Attached files

| file | filename |

|---|---|

| 8-K - Vertro, Inc. | form8ksidoticonference01-0.htm |

1 NASDAQ: VTRO

Safe harbor and use of non-GAAP financial measures 2 This presentation contains certain forward-looking statements that are based upon current expectations and involve certain risks and uncertainties within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. Words or expressions such as “plan,” “intend,” “believe,” or “expect” or variations of such words and similar expressions are intended to identify such forward-looking statements. Key risks are described in Vertro reports filed with the U.S. Securities and Exchange Commission. Readers should note that these statements may be impacted by several factors, including economic changes and changes in the Internet industry generally and, accordingly, Vertro actual performance and results may vary from those stated herein, and Vertro undertakes no obligation to update the information contained herein. This presentation contains GAAP financial measures and non-GAAP financial measures where management believes it to be helpful in understanding Vertro's results of operations or financial position. Where non-GAAP financial measures are used, the comparable GAAP financial measure, as well as the reconciliation to the comparable GAAP financial measure, can be found in the current quarter earnings release, which can be found on Vertro's website at www.vertro.com.

Overview •Vertro owns and operates the alOt product portfolio Our focus is a creative App strategy using the Internet to acquire and retain consumers that want ease of use and convenience when accessing the web Apps built both in-house and through third-party relationships •Proprietary lifetime value model and online buying expertise •Operating in Multiple High-Growth Markets Marketed in 20 countries in 8 languages Continuing releases in high-growth target markets •Headquartered in New York, 34 employees as of September 30, 2011 •Solid balance sheet, cash position and net working capital $4.0M in cash as of the third quarter 2011 No debt Untapped credit line of up to $8M with Bridge Bank NA Reduced operating costs 3

Market Strategy : Maximize Return Per Live User • Target customer acquisition with online buying expertise Direct marketing team acquires desired volume of users at optimal target price points Buying into over 200 verticals around the world, bidding on millions of keywords to diversify and grow our user base Proven capabilities • High Quality products create positive user experience Promoted and designed to increase user installations and user downloads Apps built for targeted users increase engagement and activity Enhanced response to targeted advertising in search and display Maximize Revenue per User • Application Strategy : Increase product distribution, user retention or non-search revenue Continued pipeline of App releases to increase user attraction New high quality Apps designed to keep users for the long term Attrition improvements have significant effect on life time value of users Increase non-search revenue through e-Commerce, display ads, app sponsorship and other third party relationships 4

Customer Acquisition : Our Go-To Market Strategy 5 We market these products via online advertising and brand marketing We target audiences based on our buying expertise Adding new verticals each month - we make the internet user friendly

