Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - LOCAL Corp | d287209d8k.htm |

Local

Corporation Overview January 2012

Connecting Local Merchants with Online Consumers

Exhibit 99.1 |

Local Corporation Presentation | January 2012

Safe Harbor Statement; Non-GAAP Financial Measures

2

Certain matters being discussed by Local Corporation’s management

today include forward looking statements which are made pursuant to

the Safe Harbor provisions of section 21-E of the Securities Exchange

Act of 1934. Investors are cautioned that statements which are not

strictly historical statements, including statements concerning future

expected financial performance, management objectives and plans for

future operations, our relationships with strategic or other partners, the

release of new products or services or enhancements to existing

products or services, our expectations regarding potential acquisitions

and the future performance of past acquisitions including our ability to

realize expected synergies, trends in the market for our current or

planned products or services, and market acceptance of our products or

services, constitute forward looking statements. The

forward looking statements include, but are not limited to, any statements containing the words

“expect”, “anticipate”, “estimates”, “believes”,

“should”, “could”, “may”, “possibly”, and similar expressions

and the negatives thereof. These forward looking statements involve a

number of risks and uncertainties that could cause actual results to differ

materially from the forward looking statements. Those risks and

uncertainties are detailed in the company’s filings from time to time with

the Securities and Exchange Commission. The information contained in

the forward looking statements is provided as of the date of such oral

statements and the company disclaims any obligation to update such

statements.

This document includes the non-GAAP financial measure of “Adjusted

Net Income/Loss” which we define as net income/loss excluding:

provision for income taxes; interest and other income (expense), net;

depreciation; amortization; stock based compensation charges, warrant

revaluation charges and non-recurring items. Adjusted Net Income/Loss,

as defined above, is not a measurement under GAAP. Adjusted Net

Income/Loss is reconciled to net loss and loss per share, which we

believe are the most comparable GAAP measures, at the end of this

presentation. Management believes that Adjusted Net Income/Loss

provides useful information to investors about the company’s

performance because it eliminates the effects of period-to-period

changes in income from interest on the company’s cash and marketable

securities, expense from the company’s financing transactions and the

costs associated with income tax expense, capital investments, stock-

based compensation expense, warrant revaluation charges, and non-

recurring charges which are not directly attributable to the underlying

performance of the company’s business operations. Management uses

Adjusted Net Income/Loss in evaluating the overall performance of the

company’s business operations. A

limitation of non-GAAP Adjusted Net Income/Loss is that it excludes items that often have

a material effect on the company’s net income and earnings per common share calculated in

accordance with GAAP. Therefore, management compensates for this limitation by using

Adjusted Net Income/Loss in conjunction with GAAP net loss and loss

per share measures. The company believes that Adjusted Net

Income/Loss provides investors with an additional tool for evaluating the

company’s core performance, which management uses in its own

evaluation of overall performance, and as a base-line for assessing the

future earnings potential of the company. While the GAAP results are

more complete, the company prefers to allow investors to have this

supplemental metric since, with reconciliation to GAAP (as noted above

it may provide greater insight into the company’s financial results. The

non-GAAP measures should be viewed as a supplement to, and not as

a substitute for, or superior to, GAAP net income or earnings per share.

