Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Assertio Therapeutics, Inc | a12-2323_18k.htm |

Exhibit 99.1

|

|

Confidential Information January 9, 2012 An Emerging Specialty Pharmaceutical Leader |

|

|

Statements made in this presentation that are not historical facts are forward-looking statements that involve risks and uncertainties. The inclusion of forward-looking statements, including those related to our commercialization plans for GraliseTM, our clinical development programs, potential benefits of our products and product candidates, and financial projections and expectations, should not be regarded as a representation that any of our plans will be achieved. Actual results may differ materially from those described in this presentation due to the risks and uncertainties inherent in our business, including, without limitation, risks and uncertainties related to: our research and development efforts, including pre-clinical and clinical testing; regulation by the FDA and other government agencies; the timing of regulatory applications and product launches; our ability to successfully commercialize our products; the success of our collaborative arrangements with development and commercialization partners; and other risks detailed in our filings with the Securities and Exchange Commission filings, including our most recent Annual Report on Form 10-K and our most recent Quarterly Report on Form 10-Q. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. We undertake no obligation to revise or update this presentation to reflect events or circumstances that occur after the date of this presentation. Note on Forward-Looking Statements Depomed, Inc. | January 9, 2012 | Page 2 |

|

|

Depomed Investment Opportunity Establishing leadership in the CNS specialty pharmaceutical sector Building a successful, profitable, product-focused pharmaceutical business Delivering sustainable value to stakeholders: patients/families, physicians, providers, payers, shareholders, employees Strong foundation for future growth Strong balance sheet: $154.2 million as of 3Q11, no debt Gralise: commercially attractive new product launch successfully underway Solid Glumetza base business with significant growth potential Core technology deals strengthen bottom line Accomplished, results-oriented, business-focused management team “3 in 3” business model: 3 growth strategies over next 3 years Depomed, Inc. | January 9, 2012 | Page 3 |

|

|

3 in 3 Business Model: 3-Pronged Growth Strategy Grow top line Achieve commercial success of branded marketed products Gralise in PHN: cornerstone of CNS-focused franchise, with realizable $100 million+ market potential Grow bottom line “Cash cow” Glumetza strategy: restructured Santarus agreement provides 29.5% royalty on $100+ million run rate Acuform technology monetization: current and additional BD deals that include potential royalty and milestone upside Grow CNS franchise Selected acquisition/in-licensing of marketed or late-stage, differentiated assets that meet short and longer-term financial goals: Accelerate revenue and EPS growth Have significant commercial potential Depomed, Inc. | January 9, 2012 | Page 4 |

|

|

3-Year Plan to Sustained Profitability and Shareholder ROI 2011: Setting the Stage Pivotal year assembling the building blocks of CNS franchise business Reacquired, successfully launched flagship product Gralise with pharma-quality commercial implementation Early indicators: market uptake ramping nicely Restructured Glumetza deal with Santarus Enhanced economics with significant upside Strengthened the bottom line, increased cash position $101 million from deals and milestones Year-end cash balance expected to be at the top end of $131-138 million of Q3 2011 guidance Management team of proven, successful leaders Commercialization: collective experience launching multiple billion-dollar products Corporate strategy: quantitative, data driven, results-focused Smart deal-making: 20 transactions since 2002; worth hundreds of $millions Track records of building successful companies, products Depomed, Inc. | January 9, 2012 | Page 5 |

|

|

2012: Execution Grow Gralise market penetration – keys to growth Pain specialists Neurologists Managed care Deals build on track record of > $230 million cash received from in non-dilutive deals since 2006 Grow CNS franchise Opportunistically acquire selective, financially sound assets Depomed, Inc. | January 9, 2012 | Page 6 |

|

|

2013: Aggressive Growth Establish Gralise year-end run rate of $100+ million Glumetza contributing potentially $40+ million to bottom line Selective acquisition or development of portfolio assets with immediate or near-term revenue potential Meaningful valuation and EPS growth: reaching cash-positive goal during 2013 Depomed, Inc. | January 9, 2012 | Page 7 |

|

|

2014: Leadership Depomed established as a successful, profitable mid-sized specialty pharmaceutical company Expanded portfolio of assets with significant growth potential, driving sales and profitability Continue to deliver significant shareholder value Depomed, Inc. | January 9, 2012 | Page 8 |

|

|

A Potential New Standard of Care in PHN Large market opportunity Clinical differentiation; unmet medical need Pharma-quality pre-launch and launch (October 2011) 164 rep sales force targeting all customer segments: physicians, payors, pharmacies Post-launch monitoring and adjustments as needed Depomed, Inc. | January 9, 2012 | Page 9 |

