Attached files

| file | filename |

|---|---|

| EX-32 - Gunpowder Gold Corp | ex32.htm |

| EX-31 - Gunpowder Gold Corp | ex31.htm |

U.S. Securities and Exchange Commission

Washington, D.C. 20549

Form 10-K/A

(Amendment No. 1)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES AND EXCHANGE ACT OF 1934 |

For the fiscal year ended August 31, 2011

or

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ______________ to ______________

Commission File Number: 001-34976

Gunpowder Gold Corporation

(fka Spartan Business Services Corporation)

(Exact name of registrant as specified in its charter)

| Nevada | 26-3751595 | |

| (State or other jurisdiction of | (I.R.S. Employer Identification No.) | |

| incorporation or organization) |

4835 Impressario Court

Suite 109

Las Vegas, NV 89149

(Address of principal executive offices)

Registrant’s telephone number, including area code: 702-380-7865

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, $.001 par value

Title of Class

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§229.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company.

| Large accelerated filer ¨ | Accelerated filer ¨ |

| Non-accelerated filer ¨ | Smaller reporting company x |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

The aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the average bid and asked price of such common equity as of November 27 was approximately $18,100,392.

APPLICABLE ONLY TO REGISTRANTS INVOLVED IN BANKRUPTCY

PROCEEDINGS DURING THE PRECEDING FIVE YEARS

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Section 12, 13 or 15(d) of the Securities Exchange Act of 1943 subsequent to the distribution of securities under a plan confirmed by a court. Yes No

(APPLICABLE ONLY TO CORPORATE REGISTRANTS)

Indicate the number of shares outstanding of each of the registrant's classes of common stock, as of the last practicable date: 90,501,961 shares outstanding $ .001 par value

DOCUMENTS INCORPORATED BY REFERENCE

List hereunder the following documents if incorporated by reference and the Part of the Form 10-K (e.g., Part I, Part II, etc.) into which the document is incorporated: (1) Any annual report to security holders; (2) Any proxy or information statement; and (3) Any prospectus filed pursuant to Rule 424(b) or (c) under the Securities Act of 1933: None.

EXPLANATORY NOTE

The purpose of this Amendment No. 1 to the Company's Annual Report on Form 10-K for the year ended August 31, 2011, filed with the Securities and Exchange Commission on December 14, 2011 (the "Form 10-K"), is solely to correct a clerical error on the cover page and in Item 12.

No other changes have been made to the Form 10-K. This Amendment No. 1 to the Form 10-K continues to speak as of the original filing date of the Form 10-K and does not reflect events that may have occurred subsequent to the original filing date, and does not modify or update in any way disclosures made in the original Form 10-K.

Item 6. Exhibits.

| Exhibit No. | Description | Where Found | |

| 31.1 | Rule 13a-14(a)/15d14(a) Certifications | Filed Previously | |

| 32.1 | Section 1350 Certifications | Filed Previously | |

Gunpowder Gold Corporation

TABLE OF CONTENTS

Glossary of Mining Terms

| PART I | ||

| Item 1 | Business | 3 |

| Item 1A | Risk Factors | 5 |

| Item 1B | Unresolved Staff Comments | 12 |

| Item 2 | Properties | 12 |

| Item 3 | Legal Proceedings | 18 |

| Item 4 | (Removed and Reserved) | 18 |

| PART II | ||

| Item 5 | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | 18 |

| Item 6 | Selected Financial Data | 19 |

| Item 7 | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 20 |

| Item 7A | Quantitative and Qualitative Disclosures About Market Risk | 22 |

| Item 8 | Financial Statements and Supplementary Data | 23 |

| PART III | ||

| Item 10 | Directors, Executive Officers and Corporate Governance | 34 |

| Item 11 | Executive Compensation | 35 |

| Item 12 | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 37 |

| Item 13 | Certain Relationships and Related Transactions, and Director Independence | 37 |

| Item 14 | Principal Accounting Fees and Services | 38 |

| PART IV | ||

| Item 15 | Exhibits, Financial Statement Schedules | 38 |

| Signatures | 39 | |

Glossary of Mining Terms

Adit(s), Historic working driven horizontally, or nearly so into a hillside to explore for and exploit ore.

Adularia. A potassium-rich alteration mineral – a form of orthoclase.

Air track holes. Drill hole constructed with a small portable drill rig using an air-driven hammer.

BLEG sampling. Bulk leach sampling. A large sample of soil or rock that is leached using cyanide to determine gold and silver content down to a detection limit of as little as 1.0 parts per billion.

CSMT Survey. A Controlled Source Magneto-telluric geophysical method used to map the variation of the Earth’s resistance to conduct electricity by measuring naturally occurring electric and magnetic fields at the Earth’s surface.

Controlled Source Magneto-telluric Survey (CSMT). The recording of variations in a generated electrical field using sophisticated geophysical survey methods.

Core holes. A hole in the ground that is left after the process where a hollow drill bit with diamond chip teeth is used to drill into the ground. The center of the hollow drill fills with the core of the rock that is being drilled into, and when the drill is extracted, a hole is left in the ground.

Felsic Tertiary Volcanic Rocks. Quartz-rich rocks derived from volcanoes and deposited between two and sixty-five million years ago.

Geochemical sampling. Sample of soil, rock, silt, water or vegetation analyzed to detect the presence of valuable metals or other metals which may accompany them. For example, arsenic may indicate the presence of gold.

Geologic mapping. Producing a plan and sectional map of the rock types, structure and alteration of a property.

Geophysical survey. Electrical, magnetic, gravity and other means used to detect features, which may be associated with mineral deposits

Ground magnetic survey. Recording variations in the earth’s magnetic field and plotting same.

Ground radiometric survey. A survey of radioactive minerals on the land surface.

Leaching. Leaching is a cost effective process where ore is subjected to a chemical liquid that dissolves the mineral component from ore, and then the liquid is collected and the metals extracted from it.

Level(s), Main underground passage driven along a level course to afford access to stopes or workings and provide ventilation and a haulage way for removal of ore.

Magnetic lows. An occurrence that may be indicative of a destruction of magnetic minerals by later hydrothermal (hot water) fluids that have come up along faults. These hydrothermal fluids may in turn have carried and deposited precious metals such as gold and/or silver.

Plug. A vertical pipe-like body of magma representing a volcanic vent similar to a dome.

Quartz Monzonite. A medium to coarse crystalline rock composed primarily of the minerals quartz, plagioclase and orthoclase.

Quartz Stockworks. A multi-directional system of quartz veinlets.

| 1 |

RC holes. Short form for Reverse Circulation Drill holes. These are holes left after the process of Reverse Circulation Drilling.

Resource. An estimate of the total tons and grade of a mineral deposit defined by surface sampling, drilling and occasionally underground sampling of historic diggings when available.

Reverse circulation drilling. A less expensive form of drilling than coring that does not allow for the recovery of a tube or core of rock. The material is brought up from depth as a series of small chips of rock that are then bagged and sent in for analysis. This is a quicker and cheaper method of drilling, but does not give as much information about the underlying rocks.

Rhyolite plug dome. A domal feature formed by the extrusion of viscous quartz-rich volcanic rocks.

Scintillometer survey. A survey of radioactive minerals using a scintillometer, a hand-held, highly accurate measuring device.

Scoping Study. A detailed study of the various possible methods to mine a deposit.

Silicic dome. A convex landform created by extruding quartz-rich volcanic rocks

Stope(s), An excavation from which ore has been removed from sub-vertical openings above or below levels.

Tertiary. That portion of geologic time that includes abundant volcanism in the western U.S.

Trenching. A cost effective way of examining the structure and nature of mineral ores beneath gravel cover. It involves digging long usually shallow trenches in carefully selected areas to expose unweathered rock and allow sampling.

