Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) December 30, 2011

|

TRANSAX INTERNATIONAL LIMITED

|

||

|

(Exact name of registrant as specified in its charter)

|

||

|

Colorado

(State or other jurisdiction of incorporation)

|

0-27845

(Commission File Number)

|

90-0287423

(IRS Employer Identification No.)

|

|

South Part 1-101, Nanshe Area, Pengnan Industrial Park on North Yingbinbei Road in Waisha Town of Longhu District in Shantou, Guangdong, China

|

515023

|

|

(Address of principal executive offices)

|

(Zip Code)

|

|

Registrant's telephone number, including area code

|

(86) 754 83238888

|

|

1133 S. University Drive, Suite 210, Plantation, Florida 33324

|

|

(Former name or former address, if changed since last report)

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 1.01 Entry into a Material Definitive Agreement.

Item 2.01 Completion of Acquisition or Disposition of Assets.

The following agreements were entered into in connection with the acquisition of Big Tree International Company Limited, a Brunei company, ("BT Brunei"):

The Share Exchange Agreement and Related Transactions

On March 18, 2011 Lins (HK) International Trading Limited ("BT Hong Kong"), was formed in Hong Kong. On April 13, 2011, BT Hong Kong acquired 100% of the equity interest in Big Tree International Company, a Brunei company, ("BT Brunei"). On July 5, 2011 BT Brunei acquired 100% of the equity interest in Shantou Big Tree Toys Co., Ltd. (“BT Shantou”) from its shareholders, Mr. Wei Lin and his wife, Ms. Guihong Zheng, in exchange for its agreement to pay them RMB5,000,000 (approximately $774,881). On October 13, 2011, BT Shantou received its business license as a wholly foreign owned enterprise (“WFOE”) that recognizes BT Brunei as its sole shareholder.

Transax International Limited (“we,” “us,” “our,” "TNSX" or the "Company") was incorporated in the State of Colorado in 1987. The Company currently trades on the OTCBB market under the symbol "TNSX" and the Frankfurt and Berlin Stock Exchanges under the symbol "TX6". Prior to April 4, 2011, the Company, through its subsidiary, Medlink Conectividade em Saude Ltda (“Medlink Conectividade”) was an international provider of information network solutions specifically designed for healthcare providers and health insurance companies. The Company's MedLink Solution enabled the real time automation of routine patient eligibility, verification, authorizations, claims processing and payment functions. On April 4, 2011, TNSX sold 100% of its interest in its operating subsidiary. Since April 4, 2011, TNSX has had no revenues and has been seeking through a merger or similar transaction an operating business.

In anticipation of the Reorganization discussed below, on December 29, 2011 BT Hong Kong entered into an Option Agreement with the former shareholders of BT Shantou (the “Option Agreement") whereby these former shareholders have a five year right to acquire up to 6,500,000 shares of our unregistered common stock (the “Acquisition Shares") from BT Hong Kong, upon the occurrence of the conditions described below. The optionees who are parties to the Option Agreement are the two former shareholders of BT Shantou, including Mr. Wei Lin, who will receive 96% of the total shares, or 6,240,000 shares, and Ms. Guihong Zheng, who will receive 4% of the total shares, or 260,000 shares. Both of these shareholders are senior executives or senior level employees of BT Shantou.

|

Condition

|

Number of Shares

which may be acquired

|

|||

|

Entry by TNSX, BT Brunei and BT Hong Kong into the Share Exchange Agreement, which condition was met on December 30, 2011.

|

2,166,667

|

|||

|

TNSX achieving not less than $30,800,000 in Gross Revenues, as determined under US GAAP for any consecutive 12 months during the period from January 1, 2012 through December 31, 2013 (the " Revenue")..

|

2,166,667

|

|||

|

TNSX achieving not less than $2,400,000 in pre-tax profits, as determined under US GAAP for any consecutive 12 months during the period from January 1, 2012 through December 31, 2013 (the "profit").

|

2,166,666

|

|||

We accounted for the Acquisition Shares as paid in capital as part of the Share Exchange Agreement discussed below and the Option Agreement has no accounting impact on us.

On December 30, 2011, we entered into debt exchange agreements (the “Debt Exchange Agreements”) with the holders of $848,878.39 in our outstanding debt whereby we exchanged 820,016 shares of our Series B convertible preferred stock (the “Series B Convertible Preferred Stock”) for this debt. The following table sets forth the name of the debt holder, amount of debt exchanged and number of shares exchanged:

|

Name of Holder of Debt

|

Amount of Debt to be Exchanged

|

No. of Shares of Series B Convertible Preferred Stock to be Exchanged

|

||||||

|

Stephen Walters

|

$ | 122,163.92 | 118,010 | |||||

|

Carlingford Investments Limited

|

151,309.58 | 146,165 | ||||||

|

CFO Oncall, Inc.

|

37,092.00 | 35,831 | ||||||

|

China Direct Investments, Inc.*

|

538,312.89 | 520,010 | ||||||

|

Total

|

$ | 848,878.39 | 820,016 | |||||

*China Direct Investments, Inc. purchased this debt acquired from Stephen Walters for $75,000.00 pursuant to a Bill of Sale and Assignment dated December 30, 2011.

- 1 -

Each share of the Series B Convertible Preferred Stock is automatically convertible into one share of our common stock, $0.00001 par value after giving effect to an anticipated 1 for 700 reverse stock split of our Common Stock. (the “Reverse Stock Split”) following the date on which we shall have filed Articles of Amendment to our Articles of Incorporation with the Secretary of State of Colorado increasing the number of our authorized shares of our common stock or upon completion of the Reverse Stock Split without any action of the holders of the Series B Convertible Preferred Stock. The number of shares in which the Series B Convertible Preferred Stock are convertible into is not subject to adjustment unless, during the time the shares are outstanding, we were to declare a stock dividend or make other distributions of our common stock or if we were to merge with or transfer our assets to an unrelated entity.

On December 30, 2011, TNSX entered into a Share Exchange Agreement (the “Share Exchange Agreement") among TNSX, BT Brunei and its shareholder BT Hong Kong. Under the Share Exchange Agreement, we exchanged 6,500,000 shares of TNSX's Series C Convertible Stock (the "Series C Preferred Stock") to acquire 100% of the issued and outstanding shares of BT Brunei from its sole shareholder BT Hong Kong. Each share of the Series C Preferred Stock is convertible into one share of our common stock after giving effect to a 1 for 700 reverse stock split (the “Reverse Stock Split”) and will represent approximately 65% of the issued and outstanding shares of TNSX’s common stock, and is hereinafter referred to as the “Exchange”. On December 30, 2011, BT Hong Kong became a shareholder of TNSX. The Share Exchange Agreement was approved by our Board of Directors on December 30, 2011 and no approval of our shareholders was necessary under Colorado law. The transaction will be accounted for as a reverse merger and recapitalization of BT Brunei whereby BT Brunei is considered the acquirer for accounting purposes and the 6,500,000 shares of our Series C Preferred Stock were accounted for as paid in capital of TNSX. As a result of the consummation of the Share Exchange, BT Brunei and BT Shantou are now our wholly-owned subsidiaries.

As compensation for services under the December 30, 2011 consulting agreement we entered into with China Direct Investments, Inc. and its affiliate Capital One Resource Co., Ltd. (collectively, “China Direct”), we issued China Direct Investments 2,542,743 shares of our Series B Convertible Preferred Stock. Each share of the Series B Preferred Stock is convertible into one share of our common stock after giving effect to the Reverse Stock Split. The services China Direct provided to us included an evaluation of several different business opportunities, including the acquisition of BT Brunei and BT Shantou. The Series B Preferred Stock issued to China Direct will be accounted for as an expense of our company prior to the merger and recapitalization with BT Brunei and the resulting effect in net equity was eliminated upon completion of the reverse merger and recapitalization with BT Brunei.

