Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - ENDEAVOUR INTERNATIONAL CORP | d273898d8k.htm |

| EX-99.1 - PRESS RELEASE - ENDEAVOUR INTERNATIONAL CORP | d273898dex991.htm |

North

Sea Asset Acquisition

Exhibit 99.2 |

Disclaimers/Forward Looking Statements

2

This presentation contains forward-looking statements within the

meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities

Exchange Act of 1934. These forward-looking statements include

statements that express a belief, expectation, or intention, as well as those that are not

statements of historical fact, and may include projections and

estimates concerning the timing and success of specific projects and our future production,

revenues, income and capital spending. Our forward-looking

statements are generally accompanied by words such as "estimate," "project," "predict," "believe,"

"expect," "anticipate," "potential,"

"plan," "goal" or other words that convey the uncertainty of future events or outcomes. We caution you not to rely on them

unduly. We have based these forward-looking statements on our

current expectations and assumptions about future events. While our management considers

these expectations and assumptions to be reasonable, they are

inherently subject to significant business, economic, competitive, regulatory and other risks,

contingencies and uncertainties, most of which are difficult to predict

and many of which are beyond our control. These risks, contingencies and uncertainties

relate to the following: discovery, estimation, development and

replacement of oil and gas reserves; decreases in proved reserves due to technical or economic

factors; drilling of wells and other planned exploitation activities;

timing and amount of future production of oil and gas; the volatility of oil and gas prices;

availability and terms of capital; operating costs such as lease

operating expenses, administrative costs and other expenses; our future operating or financial

results; amount, nature and timing of capital expenditures, including

future development costs; cash flow and anticipated liquidity; availability of drilling and

production equipment; uncertainties related to drilling and production

operations in a new region; cost and access to natural gas gathering, treatment and pipeline

facilities; business strategy and the availability of acquisition

opportunities; and factors not known to us at this time. Any of these factors, or any combination of

these factors, could materially affect our future financial condition

or results of operations and the ultimate accuracy of a forward-looking statement. The

forward-looking statements are not guarantees of our future

performance, and our actual results and future developments may differ materially from those

projected in the forward-looking statements. In addition, any or

all of our forward-looking statements included in this presentation may turn out to be incorrect.

They can be affected by inaccurate assumptions we might make or by

known or unknown risks and uncertainties, including those included in our Annual Report

on Form 10-K for the year ended December 31, 2010 and our Quarterly

Reports on Form 10-Q for the quarterly periods ended June 30, 2011 and September 30,

2011.

As of January 1, 2010, the Securities and Exchange Commission

(“SEC”) changed its rules to permit oil and gas companies, in their filings with the SEC, to

disclose not only proved reserves, but also probable reserves and

possible reserves. Proved oil and gas reserves are those quantities of oil and gas, which, by

analysis of geosciences and engineering data, can be estimated with

reasonable certainty to be economically producible — from a given date forward, from

known reservoirs, and under existing economic conditions, operating

methods, and government regulations — prior to the time at which contracts providing the

right to operate expire. Probable reserves include those

additional reserves that a company believes are as likely as not to be recovered and possible reserves

include those additional reserves that are less certain to be recovered

than probable reserves. We do not represent that the probable reserves described herein meet

the recoverability thresholds established by the SEC in its

definitions. Investors are urged to also consider closely the disclosure in our filings with the SEC,

available from our website at www.endeavourcorp.com. Endeavour is

also subject to the requirements of the London Stock Exchange and considers the

disclosures in this presentation to be appropriate and/or required

under the guidelines of that exchange. |

Transaction Strategic Highlights

Substantially grows Endeavour’s North Sea producing asset base,

expanding exposure to favourably priced Brent crude oil

•

Adds approximately 10,000 boepd to current production

•

2P Reserve additions in excess of 33 mmboe

•

Three existing oil fields –

Alba, MacCulloch and Nicol

Adds significant scope and scale, together with Bacchus and Greater

Rochelle, Endeavour becomes one of larger independents in the North

Sea

Significantly improved operating profile and credit metrics, adding

approximately $300 million in Ebitda at current production levels

Valuable upside potential with the new fields

Low annual maintenance CapEx going forward

Accelerates the monetization of existing U.K. tax benefits

3 |

Transaction Summary

Deal Value: $330 million with a 28% allocation to tax basis

•

Purchase price to be reduced by cash flow from the effective economic date to

closing (Approximately $72 million after tax if measured at 12/31/11)

•

Effective date: January 1, 2011

Current performance:

•

2011 Net Production: average of approximately 10,000 boepd

•

June 30, 2011 2P Reserves: in excess of 33 mmboe

Expected closing in the first half of 2012

•

Subject to normal government regulatory approval; partner consents and other

customary closing conditions

4 |

Transaction Details

5

(in millions)

Purchase Price

$ 330

2011 Cash Flow Estimate*

(72)

Tax Benefit to Endeavour**

(58)

Adjusted Purchase Price

$ 200

* Estimates as of December 31, 2011

** Tax value of $58 million = $94 million x 62% tax rate

|

84%

16%

54%

27%

19%

41%

59%

Significant

Production

Growth

–

Acquisition

and

Near-Term

Projects

6

3,500 –

4,500 boepd

13,000 –

18,000 boepd

Current Production

Pro-forma Production with

Bacchus on-line and the

acquisition of N. Sea Assets

U.K. Oil

U.S. Gas

U.K. Gas

Pro-forma Production with

Greater Rochelle on-line

18,000 –

25,000 boepd |

Pro

Forma Position of Endeavour in the U.K. 7

Mid-Cap Market

Source: Woodmac Data

Endeavour + U.K.

