Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - LENNOX INTERNATIONAL INC | t72157_8k.htm |

| EX-99.2 - EXHIBIT 99.2 - LENNOX INTERNATIONAL INC | ex99-2.htm |

Exhibit 99.1

|

2011

Investment Community Meeting

December 14, 2011

|

|

FORWARD-LOOKING STATEMENTS

This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements are subject to numerous risks and uncertainties that could cause actual results to differ materially from such statements. Such risks and uncertainties include, but are not limited to, the impact of higher raw material and commodity prices, the impact of unfavorable weather, and the ability of the company to execute its strategic plans. For more information concerning these and other risks and uncertainties, see Lennox International’s Form 10-K and other publicly available filings with the Securities and Exchange Commission. LII disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Use of Non-GAAP Financial Measures

A reconciliation of non-GAAP financial measures appearing in this presentation to financial measures prepared in accordance with U.S. Generally Accepted Accounting Principles

(GAAP) is posted on the company’s website at www.lennoxinternational.com.

2

|

|

Who We Are

Update on Strategic Priorities 2011 Review & 2012 Guidance Questions & Answers

3

|

|

Lennox International

… is continuing to aggressively reduce its cost structure

… is continuing to make transformational investments in the business

… is participating in growth markets with significant pent-up demand

… is driving shareholder value with a disciplined use of free cash flow

4

|

|

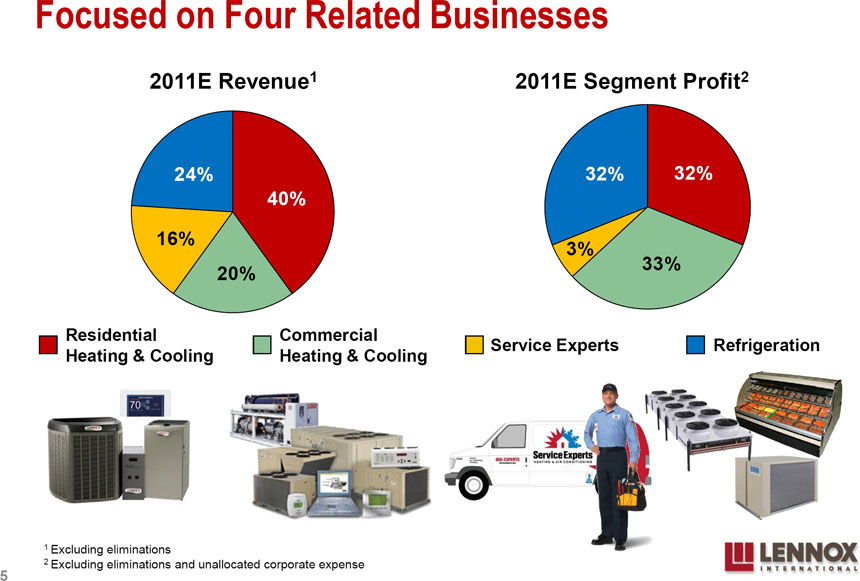

Focused on Four Related Businesses

2011E Revenue1 2011E Segment Profit2 24% 32% 32% 40% 16% 3% 33% 20% Residential Commercial

