Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Approach Resources Inc | d281592d8k.htm |

Approach

Resources Inc. Investor Presentation

JANUARY 12, 2012

Exhibit 99.1 |

| 2 |

APPROACH RESOURCES

Forward-Looking Statements

Cautionary Statements Regarding Oil & Gas Quantities

This presentation contains forward-looking statements within the meaning of Section 27A of

the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. All statements, other than

statements of historical facts, included in this presentation that address activities, events

or developments that the Company expects, believes or anticipates will or may occur in the future are forward-looking

statements. Without limiting the generality of the foregoing, forward-looking statements

contained in this presentation specifically include the expectations of management regarding plans, strategies, objectives,

anticipated financial and operating results of the Company, including as to the Company’s

Wolffork shale resource play, estimated oil and gas in place and recoverability of the oil and gas, estimated reserves and

drilling locations, capital expenditures, typical well results and well profiles, and

production and operating expenses guidance included in the presentation. These statements are based on certain assumptions

made by the Company based on management's experience and technical analyses, current

conditions, anticipated future developments and other factors believed to be appropriate and believed to be reasonable

by management. When used in this presentation, the words “will,”

“potential,” “believe,” “intend,” “expect,” “may,” “should,” “anticipate,” “could,” “estimate,” “plan,” “predict,” “project,”

“target,” “profile,” “model” or their negatives, other

similar expressions or the statements that include those words, are intended to identify forward-looking statements, although not all forward-looking statements contain such

identifying words. Such statements are subject to a number of assumptions, risks and

uncertainties, many of which are beyond the control of the Company, which may cause actual results to differ materially from

those implied or expressed by the forward-looking statements. In particular, careful

consideration should be given to the cautionary statements and risk factors described in the Company's Annual Report on Form

10-K for the year ended December 31, 2010, and the Company’s Quarterly Report on Form

10-Q for the quarterly period ended September 30, 2011. Any forward-looking statement speaks only as of the date on

which such statement is made and the Company undertakes no obligation to correct or update any

forward-looking statement, whether as a result of new information, future events or otherwise, except as

required by applicable law.

The Securities and Exchange Commission (“SEC”) permits oil and gas companies, in

their filings with the SEC, to disclose only proved, probable and possible reserves that meet the SEC’s definitions for such terms,

and price and cost sensitivities for such reserves, and prohibits disclosure of resources that

do not constitute such reserves. The Company uses the terms “estimated ultimate recovery” or “EUR,” reserve or

resource “potential,” “upside,” “oil and gas in place” or

“OGIP,” “OIP” or “GIP,” and other descriptions of volumes of reserves potentially recoverable through additional drilling or recovery techniques that the

SEC’s rules may prohibit the Company from including in filings with the SEC. These

estimates are by their nature more speculative than estimates of proved, probable and possible reserves and accordingly are

subject to substantially greater risk of being actually realized by the Company.

EUR estimates, potential drilling locations, resource potential and OGIP estimates have not

been risked by the Company. Actual locations drilled and quantities that may be ultimately recovered from the

Company’s interest may differ substantially from the Company’s estimates.

There is no commitment by the Company to drill all of the drilling locations that have been attributed these quantities. Factors affecting

ultimate recovery include the scope of the Company’s ongoing drilling program, which will

be directly affected by the availability of capital, drilling and production costs, availability of drilling and completion

services and equipment, drilling results, lease expirations, regulatory approval and actual

drilling results, including geological and mechanical factors affecting recovery rates. Estimates of unproved reserves,

type/decline curves, per well EUR, OGIP and resource potential may change significantly as

development of the Company’s oil and gas assets provides additional data. Type/decline curves, estimated EURs, typical well-related oil and gas in place, recovery

factors and well costs represent Company estimates based on evaluation of petrophysical analysis, core data and well logs,

well performance from limited drilling and recompletion results and seismic data, and

have not been reviewed by independent engineers. These are presented as hypothetical recoveries if assumptions and

estimates regarding recoverable hydrocarbons, OGIP, recovery factors and costs prove correct.

The Company has very limited production experience with these projects, and accordingly, such estimates may

change significantly as results from more wells are evaluated. Estimates of resource

potential, EURs and OGIP do not constitute reserves, but constitute estimates of contingent resources which the SEC has

determined are too speculative to include in SEC filings. Unless otherwise noted, IRR

estimates assume NYMEX forward-curve oil and gas pricing and Company-generated EUR and decline curve estimates based

on Company drilling and completion cost estimates that do not include land, seismic or G&A

costs. |

| 3 |

APPROACH RESOURCES

Company Overview

Notes:

Proved

reserves

and

acreage

as

of

6/30/2011

and

9/30/2011,

respectively.

All

Boe

and

Mcfe

calculations

are

based

on

a

6

to

1

conversion

ratio.

Enterprise

value

is

equal

to

market

capitalization

using

the

closing

share

price

of

$29.41

per

share

on

12/30/2011,

plus

net

debt

as

of

9/30/2011.

See

liquidity

calculation

in

appendix.

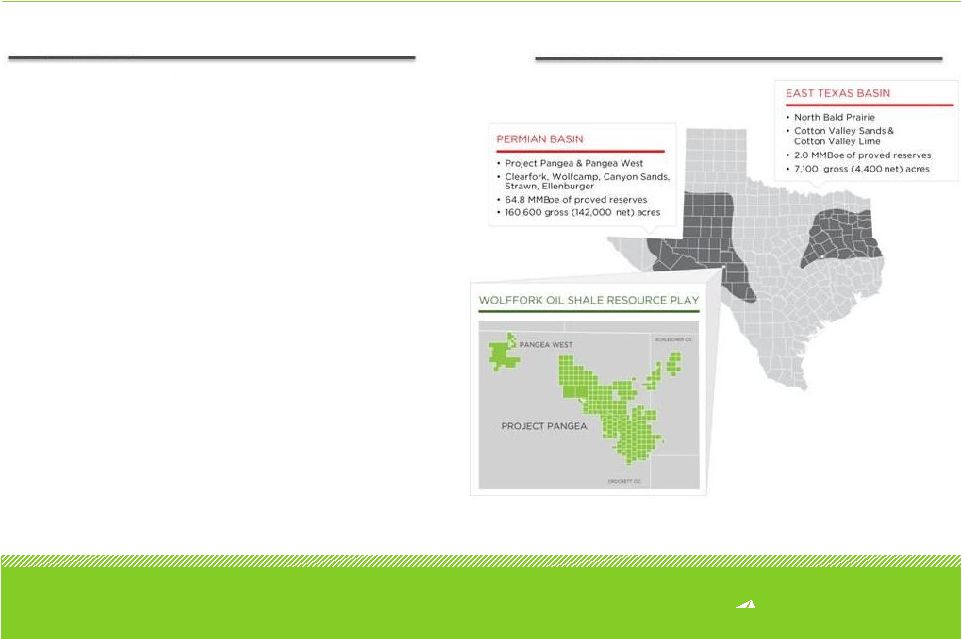

AREX OVERVIEW

ASSET OVERVIEW

•

Enterprise value $958 MM

•

High quality reserve base

•

Permian core operating area

160,600 gross (142,000 net) acres

500+ MMBoe gross, unrisked resource

potential

Extensive inventory of drilling and

recompletion opportunities

•

Strong balance sheet to execute plan

Borrowing base increased 30% to $260 MM

from $200 MM

66.8 MMBoe proved reserves

97% Permian Basin

55% Oil & NGLs

Pro forma liquidity of $260 MM at 9/30/2011 |

| 4 |

APPROACH RESOURCES

Notes: Oil weighted peers include BRY, CXO, KOG, NOG, OAS, SD. Data based on SEC filings and

