Attached files

| file | filename |

|---|---|

| EX-5.1 - EX-5.1 - Dynamic Offshore Resources, Inc. | a2206894zex-5_1.htm |

| EX-23.3 - EX-23.3 - Dynamic Offshore Resources, Inc. | a2206512zex-23_3.htm |

| EX-23.2 - EX-23.2 - Dynamic Offshore Resources, Inc. | a2206512zex-23_2.htm |

| EX-23.1 - EX-23.1 - Dynamic Offshore Resources, Inc. | a2206512zex-23_1.htm |

As filed with the Securities and Exchange Commission on January 17, 2012

Registration No. 333-176521

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 6

TO

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

Dynamic Offshore Resources, Inc.

(Exact name of registrant as specified in its charter)

| Delaware (State or other jurisdiction of incorporation or organization) |

1311 (Primary Standard Industrial Classification Code Number) |

45-3034172 (I.R.S. Employer Identification No.) |

1301 McKinney, Suite 900

Houston, Texas 77010

(713) 728-7840

(Address, including zip code, and telephone number, including area code, of registrant's principal executive offices)

Thomas R. Lamme

Senior Vice President and General Counsel

1301 McKinney, Suite 900

Houston, Texas 77010

(713) 728-7840

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| T. Mark Kelly Matthew R. Pacey Vinson & Elkins L.L.P. 1001 Fannin, Suite 2500 Houston, Texas 77002-6760 (713) 758-2222 |

Sean T. Wheeler Ryan J. Maierson Latham & Watkins LLP 811 Main Street, Suite 3700 Houston, Texas 77002 (713) 546-5400 |

Approximate date of commencement of proposed sale to the public:

As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box: o

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

| Large accelerated filer o | Accelerated filer o | Non-accelerated filer ý (Do not check if a smaller reporting company) |

Smaller reporting company o |

The registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until this Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. We and the selling stockholders may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and we and the selling stockholders are not soliciting offers to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED JANUARY 17, 2012

Prospectus

16,666,667 Shares

Dynamic Offshore Resources, Inc.

Common Stock

Dynamic Offshore Resources, Inc. is offering 16,666,667 shares of its common stock. This is our initial public offering, and no public market currently exists for our shares. We anticipate that the initial public offering price of our common stock will be between $17.00 and $19.00 per share.

We have been approved, subject to official notice of issuance, to list our common stock on the New York Stock Exchange under the symbol "DOR".

Investing in our common stock involves risks. Please read "Risk Factors" beginning on page 20.

| |

Price to Public | Underwriting Discounts and Commissions |

Proceeds to Company |

|||||||

|---|---|---|---|---|---|---|---|---|---|---|

Per Share |

$ | $ | $ | |||||||

Total |

$ | $ | $ | |||||||

The selling stockholders have granted the underwriters the right to purchase up to an additional 2,500,000 shares of common stock to cover over-allotments. We will not receive any proceeds from the sale of shares by the selling stockholders.

The Securities and Exchange Commission and state securities regulators have not approved or disapproved of these securities, or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the shares of common stock to purchasers on , 2012.

| Citigroup | Credit Suisse | |||

| Deutsche Bank Securities | Tudor, Pickering, Holt & Co. | UBS Investment Bank |

| Capital One Southcoast | ||||||||

| FBR Capital Markets | ||||||||

| Howard Weil Incorporated | ||||||||

| IBERIA Capital Partners L.L.C. | ||||||||

| Johnson Rice & Company L.L.C. | ||||||||

| Dahlman Rose & Company | Morgan Keegan | Natixis | RBS |

The date of this prospectus is , 2012.

You should rely only on the information contained in this prospectus and any free writing prospectus prepared by or on behalf of us or to which we have referred you. Neither we nor the selling stockholders have authorized anyone to provide you with information different from that contained in this prospectus and any free writing prospectus. The information in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or any sale of the common stock.

We and the selling stockholders are offering to sell shares of common stock and seeking offers to buy shares of common stock only in jurisdictions where offers and sales are permitted. We have not taken any action to permit a public offering of the shares of common stock outside the United States or to permit the possession or distribution of this prospectus outside the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about and observe any restrictions relating to the offering of the shares of common stock and the distribution of this prospectus outside the United States.

Until , 2012, all dealers that buy, sell or trade our common stock, whether or not participating in this offering, may be required to deliver a prospectus. This requirement is in addition to the dealers' obligation to deliver a prospectus when acting as underwriters and with respect to their unsold allotments or subscriptions.

This prospectus contains forward-looking statements that are subject to a number of risks and uncertainties, many of which are beyond our control. Please read "Risk Factors" beginning on page 20 and "Cautionary Note Regarding Forward-Looking Statements" beginning on page 41.

Industry and Market Data

The market data and certain other statistical information used throughout this prospectus are based on independent industry publications, government publications or other published independent sources. Some data is also based on our good faith estimates. Although we believe these third-party sources are reliable and that the information is accurate and complete, we have not independently verified the information.

i

This summary provides a brief overview of information contained elsewhere in this prospectus. Because it is abbreviated, this summary does not contain all of the information that you should consider before investing in our common stock. You should read the entire prospectus carefully before making an investment decision, including the information presented under the headings "Risk Factors," "Cautionary Note Regarding Forward-Looking Statements," "Management's Discussion and Analysis of Financial Condition and Results of Operations" and the historical consolidated financial statements and unaudited pro forma financial information and the related notes thereto included elsewhere in this prospectus. We have provided definitions for certain oil and natural gas terms used in this prospectus in the "Glossary of Oil and Natural Gas Terms" beginning on page A-1 of this prospectus.

Unless otherwise indicated, the estimated reserve volumes and related operational measures presented in this prospectus include the properties acquired in the XTO Acquisition and the MOR Transaction described under "—Recent Developments" beginning on page 6. Unless otherwise indicated, the information presented in this prospectus assumes that the underwriters' option to purchase additional shares of common stock to cover over-allotments is not exercised.

In this prospectus, unless the context otherwise requires, the terms "we," "us," "our" and the "Company" refer to Dynamic Offshore Holding, LP and its subsidiaries before the completion of our corporate reorganization and Dynamic Offshore Resources, Inc. and its subsidiaries as of and following the completion of our corporate reorganization.

Dynamic Offshore Resources, Inc.

Overview

We are an independent exploration and production company focused on the acquisition and development of producing oil and natural gas properties in the Gulf of Mexico. Since we commenced operations in 2008, we have pursued an active growth strategy as an acquirer of producing assets that provide attractive development opportunities. We seek to maximize the value of our reserves through focused operations and exploitation to generate attractive cash returns. Our management team has an average of more than 28 years of energy industry experience, primarily in the Gulf of Mexico, and is experienced in the unique aspects of evaluating, acquiring and developing offshore properties.

As of July 31, 2011, our estimated net proved reserves were 60.1 MMBoe, of which 50% was oil and 81% was proved developed, with an associated PV-10 of approximately $1.7 billion, based on Securities and Exchange Commission ("SEC") pricing of $88.44 per Bbl for oil and $4.19 per MMBtu for natural gas. As of that same date, our estimated net probable reserves were 16.0 MMBoe with an associated PV-10 of approximately $370.1 million. Please read "—Summary Historical Operating and Reserve Data—Summary Reserve Data" beginning on page 15 for information on our estimated net proved and probable reserves, PV-10 and related pricing. During November 2011, our properties had aggregate average net daily production in excess of 27,000 Boe per day.

