Attached files

| file | filename |

|---|---|

| 8-K/A - FORM 8-K/A - TODA INTERNATIONAL HOLDINGS INC. | v244033_8ka.htm |

| EX-99.3 - EXHIBIT 99.3 - TODA INTERNATIONAL HOLDINGS INC. | v244033_ex99-3.htm |

Exhibit 99.1

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

TO THE OWNERS AND BOARD OF DIRECTORS OF

VICTOR SCORE LIMITED AND SUBSIDIARIES

We have audited the accompanying consolidated balance sheets of Victor Score Limited and Subsidiaries (the “Company”) as of December 31, 2010 and 2009, and the related consolidated statements of operations and other comprehensive income, changes in owners’ equity and cash flows for the years ended December 31, 2010 and 2009. These consolidated financial statements are the responsibility of the management of the Company. Our responsibility is to express an opinion on these consolidated financial statements based on our audits.

We conducted our audits in accordance with standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the consolidated financial statements are free of material misstatement. The Company is not required to have, nor are we engaged to perform, and audit of its internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the consolidated financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the consolidated financial statements referred to above present fairly, in all material respects, the consolidated balance sheets of Victor Score Limited and Subsidiaries as of December 31, 2010 and 2009, and the consolidated results of its operations and its cash flows for the years ended December 31, 2010 and 2009 in conformity with accounting principles generally accepted in the United States of America.

As described in Note 2, the Company has restated its consolidated financial statements as of and for the year ended December 31, 2010 to (i) accurately include the financial statements for Apex Wealth Holdings Limited and Dalian Xinding New Material Technology Consultancy Co., Ltd. in the consolidated financial statements as of and for the year ended December 31, 2010 and (ii) reclassify (a) a portion of the Company’s cash from “cash and cash equivalents” to “restricted cash” and (b) costs related to the sales of raw material from “selling and distribution expenses” to “other income (expense)” for the year ended December 31, 2010 to conform with the standards of the Public Company Accounting Oversight Board (United States). Accordingly, our opinion on the financial statements as of and for the year ended December 31, 2010, as presented herein, is different from that expressed in our original report.

UHY VOCATION HK CPA LIMITED

Certified Public Accountants

Hong Kong, The People’s Republic of China

March 31, 2011, except for Note 2 as to which the date is December 20, 2011

VICTOR SCORE LIMITED

CONSOLIDATED BALANCE SHEETS

(IN US DOLLARS)

|

|

December 31,

2010

|

|

|

December 31,

2009

|

|

|||

|

|

(As Restated)

|

|

|

(A)

|

|

|||

|

Assets

|

||||||||

|

Current assets

|

||||||||

|

Cash

|

$

|

2,431,893

|

$

|

772,977

|

||||

|

Restricted cash

|

1,266,667

|

-

|

||||||

|

Accounts receivable

|

11,825,238

|

6,261,664

|

||||||

|

Inventories

|

5,580,175

|

3,188,132

|

||||||

|

Due from owners

|

12,420

|

2,357,968

|

||||||

|

Prepaid expenses and other current assets

|

5,741,549

|

3,506,321

|

||||||

|

Due from a related company

|

775,456

|

2,649,914

|

||||||

|

Tax receivable

|

-

|

39,780

|

||||||

|

Total current assets

|

27,633,398

|

18,776,756

|

||||||

|

Property, plant and equipment, net

|

3,123,858

|

1,162,827

|

||||||

|

Construction in progress

|

1,368,351

|

151,060

|

||||||

|

Land use right, net

|

287,873

|

284,395

|

||||||

|

Intangible asset

|

4,248,422

|

-

|

||||||

|

Total assets

|

$

|

36,661,902

|

$

|

20,375,038

|

||||

|

Liabilities and owners' equity

|

||||||||

|

Current liabilities

|

||||||||

|

Bank loans

|

$

|

7,945,543

|

$

|

6,812,040

|

||||

|

Accounts payable

|

3,706,251

|

938,088

|

||||||

|

Accrued liabilities and other payables

|

435,999

|

-

|

||||||

|

Advances from unrelated parties

|

196,111

|

979,187

|

||||||

|

Income tax payable

|

1,316,676

|

365,141

|

||||||

|

Due to a related company

|

-

|

87,900

|

||||||

|

Due to owners

|

-

|

165,093

|

||||||

|

Total liabilities

|

13,600,580

|

9,347,449

|

||||||

|

Owners' equity

|

||||||||

|

Share capital

|

50,000

|

50,000

|

||||||

|

Additional paid-in capital

|

3,084,380

|

2,262,820

|

||||||

|

Retained earnings

|

18,927,038

|

8,305,011

|

||||||

|

Accumulated other comprehensive income

|

999,904

|

409,758

|

||||||

|

Total owners' equity

|

23,061,322

|

11,027,589

|

||||||

|

Total liabilities and owners' equity

|

$

|

36,661,902

|

$

|

20,375,038

|

||||

|

(A)

|

Represents the combined operations of Dalian TOFA New Materials Development Co., Ltd. and Dalian Tongda Equipment Technology Development Co., Ltd. prior to restructure in 2010. (See note 1)

|

See notes to consolidated financial statements.

2

VICTOR SCORE LIMITED

CONSOLIDATED STATEMENTS OF OPERATIONS AND OTHER COMPREHENSIVE INCOME

(IN US DOLLARS)

|

|

|

For the Years Ended

December 31,

|

|

|||||

|

|

|

2010

|

|

|

2009

|

|

||

|

( As Restated)

|

(A)

|

|||||||

|

Revenue

|

||||||||

|

- Product sales to third parties

|

$

|

35,973,392

|

$

|

19,512,465

|

||||

|

- Product sales to related parties

|

1,423,123

|

3,780,978

|

||||||

|

- Licensing technology

|

2,234,237

|

732,687

|

||||||

|

Total revenue

|

39,630,752

|

24,026,130

|

||||||

|

Costs of sales

|

||||||||

|

- Product sales to third parties

|

(23,411,057

|

)

|

(14,274,834

|

)

|

||||

|

- Product sales to related parties

|

(976,487

|

)

|

(2,760,030

|

)

|

||||

|

- Licensing technology

|

(233,109

|

)

|

(52,016

|

)

|

||||

|

Total cost of sales

|

(24,620,653

|

)

|

(17,086,880

|

)

|

||||

|

Gross profit

|

15,010,099

|

6,939,250

|

||||||

|

Operating expenses:

|

||||||||

|

Selling and distribution expenses

|

(445,951

|

)

|

(504,007

|

)

|

||||

|

Administrative and other expenses

|

(1,857,785

|

)

|

(720,440

|

)

|

||||

|

Total operating expenses

|

(2,303,736

|

)

|

(1,224,447

|

)

|

||||

|

Operating income

|

12,706,363

|

5,714,803

|

||||||

|

Other income

|

95,237

|

124,843

|

||||||

|

Interest expense

|

(381,564

|

)

|

(497,721

|

)

|

||||

|

Income before income taxes

|

12,420,036

|

5,341,925

|

||||||

|

Income tax expenses

|

(1,798,009

|

)

|

(693,820

|

)

|

||||

|

Net income

|

10,622,027

|

4,648,105

|

||||||

|

Other comprehensive income:

|

||||||||

|

- Foreign currency translation adjustments

|

590,146

|

(4,337

|

)

|

|||||

|

Total comprehensive income

|

$

|

11,212,173

|

$

|

4,643,768

|

||||

|

Earnings per share:

|

||||||||

|

Basic and diluted

|

212

|

93

|

||||||

|

Weighted average ordinary shares outstanding

|

||||||||

|

Basic

|

50,000

|

50,000

|

||||||

|

Diluted

|

50,000

|

50,000

|

||||||

|

(A)

|

Represents the combined operations of Dalian TOFA New Materials Development Co., Ltd. and Dalian Tongda Equipment Technology Development Co., Ltd. prior to restructure in 2010. (See note 1)

|

See notes to consolidated financial statements.