Service Experts Refrigeration Heating & Cooling Heating & Cooling

1 Excluding eliminations

2 Excluding eliminations and unallocated corporate expense

5

|

|

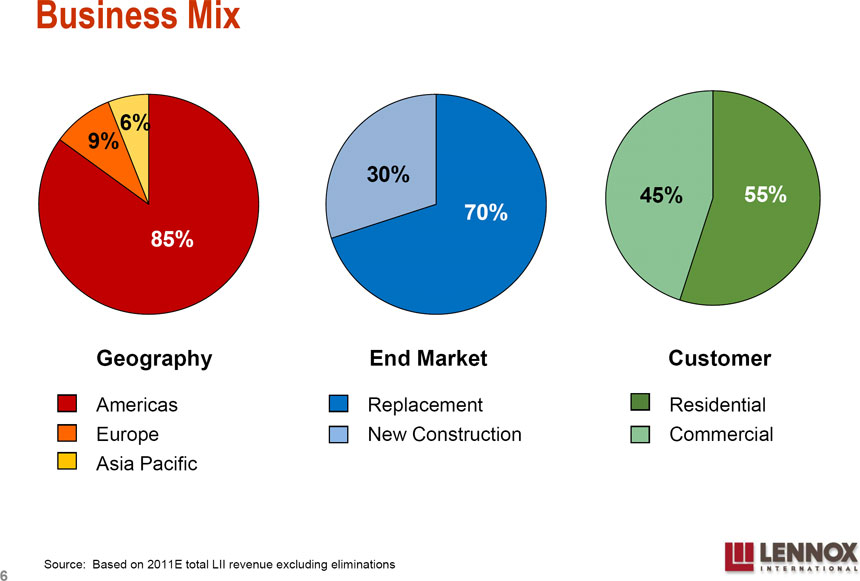

Business Mix

9% 6%

30%

45% 55%

70% 85%

Geography End Market Customer

Americas Replacement Residential Europe New Construction Commercial Asia Pacific

Source: Based on 2011E total LII revenue excluding eliminations

6

|

|

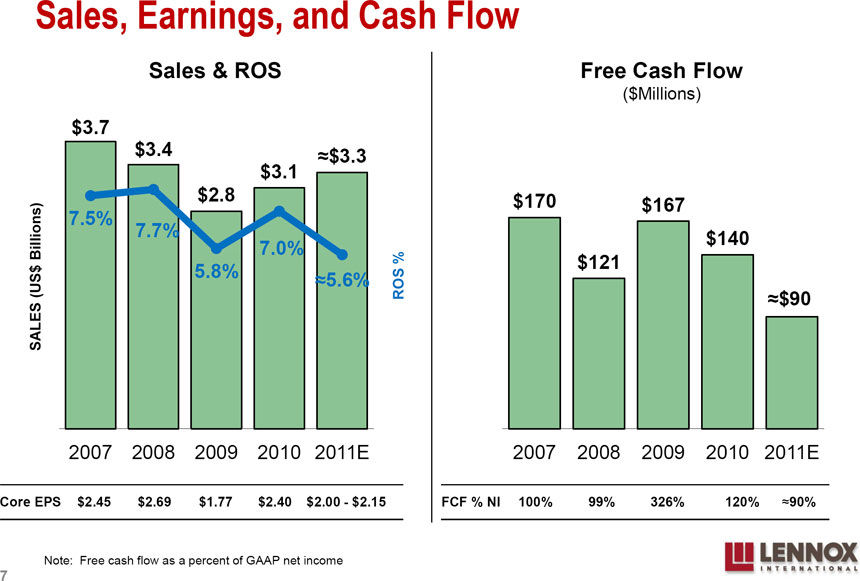

Sales, Earnings, and Cash Flow

Sales & ROS Free Cash Flow

($Millions)

