Attached files

| file | filename |

|---|---|

| 8-K - PXD JAN 9, 2012 PRESENTATION 8-K - PIONEER NATURAL RESOURCES CO | pxdjan98k.htm |

Investor Presentation

January 2012

January 2012

EXHIBIT 99.1

2

Forward-Looking Statements

Except for historical information contained herein, the statements, charts and graphs in this

presentation are forward-looking statements that are made pursuant to the Safe Harbor Provisions

of the Private Securities Litigation Reform Act of 1995. Forward-looking statements and the

business prospects of Pioneer are subject to a number of risks and uncertainties that may cause

Pioneer's actual results in future periods to differ materially from the forward-looking statements.

These risks and uncertainties include, among other things, volatility of commodity prices, product

supply and demand, competition, the ability to obtain environmental and other permits and the

timing thereof, other government regulation or action, the ability to obtain approvals from third

parties and negotiate agreements with third parties on mutually acceptable terms, litigation, the

costs and results of drilling and operations, availability of equipment, services and personnel

required to complete the Company's operating activities, access to and availability of

transportation, processing and refining facilities, Pioneer's ability to replace reserves, implement

its business plans or complete its development activities as scheduled, access to and cost of capital,

the financial strength of counterparties to Pioneer's credit facility and derivative contracts and the

purchasers of Pioneer's oil, NGL and gas production, uncertainties about estimates of reserves and

resource potential and the ability to add proved reserves in the future, the assumptions underlying

production forecasts, quality of technical data, environmental and weather risks, including the

possible impacts of climate change, international operations and acts of war or terrorism. These

and other risks are described in Pioneer's 10-K and 10-Q Reports and other filings with the

Securities and Exchange Commission. In addition, Pioneer may be subject to currently unforeseen

risks that may have a materially adverse impact on it. Pioneer undertakes no duty to publicly

update these statements except as required by law.

presentation are forward-looking statements that are made pursuant to the Safe Harbor Provisions

of the Private Securities Litigation Reform Act of 1995. Forward-looking statements and the

business prospects of Pioneer are subject to a number of risks and uncertainties that may cause

Pioneer's actual results in future periods to differ materially from the forward-looking statements.

These risks and uncertainties include, among other things, volatility of commodity prices, product

supply and demand, competition, the ability to obtain environmental and other permits and the

timing thereof, other government regulation or action, the ability to obtain approvals from third

parties and negotiate agreements with third parties on mutually acceptable terms, litigation, the

costs and results of drilling and operations, availability of equipment, services and personnel

required to complete the Company's operating activities, access to and availability of

transportation, processing and refining facilities, Pioneer's ability to replace reserves, implement

its business plans or complete its development activities as scheduled, access to and cost of capital,

the financial strength of counterparties to Pioneer's credit facility and derivative contracts and the

purchasers of Pioneer's oil, NGL and gas production, uncertainties about estimates of reserves and

resource potential and the ability to add proved reserves in the future, the assumptions underlying

production forecasts, quality of technical data, environmental and weather risks, including the

possible impacts of climate change, international operations and acts of war or terrorism. These

and other risks are described in Pioneer's 10-K and 10-Q Reports and other filings with the

Securities and Exchange Commission. In addition, Pioneer may be subject to currently unforeseen

risks that may have a materially adverse impact on it. Pioneer undertakes no duty to publicly

update these statements except as required by law.

Please see the appendix slides included in this presentation for other important information.

3

§ 2012 drilling program focused in four liquids-rich plays with

substantial resource potential

substantial resource potential

– Spraberry Vertical

– Wolfcamp Shale Horizontal

– Eagle Ford Shale

– Barnett Shale Combo

§ Forecasting 18+% compound annual production growth and ~30%

compound annual operating cash flow growth through 20141

compound annual operating cash flow growth through 20141

§ Vertical integration substantially improving returns

§ Attractive derivative positions protect margins; 85% coverage for

oil and 80% coverage for gas in 2012

oil and 80% coverage for gas in 2012

§ Strong financial position

Investment Highlights

1) Commodity prices of $90/bbl and $5/mcf

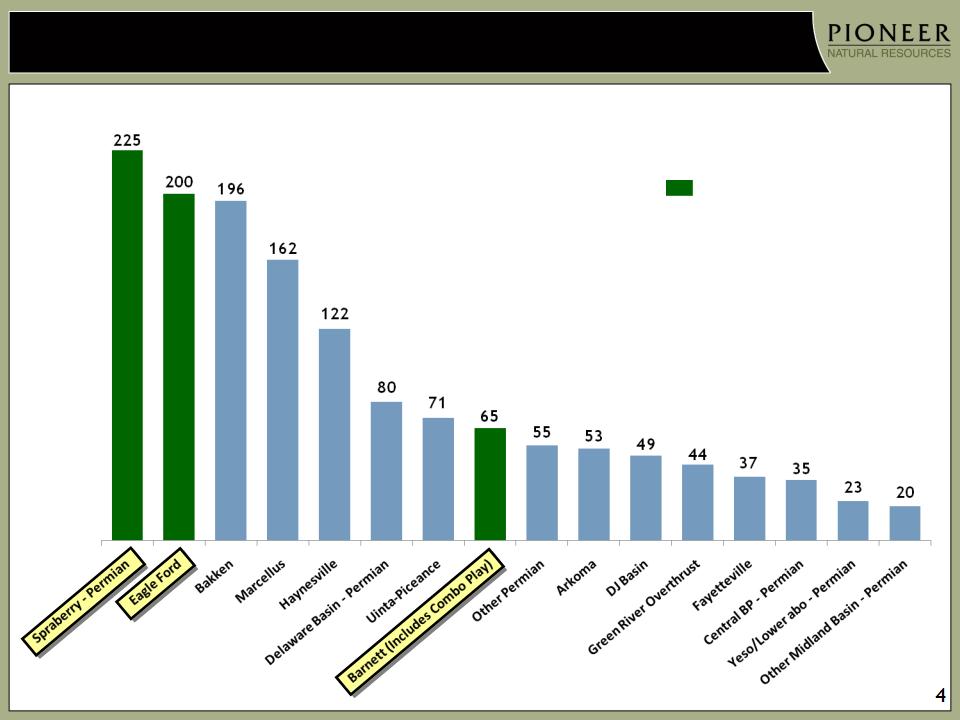

Pioneer is a Leader in the Two Most Active U.S. Plays

U.S. Rig Activity1

1) Source: ISI Group, Inc.

Pioneer Growth Areas

5

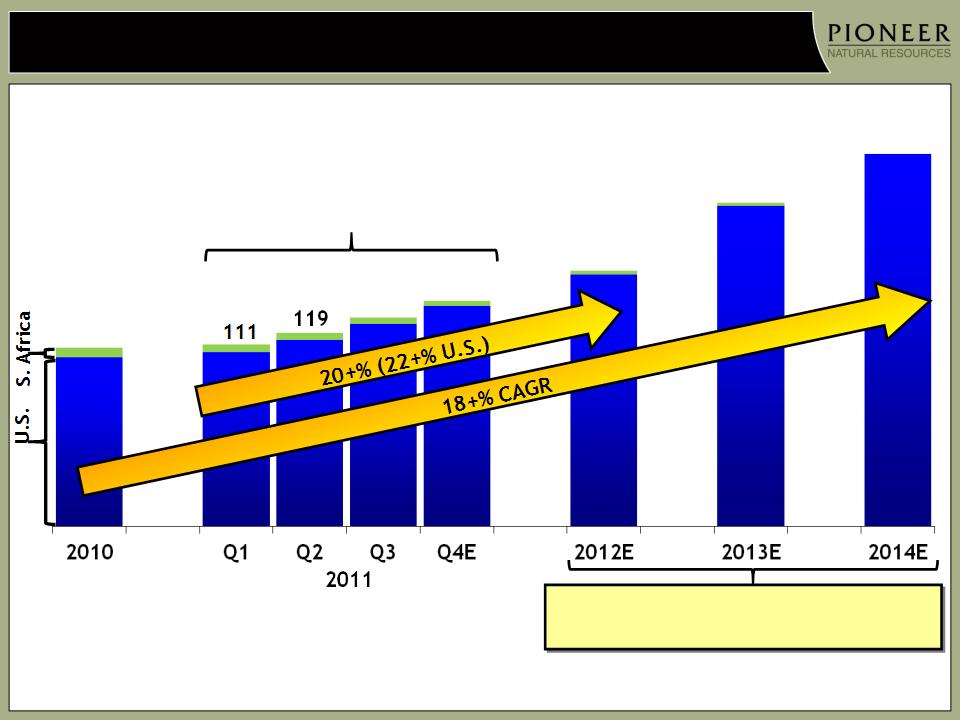

Targeting 18+% Compound Annual Production Growth For 2011 - 2014

MBOEPD

109

1) Reflects Tunisia as discontinued operations

2) 2011 annual production reduced by an estimated 3,500 BOEPD - 4,000 BOEPD due to severe weather and delayed delivery of frac fleets in Q1, Spraberry oil

transport truck shortfall in Q2, third-party water injection supply shortages in Alaska and unplanned South Africa GTL plant downtime in 2H

transport truck shortfall in Q2, third-party water injection supply shortages in Alaska and unplanned South Africa GTL plant downtime in 2H

1

1

128

136 - 141

44%

Liquids

Liquids

60%

Liquids

Liquids

52%

Liquids

Liquids

Up ~15% vs. 2010

Excludes impact from planned expansion of

horizontal Wolfcamp Shale drilling

horizontal Wolfcamp Shale drilling

2

6

|

Oil

|

2012

|

2013

|

2014

|

2015

|

|

Swaps - WTI (BPD)

|

3,000

|

3,000

|

-

|

-

|

|

NYMEX WTI Price ($/BBL)

|

$ 79.32

|

$ 81.02

|

-

|

-

|

|

Collars - (BPD)

|

2,000

|

-

|

-

|

-

|

|

NYMEX Call Price ($/BBL)

|

$ 127.00

|

-

|

-

|

-

|

|

NYMEX Put Price ($/BBL)

|

$ 90.00

|

-

|

-

|

-

|

|

Three Way Collars - (BPD)1

|

41,000

|

39,000

|

17,000

|

-

|

|

NYMEX Call Price ($/BBL)

|

$ 118.50

|

$ 118.96

|

$122.92

|

-

|

|

NYMEX Put Price ($/BBL)

|

$ 82.32

|

$ 85.08

|

$88.53

|

-

|

|

NYMEX Short Put Price ($/BBL)

|

$ 66.46

|

$ 67.00

|

$ 71.47

|

-

|

|

% Total Oil Production

|

~85%

|

~60%

|

~25%

|

-

|

|

|

|

|

|

|

|

Natural Gas Liquids

|

2012

|

2013

|

2014

|

2015

|

|

Swaps - (BPD)

|

750

|

-

|

-

|

-

|

|

Blended Index Price ($/BBL)2

|

$ 35.03

|

-

|

-

|

-

|

|

Collars - (BPD)

|

-

|

-

|

-

|

-

|

|

NYMEX Call Price ($/BBL)

|

-

|

-

|

-

|

-

|

|

NYMEX Put Price ($/BBL)

|

-

|

-

|

-

|

-

|

|

Three Way Collars - (BPD)1

|

3,000

|

-

|

-

|

-

|

|

NYMEX Call Price ($/BBL)

|

$ 79.99

|

-

|

-

|

-

|

|

NYMEX Put Price ($/BBL)

|

$ 67.70

|

-

|

-

|

-

|

|

NYMEX Short Put Price ($/BBL)

|

$ 55.76

|

-

|

-

|

-

|

|

% Total NGL Production

|

~15%

|

-

|

-

|

-

|

|

|

|

|

|

|

|

% Total Liquids

|

~65%

|

~35%

|

~15%

|

-

|

PXD Open Commodity Derivative Positions as of 1/4/2012 (includes PSE)

1) When NYMEX price is above Call price, PXD receives Call price. When NYMEX price is between Put price and Call price, PXD receives NYMEX price. When NYMEX price is between the Put price and the Short Put

price, PXD receives Put price. When NYMEX price is below the Short Put price, PXD receives NYMEX price plus the difference between the Short Put price and Put price

price, PXD receives Put price. When NYMEX price is below the Short Put price, PXD receives NYMEX price plus the difference between the Short Put price and Put price

