Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - ACCURIDE CORP | acw12-8kjan11.htm |

Page | 1

Investor Presentation

January 11, 2012

January 11, 2012

Page | 2

Imperial

Gunite

Brillion

Accuride

Fuel Tank Straps

Fuel Tank Assemblies

Windshield

Frames

Hood

Tops and

Skins

Battery/Tool Boxes

Grill

Assemblies

Bumpers

Fuel Tank Ends

Crown

Assemblies

Sunvisors

Engine

Castings

Steel and Aluminum

Wheels

Chassis &

Suspension

Brackets

Fenders

Brake Drums, Disc Wheel

Hubs, Spoke Wheels, Rotors

Exhaust Stacks

& Assemblies

Steel wheels

#1

Aluminum wheels

#2

Brake drums

Disc wheel hubs

#2

Metal bumpers #2

Note: Market defined as North American commercial truck market.

(1) Bostrom & Fabco

Company Products & Key Brands

Accuride Business Units

Leading Brands

% 2011

Revenues

through Q3

Revenues

through Q3

42%

26%

13%

15%

Divested

Units

Units

4%

(1)

Top Ten NA

Casting Operation

Page | 3

End Markets & Customers

YTD Q3 2011 Revenue by End Market

YTD Q3 2011 Revenue by Customer

Heavy-Duty Truck (Class 8)

Heavy Conventional

Transit Bus

Tandem-Axle Van

Medium-Duty Truck (Class 5-7)

Stake

Walk-In Van

School Bus

Flat Bed

Tanker

Light Truck (Class 3-4)

Pick-Up

Trailer

Note: Includes revenue from divested business units.

Page | 4

2011 - A Year of Transformation

Ø Upgraded, Co-located & Focused Senior Leadership Team

• New President & CEO

• 70% of Senior Leadership team replaced or reassigned

• Revised compensation plan for 2012 - ROA and FCF

Ø Revised Strategic Plan Developed & Implementation Initiated:

• New Vision, Mission, Values

• “Fix & Grow” Strategy Developed

• International Expansion delayed 12-18 months

Ø “Core” vs. “Non-Core” Focus Established:

• Fix & Grow: Accuride Wheels, Gunite

• Divested: Bostrom Seating, Fabco

• TBD: Imperial, Brillion Iron Works

Ø Commitment to Restore Operating Excellence & Technological Leadership:

• Rebuilt “Core” skills & team: MFG, Product Engineering, Quality, Supply Chain

• Two-year CAPEX plan (2011-12) to update manufacturing capability & expand/rationalize capacity:

• $55M investment in Accuride Wheels business

• $55M investment in Gunite Wheel-end business

• Three-year Product Portfolio plans developed to ensure industry benchmark technology

Ø Re-established Commercial Discipline:

• Gunite price increases in both OEM and Aftermarket Segments

• Brillion Iron Works price increases

• Successfully pursuing anti-dumping campaign for Steel Wheels

Page | 5

Strategic Objectives

Ø #1-2 globally in wheel-end systems

Ø ROIC > 20% through a cycle

Ø >80% of revenue from CORE products

Ø Balanced geographical revenues:

• 40% North America

• 30% Asia

• 20% Europe

• 10% South America

Ø >95% retention of personnel

Ø Maximize ACW share price

Share

Price

Grow Globally

Create a Competitive

Cost Structure &

LEAN Operating Culture

Divest Non-Core Assets

Fix Core Business & Operations

Customer Centric, Technology Leadership

Ethical People, Selfless Leaders, Team Oriented

Accuride Vision: Accuride will be the premier supplier of wheel-end system

solutions to the global commercial vehicle industry

solutions to the global commercial vehicle industry

Our Focus

Page | 6

2012 - A Year of Execution

Ø Complete the operational turn-around of our “Core” assets:

• Complete Aluminum wheel capacity expansion

• Complete rationalization study for Steel Wheel Capacity (4Q)

• Upgrade capability and consolidate Gunite manufacturing footprint:

• Quality, Delivery, Daily production stability (1Q)

• Install & launch 2.1M/year drum machining capacity (2Q/3Q)

• Install new & transfer existing capacity while selectively outsourcing hub machining (4Q)

• Repair & Selectively upgrade foundry and facility at Rockford (2012-13)

• Complete consolidation of Imperial assets (1Q)

• Implement common LEAN Manufacturing systems (2012-13)

Ø Fully understand and revamp our supply chain (>55% of COGS):

• Scheduling systems integrated & coordinated

• Consolidate MRO buy for key commodities (tools, MRO, chemicals)

• Aggressively manage raw material pricing with both suppliers and customers

Ø Focused sales initiatives:

• Re-negotiate & extend LTAs with the “Big 4” Truck OEMs

• Dedicate & focus resources on specific fleets, trailer OEMs and key AM customers

• Use open capacity & “total wheel-end” product portfolio for “value selling”

• Fill-up open capacity at Imperial and Brillion

Ø Continue to explore opportunistic strategic opportunities

Page | 7

Aluminum Capacity Expansion

Ø Market penetration of aluminum

wheels continues to grow

wheels continues to grow

Ø Phase 1 complete:

• Mega-line at 1,000/day

• Mexico at 300+/day

• Acquisition & integration of Forgitron

Ø Phase 2 underway:

• $20M CAPEX

• Double capacity in MX and SC

Ø Key customers targeted:

• Truck OEMs: Volvo, Daimler, Paccar

• Trailer OEMs

Page | 8

Footprint Aligned w/ Customers

Kenworth

Peterbilt

Kenworth

Peterbilt

Navistar

Navistar

Mack

Daimler

Daimler

Kenworth

Please note that the circles

encompass 200, 400, and 600

miles from each Wheels facility.

encompass 200, 400, and 600

miles from each Wheels facility.

