Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - Ameritrust Corp | Financial_Report.xls |

| EX-31.2 - GRYPHON RESOURCES 10K, CERTIFICATION 302, CFO - Ameritrust Corp | gryphonexh31_2.htm |

| EX-31.1 - GRYPHON RESOURCES 10K, CERTIFICATION 302, CEO - Ameritrust Corp | gryphonexh31_1.htm |

| EX-32.1 - GRYPHON RESOURCES 10K, CERTIFICATION 906, CEO/CFO - Ameritrust Corp | gryphonexh32_1.htm |

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

______________________

FORM 10-K

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For Fiscal Year Ended September 30, 2011

OR

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

FOR THE TRANSITION PERIOD FROM ___________________ TO ___________________

Commission File # 000-53371

GRYPHON RESOURCES, INC.

(Exact name of registrant as specified in its charter)

Nevada

(State or other jurisdiction of incorporation or organization)

98-0465540

(IRS Employer Identification Number)

1313 East Maple Street, Suite 201-462

Bellingham, Washington 98225

(Address of principal executive offices) (Zip Code)

(360) 685-4238

(Registrant’s telephone no., including area code)

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, $0.001 par value

(Title of class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act: Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act: Yes x No o

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days: Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K: Yes o No x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company:

|

Large accelerated filer

|

o

|

Accelerated filer

|

o

|

|

|

Non-accelerated filer

|

o

|

Smaller reporting company

|

x

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act): Yes o No x

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter:

Based on the closing price on December 27, 2011 of $0.01, the aggregate market value of the 68,675,000 common shares held by non-affiliates was $686,750.

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date: 117,425,000 Common shares were outstanding as of December 27, 2011.

Documents incorporated by reference: None

GRYPHON RESOURCES, INC.

(An Exploration Stage Company)

Table of Contents

PART I

ITEM 1. DESCRIPTION OF BUSINESS

General

Gryphon Resources, Inc. was incorporated in the State of Nevada on January 16, 2006. We are a mineral exploration company and are exploring for gold, silver and copper-porphyry; and lithium on two different properties in Arizona, USA.

(Hereinafter Gryphon Resources, Inc. may herein be referred to: “Gryphon Resources”, “Gryphon”, “We”, “Us”, the “Registrant”, or the “Company”).

The Company’s common stock is traded in the Pink Sheets over-the-counter market under the symbol “GRYO”. Prior to our current fiscal year, our shares also traded on the Over-The-Counter Bulletin Board, but such listing ceased due to the failure of a primary market-maker to file an updated Form 15-2c11 to comply with FINRA guidelines related to minimum required trading activity.

Our fiscal year end is September 30th.

ITEM 1A. RISK FACTORS

The following risk factors should be considered in connection with an evaluation of the business of our business:

THE COMPANY'S LIMITED OPERATING HISTORY MAKES IT DIFFICULT FOR YOU TO JUDGE ITS PROSPECTS.

The Company has a limited operating history upon which an evaluation of the Company, its current business and its prospects can be based. You should consider any purchase of the Company's shares in light of the risks, expenses and problems frequently encountered by all companies in the early stages of its corporate development.

LIQUIDITY AND CAPITAL RESOURCES ARE UNCERTAIN.

For the year ended September 30, 2011, the Company incurred a net loss of $(353,621) and have incurred net losses since inception of $(661,509), net of a non-cash gain of $97,920. The Company may need to raise additional capital by way of an offering of equity securities, an offering of debt securities, or by obtaining financing through a bank or other entity. The Company has not established a limit as to the amount of debt it may incur nor has it adopted a ratio of its equity to debt allowance. If the Company needs to obtain additional financing, there is no assurance that financing will be available from any source, that it will be available on terms acceptable to us, or that any future offering of securities will be successful. If additional funds are raised through the issuance of equity securities, there may be a significant dilution in the value of the Company’s outstanding common stock. The Company could suffer adverse consequences if it is unable to obtain additional capital which would cast substantial doubt on its ability to continue its operations and growth.

THE VALUE AND TRANSFERABILITY OF THE COMPANY'S SHARES MAY BE ADVERSELY IMPACTED BY THE LIMITED TRADING MARKET FOR ITS SHARES AND THE PENNY STOCK RULES.

There is only a limited trading market for the Company's shares. The Company's common stock is traded in the Pink Sheets over-the-counter market (‘Pink Sheets’) and "bid" and "asked" quotations regularly appear on the Pink Sheets under the symbol "GRYO". Prior to our current fiscal year, our shares also traded on the Over-The-Counter Bulletin Board, but such listing ceased due to the failure of a primary market-maker to file an updated Form 15-2c11 to comply with FINRA guidelines related to minimum required trading activity. There can be no assurance that the Company's common stock will trade at prices at or above its present level and an inactive or illiquid trading market may have an adverse impact on the market price. In addition, holders of the Company's common stock may experience substantial difficulty in selling their securities as a result of the "penny stock rules" which restrict the ability of brokers to sell certain securities of companies whose assets or revenues fall below the thresholds established by those rules.

FUTURE SALES OF SHARES MAY ADVERSELY IMPACT THE VALUE OF THE COMPANY'S STOCK.

If required, the Company may seek to raise additional capital through the sale of common stock. Future sales of shares by the Company or its stockholders could cause the market price of its common stock to decline.

MINERAL EXPLORATION AND DEVELOPMENT ACTIVITIES ARE SPECULATIVE IN NATURE.

Resource exploration and development is a speculative business, characterized by a number of significant risks including, among other things, unprofitable efforts resulting not only from the failure to discover mineral deposits but from finding mineral deposits which, though present, are insufficient in quantity and quality to return a profit from production. The marketability of minerals acquired or discovered by the Company may be affected by numerous factors which are beyond the control of the Company and which cannot be accurately predicted, such as market fluctuations, the proximity and capacity of milling facilities, mineral markets and processing equipment and such other factors as government regulations, including regulations relating to royalties, allowable production, importing and exporting of minerals and environmental protection, the combination of which factors may result in the Company not receiving an adequate return of investment capital.

Substantial expenditures are required to establish ore reserves through drilling, to develop metallurgical processes to extract the metal from the ore and, in the case of new properties, to develop the mining and processing facilities and infrastructure at any site chosen for mining. Although substantial benefits may be derived from the discovery of a major mineralized deposit, no assurance can be given that minerals will be discovered in sufficient quantities and grades to justify commercial operations or that funds required for development can be obtained on a timely basis. Estimates of reserves, mineral deposits and production costs can also be affected by such factors as environmental permitting regulations and requirements, weather, environmental factors, unforeseen technical difficulties, unusual or unexpected geological formations and work interruptions. In addition, the grade of ore ultimately mined may differ from that indicated by drilling results. Short term factors relating to reserves, such as the need for orderly development of mineralized zones or the processing of new or different grades, may also have an adverse effect on mining operations and on the results of operations. Material changes in ore reserves, grades, stripping ratios or recovery rates may affect the economic viability of any project.

THE COMPANY WILL BE SUBJECT TO OPERATING HAZARDS AND RISKS WHICH MAY ADVERSELY AFFECT THE COMPANY'S FINANCIAL CONDITION.

Mineral exploration involves many risks, which even a combination of experience, knowledge and careful evaluation may not be able to overcome. The Company's operations will be subject to all the hazards and risks normally incidental to exploration, development and production of metals, such as unusual or unexpected formations, cave-ins or pollution, all of which could result in work stoppages, damage to property and possible environmental damage. The Company does not have general liability insurance covering its operations and does not presently intend to obtain liability insurance as to such hazards and liabilities. Payment of any liabilities as a result could have a materially adverse effect upon the Company's financial condition.

THE COMPANY'S ACTIVITIES WILL BE SUBJECT TO ENVIRONMENTAL AND OTHER INDUSTRY REGULATIONS WHICH COULD HAVE AN ADVERSE EFFECT ON THE FINANCIAL CONDITION OF THE COMPANY.