$4 10% $250

$3.7 $3.4 $3.1 $3.3

8% $200

$3 $2.8 $170 $167 7.5% 7.7% $140 7.0% 6% $150 $121

$2 5.8% 5.6% ROS %

SALES (US$ Billions) 4% $100 $90

$1

2% $50

$0 0% $0

2007 2008 2009 2010 2011E 2007 2008 2009 2010 2011E

Core EPS $2.45 $2.69 $1.77 $2.40 $2.00 - $2.15 FCF % NI 100% 99% 326% 120% 90%

Note: Free cash flow as a percent of GAAP net income

7

|

|

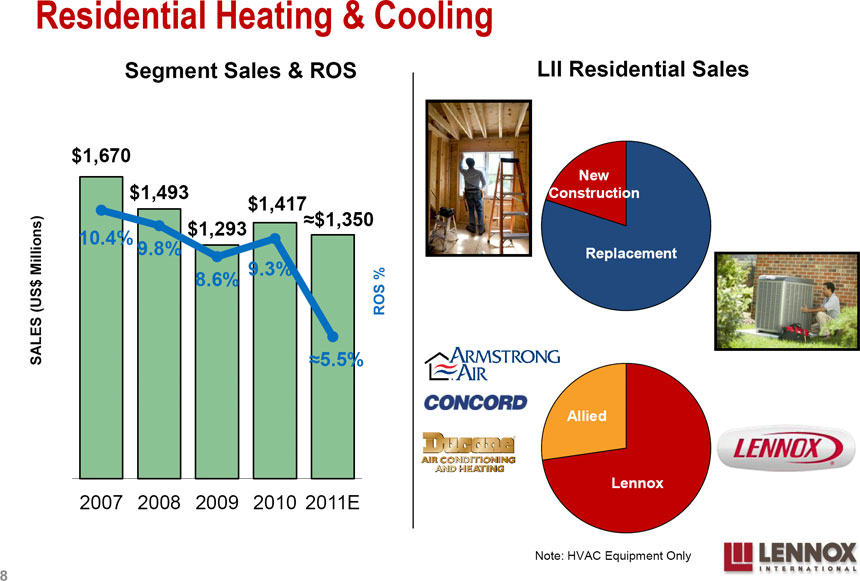

Residential Heating & Cooling

Segment Sales & ROS LII Residential Sales $2,000 14% Replacement

$1,670

12% NC

New NC $1,493 Construction

$1,500

$1,293$1,417 $1,35010% Replacement 10.4% 9.8% Replacement

8.6% 9.3% 8%

$1,000 ROS %

SALES (US$ Millions) 6%

5.5%

4% $500

Allied Allied 2%

Lennox

$0 0% Lennox

2007 2008 2009 2010 2011E

Note: HVAC Equipment Only

8

|

|

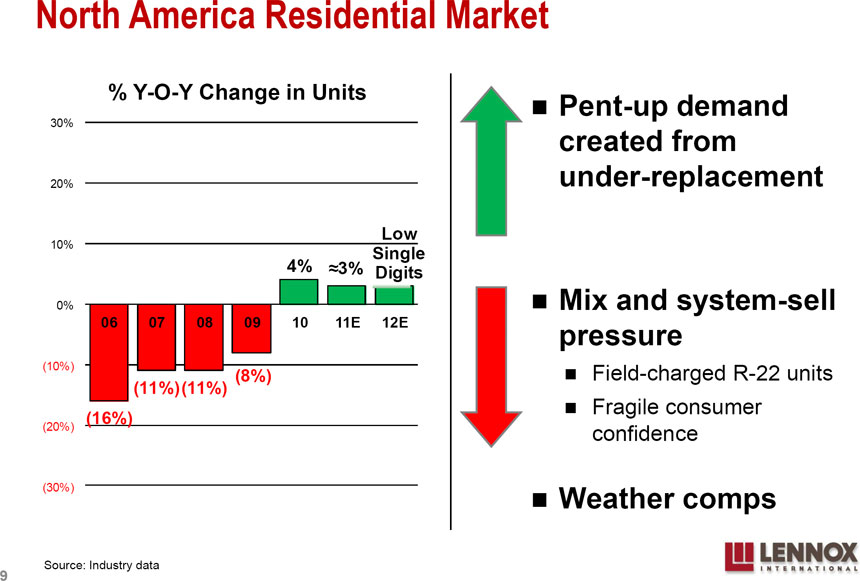

North America Residential Market % Y-O-Y Change in Units Pent-up demand

30% created from 20% under-replacement Low 10% Single 4% 3% Digits 0% Mix and system-sell

06 07 08 09 10 11E 12E pressure (10%) Field-charged R-22 units (11%)(11%) (8%) Fragile consumer

(16%) (20%) confidence (30%) Weather comps Source: Industry data

9

|

|

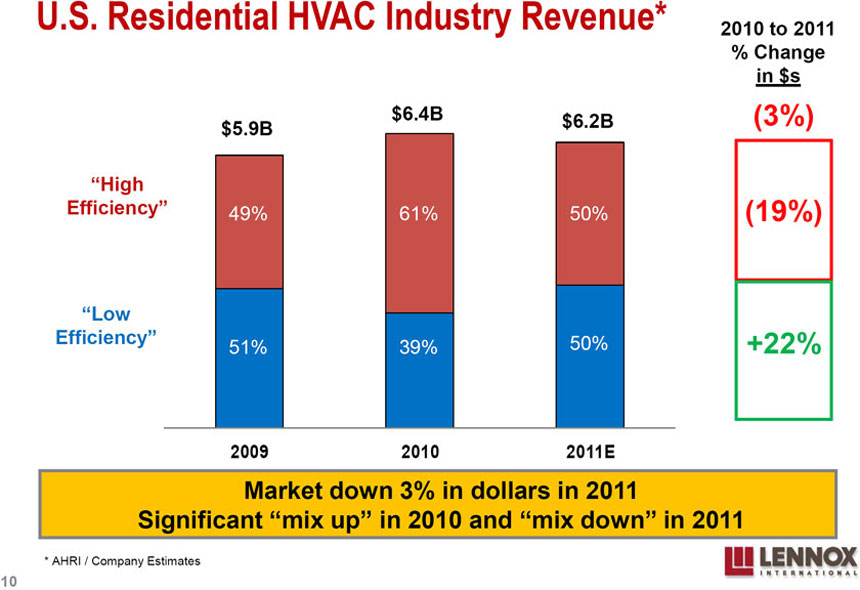

U.S. Residential HVAC Industry Revenue* 2010 to 2011

% Change in $s $6.4B $6.2B (3%) $5.9B

“High 50%

Efficiency” 49% 61% 50% (19%)

“Low 50%

Efficiency” 50% +22% 51% 39%

2009 2010 2011E

Market down 3% in dollars in 2011

Significant “mix up” in 2010 and “mix down” in 2011

* AHRI / Company Estimates

10

|

|

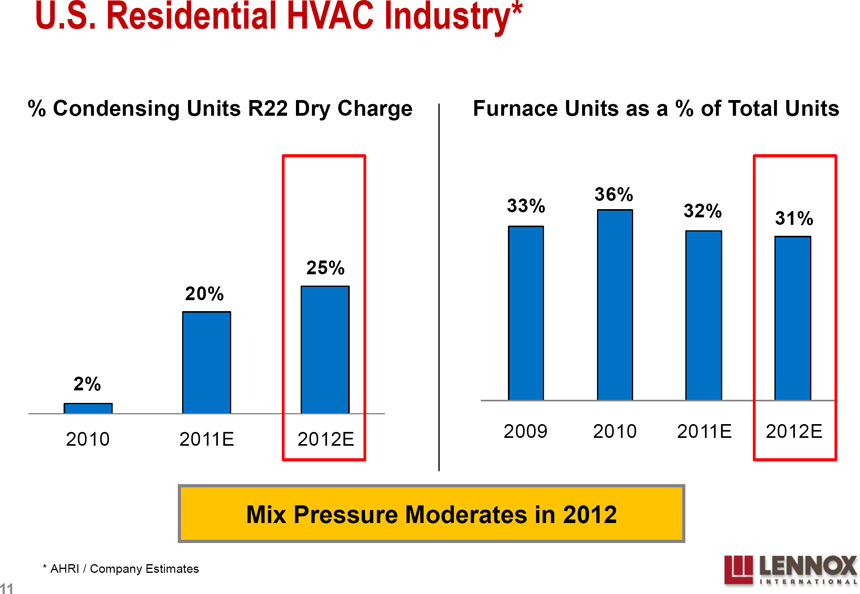

U.S. Residential HVAC Industry*

% Condensing Units R22 Dry Charge Furnace Units as a % of Total Units

36% 33% 32% 31% 25% 20%

2% 2010 2011E 2012E 2009 2010 2011E 2012E

Mix Pressure Moderates in 2012 * AHRI / Company Estimates

11

|

|

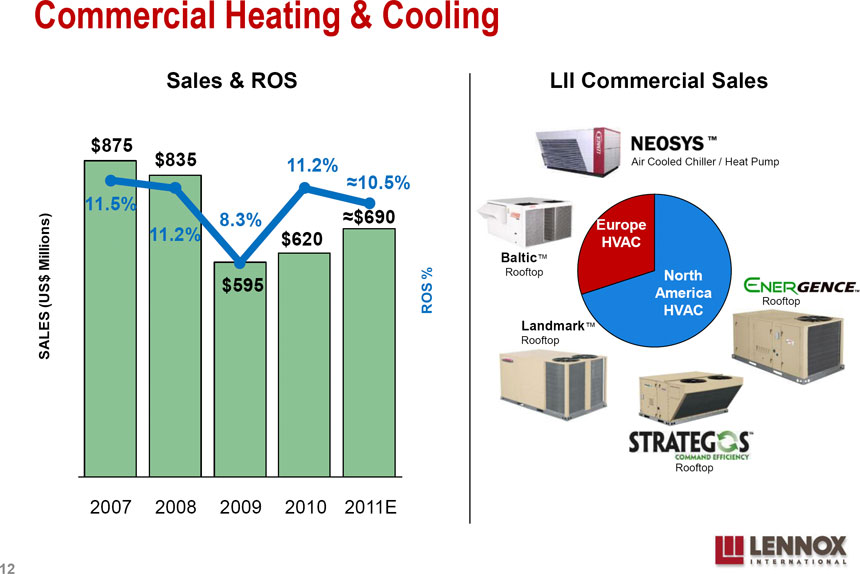

Commercial Heating & Cooling

Sales & ROS LII Commercial Sales

$1,000 14%

$875

$835 11.2% Air Cooled Chiller / Heat Pump

12%

$800 10.5% 11.5%

8.3% $690 10% Europe

11.2% $620

HVAC $600 Baltic

8% Rooftop North $595 America

ROS % Rooftop

HVAC

6% Landmark $400

SALES (US$ Millions) Rooftop

4% $200 2%

Rooftop

$0 0%

2007 2008 2009 2010 2011E

12

|

|

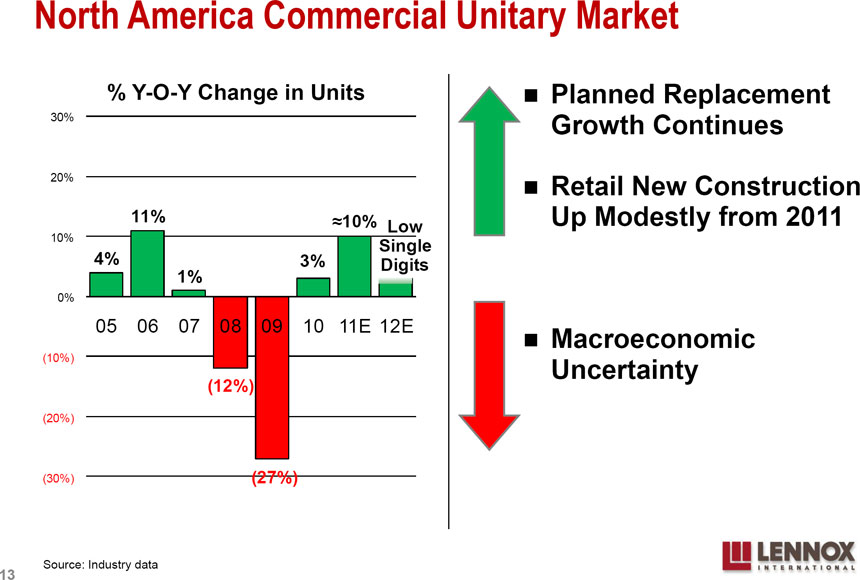

North America Commercial Unitary Market

% Y-O-Y Change in Units Planned Replacement

30% Growth Continues

20% Retail New Construction 11% Up Modestly from 2011

10% Low

10% Single

4% 3% Digits

1% 0% 05 06 07 08 09 10 11E 12E Macroeconomic (10%) Uncertainty

(12%) (20%)