|

Local Corporation Presentation | January 2012

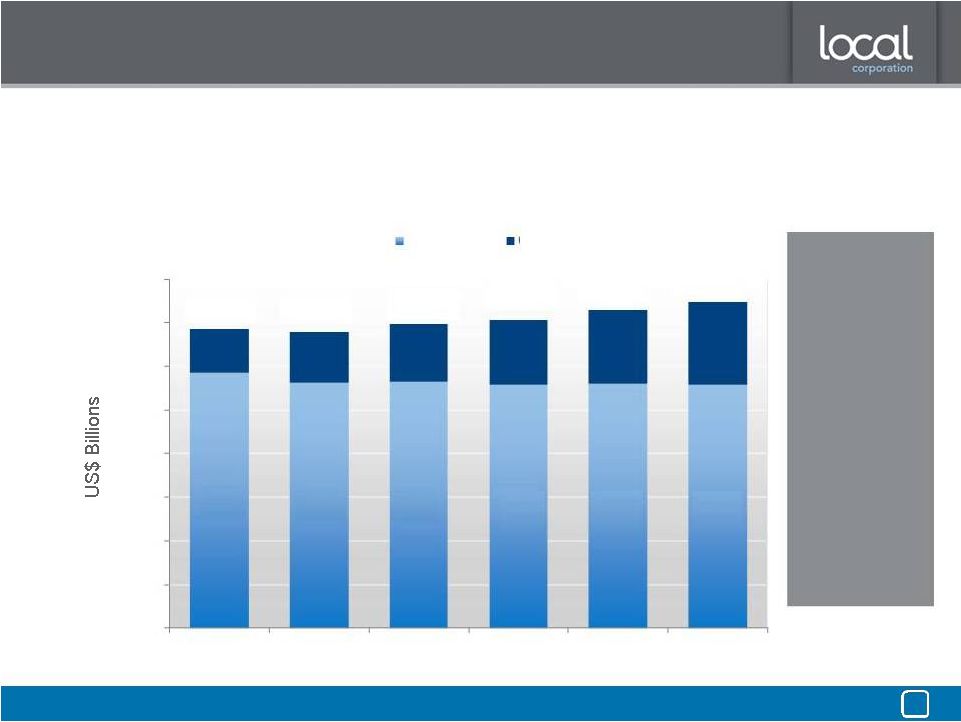

Why invest in this industry [local online advertising]?

3

Source: BIA/Kelsey, November 2011. Numbers are rounded.

Online/Digital

Media

CAGR 13.6%

$135.9

$137.2

$139.5

$141.5

$146.0

$149.4

$23.3

$26.4

$29.9

$33.8

$37.9

$20.0

$0.0

$20.0

$40.0

$60.0

$80.0

$100.0

$120.0

$140.0

$160.0

2010

2011

2012

2013

2014

2015

$112.5

$111.6

$112.2

$111.5

$117.2

$113.1

2010

2015

CAGRs:

Traditional

Online/Digital

Total Media

CAGR 1.7%

Traditional Media

CAGR

1.0%

-

sec·u·lar

trends

[sek-yuh-ler]

adjective.noun

1.

a secular

trend

away

from

traditional

to

digital

media

caused

by

increased

consumption

of

digital

content

2.

consumers

are

spending

more

time

online

and

ad

dollars

are

following

them |

Local Corporation Presentation | January 2012

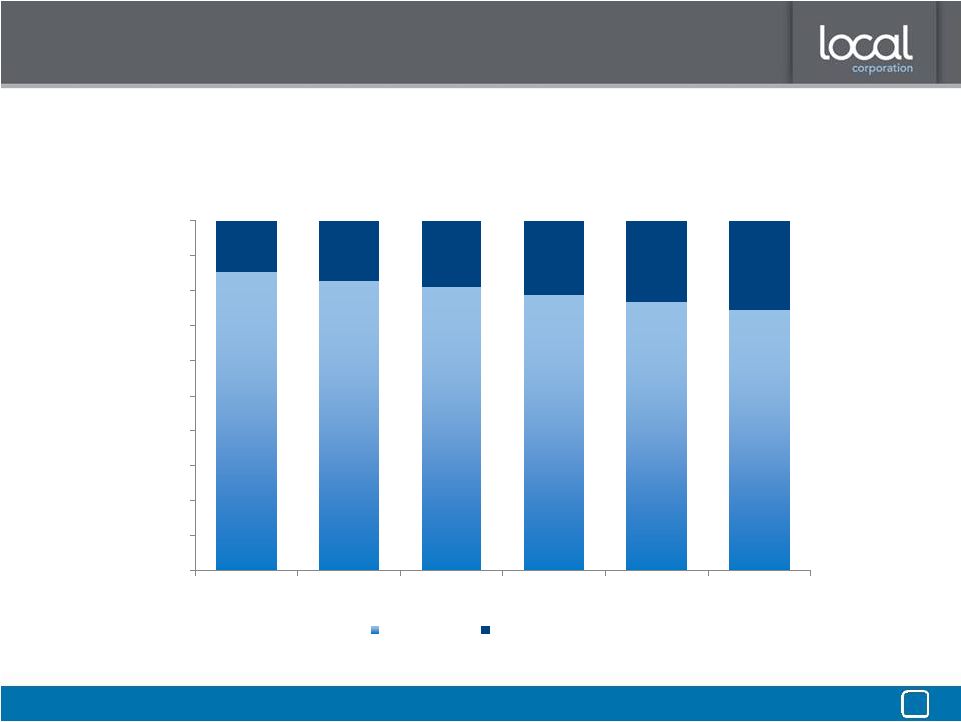

Why invest in this industry [local online advertising]?