The Company's activities are subject to environmental regulations promulgated by government agencies from time to time. Environmental legislation generally provides for restrictions and prohibitions on spills, releases or emissions of various substances produced in association with certain mining industry operations, such as seepage from tailing disposal areas, which would result in environmental pollution. A breach of such legislation may result in imposition of fines and penalties. In addition, certain types of operations require the submission and approval of environmental impact assessments. Environmental legislation is evolving in a manner which means stricter standards and enforcement, fines and penalties for non-compliance are more stringent. Environmental assessments of proposed projects carry a heightened degree of responsibility for companies and directors, officers and employees. The cost of compliance with changes in governmental regulations could have an adverse effect on the financial condition of the Company.

The operations of the Company include exploration and development activities and commencement of production on its properties, require permits from various federal, state, provincial and local governmental authorities and such operations are and will be governed by laws and regulations governing prospecting, development, mining, production, exports, taxes, labor standards, occupational health, waste disposal, toxic substances, land use, environmental protection, mine safety and other matters. Companies engaged in the development and operation of mines and related facilities generally experience increased costs and delays in production and other schedules as a result of the need to comply with applicable laws, regulations and permits.

Failure to comply with applicable laws, regulations, and permitting requirements may result in enforcement actions, including orders issued by regulatory or judicial authorities causing operations to cease or be curtailed, and may include corrective measures requiring capital expenditures, installation of additional equipment, or remedial actions. Parties engaged in mining operations may be required to compensate those suffering loss or damage by reason of the mining activities and may have civil or criminal fines or penalties imposed for violations of applicable laws or regulations and, in particular, environmental laws.

COMPETITION MAY HAVE AN IMPACT ON THE COMPANY'S ABILITY TO ACQUIRE ATTRACTIVE METALS PROPERTIES, WHICH MAY HAVE AN ADVERSE IMPACT ON THE COMPANY'S OPERATIONS.

Significant and increasing competition exists for the limited number of metals acquisition opportunities available. As a result of this competition, some of which is with large established mining companies with substantial capabilities and greater financial and technical resources than the Company, the Company may be unable to acquire attractive metals properties on terms it considers acceptable. Accordingly, there can be no assurance that any exploration program intended by the Company on properties it intends to acquire will yield any reserves or result in any commercial mining operation.

DOWNWARD FLUCTUATIONS IN METAL PRICES MAY SEVERELY REDUCE THE VALUE OF THE COMPANY.

The Company has no control over the fluctuations in the prices of the metals for which it is exploring. A significant decline in such prices would severely reduce the value of the Company.

THE COMPANY CURRENTLY RELIES ON CERTAIN KEY INDIVIDUALS AND THE LOSS OF ONE OF THESE CERTAIN KEY INDIVIDUALS COULD HAVE AN ADVERSE EFFECT ON THE COMPANY.

The Company's success depends to a certain degree upon certain a key member of the management. This individual is a significant factor in the Company's growth and success. The loss of the service of current members of the management and advisory board could have a material adverse effect on the Company. In particular, the success of the Company is highly dependent upon the efforts of the President & CEO, CFO, PAO, Secretary & Treasurer, Chair & Director of the Company, the loss of whose services would have a material adverse effect on the success and development of the Company.

THE COMPANY DOES NOT MAINTAIN KEY MAN INSURANCE TO COMPENSATE THE COMPANY FOR THE LOSS OF CERTAIN KEY INDIVIDUALS.

Due to cost considerations, the Company does not anticipate putting key man insurance in place in respect of its senior officer or personnel.

WE ARE AN EXPLORATION STAGE COMPANY, AND THERE IS NO ASSURANCE THAT A COMMERCIALLY VIABLE DEPOSIT OR "RESERVE" EXISTS ON ANY PROPERTIES FOR WHICH THE COMPANY HAS, OR MIGHT OBTAIN, AN INTEREST.

The Company is an exploration stage company and cannot give assurance that a commercially viable deposit, or “reserve,” exists on any properties for which the Company currently has (through an option) or may have (through potential future joint venture agreements or acquisitions) an interest. Therefore, determination of the existence of a reserve depends on appropriate and sufficient exploration work and the evaluation of legal, economic, and environmental factors. If the Company fails to find a commercially viable deposit on any of its properties, its financial condition and results of operations will be materially adversely affected.

WE REQUIRE SUBSTANTIAL FUNDS MERELY TO DETERMINE WHETHER COMMERCIAL METAL DEPOSITS EXIST ON OUR PROPERTIES.

Any potential development and production of the Company’s exploration properties depends upon the results of exploration programs and/or feasibility studies and the recommendations of duly qualified engineers and geologists. Such programs require substantial additional funds. Any decision to further expand the Company’s operations on these exploration properties is anticipated to involve consideration and evaluation of several significant factors including, but not limited to:

|

|

§

|

Costs of bringing each property into production, including exploration work, preparation of production feasibility studies, and construction of production facilities;

|

|

|

§

|

Availability and costs of financing;

|

|

|

§

|

Ongoing costs of production;

|

|

|

§

|

Market prices for the metals to be produced;

|

|

|

§

|

Environmental compliance regulations and restraints; and

|

|

|

§

|

Political climate and/or governmental regulation and control.

|

GENERAL MINING RISKS

Factors beyond our control may affect the marketability of any substances discovered from any resource properties the Company may acquire. Metal prices have fluctuated widely in recent years. Government regulations relating to price, royalties, and allowable production and importing and exporting of metals can adversely affect the Company. There can be no certainty that the Company will be able to obtain all necessary licenses and permits that may be required to carry out exploration, development and operations on any projects it may acquire and environmental concerns about mining in general continue to be a significant challenge for all mining companies.

ITEM 1B. UNRESOLVED STAFF COMMENTS

None.

ITEM 2. PROPERTIES

Summary

At September 30, 2011, the Company’s material property investments comprise: (i) an option to purchase certain mineral exploration rights to a property in south-central Arizona, USA, named the Cruce Property on which the Company is primarily exploring for gold, silver and copper-porphyry, all leases on which are currently in good standing; and (ii) an option to purchase certain mineral exploration rights to a property in south-eastern Arizona, USA, named the L.G. Property on which the Company is primarily exploring for lithium, of which the Company has let lapse approximately 90% of the leases thereunder.

As required by generally accepted accounting principles, during the year ended September 30, 2011, the Company determined its mineral property acquisition costs were impaired and recorded an impairment loss of $121,000. At present, the Company has no mineral property balances which are classified as assets under generally accepted accounting principles.

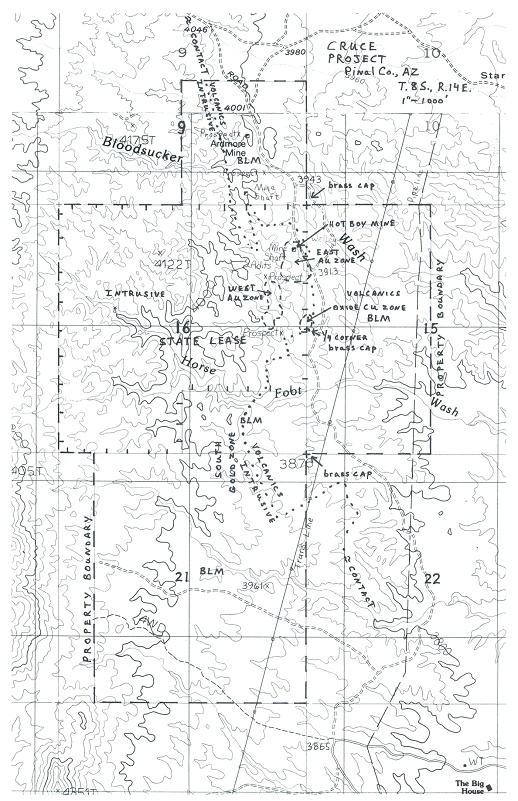

Cruce Map

CRUCE PROPERTY

Cruce Property Area of Interest

The Cruce Property covers 560 acres and is located approximately 40 miles north of Tucson in south-central Arizona. The Cruce Agreement area of interest is composed of all lands within that area in the State of Arizona described as: Section 16, Township 8 South, Range 14 East, G&SR Mer., and three miles extended in each direction from the exterior boundaries of Section 16.