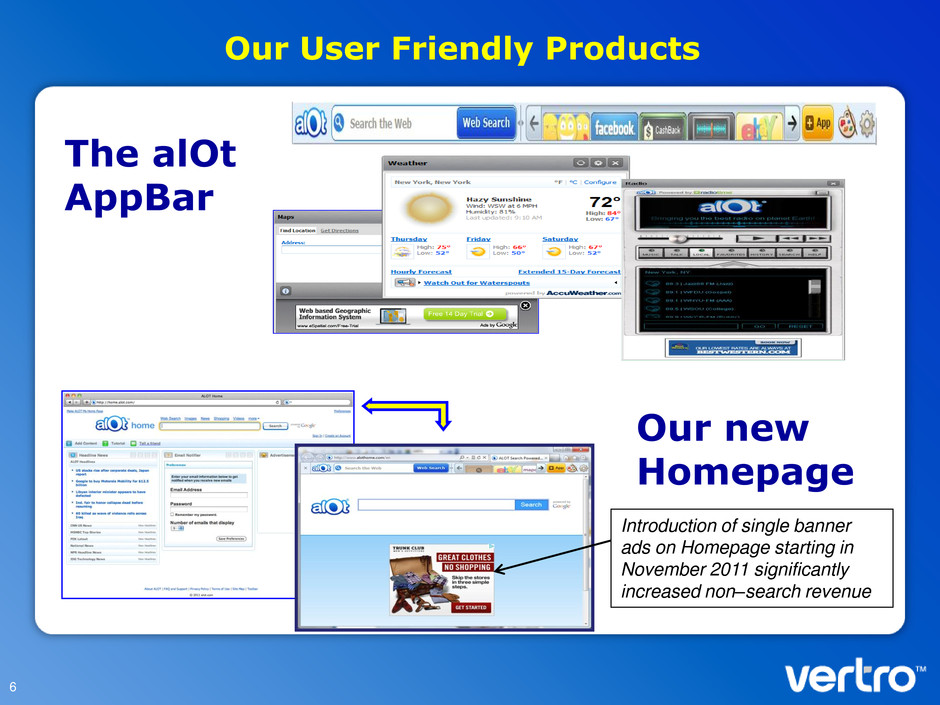

Our User Friendly Products 6 The alOt AppBar Our new Homepage Introduction of single banner ads on Homepage starting in November 2011 significantly increased non–search revenue

Vibrant App Strategy Apps Designed to Increase Distribution, Retention, or Non-Search Revenue Third Party Apps In House Apps 7 AccuWeather.com Maps Email Notifier Facebook Birthdays Package Tracker

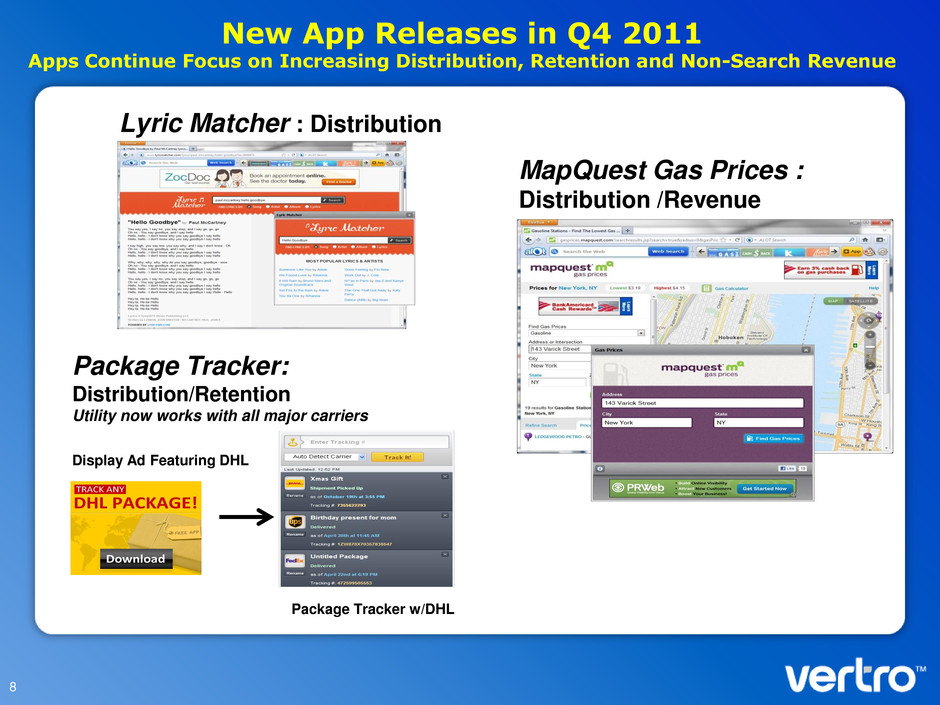

New App Releases in Q4 2011 Apps Continue Focus on Increasing Distribution, Retention and Non-Search Revenue 8 Lyric Matcher : Distribution MapQuest Gas Prices : Distribution /Revenue Display Ad Featuring DHL Package Tracker w/DHL Package Tracker: Distribution/Retention Utility now works with all major carriers

