Attached files

| file | filename |

|---|---|

| EX-31.1 - Gulf United Energy, Inc. | ex31-1.htm |

| EX-31.2 - Gulf United Energy, Inc. | ex31-2.htm |

| EX-32.1 - Gulf United Energy, Inc. | ex32-1.htm |

| EX-32.2 - Gulf United Energy, Inc. | ex32-2.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A

Amendment No. 1

[ X ] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended August 31, 2011

or

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from __________ to ___________

Commission file number 0-52322

GULF UNITED ENERGY, INC.

(Exact name of registrant as specified in its charter)

|

Nevada

(State or other jurisdiction of incorporation or organization)

P.O. Box 22165

Houston, Texas

(Address of principal executive offices)

|

20-5893642

(I.R.S. Employer Identification

No.)

77227-2165

(Zip Code)

|

Registrant’s telephone number, including area code:

(713) 942-6575

Securities registered pursuant to Section 12(b) of the Act:

None

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No ü

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No ü

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ü No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer o

|

Accelerated filer o

|

|

Non-accelerated filer (Do not check if a smaller reporting company) o

|

Smaller reporting company ü

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).Yeso No þ

The aggregate market value of the voting stock held by non-affiliates of the registrant, based upon the last reported sales price on the OTCQB on February 28, 2011, is $ 72,571,740. Shares of common stock held by each current executive officer and director and by each person known by the registrant to own 5% or more of the outstanding common stock have been excluded from this computation in that such persons may be deemed to be affiliates

As of November 25, 2011, there were 460,267,726 shares of common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

None.

Gulf United Energy, Inc. (the “Company”) is filing this Amendment No. 1 (“Amendment”) to its Annual Report on Form 10-K for the year ended August 31, 2011 filed with the Securities and Exchange Commission on November 29, 2011 (the “Original Filing”) solely for the purpose of correcting portions of the Balance Sheet, Statement of Operations and Statements of Cash Flows that were presented incorrectly in the Original filing due to errors arising during the EDGARization process. We are including in this filing the complete text of our consolidated financial statements, as corrected, along with updated certifications contained in Exhibits 31.1, 31.2, 32.1, and

32.2. Except as discussed in this Explanatory Note, no other changes have been made to the Original Filing and we have not updated disclosures contained herein to reflect any events that occurred subsequent to the date of the Original Filing.

PART IV

Item 15. Exhibits and Financial Statement Schedules

|

(a)

|

The following documents are filed as a part of this report:

|

||||

|

(1)

|

Consolidated Financial Statements:

|

Page

|

|||

|

Report of Independent Registered Public Accounting Firm

Consolidated Balance Sheets as of August 31, 2011 and 2010

Consolidated Statements of Operations for the years ended August 31, 2011 and 2010 and for the period from inception (September 19, 2003) through August 31, 2011

Consolidated Statements of Cash Flows for the years ended August 31, 2011 and 2010 and for the period from inception (September 19, 2003) through August 31, 2011

Statements of Changes in Stockholder’s Equity for the period from inception (September 19, 2003) through August 31, 2011

Notes to the Consolidated Financial Statements

|

F-1

F-2

F-3

F-4

F-5

F-7

|

||||

|

(2)

|

All schedules are omitted because they are not applicable or the required information is shown in the financial statements or the notes thereto.

|

|||

|

(3)

|

Exhibits:

|

|||

|

3.1

|

Amended and Restated Articles of Incorporation incorporated by reference to Exhibit 10.4 of the Company’s Form 10-Q for the quarter ended May 31, 2010 filed with the SEC on July 20, 2010.

|

|||

|

3.2

|

Amended and Restated Bylaws incorporated by reference to Exhibit 10.5 of the Company’s Form 10-Q for the quarter ended May 31, 2010 filed with the SEC on July 20, 2010.

|

|||

|

4.1

|

Common Stock Specimen incorporated by reference to Exhibit 4.1 of the Company’s Form 10-K filed with the SEC on November 29, 2011.

|

|||

|

4.2

|

Form of Placement Agent Warrant incorporated by reference to Exhibit 4.1 of the Company’s Form 8-K filed with the SEC on February 17, 2011.

|

|||

|

10.1

|

Assignment Agreement dated March 12, 2010, by and between the Company, James M. Askew, John B. Connally III, Ernest B. Miller IV, and Rodeo Resources, LP. incorporated by reference to Exhibit 10.1 to the Company’s Form 8-K filed with the SEC on March 18, 2010.

|

|||

|

10.2

|

Assignment Agreement dated April 5, 2010, by and between the Company, James M. Askew, John B. Connally III, Ernest B. Miller IV, and Rodeo Resources, LP incorporated by reference to Exhibit 10.1 to the Company’s Form 8-K filed with the SEC on July 19, 2010.

|

|||

|

10.3

|

Farmout Agreement, dated July 13, 2010, by and between Gulf United Energy Cuenca Trujillo Ltd. and SK Energy, Sucursal Peruana incorporated by reference to Exhibit 10.2 to the Company’s Form 8-K filed with the SEC on July 19, 2010.

|

|||

|

10.4

|

Farmout Agreement, dated July 31, 2010, by and between Gulf United Energy del Colombia Ltd. and SK Energy Co., Ltd. incorporated by reference to Exhibit 10.2 to the Company’s Form 8-K filed with the SEC on August 5, 2010.

|

|||

|

10.5

|

Novation and Settlement Agreement, dated effective as of March 12, 2010, by and between Upland Oil and Gas, LLC Sucursal del Peru and Gulf United Energy del Peru Ltd., incorporated by reference to Exhibit 10.1 of the Company’s Form 8-K filed with the SEC on November 9, 2010.

|

|||

|

10.6

|

Stock Purchase Agreement, dated effective September 23, 2010, by and among the Company, Cia. Mexicana de Gas Natural, S.A. de. C.V., Manuel Calvillo Alvarez, and Fernando Calvillo Alvarez incorporated by reference to Exhibit 10.1 of the Company’s Form 8-K filed with the SEC on November 5, 2010.

|

|||

|

10.7

|

Amendment No. 1 to Farmout Agreement, dated effective August 25, 2011, by and between SK Innovation Co., Ltd. (formerly SK Energy Co. Ltd.) and Gulf United Energy, de Colombia, incorporated by reference to Exhibit 10.1 of the Company’s Form 8-K filed with the SEC on August 26, 2011.

|

|||

|

10.8

|

Amended and Restated Employment Agreement, dated effective July 11, 2011, by and between the Company and John B. Connally III, incorporated by reference to Exhibit 10.6 of the Company’s Form 10-Q for the quarter ended May 31, 2011 filed with the SEC on July 15, 2011.

|

|||

|

10.9

|

Employment Agreement, dated effective July 11, 2011, by and between the Company and Jim D. Ford, incorporated by reference to Exhibit 10.7 of the Company’s Form 10-Q for the quarter ended May 31, 2011 filed with the SEC on July 15, 2011.

|

|||

|

10.10

|

Amended and Restated Employment Agreement, dated effective July 11, 2011, by and between the Company and Ernest B. Miller IV, incorporated by reference to Exhibit 10.8 of the Company’s Form 10-Q for the quarter ended May 31, 2011 filed with the SEC on July 15, 2011.

|

|||

|

10.11

|

Amended and Restated Employment Agreement, dated effective July 11, 2011, by and between the Company and James C. Fluker III, incorporated by reference to Exhibit 10.9 of the Company’s Form 10-Q for the quarter ended May 31, 2011 filed with the SEC on July 15, 2011.

|

|||

|

10.12

|

Employment Agreement, dated effective November 11, 2011, by and between the Company and David Pomerantz, incorporated by reference to Exhibit 10.1 of the Company’s Form 8-K filed with the SEC on November 15, 2011.

|

|||

|

10.13

|

2011 Stock Incentive Plan incorporated by reference to Exhibit 10.10 of the Company’s Form 10-Q for the quarter ended May 31, 2011 filed with the SEC on July 15, 2011.

|

|||

|

10.14

|

Amendment No. 2 to Farmout Agreement, dated effective November 28, 2011, by and between SK Innovation Co., Ltd. (formerly SK Energy Co. Ltd.) and Gulf United Energy, de Colombia. incorporated by reference to Exhibit 10.14 of the Company’s Form 10-K filed with the SEC on November 29, 2011.

|

|||

|

14.1

|

Code of Ethics incorporated by reference to Exhibit 14.1 of the Company’s Form 10-K for the fiscal year ended August 31, 209 filed with the SEC on December 15, 2009.

|

|||

|

21.1

|

Subsidiaries

|

|||

|

23.1

|

Consent of Independent Registered Public Accounting Firm, Harper & Pearson Company, P.C.

|

|||

|

31.1

|

Certification of Chief Executive Officer Pursuant to Section 302 of the Sarbanes-Oxley Act of 2002(1)

|

|||

|

31.2

|

Certification of Chief Financial Officer Pursuant to Section 302 of the Sarbanes-Oxley Act of 2002(1)

|

|||

|

32.1

|

Certification of Chief Executive Officer Pursuant to 18 U.S.C. Section 1350 as adopted Pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 (1)

|

|||

|

32.2

|

Certification of Chief Financial Officer Pursuant to 18 U.S.C. Section 1350 as adopted Pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 (1)

|

|||

(1) Attached herewith

SIGNATURES

Pursuant to the requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

Dated: January 5, 2012

|

GULF UNITED ENERGY, INC.

