Attached files

| file | filename |

|---|---|

| EX-31.2 - EXHIBIT 31.2 - Trunkbow International Holdings Ltd | v243754_ex31-2.htm |

| EX-32.1 - EXHIBIT 32.1 - Trunkbow International Holdings Ltd | v243754_ex32-1.htm |

| EX-31.1 - EXHIBIT 31.1 - Trunkbow International Holdings Ltd | v243754_ex31-1.htm |

| EX-32.2 - EXHIBIT 32.2 - Trunkbow International Holdings Ltd | v243754_ex32-2.htm |

U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A

(Amendment No. 1)

(MARK ONE)

|

x

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the Fiscal Year Ended December 31, 2010

OR

|

¨

|

TRANSITION REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the Transition Period from _______________ to _________________

Commission file number: 000-53934

TRUNKBOW INTERNATIONAL HOLDINGS LIMITED

(Exact name of Registrant as Specified in Its Charter)

|

NEVADA

|

26-3552213

|

|

|

(State or Other Jurisdiction

|

(I.R.S. Employer Identification No.)

|

|

|

of Incorporation or Organization)

|

|

Unit 1217-1218, 12F of Tower B, Gemdale Plaza,

No. 91 Jianguo Road Chaoyang District, Beijing,

People’s Republic of China

|

100022

|

|

|

(Address of principal executive offices)

|

(Zip Code)

|

|

Registrant’s telephone number, including area code:

(86) 10-8571-2518

Securities Registered Pursuant To Section 12 (B) Of The Act:

Common Stock, Par Value $0.001 Per Share

Securities Registered Pursuant To Section 12 (G) Of The Act:

Name of each exchange on which registered: The NASDAQ Stock Market LLC

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ¨ Yes x No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. ¨ Yes x No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. x Yes ¨ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§229.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated

filer ¨

|

Accelerated

filer ¨

|

Non-accelerated filer ¨

(Do not check if a smaller reporting company)

|

Smaller reporting

company x

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ¨ Yes x No

The aggregate market value of the shares of common stock, par value $0.001 per share, of the registrant held by non-affiliates on June 30, 2010 was zero.

There were 36,807,075 shares of common stock of the registrant outstanding as of December 28, 2011.

Explanatory Note

This Amendment No. 1 to the Annual Report on Form 10-K filed by Trunkbow International, Inc., a Nevada corporation (“we,” “our,” “us,” or the “Company”), on March 29, 2011 is being filed to (i) amend Item 1A - Risk Factors (ii) amend Item 7 - Management’s Discussion and Analysis of Financial Condition and Results of Operation (iii) amend Item 8 – Financial Statements and Supplementary Data and (iv) include updated Exhibit 31 and 32 certifications for our principal executive and financial officers.

Except as specifically referenced herein, this Amendment No. 1 to Annual Report on Form 10-K/A does not reflect any event occurring subsequent to March 29, 2011, the filing date of the original report, and no other changes have been made to the report.

PART I

|

Item 1A.

|

Risk Factors.

|

In addition to the other information in this Form 10-K, readers should carefully consider the following important factors. These factors, among others, in some cases have affected, and in the future could affect, our financial condition and results of operations and could cause our future results to differ materially from those expressed or implied in any forward-looking statements that appear in this on Form 10-K or that we have made or will make elsewhere.

Risks Related to Our Business

We have a limited operating history as a separate wholly owned foreign company which makes it difficult to evaluate our business and future prospects.

Our limited operating history following our separation from Trunkbow Shenzhen Technologies Limited in December 2007 and the early stage of development of the mobile payment industry in which we operate makes it difficult to evaluate our business and future prospects. Although our revenues have grown rapidly, we cannot assure you that we will maintain profitability or that we will not incur net losses in the future. Our business model includes recurring revenues from revenue sharing agreements with resellers and the Big Three. To date, less than five percent of our revenues have been derived from these revenue sharing agreements. There is no assurance that we will generate significant revenue from such agreements. We expect that our operating expenses will increase as we expand. Any significant failure to realize anticipated revenue growth could result in significant operating losses. We will continue to encounter risks and difficulties in implementing our business model, including potential failure to:

|

|

•

|

increase awareness of its products, protect its reputation and develop customer loyalty;

|

|

|

•

|

manage its expanding operations and service offerings, including the integration of any future acquisitions;

|

|

|

•

|

maintain adequate control of its expenses; and

|

|

|

•

|

anticipate and adapt to changing conditions in the markets in which it operates as well as the impact of any changes in government regulation, mergers and acquisitions involving its competitors, technological developments and other significant competitive and market dynamics.

|

If we are not successful in addressing any or all of these risks, our business may be materially and adversely affected.

Our business depends to a large extent on mobile telecommunications service providers in the PRC and any deterioration of such relationships may have a material and adverse effect on our results of operations.

We have derived, and believe we will continue to derive, a significant portion of our revenues from a limited number of large customers, such as China Mobile, China Telecom, and China Unicom which are our only major customers and who have been customers for over five years. We have passed a rigorous supplier approval process carried out by each of the three major carriers to become an “approved vendor” to each of them. Our approved vendor status allows us to be eligible to enter into individual customer contracts with the relevant provincial branch of each respective carrier in each province in which we operate. Such individual contracts are similar to purchase orders for our technology platforms, in the form of proprietary software licensing and revenue sharing arrangements with the relevant branch of China Mobile, China Telecom or China Unicom, as the case may be. Currently, China Mobile, China Telecom and China Unicom are the only mobile telecommunications service providers in China that operate mobile payment platforms. Our agreements are generally for a period of less than five years and generally do not have automatic renewal provisions. If any of the carriers is unwilling to continue to cooperate and negotiate with us upon expiration of such agreements, we will not be able to conduct our existing mobile payment business at the levels we anticipate.

Revenues from sales to the Big Three, including revenues generated through the resale of our products to mobile carriers through intermediaries (i.e., direct and indirect sales to these carriers), accounted for approximately 16%, 47% and 20%, and 42%, 15% and 42% of our total revenues for the fiscal years ended December 31, 2010 and 2009. Further, four resellers accounted for approximately 81% and two provincial branches of China Unicom accounted for approximately 81% of our total revenue for the fiscal years ended December 31, 2009 and 2008, respectively. The loss of our status as a approved vendor to any of China Mobile, China Telecom or China Unicom, or our inability to renegotiate our revenue sharing agreements with resellers on terms as favorable as those under which we presently operate, would have a significant negative impact on our business and on our financial results.

1

In addition, if either China Mobile, China Telecom or China Unicom decides to change its content or transaction fees or its share of revenues, our revenues and profitability could also be materially adversely affected.

Our financial condition and results of operations may be materially affected by the changes in policies or guidelines of the mobile telecommunications service providers.

The mobile telecommunications service providers in the PRC may, from time to time, issue certain operating policies or guidelines, requesting or stating their preference for certain actions to be taken in choosing their partners in certain application service platforms. Due to our reliance on the mobile telecommunications service providers, a significant change in their policies or guidelines may have a material adverse effect on our business. Such change in policies or guidelines may result in lower revenue or additional operating costs for us, and as such, we cannot assure you that our financial condition and results of operations will not be materially adversely affected by any such policy or guideline change.

Our customers are concentrated in a limited number of industries and an economic downturn in any of these industries could have a material adverse effect on our results of operations.