3

VICTOR SCORE LIMITED

CONSOLIDATED STATEMENTS OF CHANGES IN OWNERS’ EQUITY

FOR THE YEARS ENDED DECEMBER 31, 2010 AND 2009

(IN US DOLLARS)

|

|

|

Registered

capital

|

|

|

Additional

paid-in

capital

|

|

|

Retained

earnings

|

|

|

Accumulated

other

comprehensive

income

|

|

|

Total

|

|

|||||

|

Balance as of January 1, 2009

|

$

|

50,000

|

$

|

2,262,820

|

$

|

3,656,906

|

$

|

414,095

|

$

|

6,383,821

|

||||||||||

|

Net income

|

-

|

-

|

4,648,105

|

-

|

4,648,105

|

|||||||||||||||

|

Foreign currency translation loss

|

-

|

-

|

-

|

(4,337

|

)

|

(4,337

|

)

|

|||||||||||||

|

Balance as of December 31, 2009

|

$

|

50,000

|

$

|

2,262,820

|

$

|

8,305,011

|

$

|

409,758

|

$

|

11,027,589

|

||||||||||

|

Cash contribution of capital

|

-

|

821,560

|

-

|

-

|

821,560

|

|||||||||||||||

|

Net income

|

-

|

-

|

10,622,027

|

-

|

10,622,027

|

|||||||||||||||

|

Foreign currency translation gain

|

-

|

-

|

-

|

590,146

|

590,146

|

|||||||||||||||

|

Balance as of December 31, 2010

(As Restated)

|

$

|

50,000

|

$

|

3,084,380

|

$

|

18,927,038

|

$

|

999,904

|

$

|

23,061,322

|

||||||||||

See notes to consolidated financial statements.

4

VICTOR SCORE LIMITED

CONSOLIDATED STATEMENTS OF CASH FLOWS

(IN US DOLLARS)

|

|

|

For the

|

|

|||||

|

|

|

Years Ended December 31,

|

|

|||||

|

2010

|

2009

|

|||||||

|

(As Restated)

|

(A)

|

|||||||

|

Cash flows from operating activities:

|

||||||||

|

Net income

|

$

|

10,622,027

|

$

|

4,648,105

|

||||

|

Adjustments to reconcile net income to net cash provided by operating activities:

|

||||||||

|

Depreciation

|

197,769

|

190,968

|

||||||

|

Amortization of land use right

|

6,151

|

6,051

|

||||||

|

Amortization of intangible assets

|

336,687

|

-

|

||||||

|

Loss on disposal of property, plant and equipment

|

-

|

1,716

|

||||||

|

Changes in assets and liabilities:

|

||||||||

|

Accounts receivable

|

(5,258,662

|

)

|

(2,377,132

|

)

|

||||

|

Inventories

|

(2,244,260

|

)

|

2,467,535

|

|||||

|

Prepaid expenses and other current assets

|

(1,792,661

|

)

|

(2,368,823

|

)

|

||||

|

Tax receivable

|

40,184

|

(33,694

|

)

|

|||||

|

Accounts payable

|

2,689,719

|

(1,739,339

|

)

|

|||||

|

Accrued liabilities and the payables

|

435,999

|

(383,731

|

)

|

|||||

|

Advanced from unrelated parties

|

(783,076

|

)

|

979,187

|

|||||

|

Income tax payable

|

923,395

|

(169,523

|

)

|

|||||

|

Net cash provided by operating activities

|

5,173,272

|

1,221,320

|

||||||

|

Cash flows from investing activities:

|

||||||||

|

Increase in restricted cash

|

(1,266,667

|

)

|

-

|

|||||

|

Purchase of property, plant and equipment

|

(2,086,463

|

)

|

(473,831

|

)

|

||||

|

Purchase of intangible assets

|

(4,513,160

|

)

|

-

|

|||||

|

Cash paid for construction in progress

|

(1,191,593

|

)

|

-

|

|||||

|

Net cash used in investing activities

|

(9,057,883

|

)

|

(473,831

|

)

|

||||

|

Cash flows from financing activities:

|

||||||||

|

Advances from related companies

|

1,396,239

|

1,073

|

||||||

|

Advances from/(to) owners

|

2,373,129

|

2,001,698

|

||||||

|

Proceeds from bank loans

|

885,098

|

12,923,361

|

||||||

|

Repayment of bank loans

|

-

|

(15,100,341

|

)

|

|||||

|

Capital contribution

|

821,560

|

-

|

||||||

|

Net cash provided by/(used in) financing activities

|

5,476,026

|

(174,209

|

)

|

|||||

|

Net increase in cash

|

1,591,415

|

573,280

|

||||||

|

Effect of foreign exchange rate changes

|

67,501

|

(242

|

)

|

|||||

|

Cash, beginning of year

|

772,977

|

199,939

|

||||||

|

Cash, end of year

|

$

|

2,431,893

|

$

|

772,977

|

||||

|

Supplemental disclosures of cash flow information:

|

||||||||

|

Cash paid during the year for:

|

||||||||

|

Interest paid

|

$

|

381,564

|

$

|

497,721

|

||||

|

Income tax paid

|

$

|

1,419,055

|

$

|

863,567

|

||||

|

(A)

|

Represents the combined operations of Dalian TOFA New Materials Development Co., Ltd. and Dalian Tongda Equipment Technology Development Co., Ltd. prior to restructure in 2010. (See note 1)

|

See notes to consolidated financial statements.

5

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(IN US DOLLARS)

|

1.

|

Organization and principal activities

|

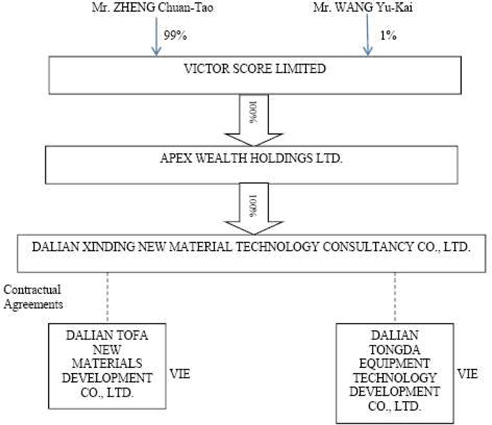

Victor Score Limited (the “Company”) was incorporated in British Virgin Islands on May 13, 2010 and is controlled by Mr. ZHENG, Chuan-Tao as of December 31, 2010. The Company is the parent company of Apex Wealth Holdings Limited ("Apex Wealth"), a Hong Kong limited liability company incorporated on February 12, 2010. The Company acquired 100% of the equity interest of Apex Wealth from Fernside Limited on June 8, 2010 for HK$1.00 (approximately US$0.128 based on the exchange rate on that date). Prior to June 8, 2010, Apex Wealth was owned 100% by Fernside Limited.