J.S. Herold data. Lifting costs defined as lease operating expense plus taxes other than

income and gathering and transportation expense. See F&D cost reconciliation page in

appendix for reconciliation of 3-year F&D costs. Historical Results and Cost

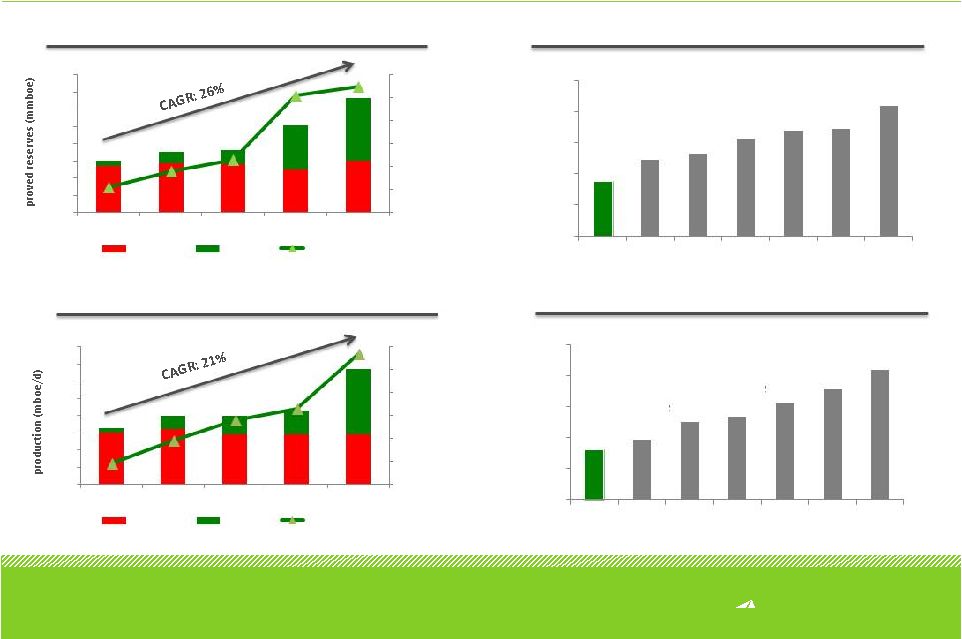

Structure RESERVE GROWTH

3-YEAR AVERAGE F&D COSTS ($/BOE)

PRODUCTION GROWTH

3Q’11 LIFTING COSTS ($/BOE)

$8.78

$12.21

$13.29

$15.60

$16.95

$17.22

$20.96

AREX

Peer 1

Peer 2

Peer 3

Peer 4

Peer 5

Peer 6

$0

$5

$10

$15

$20

$25

$8.14

$9.73

$12.60

$13.32

$15.69

$17.88

$20.95

$0

$5

$10

$15

$20

$25

AREX

Peer 1

Peer 2

Peer 3

Peer 4

Peer 5

Peer 6

0%

10%

20%

30%

40%

50%

60%

2007

2008

2009

2010

9/30/2011

0%

10%

20%

30%

40%

50%

60%

2007

2008

2009

2010

6/30/2011

natural gas

oil & ngls

percent liquids

natural gas

oil & ngls

percent liquids

0

10

20

30

40

50

60

70

80

0.0

1.0

2.0

3.0

4.0

5.0

6.0

7.0

8.0 |

| 5 |

APPROACH RESOURCES

•

46.4 MMBoe proved reserves

•

4.5 MBoe/d daily production

•

98,000 net acres in Permian Basin

THEN…NOVEMBER 2010

NOW…2011 ACCOMPLISHMENTS

•

66.8 MMBoe proved reserves (+44% YoY)

•

6.7 MBoe/d daily production (+46% YoY)

•

142,000 net acres in Permian Basin (+45% YoY)

•

50% of proved reserves were liquids

•

34% of production were liquids

•

55% of proved reserves are liquids

•

57% of production is liquids

•

3 recompletions and 1 vertical well

commingled in Wolffork oil shale

resource play

•

11 recompletions and 10 vertical wells

completed through 10/30/11

•

7 horizontal Wolfcamp wells completed with 3

recent

IPs

ranging

798

–

1,044

Boe/d

•

Approach’s early view on the play has been

validated by the industry

•

$150 MM borrowing base

•

$173 MM pro forma liquidity

•

Q3 2010 EBITDAX of $12 MM

•

$260 MM borrowing base

•

$260 MM pro forma liquidity

•

Q3 2011 EBITDAX of $22 MM (+83% YoY)

Note: See EBITDAX reconciliation and liquidity calculation in appendix.