Cruce Property Agreement:

As executed on January 21, 2011 (the "Cruce Execution Date"') and amended on January 25, 2011, the Company entered into an option to purchase certain mineral exploration rights to a property in Arizona, USA, named the Cruce Property from two individuals (collectively the “Cruce Vendors”). The Cruce Vendors each owned a 50% interest in the mineral exploration rights to the Cruce Property and held the sole right, title and interest to the Cruce Property exploration rights (subject to the rights and title of the State of Arizona), free and clear of all liens and encumbrances. Through the option agreement (the “Cruce Agreement”), the Cruce Vendors granted an exclusive option to the Company to purchase a 100% undivided right, title and interest in the Cruce Vendors’ rights to the Cruce Property, and the Company acquired an option to purchase the Cruce Vendors’ rights to the Cruce Property from the Cruce Vendors, upon the terms and conditions set forth in the Cruce Agreement, as amended (incorporated herein by reference as Exhibits 10.3 and 10.4).

To exercise the option included in the Cruce Agreement (the “Cruce Option”), the Company must: (i) pay the aggregate sum of $265,000 to the Cruce Vendors; (ii) incur an aggregate of at least $335,000 of exploration expenditures on the Cruce Property; and (iii) issue to the Cruce Vendors an aggregate of 2,600,000 restricted shares of common stock in Gryphon (or any public company created by Gryphon for the purpose of development of the Cruce Property), based on the following schedules:

|

(a)

|

Cash sums on or before the dates described below:

|

||

| (i) |

$40,000 upon execution of the Letter of Intent regarding the Cruce Agreement (such payment which has been made)

|

||

|

|

(ii)

|

$50,000 on or before November 30, 2011 (such payment which has not been made); | |

|

|

(iii)

|

$75,000 on or before November 30, 2012; | |

|

|

(iv)

|

$100,000 on or before November 30, 2013; and | |

|

(b)

|

Share issuances on or before the dates described below:

|

||

|

|

(i) |

100,000 shares upon execution of the Cruce Agreement (such issuance which has been made and was valued at $6,000);

|

|

|

|

(ii)

|

100,000 shares on or before November 30, 2011 (such issuance which has subsequently been made and was valued at $1,000); | |

|

|

(iii)

|

200,000 shares on or before November 30, 2012; and | |

|

|

(iv)

|

200,000 shares on or before November 30, 2013. | |

Once the Company has paid the Cruce Option price in full, the Company will have exercised the Cruce Option and have acquired an undivided 100% right, title and interest in and to the Cruce Property, the Company will then be obligated to pay the following additional consideration:

|

(a)

|

2,000,000 restricted shares of Gryphon common stock;

|

|

|

(b)

|

a minimum annual royalty of $250,000 on or before November 30, 2014 and a minimum annual royalty of $250,000 every 12 months for each year that Gryphon holds the Cruce Property;

|

|

|

(c)

|

a 3% (three percent) Net Returns Royalty on all minerals actually produced and sold from the Cruce Property.

|

The parties also agreed that the Company will incur the following amounts on exploration expenditures on the Cruce Property:

|

(i)

|

$60,000 within 12 months following the Cruce Execution Date.

|

||

|

(ii)

|

an additional $75,000 on or before 24 months following the Cruce Execution Date;

|

||

|

(iii)

|

$100,000 on or before 36 months following the Cruce Execution Date; and

|

||

|

(iv)

|

$100,000 on or before 48 months following the Cruce Execution Date.

|

Upon the failure of the Company to deliver or spend the consideration comprising the Cruce Option price within the time periods set forth herein, the Cruce Agreement will terminate 30 days after the Cruce Vendors give the Company written notice of such failure (during which time the Company may deliver or spend the consideration overdue, and therefore maintain the Cruce Agreement in good standing). As of the date of these financial statements, the Company had made all shares payments currently due under the terms of Cruce Agreement and had expended the entire required amount of its first year work commitment. The Company met it first scheduled cash installment of $40,000 to the Cruce Vendors, but is currently late on its second scheduled cash installment of $50,000 which was due by November 30, 2011. The Cruce Vendors have not indicated they plan to give the Company any written notice which would cause a termination of the Cruce Agreement.

L.G. PROPERTY

L.G. Property Area of Interest

The L.G. Agreement area of interest is composed of all lands within that area in the State of Arizona described as: T5S, R23 and 24E; T6S, R23, 24 and 25E; T7S, R25 and 26E; R26 and 27E; T9S, R26 and 27E; R10S, R26 and 27E and Sections 15 through 22 and 27 through 35 in T5S, R25E; Sections 6, 7, and 8, 16 through 23, and 25 through 36 in T6S, R26E; Sections 1 through 6 and 10 through 12 in T7S, R23E; Sections 1 through 18 in T7S, R24E; Sections 3 through 9, 16 through 20, and 29 through 33 in T7S, R27E; Sections 1, 2, 11through 14, 24, 25, and 36 in T8S, R25E, G&SR Mer.

Subsequent to September 30, 2011, the Company did not make United States Bureau of Land Management ('BLM') property maintenance payments covering 10 lease sections on approximately 4091 acres and therefore these leases have lapsed. The Company had also previously let lapse one other BLM lease. These areas cover approximately 90% of the claim areas included in the L.G. Agreement. The Company is currently reviewing whether it will re-stake these claims in the future.

L.G.. Property Agreement

As executed on July 19, 2010 (the "'L.G. Execution Date") and amended on February 27, 2011, the Company entered into an option to purchase certain mineral exploration rights to a property in south-eastern Arizona, USA, named the L.G. Property from two individuals (collectively the “L.G. Vendors”). The Vendors each owned a 50% interest in the mineral exploration rights to the L.G. Property and held the sole right, title and interest to the L.G. Property exploration rights (subject to the rights and title of the State of Arizona), free and clear of all liens and encumbrances. Through the option agreement, as amended (the “L.G. Agreement”), the L.G. Vendors granted an exclusive option to the Company to purchase a 100% undivided right, title and interest in the L.G. Vendors’ rights to the L.G. Property, and the Company acquired an option to purchase L.G. Vendors’ rights to the L.G. Property from the L.G. Vendors, upon the terms and conditions set forth in the L.G. Agreement, as amended (incorporated herein by reference as Exhibits 10.1 and 10.2).

To exercise the option included in the L.G. Agreement (the “L.G. Option”), the Company must: (i) pay the aggregate sum of $240,000 to the L.G. Vendors; (ii) incur an aggregate of at least $550,000 of exploration expenditures on the L.G. Property; and (iii) issue to the L.G. Vendors an aggregate of 1,000,000 restricted shares of common stock in Gryphon (or any public company created by Gryphon for the purpose of development of the L.G. Property), based on the following schedules:

|

(a)

|

Cash sums on or before the dates described below:

|

||

|

(i)

|

$15,000 upon execution of the L.G. Agreement (such payment which has been made);

|

||

|

(ii)

|

$15,000 on or before August 10, 2010 (such payment which has been made);

|

||

|

(iii)

|

$50,000 on or before March 1, 2011 (such payment which has been made);

|

||

|

(iv)

|

$60,000 on or before March 1, 2012; and

|

||

|

(v)

|

$100,000 on or before March 1, 2013.

|

||

|

(b)

|

Share issuances on or before the dates described below:

|

||

|

(i)

|

250,000 restricted common shares upon execution of the L.G. Agreement (such payment which has been made and was valued at $12,500);

|

||

|

(ii)

|

250,000 restricted common shares on or before February 1, 2011 (such payment which has been made and was valued at $25,000);

|

||

|

(iii)

|

250,000 restricted common shares on or before February 1, 2012; and

|

||

|

(iv)

|

250,000 restricted common shares on or before February 1, 2013.