Apex Wealth formed Dalian Xinding New Material Technology Consultancy Inc. (“Dalian Xinding”), a wholly-owned foreign enterprise approved in China on August 18, 2010, as a wholly-owned subsidiary and holds 100% of the equity interests in Dalian Xinding. The registered capital of Dalian Xinding is RMB5,000,000 (US$732,504).

Pursuant to a group reorganization completed on October 12, 2010, Dalian TOFA New Materials Development Co., Ltd. (“TOFA”) and Dalian Tongda Equipment Technology Development Co., Ltd., (“Tongda”) signed a series of contractual agreements with Dalian Xinding, a wholly owned subsidiary of the Company.

Under the contractual agreements, Dalian Xinding is the primary beneficiary of the Variable Interest Entities (“VIE”) of TOFA and Tongda as defined under FASB ASC 810-10.

|

·

|

TOFA, a company incorporated under the laws of PRC on November 12, 1997 that is engaged in the manufacturing and sale of bimetallic composite wire products.

|

|

·

|

Tongda, a company incorporated under the laws of PRC on January 28, 2008 that is engaged in the manufacturing and sale of wiring equipment and provision of consulting services.

|

6

The consolidated structure is detailed as follows:-

7

The Company will conduct substantially all of its business in the PRC through TOFA and Tongda as a result of the reorganization in 2010. TOFA and Tongda will be controlled by the Company. The Company is owned by Mr. ZHENG Chuan-Tao (99%) and Mr. WANG Yu-Kai (1%), and as a result of contractual arrangements, the assets, liabilities, revenue, expenditure, operating results and cash flows of TOFA and Tongda are included in the consolidated financial statements of the Company. Mr. ZHENG Chuan Tao and Mr. WANG Yu-Kai are also the legal representatives, chief executive officers and general managers of the TOFA and Tongda.

The contractual arrangements between the Company, TOFA and Tongda have an initial term of 10 years. The parties may mutually seek to extend these agreements upon the expiry of the current term; however, Dalian Xinding has the sole right to extend any of these agreements. The Company is not aware of any legal impediments that may affect the renewal of these agreements under current PRC laws. In order for the Company to continue to derive the economic benefits from its interest in the operation of TOFA and Tongda, it must renew these contractual agreements.

As of December 31, 2010, the details of the registered and paid-up capital for the TOFA and Tongda and the lists of owners are as follows:

|

|

|

TOFA

|

|

|

Tongda

|

|

||||||||||

|

Name of owners

|

|

Shares held

|

|

|

% holding

|

|

|

Shares held

|

|

|

% holding

|

|

||||

|

Mr. FEI Li Zhi

|

-

|

-

|

546,000

|

8

|

%

|

|||||||||||

|

Mr. LI Zong Li

|

2,355,000

|

15

|

%

|

-

|

-

|

|||||||||||

|

Mr. LIU Pi Jia

|

1,290,000

|

9

|

%

|

-

|

-

|

|||||||||||

|

Mr. WANG Di

|

-

|

-

|

2,884,000

|

41

|

%

|

|||||||||||

|

Mr. WANG Yu-Kai

|

-

|

-

|

3,570,000

|

51

|

%

|

|||||||||||

|

Mr. ZHENG Chuan Tao

|

11,355,000

|

76

|

%

|

-

|

-

|

|||||||||||

|

Total

|

15,000,000

|

100

|

%

|

7,000,000

|

100

|

%

|

||||||||||

The principal activities of TOFA and Tongda are as follows:

TOFA is principally engaged in the manufacturing and trading of copper coated aluminum wire and its related products.

Tongda is principally engaged in the manufacturing of wiring equipment and leasing copper coated aluminum wire technology.

Both companies are situated at Dalian, Liaoning Province, PRC.

|

2.

|

Restatement

|

The consolidated financial statements as of and for the year ended December 31, 2010 were originally issued on March 31, 2011 and included in the Company’s Amendment No. 1 to the Current Report on Form 8-K/A filed on March 31, 2011. The discussion of the restatement below describes the cumulative changes between these 2010 financial statements and those originally issued on March 31, 2011.

The consolidated financial statements as of and for the year ended December 31, 2010, as previously issued, have been restated to (i) accurately include the financial statements for Apex Wealth and Dalian Xinding in the consolidated financial statements as of and for the year ended December 31, 2010 and (ii) reclassify (a) a portion of the Company’s cash from “cash and cash equivalents” to “restricted cash” and (b) costs related to the sales of raw material from “selling and distribution expenses” to “other income (expense)”.

The following financial statement line items were affected by the restatement:

Balance sheet as of December 31, 2010

|

As previously

reported

|

As restated

|

Effect of

change

|

||||||||||

|

Cash

|

$

|

3,650,370

|

$

|

2,431,893

|

$

|

(1,218,477

|

) | |||||

|

Restricted cash

|

-

|

1,266,667

|

1,266,667

|

|||||||||

|

Prepaid expenses and other current assets

|

5,521,916

|

5,741,549

|

219,633

|

|||||||||

|

Total current assets

|

27,365,575

|

27,633,398

|

267,823

|

|||||||||

|

Total assets

|

36,394,079

|

36,661,902

|

267,823

|

|||||||||

|

Accrued liabilities and other payables

|

20,454

|

435,999

|

415,545

|

|||||||||

|

Total liabilities

|

13,185,035

|

13,600,580

|

415,545

|

|||||||||

|

Additional paid-in capital

|

3,034,380

|

3,084,380

|

50,000

|

|||||||||

|

Retained earnings

|

19,127,131

|

18,927,038

|

(200,093

|

)

|

||||||||

|

Accumulated other comprehensive income

|

997,533

|

999,904

|

2,371

|

|||||||||

|

Total owners’ equity

|

23,209,044

|

23,061,322

|

(147,722

|

)

|

||||||||

|

Total liabilities and owners’ equity

|

$

|

36,394,079

|

$

|

36,661,902

|

$

|

267,823

|

||||||

Statement of Income for the year ended December 31, 2010

|

As previously

reported

|

As restated

|

Effect of

change

|

||||||||||

|

Selling and distribution expenses

|

$

|

1,308,767

|

$

|

445,951

|

$

|

(862,816

|

)

|

|||||

|

Administrative and other expenses

|

1,890,801

|

1,857,785

|

(33,016

|

)

|

||||||||

|

Total operating expenses

|

3,199,568

|

2,303,736

|

(895,832

|

)

|

||||||||

|

Operating income

|

12,043,640

|

12,706,363

|

662,723

|

|||||||||

|

Other income

|

958,053

|

95,237

|

(862,816

|

)

|

||||||||

|

Income before income taxes

|

12,620,129

|

12,420,036

|

(200,093

|

)

|

||||||||

|

Net income

|

10,822,120

|

10,622,027

|

(200,093

|

)

|

||||||||

|

Other comprehensive income

|

587,775

|

590,146

|

2,371

|

|||||||||

|

Total comprehensive income

|

$

|

11,409,895

|

$

|

11,212,173

|

$

|

(197,722

|

)

|

|||||

|

Earnings per ordinary share – Basic and Diluted

|

216

|

212

|

(4

|

)

|

||||||||

Statement of Cash Flows for the year ended December 31, 2010

|

As previously

reported

|

As restated

|

Effect of change

|

||||||||||

|

Net income

|

$

|

10,822,120

|

$

|

10,622,027

|

$

|

(200,093

|

)

|

|||||

|

Net cash provided by operating activities

|

5,157,421

|

5,173,272

|

15,851

|

|||||||||

|

Net cash used in investing activities

|

(7,791,216

|

) |

(9,057,883

|

) |

(1,266,667

|

) | ||||||

|

Net cash provided by financing activities

|

5,436,449

|

5,476,026

|

39,577

|

|||||||||

|

Net increase in cash

|

2,802,654

|

1,591,415

|

(1,211,239

|

) | ||||||||

|

Effect of foreign exchange rate changes

|

74,739

|

67,501

|

(7,238

|

)

|

||||||||

|

Cash, end of year

|

$

|

3,650,370

|

$

|

2,431,893

|

$

|

(1,218,477

|

) | |||||

|

3.

