Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT ON FORM 8-K - PEPCO HOLDINGS LLC | jan10-phi8k.htm |

Williams Capital Group Transmission Seminar

William Gausman

Senior Vice President, Strategic Initiatives

NEW YORK, NY • JANUARY 11, 2012

1

Safe Harbor Statement

Some of the statements contained in today’s presentation with respect to Pepco Holdings, Pepco, Delmarva Power and Atlantic City Electric, and each of their respective

subsidiaries, are forward-looking statements within the meaning of the U.S. federal securities laws and are subject to the safe harbor created thereby and by the Private

Securities Litigation Reform Act of 1995. These statements include declarations regarding each reporting company’s intents, beliefs and current expectations. You can

generally identify forward-looking statements by terminology such as “may,” “might,” “will,” “should,” “could,” “expects,” “intends,” “assumes,” “seeks to,” “plans,” “anticipates,”

“believes,” “projects,” “estimates,” “predicts,” “potential,” “future,” “goal,” “objective,” or “continue”, the negative or other variations of such terms, or comparable terminology,

or by discussions of strategy that involve risks and uncertainties. Forward-looking statements involve estimates, assumptions, known and unknown risks, uncertainties and

other factors that may cause one or more reporting company’s actual results, levels of activity, performance or achievements to be materially different from any future results,

levels of activity, performance or achievements expressed or implied by such forward-looking statements. Therefore, forward-looking statements are not guarantees or

assurances of future performance, and actual results could differ materially from those indicated by the forward-looking statements. These forward-looking statements are

qualified in their entirety by, and should be read together with, the risk factors included in the “Risk Factors” section of each reporting company’s annual and quarterly reports

filed in 2011, and investors should refer to these risk factor sections. The forward-looking statements contained herein are also qualified in their entirety by reference to, and

should be read together with, the following important factors, which are difficult to predict, contain uncertainties, are beyond each reporting company’s control and may cause

actual results to differ materially from those contained in forward-looking statements: demonstrating compliance with applicable regulatory requirements, including regulatory

orders; fines, penalties or other sanctions which may be assessed by regulatory authorities against Pepco Holdings’ regulated utilities in the future; potential outcomes of

pending and future rate cases, including the possible disallowance of costs and expenses; the amount of expenditures necessary to comply with regulatory requirements,

including regulatory orders, and to implement reliability enhancement, emergency response and customer service improvement programs; changes in prevailing

governmental policies and regulatory actions affecting the energy industry, including allowed rates of return, industry and rate structure, acquisition and disposal of assets

and facilities, operation and construction of transmission and distribution facilities, and the recovery of purchased power expenses; weather conditions affecting usage and

emergency restoration costs; population growth rates and changes in demographic patterns; changes in customer energy demand due to conservation measures and the

use of more energy-efficient products; general economic conditions, including the impact of an economic downturn or recession on energy usage; changes in and

compliance with environmental and safety laws and policies; changes in tax rates or policies or in rates of inflation; changes in accounting standards or practices; changes in

project costs; unanticipated changes in operating expenses and capital expenditures; the ability to obtain funding in the capital markets on favorable terms; rules and

regulations imposed by, and decisions of, Federal and/or state regulatory commissions, PJM, the North American Electric Reliability Corporation and other applicable electric

reliability organizations; legal and administrative proceedings (whether civil or criminal) and settlements that influence each reporting company’s business and profitability;

pace of entry into new markets; volatility in customer demand for electricity and natural gas; interest rate fluctuations and the impact of credit and capital market conditions on

the ability of a reporting company to obtain funding on favorable terms; and effects of geopolitical events, including the threat of domestic terrorism or cyber attacks. Any

forward-looking statements speak only as to the date of this presentation and each reporting company undertakes no obligation to update any forward-looking statements to

reflect events or circumstances after the date on which such statements are made or to reflect the occurrence of unanticipated events. New factors emerge from time to time,

and it is not possible for a reporting company to predict all such factors, nor can any reporting company assess the impact of any such factor on such reporting company’s

business or the extent to which any factor, or combination of factors, may cause results to differ materially from those contained in any forward-looking statement. The

foregoing factors should not be construed as exhaustive.

subsidiaries, are forward-looking statements within the meaning of the U.S. federal securities laws and are subject to the safe harbor created thereby and by the Private

Securities Litigation Reform Act of 1995. These statements include declarations regarding each reporting company’s intents, beliefs and current expectations. You can

generally identify forward-looking statements by terminology such as “may,” “might,” “will,” “should,” “could,” “expects,” “intends,” “assumes,” “seeks to,” “plans,” “anticipates,”

“believes,” “projects,” “estimates,” “predicts,” “potential,” “future,” “goal,” “objective,” or “continue”, the negative or other variations of such terms, or comparable terminology,

or by discussions of strategy that involve risks and uncertainties. Forward-looking statements involve estimates, assumptions, known and unknown risks, uncertainties and

other factors that may cause one or more reporting company’s actual results, levels of activity, performance or achievements to be materially different from any future results,

levels of activity, performance or achievements expressed or implied by such forward-looking statements. Therefore, forward-looking statements are not guarantees or

assurances of future performance, and actual results could differ materially from those indicated by the forward-looking statements. These forward-looking statements are

qualified in their entirety by, and should be read together with, the risk factors included in the “Risk Factors” section of each reporting company’s annual and quarterly reports

filed in 2011, and investors should refer to these risk factor sections. The forward-looking statements contained herein are also qualified in their entirety by reference to, and

should be read together with, the following important factors, which are difficult to predict, contain uncertainties, are beyond each reporting company’s control and may cause

actual results to differ materially from those contained in forward-looking statements: demonstrating compliance with applicable regulatory requirements, including regulatory

orders; fines, penalties or other sanctions which may be assessed by regulatory authorities against Pepco Holdings’ regulated utilities in the future; potential outcomes of

pending and future rate cases, including the possible disallowance of costs and expenses; the amount of expenditures necessary to comply with regulatory requirements,

including regulatory orders, and to implement reliability enhancement, emergency response and customer service improvement programs; changes in prevailing

governmental policies and regulatory actions affecting the energy industry, including allowed rates of return, industry and rate structure, acquisition and disposal of assets

and facilities, operation and construction of transmission and distribution facilities, and the recovery of purchased power expenses; weather conditions affecting usage and

emergency restoration costs; population growth rates and changes in demographic patterns; changes in customer energy demand due to conservation measures and the

use of more energy-efficient products; general economic conditions, including the impact of an economic downturn or recession on energy usage; changes in and

compliance with environmental and safety laws and policies; changes in tax rates or policies or in rates of inflation; changes in accounting standards or practices; changes in

project costs; unanticipated changes in operating expenses and capital expenditures; the ability to obtain funding in the capital markets on favorable terms; rules and

regulations imposed by, and decisions of, Federal and/or state regulatory commissions, PJM, the North American Electric Reliability Corporation and other applicable electric

reliability organizations; legal and administrative proceedings (whether civil or criminal) and settlements that influence each reporting company’s business and profitability;

pace of entry into new markets; volatility in customer demand for electricity and natural gas; interest rate fluctuations and the impact of credit and capital market conditions on

the ability of a reporting company to obtain funding on favorable terms; and effects of geopolitical events, including the threat of domestic terrorism or cyber attacks. Any

forward-looking statements speak only as to the date of this presentation and each reporting company undertakes no obligation to update any forward-looking statements to

reflect events or circumstances after the date on which such statements are made or to reflect the occurrence of unanticipated events. New factors emerge from time to time,

and it is not possible for a reporting company to predict all such factors, nor can any reporting company assess the impact of any such factor on such reporting company’s

business or the extent to which any factor, or combination of factors, may cause results to differ materially from those contained in any forward-looking statement. The

foregoing factors should not be construed as exhaustive.