On December 30, 2011, Mr. Wei Lin was appointed as a member and Chairman of our Board of Directors and our Chief Executive Officer, Mr. Jiale Cai as our Chief Financial Officer and Chaojun Lin as was appointed as a member of our Board of Directors in connection with our acquisition of BT Brunei. Chaojun Lin is unrelated to Wei Lin. Mr. Wei Lin and Ms. Zheng are related parties to our company as they are the former shareholders of BT Shantou and officers and directors of BT Shantou and Mr. Lin is an officer and director of our company. Mr. Dore Scott Perler is the sole director of BT Hong Kong and BT Brunei. Also on December 30, 2011, Stephen Walters and Laurie Bewes resigned as directors and all offices they held with our company. On December 30, 2011, Mr. Lin and Ms. Lin appointed Chaoqun Xian as a director of our company.

We plan to seek the approval of a majority of our shareholders in order to amend our articles of incorporation to effectuate the Reverse Stock Split as required under the Colorado Corporate Code. If our shareholders approve the Reverse Stock Split, each seven hundred (700) shares of our common stock issued and outstanding, or held as treasury shares, immediately prior to the effective date of the Reverse Stock Split, will become one (1) share of the same class of our common stock on the effective date of the Reverse Stock Split.

The Reverse Stock Split was one alternative we considered at the time we entered into the Share Exchange Agreement to acquire BT Brunei as part of the financing for this transaction. Based on our capitalization at the time we were negotiating to acquire BT Brunei, we only had approximately 3,921,040 shares (without giving effect the Reverse Stock Split), or 3.9% of our total authorized and unissued common stock available for issuance. These shares were not sufficient to complete the acquisition of BT Brunei. In order to enable us to complete this acquisition on terms acceptable to BT Brunei and pay the fees payable to China Direct due under our consulting agreement with that firm through the issuance of our common stock, we agreed to pay the purchase price for the acquisition, as well as the fees payable to China Direct, through our issuance of convertible preferred stock.

- 2 -

FORM 10 DISCLOSURE

Following the transaction between TNSX and BT Hong Kong, our business and operations are now those of BT Brunei and its wholly-owned subsidiary BT Shantou. The information which appears on our web site is not part of this report.

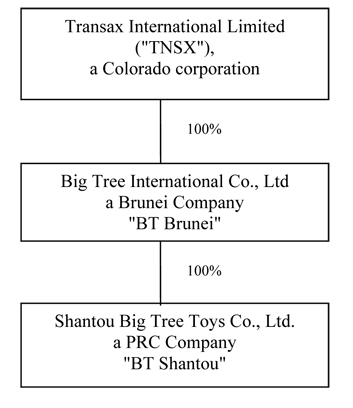

Our Corporate Structure

Shantou Big Tree Toys Co., Ltd. (“BT Shantou”), our principal operating subsidiary in the People’s Republic of China (the “PRC”) was established under the laws of the PRC on November 21, 2003.

Big Tree International Co., Ltd. (“BT Brunei”) was formed in the State of Brunei Darussalam by a Hong Kong company Lins (HK) International Trading Limited (the “BT Hong Kong”) on April 13, 2011.

On July 5, 2011, BT Brunei agreed to acquire 100% of the equity interest of BT Shantou in exchange for payment of RMB 5,000,000 (approximately US$774,881) to the shareholders of BT Shantou. On September 6, 2011, Bureau of Foreign Trade and Economic Cooperation of Shantou approved the acquisition to be effective as of October 13, 2011. BT Shantou received its business license as a wholly foreign owned enterprise ( “WFOE”) that recognizes BT Brunei as its sole shareholder.

Transax International Limited ("TNSX") is a U.S. holding company, incorporated in the State of Colorado in 1987. As a result of the reorganization plan, discussed below, TNSX now owns a 100% equity interest in BT Brunei and its wholly-owned subsidiary BT Shantou.

The chart below illustrates the current corporate structure of TNSX:

- 3 -

The Reorganization

In February 2011, the shareholders of BT Shantou, Mr. Wei Lin and Ms. Guihong Zheng, (the "BT Shantou Shareholders") developed a plan to expand and obtain the benefits of a U.S. public company (the “Reorganization"). A key element of the Reorganization was to enter into a transaction with a public shell company in the United States by which the public shell company, would acquire operations based in the PRC, all in compliance with PRC law.

To accomplish this step, BT Hong Kong formed BT Brunei to acquire BT Shantou. The second step in the Restructuring was for the BT Shantou shareholders to transfer their ownership interest in BT Shantou to BT Brunei. The third step was for BT Brunei and BT Hong Kong to enter into and complete a transaction with a U.S. public reporting company whereby that company would acquire BT Brunei.

To accomplish the first step in the Reorganization plan, BT Hong Kong was formed by Mr. Dore Scott Perler under the laws of Hong Kong on March 18, 2011. On April 13, 2011 BT Hong Kong formed BT Brunei under the laws of the State of Brunei Darussalam. As part of the second step, on July 5, 2011 BT Brunei acquired 100% of the equity interest in BT Shantou from the BT Shantou Shareholders, Mr. Lin and Ms Zheng, at the price of RMB 5,000,000 (approximately US$774,881). On September 6, 2011, the Bureau of Foreign Trade and Economic Cooperation of Shantou approved the acquisition to be effective as of October 13, 2011. BT Shantou received its business license as a wholly foreign owned enterprise (“WFOE”) that recognized BT Brunei as its sole shareholder. BT Shantou then became a wholly-owned subsidiary of BT Brunei. As part of the second step of the Reorganization plan, the former shareholders of BT Shantou, Mr. Lin and Ms. Zheng, entered into an Option Agreement with BT Hong Kong that allows them to purchase for a nominal amount, the shares of the U.S. public reporting company held by BT Hong Kong. Thereafter BT Shantou could undertake the third and final step of the Restructuring to enter into and complete a transaction with a U.S. public reporting company whereby that company would acquire BT Brunei.

The Reorganization and acquisition of BT Shantou was structured to comply with the New M&A Rules discussed on page 12 of this report “Regulation of foreign exchange in certain onshore and offshore transactions.” Under the New M&A Rules, the acquisition of PRC companies by foreign companies that are controlled by PRC citizens who are affiliated with BT Shantou is strictly regulated and requires approval from the Ministry of Commerce, which approval is burdensome to obtain. Such restrictions, however, do not apply to foreign entities which are controlled by foreign persons. These restrictions apply only at a “snapshot in time that occurs at the time PRC companies are acquired by a foreign entity. In our case, this was effective on July 5, 2011 when BT Brunei acquired 100% of the equity interests of BT Shantou from the BT Shantou Shareholders for aggregate consideration of RMB5,000,000 (approximately $774,881) which was the registered and fully paid up capital of BT Shantou. At that time BT Brunei was owned 100% by BT Hong Kong , and BT Hong Kong was owned 100% by Dore Perler, a U.S. citizen, as trustee for Mr. Wei Lin. BT Brunei’s acquisition of BT Shantou was a cross-border transaction governed by and permitted under the New M&A Rules.

Since the New M&A Rules would have prohibited the BT Shantou Shareholders who were PRC citizens from immediately receiving a controlling interest in TNSX in a share exchange as consideration for the sale of their interest in BT Shantou, the BT Shantou Shareholders and BT Hong Kong instead agreed that they would enter into an Option Agreement to grant those BT Shantou Shareholders the right to acquire all of BT Hong Kong’s interest in TNSX. However, there is no prohibition under PRC laws for those former BT Shantou shareholders to acquire an interest in TNSX after the acquisition of BT Brunei and its wholly-owned subsidiary, BT Shantou, were consummated.