|

|

Large Market Opportunity Gabapentin + Lyrica > $2 billion market ~38 million prescriptions annually in the US US gross sales for target market ($ billions) Depomed, Inc. | January 9, 2012 | Page 10 |

|

|

Clinically Differentiated Effective 24-hour pain control Significant and lasting improvement in pain scores in clinical studies Once-daily dosing with an evening meal Patented polymer technology allows for peak plasma levels during the night and low rates of side effects during the day Favorable tolerability profile Discontinuation rates due to AEs 9.7% vs. 6.9% with placebo Reported incidence of 4.5% somnolence vs.2.7% with placebo, dizziness of 10.9% vs. 2.2% with placebo Titration to an effective dose in 2 weeks 1800mg established in 2 weeks Gralise is not interchangeable with other gabapentin products Depomed, Inc. | January 9, 2012 | Page 11 |

|

|

Effective, 24-Hour PHN Pain Control with Once-Daily Gabapentin Gralise (1800mg) Neurontin (1800-2400mg) Lyrica (15-300mg) Reduction in Pain Score(1) -2.4 -2.2 to -2.3 -1.8 to -2.2 Dosing 1x daily dosing 3 to 4x daily dosing 2 to 3x daily dosing Dizziness 10.9% 31% - 33% 12% - 28% Somnolence 4.5% 17% - 20% 15% - 24% (1) In PHN. Based on LOCF (last observation carried forward). (2) Note: Not based on head-to-head studies. Depomed, Inc. | January 9, 2012 | Page 12 |

|

|

Starter Pack Simplifies Titration for Doctors and Patients The 30-Day Starter “G-Pack” guides patients through the 2-week titration period and 2 weeks of therapy at the recommended dose of 1800 mg. Comes with clear instructions for patients on when to increase the Gralise dose. Depomed, Inc. | January 9, 2012 | Page 13 |

|

|

Market Addressable with 164 Sales Reps Decile 3-10 Neurologists, Pain Specialists; Decile 5-10 PCPs; further segmented based on behavioral characteristics and treatment patterns. Written by target prescribers. Addressable Rx Market: Gabapentin and Lyrica ~23 million TRx(2) Neurologists, Pain Specialists and high-decile PCPs, further segmented by behavioral patterns Launch Target Prescribers(1) Potential Future Non-Targeted (Deciles 1-2) Depomed, Inc. | January 9, 2012 | Page 14 |

|

|

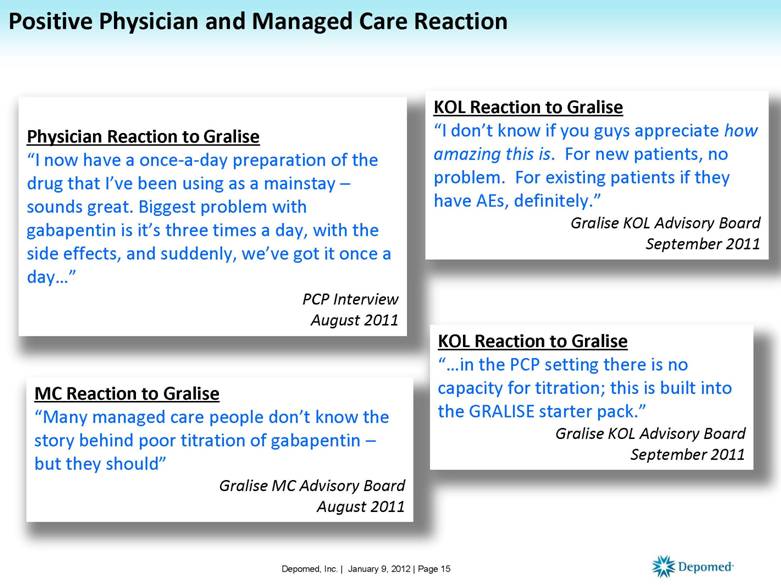

Physician Reaction to Gralise “I now have a once-a-day preparation of the drug that I’ve been using as a mainstay – sounds great. Biggest problem with gabapentin is it’s three times a day, with the side effects, and suddenly, we’ve got it once a day...” PCP Interview August 2011 KOL Reaction to Gralise “I don’t know if you guys appreciate how amazing this is. For new patients, no problem. For existing patients if they have AEs, definitely.” Gralise KOL Advisory Board September 2011 MC Reaction to Gralise “Many managed care people don’t know the story behind poor titration of gabapentin – but they should” Gralise MC Advisory Board August 2011 KOL Reaction to Gralise “...in the PCP setting there is no capacity for titration; this is built into the GRALISE starter pack.” Gralise KOL Advisory Board September 2011 Positive Physician and Managed Care Reaction Depomed, Inc. | January 9, 2012 | Page 15 |