2

Power Delivery

Energy Services

Our Businesses

PHI Service Territory

Forecast

Business Mix*

Business Mix*

90 - 95%

5 - 10%

* Percentages based on projected operating income for 2011 - 2015

Note: See Safe Harbor Statement at the beginning of today’s presentation.

Diverse, Stable Service Territory

Regulatory Diversity, 2010 Rate Base

3

Residential

37%

Commercial

47%

Government

10%

Industrial

6%

Customer Diversity, 2010 MWh Sales

Diversified customer base and more stable employment trends help

to minimize recessionary impacts on our service territory

to minimize recessionary impacts on our service territory

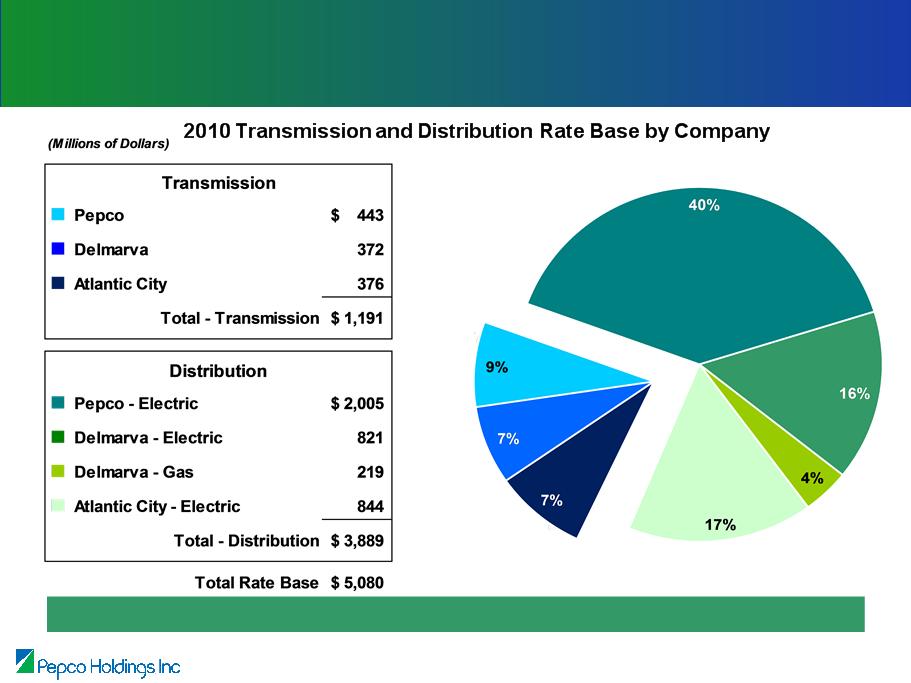

Rate Base Summary

Distribution is 77% and Transmission is 23% of our 2010 year-end rate base

Note: See Safe Harbor Statement at the beginning of today’s presentation.

4

5

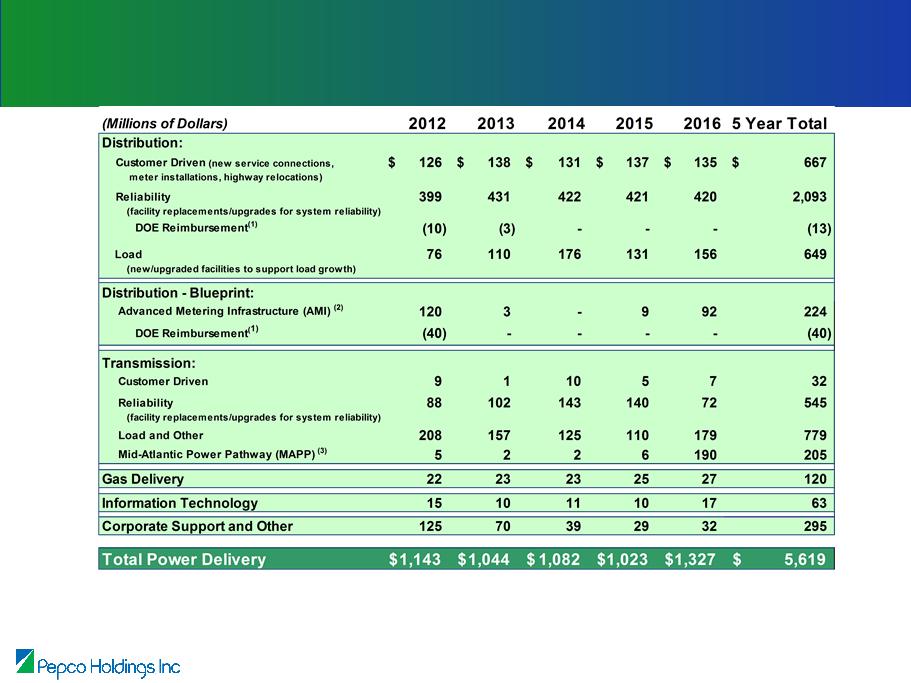

Capital Expenditures - 2012 - 2016 Forecast

Note: See Safe Harbor Statement at the beginning of today’s presentation.

(1) Assumes Mid-Atlantic Power Pathway (MAPP) in-service date of 2020.

(2) Reflects the remaining anticipated reimbursement pursuant to awards from the U.S. DOE under the ARRA.