sec·u·lar trends

[sek-yuh-ler] adjective.noun

1.

online advertising continues to eat into traditional media market share

4

85.4%

82.8%

81.1%

78.9%

76.9%

74.6%

14.6%

17.2%

18.9%

21.1%

23.1%

25.4%

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

2010

2011

2012

2013

2014

2015

Traditional

Online/Digital

Source: BIA/Kelsey, November 2011. Numbers are rounded.

|

Local Corporation Presentation | January 2012

Within local online advertising is [local search]

growth

[grohth] noun

1.

local search volumes are growing faster than non-local searches

2.

consumers are searching for local goods and services more frequently

5

Source: BIA/Kelsey, November 2011. Numbers are rounded.

|

Local Corporation Presentation | January 2012

Within local online advertising is [local search]

growth

6

Source: BIA/Kelsey, November 2011. Numbers are rounded.

[grohth] noun

1.

search ad spend is shifting from non-local into local search

2.

local search revenue is growing faster than volume because advertisers pay higher prices to

reach local consumers |

Local Corporation Presentation | January 2012

Within local online advertising is [local display]

growth

[grohth]

noun

1.

display is growing, but local display is growing faster

2.

local

rich

media

is

projected

to

grow

50%

CAGR

through

2015

7

Source: BIA/Kelsey, November 2011. Numbers are rounded.

US Local Display as % of Top Line Market |

Local Corporation Presentation | January 2012

Within local online advertising is [daily deals]

growth

[grohth]

noun

1.

a disruptive ad model that is accelerating the shift in spend from old media

2.

a highly attractive performance ad product for lagging online advertisers such as

restaurants 8

Source: BIA/Kelsey, November 2011. Numbers are rounded.

0

500

1,000

1,500

2,000

2,500

3,000

3,500

4,000

4,500

2010

2011

2012

2013

2014

2015

$873

$1,970

$2,455

$2,987

$3,564

$4,171

+36.7% CAGR |

Local Corporation Presentation | January 2012

Local Corporation

lo·cal

cor·po·ra·tion

[loh-kuhl] [kawr-puh-rey-shuhn] adjective.noun

Founded 1999, IPO 2004: NASDAQ: [LOCM]

1.

a

diversified

local

online

media

business

focused

on

high

growth

markets

2.

specializes in connecting local merchants with online consumers

3.

reaches one million consumers every day across over 1,000 sites via search, display and

email 4.

a rapidly growing local display network that served almost 1BB impressions in December

2011 5.

a proprietary technology platform covered by 9 patents (8 pending); serves over 30,000

customers with web hosting, search engine optimization, display, pay per click,

subscription and daily deals ads 9 |

Local Corporation Presentation | January 2012

Publisher Partners

MUVs in 4Q11

Channel SMBs

Daily Deal Members

Daily Deals Markets

Our Large & Growing Ecosystem

Flagship Property

Direct SMBs

White Label Sites

Organic Traffic

Business Listings

Local Merchants

Non-search

We Connect a Million Consumers with Local Merchants Every Day

We generate revenue

from ads, including pay-per-click,

pay-per-call, subscription, daily deals & display

Search

Impressions Dec 2011

Consumers

Deals

-

Spreebird

-

Facebook, Twitter

1

14

40%

-

Google

-

Yahoo

-

SuperMedia

-

ATTi

Ad Partners

Regional Media Publishers

-

Newspapers, TV, radio

stations, yellow pages

Ad Agencies

Channel Partners

SMB Subscribers

Direct

100

1,000+

9,000

31,000

400,000

18MM

94MM

1BB

Display

Social Media

Consumer Properties

-

Local.com

-

Krillion.com

-

1,000+ partner sites

10

-

Feet on the street sales

-

Telesales |

Local Corporation Presentation | January 2012

Our Target Demographic

11

Gender

Female

57%

Male

43%

Age

18 to 24

10%

25 to 34

17%

35 to 44

20%

45 to 54

18%

Household Income

$25K -

$39,999

17.8%

$40K -

$59,999

23.7%

$60K -

$74,999

9.6%

$75K -

$99,999

11.7%

$100,000 +

17.1%

Local.com Source: ComScore, January 2011

We reach household managers with

high buying intent when they are

looking for local solutions |

Local Corporation Presentation | January 2012

Advertisers Pay More For Local Consumers

•

57% of our traffic is the Household Manager

»