|

|

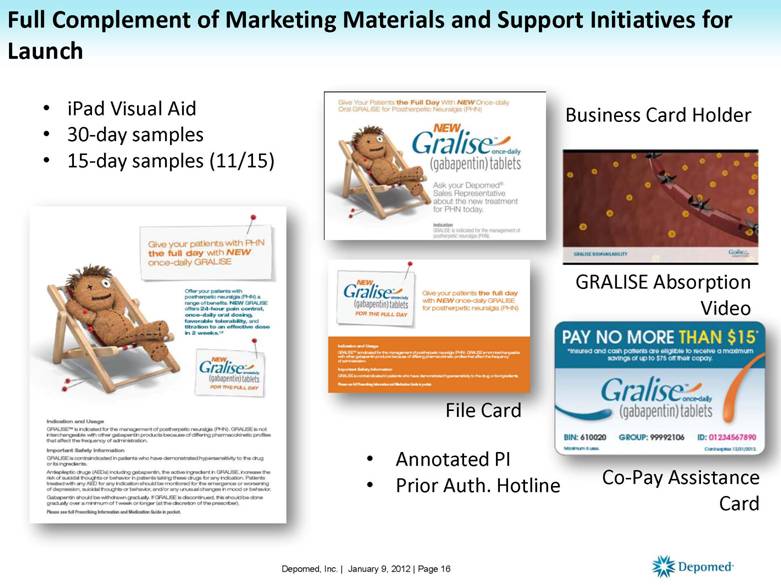

Full Complement of Marketing Materials and Support Initiatives for Launch iPad Visual Aid 30-day samples 15-day samples (11/15) File Card Business Card Holder GRALISE Absorption Video Co-Pay Assistance Card Annotated PI Prior Auth. Hotline Depomed, Inc. | January 9, 2012 | Page 16 |

|

|

Coverage as of 12/31/2011 8 out of 10 lives have access to Gralise 91% of Commercial Plans have Gralise at Tier 3 or better Managed Care Team Actively Engaged with All Payer Types Government TriCare (9MM lives): $12 co-pay NY Medicaid (5MM beneficiaries) and TX Medicaid (3.2MM beneficiaries): unrestricted access Medicare Part D HealthNet (1.3M lives): Tier 3 Emblem Health (250k lives): Tier 3 Commercial Anthem/Wellpoint (13.5MM lives) – Tier 3 Well-Stocked Shipped over $7.5 million of product to wholesalers in 4Q (revenue recognized based on prescriptions) Auto-shipped to >5,000 drugstores Depomed, Inc. | January 9, 2012 | Page 17 Well-Stocked and Launched with Broad Managed Care Coverage |

|

|

Solid Growth to Annualized Gross Revenue Run Rate > $5M at Week 10 Depomed, Inc. | January 9, 2012 | Page 18 $3.4 $3.9 $4.9 $5.2 $- $1.0 M $2.0 M $3.0 M $4.0 M $5.0 M $6.0 M 12/2/2011 12/9/2011 12/16/2011 12/23/2011 Annualized Gross Revenue (prescription basis) Week Ending |

|

|

TRx Breakdown Shows Strong Specialist Uptake Depomed, Inc. | January 9, 2012 | Page 19 Gralise TRx by Specialty TRx by Payment Type (November 2011) |

|

|

Taking Share From Others Depomed, Inc. | January 9, 2012 | Page 20 Gralise Source of Business Patients switching to Gralise were taking: 11% of Gralise patients are refills (continuing therapy) 57% of Gralise patients are switching from an existing therapy (either a gabapentinoid, Lidoderm or Cymbalta) 32% of Gralise scripts are to de-novo patients (New Therapy Starts2) Switch From 37% 32% 61% 57% 11% 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% Oct-11 Nov-11 Continuation Switch To New Therapy Start 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% Oct-11 Nov-11 Lyrica Lidoderm Horizant Gabapentin TID Cymbalta |

