Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Conmed Healthcare Management, Inc. | v245312_8k.htm |

NYSE Amex: CONM A Trusted Partner Providing Quality County - Level Correctional Healthcare Services JANUARY 2012

Forward Looking Statements This presentation contains forward - looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including statements with respect to the company's plans, objectives, expectations and intentions. These statements identified by words such as "may", "could", "would", "should", "believes", "expects", "anticipates", "estimates", "intends", "plans" or similar expressions. Such forward - looking statements statements are based upon the current beliefs and expectations of the company's management, and involve known and unknown risks, uncertainties, and other factors that may cause actual results to differ materially from those projected in the forward - looking statements. Factors that might cause future results to differ include, but are not limited to, the following: the company's ability to increase revenue; its continued success in obtaining contract renewals and extensions; general economic conditions; and other risks and uncertainties that may be detailed, from time - to - time, in Conmed’s reports filed with the SEC. All forward - looking statements contained herein are neither promises nor guarantees. Conmed does not undertake any responsibility to revise or update any forward - looking statements. 2

Corporate Overview ▪ C orrectional healthcare services ▪ 26 - year history ▪ Recognized as a consolidator ▪ Solid financial foundation for continued growth • Cash positive • No long - term debt 3

Our Business ▪ Outsourced provider of cost - effective, high quality, compliant healthcare services • County and municipal detention facilities ▫ Jails, NOT prisons • Satisfies U.S. Constitutional obligation to provide healthcare services to detainees ▪ Strong brand recognition • Exceptional customer retention record • Emerging as the “Go to / Fix it” provider • Audit success rate: 100% 4

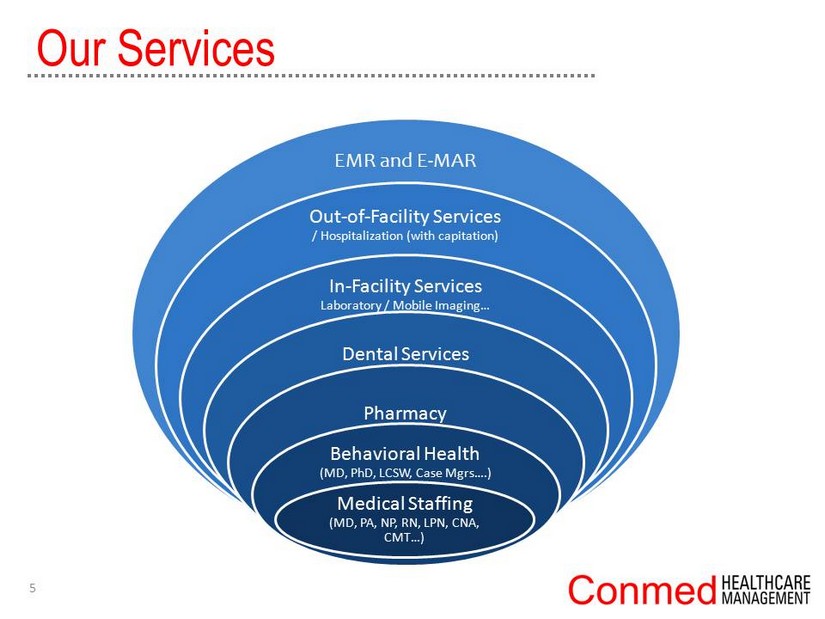

Our Services 5 EMR and E - MAR Out - of - Facility Services / Hospitalization (with capitation) In - Facility Services Laboratory / Mobile Imaging… Dental Services Pharmacy Behavioral Health (MD, PhD, LCSW, Case Mgrs….) Medical Staffing (MD, PA, NP, RN, LPN, CNA, CMT…)

We Serve ▪ 2 0,500 inmates ▪ 54 adult and juvenile detention facilities ▪ 41 counties & municipalities ▪ 9 states • Arizona • Kansas • Maryland 6 • New Jersey • Oregon • Tennessee • Texas • Virginia • Washington