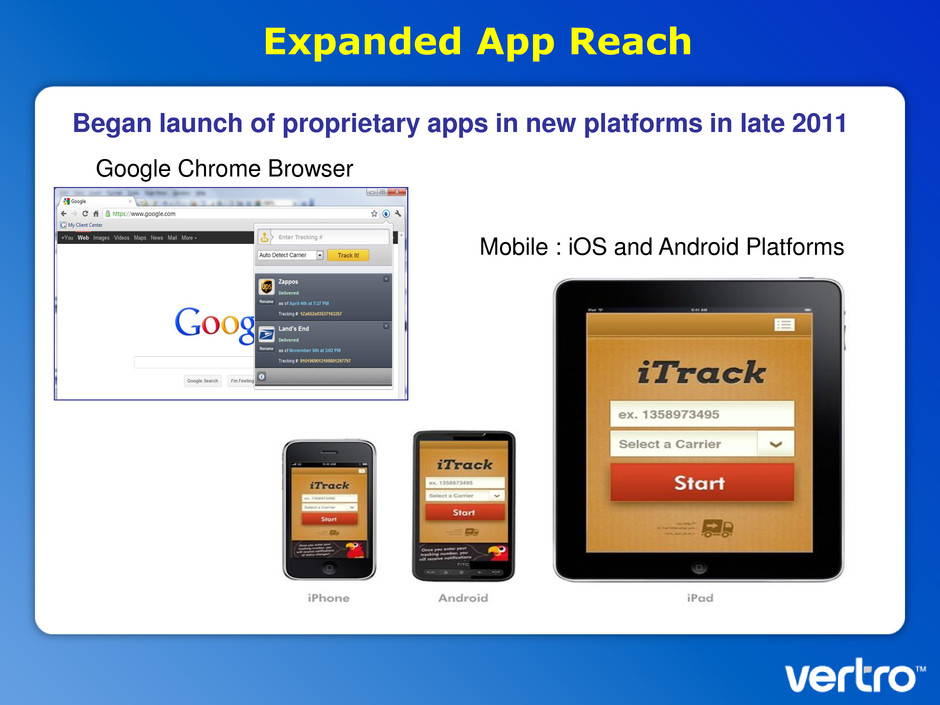

Expanded App Reach Google Chrome Browser Mobile : iOS and Android Platforms Began launch of proprietary apps in new platforms in late 2011