|

||

Once the Company has paid the L.G. Option price in full, the Company will have exercised the L.G. Option and have acquired an undivided 100% right, title and interest in and to the L.G. Property, the Company will then be obligated to pay the following additional consideration to the L.G. Vendors:

|

(a)

|

1,000,000 restricted shares of Gryphon common stock;

|

|

|

(b)

|

a minimum annual royalty of $150,000 on or before December 31, 2014 and a minimum annual royalty of $150,000 every 12 months for each year that Gryphon holds the L.G. Property;

|

|

|

(c)

|

a 5% (five percent) Gross Production Royalty on lithium minerals actually produced and sold from the L.G. Property; and

|

|

|

(d)

|

a 3-1/2% (three and one-half percent) Net Returns Royalty on all other minerals actually produced and sold from the L.G. Property.

|

The parties also agreed that the Company will incur the following amounts on exploration expenditures on the L.G. Property:

|

(i)

|

$50,000 within 12 months following the L.G. Execution Date;

|

|

|

(ii)

|

an additional $100,000 on or before 24 months following the L.G. Execution Date;

|

|

|

(iii)

|

$200,000 on or before 36 months following the L.G. Execution Date; and

|

|

|

(iv)

|

$200,000 on or before 48 months following the L.G. Execution Date.

|

Upon the failure of the Company to deliver or spend the consideration comprising the L.G. Option price within the time periods set forth herein, the L.G. Agreement will terminate 30 days after the L.G. Vendors give the Company written notice of such failure (during which time the Company may deliver or spend the consideration overdue, and therefore maintain the L.G. Agreement in good standing). As of the date of these financial statements, the Company had made all cash and shares payments currently due under the terms of L.G. Agreement, but had not expended the entire required amount of its first year work commitment. The L.G. Vendors have not indicated they plan to give the Company any written notice which would cause a termination of the L.G. Agreement.

Office Premises

Gryphon’s office is located at suite 1313 East Maple Street, Suite 201-462, Bellingham, Washington 98225. The rental agreement for these premises may be cancelled with one month’s notice.The

Company’s CEO also provides office facilities in New Zealand free of charge to the Company.

ITEM 3. LEGAL PROCEEDINGS

There are no material, active, or pending legal proceedings against us, nor are we involved as a plaintiff in any material proceedings or pending litigation. There are no proceedings in which any of our officer and director, or any registered or beneficial shareholders are an adverse party or has a material interest adverse to us.

ITEM 4. [REMOVED AND RESERVED]

PART II

ITEM 5. MARKET FOR COMMON EQUITY AND RELATED STOCKHOLDER MATTERS

Market Information

Our common stock is currently quoted on the Pink Sheets over the counter market under the symbol: “GRYO.” Prior to our current fiscal year, our shares also traded on the Over-The-Counter Bulletin Board, but such listing ceased due to the failure of a primary market-maker to file an updated Form 15-2c11 to comply with FINRA guidelines related to minimum required trading activity.

The following table sets forth the range of high and low bid quotations for our common stock as reported by the Pink Sheets for each of the periods indicated. The market for our shares is limited, volatile and sporadic. These quotations reflect inter-dealer prices, without retail mark-up, mark-down or commission and may not necessarily represent actual transactions.

|

Quarter Ended:

|

High Trade

|

Low Trade

|

Closing Trade(1)

|

|||||||||

|

FY2011:

|

||||||||||||

|

December 31, 2010

|

$ | 0.39 | $ | 0.01 | $ | 0.08 | ||||||

|

March 31, 2011

|

0.10 | 0.03 | 0.04 | |||||||||

|

June 30, 2011

|

0.12 | 0.03 | 0.04 | |||||||||

|

September 30, 2011

|

0.04 | 0.02 | 0.02 | |||||||||

|

FY2010:

|

||||||||||||

|

December 31, 2009

|

$ | 2.00 | $ | 0.36 | $ | 0.51 | ||||||

|

March 31, 2010

|

0.51 | 0.05 | 0.05 | |||||||||

|

June 30, 2010

|

0.05 | 0.05 | 0.05 | |||||||||

|

September 30, 2010

|

0.26 | 0.01 | 0.26 | |||||||||

|

FY2009:

|

||||||||||||

|

December 31, 2008

|

$ | 1.40 | $ | 0.50 | $ | 1.40 | ||||||

|

March 31, 2009

|

1.80 | 1.40 | 1.73 | |||||||||

|

June 30, 2009

|

1.80 | 1.15 | 1.73 | |||||||||

|

September 30, 2009

|

1.75 | 0.36 | 0.51 | |||||||||

| Notes: | ||||||||||||

| (1) | Over-the-counter market quotations reflect inter-dealer prices without retail mark-up, mark-down or commission, and may not represent actual transactions. | |||||||||||

Shareholders

On December 27, 2011, there were 7 shareholders of record of the 117,425,000 shares outstanding of our common stock.

Dividends

We intend to retain future earnings to support our growth. Any payment of cash dividends in the future will be dependent upon: the amount of funds legally available therefore; our earnings; financial condition; capital requirements; and other factors which our Board of Directors deems relevant.

Section 15(g) of the Securities Exchange Act of 1934

The Company’s shares are covered by Section 15(g) of the Securities Exchange Act of 1934, as amended, which imposes additional sales practice requirements on broker/dealers who sell such securities to persons other than established customers and accredited investors (generally institutions with assets in excess of $5,000,000 or individuals with net worth in excess of $1,000,000 or annual income exceeding $200,000 or $300,000 jointly with their spouses). For transactions covered by this Section 15(g), the broker/dealer must make a special suitability determination for the purchase and must have received the purchaser’s written agreement to the transaction prior to the sale. Consequently, Section 15(g) may affect the ability of broker/dealers to sell the Company’s securities and also may affect your ability to sell your shares in the secondary market.

Section 15(g) also imposes additional sales practice requirements on broker/dealers who sell penny securities. These rules require a one page summary of certain essential items. The items include the risk of investing in penny stocks in both public offerings and the secondary market; terms important to an understanding of the function of the penny stock market, such as “bid” and “offer” quotes, a dealers “spread” and broker/dealer compensation; the broker/dealer compensation, the broker/dealers duties to its customers, including the disclosures required by any other penny stock disclosure rules; the customer’s rights and remedies in causes of fraud in penny stock transactions; and, the NASD’s toll free telephone number and the central number of the North American Administrators Association, for information on the disciplinary history of broker/dealers and their associated persons.

Recent Sales of Unregistered Securities

Subsequent to the year ended September 30, 2011, on December 8, 2011, the Company issued 100,000 shares of its common stock to Vendors of the Cruce Property. This transaction was valued at a board approved value of $0.01 per share for total deemed proceeds of $1,000. These shares are deemed "restricted" securities under the Securities Act and may not be sold or transferred other than pursuant to an effective registration statement under the Securities Act or any exemption from the registration requirements of the Securities Act.

Subsequent to the year ended September 30, 2011, the Company issued 12,300,000 restricted common shares which included payment from the September 30, 2011 balance of $106,000 of Common Shares Subscribed But Not Issued shown on the September 30, 2011 balance sheet included in this Report; plus an additional $17,000 raised subsequent to year end. The total value of this private placement was $123,000 and represented the sale of 12,300,000 restricted common shares at a price of $0.01 per share. These shares were issued to offshore investors pursuant to Regulation S of the Securities Act of 1933, as amended, and the Company did not engage in any general solicitation or advertising regarding this offering.