As part of the first and second steps of the Reorganization, BT Hong Kong and the BT Shantou Shareholders entered into the Option Agreement. The Option Agreement was succeeded by and developed in connection with the Share Exchange. These agreements taken together provided the BT Shantou Shareholders with a process under which they could purchase for a nominal amount the shares held by BT Hong Kong. The Option Agreement provides for the former BT Shantou Shareholders to obtain legal ownership of TNSX’s shares issued to BT Hong Kong in the Share Exchange. The Option Agreement enables the BT Brunei and BT Shantou Shareholders to purchase 6,500,000 shares (after giving effect to a planned 700 for 1 reverse stock split) of TNSX (the “Option Shares") from BT Hong Kong for a nominal amount per share provided that BT Brunei enters into a Share Exchange Agreement with BT Hong Kong and TNSX meets certain performance targets for the period January 1, 2012 through December 31, 2013.

The Option Agreement reflects the intent and purpose of the parties in undertaking and accomplishing the Restructuring. And, following completion of the third step in the Restructuring, the Option Agreement is the operative agreement for all purposes with respect to the relationship of the BT Brunei and BT Shantou Shareholders to the TNSX.

- 4 -

Under the Option Agreement, BT Hong Kong has legal title to the shares of the Company’s preferred stock issuable under the Share Exchange Agreement and is entitled to elect two directors to TNSX’s Board of Directors. Under the Option Agreement, the BT Shantou Shareholders have the right to obtain the economic benefits of the Option Shares by purchasing them from BT Hong Kong for a nominal amount upon the Company entering into the Share Exchange Agreement and it's attaining the specified financial thresholds in the agreement which trigger their purchase rights.

On December 30, 2011, the goal of the Reorganization was realized when TNSX entered into and completed a share exchange agreement with BT Hong Kong and BT Brunei. At that time TNSX was controlled by its public shareholders who owned approximately 100% of its common stock. Pursuant to the Share Exchange Agreement, TNSX acquired 100% of the equity of BT Brunei from BT Hong Kong in exchange for the issuance of an aggregate of 6,500,000 shares of the Series C Preferred Stock. As a result of this transaction, TNSX is a holding company which, through its direct ownership of BT Brunei and BT Shantou, now has operations based in the PRC.

BUSINESS

The Company’s main business focus is to function as a “one stop shop” for the sourcing, distribution and specialty manufacturing of toys and related products. The Company conducts these operations through our BT Shantou subsidiary. located in Shantou City of Guangdong province, the geographical region well-known for toys manufacturing and exporting in China. Since inception, BT Shantou has provided a number of procurement services for international toy distributors and wholesalers since its inception in 2003, including identifying, evaluating, and engaging local manufacturers for supply of toys as well as to provide original equipment manufacturing ("OEM") services. BT Shantou sources a wide variety of 800,000 toys made of plastic, wood, metal, wool, and electronic materials, primarily targeting children from infants to teenagers. BT Shantou enables customers to view these toys either through its website or at our extensive toy showroom of approximately 21,528 square feet located in Shantou, China. Customers can easily contact our online representatives for inquiry and place orders, or visit the toy showroom and choose from the displayed toy samples provided by our manufacturing partners.

In a move to expand our business in 2009, BT Shantou developed a proprietary construction toy consisting of plastic pieces that can plug-in together to make a wide variety of objects, and which we refer to as our Magic Puzzle (3D). We registered the patents for its utility model and appearance design in Hong Kong and mainland China during 2010 and 2011. On June 1, 2010, BT Shantou entered into a 10-year contract manufacturing agreement with a local toy manufacturer Shantou Xinzhongyang Toy Industrial Co., Ltd. (“Xinzhongyang”) to produce this proprietary toy under the name of Big Tree Educational Magic Puzzle (the “Big Tree Magic Puzzle”). The Big Tree Magic Puzzle are currently promoted and distributed in the Chinese domestic market only through BT Shantou’s online store and at six Dennis Department Store locations. The Chief Executive Officer of BT Shantou, Ms. Guihong Zheng, owns a 16.7% equity interest in Xinzhongyang. Ms. Zheng is the wife of the Chairman of BT Shantou Mr. Wei Lin. Mr. Lin, Chairman of BT Shantou, owns the remaining 83.3% equity interest in Xinzhongyang.

Product Description

BT Shantou sources a wide variety of more than 800,000 toys made of plastic, wood, metal, wool, and electronic materials, primarily targeting at children from infants to teenagers. These toys include, but are not limited to, infant appliances, games, balls, dolls, stuffed toys, transformers, racing track sets, play sets, water toys, and educational toys. The offered toys can be operated by battery, manual power, wire control, remote control, voice control, infrared ray control, and other applications.

Our proprietary Big Tree Magic Puzzle (3D) cater to consumers ranging from minor children to adults. Big Tree Magic Puzzle (3D) are composed of 18 assembly parts made of ABS environmental-friendly plastic materials in multiple shapes including, but not limited to, squares, triangles, right-angled connectors, etc. The Magic Puzzle adopt an innovative plug-in design that goes beyond the traditional planar and linear plug-in to achieve the transformations among the common and unconventional shapes such as diamond, sphere and dynamic warping, etc. Each assembly part offers 10 color choices that encourage children to learn colors and shapes in an interesting and attractive playing environment.

- 5 -

Patents and Trademarks

We have registered the design of our proprietary Big Tree Magic Puzzle (3D Blocks) with and were granted an eight year patent by the Intellectual Property Department of the Hong Kong Special Administrative Region in 2010. We have also obtained the patents for utility model and design from the State Intellectual Property Office of the People’s Republic of China (the “SIPO”) during 2010 and 2011. Based on our patent registrations, and applicable Hong Kong and PRC laws, we have the exclusive right on the proprietary Big Tree Magic Puzzle (3D Blocks) in Hong Kong and mainland China, and can prevent other competitors from making, using, selling, or distributing the patented invention without our permission during the term. The registration information of the patents is listed in the table below:

|

Patent

|

Title of Invention

|

Granting Agency

|

Term

|

Patent No.

|

Region

|

|||

|

Short-term Patent

|

Assembled Toy Plug-in Blocks

|

Patents Registry of Intellectual Property Department

|

Eight years starting on December 18, 2009

|

HK1133784

|

Hong Kong

|

|||

|

Registration of Design

|

Toy bricks

|

Design Registry Intellectual Property Department

|

Five years starting on December 16, 2009

|

0902157.3 |

Hong Kong

|

|||

|

Utility Model

|

Assembled Toy Plug-in bricks

|

SIPO

|

Ten years starting on December 1, 2009

|

ZL. 2009 2 0292981.6

|

PRC

|

|||

|

Registration of Design I

|

Toy bricks

|

SIPO

|

Ten years starting on January 28, 2010

|

ZL 2010 3 0103327.4

|

PRC

|

|||

|

Registration of Design II

|

Toy bricks

|

SIPO

|

Ten years starting on December 12, 2009

|

ZL 2009 3 0680023.1

|

PRC

|

|||

In addition, we sell some of our products under two brand names and registered trademarks listed in the table below. Our trademarks have been registered with the Trademark Office of the State Administration for Industry and Commerce of the People’s Republic of China (the “SAIC”). Based on our trademark registration and applicable PRC laws, we have the exclusive right to use a trademark for products and services for which the trademark has been registered with the SAIC. A trademark registration is valid for 10 years commencing from the approval date.

|

Brand Name

|

Trademark

|

Class/Products

|

Validity Term

|

SAIC Registration No.

|

||||

|

Big Tree Carnival

|

大树嘉年华

Big Tree Carnival

|

28/game stations, magician gears, toys, chesses, sport balls, fitness apparatus, exercise instruments, swimming pools for entertainment purpose, roller skates, adornments (except for lights and candies) for Christmas tree

|

From September 14, 2010 to September 13, 2020

|

7012858 | ||||

|

Bigtree

|

|

28/game stations, magician gears, toys, chesses, sport balls, fitness apparatus, exercise instruments, swimming pools for entertainment purpose, roller skates, adornments (except for lights and candies) for Christmas tree

|

From December 14, 2010 to December 13, 2020

|

6987896 | ||||

- 6 -

Certifications

For our sourcing business, BT Shantou requires all of its manufacturer partners to provide Export Toy Quality Licenses as mandated by the General Administration of Quality Supervision, Inspection and Quarantine of the People’s Republic of China (the “AQSIQ”) and Certification and Accreditation Administration of the People’s Republic of China (the “CNCA”). In cases where international distributors demand additional product testing, facility auditing, and/or quality certifications, we would evaluate and identify the qualified local manufacturers to source goods in compliance with the desired standards set by the distributors.

