Attached files

| file | filename |

|---|---|

| 8-K - 8-K - REGIONS FINANCIAL CORP | d259443d8k.htm |

| EX-99.1 - EX-99.1 - REGIONS FINANCIAL CORP | d259443dex991.htm |

| EX-99.3 - EX-99.3 - REGIONS FINANCIAL CORP | d259443dex993.htm |

Regions Financial

Divestiture of Morgan Keegan

January 11, 2012

Exhibit 99.2 |

Regions Rationale

2

›

Divestiture provides enhanced liquidity at the holding company, improvement in key

capital ratios, and reduced risk

›

Total consideration of $1.180 billion creates significant additional liquidity at

the holding company ›

After-tax

GAAP

loss

and

stockholders’

equity impact estimated at $(673) million*, primarily due to elimination of

goodwill ›

Indemnification liability estimate of $210 million established for potential

future claims and certain legal costs ›

Eliminates ongoing risk of owning a highly regulated entity

›

Improves key capital ratios

›

Creates a new low-cost source of deposits at the bank

›

Provides incremental revenue opportunities through establishing a strong

partnership with Raymond James

›

›

Strengthens focus on our core banking business

* See page 10, note 6, for disclosure related to goodwill

›

Depository, lending and processing relationships

›

Loan referrals to Regions to include: small business, marine, aviation,

automobile and construction products as well as referrals

from

Raymond

James’