(Registrant)

|

|

/s/ John B. Connally III

John B. Connally III

Chief Executive Officer

(Principal Executive Officer)

|

|

|

/s/ David Pomerantz

David Pomerantz

Chief Financial Officer

(Principal Financial and Accounting Officer)

|

Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

|

Signature

|

Capacity

|

Date

|

|

/s/ John B. Connally III

John B. Connally III

|

Director and Chairman of the Board Chief Executive Officer

(Principal Executive Officer)

|

January 5, 2012

|

|

/s/ David Pomerantz

David Pomerantz

|

Chief Financial Officer

(Principal Financial and Accounting Officer)

|

January 5, 2012

|

|

/s/ John N. Seitz

John N. Seitz

|

Director

|

January 5, 2012

|

|

/s/ Thomas G. Loeffler

Thomas G. Loeffler

|

Director

|

January 5, 2012

|

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors and

Stockholders of Gulf United Energy, Inc.

We have audited the accompanying consolidated balance sheets of Gulf United Energy, Inc. and subsidiaries as of August 31, 2011 and 2010, and the related consolidated statements of operations, stockholders’ equity and comprehensive income, and cash flows for each of the years in the two-year period ended August 31, 2011, and for the period from inception (September 19, 2003) through August 31, 2011. We also have audited Gulf United Energy, Inc.’s internal control over financial reporting as of August 31, 2011, based on criteria established in Internal Control—Integrated Framework issued by the Committee of Sponsoring Organizations of the

Treadway Commission (COSO). Gulf United Energy, Inc.’s management is responsible for these financial statements, for maintaining effective internal control over financial reporting, and for its assessment of the effectiveness of internal control over financial reporting, included in the accompanying Management’s Report on Internal Control over Financial Reporting. Our responsibility is to express an opinion on these financial statements and an opinion on the Company’s internal control over financial reporting based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the financial statements are free of material misstatement and whether effective internal control over financial reporting was maintained in all material respects. Our audits of the financial statements included examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. Our audit of internal control

over financial reporting included obtaining an understanding of internal control over financial reporting, assessing the risk that a material weakness exists, and testing and evaluating the design and operating effectiveness of internal control based on the assessed risk. Our audits also included performing such other procedures as we considered necessary in the circumstances. We believe that our audits provide a reasonable basis for our opinions.

A company’s internal control over financial reporting is a process designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles. A company’s internal control over financial reporting includes those policies and procedures that (1) pertain to the maintenance of records that, in reasonable detail, accurately and fairly reflect the transactions and dispositions of the assets of the company; (2) provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with generally accepted

accounting principles, and that receipts and expenditures of the company are being made only in accordance with authorizations of management and directors of the company; and (3) provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use, or disposition of the company’s assets that could have a material effect on the financial statements.

Because of its inherent limitations, internal control over financial reporting may not prevent or detect misstatements. Also, projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate.

In our opinion, the consolidated financial statements referred to above present fairly, in all material respects, the financial position of Gulf United Energy, Inc. and subsidiaries as of August 31, 2011 and 2010, and the results of their operations and their cash flows for each of the years in the two-year period ended August 31, 2011, and for the period from inception through August 31, 2011, in conformity with accounting principles generally accepted in the United States of America. Also in our opinion, Gulf United Energy, Inc. maintained, in all material respects, effective internal control over financial reporting as of August 31, 2011, based on criteria established in

Internal Control—Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission (COSO).

|

//S// Harper & Pearson Company, P.C.

Houston, Texas

November 29, 2011

|

F-1

GULF UNITED ENERGY, INC. AND SUBSIDIARIES

(A Development Stage Company)

Consolidated Balance Sheets

|

August 31,

|

August 31,

|

|||||||

|

2011

|

2010

|

|||||||

|

ASSETS

|

||||||||

|

Current Assets

|

||||||||

|

Cash

|

$ | 7,251,657 | $ | 19,679 | ||||

|

Payroll taxes receivable

|

- | 39,153 | ||||||

|

Pre-paid expenses

|

4,443 | 20,000 | ||||||

|

Total Current Assets

|

7,256,100 | 78,832 | ||||||

|

Fixed Assets:

|

||||||||

|

Computer Equipment

|

12,255 | 3,300 | ||||||

|

Software License

|

62,563 | 62,563 | ||||||

|

Less: Accumulated Depreciation

|

(35,696 | ) | (13,727 | ) | ||||

|

Net Fixed Assets

|

39,122 | 52,136 | ||||||

|

Other Assets

|

||||||||

|

Investment in oil and gas properties (Note 9)

|

20,160,581 | 7,574,581 | ||||||

|

Total Other Assets

|

20,160,581 | 7,574,581 | ||||||

|

Total Assets

|

$ | 27,455,803 | $ | 7,705,549 | ||||

|

LIABILITIES

|

||||||||

|

Current

|

||||||||

|

Accounts payable and accrued liabilities

|

$ | 282,286 | $ | 387,692 | ||||

|

Accounts payable to operators of working interests

|

974,769 | 1,150,000 | ||||||

|

Loans payable related parties (Note 7)

|

26,574 | 26,574 | ||||||

|

Shareholder loans payable and accrued interest (Net of note discount of

|

||||||||

|

$110,277 at August 31, 2011 and $856,433 at August 31, 2010 (Note 7)

|

1,389,634 | 3,223,516 | ||||||

|

Total Current Liabilities

|

2,673,263 | 4,787,782 | ||||||

|

Total Liabilities

|

$ | 2,673,263 | $ | 4,787,782 | ||||

|

STOCKHOLDERS' EQUITY (DEFICIENCY)

|

||||||||

|

Common Stock

|

||||||||

|

Authorized:

|

||||||||

|

700,000,000 shares with a par value of $0.001

|

- | - | ||||||

|

Issued and Outstanding:

|

||||||||

|

454,667,726 as of August 31, 2011 and

|

454,668 | 293,700 | ||||||

|

293,700,000 as of August 31, 2010

|

||||||||

|

Common stock subscribed

|

824,600 | - | ||||||

|

Additional paid-in capital

|

42,445,865 | 6,992,910 | ||||||

|

Accumulated other comprehensive income

|

(29 | ) | - | |||||

|

Deficit Accumulated During The Development Stage

|

(18,942,564 | ) | (4,368,843 | ) | ||||

|

Total Stockholders' Equity (Deficiency)

|

24,782,540 | 2,917,767 | ||||||

|

Total Liabilities and Stockholders' Equity (Deficiency)

|

$ | 27,455,803 | $ | 7,705,549 | ||||

The accompanying notes are an integral part of these consolidated financial statements.