Distribution is 72% and Transmission is 28% of Power Delivery

Capital Expenditures forecasted over the next five years

6

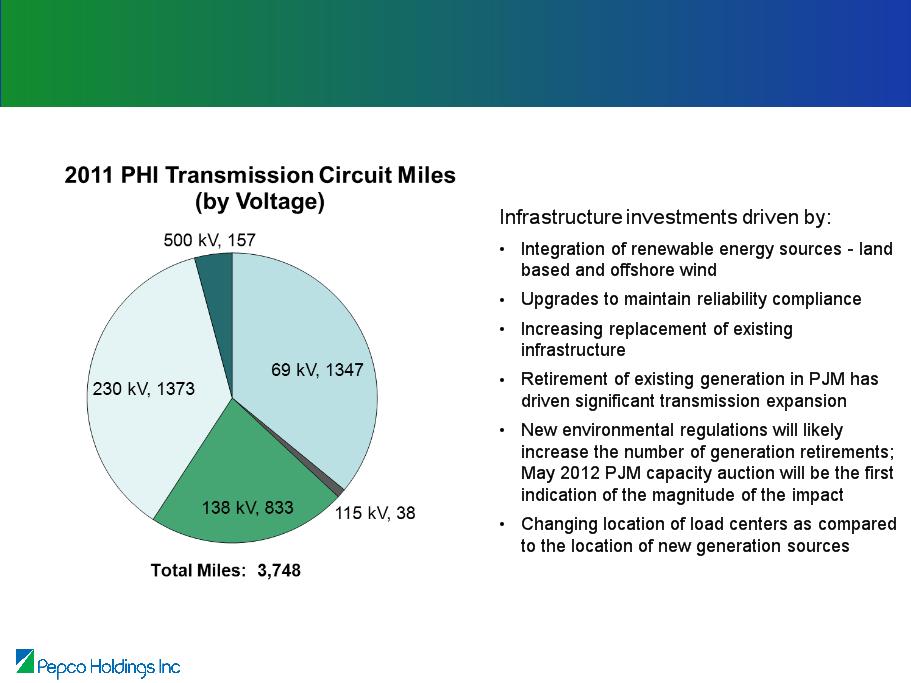

Transmission Overview

Note: See Safe Harbor Statement at the beginning of today’s presentation.

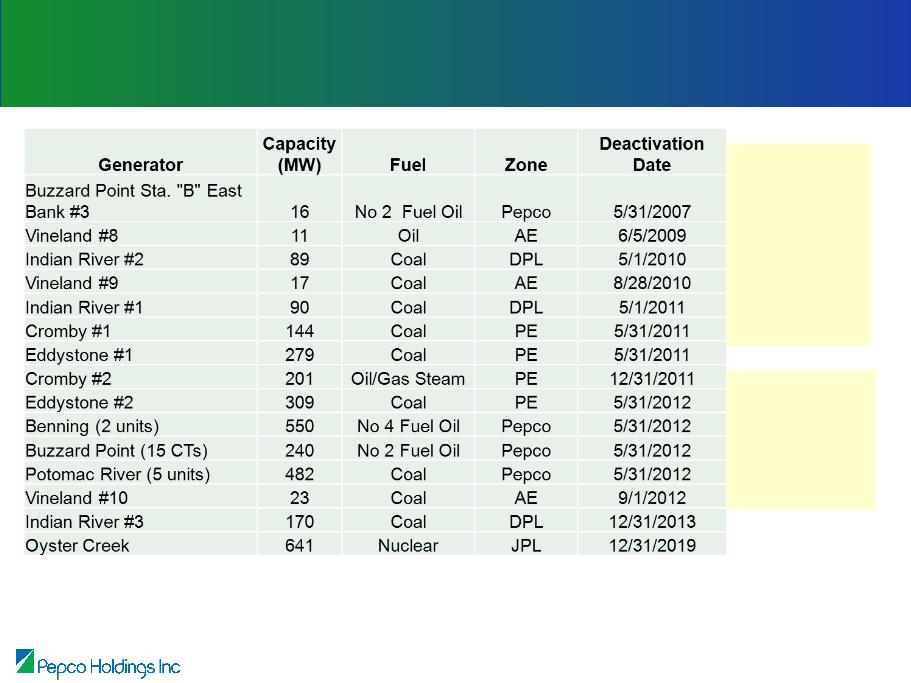

Generation Deactivations

Source:

http://www.exeloncorp.com/powerplants/oystercreek/Pages/profile.aspx

http://www.pjm.com/planning/generation-retirements.aspx

http://www.pjm.com/documents/reports/eia-reports.aspx

Approximately

847 MW of

generation

within the PHI

footprint and

surrounding

area have been

retired in the

last 5 years

847 MW of

generation

within the PHI

footprint and

surrounding

area have been

retired in the

last 5 years

Approximately

2415 MW have

announced

future

deactivation

dates

2415 MW have

announced

future

deactivation

dates

7

Need for Transmission Enhancements

• Need for new transmission lines is not primarily driven by load growth

• NERC reliability requirements have added new operating requirements and, as a result,

are a significant driver for new transmission facilities across all three operating

companies

are a significant driver for new transmission facilities across all three operating

companies

• Generation retirement can occur with very little advanced notice and much faster than

the Company can build new transmission lines - PJM planning process being revised

the Company can build new transmission lines - PJM planning process being revised

• Since load growth is not driving the need, replacement of existing facilities is generally