Investment Banking clients

›

Ongoing depository, lending, and investment relationships

›

RMK Trust and Morgan Asset Management to be retained by Regions

Critical business relationships maintained between Regions and Morgan Keegan

|

Transaction Highlights

3

Description

›

Raymond James Financial (NYSE: RJF) to acquire 100% of the outstanding

stock of Morgan Keegan & Company, Inc. (broker / dealer), MK Holding and

related entities

›

RMK Trust and Morgan Asset Management to be retained by Regions

Purchase Price to Regions

›

$930 million, subject to adjustment based on the closing tangible

equity of Morgan Keegan and retention of Morgan Keegan associates in the

immediate post-closing period

Anticipated Pre-Closing

Dividend

›

$250 million

Total Consideration to Regions

›

$1.180 billion

Closing Conditions

›

Customary, including regulatory approvals

Anticipated Closing

›

1Q 2012

Ongoing RF / RJF Business

Relationships

›

Depository, business services, corporate banking, and investments

Legal Indemnification

›

Regions to indemnify Raymond James Financial for all litigation matters related

to pre-closing activities

›

In addition, Regions will receive the benefit of previously established reserves

by Regions at Morgan Keegan |

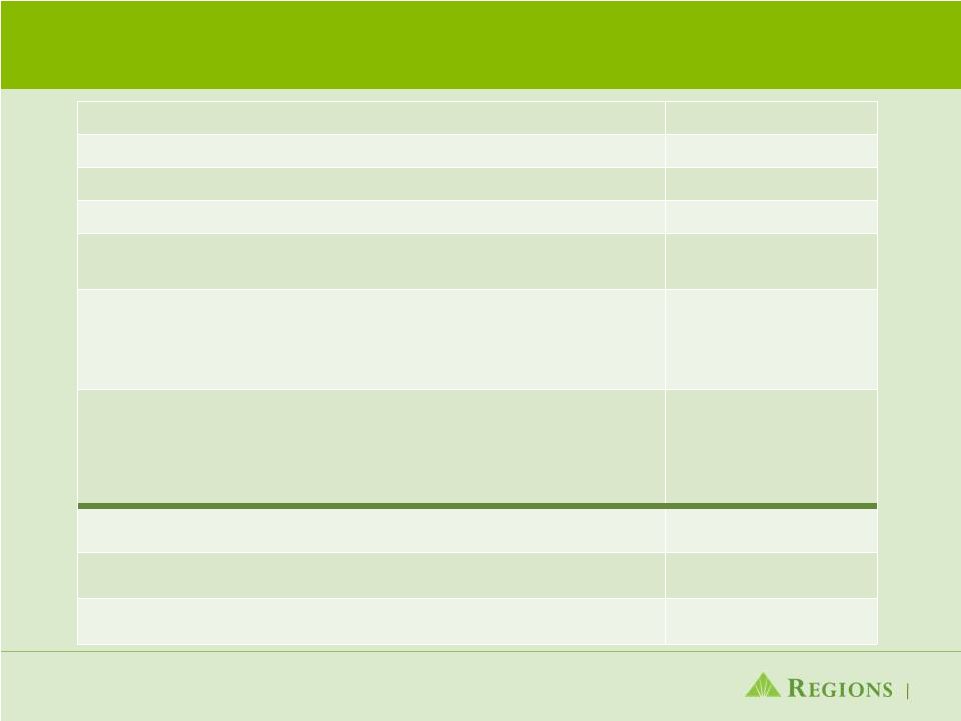

Estimated Financial Impact to Regions

3Q11 Pro Forma Selected Metrics

4

1.

Estimates after-tax impact from transaction, indemnification, goodwill

impairment and deal costs. 2.

See page 10 for disclosure related to goodwill , note 6

3.

Includes

write-off

of

goodwill,

adjustment

to

disallowed

deferred

tax

asset

for

regulatory

purposes

and

reduction

in

risk-weighted

assets

4.

Excludes

RMK

Trust

and

Morgan

Asset

Management

to

be

retained

by

Regions

5.

See appendix for reconciliation to GAAP financial measures

6.

Tier 1 Common Equivalent amount calculated as 9 basis point impact times the pro

forma risk weighted assets of $91,986 billion (with minor differences due to rounding)

7.

Tangible Common Equity Equivalent amount calculated as 13 basis points impact times

the pro forma tangible assets of $122.426 billion (with minor differences due to rounding)

After-Tax

GAAP

Loss

&

Impact

to

Stockholders’

Equity

$(673) million

Intangibles Eliminated

$725 million

Net Risk-Weighted Asset Reduction

$800 million

Tier 1 Capital Ratio Increase

13 bps

Tier

1

Common

Ratio

(non-GAAP)

5

Tier

1

Common

Basel

III

(non-GAAP)

5

8.25%

7.77%

Tier

1

Common

Equivalent

/

Basis

Points

Impact

3

(non-GAAP)

5

-

Excluding Indemnification

-

Impact of Indemnification

-

Tier

1

Common

Equivalent

Increase

(Net)

6

$293 million / 32 bps

$210 million / 23 bps

$83 million / 9 bps

Tangible

Common

Equity

Ratio

Increase

(non-GAAP)

5

-

Excluding Indemnification

-

Impact of Indemnification

-

Tangible

Common

Equity

Equivalent

Increase

(Net)

7

$284 million / 24 bps

$130 million / 11 bps

$154 million / 13 bps

YTD

Morgan

Keegan

Net

Income

4

$63 million

YTD

Fee

Income

Ratio

(Reported

/

Pro

Forma)

(non-GAAP)

5

46.5% / 37.3%

YTD

Efficiency

Ratio

(Reported

/

Pro

Forma)

(non-GAAP)