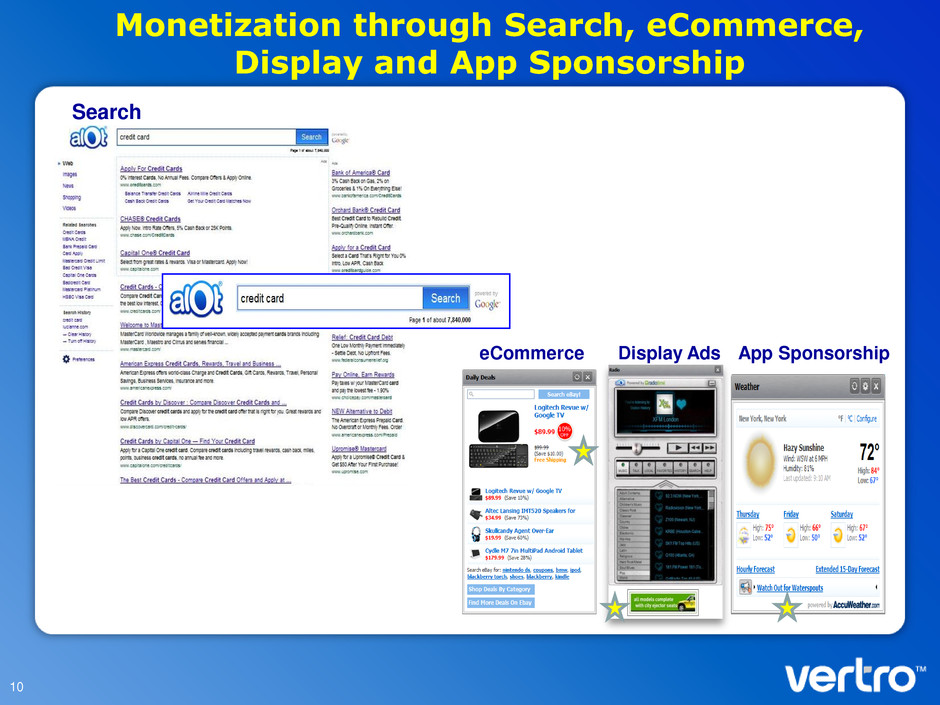

10 App Sponsorship eCommerce Display Ads Monetization through Search, eCommerce, Display and App Sponsorship Search

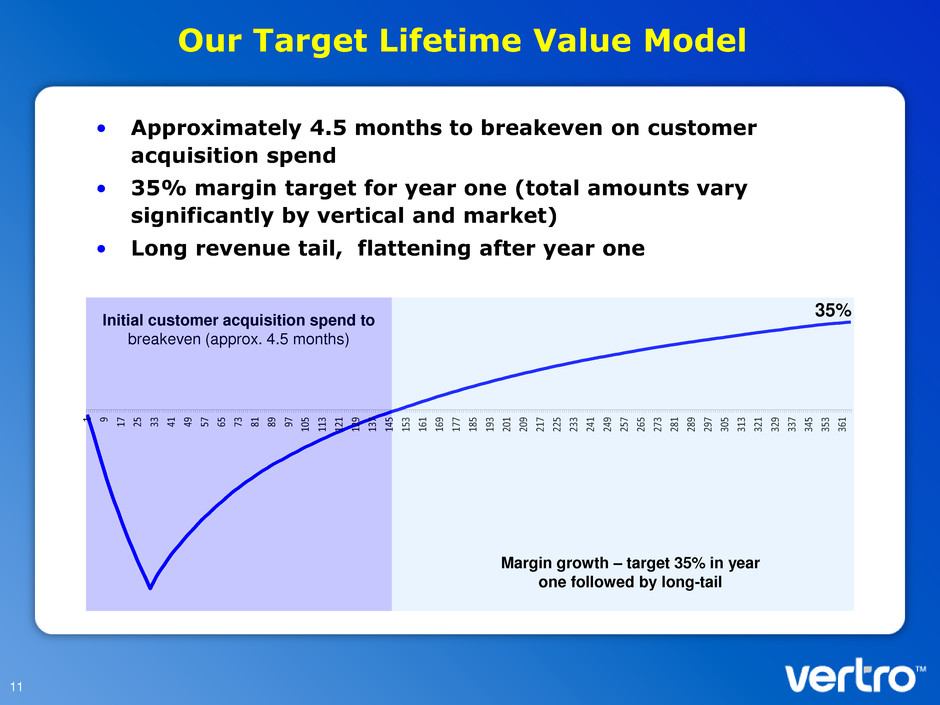

Our Target Lifetime Value Model • Approximately 4.5 months to breakeven on customer acquisition spend • 35% margin target for year one (total amounts vary significantly by vertical and market) • Long revenue tail, flattening after year one 11 1 9 17 25 33 41 49 57 65 73 81 89 97 105 113 121 129 137 145 153 161 169 177 185 193 201 209 217 225 233 241 249 257 265 273 281 289 297 305 313 321 329 337 345 353 361 Initial customer acquisition spend to breakeven (approx. 4.5 months) Margin growth – target 35% in year one followed by long-tail 35%