Volcanic center. Origin of major volcanic activity

Volcanoclastic. Coarse, unsorted sedimentary rock formed from erosion of volcanic debris.

| 2 |

PART I

Forward-Looking Statements

This Annual Report on Form 10-K contains forward-looking information. Forward-looking information includes statements relating to future actions, prospective products, future performance or results of current or anticipated products, sales and marketing efforts, costs and expenses, interest rates, outcome of contingencies, financial condition, results of operations, liquidity, business strategies, cost savings, objectives of management of Gunpowder Gold Corporation. (hereinafter referred to as the “Company,” “Gunpowder Gold” or “we”) and other matters. Forward-looking information may be included in this Annual Report on Form 10-K or may be incorporated by reference from other documents filed with the Securities and Exchange Commission (the “SEC”) by the Company. One can find many of these statements by looking for words including, for example, “believes,” “expects,” “anticipates,” “estimates” or similar expressions in this Annual Report on Form 10-K or in documents incorporated by reference in this Annual Report on Form 10-K. The Company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information or future events.

The Company has based the forward-looking statements relating to the Company’s operations on management’s current expectations, estimates and projections about the Company and the industry in which it operates. These statements are not guarantees of future performance and involve risks, uncertainties and assumptions that we cannot predict. In particular, we have based many of these forward-looking statements on assumptions about future events that may prove to be inaccurate. Accordingly, the Company’s actual results may differ materially from those contemplated by these forward-looking statements. Any differences could result from a variety of factors, including, but not limited to general economic and business conditions, competition, and other factors.

Item 1. Description of Business

Gunpowder Gold Corporation (formerly called Spartan Business Services Corporation) (the “Company) is engaged in natural resource exploration and is focused on the acquisition, exploration and development of natural resource properties. Currently, we are in the exploration state and are undertaking exploration programs in Arizona.

History

On November 19, 2008, the Company was incorporated under the laws of the State of Nevada, with the corporate name of Spartan Business Services Corporation.. The Company intended to provide various business services to third parties but did not conduct any active business.

On August 10, 2010, Mr. Neil J. Pestell acquired control of the Company through his acquisition of all of the common stock of the Company formerly owned by Mr. Reno J. Calabrigo. Effective August 10, 2010, Mr. Pestell became the sole director, Chief Executive Officer, President, Treasurer and Secretary of the Company and Mr. Calabrigo resigned from such positions and Mr. Pestell promptly chose to redirect the Company resources and pursue potential mining and exploration opportunities for gold, silver and precious metals.

In November 2010, the Company revised and restated its Articles of Incorporation to change its name to Gunpowder Gold Corp, and to increase the amount of authorized capital to 305,000,000, consisting of 5,000,000 Preferred shares and 300,000,000 Common shares, and to affect a 10:1 forward stock split.

The Company changed its name to Gunpowder Gold Corporation, and changed its trading symbol on the over-the-counter Bulletin Board (OTCQB) to GUNP to reflect this new focus.

On January 21, 2011, the Company entered into an Option Agreement with Horizon Exploration Inc. ("Horizon"), whereby Horizon granted the Company the sole and exclusive right and option to acquire an undivided 100% right, title and interest in and to the Dome Rock Property being located in La Paz County, Arizona subject to a 3.0% net smelter royalty. The 1,280 acre Dome Rock property, consists of 62 unpatented mining claims in the Dome Rock Mountains in the northwest area of the State of Arizona, in the fairway of the world famous Walker Lane Gold Trend (the "Property").

On January 24, 2011, Mr. Richard Kehmeier and Mr. Dennis Lance were appointed Directors of the Company.

| 3 |

Business Operations

We are a natural resource exploration and mining company with an objective of acquiring, exploring, and if warranted and feasible, developing natural resource properties. Our primary focus in the natural resource sector is gold. We are an exploration stage company.

Though the Company could focus on developing a resource property from the identification stage to the stage of mining production, the costs and time frame for doing so are considerable. The subsequent return on investment for our shareholders would be very long term. Therefore, we anticipate selling or partnering any ore bodies that we may discover to a major mining company. Many major mining companies obtain their ore reserves through the purchase of ore bodies found by junior exploration companies. Although these major mining companies do some exploration work themselves, many of them rely on the junior resource exploration companies to provide them with future deposits for them to mine. By selling or partnering a deposit found by Gunpowder Gold Corporation to these major mining companies, it would provide an immediate return to our shareholders eliminating the need for a long term focus. This strategy also mitigates the need for the Company to raise considerable exploration capital, source further management expertise in this specialized field and also minimizes exposure to the many risks of mine startup. If successful, this strategy will provide the Company with a future capital source to support future operations and growth.

The search for valuable natural resources as a business is extremely risky. We can provide investors with no assurance that the properties we have either optioned or purchased in Arizona contain commercially exploitable reserves. Exploration for natural reserves is a speculative venture involving substantial risk. Few properties that are explored are ultimately developed into producing commercially feasible reserves. Problems such as unusual or unexpected formations and other conditions are involved in mineral exploration and often result in unsuccessful exploration efforts. In such a case, we would be unable to complete our business plan and any money spent on exploration would be lost.

Natural resource exploration and development requires significant capital and our assets and resources are limited. Therefore, we anticipate participating in the natural resource industry through the selling or partnering of our properties, the purchase of small interests in producing properties, the purchase of properties where feasibility studies already exist or by the optioning of natural resource exploration and development projects. To date we have a property under option, and are in the early stages of exploring thi property. There has been no definitive indication as yet that any commercially viable mineral deposits exist on thi property, and there is no assurance that a commercially viable mineral deposit exists on the property. Further exploration will be required before a final evaluation as to the economic and legal feasibility is determined

Competition

The mineral exploration industry, in general, is intensively competitive and even if commercial quantities of ore are discovered, a ready market may not exist for sale of same. Numerous factors beyond our control may affect the marketability of any substances discovered. These factors include market fluctuations, the proximity and capacity of natural resource markets and processing equipment, government regulations, including regulations relating to prices, taxes, royalties, land tenure, land use, importing and exporting of minerals and environmental protection. The exact effect of these factors cannot be accurately predicted, but the combination of these factors may result in our not receiving an adequate return on invested capital.

Government Regulation

The federal government and various state and local governments have adopted laws and regulations regarding the protection of natural resources, human health and the environment. We will be required to conduct all exploration activities in accordance with all applicable laws and regulations. These may include requiring working permits for any exploration work that results in physical disturbances to the land and locating claims, posting claims and reporting work performed on the mineral claims. The laws and regulations may tell us how and where we can explore for natural resources, as well as environmental matters relating to exploration and development. Because these laws and regulations change frequently, the costs of compliance with existing and future environmental regulations cannot be predicted with certainty.

| 4 |

Any exploration or production on United States Federal land will have to comply with the Federal Land Management Planning Act which has the effect generally of protecting the environment. Any exploration or production on private property, whether owned or leased, will have to comply with the Endangered Species Act and the Clean Water Act. The cost of complying with environmental concerns under any of these acts varies on a case-by-case basis. In many instances the cost can be prohibitive to development. Environmental costs associated with a particular project must be factored into the overall cost evaluation of whether to proceed with the project.

Other than the normal bonding requirements, there are no costs to us at the present time in connection with compliance with environmental laws. However, since we do anticipate engaging in natural resource projects, these costs could occur at any time. Costs could extend into the millions of dollars for which we could be liable. In the event of liability, we would be entitled to contribution from other owners so that our percentage share of a particular project would be the percentage share of our liability on that project. However, other owners may not be willing or able to share in the cost of the liability. Even if liability is limited to our percentage share, any significant liability would wipe out our assets and resources.