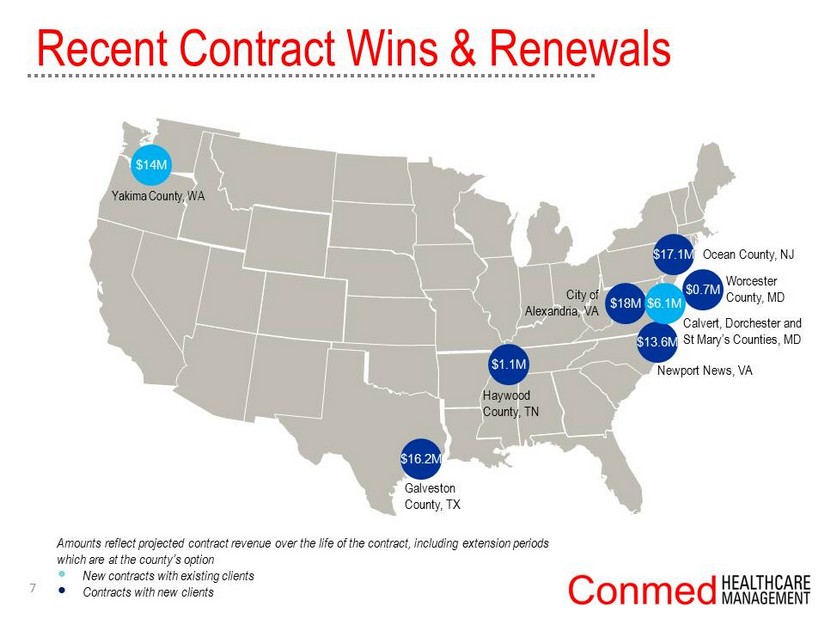

7 $18M $ 14M $1.1M Haywood County, TN City of Alexandria, VA Yakima County, WA Galveston County, TX $ 17.1M Ocean County, NJ $ 13.6M Newport News, VA Recent Contract Wins & Renewals $0.7M Worcester County, MD Amounts reflect projected contract revenue over the life of the contract, including extension periods which are at the county’s option • New contracts with existing clients • Contracts with new clients $16.2M $6.1M Calvert, Dorchester and St Mary’s Counties, MD

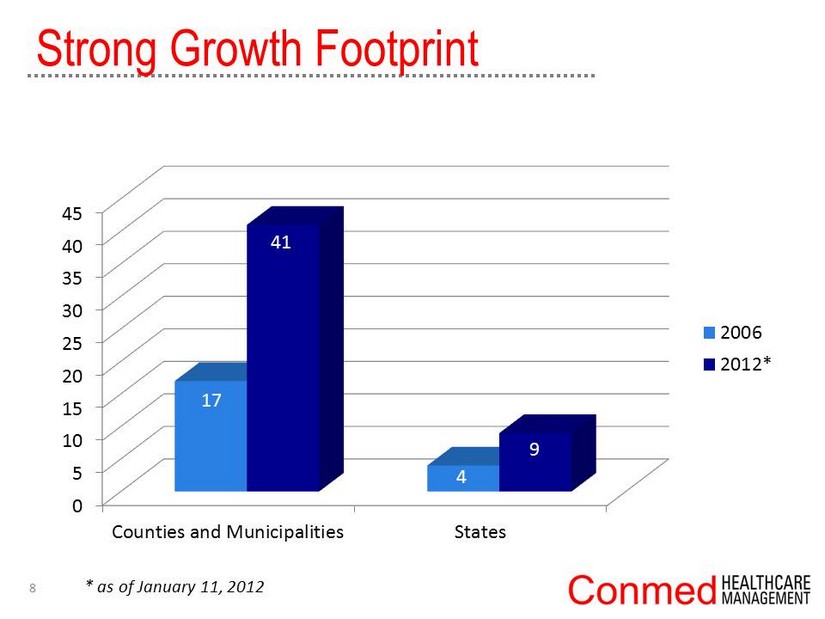

Strong Growth Footprint 0 5 10 15 20 25 30 35 40 45 Counties and Municipalities States 17 4 41 9 2006 2012* 8 * as of January 11, 2012