5

68.7% / 64.6%

2

1 |

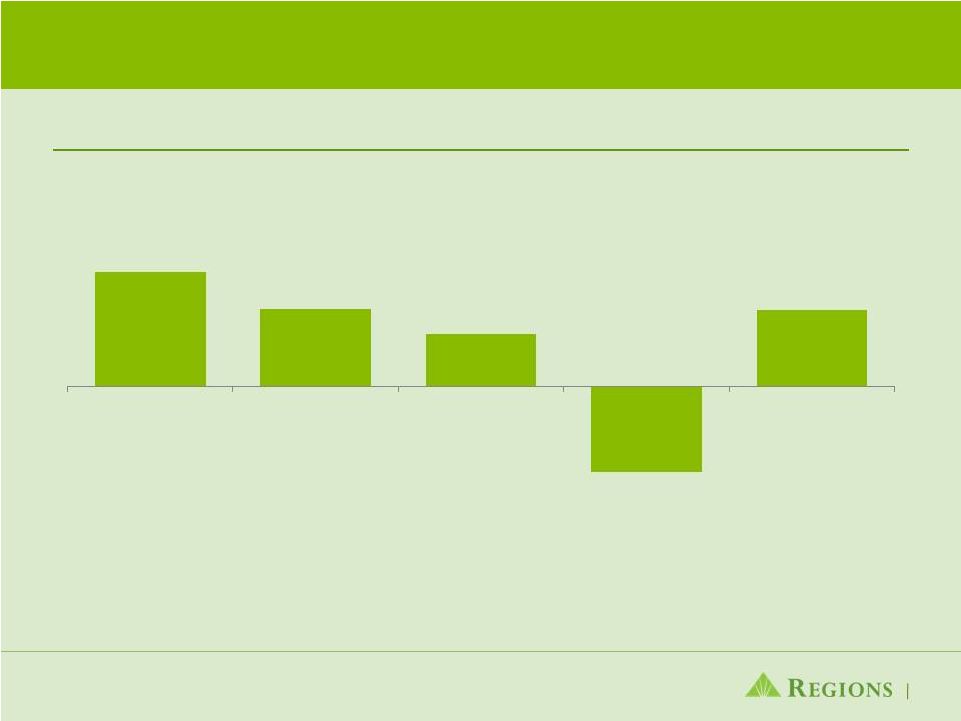

Historical Morgan Keegan Contribution

5

Morgan Keegan¹

Net Income / (Loss)

($ in millions)

²

³

$ 95

$ 64

$ 43

$(71)

2007

2008

2009

2010

2011 YTD

(through 3Q11)

$ 63

1.

Excludes RMK Trust and Morgan Asset Management to be retained by Regions 2.

Reflects impact of $125 million regulatory settlement charge 3.

Includes $27 million tax-benefit related to the regulatory settlement |

Summary of Transaction Benefits

6

Reduces overall risk profile

Creates significant additional liquidity at the holding company

Provides a new low-cost source of deposits at the bank

Improves key capital ratios

Incremental revenue opportunities created through new strategic alliances with

Raymond James

Ongoing partnerships maintained for critical business relationships between

Regions and Morgan Keegan

Strengthens focus on our core banking business |

Appendix

7 |

Disclosure –

Capital

8

Unaudited pro forma financial information has been presented to give effect to and

show the pro forma impact of the transaction on certain of Regions' capital

amounts and ratios as of September 30, 2011 presented on pages 9 and

11. No assurance can be given that such transaction will be completed

on the terms assumed

for

the

purposes

of

this

presentation

of

pro

forma

financial

information

or at all.

The unaudited pro forma capital information is presented for illustrative purposes

only and does not necessarily indicate the results that would have

been

realized

had

the

transaction

been

completed

as

of

September

30,

2011.

The

pro

forma

impact

of

the

transaction

assumes

a

purchase

price

of

$930

million

and

a

dividend

to

Regions

of

$250

million

before

closing,

resulting

in

total

proceeds

of

$1.180 billion.

The

unaudited

pro

forma

capital

information

has

been

derived

from,

and

should

be

read

in

conjunction

with

Regions'

historical

unaudited

consolidated

financial

statements included

in Regions' Quarterly Report on Form 10-Q for the three and nine months ended

September 30, 2011 filed with the SEC. The

following

tables

provide

calculations

of

end

of

period

"tangible

common

stockholders'

equity

to

tangible

assets"

(non-GAAP),

"tangible common

book

value

per

share"

(non-GAAP),

and

"Tier

1

common

risk-based”

(non-GAAP)

ratios, as well as a reconciliation of stockholders' equity (GAAP) to

Tier

1

capital

(regulatory)

and

to

"Tier

1

common

equity"

(non-GAAP). Tangible common stockholders' equity ratios have become a focus of some investors

and management believes they may assist investors in analyzing the

capital position of the Company absent the effects of intangible assets and preferred

stock. Traditionally, the Federal Reserve and other banking regulatory bodies

have assessed a bank's capital adequacy based on Tier 1 capital, the

calculation of which is codified in federal banking regulations.

