Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - TESSERA TECHNOLOGIES INC | d279370d8k.htm |

Investor Overview

Robert A. Young

President and CEO

January 2012

Exhibit 99.1 |

2

Safe Harbor

This presentation contains forward-looking statements, which are made pursuant

to the safe harbor provisions of the Private Securities Litigation Reform

Act of 1995. Forward-looking statements involve risks and uncertainties that could cause actual results to

differ significantly from those projected, particularly with respect to the

Company’s financial results and milestones; the impact of changes to

executive management and the board of directors; growth of the Company’s served markets; market opportunities;

industry and technology trends; use of the Company’s technology in additional

applications; growth opportunities, including with respect to the delivery

of next generation chip packaging, the diversification of the Company’s IP business, the development and

acquisition of camera module components, the production of integrated mobile camera

modules, the sourcing of MEMS components and expected design wins relating

to integrated mobile camera modules; growth drivers; expansion into adjacent and other markets;

the characteristics, benefits, advantages, features, disruptive qualities and

potential of the Company’s technologies and products, including with

respect to 3-D IC and other packaging solutions in the Company’s Micro-electronics segment and new generation

camera

modules

and

related

vertical

integration

opportunities

in

the

Company’s

Digital

Optics

segment,

and

the

commercialization

of

such technologies and products; profit growth in the Digital Optics segment; future

investment and research and development resources, including with respect to

strategic growth opportunities; ability to address upcoming needs of key market segments; the

expansion of the Company’s technology licensing expertise, including with

respect to the Company’s IP portfolio and the renewal of licenses with

major licensees; and the Company’s IP protection efforts, including litigation. Material factors that may cause results to

differ from the statements made include changes to the plans or operations relating

to the Company’s businesses and groups, market or industry conditions;

the future expiration of license agreements and the cessation of related royalty income; the failure or refusal of

licensees to pay royalties; delays, setbacks or losses relating to the

Company’s intellectual property or intellectual property litigation, or

any invalidation or limitation of key patents; fluctuations in operating results due to the timing of new license agreements and

royalties, or due to legal costs; changes in patent laws, regulation or

enforcement, or other factors that might affect the Company’s ability

to protect our intellectual property; the risk of a decline in demand for semiconductor products; failure by the industry to adopt

technologies covered by the Company’s patents; and the future expiration of

the Company’s patents. You are cautioned not to place undue reliance on

the forward-looking statements, which speak only as of the date of this release. The Company’s filings with the

Securities and Exchange Commission, including its Annual Report on Form 10-K

for the year ended Dec. 31, 2010 and Form 10-Q for the period ended

Sept. 30, 2011, include more information about factors that could affect the Company’s financial results. The

Company

assumes

no

obligation

to

update

information

contained

in

this

presentation.

Although

this

release

may

remain

available

on

the Company’s website or elsewhere, its continued availability does not

indicate that the Company is reaffirming or confirming any of the

information contained herein. This document includes trademarks, tradenames

and tradedress of the Company, its subsidiaries and of third parties. Those

intellectual property rights are owned by their respective owners.

|

3

Additional Information and Where to Find It

Tessera Technologies, Inc. (the “Company”), its directors and certain

executive officers and employees may become participants in the solicitation

of proxies from stockholders in connection with the Company’s 2012

Annual Meeting of Stockholders (the “Annual Meeting”). The Company plans to file a

proxy

statement

with

the

Securities

and

Exchange

Commission

(the

“SEC”)

in

connection

with

the

solicitation of proxies for the Annual Meeting (the “2012 Proxy

Statement”). Robert J. Boehlke, John B. Goodrich, David C. Nagel, Kevin

G. Rivette, Anthony J. Tether, and Robert A. Young, all of whom are members

of the Company’s Board of Directors, and Michael Anthofer, Executive Vice President and

Chief Financial Officer, Bernard J. Cassidy, Executive Vice President, General

Counsel and Secretary and Moriah Shilton, Senior Director, Investor

Relations, may become participants in the Company’s solicitation.

Information

regarding

the

Company’s

directors’

and

executive

officers’

respective

interests

in

the Company by security holdings or otherwise is set forth in the Company’s

proxy statement relating to the 2011 annual meeting of stockholders.