2011 –

A Transformational Year for AREX

Growth

Reserves /

production mix

Financial

strength

Derisking

Wolffork play |

APPROACH

RESOURCES Wolffork Oil Shale

Resource Play

PLAY IDENTIFICATION |

| 7 |

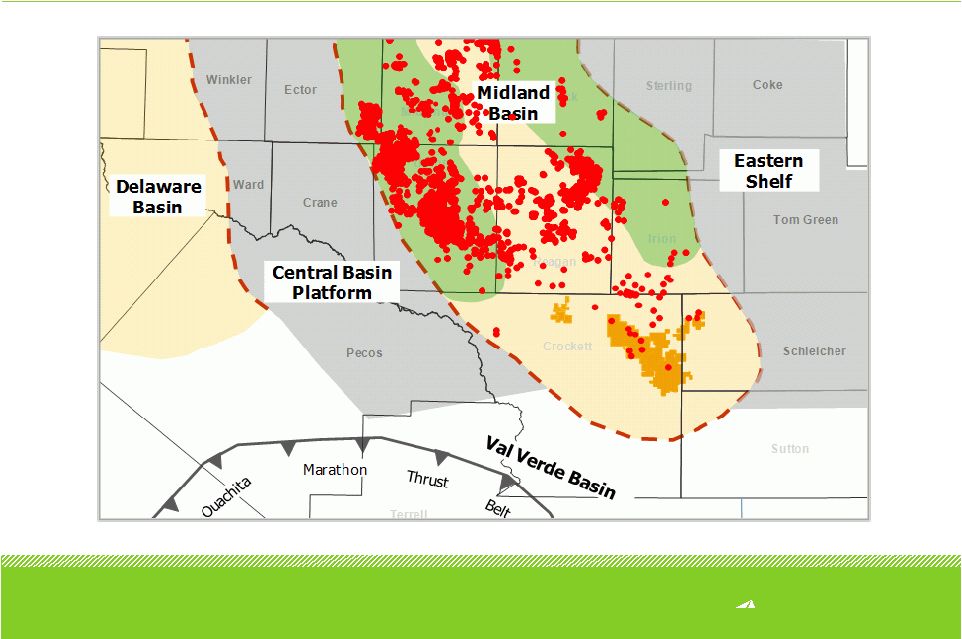

APPROACH RESOURCES

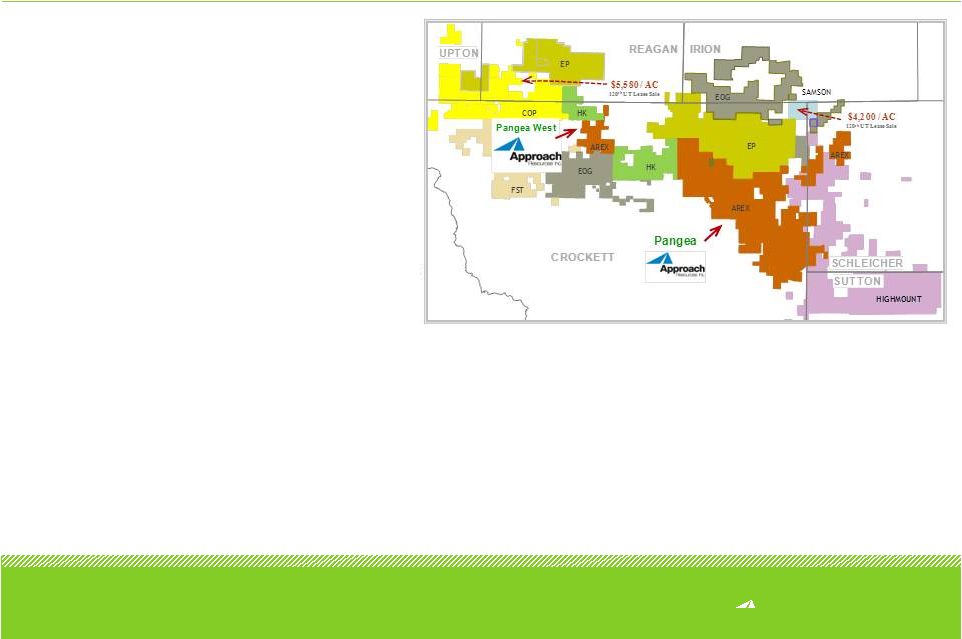

AREX Acreage Position –

Favorably Located in the Midland Basin |

| 8 |

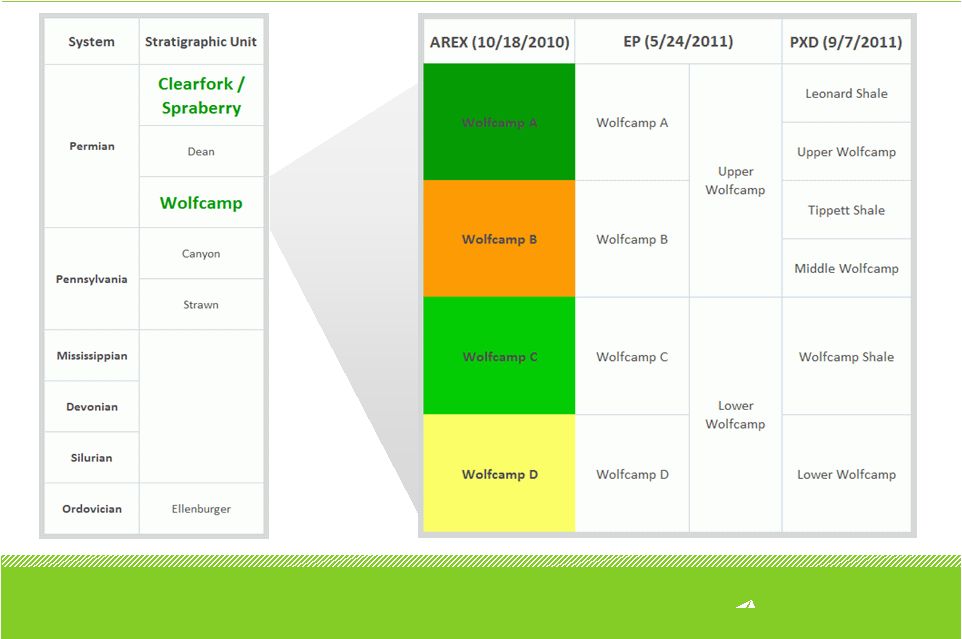

APPROACH RESOURCES

Wolfcamp

Shale

Name

Convention

–

Southern

Midland

Basin

Wolfcamp shale name conventions are based on investor presentations of AREX (10/18/2010), EP

(5/24/2011) and PXD (9/7/2011). |

| 9 |

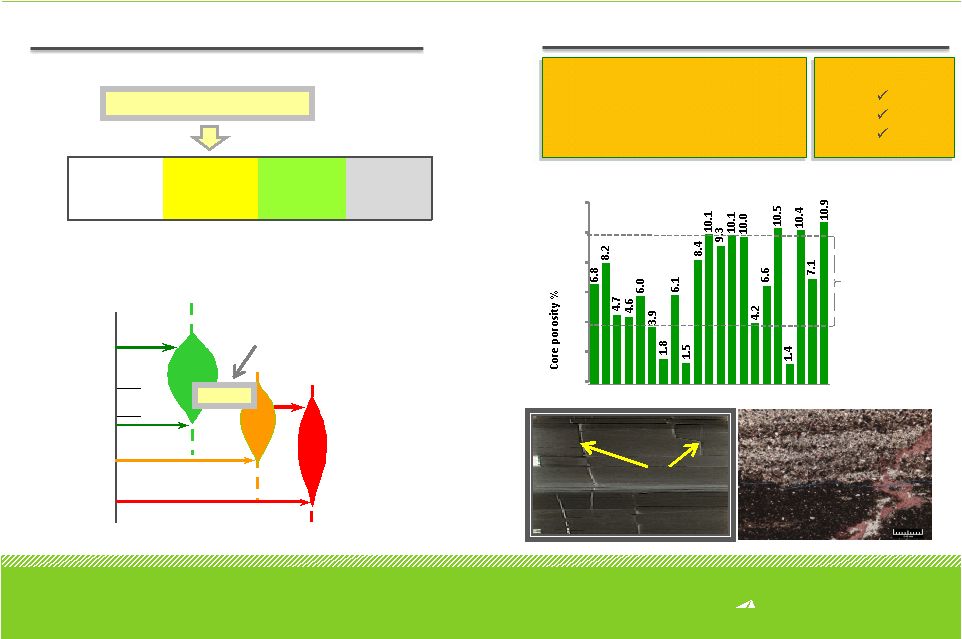

APPROACH RESOURCES

•

Thermal Maturity:

Wolfcamp Rock Characteristics

OIL

.6

.9

1.20

1.35

2.0

3.0

Peak

Wet

Gas

Dry

Gas

Peak

Oil Floor

Wet Gas Floor

Dry Gas Floor

R

R

0

0

Baker A112

Wolfcamp R

0

~0.95-0.97

Richness

Good -

Excellent

Fair

TOC (%)

2-10

1-2

<1

Poor

2.24% –

7.24%

Natural

Fractures

Organic

material

Quartz and

carbonate

materials

Commonly

observed core

porosity values

for established

commercial

shale plays

0.0

2.0

4.0

6.0

8.0

10.0

12.0

Core porosity for Baker A 112:

Fractures

Absorption

WORLD CLASS SOURCE ROCK IN OIL WINDOW

SIGNIFICANT OIL & GAS STORAGE SPACE

•

TOC for Wolfcamp Shale from whole core of Baker A 112:

Oil & gas storage criteria for shales:

•

Matrix pore space

•

Fractures

•

Adsorption

Wolfcamp Shale:

-------------------------------------------------------------

|

| 10 |

APPROACH RESOURCES

Wolfcamp Rock Characteristics

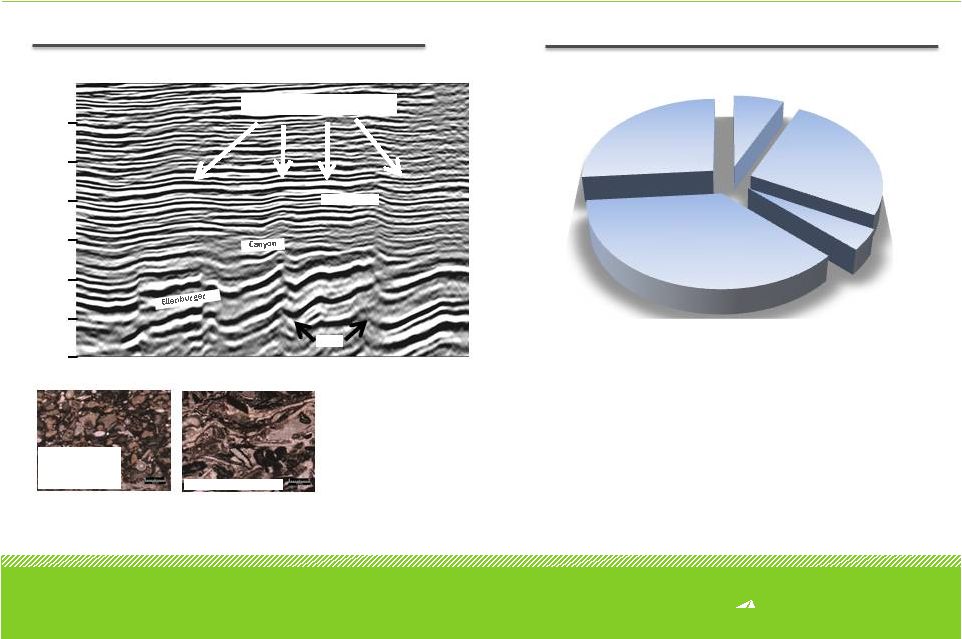

HYDROCARBON PATHWAY TO WELLBORE

WOLFCAMP SHALE COMPONENTS

Proximity to Ouachita-Marathon

thrust belt and high

concentration of carbonate and

quartz minerals provide

favorable conditions for fracture

development at Wolfcamp level

Fossil fragments

Quartz,

carbonate, and

fossils

Average Wolfcamp Shale components based on petrophysical analyses

and core data from AREX Baker A 112

W

E

4,000’

5,000’

6,000’

7,000’

8,000’

9,000’

10,000’

Depth

(feet)

Carbonate

26.2%

Quartz etc

36.8%

Porosity

7.0%

Clay

25.8%

TOC

4.2%

likely high fracture density areas

Wolfcamp

Faults |

| 11 |

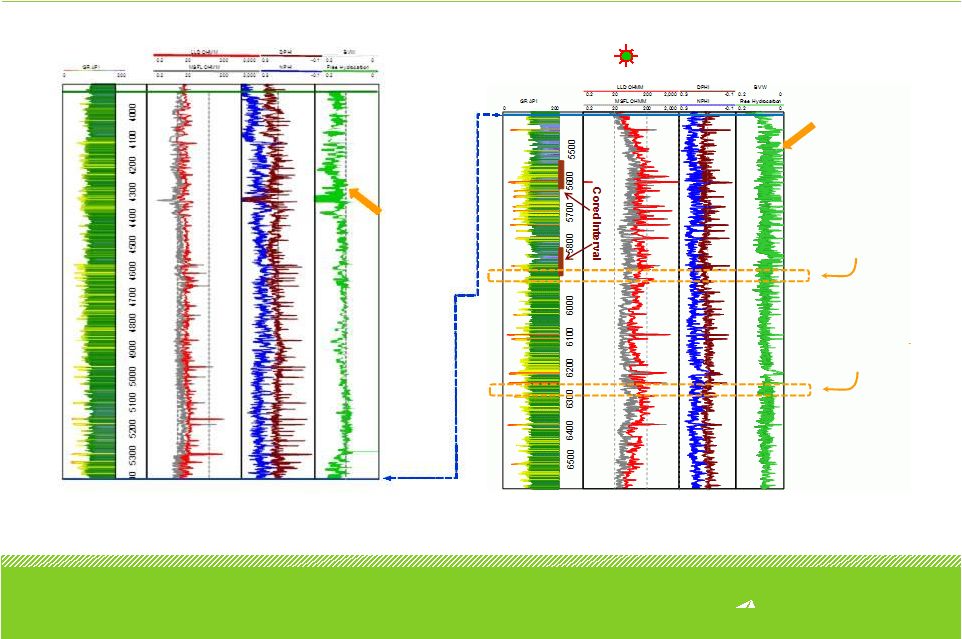

APPROACH RESOURCES

Clearfork A

Clearfork B

Clearfork C

Hydrocarbon

bearing

zone

Wolffork

Hydrocarbon

Column

–

Over

2,500’

Thick

AREX Baker A 112

Wolfcamp

A

Wolfcamp

B

Wolfcamp

C

Hydrocarbon

bearing

zone

Current Lateral

Placement

Current Lateral

Placement |

| 12 |

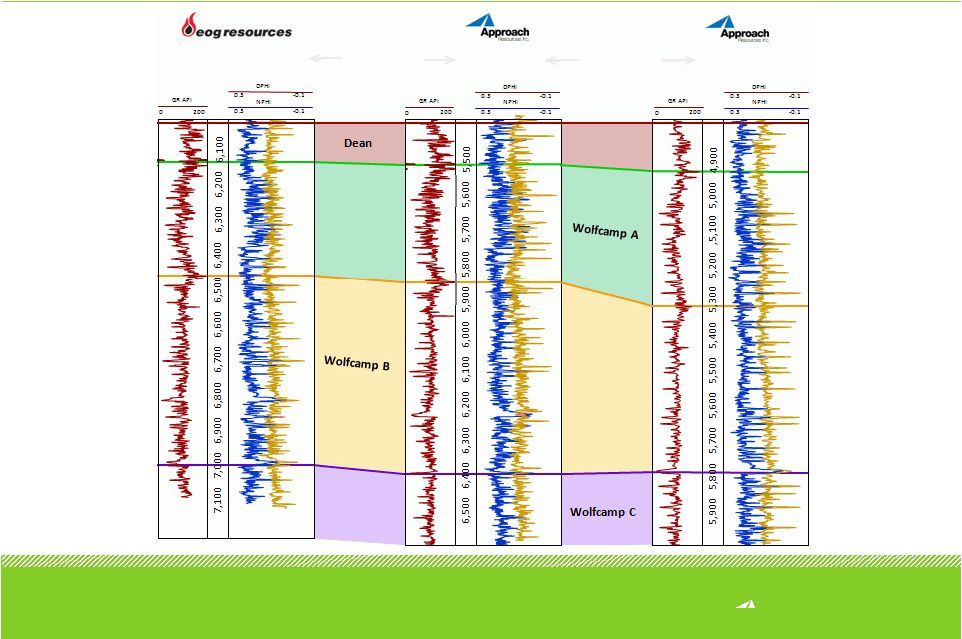

APPROACH RESOURCES

Wolfcamp Regional Correlation

University 40-13 1H

Baker A 112

Bailey 310

~12.5 miles

~12.8 miles

SW Irion Co

Cinco Terry

Ozona NE |

| 13 |

APPROACH RESOURCES

*Density porosity ranges from 8% to 15%.