2) Represents weighted average index price of each NGL component price per barrel

7

|

Gas

|

2012

|

2013

|

2014

|

2015

|

|

Swaps - (MMBTUPD)

|

105,000

|

67,500

|

50,000

|

-

|

|

NYMEX Price ($/MMBTU)1

|

$ 5.82

|

$ 6.11

|

$6.05

|

-

|

|

Collars - (MMBTUPD)

|

65,000

|

150,000

|

140,000

|

50,000

|

|

NYMEX Call Price ($/MMBTU)1

|

$ 6.60

|

$ 6.25

|

$ 6.44

|

$ 7.92

|

|

NYMEX Put Price ($/MMBTU)1

|

$ 5.00

|

$ 5.00

|

$ 5.00

|

$ 5.00

|

|

Three Way Collars - (MMBTUPD)1,2

|

170,000

|

45,000

|

60,000

|

30,000

|

|

NYMEX Call Price ($/MMBTU)

|

$ 7.92

|

$ 7.49

|

$ 7.80

|

$ 7.11

|

|

NYMEX Put Price ($/MMBTU)

|

$ 6.07

|

$ 6.00

|

$ 5.83

|

$ 5.00

|

|

NYMEX Short Put Price ($/MMBTU)

|

$ 4.50

|

$ 4.50

|

$ 4.42

|

$ 4.00

|

|

% U.S. Gas Production

|

~80%

|

~55%

|

~45%

|

~15%

|

PXD Open Commodity Derivative Positions as of 1/4/2012 (includes PSE)

1) Represents the NYMEX Henry Hub index price or approximate NYMEX price based on historical differentials to the index price at the time the derivative was entered into

2) When NYMEX price is above Call price, PXD receives Call price. When NYMEX price is between Put price and Call price, PXD receives NYMEX price. When NYMEX price is between

the Put price and the Short Put price, PXD receives Put price. When NYMEX price is below the Short Put price, PXD receives NYMEX price plus the difference between Short Put

price and Put price

the Put price and the Short Put price, PXD receives Put price. When NYMEX price is below the Short Put price, PXD receives NYMEX price plus the difference between Short Put

price and Put price

|

Gas Basis Swaps

|

2012

|

2013

|

2014

|

2015

|

|

Spraberry (MMBTUPD)

|

32,500

|

52,500

|

45,000

|

-

|

|

Price Differential ($/MMBTU)

|

$ (0.38)

|

$ (0.23)

|

$ (0.27)

|

-

|

|

Mid-Continent (MMBTUPD)

|

50,000

|

30,000

|

30,000

|

-

|

|

Price Differential ($/MMBTU)

|

$ (0.53)

|

$ (0.38)

|

$ (0.27)

|

-

|

|

Gulf Coast (MMBTUPD)

|

53,500

|

60,000

|

40,000

|

-

|

|

Price Differential ($/MMBTU)

|

$ (0.15)

|

$ (0.14)

|

$ (0.16)

|

-

|

8

Liquidity Position (09/30/11 Pro Forma)1

Net debt (net of cash balance of $695 MM): $1.9 B

Unsecured Senior Credit Facility availability: $1.2 B

Net Debt-to-Book Capitalization: 25%

1) Includes net proceeds from November equity offering of $484 MM; excludes $97 MM of borrowings under PSE’s $300 MM Credit Facility that matures in May 2013

2) Excludes net discounts and deferred hedge losses of ~$80 MM

3) Convertible senior notes due 2038, with first put/call in 2013

4) Excludes ~$65 MM of outstanding letters of credit on Senior Credit Facility

Maturities and Balances2

Unsecured Senior Credit Facility matures in 2016

No bond maturities until 2013

Investment Grade Rated by Standard & Poor’s

2011

2012

2016

$250 MM

7.20%

2017

$455 MM

5.875%

2028

$450 MM

6.875%

$0 MM4 of

$1.25 B Unsecured Senior Credit Facility

2018

$485 MM

6.65%

2013

$480 MM3

2.875%

$450 MM

7.50%

2020

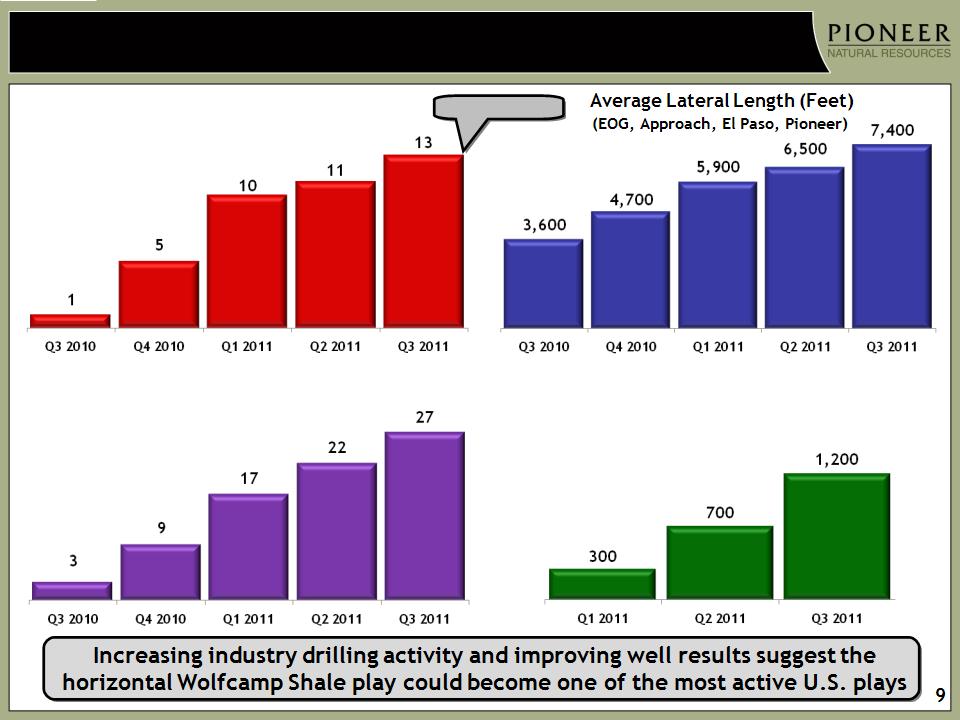

Industry Increasing Horizontal Wolfcamp Shale Activity

Average Drilling Rigs

(All Companies)

Average 24-hr Peak IPs (BOEPD)

(EOG, Approach, El Paso, Pioneer)

21 rigs currently

Horizontal Wells Drilled

(All Companies)

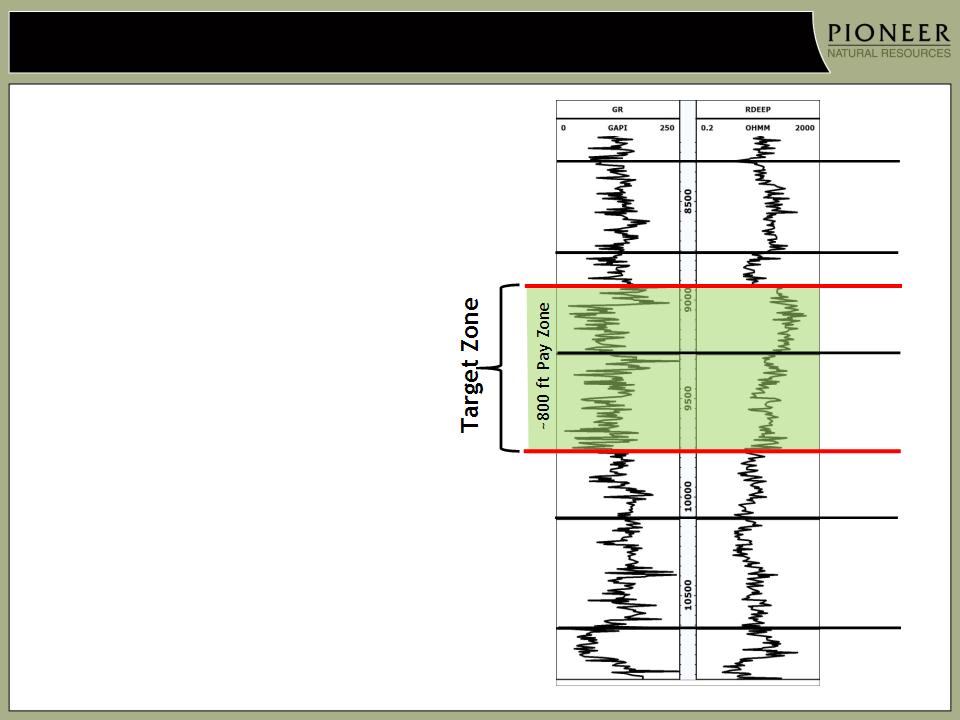

§ XBC Giddings Estate 2041H

− First horizontal Wolfcamp Shale well in Upton County

− 24-hour IP rate of 854 BOEPD1

(686 BOPD + 102 BNGLPD + 395 MCFD)

(686 BOPD + 102 BNGLPD + 395 MCFD)

− Peak 30-day average natural flow rate of 643 BOEPD1

(519 BOPD + 75 BNGLPD + 290 MCFD)

(519 BOPD + 75 BNGLPD + 290 MCFD)

− 5,800 foot lateral with 30-stage completion

− Landed lateral between Upper and Middle Wolfcamp

Shale intervals

Shale intervals

§ Microseismic analysis of XBC Giddings Estate

2041H completion showed successful

stimulation

2041H completion showed successful

stimulation

− Successfully fractured entire 800 foot thick target zone

Dean

Lower

Spraberry

Shale

Shale

Upper

Wolfcamp

Shale

Wolfcamp

Shale

Lower

Wolfcamp

Shale

Wolfcamp

Shale

Strawn

Middle

Wolfcamp

Shale

Wolfcamp

Shale

Jo Mill

PXD’s Successful Horizontal Wolfcamp Shale Well

10

1) NGL volumes estimated with an average NGL yield of 140 BBL/MMCF and 46% shrink