Aged between 25-45 with one child or more at home

»

Controls significant portion of the household purse strings

»

Typically spends 80% of that money within 20 miles of home

•

Advertisers often pay more to reach ready-to-buy Household Managers

»

Just conducted local & commercial searches online

»

89% of in-store purchasers in key categories have conducted online

research**

»

82% of people visiting local search sites follow-up with offline action

(store visit/call)*

12

Search Term

Click

Bids*

Premium

Restaurant

$0.22

577%

San Francisco

Restaurant

$1.27

Credit Union

$0.45

116%

Seattle

Credit Union

$0.52

Plumber

$2.60

275%

Plumber

$7.14

Moving Company

$2.35

252%

Denver

Moving Company

$5.93

Divorce Attorney

$2.03

186%

Divorce Attorney

Las Vegas

$3.77

Auto Repair

$1.97

157%

Dallas

Auto Repair

$3.09

Wedding Florist

$0.51

278%

Orlando

Wedding Florist

$1.42

Hotel

$0.99

138%

New

York City

Hotel

$1.37

* Bids as of January 6, 2011

Advertisers often pay more to reach local consumers…

Los Angeles

** TMP/Yahoo-comScore

study

–

2007 |

Local Corporation Presentation | January 2012

More Proprietary Products for Our Customers

13

Channel

Local Merchants

Consumers

•

Local Premium

»

Subscription ads on Local.com

•

Web Hosting

»

Basic product for ~$15/month

•

LocalConnect

Business Directory

»

‘Local businesses’

tab for newspaper,

tv, radio station websites

•

Five Exact Match SMB Solutions

»

Mobile, SEO, display and social media

»

More coming soon

•

Deals

via Spreebird.com

•

Local.com

»

Local business search

•

Krillion.com

»

Local product search

•

Spreebird.com

»

Deal-of-the-day

»

Travel deals

•

Krillion

Product Directory

»

‘Local products’

tab for newspaper,

tv, radio station websites

•

Rovion Ad Management Platform

»

Rich media ad management for

agencies and national brands to

localize national ad campaigns

•

Five Exact Match SMB Solutions

»

White label products coming soon |

Consumers: Our

Network of Properties & Services 14

•

A network of over 1,000 Owned or Private Label sites

»

Flagship Local.com; Spreebird.com; Krillion.com

»

Business name/category search

»

Product search (80k products in over 70k locations)

»

Coupons, specials, daily & travel deals

»

Events, activities, topics, reviews & more

•

A record 94MM MUVs in 4Q11

»

One-third of traffic was organic

»

Balance of traffic via SEM (Google/Yahoo/Bing)

»

All users doing local-&-commercial searches

•

Expanding mobile product range

»

Five products launched; five more coming

Local shopping info

embedded in rich media

display ads

Engage via mobile

web & apps

(coming soon)

Data published across

Consumer Properties

Local Corporation Presentation | January 2012 |

Local Corporation Presentation | January 2012

15

Local Merchants & Channel: Display Ad Platform

»

Launched 4Q11

»

Designed for national brands with local presence,

including movie studios, big box retailers, regional and

national agencies/media brands, automotive brands

and luxury goods retailers

»

Local rich media ad units with available real-time ‘in

store’

product, inventory and pricing data

»

A unique, patented local platform designed to capture

transitioning national-to-local ad spend

»

A wide variety of ad units including expandable,

floating, pre-page interstitial banners & InPerson

»

Agency quality creative with web-based drag-and-

drop interface and cloud storage of digital assets

»

Improves ROI –

no need for flash ad programmers

»

Lower cost, faster turnaround ad production

•

Purpose-built for emerging local rich media segment

•

Enables the development and management of…

•

Saves agencies & brands time and money |

Local Corporation Presentation | January 2012

16

Local Merchants & Channel: Display Ad Distribution

Local Corporation Display Business

Our

national

sales

organization

sells

display

advertising

across

three

networks

Local.com

Local Syndication

Network

Local Display Ad

Network

The search results

pages within the

flagship site owned

and operated by

Local Corp.