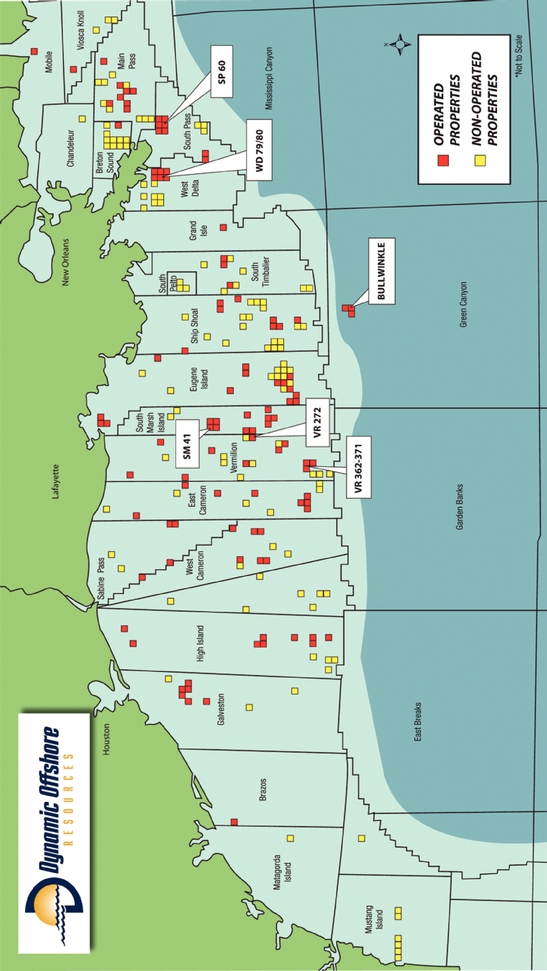

As of September 30, 2011, we had interests in approximately 270 net productive wells and over 250 offshore oil and gas leases in federal and state waters of the Gulf of Mexico, representing approximately 830,000 gross (490,000 net) acres. Importantly, we operate more than 90% of our assets based on the PV-10 of our proved oil and natural gas reserves as of July 31, 2011, allowing us to maintain better control over our asset portfolio. Our properties are predominantly located in water depths of less than 300 feet. In addition, we own a 49% interest in and operate the deepwater Bullwinkle field and associated platform, located in approximately 1,350 feet of water. Similar to our shallow water properties, the Bullwinkle field produces from a fixed-leg platform utilizing surface wellheads and blowout preventers and, consequently, is not subject to recent regulations instituted for deepwater drilling.

1

Our Acquisition History

A significant portion of our growth has been achieved through a series of acquisitions. Since we began operations in 2008, we have completed ten material acquisitions, creating significant value relative to the capital employed. Since inception, our principal equity owners have invested approximately $225 million and have received approximately $123 million in aggregate distributions from cash flows, for a net investment of $102 million. Over this same period, we have incurred a total of $555 million in debt, with $365 million of debt outstanding and $59 million of cash and cash equivalents as of December 31, 2011. As a result of these acquisitions and our operations, the PV-10 of our proved oil and natural gas reserves totaled approximately $1.7 billion as of July 31, 2011.

We believe that the Gulf of Mexico continues to represent an attractive buyer's market, given the limited number of competitors and the availability of acquisition opportunities, as other oil and natural gas companies divest their Gulf of Mexico properties. For example, on August 31, 2011, we acquired substantially all of the Gulf of Mexico assets that Exxon Mobil Corporation ("Exxon") acquired as part of its acquisition of XTO Energy Inc. in 2010. Please read "—Recent Developments—XTO Acquisition" beginning on page 7. We will continue to be opportunistic in evaluating potential acquisition targets, which we expect will include both shallow water properties and properties in deeper waters with characteristics similar to the Bullwinkle field.

The following table presents key metrics related to each of our material acquisitions. For more information, please read "Business—Our Acquisition History" beginning on page 70.

| |

|

|

As of Acquisition Date(1) | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Acquisition

|

Acquisition Date |

Major Fields | Net Proved Reserves (MMBoe) |

% Oil | % Proved Developed |

|||||||||

SPN Resources(2) |

March 2008 | South Pass 60, West Delta 79/80 | 10.2 | 57 | % | 90 | % | |||||||

Northstar |

July 2008 | Eugene Island 307, Eugene Island 32 | 8.7 | 46 | % | 75 | % | |||||||

Bayou Bend Petroleum |

May 2009 | Marsh Island | 0.6 | 13 | % | 73 | % | |||||||

Beryl Oil and Gas(2) |

October 2009 | Vermilion 362-371 | 14.3 | 25 | % | 85 | % | |||||||

Shell |

January 2010 | Bullwinkle | 6.2 | 89 | % | 68 | % | |||||||

Samson Resources |

July 2010 | Vermilion 272, High Island 52 | 4.9 | 48 | % | 92 | % | |||||||

Providence Resources |

March 2011 | Ship Shoal 252/253, Main Pass 19 | 1.4 | 22 | % | 82 | % | |||||||

Gryphon Exploration |

May 2011 | High Island 52, Ship Shoal 301 | 2.1 | 12 | % | 100 | % | |||||||

XTO |

August 2011 | South Marsh Island 41, West Cameron 485/507 | 13.5 | 39 | % | 72 | % | |||||||

MOR |

September 2011 | South Pass 60, West Delta 79/80 | (3) | 3.4 | 65 | % | 92 | % | ||||||

- (1)

- Based

on reserve reports or our internally generated reserve estimates prepared at or near the acquisition date.

- (2)

- Includes

interests subsequently acquired from Superior in exchange for a 10% equity interest in us.

- (3)

- We acquired from MOR the remaining 25% working interest in the properties that we acquired from SPN Resources in 2008.

Since our inception, we have acquired 65.5 MMBoe of net proved reserves through ten material acquisitions (including the XTO Acquisition and the MOR Transaction) and as of July 31, 2011, have produced 14.7 MMBoe. At July 31, 2011, our estimated net proved reserves were 60.1 MMBoe (including the additional reserves that we acquired in the XTO Acquisition and the MOR Transaction).

Our Significant Fields

All of our oil and natural gas properties are located in federal and state waters in the Gulf of Mexico. In the aggregate, our six largest fields accounted for approximately 66% of the PV-10 of our proved oil and natural gas reserves as of July 31, 2011. Our largest fields include the following:

- •

- Bullwinkle field: The Bullwinkle field is located in approximately 1,350 feet of water and encompasses all of Green Canyon blocks 65, 108 and 109. Cumulative production from our

2

- •

- South Marsh Island 41 field: The South Marsh

Island 41 field is located in approximately 100 feet of water and encompasses all of South Marsh Island blocks 40, 41, 44 and 45. Cumulative production from our South Marsh

Island 41 field from first production in 1967 through April 2011 totaled approximately 14 MMBbls of oil and 87 Bcf of natural gas.

- •

- South Pass 60 field: The South Pass 60 field

is located in approximately 250 feet of water and encompasses all or portions of South Pass blocks 6, 17, 59, 60, 61, 66 and 67. Cumulative production from our South Pass 60 field

from first production in 1972 through April 2011 totaled approximately 229 MMBbls of oil and 498 Bcf of natural gas.

- •

- West Delta 79/80 field: The West Delta 79/80

field is located in approximately 150 feet of water and encompasses all or portions of West Delta blocks 57, 79 and 80. Cumulative production from our West Delta 79/80 field from

first production in 1970 through April 2011 totaled approximately 162 MMBbls of oil and 616 Bcf of natural gas.

- •

- Vermilion 362-371 field: The

Vermilion 362-371 field is located in approximately 300 feet of water and encompasses all of Vermilion blocks 362, 363 and 371. Cumulative production from our

Vermilion 362-371 field from first production in 1994 through April 2011 totaled approximately 6 MMBbls of oil and 65 Bcf of natural gas.

- •

- Vermilion 272 field: The Vermilion 272 field is located in approximately 175 feet of water and encompasses all of Vermilion block 272 and all of South Marsh Island blocks 87 and 102. Cumulative production from our Vermilion 272 field from first production in 2003 through April 2011 totaled approximately 6 MMBbls of oil and 14 Bcf of natural gas.

Bullwinkle field from first production in 1989 through April 2011 totaled approximately 113 MMBbls of oil and 175 Bcf of natural gas. Also, the Bullwinkle platform serves as a major processing hub for deepwater production of third party fields for which we receive significant production handling revenues.

The following table presents summary data regarding our largest fields as of the date and for the period indicated:

| |

|

|

As of July 31, 2011 | |

||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Field

|

Acquired From |

Operator | Average Working Interest |

% Oil of Proved Reserves |

November 2011 Average Net Daily Production (Boe/d) |

|||||||||

Bullwinkle |

Shell | Dynamic | 49 | % | 84 | % | 1,745 | |||||||

South Marsh Island 41 |

XTO | Dynamic | 100 | % | 90 | % | 1,835 | |||||||

South Pass 60 |

SPN | Dynamic | 100 | % | 84 | % | 2,208 | |||||||

West Delta 79/80 |

SPN | Dynamic | 100 | % | 65 | % | 1,395 | |||||||

Vermilion 362-371 |

Beryl | Dynamic | 67 | % | 35 | % | 1,685 | |||||||

Vermilion 272 |

Samson | Dynamic | 100 | % | 85 | % | 830 | |||||||

Our Business Strategies

Our goal is to increase stockholder value by growing reserves, production and cash flows at an attractive return on invested capital. We seek to achieve this goal through the following strategies:

- •

- Continue to pursue strategic acquisitions. We intend to continue to selectively acquire companies and producing properties based on disciplined valuations of proved reserves. Our acquisition strategy is focused on identifying motivated sellers of operated properties with underworked assets where the total asset retirement obligation is proportionate to the proved reserve value of the assets. We believe these types of assets are candidates for lower-risk production enhancement activities. By applying a disciplined valuation methodology, we reduce the risk of underperformance on the acquired properties while maintaining the potential for higher returns

3

- •

- Enhance returns by focusing on operations and cost

efficiencies. We believe that our focus on lower risk production enhancement activities, such as workovers and recompletions on

producing and shut-in wellbores, is one of the most cost-effective ways to maintain and grow production. We are engaged in a continual effort to monitor and reduce operating

expenses by finding opportunities to safely increase operational efficiencies related to staffing, transportation and operational procedures. Moreover, our ability to accurately estimate and manage

plugging and abandonment ("P&A") costs associated with potential acquisitions increases the likelihood of achieving our target returns on investment.