In connection with the Company’s Comprehensive Capital Assessment and Review

process, these regulators supplement their assessment of the capital

adequacy of a bank based on a variation of Tier 1 capital, known as Tier 1 common

equity. While not codified, analysts and banking regulators have

assessed Regions' capital adequacy using the tangible common stockholders' equity

and/or the Tier 1 common equity measure. Because tangible common

stockholders' equity and Tier 1 common equity are not formally defined by GAAP

or codified in the federal banking regulations, these measures are considered to be

non-GAAP financial measures and other entities may calculate them

differently than Regions' disclosed calculations. Since analysts and banking

regulators may assess Regions' capital adequacy using tangible common

stockholders' equity and Tier 1 common equity, we believe that it is useful to

provide investors the ability to assess Regions' capital adequacy on these

same bases. The tables also include the impact of the indemnification liability on

each of the capital ratios as well as each capital ratio excluding the

indemnification. These amounts are included to illustrate the impact of

components of the transaction on each applicable ratio. Tier 1 common equity

is often expressed as a percentage of risk-weighted assets. Under the risk-based capital framework, a company's balance sheet

assets and credit equivalent amounts of off-balance sheet items are assigned to

one of four broad risk categories. The aggregated dollar amount in each

category is then multiplied by the risk-weighted category. The resulting

weighted values from each of the four categories are added together and this sum

is the risk-weighted assets total that, as adjusted, comprises the denominator

of certain risk-based capital ratios. Tier 1 capital is then divided by this

denominator (risk-weighted assets) to determine the Tier 1 capital ratio.

Adjustments are made to Tier 1 capital to arrive at Tier 1 common equity. Tier 1

common equity is also divided by the risk-weighted assets to determine the Tier

1 common equity ratio. The amounts disclosed as risk-weighted assets

are calculated consistent with banking regulatory requirements.

|

Estimated

Impact

of

Transaction

-

Capital

(Unaudited)

9

Note: See Footnotes on page 10

($ amounts in millions, except per share data)

As Reported

9/30/11

Goodwill Impairment-

Discontinued

Operations

Goodwill Impairment-

Continuing

Operations

Pro Forma

09/30/11

17,263

$

(428)

$

(6)

(265)

$

(6)

20

$

(1)

16,590

$

3,409

-

-

-

3,409

$

6,039

(428)

(6)

(265)

(6)

(32)

$

(2)

5,314

$

(220)

-

-

-

(220)

$

A

8,035

$

-

$

-

$

52

$

8,087

$

129,762

$

(428)

$

(265)

$

(1,549)

$

(3)

127,520

$

6,039

(428)

(265)

(32)

5,314

$

Deferred tax liability related to intangibles (GAAP)

(220)

-

-

-

(220)

$

B

123,943

$

-

$

-

$

(1,517)

$

122,426

$

C

1,259

1,259

1,259

A/B

6.48%

0.13%

6.61%

TCE/TA -

Impact of Indemnification (non-GAAP)

(0.11%)

(4)

TCE/TA -

Excluding Indemnification (non-GAAP)

0.24%

A/C

6.38

$

0.04

$

6.42

$

17,263

$

(428)

$

(6)

(265)

$

(6)

20

$

16,590

$

(92)

-

-

-

(92)

$

(5,649)

428

(6)

265

(6)

32

(4,924)

$

(506)

-

-

(38)

(544)

$

(36)

-

-

-

(36)

$

92

-

-

-

92

$

846

-

-

-

846

$

D

11,918

$

-

$

-

$

14

$

11,932

$

Tier 1 capital risk-based ratio (regulatory)

D/F

12.84%

0.13%

12.97%

Tier

1

capital

risk-based

ratio

-

Impact

of

Indemnification

(non-GAAP)

(0.23%)

(5)

Tier

1

capital

risk-based

ratio

-

Excluding

Indemnification

(non-GAAP)

0.36%

D

11,918

$

-

$

-

$

14

$

11,932

$

(92)

-

-

-

(92)

$

(846)

-

-

-

(846)

$

(3,409)

-

-

-

(3,409)

$

E

7,571

$

-

$

-

$

14

$

7,585

$

F

92,786

-

-

(800)

91,986

$

E/F

8.16%

0.09%

8.25%

Tier

1

common

risk-based

ratio

-

Impact

of

Indemnification

(non-GAAP)

(0.23%)

(5)

Tier

1

common

risk-based

ratio

-

Excluding

Indemnification

(non-GAAP)

0.32%

Tier 1 capital (regulatory)