No other participants own in excess of 1% of the Company’s common

stock. Additional information regarding the interests of such participants will be included in the

2012 Proxy Statement and other relevant documents to be filed with the SEC in

connection with the Annual Meeting. Promptly after filing its definitive

2012 Proxy Statement with the SEC, the Company will mail the definitive 2012

Proxy Statement and a proxy card to each stockholder entitled to vote at the

Annual Meeting. STOCKHOLDERS ARE URGED TO READ THE 2012 PROXY STATEMENT

(INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO) AND ANY OTHER RELEVANT

DOCUMENTS THAT THE COMPANY WILL FILE WITH THE SEC WHEN THEY BECOME AVAILABLE

BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. Stockholders may obtain, free of

charge, copies of the definitive 2012 Proxy Statement and any other

documents filed by the Company with the SEC in connection with the Annual

Meeting at the SEC’s website (http://www.sec.gov), at the

Company’s website (http://ir.tessera.com/sec.cfm) or by writing to the

Secretary, Tessera Technologies, Inc., 3025 Orchard Parkway, San Jose,

California 95134. |

4

Tessera Technologies, Inc. at a Glance (NASDAQ: TSRA)

•

Founded in 1990 and headquartered in San Jose, California

•

Market capitalization of $919.9 million (as of Jan. 6, 2012)

Two business reporting segments:

•

Micro-electronics

-

Generating sustainable high margin cash flows from broad IP portfolio

-

Focused on chip packaging bottlenecks and 3D IC

-

Well-positioned to grow revenue base beyond semiconductor packaging

•

Digital Optics

-

Developing/producing the components of advanced camera modules for

mobile phones

-

Well-positioned to address near-term ~$1 billion MEMS auto-focus

market opportunity*

* Source:

Tessera

internal

forecast |

5

Why Tessera?

•

IP licensing leader

•

Strong cash flow / strong balance sheet

•

New leadership team

•

Significant growth opportunities in 2012 and beyond |

6

Industry Validated IP Portfolio

More than 70 companies have licensed our IP

60 billion chips have shipped with Tessera IP |

7

New Leadership in 2011

Bob Young

President & CEO

IBM

Dillon Read

Bob Roohparvar

President, Digital Optics

Flextronics

Broadcom

Rich Chernicoff

President, Micro-electronics

SanDisk

Skadden Arps

Kevin Rivette

Director

IBM

Author: Rembrandts

in the Attic

Bob Boehlke

Non-executive

Chairman

KLA-Tencor

Tony Tether

Director

Director, DARPA

Loral /Ford Aerospace |

8

* Source: Tessera internal forecast

Significant Growth Opportunities: Micro-electronics

•

IP licensing well-positioned

-

Renewed Hynix and Samsung in Nov. 2011

-

Others in 2012

•

New chip technologies coming to market

-

xFD (3 billion unit market opportunity)*

-

3D IC

•

Expanding into adjacent and other markets |

9

* Source: Tessera internal forecast

Significant Growth Opportunities: Digital Optics

•

Developed / acquired multiple camera module components now

being shipped worldwide

-

90% of digital still camera leading OEMs

-

6 of top 10 mobile phone OEMs

•

Beginning to source key MEMS auto-focus component

-

Near-term ~$1 billion market opportunity*

-

Tier One qualified

•

Pursuing integrated mobile camera module opportunity

-

$9 billion market*

-

In discussions with major mobile phone makers

-

Expect major design wins in 2012 |

10

Micro-electronics |

11

Tessera Solved a Critical Chip Packaging Problem

•

Packaging enables chips to be attached to

circuit boards

•

As chips became faster, the package became

a limiting factor and had to be made smaller

•

With packages near chip size, reliability

became a significant issue

•

We invented better chip scale package

technologies -

smaller, faster and more

reliable

TSOP

Tessera’s CSP

We Licensed the Industry |

12

Focused on Next Generations of Chip Packaging

2D Packaging

3D Interconnect

Space

Cost

Power

Performance

Strategic collaboration is a central

component of our development and

commercialization strategy |

13

* Source: Tessera internal forecast

Our Latest Packaging Innovation: xFD for Stacked DRAM

Existing Solution: SO-DIMM

xFD: SO-DIMM in a Package

Delivering Smaller, Faster and Lower Cost Solutions

Growing to 3 billion units in 2013* |

14

Tessera’s Industry Leading Roadmap

xFD for

Stacked DRAM

Fine Pitch PoP

for Mobile Apps

Low Cost

DRAM CSP

2.5D

Interposer

3D IC

Our ongoing investment in

R&D sustains and grows our

packaging royalty base

Recently

commercialized

Near-term R&D

investments

Long-term R&D

investments plus

partnership |

15

IP Business: Organic Growth and Diversification

* 3-Year

(2008

–

2010)