Employees

Currently, we have no full time employees. Our sole officer and three Directors provide planning and organizational services on a part-time basis.

Item 1A. Risk Factors

General Risks

Our auditors have issued a going concern opinion expressing substantial doubt that we can continue as a going concern.

The probability of our future prospective mining claims having commercial reserves is remote, and any funds spent on exploration will probably be lost. In all probability, our future claims do not contain any commercial reserves, or may contain reserves which are not economically feasible to recover. As such, any funds spent on exploration will, in all probability, be lost.

Our management has no technical training or experience in exploring for gold and silver resources or starting and operating a mining exploration program. Further, our management has no training or experience in these areas, and as a result, may not be fully aware of many of the specific requirements related to working the claims within such industry. Our management's decisions and choices may not take into account the standard engineering or managerial approaches that mineral exploration companies commonly use. Consequently our activities, earnings, and ultimate financial success could suffer irreparable harm due to our management's lack of experience in this industry. As a result, we may have to suspend or cease activities.

We will need additional funding to initiate and complete the exploration processes that may be recommended by engineers. Even if we raise all of the funds which we intend to raise in any future offerings, we may not have enough capital to complete the exploration phases recommended in the geological evaluation report of our contracted mining engineer with regard to our claims. To complete the recommended exploration phases, we may be required to raise additional capital through securities offerings, debt or loans, or from our officers or directors. We cannot guarantee that we will be able to raise the capital necessary to complete the recommended phases of exploration of our future properties. If we are unable to raise additional capital, and cannot complete the recommended exploration phases, we will not be able to successfully begin operations and will not be able to realize any revenue. As a result, we would be forced to cease all operations.

The Company has not commenced any mining exploration or production, thus it has had no revenues and faces a high degree of risk. We do not own any currently producing properties, nor own any property that has proven reserves of commercially viable quantities of valuable metals. Accordingly, we have no revenues and we have no way to evaluate the likelihood that our business will be successful. We have been involved primarily in organizational activities, due diligence on potential claims, and preparing to engage a professional engineer to prepare an initial report and evaluation of future claims. We have not generated any revenues since our inception.

| 5 |

You should be aware of the difficulties normally encountered by new mineral exploration companies and the high rate of failure of such enterprises. The likelihood of success must be considered in light of the problems, expenses, difficulties, complications, and delays encountered in connection with the exploration of mineral properties. These potential problems include, but are not limited to, unanticipated problems relating to exploration, and additional costs and expenses that may exceed current estimates. Prior to completion of our exploration stages, we anticipate that we will continue to incur increased operating expenses without realizing any revenues. We therefore expect to incur significant losses into the foreseeable future. We recognize that if we are unable to generate significant revenues from the development of our future mining properties and the production of minerals from our future claims, we will not be able to earn profits or continue operations. If we are unsuccessful in addressing these risks, the business of the Company will most likely fail.

We lack an operating history and have losses which we expect to continue into the future. We were incorporated on November 19, 2008, and we have not started our proposed business activities or realized any revenues. We have no operating history upon which an evaluation of our future success or failure can be made. Our ability to achieve and maintain profitability and positive cash flow is dependent upon our ability to explore our mining claims and our ability to generate revenues from operations upon our claim. Based upon our current plans, we expect to incur operating losses in the foreseeable future. This will happen because there will be expenses associated with the research and exploration of our future mineral properties when they are acquired, and we may not generate revenues in the future. Failure to generate revenues may cause us to suspend or cease activities.

Because we are small and do not have much capital, we may have to limit our exploration activity which may result in a loss. Because we are small and do not have a large reserve of capital, we may be required to limit our exploration activity. As such we may not be able to complete an exploration program that is as thorough as we would like. In that event, an existing reserve may go undiscovered. Without a reserve or commercial mining operations, we cannot generate revenues unless we sell our mining claims or other mining rights.

Because we will have to spend additional funds to determine if we have commercial reserves, we will have to raise additional money or risk having to cease our operations. Even if we complete an exploration program and we are successful in identifying a mineral deposit, we will have to spend substantial funds on further drilling, testing, exploration, and engineering studies before we will know if we have a commercially viable gold and silver deposit. Because our current capitalization is insufficient to achieve such further drilling, testing, exploration, and engineering studies, it will be necessary to raise additional funds. If we are unable to raise such funds, we would be forced to suspend or cease our activities.

Because our officers and directors have other business activities and will only be devoting a percentage of their time to our operations, our operations may be sporadic with periodic interruptions or suspensions of exploration.

Risks in the Mining Industry

Because of the inherent dangers involved in mineral exploration, there is a risk that we may incur liability or damages which could hurt our financial position and possibly result in the failure of our business. Mineral exploration and development involves numerous hazards. As a result, we may become subject to liability for such hazards, including pollution, cave-ins, and other hazards against which we cannot insure or against which we may elect not to insure. The payment of such liabilities may have a material, adverse effect on our financial position, or could cause us to cease operations.

If we discover commercial reserves of precious metals on our future mineral properties, we can provide no assurance that we will be able to successfully advance the future mineral claims into commercial production. If our exploration program is successful in establishing the existence of gold and silver of commercially and economically viable tonnage and grade on any of our claims, we will require additional funds in order to begin operations of commercial production. Obtaining additional financing would be subject to a number of factors, including the market price for the minerals, investor acceptance of our claims, and general market conditions. These factors may make the timing, amount, terms or conditions of additional financing unavailable to us. The most likely source of future funds is through the sale of equity capital. Any sale of share capital will result in dilution to existing shareholders. We may be unable to obtain any such funds, or to obtain such funds on terms that we consider economically feasible.

| 6 |

If access to our mineral claims is restricted by inclement weather, we may be delayed in our exploration and any future mining efforts. It is possible that snow, rain, or other environmental factors could cause the mining roads providing access to our future claims to become impassable. If the roads are impassable, we would be delayed in our exploration timetable and incur unforeseen expenses.

If we become subject to burdensome government regulation or other legal uncertainties, our business will be negatively affected. There are federal and state governmental regulations that oversee and materially restrict mineral property exploration and development. Under United States, Canada and other mining laws, to engage in certain types of exploration will require work permits, the posting of bonds, and the performance of remediation work for any physical disturbance to the land. While such laws will not affect our future exploration plans, if we begin drilling operations on our properties, we will incur such regulatory oversight and regulatory compliance costs.

In addition, the legal and regulatory environment that pertains to the exploration of gold and silver is subject to change. Change in existing regulations and new regulations could increase our costs of doing business, and prevent us from beginning or continuing operations.

We are in a highly competitive industry. Gold and silver exploration and development is highly competitive. The Company faces competition from multinational, national, and regional companies. Many of the Company’s competitors are larger, longer established, and have far greater financial resources and exploration and operational experience than our Company. The Company may be unable to compete effectively.

Because of consumer demand, the demand for any gold and silver that we may recover from our future claims may be slowed, resulting in reduced revenues to the Company. Our success will be dependent on the demand for gold and silver. If consumer or industrial demand slows our revenues may be significantly affected. This could limit our ability to generate revenues, and our financial condition and operating results may be harmed, possibly resulting in loss of investment.

The prices of gold and silver metal is volatile, and price changes are beyond our control. The price of base metal fluctuates. The prices of base metal have been and will continue to be affected by numerous factors beyond our control. Factors that affect such metals include the demand from consumers, economic conditions, over supply from secondary sources, and costs of production. Price volatility and downward price pressure, which can lead to lower prices, could have a material adverse effect on the costs and the viability of our operations.