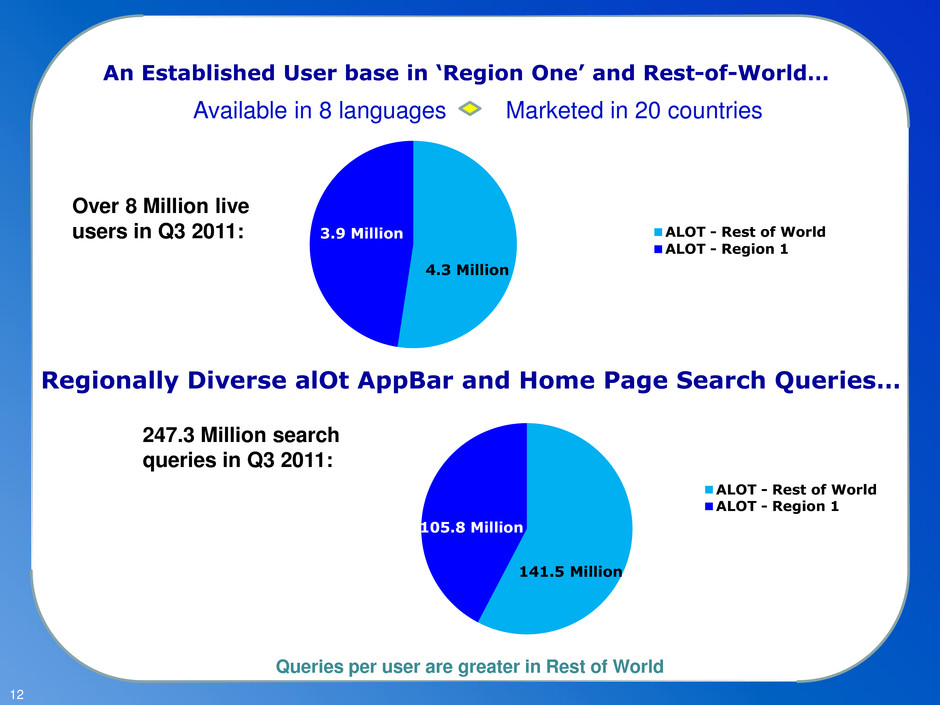

12 247.3 Million search queries in Q3 2011: Regionally Diverse alOt AppBar and Home Page Search Queries… 105.8 Million ALOT - Rest of World ALOT - Region 1 141.5 Million An Established User base in ‘Region One’ and Rest-of-World… Available in 8 languages Marketed in 20 countries 4.3 Million 3.9 Million ALOT - Rest of World ALOT - Region 1 Over 8 Million live users in Q3 2011: Queries per user are greater in Rest of World