Average

Non-GAAP

Operating

Margin

-

69.1%;

GAAP

Operating

Margin

-

66.7%

Existing Technologies & Customers

New Packaging Technologies

Existing Technologies , New Customers

Acquired IP in New Technologies

Revenue

2021

2012 |

16 |

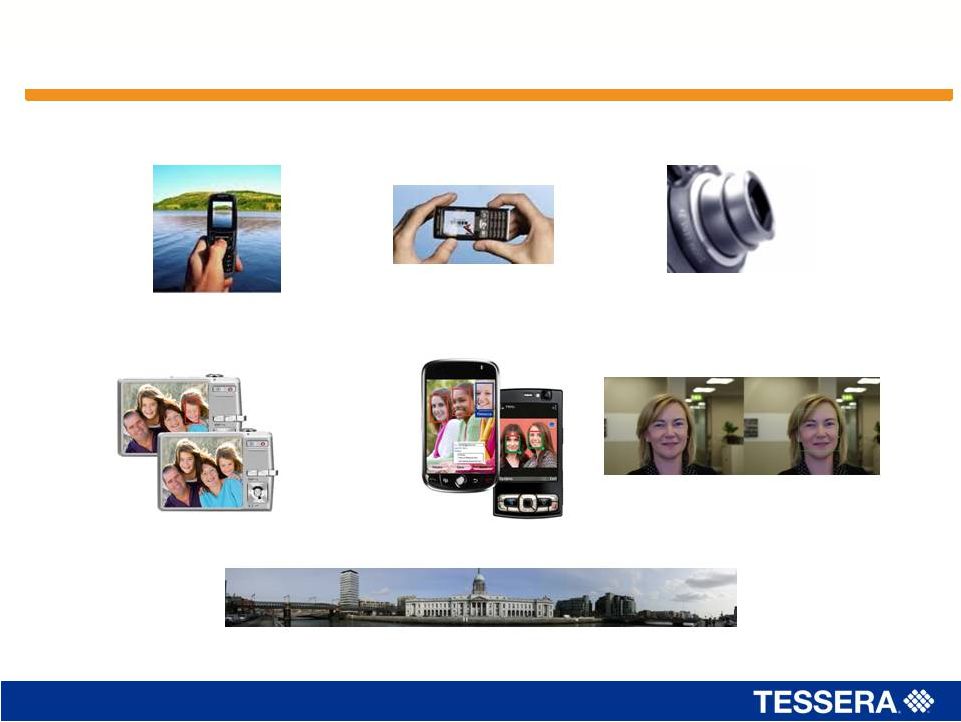

Targeting the Primary Camera Module Market Needs

Auto Focus

Zoom

Image

Stabilization

Image Enhancement

Face Beautification

Face Recognition

Face Detection

Panorama, Wide Field of View

17 |

18

DOC Technologies are Embedded in Handsets

of 6 of the Top 10 OEMs

DOC Technologies are used in DSC cameras

of more than 90% of the Leading OEMs

Transitioning DOC ‘Standard’

in DSC Image Enhancement to the

Mobile Imaging Market

Strong Market Acceptance for DOC Technologies |

19

DOC’s Latest Product is a Game Changer

MEMS Actuator for Auto Focus vs Current Technology

•

Size

-

Smaller footprint

-

Thinner

•

Speed

-

7x faster settling time

-

7x faster auto focus time

•

Lower Power Consumption

-

Uses 1/300th of current power consumption

•

Image Quality

-

More accurate auto focus |

20

MEMS Auto-focus: a Technology Breakthrough

Today: Typical cell phone camera lens actuator has 14 parts

Digital Optics’

new MEMS auto-focus actuator has 3 parts

1

3

2

New MEMS auto-

focus system can

‘plug and play’

in

same socket as

older systems

1

2

3

4

5

6

7

8

9

10

11-14

confidential |

21

Source: Yole Development, January 2010

Sizable MEMS Auto-focus Market Opportunity

Targeting ~$1 billion

actuator market for

mobile phones

•

Fragmented

•

High volume

•

Lower margin

•

Commoditized

components

~660 million units in 2012 growing to ~1.1 billion units in 2015

|

DOC

Technologies are Differentiators Fast, Low Power

MEMS AF for

‘continuous auto

focus’