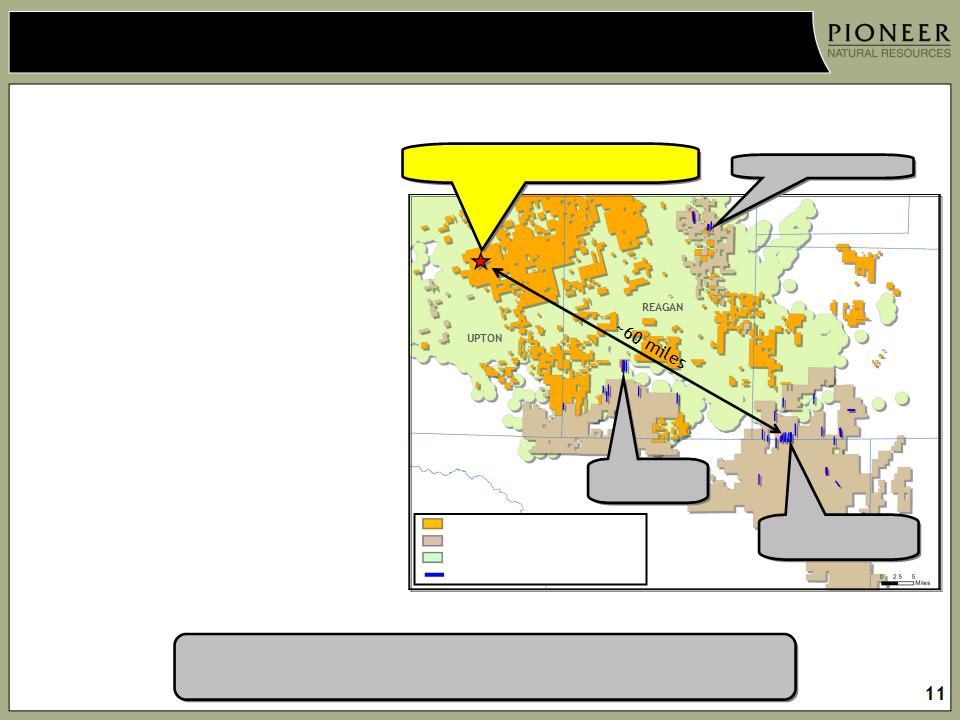

PXD’s Acreage Has Significant Horizontal Wolfcamp Shale Potential

§ PXD and industry well results

coupled with PXD geologic

interpretation suggest significant

horizontal Wolfcamp Shale

potential within PXD’s acreage

coupled with PXD geologic

interpretation suggest significant

horizontal Wolfcamp Shale

potential within PXD’s acreage

− >400,000 acres potentially prospective

for horizontal Wolfcamp Shale within

PXD’s acreage

for horizontal Wolfcamp Shale within

PXD’s acreage

− Petrophysical and core analysis shows

substantial oil in place

substantial oil in place

• 50 - 100 MMBO/section

− PXD currently focused on >200,000

acres in the southern part of the field

acres in the southern part of the field

− PXD has not been drilling vertical

Spraberry wells in this area due to

marginal returns

Spraberry wells in this area due to

marginal returns

IRION

CROCKETT

STERLING

PXD Acreage

Competitor Horizontal Acreage

Spraberry Field

Competitor Horizontal

PXD Giddings Estate 2041H: 854 BOEPD IP

Industry 700+ BOEPD IPS

Main Industry Activity

1,000+ BOEPD IPs

Recent Industry

700+ BOEPD

IPs

IPs

Expect horizontal Wolfcamp Shale to be PXD’s

4th liquids-rich, high-return growth asset in Texas

4th liquids-rich, high-return growth asset in Texas

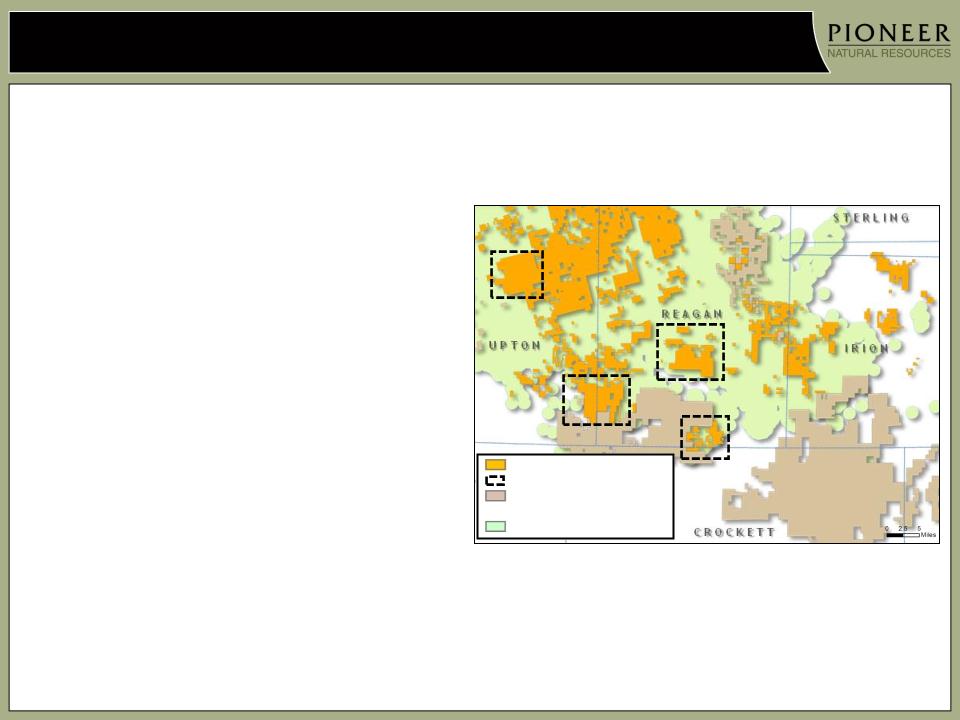

PXD’s Horizontal Wolfcamp Shale Drilling Metrics & Plan

12

Drilling Metrics

§ Total vertical well depth: 9,000 ft - 10,000 ft

§ Well design: 7,000+ ft lateral, 30+ stages

§ Wells / rig / year: 8

§ EUR per well: 350 - 500 MBOE1

§ Planned spacing: 140 acres

§ Blended well cost:

− Science well: $8 MM - $9 MM

− Development well: $6 MM - $7 MM

§ Expect IRRs similar to Spraberry vertical wells

2012 - 2013 Drilling Plan

§ Expect to drill ~80 wells by YE 2013 to hold

expiring acreage (~50,000 acres)

expiring acreage (~50,000 acres)

§ Increasing from 1 rig to 3 rigs in Q1; expect

to ramp up to 7 rigs by year end

to ramp up to 7 rigs by year end

− Currently flowing second well in Upton County

• ~6,000 foot lateral with 30-stage completion

− Third and fourth wells will test longer laterals in

southern Reagan County

southern Reagan County

§ Acquiring 260 sq. mi. 3-D seismic in Q1

PXD Acreage

PXD Initial Drilling Areas

Competitor Horizontal

Acreage

Spraberry Field

1) Pioneer and offset operator data

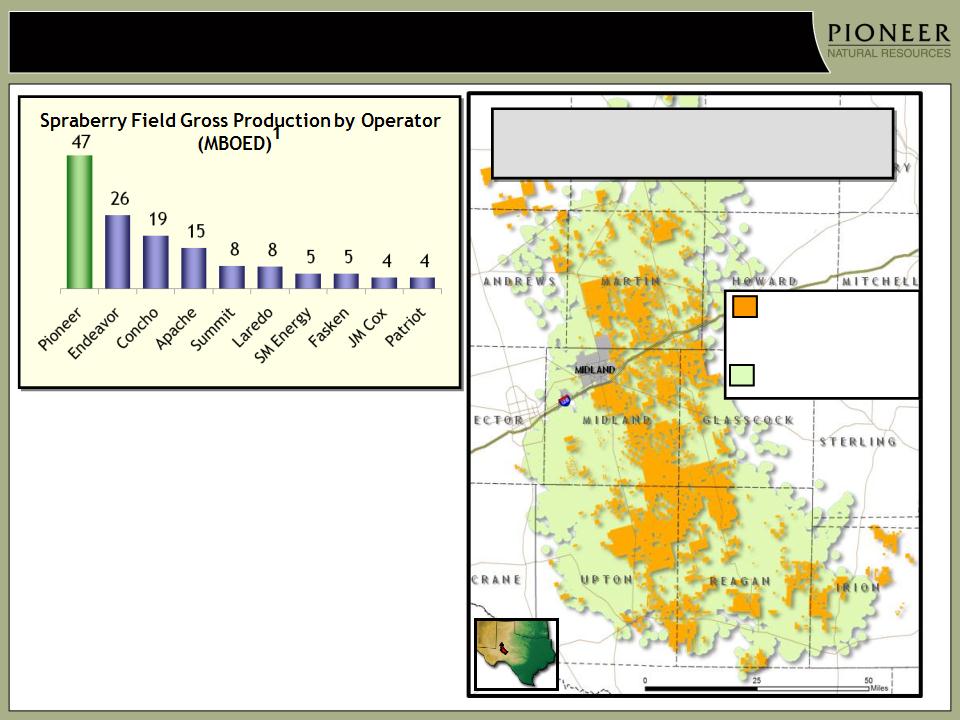

PXD - Largest Spraberry Acreage Holder, Driller and Producer

PXD Acreage

(~900,000 Acres;

~75% HBP)

~75% HBP)

>20,000 Vertical Drilling Locations

(Central and Northern Parts of Field)

13

Spraberry Field

§ 2011 average Lower Wolfcamp blended

vertical well cost: $1.5 - $1.6 MM

vertical well cost: $1.5 - $1.6 MM

§ Before tax IRR: ~40%2

− Reflects 140 MBOE type curve for 40-acre

Lower Wolfcamp vertical well

Lower Wolfcamp vertical well

− Drilling deeper to Strawn, Atoka and

Mississippian intervals enhances IRR

Mississippian intervals enhances IRR

1) Based on 2010 data from Railroad Commission of Texas

2) Commodity prices of $90/bbl and $5/mcf

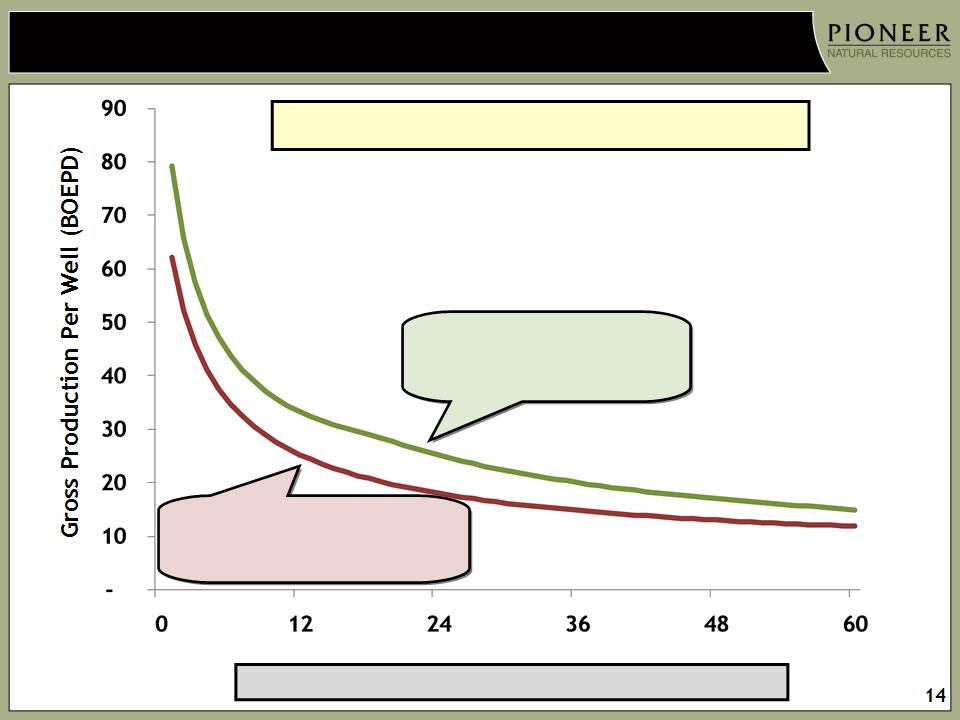

140 MBOE Spraberry 40-Acre Vertical Well Type Curve

Month

Strawn / Atoka / Mississippian Potential Not Included

140 MBOE

Spraberry/Dean/Full

Wolfcamp

Wolfcamp

(70% oil, 20% NGLs, 10% gas)

110 MBOE

Spraberry/Dean/Upper Wolfcamp

(70% oil, 20% NGLs, 10% gas)

Deeper drilling in Spraberry increasing EURs

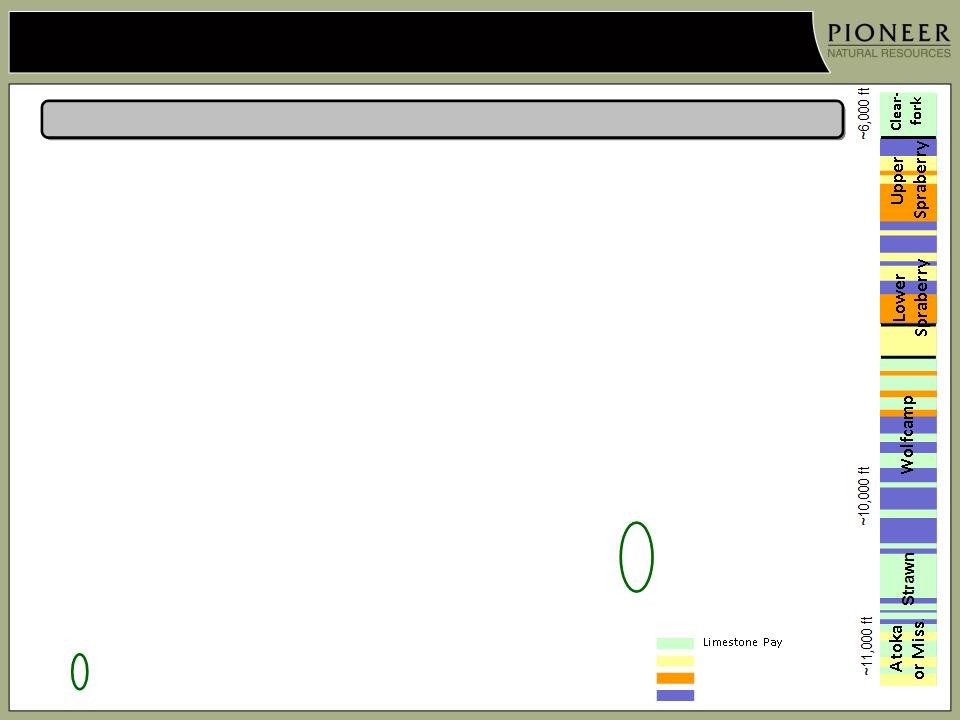

Deeper Vertical Drilling in Spraberry Increasing EURs (Intervals Below Wolfcamp)