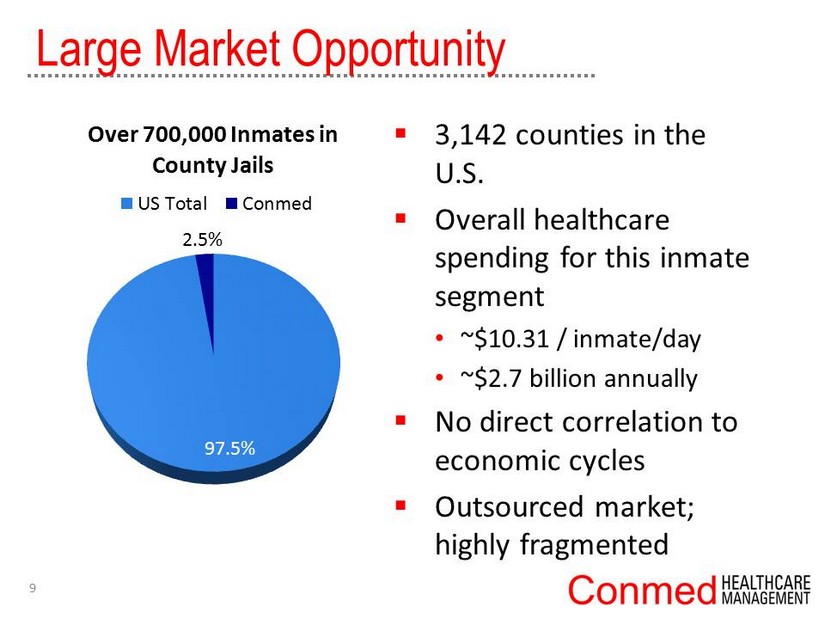

▪ 3,142 counties in the U.S. ▪ Overall healthcare spending for this inmate segment • ~$10.31 / inmate/day • ~$2.7 billion annually ▪ No direct correlation to economic cycles ▪ Outsourced market; highly fragmented 97.5% 2.5% Over 700,000 Inmates in County Jails US Total Conmed Large Market Opportunity 9

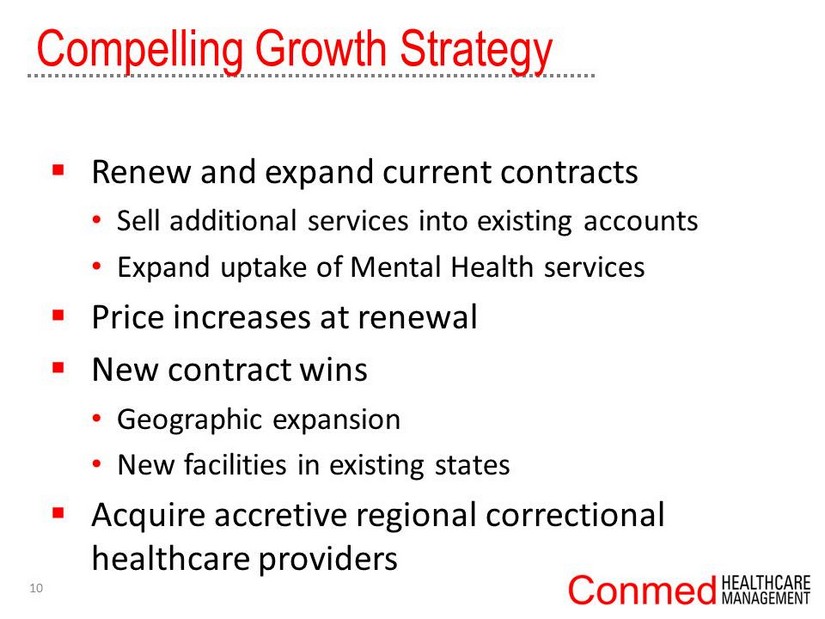

▪ Renew and expand current contracts • Sell additional services into existing accounts • Expand uptake of Mental Health services ▪ Price increases at renewal ▪ New contract wins • Geographic expansion • New facilities in existing states ▪ Acquire accretive regional correctional healthcare providers 10 Compelling Growth Strategy