We have quality control professionals to provide services for our customers. We strictly comply with quality control regulations for preproduction, mass production, and final inspection. On the timely manner, we issue quality control report and keep the pictures for process control and loading. The service package covers production supervision, quality control, shipment, and after-sale services.

Our proprietary Big Tree Magic Puzzle 3D ("Block") are manufactured under GB6675-2003 National Safety Technical Code for Toys targeting children under 14, a Chinese national product standard set by Standardization Administration of China (the “SAC”) which define and establish toy safety understanding and implement technical specifications for the toy manufacturing industry. On January 13, 2010, we received China Compulsory Product Certification for Big Tree Magic Puzzle 3D ("Block") from the Certification Center of Light Industry Council (the “CCLC”), an independent certification institution in China. The certification is valid until December 1, 2014.

Customers

The customers for our toy sourcing business consist of distributors, trading companies, and wholesalers primarily located in mainland China, Hong Kong, Europe, South America, and Asia. From a geographic perspective, outside of Asia, Britain and Mexico represented 14% and 10% of our total revenues, respectively during the first nine months of 2011. During the first nine months of 2011, our top five customers represented approximately 37% of our total revenues, and one of those customers, Pacific Toys (HK) Limited represented 10% of our total revenues. The products sourced to these top five customers are primarily battery-operated and non-battery operated plastic toys.

Our Big Tree Magic Puzzle (3D) are currently marketed directly to consumers in China through our sales locations in Dennis Department Stores and our online store at Taobao Mall (www. Tmall.com), the largest B2C online retailing platform in China. Sales from this segment represent less than 1% of our total revenue during the first nine months of 2011. Management intends to expand the number of sales locations by opening or acquiring additional stores in China in 2012.

Sales and Marketing

In our toy sourcing and distribution business, we market primarily through our company website (www.bigtreetoys.com) and our 21,500 square feet toy showroom in Shantou, China. Customers can either browse the lines of toys on the website and contact our online representatives for inquiry and place orders, or visit the toy showroom and choose from the displayed toy samples provided by our manufacturing partners. We also market as well as provide customer support actively seek and serve customers who reach us through company website and/or facility visit to ask for OEM production sourcing. We have 26 full-time salesmen working in the Shantou headquarters dedicated to the distribution business. They are compensated based on salary and performance bonus at management’s discretion.

We market our Big Tree Magic Puzzle (3D) through current sales locations in six Dennis Department Store locations in Henan province in China. On January 1, 2011 we entered the one-year Joint Sales Contract with Dennis Department Stores that allows us to have a 20-square-meter sale counter dedicated to the sale of Big Tree Magic Puzzle (3D) in each of its six designated stores in Henan. Dennis charges us a certain percentage of sales as a commission in addition to a monthly management fee of RMB 200 (or approximately $32) pursuant to the terms of the Joint Sales Contract. We manage the sale counters for the display, pricing, quality warranty, and customer services. We currently have nine sales employees working at these locations.

In August 2011, we entered into a B2C Service Agreement with Taobao (China) Software Co., Ltd. and Zhejiang Taobao Network Co, Limited, the affiliates of Alibaba Group, the leading e-commerce company in China, to open a retailer account at Taobao Mall (www.tmall.com), the largest B2C online retailing platform in China. Our retailer account operating under the name of Big Tree Toys Flagship Store (the “Taobao store”) is dedicated to the marketing and sale of our Big Tree Magic Puzzle (3D). We currently have two full time employees servicing the Taobao store.

- 7 -

For the first nine months of 2011, sales of Big Tree Magic Puzzle (3D) represented approximately 0.3% of our total revenues.

Suppliers

We source our customer orders from local qualified manufacturers and trading companies. We also monitor the quality control process at the manufacturers’ facilities and inspect final products upon delivery. The products are then shipped to our warehouse where we pack customer orders into containers for shipping. For the first nine months of 2011, our top four suppliers represented 89.7% of our total purchase. During the period, our biggest supplier Universal Toys Trading (Hong Kong) Limited (the “Universal Toys”) accounted for approximately 83.3% of BT Shantou’s total purchases. The other three suppliers, all of whom are unrelated parties, are all local toy manufacturers and each of them represented less than 10% of our total purchase.

The sole shareholder of Universal Toys is Mr. Xiaodong Ou, brother-in-law of the Chairman of BT Shantou, Mr. Wei Lin.

On June 1, 2010 BT Shantou entered into a 10-year contract manufacturing agreement with Xinzhongyang to produce the Big Tree Magic Puzzle (3D). Pursuant to the agreement, BT Shantou is responsible for product research and development and providing the designs and technical support to Xinzhongyang for production. BT Shantou has contracted to place a monthly order on the fifth day of each month, and Xinzhongyang is required to confirm the order within three business days upon the receipt of the order and begin delivery of the products at Xinzhongyang’s facility on the 15th day after the receipt of the order. For the first nine months of 2011, the orders from Xinzhongyang represented about 0.6% of our total purchases. In addition to its production requirements, BT Shantou has permitted Xinzhongyang to sell the Big Tree Magic Puzzle (3D) to third parties.

.

Facility

BT Shantou leases approximately 16,146 square feet of office space from Yunjia Fashion Clothing Co., Ltd. The office space is located at South Part No.1-101, Nanshe Area, Pengnan Industrial Park on North Yingbin Road in Waisha Town of Longhu District in Shantou, Guangdong, China, 515023. The annual rent is RMB 72,000 (or approximately $11,430) due on December 31, of each calendar year. Mr. Wei Lin and Ms. Guihong Zheng respectively own 80% and 20% of equity interest in Yunjia.

Yunjia Fashion Clothing Co., Ltd. has also granted BT Shantou free use of 21,500 square feet of space in the second and third floor of that same office building to house BT Shantou toy showroom.

Quality Control Process

Our quality control process includes identifying and evaluating qualified manufacturers for specific orders. We ensure that each manufacturer meets the qualifications and required industry standards set by the PRC government. Once the manufacturers are verified, we monitor the quality control during the purchase of raw materials and production process at the manufacturers’ facilities. We thoroughly examine the quality and quantity of the final product upon delivery to our warehouse prior to shipping. The orders are then packed into containers and shipped to our customers.

Research and Development (R&D)

BT Shantou R&D department focuses on developing children’s do-it-yourself educational toys that encourage skill dexterity and improve creative thinking and learning in an interesting and safe play set. We have 6 full-time R&D engineers dedicated to product hardware and packaging design. Hardware designers are responsible for the research and design of the product structure and configuration. The Packaging designers focus on packaging design and making product profile charts. Currently, our R&D department has developed over 10 series of Big Tree Magic Puzzle (3D) including about 200 product items.

- 8 -

Industry

According to 2010-2011Global and Chinese Toy Industry Research Report, the global toys sales in 2010 was approximately US$83.3billion, an increase of 4.7% from 2009. In 2010, Asian toy market grew by 9.2% and became the world's second largest toy market trailing North America while Europe was in third place. The United States is the world’s largest toy consumption country with sales of $ 21.9 billion followed by Japan, China, Britain and France.

Toy Industry Association (TIA), the non-profit trade association for producers and importers of toys and youth entertainment products sold in North America, disclosed in its research that the global financial crisis had limited impact on total toys revenues globally, except in Britain due to the closure of a major retailers in that country. Consumers continue to look for “value” of their toys purchases; however, the demand for toys has not yet shifted to less expensive toys since most parents have opted to slash other family expenditures in order to satisfy their children's preferences.