15

Dean

Sandstone Pay

Non-Organic Shale Non-Pay

Organic Rich Shale Pay

|

|

Wells

Completed Through Q3 |

Incremental Cost

|

Single-Zone

Peak Rate |

Potential

Incremental EUR |

Prospective

PXD Acreage |

|

Strawn

|

113

|

$60 M

|

70 BOEPD

|

20 - 40 MBOE

|

40%

|

|

Atoka

|

3

|

$300 M - $350 M

|

150 BOEPD

|

50 - 70 MBOE

|

25% - 50%

|

|

Mississippian

|

2

|

$300 M - $350 M

|

105 BOEPD

|

15 - 30 MBOE

|

10% - 20%

|

Potential to add up to 110 MBOE to EUR from deeper drilling

Current Spraberry 40-acre type curve EUR including Lower Wolfcamp: 140 MBOE

Deeper Drilling Potential

|

|

Q3 2011 Results1

|

2012 Drilling Program

|

|

Strawn

|

25+% increase in cumulative production

during first 10 months compared to offset Lower Wolfcamp wells |

Complete in 25% of wells

|

|

Atoka

|

1 zonal test of 127 BOEPD

|

15% - 20% of program

|

|

Mississippian

|

1 zonal test of 92 BOEPD

|

~10% of program

|

Q3 2011 Deeper Drilling Results

1) Q4 2011 results to be discussed in Q4 earnings release

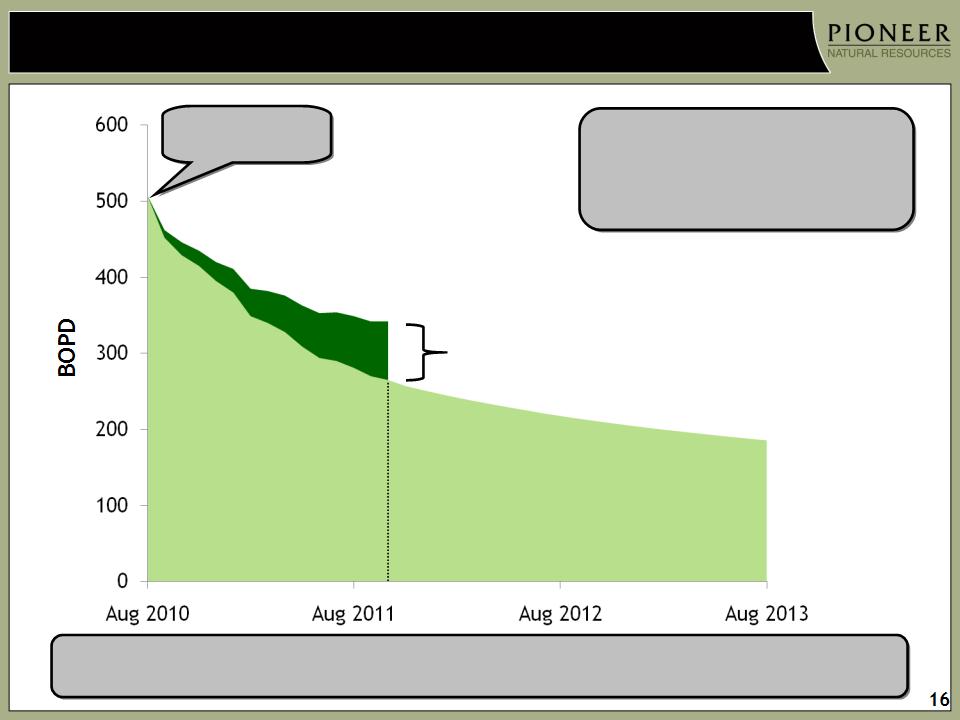

Early Results of Spraberry Waterflood Encouraging

Upper

Spraberry Base

Production

Spraberry Base

Production

(110 wells)

Upper

Spraberry Base

Production

Forecast

Spraberry Base

Production

Forecast

§ Production wedge building as

additional wells respond to waterflood

additional wells respond to waterflood

§ Early results support reserve adds

Waterflood has increased cumulative Upper Spraberry production >10% within

project area compared to base production decline; further increase expected

project area compared to base production decline; further increase expected

§ 7,000-acre project in Spraberry

§ 12 injectors and 110 producers

§ Injecting 4,100 BWPD

§ $6 - $7 MM capital cost

§ LOE savings from water handling

Water injection

begins

begins

Spraberry 20-Acre Vertical Well Update

17

20-Acre Drilling (~13,000 locations)

§ Drilled 11 wells through Q3 2011; 6 on

production

production

§ Capturing pay from Lower Wolfcamp, Strawn

and shale/silt intervals

and shale/silt intervals

§ Results to date indicate production

outperforming previous 110 MBOE type curve

for a 40-acre Spraberry/Dean well

outperforming previous 110 MBOE type curve

for a 40-acre Spraberry/Dean well

§ Targeting 30 - 50 wells in 2012

Spraberry Drilling Rig

Continuing to Successfully Grow Spraberry Production

18

Spraberry Net Production1

(MBOEPD)

(MBOEPD)

54 - 59

68 - 74

1) Includes expiration of VPP commitments (3 MBOEPD @ YE 2010 and 4 MBOEPD @ YE 2012)

47

2011E

(expect to be towards high end

of 43 - 46 MBOEPD FY guidance)

of 43 - 46 MBOEPD FY guidance)

77 - 84

51 - 53

Excludes potential contributions from deeper

intervals below Lower Wolfcamp in vertical

wells and impacts from expected expansion

of horizontal Wolfcamp Shale drilling

wells and impacts from expected expansion

of horizontal Wolfcamp Shale drilling

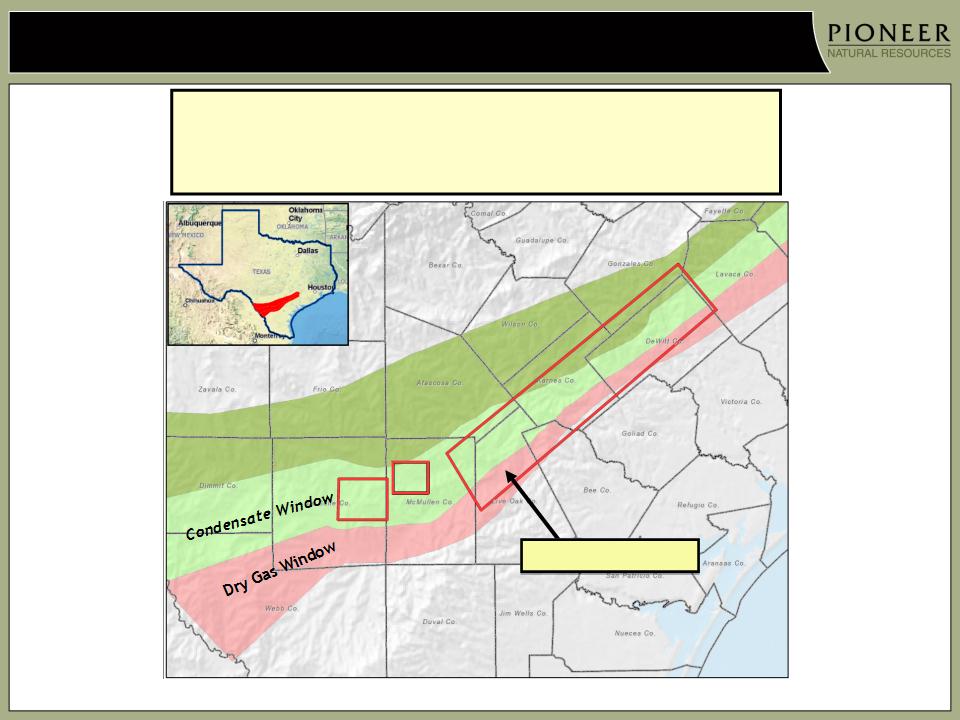

Eagle Ford Shale: A Burgeoning Liquids-Rich Shale Play

19

§ Gross resource potential of play: ~25 BBOE (~150 TCFE)1

§ Estimated Gross Production of ~3.5 MMBOEPD by 20202

§ ~200 rigs currently running in the play

Oil Window

Map source: PXD

1) Source: Tudor, Pickering, Holt & Co.

2) Source: FBR

PXD Acreage Area

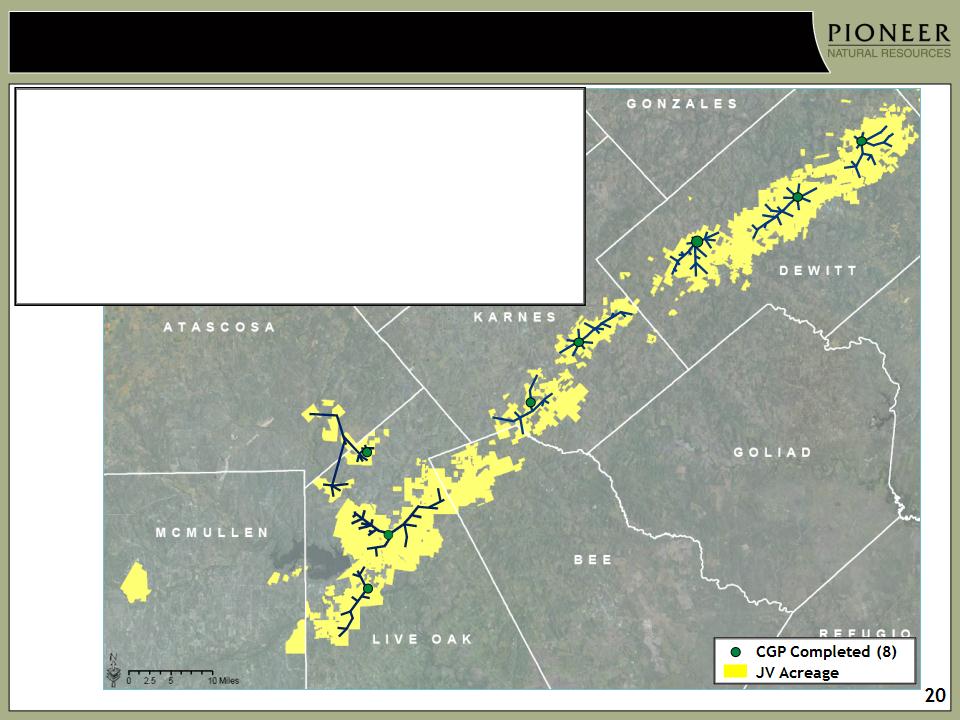

Eagle Ford Shale Operational Update

§ Running 12 rigs

− Current gross well cost: $7 MM - $8 MM

− Before tax IRRs1: ~80% for rich condensate and ~60% for lean condensate

(excludes carry benefit)

(excludes carry benefit)

§ Average lateral length ~5,500 feet with 13-stage completion

§ Using white sand proppant in shallower areas (~30% of program)