Tier 1 common risk-based ratio (non-GAAP)

Tier 1 capital (regulatory)

Qualifying non-controlling interests

Qualifying trust preferred securities

Preferred stock

Tier 1 common equity (non-GAAP)

Risk-weighted assets (regulatory)

Accumulated other comprehensive (income) loss

Non-qualifying goodwill and intangibles

Disallowed deferred tax assets

Disallowed servicing assets

Shares outstanding--end of quarter

Tangible common stockholders' equity to tangible assets (non-GAAP)

Tangible common book value per share (non-GAAP)

TIER 1 CAPITAL AND TIER 1 COMMON RISK-BASED RATIO

Stockholders' equity (GAAP)

Less: Intangible assets (GAAP)

Stockholders' equity (GAAP)

Less: Preferred equity (GAAP)

Intangible assets (GAAP)

Deferred tax liability related to intangibles (GAAP)

Tangible common stockholders' equity (non-GAAP)

Total assets (GAAP)

Qualifying non-controlling interests

Qualifying trust preferred securities

Tangible assets (non-GAAP)

Estimated Impact

Upon Closing |

Estimated

Impact

of

Transaction

-

Capital

(Footnotes related to page 9)

10

1.

Estimated

after-tax

impact

from

transaction,

indemnification,

goodwill

elimination

and

deal

costs

to

stockholders’

equity

2.

Estimated goodwill to be eliminated at sale date

3.

Estimated adjustment to tangible assets sold net of cash proceeds and deferred

taxes recognized from transaction 4.

Estimated $210 million indemnification (net of 38% assumed effective tax rate) as a

percentage of pro forma tangible assets 5.

Estimated $210 million indemnification as a percentage of pro forma risk weighted

assets. No tax impact included as to be disallowed for regulatory

purposes. 6.

As a result of the process of selling Morgan Keegan,

Regions

expects

to

record an impairment charge (primarily non-deductible) in the fourth

quarter

of

2011

related

to

the

$745

million

of

goodwill

included

in

its

Investment

Banking/Brokerage/Trust

segment.

Based

on

the

relative

fair

value

allocation,

portions

of

the

charge

will

be

recorded

in

the

statement

of

operations

within

both

Discontinued

Operations

and

Continuing

Operations. The

calculations

of

the

amount

of

the

charge

and

the

allocations

are not yet complete and these estimates are subject to change.

Based on currently

available

estimates,

Regions

has

assumed

a

range

of

total

fourth

quarter

2011

impairment

charge

of

$575

-

$745 million.

The goodwill impairment charge is a non-cash item which will not have a

negative impact on regulatory capital. For

purposes

of

the

attached

pro

forma

financial

information,

Regions

has

assumed

a

fourth

quarter

goodwill

impairment

charge

of

$693 million

consisting of $428 million in Discontinued Operations and $265 million in

Continuing Operations. The total amount and these allocations are not

yet complete and are subject to change.

Upon

consummation

of

the

sale

of

Morgan

Keegan,

the

remaining

goodwill

allocated

to

Discontinued

Operations

will

be

derecognized

and

included

in

the

gain/loss

on

sale.

For

purposes

of

the

attached

pro

forma

financial

information

the amount of goodwill derecognized is expected

to be approximately $32 million and the resulting gain is estimated to be

approximately $20 million. The

actual

impairment

charge

is

expected

to

be

in

the

range

listed

above

but

likely

to

vary

from

the

amounts

included

in

the

pro

forma financial

information. Actual results could also vary from the expected ranges.

The allocations between Discontinued and Continuing Operations could

also

vary

from

the

allocations

assumed

in

the

attached

pro

forma

financial information. |

Estimated

Impact

of

Transaction

–

Capital

Basel

III

(unaudited)

11

($ amounts in millions)

As Reported

09/30/11

Goodwill Impact -

Discontinued

Operations

Goodwill Impact-

Continuing

Operations

Estimated Impact

Upon Closing

Pro Forma

09/30/11

Stockholders' equity (GAAP)

17,263

$

(428)

$

*

(265)

$

*

20

$

*

16,590

$

Non-qualifying goodwill and intangibles

(1)

(5,820)

428

*

265

*

32

*

(5,095)