Navistar

Accuride

Page | 9

Gunite Operational Turn-Around

Note: Representative customer quality data

DEC

10,417

Page | 10

Gunite Financial Turn-Around

Ø Pricing Activity with customers (1Q)

• AM (Drums +3%, Spoke Wheels +30%, Other)

• OEM (8-18%)

Ø Increased hub pricing from Brillion (1Q)

Ø Eliminate CS2 (1Q) and CS1 (2Q) Inspection

Ø Improved daily production

Ø New Drum (3Q) & Hub (4Q) Machining:

• Scrap: 4.0% to 2.2%

• Tooling: 2.5% to 2.0%

• Labor/OT: 13.5% to 10.0%

• Freight: 3.5% to 3.0%

Ø Volume & Mix: TBD

Page | 11

Sales & Marketing Initiatives

• Numerous meetings with OEMs

• Completed branding survey

Ø Revised Organization:

• Reduction in headcount/operating

expense (>$1.25M)

expense (>$1.25M)

• Aggressive management of AR

• Order & Inventory management

Note: Market share based on company estimates

Page | 12

Sales & Marketing Initiatives

Note: Market share based on company estimates

Aftermarket (Cast) Drum Share

Trailer OEM (Cast) Drum Share

Truck OEM (Cast) Drum Share

Page | 13

Supply Chain Initiatives

Ø Key recent staff additions:

• MRO Buyer

• Metals Buyer

Ø Outside advisor engaged to help us fully understand “current”

situation and identify opportunities by 1Q12

situation and identify opportunities by 1Q12

Ø Concerted efforts to fix scheduling and inventory management

Ø Minimize steel economic headwind 1H12

Page | 14

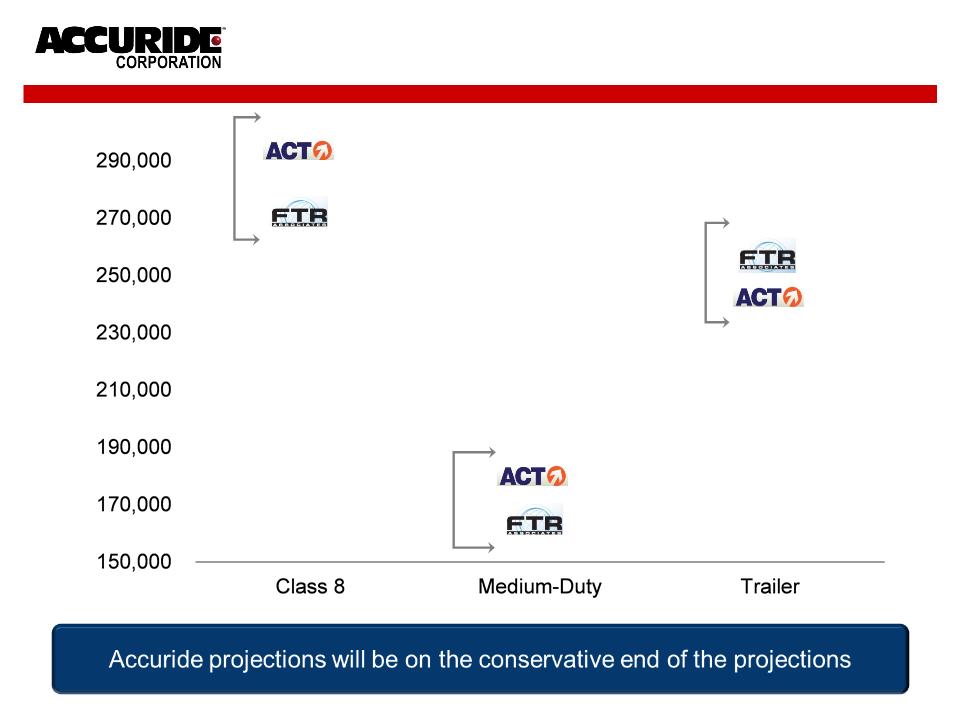

Industry Forecasts

295,545

176,111

271,000

167,900

251,000

246,300

Page | 15

Initiatives to Improve Liquidity

Ø Aggressive Working Capital Management:

• Scheduling systems & inventory management

• AR collection (<5% past due >90 days)

• AP terms extension

Ø ABL expansion 1Q12

Ø Potential divestiture of non-core asset in 1H12

Ø Improved operating performance:

• Gunite (pricing, daily operations, eliminate CS1 & CS2 inspection)

• Imperial (capacity consolidation, SGA & premium reduction)

• Brillion (pricing, daily operations, capacity utilization)

Ø Execution of key CAPEX projects:

• Core business (<3 year payback at >15% IRR)

• Non-core business (<1 year payback only)

Page | 16

• “Fix & Grow” Strategy developed & being executed

• Experienced leadership team on-board & performing

• Resources focused on key priorities

• All major initiatives on-schedule and on-budget

• Market trends favorable heading into 2012

• Some headwind on steel pricing in 1H12

• Adequate liquidity and initiatives to improve it

• Strategic opportunities exist to “Fix & Grow” the company

• We are executing our plan!

Summary

Page | 17