− 20 wells stimulated using white sand; early well performance similar to

direct offset ceramic-stimulated wells

direct offset ceramic-stimulated wells

− Reduces frac cost by ~$700 M

§ 8 CGPs on line; 3 additional planned for 2012

§ Oil prices improving relative to WTI

1) Commodity prices of $90/bbl and $5/mcf

21

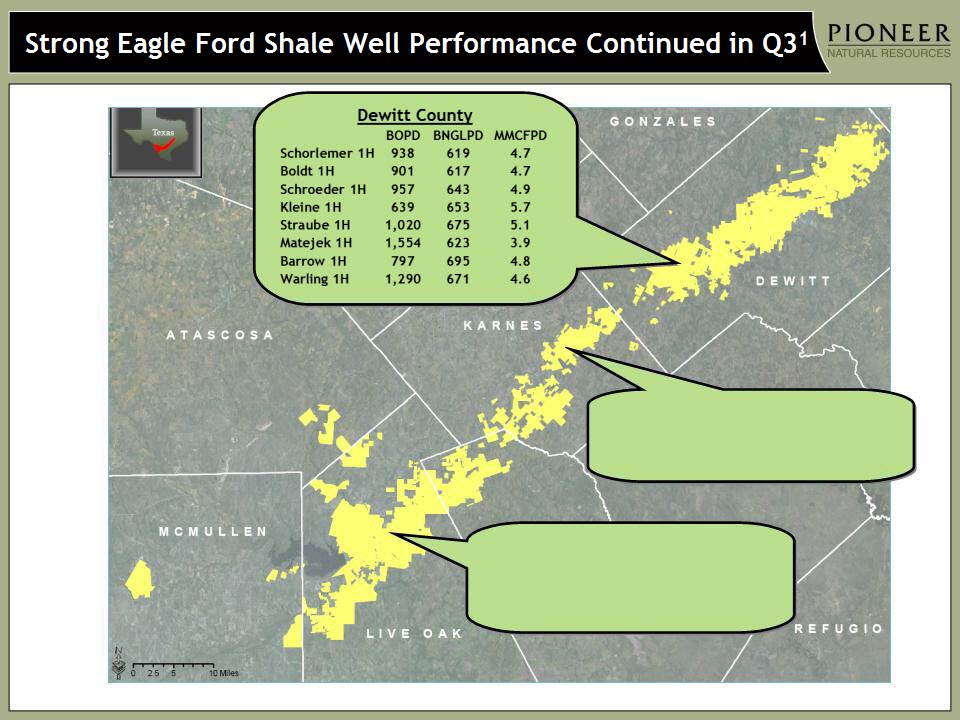

1) 24-hour restricted flow tests at 16/64th choke; NGL volumes estimated with an average NGL yield of 120 BBL/MMCF and 16% shrink

Karnes County

BOPD BNGLPD MMCFPD

Ridley 1H 391 571 3.6

Ridley Farms 1H 880 768 6.4

Live Oak County

BOPD BNGLPD MMCFPD

Jack Meeks 2H 785 190 1.0

HT Chapman 3H 1,011 362 2.2

Three Sisters 3H 813 332 2.1

22

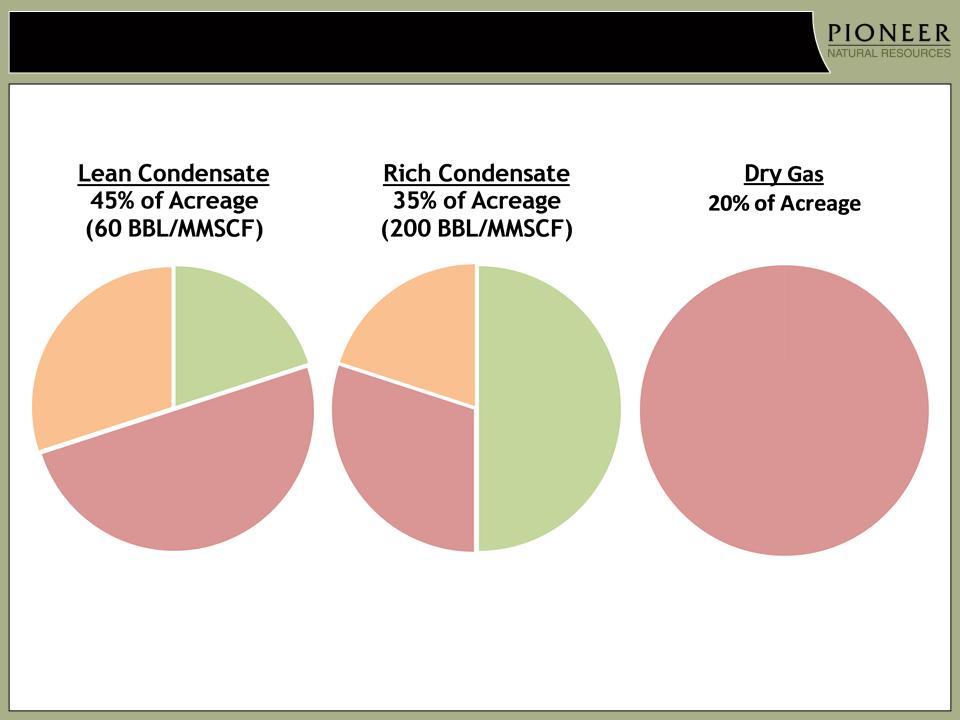

Eagle Ford Shale Resource Breakdown

30%

NGL*

NGL*

50%

Gas

Gas

20%

Condensate

20%

NGL*

NGL*

30%

Gas

Gas

100%

Gas

Gas

50%

Condensate

*NGLs are 50% ethane, 25% propane, 15% butanes and 10% heavier liquids

~

~

~

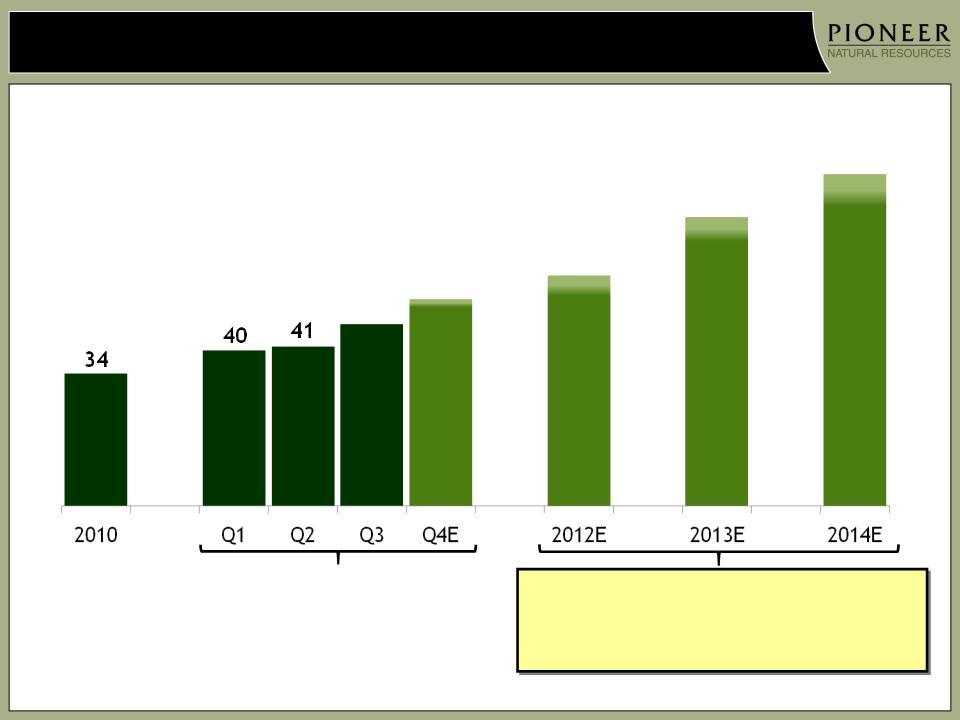

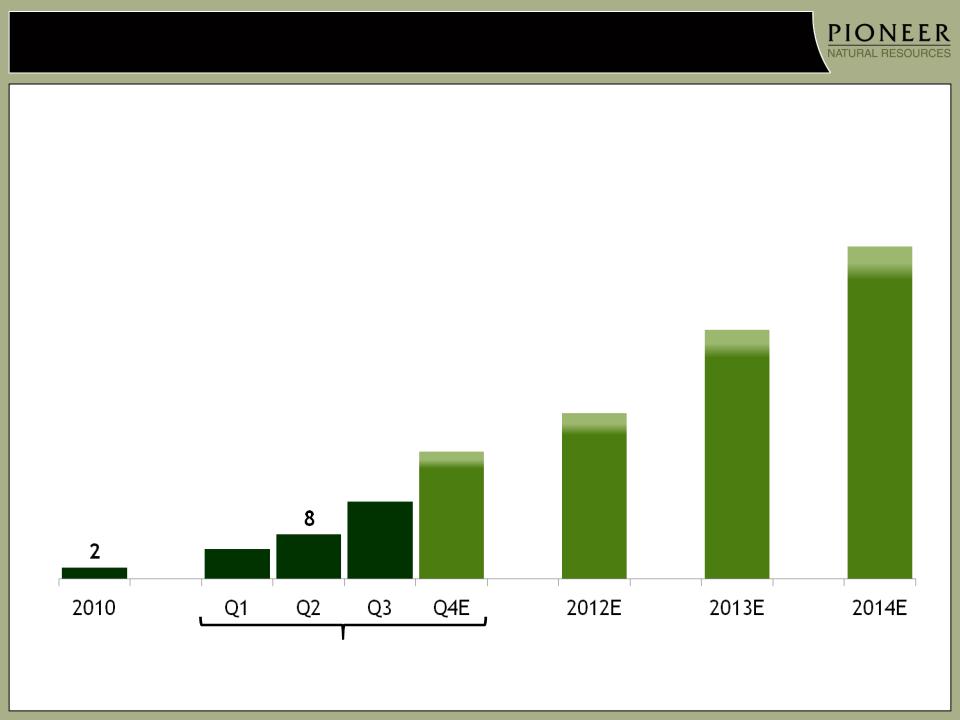

Successfully Growing Eagle Ford Shale Production

23

Eagle Ford Net Production1

(MBOEPD)

(MBOEPD)

26 - 30

40 - 45

5

14

2011E

(expect to be within 12 - 15 MBOEPD FY guidance)

54 - 60

20 - 23

1) Reflects Pioneer’s ~33% share of total gross production

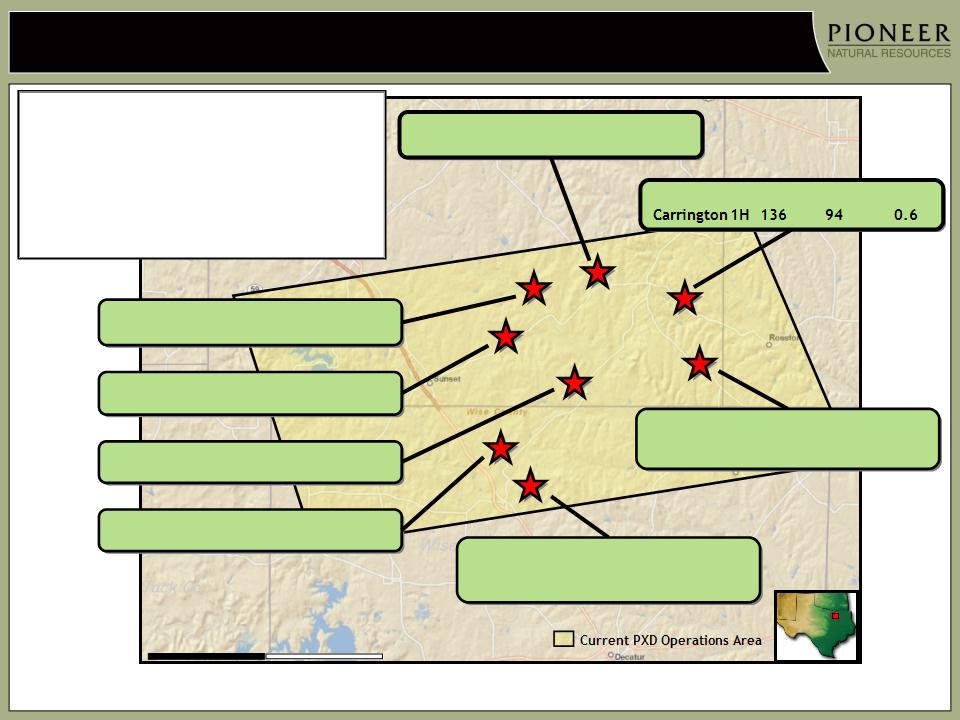

Strong Barnett Shale Combo Well Performance Continued in Q31,2

24

BOPD BNGLPD MMCFPD

BOPD BNGLPD MMCFPD

Moninger 1H 327 16 0.1

BOPD BNGLPD MMCFPD

Steadham A1H 261 122 0.8

BOPD BNGLPD MMCFPD

Morrison 2H 95 149 0.9

BOPD BNGLPD MMCFPD

Proctor 2H 318 17 0.1

1) 7-day IPs

2) NGL volumes estimated with an average NGL yield of 110 BBL/MMCF and 30% shrink