Environmental concerns and toy safety have becoming key issues in customers' purchases. Europe and United States both have updated their toys quality and safety standards, which have inevitably caused the increase of costs on production, quality control, and certification and have caused concerns to their major importers, especially to China as the major sourcing country for low-priced toys. Consequently, those standards and policy updates may potentially impact the world toy market, including pricing and availability for low-priced products.

Despite the uncertainty brought by these policy changes, the world’s toy market is estimated to continue expanding in the next few years with a substantial demand expected to occur in Asian countries, especially in China. According to China Social Investigation Firm (SSIC), China has 400 million infants and children below 14-year-old with one third residing in urban areas and two-thirds in rural areas. Currently, China's urban per capita annual consumption of children's toys is under $9, while rural per capita consumption of toys is less than $5. It is relatively low compared to United States where the per capita annual consumption of toys is around $280, and $288 in Japan, $361 in Britain, and even $51in Brazil. The significant gap between market capacity and current sale scale in China has created an expansion potential of China’s toy market.

China is the world’s largest toy manufacturer and exporter with more than 20,000 toy companies that produce and distribute two-thirds of the global toys' demand. China's toy manufacturing is highly regionally concentrated with most output produced in the developed eastern coastal areas of China. For instance, the five provinces of Guangdong, Jiangsu, Zhejiang, Shandong and Fujian, as well as Shanghai, have collectively accounted for 95% of toy sales in China. Guangdong province, the most important Chinese toy production and export base, represents 70% of toy sales by China.

China toy industry is historically export-oriented. More than 70% of the toys produced in China are for exports. North America and Europe are top two export destinations of toys made in China. The export orientation has made the industry susceptible to the fluctuations and uncertainty of international trading conditions, currency exchange rates, and global financial crisis, especially in North America and Europe. In addition, due to the inflation and continuous appreciation of RMB currency in the past few years, the toy manufacturers are facing the challenge of soaring costs of raw materials and stagnant sale prices of final products at the expense of profit margin.

Chinese toy industry as a whole is undergoing the transition from current export-oriented, low tech, few branding and OEM-oriented manufacturing to the more sustainable development model featured with significant growth of domestic sales, high tech, better quality, and more offerings of proprietary brands and products.

Our Competitive Advantage

We believe our company has several key competitive advantages in our sourcing and distribution business as well as in the marketing of our Big Tree Magic Puzzle (3D).

- 9 -

|

|

1.

|

Strategic location in Shantou City of Guangdong Province

|

BT Shantou is located in Shantou City of Guangdong Province, the geographical region well known for toy manufacturing and exporting in China. Based on decades of development in the toy manufacturing and trading industry, this region has established a comprehensive local industrial cluster composed of toy manufacturers, trading companies, R&D professionals, quality certifications, shipping logistics and related distribution service providers. Distributors and direct customers are drawn to this region to procure toys and gifts related items, which provides us with a steady flow of customers. In addition, the easy accessibility and ample choices of qualified manufacturers and professional service providers allow us to find attractive distribution opportunities for our customers, and thus maximize our sales revenue stream.

|

|

2.

|

Well established network of suppliers and customers in the distribution business

|

BT Shantou has been in the sourcing and distribution services business since 2003. Over that time, BT Shantou has established strong business relationships with major suppliers and customers in the toy industry. The mutual trust built has enabled us to enhance our reputation and increase our sales with a stable customer base.

|

|

3.

|

Proprietary products and trademarks

|

We have differentiated ourselves from other sourcing and distribution companies by developing proprietary products featured by our Big Tree Magic Puzzle (3D). Because the patents and trademarks were registered in Hong Kong and mainland China, we have the exclusive rights to our distinctive Big Tree Magic Puzzle (3D) and trademarks. This is critical component in developing our market for the Big Tree Magic Puzzle (3D) brand in the toy industry, and will help us build new distribution channels in the Chinese domestic market.

|

|

4.

|

Comprehensive marketing and distribution strategies

|

Through our two pronged business strategy, our company is building a diversified revenue base consisting of toy sourcing and distribution and direct to consume marketing of our own line of proprietary Big Tree Magic Puzzle (3D). We believe this will further differentiate our company from our competitors who typically rely solely on distribution. Additionally, because we provide customers with a wide variety of toys from different manufacturers, we are able to combine orders produced from different manufacturers to ship in one container and pass that savings through to our customers.

Growth Strategy

Our growth strategies include the following:

|

|

1.

|

Build satellite sales offices and branches in major target countries and regions. We intend to open a satellite office in the United States to expand our customer base in North and South America. We also will use this office as a hub for potential products outside of China to expand our distribution offerings. Additionally, we intend to open sales offices in several major cities of China to further grow our customer base.

|

|

|

2.

|

Acquire major regional distributors. For our proprietary products, we intend to grow through opening sales locations or acquiring distributors with sales locations or stores in high traffic areas such as shopping malls where customers can try our products and see just how fun, unique and educational they are for children. We intend to prominently feature our Big Tree branding and proprietary products like Big Tree Magic Puzzle (3D).

|

|

|

3.

|

Additional acquisitions. We believe that as our business grows there are certain strategic acquisitions that would enhance the value of our company and provide for more streamlined operations. First, we intend to acquire our current landlord, Yunjia, including its commercial real estate property, our current office building, toys showroom, and production space to expand our business services, including the addition of more showrooms and an OEM procurement center. Second, when sales of our Big Tree Magic Puzzle (3D) begin to build to a significant and sustainable level, we believe the acquisition of our contract manufacturer, Xinzhongyang, will enable us to have complete control over our production process to ensure quality and timeliness of product delivery.

|

Competition

The Chinese toy industry is highly competitive and regionally concentrated. There are numerous toy manufacturers, trading companies, and distributors scattered throughout the PRC. We face intense competition from existing competitors and new market entrants.

- 10 -

Big Tree has transformed itself from being a small privately owned trading enterprise that competed on pricing into a sophisticated sourcing and distribution company, providing “one-stop-shop” services for distributors and wholesalers globally. Its development of proprietary product further sets themselves apart from competition. Big Tree intends to build its reputation and brand recognition and compete primarily based on product quality, brand recognition, reputation, extensive sourcing distribution capability.

GOVERNMENT REGULATION

General Regulatory Environment

We operate our business in the PRC under a legal regime consisting of the State Council, which is the highest authority of the executive branch of the PRC central government, and several ministries and agencies under its authority, including the State Administration for Industry and Commerce, or SAIC, the Ministry of Commerce, or MOFCOM, the State Administration of Foreign Exchange, or SAFE, and their respective authorized local counterparts.

Toy Safety Regulations

Our products are subject to various laws, including China's National Safety Technical Code for Toys - GB 6657-2003 and Safety of Electric Toys – GB19865-2005. These laws establish mandatory safety standards for the mechanical and physical safety, toxicity and flammability of toys and electronic toys. In addition, our suppliers are required to obtain Export Toy Quality Licenses as mandated by General Administration of Quality Supervision, Inspection and Quarantine of the People’s Republic of China (the “AQSIQ”) and Certification and Accreditation Administration of the People’s Republic of China (the “CNCA”). Any failure to comply with these requirements could result in product liability claims, loss of sales, diversion of resources, damage to our reputation, increased warranty costs and removal of our products from the market. Similar laws exist in some states and cities and in various international markets. We maintain a quality control program designed to ensure compliance with all applicable laws.

BT Shantou believes its operations in the PRC comply with the current toy safety and export laws. BT Shantou is not subject to any admonition, penalty, investigations or inquiries imposed by government regulators, nor is it subject to any claims or legal proceedings to which it was named as a defendant for violation of any toy safety or export laws.