Acquisition

2011 U.K. Company Data

END U.K.(including Bacchus and Greater

Rochelle) + New U.K. Asset Acquisition |

Alba

Field Overview: Block 16/26a 450ft water depth

Late Eocene reservoir at ~6,200ft depth

•

Massive homogeneous unconsolidated sands

with excellent quality

35 Platform and subsea wells

Infill drilling used to maximize

reservoir performance

Oil exported by tanker

8

END WI:

25.68%*

Operator:

Chevron (23.37% WI)

Partners:

Statoil (17% WI)

BP (13% WI)

Total (12.65% WI)

CIECO/Itochu (8% WI)

Discovered/1

st

Production

1984/1994

Current Production Rate

~7,500 boepd

* Combination of END’s existing WI 2.25% and the COP’s interest of

23.43%. |

MacCulloch Field Overview: Block 15/24b

490ft water depth

Paleocene reservoir at ~6,200ft depth

•

Large and extensive natural aquifer pressure

support

5 active wells

FPSO off-take solution

Currently operated by ConocoPhillips.

Transfer of operatorship to Endeavour

subject to partner consent

9

END WI:

40% WI

Partners:

ENI(40% WI)

Noble Energy (14% WI)

Talisman (6% WI)

Discovered/1

st

Production

1990/1997

Current Production Rate

~3,100 boepd |

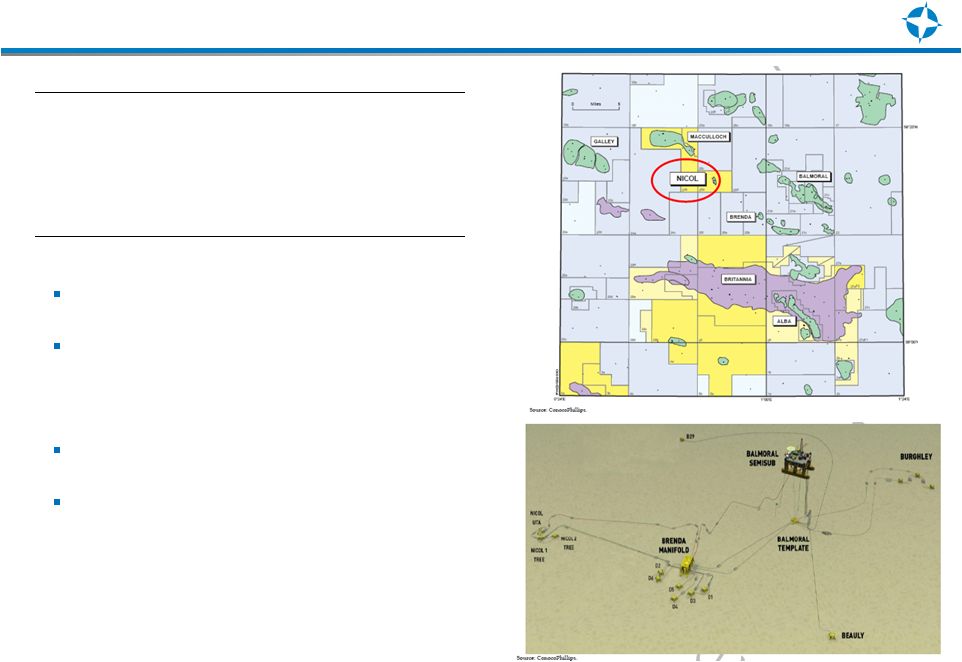

Nicol

Field

Overview

–

Block

15/25a

480ft water depth

Paleocene reservoir at ~6,400ft depth

•

Large, extensive natural aquifer pressure

support

One active well

Subsea tie-back to the Brenda

manifold with a booster pump

10

END WI:

18%

Operator:

Premier(70% WI)

Partners:

Eni (12% WI)

Discovered/1

st

Production

1988/2006

Current Production Rate

~200 boepd |

LSE:ENDV

NYSE:END

www.endeavourcorp.com

Mike Kirksey

Chief Financial Officer

(713) 307-8788 / +44 (0)207 451 2381

mike.kirksey@endeavourcorp.com

Darcey Matthews

Director of Investor Relations

(713) 307-8711

darcey.matthews@endeavourcorp.com

INVESTOR CONTACTS: |