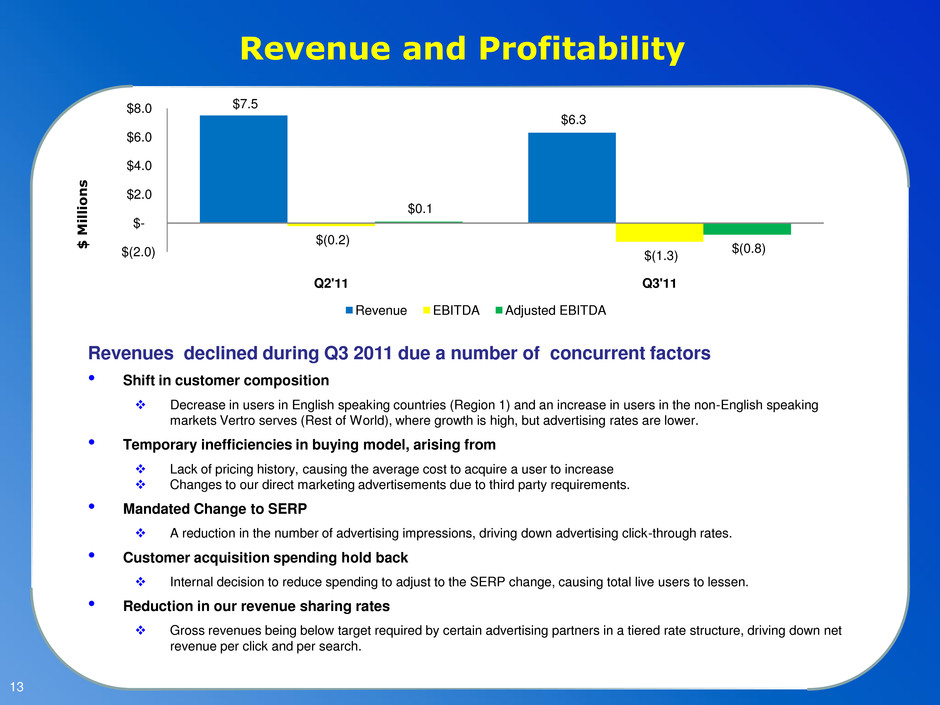

13 Revenues declined during Q3 2011 due a number of concurrent factors • Shift in customer composition Decrease in users in English speaking countries (Region 1) and an increase in users in the non-English speaking markets Vertro serves (Rest of World), where growth is high, but advertising rates are lower. • Temporary inefficiencies in buying model, arising from Lack of pricing history, causing the average cost to acquire a user to increase Changes to our direct marketing advertisements due to third party requirements. • Mandated Change to SERP A reduction in the number of advertising impressions, driving down advertising click-through rates. • Customer acquisition spending hold back Internal decision to reduce spending to adjust to the SERP change, causing total live users to lessen. • Reduction in our revenue sharing rates Gross revenues being below target required by certain advertising partners in a tiered rate structure, driving down net revenue per click and per search. $7.5 $6.3 $(0.2) $(1.3) $0.1 $(0.8) $(2.0) $- $2.0 $4.0 $6.0 $8.0 Q2'11 Q3'11 Revenue EBITDA Adjusted EBITDA $ M il li on s Revenue and Profitability

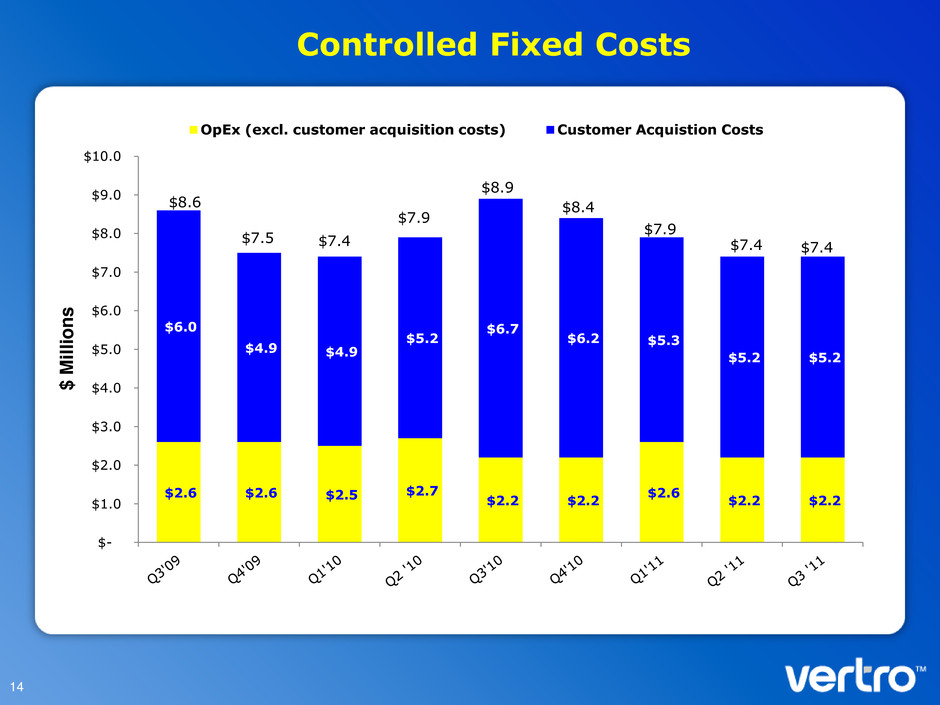

Controlled Fixed Costs 14 $2.6 $2.6 $2.5 $2.7 $2.2 $2.2 $2.6 $2.2 $2.2 $6.0 $4.9 $4.9 $5.2 $6.7 $6.2 $5.3 $5.2 $5.2 $- $1.0 $2.0 $3.0 $4.0 $5.0 $6.0 $7.0 $8.0 $9.0 $10.0 OpEx (excl. customer acquisition costs) Customer Acquistion Costs $8.6 $7.5 $7.4 $7.9 $8.4 $7.9 $7.4 $7.4 $8.9 $ M il li o n s