Regulation of Foreign Exchange

The PRC government imposes restrictions on the convertibility of the RMB and on the collection and use of foreign currency by PRC entities. Under current regulations, the RMB is convertible for current account transactions, which include dividend distributions, and the import and export of goods and services. Conversion of RMB into foreign currency and foreign currency into RMB for capital account transactions, such as direct investment, portfolio investment and loans, however, is still generally subject to the prior approval of or registration with SAFE.

Under current PRC regulations, foreign-invested enterprises such as our PRC subsidiaries are required to apply to SAFE for a Foreign Exchange Registration Certificate for Foreign-Invested Enterprise. With such a certificate (which is subject to review and renewal by SAFE on an annual basis), a foreign-invested enterprise may open foreign exchange bank accounts at banks authorized to conduct foreign exchange business by SAFE and may buy, sell and remit foreign exchange through such banks, subject to documentation and approval requirements. Foreign-invested enterprises are required to open and maintain separate foreign exchange accounts for capital account transactions and current account transactions. In addition, there are restrictions on the amount of foreign currency that foreign-invested enterprises may retain in such accounts.

- 11 -

Regulation of foreign exchange in certain onshore and offshore transaction

In October 2005, SAFE issued the Notice on Issues Relating to the Administration of Foreign Exchange in Fund-Raising and Return Investment Activities of Domestic Residents Conducted via Offshore Special Purpose Companies, or SAFE Circular 75, which became effective as of November 1, 2005. According to SAFE Circular 75, prior to establishing or assuming control of an offshore company for the purpose of financing that offshore company with assets or equity interests in an onshore enterprise in the PRC, each PRC resident, whether a natural or legal person, must complete certain overseas investment foreign exchange registration procedures with the relevant local SAFE branch. An amendment to the registration with the local SAFE branch is required to be filed by any PRC resident that directly or indirectly holds interests in that offshore company upon either (i) the injection of equity interests or assets of an onshore enterprise to the offshore company or (ii) the completion of any overseas fund-raising by such offshore company. An amendment to the registration with the local SAFE branch is also required to be filed by such PRC resident when there is any material change involving a change in the capital of the offshore company, such as (i) an increase or decrease in its capital, (ii) a transfer or swap of shares, (iii) a merger or division, (iv) a long-term equity or debt investment or (v) the creation of any security interests.

SAFE Circular 75 applies retroactively. As a result, PRC residents who established or acquired control of offshore companies that made onshore investments in the PRC in the past were required to complete the relevant overseas investment foreign exchange registration procedures by March 31, 2006. Under SAFE Circular 75, failure to comply with the registration procedures may result in restrictions on the relevant onshore entity, including restrictions on the payment of dividends and other distributions to its offshore parent or affiliate and restrictions on the capital inflow from the offshore entity, and may also subject relevant PRC residents to penalties under the PRC foreign exchange administration regulations.

As a U.S. company, we are considered a foreign entity in the PRC. If we purchase the assets or equity interests of a PRC company owned by PRC residents in exchange for our equity interests, such PRC residents will be subject to the registration procedures described in SAFE Circular 75. Moreover, PRC residents who are beneficial holders of our shares are required to register with SAFE in connection with their investment in us.

In addition, on August 8, 2006, six PRC regulatory authorities, including the Ministry of Commerce, the State Assets Supervision and Administration Commission, the State Administration for Taxation, the State Administration for Industry and Commerce, the CSRC and SAFE, jointly issued the Regulations on Mergers and Acquisitions of Domestic Enterprises by Foreign Investors, or the New M&A Rules, which became effective on September 8, 2006. This regulation, among other things, includes provisions that purport to require that an offshore special purpose vehicle formed for purposes of overseas listing of equity interests in PRC companies and controlled directly or indirectly by PRC companies or individuals obtain the approval of the CSRC prior to the listing and trading of such special purpose vehicle’s securities on an overseas stock exchange. On September 21, 2006, the CSRC published on its official website procedures regarding its approval of overseas listings by special purpose vehicles. The CSRC approval procedures require the filing of a number of documents with the CSRC and it would take several months to complete the approval process.

Regulations on dividend distribution

The principal regulations governing dividend distributions by wholly foreign-owned enterprises and Sino-foreign equity joint ventures include:

|

·

|

Wholly Foreign-Owned Enterprise Law (1986), as amended;

|

|

|

·

|

Wholly Foreign-Owned Enterprise Law Implementing Rules (1990), as amended;

|

|

|

·

|

Sino-foreign Equity Joint Venture Enterprise Law (1979), as amended; and

|

|

|

·

|

Sino-foreign Equity Joint Venture Enterprise Law Implementing Rules (1983), as amended.

|

Under these regulations, wholly foreign-owned enterprises and Sino-foreign equity joint ventures in the PRC may pay dividends only out of their accumulated profits, if any, determined in accordance with PRC accounting standards and regulations. Additionally, these foreign-invested enterprises are required to set aside certain amounts of their accumulated profits each year, if any, to fund certain reserve funds. These reserves are not distributable as cash dividends.

- 12 -

Regulation of overseas listings

On August 8, 2006, six PRC regulatory agencies, including the China Securities Regulatory Commission (“CSRC"), promulgated the Regulation on Mergers and Acquisitions of Domestic Companies by Foreign Investors, which became effective on September 8, 2006 and was amended by the MOFCOM on June 22, 2009. This regulation, among other things, has certain provisions that require offshore special purpose vehicles, or SPVs, formed for the purpose of acquiring PRC domestic companies and controlled by PRC individuals, to obtain the approval of the CSRC prior to listing their securities on an overseas stock exchange. On September 21, 2006, the CSRC published on its official website a notice specifying the documents and materials that are required to be submitted for obtaining CSRC approval.

There remains some uncertainty as to how this regulation will be interpreted or implemented in the context of an overseas offering. If the CSRC or another PRC regulatory agency subsequently determines that the CSRC’s approval is required in connection with our acquisition of Shaoxing High School, we may face sanctions by the CSRC or another PRC regulatory agency. If this happens, these regulatory agencies may impose fines and penalties on our operations in the PRC, limit our operating privileges in the PRC, restrict or prohibit payment or remittance of dividends by our PRC subsidiaries to us or take other actions that could have a material adverse effect on our business, financial condition, results of operations, reputation and prospects, as well as the trading price of our common stock.

SAFE regulations on employee share options

On March 28, 2007, SAFE promulgated the Application Procedures of Foreign Exchange Administration for Domestic Individuals Participating in Employee Share Holding Plan or Share Option Plan of Overseas Listed Company, or the Share Option Rule. The purpose of the Share Option Rule is to regulate foreign exchange administration of PRC domestic individuals who participate in employee share holding plans and share option plans of overseas listed companies. According to the Share Option Rule, if a PRC domestic individual participates in any employee share holding plan or share option plan of an overseas listed company, a PRC domestic agent or the PRC subsidiary of such overseas listed company is required to, among others things, file, on behalf of such individual, an application with SAFE to obtain approval for an annual quota with respect to the purchase of foreign exchange in connection with share holding or share option exercises as PRC domestic individuals may not directly use overseas funds to purchase shares or exercise share options. Concurrently with the filing of such application with SAFE, the PRC subsidiary shall obtain approval from SAFE to open a special foreign exchange account at a PRC domestic bank to hold the funds required in connection with the share purchase or option exercise, any returned principal or profits from sales of shares, any dividends issued on the shares and any other income or expenditures approved by SAFE. The PRC subsidiary is also required to obtain approval from SAFE to open an overseas special foreign exchange account at an overseas bank to hold overseas funds used in connection with any share purchase or option exercise. All proceeds obtained by PRC domestic individuals from sales of shares shall be remitted back to China after relevant overseas expenses are deducted. The foreign exchange proceeds from these sales can be converted into RMB or transferred to such individuals foreign exchange savings account after the proceeds have been remitted back to the special foreign exchange account opened at the PRC domestic bank. If the share option is exercised in a cashless exercise, the PRC domestic individuals are required to remit the proceeds to the special foreign exchange account.