The volatility of gold or silver prices in general may adversely affect our exploration efforts. If prices for these metals decline, it may not be economically feasible for us to continue our exploration of our properties or to interest a joint venture partner in funding exploration or developing commercial production at our properties. We may make substantial expenditures for exploration or development of the properties, which cannot be recovered if production becomes uneconomical. Gold and silver prices historically have fluctuated widely, based on numerous factors including, but not limited to:

| o | industrial and jewelry demand; |

| o | market supply from new production and release of existing bullion stocks; |

| o | central bank lending, sales and purchases of gold or silver; |

| o | forward sales of gold and silver by producers and speculators; |

| o | production and cost levels in major metal-producing regions; |

| o | rapid short-term changes in supply and demand because of speculative or hedging activities; and |

| o | macroeconomic factors, including confidence in the global monetary system; inflation expectations; interest rates and global or regional political or economic events. |

Gold and silver exploration and prospecting is highly competitive and speculative business and we may not be successful in seeking available opportunities.

The process of gold and silver exploration and prospecting is a highly competitive and speculative business. Individuals are not subject to onerous accreditation and licensing requirements prior to beginning mineral exploration and prospecting activities, and as such the Company, in seeking available opportunities, will compete with numerous individuals and companies, including established, multi-national companies that have substantially more experience and resources than our Company. The exact number of active competitors at any one time is heavily dependent on current economic conditions; however, statistics provided by the AEBC (The Association for Mineral Exploration, British Columbia), state that approximately 1,000 mining companies operate in North America, including gold and silver.

| 7 |

Because we may not have the financial and managerial resources to compete with other companies, we may not be successful in our efforts to acquire projects of value, which, ultimately, become productive. However, while we compete with other exploration companies for the rights to explore other claims, there is no competition for the exploration or removal of mineral from our prospective claims by other companies, as we have no agreements or obligations that limit our right to explore or remove minerals from our prospective claims.

Compliance with environmental considerations and permitting could have a material adverse effect on the costs or the viability of our projects. The historical trend toward stricter environmental regulation may continue, and, as such, represents an unknown factor in our planning processes.

All mining is regulated by the government agencies at the federal, state and county levels of government in the United States. Compliance with such regulation has a material effect on the economics of our operations and the timing of project development. Our primary regulatory costs are expected to be related to filing fees pertaining to the location of unpatented mining claims which were staked on Federal ground. In the event mineralization of commercial interests would be found by the proposed exploration program, obtaining licenses and permits from government agencies before the commencement of mining activities would be very expensive and time consuming. An environmental impact study may be required to be undertaken on our property in order to obtain governmental approval to commence and conduct mining on our future properties.

The possibility of more stringent regulations exists in the areas of worker health and safety, the dispositions of wastes, the decommissioning and reclamation of mining and milling sites and other environmental matters, each of which could have an adverse material effect on the costs or the viability of a particular project. Compliance with environmental considerations and permitting could have a material adverse effect on the costs or the viability of our projects.

We face substantial governmental regulation.

Safety

If we commence mining operations in the United States, for example, we will be subject to inspection and regulation by the Mine Safety and Health Administration of the United States Department of Labor ("MSHA") under the provisions of the Mine Safety and Health Act of 1977. The Occupational Safety and Health Administration ("OSHA") also has jurisdiction over safety and health standards not covered by MSHA.

Current Environmental Laws and Regulations

We must comply with environmental standards, laws and regulations that may result in greater or lesser costs and delays depending on the nature of the regulated activity and how stringently the regulations are implemented by the regulatory authority. The costs and delays associated with compliance with such laws and regulations could stop us from proceeding with the exploration of a project or the operation or future exploration of a mine. Laws and regulations involving the protection and remediation of the environment and the governmental policies for implementation of such laws and regulations are constantly changing and are generally becoming more restrictive. We expect to make in the future significant expenditures to comply with such laws and regulations. These requirements include regulations under many state and U.S. federal laws and regulations, including:

| o | the Comprehensive Environmental Response, Compensation and Liability Act of 1980 ("CERCLA" or "Superfund") which regulates and establishes liability for the release of hazardous substances; |

| o | the U.S. Endangered Species Act; |

| o | the Clean Water Act; |

| o | the Clean Air Act; |

| o | the U.S. Resource Conservative and Recovery Act ("RCRA"); |

| o | the Migratory Bird Treaty Act; |

| o | the Safe Drinking Water Act; |

| o | the Emergency Planning and Community Right-to-Know Act; |

| o | the Federal Land Policy and Management Act; |

| o | the National Environmental Policy Act; and |

| o | the National Historic Preservation Act. |

| 8 |

The United States Environmental Protection Agency continues the development of a solid waste regulatory program specific to mining operations such as our proposed operation, where the mineral extraction and beneficiation wastes are not regulated as hazardous wastes.

Our future properties may be in a historic mining district with past production and abandoned mines. We may be exposed to liability, or assertions of liability that would require expenditure of legal defense costs under joint and several liability statutes for cleanups of historical wastes that have not yet been completed.

Environmental Regulations

Environmental laws and regulations may also have an indirect impact on us, such as increased costs for electricity due to acid rain provisions of the United States Clean Air Act Amendments of 1990. Charges by refiners to which we may sell any metallic concentrates and products have substantially increased over the past several years because of requirements that refiners meet revised environmental quality standards. We have no control over the refiner's operations or their compliance with environmental laws and regulations.

Potential Legislation

Changes to the current laws and regulations governing the operations and activities of mining companies, including changes in permitting, environmental, title, health and safety, labor and tax laws, are actively considered from time to time. We cannot predict such changes, and such changes could have a material adverse impact on our business. Expenses associated with the compliance with such new laws or regulations could be material. Further, increased expenses could prevent or delay exploration projects and could, therefore, affect future levels of mineral production.

Governmental Regulation

If we commence mining operations in the future, we will be subject to inspection and regulation by:

| o | Mine Safety and Health Administration of the United States Department of Labor ("MSHA") under the provisions of the Mine Safety and Health Act of 1977. |

| o | The Occupational Safety and Health Administration ("OSHA") also has jurisdiction over safety and health standards not covered by MSHA. |

Environmental Liability

We are subject to potential risks and liabilities associated with pollution of the environment and the disposal of waste rock and materials that could occur as a result of our mineral exploration and production. To the extent that we are subject to environmental liabilities, the payment of such liabilities or the costs that we may incur to remedy environmental pollution would reduce funds otherwise available to us and could have a material adverse effect on our financial condition or results of operations. If we are unable to fully remedy an environmental problem, we might be required to suspend operations or enter into interim compliance measures pending completion of the required remedy. The potential exposure may be significant and could have a material adverse effect on us. We have not purchased insurance for environmental risks (including potential liability for pollution or other hazards as a result of the disposal of waste products occurring from exploration and production) because it is not generally available at a reasonable price.

Environmental Permits

All of our exploration activities will be subject to regulation under one or more of the various State and federal environmental laws and regulations in the U.S. and in other countries. Many of the regulations require us to obtain permits for our activities. We must update and review our permits from time to time, and are subject to environmental impact analyses and public review processes prior to approval of the additional activities. It is possible that future changes in applicable laws, regulations and permits or changes in their enforcement or regulatory interpretation could have a significant impact on some portion of our business, causing those activities to be economically reevaluated at that time.

Those risks include, but are not limited to, the risk that regulatory authorities may increase bonding requirements beyond our financial capabilities. The posting of bonding in accordance with regulatory determinations is a condition to the right to operate under all material operating permits, and therefore increases in bonding requirements could prevent our operations from continuing even if we were in full compliance with all substantive environmental laws.

| 9 |

There may be possible title defects on our future mining claims.