Summary • Highly attractive portfolio of applications • Vibrant App Strategy with branded partners that will help drive future growth • Proprietary lifetime value model and online buying expertise • Marketed in 20 countries and in 8 languages to a targeted audience • Solid balance sheet, cash position and net working capital $4.0 million in cash as of the third quarter 2011 No debt Untapped credit line of up to $8M with Bridge Bank NA Reduced operating costs through streamlined organization 15 .

Proposed Transaction Inuvo Vertro

17 Key Transaction Terms Combined Scale: Scaled revenues due to a combined team and product Operating expense synergies Stock symbols: INUV - VTRO Consideration: 100% stock Exchange Rate: 1.546 shares of Inuvo per Vertro share Board/Governance: New Seven-Member Board: • Inuvo – Rich Howe (Executive Chairman), Charles Morgan, Charles Pope • Vertro – Peter Corrao (President and CEO), Joseph Durrett, Adele Goldberg • Independent – TBD by the new board after the close Timing: Expected to Close First Quarter 2012 Closing Conditions: Stockholder vote, secured bank loan, regulatory approvals and other customary closing conditions

18 Strategic Considerations Scale A stronger core business, providing more scale from which to attract advertisers, publishers and consumers. Synergies Overlapping company operating expense synergies ($2.4mm). Concentration Single supplier risk mitigation through the combined relationships of both companies (Yahoo!, Google, Others). Distribution An existing install and distribution capability through Vertro’s ALOT for Inuvo’s consumer facing innovations (Over 8 million users). Access to Capital A stronger business from which to access both debt and capital markets to fuel growth. Site Expansion Ability to launch additional properties for local search and retail. Seasoned Management A combination of seasoned and experienced digital marketing teams.

