Attached files

| file | filename |

|---|---|

| EX-23.1 - CONSENT OF SATURNA GROUP CHARTERED ACCOUNTANTS LLP. - CANYON COPPER CORP. | exhibit23-1.htm |

| EX-23.4 - CONSENT OF GARY GIROUX. - CANYON COPPER CORP. | exhibit23-4.htm |

| EX-23.3 - CONSENT OF MEL KLOHN. - CANYON COPPER CORP. | exhibit23-3.htm |

| EX-5.1 - OPINION OF NORTHWEST LAW GROUP WITH CONSENT TO USE - CANYON COPPER CORP. | exhibit5-1.htm |

| EX-23.2 - CONSENT OF CHRIS BROILI. - CANYON COPPER CORP. | exhibit23-2.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C.

20549

FORM S-1 /A

(Amendment No.1 to Form S-1)

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

CANYON COPPER CORP.

(Exact

name of Registrant as specified in its charter)

NEVADA

(State or other jurisdiction of

incorporation or organization)

1000

(Primary Standard Industrial

Classification Code Number)

88-0452792

(I.R.S. Employer Identification

Number)

Suite 408, 1199 West Pender Street

Vancouver, BC V6E 2R1

Tel: (604) 331-9326

(Address, including zip code, and

telephone number, including area code, of Registrant’s principal executive

offices)

CAMLEX MANAGEMENT (NEVADA) INC.

8275 S. Eastern

Avenue, Suite 200, Las Vegas, NV 89123

Tel: (702)

990-8405

(Name, address, including zip code, and telephone number,

including area code, of agent for service)

Copies to: NORTHWEST LAW GROUP

Suite 950, 650 West

Georgia Street, Vancouver, BC V6B 4N8

Tel: (604) 687-5792

As soon as practicable after this Registration Statement

is declared effective.

(Approximate date of commencement of proposed

sale to the public)

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box: [X]

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer [ ] | Accelerated filer [ ] | |

| Non-accelerated filer [ ] | (Do not check if a smaller reporting company) | Smaller reporting company [ X ] |

| CALCULATION OF REGISTRATION FEE | ||||

| Title of Each Class of Securities to be Registered |

Amount to be Registered(1) |

Proposed Maximum Offering Price Per Unit(2) |

Proposed Maximum Aggregate Offering Price(2) |

Amount of Registration Fee(2) |

| Common Stock, par value $0.00001 per share |

9,897,554 |

$0.18 |

$1,781,559.72 |

$204.17 |

| (1) |

9,897,554 shares of common stock, par value $0.00001 per share, of Canyon Copper Corp., a Nevada corporation (the “Registrant”), are being registered hereunder. The shares consist of: (i) 6,468,528 shares issued in private placement transactions completed in May 2011, June 2011 and July 2011; (ii) 3,234,260 shares issuable upon exercise of share purchase warrants issued by the Registrant in May 2011, June 2011 and July 2011; (iii) 129,844 shares issuable upon exercise of an option (the “Agent’s Option”) issued by the Registrant in July 2011; and (iv) 64,922 shares issuable upon exercise of warrants underlying the Agent’s Option. |

| (2) |

Estimated solely for the purpose of calculating the registration fee in accordance with Rule 457 under the Securities Act of 1933, as amended. Based on the average high and low price of the common stock on December 13, 2011. Previously paid registration fee of $275.79. |

|

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act, or until this Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine. |

SUBJECT TO COMPLETION, DATED DECEMBER 14, 2011

The information contained in this prospectus is not complete and may be changed. The selling security holders may not sell these securities until the registration statement filed with the United States Securities and Exchange Commission (the “SEC”) is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

| CANYON COPPER CORP. |

| PROSPECTUS |

| 9,897,554 SHARES OF COMMON STOCK |

We are registering 9,897,554 shares of common stock for sale by the selling security holders listed in this prospectus. Of the 9,897,554 shares being registered, 6,468,528 shares were issued in private placement transactions completed in May 2011, June 2011 and July 2011; 3,234,260 shares are issuable upon exercise of share purchase warrants issued by us in May 2011, June 2011 and July 2011 (the “Warrants”), 129,844 shares issuable upon exercise of an option (the “Agent’s Option”) issued by us, and 64,922 shares issuable upon exercise of warrants (the “Agent’s Warrants”) underlying the Agent’s Option.

The selling security holders may resell their shares to or through underwriters, broker-dealers or agents, who may receive compensation in the form of discounts, concessions or commissions, as well as private transactions. We will not receive any proceeds from the sale of shares being sold by the selling security holders. The prices at which the selling security holders may sell their shares will be determined by prevailing market prices, prices related to prevailing market prices or at privately negotiated prices. The selling security holders named in this prospectus will bear the costs of all commission or discounts, if any, attributable to the sale of their shares. We are bearing the costs, expenses and fees associated with the registration of the shares in this prospectus. We will not receive any proceeds from the sale of shares of common stock covered by this prospectus. We will receive proceeds on the exercise of the Warrants, the Agent’s Option or the Agent’s Warrants, the underlying shares of which are covered by this prospectus. However, the selling security holders listed in this prospectus are not required to exercise the Warrants, the Agent’s Option or the Agent’s Warrants and there is no assurance that they will exercise these securities. If all Warrants, Agent’s Option, Agent’s Warrants are exercised, we will receive total gross proceeds of CDN $1,695,036.40.

Our common stock trades in Canada on the TSX Venture Exchange under the symbol “CNC” and over the counter in the United States on the OTC Bulletin Board and OTCQB market place under the symbol “CNYC." The last reported sale price of our common stock on the OTC Bulletin Board at the close of business on December 13, 2011 was $0.18 per share.

The purchase of the securities offered through this prospectus involves a high degree of risk. You should carefully read and consider the section of this prospectus titled “Risk Factors” on page 6 before buying any shares of our common stock.

Neither the SEC nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

This Prospectus is Dated December 14, 2011

i

CANYON COPPER CORP.

PROSPECTUS

ii

GLOSSARY OF GEOLOGICAL DEFINED TERMS

The following definitions and terms apply throughout this document unless the context otherwise requires:

| Actinolite |

A mineral containing magnesium and iron and is commonly formed in metamorphic rocks. |

| Alluvial |

A placer formed by the action of running water, as in a stream channel or alluvial fan. |

| Alluvium |

A general term for clay, silt, sand, gravel, or similar unconsolidated detrital material, deposited during comparatively recent geologic time by a stream or other body of running water. |

| Andesite |

An extrusive igneous, volcanic rock. |

| Argillaceous |

Sediment or a sedimentary rock containing an appreciable amount of clay. |

| Au |

Gold. |

| Argillite |

A compact rock, derived either from mudstone, or shale, that has undergone a somewhat higher degree of induration than mudstone or shale but is less clearly laminated and without its fissility, and that lacks the cleavage distinctive of slate. |

| Azurite |

A mineral found in oxidized parts of copper deposits. |

| Basal Conglomerate |

A well-sorted, lithologically homogeneous conglomerate that forms the bottom stratigraphic unit of a sedimentary series and that rests on a surface of erosion. |

| Basalt |

A common extrusive volcanic rock. It is usually grey to black and fine grained due to rapid cooling of lava. |

| Bedded |

Applied to rocks resulting from consolidated sediments and accordingly exhibiting planes of separation designated bedding planes. |

| Belt |

Regional surface zone along which mines and prospects occur. |

| Bioclastic |

Rocks consisting of fragmental organic remains. |

| Bornite |

An important copper ore mineral occurs widely in porphyry copper and chalcopyrite. |

| Calcareous |

A substance that contains calcium carbonate. |

| Calcite |

A common constitute of sedimentary rocks and in particular limestone. |

| Calcsilicate |

A metamorphic rock consisting mainly of calcium-bearing silicates. |

| Carbonaceous |

Carbonaceous sediments include original organic tissues and subsequently produced derivatives of which the composition is organic chemically. |

| Chalcopyrite |

A copper iron sulfide mineral. |

| Chrysocolla |

A bluish green to emerald green mineral that forms in crustations and thin seams in oxidized parts of copper-mineral veins. |

| Claystone |

A concretionary mass of clay frequently found in alluvial deposits. |

| Colluvium |

A loose body of sediment that have been built up at the bottom of a low-grade slope. |

| Conglomerate |

A coarse-grained clastic sedimentary rock, composed of rounded to subangular fragments larger than 2 mm in diameter set in a fine-grained matrix of sand or silt, and commonly cemented by calcium carbonate, iron oxide, silica, or hardened clay; the consolidated equivalent of gravel. |

| Cretaceous |

A geological period from 145 to 65 million years ago. |

| Diopside |

A white to light green mineral occurring in metamorphic rocks. |

1

| Diorite |

A grey to dark grey intermediate intrusive igneous rock composed principally of plagioclase feldspar. |

| Dip |

The angle at which a bed, stratum, or vein is inclined from the horizontal, measured perpendicular to the strike and in the vertical plane. |

| Displacement |

A general term for the change in position of any point on one side of a fault plane relative to any corresponding point on the opposite side of the fault plane. |

| Dolomite |

A carbonate mineral composed of calcium magnesium carbonate and is a common sedimentary rock forming mineral. |

| Dolomitic Limestone |

A limestone that has been incompletely dolomitized. |

| Drag |

Fragments of ore torn from a lode by a fault. |

| Epidote |

An abundant rock forming mineral, but one of secondary origin. |

| Fault |

A fracture or a fracture zone in crustal rocks along which there has been displacement of the two sides relative to one another parallel to the fracture. |

| Fault Zones |

A fault that is expressed as a zone of numerous small fractures. |

| Feldspar |

A group of rock forming minerals that make up approximately 60% of the Earth’s crust. |

| Flotation (testing) |

A milling process in which valuable mineral particles are induced to become attached to bubbles and float as others sink. |

| Fossilferous |

Containing fossils. |

| Garnet |

A group of minerals used as gemstones and abrasives. |

| Goethite |

An iron bearing oxide mineral found in soil and other low temperature environments. |

| Granite |

A common and widely occurring type of intrusive, felsic and igneous rock. |

| Granodiorites |

Course grained igneous rock intermediate in composition between granite and diorite. |

| HCI |

Hydrogen Chloride. |

| HNO3 |

Nitric Acid. |

| Hedenbergite |

A common rock-forming mineral in iron-rich metamorphic rocks, limestone skarns, and fayalite-bearing plutonic rocks. |

| Hematite |

The mineral form of iron (III) oxide. |

| Hornfels(ed) |

A fine-grained rock composed of a mosaic of equidimensional grains without preferred orientation and typically formed by contact metamorphism. |

| Intercalated |

Means layered material. |

| Intrusive |

A body of igneous rock formed by the consolidation of magma intruded into other rocks. |

| Jasperoid |

A dense, usually gray, chertlike siliceous rock, in which chalcedony or cryptocrystalline quartz has replaced the carbonate minerals of limestone or dolomite; a silicified limestone. It typically develops as the gangue of metasomatic sulfide deposits of the lead-zinc type, such as those of Missouri, Oklahoma, and Kansas. |

| Jaw Crusher |

A primary crusher designed to reduce large rocks or ores to sizes capable of being handled by any of the secondary crushers. |

2

| Jones riffle (splitter) |

An apparatus used for cutting the size of a sample. It consists of a hopper above a series of open-bottom pockets, usually 1/2 in or 3/4 in (1.27 cm or 1.91 cm) wide, which are so constructed as to discharge alternately, first into a pan to the right, and then into another pan to the left. Each time the sample is passed through the riffle, it is divided into two equal parts; the next pass of one of those parts will give a quarter of the original sample, and so on, until the sample is reduced to the desired weight. |

| Jurassic |

The geological period between 190 million years and 135 million years ago. |

| Lacustrine |

Formed at the bottom or on the shore of lakes. |

| Latite |

A porphyritic extrusive rock having phenocrysts of plagioclase and potassium feldspar in nearly equal amounts, little or no quartz, and a finely crystalline to glassy groundmass, which may contain obscure potassium feldspar; the extrusive equivalent of monzonite. |

| Limestone |

A sedimentary rock composed largely of mineral calcite. |

| Leaching |

The separation, selective removal, or dissolving-out of soluble constituents from a rock or orebody by the natural action of percolating water. |

| Lode |

A mineral deposit in solid rock. |

| Mafic |

A silicate mineral or rock that is rich in magnesium or iron. |

| Magnetite |

A mineral commonly found in iron formations and magmatic iron deposits. |

| Malachite |

A carbonate mineral known as copper carbonate. |

| Member |

A division of a formation, generally of distinct character and of only local extent. |

| Metasomatic |

The chemical alteration of rock by hydrothermal or other fluids. |

| Metasomatism |

The process of practically simultaneous capillary solution and deposition by which a new mineral of partly or wholly different chemical composition may grow in the body of an old mineral or mineral aggregate. The presence of interstitial, chemically active pore liquids or gases contained within a rock body or introduced from external sources is essential for the replacement process, that often, though not necessarily, occurs at constant volume with little disturbance of textural or structural features. |

| Mineralization |

The concentration of metals and their chemical compounds within a body of rock. |

| Miocene |

A geological epoch from about 23 million years ago to 5.3 million years ago. |

| Molybdenite |

A mineral found in molybdenum. |

| Molybdenum |

A hard, silvery-white metallic element used to toughen alloy steels and soften tungsten alloy. |

| Monzonites |

A granular plutonic rock containing approximately equal amounts of orthoclase and plagioclase, and thus intermediate between syenite and diorite. |

| Oligocene |

A geological period from about 34 million years ago to 23 million years ago. |

| Ore |

A mixture of minerals and gangue from which at least one metal can be extracted at a profit. |

| Permeable |

Means permitting passage of liquids or gases. |

| Porphyritic |

Containing relatively large isolated crystals in a mass of fine texture. |

| Porphyry |

A heterogeneous rock characterized by the presence of crustals in a relatively finer- grained matrix. |

| Pyrite |

The most common of the sulphide minerals. It is usually found associated with other sulphides or oxides in quartz veins, sedimentary rock and metamorphic rock, as well as in coal beds, and as the replacement mineral in fossils. |

3

| Pyrrhotite |

An unusual iron sulphide mineral with variable iron content. |

| Quartz |

A mineral whose composition is silicon dioxide. A crystalline form of silica. |

| Quatenary Period |

The geological time period roughly 2.588 million years ago. |

| Reverse Circulation (RC) |

The circulation of bit-coolant and cuttings-removal liquids, drilling fluid, mud, air, or gas down the borehole outside the drill rods and upward inside the drill rods. Also called countercurrent; counterflush. |

| Rhyolite |

An igneous, volcanic rock of felsic composition. |

| Sedimentary |

A type of rock that is formed by sedimentation of material at the Earth’s surface. |

| Serpentinite |

A rock consisting almost wholly of serpentine-group minerals. |

| Shale |

A rock formed by consolidation of clay, mud, or silt, having a laminated structure and composed of minerals essentially unaltered since deposition. |

| Sill |

A bed of lava or tuff between older layer of rocks. |

| Siltstone |

A sedimentary rock with a grain size in the silt range. |

| Skarn |

Forms in the process of metamorphism and in the contact zone of magmatic intrusions. |

| Specularite |

A black or gray variety of hematite with splendant metallic. |

| Sphalerite |

An mineral that is a source for zinc. |

| Stockwork |

A complex system of structurally controlled or randomly oriented veins. |

| Stratum (Strata) |

A bed or layer of rock; strata, more than one layer. |

| Strike-Shift Fault |

A fault on which the movement is parallel to the fault's strike. |

| Sulfide |

A mineral compound characterized by the linkage of sulfur with a metal or semimetal. |

| Supergene |

A mineral deposit or enrichment formed near the surface, commonly by descending solutions; also, said of those solutions and of that environment. |

| Tactite |

A rock formed by contact metamorphism and metasomatism of carbonate rocks. |

| Talc |

A mineral that occurs as hydrothermal alteration of ultramafic rocks. |

| Tenor (Grade) |

The relative quantity or the percentage of ore-mineral or metal content in an orebod. |

| Tertiary |

The geological period between 65 to 1.64 million years ago. |

| Triassic |

A geological period between 210 and 250 million years ago. |

| Tremolite |

A mineral with magnesium replaced by iron, and silicon by aluminum toward actinolite. |

| Tuffaceous |

Means sediments containing up to 50% tuff. |

| Tuffs |

Rock composed of fine volcanic ash. |

| Tungsten |

A hard, brittle, white or gray metallic element. |

| Vein |

An occurrence of ore with an irregular development in length, width and depth usually from an intrusion of igneous rock. |

| Volcanic |

Characteristics of, pertaining to, situated in or upon, formed in, or derived from volcanoes. |

| Volcanism |

The processes by which magma and its associated gases rise in the crust and are extruded onto the Earth's surface and into the atmosphere. |

| Volcanoclastic |

Volcanic material that has been transported and reworked through wind or water. |