$

Adjustments, including other comprehensive income related to cash flow hedges,

disallowed deferred tax assets, threshold deductions and other

adjustments (809)

-

-

(2)

(811)

$

10,634

-

-

50

10,684

Qualifying non-controlling interests

4

-

-

-

4

$

Basel III Tier 1 Capital (non-GAAP)

10,638

-

-

50

10,688

Basel III Tier 1 Capital (non-GAAP)

10,638

-

-

50

10,688

$

Preferred stock

(3,409)

-

-

-

(3,409)

$

Qualifying non-controlling interests

(4)

-

-

-

(4)

$

Basel III Tier 1 Common (non-GAAP)

7,225

$

-

$

-

$

50

$

7,275

$

Basel I risk-weighted assets (regulatory)

92,786

$

-

$

-

$

(800)

$

91,986

$

Basel III risk-weighted assets (non-GAAP)

(2)

94,389

$

-

$

-

$

(800)

$

93,589

$

Minimum

Basel III Tier 1 Capital Ratio (non-GAAP)

8.5%

11.27%

11.42%

Basel III Tier 1 Common Ratio (non-GAAP)

7.0%

7.65%

7.77%

Regions currently calculates its risk-based capital ratios under guidelines adopted by the Federal

Reserve based on the 1988 Capital Accord (“Basel I”) of the Basel Committee on

Banking Supervision (the “Basel Committee”). In December 2010, the Basel Committee released

its final framework for Basel III, which will strengthen international capital and liquidity

regulation. When implemented by U.S. bank regulatory agencies and fully phased-in, Basel III will

change capital requirements and place greater emphasis on common equity. Implementation of

Basel III will begin on January 1, 2013, and will be phased in over a multi-year period. The U.S. bank regulatory agencies have not yet finalized regulations

governing the implementation of Basel III. Accordingly, the calculations provided below are estimates,

based on Regions’ current understanding of the framework, including the Company’s

reading of the requirements, and informal feedback received through the regulatory process. Regions’ understanding of the framework is evolving and will likely change as

the regulations are finalized. Because the Basel III implementation regulations are not formally

defined by GAAP and have not yet been finalized and codified, these measures are considered to

be non-GAAP financial measures, and other entities may calculate them differently from Regions’ disclosed calculations. Since analysts and banking regulators may

assess

Regions’

capital

adequacy

using

the

Basel

III

framework,

we

believe

that

it

is

useful

to

provide

investors

the

ability

to

assess

Regions’

capital

adequacy

on

the

same

basis.

*

See related footnote explanations on the "Estimated Impact of Transaction - Capital" page

10 1.

Under Basel III, regulatory capital must be reduced by purchased credit card relationship intangible

assets. These assets are partially allowed in Basel I capital. 2.

Regions continues to develop systems and internal controls to precisely calculate risk-weighted

assets as required by Basel III. The amount included above is a reasonable approximation, based

on our understanding of the requirements. |

Disclosure on Reconciliation to Certain non-GAAP

Financial Measures

12 |

Reconciliation to Certain non-GAAP Financial Measures

(unaudited)

13

Note: References to Morgan Keegan on this slide exclude RMK Trust and Morgan

Asset Management. See related disclosure on page 12.

As of and for Quarter Ended

($ in millions)

3/31/11

6/30/11

9/30/11

YTD 9/30/11

Reported

Non-interest expense (GAAP)

$

1,167

$

1,198

$

1,066

$

3,431

Adjustments:

Branch consolidation and property and equipment charges

–

(77)

–

(77)

Adjusted non-interest expense (non-GAAP)

A

$

1,167

$

1,121

$

1,066

$

3,354

Net interest income, taxable-equivalent basis (GAAP)

$

872

$

872

$

866

$

2,610

Non-interest income (GAAP)

$

843

$

781

$

745

$

2,369

Adjustments:

Securities (gains) losses, net

(82)

(24)

1

(105)

Leveraged lease termination losses, net

–

–

2

2

Loss on sale of mortgage loans

3

–

–

3

Adjusted non-interest income (non-GAAP)

B

$

764

$

757

$

748

$

2,269

Adjusted total revenue (non-GAAP)