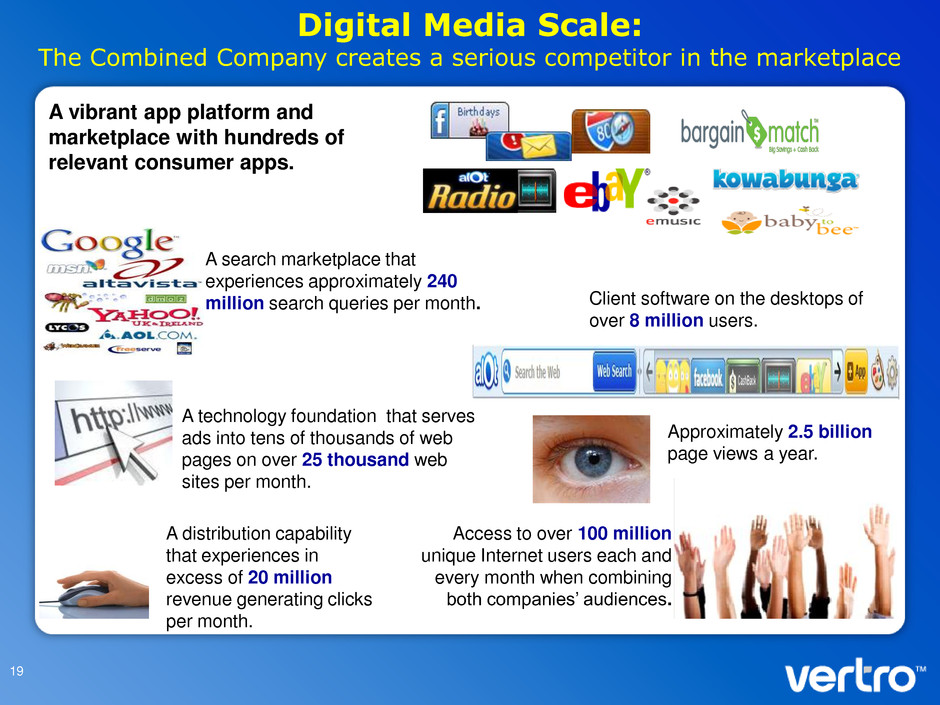

A technology foundation that serves ads into tens of thousands of web pages on over 25 thousand web sites per month. Client software on the desktops of over 8 million users. A distribution capability that experiences in excess of 20 million revenue generating clicks per month. Access to over 100 million unique Internet users each and every month when combining both companies’ audiences. A search marketplace that experiences approximately 240 million search queries per month. Digital Media Scale: The Combined Company creates a serious competitor in the marketplace A vibrant app platform and marketplace with hundreds of relevant consumer apps. 19 Approximately 2.5 billion page views a year.

Deal Highlights Growing markets We are focused on Search, Affiliate, Local Deals and Consumer Applications Exciting growth potential Vertro acquisition expected to provide significant scale and additional distribution for Inuvo products. New Apps designed to create more revenue per user: • Improved retention Increased searches per user Substantially increased LTVs Public company and operational savings Company focused on expansion Streamlined company positioned to accelerate innovative opportunities Concentration on core ad platform • Risk associated with poorer performing assets removed Making technology investments in new online markets 20

Additional information has been filed with the Securities and Exchange Commission This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. The proposed merger between Inuvo and Vertro will be submitted to the respective stockholders of Inuvo and Vertro for their consideration. In connection with the proposed Merger, Inuvo has filed with the U.S. Securities and Exchange Commission (the “SEC”), a registration statement on Form S-4 that includes a joint proxy statement of Inuvo and Vertro that also constitutes a prospectus of Inuvo. The joint proxy statement/prospectus describes the planned meeting of each of Inuvo's and Vertro's stockholders and the registration of the securities of Inuvo to be issued in the Merger. The joint proxy statement/prospectus contains important information about Inuvo, Vertro, the proposed merger and related matters. Inuvo and Vertro will mail the joint proxy statement/prospectus to their respective stockholders. INVESTORS AND SECURITY HOLDERS OF INUVO AND VERTRO ARE URGED TO READ THE JOINT PROXY STATEMENT/PROSPECTUS AND OTHER RELEVANT DOCUMENTS THAT WILL BE FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. Investors and stockholders are able to obtain free copies of all documents filed with the SEC, including by Inuvo and Vertro, when they become available, through the website maintained by the SEC at www.sec.gov. Inuvo and Vertro make available free of charge at www.inuvo.com and www.vertro.com, respectively (in the “Investors” section and the “Financial Information” section, respectively), copies of materials they file with, or furnish to, the SEC, or investors and stockholders may contact Inuvo at (727) 324-0211 or Vertro at (646) 253-0606 to receive copies of documents that each company files with or furnishes to the SEC. Participants in the Merger Solicitation Inuvo, Vertro, and certain of their respective directors, executive officers and certain other members of management and employees may be deemed to be participants in the solicitation of proxies from the stockholders of Inuvo and Vertro in connection with the proposed transaction. Information about the directors and executive officers of Inuvo is set forth in its proxy statement for its 2011 annual meeting of stockholders, which was filed with the SEC on May 2, 2011. Information about the directors and executive officers of Vertro is set forth in its proxy statement for its 2011 annual meeting of stockholders, which was filed with the SEC on April 29, 2011. These documents can be obtained free of charge from the sources indicated above. Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, is contained in the joint proxy statement/prospectus, which was filed with the SEC on November 15, 2011, and other relevant materials to be filed with the SEC when they become available. 21

22 NASDAQ: VTRO