F-2

GULF UNITED ENERGY, INC. AND SUBSIDIARIES

(A Development Stage Company)

Consolidated Statements of Operations

|

Period From

|

||||||||||||

|

Inception

|

||||||||||||

|

(September 19, 2003)

|

||||||||||||

|

Year Ended August 31,

|

through

|

|||||||||||

|

2011

|

2010

|

August 31, 2011

|

||||||||||

|

Revenues

|

$ | - | $ | - | $ | - | ||||||

|

Cost of Sales

|

- | - | - | |||||||||

|

Gross Profit

|

- | - | - | |||||||||

| General and administrative expenses | 4,216,766 | 805,249 | 5,536,322 | |||||||||

| General and administrative expenses - related parties | 9,087,043 | - | 9,087,043 | |||||||||

|

Operating Loss

|

(13,303,809 | ) | (805,249 | ) | (14,623,365 | ) | ||||||

|

Other (Income) and Expense

|

||||||||||||

|

Gain on settlement of debt

|

- | - | (3,333 | ) | ||||||||

|

Interest expense

|

942,003 | 146,676 | 1,089,358 | |||||||||

|

Interest expense - related parties

|

692,826 | 423,034 | 1,631,374 | |||||||||

|

Interest Income

|

(14,917 | ) | - | (14,917 | ) | |||||||

|

Loss from continuing operations

|

(14,923,721 | ) | (1,374,959 | ) | (17,325,847 | ) | ||||||

|

Gain (Loss) from discontinued operations

|

350,000 | (940,240 | ) | (1,616,717 | ) | |||||||

|

Net Loss

|

$ | (14,573,721 | ) | $ | (2,315,199 | ) | $ | (18,942,564 | ) | |||

|

Basic And Diluted Loss per share

|

||||||||||||

|

from continuing operations

|

$ | (0.04 | ) | $ | (0.01 | ) | $ | (0.21 | ) | |||

|

Basic And Diluted Loss per share

|

||||||||||||

|

from discontinued operations

|

$ | 0.00 | $ | (0.01 | ) | $ | (0.02 | ) | ||||

|

Basic And Diluted Net Loss per share

|

$ | (0.04 | ) | $ | (0.02 | ) | $ | (0.23 | ) | |||

|

Weighted Average Shares Outstanding

|

394,388,436 | 115,018,082 | 83,557,935 | |||||||||

The accompanying notes are an integral part of these consolidated financial statements.

F-3

GULF UNITED ENERGY, INC. AND SUBSIDIARIES

(A Development Stage Company)

Consolidated Statements of Cash Flows

|

Period From

|

||||||||||||

|

Inception

|

||||||||||||

|

(September 19, 2003)

|

||||||||||||

|

Year Ended August 31,

|

Through

|

|||||||||||

|

2011

|

2010

|

August 31, 2011

|

||||||||||

|

Cash Flows From Operating Activities

|

||||||||||||

|

Net loss for the period

|

$ | (14,573,721 | ) | $ | (2,315,199 | ) | $ | (18,942,564 | ) | |||

|

Adjustments to reconcile net loss to net cash used by

|

||||||||||||

|

operating activities:

|

||||||||||||

|

Depreciation expense

|

21,970 | 11,527 | 35,697 | |||||||||

|

Expenses paid by issuance of common stock

|

9,848,400 | 192,600 | 10,041,000 | |||||||||

|

Accrued interest added to (paid from) shareholder loans

|

9,647 | 206,193 | 731,355 | |||||||||

|

Compensation expense paid by stock option issuance

|

74,772 | - | 74,772 | |||||||||

|

Loan discount amortization

|

1,369,388 | 329,358 | 1,698,746 | |||||||||

|

Non-cash portion of interest expense

|

- | - | 3,333 | |||||||||

|

Gain on settlement of debt

|

- | - | (3,333 | ) | ||||||||

|

Foreign currency translation loss

|

(29 | ) | - | (29 | ) | |||||||

|

Impairment of investment in joint venture projects

|

- | 940,240 | 1,951,210 | |||||||||

|

Change in operating assets and liabilities

|

||||||||||||

|

Payroll tax receivable

|

39,153 | (39,153 | ) | - | ||||||||

|

Pre-paid expenses

|

(4,443 | ) | - | (4,443 | ) | |||||||

|

Accounts payable and accrued liabilities

|

(280,638 | ) | 286,741 | 107,054 | ||||||||

|

Net Cash Used By Operating Activities

|

(3,495,501 | ) | (387,693 | ) | (4,307,202 | ) | ||||||

|

Cash Flows From Investing Activities

|

||||||||||||

|

Capital Expenditures

|

(8,955 | ) | (62,563 | ) | (74,818 | ) | ||||||

|

Investment in oil and gas projects

|

(12,496,000 | ) | (2,868,581 | ) | (15,364,581 | ) | ||||||

|

Advances to and investment in joint venture projects

|

- | - | (250,000 | ) | ||||||||

|

Net cash used by investing activities

|

(12,504,955 | ) | (2,931,144 | ) | (15,689,399 | ) | ||||||

|

Cash Flows From Financing Activities

|

||||||||||||

|

Proceeds from sale of common stock

|

25,822,119 | 587,500 | 26,435,669 | |||||||||

|

Proceeds of bridge financing

|

3,800,000 | - | 3,800,000 | |||||||||

|

Principal payment on bridge financing

|

(3,800,000 | ) | - | (3,800,000 | ) | |||||||

|

Increase in loans payable to related parties

|

- | - | 226,574 | |||||||||

|

Principal payments on shareholder loans

|

(3,989,685 | ) | (150,000 | ) | (4,139,685 | ) | ||||||

|

Proceeds from (Payments for) shareholder loans payable

|

1,400,000 | 2,900,500 | 4,725,700 | |||||||||

|

Net cash provided by financing activities

|

23,232,434 | 3,338,000 | 27,248,258 | |||||||||

|

Increase/(Decrease) In Cash During The Period

|

7,231,978 | 19,163 | 7,251,657 | |||||||||

|

Cash, Beginning Of Period

|

19,679 | 516 | - | |||||||||

|

Cash, End Of Period

|

$ | 7,251,657 | $ | 19,679 | $ | 7,251,657 | ||||||

The accompanying notes are an integral part of these consolidated financial statements.

F-4

GULF UNITED ENERGY, INC. AND SUBSIDIARIES

(A Development Stage Company)

Consolidated Statements of Stockholders’ Equity and Comprehensive Income

|

DEFICIT

|

||||||||||||||||||||||||||||

|

ACCUMULATED

|

ACCUMULATED

|

|||||||||||||||||||||||||||

|

COMMON SHARES

|

ADDITIONAL

|

COMMON

|

OTHER

|

DURING THE

|

||||||||||||||||||||||||

|

PAR

|

PAID-IN

|

SHARES

|

COMPREHENSIVE

|

DEVELOPMENT

|

||||||||||||||||||||||||

|

NUMBER

|

VALUE

|

CAPITAL

|

SUBSCRIBED

|

INCOME

|

STAGE

|

TOTAL

|

||||||||||||||||||||||

|

Balance, September 19,

|

||||||||||||||||||||||||||||

|

2003 (date of inception)

|

- | $ | - | $ | - | $ | - | $ | - | $ | - | $ | - | |||||||||||||||

|

Capital stock issued for cash:

|

||||||||||||||||||||||||||||

|

October 2003 at $0.001

|

2,500,000 | 2,500 | - | - | - | - | 2,500 | |||||||||||||||||||||

|

November 2003 at $0.005

|

160,000 | 160 | 640 | - | - | - | 800 | |||||||||||||||||||||

|

December 2003 at $0.005

|

1,400,000 | 1,400 | 5,600 | - | - | - | 7,000 | |||||||||||||||||||||

|

June 2004 at $0.01

|

1,000,000 | 1,000 | 9,000 | - | - | - | 10,000 | |||||||||||||||||||||

|

July 2004 at $0.25

|

23,000 | 23 | 5,727 | - | - | - | 5,750 | |||||||||||||||||||||

|

Net loss for the period

|

- | - | - | - | - | (15,880 | ) | (15,880 | ) | |||||||||||||||||||

|

Balance, August 31, 2004

|

5,083,000 | 5,083 | 20,967 | - | - | (15,880 | ) | 10,170 | ||||||||||||||||||||

|

Net loss for the year

|

- | - | - | - | - | (16,578 | ) | (16,578 | ) | |||||||||||||||||||

|

Balance, August 31, 2005

|

5,083,000 | 5,083 | 20,967 | - | - | (32,458 | ) | (6,408 | ) | |||||||||||||||||||

|

November 10, 2005 Stock

|

||||||||||||||||||||||||||||

|

Split Adjustment

|

20,332,000 | 20,332 | (20,332 | ) | - | - | - | - | ||||||||||||||||||||

|

Net loss for the year

|

- | - | - | - | - | (31,577 | ) | (31,577 | ) | |||||||||||||||||||

|

Balance, August 31, 2006

|

25,415,000 | 25,415 | 635 | (64,035 | ) | (37,985 | ) | |||||||||||||||||||||

|

Capital stock issued for investment:

|

||||||||||||||||||||||||||||

|

January 2007 at $0.735 per share

|

185,000 | 185 | 135,790 | - | - | - | 135,975 | |||||||||||||||||||||

|

July 2007 at $0.735 per share

|

750,000 | 750 | 550,500 | - | - | - | 551,250 | |||||||||||||||||||||

|

Net loss for the year

|

- | - | - | - | - | (257,804 | ) | (257,804 | ) | |||||||||||||||||||

|

Balance, August 31, 2007

|

26,350,000 | 26,350 | 686,925 | (321,839 | ) | 391,436 | ||||||||||||||||||||||

|

Net loss for the year

|

- | - | - | - | - | (378,039 | ) | (378,039 | ) | |||||||||||||||||||

|

Balance, August 31, 2008

|

26,350,000 | 26,350 | 686,925 | (699,878 | ) | 13,397 | ||||||||||||||||||||||

|

Net loss for the year

|

- | - | - | - | - | (1,353,766 | ) | (1,353,766 | ) | |||||||||||||||||||

|

Balance, August 31, 2009

|

26,350,000 | 26,350 | 686,925 | - | - | (2,053,644 | ) | (1,340,369 | ) | |||||||||||||||||||

|

Capital stock issued for settlement

|

||||||||||||||||||||||||||||

|

of name issue:

|

||||||||||||||||||||||||||||

|

January 2010 at $0.01 per share

|

50,000 | 50 | 450 | - | - | - | 500 | |||||||||||||||||||||

|

Capital stock issued to buy

|

||||||||||||||||||||||||||||

|

subsidiary:

|

||||||||||||||||||||||||||||

|

March 2010 at $0.032 per share

|

300,000 | 300 | 9,300 | - | - | - | 9,600 | |||||||||||||||||||||

|

Capital stock issued for cash:

|

||||||||||||||||||||||||||||

|

March 2010 at $0.01 per share

|

59,750,000 | 59,750 | 527,750 | - | - | - | 587,500 | |||||||||||||||||||||

|

Capital stock issued for services:

|

||||||||||||||||||||||||||||

|

March 2010 at $0.01 per share

|

20,750,000 | 20,750 | 186,750 | - | - | - | 207,500 | |||||||||||||||||||||

|

April 2010 at $0.01 per share

|

1,500,000 | 1,500 | 13,500 | - | - | - | 15,000 | |||||||||||||||||||||

|

Capital stock issued for oil and

|

||||||||||||||||||||||||||||

|

gas properties:

|

||||||||||||||||||||||||||||

|

March 2010 at $0.01 per share

|

40,000,000 | 40,000 | 384,000 | 200,000 | - | - | 624,000 | |||||||||||||||||||||

|

Capital stock issued for loan

|

||||||||||||||||||||||||||||

|

conversion:

|

||||||||||||||||||||||||||||

|

March 2010 at $0.01 per share

|

20,000,000 | 20,000 | 180,000 | 200,000 | - | - | 400,000 | |||||||||||||||||||||

|

Shareholder loan interest forgiven

|

- | - | 631,444 | - | - | - | 631,444 | |||||||||||||||||||||

|

Capital stock issued with short-

|

||||||||||||||||||||||||||||

|

term debt:

|

||||||||||||||||||||||||||||

|

April 2010 at $0.065 per share

|

17,500,000 | 17,500 | 671,894 | - | - | - | 689,394 | |||||||||||||||||||||

|

May 2010 at $0.065 per share

|

5,000,000 | 5,000 | 191,970 | - | - | - | 196,970 | |||||||||||||||||||||

|

June 2010 at $0.087 per share

|

2,500,000 | 2,500 | 113,810 | - | - | - | 116,310 | |||||||||||||||||||||

|

July 2010 at $0.075 per share

|

3,000,000 | 3,000 | 125,571 | - | - | - | 128,571 | |||||||||||||||||||||

|

July 2010 at $0.120 per share

|

500,000 | 500 | 26,773 | - | - | - | 27,273 | |||||||||||||||||||||

|

August 2010 at $0.120 per share

|

500,000 | 500 | 26,773 | - | - | - | 27,273 | |||||||||||||||||||||

F-5

GULF UNITED ENERGY, INC. AND SUBSIDIARIES

(A Development Stage Company)

Consolidated Statements of Stockholders’ Equity and Comprehensive Income

|

DEFICIT

|

||||||||||||||||||||||||||||

|

ACCUMULATED

|

ACCUMULATED

|

|||||||||||||||||||||||||||

|

COMMON SHARES

|

ADDITIONAL

|

COMMON

|

OTHER

|

DURING THE

|

||||||||||||||||||||||||

|

PAR

|

PAID-IN

|

SHARES

|

COMPREHENSIVE

|

DEVELOPMENT

|

||||||||||||||||||||||||

|

NUMBER

|

VALUE

|

CAPITAL

|

SUBSCRIBED

|

INCOME

|

STAGE

|

TOTAL

|

||||||||||||||||||||||

|

Capital stock issued for oil and

|

||||||||||||||||||||||||||||

|

gas properties:

|

||||||||||||||||||||||||||||

|

June 2010 at $0.01 per share

|

20,000,000 | $ | 20,000 | $ | 180,000 | $ | (200,000 | ) | $ | - | $ | - | $ | - | ||||||||||||||

|

July 2010 at $0.052 per share

|

56,000,000 | 56,000 | 2,856,000 | - | - | - | 2,912,000 | |||||||||||||||||||||

|

Capital stock issued for loan

|

||||||||||||||||||||||||||||

|

conversion:

|

||||||||||||||||||||||||||||

|

June 2010 at $0.01 per share

|

20,000,000 | 20,000 | 180,000 | (200,000 | ) | - | - | - | ||||||||||||||||||||

|

Net loss for the period

|

- | - | - | - | - | (2,315,199 | ) | (2,315,199 | ) | |||||||||||||||||||

|

Balance, August 31, 2010

|

293,700,000 | 293,700 | 6,992,910 | - | - | (4,368,843 | ) | 2,917,767 | ||||||||||||||||||||

|

Capital stock issued for services:

|

||||||||||||||||||||||||||||

|

September 2010 at $0.06 per share

|

2,500,000 | 2,500 | 147,500 | - | - | - | 150,000 | |||||||||||||||||||||

|

October 2010 at $0.057 per share

|

1,200,000 | 1,200 | 67,200 | - | - | - | 68,400 | |||||||||||||||||||||

|

December 2010 at $0.081 per share

|

40,000,000 | 40,000 | 7,960,000 | - | - | - | 8,000,000 | |||||||||||||||||||||

|

January 2011 at $0.063 per share

|

2,700,000 | 2,700 | 167,400 | (170,100 | ) | - | - | - | ||||||||||||||||||||

|

February 2011 at $0.15 per share

|

304,000 | 304 | 60,496 | - | - | - | 60,800 | |||||||||||||||||||||

|

March 2011 at $0.30 per share

|

125,000 | 125 | 37,375 | (37,500 | ) | - | - | - | ||||||||||||||||||||

|

March 2011 at $0.26 per share

|

2,000,000 | 2,000 | 515,000 | - | 517,000 | |||||||||||||||||||||||

|

July 2011 at $0.155 per share

|

824,600 | 824,600 | ||||||||||||||||||||||||||

|

Capital stock issued for cash:

|

||||||||||||||||||||||||||||

|

December 2010 at $0.20 per share

|

3,875,000 | 3,875 | 746,915 | - | - | - | 750,790 | |||||||||||||||||||||

|

January 2011 at $0.20 per share

|

9,750,000 | 9,750 | 1,878,553 | 25,000 | - | - | 1,913,303 | |||||||||||||||||||||

|

February 2011 at $0.30 per share

|

83,388,726 | 83,389 | 23,074,637 | - | - | - | 23,158,026 | |||||||||||||||||||||

|

March 2011 at $0.020 per share

|

125,000 | 125 | 24,875 | (25,000 | ) | - | - | |||||||||||||||||||||

|

Capital stock subscribed for services:

|

||||||||||||||||||||||||||||

|

September 2010 at $0.063 per share

|

- | - | - | 170,100 | - | - | 170,100 | |||||||||||||||||||||

|

February 2011 at $0.30 per share

|

- | - | - | 37,500 | - | - | 37,500 | |||||||||||||||||||||

|

Capital stock issued with short-

|

||||||||||||||||||||||||||||

|

term debt:

|

||||||||||||||||||||||||||||

|

September 2010 at $0.043 per share

|

6,500,000 | 6,500 | 272,073 | - | - | - | 278,573 | |||||||||||||||||||||

|

October 2010 at $0.047 per share

|

1,000,000 | 1,000 | 45,524 | - | - | - | 46,524 | |||||||||||||||||||||

|

October 2010 at $0.043 per share

|

1,500,000 | 1,500 | 62,787 | - | - | - | 64,287 | |||||||||||||||||||||

|

November 2010 at $0.047 per share

|

1,500,000 | 1,500 | 68,286 | - | - | - | 69,786 | |||||||||||||||||||||

|

Januuary 2011 at $0.047 per share

|

1,500,000 | 1,500 | 68,286 | (69,786 | ) | - | - | - | ||||||||||||||||||||

|

February 2011 at $0.047 per share

|

1,000,000 | 1,000 | 45,524 | (46,524 | ) | - | - | - | ||||||||||||||||||||

|

March 2011 at $0.047 per share

|

1,000,000 | 1,000 | 46,752 | (47,752 | ) | - | ||||||||||||||||||||||

|

Capital stock subscribed with

|

||||||||||||||||||||||||||||

|

short-term debt:

|

||||||||||||||||||||||||||||

|

November 2010 at $0.047 per share

|

- | - | - | 139,572 | - | - | 139,572 | |||||||||||||||||||||

|

November 2010 at $0.049 per share

|

- | - | - | 24,490 | - | - | 24,490 | |||||||||||||||||||||

|

Capital stock issued for oil and

|

||||||||||||||||||||||||||||

|

gas properties:

|

||||||||||||||||||||||||||||

|

November 2010 at $0.09 per share

|

1,000,000 | 1,000 | 89,000 | - | - | - | 90,000 | |||||||||||||||||||||

|

Compensation expense paid by

|

||||||||||||||||||||||||||||

|

stock option issuance

|

- | - | 74,772 | - | - | - | 74,772 | |||||||||||||||||||||

|

Comprehensive loss:

|

||||||||||||||||||||||||||||

|

Net loss

|

- | - | - | - | - | (14,573,721 | ) | (14,573,721 | ) | |||||||||||||||||||

|

Other comprehensive income -

|

||||||||||||||||||||||||||||

|

Cumulative currency transalation adjustment

|

(29 | ) | (29 | ) | ||||||||||||||||||||||||

|

Total comprehensive loss

|

(14,573,750 | ) | ||||||||||||||||||||||||||

|

Balance, August 31, 2011

|

454,667,726 | $ | 454,668 | $ | 42,445,865 | $ | 824,600 | $ | (29 | ) | $ | (18,942,564 | ) | $ | 24,782,540 | |||||||||||||

The accompanying notes are an integral part of these consolidated financial statements.

F-6

Notes to Consolidated Financial Statements

August 31, 2011 and 2010

Note 1 — Description of Business

Gulf United Energy, Inc. (“Gulf United” or the “Company”) is a development stage oil and gas exploration and production company with operations in South America. The Company currently has limited operations and is a development stage company as defined by the Financial Accounting Standards Board (FASB) Accounting Standards for Development Stage Entities. Gulf United’s current asset portfolio includes participation in two hydrocarbon exploration blocks operated by SK Innovation Co. Ltd. (“SK Innovation” –

Formerly SK Energy, Ltd.). SK Innovation is a subsidiary of SK Innovation Group, one of South Korea’s top five industrial conglomerates. SK Innovation is Korea’s largest petroleum refiner and is currently active in 29 blocks in 16 countries.

In Colombia, we acquired, subject to regulatory approval, a 12.5% working interest in the 345,592 acre CPO-4 block in the Llanos Basin. Block CPO-4 is near existing production and immediately adjacent to and on trend with the Guatiquia block operated by Petrominerales Ltd. (TSX:PMG). Block CPO-4 is the near-term focus of the Company and SK Innovation, with drilling commencing in July, 2011. We spudded one well of two planned wells on Block CPO-4 on July 12, 2011 as described under oil and gas properties above. As reported in the Form 8-K filed July 14, 2011, the well showed indications of oil and a significant amount of

associated gas. The Form 8-K also reported several technical factors causing the operator significant delays in completing the well to its final depth of 16,300 feet. While the well is taking longer to drill than anticipated, we believe that the presence of hydrocarbons at the 12,200 to 12,500 foot depth may increase the likelihood of hydrocarbons in the lower sands as production from fields in this area of the Llanos Basin have been historically associated with stacked pay sequences. As a result, we believe that the geologic risk in the well may have been reduced. However, despite the information derived from the initial wellbore, there is no assurance that we will locate hydrocarbons in sufficient quantities to be commercially viable, or that the drilling program will be successful.

In Peru, we acquired, subject to regulatory approval, a 40% working interest in the 2,803,411 acre Z-46 offshore block in the Trujillo Basin. Recently re-processed 2-D seismic data suggests a submarine fan deposition on the block and multiple leads have been identified. Two wells previously drilled on the block by Repsol reported oil, indicating an active hydrocarbon system. The Company and SK Innovation began the acquisition of additional infill 2-D seismic data in December 2010; additional acquisition and analysis of data is ongoing.

Also in Peru, we acquired, subject to regulatory approval, a 5% participating interest in Block XXIV, an approximately 276,137 gross acre concession, and a 2% participating interest in the Peru Technical Evaluation Area (the “Peru TEA”). The Peru TEA consists of four contiguous blocks totaling approximately 40 million gross acres onshore on the western flank of the Andes Mountains. Block XXIV and Peru TEA are both operated by Upland Oil & Gas, LLC (“Upland”). Two exploratory wells have been drilled on Block XXIV and both wells are considered dry holes. Upland has completed the field work on a 200 kilometer seismic shoot and the information is in for processing. The plan for

the coming year is further geological studies and the potential drilling of one or two wells. On the Peru TEA, Upland has completed a gravity aeromagnetic program and satellite imaging study covering a large portion of the TEA’s. The plan for the coming year is for additional geological studies on selected areas to be determined at a future date.

We have begun the process of obtaining the necessary approvals described above. While we believe that we will be successful in obtaining the necessary approvals, if we do not receive such approvals or are not able to work out a favorable alternative arrangement with the parties to our agreements, then we may not be able to legally protect or enforce our rights to the affected oil and gas interests. As we do not currently have recordable title to any of our oil and gas interests, our business would be materially adversely affected if we are unable to protect or enforce our rights to maintain our rights to our oil and gas interests. Moreover, while we believe that we would have rights to

receive or be refunded all amounts paid under our agreements, there is no assurance that our operating partners would have readily available funds from which to reimburse our advances.

F-7

GULF UNITED ENERGY, INC. AND SUBSIDIARIES

(A Development Stage Company)

Notes to the Consolidated Financial Statements

August 31, 2011 and 2010

We expect to engage in additional investment opportunities in oil and gas exploration and development as our resources permit. The scope of our activities in this regard may include, but may not be limited to, the acquisition or assignment of rights to develop exploratory acreage under concessions with government authorities and other private or public exploration and production companies, the purchase of oil and gas producing properties, farm-in and farmout opportunities (i.e., the assumption or assignment of obligations to fund the cost of drilling and development). We plan to continue our focus on early-stage exploration of hydrocarbons through a variety of transactions aimed at building a resource base.

Note 2 — Summary of Significant Accounting Policies

Basis of Accounting

The Company maintains its accounts on the accrual method of accounting in accordance with accounting principles generally accepted in the United States of America (GAAP). The accompanying consolidated financial statements of the Company have been prepared in accordance with accounting principles generally accepted in the United States of America and the rules of the Securities and Exchange Commission (“SEC”). In the opinion of management, all adjustments necessary for a fair presentation of consolidated financial position and the results of operations have been reflected herein.

Concentration of Credit Risk

Financial instruments which potentially subject the Company to concentration of credit risk at this time consist principally of cash. The Company places its cash with high credit quality financial institutions. At times, such amounts may exceed FDIC limits; however, these deposits typically may be redeemed upon demand and therefore bear minimal risk. In monitoring this credit risk, the Company periodically evaluates the stability of the financial institutions.