Notes: The shale rock property (SRP) data for Bakken, Barnett, Eagle Ford and Niobrara are from

industry publications. The SRP data for Wolffork are based on AREX Baker A 112 whole

core. SHALE

Wolffork

Bakken

Barnett Oil

Combo

Eagle Ford

Niobrara

BASIN

Midland

Williston

Fort Worth

South Texas

DJ Basin

AGE

Permian

Late Devonian / early

Mississipian

Mississippian

Cretaceous

Cretaceous

DEPTH (feet)

4,000-8,000

7,000-11,000

6,500-8,500

8,000-12,000

7,000-9,000

THICKNESS (feet)

2,500-3,000

20-140

150-1,500

150-350

270-375

TOC (%)

2.2-7.2

2.0-18.0

4.5

2.0-6.5

4.0-4.5

TOTAL POROSITY (%)

4-11*

3-12

4-5

4-15

10-18

OOIP (MMboe)/640 Acres

119-182

5-10

100-200

27-57

20-30

Oil Shale Play Comparison

•

How

does

the

Wolffork

play

stack

up

against

other

commercial

oil

shale

plays? |

APPROACH

RESOURCES Wolffork Oil Shale

Resource Play

PILOT PROGRAM, EVALUATION & FUTURE POTENTIAL |

| 15 |

APPROACH RESOURCES

AREX Wolffork Oil Shale Resource Play

•

Large, primarily contiguous acreage position

160,600 gross (142,000 net) acres

(~76% NRI)

Low acreage cost ~$350 per acre

•

Low-risk, long-life reserve base

64.8 MMBoe proved reserves

8.4 MMBoe proved reserves booked to

Wolffork oil shale resource play

57% liquids (51% proved developed)

Note: other large independents with Wolffork / Wolfberry

activities nearby include PXD, DVN and CXO

•

3 operated drilling rigs

2 vertical rigs, 1 horizontal rig

•

Vertical pilot program shifting to development

stage

152 BOEPD average IP for 9 recent Wolffork

recompletions (75% liquids)

140 BOEPD average IP for 7 recent vertical

Wolffork wells (72% liquids) |

| 16 |

APPROACH RESOURCES

AREX Wolffork Oil Shale Resource Play –

Activity Map

Crockett

Irion

Reagan

Schleicher

•

59,000 gross acres

•

Continue pilot program

•

Encouraging results from pilot wells

•

85,000 gross acres

•

Begin vertical development

•

Establish horizontal development

•

18,000 gross acres

•

3-D seismic acquisition completed

•

Begin horizontal drilling 1Q 2012

BAKER C 1201

CT B 1601

CT G 701H

CT M 901H

54-13 1

45 D 901H

42-21 1H

45 E 1101H

45 B 2401H

45 A 701H

Baker B 203

45 D 902H

Chandler 4403

CT B 1303

Childress 603

Childress G 1008

42 B 1001H

45 C 803H ST

54-12 1

54-15 1

42-11 2R

42-23 9

Vertical Pilot –

2 phase

Horizontal Pilot

Horizontal Drilling in Progress

Legend

Horizontal Waiting on Completion

54-9 1

54-19 3

54-2 1

54-15 2

54-16 3

CT B 1308

Baker A 114

West 2308

42-23 11

42-14 10

45 F 2301H

45 F 2302H

45 A 702H

Horizontal Permitted Location

3-D seismic

early-1Q 2012

nd

Pangea West

Pangea West

Northern & Central Pangea

Northern & Central Pangea

Southern Pangea

Southern Pangea |

| 17 |

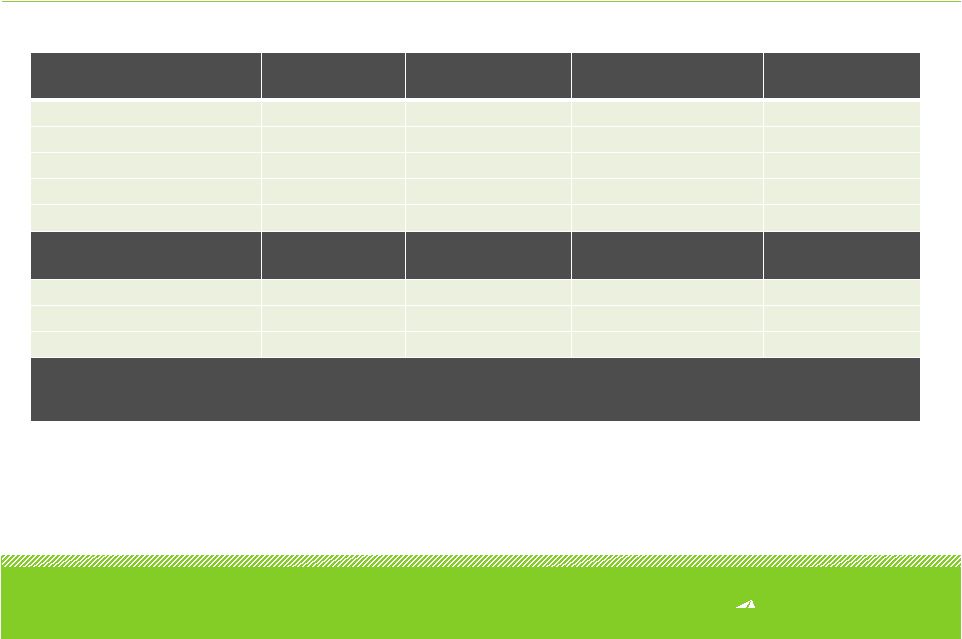

APPROACH RESOURCES

AREX’s Wolffork Drilling Targets & Resource Potential

Notes: Potential locations based on 20-acre spacing for Vertical Wolffork, 20 to

40-acre spacing for Vertical Wolffork Recompletions, 40-acre spacing for Vertical Canyon Wolffork,

and 1,000-foot spacing between each horizontal well for Horizontal Wolfcamp.

PLAY TYPE

Vertical Wolffork

Vertical Wolffork

Recompletion

Vertical Canyon Wolffork

Horizontal

Wolfcamp

EUR (MBoe)

110

93

193

450

24-hr. IP (Boe/d)

80

72

170

325

Well cost ($ MM)

$1.2

$0.75

$1.5

$5.5

F&D ($ MM)

$10.91

$8.06

$7.77

$12.22

Potential locations

1,825

190

440

500

GROSS RESOURCE POTENTIAL

(MMBoe)

200+

17+

85

225

Target

Clearfork, Wolfcamp

Clearfork, Wolfcamp

Canyon, Clearfork, Wolfcamp

Wolfcamp

Drilling depth (ft.)