FINANCIALS 11

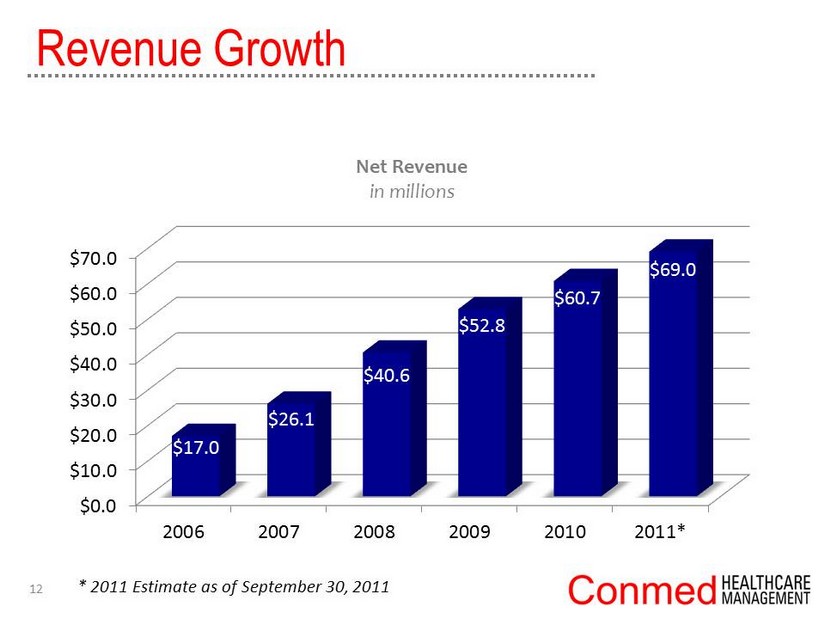

Revenue Growth $0.0 $10.0 $20.0 $30.0 $40.0 $50.0 $60.0 $70.0 2006 2007 2008 2009 2010 2011* $17.0 $26.1 $40.6 $52.8 $60.7 $69.0 Net Revenue in millions * 2011 Estimate as of September 30, 2011 12

Quarterly Revenue Growth $0.0 $2.0 $4.0 $6.0 $8.0 $10.0 $12.0 $14.0 $16.0 $18.0 $20.0 13 Revenue Growth in millions

Gross Profit Growth $0.0 $0.5 $1.0 $1.5 $2.0 $2.5 $3.0 $3.5 14 Gross Profit Growth in millions