- •

- Focus primarily on the shallow waters of the Gulf of

Mexico. Our experience in the Gulf of Mexico has led us to focus our efforts in that particular region, where we are familiar with the

regulatory, geological and operational characteristics of this environment. This geographic focus enables us to minimize logistical costs and required staff.

- •

- Maintain a disciplined financial policy. We intend to

continue to pursue a disciplined financial policy by maintaining a prudent capital structure and managing our exposure to interest rate and commodity price risk. We plan to continue maintaining

relatively modest leverage and financing our growth with a balanced combination of equity and debt. Maintaining a balanced capital structure allows us to use our available capital to selectively

pursue attractive investments or acquisition opportunities.

- •

- Manage our exposure to commodity price risk. We intend to continue to manage our exposure to commodity price risk in the near term while remaining opportunistic over the long term. We use a variety of hedging instruments to accomplish our risk management objectives and enhance the stability of our cash flows. Our commodity derivative contracts are currently in the form of basic swaps and collars that are designed to provide a fixed price (swaps) or defined range of prices (collars) that we will receive. We actively monitor our hedge portfolio to support our cash flow objectives.

on our investment. We believe that opportunities to consolidate interests in our existing properties will continue to be available and that these consolidation transactions can generate attractive returns without the risks associated with acquiring and operating new assets. For example, we recently acquired from Moreno Offshore Resources, LLC the remaining interests in the properties we previously acquired from SPN Resources in 2008. Please read "—Recent Developments—MOR Transaction" beginning on page 7. We also believe that maintaining a strong financial profile through our disciplined financial policy helps position us as a preferred buyer by mitigating sellers' concerns regarding our ability to close transactions and fund future abandonment obligations.

Our Competitive Strengths

We have a number of competitive strengths that we believe will help us to successfully execute our business strategies:

- •

- Acquisition execution capabilities. We have a proven track record of identifying, evaluating and executing the purchase of oil and natural gas assets and companies. Since we began operations in 2008, we have completed ten material acquisitions, creating significant value relative to the capital employed. The significant history, experience and familiarity of our executive management team with the Gulf of Mexico leads potential sellers to contact us directly, which reduces potential competition from other buyers. We have an experienced team of professionals dedicated primarily to the technical evaluation of acquisitions and reserve analysis, which allows us to continuously pursue opportunities without compromising the management of our existing assets. Moreover, we believe that our expertise related to the legal, financial and regulatory aspects of mergers and acquisitions allows us to quickly and successfully close transactions.

4

- •

- High-quality asset base with significant production enhancement

opportunities. Our producing asset base is composed of some of the largest fields discovered in the Gulf of Mexico. Given the prolific

nature of our assets, we believe that our fields are characterized by lower-risk properties and offer significant additional development and exploration potential. Specifically, our

geological and geophysical professionals have identified a multi-year inventory of potential drilling locations in our fields associated with our proved reserves, which we believe

represent lower-risk opportunities. In addition, we have identified a substantial inventory of unproven prospects through the technical evaluation of our properties. We have licenses for

recent 3-D seismic data utilizing modern processing techniques on more than 450 offshore blocks. Our seismic data covers the vast majority of our acreage holdings, including multiple data

sets over several of our more valuable properties. Many of our fields contain several producing zones, providing us increased opportunities for production enhancement activities within each wellbore.

Additionally, we own the rights to deep intervals on the vast majority of our approximately 830,000 gross (490,000 net) acres in the Gulf of Mexico, which includes the depths at which ultra-deep

exploration is underway on the Gulf of Mexico shelf.

- •

- Operating control over the majority of our portfolio of

assets. We operate more than 90% of our assets based on the PV-10 of our proved oil and natural gas reserves as of

July 31, 2011, allowing us to maintain better control over our asset portfolio. We believe that controlling operations will allow us to dictate the pace of development as well as the costs,

type and timing of exploration and development activities. We also believe that maintaining operational control over the majority of our assets allows us to better pursue our strategies of enhancing

returns through focusing on production enhancement opportunities, operational and cost efficiencies, maximizing hydrocarbon recovery and effectively managing our P&A liabilities.

- •

- Strong financial profile. We believe that our strong

financial profile positions us as a preferred buyer for potential acquisitions. After the completion of this offering, we expect to continue to have strong liquidity and financial flexibility

sufficient to fund our anticipated capital needs and future growth opportunities. As of September 30, 2011, after giving effect to the application of the net proceeds of this offering, we would

have had approximately $108.0 million outstanding under our revolving credit facility, with additional availability of approximately $322.0 million. Please read "—Recent

Developments—XTO Acquisition" beginning on page 7, "—MOR Transaction" beginning on page 7, and "—Borrowing Base Increases and Debt Repayment;

Distributions to Equity Owners" beginning on page 8. We expect that cash flows from our assets will be sufficient to fund our planned capital expenditure activities, and given our high level of

operational control, we should be able to maintain control over the pace of spending.

- •

- Significant oil exposure. As of July 31, 2011, our

estimated net proved reserves were composed of approximately 50% oil. This oil exposure allows us to benefit from the disparity between relative oil and natural gas prices, which has persisted over

the last several years and which we expect to continue in the future. Nearly all of our oil is sold at LLS, HLS and EIC prices, which have recently traded at a significant premium to NYMEX WTI

benchmark prices. Consequently, our oil production benefits from higher pricing differentials relative to many other North American crude oil producers in other areas. For example, for the three

months ended September 30, 2011, the average realized price before the effect of commodity derivative contracts for our oil production was $104.91 per Bbl, compared to an average WTI index

price of $89.54 per Bbl for the same period.

- •

- Efficient management of our P&A activities. We consider the evaluation and execution of P&A activities to be one of our core competencies. We have an experienced internal team with a dedicated focus on managing our P&A activities and estimating P&A costs associated with acquisition opportunities. Our ongoing effort to manage our P&A liabilities by proactively

5

- •

- Experienced and incentivized management team. Our

management team has an average of more than 28 years of energy industry experience, primarily focused on the Gulf of Mexico. In addition, our executive officers, management and other employees

have a meaningful economic interest in us, which is expected to total approximately 10.1% of our common stock following the completion of this offering, thereby aligning management's interests with

those of our stockholders.

- •

- Affiliation with Riverstone. Investment funds managed or

advised by Riverstone Holdings LLC ("Riverstone") have significant energy and financial expertise to complement their investment in us. To date, affiliates of Riverstone and the Carlyle Group (such

affiliates, the "Riverstone/Carlyle Funds") have committed approximately $16.0 billion to 79 investments across the midstream, upstream, power, oilfield service and renewable sectors of the

energy industry. Following the completion of this offering, the Riverstone/Carlyle Funds will own an approximate 52.3% interest in us. While we expect that our relationship with Riverstone will

continue to provide us with several significant benefits, including access to potential transactions and financial professionals with a successful track record of investing in energy assets,

Riverstone is under no obligation to provide us with such access and is likely to do so only to the extent such access would prove beneficial to Riverstone. In addition, we have renounced our interest

in certain business opportunities that may be presented to Riverstone and its affiliates. Further, affiliates of Riverstone currently have, and may make in the future, investments in other similar

companies that compete with us. Please read "Certain Relationships and Related Party Transactions—Riverstone/Carlyle Funds Investments in Dynamic" beginning on page 126.

- •

- Relationship with Superior. Superior Energy Services and its affiliates (collectively, "Superior") will continue to own a significant equity interest in us following this offering and is a co-owner in Bullwinkle. We believe this relationship offers several significant benefits, including access to technical expertise related to well intervention and decommissioning and insight into offshore service market conditions. Our complementary areas of expertise and operational capabilities position us favorably in the pursuit of future acquisition opportunities. Please read "Certain Relationships and Related Party Transactions—Transactions with Superior" beginning on page 128 and "Description of Capital Stock—Corporate Opportunity" on page 138.

removing inactive structures, wellbores and pipelines meaningfully reduces our operating expenses, maintenance expenses, insurance premiums and overall risk exposure.