Use of Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the consolidated financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates. Certain of our more critical accounting policies require the application of significant judgment by management in selecting the appropriate assumptions for calculating financial estimates. By their nature, these judgments are subject

to an inherent degree of uncertainty. These judgments are based on our historical experience, terms of existing contracts, and our observance of trends in the industry and information available from other outside sources, as appropriate. Different, reasonable estimates could have been used in the current period. Additionally, changes in accounting estimates are reasonably likely to occur from period to period. These, and other, factors could have a material impact on the presentation of our financial condition, changes in financial condition or results of operations.

Cash

Cash includes cash in a demand deposit account and a money market account with a Houston bank. In addition, the Company has established a cash account in Bogota, Colombia as required by local regulations. This account is maintained in Colombian pesos.

F-8

GULF UNITED ENERGY, INC. AND SUBSIDIARIES

(A Development Stage Company)

Notes to the Consolidated Financial Statements

August 31, 2011 and 2010

Fair Value of Financial Instruments

The Company’s financial instruments consist of cash, accounts payable, accrued liabilities and debt. It is management’s opinion that the Company is not exposed to significant interest or credit risks arising from these instruments. The fair value of these financial instruments approximates their carrying values.

The carrying amount of these financial instruments approximates fair value due either to length of maturity or interest and discount rates that approximate prevailing market rates. In determining fair values, there are three levels of inputs used to determine value. Level 1 inputs are quoted prices in active markets for identical assets and liabilities. Level 2 inputs are inputs other than quoted prices that are observable for the asset or liability, either directly or indirectly. Level 3 inputs are unobservable inputs which include risk inherent in the asset or liability.

Software License and Fixed Assets

The value of the software license and computer equipment is stated at cost. Depreciation is computed using the straight-line method over the thirty six-month estimated useful life of the software and equipment. Any costs associated with maintenance and upgrades will be charged to expense as incurred. When an asset is retired or otherwise disposed of, the costs and related accumulated depreciation are removed from the accounts, and any resulting gain or loss is recognized in income for the period; significant renewals and betterments are capitalized. Depreciation expense for the years ended August 31, 2011 and 2010 was $21,970 and $11,527, respectively.

Impairment of Long-lived Assets

The Company evaluates impairment when events or circumstances indicate that a long-lived asset’s carrying value may not be recovered. These events include market declines, decisions to sell an asset and adverse changes in the legal or business environment. If events or circumstances indicate that a long-lived asset’s carrying value may not be recoverable, the Company estimates the future undiscounted cash flows from the asset for which the lowest level of separate cash flows may be determined, to determine if the asset is impaired. If the total undiscounted future cash flows are less than the carrying amount for the asset, the Company estimates the fair value of the

asset through reference to sales data for similar assets, or by using a discounted cash flow approach. The asset’s carrying value is then adjusted downward to the estimated fair value. At August 31, 2011, management did not believe that any impairment exists with respect to its long-lived assets.

Inflation

The Company's results of operations have not been significantly affected by inflation and management does not expect inflation to have a significant effect on its operations in the foreseeable future.

Oil and gas properties

The Company follows the full cost method of accounting for its oil and gas properties, whereby all costs incurred in connection with the acquisition, exploration for and development of petroleum and natural gas reserves are capitalized. Such costs include costs of acquisition, geological and geophysical activities, rentals on non-producing leases, drilling, completing and equipping of oil and gas wells and administrative costs directly attributable to those activities and asset retirement costs. Sales or other dispositions of oil and gas properties will be accounted for as adjustments to capitalized costs, with no gain or loss recorded unless the ratio of capitalized costs to proven reserves would

significantly change, or to the extent that the sales proceeds exceed our capitalized costs. As of August 31, 2011 and 2010, the Company had oil and gas property investments in the amount of $20,160,581 and $7,574,581 that are excluded from depletion because reserves have not been proven to be associated with those properties.

F-9

GULF UNITED ENERGY, INC. AND SUBSIDIARIES

(A Development Stage Company)

Notes to the Consolidated Financial Statements

August 31, 2011 and 2010

If proved reserves are found and when its quantity can be estimated, costs in excess of the present value of estimated future net revenues, if any, will be charged to impairment expense. The Company will apply the full cost ceiling test on a quarterly basis on the date of the latest consolidated balance sheet presented. It is not known at this time if any recoverable reserves of oil and gas exist. As of the date of this report and based upon all the known facts and circumstances, management does not believe that any impairment exists with respect to oil and gas properties.

Asset retirement costs will be recognized when an asset is placed in service and will be included in the amortization base and will be amortized over proved reserves, if any, using the units of production method. Depletion of proved oil and gas properties will be calculated on the units-of-production method based upon estimates of proved reserves, if any. Such calculations include the estimated future costs to develop proved reserves, if any. Costs of unproved properties are not included in the costs subject to depletion. These costs will also be assessed quarterly for impairment.

Asset Retirement Obligation

GAAP requires that an asset retirement obligation (ARO) associated with the retirement of a tangible long-lived asset be recognized as a liability in the period in which it is incurred and becomes determinable. Under this method, when liabilities for dismantlement and abandonment costs, excluding salvage values, are initially recorded, the carrying amount of the related oil and natural gas properties is increased. The fair value of the ARO asset and liability is measured using expected future cash outflows discounted at the Company’s credit-adjusted risk-free interest rate. Accretion of the liability is recognized each period using the

interest method of allocation, and the capitalized cost is depleted using the units of production method. Should either the estimated life or the estimated abandonment costs of a property change materially upon the Company’s quarterly review, a new calculation is performed using the same methodology of taking the abandonment cost and inflating it forward to its abandonment date and then discounting it back to the present using the Company’s credit-adjusted, risk-free rate.

The carrying value of the asset retirement obligation is adjusted to the newly calculated value, with a corresponding offsetting adjustment to the asset retirement cost related to oil and gas property accounts. At August 31, 2011 and 2010, the Company has no material asset retirement obligations.

Basic Loss per Share

The Company is required to provide basic and diluted earnings (loss) per common share information. The basic net loss per common share is computed by dividing the net loss applicable to common stockholders by the weighted average number of common shares outstanding. Diluted net loss per common share is computed by dividing the net loss applicable to common stockholders, adjusted on an "as if converted" basis, by the weighted average number of common shares outstanding plus potential dilutive securities. During the period ended August 31, 2011, the Company issued five-year warrants to purchase up to 1 million shares of common stock at an exercise price of $0.30 per share as described in Note

4. In addition, on June 14, 2011 the Company adopted the 2011 Stock Incentive Plan under which the Company may issue incentive stock grants and incentive stock options to Company employees, directors and consultants up to 45,000,000 shares which may not exceed 10,000,000 shares in total and may not exceed 1,000,000 shares to any individual during any calendar year. These incentive share grants and option grants generally vest over a three-year period from the date of each grant. As of August 31, 2011, the Company has granted a total of 1,200,000 shares in incentive stock grants and incentive stock options to purchase 3,000,000 shares at an exercise price of $0.32 per share.

Potential dilutive securities as of August 31, 2011 have been considered, but the potential dilutive effect of these securities is not believed to be material and would be anti-dilutive. The Company reported net losses in the twelve month periods ended August 31, 2011 and 2010 of $14,573,721 and $2,315,199, respectively; accordingly, the effects of any additional shares would be anti-dilutive. The weighted average number of common and common equivalent shares outstanding was 394,388,436 and 115,018,082 for the years ended August 31, 2011 and 2010, respectively.

F-10

GULF UNITED ENERGY, INC. AND SUBSIDIARIES

(A Development Stage Company)

Notes to the Consolidated Financial Statements

August 31, 2011 and 2010

Principles of Consolidation

The accompanying consolidated financial statements include the accounts of Gulf United Energy, Inc. and its wholly-owned subsidiaries, Gulf United Energy del Peru, Ltd., Gulf United Energy Cuenca Trujillo, Ltd. and Gulf United Energy de Colombia, Ltd. as of August 31, 2011 and August 31, 2010. All significant inter-company transactions and balances have been eliminated in the consolidation.