Undetected title defects could affect our interests in future mining claims acquired and owned by the Company in the future. We will investigate title to our future claims and may not obtain title opinions and title insurance with respect to such claims. This should not be construed as a guarantee of title and there is no guarantee that the title to our future properties will not be challenged or impugned. Any challenge to our title could delay the exploration, financing, and development of the property and could ultimately result in the loss of some or all of our interest in our properties. Our properties may be subject to prior unregistered agreements or transfers or native land claims and title may be affected by undetected defects.

We may not have access to all of the supplies and materials we need to begin exploration which could cause us to delay or suspend activities.

Competition and unforeseen limited sources of supplies in the industry could result in occasional spot shortages of supplies, such as dynamite, and certain equipment such as bulldozers and excavators that we might need to conduct exploration. We have not attempted to locate or negotiate with any suppliers of products, equipment or materials. We will attempt to locate products, equipment and materials when financing becomes available. If we cannot find the products and equipment we need, we will have to suspend our exploration plans until we do find the products and equipment we need.

We will require additional funds to achieve our current business strategy goals. An inability to secure adequate funding will cause our business to fail.

Based upon current plans, we expect to incur operating losses in future periods. This will happen because there are expenses associated with the acquisition and exploration of natural resource properties. We will need to raise additional funds in the future through public or private debt or equity sales in order to fund our future operations and fulfill contractual obligations. These financings may not be available when needed. Even if these financings are available, it may be on terms that we deem unacceptable or are materially adverse to its interests with respect to dilution of book value, dividend preferences, liquidation preferences, or other terms. Our inability to obtain financing would have an adverse effect on our ability to implement our current exploration, and as a result, could require us to diminish or suspend our operations and possibly cease our existence. Obtaining additional financing would be subject to a number of factors, including the market prices for the mineral property and silver and copper. These factors may make the timing, amount, terms or conditions of additional financing unavailable to us.

Because our Directors serve as officers and directors of other companies engaged in mineral exploration, a potential conflict of interest could negatively impact our ability to acquire properties to explore and to run our business.

Certain directors work for other mining and mineral exploration companies. Due to time demands placed on our directors and officers, and due to the competitive nature of the exploration business, the potential exists for conflicts of interest to occur from time to time that could adversely affect our ability to conduct our business. Certain directors’ full-time employment with other entities limits the amount of time they can dedicate to us as a director. Our directors may have a conflict of interest in helping us identify and obtain the rights to mineral properties because they may also be considering the same properties. To mitigate these risks, we work with several geologists in order to ensure that we are not overly reliant on any one of our directors to provide us with geological services. However, we cannot be certain that a conflict of interest will not arise in the future. To date, there have not been any conflicts of interest between any of our directors or officers and the Company.

Our auditors have issued a going concern opinion expressing substantial doubt that we can continue.

As noted in our financial statements, the Company has incurred a net operating loss of $489,375 through August 31, 2011. The Company has not commenced its operations and is still in the exploration stage, raising substantial doubt about the Company’s ability to continue as a going concern.

In order to continue as a going concern, the Company will need, among other things, additional capital resources. Management’s plan is to obtain such resources for the Company by obtaining capital from management, significant shareholders and others sufficient to meet its minimal operating expenses and seeking equity and/or debt financing. However management cannot provide any assurances that the Company will be successful in accomplishing any of its plans.

| 10 |

The ability of the Company to continue as a going concern is dependent upon its ability to successfully accomplish the plans described in the preceding paragraph and eventually secure other sources of financing and attain profitable operations.

Because of the speculative nature of exploration and development, there is a substantial risk that our business will fail.

The search for valuable natural resources as a business is extremely risky. We can provide investors with no assurance that the property options we have in Arizona prove to contain commercially exploitable reserves. Exploration for natural reserves is a speculative venture involving substantial risk. Few properties that are explored are ultimately developed into producing commercially feasible reserves. Problems such as unusual or unexpected formations and other conditions are involved in mineral exploration and often result in unsuccessful exploration efforts. In such a case, we would be unable to complete our business plan.

Because we have not commenced business operations, we face a high risk of business failure due to our inability to predict the success of our business

We are in the early stages of exploration of our mineral claims and thus have no way to evaluate the likelihood that we will be able to operate our business successfully. To date we have been involved primarily in organizational activities, and the acquisition and exploration of the mineral claims. We have not earned any revenues as of the date of this report.

Because of the unique difficulties and uncertainties inherent in mineral exploration and the mining business, we face a high risk of business failure

Potential investors should be aware of the difficulties normally encountered by early-stage mineral exploration companies and the high rate of failure of such enterprises. The likelihood of success must be considered in light of the problems, expenses, difficulties, complications and delays encountered in connection with the exploration of the mineral properties that we plan to undertake. These potential problems include, but are not limited to, unanticipated problems relating to exploration, and additional costs and expenses that may exceed current estimates.

In addition, the search for valuable minerals involves numerous hazards. As a result, we may become subject to liability for such hazards, including pollution, cave-ins and other hazards against which we cannot insure or against which we may elect not to insure. The payment of such liabilities may have a material adverse effect on our financial position.

Because we anticipate our operating expenses will increase prior to our earning revenues, we may never achieve profitability

Prior to completion of our exploration stage, we anticipate that we will incur increased operating expenses without realizing any revenues. Therefore, we expect to incur significant losses into the foreseeable future. We recognize that if we are unable to generate significant revenues from the exploration of our mineral claims we will not be able to earn profits or continue operations. There is no history upon which to base any assumption as to the likelihood that we will prove successful, and we can provide shareholders and potential investors with no assurance that we will generate any operating revenues or ever achieve profitable operations. If we are unsuccessful in addressing these risks, our business will most likely fail.

Because access to our mineral claim may be restricted by inclement weather, we may be delayed in our exploration

Access to our mineral properties may be restricted through some of the year due to weather in the area. As a result, any attempt to test or explore the property is largely limited to the times when weather permits such activities. These limitations can result in significant delays in exploration efforts. Such delays can have a significant negative effect on our results of operations.

Because our President has only agreed to provide his services on a part-time basis, he may not be able or willing to devote a sufficient amount of time to our business operations, causing our business to fail

| 11 |

Because we are in the early stages of our business, Mr. Pestell, the only officer of the company, will not be spending all of his time working for the Company. Mr. Pestell will expend enough time to undertake the work programs that have been approved by the Company. Later, if the demands of our business require additional time from Mr. Pestell, he is prepared to adjust his timetable to devote more time to our business. However, it still may not be possible for Mr. Pestell to devote sufficient time to the management of our business, as and when needed, especially if the demands of Mr. Pestell’s other interests increase. Competing demands on Mr. Pestell’s time may lead to a divergence between his interests and the interests of our shareholders.

Risks Related To Governmental Regulations

As we undertake exploration of our mineral claims, we will be subject to compliance with government regulation that may increase the anticipated cost of our exploration programs

There are several governmental regulations that materially restrict mineral exploration. We will be subject to the federal, state and local laws of the United States, where we carry out our exploration programs. We may be required to obtain work permits, post bonds and perform remediation work for any physical disturbance to the land in order to comply with these laws. While our planned exploration program budgets for regulatory compliance, there is a risk that new regulations could increase our costs of doing business and prevent us from carrying out our exploration programs.

Item 1B. Unresolved Staff Comments.

None

Item 2. Description of Properties.

The principal executive offices of the Company are leased and are located at 4830 Impressario Court, Suite 109, Las Vegas, NV 89149.

In the following discussion relating to our interests in mining property, there are references to “patented” mining claims and “unpatented” mining claims. A patented mining claim is one for which the U.S. government has passed its title to the claimant, giving that person title to the land as well as the minerals and other resources above and below the surface. The patented claim is then treated like any other private land and is subject to local property taxes. An unpatented mining claim on U.S. government lands establishes a claim to the locatable minerals (also referred to as stakeable minerals) on the land and the right of possession solely for mining purposes. No title to the land passes to the claimant. If a proven economic mineral deposit is developed, provisions of federal mining laws permit owners of unpatented mining claims to patent (to obtain title to) the claim. If one purchases an unpatented mining claim that is later declared invalid by the U.S. government, one could be evicted.