|

Summary of significant accounting policies

|

|

(a)

|

Basis of Presentation

|

These consolidated financial statements include the accounts of the Company, its wholly-owned subsidiaries and VIEs in which the Company is the primary beneficiary and were prepared in accordance with generally accepted accounting principles in the United States of America (“US GAAP”). All significant inter-company transactions and balances within the Group are eliminated upon consolidation.

The functional currency of the Company is the Renminbi ("RMB"). Assets and liabilities are translated at the rate of exchange in effect on the balance sheet date whereas income and expenses are translated at the average rate of exchange prevailing during the reporting period. The related rate exchange adjustments are reflected in "Accumulated other comprehensive income" in the owners' equity section of the balance sheets.

8

As disclosed in Note 1 above, the Company was established on May 13, 2010. Existing shareholders of TOFA and Tongda received an equivalent number of shares of the Company on October 12, 2010. Through contractual arrangements between the Dalian Xinding, TOFA and Tongda, the economic interests in TOFA and Tongda were transferred to the Company’s wholly owned subsidiary, Dalian Xinding.

Since Dalian Xinding, TOFA and Tongda are under common control, the financial statements of the Company have been presented on a combined basis for all periods presented. Accordingly, financial information related to periods prior to the receipt of shares and the contractual arrangements are those of TOFA and Tongda.

On August 8, 2006, six PRC regulatory agencies, namely, the PRC Ministry of Commerce, the State Assets Supervision and Administration Commission, the State Administration for Taxation, the State Administration for Industry and Commerce, the China Securities Regulatory Commission (the “ CSRC ”), and the State Administration of Foreign Exchange, jointly adopted the Regulations on Mergers and Acquisitions of Domestic Enterprises by Foreign Investors (the “ New M&A Rule ”), which became effective on September 8, 2006. The New M&A Rule purports, among other things to require offshore special purpose vehicles, or SPVs, formed for overseas listing purposes through acquisitions of PRC domestic companies and controlled by PRC companies or individuals, to obtain the approval of the CSRC prior to publicly listing their securities on an overseas stock exchange. Based on our understanding of current PRC Laws, we believe that CSRC approval is not required in the context of this transaction, because (A) Dalian Xinding was incorporated by a foreign owned enterprise, and there was no acquisition of the equity or assets of a “PRC domestic company” as such term is defined under the New M&A Rule; and (B) there is no provision in the New M&A Rule that clearly classifies the contractual arrangements between Dalian Xinding and each of TOFA and Tongda as the kind of transaction falling under the New M&A Rule. In order to avoid the complicated process to obtain the approval from CSRC, we entered into contractual agreements rather than acquire a direct ownership interest in the TOFA and Tongda.

|

(b)

|

Consolidation of Variable Interest Entities

|

VIEs are entities that lack one or more voting interest entity characteristics. The Company consolidates VIEs in which it is the primary beneficiary of its economic gains or losses. The FASB has issued ASC 810-10, Consolidation of Variable Interest Entities. ASC 810-10 clarifies the application of Accounting Research Bulletin No. 51, Consolidated Financial Statements, to certain entities in which equity investors do not have the characteristics of a controlling financial interest or do not have sufficient equity at risk for the entity to finance its activities without additional subordinated financial support from other parties. It separates entities into two groups: (1) those for which voting interests are used to determine consolidation and (2) those for which variable interests are used to determine consolidation (the subject of FASB ASC 810-10). FASB ASC 810-10 clarifies how to identify a variable interest entity and how to determine when a business enterprise should include the assets, liabilities, noncontrolling (“minority”) interests and results of activities of a variable interest entity in its consolidated financial statements.

In accordance with FASB ASC 810-10, the Company has evaluated its economic relationships with TOFA and Tongda and has determined that it is required to consolidate these two entities pursuant to the rules of FASB 810-10. Therefore TOFA and Tongda are considered to be a VIE, as defined by FASB ASC 810-10, of which the Company is the primary beneficiary. The Company, as mentioned above, absorbs a majority of the economic risks and rewards of all of these VIEs that are being consolidated in the accompanying financial statements.

Specifically, the VIE Agreements grant Dalian Xinding the power to direct the activities that most significantly impact the Company’s economic performance and right to economic returns in the following manner:

|

(a)

|

Pursuant to the terms of the Business Operation Agreement, Dalian Xinding effectively gained management control of TOFA and Tongda.

|

9

|

·

|

Without written consent of Dalian Xinding, neither TOFA nor Tongda can enter into or consummate a transaction that might significantly affect the assets, obligations, rights and operations of TOFA or Tongda.

|

|

·

|

Dalian Xinding is entitled to provide advice and guidance regarding hiring and firing employees, daily operations and financial management of TOFA and Tongda, and the management of TOFA and Tongda have agreed to accept such advice and guidance.

|

|

·

|

Dalian Xinding is entitled to recommend all candidates for directors and executive officers of TOFA and Tongda and TOFA and Tongda have agreed to appoint the candidates recommended by Dalian Xinding.

|

|

·

|

TOFA and Tongda have issued a letter of authorization that authorizes designated officers of Dalian Xinding to act as their proxies and exercise all rights of shareholders at any shareholders meetings of TOFA or Tongda pursuant to PRC law and the bylaws of TOFA and Tongda.

|

|

(b)

|

Pursuant to the terms of the Lease Agreement, TOFA and Tongda have leased all of the property, plant and equipment of TOFA and Tongda to Dalian Xinding and Dalian Xinding possesses the right to use all of such property, plant and equipment during the lease term.

|

The VIE Agreements each have an initial term of 10 years and may only be extended upon the written agreement of Dalian Xinding.

The Company's Consolidated VIEs—Balance Sheet Classification

The following table presents the carrying amounts and classifications of consolidated assets that are collateral for consolidated VIE obligations:

|

|

|

December 31,

2010

|

|

|

December 31,

2009

|

|

||

|

(As Restated)

|

||||||||

|

Assets

|

||||||||

|

Current assets

|

||||||||

|

Cash

|

$

|

2,383,703

|

$

|

772,977

|

||||

|

Restricted cash

|

1,266,667

|

-

|

||||||

|

Accounts receivable

|

11,825,238

|

6,261,664

|

||||||

|

Inventories

|

5,580,175

|

3,188,132

|

||||||

|

Prepaid expenses and other current assets

|

5,521,916

|

3,506,321

|

||||||

|

Due from a related company& owners and tax receivable

|

787,876

|

5,047,662

|

||||||

|

Other assets

|

9,028,504

|

1,598,282

|

||||||

|

Total assets of consolidated VIEs

|

$

|

36,394,079

|

$

|

20,375,038

|

||||

10

The following table presents the carrying amounts and classification of the third-party liabilities of the consolidated VIEs:

|

|

|

December 31,

2010

|

|

|

December 31,

2009

|

|

||

|

Current liabilities

|

||||||||

|

Bank loans

|

$

|

7,945,543

|

$

|

6,812,040

|

||||

|

Accounts payable

|

3,706,251

|

938,088

|

||||||

|

Other liabilities

|

1,533,241

|

1,597,321

|

||||||

|

Total liabilities of consolidated VIEs

|

$

|

13,185,035

|

$

|

9,347,449

|

||||

The consolidated VIEs included in the table above represent the two separate entities with which the Company is involved. The creditors of consolidated VIEs have legal recourse only to the assets of the VIEs and do not have such recourse to the Company. In addition, the assets are generally restricted only to pay such liabilities. Thus, the Company's maximum legal exposure to loss related to consolidated VIEs is significantly less than the carrying value of the consolidated VIE assets due to outstanding third-party financing. Intercompany liabilities are excluded from the table.

ASC 810-10-25-38A indicates that one characteristic a reporting entity must have to be considered the primary beneficiary of a VIE is the “power to direct the activities of a VIE that most significantly impact the VIE’s economic performance.”

The following clauses in the contractual agreements grant Xinding to direct activities that most significantly impact the economic performance activities and the right to economic return of TOFA and Tongda, our VIEs:

|

·

|

Dalian Xinding provides our VIEs with a variety of technical, consulting, and administrative services.

|

|

·

|

The employees of Dalian Xinding act as management for our VIEs.

|

|

·

|

The Dalian Xinding holds options or other securities to acquire the equity investors’ interests in our VIEs.

|

|

·

|

The Dalian Xinding is obligated to provide additional funding when operating losses occur, current funding is insufficient, or both in our VIEs.

|

After comparing the nature and extent of the activities between Dalian Xinding and our VIEs with the entire set of our VIE’s activities, we believe that substantially all (90 percent or more) of our VIE’s activities are conducted on behalf of Dalian Xinding.

Dalian Xinding’s contractual arrangements with TOFA and Tongda may not be as effective in providing control over TOFA and Tongda as direct ownership of TOFA and Tongda and the shareholders of TOFA and Tongda may have potential conflicts of interest with us.

The Company has no ownership interest in TOFA and Tongda and conducts substantially all of its operations and generates substantially all of its revenues through contractual arrangements that Dalian Xinding had entered into with TOFA and Tongda, and such contractual arrangements are designed to provide the Company with effective control over TOFA and Tongda. See “company overview” for a description of these contractual arrangements. The Company depends on TOFA and Tongda for the operation and business. TOFA and Tongda also own all of the necessary intellectual property, facilities and other assets relating to the operation of its business, and employs personnel for its operations and distribution.

Although in the opinion of the Company’s PRC counsel, each of these contractual arrangements is valid, binding and enforceable, and will not result in any violation of PRC laws or regulations currently in effect, they may not be as effective in providing control over TOFA and Tongda as direct ownership. If the Company had direct ownership of TOFA and Tongda, it would be able to exercise its rights as a shareholder to effect changes in the board of directors of TOFA and Tongda, which in turn could affect changes, subject to any applicable fiduciary obligations, at the management level. Due to the VIE structure, the Company must rely on contractual rights to exercise control and management of TOFA and Tongda, which exposes it to the risk of potential breach of contract by the shareholders of TOFA and Tongda. In addition, as TOFA and Tongda are jointly owned by their shareholders, it may be difficult to change the corporate structure if such shareholders refuse to cooperate with the Company.

11

The shareholders of TOFA and Tongda may breach, or cause TOFA and Tongda to breach, the contracts for a number of reasons. For example, their interests as shareholders of TOFA and Tongda and the interests of our company may conflict and the Company may fail to resolve such conflicts; the shareholders may believe that breaching the contracts will lead to greater economic benefit for them; or the shareholders may otherwise act in bad faith. If any of the foregoing were to happen, the Company may have to rely on legal or arbitral proceedings to enforce its contractual rights, including specific performance or injunctive relief, and claiming damages. Such arbitral and legal proceedings may cost the Company substantial financial and other resources, and result in disruption of its business, and the Company cannot assure you that the outcome will be in our favor.

In addition, as all of these contractual arrangements are governed by PRC law and provide for the resolution of disputes through either arbitration or litigation in the PRC, they would be interpreted in accordance with PRC law and any disputes would be resolved in accordance with PRC legal procedures. The legal environment in the PRC is not as developed as in other jurisdictions, such as the United States. As a result, uncertainties in the PRC legal system could further limit our ability to enforce these contractual arrangements. Furthermore, these contracts may not be enforceable in China if PRC government authorities or courts take a view that such contracts contravene PRC laws and regulations or are otherwise not enforceable for public policy reasons. In the event we are unable to enforce these contractual arrangements, we may not be able to exert effective control over TOFA and Tongda, and our ability to conduct our business may be materially and adversely affected.

An assessment of risk for the lack of enforceability of the contractual agreements is as follows:

|

|

|

December 31,

2010

|

|

|

December 31,

2009

|

|

||

|

Negative impact on net income ($million)

|

$

|

10.6

|

$

|

4.6

|

||||

|

(c)

|

Subsequent events

|

The Company discloses as subsequent events that all events that occur after the balance sheet through December 20, 2011.

|

(d)

|

Revenue recognition

|

The Company generates revenue primarily from manufacturing and trading of copper coated aluminum wire, equipment and its related products and licensing of copper coated aluminum wire technology.

Licensing technology represents the revenue from the leasing of several exclusive production technologies (i.e., the unique skills applied to the assembly of the wiring equipment, which is leased separately from the wiring equipment) to independent third parties. The production technology has been internally developed by Tongda’s research and development department and is related to the technical know-how in the production process have not been patent in accordance with the relevant laws and regulations of the PRC.

Revenue represents the invoiced value of goods sold and the rental income of certain production technology to independent parties. Revenue is recognized when all of the following criteria are met: (1) persuasive evidence of an arrangement exists; (2) delivery has occurred and the customer has taken ownership and assumed the risk of loss, or services have been rendered; (3) the seller’s price to the buyer is fixed or determinable; and (4) collectability is reasonably assured.

12

These criteria as they relate to each of the Company’s major revenue generating activities are described below.

For product sales to PRC customers, products are considered delivered when they reach the customers’ location and are accepted by customers, which is the point when the customers take ownership and assume risk of loss. For sales to overseas customers, products are considered delivered when they reach the named port of shipment, which is the point when the customers take ownership and assume risk of loss. Delivery is evidenced by a signed customer acceptance form for PRC sales and is evidenced by signed bills of lading for sales to overseas customers. The Company’s sales agreements do not provide customers the right of return, price protection or any other concessions.

For leasing of production technology, revenue recognition takes place when the installation drawings and the manuals have been handed over to the customer according to the contractual terms. The method used to determine the lease price of the production technology is the Income Approach - estimating the future income streams expected from the use of the production technology then discounted via present value calculations to determine their current value. The estimates involved to determine these sales include: Annual Company (the buyer of production technologies) Revenues, Portion Attributable to application of the production technologies, Years of Future Use and Discount Rate.

Shipping and handling costs related to delivery of products are included in selling expenses, which were USD390,627 and USD461,689 for the years ended December 31, 2010 and 2009 , respectively, while shipping and handling costs related to sales of raw materials are included in other income (other expense).

|

(e)

|

Cash

|

Cash consist of cash on hand and in banks. The Company consider all highly investments with original maturities of three months or less to be cash. Substantially all of the cash deposits of the Group are held with financial institutions located in the PRC. Management believes these financial institutions are of high credit quality.

Cash is considered to be restricted if it is designated to be used for a specific purpose. The restricted cash in the Company was pledged to obtain an irrevocable letter of credit.

|

(f)

|

Accounts receivable

|

Accounts receivable are recorded at the invoiced amount and do not bear interest. The Company generally extends unsecured credit up to three months to its customers in the ordinary course of business. The Company mitigates the associated risks by performing credit checks and actively pursuing past due accounts. An allowance for doubtful accounts is established and determined based on managements' assessment of known requirements, aging of receivables, payment history, the customer's current credit worthiness, and the economic environment. When a specific accounts receivable balance is deemed uncollectible, a charge is taken to statement of operation and comprehensive income. Recoveries of balances previously written off are reflected as income in the statement of operations and comprehensive income. Based on the Company’s assessment of collectability, there has been no allowance for doubtful accounts recognized for the years ended December 31, 2010 and 2009.

|

(g)

|

Inventories

|

Inventories consisting of raw material, work-in-progress and finished goods of copper coated aluminum wire and related products which are stated at the lower of cost or net realizable value. Finished goods comprised of direct materials, direct labour and a portion of overheads. Inventory costs are calculated using a weighted average method of accounting.

Allowances are recorded for obsolete, slow-moving and damaged inventory and are deducted from the related inventory balances. No provision was made as of December 31, 2010 and 2009.

13

|

(h)

|

Property, plant and equipment

|

Property, plant and equipment are recorded at cost less accumulated depreciation and any impairment. Maintenance, repairs and minor renewals are expensed as incurred; major renewals and improvements that extend the lives or increase the capacity of plant assets are capitalized.

When assets are retired or disposed of, the cost and accumulated depreciation are removed from the accounts, and any resulting gains or losses are included in income in the reporting period of disposition.

Depreciation is calculated on a straight-line basis over the estimated useful life of the assets after taking into account their respective estimated residual value. The estimated useful life of the assets is as follows:

|

Years

|

|||

|

Buildings

|

10 – 20 | ||

|

Plant equipment

|

3 – 10 | ||

|

Office equipment

|

3 – 5 | ||

|

Motor vehicles

|

3 – 8 |

|

(i)

|

Land use right

|

Land use right is recorded as cost less accumulated amortization. Land use rights represent the prepayments for the use of the parcels of land in the PRC where the Company’s production facilities are located, and are charged to expense over their respective lease periods of 50 years. According to the laws of the PRC, the government owns all of the land in the PRC. Company or individuals are authorized to use the land only through land use rights granted by the PRC government for a certain period (usually 50 years).

|

(j)

|

Intangible assets

|

Intangible assets acquired separately and with finite useful lives are carried at costs less accumulated amortization and any accumulated impairment losses. Amortization for intangible assets with finite useful lives is provided on a straight-line basis over their estimated useful lives. Alternatively, intangible assets with indefinite useful lives are carried at cost less any subsequent accumulated impairment losses.

Gains or losses arising from derecognition of the intangible asset is measured at the difference between the net disposal proceeds and the carrying amount of the assets and are recognized in the statement of comprehensive income when the asset is disposed.

|

(k)

|

Construction in progress

|

Construction in progress represents property, plant and equipment under construction and pending installation and is stated at cost less accumulated impairment losses, if any.

No provision for depreciation is made on construction in progress until such time as the relevant assets are completed and are available for intended use. When the assets are placed in service, the costs are transferred to property, plant and equipment and depreciated in accordance with the accounting policy of the Company.

|

(l)

|

Research and development costs

|

Research and development costs are charged to expense as incurred. Research and development costs mainly consist of remuneration for the research and development staff and material costs for research and development. The Company incurred $171,621 and $132,180 for years ended December 31, 2010 and 2009, respectively.

14

|

(m)

|

Impairment of long-lived assets

|

The long-lived assets held and used by the Company are reviewed for impairment whenever events or changes in circumstances indicate that the carrying amount of assets may not be recoverable. It is reasonably possible that these assets could become impaired as a result of technology or other industry changes. Determination of recoverability of assets to be held and used is by comparing the carrying amount of an asset to future net undiscounted cash flows to be generated by the assets. If such assets are considered to be impaired, the impairment to be recognized is measured by the amount by which the carrying amount of the assets exceeds the fair value of the assets. Assets to be disposed of are reported at the lower of the carrying amount or fair value less costs to sell.

No impairment was recognized as of December 31, 2010 and 2009.

|

(n)

|

Comprehensive income

|

The Company has adopted ASC 220, "Comprehensive Income." This statement establishes rules for the reporting of comprehensive income and its components. Comprehensive income consists of net income and foreign currency translation adjustments.

|

(o)

|

Income taxes

|

The Company accounts for income taxes under ASC 740 "Income Taxes." Deferred income tax assets and liabilities are determined based upon differences between the financial reporting and tax bases of assets and liabilities and are measured using the enacted tax rates and laws that will be in effect when the differences are expected to reverse. Deferred tax assets are reduced by a valuation allowance to the extent management concludes it is more likely than not that the assets will not be realized. Deferred tax assets and liabilities are measured using enacted tax rates expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or settled. The effect on deferred tax assets and liabilities of a change in tax rates is recognized in the statements of operations in the period that includes the enactment date.

During 2009, the Company adopted ASC 740-10 "Income Taxes." which prescribes a more-likely-than-not threshold for financial statement recognition and measurement of a tax position taken in the tax return. This interpretation also provides guidance on de-recognition of income tax assets and liabilities, classification of current and deferred income tax assets and liabilities, accounting for interest and penalties associated with tax positions, accounting for income taxes in interim periods and income tax disclosures. As of December 31, 2010 and 2009, there were no amounts that had been accrued with respect of uncertain tax positions.

A reconciliation of the differences between the statutory tax rate and the effective tax rate for Enterprises Income Tax (“EIT”) is as follows:

|

|

December

31,

2010

|

December

31,

2009

|

||||||

|

EIT statutory rates

|

||||||||

|

- TOFA

|

15

|

%

|

15

|

%

|

||||

|

- Tongda

|

25

|

%

|

25

|

%

|

||||

|

EIT effective rates

|

||||||||

|

- TOFA

|

15

|

%

|

15

|

%

|

||||

|

- Tongda

|

10

|

%

|

0

|

%

|

||||

The tax effects of temporary differences of the Company as of December 31, 2010 and 2009 are immaterial.

15

|

(p)

|

Value added tax

|

The Company’s VIEs TOFA and Tongda are registered as the "General Taxpayer" with the relevant PRC tax authorities which means that they are subject to VAT at 17% on sales of goods.

The Company presents its revenue on a net basis. At the end of a given month: (i) if the balance of the VAT calculation is positive, the Company pays the appropriate VAT for the period and (ii) if the balance of the VAT calculation is negative, the Company takes a deduction in the next month.

|

(q)

|

Fair value measurements

|

In April 2009, the FASB issued ASC 820-10-65-4 (formerly FSP No. 157-4, “Determining Fair Value When the Volume and Level of Activity for the Asset and Liability Have Significantly Decreased and Identifying Transactions That Are Not Orderly”). This standard emphasizes that even if there has been a significant decrease in the volume and level of activity, the objective of a fair value measurement remains the same. Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction (that is, not a forced liquidation or distressed sale) between market participants. This standard provides a number of factors to consider when evaluating whether there has been a significant decrease in the volume and level of activity for an asset or liability in relation to normal market activity. In addition, when transactions or quoted prices are not considered orderly, adjustments to those prices based on the weight of available information may be needed to determine the appropriate fair value. This standard is effective for interim and annual reporting periods ending after September 15, 2009, and shall be applied prospectively. Early adoption is permitted for periods ending after March 15, 2009. The adoption of this standard did not have a material effect on the consolidated financial statements.

In August 2009, the FASB issued Accounting Standards Update “ASU” 2009-5 “Measuring Liabilities at Fair Value”. This ASU provides amendments to ASC 820-10 “Fair Value Measurements and Disclosures” to address concerns regarding the determination of the fair value of liabilities. Because liabilities are often not “traded”, due to restrictions placed on their transferability, there is typically a very limited amount of trades (if any) from which to draw market participant data. As such, many entities have had to determine the fair value of a liability through the use of a hypothetical transaction. This ASU clarifies the valuation techniques that must be used when the liability subject to the fair value determination is not traded as an asset in an active market. The management does not expect the adoption of this ASU to have a material effect on the consolidated financial statements.

In January 2010, the FASB issued Accounting Standards Update “ASU 2010-06” “Fair Value Measurements and Disclosures”. The new guidance clarifies two existing disclosure requirements and requires two disclosures as follows: (1) a “gross" presentation of activities (purchases, sales, and settlements) within the Level 3 roll forward reconciliation, which will replace the “net” presentation format; and (2) detailed disclosures about the transfers in and out of Level 1 and 2 measurements. This guidance is effective for the first interim or annual reporting period beginning after December 15, 2009, except for the gross presentation of Level 3 roll forward information, which is required for annual reporting periods beginning after December 15, 2010, and for interim reporting periods thereafter. The Group adopted the amended fair value disclosures guidance on January 1, 2010, except for the gross presentation of the Level 3 roll forward information, which the Group is not required to adopt until January 1, 2011.

|

(r)

|

Employee benefits

|

|

i)

|

Salaries, wages, annual bonuses, paid annual leave and staff welfare are accrued in the year in which the associated services are rendered by employees of the Company. Where payment or settlement is deferred and the effect would be material, these amounts are stated at their present values.

|

|

ii)

|

Contributions to appropriate local defined contribution retirement schemes pursuant to the relevant labor rules and regulations in the PRC are recognized as an expense in the statement of operations as incurred.

|

16

|

(s)

|

Retirement benefits

|

Contributions to defined contribution plans are charged to cost of sales and general and administrative expenses in the statements of operation as and when the related employee service is provided.

|

(t)

|

Use of estimates

|

The preparation of financial statements in conformity with accounting principles generally accepted in the United States requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Significant items subject to such estimates and assumptions include the recoverability of the carrying amount and the estimated useful lives of long lived assets’ valuation allowance for receivables and realizable values for inventories. Actual results may differ from those estimates.

|

(u)

|

Foreign currency transaction

|

The Company maintains its books and accounting records in PRC currency "Renminbi" ("RMB"), which is determined as the functional currency. Transactions denominated in currencies other than RMB are translated into RMB at the exchange rates quoted by the People’s Bank of China (“PBOC”) prevailing at the date of the transactions. Monetary assets and liabilities denominated in currencies other than RMB are translated into RMB using the applicable exchange rates quoted by the PBOC at the balance sheet dates. Gain and losses resulting from foreign currency transactions are included in operations.

The financial statements of the Company are translated into the reporting currency, the United States Dollar (“USD”). Assets and liabilities of the Company are translated at the prevailing exchange rate at each reporting period end. Contributed capital accounts are translated using the historical rate of exchange when capital is injected. Income and expense accounts are translated at the average rate of exchange during the reporting period. Translation adjustments resulting from translation of these financial statements are reflected as other comprehensive income in the statements of operations and accumulated other comprehensive income in the statements of changes in shareholders' equity. The translation rates are as follows:

|

|

|

December 31,

|

|

|||||

|

|

|

2010

|

|

|

2009

|

|

||

|

Year end RMB : USD exchange rate

|

6.6000

|

6.8259

|

||||||

|

Average RMB : USD exchange rate

|

6.7137

|

6.8242

|

||||||

|

Year end HKD : USD exchange rate

|

7.7810

|

7.7536

|

||||||

|

Average HKD : USD exchange rate

|

7.7683

|

7.7520

|

||||||

|

(v)

|

Contingencies

|

In the normal course of business, the Company is subject to contingencies, including legal proceedings and claims arising out of the businesses that relate to a wide range of matters, including among others, product liability. The Company records accruals for such contingency based upon the assessment of the probability of occurrence and, where determinable, an estimate of the liability. Management may consider many factors in making these assessments including past history, scientific evidence and the specifics of each matter. As management has not become aware of any product liability claim, no contingent liability has been recorded for the years ended December 31, 2010 and 2009.

17

|

(w)

|

Concentrations of credit risk

|

The Company sells its products primarily to domestic and overseas customers. Credit is extended based on an evaluation of the customer's financial condition. At December 31, 2010 and 2009, the Company has no significant concentration of credit risk as sales deposits were received in advance from certain customers prior to the delivery of products to customers of the Company.

The Company maintains its cash with high-quality institutions. Deposits held with banks in PRC may not be insured or exceed the amount of insurance provided on such deposits.

|

(x)

|

Economic and political risk

|

The major operations of the Company are conducted in the PRC. Accordingly, the political, economic, and legal environments in the PRC, as well as the general state of the PRC's economy may influence the business, financial condition, and results of operations of the Company.

The major operations of the Company in the PRC are subject to special considerations and significant risks not typically associated with Company in North America and Western Europe. These include risks associated with, among others, the political, economic, and legal environment.

The results of the Company may be adversely affected by changes in governmental policies with respect to laws and regulations, anti-inflationary measures, and rates and methods of taxation, among other things.

|

(y)

|

Recently issued accounting standards

|

The Company describes below recent pronouncements that have had or may have a significant effect on our financial statements. We do not discuss recent pronouncements that are not anticipated to have an impact on or are unrelated to our financial condition, results of operations, or disclosures.

In May 2009, the FASB issued guidance within Topic 855-10 (formerly SFAS 165, “Subsequent Events”) relating to subsequent events. This guidance establishes principles and requirements for subsequent events. This guidance defines the period after the balance sheet date during which events or transactions that may occur would be required to be disclosed in the Company’s financial statements. Public entities are required to evaluate subsequent events through the date that financial statements are issued. This guidance also provides guidelines in evaluating whether or nor events or transactions occurring after the balance sheet date should be recognized in the financial statements. This guidance requires disclosure of the date through which subsequent events have been evaluated. This Statement is effective for interim and annual periods ending after June 15, 2009. The Company has adopted this standard as of December 31, 2009. The adoption of this standard does not have a material impact on the Company’s financial statements.

In July 2009, the Company adopted changes issued by the FASB to the authoritative hierarchy of GAAP. These changes establish the FASB Accounting Standards Codification (“Codification”) as the source of authoritative accounting principles recognized by the FASB to be applied by the nongovernmental entities in the preparation of financial statements in conformity with GAAP.

The FASB will no longer issue new standards in the form of Statements, FASB Staff Positions, or Emerging Issues Task Force Abstracts; instead the FASB will issue Accounting Standards Updates (“ASUs”). ASUs will not be authoritative in their own right as they will only serve to update the Codification. These changes and the Codification itself do not change GAAP. Other that the manner in which new accounting guidance is referenced, the adoption of these changes had no impact on the Company’s consolidated financial statements.

18

In January 2010, the FASB issued ASU 2010-6, Improving Disclosures About Fair Value Measurements, which requires reporting entities to make new disclosures about recurring or nonrecurring fair-value measurements including significant transfers into and out of Level 1 and Level 2 fair-value measurements and information on purchases, sales, issuances, and settlements on a gross basis in the reconciliation of Level 3 fair-value measurements. ASU 2010-6 is effective for annual reporting periods beginning after December 15, 2009, except for Level 3 reconciliation disclosures which are effective for annual periods beginning after December 15, 2010. The adoption of ASU 2010-6 will not have a material impact on our consolidated financial statement disclosures.

Management does not believe that any other recently issued, but not yet effective accounting pronouncements, if adopted, would have a material effect on the accompanying financial statements.

|

4.

|

Restricted cash

|

Restricted cash consists of the following:

|

|

|

December 31,

|

|

|||||

|

|

|

2010

(As Restated)

|

|

|

2009

|

|

||

|

Collateral for an irrevocable letter of credit

|

$

|

1,266,667

|

$

|

-

|

||||

|

5.

|

Accounts receivable

|

Accounts receivable consist of the following:

|

|

|

December 31,

|

|

|||||

|

|

|

2010

(As Restated)

|

|

|

2009

|

|

||

|

Accounts receivable, trade

|

$

|

11,825,238

|

$

|

6,261,664

|

||||

|

Less: allowance for doubtful debts

|

-

|

-

|

||||||

|

$

|

11,825,238

|

$

|

6,261,664

|

|||||

|

6.

|

Inventories

|

Inventories are stated at the lower of cost (determined using the weighted average cost) or market value and are composed of the following:

|

|

|

December 31,

|

|

|||||

|

|

|

2010

(As Restated)

|

|

|

2009

|

|

||

|

Raw materials

|

$

|

822,027

|

$

|

662,519

|

||||

|

Work-in-progress

|

2,560,813

|

1,153,993

|

||||||

|

Finished goods

|

2,197,335

|

1,371,620

|

||||||

|

$

|

5,580,175

|

$

|

3,188,132

|

|||||

|

7.

|

Due from owners

|

|

|

|

|

December 31,

|

|

||||||

|

Name

|

Nature

|

|

2010

(As Restated)

|

|

|

2009

|

|

|||

|

Mr. LIU Pi Jia

|

Cash advances

|

$

|

-

|

$

|

413,718

|

|||||

|

Mr. SONG Yu-chun

|

Cash advances

|

1,515

|

1,051,130

|

|||||||

|

Mr. WANG Yukai

|

Cash advances

|

10,905

|

-

|

|||||||

|

Mr. ZHENG Chuan Tao

|

Cash advances

|

-

|

893,120

|

|||||||

|

$

|

12,420

|

$

|

2,357,968

|

|||||||

The amounts due from owners are interest free and unsecured. In the opinion of the directors, the amounts are receivable within the twelve months of the balance sheet date and repayable on demand.

19

|

8.

|

Prepaid expenses and other current assets

|

Prepaid expenses and other current assets consist of the following:

|

|

|

December 31,

|

|

|||||

|

Nature

|

|

2010

(As Restated)

|

|

|

2009

|

|

||

|

Trade deposits

|

$

|

3,878,788

|

$

|

1,391,758

|

||||

|

Prepaid staff welfare

|

215,553

|

832,974

|

||||||

|

Other short term advances to third parties

|

1,643,875

|

1,186,657

|

||||||

|

Sundry and utility deposits

|

3,333

|

94,932

|

||||||

|

$

|

5,741,549

|

$

|

3,506,321

|

|||||

The other short term advances to third parties are interest free and unsecured. In the opinion of the directors, the amounts are receivable within the twelve months of the balance sheet date and repayable on demand.

|

9.

|

Due from a related company

|

|

|

|

|

December 31,

|

|

||||||

|

Nature

|

Nature

|

|

2010

(As Restated)

|

|

|

2009

|

|

|||

|

Shenzhen Tofa Complex Metal

|

||||||||||

|

Material Co., Ltd.

|

Sales of goods

|

$

|

775,456

|

$

|

2,649,914

|

|||||

The above company was controlled by ZHENG Chuan Tao, the director of TOFA.

The amount due is interest free and unsecured. In the opinion of the directors, the amount is receivable within the twelve months of the balance sheet date and repayable on demand.

During the years ended December 31, 2010 and 2009, the Company sold goods to Shenzhen Tofa Complex Metal Material Co., Ltd. amounted to $1,423,123 and $3,275,463 respectively.

|

10.

|

Property, plant and equipment, net

|

Property, plant and equipment, net, consists of the following at:

|

|

|

December 31,

|

|

|||||

|

|

|

2010

(As Restated)

|

|

|

2009

|

|

||

|

Land and buildings

|

$

|

918,846

|

$

|

888,439

|

||||

|

Plant equipment

|

3,693,032

|

1,803,296

|

||||||

|

Office equipment

|

163,150

|

138,294

|

||||||

|

Motor vehicles

|

484,513

|

203,284

|

||||||

|

$

|

5,259,541

|

$

|

3,033,313

|

|||||

|

Less: Accumulated depreciation

|

(2,135,683

|

)

|

(1,870,486

|

)

|

||||

|

Net

|

$

|

3,123,858

|

$

|

1,162,827

|

||||

Depreciation expense for the years ended December 31, 2010 and 2009 amounted to $197,769 and $190,968, respectively.

The land and buildings, plant and office equipment are pledged as collateral to Shanghai Pudong Development Bank for the bank loans granted to the Company.

20

|

11.

|

Construction in progress

|

A summary of construction in progress is as follows:

|

|

|

December 31,

|

|

|||||

|

|

|

2010

(As Restated)

|

|

|

2009

|

|

||

|

Balance beginning

|

$

|

151,060

|

$

|

151,135

|

||||

|

Additions

|

1,212,121

|

-

|

||||||

|

Effect of foreign exchange rate changes

|

5,170

|

(75

|

)

|

|||||

|

Balance ending

|

$

|

1,368,351

|

$

|

151,060

|

||||

The additional capital commitment for construction in progress contracted for but not provided in the consolidated financial statements as at December 31, 2010 was $1,666,667.

|

|

|

Balance at

December 31, 2010

|

|

|

Estimated cost to