the preferred solution as opposed to constructing new lines

the preferred solution as opposed to constructing new lines

• Increased load forecast can accelerate the upgrades to maintain N-1-1 NERC

compliance

compliance

8

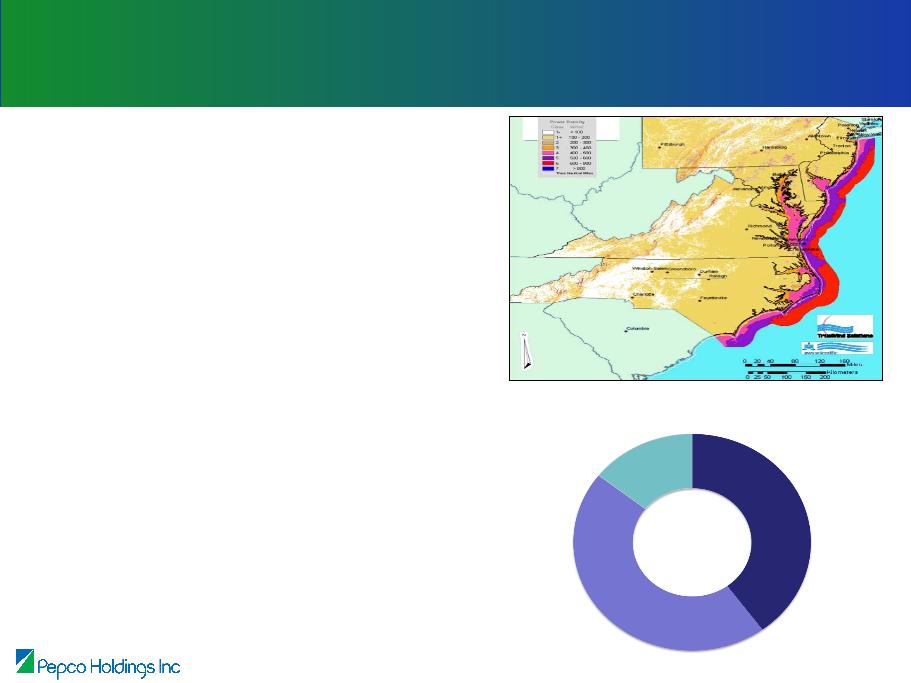

Integrating Renewable Resources into the PHI System

• The PHI service territory offers a unique

opportunity with one of the greatest

concentrations of strong off-shore wind

resources existing along the Mid-Atlantic

region

opportunity with one of the greatest

concentrations of strong off-shore wind

resources existing along the Mid-Atlantic

region

• In order to develop large scale off-shore wind

projects, additional transmission

infrastructure will be needed as existing

transmission systems were designed to

deliver energy in only one direction to the

coastal service territory of PHI and not from

off-shore wind generators

projects, additional transmission

infrastructure will be needed as existing

transmission systems were designed to

deliver energy in only one direction to the

coastal service territory of PHI and not from

off-shore wind generators

• Solar integration can impact the transmission

system by its variable nature during peak

load conditions

system by its variable nature during peak

load conditions

• Variable resources present new dimensions

into transmission planning and will require

new solutions - high speed switching with

Static Var Compensator (SVC) and High

Voltage Direct Current (HVDC) systems

into transmission planning and will require

new solutions - high speed switching with

Static Var Compensator (SVC) and High

Voltage Direct Current (HVDC) systems

• A strong transmission system and advanced

system monitoring are needed to be able to

operate with high concentrations of variable

resources

system monitoring are needed to be able to

operate with high concentrations of variable

resources

PSEG

367 MW

JCPL

1,164

MW

ACE

1,017

MW

New Jersey Utilities: Solar Projects In PJM Queue

As of April 19th 2011

9

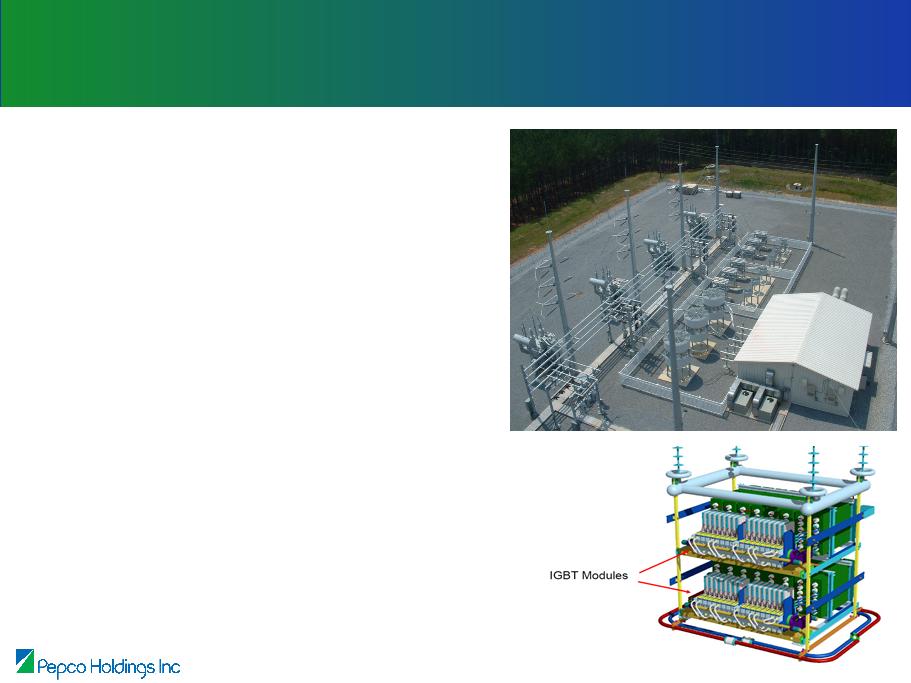

Need For Advanced Technologies

• The transmission systems of the future will incorporate advanced

technologies to control flow, manage voltage variations and improve

monitoring for operations and maintenance requirements

technologies to control flow, manage voltage variations and improve

monitoring for operations and maintenance requirements

• PHI is incorporating these technologies into the systems we are

building today:

building today:

– Installing our fifth SVC

– Utilizing HVDC for the MAPP project

– Installing high temperature conductors

– PHI identified four Phasor Monitoring Units (PMU) locations, and two

Phasor Data Concentrators (PDC) locations

Phasor Data Concentrators (PDC) locations

– Installing 99 Dissolved Gas Analysis (DGA) monitors on substation

transformers

transformers

10

Benefits of New Technologies

SVCs and HVDC

• High speed switching to

respond to changing

conditions on the transmission

system

respond to changing

conditions on the transmission

system

• Increases grid voltage by

supplying reactive power

supplying reactive power

• Decreases grid voltage by

consuming reactive power

consuming reactive power

• Control flows on the system

• HVDC can provide black start

and Bi-directional operation

that are needed to support

renewable resources

and Bi-directional operation

that are needed to support

renewable resources

11

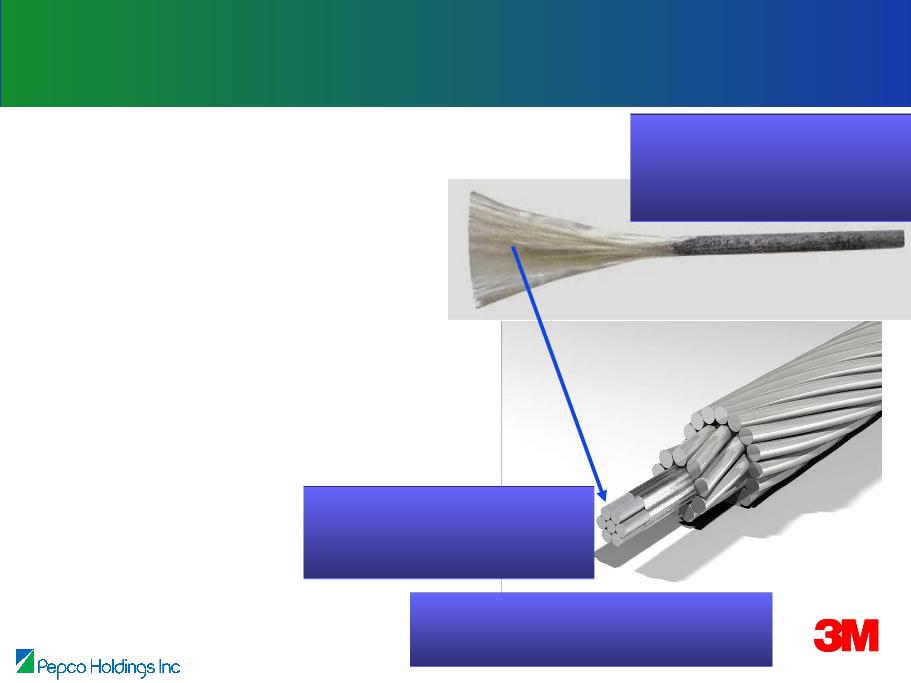

High Temp Al

-Zr

240° C

-Zr

240° C

Composite

Core Wires

Core Wires

Aluminum

Tape

Tape

Aluminum

Oxide

Fibers

Oxide

Fibers

Aluminum

Matrix

Composite

Core Wire

Matrix

Composite

Core Wire

• Stable, compatible materials,

even at high temperatures

even at high temperatures

• Construction similar to ACSR with >2

times the ampacity

times the ampacity

• Rated at 210°C continuous

operation and 240°C

emergency

operation and 240°C

emergency

© 3M 2011. All rights reserved.