ITEM 6. SELECTED FINANCIAL DATA

|

FISCAL

2011

|

FISCAL

2010

|

FISCAL

2009

|

FISCAL

2008

|

FISCAL

2007

|

|

|

$

|

$

|

$

|

$

|

$

|

|

|

Operating Revenue:

|

|||||

|

Quarter One - Three Months to December 31st

|

Nil

|

Nil

|

Nil

|

Nil

|

Nil

|

|

Quarter Two - Three Months to March 31st

|

Nil

|

Nil

|

Nil

|

Nil

|

Nil

|

|

Quarter Three- Three Months to June 30th

|

Nil

|

Nil

|

Nil

|

Nil

|

Nil

|

|

Full Year – Twelve Months to September 30th

|

Nil

|

Nil

|

Nil

|

Nil

|

Nil

|

|

Net Income/(Loss):

|

|||||

|

Quarter One - Three Months to December 31st

|

(109,196)

|

(4,445)

|

(15,991)

|

(7,981)

|

(12,772)

|

|

Quarter Two - Three Months to March 31st

|

(172,145)

|

(17,885)

|

(45,375)

|

(23,758)

|

(5,176)

|

|

Quarter Three- Three Months to June 30th

|

(39,653)

|

(28,752)

|

(27,074)

|

(25,334)

|

(11,500)

|

|

Full Year – Twelve Months to September 30th

|

(353,621)

|

(57,322)

|

(126,550)

|

(75,571)

|

(47,972)

|

|

Earnings/(Loss) per share:

|

|||||

|

Quarter One - Three Months to December 31st

|

Nil

|

Nil

|

Nil

|

Nil

|

Nil

|

|

Quarter Two - Three Months to March 31st

|

Nil

|

Nil

|

Nil

|

Nil

|

Nil

|

|

Quarter Three- Three Months to June 30th

|

Nil

|

Nil

|

Nil

|

Nil

|

Nil

|

|

Full Year – Twelve Months to September 30th

|

Nil

|

Nil

|

Nil

|

Nil

|

(0.01)

|

|

Cash:

|

|||||

|

Quarter One - Three Months to December 31st

|

119,286

|

18,479

|

23,893

|

4,703

|

21,317

|

|

Quarter Two - Three Months to March 31st

|

27,469

|

35,457

|

11,918

|

11,126

|

17,860

|

|

Quarter Three- Three Months to June 30th

|

37,286

|

103,344

|

6,173

|

9,978

|

6,435

|

|

Full Year – Twelve Months to September 30th

|

7,073

|

10,252

|

1,572

|

33,895

|

11,208

|

|

Total assets:

|

|||||

|

Quarter One - Three Months to December 31st

|

123,594

|

20,192

|

28,797

|

24,244

|

49,914

|

|

Quarter Two - Three Months to March 31st

|

42,141

|

28,291

|

15,090

|

13,567

|

37,385

|

|

Quarter Three- Three Months to June 30th

|

48,807

|

119,017

|

15,079

|

12,751

|

25,582

|

|

Full Year – Twelve Months to September 30th

|

17,260

|

30,023

|

3,354

|

37,039

|

30,706

|

|

Total stockholders’ equity (deficit):

|

|||||

|

Quarter One - Three Months to December 31st

|

116,916

|

(203,527)

|

(88,507)

|

(4,746)

|

49,061

|

|

Quarter Two - Three Months to March 31st

|

30,651

|

(221,412)

|

(133,882)

|

(28,504)

|

32,309

|

|

Quarter Three- Three Months to June 30th

|

42,118

|

(95,270)

|

(160,957)

|

(53,838)

|

20,809

|

|

Full Year – Twelve Months to September 30th

|

9,491

|

29,852

|

(199,066)

|

(72,516)

|

3,235

|

|

Cash dividends per share:

|

|||||

|

Quarter One - Three Months to December 31st

|

Nil

|

Nil

|

Nil

|

Nil

|

Nil

|

|

Quarter Two - Three Months to March 31st

|

Nil

|

Nil

|

Nil

|

Nil

|

Nil

|

|

Quarter Three- Three Months to June 30th

|

Nil

|

Nil

|

Nil

|

Nil

|

Nil

|

|

Full Year – Twelve Months to September 30th

|

Nil

|

Nil

|

Nil

|

Nil

|

Nil

|

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OR PLAN OF OPERATIONS

Certain information included herein contains forward-looking statements that involve risks and uncertainties within the meaning of Sections 27A of the Securities Act, as amended; Section 21E of the Securities Exchange Act of 1934. These sections provide that the safe harbor for forward looking statements does not apply to statements made in initial public offerings. The words, such as "may," "would," "could," "anticipate," "estimate," "plans," "potential," "projects," "continuing," "ongoing," "expects," "believe," "intend" and similar expressions and variations thereof are intended to identify forward-looking statements. These statements appear in a number of places in this Form 10-K and include all statements that are not statements of historical fact regarding intent, belief or current expectations of the Company, our directors or our officers, with respect to, among other things: (i) our liquidity and capital resources; (ii) our financing opportunities and plans; (iii) continued development of business opportunities; (iv) market and other trends affecting our future financial condition; (v) our growth and operating strategy. Investors and prospective investors are cautioned that any such forward-looking statements are not guarantees of future performance and involve risks and uncertainties, and that actual results may differ materially from those projected in the forward-looking statements as a result of various factors. The factors that might cause such differences include, among others, the following: (i) we have incurred significant losses since our inception; (ii) any material inability to successfully develop our business plans; (iii) any adverse effect or limitations caused by government regulations; (iv) any adverse effect on our ability to obtain acceptable financing; (v) competitive factors; and (vi) other risks including those identified in our other filings with the Securities and Exchange Commission.

Operational Developments during Fiscal 2011

Summer Work Program:

During summer 2011, the Company conducted an active work program on it claims and expended $111,218 for exploration and mineral license fees. Exploration to date has not yielded economically viable probable or proven reserves of lithium, gold and silver, or copper porphyry and as of the date of these financial statements, the Company is engaged in a new private placement initiatives to raise funds to support corporate requirements and further exploration in the future.

$320,000 Private Placement:

On November 29, 2010, the Company completed a private placement totalling $320,000. This financing was based on the sale of 6,400,000 restricted common shares priced at US$0.05 per share and included a debt to shares conversion which eliminated $118,846 of loans from the Company’s balance sheet.

$150,000 Private Placement:

On December 23, 2010, the Company also concluded a private placement offering of its common shares which raised aggregate proceeds of US$150,000 based on the sale of 1,500,000 restricted common shares priced at US$0.10 per share.

Staff changes:

On July 20, 2011, Mr. Stephen Sutorius resigned his positions as a Director of the Company and as Secretary and Treasurer of the Company. Mr. Sutorius resigned for personal reasons and there was no disagreement with the Company relating to its operations, policies or practices. In addition to his other duties Mr. Alan Muller assumed the position of Secretary and Treasurer concurrent with Mr. Sutorius' departure.

At the end of the summer exploration season, Mr. Nicholas Barr resigned from his role as our primary geologist so as to engage in other work opportunities, but has continued to provide support to the Company on an ad hoc basis.

Operational Developments subsequent to September 30, 2011 year end

Leases expiries:

Subsequent to September 30, 2011, the Company did not make United States Bureau of Land Management ('BLM') property maintenance payments covering 10 lease sections on approximately 4091 acres of its L.G. Property and therefore these leases have lapsed. The Company had also previously let lapse one other BLM lease on the L.G. Property. These areas cover approximately 90% of the claim areas included in the L.G. Agreement. The Company is currently reviewing whether it will re-stake these claims in the future.

$123,000 Private Placement:

On December 9, 2011, the Company completed a private placement totalling $123,000. This financing was based on the sale of 12,300,000 restricted common shares priced at US$0.01 per share and included application of $106,000 of funds which had been recorded on our balance sheet for the year ended September 30, 2011 as Shares Subscribed But Not Issued.

RESULTS OF OPERATIONS

The following discussion and analysis covers material changes in the financial condition of Gryphon during the years ended September 30, 2011 and September 30, 2010 and the Period January 16, 2006 (date of inception) to September 30, 2011 (the “Exploration Stage”).

Revenues

Gryphon did not earn revenues during the periods included in the financial statements in this report.

Expenses

Our operating expenses are classified into five categories:

- Exploration Expenses

- Professional and Consultant Fees

- Administrative Expenses

- Investor Relations

- Mineral Properties Impairment

Exploration Expenses

Exploration expenses for the year ended September 30, 2011 totaled $111,218 compared to $32,422 for the year ended September 30, 2010. Expenses for the Exploration Stage totaled $152,749. During fiscal 2011, these expenses were primarily comprised of geologist fees, assays, and costs for mineral rights applications to the Arizona State Land Department and property rental fee deposits. We cannot predict what the level of these expenses will be during upcoming fiscal 2012.

Professional and Consultant Fees

Professional & consultant Fees are comprised of fees paid for officer and director fees, and for work performed by audit, legal and accounting professionals. During the year ended September 30, 2011 these fees totaled $81,321 compared with $41,944 for the year ended September 30, 2010. For the Exploration Stage, these costs totaled $215,669. We anticipate Professional & Consultant Fees to decrease during the upcoming fiscal year.

Administrative Expenses

Administrative expenses were $20,517 for the year ended September 30, 2011 compared with $11,559 during the year ended September 30, 2010. For the Exploration Stage, administrative expenses totaled $53,495. These expenses are composed of Edgar agent filing fees, stock transfer agent fees and general office expenses. We anticipate Administrative Expenses will remain at current levels during the upcoming fiscal year.

Investor Relations

Investor relations expenses comprise costs for press releases, maintenance of the Company’s website and other investor information initiatives. During the year ended September 30, 2011, these expenses totaled $19,565 versus $4,610 for the year ended September 30, 2010. For the Exploration Stage, Investor Relations expenses totaled $28,828. We anticipate Investor Relations expenses will decrease during the upcoming fiscal year.

Mineral Properties Impairment

As required by generally accepted accounting principles, at year end date of September 30, 2011 the Company undertook a review of the Company’s exploration projects and affirmed an impairment charge of $121,000 which had been recorded during fiscal 2011 against its current year mineral property purchases. Mineral properties impairment charges were $42,500 for the year ended September 30, 2010 and totaled $182,498 for the Exploration Stage.

Discontinued Operations

On September 27, 2010, we sold our entire shareholding in our former Turkish subsidiary to an unrelated third party and ceased all operations in Turkey. The sale of the former subsidiary was recorded as a discontinued operation and resulted in: (i) a net loss from discontinued operations of $(16,577) for the year ended September 30, 2010 and $(112,932) in the Exploration Stage; and (ii) a non-cash gain of $97,920 in both the year ended September 30, 2010 and the Exploration Stage due to the elimination from the previously consolidated balance sheet of the Company of debt the former subsidiary had owed to a third party.

Net (Loss)

We incurred a net loss of $(353,621) for the twelve months ended September 30, 2011, compared with a net loss of $(57,322) for the same period ended September 30, 2010. For the Exploration Stage, the Net Loss totaled $(661,509).

Liquidity and Capital Resources

Since the date of our incorporation, we have raised $508,654 though private placements of our common shares (including $106,000 recorded as Shares Subscribed But Note Issued in our financial statements for the year ended September 30, 2011); $112,088 through shareholder loans and advances; and $91,038 through loans from other parties.

As of September 30, 2011 we had cash on hand of $7,073 and a prepaid expenses balance of $10,187. We estimate we will need to attempt to raise additional funds during the coming twelve months and project we will be able to raise these funds through private placements of our common shares and/or shareholder loans from our CEO.

Off-Balance Sheet Arrangements

The Company does not have any off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that are material to investors.

Contractual Obligations

Other than as noted in Item 2, the Company has no material contractual obligations outstanding.

Material Events and Uncertainties

Our operating results are difficult to forecast. Our prospects should be evaluated in light of the risks, expenses and difficulties commonly encountered by comparable early stage companies in rapidly evolving markets.

There can be no assurance that we will successfully address such risks, expenses and difficulties.

Our financial statements are prepared in accordance with U.S. generally accepted accounting principles. We have expensed all development costs related to our establishment.

Employees

As of September 30, 2011, we had no employees and used contracted services to perform geological work, legal services and our bookkeeping. Going forward, the Company will use consultants with specific skills to assist with various aspects of its project evaluation, due diligence, acquisition initiatives, corporate governance and property management and will hire additional staff as needed.

Critical Accounting Policies

Gryphon’s financial statements and related public financial information are based on the application of accounting principles generally accepted in the United States (“GAAP”). GAAP requires the use of estimates; assumptions, judgments and subjective interpretations of accounting principles that have an impact on the assets, liabilities, revenues and expense amounts reported. These estimates can also affect supplemental information contained in our external disclosures including information regarding contingencies, risk and financial condition. We believe our use if estimates and underlying accounting assumptions adhere to GAAP and are consistently and conservatively applied. We base our estimates on historical experience and on various other assumptions that we believe to be reasonable under the circumstances. Actual results may differ materially from these estimates under different assumptions or conditions. We continue to monitor significant estimates made during the preparation of our financial statements.

Our significant accounting policies are summarized in NOTE 2 of our financial statements. While all these significant accounting policies impact its financial condition and results of operations, Gryphon views certain of these policies as critical. Policies determined to be critical are those policies that have the most significant impact on Gryphon’s financial statements and require management to use a greater degree of judgment and estimates. Actual results may differ from those estimates.

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

We have not entered into derivative contracts either to hedge existing risk or for speculative purposes.

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

Our financial statements, together with the report of auditors, are as follows:

INDEX TO

FINANCIAL STATEMENTS

|

Page

|

|

GRYPHON RESOURCES, INC.

(An Exploration Stage Company)

Report of Independent Registered Public Accounting Firm

To Board of Directors and

Stockholders of Gryphon Resources, Inc.

(an Exploration Stage Company)

We have audited the accompanying balance sheets of Gryphon Resources, Inc. (an Exploration Stage Company) (the Company) as of September 30, 2011 and 2010, and the related statements of operations, stockholders’ equity (deficit), and cash flows for each of the years in the two-year period ended September 30, 2011, and for the period January 16, 2006 (date of inception) to September 30, 2011. The Company’s management is responsible for these financial statements. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audit included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material aspects, the financial position of Gryphon Resources, Inc. (an Exploration Stage Company) as of September 30, 2011 and 2010, and the results of its operations and its cash flows for each of the years in the two-year period ended September 30, 2011, and for the period January 16, 2006 to September 30, 2011, in conformity with accounting principles generally accepted in the United States of America.

The accompanying financial statements have been prepared assuming that the Company will continue as a going concern. The Company will need additional working capital to service its debt and for its planned activity, which raises substantial doubt about its ability to continue as a going concern. Management’s plans in regard to these matters are described in the notes to the financial statements. These financial statements do not include any adjustments that might result from the outcome of this uncertainty.

/s/ Madsen & Associates CPAs, Inc.

Madsen & Associates CPAs, Inc.

Salt Lake City, Utah

December 18, 2011

GRYPHON RESOURCES, INC.

(An Exploration Stage Company)

Balance Sheets

|

|

September 30, 2011

|

September 30, 2010

|

||||||

|

ASSETS

|

||||||||

|

CURRENT ASSETS

|

||||||||

|

Cash

|

$ | 7,073 | $ | 10,252 | ||||

|

Prepaid expenses

|

10,187 | 19,771 | ||||||

|

Total current assets

|

17,260 | 30,023 | ||||||

|

Total assets

|

$ | 17,260 | $ | 30,023 | ||||

|

LIABILITIES AND STOCKHOLDERS’ (DEFICIT)

|

||||||||

|

CURRENT LIABILITIES

|

||||||||

|

Accounts payable

|

1,269 | 171 | ||||||

|

Shareholder advances (Note 6)

|

6,500 | - | ||||||

|

Total current liabilities

|

$ | 7,769 | $ | 171 | ||||

|

Total liabilities

|

$ | 7,769 | $ | 171 | ||||

|

COMMITMENTS AND CONTINGENCIES

(Notes 2, 3, 5, 9 and 10)

|

— | — | ||||||

|

STOCKHOLDERS’ EQUITY (DEFICIT)

|

||||||||

|

Common shares, 400,000,000 shares par value $0.001 authorized, 105,025,000 and 96,775,000 issued and outstanding at September 30, 2011 and September 30, 2010 (Note 9)

|

105,025 | 96,775 | ||||||

|

Paid-in Capital

|

459,975 | (32,775 | ) | |||||

|

Common shares subscribed but not issued (Note 9)

|

106,000 | 273,740 | ||||||

|

Accumulated deficit in the exploration stage

|

(661,509 | ) | (307,888 | ) | ||||

|

Total stockholders’ equity (deficit)

|

9,491 | 29,852 | ||||||

|

Total liabilities and stockholders’ equity (deficit)

|

$ | 17,260 | $ | 30,023 | ||||

The accompanying notes to financial statements are an integral part of these financial statements

GRYPHON RESOURCES, INC.