Recent Developments

Preliminary 2011 Operational and Financial Results

Although we are in the early stages of compiling our operational and financial results for the fourth quarter and full year of 2011, our preliminary estimated results indicate our production was approximately 26,000 to 26,500 Boe per day for the three months ended December 31, 2011, an increase of 33% to 35% as compared to 19,609 Boe per day in the quarter ended September 30, 2011. The increase in our production for the three months ended December 31, 2011 was primarily attributable to the inclusion of a full quarter's results of the August 2011 XTO Acquisition described below.

We estimate that our proved reserves, net of production, increased slightly between July 31, 2011 and December 31, 2011.

We expect our average realized price before the effect of commodity derivative contracts for our oil production to be between $114.00 and $115.00 per Bbl for the three months ended December 31, 2011, compared to an average WTI index price of $94.06 per Bbl for the same period. For the three months ended December 31, 2011, we expect our average realized price before the effect of commodity

6

derivative contracts for our natural gas production to be between $3.65 and $3.85 per Mcf, compared to an average Henry Hub benchmark price of $3.46 per MMBtu for the same period.

For the three months ended December 31, 2011 as compared to the three months ended September 30, 2011, we expect that (i) our lease operating expenses were slightly lower on a per Boe basis, (ii) our general and administrative expense was comparable and (iii) our workover expense was lower on a per Boe basis.

These results are preliminary and may differ from those ultimately reported in our future SEC filings. The preliminary financial data included in this prospectus has been prepared by, and is the responsibility of, our management. Hein & Associates LLP, our independent registered public accountants, has not audited, reviewed, compiled or performed any procedures with respect to the preliminary financial data underlying these results. Accordingly, Hein & Associates LLP does not express an opinion or any other form of assurance with respect thereto. The preliminary reserve estimates underlying our expectations described above have been prepared by our internal engineers; Netherland, Sewell & Associates, Inc., our independent reserve engineers, have not reviewed or prepared any reports with respect to those estimates.

XTO Acquisition

On August 31, 2011, we acquired from XTO Offshore Inc., HHE Energy Company and XH, LLC, each an indirect subsidiary of Exxon, certain oil and natural gas interests in the Gulf of Mexico for approximately $182.5 million (the "XTO Acquisition"). The properties acquired comprise substantially all of the Gulf of Mexico assets that Exxon acquired as part of its acquisition of XTO Energy, Inc. in 2010 (the "XTO Acquisition Properties"). As of July 31, 2011, based on a reserve report prepared by NSAI and our internally prepared reserve estimates, these properties contained 13,535 MBoe of proved reserves, of which 39% was oil, and 7,025 MBoe of probable reserves. As of that same date, the PV-10 of the proved oil and natural gas reserves was approximately $329 million, and the PV-10 of the probable oil and natural gas reserves was approximately $87 million, in each case based on SEC pricing of $88.44 per Bbl for oil and $4.19 per MMBtu for natural gas. Please read "—Summary Historical Operating and Reserve Data—Summary Reserve Data" beginning on page 15.

The XTO Acquisition Properties include approximately 250,000 gross (130,000 net) acres and 135 gross (62 net) producing wells. At the time of acquisition, net production from the XTO Acquisition Properties during August 2011 was greater than 7,500 Boe/d. Additionally, our geological and geophysical professionals have identified an inventory of over 30 potential drilling locations within the XTO Acquisition Properties. We operate over 90% of the XTO Acquisition Properties.

For more information about the XTO Acquisition Properties, please read "Business—XTO Acquisition" beginning on page 72, "—Our Operations" beginning on page 79 and the statements of revenues and direct operating expenses for the XTO Acquisition Properties included elsewhere in this prospectus.

MOR Transaction

On September 14, 2011, we acquired directly from a subsidiary of Moreno Offshore Resources, LLC ("MOR") for $68.0 million the remaining 25% working interest in the properties that we acquired from SPN Resources in 2008 (the "MOR Transaction"). MOR had originally acquired this interest from SPN Resources at the same time as our initial acquisition. As of July 31, 2011, MOR's 25% working interest represented approximately 3.4 MMBoe of proved reserves, of which approximately 65% was oil, and 0.3 MMBoe of probable reserves. As of that same date, the PV-10 of the proved oil and natural gas reserves associated with MOR's working interest was approximately $104.2 million, and the PV-10 of the probable oil and natural gas reserves was approximately $10.7 million, in each case based on SEC pricing of $88.44 per Bbl for oil and $4.19 per MMBtu for natural gas. At the time of

7

acquisition, net production attributable to MOR's 25% working interest during August 2011 was approximately 1,300 Boe/d. We currently operate substantially all of the properties we acquired in the MOR Transaction.

For more information about the properties acquired in the MOR Transaction, please read "Business—MOR Transaction" beginning on page 73.

Borrowing Base Increases and Debt Repayment; Distributions to Equity Owners

In connection with the XTO Acquisition and the MOR Transaction, the lenders under our credit facility approved two independent increases to our borrowing base of $105 million and $25 million, respectively. Following the closing of the XTO Acquisition and the MOR Transaction, our borrowing base increased from $300 million to $430 million. On November 7, 2011, the lenders under our credit facility reaffirmed the borrowing base of $430 million. On December 28, 2011, we repaid $20 million in borrowings under our revolving credit facility, leaving $365 million in borrowings outstanding as of that date. As of September 30, 2011, after giving effect to the application of the net proceeds of this offering, we would have had approximately $108.0 million outstanding under our revolving credit facility, with additional availability of approximately $322.0 million.

In the fourth quarter of 2011, we made an approved tax distribution to our equity owners of approximately $18 million, and on January 13, 2012, we made an additional approved distribution to our equity owners of $25 million.

Risk Factors

For a discussion of the risks and other considerations that could negatively affect us, including risks related to this offering and our common stock, please read "Risk Factors" beginning on page 20 and "Cautionary Note Regarding Forward-Looking Statements" beginning on page 41.

Conflicts of Interest

Affiliates of Citigroup Global Markets Inc., Credit Suisse Securities (USA) LLC, Deutsche Bank Securities Inc., UBS Securities LLC, Capital One Southcoast, Inc., IBERIA Capital Partners L.L.C., Natixis Securities Americas LLC and RBS Securities Inc. are lenders, and in several cases, agents for the lenders, under our credit facility and may receive more than 5% of the net proceeds of this offering in connection with our repayment of outstanding borrowings under our credit facilty. See "Use of Proceeds" on page 43. A "conflict of interest" under Rule 5121 of the Financial Industry Regulatory Authority, or FINRA, is therefore deemed to exist. Accordingly, this offering is being made in compliance with Rule 5121. Pursuant to Rule 5121, the initial public offering price of the shares of common stock must not be higher than that recommended by a "qualified independent underwriter" meeting certain standards, and the qualified independent underwriter must exercise the usual standards of due diligence with respect to the registration statement of which this prospectus forms a part. Tudor Pickering, Holt & Co. has assumed the responsibilities of acting as the qualified independent underwriter in this offering. Please read "Underwriters—Conflicts of Interest" beginning on page 147.

8

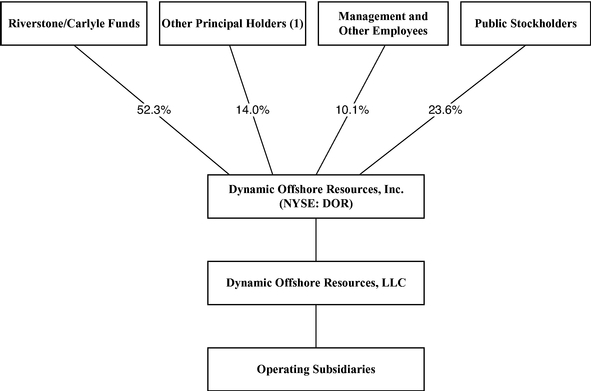

Corporate Reorganization

Pursuant to the terms of a corporate reorganization, which will be completed immediately prior to the closing of this offering, all of the interests in Dynamic Offshore Holding, LP will be transferred to its wholly owned subsidiary, Dynamic Offshore Resources, Inc., through a combination of a contribution of such interests and a merger of Dynamic Offshore Holding, LP into Dynamic Offshore Resources, Inc. and all limited partner interests in Dynamic Offshore Holding, LP will be converted into the right to receive common stock of Dynamic Offshore Resources, Inc. The following diagram indicates our ownership structure after giving effect to our corporate reorganization and this offering based on an assumed initial public offering price of $18.00 per share (the mid-point of the price range set forth on the cover of this prospectus) and assuming no exercise of the underwriters' over-allotment option.

- (1)

- Includes Superior, MOR DOH Holdings, L.L.C. and trusts held for the benefit of family members of our executive officers and other employees.