Our customers are concentrated primarily in the telecommunications, media and technology industries, and to a lesser extent, the transportation, financial services, and retail industries, where we provide applications for their industries. Our ability to generate revenue depends on the demand for our services in these industries. An economic downturn, or a slowdown or reversal of the tendency in any of these industries to rely on our services could have a material adverse effect on our business, results of operations or financial condition.

The markets in which we operate are highly competitive and we may not be able to maintain market share.

We offer only one Mobile Payment model. Competing technologies from larger, better financed international companies are increasing their effort to gain a foothold in the PRC market. This may result in erosion of our market share in mobile payment services.

Increasing competition among telecommunication companies in greater China has led to a reduction in telecommunication services fees that can be charged by such companies. Within the MVAS Application Platform segment, our principal competitors are Huawei and ZTE. Within the Mobile Payment System segment, our primary competitors are UMPay, HiSun Technology, Shanghai Huateng, Huawei, ZTE, Fujian Fujisu and Digital China Si Tech. If a reduction in telecommunication services fees negatively impacts revenue generated by our customers, they may require us to reduce the price of our services, or seek competitors that charge less, which could reduce our market share. If we must significantly reduce the price of our services, the decrease in revenue could materially and adversely affect our profitability.

Our operating results may fluctuate significantly from quarter to quarter, which could lead to volatility in our stock price.

Our quarterly operating results have varied significantly in the past and are likely to continue to vary significantly in the future. Historically, we have generally experienced a slowdown or decrease in generating revenues in the first and fourth quarter of the year due to the Chinese Lunar New Year. In addition, our quarterly revenues are subject to fluctuation because they substantially depend upon the timing of orders. As a result, you may not be able to rely on period-to-period comparisons of our operating results as an indication of our future performance. Our actual quarterly results may differ from market expectations, which could adversely affect our stock price.

2

The loss of certain employees that are essential to our business could have a material adverse effect on our results of operations.

Li Qiang, Chief Executive Officer, Hou Wanchun, Chairman, and Ye Yuanjun, Chief Financial Officer are essential to our ability to continue to grow our business. Messrs. Li, Hou and Ms. Ye have established relationships within the industries in which we operate. If either of them were to leave us, our growth strategy might be hindered, which could limit our ability to increase revenue. We do not maintain key-person insurance coverage. In addition, we face competition for attracting skilled personnel. If we fail to attract and retain qualified personnel to meet current and future needs, this could slow our ability to grow our business, which could result in a decrease in market share.

International operations require significant management attention, which could detract from the time and attention management spends on our domestic operations and have a material adverse effect on our results of operations.

Our operations in countries outside of the PRC are subject to various unique risks, including the following, which, if not planned and managed properly, could materially adversely affect our business, financial condition and operating results:

|

|

•

|

legal uncertainties or unanticipated changes regarding regulatory requirements, political instability, liability, export and import restrictions, tariffs and other trade barriers;

|

|

|

•

|

longer customer payment cycles and greater difficulties in collecting accounts receivable;

|

|

|

•

|

uncertainties of laws and enforcement relating to the protection of intellectual property; and

|

|

|

•

|

potentially uncertain or adverse tax consequences.

|

Additionally, international operations require significant management attention, which could detract from the time and attention management spends on our domestic operations and have a material adverse effect on our results of operations.

We expect to need additional financing, which may not be available on satisfactory terms or at all.

We believe that our existing cash, including the net proceeds from the private placement in February 2010 and our IPO in February 2011, will be sufficient to support our current operating plan through 2012. Our capital requirements may be accelerated as a result of many factors, including timing of development activities, underestimates of budget items, unanticipated expenses or capital expenditures, limitation of development of new potential products, future product opportunities with collaborators, future licensing opportunities and future business combinations. Consequently, we may need to seek additional debt or equity financing, which may not be available on favorable terms, if at all, and which may be dilutive to you.

We may seek to raise additional capital through public or private equity offerings, debt financings or additional corporate collaboration and licensing arrangements. To the extent we raise additional capital by issuing equity securities, our stockholders may experience dilution. To the extent that we raise additional capital by issuing debt securities, we would likely incur substantial interest obligations, may be required to pledge assets as security for the debt and may be constrained by restrictive financial and/or operational covenants. Debt financing would also be superior to your interest in bankruptcy or liquidation. To the extent we raise additional funds through collaboration and licensing arrangements, it may be necessary to relinquish some rights to our technologies or product candidates, or grant licenses on unfavorable terms.

We are exposed to credit risk on our accounts receivable which is heightened during periods when economic conditions worsen.

We operate our business in the PRC, where credit periods vary substantially across industries, segments, types and size of companies. We operate in a niche of the PRC telecommunication industry, specifically in the provision of Mobile Value Added services and Mobile Payment systems. Our customers include the Big Three and resellers that further provide services to the Big Three. We may not collect our accounts receivable in accordance with the terms of our contracts with our customers.

3

Our management determines the collectability of outstanding accounts based on the following considerations:

|

1.

|

Reputable customers: our customers or ultimate customers through the resellers are the three mobile operators, which are listed companies and have good reputations and stable cash flows.

|

|

2.

|

Evaluation of resellers: in the arrangements that are through resellers to reach the mobile operators, management investigates all aspects of the resellers, including the arrangement between the mobile operators and the resellers, the particular reseller’s credit reputation and payment history, the financial status and customer lists of our resellers. Only reputable resellers with good quality of assets and cash flows can sign up with us.

|

|

3.

|

Continuous collection of accounts receivable: we have been able to collect our accounts receivable on a continual basis.

|

|

4.

|

In the event accounts receivable are due and the balance remains outstanding, we negotiate repayment plans with our customers. Credit periods will be extended when our customers have a continuous payment history. Constant review of the recoverability of the accounts receivable is performed by management and if there is any indication that a customer may default, allowance for doubtful debts are provided to the accounts receivable.

|

|

5.

|

No defaults on historical collection of accounts receivable: we started in 2001 and during the past 10 years, we never had a bad debt on accounts receivable.

|

However, if our actual collection experience with our customers or other conditions change, or the other factors that we consider indicate that it is appropriate, provision for doubtful accounts may be required, which could adversely affect our financial results.

We must respond quickly and effectively to new technological developments, and the failure to do so could have a material and adverse effect on our results of operations.

Our business is highly dependent on its computer and telecommunications equipment, including mobile handsets, and software systems. Our failure to maintain our technological capabilities or to respond effectively to technological changes could adversely affect our business, results of operations or financial condition. Our future success also depends on our ability to enhance existing software and systems and to respond to changing technological developments. If we are unable to successfully develop and bring to market new software and systems in a timely manner, our competitors’ technologies or services may render our products or services noncompetitive or obsolete.

If we fail to protect adequately or enforce our intellectual property rights, or to secure rights to patents of others, the value of our intellectual property rights could diminish.

Our success, competitive position and future revenues will depend in part on our ability, and the ability of our licensors, to obtain and maintain patent protection for our products, methods, processes and other technologies, to preserve our trade secrets, to prevent third parties from infringing on our proprietary rights and to operate without infringing upon the proprietary rights of third parties.

To date, our technology is the subject of 164 filed patent applications with 50 patents issued by the National Intellectual Property Administration of the PRC. We anticipate filing additional patent applications both in the PRC and in other countries, as appropriate. However, we cannot predict the degree and range of protection patents will afford us against competitors, including whether third parties will find ways to invalidate or otherwise circumvent our patents, if and when patents will be issued, whether or not others will obtain patents claiming aspects similar to our patent applications, or if we will need to initiate litigation or administrative proceedings, which may be costly whether we win or lose.

