UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 6, 2012

MORNINGSTAR, INC.

(Exact name of registrant as specified in its charter)

|

Illinois |

|

000-51280 |

|

36-3297908 |

|

(State or other jurisdiction |

|

(Commission |

|

(I.R.S. Employer |

22 West Washington Street

Chicago, Illinois 60602

(Address of principal executive offices)

(312) 696-6000

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 7.01. Regulation FD Disclosure.

The following information is included in this Current Report on Form 8-K as a result of Morningstar, Inc.’s policy regarding public disclosure of corporate information. Answers to additional inquiries, if any, that comply with this policy are scheduled to become available on February 3, 2012.

Caution Concerning Forward-Looking Statements

This current report on Form 8-K contains forward-looking statements as that term is used in the Private Securities Litigation Reform Act of 1995. These statements are based on our current expectations about future events or future financial performance. Forward-looking statements by their nature address matters that are, to different degrees, uncertain, and often contain words such as “may,” “could,” “expect,” “intend,” “plan,” “seek,” “anticipate,” “believe,” “estimate,” “predict,” “potential,” or “continue.” These statements involve known and unknown risks and uncertainties that may cause the events we discuss not to occur or to differ significantly from what we expect. For us, these risks and uncertainties include, among others,

· general industry conditions and competition, including ongoing economic weakness and uncertainty;

· the effect of market volatility on revenue from asset-based fees;

· damage to our reputation resulting from claims made about possible conflicts of interest;

· liability for any losses that result from an actual or claimed breach of our fiduciary duties;

· the increasing concentration of data and development work carried out at our offshore facilities in China and India;

· failing to differentiate our products and continuously create innovative, proprietary research tools;

· failing to successfully integrate acquisitions;

· challenges faced by our non-U.S. operations; and

· a prolonged outage of our database and network facilities.

A more complete description of these risks and uncertainties can be found in our Annual Report on Form 10-K for the year ended December 31, 2010. If any of these risks and uncertainties materialize, our actual future results may vary significantly from what we expected. We do not undertake to update our forward-looking statements as a result of new information or future events.

Investor Questions and Answers: January 2012

We plan to make written responses available addressing investor questions about our business on the first Friday of every month. The following answers respond to selected questions received through January 5, 2012. We intend to answer as many questions as time allows, although we will not answer product support questions through this channel. We may wait to respond to a given question until the following month if we need more time to research the answer.

If you would like to submit a question, please send an e-mail to investors@morningstar.com, contact us via fax at 312-696-6009, or write to us at the following address:

Morningstar, Inc.

Investor Relations

22 W. Washington

Chicago, IL 60602

Customer Health

1. In reporting its most recent quarterly results, investment-data firm FactSet noted a sharp decline in headcount at large sell-side firms that affected its subscriptions. They added that they weren’t sure how that customer base would evolve in the current environment. More broadly, they indicated that institutional clients have turned cautious again with regard to budgeting and spending overall. What percentage of your revenue/earnings comes from the large sell-side firms like BAC/ML, JPM, MS, GS, etc.? Are you seeing similar retrenchment in your customer base versus a year ago? Deferred revenue growth seems to have moderated of late—is that one indication of some caution amongst customers?

We do business with a number of large sell-side firms, but we believe we have a lower level of exposure to that portion of the market than some of our competitors. We estimate that less than 10% of our company-wide book of business was from sell-side firms as of September 30, 2011. It’s also worth noting that we typically don’t sell to the investment banking divisions of sell-side firms; instead, we generally sell to their asset management and distribution divisions, which have held up better.

Regarding the last couple of questions, we have seen some signs of caution and cost pressures among our clients, and we agree that slower growth in deferred revenue is one indication of that.

Expense Management

2. Given the uncertainties of the current environment, are you taking steps to ratchet down spending or headcount growth in the current environment— limiting travel, slowing spending on new ventures, etc.?

Yes. We’ve been carefully scrutinizing spending plans during our 2012 budgeting process (even more so than usual) and have also looked at options for reducing expense growth (such as cutting back on headcount growth, travel, and marketing spending) if market uncertainty were to worsen.

Revenue Growth

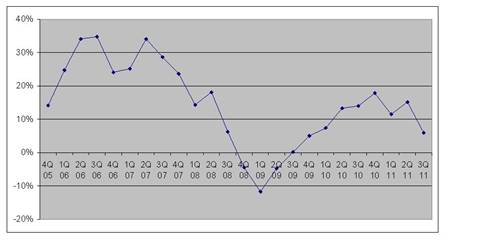

3. Below is a chart of your year-over-year revenue growth (total revenue, including acquisitions) from 4Q 2005 through the most recent quarter. Overall, it looks as if your larger revenue base—$607.5mm in the last 12 months vs. $227mm in 2005—is naturally becoming tougher to grow at a high rate. After recovering from the credit crisis, top-line growth has started to slow again. It seems as if the 20%+ growth rates you’ve delivered in the past may not be rational to expect in the future. Over the past five years it looks like you’ve been able to grow the top-line at a roughly 15% CAGR, but this has dropped to the 8% range over the past three years (if my math is right).

I’m not asking for guidance in this year or any other. But I’m curious about a broader question: How do you think about a rational longer-term organic growth rate for the business—over the next 5 or 10 years? Is it rational to expect double-digit sales growth on a long-term basis—i.e. 5% to 7% new customer growth plus 2% to 5% price growth, for instance? Or is that not the correct way to think about the inputs and outputs? Given the uncertain macro-economic and regulatory issues facing your key institutional customers globally—financial services companies mainly—would it be rational to think those customer pressures are playing out in your contract renewals and internal growth forecasts?

There are several different factors to keep in mind when thinking about long-term revenue growth. As you mentioned, it’s more difficult to sustain high growth rates from a larger revenue base, as each additional dollar of revenue has less impact in percentage terms. Continued market uncertainty, regulatory issues, and client spending constraints have also put pressure on growth in new business and, to a lesser extent, client renewals.

On the positive side, though, we still see ample opportunities for long-term growth. We’re still a relatively small player in a $20 billion+ market for financial information spending, and we’re focusing our efforts on a few key areas (including our three software platforms, credit ratings, investment management, and managed retirement accounts) that we believe have the potential to significantly expand our revenue base. We don’t forecast revenue by assuming a certain growth rate in customers and pricing; instead, it’s a bottom-up process that flows from our expectations for individual products.

Credit Ratings

4. If Morningstar is performing credit ratings in Europe, will Morningstar be subject to direct supervision from a single European Union market regulator for the first time (as will Moody’s Investors Service, Standard & Poor’s and Fitch Ratings), after those entities registered with the European Securities and Markets Authority (“ESMA”)?

You are correct that given the current regulatory structure in Europe, registered credit rating agencies are subject to one European Union market regulator. If we decided to make our credit research and ratings available in Europe in such a way that registration is required, we would be subject to the direct oversight of ESMA for the first time.

However, the credit research and ratings that we currently offer to institutional investors in Europe are structured in a way that doesn’t require registration. We currently publish credit ratings on approximately 130 European firms as part of our overall coverage on corporate credits. We’re in the early stages of offering our credit research and ratings to institutional investors based in Europe and so, as that offering evolves, we may choose to expand the business in a fashion that would require registration.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

MORNINGSTAR, INC. | |

|

|

|

|

|

|

|

|

|

|

|

Date: January 6, 2012 |

|

By: |

/s/ Scott Cooley |

|

|

|

Name: |

Scott Cooley |

|

|

|

Title: |

Chief Financial Officer |