Accounting for Uncertain Tax Positions

GAAP provides detailed guidance for the financial statement recognition, measurement and disclosure of uncertain tax positions recognized in an entity’s financial statements. GAAP requires an entity to recognize the financial statement impact of a tax position when it is more likely that not that the position will be sustained upon examination. The Company believes that all significant tax positions utilized by the Company will more likely than not be sustained upon examination. As of the Company’s fiscal year-end, August 31, 2011, the tax years that remain subject to examination by the major tax jurisdictions under the statute of limitations are from the fiscal year 2008 forward

(with limited exceptions). Tax penalties and interest, if any, would be accrued as incurred and would be classified as tax expense in the consolidated statements of operations.

Stock-Based Compensation Arrangements

GAAP requires all share-based payments to employees, including grants of employee stock options, to be based on their fair values. In accordance with the provisions of GAAP, share-based compensation cost is measured at the grant date, based on the calculated fair value of the award. The Company recognizes compensation cost net of a forfeiture rate and recognizes the compensation cost for only those awards expected to vest on a straight-line basis over the requisite service period of the award, which is generally the vesting term. The Company estimated the forfeiture rate based on its historical experience and its expectations of future forfeitures. We currently expect no

forfeitures. This stock-based compensation is recognized as general and administrative expense over the employee’s requisite service period (generally the vesting period of the equity award). We apply the fair value method in accounting for stock option grants using the Black-Scholes Method.

We grant restricted stock and stock options to employees and directors as incentive compensation. The restricted stock and options generally vest over three years. The vesting of these shares and options is dependent upon the continued service of the grantees with Gulf United Energy, Inc. Upon the occurrence of a change in control, each outstanding share of restricted stock and stock option will immediately vest.

The fair value of each option award is estimated on the date of grant using the Black-Scholes option-pricing model. The following summarizes the assumptions used in the option-pricing model and the method for determining the assumptions:

| 2011 | Method of Determining Assumptions | ||||

|

Risk-free rate

|

1.67% |

U.S. treasury yield for 5-year treasury notes in effect at the time of grant.

|

|||

|

Expected years until exercise

|

5.00 |

Average option term

|

|||

|

Expected stock volatility

|

100% |

Historical Gulf United Energy, Inc. for the period since recent change in capitalization.

|

|||

|

Dividend yield

|

_

|

Historical record and plan

|

|||

F-11

GULF UNITED ENERGY, INC. AND SUBSIDIARIES

(A Development Stage Company)

Notes to the Consolidated Financial Statements

August 31, 2011 and 2010

At August 31, 2011, total compensation cost related to non-vested options and awards not yet recognized was approximately $0.6 million and is expected to be recognized over a period of less than three years.

Stock Options

Information relating to stock options is summarized as follows:

|

Weighted

|

Weighted

|

|||||||||||

|

Number of

|

Average

|

Average

|

||||||||||

|

Shares

|

Exercise

|

Contractual

|

Aggregate

|

|||||||||

|

Underlying

|

Price per

|

Life in

|

Intrinsic

|

|||||||||

|

Options

|

Share

|

Years

|

Value

|

|||||||||

|

Balance outstanding September 1, 2010

|

-

|

|||||||||||

|

Granted

|

3,000,000

|

0.32

|

||||||||||

|

Exercised

|

-

|

|||||||||||

|

Forfeited

|

-

|

|||||||||||

|

Expired

|

-

|

|||||||||||

|

Balance outstanding — August 31, 2011

|

3,000,000

|

$

|

0.32

|

5.0

|

$

|

688,677 | ||||||

|

Currently exercisable — August 31, 2011

|

-

|

$

|

0.00

|

5.0

|

$

|

- | ||||||

The weighted average grant-date fair value of options granted during 2011 was $0.32.

Restricted Stock Awards

At August 31, 2011, our employees and directors held 1.2 million restricted shares of our common stock that vest over the service period of up to three years. The restricted stock awards were valued based on the closing price of our common stock on the measurement date, typically the date of grant, and compensation expense is recorded on a straight-line basis over the restricted share vesting period.

The following table summarizes the restricted stock awards activity during the twelve months ended August 31, 2011:

|

Weighted

|

||||||||

|

Average Grant

|

||||||||

|

Date Fair

|

||||||||

|

Number of

|

Value per

|

|||||||

|

Shares

|

Share

|

|||||||

|

Balance outstanding — September 1, 2010

|

0

|

$

|

-

|

|||||

|

Granted

|

1,200,000

|

0.32

|

||||||

|

Vested

|

0

|

-

|

||||||

|

Forfeited

|

0

|

-

|

||||||

|

Balance outstanding — August 31, 2011

|

1,200,000

|

$

|

0.32

|

|||||

|

Total grant date fair value of shares vesting during the period

|

|

0

|

$ |

-

|

||||

F-12

GULF UNITED ENERGY, INC. AND SUBSIDIARIES

(A Development Stage Company)

Notes to the Consolidated Financial Statements

August 31, 2011 and 2010

Non-Cash stock-based compensation is recorded in G&A expenses as follows:

|

2011

|

||||

|

G&A Expenses

|

$

|

74,772

|

||

|

Total non-cash stock-based compensation

|

$

|

74,772

|

||

Recently Issued Accounting Pronouncements

In February 2010, the FASB amended guidance on subsequent events to alleviate potential conflicts between FASB guidance and Securities and Exchange Commission (“SEC”) requirements. Under this amended guidance, SEC filers are no longer required to disclose the date through which subsequent events have been evaluated in originally issued and revised financial statements.

There were various other updates recently issued, most of which represented technical corrections to the accounting literature or application to specific industries and are not expected to a have a material impact on the Company's consolidated financial position, results of operations or cash flows.

Note 3 – Investments

Investment in Joint Venture Entities - Sold

As reported in the Company’s Form 8K filed on November 5, 2010, the Company closed on an agreement with its former joint venture partner, Cia. Mexicana de Gas Natural, S.A. de C.V., to sell all of the Company’s shares in Fermaca LNG de Cancun, S.A. de C.V. and Fermaca Gas de Cancun, S.A. de C.V. for a total amount of $1,000,000 of which $50,000 was paid upon entry into the sale agreement, $150,000 of which was paid at the close of the transaction, $120,000 of the next $150,000 was paid as of February 28, 2011 with the remaining $30,000 paid in March, 2011. Because the Company is no longer involved in any downstream oil and gas activities, and because the Company has no further

involvement in the joint ventures, the amounts related to the joint ventures have been reclassified to discontinued operations in accordance with GAAP. The next installment of $150,000 was due on May 1, 2011 and the following $150,000 installments were due on August 1, 2011 and November 1, 2011. As of November 25, 2011, none of these installments have been paid. The final payment of $200,000 is due February 1, 2012. No interest accrues on the installments; however, the contract provides for 7% interest to be paid on late payments. Management is currently negotiating an extended repayment schedule; however, there is no certainty that all or any of the installments will be paid. We have recognized payments as gain on the sale of the joint venture investment as the sales proceeds are received. Because the sale of the joint

venture interests ended the Company’s investments in pipeline and LNG infrastructure, the gain from the sale and the impairment losses have been reclassified to discontinued operations. As of August 31, 2011, the unrecorded present value of the $650,000 cannot be determined because the timing of the payments is uncertain.

Investments in oil and gas properties

Colombia CPO-4

On July 30, 2010, the Company entered into a farmout agreement with SK Innovation pursuant to which, the Company, through its wholly owned subsidiary, Gulf United Energy de Colombia Ltd., acquired the right to earn an undivided twelve and one-half percent (12.5%) participation interest in the CPO-4 block located in the Llanos Basin of Colombia. The assignment of the interest in CPO-4 is conditioned upon the approval by the National Hydrocarbon Agency of Colombia (“ANH”) and the Republic of Korea.