3) Commodity prices of $90/bbl and $5/mcf

§ Current acreage: ~76 M net acres

— >700 drilling locations

§ Running 2 rigs

— Gross well cost: ~$3 MM

— Gross EUR: ~320 MBOE

— Est. Resource: 42% gas, 42% NGLs, 16% oil

— Before tax IRR: ~40%3

§ Lateral length: 3,500 ft - 6,500 ft

BOPD BNGLPD MMCFPD

Greenroy 1H 289 106 1.0

Greenroy 3H 282 119 0.8

BOPD BNGLPD MMCFPD

Alvord 1H 249 109 0.7

Alvord 2H 277 66 0.4

Miles

5

10

0

BOPD BNGLPD MMCFPD

I. Lynch 3H 87 148 1.0

Montague County

Wise County

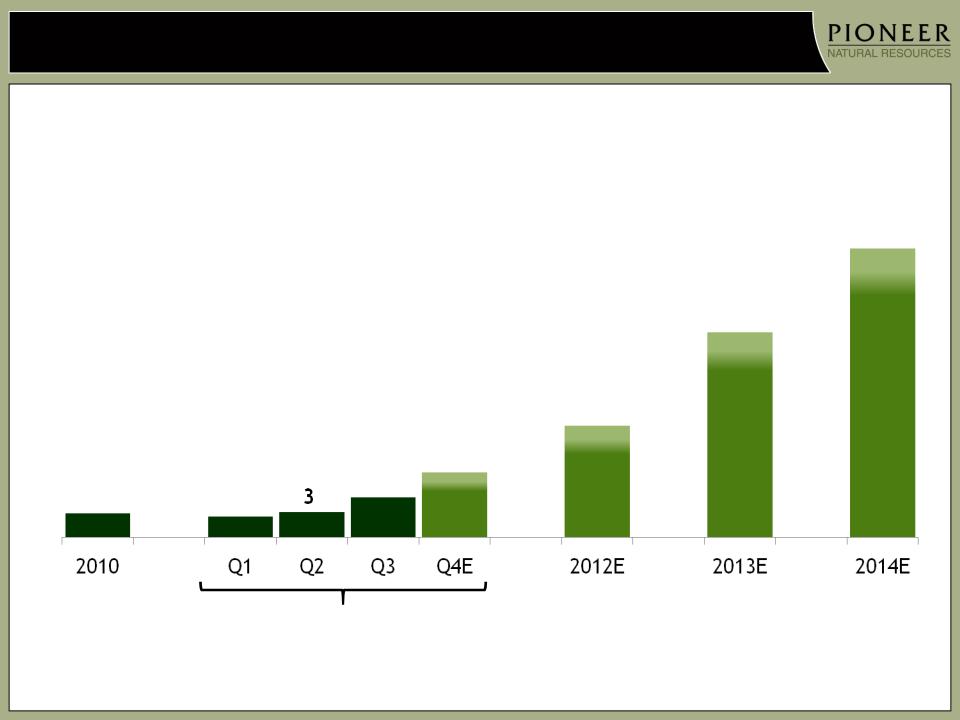

Successfully Growing Barnett Shale Combo Production

25

Barnett Shale Net Production1

(MBOEPD)

(MBOEPD)

9 - 12

18 - 22

2

2011E

(expect to be within 4 - 5

MBOEPD FY guidance)

MBOEPD FY guidance)

3

1) 2010 production reflects legacy Barnett Shale gas production; production growth in 2011 - 2014 driven by Barnett Shale Combo development

4

26 - 31

5 - 7

26

Pioneer’s Vertical Integration Improves Returns and Enhances Execution

Eagle Ford Shale

2 frac fleets

1 coiled tubing units

(adding 2nd unit Q2 2012)

Spraberry

5 frac fleets (~20,000 HP each)

(adding 70,000 HP by mid-2012)

15 drilling rigs

Other service equipment1

Year-End 2011

Total Vertical Integration Investment: $440 MM2

Total Frac Horsepower: 225 M

1) Includes pulling units, frac tanks, hot oilers, water trucks, blowout preventers, construction equipment and fishing tools

2) Includes spending in 2011 for additional frac fleets to be delivered mid-2012

Barnett Shale Combo

1 frac fleet

1 coiled tubing unit

Spraberry Eagle Ford Shale Barnett Shale Combo

Frac Fleets

Current (225,000 HP) 5 2 1

% of Total Wells Fraced ~70% ~65% ~100%

Fracs/Fleet/Year ~115 ~55 ~60

Savings Per Frac1 $0.35 MM $1.70 MM $0.75 MM

Annual Savings2,3 $200 MM $185 MM $45 MM

Rigs and Other Services4

Annual Savings1 $30 MM - -

Total Annualized Cash Savings

At Year-End 2011 Run Rate $230 MM $185 MM $45 MM

Vertical Integration Significantly Reduces Well Costs

27

1) Generally reflects current savings vs. longer-term contract rates

2) Excludes savings from frac fleets scheduled for delivery in mid-2012

3) Includes direct savings to PXD and charges to third-parties

4) Includes 15 rigs and other service equipment including pulling units, frac tanks, hot oilers, water trucks, blowout preventers, construction equipment and fishing tools

5) Includes spending in 2011 for additional frac fleets to be delivered mid-2012

Total Year-End 2011 Vertical Integration Investment: $440 MM5

Total PXD Annualized Year-End 2011 Cash Savings: $460 MM

Additional 70,000 HP frac capacity scheduled for delivery by mid-2012

28

Why Invest In PXD?

Significant Upside Potential From:

§Oil exposure with large drilling inventory

§Aggressive Spraberry & Eagle Ford Shale drilling program

§Extensive horizontal Wolfcamp Shale potential

§18+% compound annual production growth for 2011 - 2014

§~30% compound annual operating cash flow growth for 2011 - 2014

§Strong returns from vertical integration

§Margin protection from attractive derivatives

§Strong balance sheet

Appendix

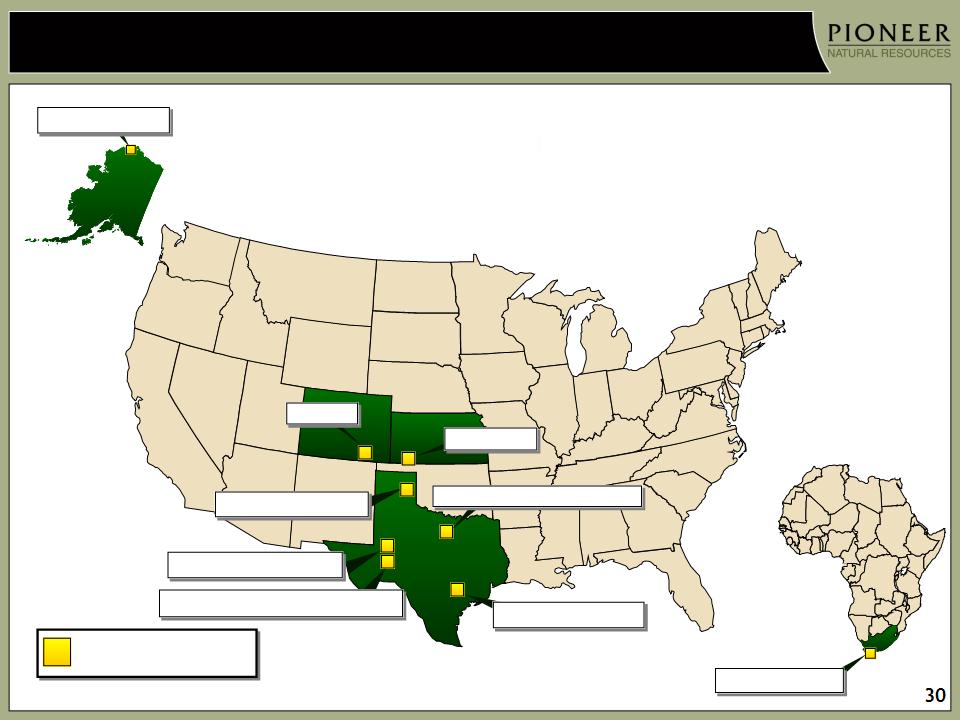

Pioneer Operations

North Slope

South Africa

Eagle Ford Shale

West Panhandle

Raton

Hugoton

Spraberry Vertical

Barnett Shale Combo

Operating Areas

Note: 2010 metrics include Tunisia assets sold Q1 2011; operating cash flow includes $0.4 B attributable to deepwater GOM refunds, insurance recoveries and Tunisia operations.

Horizontal Wolfcamp Shale

31

November Equity Offering Summary

§ PXD believes it is the largest holder of prospective acreage in the horizontal Wolfcamp

Shale play in West Texas with >400 M acres under lease (75% HBP)

Shale play in West Texas with >400 M acres under lease (75% HBP)

− Initial focus will be on >200 M acres in the southern portion of the Spraberry field

§ Equity offering of 5.5 MM shares with net proceeds of $484 MM will allow Pioneer to

expand drilling in the horizontal Wolfcamp Shale play in 2012-2013 while continuing to:

expand drilling in the horizontal Wolfcamp Shale play in 2012-2013 while continuing to:

− Actively develop its 3 high-return, liquids-rich growth assets in Texas

− Maintain its strong balance sheet

§ Expanded horizontal Wolfcamp Shale drilling program in 2012 - 2013 includes:

− Holding ~50 M strategic acres expiring over the next 2 years within >200 M acre initial

focus area (~80 wells required to hold this acreage)

focus area (~80 wells required to hold this acreage)

− Adding infrastructure and bolt-on acreage

§ Horizontal Wolfcamp Shale wells expected to deliver similar IRRs to Spraberry vertical

wells

wells

32

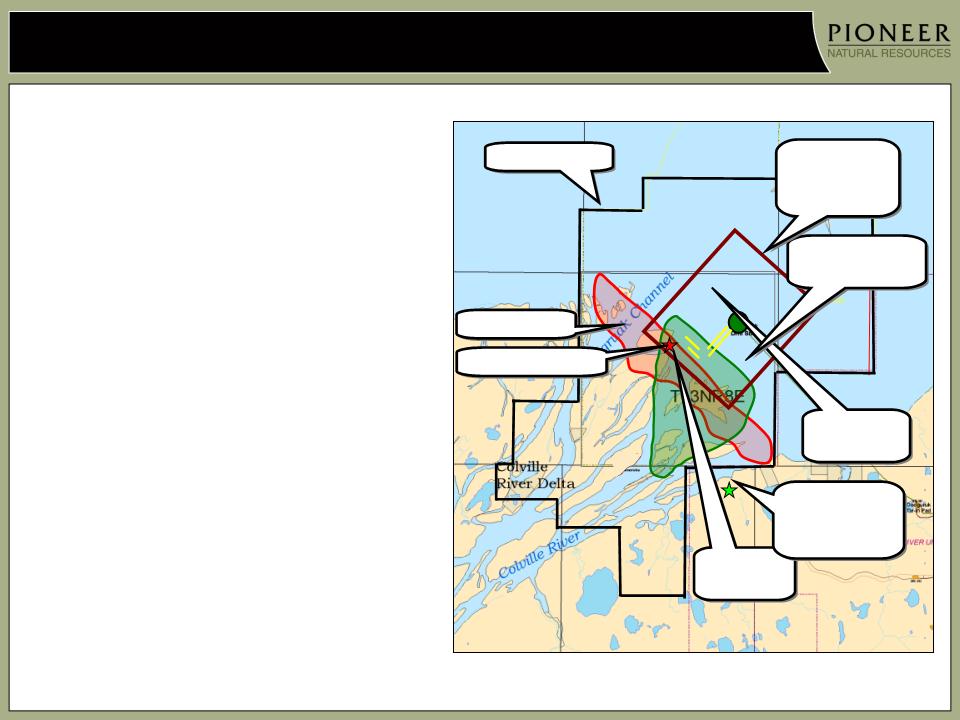

Alaska - Oooguruk

§ 1-rig drilling program continues

targeting Kuparuk and Nuiqsut

intervals

targeting Kuparuk and Nuiqsut

intervals

§ Second rig to test Torok zone and a

deeper Ivishak zone (main

producing zone in Prudhoe Bay)