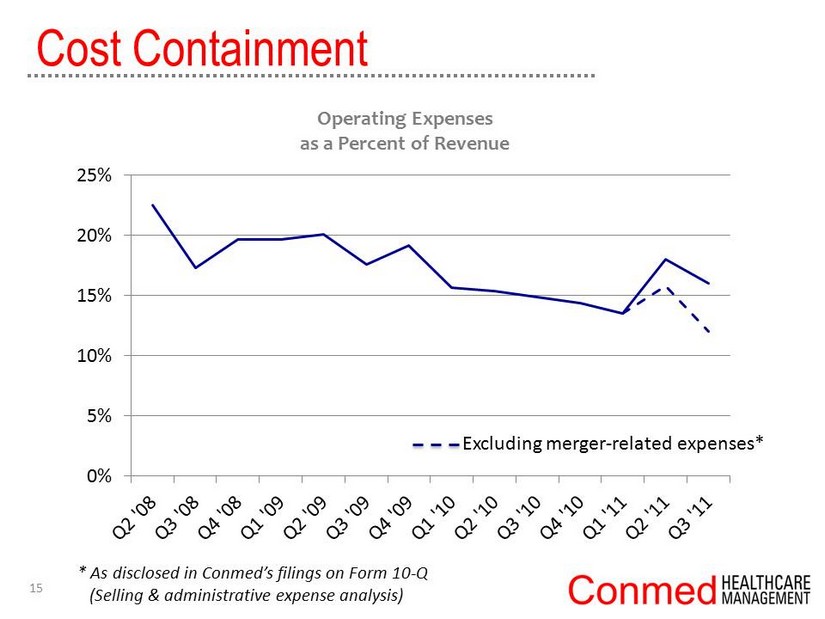

* As disclosed in Conmed’s filings on Form 10 - Q (Selling & administrative expense analysis) Cost Containment 0% 5% 10% 15% 20% 25% Operating Expenses as a Percent of Revenue 15 Excluding merger - related expenses*

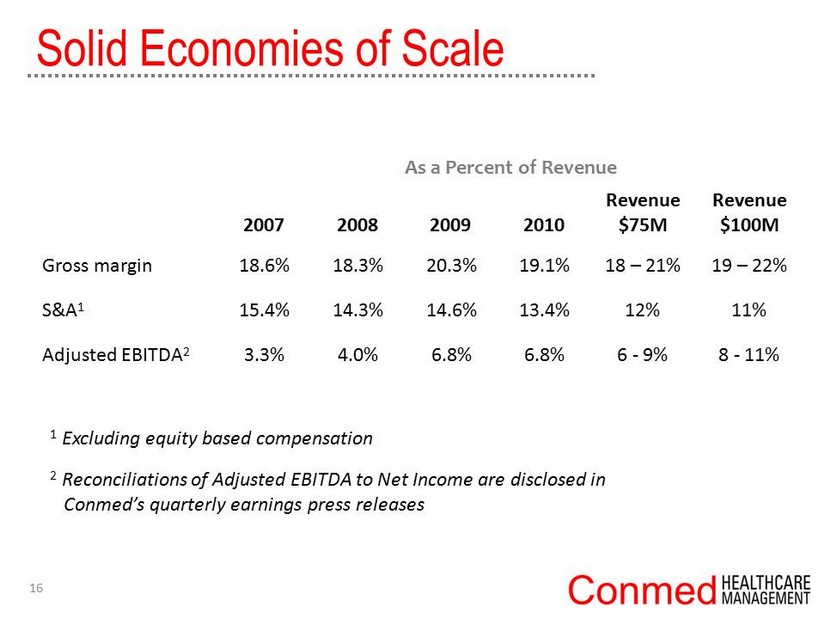

As a Percent of Revenue 2007 2008 2009 2010 Revenue $75M Revenue $100M Gross margin 18.6% 18.3% 20.3% 19.1% 18 – 21% 19 – 22% S&A 1 15.4% 14.3% 14.6% 13.4% 12% 11% Adjusted EBITDA 2 3.3% 4.0% 6.8% 6.8% 6 - 9% 8 - 11% 1 Excluding equity based compensation 2 Reconciliations of Adjusted EBITDA to Net Income are disclosed in Conmed’s quarterly earnings press releases 16 Solid Economies of Scale