F-13

GULF UNITED ENERGY, INC. AND SUBSIDIARIES

(A Development Stage Company)

Notes to the Consolidated Financial Statements

August 31, 2011 and 2010

To date, we have not obtained the written approvals from the Republic of Korea or the ANH. The farmout agreement with SK Innovation, as amended, requires these approvals by April 30, 2012. Pursuant to the existing farmout with SK Innovation, if the Company does not receive the approvals by April 30, 2012, the agreement calls for a thirty day grace period during which the Company and SK Innovation have agreed to negotiate an amendment to the farmout agreement on mutually agreeable terms. If the Company and SK Innovation are unable to agree upon any additional amendments during such thirty day grace period, SK Innovation has the right to terminate the farmout agreement. Management believes that it

maintains good relations with SK Innovation and, as a result, should be able to negotiate any necessary amendments to the farmout agreement on mutually agreed economic terms in the event the approvals are not ultimately obtained. Notwithstanding the above, if SK Innovation elects to exercise its termination right as the result of the failure to obtain the written approvals from the ANH or the Republic of Korea, the Company’s interest in Block CPO-4 will be deemed re-assigned back to SK Innovation, and the Company will have the right to have returned any amounts paid under the farmout agreement, without interest. The Company has paid SK its share of past costs and has paid and will pay SK its proportionate share of on-going costs and an additional twelve and one-half percent (12.5%) of seismic acquisition costs amounting to $7,249,002 and $650,000 at August 31, 2011 and 2010

respectively. The Company will pay a total of twenty-five percent (25%) of seismic acquisition costs.

SK Innovation serves as operator on CPO-4. Block CPO-4 is near existing production and immediately adjacent to and on trend with the Guatiquia block operated by Petrominerales Ltd. (TSX:PMG). Block CPO-4 is the near-term focus of the Company and SK Innovation, with drilling commencing in July 2011. In July 2011, the Company spudded the Tamandua-1, a 16,300 foot well, in the northern part of CPO-4 as described above under oil and gas properties.

Peru Z-46

On July 13, 2010, the Company entered into a farmout agreement with SK Innovation pursuant to which the Company will pay to SK Innovation approximately $2,914,917 for past costs and expenses incurred through May 31, 2010 to earn an undivided forty percent (40%) participation interest in Block Z-46. The payment for past costs is due within thirty (30) days after receipt of the approval from Perupetro S.A. which is expected in February 2012.

The Company has paid and will pay SK Innovation its proportionate share of on-going costs and an additional thirty-five percent (35%) of seismic acquisition costs (the Company pays a total of seventy five percent (75%) of certain seismic acquisition costs) amounting to $8,586,240 and $2,999,299 at August 31, 2011 and 2010, respectively. The assignment of the participation interest in Block Z-46 is conditioned upon the approval of the assignment by Perupetro S.A. (“Perupetro”), the state owned entity responsible for promoting, negotiating, underwriting and monitoring contracts for exploration and exploitation of hydrocarbons in Peru. The Company, with the assistance of

SK Innovation, has completed the documentation required for the approval of the assignment; however confirmation of the approval has not yet been obtained. The farmout agreement with SK Innovation requires approval from Perupetro by November 30, 2011. The Company and SK Innovation have met to discuss possible amendments to the farmout agreement, which may include an extension to the approval date from Perupetro and/or deletion of the approval condition altogether as a result of a re-structured economic deal. Pursuant to the existing farmout with SK Innovation, if the Company did not receive the Perupetro approval by November 30, 2011, the agreement calls for a thirty day grace period during which the Company and SK Innovation have agreed to negotiate an amendment to the farmout agreement on mutually agreeable terms. If the Company and SK Innovation are unable to agree

upon any additional amendments during such thirty day grace period, SK Innovation has the right to terminate the agreement commencing December 31, 2011. Management believes that it maintains good relations with SK Innovation, and as a result, will be able to negotiate any necessary amendments to the farmout agreement on mutually agreed economic terms in the event the Perupetro approval is not ultimately obtained.

F-14

GULF UNITED ENERGY, INC. AND SUBSIDIARIES

(A Development Stage Company)

Notes to the Consolidated Financial Statements

August 31, 2011 and 2010

Notwithstanding the above, if SK Innovation elects to exercise its termination right, which will be effective as of December 31, 2011 assuming no new developments, the Company’s interest in Block Z-46 will be deemed re-assigned back to SK Innovation, and the Company will have the right to have returned any amounts paid under the farmout agreement, without interest ($5,626,488 has been paid through August 31, 2011).

Recently re-processed 2-D seismic data suggests a submarine fan deposition on the block and multiple leads have been identified. Two wells previously drilled on the block by Repsol reported oil, indicating an active hydrocarbon system. The Company and SK Innovation began the acquisition of additional infill 2-D seismic data in December 2010; the acquisition, processing and analysis of seismic data is ongoing.

Peru Block XXIV and TEA

On July 31, 2010, the Company entered into an amendment to the participation agreement dated March 12, 2010 covering blocks XXIV Peru and the Peru TEA. Under the terms of the amendment, the Company acquired an undivided 5% working interest in Block XXIV, an approximately 280,000 acre onshore and offshore property and an undivided 2% working interest in the Peru TEA which consists of four contiguous blocks totaling approximately 40,000,000 acres.

The assignment to the Company of the interests in Block XXIV and the Peru TEA are also subject to the approval of Perupetro S.A., along with certain governmental agencies of the Republic of Peru. Until such time as the approvals are received, Upland is holding the Block XXIV and Peru TEA interests in escrow. Upland has begun the process of obtaining the necessary approvals on behalf of the Company. We have requested a status report on the approval process, but have not received it as of the date of this report.

Upland spudded two wells on Block XXIV prior to August 31, 2011. Both wells are currently considered dry holes. On Block XXIV, Upland has completed the field work on a 200 kilometer seismic shoot and the information is in for processing. The plan for the coming year is further geological studies and the potential drilling of one or two wells. On the Peru TEA, Upland has completed a gravity aeromagnetic program and satellite imaging study covering a large portion of the TEA. The plan for the coming year is for additional geological studies on selected areas to be determined at a future

date. The Company incurred costs amounting to $4,240,052 and $3,945,282 during the fiscal years ending August 31, 2011 and 2010, respectively.

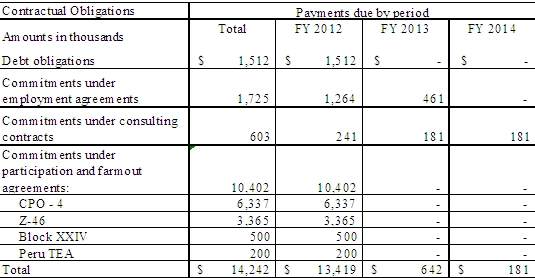

At August 31, 2011, the Company does not have sufficient cash or credit facilities to fund all of the above-noted short-term costs which are summarized below. At August 31, 2011, the Company’s investment in oil and gas properties and approximate fiscal 2012 commitments are as follows:

|

Estimated Fiscal 2012

To Date

|

Commitment

|

|||||||

|

Block XXIV and TEA – Peru

|

$ | 4,240,052 | $ | 700,000 | ||||

|

Block Z-46 – Peru

|

8,566,240 | 3,365,000 | ||||||

|

CPO-4 – Colombia

|

7,354,289 | 6,337,000 | ||||||

| $ | 20,160,581 | $ | 10,402,000 | |||||

As of the date of this report and based upon all the known facts and circumstances, management does not believe that any impairment exists with respect to these properties.

F-15

GULF UNITED ENERGY, INC. AND SUBSIDIARIES

(A Development Stage Company)

Notes to the Consolidated Financial Statements

August 31, 2011 and 2010

Note 4 – Stockholders’ Equity

Preferred Stock

As of August 31, 2011 and 2010, the Company has authorized 50 million shares of blank check preferred stock, none of which are issued and outstanding. Our board of directors has the authority, without action by the shareholders, to designate and issue preferred stock in one or more series. Our board of directors may also designate the rights, preferences, and privileges of each series of preferred stock.

Common Stock

As of August 31, 2011 and August 31, 2010, the Company had 454,667,726 and 293,700,000 shares of its $.001 par value common stock issued and outstanding, respectively.

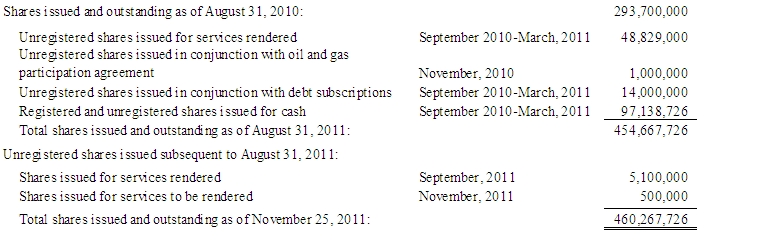

The following schedule is a summary of transactions in the Company’s common stock since August 31, 2010: