Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - PATHEON INC | d269997d8k.htm |

| EX-99.1 - PRESS RELEASE - PATHEON INC | d269997dex991.htm |

December

2011 Exhibit 99.2

Patheon Fiscal 2011 Results |

2

This

presentation

contains

forward-looking

statements

or

information

which

reflect

our

expectations

regarding

possible

events,

conditions, our future growth, results of operations, performance, and business prospects and

opportunities. All statements, other than statements of historical fact, are

forward-looking statements. Forward-looking statements necessarily involve

significant known and unknown risks, assumptions and uncertainties that may cause our

actual results in future periods to differ materially from those expressed or implied

by such forward-looking statements. These risks are described in our Registration Statement on

Form 10, as amended, and our other filings with the U.S. Securities and Exchange Commission

and with the Canadian Securities Administrators. Accordingly, you are cautioned not to

place undue reliance on forward-looking statements. These forward-looking

statements are made as of the date hereof, and except as required by law, we assume no

obligation to update or revise them to reflect new events or circumstances.

Use of Non-GAAP Financial Measures

References “Adjusted EBITDA”

are to income (loss) before discontinued operations before repositioning expenses, interest

expense, foreign exchange losses reclassified from other comprehensive income,

refinancing expenses, gains and losses on sale of fixed assets, gain on extinguishment

of debt, income taxes, asset impairment charge, depreciation and amortization and other

income and expenses. Since Adjusted EBITDA is a non-GAAP measure that does not have

a standardized meaning, it may not be comparable to similar measures presented by other

issuers. Readers are cautioned that these non-GAAP measures should not be

construed as alternatives to net income (loss) determined in accordance with GAAP as

indicators of performance. Adjusted

EBITDA is used by management as an internal measure of profitability.

The company has included these measures because it

believes that this information is used by certain investors to assess its financial

performance, before non-cash charges and certain costs that the company does not

believe are reflective of its underlying business. An Adjusted EBITDA reconciliation of

these amounts to the closest Canadian GAAP measure is included in the

appendix.

Forward-Looking Statements |

3

3

•

2011 Financial Results

•

Transformation Results

•

Q&A

Agenda |

4

Fiscal 2011 Results |

5

Fiscal 2011 Results

Full Year 2011 Summary

•Revenues

for fiscal 2011 for Commercial Manufacturing were $572.6m up from

$545.3m for fiscal 2010. Adjusted EBITDA for

Commercial Manufacturing segment was $80.0m

up from $72.3m for fiscal 2010.

•Revenues

for fiscal 2011 for Pharmaceutical Development Services were $127.4m up from

$125.9m for fiscal 2010. Adjusted EBITDA for

the PDS segment was $29.9m vs. $46.8m for

fiscal 2010.

4

th

Quarter

Summary

•

Revenues for Q4 for Commercial

Manufacturing were $146.8m up from

$144.8m in the same period last year. Adjusted

EBITDA for Commercial Manufacturing segment

was $15.9m down from $26.6m in the same

period last year.

•Revenues

for Q4 in Pharmaceutical Development Services were $34.8m up from $33.0m in the

same period last year. Adjusted EBITDA for the

PDS segment was $9.9m vs. $11.0m in the same

period last year.

•

SG&A for Q4 was $35.9m up from $28.5m for

same period last year due primarily to higher

consulting fees for strategic initiatives. |

6

Select Financial Data

This includes $32.9 M in 1Q11 and $17.5 M in 2Q11 related to deferred revenue and a reservation

fee from an amended manufacturing supply agreement in the UK

Quarterly results for fiscal 2011

Q1 2011

Q2 2011

Q3 2011

Q4 2011

2011

(in millions of U.S. dollars)

$

$

$

$

$

Revenues

175.7

170.0

172.7

181.6

700.0

Cost of goods sold

132.7

138.0

145.3

145.9

561.9

Gross profit

43.0

32.0

27.4

35.7

138.1

Selling, general and administrative expenses

27.8

24.8

31.7

35.9

120.2

Operating income (loss)

14.3

6.5

(6.2)

(3.7)

10.9

Income (loss) before discontinued operations

0.7

(11.1)

(0.5)

(5.3)

(16.2)

Adjusted EBITDA

29.5

14.3

11.9

17.3

73.0

|

7

Our strategy will be executed across four elements

Our strategy is executed across four elements

Element I

Strengthen core

operations

Element II

Sell business

differently

Element III

Enter adjacencies

Element IV

Drive industry

consolidation |

8

Operating

System

Mindsets,

Capabilities

& Behaviors

Management

Infrastructure

The formal

structures, processes

and systems through

which the operating

system is managed

to deliver the

business objectives

The way

physical assets

and resources

are configured

and optimized to

create value and

minimize losses

The way people think, feel and

conduct themselves in the

workplace, both individually and

collectively

Strengthen our core operations |

9

•Right First Time (Reduced

Overtime)

•Operational Flow Efficiencies

& Output per Employee (ex.

lab testing)

•Improved Planning Process

•Decreased Labor Costs

•Increased Capacity (de-

creased bottlenecks)

•Increased throughput due

to labor efficiencies

•Develop Strategic Client

Relationships

•Improved Right First Time

•Reduce Inventory Write Offs

•Reduce Working Capital

Strengthen our Core: Operational Effectiveness

Increased

Margins

& Improved

Adjusted

EBITDA

“Rigorous

Transformation

Efforts focused on

expanding Revenue

Opportunities,

Increasing Operating

Margins, and

Improving Quality”

Wave 1

Diag.

Wave 1

Diag.

Diag.

Adjacent Areas

Wave 1

Diag.

Adjacent Areas

Wave 1

Diag.

Adjacent Areas

Wave 1

Rest of Sites

Italy

Cincinnati

Puerto Rico

Canada

Adjacent Areas

2Q11

3Q11

4Q11

1Q12

2Q12

Adjacent Areas |

10

Our strategy is executed across four elements

Element I

Strengthen core

operations

Element II

Sell business

differently

Element III

Enter adjacencies

Element IV

Drive industry

consolidation |

11

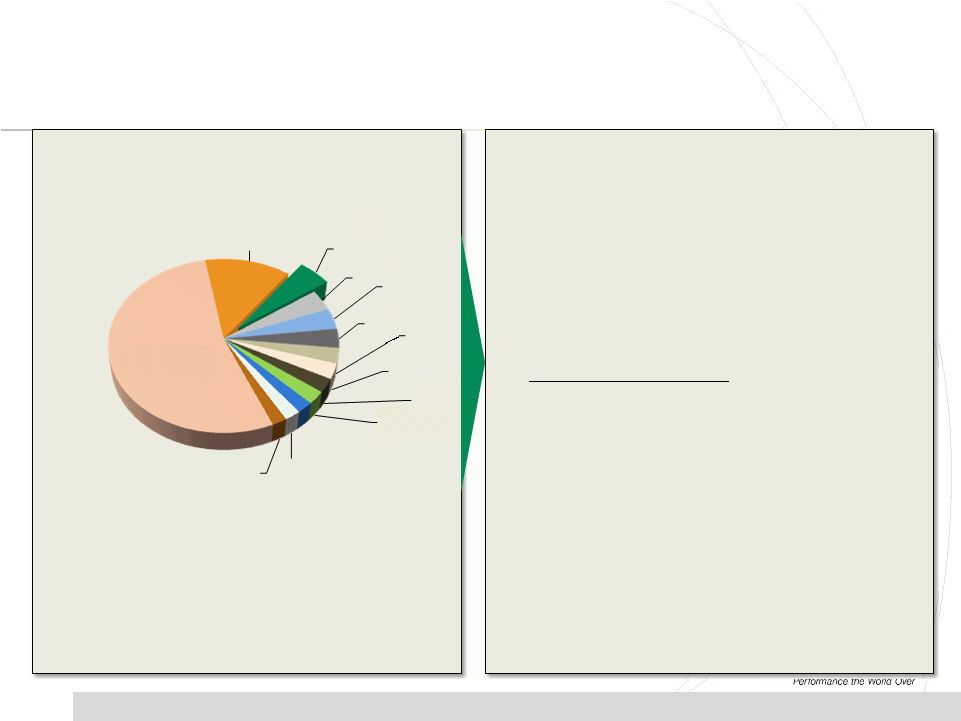

Source: PharmSource (2011)

CMO Market Trends and Implications

Competitive Landscape Trends

•

Highly fragmented market, and industry consolidation

is progressing slowly

•

3% to 5% annual growth forecasted (2011 –

2015)

•

CMOs continue to add capabilities/capacity despite

indication of oversupply

•

Fragmentation has led to low margins/pricing pressure

Implications for Patheon

•

Opportunity to better manage capacity and operational

efficiencies to deliver cost-effective manufacturing

solutions (i.e., lower cost of goods)

•

Potential for preferred provider model as pharma looks

to reduce sourcing costs

•

Opportunity to deliver higher-value offerings

(e.g.,

drug delivery technologies; solubility technologies)

Catalent

13%

Patheon

5%

Vetter

4%

Baxter

4%

Famar

3%

Aenova

3%

Fareva

3%

Haupt

3%

DPT

2%

Recipharm

2%

Nextpharma

2%

Hospira

2%

400+ Others

54%

CMO Market = $11.7 B. |

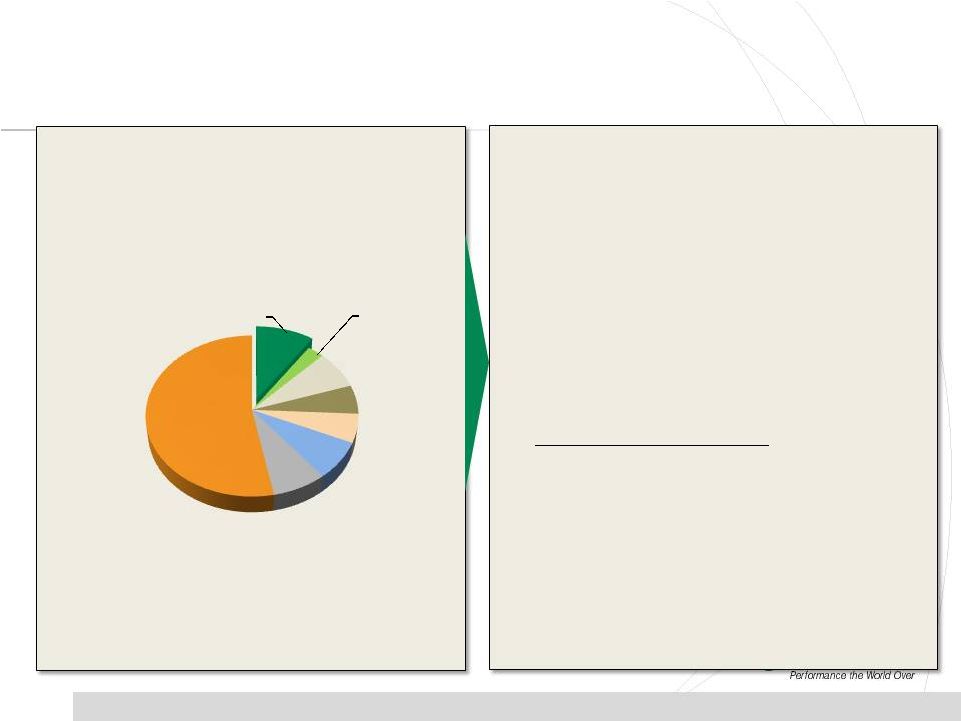

•

Competition intensifies as new competitor

types (e.g., CROs) have broadened their

service offerings, expanding towards the PDS

space

•

Reduced funding for emerging pharmas’

early

development projects, and shrinking R&D

efforts within big pharma, are forcing smaller

CDOs to restructure/downsize

•

Market growth rates projected to approach 3%

annually (2011 through 2015)