Our success also depends on the skills, knowledge and experience of our scientific and technical personnel, consultants, advisors, licensors and contractors. To help protect its proprietary know-how and inventions for which patents may be unobtainable or difficult to obtain, we rely on trade secret protection and confidentiality agreements. To this end, we require all of our employees, consultants, advisors and contractors to enter into confidentiality and, where applicable, grant-back agreements. These agreements may not provide adequate protection in the event of unauthorized use or disclosure or the lawful development by others of such information. If any of our intellectual property is disclosed, its value would be significantly impaired, and our business and competitive position would suffer.

4

If we infringe on the rights of third parties, we could be prevented from selling products, forced to pay damages and compelled to defend against litigation.

If our products, methods, processes and other technologies infringe proprietary rights of other parties, we could incur substantial costs, and may have to obtain licenses (which may not be available on commercially reasonable terms, if at all), redesign our products or processes, stop using the subject matter claimed in the asserted patents, pay damages, or defend litigation or administrative proceedings, which may be costly whether we win or lose. All these efforts could result in a substantial diversion of valuable management resources.

We believe we have taken reasonable steps, including comprehensive internal and external prior patent searches, to ensure we have freedom to operate and that our development and commercialization efforts can be carried out as planned without infringing upon the proprietary rights of others. However, we cannot guarantee that no third party patent has been filed or will be filed that may contain subject matter of relevance to its development, causing a third party patent holder to claim infringement. Resolving such issues has traditionally resulted, and could in our case result, in lengthy and costly legal proceedings, the outcome of which cannot be predicted accurately.

We have never paid cash dividends and are not likely to do so in the foreseeable future.

We have never declared or paid any cash dividends on our common stock. We currently intend to retain any future earnings for use in the operation and expansion of our business. We do not expect to pay any cash dividends in the foreseeable future but will review this policy as circumstances dictate.

Failure to manage our growth or develop appropriate internal organizational structures, internal control environment and risk monitoring and management systems in line with our rapid growth could negatively affect our business and prospects.

Our business and operations have expanded rapidly since our formation. Significant management resources must be expended to develop and implement appropriate structures for internal organization and information flow, an effective internal control environment and risk monitoring and management systems in line with our rapid growth, as well as to hire and integrate qualified employees into our organization. In addition, the disclosure and other ongoing obligations associated with becoming a public company increase the challenges to our finance and accounting team. Our general and administrative expenses for the fiscal year ending December 31, 2010 were $3,075,833, as compared to $1,877,732 for the 2009 fiscal year. It is possible that our existing internal control and risk monitoring and management systems could prove to be inadequate. If we fail to appropriately develop and implement structures for internal organization and information flow, an effective internal control environment and a risk monitoring and management system, we may not be able to identify unfavorable business trends, administrative oversights or other risks that could materially adversely affect our business, operating results and financial condition.

There are substantial risks associated with doing business in greater China, as set forth in the following risk factors.

Adverse changes in the political and economic policies of the PRC government could materially and adversely affect the overall economic growth of China, which could adversely affect our business.

Substantially all of our assets are located in the PRC and all of our revenues are derived from our operations there. Accordingly, economic, political and legal developments in the PRC significantly affect our business, financial condition, results of operations and prospects. The PRC economy differs from the economies of most developed countries in many respects, including the amount of government involvement, level of development, growth rate, control of foreign exchange and allocation of resources. While the PRC economy has grown significantly in the past 30 years, the growth has been uneven across different periods, regions and economic sectors of the PRC. We cannot assure you that the PRC economy will continue to grow, or that any such growth will be steady and uniform, or that if there is a slowdown, such a slowdown will not have a negative effect on our business.

5

The PRC government also exercises significant control over the PRC’s economic growth through the allocation of resources, controlling payment of foreign currency-denominated obligations, setting monetary policy and providing preferential treatment to particular industries or companies. From late 2003 to mid-2008, the PRC government implemented a number of measures, such as increasing the People’s Bank of China’s statutory deposit reserve ratio and imposing commercial bank lending guidelines that had the effect of slowing the growth of credit, which in turn may have slowed the growth of the PRC economy. In response to the recent global and Chinese economic downturn, the PRC government has promulgated several measures aimed at expanding credit and stimulating economic growth. Since August 2008, the People’s Bank of China has decreased the statutory deposit reserve ratio and lowered benchmark interest rates several times. It is unclear whether the PRC government will continue such policies, or whether PRC economic policies will be effective in creating stable economic growth. Any further slowdown in the economic growth of the PRC could reduce demand for our solutions and services, which could materially and adversely affect our business, our financial condition and results of operations.

Uncertainties with respect to the PRC legal system could adversely affect us.

We conduct our business primarily through our PRC subsidiaries. Our operations in the PRC are governed by PRC laws and regulations. Our PRC subsidiaries are foreign-invested enterprises and are subject to laws and regulations applicable to foreign investment in the PRC and, in particular, laws applicable to foreign-invested enterprises. The PRC legal system is largely a civil law system based on written statutes. Unlike the common law system, prior court decisions may be cited for reference but have limited precedential value.

In 1979, the PRC government began to promulgate a comprehensive system of laws and regulations governing general economic matters. The overall effect of legislation over the past two decades has significantly enhanced the protections afforded to various foreign investments in the PRC. However, the PRC has not developed a fully integrated legal system, and recently enacted laws and regulations may not sufficiently cover all aspects of economic activities in the PRC. Because these laws and regulations are relatively new, and published court decisions are limited and nonbinding in nature, the interpretation and enforcement of these laws and regulations involve uncertainties. In addition, the PRC legal system is based in part on government policies and internal rules, some of which are not published on a timely basis or at all, which may have a retroactive effect. As a result, we may not be aware of our violation of these policies and rules until after the violation occurs. Any administrative and court proceedings in the PRC may be protracted, resulting in substantial costs and diversion of resources and management attention. However, since PRC administrative and court authorities have significant discretion in interpreting and implementing statutory and contractual terms, it may be more difficult to evaluate the outcome of administrative and court proceedings and the level of legal protection we enjoy than in more developed legal systems. These uncertainties may also impede our ability to enforce the contracts entered into by our PRC subsidiaries. As a result, these uncertainties could materially and adversely affect our business and results of operations.

The contractual arrangement with Trunkbow Technologies and its shareholders entered into in 2007 may require further approval.

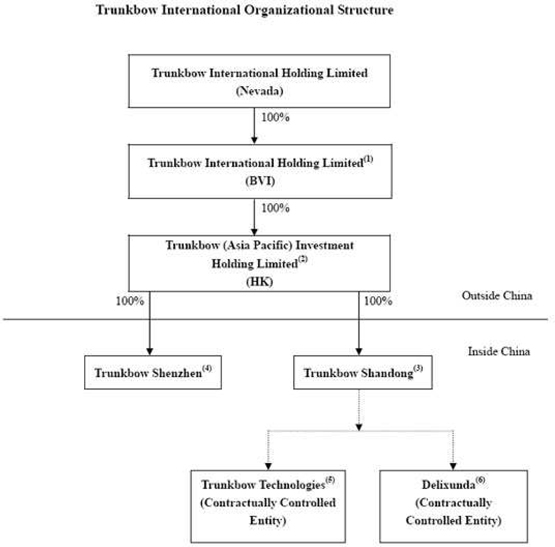

On December 20, 2007, Trunkbow Shandong entered into a series of contracts with Trunkbow Technologies and its shareholders. Through these contractual arrangements, Trunkbow Technologies became a contractually controlled entity of Trunkbow Shandong.