For more information regarding our principal stockholders, please read "Principal and Selling Stockholders" beginning on page 132 and "Certain Relationships and Related Party Transactions" beginning on page 126. For more information regarding our corporate reorganization, please read "Corporate Reorganization" beginning on page 131.

Corporate Information

Our principal executive offices are located at 1301 McKinney, Suite 900, Houston, Texas 77010, and our telephone number at that address is (713) 728-7840. Our website is located at www.dynamicosr.com. We expect to make our periodic reports and other information filed with or furnished to the SEC available free of charge through our website as soon as reasonably practicable after those reports and other information are electronically filed with or furnished to the SEC. Information on our website or any other website is not incorporated by reference herein and does not constitute a part of this prospectus.

9

Common stock offered by Dynamic Offshore Resources, Inc. |

16,666,667 shares. | |

Common stock to be outstanding after the offering |

70,533,333 shares. |

|

Over-allotment option |

The selling stockholders have granted the underwriters a 30-day option to purchase up to an aggregate of 2,500,000 additional shares of our common stock to cover over-allotments. |

|

Use of proceeds |

We expect to receive approximately $277.0 million of net proceeds from the sale of the common stock offered by us, based upon the assumed initial public offering price of $18.00 per share (the midpoint of the price range set forth on the cover page of this prospectus), after deducting underwriting discounts and estimated offering expenses. Each $1.00 increase (decrease) in the public offering price would increase (decrease) our net proceeds by approximately $15.6 million. We intend to use the net proceeds from this offering to repay outstanding borrowings under our revolving credit facility. We will not receive any proceeds from the sale of shares by the selling stockholders pursuant to any exercise of the underwriters' over-allotment option to purchase additional shares of our common stock. |

|

|

Affiliates of certain of the underwriters are lenders under our revolving credit facility and, accordingly, will receive a portion of the proceeds of this offering. Please read "Use of Proceeds" on page 43, "Corporate Reorganization" on page 131, and "Underwriters" beginning on page 144. |

|

Dividend policy |

We do not anticipate paying any cash dividends on our common stock. In addition, our revolving credit facility places certain restrictions on our ability to pay cash dividends. Please read "Dividend Policy" on page 43. |

|

Risk factors |

You should carefully read and consider the information beginning on page 20 of this prospectus set forth under the heading "Risk Factors" and all other information set forth in this prospectus before deciding to invest in our common stock. |

|

Listing and trading symbol |

We have been approved, subject to official notice of issuance, to list our common stock on the New York Stock Exchange under the symbol "DOR". |

10

Summary Historical Consolidated and Unaudited Pro Forma Financial Data

You should read the following summary financial data in conjunction with "Selected Historical Consolidated and Unaudited Pro Forma Financial Data" beginning on page 46, "Corporate Reorganization" beginning on page 131, "Management's Discussion and Analysis of Financial Condition and Results of Operations" beginning on page 51 and our historical consolidated financial statements and unaudited pro forma financial information and related notes thereto included elsewhere in this prospectus. The financial information included in this prospectus may not be indicative of our future results of operations, financial position and cash flows.

Set forth below is (i) summary historical consolidated financial data for the period from January 1, 2008 through March 13, 2008 of SPN Resources LLC, our accounting predecessor, which has been derived from the audited financial statements of SPN Resources LLC included elsewhere in this prospectus, (ii) our summary historical consolidated financial data for the years ended December 31, 2008, 2009 and 2010, and balance sheet data at December 31, 2009 and 2010, which has been derived from the audited financial statements of Dynamic Offshore Holding, LP included elsewhere in this prospectus, (iii) our summary historical consolidated financial data for the nine months ended September 30, 2010 and 2011 and balance sheet data at September 30, 2011, which has been derived from the unaudited financial statements of Dynamic Offshore Holding, LP included elsewhere in this prospectus, and (iv) pro forma consolidated financial data for the year ended December 31, 2010 and the nine months ended September 30, 2011 and pro forma balance sheet data at September 30, 2011, which has been derived from the unaudited pro forma financial statements included elsewhere in this prospectus.

We have accounted for the MOR Transaction as a transaction between entities under common control because of our relationship with Riverstone, which also controls (as defined in the accounting standards codification master glossary) the Moreno Group companies. Transfers of net assets between entities under common control are accounted for as if the transfer occurred at the beginning of the period, and prior years are retrospectively adjusted to furnish comparative information similar to the pooling method.

The unaudited pro forma financial data for the year ended December 31, 2010, which reflects our acquisition of certain oil and natural gas properties from Samson Resources on July 8, 2010 (the "Samson Acquisition Properties"), our recently completed XTO Acquisition, our corporate reorganization and the effects of this offering and the application of the net proceeds, was derived from the unaudited pro forma financial information included elsewhere in this prospectus. The unaudited pro forma financial information for the year ended December 31, 2010 and the nine months ended September 30, 2011 was prepared as if each of these transactions occurred on January 1, 2010. The unaudited pro forma financial information as of September 30, 2011 was prepared as if our corporate reorganization and this offering and the application of the net proceeds had occurred on September 30, 2011.

11

| |

Historical | Pro Forma | ||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

Predecessor | Dynamic Offshore Holding, LP | ||||||||||||||||||||||||

| |

January 1, 2008 Through March 13, 2008 |

Year Ended December 31, |

Nine Months Ended September 30, |

|

Nine Months Ended September 30, 2011 |

|||||||||||||||||||||

| |

Year Ended December 31, 2010 |

|||||||||||||||||||||||||

| |

2008 | 2009 | 2010 | 2010 | 2011 | |||||||||||||||||||||

| |

(In thousands) |

|||||||||||||||||||||||||

Statement of operations data: |

||||||||||||||||||||||||||

Oil and gas revenues |

$ | 56,179 | $ | 209,219 | $ | 178,992 | $ | 345,812 | $ | 255,496 | $ | 340,541 | 536,507 | 436,179 | ||||||||||||

Other operating revenues |

741 | 1,695 | 2,017 | 12,815 | 7,770 | 11,926 | 12,815 | 11,926 | ||||||||||||||||||

|

56,920 | 210,914 | 181,009 | 358,627 | 263,266 | 352,467 | 549,322 | 448,105 | ||||||||||||||||||

Operating expenses: |

||||||||||||||||||||||||||

Lease operating expense |

8,791 | 36,725 | 60,618 | 89,399 | 63,511 | 78,998 | 126,135 | 98,605 | ||||||||||||||||||

Exploration expense |

— | 80 | 8,999 | 2,100 | 1,736 | 7,285 | 2,100 | 7,285 | ||||||||||||||||||

Depreciation, depletion and amortization |

13,414 | 49,648 | 88,573 | 195,122 | 96,205 | 102,417 | 271,568 | 132,289 | ||||||||||||||||||

General and administrative expense |

2,275 | 17,843 | 25,655 | 24,328 | 19,280 | 19,328 | 24,328 | 19,328 | ||||||||||||||||||

Other operating expense(1) |

4,786 | 29,930 | 51,142 | 73,047 | 50,114 | 51,709 | 82,931 | 58,328 | ||||||||||||||||||

|

29,266 | 134,226 | 234,987 | 383,996 | 230,846 | 259,737 | 507,062 | 315,835 | ||||||||||||||||||

Income (loss) from operations |

27,654 | 76,688 | (53,978 | ) | (25,369 | ) | 32,420 | 92,730 | 42,260 | 132,270 | ||||||||||||||||

Other income (expense): |

||||||||||||||||||||||||||

Interest expense, net |

(34 | ) | (2,492 | ) | (7,138 | ) | (13,541 | ) | (10,688 | ) | (6,409 | ) | (12,123 | ) | (4,324 | ) | ||||||||||

Commodity derivative income (expense) |

— | 159,939 | (21,887 | ) | 6,990 | 29,838 | 61,889 | 6,990 | 61,889 | |||||||||||||||||

Bargain purchase gain |

— | — | 161,351 | 4,024 | 4,024 | — | 4,024 | — | ||||||||||||||||||

Other |

— | (103 | ) | — | (1,080 | ) | — | (146 | ) | (1,080 | ) | (146 | ) | |||||||||||||

Income (loss) before income taxes |

27,620 | 234,032 | 78,348 | (28,976 | ) | 55,594 | 148,064 | 40,071 | 189,689 | |||||||||||||||||

Income tax benefit (expense) |

— | (14,738 | ) | 20,387 | 14,814 | 4,344 | 1,544 | (14,719 | ) | (66,387 | ) | |||||||||||||||

Net income (loss) |

27,620 | 219,294 | 98,735 | (14,162 | ) | 59,938 | 149,608 | 25,352 | 123,302 | |||||||||||||||||