during current winter drilling

season

deeper Ivishak zone (main

producing zone in Prudhoe Bay)

during current winter drilling

season

Torok

Wells

Wells

Island Drill

Site

Site

Initial

Development

Area

Development

Area

PXD Acreage

Torok

Area

Area

Torok

Onshore Drill

Site

Onshore Drill

Site

Ivishak Drill Site

Ivishak Area

33

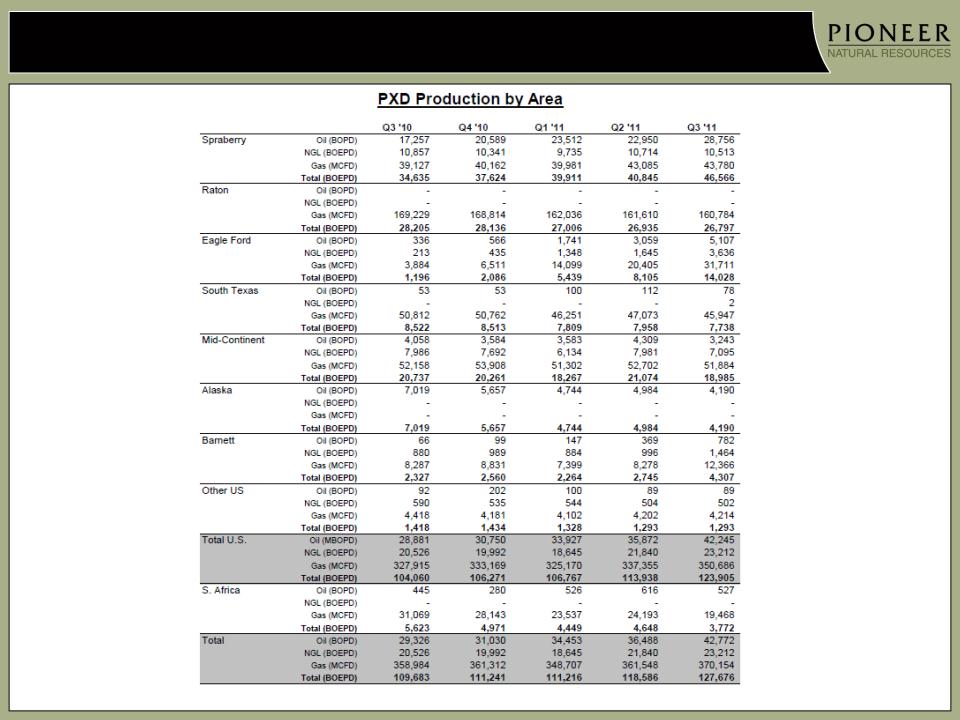

Production (MBOEPD)1

|

|

Q3 ’10

|

Q4 ’10

|

Q1 ’11

|

Q2 ’11

|

Q3 ’11

|

|

Spraberry

|

35

|

38

|

40

|

41

|

47

|

|

Raton

|

28

|

28

|

27

|

27

|

27

|

|

Eagle Ford Shale

|

1

|

2

|

5

|

8

|

14

|

|

South Texas

|

9

|

9

|

8

|

8

|

8

|

|

Mid-Continent

|

21

|

20

|

182

|

212

|

19

|

|

Barnett

|

2

|

2

|

2

|

3

|

4

|

|

Alaska

|

7

|

6

|

5

|

5

|

4

|

|

Other U.S.

|

1

|

1

|

2

|

1

|

1

|

|

Total N. America

|

104

|

106

|

107

|

114

|

124

|

|

S. Africa

|

6

|

5

|

4

|

5

|

4

|

|

Total

|

110

|

111

|

111

|

119

|

128

|

1) All periods presented have been restated to exclude discontinued operations

2) ~1 MBPD of NGLs inventoried in Q1 due to third-party fractionator downtime and sold in Q2

34

Production (MBOEPD)1

1) All periods presented have been restated to exclude discontinued operations

35

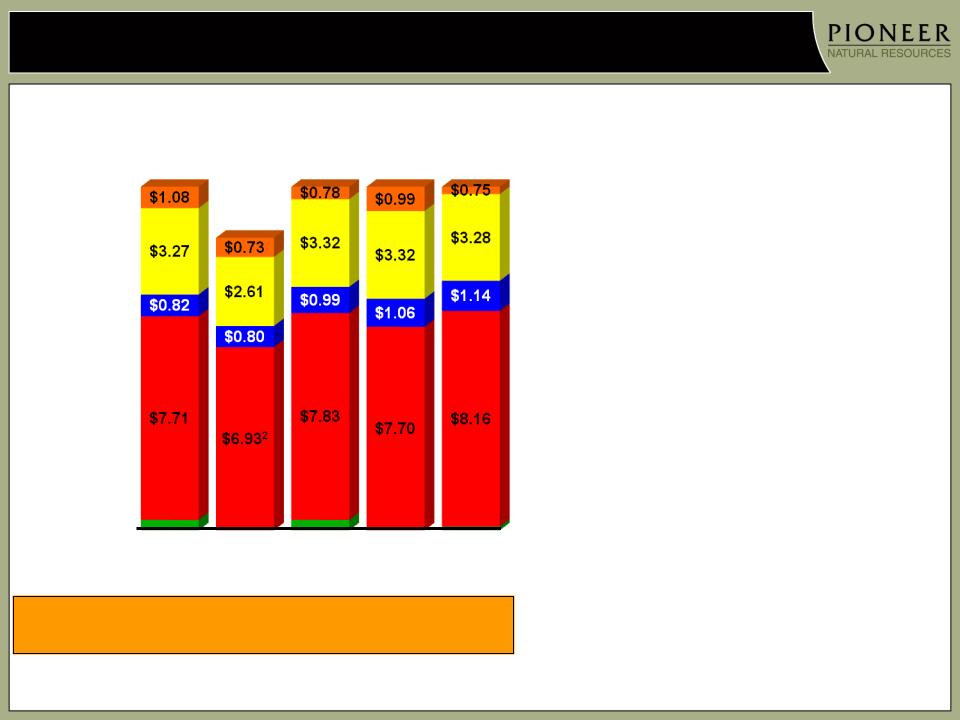

Production Costs (per BOE)1

Production &

Ad Valorem Taxes

Ad Valorem Taxes

VPP-Adjusted3

Workovers

LOE

Third Party

Transportation

Transportation

Q3 ’10

Production Cost

Q1 ’11

Q4 ’10

$12.43

Q3 ’11 vs. Q2 ’11 Comparison

§ Higher LOE primarily due to

increased labor rates and

maintenance costs

increased labor rates and

maintenance costs

§ Higher natural gas processing costs

due primarily to unplanned

downtime and takeaway limitations

at Midkiff / Benedum plants in the

Spraberry field

due primarily to unplanned

downtime and takeaway limitations

at Midkiff / Benedum plants in the

Spraberry field

Natural Gas

Processing

Processing

Q2 ’11

$12.48

1) All periods presented have been restated to exclude discontinued operations

2) Q4 LOE benefited from a non-recurring $10 MM Alaska processing fee recovery (~$1.00/BOE benefit in LOE)

3) See supplemental information slides

$10.33

$0.39

Q3 ’11

($0.13)

$12.88

$0.39

$13.08

$13.27

($0.25)

$0.14

$10.94

$13.31

$12.82

$13.47

36

VPP - Adjusted Production Costs1

Pioneer presents VPP-Adjusted Production Costs (per BOE) to assist

investors in considering the Company’s costs in relation to the total BOEs

(reported sales volumes plus VPP delivered volumes) in connection with

which those costs were incurred. VPP-Production Costs (per BOE) are

calculated as follows:

investors in considering the Company’s costs in relation to the total BOEs

(reported sales volumes plus VPP delivered volumes) in connection with

which those costs were incurred. VPP-Production Costs (per BOE) are

calculated as follows:

Q3 ’10 Q4 ’10 Q1 ’11 Q2 ’11 Q3 ’11

Production costs as reported (thousands) $ 133,757 $ 112,014 $ 133,228 $ 138,319 $ 158,151

Production (MBOE):

As reported 10,091 10,225 10,009 10,791 11,746

VPP deliveries 627 622 338 341 345

VPP-adjusted production 10,718 10,847 10,347 11,132 12,091

Production costs per BOE:

As reported $ 13.27 $ 10.94 $ 13.31 $ 12.82 $ 13.47

VPP-adjusted $ 12.48 $ 10.33 $ 12.88 $ 12.43 $ 13.08

1) All periods presented have been restated to exclude discontinued operations

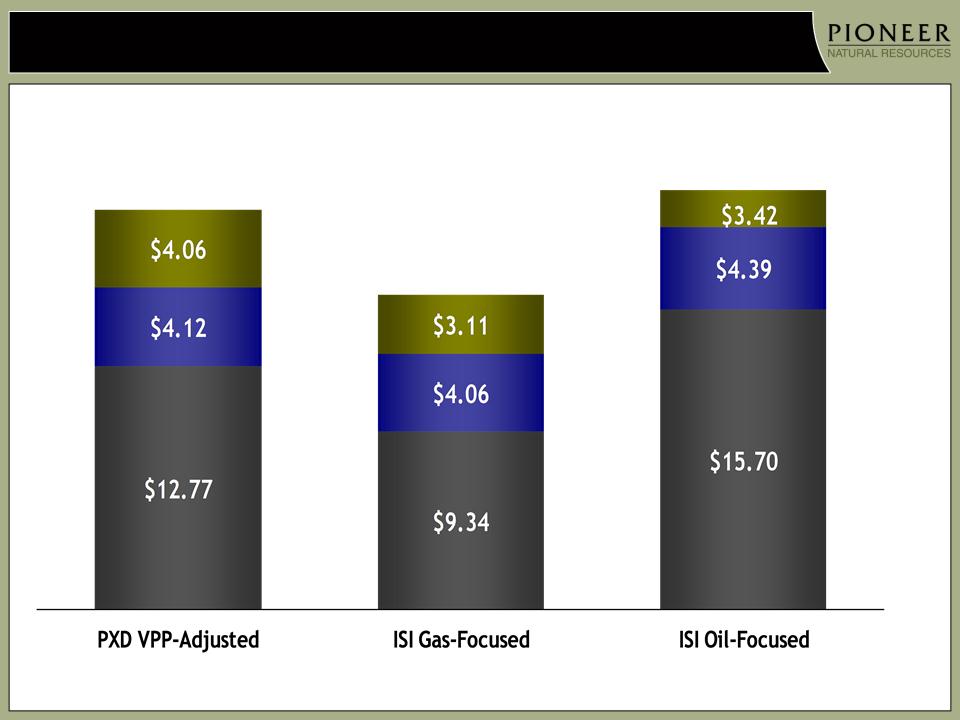

Source: ISI Group

9 Months 2011 Cash Costs ($ / BOE)1

1) Includes production costs, production taxes, G&A (excluding capitalized G&A for full-cost companies), and interest expense

2) ISI group gas-focused companies include APC, CHK, CRK, CRZO, DVN, ECA, EOG, EQT, FST, KOG, KWK, NFX, QEP, ROSE, RRC, SD , SWN & UPL

3) ISI group oil-focused companies include APA, BRY, CXO, DNR, MUR, NBL, PXD, PXP, REXX, SFY, VQ, WLL & XEC

$16.51

G&A

Interest

$20.95

Prod Costs

$23.51

2

3

PXD Cash Costs vs. Peers For First 9 Months of 2011

37

38

1) When NYMEX price is above Call price, PSE receives Call price. When NYMEX price is between Put price and Call price, PSE receives NYMEX price. When NYMEX price is between the