The Regulation on Mergers and Acquisitions of Domestic Companies by Foreign Investors jointly issued by six PRC regulatory agencies, including MOFCOM, the State Assets Supervision and Administration Commission, the State Administration for Taxation, the State Administration for Industry and Commerce, China Securities Regulatory Commission (“CSRC”) and the State Administration of Foreign Exchange (“SAFE”) on August 8, 2006, or the New M&A Rule, has a particular provision which requires that MOFCOM’s approval is required if a PRC resident acquires its/his affiliated Chinese company in the name of an offshore enterprise established or controlled by it or him. The New M&A Rule further provides that the aforesaid requirement cannot be circumvented by a foreign invested enterprise’s domestic investment or “by other means” in China. At the time of entering into the contractual arrangements between Trunkbow Shandong and Trunkbow Technologies in December 2007, Trunkbow Hong Kong was an offshore enterprise indirectly controlled by Hou Wanchun and Li Qiang who are PRC residents. Trunkbow Shandong is a foreign invested enterprise 100% owned by Trunkbow Hong Kong. Hou Wanchun and Li Qiang are two shareholders of Trunkbow Technologies. According to the New M&A Rule, the approval of MOFCOM would be required if we acquired the beneficiary ownership of Trunkbow Technologies by our Company or its Trunkbow Hong Kong directly, and the adoption of the contractual arrangements might be deemed to be circumvent of such approval requirements “by other means”. As the interpretation and implementation of the New M&A Rule are unclear, if the approval of MOFCOM is required, Trunkbow Hong Kong may need to obtain further approval from MOFCOM.

6

Our contractual arrangements with our VIEs and their shareholders may not be as effective in providing control over our VIEs as direct ownership.

Our contractual arrangements with our VIEs and their respective shareholders provide us with effective control over our VIEs. As a result of these contractual arrangements, we are considered to be the primary beneficiary of our VIEs; we consolidate the results of operations, assets and liabilities of our VIEs in our financial statements. Although we have been advised by Han Kun, our PRC legal counsel, that each contract under these contractual arrangements is valid and binding under current PRC laws and regulations, these contractual arrangements may not be as effective in providing us with control over our VIEs as direct ownership of these companies. If our VIEs or their shareholders fail to perform their respective obligations under these contractual arrangements, we may have to incur substantial costs and resources to enforce such arrangements, and rely on legal remedies under PRC law, including seeking specific performance or injunctive relief, and claiming damages, which we cannot assure you will be effective.

Trunkbow Technologies no longer accounts for any of our new business and is being operationally wound down. For the fiscal years ended December 31, 2010 and 2009, Trunkbow Technologies represented 11.7% and 9% , respectively, of our consolidated revenue. As at December 31, 2010 and 2009, Trunkbow Technologies represented 7.6% and 9% respectively, of our total consolidated assets.

The shareholders of our VIEs may have potential conflicts of interest with us, which may materially and adversely affect our business and financial condition.

Trunkbow Technologies and Delixunda are jointly owned by nominee shareholders, including Mr. Hou Wanchun, our chairman, Mr. Li Qiang, our CEO, and Mr. Xie Liangyao. Conflict of interests between these nominee shareholders of our contractually controlled entity and their duties to our company may arise. PRC law provides that a director or member of management owes a fiduciary duty to the company he directs or manages. Mr. Hou and Mr. Li must therefore act in good faith and in the best interests of our VIEs and must not use their respective positions for personal gain. These laws do not require them to consider our best interests when making decisions as a director or member of management of the contractually controlled entity. We cannot assure you that when conflicts of interest arise, these individuals will act in the best interests of our company or that conflicts of interest will be resolved in our favor. In addition, these individuals may breach or cause our contractually controlled entity to breach or refuse to renew the existing contractual arrangements that allow us to effectively control it and receive economic benefits from it. Currently, we do not have arrangements to address potential conflicts of interest between these individuals and our company and a conflict could result in these individuals as officers of our company violating fiduciary duties to us. If we cannot resolve any conflicts of interest or disputes between us and the shareholders of our VIEs, we would have to rely on legal proceedings, which could result in disruption of our business, and there would be substantial uncertainty as to the outcome of any such legal proceedings.

Contractual arrangements we have entered into may be subject to scrutiny by the PRC tax authorities, and a finding that we or our affiliated entities owe additional taxes could reduce our net income and the value of your investment.

As required by applicable PRC laws and regulations, arrangements and transactions among related parties may be subject to audit or challenge by the PRC tax authorities. We could face adverse tax consequences if the PRC tax authorities determine that the contractual arrangements between Trunkbow Shandong and our VIEs do not represent an arm’s-length price and adjust our VIEs’ income in the form of a transfer pricing adjustment. A transfer pricing adjustment could, among other things, result in a reduction, for PRC tax purposes, of expense deductions recorded by our VIEs, which could in turn increase its respective tax liabilities. In addition, the PRC tax authorities may impose late payment fees and other penalties on our affiliated entities for underpaid taxes.

7

Our net income may be adversely affected if our VIEs’ tax liabilities increase or if it is found to be subject to late payment fees or other penalties.

We have not yet registered the equity pledges made by our VIE shareholders of their equity in Trunkbow Technologies or Delixunda, which means that these pledges have not been officially validated. Accordingly, the contractual arrangements among the nominee shareholders, Trunkbow Shandong and our VIEs, designed to control our VIEs’ operations and extract their profits, may be undermined.

PRC Property Law provides that all equity pledges under equity pledge agreements must be registered to be validated. Our subsidiary, Trunkbow Shandong, has entered into equity pledge agreements with the nominee shareholders of Trunkbow Technologies and Delixunda, whereby such nominee shareholders are obligated to promptly take necessary steps to register and perfect the equity pledges to secure the service fees under the relevant service agreements and the loans under the loan agreements between Trunkbow Shandong and them. Trunkbow Shandong is now coordinating with the nominee shareholders to prepare various equity pledge registration application documents (including the Chinese versions of the equity pledge agreements and other application forms) in accordance with the requirements of the local competent branch of the State Administration for Industry and Commerce. However, until the equity pledges are registered and perfected, we may not enforce these pledges in PRC courts, and accordingly the contractual arrangements among the nominee shareholders, Trunkbow Shandong and our VIEs, designed to control the VIEs’ operations and extract their profits, will be undermined. Moreover, it is possible that, in the absence of a validated pledge, the nominee shareholders may pledge or otherwise dispose of their equity interests in the relevant VIE to third parties.

We may rely on dividends and other distributions from our subsidiaries in the PRC to fund our cash and financing requirements, and any limitation on the ability of our subsidiaries to make payments to us could materially adversely affect our ability to conduct our business.

As an offshore holding company, we may rely principally on dividends from our subsidiaries in the PRC for our cash requirements, including to pay dividends or make other distributions to our shareholders or to service our debt we may incur and to pay our operating expenses. The payment of dividends by entities organized in the PRC is subject to limitations. In particular, the PRC regulations permit our subsidiaries to pay dividends to us only out of their accumulated profits, if any, as determined in accordance with Chinese accounting standards and regulations. In addition, each of our subsidiaries in the PRC is required to set aside a certain amount of its after-tax profits each year, if any, to fund certain statutory reserves. These reserves are not distributable as cash dividends.

If our subsidiaries in the PRC incur debt on their own behalf, the instruments governing the debt may restrict their ability to pay dividends or make other distributions to us. Any limitation on the ability of our subsidiaries to distribute dividends or other payments to us could materially adversely limit our ability to grow, make investments or acquisitions, pay dividends and otherwise fund and conduct our business.

We may be subject to penalties, including restriction on our ability to inject capital into our PRC subsidiaries and our PRC subsidiaries’ ability to distribute profits to us, if our PRC resident shareholders or beneficial owners fail to comply with relevant PRC foreign exchange rules.

SAFE issued a public notice in October 2005 requiring PRC residents to register with the local SAFE branch before establishing or controlling any company outside of the PRC for the purpose of capital financing with assets or equities of PRC companies, referred to in the notice as an “offshore special purpose vehicle”. PRC residents that are shareholders and/or beneficial owners of offshore special purpose companies established before November 1, 2005 were required to register with the local SAFE branch before March 31, 2006. In addition, any PRC resident that is a shareholder of an offshore special purpose vehicle is required to amend its SAFE registration with respect to that offshore special purpose company in connection with any increase or decrease of capital, transfer of shares, merger, division, equity investment or creation of any security interest over any assets located in China or other material changes in share capital.

8

We have requested our current shareholders and/or beneficial owners to disclose whether they or their shareholders or beneficial owners fall within the ambit of the SAFE notice and urge those who are PRC residents to register with the local SAFE branch as required under the SAFE notice. However, we cannot provide any assurance that all of our shareholders and beneficial owners who are PRC residents will comply with our request to make, obtain or update any applicable registrations or comply with other requirements required by the SAFE notice or other related rules. In case of any non-compliance on any of our PRC resident shareholders or beneficial owners, our PRC subsidiaries and such shareholders and beneficial owners may be subject to fines and other legal sanctions.

Governmental control of currency conversion may limit our ability to utilize our revenues effectively and affect the value of your investment.

The PRC government imposes controls on the convertibility of the Renminbi into foreign currencies and, in certain cases, the remittance of currency out of the PRC. We receive substantially all of our revenues in Renminbi. Under our current corporate structure, our Nevada holding company primarily relies on dividend payments from our wholly-owned PRC subsidiaries in the PRC to fund any cash and financing requirements we may have.

Under existing PRC foreign exchange regulations, payments of current account items, including profit distributions, interest payments and trade and service-related foreign exchange transactions, can be made in foreign currencies without prior SAFE approval by complying with certain procedural requirements. Therefore, our wholly owned PRC subsidiaries may pay dividends in foreign currency to us without pre-approval from SAFE. However, approval from or registration with competent government authorities is required where the Renminbi is to be converted into foreign currency and remitted out of the PRC to pay capital expenses such as the repayment of loans denominated in foreign currencies. With the prior approval from SAFE, cash generated from the operations of our PRC subsidiary may be used to pay off debt they owe to entities outside the PRC in a currency other than the Renminbi. The PRC government may at its discretion restrict access to foreign currencies for current account transactions in the future. If the foreign exchange control system prevents us from obtaining sufficient foreign currencies to satisfy our foreign currency demands, we may not be able to pay dividends in foreign currencies to our shareholders.

Currency fluctuations and restrictions on currency exchange may adversely affect our business, including limiting our ability to convert Chinese Renminbi into foreign currencies and, if Chinese Renminbi were to decline in value, reducing our revenue in U.S dollar terms.

Our reporting currency is the U.S. dollar and our operations in the PRC use their local currency as their functional currencies. Substantially all of our revenue and expenses are in Chinese renminbi. We are subject to the effects of exchange rate fluctuations with respect to any of these currencies. For example, the value of the renminbi depends to a large extent on PRC government policies and the PRC’s domestic and international economic and political developments, as well as supply and demand in the local market. Since 1994, the official exchange rate for the conversion of renminbi to the U.S. dollar had generally been stable and the renminbi had appreciated slightly against the U.S. dollar. However, on July 21, 2005, the PRC government changed its policy of pegging the value of Chinese renminbi to the U.S. dollar. Under the new policy, Chinese renminbi may fluctuate within a narrow and managed band against a basket of certain foreign currencies. Following the removal of the U.S. dollar peg, the Renminbi appreciated more than 20% against the U.S. dollar over the following three years. From mid-2008 to mid-2010 the Renminbi traded within a narrow range against the U.S. dollar at approximately RMB6.83 per U.S. dollar. In June 2010, the People’s Bank of China announced the removal of the de facto peg. Following this announcement, the Renminbi has appreciated modestly. It is difficult to predict when and how Renminbi exchange rates may change going forward.

The income statements of our operations are translated into U.S. dollars at the average exchange rates in each applicable period. To the extent the U.S. dollar strengthens against foreign currencies, the translation of these foreign currency denominated transactions results in reduced revenue, operating expenses and net income for our operations. Similarly, to the extent the U.S. dollar weakens against foreign currencies, the translation of these foreign currency denominated transactions results in increased revenue, operating expenses and net income for our operations. We are also exposed to foreign exchange rate fluctuations as we convert the financial statements of our foreign subsidiaries into U.S. dollars in consolidation. If there is a change in foreign currency exchange rates, the conversion of the foreign subsidiaries’ financial statements into U.S. dollars will lead to a translation gain or loss which is recorded as a component of other comprehensive income. In addition, we have certain assets and liabilities that are denominated in currencies other than the relevant entity’s functional currency. Changes in the functional currency value of these assets and liabilities create fluctuations that will lead to a transaction gain or loss. We have not entered into agreements or purchased instruments to hedge its exchange rate risks, although it may do so in the future. The availability and effectiveness of any hedging transaction may be limited and we may not be able to successfully hedge its exchange rate risks.

9

Although PRC governmental policies were introduced in 1996 to allow the convertibility of Chinese renminbi into foreign currency for current account items, conversion of Chinese renminbi into foreign exchange for capital items, such as foreign direct investment, loans or securities, requires the approval of SAFE, which is under the authority of the People’s Bank of China. These approvals, however, do not guarantee the availability of foreign currency conversion. We cannot be sure that we will be able to obtain all required conversion approvals for our operations or that PRC regulatory authorities will not impose greater restrictions on the convertibility of Chinese renminbi in the future. Because a significant amount of our future revenue may be in the form of Chinese renminbi, our inability to obtain the requisite approvals or any future restrictions on currency exchanges could limit our ability to utilize revenue generated in Chinese renminbi to fund our business activities outside of the PRC, or to repay foreign currency obligations, including our debt obligations, which would have a material adverse effect on our financial condition and results of operations.

We may have limited legal recourse under PRC law if disputes arise under our contracts with third parties.