(An Exploration Stage Company)

Statements of Operations

|

Year ended

September 30, 2011

|

Year ended

September 30, 2010

|

January 16, 2006

(date of inception) through

September 30, 2011

|

||||||||||

|

EXPENSES:

|

||||||||||||

|

Exploration expenses

|

111,218 | 32,422 | 152,749 | |||||||||

|

Professional and consultant fees

|

81,321 | 41,944 | 215,669 | |||||||||

|

Administrative expenses

|

20,517 | 11,559 | 53,495 | |||||||||

|

Investor relations

|

19,565 | 4,610 | 28,828 | |||||||||

|

Mineral properties impairments (Notes 2, 4 and 5)

|

121,000 | 42,500 | 182,498 | |||||||||

|

Total expenses

|

$ | 353,621 | $ | 133,035 | $ | 633,239 | ||||||

|

Net loss from operations

|

$ | (353,621 | ) | $ | (133,035 | ) | $ | (633,239 | ) | |||

|

Other (Expense) Income:

|

||||||||||||

|

Interest expense

|

— | (5,630 | ) | (13,258 | ) | |||||||

|

Net loss from continuing operations

|

(353,621 | ) | (138,665 | ) | (646,497 | ) | ||||||

| Discontinued Operations: | ||||||||||||

|

Net loss from discontinued operations (Note 8)

|

$ | — | $ | (16,577 | ) | $ | (112,932 | ) | ||||

|

Gain on Sale of Subsidiary (Note 8)

|

$ | — | $ | 97,920 | $ | 97,920 | ||||||

|

Net (Loss)

|

$ | (353,621 | ) | $ | (57,322 | ) | $ | (661,509 | ) | |||

|

Less: Net Loss attributable to Non-Controlling Interest related to discontinued operations (Notes 2 and 8)

|

n/a | 166 | 936 | |||||||||

|

Equals: Net Loss attributable to Gryphon Resources, Inc. (Notes 2 and 8)

|

(353,621 | ) | (57,156 | ) | (660,573 | ) | ||||||

|

Loss per common share (Notes 2 and 8), basic and diluted from discontinued operations

|

$ | n/a | $ | 0.00 | ||||||||

|

Loss per common share (Note 2), basic and diluted from continuing operations

|

$ | 0.00 | $ | 0.00 | ||||||||

|

Weighted average shares outstanding , basic and diluted (Notes 2 and 7)

|

102,845,412 | 96,575,684 | ||||||||||

The accompanying notes to financial statements are an integral part of these financial statements

GRYPHON RESOURCES, INC.

(An Exploration Stage Company)

Statement of Stockholders’ Equity (Deficit)

|

Common

Shares

|

Common

Stock

|

Paid-in

Capital

|

Shares subscribed but not issued

|

Deficit Attributable to Non-Controlling Interest

|

Deficit Accumulated During the Exploration

Stage

|

Total

Stockholders’ Equity

|

||||||||||||||||||||||

|

Date of Inception January 16, 2006

|

— | $ | — | $ | — | $ | — | $ | — | $ | — | $ | — | |||||||||||||||

|

Common shares issued for cash at $0.001 per share on January 27, 2006

|

48,750,000 | $ | 48,750 | $ | (46,250 | ) | $ | — | $ | — | $ | — | $ | 2,500 | ||||||||||||||

|

Common shares issued for cash at $0.02 per share during the period ended September 30, 2006

|

47,775,000 | $ | 47,775 | $ | 1,225 | $ | — | $ | — | $ | — | $ | 49,000 | |||||||||||||||

|

Net loss for the period from January 16, 2006 (inception) to September 30, 2006

|

— | $ | — | $ | — | $ | — | $ | — | $ | (1,243 | ) | $ | (1,243 | ) | |||||||||||||

|

Balance, September 30, 2006

|

96,525,000 | $ | 96,525 | $ | (45,025 | ) | $ | — | $ | — | $ | (1,243 | ) | $ | 50,257 | |||||||||||||

|

Net loss for year ended September 30, 2007

|

— | $ | — | $ | — | $ | — | $ | — | $ | (47,022 | ) | $ | (47,022 | ) | |||||||||||||

|

Balance, September 30, 2007

|

96,525,000 | $ | 96,525 | $ | (45,025 | ) | $ | — | $ | — | $ | (48,265 | ) | $ | 3,235 | |||||||||||||

|

Net loss for year ended September 30, 2008

|

— | $ | — | $ | — | $ | — | $ | — | $ | (75,751 | ) | $ | (75,751 | ) | |||||||||||||

|

Balance, September 30, 2008

|

96,525,000 | $ | 96,525 | $ | (45,025 | ) | $ | — | $ | — | $ | (124,016 | ) | $ | (72,516 | ) | ||||||||||||

|

Net loss for year ended September 30, 2009

|

— | $ | — | $ | — | $ | — | $ | (770 | ) | $ | (125,780 | ) | $ | (126,550 | ) | ||||||||||||

|

Balance, September 30, 2009

|

96,525,000 | $ | 96,525 | $ | (45,025 | ) | $ | — | $ | (770 | ) | $ | (249,796 | ) | $ | (199,066 | ) | |||||||||||

|

Common shares issued for mineral property acquisition payment at $0.05 per share on July 19, 2010

|

250,000 | $ | 250 | $ | 12,250 | $ | — | $ | — | $ | — | $ | 12,500 | |||||||||||||||

|

Shares subscribed but not issued at September 30, 2010

|

— | $ | — | $ | — | $ | 273,740 | $ | — | $ | — | $ | 273,740 | |||||||||||||||

|

Non-controlling Interest earnings for fiscal 2010 prior to sale of subsidiary

|

— | $ | — | $ | — | $ | — | $ | (166 | ) | $ | — | $ | (166 | ) | |||||||||||||

|

Elimination of Non-Controlling Interest due to sale of subsidiary on September 27, 2010

|

— | $ | — | $ | — | $ | — | $ | 936 | $ | — | $ | 936 | |||||||||||||||

|

Net loss for year ended September 30, 2010

|

— | $ | — | $ | — | $ | — | $ | — | $ | (57,322 | ) | $ | (57,322 | ) | |||||||||||||

|

Balance, September 30, 2010

|

96,775,000 | $ | 96,775 | $ | (32,775 | ) | $ | 273,740 | $ | — | $ | (307,888 | ) | $ | 29,852 | |||||||||||||

|

Common shares issued for cash at $0.05 per share on November 18, 2010

|

6,400,000 | $ | 6,400 | $ | 313,600 | $ | (273,740 | ) | $ | — | $ | — | $ | 46,260 | ||||||||||||||

|

Common shares issued for mineral property acquisition payment at $0.06 per share January 25, 2011

|

100,000 | $ | 100 | $ | 5,900 | $ | — | $ | — | $ | — | $ | 6,000 | |||||||||||||||

|

Common shares issued for cash at $0.10 per share on March 11, 2011

|

1,500,000 | $ | 1,500 | $ | 148,500 | $ | — | $ | — | $ | — | $ | 150,000 | |||||||||||||||

|

Common shares issued for mineral property acquisition payment at $0.10 per share on March 31, 2011

|

250,000 | $ | 250 | $ | 24,750 | $ | — | $ | — | $ | — | $ | 25,000 | |||||||||||||||

|

Shares subscribed but not issued at September 30, 2011

|

— | $ | — | $ | — | $ | 106,000 | $ | — | $ | — | $ | 106,000 | |||||||||||||||

|

Net loss for year ended September 30, 2011

|

— | $ | — | $ | — | $ | — | $ | — | $ | (353,621 | ) | $ | (353,621 | ) | |||||||||||||

|

Balance, September 30, 2011

|

105,025,000 | $ | 105,025 | $ | 459,975 | $ | 106,000 | $ | — | $ | (661,509 | ) | $ | 9,491 | ||||||||||||||

The accompanying notes to financial statements are an integral part of these financial statements

GRYPHON RESOURCES, INC.