< 7,500

< 7,500

< 8,500

7,000+ (lateral length)

Activity (# of rigs)

1

2 -

4 recompl. / month

1

1

500+ MMBoe Total Gross Resource Potential |

| 18 |

APPROACH RESOURCES

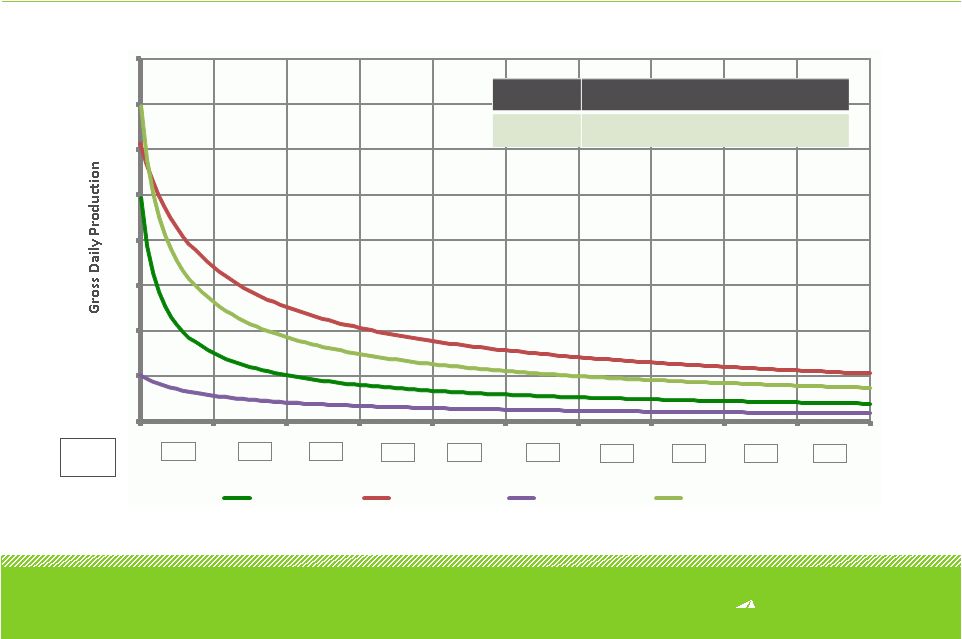

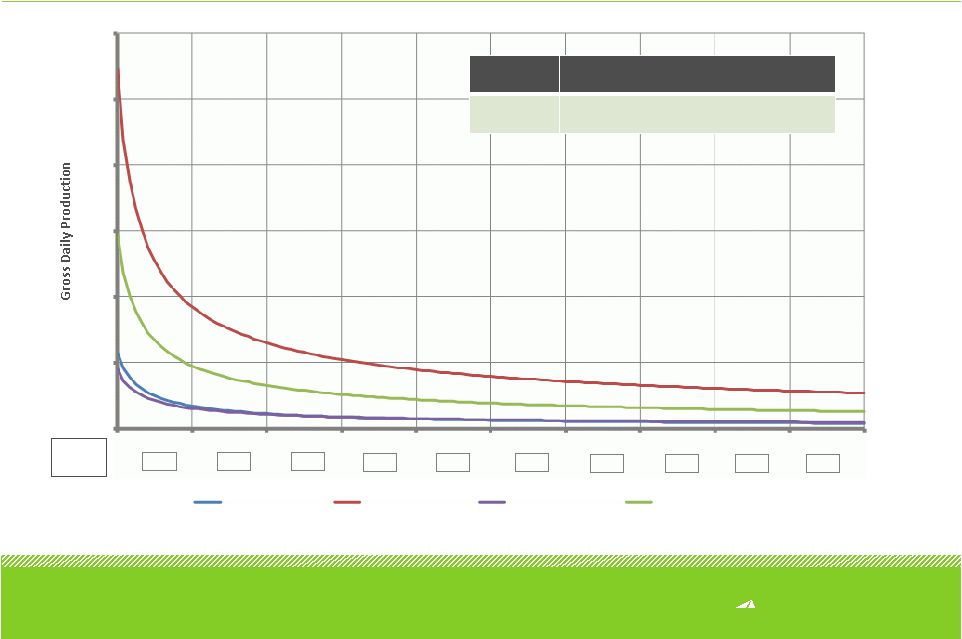

Vertical Wolffork Well Profile

Annual

Decline

62%

29%

20%

15%

12%

10%

9%

8%

7%

6%

0

10

20

30

40

50

60

70

80

0

1

2

3

4

5

6

7

8

9

10

Year

Gross Oil (bbl/d)

Sales Gas (mcf/d)

Gross NGL (bbl/d)

BOE (bbl/d)

IP Profile

Avg. EUR

58 BO, 11 Bbls NGLs, 64 Mcf gas

110 MBoe |

| 19 |

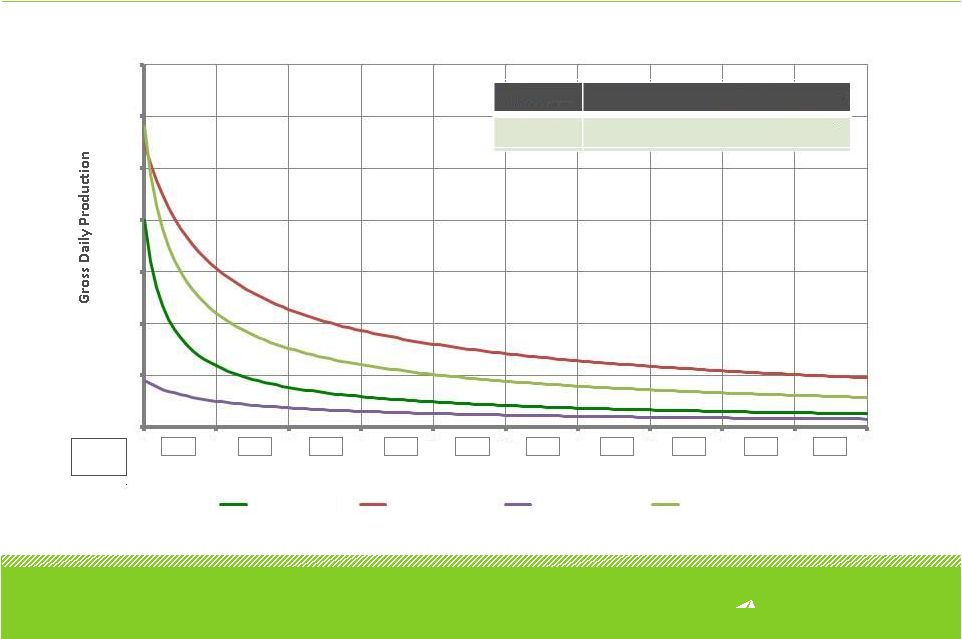

APPROACH RESOURCES

Vertical Canyon Wolffork Well Profile

Annual

Decline

68%

32%

21%

16%

12%

10%

9%

8%

7%

6%

0

50

100

150

200

250

300

0

1

2

3

4

5

6

7

8

9

10

Year

Gross Oil (bbl/d)

Sales Gas (mcf/d)

Gross NGL (bbl/d)

BOE (bbl/d)

IP Profile

66 BO, 52 Bbls NGLs, 315 Mcf gas

Avg. EUR

193 MBoe |

| 20 |

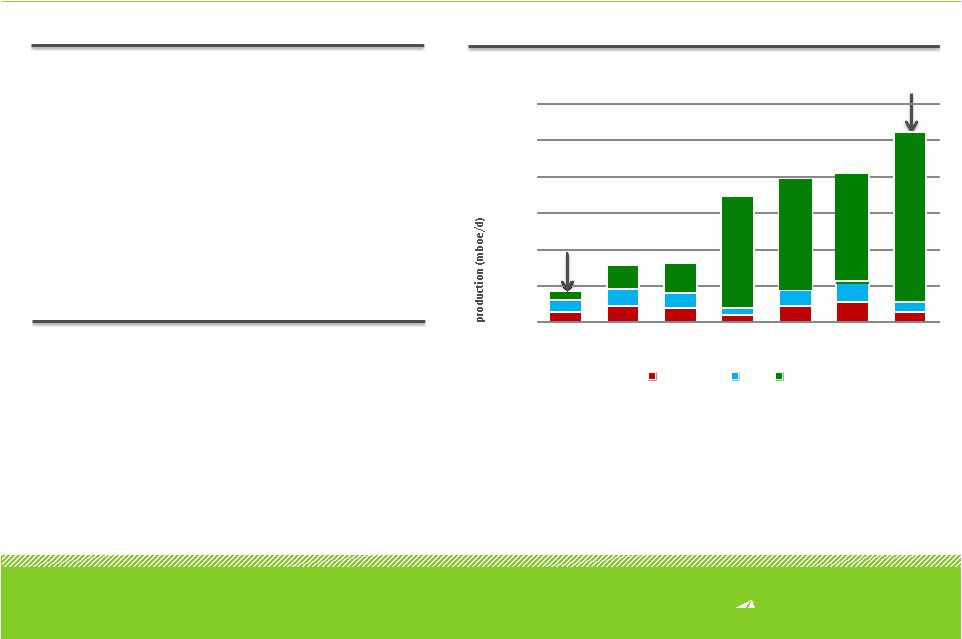

APPROACH RESOURCES

Horizontal Wolfcamp Well Profile

Annual

Decline

62%

31%

21%

16%

13%

11%

9%

8%

7%

6%

IP Profile

230 BO, 47 Bbls NGLs, 285 Mcf gas

Avg. EUR

450 MBoe

0

50

100

150

200

250

300

350

Year

Gross Oil (bbl/d)