|

|

More than 1000 Unique Prescribers at Week 10 Depomed, Inc. | Private & Confidential | 19 Active Prescriber: Prescribing Gralise >0 times in the most recent rolling 4 week period Unique Prescriber: Prescribing Gralise >0 times since launch Source: IMS through 12/16/2011, retail & mail order |

|

|

Glumetza: Bottom-Line Growth Driver Santarus Glumetza #1 product (>50% of total revenue) eVoucher program (= $10 co-pay) initiated in September 2011 Weekly Glumetza Rx and number of tablets up by 17% Adding 40 sales rep in January (150 reps total) Depomed Cash cow product with significant growth potential Restructured Santarus agreement 29.5% royalty in 2012 on ~$100 million run rate Increases to 32% in 2013 Depomed, Inc. | January 9, 2012 | Page 22 eVoucher initiated 1,000 1,200 1,400 1,600 1,800 2,000 2,200 2,400 2,600 2,800 3,000 3,000 3,500 4,000 4,500 5,000 5,500 6,000 6,500 31 - Dec - 10 14 - Jan - 11 28 - Jan - 11 11 - Feb - 11 25 - Feb - 11 11 - Mar - 11 25 - Mar - 11 8 - Apr - 11 22 - Apr - 11 6 - May - 11 20 - May - 11 3 - Jun - 11 17 - Jun - 11 1 - Jul - 11 15 - Jul - 11 29 - Jul - 11 12 - Aug - 11 26 - Aug - 11 9 - Sep - 11 23 - Sep - 11 7 - Oct - 11 21 - Oct - 11 4 - Nov - 11 18 - Nov - 11 2 - Dec - 11 16 - Dec - 11 NRx TRx Glumetza Prescription Trends TRx NRx |

|

|

Acuform Gastric Retention Technology is a continuing source of revenue and cash: License Fees Milestones Royalties Five Acuform technology licenses — potential future milestones (2011 – 2015+) and royalties (2012+) Strengthens bottom line with limited expenditure of resources Acuform® Technology Platform: Highly Monetizable Asset Depomed, Inc. | January 9, 2012 | Page 23 |

|

|

Strong Recurring Revenue from Acuform Technology Deals Janumet XR -- Januvia (sitagliptin) / metformin XR combination NDA approval pending Regulatory filings ex-US in process Modest royalty upon market launch SGLT2 inhibitor / metformin XR combination Additional milestone and royalties Boehringer compounds / metformin XR combinations $10m upfront in Q1:2011 $2.5m milestone for delivery of formulations plus additional milestones and royalties Acetaminophen / opiate combination products 1st and 2nd formulation launch as soon as 2013 and 2014, respectively Up to $15 million in additional milestones per formulation Ironwood technology deal announced August 4, 2011 New gastrointestinal disorder program. Upfront payment with potential milestones and royalties Depomed, Inc. | January 9, 2012 | Page 24 |

|

|

Strong IP/Regulatory Protection for Marketed Products Glumetza 500mg - Depomed formulation 4 Orange Book listed technology patents expiring 2016 - 2021 1000mg - Valeant formulation 2 Orange Book listed patents listed expiring 2021 and 2025 Gralise Depomed proprietary formulation 6 Orange Book listed patents for both strengths expiring 2016 – 2024 Formulation patents expire 2022 and 2024 Multiple defensive patents Additional Prosecution ongoing (>10 applications pending) Orphan Drug exclusivity pending Depomed, Inc. | January 9, 2012 | Page 25 |

|

|

Serada® for Menopausal Hot Flashes Breeze 3 top line data announced October 2011 Three of four co-primary endpoints met Two key secondary endpoints not met All met on ANCOVA analysis Further evaluation ongoing Analyzing Breeze 3 data Compiling combined data from Breeze 3 and two prior trials Plan to meet with the FDA in 1H 2012 Discuss path to NDA submission and registration Large unmet need and market opportunity Depomed, Inc. | January 9, 2012 | Page 26 |

|

|

Cash position: $154.2 million on 9/30/2011 No debt Strong Balance Sheet Depomed, Inc. | January 9, 2012 | Page 27 |

|

|

Depomed Today Commercially attractive, new product launch successfully underway Solid base of business with significant growth potential Strong balance sheet Strong and defensible IP position Multiple value-creating milestones upcoming Experienced, proven leadership team aggressively pursuing realistic pathway to sustained profitability Ambitious, realistic “3 in 3” business model: aggressive growth and value creation achievable in the near term Depomed, Inc. | January 9, 2012 | Page 28 |

|

|

Confidential Information January 9, 2012 An Emerging Specialty Pharmaceutical Leader |