The pages within the

sites owned and

operated by

partners who have

implemented the

Local hosted search

product.

The pages within

sites owned and

operated by third-

party ad networks.

In

December

2011

we

served

over

1

billion

impressions

–

up

from

about

100

million

impressions

in

January

2011 |

Local Corporation Presentation | January 2012

Local Merchants & Channel: Proprietary SMB Ad Products

17

•

Exact Match suite of SMB ad products

»

Five products released since mid-2011 (two mobile)

»

More coming soon

•

Subscription pricing from $129-$199/month

»

‘Do it for me’

»

Multi-channel access to consumers via seo, social media,

display and mobile

Helping Local Merchants Reach Online Consumers |

Local Corporation Presentation | January 2012

Local Merchants: Spreebird Daily Deals

18

•

Daily deals is a desirable performance ad product

»

SMBs

only

pay

when

we

drive

a

customer

to

their

register

•

Launched

Spreebird

in

May

2011,

acquired

Screamin’

Daily

Deals

July

2011

»

Not urban –

suburban

•

Step 1. Partner with school PTA for fundraising

•

Step 2. Pay a bounty when ‘Mom’

signs up

•

Step 3. Pay a bounty when Mom buys from local merchant

»

10% of our revenue share is paid to school of Mom’s choice in

merchant’s name

»

Merchant becomes ‘community hero’, leading to repeat

hyperlocal business from a desirable demographic

School

Rewards:

Each

time

a

Household

Manager

saves

money

on

great,

hyperlocal

Spreebird

deals,

we

donate

10%

of

our

revenue

back

to

the

kids’

school

in

the

merchant’s

name!

Donation to school in

merchant’s

name

= Community Hero!!!

Local merchant

Household

Manager

Hyperlocal node |

Proprietary

Technology Portfolio Powers Products/Network 19

•

Multiple databases with

millions of SMB listings to

validate business

information

•

We crawl the web and use

our proprietary Keyword

DNA™

+ web indexing

algorithms to generate all

our search results

•

Ingest real-time ad and data

feeds from multiple partners

•

Syndicates those feeds to

over 100,000 sites

•

A fully featured group-

buying distribution

platform

•

Personalization engine

driving enhanced user

experience

•

API, RSS, widget

syndication for our regional

media network and

planned partners

•

Rich media ad management

and serving platform

•

Automated creation,

production, management

and serving of ads

•

Rovion ‘in-person’

video unit

•

Green screen studios &

network

•

Highly scalable geo-category

domain acquisition

•

Automated website hosting

& mgt. features

•

Content marketplace for the

procurement, creation,

payment and management

of custom local content for

SMB websites

•

Pulls real-time product

inventory directly from

manufacturers, retailers

•

Data aggregation and

normalization technologies

and know-how

•

Product-based search results

•

9 patents issued, 8 pending in local/mobile/data/display

•

Local Corporation Presentation | January 2012

Each acquisition has strategically increased our ability to serve this rapidly growing segment

with a wider range of proprietary products & services |

Local Corporation Presentation | January 2012

Experienced Team with Strategy Discipline

20

Heath Clarke

Founder, Chairman & CEO

20+ yrs exp

Founded Local in ’99

VP eCommerce LanguageForce

CEO/Founder AFP (Australia)

Erick Herring

SVP Technology

Founder Townloop

CTO Feedback.com

CTO, VP Product Webvisible

CTO Adapt Technologies

Ken Cragun

CFO

20+ yrs exp

CFO Modtech

SVP MIVA

CFO ImproveNet

CFO NetCharge.com

CPA; Big 4 Exp.

Malcolm Lewis

SVP, GM Social Buying

Founder, Fablistic

SVP/GM, Local Corporation

Sr. Management, Oracle Corporation

Mike Sawtell

COO

20+ yrs exp

Chairman & CEO, DigitalPost Interactive

Pres. & COO , Interchange Corp. (now

Local Corporation)

COO & VP of Sales, Informative Research

Peter Hutto

SVP, Corporate Development

Co-Founder, ZeroDegrees

Managing Director, EDS & MCI

Systemhouse

Tullio Siragusa

SVP, Sales

Head of Sales, Ansearch Ltd.