Less: Net income (loss) attributable to noncontrolling interests |

— | 34,648 | 57,663 | (4,070 | ) | 10,184 | 460 | (2,645 | ) | 299 | ||||||||||||||||

Net income (loss) attributable to Dynamic Offshore Holding, LP |

$ | 27,620 | $ | 184,646 | $ | 41,072 | $ | (10,092 | ) | $ | 49,754 | $ | 149,148 | $ | 27,997 | $ | 123,003 | |||||||||

Pro forma net income (loss) attributable to Dynamic Offshore Holding, LP/Dynamic Offshore Resources, Inc. |

$ | 129,600 | $ | 13,634 | $ | (16,883 | ) | $ | 29,516 | $ | 95,947 | $ | 27,997 | $ | 123,003 | |||||||||||

Pro forma basic and diluted earnings per share |

$ | 1.84 | $ | 0.19 | $ | (0.24 | ) | $ | 0.42 | $ | 1.36 | $ | 0.40 | $ | 1.74 | |||||||||||

Adjusted EBITDA(2) |

$ | 41,953 | $ | 154,165 | $ | 131,440 | $ | 235,567 | $ | 175,756 | $ | 206,158 | $ | 383,626 | $ | 278,064 | ||||||||||

- (1)

- Includes

insurance expense, workover expense, accretion expense, casualty loss (gain), loss on abandonments, loss (gain) on sale of assets and other.

- (2)

- Adjusted EBITDA is a non-GAAP financial measure. For a definition of Adjusted EBITDA and a reconciliation of Adjusted EBITDA to our net income (loss) and net cash provided by operating activities, please read "—Non-GAAP Financial Measure" beginning on page 13.

| |

As of December 31, | |

|

||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

As of September 30, 2011 |

Pro Forma As of September 30, 2011 |

|||||||||||

| |

2009 | 2010 | |||||||||||

| |

(In thousands) |

||||||||||||

Balance sheet data: |

|||||||||||||

Cash and cash equivalents |

$ | 88,457 | $ | 75,162 | $ | 18,765 | $ | 18,766 | |||||

Net property, plant and equipment |

861,204 | 864,645 | 1,145,544 | 1,145,544 | |||||||||

Total assets |

1,138,999 | 1,067,131 | 1,374,766 | 1,371,767 | |||||||||

Long-term debt |

243,000 | 203,205 | 385,000 | 108,000 | |||||||||

Total owners'/stockholders' equity |

526,244 | 475,531 | 530,579 | 704,580 | |||||||||

12

| |

Predecessor | Dynamic Offshore Holding, LP | |||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

January 1, 2008 Through March 13, 2008 |

Years Ended December 31, |

Nine Months Ended September 30, |

||||||||||||||||

| |

2008 | 2009 | 2010 | 2010 | 2011 | ||||||||||||||

| |

(In thousands) |

||||||||||||||||||

Other financial data: |

|||||||||||||||||||

Net cash provided by operating activities |

$ | 22,836 | $ | 173,704 | $ | 37,796 | $ | 157,656 | $ | 139,553 | $ | 156,602 | |||||||

Net cash provided by (used in) investing activities |

(3,627 | ) | (431,423 | ) | 62,075 | (94,605 | ) | (113,576 | ) | (296,676 | ) | ||||||||

Net cash provided by (used in) financing activities |

—- | 309,749 | (63,589 | ) | (76,346 | ) | 5,823 | 83,677 | |||||||||||

Non-GAAP Financial Measure

Adjusted EBITDA

Adjusted EBITDA is a supplemental non-GAAP financial measure that is used by management and external users of our consolidated financial statements, such as industry analysts, investors, lenders and rating agencies, to compare our performance across reporting periods on a consistent basis by excluding items that we do not believe are indicative of our core operating performance.

We define Adjusted EBITDA as revenues, including commodity derivative settlements, less lease operating expense, workover expense, insurance expense and general and administrative expense. Adjusted EBITDA is not a measure of net income or cash flows as determined by United States generally accepted accounting principles ("GAAP").

Our senior management reviews Adjusted EBITDA monthly as a core internal management process. We believe that investors benefit from having access to the same financial measures that our management uses in evaluating our operating results. Adjusted EBITDA provides useful information to investors because it is a supplemental financial measure used by us and by external users of our financial statements, including investors, commercial banks and others, to assess:

- •

- the financial performance of our assets without regard to financing methods, capital structure or historical cost basis;

- •

- our operating performance and return on capital as compared to other companies in our industry, without regard to

financing or capital structure; and

- •

- the viability of acquisitions and capital expenditure projects and the overall rates of return on alternative investment opportunities.

Adjusted EBITDA has limitations as an analytical tool and should not be considered as an alternative to, or more meaningful than, performance measures calculated in accordance with GAAP. Some of these limitations are:

- •

- certain items excluded from Adjusted EBITDA are significant components in understanding a company's financial performance,

such as a company's cost of capital and tax structure;

- •

- Adjusted EBITDA does not reflect our cash expenditures or future requirements for capital expenditures or contractual

commitments;

- •

- Adjusted EBITDA does not reflect changes in, or cash requirements for, our working capital needs;

13

- •

- Adjusted EBITDA does not consider the potentially dilutive impact of share-based compensation;

- •

- although depreciation and amortization are non-cash charges, the assets being depreciated and amortized will

often have to be replaced in the future, and Adjusted EBITDA does not reflect any cash requirements for such replacements; and

- •

- our computations of Adjusted EBITDA may not be comparable to other similarly titled measures of other companies.

Management compensates for the limitations of Adjusted EBITDA as an analytical tool by reviewing the comparable GAAP measures, understanding the differences between the measures and incorporating that understanding into its decision-making processes.

The following tables present a reconciliation of the non-GAAP financial measure of Adjusted EBITDA to the GAAP financial measures of net income (loss) and net cash provided by operating activities.

| |

Historical | Pro Forma | |||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

Predecessor | Dynamic Offshore Holding, LP | |||||||||||||||||||||||

| |

January 1, 2008 Through March 13, 2008 |

Year Ended December 31, |

Nine Months Ended September 30, |

|

Nine Months Ended September 30, 2011 |

||||||||||||||||||||

| |

Year Ended December 31, 2010 |

||||||||||||||||||||||||

| |

2008 | 2009 | 2010 | 2010 | 2011 | ||||||||||||||||||||

| |

(In thousands) |

||||||||||||||||||||||||

Reconciliation of net income (loss) to Adjusted EBITDA: |

|||||||||||||||||||||||||

Net income (loss) |

$ | 27,620 | $ | 219,294 | $ | 98,735 | $ | (14,162 | ) | $ | 59,938 | $ | 149,608 | $ | 25,352 | $ | 123,302 | ||||||||

Interest expense, net |

34 | 2,492 | 7,138 | 13,541 | 10,688 | 6,409 | 12,123 | 4,324 | |||||||||||||||||

Income tax expense (benefit) |

— | 14,738 | (20,387 | ) | (14,814 | ) | (4,344 | ) | (1,544 | ) | 14,719 | 66,387 | |||||||||||||

Depreciation, depletion and amortization |

13,414 | 49,648 | 88,573 | 195,122 | 96,205 | 102,417 | 271,568 | 132,289 | |||||||||||||||||

Unrealized (gain) loss on commodity derivatives |

— | (146,671 | ) | 97,975 | 36,181 | 7,043 | (67,507 | ) | 36,181 | (67,507 | ) | ||||||||||||||

Other operating expense |

885 | 14,561 | 20,757 | 22,643 | 10,250 | 16,629 | 26,627 | 19,123 | |||||||||||||||||

Bargain purchase gain |

— | — | (161,351 | ) | (4,024 | ) | (4,024 | ) | — | (4,024 | ) | — | |||||||||||||

Other |

— | 103 | — | 1,080 | — | 146 | 1,080 | 146 | |||||||||||||||||

Adjusted EBITDA |

$ | 41,953 | $ | 154,165 | $ | 131,440 | $ | 235,567 | $ | 175,756 | $ | 206,158 | $ | 383,626 | 278,064 | ||||||||||

Reconciliation of net cash provided by operating activities to Adjusted EBITDA: |

|||||||||||||||||||||||||

Net cash provided by operating activities |

$ | 22,836 | $ | 173,704 | $ | 37,796 | $ | 157,656 | $ | 139,553 | $ | 156,602 | |||||||||||||