Aluminum Conductor Composite Reinforced (ACCR)

Benefits of New Technologies

• Less sag at high temperatures - maintain or

improve clearances at high energy levels

improve clearances at high energy levels

• Higher strength-to-weight ratio - maintain or

improve stress on structures

improve stress on structures

• Twice the ampacity on existing structures,

while matching tensions, clearances

while matching tensions, clearances

• Reduced time to permit and environmental

impacts

impacts

• Utilize existing structures without

modifications

modifications

12

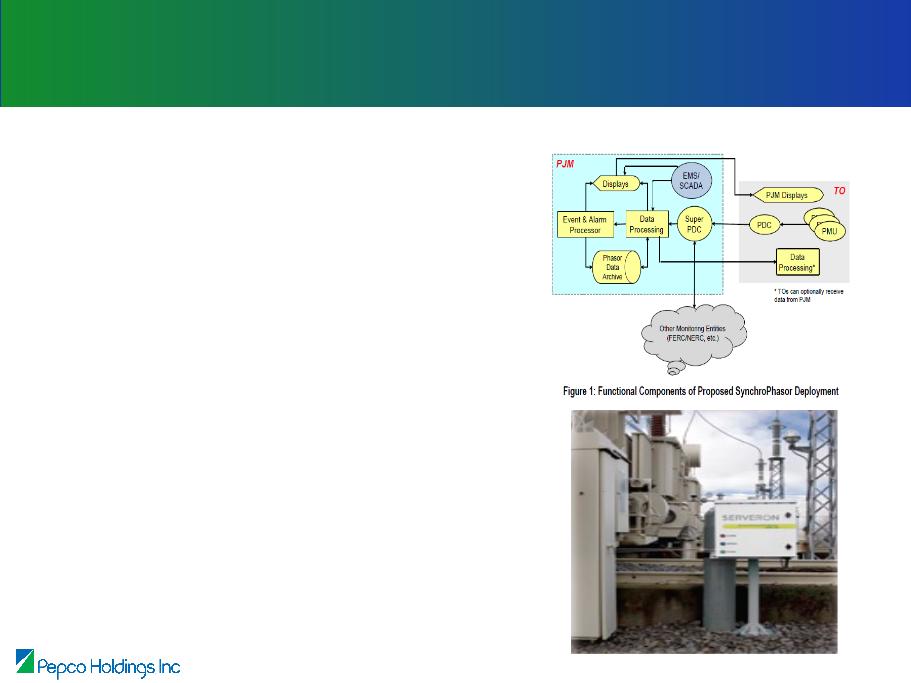

Benefits of New Technologies

• Measurements of voltages and

currents, which are time-tagged with

high precision via GPS time signal

receivers

currents, which are time-tagged with

high precision via GPS time signal

receivers

• Operators can make better control

decisions

decisions

• Enhanced post-disturbance analysis

• Continuous asset monitoring

improves reliability and increases

cost effectiveness of maintenance

improves reliability and increases

cost effectiveness of maintenance

• Broad dissemination of asset health

• An easy-to-use human interface for

monitoring prevents data overload

and unnecessary time spent trying

to identify a problem

monitoring prevents data overload

and unnecessary time spent trying

to identify a problem

Phasor Monitoring Units and Dissolved Gas Analysis

13

14

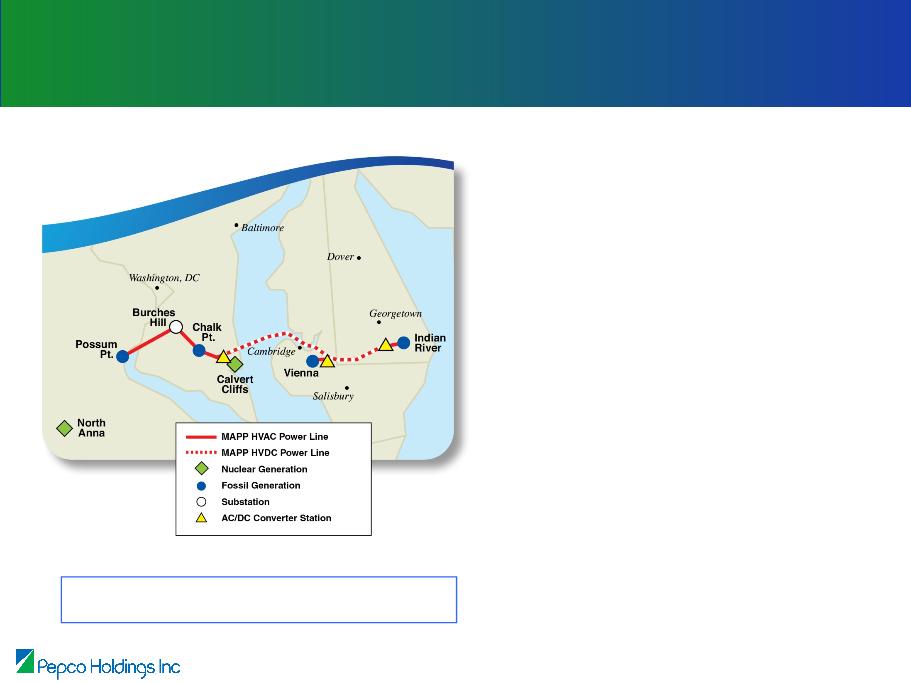

• PJM provided notice to PHI in August

2011 that the MAPP project in-service

date will be delayed until 2019 - 2021

2011 that the MAPP project in-service

date will be delayed until 2019 - 2021

• PHI suspended most permitting,

engineering, and environmental

studies

engineering, and environmental

studies

• Maryland PSC approved our request to

delay the procedural schedule for one

year or until PJM has issued its 2012

Regional Transmission Expansion

Plan

delay the procedural schedule for one

year or until PJM has issued its 2012

Regional Transmission Expansion

Plan

• PHI plans to spend approximately $5

million in 2012 to complete right-of-way

acquisition in Dorchester County and

some permitting and environmental

activities

million in 2012 to complete right-of-way

acquisition in Dorchester County and

some permitting and environmental

activities

Mid-Atlantic Power Pathway - Project Update

FERC Approved ROE: 12.8%

2020 in-service date currently planned

Note: See Safe Harbor Statement at the beginning of today’s presentation.

15

PHI - Positioned for Growth

• $5.6 billion in planned infrastructure investment over 5 years, with 28% in

transmission

transmission

• Significant transmission growth to support generation retirements and NERC

policy compliance

policy compliance

• Timely transmission cost recovery by FERC formula and incentive rates

• Reasonable regulatory outlook - ongoing distribution rate cases focused on

timely cost recovery

timely cost recovery

• PHI focused on continued improvement in operating performance - safety,

customer satisfaction, reliability, cost

customer satisfaction, reliability, cost

Note: See Safe Harbor Statement at the beginning of today’s presentation.