SVP Global Sales, Operative Media

VP Strategic Accounts, Acxiom |

Local Corporation Presentation | January 2012

Financial Performance

21

Adjusted Net Income (Loss) = Net income (loss) before interest, taxes, depreciation,

amortization, stock-based compensation, warrant revaluation charges, and

non-recurring Items Q4-2011 annualized revenue = $96.0M

•

Financials (non-GAAP)

»

40% CAGR 2006-2010; ~50% growth between 2Q and 4Q2011

»

4Q11 Revenue guidance: $24MM and break-even Adjusted Net Income

»

FY11 Revenue guidance: ~$78MM

$14.2M

$21.5M

$38.3M

$56.3M

$84.1M

$77.3M

$(0.96)

$(0.63)

$(0.33)

$0.21

$0.82

$(1.10)

$(0.60)

$(0.10)

$0.40

$0.90

$1.40

$0.0M

$10.0M

$20.0M

$30.0M

$40.0M

$50.0M

$60.0M

$70.0M

$80.0M

$90.0M

$100.0M

2006

2007

2008

2009

2010

2011 Fcst |

Local Corporation Presentation | January 2012

4Qs of Transformation Return

to Strong Growth 22

Acquired Octane360 –

SEO

& web hosting platform

4Q>2Q Yahoo/Bing impact

Acquired Rovion rich media ad platform

Acquired Krillion shopping data platform

Launched Spreebird (daily deals)

Acquired Screamin’

Media Group

(daily deals)

Google ad feed begins

Situational Challenge

•

Yahoo/Bing alliance caused

monetization drop

•

Dealt with by switching partner at

end of contract

We didn’t stop there…

Diversified Revenue & Products

•

Retained Yahoo partnership

•

Expanded into non-search

revenues & products

Delivered Record Traffic

•

18% YOY growth

Expanded

Technology

Platform

•

Rich media & daily deals

•

Local product search

•

New patents

Modified Team

•

Faster product development

•

Improved sales organization

$0.0M

$5.0M

$10.0M

$15.0M

$20.0M

$25.0M

Q1-09

Q2-09

Q3-09

Q4-09

Q1-10

Q2-10

Q3-10

Q4-10

Q1-11

Q2-11

Q3-11

Q4-11E |

Our

Revenue Streams and Mid-Term Growth Expectations 53%

30%

17%

2%

0%

0%

15%

65%

21%

14%

2%

1%

1%

10%

15%

30%

50%

50%

60%

400%

-50%

30%

50%

80%

80+%

100%

80%

100%

100%

100%

20%

40%

10%

10%

20%

20%

15%

70%

$44M

$25M

$15M

$48M

$17M

$12M

23

Local Corporation Presentation | January 2012 |

Local Corporation Presentation | January 2012

3Q11 Balance Sheet & Capitalization

24

September 30, 2011

Common stock

22,009

Options

(Avg.

Exercise

Price

$4.65)

4,566

Warrants

(Avg.

Exercise

Price

7.11)

1,478

Fully Diluted

28,053

I.

II.

III.

1

1

Additional Data:

In January 2011 the Company completed a public offering of 4.6 million shares at a price of

$4.25 per share. Net proceeds of $18.2 million

Total authorized shares 65,000,000 common and 10,000,000 preferred September

30, 2011 Cash

$10,119

Accounts Receivable

13,018

Total Assets

76,478

Total Debt

8,000

Total Liabilities

23,978

Shareholders Equity

$52,500

Key Balance Sheet Items

(in thousands)

Capitalization

(in thousands)

1.

Options and warrants represent approximately $31MM in cash

In August 2011 the Company closed on a $12 million credit facility

|

Local Corporation Presentation | January 2012

Why Invest in Local Corporation?