(An Exploration Stage Company)

Statements of Cash Flows

|

Year ended

September 30, 2011

|

Year ended

September 30, 2010

|

January 16, 2006

(date of inception)

through

September 30, 2011

|

||||||||||

|

Cash flows from operating activities:

|

||||||||||||

|

Net Income (Loss) for period

|

$ | (353,621 | ) | $ | (57,322 | ) | $ | (661,509 | ) | |||

|

Reconciling adjustments:

|

||||||||||||

|

Adjustments to reconcile net loss to net cash used in operating activities:

|

||||||||||||

|

Non-cash gain on sale of subsidiary

|

— | (97,920 | ) | (97,920 | ) | |||||||

|

Accrued interest on shareholder loans

|

— | 5,630 | 13,258 | |||||||||

|

Accrued interest related to discontinued operation

|

— | 4,854 | 6,882 | |||||||||

|

Mineral property impairments

|

121,000 | 42,500 | 182,498 | |||||||||

|

Net change in operating assets and liabilities:

|

||||||||||||

|

Prepaid expenses

|

9,584 | (17,989 | ) | (10,187 | ) | |||||||

|

Accounts payable

|

1,098 | (7,379 | ) | 1,269 | ||||||||

|

Net cash provided (used) by operating activities

|

(221,939 | ) | (127,626 | ) | (565,709 | ) | ||||||

|

Cash flows from investing activities:

|

||||||||||||

|

Purchase of mineral properties

|

(90,000 | ) | (30,000 | ) | (138,998 | ) | ||||||

|

Net cash provided by investing activities

|

(90,000 | ) | (30,000 | ) | (138,998 | ) | ||||||

|

Cash flows from financing activities:

|

||||||||||||

|

Common shares issued for cash

|

196,260 | — | 402,654 | |||||||||

|

Proceeds from common shares subscribed but not issued

|

106,000 | 154,894 | 106,000 | |||||||||

|

Proceeds from loans related to discontinued operation

|

— | 11,412 | 91,038 | |||||||||

|

Proceeds from shareholder advances

|

6,500 | — | 112,088 | |||||||||

|

Net cash provided by financing activities

|

308,760 | 166,306 | 711,780 | |||||||||

|

Net increase (decrease) in cash

|

(3,179 | ) | 8,680 | 7,073 | ||||||||

|

Cash, beginning of period

|

10,252 | 1,572 | — | |||||||||

|

Cash, end of period

|

$ | 7,073 | $ | 10,252 | $ | 7,073 | ||||||

The accompanying notes to financial statements are an integral part of these financial statements

GRYPHON RESOURCES, INC.

(An Exploration Stage Company)

Supplemental Disclosure of Non-cash Investing and Financing Activities

|

Year ended

September 30, 2011

|

Year ended

September 30, 2010

|

January 16, 2006(inception) through

September 30, 2011

|

||||||||||

|

Shares issued for mineral property acquisition

|

$ | 31,000 | $ | 12,500 | $ | 43,500 | ||||||

|

Conversion of debt into common stock subscribed but not issued

|

$ | — | $ | 118,846 | $ | 118,846 | ||||||

The accompanying notes to financial statements are an integral part of these financial statements

GRYPHON RESOURCES, INC.

(An Exploration Stage Company)

Notes to Financial Statements

NOTE 1 – Nature of Business and Operations

Gryphon Resources, Inc. is a mineral exploration enterprise which was incorporated in the State of Nevada on January 16, 2006. On April 28, 2008 we incorporated a subsidiary and conducted an exploration project through this subsidiary in Turkey until September 27, 2010, at which time it was sold to an unrelated third party. Activities of this former subsidiary are treated in these financial statements as a discontinued operation. Currently our activities include exploring for lithium; and gold and silver in Arizona, USA. Our fiscal year end is September 30th. (Hereinafter Gryphon Resources, Inc. may herein be referred to: “Gryphon Resources”, “Gryphon”, “We”, “Us”, the “Registrant”, or the “Company”).

Exploration Stage Activities

The Company has been in the exploration stage since January 16, 2006 and has not yet realized any revenues from its operations.

NOTE 2 – Summary of Significant Accounting Policies

This summary of significant accounting policies is presented to assist in understanding Gryphon’s financial statements. The financial statements and notes are representations of the Company’s management, who is responsible for their integrity and objectivity. These accounting policies conform to generally accepted accounting principles in the United States of America and have been consistently applied in the preparation of the financial statements, which are stated in U.S. Dollars.

The financial statements reflect the following significant accounting policies:

Exploration Stage Company

The Company is devoting substantially all of its present efforts to establish a new business and none of its planned principal operations have commenced. As an exploration stage enterprise, the Company discloses the deficit accumulated during the exploration stage and the cumulative statements of operations and cash flows from inception to the current balance sheet date.

Exploration Costs and Mineral Property Right Acquisitions

The Company is primarily engaged in the acquisition and exploration of mining properties. Mineral property exploration costs are expensed as incurred. Mineral property acquisition costs are initially capitalized when incurred. The Company assesses the carrying costs for impairment under Accounting Standards 930 Extractive Activities – Mining (AS 930). An impairment is recognized when the sum of the expected undiscounted future cash flows is less than the carrying amount of the mineral property. Impairment losses, if any, are measured as the excess of the carrying amount of the mineral property over its estimated fair value. When it has been determined that a mineral property can be economically developed as a result of establishing proven and probable reserves, the costs then incurred to develop such property, are capitalized. Such costs will be amortized using the units-of-production method over the estimated life of the proven and probable reserves. If mineral properties are subsequently abandoned or impaired, any capitalized costs will be charged to operations.

GRYPHON RESOURCES, INC.

(An Exploration Stage Company)

Notes to Financial Statements

Non-Controlling Interest

As required by GAAP, the Balance Sheet; Statements of Operations; and Statement of Cash Flows of the financial statements for the prior year ended September 30, 2010 and the Exploration Stage Period from January 16, 2006 to September 30, 2011 include the allocation to ‘Non-Controlling Interest’ of a proportionate share of the Company’s discontinued operations net losses and related accounts which pertained to the 1% ownership interest in its former subsidiary which was not owned by the Company.

Use of Estimates

The preparation of financial statements in conformity with generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the period. Actual results could differ from those estimates.

Earnings or (Loss) per Share

Basic loss per share is calculated by dividing the net loss available to common stockholders by the weighted average number of common shares outstanding for the period. The denominator in this calculation is adjusted to reflect any stock splits or stock dividends.

Diluted loss per share is calculated using the treasury method which requires the calculation of diluted loss per share by assuming that any outstanding stock options with an average market price that exceeds the average exercise prices of the options for the year, are exercised and the assumed proceeds are used to repurchase shares of the Company at the average market price of the common shares for the year. An incremental per share effect is then calculated for each option. The denominator of the diluted loss per share formula is the number common shares outstanding at balance sheet date plus the incremental shares assumed to be issued from treasury for option exercises, less the number of shares assumed to be repurchased, weighted by the period they are assumed to be outstanding. This dilution calculation did not affect current fiscal year results because the Company does not have an Option Plan and has not issued any stock options; nor equity securities equivalents such as warrants.

Stock-based Compensation

The Company follows ASC 718-10, Stock Compensation, which addresses the accounting for transactions in which an entity exchanges its equity instruments for goods or services, with a primary focus on transactions in which an entity obtains employee services in share-based payment transactions. ASC 718-10 requires measurement of the cost of employee services received in exchange for an award of equity instruments based on the grant-date fair value of the award (with limited exceptions). Incremental compensation costs arising from subsequent modifications of awards after the grant date must be recognized. The Company has not adopted a stock option plan and has not granted any stock options; nor has it made any awards of stock, or stock equivalents.

GRYPHON RESOURCES, INC.

(An Exploration Stage Company)

Notes to Financial Statements

Estimated Fair Value of Financial Instruments