The PRC government has enacted some laws and regulations dealing with matters such as corporate organization and governance, foreign investment, commerce, taxation and trade. However, their experience in implementing, interpreting and enforcing these laws and regulations is limited, and our ability to enforce commercial claims or to resolve commercial disputes is unpredictable. If business ventures are unsuccessful, we face the risk that the parties to these ventures may seek ways to terminate the transactions, or, may hinder or prevent us from accessing important information regarding the financial and business operations of these acquired companies. The resolution of these matters may be subject to the exercise of considerable discretion by agencies of the PRC government, and forces unrelated to the legal merits of a particular matter or dispute may influence their determination. Any rights we may have to specific performance, or to seek an injunction under PRC law, in either of these cases, are severely limited, and without a means of recourse by virtue of the Chinese legal system, we may be unable to prevent these situations from occurring. The occurrence of any such events could have a material adverse effect on our business, financial condition and results of operations.

You may have difficulty enforcing judgments against us.

We are a Nevada holding company and most of our assets are located outside of the United States. Most of our current operations are conducted in the PRC. In addition, most of our directors and officers are nationals and residents of countries other than the United States. A substantial portion of the assets of these persons is located outside the United States. As a result, it may be difficult for you to effect service of process within the United States upon these persons. It may also be difficult for you to enforce in U.S. courts judgments on the civil liability provisions of the U.S. federal securities laws against us and our officers and directors, most of whom are not residents in the United States and the substantial majority of whose assets are located outside of the United States. In addition, there is uncertainty as to whether the courts of the PRC would recognize or enforce judgments of U.S. courts (imposing monetary fines, penalties, damages or otherwise) or entertain original actions brought in the courts of the PRC against us or our directors or officers predicated upon the securities laws of the United States or any state in the United States. Courts in China may recognize and enforce foreign judgments in accordance with the requirements of the PRC Civil Procedures Law based on treaties between China and the country where the judgment is made or on reciprocity between jurisdictions. China does not have any treaties or other arrangements that provide for the reciprocal recognition and enforcement of foreign judgments with the United States. In addition, according to the PRC Civil Procedures Law, courts in the PRC will not recognize or enforce a foreign judgment against us or our directors and officers (imposing monetary fines, penalties, damages or otherwise) or entertain original actions brought in the courts of the PRC against us or our directors or officers predicated upon the securities laws of the United States or any state in the United States if they decide that the judgment violates basic principles of PRC law or national sovereignty, security or the public interest. So it is uncertain whether a PRC court would recognize or enforce a judgment rendered by a court in the United States.

10

We must comply with the Foreign Corrupt Practices Act and PRC anti-bribery law, which may put us at a competitive disadvantage.

Following the registration of our common stock under the Securities Exchange Act of 1934, as amended, we, a former shell company, will be required to comply with the United States Foreign Corrupt Practices Act, which prohibits U.S. companies from engaging in bribery or other prohibited payments to foreign officials for the purpose of obtaining or retaining business. Foreign companies, including some of our competitors, are not subject to these prohibitions. We are also subject to PRC anti-bribery law, which strictly prohibits bribery of government officials. Corruption, extortion, bribery, pay-offs, theft and other fraudulent practices occur from time-to-time in mainland China. If our competitors engage in these practices, they may receive preferential treatment from personnel of some companies, giving our competitors an advantage in securing business or from government officials who might give them priority in obtaining new licenses, which would put us at a disadvantage. Although we inform our personnel that such practices are illegal, we can not assure you that our employees or other agents will not engage in such conduct for which we might be held responsible. If our employees or other agents are found to have engaged in such practices, we could suffer severe penalties.

Under the PRC EIT Law, we, Trunkbow BVI and/or Trunkbow Hong Kong may be classified as a “resident enterprise” of the PRC. Such classification could result in PRC tax consequences to us, our non-PRC resident investors, Trunkbow BVI and/or Trunkbow Hong Kong.

On March 16, 2007, the National People’s Congress approved and promulgated a new tax law (the “EIT Law”), which took effect on January 1, 2008. Under the EIT Law, enterprises are classified as “resident enterprises” and “non-resident enterprises.” An enterprise established outside of the PRC with a “de facto management body” within the PRC is considered a “resident enterprise,” meaning that it can be treated in a manner similar to an enterprise organized under the laws of the PRC for PRC enterprise income tax purposes. The implementing rules of the EIT Law define “de facto management body” as a managing body that in practice exercises “substantial and overall management and control over the production and operations, personnel, accounting, and properties” of the enterprise; however, it remains unclear whether the PRC tax authorities would deem our managing body or the managing body of Trunkbow BVI or Trunkbow Hong Kong as being located within the PRC. Due to the short history of the EIT Law and the lack of applicable legal precedents, the PRC tax authorities determine the PRC tax resident treatment of a foreign (non-PRC) company on a case-by-case basis.

If the PRC tax authorities determine that we, Trunkbow BVI and/or Trunkbow Hong Kong is a “resident enterprise” for PRC enterprise income tax purposes, a number of PRC tax consequences could follow. First, we, Trunkbow BVI and/or Trunkbow Hong Kong could be subject to PRC enterprise income tax at a rate of 25% on our, Trunkbow BVI’s and /or Trunkbow Hong Kong’s worldwide taxable income, as well as PRC enterprise income tax reporting obligations. Second, under the EIT Law and its implementing rules dividends paid between “qualified resident enterprises” are exempt from enterprise income tax. As a result, if we, Trunkbow BVI and Trunkbow Hong Kong are treated as “qualified resident enterprises,” all dividends from Trunkbow Shenzen and Trunkbow Shandong to us (through Trunkbow Hong Kong and Trunkbow BVI) should be exempt from the PRC enterprise income tax.

If Trunkbow Hong Kong were treated as a PRC “non-resident enterprise” under the EIT Law, then dividends that Trunkbow Hong Kong receives from Trunkbow Shenzhen and Trunkbow Shandong (assuming such dividends were considered sourced within the PRC) (i) may be subject to a 5% PRC withholding tax, provided that Trunkbow Hong Kong owns more than 25% of the registered capital of Trunkbow Shenzhen or Trunkbow Shandong, as applicable, continuously within 12 months immediately prior to obtaining such dividends, and the Arrangement between the Mainland of China and the Hong Kong Special Administrative Region for the Avoidance of Double Taxation and the Prevention of Fiscal Evasion with Respect to Taxes on Income (the “PRC-Hong Kong Tax Treaty”) were otherwise applicable, or (ii) if such treaty does not apply (i.e., because the PRC tax authorities may deem Trunkbow Hong Kong to be a conduit not entitled to treaty benefits), may be subject to a 10% PRC withholding tax. Similarly, if Trunkbow BVI were treated as a “non-resident enterprise” under the EIT Law and Trunkbow Hong Kong were treated as a “resident enterprise” under the EIT Law, then the dividends that Trunkbow BVI receives from Trunkbow Hong Kong (assuming such dividends were considered sourced within the PRC) may be subject to a 10% PRC withholding tax. A similar situation may arise if we were treated as a “non-resident enterprise” under the EIT Law and Trunkbow BVI were treated as a “resident enterprise” under the EIT Law. Any such taxes on dividends could materially reduce the amount of dividends, if any, we could pay to our shareholders.

11

Finally, if we are determined to be a “resident enterprise” under the EIT Law, or dividends payable to (or gains realized by) our investors that are not tax residents of the PRC (“non-resident investors”) are otherwise treated as income derived from sources within the PRC, this could result in (i) a 10% PRC tax being imposed on dividends we pay to our non-resident investors and that are enterprises (but not individuals) and gains derived by them from transferring our common stock and (ii) a potential 20% PRC tax being imposed on dividends we pay to our non-resident investors who are individuals and gains derived by them from transferring our common stock. In such event, we may be required to withhold the applicable PRC tax on any dividends paid to our non-resident investors. Our non-resident investors also may be responsible for paying the applicable PRC tax on any gain realized from the sale or transfer of our common stock in these circumstances. We would not, however, have an obligation to withhold PRC tax with respect to such gain under the PRC tax laws.