Derivative settlements |

— | 13,268 | 76,088 | 43,171 | 36,881 | (5,618 | ) | ||||||||||||||||||

Interest expense, net |

34 | 2,492 | 7,138 | 13,541 | 10,688 | 6,409 | |||||||||||||||||||

Exploration expense |

— | 80 | 8,999 | 2,100 | 1,736 | 7,285 | |||||||||||||||||||

Amortization in interest expense, net |

— | 315 | 219 | (287 | ) | (332 | ) | (291 | ) | ||||||||||||||||

Current income tax expense |

— | — | (2,188 | ) | — | — | — | ||||||||||||||||||

Changes in operating assets and liabilities |

18,978 | (45,784 | ) | (1,299 | ) | 19,156 | (10,806 | ) | 41,178 | ||||||||||||||||

Other |

105 | 10,090 | 4,687 | 230 | (1,964 | ) | 593 | ||||||||||||||||||

Adjusted EBITDA |

$ | 41,953 | $ | 154,165 | $ | 131,440 | $ | 235,567 | $ | 175,756 | $ | 206,158 | |||||||||||||

14

Summary Historical Operating and Reserve Data

Summary Reserve Data

The following table presents summary data with respect to our estimated net proved and probable oil and natural gas reserves as of the dates indicated. The reserve estimates at July 31, 2011 for our estimated net proved and probable oil and natural gas reserves and for the estimated net proved and probable oil and natural gas reserves that we acquired in the MOR Transaction presented in the tables below are based on reports prepared by Netherland, Sewell & Associates, Inc. ("NSAI"), independent reserve engineers, in accordance with the rules and regulations of the SEC regarding oil and natural gas reserve reporting. The estimates of the net proved and probable oil and natural gas reserves that we acquired in the XTO Acquisition at July 31, 2011 presented in the tables below are based, in part, on reports prepared by NSAI for the XTO Acquisition covering 75% of the total net proved reserves (85% of the total net proved developed reserves and 85% of the present value of the total proved reserves) in accordance with the rules and regulations of the SEC regarding oil and natural gas reserve reporting. The remaining 25% of the total net proved reserves (15% of the total net proved developed reserves and 15% of the present value of the total proved reserves) and all of the total probable reserves for the XTO Acquisition are based on estimates prepared by our internal engineers.

The reserve estimates at December 31, 2010 presented in the table below are based on estimates prepared by our internal engineers, in accordance with the rules and regulations regarding oil and natural gas reserve reporting. For more information about our summary reserve data, please read "Business—Our Operations" beginning on page 79 and NSAI's reports, which have been filed as exhibits to the registration statement containing this prospectus.

The reserve estimates and the associated PV-10 and standardized measure included in this prospectus do not include the effects of insurance costs. For more detail about our aggregate insurance costs, please read the operating expense information contained within Note 3 to the audited consolidated financial statements of Dynamic Offshore Holding, LP.

Proved reserves are reserves which, by analysis of geoscience and engineering data, can be estimated with reasonable certainty to be economically producible from a given date forward from known reservoirs under existing economic conditions, operating methods and government regulations prior to the time at which contracts providing the right to operate expire, unless evidence indicates that renewal is reasonably certain. Probable reserves are reserves that are less certain to be recovered than proved reserves but which, together with proved reserves, are as likely as not to be recovered. Estimates of probable reserves which may potentially be recoverable through additional drilling or recovery techniques are by nature more uncertain than estimates of proved reserves and accordingly are subject to substantially greater risk of not actually being realized by us.

15

| |

|

At July 31, 2011 | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

At December 31, 2010(1) |

Dynamic(2) | XTO | Total | |||||||||||

Reserve Data(3): |

|||||||||||||||

Estimated proved reserves: |

|||||||||||||||

Oil (MMBbls) |

18.5 | 24.6 | 5.2 | 29.8 | |||||||||||

Natural gas (Bcf)(4) |

91.3 | 131.8 | 49.8 | 181.6 | |||||||||||

Total estimated proved reserves (MMBoe)(5) |

33.7 | 46.6 | 13.5 | 60.1 | |||||||||||

Proved developed: |

|||||||||||||||

Oil (MMBbls) |

15.0 | 19.5 | 4.4 | 24.0 | |||||||||||

Natural gas (Bcf) |

80.7 | 116.1 | 32.0 | 148.0 | |||||||||||

Total (MMBoe) |

28.5 | 38.9 | 9.8 | 48.7 | |||||||||||

Percent proved developed |

85 | % | 84 | % | 72 | % | 81 | % | |||||||

Proved undeveloped: |

|||||||||||||||

Oil (MMBbls) |

3.4 | 5.1 | 0.8 | 5.9 | |||||||||||

Natural gas (Bcf) |

10.5 | 15.7 | 17.9 | 33.6 | |||||||||||

Total (MMBoe) |

5.2 | 7.7 | 3.8 | 11.5 | |||||||||||

PV-10 of proved reserves (in millions)(6) |

$ | 947.7 | $ | 1,381.5 | $ | 328.5 | $ | 1,710.0 | |||||||

Standardized Measure (in millions)(6) |

$ | 1,184.5 | n/a | n/a | n/a | ||||||||||

Estimated probable reserves: |

|||||||||||||||

Oil (MMBbls) |

4.6 | 4.7 | 1.5 | 6.2 | |||||||||||

Natural gas (Bcf)(4) |

49.0 | 25.6 | 33.3 | 58.9 | |||||||||||

Total estimated probable reserves (MMBoe) |

12.7 | 9.0 | 7.0 | 16.0 | |||||||||||

PV-10 of probable reserves (in millions)(6) |

$ | 285.1 | $ | 282.7 | $ | 87.4 | $ | 370.1 | |||||||

- (1)

- Reflects

reserves net to our equity interests in our consolidated subsidiaries in which we owned less than 100% of the outstanding equity as of

December 31, 2010.

- (2)

- Includes

interests acquired in the MOR Transaction.

- (3)

- Our

estimated proved and probable reserves and related future net revenues and PV-10 at December 31, 2010 and July 31, 2011 and

Standardized Measure at December 31, 2010 were determined using index prices for oil and natural gas, without giving effect to derivative transactions, and were held constant throughout the

life of the properties. The unweighted arithmetic average first-day-of-the-month prices for the prior 12 months were $79.40/Bbl for oil and

$4.38/MMBtu for natural gas at December 31, 2010 and $88.44/Bbl for oil and $4.19/MMBtu for natural gas at July 31, 2011. These prices were adjusted by lease for quality, transportation

fees, geographical differentials, marketing bonuses or deductions and other factors affecting the price received at the wellhead on a historical basis.

- (4)

- Includes

NGL volumes, which we do not believe are significant.

- (5)

- One

Boe is equal to six Mcf of natural gas or one Bbl of oil or NGLs based on an approximate energy equivalency.

- (6)

- For more information about our PV-10 and Standardized Measure, please read "—PV-10 and Standardized Measure" beginning on page 17.

Price Sensitivity

The following table illustrates the sensitivity of our estimated proved and probable oil and natural gas reserves and related PV-10 to changes in product price levels. The reserve quantities and PV-10 shown below were prepared on the same basis as in the table above, except (i) that NSAI's report for the properties acquired in the XTO Acquisition covers 84% of the present value of the total proved reserves acquired and (ii) for the use of market pricing based on closing forward prices on the NYMEX for oil and natural gas on July 31, 2011 rather than average first-day-of-the-month prices for the prior 12 months as specified by the SEC. The assumed lease and well operating costs included in

16

the pricing sensitivity are based on our historical lease and well operating costs and have been held constant throughout the life of the properties. The assumed capital and abandonment costs were held constant to the date of the expenditure. Based on SEC pricing, the PV-10 of our proved oil and natural gas reserves was approximately $1.7 billion while, based on NYMEX forward pricing at July 22, 2011, as set forth below, the PV-10 of our proved oil and natural gas reserves was approximately $2.1 billion. Please read "Business—Our Operations" beginning on page 79 for further discussion of why we believe the presentation of oil and natural gas reserves using forward pricing is useful for investors.

| |

At July 31, 2011 | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

Dynamic (1) | XTO | Total | |||||||||

Reserve Data(2): |

||||||||||||

Estimated proved reserves: |

||||||||||||

Oil (MMBbls) |

25.1 | 5.3 | 30.4 | |||||||||

Natural gas (Bcf)(3) |

134.4 | 50.4 | 184.9 | |||||||||

Total estimated proved reserves (MMBoe)(4) |

47.6 | 13.7 | 61.3 | |||||||||

PV-10 of proved reserves (in millions)(5) |

$ | 1,725.9 | $ | 413.7 | $ | 2,139.6 | ||||||

Estimated probable reserves: |

||||||||||||

Oil (MMBbls) |

4.8 | 1.5 | 6.3 | |||||||||

Natural gas (Bcf)(3) |

27.5 | 37.4 | 64.9 | |||||||||

Total estimated probable reserves (MMBoe) |

9.4 | 7.7 | 17.1 | |||||||||

PV-10 of probable reserves (in millions)(5) |

$ | 349.5 | $ | 129.7 | $ | 479.2 | ||||||

- (1)

- Includes

interests acquired in the MOR Transaction.