Sales Gas (mcf/d)

Gross NGL (bbl/d)

BOE (bbl/d)

0

1

2

3

4

5

6

7

8

9

10 |

| 21 |

APPROACH RESOURCES

Horizontal Wolfcamp Well Performance

RECENT HORIZONTAL WOLFCAMP RESULTS

University 45 C 803H –

7,358’

lateral, 23 frac stages

University 45 B 2401H –

7,613’

lateral, 23 frac stages

University 45 D 902H –

7,770’

lateral, 23 frac stages

UPCOMING HORIZONTAL WOLFCAMP WELLS

University 42 B 1001H –

7,769’

lateral

Targeting the Wolfcamp “C”

zone

University 45 E 1101H –

7,712’

lateral

University 45 F 2301H –

7,749’

lateral

University 45 F 2302H –

7,698’

lateral

CONSISTENTLY IMPROVING WELL RESULTS

200

400

600

800

1,000

1,200

CT M 901H

University 42

CT G 701H

University 45

University 45

University 45

natural gas

ngls

oil

Early 2011

9/2011

21 1H

A 701H

D 902H

B 2401H

C 803H

University 45

Initial 24-hour flow rate 1,044 BOEPD, 95%

liquids (931 BO, 57 Bbls NGLs, 335 MCFG)

Initial 24-hour flow rate 811 BOEPD, 86% liquids (582

BO, 116 Bbls NGLs, 677 MCFG)

Initial 24-hour flow rate 798 BOEPD, 88% liquids (611

BO, 95 Bbls NGLs, 552 MCFG)

- |

| 22 |

APPROACH RESOURCES

Key Investor Highlights

•

Concentrated geographic footprint focused on West Texas Midland Basin oil/liquids-rich

play 142,000+ net, primarily contiguous acres, 100% operated

More than 575 wells drilled since 2004, with a 93%+ success rate

•

Strong growth track record at competitive costs

Reserve and production CAGR since 2007 of 26% and 21%, respectively

Low-cost operator with best-in-class F&D and lifting costs

•

Significant growth potential from Wolfcamp / Wolffork oil shale drilling inventory

2,900+ potential drilling and recompletion locations

Gross, unrisked resource potential totals more than 500+ MMBoe

•

Meaningful upside catalysts in near future

Wolffork oil shale resource play transitioning into development stage by Approach and other

operators Pioneer, El Paso and EOG allocating more capital to the play

Strong flow of new well result data should further derisk the play

•

Strong balance sheet to execute development plan

$260 MM borrowing base

$260 MM pro forma liquidity at 9/30/2011

Note: See liquidity calculation in appendix. |

APPROACH

RESOURCES Financial Framework &

Non-GAAP Reconciliations |

| 24 |

APPROACH RESOURCES

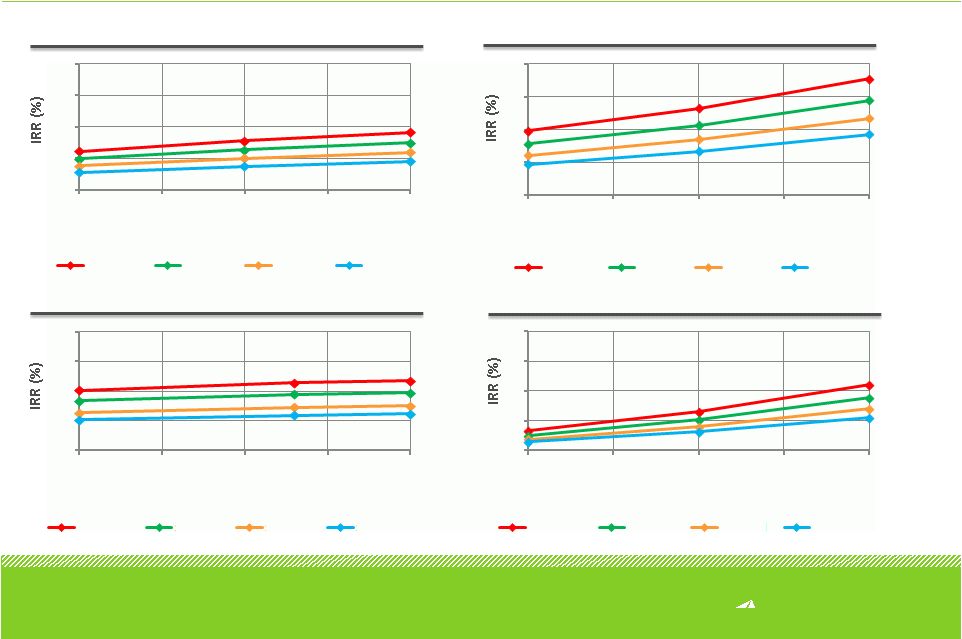

Pre-Tax IRR Sensitivities of AREX’s Wolffork Drilling Targets

VERTICAL WOLFFORK

VERTICAL WOLFFORK RECOMPLETIONS

VERTICAL CANYON WOLFFORK

HORIZONTAL WOLFCAMP

0

20

40

60

80

100

105

110

115

120

Well EUR (MBoe)

$100 / bbl

$90 / bbl

$80 / bbl

$70 / bbl

0

20

40

60

80

180

185

190

195

200

Well EUR (MBoe)

$100 / bbl

$90 / bbl

$80 / bbl

$70 / bbl

0

20

40

60

80

350

400

450

500

550

Well EUR (MBoe)

$100 / bbl

$90 / bbl

$80 / bbl

$70 / bbl

0

20

40

60

80

76

85

93

102

110

Well EUR (MBoe)

$100 / bbl

$90 / bbl

$80 / bbl

$70 / bbl |

| 25 |

APPROACH RESOURCES

2012 Capital Budget

2012 PROGRAM

2012 Capital budget $160 MM

2 Vertical rigs, 1 horizontal rig and 2 to 4 recompletions per month targeting the Wolffork oil

shale Substantially same rig program as 2011

Targeting 20%+ production growth

2012

production

guidance

2,800

MBoe

–

3,000

MBoe

Key takeaways:

Initial 2012 capital program provides flexibility to develop Wolffork oil shale and

monitor commodity prices and service

costs Increase in liquids production drives expected increase in cash flow

Increase in borrowing base strengthens liquidity

Notes: Our 2012 capital budget is subject to change depending upon a number of factors,

including economic and industry conditions at the time of drilling, prevailing and

anticipated prices for oil, NGLs and natural gas, the availability sufficient capital resources

for drilling prospects, our financial results, the availability of drilling and completion

services

and

materials

on

reasonable

terms,

and

lease

extensions

and

renewals.