Dome Rock Property

Acquisition of Interests

Pursuant to an Option Agreement, dated January 21, 2011, with Horizon Exploration Inc. ("Horizon") (the “Option Agreement”), the Company acquired the sole and exclusive right and option to acquire an undivided 100% right, title and interest in and to the Dome Rock Property located in La Paz County, Arizona subject to a 3.0% net smelter royalty.

Pursuant to the Option Agreement, the Company paid an initial cash payment to Horizon of $67,448.53 within 31 days of signing the Option Agreement, and is required to pay instalments of $20,000 US on or before January 21, 2012; $30,000 US on or before January 21, 2013; $40,000 on or before the January 21, 2014; $50,000 on or before January 21, 2015; $60,000 on or before January 21, 2016; and $60,000 on or before January 21, 2017. The Company shall also be responsible for making all necessary property payments to keep the Property in good standing which includes all annual maintenance fees, exploration and other permits, property taxes, levies, insurance, and other assessments.

The Company shall complete the following exploration expenditures on the Property as follows: (i) $750,000 on or before the first anniversary of the signing of the Agreement (ii) $750,000 on or before the second anniversary of the signing of the Agreement; and (iii) $500,000 on or before the third anniversary of the signing Agreement. If the Company fails to expend such minimum expenditures, the Option Agreement may be terminated by the seller. As of August 31, 2011, the Company has expended only $77,649, a shortfall of $672,351.

| 12 |

The Company may terminate the Agreement at any time by giving 30 days notice of such termination of the Agreement.

In the event that the company spends, in any period, more than the specified sum, the excess shall be carried forward and applied to the exploration expenditures to be incurred in the succeeding period for no more than three consecutive years. In the event the exploration expenditures are not completed during the required time frame, any deficits will be paid in cash to Horizon immediately after the end of the anniversary in which it occurs.

The Company has the right to accelerate all payments due under this Agreement in order to exercise the Option at an earlier date.

If and when the Option has been exercised, a 100% right, title and interest in and to the Property will vest in the Company free and clear of all charges, encumbrances and claims, save and except for the Royalty. At such time, the Company shall be entitled to record such transfers at its own cost with the appropriate government office to effect legal transfer of such interest in the Property into the name of the Company

Upon the Commencement of Commercial Production, the Company shall pay to Horizon a 3.0% of Net Smelter Returns on the Property (Royalty), on the terms and conditions as set out in the agreement.

If the Company is in default of the Agreement, Horizon may terminate the Agreement but only if:

Horizon has first given the Company notice of the default containing particulars of the obligations which the Company has not performed or the warranty breached and the Company has not, within 30 days following delivery of such notice of default, cured such default or commenced proceedings to cure such default by appropriate payment or performance, the Company hereby agreeing that should it so commence to cure any default it will prosecute the same to completion without undue delay. In the event the Company is forced to cure the defect to preserve the status of the property, the cure of the defect by the Company will include a 10% overhead to Horizon.

Should the Company fail to comply with the provisions in the last paragraph, Horizon may thereafter terminate this Option Agreement by giving notice thereof to the Company, always provided that the default in question has not been cured or substantially cured at the time of Horizon giving such notice of termination.

| 13 |

Description and Location of the Dome Rock Property

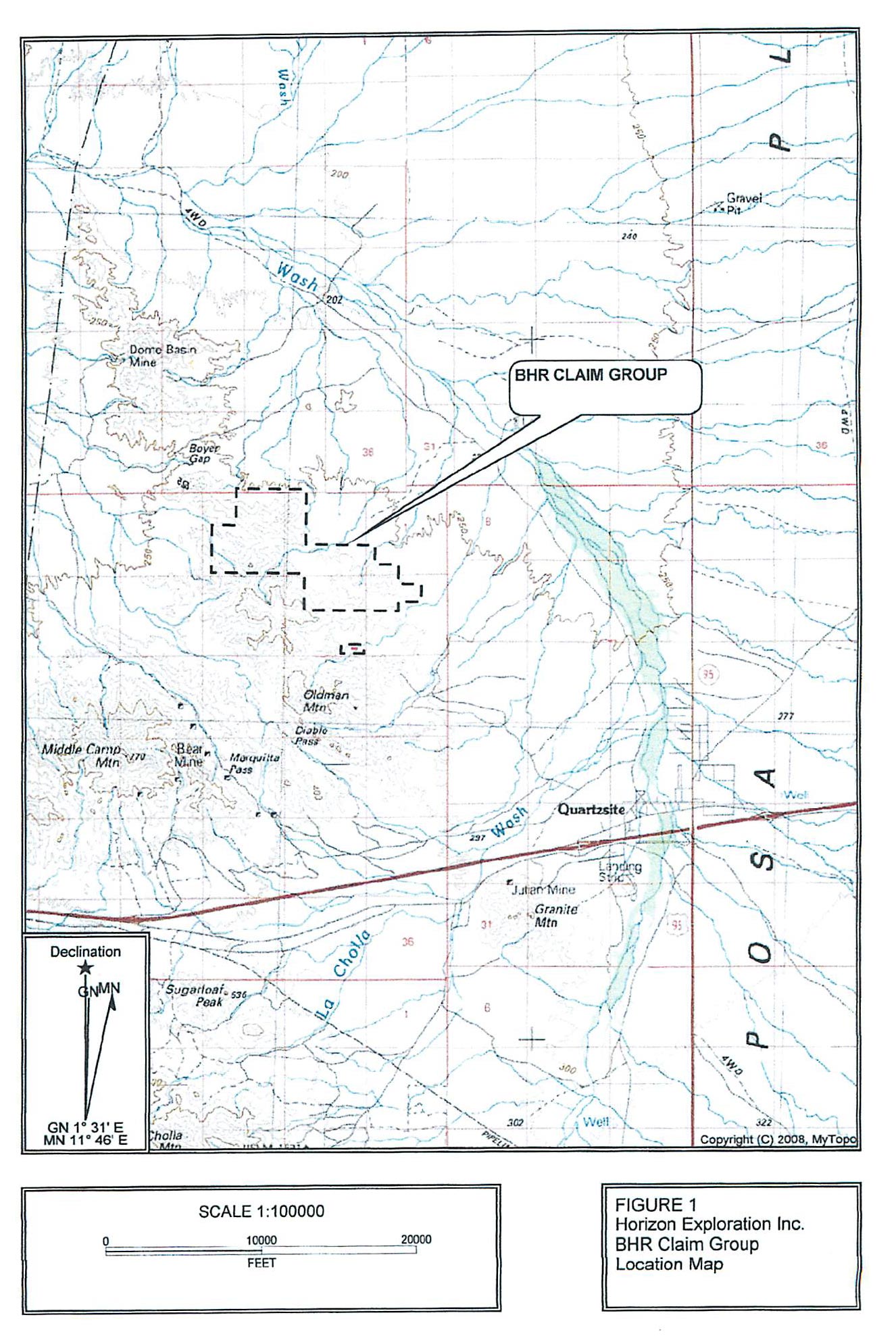

Note: The “Dome Rock” Property located in La Paz County, Arizona is identified in the maps below as “BHR CLAIM GROUP” .

| 14 |

| 15 |

The 1,280 acre Dome Rock property, identified on the map as consists of 62 unpatented mining claims in the Dome Rock Mountains in the northwest area of the State of Arizona, located in the fairway tract of the world famous Walker Lane Gold Trend (the "Dome Rock Property"). The Walker Lane has historically produced over 50 million ounces of gold and 400 million ounces of silver. Dome Rock lies in the historic Plomosa District, 5 miles north of the town of Quartzite, Arizona and approximately 150 miles southeast of Las Vegas, Nevada. This region's Lode and Placer gold has been heavily sought after since the 18th century, and based on historical records and data from former claim holders, the Company believes this property has the potential to host a commercial gold find.