C

$

1,636

$

1,629

$

1,614

$

4,879

Fee income ratio (non-GAAP)

B / C

46.7

%

46.5

%

46.3

%

46.5

%

Efficiency ratio (non-GAAP)

A / C

71.3

68.8

66.0

68.7

Pro Forma

Adjusted non-interest expense (non-GAAP)

$

1,167

$

1,121

$

1,066

$

3,354

Morgan Keegan non-interest expense

(235)

(242)

(216)

(693)

Pro forma adjusted non-interest expense (non-GAAP)

D

$

932

$

879

$

850

$

2,661

Net interest income, taxable-equivalent basis (GAAP)

$

872

$

872

$

866

$

2,610

Morgan Keegan net interest income

(8)

(8)

(8)

(24)

Pro forma net interest income, taxable-equivalent basis (GAAP)

$

864

$

864

$

858

$

2,586

Adjusted non-interest income (non-GAAP)

$

764

$

757

$

748

$

2,269

Morgan Keegan non-interest income

(263)

(238)

(232)

(733)

Pro forma adjusted non-interest income (non-GAAP)

E

$

501

$

519

$

516

$

1,536

Pro forma adjusted total revenue (non-GAAP)

F

$

1,365

$

1,383

$

1,374

$

4,122

Pro forma fee income ratio (non-GAAP)

E / F

36.7

%

37.5

%

37.6

%

37.3

%

Pro forma efficiency ratio (non-GAAP)

D / F

68.3

63.6

61.9

64.6 |

›Forward-

14

This presentation and any other written or oral statements made by or on behalf of Regions Financial

Corporation (“Regions”) in connection with the matters described in this presentation

may include forward-looking statements, including, but not limited to, statements about the

projected impact on Regions of the transaction described in the presentation. The Private Securities

Litigation Reform Act of 1995 (the “Act”) provides a safe harbor for

forward-looking statements which are identified as such and are accompanied by the identification of important

factors that could cause actual results to differ materially from the forward-looking statements.

For these statements, we, together with our subsidiaries, unless the context implies otherwise,

claim the protection afforded by the safe harbor in the Act. Forward-looking statements are

not based on historical information, but rather are related to future operations, strategies, financial results or other developments.

Forward-looking statements are based on management’s expectations as well as certain

assumptions and estimates made by, and information available to, management at the time the

statements are made. Those statements are based on general assumptions and are subject to

various risks, uncertainties and other factors that may cause actual results to differ materially from the views, beliefs and

projections expressed in such statements. In addition to factors previously disclosed in Regions’

filings with the U.S. Securities and Exchange Commission, these risks, uncertainties and other

factors include, but are not limited to: the possibility that regulatory and other approvals

and conditions to the transaction are not received or satisfied on a timely basis or at all; the possibility that modifications to the

terms of the transaction may be required in order to obtain or satisfy such approvals or conditions;

changes in the anticipated timing for closing the transaction; business disruption during the

pendency of or following the transaction; diversion of management time on

transaction-related issues; reputational risks and the reaction of customers and counterparties to

the transaction and the completion of the audit and finalization of our financial statements

for fourth quarter and fiscal year 2011.

Annualized, pro forma, projected and estimated numbers are used for illustrative purposes only, are

not forecasts and may not reflect actual results. Use of non-GAAP Financial Measures

Non-GAAP financial measures have inherent limitations, are not required to be uniformly applied

and are not audited. Although these non- GAAP financial measures are frequently used by

stakeholders in the evaluation of a company, they have limitations as analytical tools, and

should not be considered in isolation, or as a substitute for analyses of results as reported under

GAAP. See slide 9 and 11 for a reconciliation of stockholders’ equity (GAAP) to tangible common book

value (non-GAAP) to Tier 1 capital (regulatory) to Tier 1 common equity (non-GAAP) and

to estimated Basel III ratios (non-GAAP). These reconciliations also present the pro

forma impact of the transaction on stockholders’ equity, tangible common stockholders’

equity, Tier 1 capital, Tier 1 common, and estimated Basel III regulatory ratios.

See slide 13 for a detail of efficiency ratios (non-GAAP) and fee ratios (non-GAAP).

Looking

Statements |

|