We do not currently have any share option plans. Although further clarification is required as to how the Share Option Rule will be interpreted or implemented, we believe that if we were to adopt such a plan, we and our PRC employees who have been granted share options will be subject to the Share Option Rule when our company becomes an overseas listed company. If we or our PRC employees fail to comply with the Share Option Rule, we and/or our PRC employees may face sanctions imposed by foreign exchange authority or any other PRC government authorities.

In addition, the State Administration of Taxation has recently issued circulars concerning employee share options. Under these circulars, our employees working in the PRC who exercise share options will be subject to PRC individual income tax. Our PRC subsidiaries have obligations to file documents relating to employee share options with relevant tax authorities and withhold individual income taxes of those employees who exercise their share options. If our employees fail to pay and we fail to withhold their income taxes, we may face sanctions imposed by tax authorities or other PRC government authorities.

Employees

As of December 22, 2011, we had approximately 87 full time employees in the PRC.

- 13 -

DIRECTORS AND EXECUTIVE OFFICERS

In connection with the change of control of the Company described in Item 5.01 of this Current Report on Form 8-K, we have appointed the following individuals to serve as our executive officers and directors:

|

Name

|

Age

|

Positions

|

|

Wei Lin

|

40

|

Chief Executive Officer and Chairman of the Board of Directors

|

|

Chaojun Lin

|

48

|

Director

|

|

Chaoqun Xian

|

29

|

Director

|

|

Jiale Cai

|

33

|

Chief Financial Officer

|

Wei Lin is the founder and the Chairman of BT Shantou since its formation in 2003 and our Chief Executive Officer and Chairman of the Board since December 30, 2011. Mr. Lin has extensive experience with small businesses and in corporate management. Mr. Lin was the founder and president of Guangtong Network Calling Station, former CEO of Jieyang Toys Complex Group Co., Ltd, and former Chairman of Beijing Junze Cultural Communications Co., Ltd. and Shanghai Xikang Electronic Technology Development Co., Ltd. Mr. Lin graduated with an Associates Degree in Economic Management from Central South University, China (formerly known as Central South Industrial University) in 1996.

Chaojun Lin is the Deputy General Manager of BT Shantou and a member of our Board of Directors since December 30, 2011. Mr. Lin was the former deputy principal of Chenghai Tantou School. Since 1995, he was the former deputy general manager of Guangtong Network Calling Station and the principal of Guangtong Computer Training School. Mr. Lin is experienced in managing operations. Mr. Lin graduated from Chenghai Normal School, China in1985.

Chaoqun Xian, is current International Trading Director of BT Shantou and a member of our Board of Directors since December 30, 2011. Ms. Xian is experienced in marketing and team management. In January 2006, Ms. Xian joined BT Shantou and has successfully established a stable and productive sales team and a large base of customers that we expect to lead to future growth in sales. Ms. Xian graduated from Xiamen University, China with a Bachelor’s Degree in Automation in 2005.

Jiale Cai has been the Accounting Director of BT Shantou since July 2011 and our Chief Financial Officer since December 30, 2011. Mr. Cai has extensive experience in management accounting and was also accounting manager and director for state-owned, private, and foreign-owned enterprises including Guangdong Kinde Network & Technology Co., Ltd. Fukutomi (Shantou) Industrial Limited from, Shantou Longhu Dongnan Industrial Co., Ltd. and Shantou Zhongmin Group Corp. Mr. Cai obtained an Associate Degree in Accounting through the professional continuous education program from Guangdong Jinan University, China in 2009.

Key Employees

We employ certain individuals who, while not executive officers, make significant contributions to our business and operations and hold various positions within our subsidiaries.

Dore Scott Perler (age 51) was appointed as the Assistant Secretary of our company on December 30, 2011. Based in Florida, Mr. Perler consults with BT Shantou for the marketing and business development in North and South America. Mr. Perler brings over 25 years experience in management, sales, marketing, and technology development. Mr. Perler, since 2007 has been the CEO of Pearl Group Advisors, an international representative and management firm. Mr. Perler also held the position of CEO and President of China America Holdings, Inc. and Sense Holdings, Inc. until January 2009, a biometric technology developer providing security solutions to corporate, government, and private sector clients. From 1996 to 1998, Mr. Perler was vice president of sales for Ansel Communications. From 1993 to 1996, Mr. Perler was the vice president of sales and marketing for LatinRep Associates/ LatinChannels, Inc. Mr. Perler helped develop the company’s organizational infrastructure, designed business processes and operating procedures, planned and executed strategies, recruited and managed professional staff, and created and implemented marketing and business development campaigns. Mr. Perler grew up in New York and has also been a contributing speaker and columnist in the fields of biometric technology and explosives detection.

- 14 -

Our History

TRANSAX INTERNATIONAL LIMITED ("TSNX")

Transax International Limited ("TNSX" or the "Company") was incorporated in the State of Colorado in 1987. The Company currently trades on the OTCQB market under the symbol "TNSX" and the Frankfurt and Berlin Stock Exchanges under the symbol "TX6". Prior to April 4, 2011, the Company, through its subsidiary, Medlink Conectividade em Saude Ltda (“Medlink Conectividade”) was an international provider of information network solutions specifically designed for healthcare providers and health insurance companies. The Company's MedLink Solution enabled the real time automation of routine patient eligibility, verification, authorizations, claims processing and payment functions.

On March 26, 2008, we executed a stock purchase and option agreement (the “Agreement”) with Engetech, Inc., a Turks & Caicos corporation (the “Buyer”) controlled and owned 20% by Americo de Castro, director and President of Medlink Conectividade, and 80% by Flavio Gonzalez Duarte or assignees. In accordance with the terms and provisions of the Agreement, we sold to the Buyer 45% of the total issued and outstanding stock of our wholly-owned subsidiary, Transax Limited, which owns one hundred percent of the total issued and outstanding shares of: (i) Medlink Conectividade, and (ii) Medlink Technologies, Inc., (“Medlink”) a Mauritius corporation. However, the Buyer defaulted on payments and on November 24, 2010, pursuant to an agreement, the Buyer returned the 45 shares of Transax Limited held in escrow and forfeited its initial deposit of $937,700 in full and complete satisfaction of any amounts due to us.

On April 4, 2011, pursuant to a Quota Purchase and Sale Agreement amongst Transax Limited, QC Holding I Participacoes S.A., a corporation organized under the laws of Brazil (“QC Holding”), and Medlink Conectividade, we sold 100% of our interest in Medlink Conectividade. As such all related operations have been retroactively presented as discontinued operations for all periods presented and related operating assets and liabilities have been classified as assets from discontinued operations and liabilities from discontinued operations, respectively for all periods presented.

In accordance with the terms and provisions of the Agreement: (i) QC Holding acquired the equity interest of Medlink Conectividade resulting in the sale of our operating subsidiary. As consideration for the purchase and sale of 100% of our interest in Medlink Conectividade, QC paid to us approximately $298,000; (ii) QC Holding agreed to assume all debt and other contingent liabilities of Medlink Conectividade, which as of December 31, 2010 was approximately $7,800,000 including $5,300,000 in past taxes and social security contributions due to the Brazil Government; and (iii) QC contributed to Medlink Conectividade approximately $1,402,000 which will be used to repay us approximately $1,402,000 in loans and interest due to our subsidiary, Transax Limited, which owned 100% of Medlink Conectividade. In accordance with the further terms and provisions of the Agreement, we retained our relevant technology assets consisting of software code and the Postilion network processor software to carry on business outside of Brazil.

Our board of directors considered the sale of Medlink Conectividade to be in the best interests of the Company and its shareholders. Factors considered included (i) the high levels of debt in Medlink Conectividade, (ii) its continuing net operating losses and (iii) reports from Brazil counsel to Medlink Conectividade indicating that immediate tax and social security payments were due to the Brazilian Government of over $1,000,000.

Subsequent to April 4, 2011, we have had no revenues and limited operations consisting of financial reporting, general administration, and seeking new business opportunities with a merger candidate.