Williams Capital Group Transmission Seminar

William Gausman

Senior Vice President, Strategic Initiatives

NEW YORK, NY • JANUARY 11, 2012

Appendix

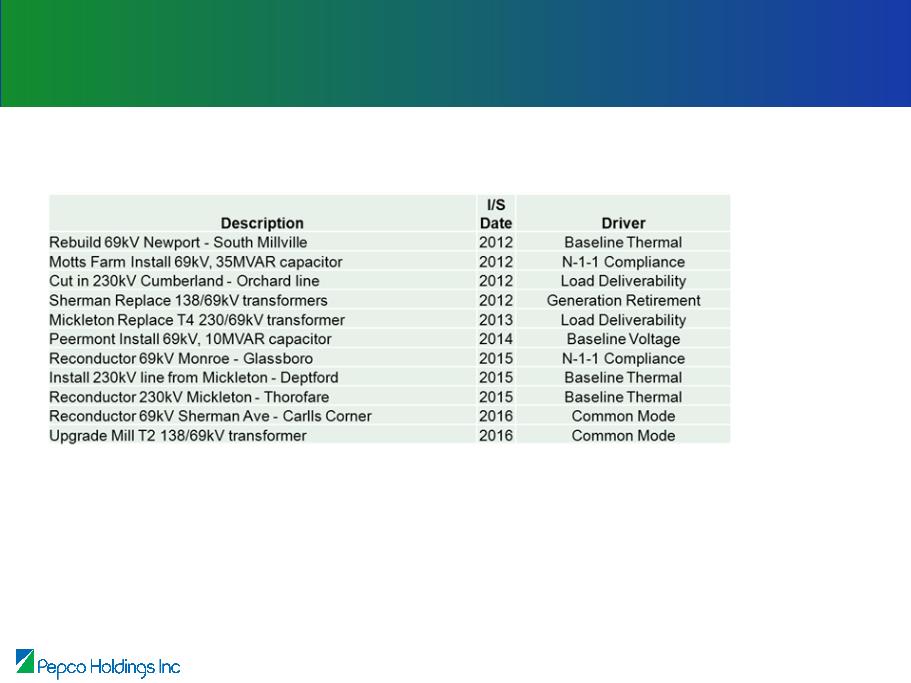

Transmission Projects 2012 - 2016

ACE

Notes:

1.Common Mode outages include line faults associated with stuck breaker, double circuit tower line, and

faulted circuit breakers and buses

faulted circuit breakers and buses

2.N-1-1 outages ensure facilities can be operated within normal thermal and voltage limits after N-1 (single)

contingency assuming re-dispatch and system adjustments and within emergency thermal ratings and voltage

limits after an additional single contingency (N-1-1)

contingency assuming re-dispatch and system adjustments and within emergency thermal ratings and voltage

limits after an additional single contingency (N-1-1)

Note: See Safe Harbor Statement at the beginning of today’s presentation.

18

Transmission Projects 2012 - 2016

DPL

Note: See Safe Harbor Statement at the beginning of today’s presentation.

19

20

Capital Expenditures Forecast -

Updated November 2011

Updated November 2011

Note: See Safe Harbor Statement at the beginning of today’s presentation.

(1) Reflects the remaining anticipated reimbursement pursuant to awards from the U.S. DOE under the ARRA.

(2) Installation of AMI in New Jersey is contingent on regulatory approval ($9 million in 2015, $92 million in

2016).

2016).

(3) Assumes MAPP in-service date of 2020.

21

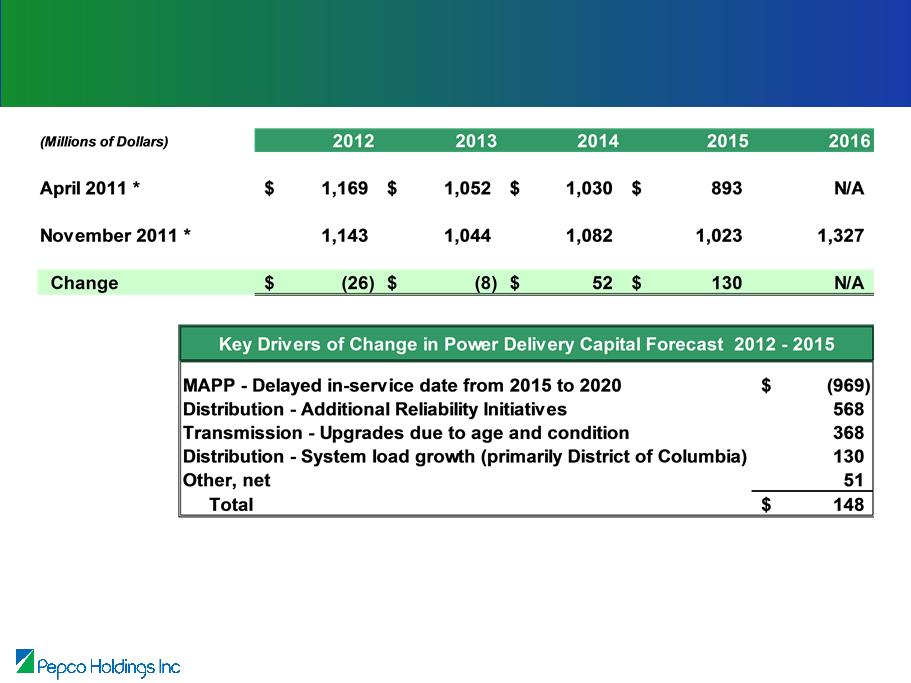

Forecast Capital Expenditures Comparison

* Amounts are net of anticipated reimbursement pursuant to awards from the U.S. DOE under the ARRA.

Note: See Safe Harbor Statement at the beginning of today’s presentation.

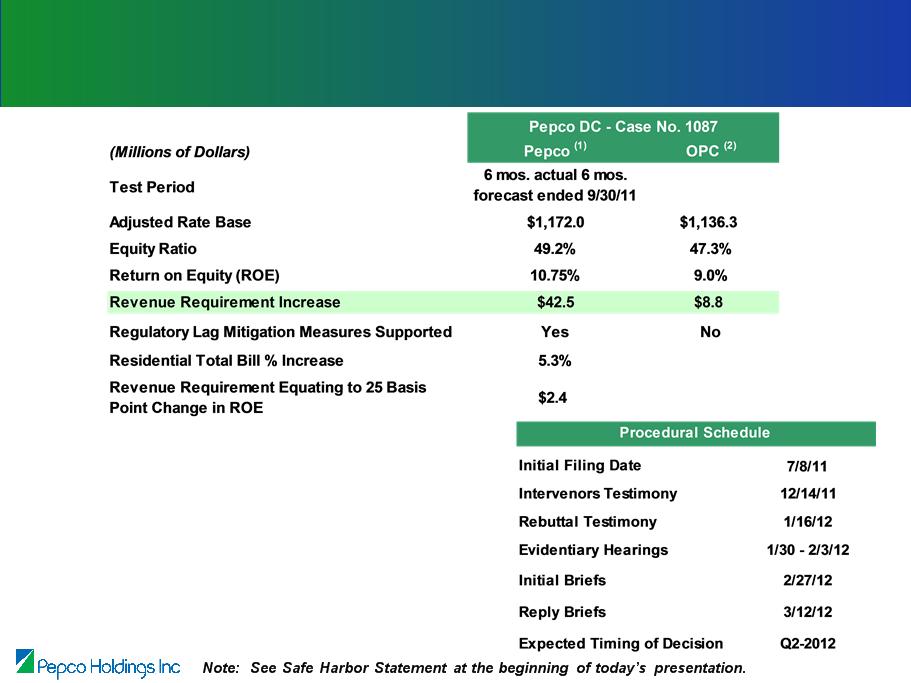

Distribution Rate Cases - Pending

Pepco - District of Columbia

Pepco - District of Columbia

Regulatory lag mitigation measures proposed:

• Reliability Investment Recovery Mechanism (RIM)

• Fully forecasted test years

Drivers of requested increase:

•Rate base growth/reliability investments

•Investment in Advanced Metering Infrastructure (AMI)

•Increase in authorized ROE

(1) Current filed position as of October 29, 2011

(2) Office of People’s Counsel

22

23

Note: See Safe Harbor Statement at the beginning of today’s presentation.

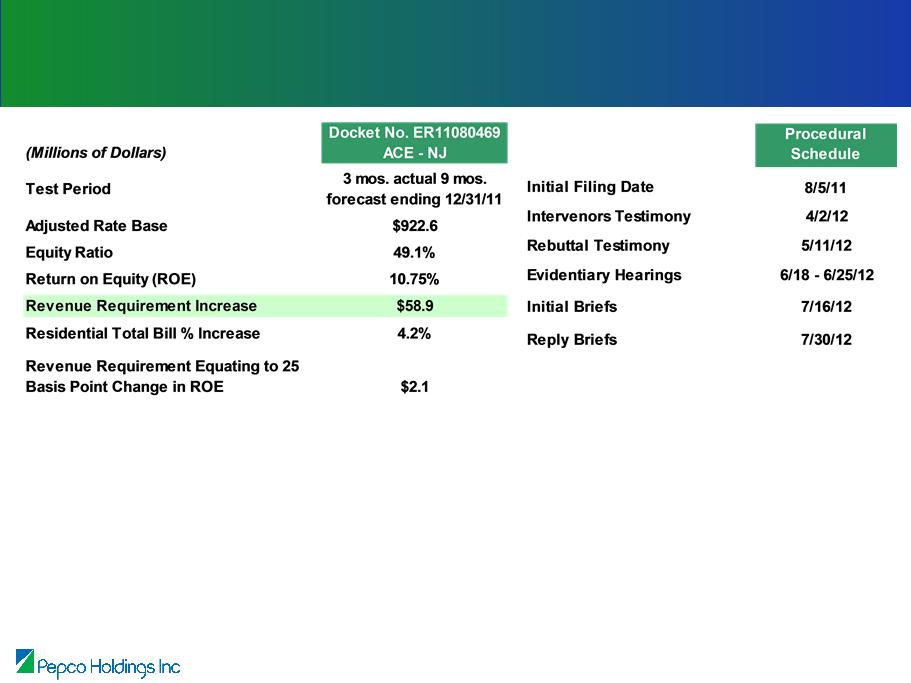

Distribution Rate Cases - Pending

Atlantic City Electric - New Jersey

Atlantic City Electric - New Jersey

Drivers of requested increase:

• Rate base growth/reliability investments

Regulatory lag mitigation measure proposed in a separate filing made October 18, 2011:

• Request the continuance and expansion of the recently completed Infrastructure Investment Program (IIP)

• Allows recovery of non-revenue generating infrastructure investment through a special rate outside of a base

rate filing

rate filing

• Under the IIP, Atlantic City Electric proposes to recover reliability-related capital expenditures of $63 million, $94

million and $81 million, in 2012, 2013 and 2014, respectively

million and $81 million, in 2012, 2013 and 2014, respectively

24

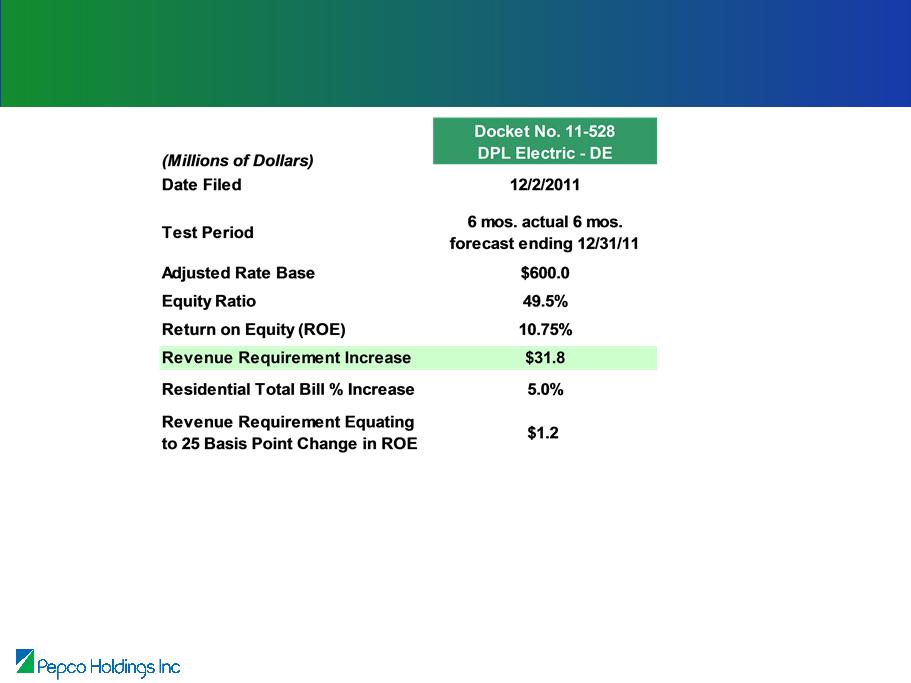

Distribution Rate Cases - Pending

Delmarva Power - Delaware Electric

Delmarva Power - Delaware Electric

Note: See Safe Harbor Statement at the beginning of today’s presentation.

Drivers of requested increase:

• Rate base growth/reliability investments

• Increase in operating expenses

Two regulatory lag mitigation measures proposed

in filing:

in filing:

•Reliability Investment Recovery Mechanism - provides full

and timely recovery of future capital investments related to

distribution system reliability

and timely recovery of future capital investments related to

distribution system reliability

•Fully forecasted test periods

25

Distribution Rate Cases - Pending

Delmarva Power - Maryland

Delmarva Power - Maryland

Note: See Safe Harbor Statement at the beginning of today’s presentation.

Drivers of requested increase:

• Rate base growth/reliability investments

• Recovery of Hurricane Irene restoration

expenses

expenses

• Customer service enhancements

• Increase in authorized ROE

Regulatory lag mitigation measures proposed in

filing:

filing:

•Reliability Investment Recovery Mechanism (RIM)

• Fully forecasted test years

26

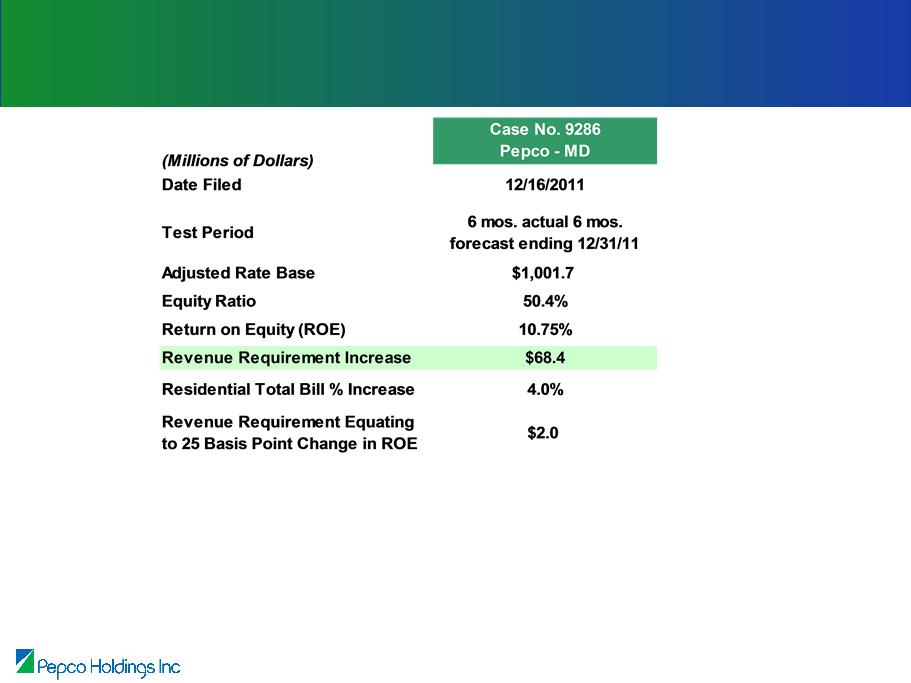

Distribution Rate Cases - Pending

Pepco - Maryland

Pepco - Maryland

Note: See Safe Harbor Statement at the beginning of today’s presentation.

Drivers of requested increase:

• Rate base growth/reliability investments

• Recovery of Hurricane Irene restoration

expenses

expenses

• Customer service enhancements

• Increase in authorized ROE

Regulatory lag mitigation measures proposed in

filing:

filing:

•Reliability Investment Recovery Mechanism (RIM)

•Fully forecasted test years

27

• Filing Cycle Status

– Pepco DC Pending - Filed July 2011

– Atlantic City Electric NJ Pending - Filed August 2011

– Delmarva Power DE - Electric Pending - Filed December 2011

– Delmarva Power MD Pending - Filed December 2011

– Pepco MD Pending - Filed December 2011

– Delmarva Power DE - Gas Filing targeted for 1Q2013

• Rate cases will be filed in 2012 if progress to reduce regulatory lag is less than

satisfactory in the current cycle of base rate cases

satisfactory in the current cycle of base rate cases

Distribution Rate Cases - The Current Cycle

Note: See Safe Harbor Statement at the beginning of today’s presentation.

28

Pepco - Maryland

Reliability Case 9240

Reliability Case 9240

• Related to power outages caused by severe weather in Pepco’s service

territory in 2010

territory in 2010

• Public Service Commission initiated the proceeding for Pepco in August 2010

to investigate the reliability of the electric distribution system and the quality of

service provided to customers

to investigate the reliability of the electric distribution system and the quality of

service provided to customers

• Reliability Enhancement Plan submitted to the Commission in August 2010

• Commission decision rendered December 21, 2011

– Imposed $1 million fine on Pepco

– Requires the filing of a detailed five-year work plan and periodic status reports

– Pepco must demonstrate improvement in reliability to recover reliability costs

• Pepco’s position

– Focused on the implementation of the Reliability Enhancement Plan

– No plan to appeal fine

– Reliability costs are being prudently incurred and should be recovered

29

Reliability Standards - Maryland

• Following working group process and rule making hearings, Commission approved draft

rules establishing requirements for:

rules establishing requirements for:

– Service interruption duration and frequency standards

– Service restoration

– Poorest performing feeder and device activation standards

– Downed wire response

– Customer communications

– Vegetation management

– Equipment inspection

– Major Outage Event Plan

• First measurement period begins as soon as the regulations are adopted (expected to be

no later than July 1, 2012)

no later than July 1, 2012)

Maryland (PSC - RM43) - Rule making proceeding applying to all electric utilities in the state to

establish comprehensive reliability and service standards

establish comprehensive reliability and service standards

30

Reliability Standards - District of Columbia

• New rules require improvement in reliability performance (outage frequency and duration) on

an annual basis beginning in 2013 and continuing through 2020

an annual basis beginning in 2013 and continuing through 2020

• Pepco filed an application for reconsideration of the regulations with the Commission in

August 2011 stating:

August 2011 stating:

– Regulations were flawed because they proposed an inconsistent method to calculate reliability

– Standards may not be realistically achievable at an acceptable level of cost over the longer term

• Revision to rules proposed by Commission in December 2011 to address certain issues

raised in Pepco’s application for reconsideration:

raised in Pepco’s application for reconsideration:

– Method to calculate reliability was revised to a manner reflecting District of Columbia-only data

– After June 2015, Pepco is permitted to petition the Commission to re-evaluate reliability standards

for 2017-2020 to address feasibility and cost issues

for 2017-2020 to address feasibility and cost issues

District of Columbia - New reliability standards adopted in July 2011, further technical

revisions proposed December 2011

revisions proposed December 2011

31

• Equity investment as of September 30, 2011 of $1.3 billion

• Annual tax benefits of $52 million

• Annual net earnings of $21 million

• Current Status:

– IRS audit settlement approved in November 2010 for the 2001/2002 periods;

disallowed net losses on the cross-border energy leases

disallowed net losses on the cross-border energy leases

– Paid $74 million of taxes, $1 million of penalties and $28 million of interest associated

with the 2001/2002 audit in 2011

with the 2001/2002 audit in 2011

– Filed a claim for refund of tax payment, interest and penalties with the IRS in July 2011

– Since the claim for refund was not approved by the IRS within the statutory six-month

period, complaints will be filed in the U.S. Court of Federal Claims against the IRS in

January 2012 to resolve the issue and recover the tax payment, interest and penalties

period, complaints will be filed in the U.S. Court of Federal Claims against the IRS in

January 2012 to resolve the issue and recover the tax payment, interest and penalties

– Absent a settlement, litigation will likely take several years to resolve

Cross-Border Energy Lease Status

Note: See Safe Harbor Statement at the beginning of today’s presentation.