

Completed NPL asset sales in PR

and US

Registered improvement in

credit trends in PR

Experienced substantial

improvement in US

Summary & Outlook

8

2012 Strategy

•

Further improve credit risk profile

•

Add low-risk assets

•

Expand efficiency efforts

•

Continue improvement at BPNA

Well positioned to improve results in 2012

•

2012 target range net income of $185

million to $200 million

Driven primarily by a reduction in

the provision expense |

Appendix

Appendix |

2005/2006

Aggressive diversification

consisting of Puerto Rico, the

U.S. and the Caribbean;

revenue diversification

through EVERTEC

Focused on growing U.S.

banking and mortgage

businesses (PFH & ELOAN )

2007/2008

Reorganized U.S. operation

to exit high-risk businesses

Shut down U.S. consumer

finance businesses (PFH &

ELOAN) & Texas region

Acquisition of P.R. Citibank

retail business

2009/2010

Focused on ensuring capital

and BHC liquidity adequacy

and participating in the P.R.

banking consolidation

Raised common equity,

completed EVERTEC sale &

Westernbank transaction

2005

2006

2007

2008

2009

2010

Net Income (Loss)

$541M

$358M

($64M)

($1,244M)

($574M)

$137M

Tier 1 Common

7.98%

7.73%

7.08%

3.19%

6.39%

10.95%

NPL/Loans

1 .77%

2.24%

2.75%

4.67%

9.60%

7.58% ¹

FTEs

13,210

12,508

12,303

10,587

9,407

8,277

Where We Are Coming From

10

Strategy

Financials

2011/2012

•

Focused on:

Puerto Rico

Credit risk profile

improvement

Efficiency

Asset acquisition

United States

•Repositioning

as community bank

•Continued

attention to asset quality and

efficiency

¹

Excludes covered loans

48,624

47,404

44,411

38,883

34,736

38,815

38,830

39,108

38,275

37,348

-

1,000

2,000

3,000

4,000

5,000

6,000

7,000

-

10,000

20,000

30,000

40,000

50,000

60,000

2005

2006

2007

2008

2009

2010

Q1 2011

Q2 2011

Q3 2011

Q4 2011

Assets

Market Cap

Tangible Capital

•

•

•

•

•

•

• |

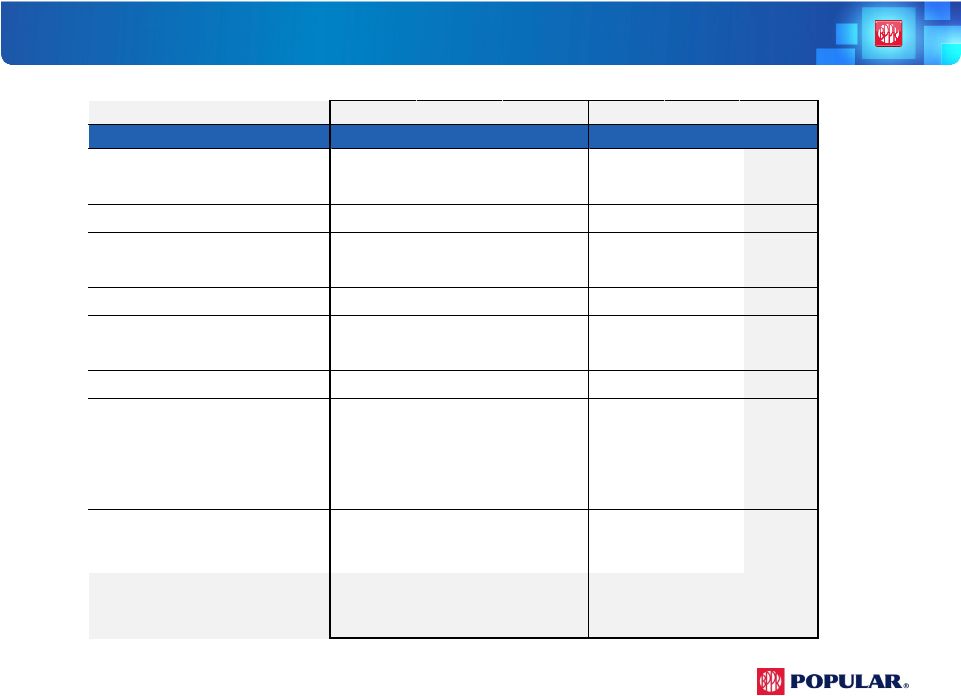

P.R. &

US Business 11

$ in millions (Unaudited)

Q4 11

Q3 11

Variance

Q4 11

Q3 11

Variance

Net Interest Income

$299

$321

($22)

$73

$73

($0)

Non Interest Income

136

118

18

21

18

3

Gross Revenues

435

439

(4)

94

91

3

Provision (non-covered)

(88)

(131)

43

(36)

(20)

(16)

Provision (covered WB)

(56)

(26)

(30)

-

-

-

Provision for loan losses

(144)

(157)

13

(36)

(20)

(16)

Expenses

(253)

(221)

(32)

(60)

(61)

1

Tax (Expense) Benefit

(4)

(7)

3

(1)

(1)

(0)

Net Income (Loss)

$34

$54

($20)

($3)

$9

($12)

NPLs (HTM) ¹

$1,371

$1,337

$34

$367

$395

($28)

NPLs (HTM + HFS) ¹

1,620

1,597

23

380

395

(15)

Loan loss reserve

578

524

54

237

249

(12)

Assets

$28,423

$29,202

($779)

$8,581

$8,720

($139)

Loans (HTM)

19,159

19,210

(51)

5,762

5,946

(184)

Loans (HTM + HFS)

19,507

19,575

(68)

5,778

5,949

(171)

Deposits

21,850

21,727

123

6,168

6,292

(124)

NIM

4.97%

5.15%

-0.18%

3.68%

3.62%

0.06%

PR

US

1

Excludes covered loans |

Financial

Results Financial Results

Fourth Quarter 2011

Fourth Quarter 2011 |