On December 30, 2011 we acquired BT Brunei and BT Shantou as discussed above under Item 1.01 of this Current Report.

RISK FACTORS

You should carefully consider the risks described below and all other information contained in this report before making an investment decision. If any of the following risks actually occur, our business, financial condition and results of operations could be materially and adversely affected. In that event, the trading price of our common stock could decline, and you may lose part or all of your investment. This report also contains forward-looking information that involves risks and uncertainties. Our actual results could differ materially from those anticipated in these forward-looking statements as a result of many factors, including the risks described below and elsewhere in this report.

- 15 -

Risks related to our business and industry

Risk Factors Relating to Our Business

Our inability to extend our existing products as consumer preferences evolve, and to develop, introduce and gain customer acceptance of new products and product, may materially and adversely impact our business, financial condition and results of operations.

Our business and operating results depend largely upon the appeal of our products. Our continued success in the toy industry will depend on our ability to extend our existing core products and product lines as consumer preferences evolve, and to develop, introduce and gain customer acceptance of new products. Several trends in recent years have presented challenges for the toy industry, including:

|

·

|

The phenomenon of children outgrowing toys at younger ages, particularly in favor of interactive and high technology products;

|

|

|

·

|

Increasing use of technology;

|

|

|

·

|

Shorter life cycles for individual products; and

|

|

|

·

|

Higher consumer expectations for product quality, functionality and value.

|

We cannot assure you that:

|

·

|

our current products will continue to be popular with consumers;

|

|

|

·

|

the product lines or products that we introduce will achieve any significant degree of market acceptance; or

|

|

|

·

|

the life cycles of our products will be sufficient to permit us to recover design, manufacturing, marketing and other costs associated with those products.

|

Our failure to achieve any or all of the foregoing benchmarks may cause the infrastructure of our operations to fail, thereby adversely affecting our business, financial condition and results of operations.

The toy industry is highly competitive and our inability to compete effectively may materially and adversely impact our business, financial condition and results of operations.

The toy industry is highly competitive. Globally, certain of our competitors have financial and strategic advantages over us, including:

|

·

|

greater financial resources;

|

|

|

·

|

larger sales, marketing and product development departments;

|

|

|

·

|

stronger name recognition;

|

|

|

·

|

longer operating histories; and

|

|

|

·

|

greater economies of scale.

|

In addition, the toy industry has no significant barriers to entry. Competition is based primarily on the ability to design and develop new toys, to procure licenses for popular characters and trademarks and to successfully market products. Many of our competitors offer similar products or alternatives to our products. We cannot assure you that we will be able to expand our sales of products or that we will be able to continue to compete effectively against current and future competitors.

- 16 -

A limited number of customers account for a large portion of our net sales, so that if one or more of our major customers were to experience difficulties in fulfilling their obligations to us, cease doing business with us, significantly reduce the amount of their purchases from us or return substantial amounts of our products, it could have a material adverse effect on our business, financial condition and results of operations.

Our five largest customers accounted for 100 % of our net sales in 2010. Except for outstanding purchase orders for specific products, we do not have written contracts with or commitments from any of our customers. A substantial reduction in or termination of orders from any of our largest customers could adversely affect our business, financial condition and results of operations. In addition, pressure by large customers seeking price reductions, financial incentives, changes in other terms of sale or for us to bear the risks and the cost of carrying inventory also could adversely affect our business, financial condition and results of operations. If one or more of our major customers were to experience difficulties in fulfilling their obligations to us, cease doing business with us, significantly reduce the amount of their purchases from us or return substantial amounts of our products, it could have a material adverse effect on our business, financial condition and results of operations. In addition, the bankruptcy or other lack of success of one or more of our significant retailers could negatively impact our revenues and bad debt expense.

We depend on Xinzhongyang, and if our relationship with this company is harmed or if they independently encounter difficulties in their manufacturing processes, we could experience product defects, production delays, cost overruns or the inability to fulfill orders on a timely basis, any of which could adversely affect our business, financial condition and results of operations.

Although we have a long term contract with Xinzhongyang, our sales of the Big Tree Magic Puzzle (3D) would be adversely affected if we lost our relationship with Xinzhongyang or if Xinzhongyang’s operations were disrupted or terminated even for a relatively short period of time. Although we do not purchase the raw materials used to manufacture our products, we are potentially subject to variations in the prices we pay Xinzhongyang to produce the Big Tree Magic Puzzle (3D), depending on what they pay for their raw materials.

From time to time we engage in related party transactions. There are no assurances that these transactions are fair to our company.

From time to time TNSX and its subsidiaries enter into transactions with related parties which include purchases from or sales to a related party, lease of facilities, financing transactions, business consulting services, among other transactions. We cannot assure you that in every instance the terms of the transactions with related parties are on terms as fair as we might receive from or extend to third parties.

We depend on third-party manufacturers who develop, provide and use the tools, dyes and molds that we generally own to manufacture our products. However, we have limited control over the manufacturing processes themselves. As a result, any difficulties encountered by the third-party manufacturers that result in product defects, production delays, cost overruns or the inability to fulfill orders on a timely basis could adversely affect our business, financial condition and results of operations.

We do not have long-term contracts with our third-party manufacturers. Although we believe we could secure other third-party manufacturers to produce our products, our operations would be adversely affected if we lost our relationship with any of our current suppliers or if our current suppliers’ operations were disrupted or terminated even for a relatively short period of time. Our tools, dyes and molds are located at the facilities of our third-party manufacturers.

Although we do not purchase the raw materials used to manufacture our products, we are potentially subject to variations in the prices we pay our third-party manufacturers for products, depending on what they pay for their raw materials.

We are dependent on certain key personnel and the loss of these key personnel could have a material adverse effect on our business, financial condition and results of operations.

Our success is, to a large degree, attributable to Wei Lin our Chief Executive Officer and Mr. Jiale Cai our Chief Financial Officer. Messrs. Lin and Cai are responsible for the management, sales and marketing, and operational expertise of our PRC subsidiary and perform key functions in the operation of our business. Although we have no reason to believe that these individuals would discontinue their services with us, the loss of one or more of these key employees could have a material adverse effect upon our business, financial condition and results of operations.

- 17 -

We may not be able to manage our business expansion and increasingly complicated operations effectively, which could harm our business.

We plan to expand by opening additional retail stores, expansion of our product offerings, increase our sales network and development of an international distribution business. If our planned expansion is successful, it will result in substantial demands on our management and personnel and our operational, technological and other resources. To manage the expected growth of our operations, we will be required to expand our existing operational, administrative and technological systems and our financial systems, procedures and controls, and to expand, train and manage the planned growth in our employee base. We cannot assure you that our current and planned personnel, systems, procedures and controls will be adequate to support our future operations, or that we will be able to effectively and efficiently manage the growth of our operations, and recruit and retain qualified personnel. Any failure to effectively and efficiently manage our expansion may materially and adversely affect our ability to capitalize on new business opportunities, which in turn may have a material adverse effect on our financial condition and results of operations.

We may lose revenue if our intellectual property rights are not protected and counterfeit Big Tree Carnival or Big Tree brand products are sold in the market.

We believe our intellectual property rights are important to our success and competitive position. A portion of our products are manufactured and marketed under our “Big Tree Carnival,” and “Big Tree” labels. We have filed our labels as trademarks in the PRC. We cannot assure you that there will not be any unauthorized usage or misuse of our trademarks or that our intellectual property rights will be adequately protected as it may be difficult and costly to monitor any infringements of our intellectual property rights in the PRC. If we cannot adequately protect our intellectual property, we may lose revenue.

In addition, we believe the branding of our products and the brand equity in our “Big Tree Carnival,” and “Big Tree” trademarks is important to our expansion effort and the continued success of our business. Our efforts to build our brand may be undermined by the sale of counterfeit goods. The counterfeiting of our products may increase if our products become more popular.