Implications for Patheon

•

Opportunity to capitalize on CDO industry

restructuring through acquisitions/partnerships

or capture of weak players’

market share

•

Opportunity to provide “integrated early

development”

offering to combat new entrants

•

Key capabilities could differentiate offerings:

Technologies (solubility-enhancing; highly

potent)

PDS Market Trends and Implications

Competitive Landscape Trends

*Market estimate includes clinical dose manufacturing, analytical services, and dose

formulation services. Source: PharmSource (2011)

Patheon,

$126

Catalent,

$35

Labs,

$100

Aptuit,

$75

AAI, $75

Almac,

$100

PPD,

$100

100+

Others,

$690

12

PDS Market Size = $1.3 B*

Lancaster |

Biopharm

Sell business differently

Solution Based offerings that drive customer value

Sterile

Backup Supply

SoluPath™

Lessons Learned

•

Campaign messaging developed around

solutions to our customers’

problems rather

than our own existing capabilities

•

Fits a specific customer need which is

currently not well met by CDMOs…

•

SoluPath: “unbiased multi-technology assessment”

•

Sterile backup: “no volume commitment required”

•

…

and for which Patheon has legitimate

strengths compared to competitors

•

SoluPath: “Patheon understands what it will take

to scale up all the way to commercial supply”

•

Sterile backup: “stellar regulatory compliance and

efficient tech transfer management”

1

1

2

2

3

3

13 |

14

Sell the business differently –

early results

Sell the business differently –

early results |

15

Principles of our Strategy

We will provide the industry’s leading customer experience. At all levels, places, and

times our customers will have a predictably outstanding experience.

Our factories must be the highest quality, most flexible, and most efficient producers

in the world.

Our Pharmaceutical Development Services will provide best technical and scientific

solutions to solve difficult development problems and enhance product value.

We will create a culture of engagement, ownership and a shared commitment to

excellence in all that we do.

We will operate our business in a disciplined, responsible, and ethical fashion such that

our shareholders will appreciate superior returns over time.

2

2

3

3

4

4

5

5

1

1 |

16

16

Q&A |

17

Appendix

Adjusted EBITDA Bridges

Q1 2011

Q2 2011

Q3 2011

Q4 2011

2011

(in millions of U.S. dollars)

$

$

$

$

$

Adjusted EBITDA

29.5

14.3

11.9

17.3

73.0

Depreciation and amortization

(14.9)

(13.5)

(12.6)

(12.4)

(53.4)

Repositioning expenses

(0.9)

(0.7)

(1.9)

(3.5)

(7.0)

Interest expense, net

(6.3)

(6.3)

(6.3)

(6.5)

(25.4)

(Provision for) benefit from income taxes

(6.6)

(4.7)

2.7

1.3

(7.3)

Other

(0.1)

5.7

(1.5)

3.9

Income (loss) before discontinued operations

0.7

(11.1)

(0.5)

(5.3)

(16.2)

(0.2)

2011

2010

2011

2010

(in millions of U.S. dollars)

$

$

$

$

Adjusted EBITDA

17.3

28.6

73.0

91.7

Depreciation and amortization

(12.4)

(16.3)

(53.4)

(55.8)

Repositioning expenses

(3.5)

(1.0)

(7.0)

(6.8)

Interest expense, net

(6.5)

(6.3)

(25.4)

(19.5)

Impairment charge

-

(0.2)

-

(3.6)

Refinancing expenses

-

(0.2)

-

(12.2)

Benefit from (provision for) income taxes

1.3

(5.4)

(7.3)

3.0

Other

(1.5)

(0.1)

3.9

(0.1)

Loss before discontinued operations

(5.3)

(0.9)

(16.2)

(3.3)

Three months ended October 31,

Year ended October 31, |