Put price and the Short Put price, PSE receives Put price. When NYMEX price is below the Short Put price, PSE receives NYMEX price plus the difference between the Short Put price and

Put price

2) Represents the weighted average index price of each NGL component price per Bbl

3) Approximate NYMEX price based on differentials to index prices at the date the derivative was entered into

|

Oil

|

2012

|

2013

|

2014

|

|

Swaps (BPD)

|

3,000

|

3,000

|

-

|

|

NYMEX Price ($/BBL)

|

$79.32

|

$81.02

|

-

|

|

Collars (BPD)

|

-

|

-

|

-

|

|

NYMEX Call Price ($/BBL)

|

-

|

-

|

-

|

|

NYMEX Put Price ($/BBL)

|

-

|

-

|

-

|

|

Three-Way Collars (BPD)1

|

1,000

|

1,000

|

4,000

|

|

NYMEX Call Price ($/BBL)

|

$103.50

|

$111.50

|

$124.75

|

|

NYMEX Put Price ($/BBL)

|

$80.00

|

$83.00

|

$90.00

|

|

NYMEX Short Put Price ($/BBL)

|

$65.00

|

$68.00

|

$72.50

|

|

% Oil Production

|

~80%

|

~75%

|

~70%

|

|

Natural Gas Liquids

|

|

|

|

|

Swaps (BPD)

|

750

|

-

|

-

|

|

Blended Index Price ($/BBL)2

|

$35.03

|

-

|

-

|

|

% NGLs Production

|

~45%

|

-

|

-

|

|

Gas

|

|

|

|

|

Swaps (MMBTUPD)

|

5,000

|

2,500

|

-

|

|

NYMEX Price ($/MMBTU)3

|

$6.43

|

$6.89

|

-

|

|

% Gas Production

|

~80%

|

~30%

|

-

|

|

|

|

|

|

|

% Total Production

|

~70%

|

~60%

|

~45%

|

|

|

|

|

|

|

Gas Basis Swaps

|

2012

|

2013

|

2014

|

|

Spraberry (MMBTUPD)

|

2,500

|

2,500

|

-

|

|

Price Differential ($/MMBTU)

|

(0.30)

|

(0.31)

|

-

|

PSE Derivative Position as of 1/4/2012

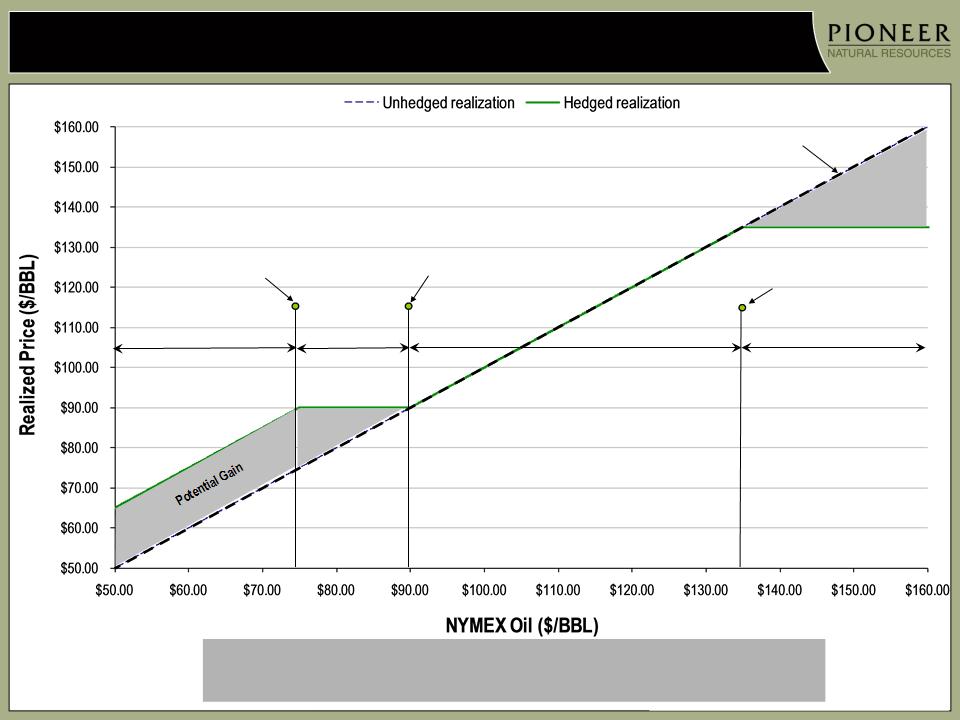

Three-Way Collars ($75 by $90 by $135 example)

Potential

Opportunity Loss

Opportunity Loss

Realize NYMEX price

plus $15/BBL

(difference between long put

and short put)

plus $15/BBL

(difference between long put

and short put)

Realize $90/BBL

Realize NYMEX price

Realize $135/BBL

Short put at $75/BBL

Long put at $90/BBL

Short call at $135/BBL

Realized Price

NYMEX Price

Three way collars protect downside while providing better

upside exposure than traditional collars or swaps

upside exposure than traditional collars or swaps

39

40

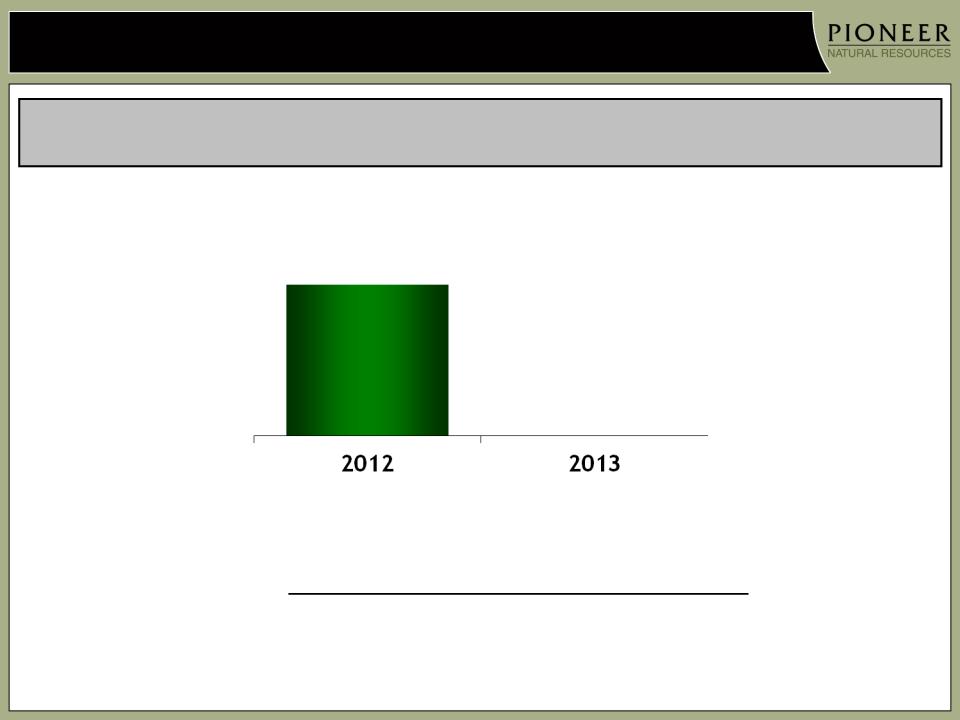

VPP Expirations

VPP Oil

Obligation

Obligation

4

MBOEPD

By the end of 2012, the entire VPP commitment will expire and provide

a 4 MBOEPD increase in production with no capital requirement

a 4 MBOEPD increase in production with no capital requirement

(MMBBLS) Q1 Q2 Q3 Q4 Total

2012 0.3 0.3 0.3 0.3 1.2

Schedule of Oil VPP Volumes

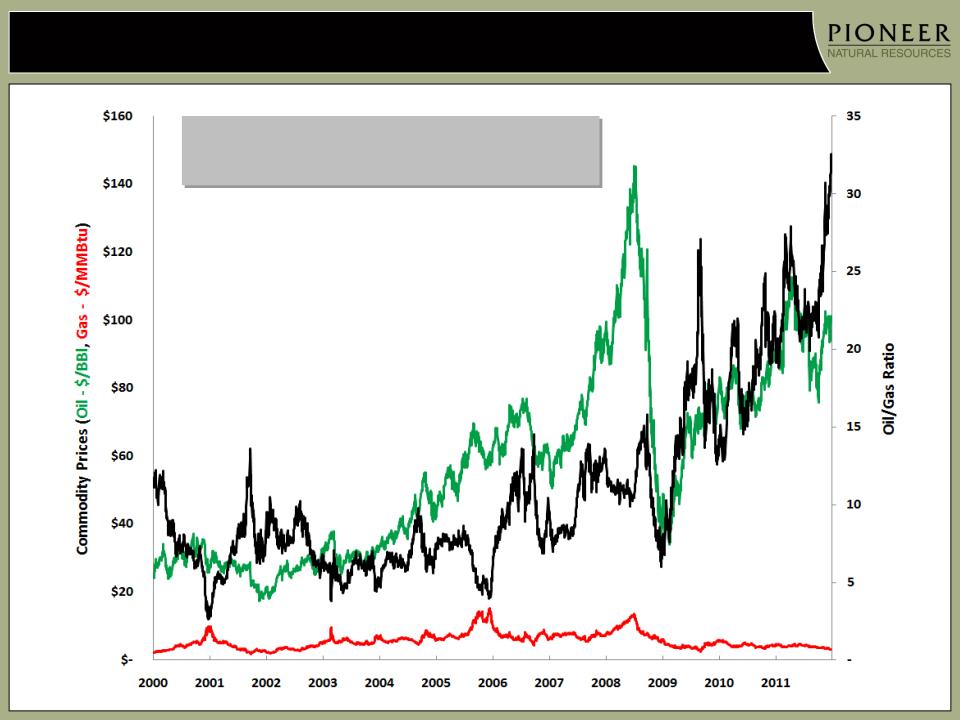

Oil/Gas Ratio Trending Up Since 2006

41

Oil Price

Gas Price

Oil/Gas Ratio

Oil/Gas ratio has increased from

5:1 in 2006 to >25:1 recently

5:1 in 2006 to >25:1 recently

42

Certain Reserve Information

Cautionary Note to U.S. Investors --The U.S. Securities and Exchange Commission (the

"SEC") prohibits oil and gas companies, in their filings with the SEC, from disclosing

estimates of oil or gas resources other than “reserves,” as that term is defined by the

SEC. In this presentation, Pioneer includes estimates of quantities of oil and gas using

certain terms, such as “resource,” “resource potential,” “EUR”, “oil in place” or other

descriptions of volumes of reserves, which terms include quantities of oil and gas that

may not meet the SEC’s definitions of proved, probable and possible reserves, and which

the SEC's guidelines strictly prohibit Pioneer from including in filings with the SEC. These

estimates are by their nature more speculative than estimates of proved reserves and

accordingly are subject to substantially greater risk of being recovered by Pioneer. U.S.

investors are urged to consider closely the disclosures in the Company’s periodic filings

with the SEC. Such filings are available from the Company at 5205 N. O'Connor Blvd.,

Suite 200, Irving, Texas 75039, Attention Investor Relations, and the Company’s website

at www.pxd.com. These filings also can be obtained from the SEC by calling 1-800-SEC-

0330.

"SEC") prohibits oil and gas companies, in their filings with the SEC, from disclosing

estimates of oil or gas resources other than “reserves,” as that term is defined by the

SEC. In this presentation, Pioneer includes estimates of quantities of oil and gas using

certain terms, such as “resource,” “resource potential,” “EUR”, “oil in place” or other

descriptions of volumes of reserves, which terms include quantities of oil and gas that

may not meet the SEC’s definitions of proved, probable and possible reserves, and which

the SEC's guidelines strictly prohibit Pioneer from including in filings with the SEC. These

estimates are by their nature more speculative than estimates of proved reserves and

accordingly are subject to substantially greater risk of being recovered by Pioneer. U.S.

investors are urged to consider closely the disclosures in the Company’s periodic filings

with the SEC. Such filings are available from the Company at 5205 N. O'Connor Blvd.,

Suite 200, Irving, Texas 75039, Attention Investor Relations, and the Company’s website

at www.pxd.com. These filings also can be obtained from the SEC by calling 1-800-SEC-

0330.