Additionally,

we

may

increase

our

2012

capital

budget

if

we

acquire

acreage

or

accelerate

our

drilling program. |

2012 Operating

and Financial Guidance Guidance is forward-looking information that is subject to a

number of risks and uncertainties, many of which are beyond the Company’s control. See slide 2, “Forward-looking

statements,”

for additional information.

2012

Guidance

Production

Total (MBoe)

2,800-

3,000

Percent Oil & NGLs

65%

Operating costs and expenses ($/per Boe)

Lease operating

$

$

$

$

$

4.50 –

5.50

Severance and production taxes

2.50 –

4.00

Exploration

4.00 –

5.00

General and administrative

5.25 –

6.25

Depletion, depreciation and amortization

12.00 –

15.00

Capital expenditures ($MM)

Approximately $160

| 26 | |

| 27 |

APPROACH RESOURCES

•

Oil (NYMEX –

West Texas Intermediate)

–

2012

Collars

contracted

for

1,200

Bbls/d

at

weighted

average

floor

$87.08

–

ceiling

$101.08

–

2013 Collars contracted for 650 Bbls/d

–

Floor $90.00 –

Ceiling $105.80

Hedge Position

CURRENT HEDGE POSITION |

| 28 |

APPROACH RESOURCES

Liquidity (unaudited)

Note: Liquidity as further adjusted is based on issuance of 4,600,000 shares at $28.00

per share. (in thousands)

Liquidity at

September 30, 2011

Liquidity with Borrowing

Base increase at

September 30, 2011

Liquidity as further

adjusted for follow-on

equity offering at

September 30, 2011

Borrowing base

$

200,000

$

260,000

$

260,000

Cash and cash equivalents

736

736

736

Outstanding letters of

credit

(350)

(350)

(350)

Long-term debt

(122,000)

(122,000)

—

Liquidity

$

78,386

$

138,386

$

260,386

Liquidity is calculated by adding the net funds available under our revolving credit facility

and cash and cash equivalents. We use liquidity as an indicator of the Company’s ability

to fund development and exploration activities. However, this measurement has

limitations. This measurement can vary from year to year for the Company and can vary among

companies based on what is or is not included in the measurement on a company’s financial

statements. This measurement is provided in addition to, and not as an alternative for,

and should be read in conjunction with, the information contained in our financial statements prepared in accordance with GAAP (including the notes), included in our SEC

filings and posted on our website.

The table below summarizes our liquidity at September 30, 2011, and our liquidity position at

September 30, 2011, reflecting the October 2011 borrowing base increase to $260 million

from $200 million, and our liquidity at September 30, 2011, as further adjusted for our November 2011 follow-on equity offering of 4,600,000 shares. |

| 29 |

APPROACH RESOURCES

We believe that providing measures of finding and development, or

F&D,

cost

is

useful

to

assist

an

evaluation

of

how

much

it

costs

the

Company, on a per Boe basis, to add proved reserves. However,

these measures are provided in addition to, and not as an

alternative for, and should be read in conjunction with, the

information contained in our financial statements prepared in

accordance with GAAP (including the notes), included in our SEC

filings and posted on our website. Due to various factors, including

timing differences, F&D costs do not necessarily reflect precisely

the costs associated with particular reserves. For example,

exploration costs may be recorded in periods before the periods in

which related increases in reserves are recorded and development

costs may be recorded in periods after the periods in which related

increases in reserves are recorded. In addition, changes in

commodity prices can affect the magnitude of recorded increases

(or decreases) in reserves independent of the related costs of such

increases.

As a result of the above factors and various factors that could

materially affect the timing and amounts of future increases in

reserves and the timing and amounts of future costs, including

factors disclosed in our filings with the SEC, we cannot assure you

that the Company’s future F&D costs will not differ materially from

those set forth above. Further, the methods we use to calculate

F&D costs may differ significantly from methods used by other

companies to compute similar measures. As a result, our F&D costs

may not be comparable to similar measures provided by other

companies.

The following tables reflect the reconciliation of our estimated

finding and development costs to the information required by

paragraphs 11 and 21 of ASC 932-235.

F&D Costs Reconciliation (unaudited)

Note: F&D costs exclude asset retirement obligations of $6.3 million at 6/30/2011 and $5.4

million at 12/31/2010. 1H 2011 Reserve summary (Mboe)

Balance –

12/31/2010

Extensions & discoveries

Purchases

Revisions

Production

50,715

8,910

10,497

(2,197)

(1,077)

66,848

Cost summary ($M)

Acquisitions

Exploration costs

Development costs

Total

85,714

$

4,914

72,061

162,689

Finding & development costs ($/Boe)

All-in F&D costs

Drill-bit F&D cost

9.45

8.64

$

$

Reserve replacement ratio (%)

Net reserve adds (Mboe)

1H’11 Production (Mboe)

Reserve replacement

17,210

(1,077)

1,598%

3-Year reserve summary (Mboe)

Balance –

12/31/2007

Balance –

12/31/2010

Extensions & discoveries

Purchases

Revisions

Production

30,067

15,880

3,244

6,008

(4,484)

50,715

Cost summary ($M)

Acquisitions

Exploration costs

Development costs

Total

Finding & development costs ($/Boe)

3-year All-in F&D costs

3-year Drill-bit F&D cost

8.78

11.96

Reserve replacement ratio (%)

Net reserve adds (Mboe)

3-year Production (Mboe)

Reserve replacement

25,132

(4,484)

561%

$

$

Balance –

6/30/2011

30,605

9,364

180,568

220,537

$ |

| 30 |

APPROACH RESOURCES

We define EBITDAX as net income, plus (1) exploration expense, (2) depletion, depreciation and

amortization expense, (3) share-based compensation expense, (4) unrealized (gain)

loss on commodity derivatives, (5) gain on sale of oil and gas properties, (6) interest expense, and (7) income taxes. EBITDAX is not a measure of net

income

or

cash

flow

as

determined

by

GAAP.

The

amounts

included

in

the

calculation

of

EBITDAX

were

computed

in

accordance

with

GAAP.

EBITDAX

is

presented

herein and reconciled to the GAAP measure of net income because of its wide acceptance by the

investment community as a financial indicator of a company's ability to

internally

fund

development

and

exploration

activities.

This

measure

is

provided

in

addition

to,

and

not

as

an

alternative

for,

and

should

be

read

in

conjunction

with,

the information contained in our financial statements prepared in accordance with GAAP

(including the notes), included in our SEC filings and posted on our website. EBITDAX

Reconciliation (unaudited) (in thousands, except per-share amounts)

Three Months Ended

September 30,

2011

2010

Net income

$

7,073

$

2,087

Exploration

1,969

568

Depletion, depreciation and amortization

8,355

5,832

Share-based compensation

1,089

1,047

Unrealized (gain) loss on commodity derivatives

(1,739)

312

Interest expense, net

1,016

615

Income tax provision

3,908

1,167

EBITDAX

$

21,671

$

11,628

EBITDAX per diluted share

$

0.76

$

0.54 |

APPROACH

RESOURCES Contact Information

MEGAN P. HAYS

MANAGER, IR & CORPORATE COMMUNICATIONS

817.989.9000 X 2108

MHAYS@APPROACHRESOURCES.COM |