- (2)

- Our

estimated proved reserves and related future net revenues and PV-10 at July 31, 2011 were determined using index prices for oil and

natural gas, without giving effect to derivative transactions. At July 22, 2011, the forward prices were: $100.14/Bbl for oil and $4.46/MMBtu for natural gas for the period ending

December 31, 2011; $102.61/Bbl for oil and $4.79/MMBtu for natural gas for the year ending December 31, 2012; $103.75/Bbl for oil and $5.19/MMBtu for natural gas for the year ending

December 31, 2013; and $103.53/Bbl for oil and $5.40/MMBtu for natural gas thereafter. These prices were adjusted by lease for quality, transportation fees, historical geographical

differentials, marketing bonuses or deductions and other factors affecting the price received at the wellhead.

- (3)

- Includes

NGL volumes, which we do not believe are significant.

- (4)

- One

Boe is equal to six Mcf of natural gas or one Bbl of oil or NGLs based on an approximate energy equivalency.

- (5)

- For more information about our PV-10 and Standardized Measure, please read "—PV-10 and Standardized Measure" below.

PV-10 and Standardized Measure

We and others in the oil and natural gas industry use PV-10 as a measure to compare the relative size and value of proved reserves held by a company without regard to the specific tax characteristics of the entity. Investors should be cautioned, however, that neither PV-10 nor Standardized Measure represents an estimate of the fair market value of our oil and natural gas reserves. PV-10 differs from Standardized Measure because it does not include the effects of income taxes on future net revenues. Until the completion of our corporate reorganization in connection with the closing of this offering, we will remain a limited partnership not subject to entity level taxation. Other than with respect to our corporate subsidiary, we have not provided for federal or state corporate income taxes because taxable income is passed through to our equity holders.

Standardized Measure represents the present value of estimated future cash inflows from proved oil and natural gas reserves, less future development, production and income tax expenses, discounted

17

at 10% per annum to reflect timing of future cash flows. Our Standardized Measure as of December 31, 2010 includes $170.2 million attributable to noncontrolling interests in our consolidated subsidiaries. In connection with the closing of this offering, we will be converted into a corporation which will be treated as a taxable entity for federal income tax purposes. Future calculations of Standardized Measure will include the effects of income taxes on future net revenues. Assuming our anticipated conversion into a corporation had occurred on December 31, 2010, we estimate that incremental income taxes of $372.9 million would have reduced our Standardized Measure to $898.1 million. For further discussion of income taxes, please read "Management's Discussion and Analysis of Financial Condition and Results of Operations" beginning on page 51.

The following table presents a reconciliation of the PV-10 of our proved reserves as of December 31, 2010 to our Standardized Measure at that date.

| |

At December 31, 2010 | |||

|---|---|---|---|---|

| |

(in millions) |

|||

PV-10 of proved reserves |

$ | 947.7 | ||

Proved reserves attributable to noncontrolling interests |

170.2 | |||

Proved reserves attributable to the MOR Transaction |

91.4 | |||

Discounted future net income taxes |

(24.8 | ) | ||

Standardized Measure |

$ | 1,184.5 | ||

In addition, we have disclosed PV-10 in certain other contexts in this prospectus, including: (i) PV-10 calculated as of an interim date, (ii) PV-10 of probable reserves, (iii) PV-10 of proved and probable reserves attributable to acquired properties and (iv) PV-10 of proved and probable reserves adjusted for pricing sensitivities. In each of these cases, the PV-10 disclosed differs from Standardized Measure of proved reserves as of December 31, 2010, which cannot be calculated on the same basis as the respective PV-10 amounts disclosed.

With respect to PV-10 calculated as of an interim date, including in connection with reserves attributable to acquired properties, it is not practicable to calculate the taxes for the related interim period because GAAP does not provide for disclosure of the Standardized Measure on an interim basis. For acquired properties, combining the seller's Standardized Measure with ours would not produce a meaningful number because the seller's tax status is irrelevant to our calculation on a going-forward basis. Similarly, Standardized Measure is based on proved reserves as of fiscal year end calculated using unweighted arithmetic average first-day-of-the-month prices for the prior 12 months. GAAP does not prescribe any corresponding GAAP measure for PV-10 of probable reserves or PV-10 of reserves adjusted for pricing sensitivities. For these reasons, it is not practicable for us to reconcile these additional PV-10 measures to GAAP Standardized Measure.

Because probable reserves are, by definition, less certain to be recovered than proved reserves, PV-10 of probable reserves is not equivalent to and should not be given the same weight as PV-10 of proved reserves.

18

Summary Operating Data

The following table sets forth summary data with respect to our production results, average sales prices and production costs on a historical basis for the periods presented. This summary data is presented on a basis consistent with our consolidated financial statements. The unaudited pro forma information was prepared as if our acquisition of oil and natural gas properties from Samson Resources and our XTO Acquisition had each occurred on January 1, 2010.

| |

Historical | Pro Forma | ||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

Predecessor | Dynamic Offshore Holding, LP | ||||||||||||||||||||||||

| |

January 1, 2008 Through March 13, 2008 |

Year Ended December 31, |

Nine Months Ended September 30, |

|

Nine Months Ended September 30, 2011 |

|||||||||||||||||||||

| |

Year Ended December 31, 2010 |

|||||||||||||||||||||||||

| |

2008 | 2009 | 2010 | 2010 | 2011 | |||||||||||||||||||||

Operating data: |

||||||||||||||||||||||||||

Net sales volumes: |

||||||||||||||||||||||||||

Oil (MBbls) |

364 | 1,363 | 2,145 | 3,289 | 2,447 | 2,559 | 4,792 | 3,171 | ||||||||||||||||||

Natural gas (MMcf) |

2,575 | 6,692 | 10,555 | 18,468 | 14,086 | 14,482 | 33,403 | 20,521 | ||||||||||||||||||

Total (MBoe) |

793 | 2,478 | 3,904 | 6,367 | 4,795 | 4,973 | 10,359 | 6,591 | ||||||||||||||||||

Average net daily production (Boe/d) |

10,859 | 6,770 | 10,696 | 17,444 | 17,564 | 18,216 | 28,381 | 24,143 | ||||||||||||||||||

Average sales prices: |

||||||||||||||||||||||||||

Oil, without realized derivatives ($/Bbl) |

96.72 | 103.80 | 62.64 | 78.65 | 76.37 | 106.23 | 78.42 | 106.41 | ||||||||||||||||||

Natural gas, without realized derivatives |

8.16 | 10.12 | 4.23 | 4.72 | 4.87 | 4.74 | 4.81 | 4.81 | ||||||||||||||||||

Oil, with realized derivatives ($/Bbl)(1) |

96.72 | 113.65 | 89.95 | 86.35 | 86.32 | 99.85 | 83.71 | 101.26 | (2) | |||||||||||||||||

Natural gas, with realized derivatives ($/Mcf)(1) |

8.16 | 10.10 | 5.89 | 5.68 | 5.76 | 5.48 | 5.35 | 5.33 | ||||||||||||||||||

Oil, WTI benchmark ($/Bbl) |

96.25 | 99.75 | 62.09 | 79.61 | 77.69 | 95.47 | 79.61 | 95.47 | (2) | |||||||||||||||||

Natural gas, Henry Hub benchmark ($/MMBtu) |

8.58 | 8.90 | 4.16 | 4.38 | 4.52 | 4.21 | 4.38 | 4.21 | ||||||||||||||||||

Costs and expenses ($/Boe): |

||||||||||||||||||||||||||

Lease operating expense(3) |

11.09 | 14.82 | 15.53 | 14.04 | 13.25 | 15.89 | 12.18 | 14.96 | ||||||||||||||||||

Depreciation, depletion and amortization |

16.92 | 20.04 | 22.69 | 30.65 | 20.06 | 20.59 | 26.22 | 20.07 | ||||||||||||||||||

General and administrative expense |

2.87 | 7.20 | 6.57 | 3.82 | 4.02 | 3.89 | 2.35 | 2.93 | ||||||||||||||||||

- (1)

- Realized

prices include realized gains or losses on cash settlements for our commodity derivative contracts, which have not been designated for hedge

accounting. We have not made any estimates of the impact of commodities derivatives on the average sales price for our predecessor.

- (2)

- For

the three months ended September 30, 2011, the average realized price before the effect of commodity derivative contracts for our oil production

was $104.91 per Bbl, compared to an average WTI index price of $89.54 per Bbl for the same period.

- (3)