On December 10, 2009, the State Administration of Taxation (“SAT”) released Circular Guoshuihan No. 698 (“Circular 698”), which reinforces the taxation of certain equity transfers by non-resident investors through overseas holding vehicles. Circular 698 is retroactively effective from January 1, 2008. Circular 698 addresses indirect equity transfers as well as other issues. According to Circular 698, where a non-resident investor that indirectly holds an equity interest in a PRC resident enterprise through a non-PRC offshore holding company indirectly transfers an equity interest in the PRC resident enterprise by selling an equity interest in the offshore holding company, and the latter is located in a country or jurisdiction where the actual tax burden is less than 12.5% or where the offshore income of its residents is not taxable, the non-resident investor is required to provide the PRC tax authorities in charge of that PRC resident enterprise with certain relevant information within 30 days of the execution of the equity transfer agreement. The tax authorities in charge will evaluate the offshore transaction for tax purposes. In the event that the PRC tax authorities determine that such transfer is abusing forms of business organization and a reasonable commercial purpose for the offshore holding company other than the avoidance of PRC income tax liability is lacking, the tax authorities will have the power to re-assess the nature of the equity transfer under the doctrine of substance over form. If the SAT’s challenge of a transfer is successful, it may deny the existence of the offshore holding company that is used for tax planning purposes and subject the non-resident investor to PRC tax on the capital gain from such transfer. Because Circular 698 has a short history, there is uncertainty as to its application. We (or a non-resident investor) may become at risk of being taxed under Circular 698 and may be required to expend valuable resources to comply with Circular 698 or to establish that we (or such non-resident investor) should not be taxed under Circular 698, which could have a material adverse effect on our financial condition and results of operations (or such non-resident investor’s investment in us).

If any PRC tax applies to a non-resident investor, the non-resident investor may be entitled to a reduced rate of PRC tax under an applicable income tax treaty and/or a deduction for such PRC tax against such investor’s domestic taxable income or a foreign tax credit in respect of such PRC tax against such investor’s domestic income tax liability (subject to applicable conditions and limitations). Investors should consult their own tax advisors regarding the applicability of any such taxes, the effects of any applicable income tax treaties, and any available deductions or foreign tax credits.

Restrictions under PRC law on our PRC subsidiaries' ability to make dividends and other distributions could materially and adversely affect our ability to grow, make investments or acquisitions that could benefit our business, pay dividends to you, and otherwise fund and conduct our businesses.

Substantially all of our revenues are earned by our PRC subsidiaries, Trunkbow Shenzhen and Trunkbow Shangdong. However, PRC regulations restrict the ability of our PRC subsidiaries to make dividends and other payments to their offshore parent company. PRC legal restrictions permit payments of dividend by our PRC subsidiaries only out of their accumulated after-tax profits, if any, determined in accordance with PRC accounting standards and regulations. Our PRC subsidiaries are also required under PRC laws and regulations to allocate at least 10% of our annual after-tax profits determined in accordance with PRC GAAP to a statutory general reserve fund until the amounts in said fund reaches 50% of our registered capital. Allocations to these statutory reserve funds can only be used for specific purposes and are not transferable to us in the form of loans, advances or cash dividends. Any limitations on the ability of our PRC subsidiaries to transfer funds to us could materially and adversely limit our ability to grow, make investments or acquisitions that could be beneficial to our business, pay dividends and otherwise fund and conduct our business.

12

SAFE regulations may limit our ability to finance our PRC subsidiaries effectively and affect the value of your investment and may make it more difficult for us to pursue growth through acquisition.

If we finance our PRC subsidiaries through additional capital contributions, MOCFOM in China or its local counterpart must approve the amount of these capital contributions. On August 29, 2008, SAFE promulgated Circular 142, a notice regulating the conversion by a foreign-invested company of foreign currency into Renminbi by restricting how the converted Renminbi may be used. The notice requires that Renminbi converted from the foreign currency-denominated capital of a foreign-invested company may only be used for purposes within the business scope approved by the applicable governmental authority and may not be used for equity investments in the PRC unless otherwise provided by laws and regulations. In addition, SAFE strengthened its oversight of the flow and use of Renminbi funds converted from the foreign currency denominated capital of a foreign-invested company. The use of such Renminbi may not be changed without approval from SAFE, and may not be used to repay Renminbi loans if the proceeds of such loans have not yet been used for purposes within the company’s approved business scope. Violations of Circular 142 may result in severe penalties, including substantial fines as set forth in the Foreign Exchange Administration Regulations. We cannot assure you that we will be able to complete the necessary government registrations or obtain the necessary government approvals on a timely basis, if at all, with respect to the use and conversion of the foreign currencies provided by us to our PRC subsidiaries by mean of loans or capital contributions in the future. If we fail to complete such registrations or obtain such approvals, our PRC subsidiaries’ ability to use and convert such foreign currencies into Renminbi may be negatively affected, in particular in our future equity investments in the PRC, which could adversely and materially affect our ability to fund and expand our business.

Failure to comply with PRC regulations regarding the registration requirements for employee stock ownership plans or share option plans may subject the PRC plan participants or us to fines and other legal or administrative sanctions.

In the future, we may choose to adopt an employee incentive option plan. Under applicable PRC regulations, all foreign exchange matters relating to employee stock ownership plans, share option plans or similar plans in which PRC citizens participate require approval from SAFE or its authorized local branch. In addition, PRC citizens who are granted share options, shares or other equity interests by an offshore listed company are required, through a PRC agent or PRC subsidiary of the offshore listed company, to register with SAFE and complete certain other procedures. Since we are an offshore listed company and may in the future adopt an employee incentive option plan, we and our PRC employees who are granted share options or shares will be subject to, and intend to comply with, these regulations. If we or our PRC employees fail to comply with these regulations, we or our Chinese employees may face sanctions imposed by SAFE or other PRC government authorities, including restrictions on foreign currency conversions and additional capital contributions to our PRC subsidiaries.

We face uncertainty with respect to indirect transfers of equity interests in PRC resident enterprises by their non-PRC holding companies.

Pursuant to the Notice on Strengthening Administration of Enterprise Income Tax for Share Transfers by Non-PRC Resident Enterprises, or SAT Circular 698, issued by the State Administration of Taxation on December 10, 2009 with retroactive effect from January 1, 2008, where a non-resident enterprise transfers the equity interests of a PRC resident enterprise indirectly via disposing of the equity interests of an overseas holding company, or an Indirect Transfer, and such overseas holding company is located in a tax jurisdiction that: (i) has an effective tax rate less than 12.5% or (ii) does not tax foreign income of its residents, the foreign investor shall report to the competent tax authority of the PRC resident enterprise this Indirect Transfer. Using a “substance over form” principle, the PRC tax authority may disregard the existence of the overseas holding company if it lacks a reasonable commercial purpose and was established for the purpose of avoiding PRC tax. As a result, gains derived from such Indirect Transfer may be subject to PRC withholding tax at a rate of up to 10%. SAT Circular 698 also provides that, where a non-PRC resident enterprise transfers its equity interests in a PRC resident enterprise to its related parties at a price lower than the fair market value, the relevant tax authority has the power to make a reasonable adjustment to the taxable income of the transaction.