Dome Rock is just 9 miles south of the famous Copperstone mine which is located at the Northern tip of the Dome Rock Mountain chain. To this day, Copperstone lays claim to the largest gold discovery in Arizona in recent history. Cyprus Gold's profitably open pit mined 500,000 oz of gold. American Bonanza Gold Corporation is presently exploring the remaining underground resource, which contains a 0.363 oz/t oxide gold resource with 313,000 ounces of gold in the Measured and Indicated categories and 256,000 ounces of gold in the Proven and Probable Mineral Reserves category.

The Company plans to utilize all historical work performed to date in the region and to conduct sedimentary rock sampling and assaying, for the purpose of developing a detailed exploration program.

Exploration History of the Dome Rock Mountains

The history of mining in southwest Arizona extends back to the times of the early Spaniards in the Americas. Later, when the pioneers

came to the region they found many old mines and prospect pits. Evidence of mining activity has been found throughout the Plomosa

Mountains, Dome Rock Mountains, the Castle Dome area, and also present-day Ehrenberg. The discovery of gold placers in the Gila

Mountains opened the door for American prospectors who scoured the mountains and deserts of Arizona in search of mineral wealth.

The 1860's witnessed big strikes in the Bradshaw Mountains, Castle Dome Mountains, and Trigo Mountains. The La Paz District and

the Rich Hill deposits were all discovered in the early 1860's. In 1894, the Fortuna vein was discovered on the west flank of the

Gila Mountains, where the Fortuna Mine produced some $3 million in gold during its first decade of operation.

The placers in the La Paz district were discovered by Captain Pauline Weaver in January 1862, when he panned a small amount of

gold from a gulch called El Arollo de la Tenaja in the Dome Rock Mountains. By 1866, the La Paz diggings had extended around the

Dome Rock Mountains west of Jackpot and into Goodman Arroyo, Arroyo La Paz, Farrar Gulch, and over into Middle Camp and southward

into the Orb Fino and La Cholla Placers. This sparked the beginning of the gold rush in the region, and led to about $1 million

in placer gold recovered in the first year and another $1 million by 1864, which totaled about 96,800 ounces in the first 5 years.

The La Cholla District is located on the eastern slopes of the Dome Rock Mountains. Here the gold is found in a bed of loose quartz

rubble that occurs at a depth of about 80 feet. The gold-bearing gravels were carried to the surface by the early miners - it is

this quartz rubble in which present-day metal detectors find gold. La Cholla is one of the few places in the west where crystallized

gold has been found.

. In the area of the Dome Rock Mountains there are 3 locations where the majority of gold activity occurred: (a) La Cholla, located

on the east side of the Dome Rock Mountains, about 7 miles west of Quartzite, in an east-west trending belt that stretches nearly

5 miles; (b) Middle Camp, at the east foot of the mountains, just north of the Oro Fino Placers, an area 4-5 miles E-W and 1 mile

N-S, in which rich seams of gravel at bedrock hosting placer gold can be found; (c) Oro Fino, at the east foot of the mountains,

where there are rich placers as well. On the west side of the Dome mountains, extensive placers and several lode mines have produced

a total of about 100,000 gold ounces from dry wash placers and 5,000 ounces of lode gold from area veins. It is estimated that

over $3 million worth of gold was recovered in the years 1868 to 1908.

The gold in placers is attributed to the erosion of the many gold-bearing veins distributed throughout the metamorphic rocks in the area. The largest areas of placer gravels are found along the more persistent gold-quartz veins.

Gunpowder's Dome Rock project is just 9 miles south of the famous Copperstone mine which is located at the Northern tip of the Dome Rock Mountain chain. To this day, Copperstone lays claim to the largest gold discovery in Arizona in recent history. Cyprus Gold profitably open pit mined 500,000 oz of gold between 1987-1983. American Bonanza Gold Corporation is presently exploring the remaining underground resource, which contains a 0.363 oz/t oxide gold resource with 313,000 ounces of gold in the Measured and Indicated categories and 256,000 ounces of gold in the Proven and Probable Mineral Reserves category.

| 16 |

Geology of the Dome Rock Property

Dome Rock lies within the central-western region of Arizona which is characterized by north to northwest trending mountain ranges

surrounded by alluvial plains, within the Basin and Range province of western Arizona loosely identified as middle to late Mesozoic

in age.

Mid-Tertiary low-angle normal faults (detachment faults) are now recognized as fundamental regional structures in this region.

The northern Dome Rock Mountains appear to structurally underlie the northeast-dipping Moon Mountain detachment fault, the lowest

of a probable overlapping stack of detachment structures in the region. Some detachment faults host significant gold deposits,

the nearest being the 500,000 oz. Copperstone deposit, located about 9 miles north of the property. The Copperstone deposit is

located in quartz latite porphyry within the hanging wall of the Moon Mountain detachment fault. This fault is reportedly exposed

in the Moon Mountains (an extension of the Dome Rock Mountains) north of the property. Other detachment fault gold deposits within

about 70 miles include Picacho, Mesquite and Fancher.

The property lies south of Boyer Gap in rocks similar in age to those near the Copperstone deposit. Rocks present on the property

are mostly metarhyodacite porphyry, metasedimentary-volcanic assemblage and south ridge augen gneiss. Middle Camp granite is present

in the southeastern part of the property. These rock types are cut by dikes of schist, metadiorites and other rock types. Quartz

veins are present here.

Gold occurs as native flakes within fault breccia, gouge and shear zones related to the faulting. The wall and host rocks are typically

Triassic sediments and Jurassic quartz latite volcanics. Gold is commonly associated with hematite, chlorite, quartz, manganese

oxide and copper oxide mineralization.

The Dome Basin Mine north of the property reportedly produced a small amount of copper, gold, and silver ore around 1900. The mine

reportedly was located under a strong iron gossan and extensive epidotization over a metavolcanic rock, possibly an intrusive sill

between sedimentary formations.

Current State of Exploration

The Company has completed

the first sub-phase (1-A) of its two part Initial exploration program on the Dome Rock property in Arizona.

The phase 1-A exploration program included sediment sampling wherein multiple sediment samples were taken on several of the washes

draining the claims. Sample locations were determined in the field and established by GPS. Samples were submitted for assay. Outcrop

sampling was also conducted and chip samples were sent for assay.

Assay results were encouraging in that several of the samples presented similar metals ratios (Cu to Au) as other deposits in the

district (Little Butte and Copperstone). Management considers this important because it indicates that the Dome Rock claim block

may be proximal to economic mineralization.

Several samples also contained the abundant hematite that is typical of ore grade mineralization in the Plomosa district.

Based on the results of the data gathered and analyzed in the first phase (1-A) of the exploration program, the Company now has

enough information to advance the project to its next phase (1-B). The Company is planning to map some of the geological structures

that are present on the Dome Rock property and also take further rock chip samples, which will be submitted for assay. The Company’s

objective is to delineate drill targets to move forward with an aggressive drilling program.

Dome Rock Claim

The property consists of steep ridges separated by deeply incised washes lying mostly on the northeast side of the Dome Rock Mountains.

Topographic relief on the property is over 500 feet. A large, northeastward-trending wash system drains most of the eastern and

central parts of the property. Smaller washes drain the extreme northern, western and southern parts. The property is accessible

using a normal passenger vehicle. The site does not have any permanent equipment , water and electricity are not currently available.

| 17 |

Geological Exploration

Program

The Dome Rock property is located in a region with extensive exploration history, indicating that resources are present and the

prospect for economic recovery of gold support management's decision to proceed with further exploration. The property is located

in close proximity to that of other major deposits along the same geological formation, and may have the potential to hold reserve

deposits equal to those of other companies located in the area.

Gunpowder has launched its Initial Phase exploration program, which includes stream sediment sampling wherein multiple stream sediment

samples will be taken on several of the washes draining the claims. Sample locations will be determined in the field and established

by GPS. Samples will be submitted for 34 element analysis by ICP (inductively-coupled plasma) and gold analysis by gold assay and

ICP finish. The 34 element analysis will cover "pathfinder minerals" which often occur with gold deposits.

Outcrop merit sampling will also be conducted during stream sediment sampling and chip samples will be taken for assaying. Fire

assays of previously taken samples will also be undertaken. The company will fire assay samples taken from BHR claims 1 through

61 together with 5 samples taken from a vein located in the BHR 62 claim.

The results of the sampling and assaying will be covered in a geological report, and recommendation will be provided to management

so that further exploration may take place on the property as expeditiously as possible.

Item 3. Legal Proceedings.

The Company is not currently a party in any legal proceedings, and there has been no previous bankruptcy, receivership, or similar proceedings involving the Company.

Item 4. Submission of Matters to a Vote of Security Holders

The Company filed an amendment to Article 4 of its Articles of Incorporation with the Secretary of State of the State of Nevada on November 5, 2010, which changed the name of the corporation to Gunpowder Gold Corporation from Spartan Business Services Corporation and which increased the authorized number of shares of Common Stock from 70,000,000 shares to 300,000,000 shares of Common Stock, $.001 par value.

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

General

Market Information.

Our Common Stock is traded on the on the OTC-QB, a marketplace developed by the OTC Markets Group, Inc. (“OTC-QB”) under the ticker symbol “GUNP.” The OTC-QB does not have any quantitative or qualitative standards such as those required for companies listed on Nasdaq. The following table sets forth the range of quarterly high and low closing bid prices of the Common Stock as reported on http://www.otcmarkets.com during the years ended August 31, 2011 and August 31, 2010:

| Financial Quarter | Bid Price Information* | ||

| Year | Quarter | High Bid Price | Low Bid Price |

| 2011 | Fourth Quarter | $0.265 | $0.20 |

| Third Quarter | $0.30 | $0.20 | |

| Second Quarter | $1.18 | $0.18 | |

| First Quarter | $1.19 | $0.35 | |

| 2010 | Fourth Quarter | $2.95 | $.30 |

| Third Quarter | $.40 | $.105 | |

| Second Quarter | $.45 | $.20 | |

| First Quarter | $.00 | $.00 | |

| 18 |

| (1) | The Common Stock of the Company became eligible for trading on the over-the-counter Bulletin Board on December 6, 2010. |

| (2) | The prices of the Common Stock of the Company have been adjusted to reflect the 10-for-1 forward stock split of the Common Stock that became effective on November 19, 2010. |

| (3) | The quotations reflect inter-dealer prices, without retail mark-up, mark-down or commission and may not represent actual transactions. |

Dividends

The Company has not declared or paid any dividends on its Common Stock and presently does not expect to declare or pay any such dividends in the foreseeable future. The Company has not yet formulated a future dividend policy in the event restrictions on its ability to pay dividends are created.

Warrants or Options.

Please refer to Note 6 under the caption “Stockholders’ Equity and Warrants” for detailed information regarding to outstanding warrants.

We have not granted any stock options to the executive officers or directors of the Company since our inception. Upon the further development of our business, we will likely grant options to directors and officers consistent with industry standards for junior mineral exploration companies.

Recent Sales of Unregistered Securities; Use of Proceeds from Registered Securities.

Please refer to Note 6 under the caption “Stockholders’ Equity and Warrants” for detailed information regarding to private placements.

Purchases of Equity Securities by the Company and Affiliated Purchasers.

There were no purchases of equity securities by the Company or affiliates during the fiscal year ended August 31, 2011.

Item 6. Selected Financial Data

| Year Ended | Year Ended | |||||||

| August 31, 2011 | August 31, 2010 | |||||||

| Revenues | $ | 0 | $ | 0 | ||||

| Operating, general and administrative expense | $ | 392,480 | $ | 74,410 | ||||

| Other Income | $ | 0 | $ | 3,500 | ||||

| Loss from foreign exchange | $ | 404 | $ | 0 | ||||

| Provision for income taxes | $ | 0 | $ | 0 | ||||

| Net loss | $ | (392,884 | ) | $ | (70,910 | ) | ||

| Comprehensive loss | $ | — | $ | — | ||||

| Net loss per share | $ | 0 | $ | 0 | ||||

| 19 |

Item 7. Management’s Discussion and Analysis of Financial Conditions and Results of Operations.

Overview

As a natural resource exploration company our focus is to locate prospective properties that may host mineral reserves that could eventually be put into mining production. With this in mind, we have to this date identified and secured interests in a mining claim with respect to property in the Walker Lane area in the State Arizona.

We do not presently intend to use any employees, with the exception of part-time clerical assistance on an as-needed basis. Outside advisors, attorneys or consultants will only be used if they can be obtained for a reasonable cost or for a deferred payment basis. Management is confident that it will be able to operate in this manner and continue during the next twelve months.

Plan of Operation

During the twelve-month period ending August 31, 2012, our objective is to continue to explore the properties subject to our mining claim. We continue to run our operations with the use of contract operators, and as such do not anticipate a material change to our company staffing levels. We remain focused on keeping the staff compliment, which currently consists of our three directors, at a minimum to conserve capital. Our staffing in no way hinders our operations, as outsourcing of necessary operations continues to be the most cost effective and efficient manner of conducting the business of the Company.

We do not anticipate any equipment purchases in the twelve months ending August 31, 2012.

The following is an overview of the project work to date, as well as anticipated work for the next twelve months. Specific dates when work will begin, and how long it will take to complete each step is subject to change due to the variables of weather, availability of work crews for a particular type of work, and the results of work that is planned, the outcome of which will determine what the next step on that project will be.

Dome Rock

On January 21, 2011 simultaneous with the execution and delivery of the Option Agreement with Horizon, the Company made the initial property option payment of $67,448.53 on March 9, 2011.

The Dome Rock Option Agreement requires on-going property payments of $20,000 US on or before January 21, 2012; $30,000 US on or before January 21, 2013; $40,000 on or before the January 21, 2014; $50,000 on or before January 21, 2015; $60,000 on or before January 21, 2016; and $60,000 on or before January 21, 2017. The Company shall also be responsible for making all necessary property payments to keep the Property in good standing which includes all annual maintenance fees, exploration and other permits, property taxes, levies, insurance, and other assessments.

The Company shall complete the following exploration expenditures on the property as follows: (i) $750,000 on or before the first anniversary of the signing of the Agreement (ii) $750,000 on or before the second anniversary of the signing of the Agreement; and (iii) $500,000 on or before the third anniversary of the signing Option Agreement.

_________________________________

By January 21, 2012, the Company is contractually required to incur $750,000 on exploration costs on the property. The total amount of exploration expenditures made on the Dome Rock Property through August 31, 2011, is $77,649, a shortfall of $672,351. If the Company fails to meet its minimum exploration requirement of a total of $750,000, its options rights to the Dome Rock property may be terminated by the seller under the terms of its Option Agreement.

We are planning to map some of the geological structures that are present on the Dome Rock property and also take further rock chip samples, which we will submit for assay. Our objective is to delineate drill targets so we can move forward with an aggressive drilling program, as rapidly as possible.

| 20 |