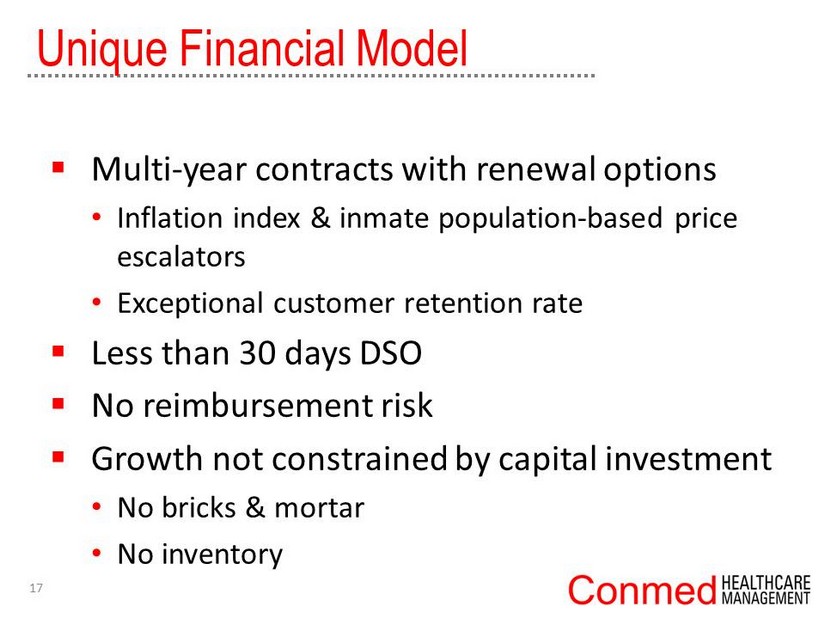

Unique Financial Model ▪ Multi - year contracts with renewal options • Inflation index & inmate population - based price escalators • Exceptional customer retention rate ▪ Less than 30 days DSO ▪ No reimbursement risk ▪ Growth not constrained by capital investment • No bricks & mortar • No inventory 17

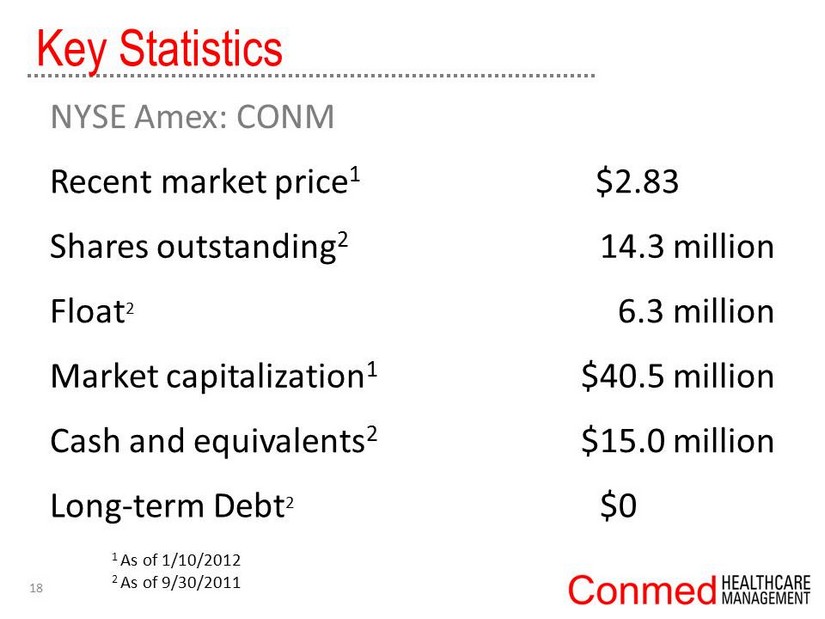

18 NYSE Amex: CONM Recent market price 1 $2.83 Shares outstanding 2 14.3 million Float 2 6.3 million Market capitalization 1 $40.5 million Cash and equivalents 2 $15.0 million Long - term Debt 2 $0 Key Statistics 1 As of 1/10/ 2012 2 As of 9/ 30/ 2011

Investment Summary ▪ Diverse, recurring revenue stream ▪ Large market opportunity • Geographic expansion • Grow current contracts ▪ Highly scalable infrastructure ▪ Predictable, consistent free cash flow ▪ Strong balance sheet, zero LT debt ▪ Strong, cohesive management team 19

INVESTOR RELATIONS CONTACTS Thomas W. Fry Lisa Wilson Chief Financial Officer President Conmed Healthcare Management In - Site Communications, Inc. 410.567.5520 212.759.3929 TFry@conmed - inc.com lwilson@insitecony.com 20