13

There is uncertainty as to the application of SAT Circular 698. For example, while the term “Indirect Transfer” is not clearly defined, it is understood that the relevant PRC tax authorities have jurisdiction regarding requests for information over a wide range of foreign entities having no direct contact with China. Moreover, the relevant authority has not yet promulgated any formal provisions or formally declared or stated how to calculate the effective tax rates in foreign tax jurisdictions, and the process and format of the reporting of an Indirect Transfer to the competent tax authority of the relevant PRC resident enterprise. In addition, there are not any formal declarations with regard to how to determine whether a foreign investor has adopted an abusive arrangement in order to avoid PRC tax. As a result, we may become at risk of being taxed under SAT Circular 698 and we may be required to expend valuable resources to comply with SAT Circular 698 or to establish that we should not be taxed under SAT Circular 698, which may have a material adverse effect on our financial condition and results of operations.

The approval of the China Securities Regulatory Commission may be required in connection with the recent listing of our common stock on NASDAQ under a regulation adopted in August 2006, and, if required, we cannot predict whether we will be able to obtain such approval.

In 2006, six PRC regulatory agencies jointly adopted the Regulations on Mergers and Acquisitions of Domestic Enterprises by Foreign Investors, or the New M&A Rule. This rule requires that, if an overseas company established or controlled by PRC domestic companies or citizens intends to acquire equity interests or assets of any other PRC domestic company affiliated with the PRC domestic companies or citizens, such acquisition must be submitted to MOFCOM for approval. In addition, this regulation requires that an overseas company controlled directly or indirectly by PRC companies or citizens and holding equity interests of PRC domestic companies needs to obtain the approval of the CSRC prior to listing its securities on an overseas stock exchange. On September 21, 2006, the CSRC, published a notice on its official website specifying the documents and materials required to be submitted by overseas special purpose companies seeking CSRC’s approval of their overseas listings.

While the application of the New M&A Rule remains unclear, based on their understanding of current PRC laws, regulations, and the notice published on September 21, 2006, our PRC counsel, Han Kun Law Offices, has advised us that, since our subsidiaries were established by means of direct investment rather than by merger or acquisition of the equity interest or assets of any “domestic company” as defined under the New M&A Rules, and no provision in the New M&A Rules classifies our contractual arrangements with Trunkbow Technologies as a type of acquisition transaction falling under the New M&A Rules, we are not required to submit an application to MOFCOM or the CSRC for its approval for our contractual control on Trunkbow Technologies and the listing and trading of our common stock on a US national securities exchange. However, MOFCOM and the CSRC may hold a different view from our PRC counsel.

If the CSRC or another PRC regulatory agency subsequently determines that the approvals from the MOFCOM and/or CSRC were required our contractual control over Trunkbow Technologies and for the listing and trading of our shares on NASDAQ, we may need to apply for a remedial approval from the CSRC and may be subject to certain administrative punishments or other sanctions from PRC regulatory agencies. The regulatory agencies may impose fines and penalties on our operations in the PRC, limit our operating privileges in the PRC, delay or restrict the repatriation of our foreign currency in our offshore bank accounts into the PRC, or take other actions that could materially and adversely affect our business, financial condition, results of operations, reputation and prospects, as well as the trading price of our common stock.

Also, if MOFCOM or CSRC later requires that we obtain its approval, we may be unable to obtain a waiver of such approval requirements, if and when procedures are established to obtain such a waiver. Any uncertainties or negative publicity regarding these approval requirements could materially and adversely affect the trading price of our common stock.

The New M&A Rule sets forth complex procedures for acquisitions conducted by foreign investors that could make it more difficult to pursue acquisitions.

The New M&A Rule sets forth complex procedures and requirements that could make merger and acquisition activities by foreign investors more time-consuming and complex, including requirements in some instances that MOFCOM be notified in advance of any change-of-control transaction in which a foreign investor takes control of a PRC domestic enterprise. Complying with the requirements of the New M&A Rule to complete such transactions could be time-consuming, and any required approval processes, including obtaining approval from MOFCOM, may delay or inhibit our ability to complete such transactions, which could affect our ability to expand our business or maintain our market share.

14

Risks Related to our Common Stock

Until February 2010 we were a “shell” company and as such, we may have material liabilities of which we are not aware.

We were incorporated as a “shell” company with nominal assets under the name Bay Peak 5 Acquisition Corp. (“BP5”). Immediately prior to the closing of the Share Exchange in February 2010, we conducted a due diligence review of BP5’s financial condition and legal status. Notwithstanding such review, BP5 may have material liabilities that we have not yet discovered. Further, although the Share Exchange Agreement contains customary representations and warranties from BP5 concerning its assets, liabilities, financial condition and affairs, we may have limited or no recourse against former owners or principals of BP5 in the event these prove to be untrue. We cannot insure against any loss we might incur as a result of undisclosed liabilities. See “Item 1 – Business” of this Report captioned “Company Background – Our History and Corporate Structure” for more information about the Share Exchange and our former status as a “shell” company.

Because we became public by means of a reverse takeover transaction, we may not be able to attract the attention of major brokerage firms.

Additional risks may exist since we became public through a “reverse takeover” with a shell company. Security analysts of major brokerage firms and securities institutions may not cover us since there are no broker-dealers who sold our stock in a public offering who would have an incentive to follow or recommend the purchase of our common stock. No assurance can be given that established brokerage firms will want to conduct any financings for us in the future.

If we are unable to establish appropriate internal financial reporting controls and procedures, it could cause us to fail to meet our reporting obligations, result in the restatement of our financial statements, harm our operating results, subject us to regulatory scrutiny and sanction, cause investors to lose confidence in our reported financial information and have a negative effect on the market price for shares of our common stock.

Effective internal controls are necessary for us to provide reliable financial reports and effectively prevent fraud. We maintain a system of internal control over financial reporting, which is defined as a process designed by, or under the supervision of, our principal executive officer and principal financial officer, or persons performing similar functions, and effected by our Board of Directors, management and other personnel, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles.

As a newly public company, we have significant additional requirements for enhanced financial reporting and internal controls. We will be required to document and test our internal control procedures in order to satisfy the requirements of Section 404 of the Sarbanes-Oxley Act of 2002, which requires annual management assessments of the effectiveness of our internal controls over financial reporting and a report by our independent registered public accounting firm addressing these assessments. The process of designing and implementing effective internal controls is a continuous effort that requires us to anticipate and react to changes in our business and the economic and regulatory environments and to expend significant resources to maintain a system of internal controls that is adequate to satisfy our reporting obligations as a public company.

We cannot assure you that we will not, in the future, identify areas requiring improvement in our internal control over financial reporting. We cannot assure you that the measures we will take to remediate any areas in need of improvement will be successful or that we will implement and maintain adequate controls over our financial processes and reporting in the future as we continue our growth. If we are unable to establish appropriate internal financial reporting controls and procedures, it could cause us to fail to meet our reporting obligations, result in the restatement of our financial statements, harm our operating results, subject us to regulatory scrutiny and sanction, cause investors to lose confidence in our reported financial information and have a negative effect on the market price for shares of our common stock.

15

Lack of experience as officers of publicly-traded companies of our management team may hinder our ability to comply with the Sarbanes-Oxley Act.