25

•

Rapidly growing company in a rapidly growing market

•

Beneficiary of secular trend towards online ad spend by SMBs

•

Extensive technology platform and differentiated product portfolio

An Attractive Position

in Fast Growing Markets

•

Growing revenue streams with considerable future growth potential

•

Proprietary products that improve operating leverage over time

•

Experienced executive team focused on execution with strategy discipline

Strong Operating Model

with Experienced Leadership

Team

•

Four quarters of change, challenge and transformation –

completed

•

Not just a search engine –

a media business

•

Returned to strong growth with greater revenue diversification

Completed a Business

Transformation |

Local Corporation Presentation | January 2012

26

Heath Clarke

Chairman & Chief Executive Officer

hclarke@local.com

Ken Cragun

Chief Financial Officer

kcragun@local.com

949.784.0800

http://corporate.local.com

Thank You |

Local Corporation Presentation | January 2012

P&L Trend –

Quarterly

27

Adjusted Net Income (Loss) = Net income (loss) before interest, taxes, depreciation,

amortization, stock-based compensation, warrant revaluation charges, and

non-recurring Items Actual

Actual

Actual

Actual

Actual

Actual

Actual

Actual

Forecast

Description

Q1-10

Q2-10

Q3-10

Q4-10

FY-10

Q1-11

Q2-11

Q3-11

Q4-11

Revenue

18,631

$

23,004

$

22,457

$

20,045

$

84,137

$

16,795

$

15,584

$

20,877

$

24,000

$

Sequential revenue growth

14%

19%

-2%

-12%

49%

-16%

-7%

34%

15%

Gross Margin

7,829

9,828

11,752

8,211

37,620

5,807

4,772

8,370

Gross Margin %

42%

43%

52%

41%

45%

35%

31%

40%

Other Operating Expenses

7,354

8,750

9,754

8,050

33,908

8,618

10,506

12,639

Operating income (loss)

475

1,078

1,998

161

3,712

(2,811)

(5,734)

(4,269)

Interest and other income (expense)

(56)

(61)

(79)

(79)

(275)

(55)

(30)

(227)

Change in fair value of warrant liability

(272)

335

1,830

(1,006)

887

1,559

411

513

Income (Loss) before income taxes

147

1,352

3,749

(924)

4,324

(1,307)

(5,353)

(5,353)

Provision for income taxes

13

122

-

(33)

102

11

51

48

Net income (loss)

134

$

1,230

$

3,749

$

(891)

$

4,222

$

(1,318)

$

(5,404)

$

(4,031)

$

Adjusted Net income (loss)

2,575

$

3,451

$

4,595

$

3,154

$

13,775

$

8

$

(1,903)

$

(1,093)

$

-

$

Weighted average shares

15,918

17,342

17,202

16,576

16,788

20,241

21,254

21,940

Net income (loss) per share

0.01

$

0.07

$

0.22

$

(0.05)

$

0.25

$

(0.07)

$

(0.25)

$

(0.18)

$

Adjusted Net income (loss) per share

0.16

$

0.20

$

0.27

$

0.19

$

0.82

$

0.00

$

(0.09)

$

(0.05)

$ |

Local Corporation Presentation | January 2012

Reconciliation:

Adjusted

Net

Income

to

GAAP

Net

Inc

-

Qtrly

28

Actual

Actual

Actual

Actual

Actual

Actual

Actual

Actual

Forecast

Description

Q1-10

Q2-10

Q3-10

Q4-10

FY-10

Q1-11

Q2-11

Q3-11

Q4-11

Adjusted Net income (loss)

2,575

$

3,451

$

4,595

$

3,154

$

13,775

$

8

$

(1,903)

$

(1,093)

$

-

$

Plus interest and other income (expense), net

(56)

(61)

(79)

(79)

(275)

(55)

(30)

(227)

(150)

Less provision for income taxes

(13)

(122)

-

33

(102)

(11)

(51)

(48)

(50)

Less amortization of intangibles

(1,230)

(1,454)

(1,561)

(1,489)

(5,734)

(1,198)

(1,210)

(1,371)

(1,700)

Less depreciation

(246)

(259)

(330)

(583)

(1,418)

(649)

(703)

(850)

(920)

Less stock-based compensation

(624)

(660)

(706)

(921)

(2,911)

(972)

(1,020)

(955)

(800)

Less revaluation of warrants

(272)

335

1,830

(1,006)

887

1,559

411

513

unknown

Less non-recurring charges

-

-

-

-

-

-

(898)

GAAP Net income (loss)

134

$

1,230

$

3,749

$

(891)

$

4,222

$

(1,318)

$

(5,404)

$

(4,031)

$

unknown |