4

SUMMARY INFORMATION, RISK FACTORS AND EARNINGS TO FIXED CHARGES

As used in this prospectus, unless the context otherwise requires, “we,” “us,” “our,” the “Company” and “Canyon” refers to Canyon Copper Corp. All dollar amounts in this prospectus are in U.S. dollars unless otherwise stated. You should read the entire prospectus before making an investment decision to purchase our common stock.

About Us

We were incorporated on January 21, 2000 under the laws of the State of Nevada. Our principal executive office is located at Suite 408, 1199 West Pender Street, Vancouver, British Columbia, Canada V6E 2R1. Our telephone number is (604) 331-9526.

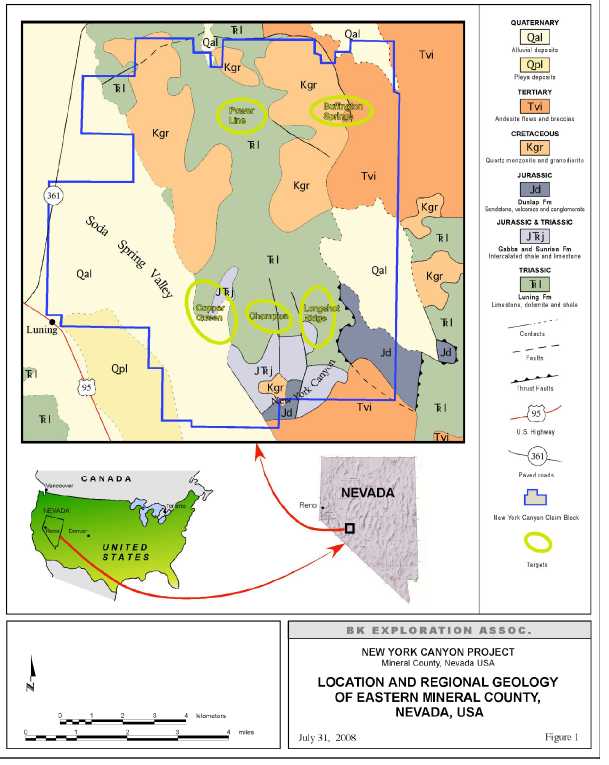

Overview of Our Business

We are an exploration stage company engaged in the acquisition, exploration and development of mineral properties. We currently hold 100% title in a major claim block totalling 1,293 unpatented mineral claims, covering approximately 25,860 acres located in Mineral County, Nevada (the “New York Canyon Claims”). We also hold 21 patented mineral claims covering an area of approximately 420 acres, located within the vicinity of the New York Canyon Claims area. We collectively refer to the New York Canyon Claims and the patented claims as the “New York Canyon Project.” See the sections titled “Our Business” and “Properties” for additional information.

We have not earned any revenues to date and do not anticipate earning revenues until such time as we enter into commercial production of our mineral properties. We are presently in the exploration stage of our business and we can provide no assurance that commercially viable mineral deposits exist on our claims or that we will discover commercially exploitable levels of mineral resources on our properties, or if such deposits are discovered, that we will enter into further substantial exploration programs.

The Offering

| Securities Offered by the Selling Security Holders: |

Up to 9,897,554 shares of our common stock. The shares consist of 6,468,528 shares previously issued by us, 3,234,260 shares issuable on exercise of the Warrants, 129,844 shares issuable on exercise of the Agent’s Option and 64,922 shares issuable on exercise of the Agent’s Warrant. See the section titled “Selling Security Holders” for additional information. |

|

| |

| Common Stock Outstanding: |

68,396,934 shares of our common stock are issued and outstanding as of the date of this prospectus. We are not issuing any additional shares of common stock. In the event that all of the Warrants, Agent’s Warrants and Agent’s Warrant Shares are exercised, of which there is no assurance, our issued and outstanding shares of common stock will be 71,825,960. |

|

| |

| Use of Proceeds: |

We will not receive any proceeds from the sale of the common stock by the selling security holders. We may receive proceeds in connection with the exercise of the Warrants, the Agent’s Option and the Agent’s Warrants. We intend to use the proceeds from such exercises for working capital and general corporate purposes. There is no assurance that any of the Warrants, Agent’s Option and Agent’s Warrant’s will ever be exercised. See the section titled “Use of Proceeds” for additional information. |

|

| |

| Risk Factors: |

An investment in our securities involves a high degree of risk and could result in a loss of your entire investment. Prior to making an investment decision, you should carefully consider all of the information in this prospectus and, in particular you should evaluate the risk factors under the section titled “Risk Factors” beginning on page 6. |

5

RISK FACTORS

An investment in our common stock involves a high degree of risk. You should carefully consider the risks described below and the other information in this prospectus before investing in our common stock. If any of the following risks occur, our business, operating results and financial condition could be seriously harmed. The quotation price of our common stock, if we obtain a public quotation at a later date, could decline due to any of these risks, and you may lose all or part of your investment.

We lack an operating history and have losses which we expect to continue into the future. As a result, we may have to suspend or cease exploration activities and if we do not obtain sufficient financing, our business will fail.

We were incorporated on January 21, 2000 and to date have been involved primarily in the acquisition of our mineral property and the exploration and development on this property. We have no exploration history upon which an evaluation of our future success or failure can be made. Our ability to achieve and maintain profitability and positive cash flow is dependent upon:

- our ability to locate a profitable mineral property; and

- our ability to generate revenues.

Our plan of operation calls for significant expenses in connection with the exploration of the New York Canyon Project, which may require us to obtain financing. We recorded a net loss of $304,976 for the three months ended September 30, 2011 and have an accumulated deficit of $22,142,744 since inception. As at September 30, 2011, we had cash of $1,310,444. For the next twelve months, management anticipates that the minimum cash requirements to fund our proposed exploration program and our continued operations will be $1,090,000. Accordingly, we have sufficient funds to meet our planned expenditures over the next twelve months. In the event that we decide to proceed with phase two of our exploration program, of which there is no assurance, we will be required to raise additional financing.

Obtaining financing would be subject to a number of factors, including the market prices for the mineral property and base and precious metals. These factors may make the timing, amount, terms or conditions of additional financing unavailable to us. Since our inception, we have used our common stock to raise money for our operations and for our property acquisitions. We have not attained profitable operations and are dependent upon obtaining financing to pursue our plan of operation.

Because we anticipate our operating expenses will increase prior to our earning revenues, we may never achieve profitability.

Prior to completion of our exploration stage, we anticipate that we will incur increased operating expenses without realizing any revenues. We therefore expect to incur significant losses into the foreseeable future. We recognize that if we are unable to generate significant revenues from the exploration of our mineral claims and the production of minerals thereon, if any, we will not be able to earn profits or continue operations. There is no history upon which to base any assumption as to the likelihood that we will prove successful, and we may not be able to ever generate any operating revenues or achieve profitable operations. If we are unsuccessful in addressing these risks, our business will most likely fail.

Because we are an exploration stage company, our business has a high risk of failure.

As noted in the financial statements that are included with this prospectus, we are an exploration stage company that has incurred net losses since inception, we have not attained profitable operations and we are dependent upon obtaining adequate financing to complete our exploration activities. These conditions, as indicated in our audit report included in this prospectus for the year ended June 30, 2011, raise substantial doubt as to our ability to continue as a going concern. The success of our business operations will depend upon our ability to obtain further financing to complete our planned exploration program and to attain profitable operations. If we are not able to complete a successful exploration program and attain sustainable profitable operations, then our business will fail.