Image Enhancement

Technologies

Improved optical

performance for

image sensors

Lowest height

camera

Video and Optical

Image Stabilization

Compact Optical

Zoom

DOC Enables Next Generation Cameraphones

22 |

23

Enable Cell Phone Cameras to have DSC Capabilities

•

With Digital Optics IP, mobile phone cameras can …

-

Be smaller than current designs

-

Use significantly less battery power

-

Plug-in directly with fewer modular parts

-

Deliver the image quality of a full-sized digital camera

|

24

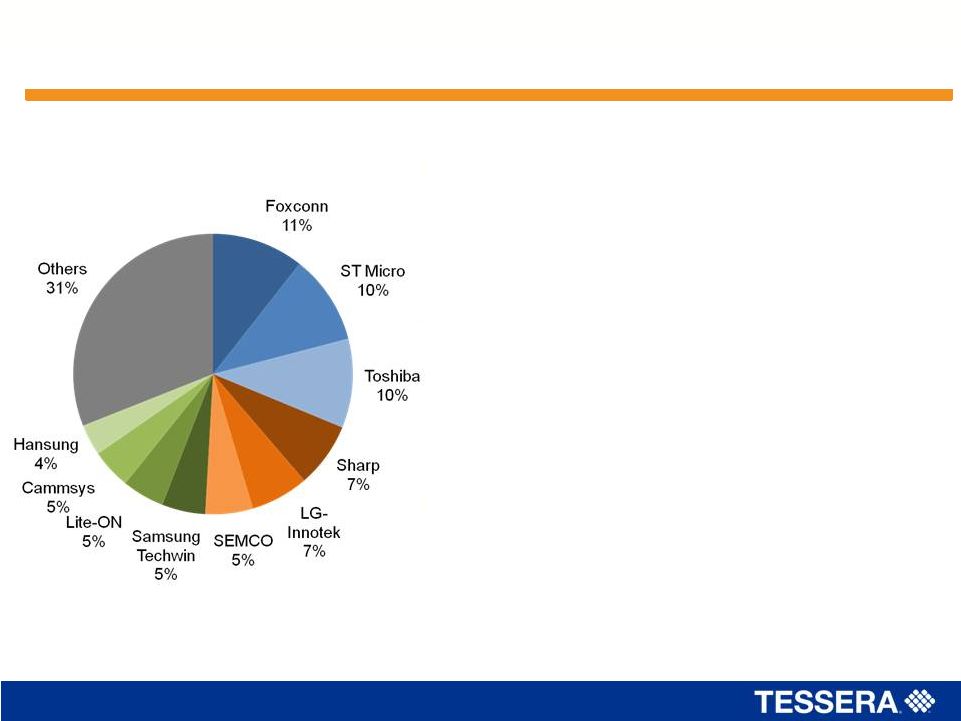

$9B Mobile Camera Module Market Has No Dominant Player

•

Fragmented market

-

No single player has broad technologies,

competencies, IP

•

No vertical integration

-

No player has vertical integration

capabilities (lens, actuators, camera

system design, image enhancement

technologies)

•

Stagnant technology

-

No player has access or internal

development of disruptive, high value

technology components (e.g., MEMS)

Camera module integrators

Source: Techno Systems Research (TSR) 2011 and DOC internal forecast

|

25

Summary

•

Micro-electronics

-

Patent monetization capabilities yielding $748 million of revenues and

compelling $499 million GAAP operating income over the last 3 years

(2008-2010)

-

Major licensees are renewing

-

Industry leading technology roadmap with transforming technology

•

Digital Optics

-

Well positioned for “sea-change”

market shift to mobile phone

photography

-

~$1 billion “plug compatible”

MEMS camera opportunity with game

changing auto-focus technology

-

Additional $9 billion vertical integration opportunity in the mobile

camera module market |

26 |