6

Because we have not commenced business operations, we face a high risk of business failure.

We have not earned any revenues as of the date of this prospectus. Potential investors should be aware of the difficulties normally encountered by new mineral exploration companies and the high rate of failure of such enterprises. The likelihood of success must be considered in light of the problems, expenses, difficulties, complications and delays encountered in connection with the exploration of the mineral properties that we plan to undertake. These potential problems include, but are not limited to, unanticipated problems relating to exploration, and additional costs and expenses that may exceed current estimates.

We have no known mineral reserves and if we cannot find any, we will have to cease operations.

We have no mineral reserves. Mineral exploration is highly speculative. It involves many risks and is often non-productive. Even if we are able to find mineral reserves on our property our production capability is subject to further risks including:

- Costs of bringing the property into production including exploration work, preparation of production feasibility studies, and construction of production facilities, all of which we have not budgeted for;

- Availability and costs of financing;

- Ongoing costs of production; and

- Environmental compliance regulations and restraints.

The marketability of any minerals acquired or discovered may be affected by numerous factors which are beyond our control and which cannot be accurately predicted, such as market fluctuations, the lack of milling facilities and processing equipment near the New York Canyon Project and such other factors as government regulations, including regulations relating to allowable production, exporting of minerals, and environmental protection. If we do not find a mineral reserve or define a mineral inventory containing gold, silver or copper or if we cannot explore the mineral reserve, either because we do not have the money to do it or because it will not be economically feasible to do it, we will have to cease operations and investors will lose their investment.

In order to maintain our rights to the New York Canyon Project, we will be required to make annual filings with federal and state regulatory agencies and/or be required to complete assessment work on the New York Canyon Project.

In order to maintain our rights to the New York Canyon Project, we will be required to make annual filings with federal and state regulatory authorities. Currently the amount of these fees is approximately $195,000; however, these maintenance fees are subject to adjustment. In addition, we may be required by federal and/or state legislation or regulations to complete minimum annual amounts of mineral exploration work on the New York Canyon Project. A failure by us to meet the annual maintenance requirements under federal and state laws could cause our rights to the New York Canyon Project to lapse.

Because of the inherent dangers involved in mineral exploration, there is a risk that we may incur liability or damages if and when we conduct mineral exploration activities.

The search for valuable minerals involves numerous hazards. As a result, if and when we conduct exploration activities we may become subject to liability for such hazards, including pollution, cave-ins and other hazards against which we cannot insure or against which we may elect not to insure. The payment of such liabilities may have a material adverse effect on our financial position.

If the price of base and precious metals declines, our financial condition and ability to obtain future financings will be impaired.

The price of base and precious metals is affected by numerous factors, all of which are beyond our control. Factors that tend to cause the price of base and precious metals to decrease include the following:

| (i) |

Sales or leasing of base and precious metals by governments and central banks; | |

| (ii) |

A low rate of inflation and a strong US dollar; | |

| (iii) |

Speculative trading; |

7

| (iv) |

Decreased demand for base and precious metals industrial, jewelry and investment uses; | |

| (v) |

High supply of base and precious metals from production, disinvestment, scrap and hedging; | |

| (vi) |

Sales by base and precious metals producers and foreign transactions and other hedging transactions; and | |

| (vii) |

Devaluing local currencies (relative to base and precious metals price in US dollars) leading to lower production costs and higher production in certain major base and precious metals producing regions. |

Our business is dependent on the price of base and precious metals. We have not undertaken hedging transactions in order to protect us from a decline in the price of base and precious metals. A decline in the price of base and precious metals may also decrease our ability to obtain future financings to fund our planned development and exploration programs.

If we are unable to hire and retain key personnel, we may not be able to implement our business plan.

Our success is dependent upon the performance of key personnel working full-time in management, supervisory and administrative capacities or as consultants. This is particularly true in highly technical businesses such as mineral exploration. These individuals are in high demand and we may not be able to attract the personnel we need. The loss of the services of senior management or key personnel could have a material and adverse effect on us, our business and results of operations. Failure to hire key personnel when needed, or on acceptable terms, would have a significant negative effect on our business.

As we undertake exploration of our New York Canyon project, we will be subject to compliance with government regulation that may increase the anticipated cost of our exploration program.

There are several governmental regulations that materially restrict mineral exploration. We are required to obtain work permits, post bonds and perform remediation work for any physical disturbance to the land in order to comply with these laws. If we enter the production phase, the cost of complying with permit and regulatory environment laws will be greater because the impact on the project area is greater. Permits and regulations will control all aspects of the production program if the project continues to that stage. Examples of regulatory requirements include:

| (i) |

Water discharge will have to meet drinking water standards; | |

| (ii) |

Dust generation will have to be minimal or otherwise re-mediated; | |

| (iii) |

Dumping of material on the surface will have to be re-contoured and re-vegetated with natural vegetation; | |

| (iv) |

An assessment of all material to be left on the surface will need to be environmentally benign; | |

| (v) |

Ground water will have to be monitored for any potential contaminants; | |

| (vi) |

The socio-economic impact of the project will have to be evaluated and if deemed negative, will have to be re-mediated; and | |

| (vii) |

There will have to be an impact report of the work on the local fauna and flora including a study of potentially endangered species. |

There is a risk that new regulations could increase our costs of doing business and prevent us from carrying out our exploration program. We will also have to sustain the cost of reclamation and environmental remediation for all exploration work undertaken. Both reclamation and environmental remediation refer to putting disturbed ground back as close to its original state as possible. Other potential pollution or damage must be cleaned-up and renewed along standard guidelines outlined in the usual permits. Reclamation is the process of bringing the land back to its natural state after completion of exploration activities. Environmental remediation refers to the physical activity of taking steps to remediate, or remedy, any environmental damage caused. The amount of these costs is not known at this time as we do not know the extent of the exploration program that will be undertaken beyond completion of the recommended work program. If remediation costs exceed our cash reserves we may be unable to complete our exploration program and have to abandon our operations.

8

If we become subject to increased environmental laws and regulation, our operating expenses may increase.

Our development and production operations are regulated by both US Federal and Nevada state environmental laws that relate to the protection of air and water quality, hazardous waste management and mine reclamation. These regulations will impose operating costs on us. If the regulatory environment for our operations changes in a manner that increases costs of compliance and reclamation, then our operating expenses would increase with the result that our financial condition and operating results could be adversely affected.

There has been a very limited public trading market for our securities, and the market for our securities may continue to be limited and be sporadic and highly volatile.

There is currently a limited public market for our common stock. Our common stock trades in Canada on the TSX Venture Exchange and over the counter in the United States on the OTC Bulletin Board and OTCQB market place. We cannot assure you that an active market for our shares will be established or maintained in the future. The OTC Bulletin Board and OTCQB are not national securities exchanges, and many companies have experienced limited liquidity when traded through these quotation systems. Holders of our common stock may, therefore, have difficulty selling their shares, should they decide to do so. In addition, there can be no assurances that such markets will continue or that any shares, which may be purchased, may be sold without incurring a loss. The market price of our shares, from time to time, may not necessarily bear any relationship to our book value, assets, past operating results, financial condition or any other established criteria of value, and may not be indicative of the market price for the shares in the future.

In addition, the market price of our common stock may be volatile, which could cause the value of our common stock to decline. Securities markets experience significant price and volume fluctuations. This market volatility, as well as general economic conditions, could cause the market price of our common stock to fluctuate substantially. Many factors that are beyond our control may significantly affect the market price of our shares. These factors include:

- price and volume fluctuations in stock markets;

- changes in our operating results;

- any increase in losses from levels expected by securities analysts;

- changes in regulatory policies or law;

- operating performance of companies comparable to us; and

- general economic trends and other external factors.

Even if an active market for our common stock is established, stockholders may have to sell their shares at prices substantially lower than the price they paid for the shares or might otherwise receive than if an active public market existed.

If we complete a financing through the sale of additional shares of our common stock, stocks will experience dilution.

The most likely source of future financing presently available to us is through the issuance of our common stock. Any sale of share capital will result in dilution to existing shareholders. The only other anticipated alternative for the financing of further exploration would be the offering by us of an interest in our properties to be earned by another party or parties carrying out further exploration thereof, which is not presently contemplated.

Because our stock is a penny stock, stockholders will be more limited in their ability to sell their stock.

The SEC has adopted rules that regulate broker-dealer practices in connection with transactions in penny stocks. Penny stocks are generally equity securities with a price of less than $5.00, other than securities registered on certain national securities exchanges or quoted on the Nasdaq system, provided that current price and volume information with respect to transactions in such securities is provided by the exchange or quotation system.

9

Because our securities constitute "penny stocks" within the meaning of the rules, the rules apply to us and to our securities. The rules may further affect the ability of owners of shares to sell our securities in any market that might develop for them. As long as the quotation price of our common stock is less than $5.00 per share, the common stock will be subject to Rule 15g-9 under the Securities Exchange Act of 1934 (the “Exchange Act”). The penny stock rules require a broker-dealer, prior to a transaction in a penny stock, to deliver a standardized risk disclosure document prepared by the SEC, that:

| 1. |

contains a description of the nature and level of risk in the market for penny stocks in both public offerings and secondary trading; | |

| 2. |

contains a description of the broker's or dealer's duties to the customer and of the rights and remedies available to the customer with respect to a violation to such duties or other requirements of securities laws; | |

| 3. |

contains a brief, clear, narrative description of a dealer market, including bid and ask prices for penny stocks and the significance of the spread between the bid and ask price; | |

| 4. |

contains a toll-free telephone number for inquiries on disciplinary actions; | |

| 5. |

defines significant terms in the disclosure document or in the conduct of trading in penny stocks; and | |

| 6. |

contains such other information and is in such form, including language, type, size and format, as the SEC shall require by rule or regulation. |

The broker-dealer also must provide, prior to effecting any transaction in a penny stock, the customer with: (a) bid and offer quotations for the penny stock; (b) the compensation of the broker-dealer and its salesperson in the transaction; (c) the number of shares to which such bid and ask prices apply, or other comparable information relating to the depth and liquidity of the market for such stock; and (d) a monthly account statements showing the market value of each penny stock held in the customer's account. In addition, the penny stock rules require that, prior to a transaction in a penny stock not otherwise exempt from those rules, the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser's written acknowledgment of the receipt of a risk disclosure statement, a written agreement to transactions involving penny stocks, and a signed and dated copy of a written suitability statement. These disclosure requirements may have the effect of reducing the trading activity in the secondary market for our stock.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain statements contained in this prospectus constitute "forward-looking statements.” These statements, identified by words such as “plan,” "anticipate,” "believe,” "estimate,” "should,” "expect" and similar expressions include our expectations and objectives regarding our future financial position, operating results and business strategy. Forward-looking statements involve known and unknown risks, uncertainties, assumptions and other factors that may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Such factors include, among others, general business, economic, competitive, political and social uncertainties; the actual results of current exploration activities; changes in project parameters as plans continue to be refined; changes in labour costs or other costs of production; future mineral prices; equipment or processes to operate as anticipated; accidents, labour disputes and other risks of the mining industry, including but not limited to environmental hazards, cave-ins, pit-wall failures, flooding, rock bursts and other acts of God or unfavourable operating conditions and losses; delays in obtaining governmental approvals or financing or in the completion of development or construction activities, as well as those factors discussed in the section titled "Risk Factors" in this prospectus.

10

Forward looking statements are based on a number of material factors and assumptions, including the results of exploration and drilling activities, the availability and final receipt of required approvals, licenses and permits, that sufficient working capital is available to complete proposed exploration and drilling activities, that contracted parties provide goods and/or services on the agreed time frames, the equipment necessary for exploration is available as scheduled and does not incur unforeseen break downs, that no labour shortages or delays are incurred and that no unusual geological or technical problems occur. While we consider these assumptions may be reasonable based on information currently available to it, they may prove to be incorrect. Actual results may vary from such forward-looking information for a variety of reasons, including but not limited to risks and uncertainties disclosed in the section titled “Risk Factors” in this prospectus.

We intend to discuss in our Quarterly Reports and Annual Reports any events or circumstances that occurred during the period to which such documents relate that are reasonably likely to cause actual events or circumstances to differ materially from those disclosed in this prospectus. New factors emerge from time to time, and it is not possible for management to predict all of such factors and to assess in advance the impact of each such factor on our business or the extent to which any factor, or combination of such factors, may cause actual results to differ materially from those contained in any forwarding looking statement.

USE OF PROCEEDS

We will not receive any proceeds from the sale of shares of our common stock sold by the selling security holders. However, we will receive proceeds in connection with any exercise of the Warrants, the Agent’s Option and the Agent’s Warrants. The Warrants are exercisable at a price of CDN $0.50 per share and the Agent’s Option is exercisable at a price of CDN $0.35 per unit. Each unit issued on exercise of the Agent’s Option will consist of one share of our common stock and one Agent’s Warrant. In the event that the Agent’s Option is exercised and the Agent’s Warrants are issued, the Agent’s Warrants are exercisable at a price of CDN $0.50 per share. If all of the Warrants, Agent’s Option and Agent’s Warrants are exercised, we will receive gross proceeds of CDN $1,695,036.40. However, there is no assurance that any of the Warrant’s Agent’s Option, Agent’s Warrants will ever be exercised. We intend to use any proceeds from the exercise of the Warrants, the Agent’s Option and the Agent’s Warrants for working capital and general corporate purposes.

The Warrants, the Agent’s Option and the Agent’s Warrants are not being offered under this prospectus; however, the shares of our common stock underlying these securities are being offering under this prospectus by the selling security holders.

SELLING SECURITY HOLDERS

The selling security holders named in this prospectus are offering 6,468,528 shares of common stock already issued and outstanding, 3,234,260 shares issuable on exercise of the Warrants, 129,844 shares issuable on exercise of the Agent’s Option and 62,922 shares issuable on exercise of the Agent’s Warrants.

The selling security holders acquired the shares of common stock offered through this prospectus from us in the following private placement offering transactions:

| (a) |

On May 11, 2011, we completed a private placement of 3,206,602 units at a price of CDN $0.35 per unit for total proceeds of CDN $ 1,122,310.70. Each unit consisted of one share of common stock and one-half of one non-transferable Warrant. Each whole Warrant entitles the holder to purchase one additional share of common stock at a price of CDN $0.50 per share until November 10, 2012. The issuance was completed pursuant to the provisions of Regulation S of the Securities Act. |

| (b) |

On May 11, 2011, we completed a private placement of 142,857 units at a price of CDN $0.35 per unit for total proceeds of approximately CDN $50,000 to a person that was a member of our Board of Directors at the time of issuance. Each unit consisted of one share of common stock and one-half of one non-transferable Warrant. Each whole Warrant entitles the holder to purchase one additional share of common stock at a price of CDN $0.50 per share until November 10, 2012. The issuance was completed pursuant to the provisions of Section 4(2) of the Securities Act. |

11

| (c) |

On June 8, 2011, we completed a private placement of 97,856 units at a price of CDN $0.35 per unit for total proceeds of CDN $34,250. Each unit consisted of one share of common stock and one-half of one non-transferable Warrant. Each whole Warrant entitles the holder to purchase one additional share of common stock at a price of CDN $0.50 per share until December 7, 2012. The issuance was completed pursuant to the provisions of Regulation S of the Securities Act. |

| (d) |

On July 8, 2011, we completed a private placement of 857,142 units at a price of CDN $0.35 per unit for gross proceeds of CDN $300,000 to a company owned by Anthony Harvey, Chairman, CEO and a member of our Board of Directors. Each unit consisted of one share of common stock and one-half of one non-transferable Warrant. Each whole Warrant entitles the holder to purchase one additional share of common stock at a price of CDN $0.50 per share until January 8, 2013. This issuance was completed pursuant to the provisions of Regulation S of the Securities Act. |

| (e) |

On July 13, 2011, we completed a private placement of 2,164,071 units at a price of CDN $0.35 per unit for gross proceeds of CDN $757,424.85. Each unit consisted of one share of common stock and one-half of one non-transferable Warrant. Each whole Warrant entitles the holder to purchase one additional share of common stock at a price of CDN $0.50 per share until January 13, 2013. The issuance was completed pursuant to the provisions of Regulation S of the Securities Act. In connection with the offering, we issued an option to purchase 129,844 units at a price of CDN $0.35 per unit until January 13, 2013 (the “Agent’s Option”). On exercise of the Agent’s Option, each unit will consist of one share of our common stock and one-half of one non-transferable Warrant (the “Agent’s Warrants”). Each whole Agent’s Warrant will entitle the holder to purchase one additional share of common stock at a price of CDN $0.50 per share until January 13, 2013. The issuance of the Agent’s Option was completed pursuant to Regulation S of the Securities Act. |

The following table provides as of December 14, 2011 information regarding the beneficial ownership of our common stock held by each of the selling security holders, including:

| 1. |

the number of shares beneficially owned by each prior to this Offering; |

| 2. |

the total number of shares that are to be offered by each; |

| 3. |

the total number of shares that will be beneficially owned by each upon completion of the Offering; |

| 4. |

the percentage owned by each upon completion of the Offering; and |

| 5. |

the identity of the beneficial holder of any entity that owns the shares. |

Name Of Selling Security Holder(1) |

Beneficial Ownership Before Offering(1) |

Number of Shares Being Offered |

Beneficial Ownership After Offering(1) | ||

| Number of Shares |

Percent(2) |

Number of Shares |

Percent(2) | ||

| MILTON DATSOPOULOS(3) | 1,695,535 | 2.4% | 214,285 | 1,481,250 | 2.1% |

| JEANNETTE COULPIER | 462,000 | * | 225,000 | 237,000 | * |

| JEFFREY R. HARVEY | 247,250 | * | 89,250 | 158,000 | * |

| IAN M. GRAY | 30,000 | * | 30,000 | 0 | * |

| GARRETT AINSWORTH | 835,000 | 1.2% | 45,000 | 790,000 | 1.1% |

| BENJAMIN AINSWORTH(4) | 1,159,084 | 1.6% | 46,500 | 1,112,584 | 1.5% |

| AE FINANCIAL MANAGEMENT LTD.(5) | 37,500 | * | 37,500 | 0 | * |

| JOHN DAVID KWONG | 45,000 | * | 45,000 | 0 | * |

| S. VAL DONOVAN | 113,035 | * | 21,427 | 91,608 | * |

| WARREN STANYER | 225,000 | * | 225,000 | 0 | * |

| DALE HALLMAN | 150,000 | * | 150,000 | 0 | * |

| ERIC M. BEDDIS | 225,000 | * | 225,000 | 0 | * |

| TDC PROPERTIES LTD.(6) | 37,500 | * | 37,500 | 0 | * |

| SUSAN J. KNOX | 30,000 | * | 30,000 | 0 | * |

| YUEN SHI CHENG | 15,000 | * | 15,000 | 0 | * |

| ARLIN MCNEILL | 15,000 | * | 15,000 | 0 | * |

12

Name Of Selling Security Holder(1) |

Beneficial Ownership Before Offering(1) |

Number of Shares Being Offered |

Beneficial Ownership After Offering(1) | ||

| Number of Shares |

Percent(2) |

Number of Shares |

Percent(2) | ||

| RONALD M. LANG | 15,000 | * | 15,000 | 0 | * |

| FRANK A. LANG | 42,862 | * | 42,862 | 0 | * |

| CHARITY MEISTER | 58,072 | * | 58,072 | 0 | * |

| BARRY SIU | 21,750 | * | 21,750 | 0 | * |

| DEBORAH L. KENNEDY | 300,000 | * | 300,000 | 0 | * |

| LORMI HOLDINGS INC.(7) | 15,000 | * | 15,000 | 0 | * |

| ATON VENTURES FUND LIMITED(8) | 1,124,096 | 1.6% | 1,071,429 | 52,667 | * |

| CLARION FINANZ AG(9) | 1,738,807 | 2.4% | 1,607,140 | 131,667 | * |

| SILVER BF VENTURES SDN BHD(10) | 3,515,118 | 4.9% | 428,571 | 3,086,547 | 4.3% |

| WALTER KNOX | 12,900 | * | 12,900 | 0 | * |

| BRUCE A. THOMSON | 75,000 | * | 75,000 | 0 | * |

| SAMANTHA THOMSON | 21,427 | * | 21,427 | 0 | * |

| ALANA THOMSON | 7,500 | * | 7,500 | 0 | * |

| MICHAEL LETTS | 42,856 | * | 42,856 | 0 | * |

| ARH MANAGEMENT LTD.(11) | 3,915,098 | 5.5% | 1,285,713 | 2,629,385 | 3.7% |

| 3408256 CANADA INC.(12) | 150,000 | * | 150,000 | 0 | * |

| OTTO FELBER | 150,000 | * | 150,000 | 0 | * |

| JAMES AITKEN | 45,000 | * | 45,000 | 0 | * |

| PETER AITKEN | 207,500 | * | 108,000 | 99,500 | * |

| WOLFGANG KYSER | 75,000 | * | 75,000 | 0 | * |

| HUGH COULSON | 105,000 | * | 105,000 | 0 | * |

| AMC LTD.(13) | 85,500 | * | 85,500 | 0 | * |

| NANCY HALL-CHAPMAN | 150,000 | * | 150,000 | 0 | * |

| DAVID CHAPMAN | 150,000 | * | 150,000 | 0 | * |

| JAMES WATT | 150,000 | * | 150,000 | 0 | * |

| FIRST CASTLE FRANK HOLDINGS LTD.(14) | 45,000 | * | 45,000 | 0 | * |

| EMIL FUNG | 42,750 | * | 42,750 | 0 | * |

| LANCE GROSLO | 42,856 | * | 42,856 | 0 | * |

| MIKE BONE | 8,550 | * | 8,550 | 0 | * |

| JERET BODE | 15,000 | * | 15,000 | 0 | * |

| MARK SMITH-WINDSOR | 15,000 | * | 15,000 | 0 | * |

| BRIAN GIBBS | 150,000 | * | 150,000 | 0 | * |

| 49 NORTH RESOURCES INC.(15) | 1,071,450 | 1.5% | 1,071,450 | 0 | * |

| DANIEL HARDIE | 112,500 | * | 112,500 | 0 | * |

| ALEXANDER MOFFAT | 21,000 | * | 21,000 | 0 | * |

| DAVID HALLS | 43,500 | * | 43,500 | 0 | * |

| DAVID S. RUPERT | 43,500 | * | 43,500 | 0 | * |

| 4665423 MANITOBA LTD.(16) | 82,500 | * | 82,500 | 0 | * |

| PERRY MEIKLE | 46,500 | * | 46,500 | 0 | * |

| TIMOTHY CAMPBELL | 90,000 | * | 90,000 | 0 | * |

| STEPHAN STUPARU | 33,000 | * | 33,000 | 0 | * |

| 1266845 ONTARIO LTD.(17) | 214,500 | * | 214,500 | 0 | * |

13

Name Of Selling Security Holder(1) |

Beneficial Ownership Before Offering(1) |

Number of Shares Being Offered |

Beneficial Ownership After Offering(1) | ||

| Number of Shares |

Percent(2) |

Number of Shares |

Percent(2) | ||

| MGI SECURITIES CORP.(18) | 171,786 | * | 171,786 | 0 | * |

| PI FINANCIAL CORP.(19) | 14,400 | * | 14,400 | 0 | * |

| BMO NESBITT BURNS INC.(20) | 8,580 | * | 8,580 | 0 | * |

| Notes: | |

| * |

Represents less than 1%. |

| (1) |

The number of shares of our common stock beneficially owned has been determined in accordance with Rule 13d-3 under the Exchange Act, and such information is not necessarily indicative of beneficial ownership for any other purpose. Under Rule 13d-3, beneficial ownership includes any shares as to which a selling stockholder has sole or shared voting power or investment power and also any shares which that selling stockholder has the right to acquire within 60 days of the date of this prospectus through the exercise of any stock options or warrants. |

| (2) |

The percentages of beneficial ownership are based on 71,825,960 shares, which assumes the exercise of the Warrants, the Agent’s Option and the Agent’s Warrants. |

| (3) |

Milton Datsopoulos served as a member of our Board of Directors until May 17, 2011. |

| (4) |

Benjamin Ainsworth is our President, Secretary and a member of our Board of Directors. |

| (5) |

Ed Low has investment and voting power over the securities that AE Financial Management Ltd. owns. |

| (6) |

Alexander Wong has investment and voting power over the securities that TDC Properties Ltd. owns. |

| (7) |

Michael Wilson has investment and voting power over the securities that Lormi Holdings Inc. owns. |

| (8) |

David Dawes has investment and voting power over the securities that Aton Ventures Fund Limited owns. |

| (9) |

Carlo Civelli has investment and voting power over the securities that Clarion Finanz AG owns. |

| (10) |

David Dawes has investment and voting power over the securities that Silver BF Ventures SDN BHD owns. |

| (11) |

Anthony Harvey, our Chairman, Chief Executive Officer and a member of our Board of Directors, has investment and voting power over the securities that ARH Management Ltd. owns. |

| (12) |

Philip Armstrong has investment and voting power over the securities that 3408256 Canada Inc. owns. |

| (13) |

Robin Balme and Anthony Balme have investment and voting power over the securities that AMC Ltd. owns. |

| (14) |

Bruno J. Arnold has investment and voting power over the securities that First Cast Frank Holdings Ltd. owns. |

| (15) |

Tom MacNeill has investment and voting power over the securities that 49 North Resources Inc. owns. |

| (16) |

Aaron Rookes has investment and voting power over the securities that 4665423 Manitoba Ltd. owns. |

| (17) |

Paul Millar has investment and voting power over the securities that 1266845 Ontario Ltd. owns. |

| (18) |

MGI Securities Inc. (“MGI”) acted as our lead agent in connection with our July 13, 2011 private placement under Regulation S of the Securities Act. As commission for the services provided by MGI for the July 13, 2011 private placement, MGI received a cash commission of CDN $45,445.49 and an option to purchase 129,844 units at a price of CDN $0.35 per unit until January 13, 2013. On exercise of the option, each unit will consist of one share of our common stock and one-half of one non-transferable Warrant. Each whole Warrant will entitle the holder to purchase an additional share of common stock at a price of CDN $0.50 per share until January 13, 2013. James Andrews has investment and voting power over the securities that this selling security holder owns. |

| (19) |

PI Financial Corp. (“PI Financial”) acted as a sub-agent in connection with our July 13, 2011 private placement under Regulation S of the Securities Act. As commission for the services provided by PI Financial for the July 13, 2011 private placement, PI Financial received an option to purchase 9,600 units at a price of CDN $0.35 per unit until January 13, 2013. On exercise of the option, each unit will consist of one share of our common stock and one-half of one non-transferable Warrant. Each whole Warrant will entitle the holder to purchase an additional share of common stock at a price of CDN $0.50 per share until January 13, 2013. Roslyn Zenovitch has investment and voting power over the securities that this selling security holder owns. |

| (20) |

BMO Nesbitt Burns Inc. (“BMO”) acted as a sub-agent in connection with our July 13, 2011 private placement under Regulation S of the Securities Act. As commission for the services provided by BMO for the July 13, 2011 private placement, BMO received an option to purchase 5,720 units at a price of CDN $0.35 per unit until January 13, 2013. On exercise of the option, each unit will consist of one share of our common stock and one-half of one non-transferable Warrant. Each whole Warrant will entitle the holder to purchase an additional share of common stock at a price of CDN $0.50 per share until January 13, 2013. Tom Flynn has investment and voting power over the securities that this selling security holder owns. |

Except as disclosed above, none of the selling security holders:

| (i) |

has had a material relationship with us other than as a stockholder at any time within the past three years; or | |

| (ii) |

has ever been one of our officers or directors. |

Except as disclosed below, to the knowledge of management, none of the selling security holders is either a registered broker-dealer or an affiliate of a registered broker-dealer:

14

| (a) | MGI Securities Inc. is an affiliate of MGI Securities (USA) Inc., a registered broker-dealer; |

|

| (b) | PI Financial Corp. is an affiliate of PI Financial (US) Corp., a registered broker-dealer; and |

|

| (c) | BMO Nesbitt Burns Inc. is an affiliate of BMO Nesbitt Burns Securities Ltd., a registered broker-dealer. |

Each of MGI Securities Inc., PI Financial Corp. and BMO Nesbitt Burns Inc. has represented to us that it acquired its securities in the ordinary course of business and at the time of the acquisition did not have any arrangements or understanding with any person to distribute the securities.

PLAN OF DISTRIBUTION

Offering by the Selling Security Holders

The selling security holders named in this prospectus may sell their shares on a continuous or delayed basis after this registration statement is declared effective. The selling security holders may sell some or all of their common stock in one or more transactions, including block transactions:

| 1. |

On such public markets as the common stock may from time to time be trading; |

| 2. |

In privately negotiated transactions; |

| 3. |

Through the writing of options on the common stock; |

| 4. |

In short sales; or |

| 5. |

In any combination of these methods of distribution. |

The selling security holders named in this prospectus may also sell their shares directly to market makers acting as agents in unsolicited brokerage transactions. Any broker or dealer participating in such transactions as agent may receive a commission from the selling security holders, or, if they act as agent for the purchaser of such common stock, from such purchaser. The selling security holders will likely pay the usual and customary brokerage fees for such services.

We are bearing all costs relating to the registration of this offering. The selling security holders, however, will pay any commissions or other fees payable to brokers or dealers in connection with any sale of the common stock.

The selling security holders named in this prospectus must comply with the requirements of the Securities Act and the Exchange Act in the offer and sale of the common stock. The selling security holders and any broker-dealers who execute sales for the selling security holders may be deemed to be an “underwriter” within the meaning of the Securities Act in connection with such sales. In particular, during such times as the selling security holders may be deemed to be engaged in a distribution of the common stock, and therefore be considered to be an underwriter, they must comply with applicable law and may among other things:

| 1. |

Not engage in any stabilization activities in connection with our common stock; |

| 2. |

Furnish each broker or dealer through which common stock may be offered, such copies of this prospectus, as amended from time to time, as may be required by such broker or dealer; and |

| 3. |

Not bid for or purchase any of our securities or attempt to induce any person to purchase any of our securities other than as permitted under the Exchange Act. |

The selling security holders should be aware that the anti-manipulation provisions of Regulation M under the Exchange Act will apply to purchases and sales of shares of common stock by the selling security holders, and that there are restrictions on market-making activities by persons engaged in the distribution of the shares. Under Regulation M, the Company, the selling security holders and their agents may not bid for, purchase, or attempt to induce any person to bid for or purchase, shares of our common stock while such persons are distributing shares covered by this prospectus. Accordingly, the selling security holders are not permitted to cover short sales by purchasing shares while the distribution is taking place. The selling security holders are advised that if a particular offer of common stock is to be made on terms constituting a material change from the information set forth above with respect to the Plan of Distribution, then, to the extent required, a post-effective amendment to the accompanying registration statement must be filed with the SEC.

15

DESCRIPTION OF SECURITIES TO BE REGISTERED

Our authorized capital consists of 131,666,666 shares of common stock, par value of $0.00001 per share, of which 68,396,934 shares of common stock are issued and outstanding.

Our common stock is entitled to one vote per share on all matters submitted to a vote of the stockholders, including the election of directors. Holders of not less than one percent (1%) of the outstanding shares of stock entitled to vote shall constitute a quorum for the transaction of business. Except as otherwise provided by law, our Articles of Incorporation or our Bylaws, all action taken by the holders of a majority of the votes cast, excluding abstentions, at any meeting at which a quorum is present shall be valid and binding; provided, however, that directors shall be elected by a plurality of the votes of the shares present in person or represented by proxy at the meeting and entitled to vote on the election of directors. Where a separate vote by a class or classes or series is required, except where otherwise provided by the statute or by our Articles of Incorporation or our Bylaws, a majority of the outstanding shares of such class or classes or series, present in person or represented by proxy, shall constitute a quorum entitled to take action with respect to that vote on that matter and, except where otherwise provided by the statute or by our Articles of Incorporation or our Bylaws, the affirmative vote of the majority (plurality, in the case of the election of directors) of the votes cast, including abstentions, by the holders of shares of such class or classes or series shall be the act of such class or classes or series. A vote by the holders of a majority of our outstanding shares is required to effectuate certain fundamental corporate changes such as liquidation, merger or an amendment to our Articles of Incorporation. Our Articles of Incorporation do not provide for cumulative voting in the election of directors.

Subject to the rights and restrictions of preferred stock, the holders of common stock are entitled to receive dividends when and if declared by the directors out of funds legally available therefore and to share pro rata in any distribution to common stockholders. The shares of common stock do not carry any subscription, redemption or conversion rights, nor do they contain any sinking fund or purchase fund provisions.

Upon our liquidation, dissolution, or winding up, the holders of the common stock, after payment of all liabilities and outstanding amounts due to the holders of the preferred stock, are entitled to receive our net assets in proportion to the respective number of shares held by them.

In the event of any merger or consolidation with or into another company in connection with which shares of our common stock are converted into or exchangeable for shares of stock, other securities or property (including cash), all holders of our common stock will be entitled to receive the same kind and amount of shares of stock and other securities and property (including cash).

Dividends

We have neither declared nor paid any cash dividends on our capital stock since our inception and do not contemplate paying cash dividends in the foreseeable future. It is anticipated that earnings, if any, will be retained for the operation of our business. Our board of directors will determine future dividend declarations and payments, if any, in light of the then-current conditions they deem relevant and in accordance with Chapter 78 of Nevada Revised Statutes (the “NRS”).

There are no restrictions in our articles of incorporation or in our bylaws which prevent us from declaring dividends. Chapter 78 of NRS, however, does prohibit us from declaring dividends where, after giving effect to the distribution of a dividend:

| (a) |

We would not be able to pay our debts as they become due in the usual course of business; or |

16

| (b) |

Our total assets would be less than the sum of our total liabilities plus the amount that would be needed to satisfy the rights of shareholders who have preferential rights superior to those receiving distributions. |

INTERESTS OF NAMED EXPERTS AND COUNSEL

No expert or counsel named in this prospectus as having prepared or certified any part of this prospectus or having given an opinion upon the validity of the securities being registered or upon other legal matters in connection with the registration or offering of the common stock was employed on a contingency basis, or had, or is to receive, in connection with the offering, a substantial interest, direct or indirect, in our company or any of its parents or subsidiaries. Nor was any such person connected with our company, or any of its parents or subsidiaries, a promoter, managing or principal underwriter, voting trustee, director, officer, or employee.

Northwest Law Group has assisted us in the preparation of this prospectus and registration statement and will provide counsel with respect to other legal matters concerning the registration and offering of the common stock. Attorneys who are members of or employed by Northwest Law Group who have provided advise with respect to this matter own shares and options to purchase shares of our common stock.

Saturna Group Chartered Accountants LLP (“Saturna”), our independent accountant, has audited our financial statements included in this prospectus and registration statement to the extent and for the periods set forth in their audit report. Saturna has presented their report with respect to our audited financial statements. The report of Saturna is included in reliance upon their authority as experts in accounting and auditing.

Chris Broili, C.P. Geo. and L.P. Geo., and Mel Klohn, L.P. Geo, both of BK Exploration Associates, and Gary Giroux, P. Eng., of Giroux Consultants Ltd., are the authors of our Canadian National Instrument 43-101 (“NI 43-101”) Technical Report titled “Technical Report on the New York Canyon Project” dated April 6, 2010 and prepared in accordance with NI 43-101.

OUR BUSINESS

Overview

We were incorporated on January 21, 2000 under the laws of the State of Nevada. On May 15, 2009, we completed a one-for-three reverse split of our common stock, decreasing our authorized capital from 500,000,000 shares of common stock, par value $0.00001 per share, to 166,666,666 shares of common stock, par value $0.00001 per share. On November 24, 2010, in order to conform our capital structure with the requirements of the TSX Venture Exchange, we completed a 79-for-100 reverse split of our common stock, decreasing our authorized capital from 166,666,666 shares of common stock, par value $0.00001 per share, to 131,666,666 shares of common stock, par value $0.00001 per share.

We are an exploration stage company engaged in the acquisition, exploration and development of mineral properties. We currently hold 100% title in a major claim block totaling 1,293 unpatented mineral claims, covering approximately 25,860 acres located in Mineral County, Nevada (the “New York Canyon Claims”). We also hold 21 patented mineral claims covering an area of approximately 420 acres, located within the vicinity of the New York Canyon Claims area. We collectively refer to the New York Canyon Claims and the patented claims as the “New York Canyon Project.”

In fiscal 2008 and 2009, we restricted our activities on the New York Canyon Project to the review and analysis of data collected during our 2006 exploration program and maintaining the New York Canyon Project in good standing. This was primarily due to the fact that we had limited funds during fiscal 2008 and 2009.

In fiscal 2010 and 2011, we primarily focused our resources on the proposed listing on the TSX Venture Exchange, updating our Canadian National Instrument 43-101 Technical Report on the New York Canyon Project and maintaining our New York Canyon Project in good standing.

Subsequent to fiscal 2011, we completed the following corporate developments:

17

Listing of TSX Venture Exchange

| 1. |

On July 18, 2011, our shares of common stock commenced trading on the TSX Venture Exchange under the symbol “CNC”. |

Entry into Assignment Agreement to Acquire Moonlight Property

| 2. |

On November 25, 2011, we entered into an assignment agreement (the “Assignment Agreement”) with Metamin Enterprises Inc. (the “Assignor”), a company controlled by Benjamin Ainsworth, our President, Secretary and director, and Metamin Enterprises USA Inc. (the “Subsidiary”), a wholly owned subsidiary of the Assignor, whereby: (i) the Assignor has agreed to assign us all of its right, title and interest in and to an option agreement dated September 20, 2010, as amended on February 18, 2011 and October 31, 2011, (the “Option Agreement”) between the Assignor and Lester Storey (the “Optionor”) in respect of a mineral property located in Plumas County, California (the “Moonlight Property”); and (ii) the Subsidiary has agreed to transfer to us certain mineral claims held by the Subsidiary that form part of the Moonlight Property. The Moonlight Property is located approximately 12 miles southwest of Susanville, Plumas County, California and is situated on the northern end of the Walker Lane Porphyry Trend. The property consists of 298 unpatented mineral claims covering an approximately 6,300 acres. The local community in the Plumas County area has been involved in logging and mining historically. |

|

Conditional upon, among other things, our obtaining approval of the transaction from the TSX Venture Exchange, we have agreed to: |

| (a) |

pay to the Assignor the following cash payments: | ||

| (i) |

$15,000 on the date of approval from the TSX Venture Exchange (the “Exchange Acceptance Date”); | ||

| (ii) |

$25,000 on or before February 18, 2012; | ||

| (iii) |

$25,000 on or before February 18, 2013; | ||

| (iv) |

an annual advanced royalty, deductible from any future royalty payments, of $15,000 commencing on February 18, 2014 and payable every year thereafter; and | ||

| (b) |

issue to the Assignor the following shares of our common stock (“Shares”): | ||

| (i) |

75,000 Shares on the Exchange Acceptance Date; | ||

| (ii) |

75,000 Shares on or before February 18, 2012; | ||

| (iii) |

150,000 Shares on or before February 18, 2013; and | ||

| (iv) |

200,000 Shares on or before February 18, 2014. | ||

We have also agreed to reimburse the Assignor, on the Exchange Acceptance Date, for annual maintenance and exploration expenses previously incurred on the Moonlight Property by the Assignor, which amount cannot exceed $200,000. The Assignor will retain a 1% net smelter return on metals extracted from the Moonlight Property, which can be repurchased by us for $1,000,000, and a gross overriding royalty of 2.5% on receipts from the sale of industrial minerals.