(30%) (27%)

Source: Industry data

13

|

|

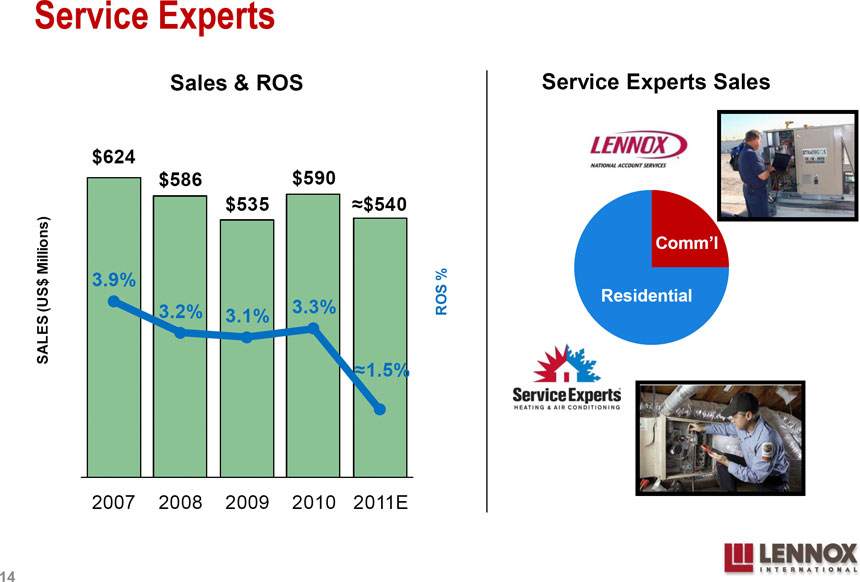

Service Experts

Sales & ROS Service Experts Sales 8% $624 $586 $590 $600

$535 $540 6%

Comm’l

$400 3.9%

4% Residential

3.2% 3.3% ROS %

SALES (US$ Millions) 3.1%

1.5%

$200 2% $0 0%

2007 2008 2009 2010 2011E

14

|

|

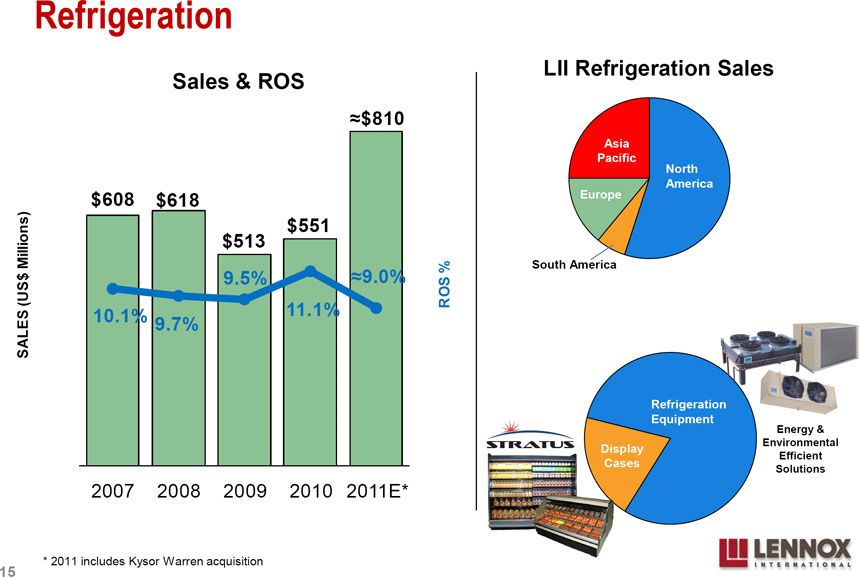

Refrigeration

LII Refrigeration Sales Sales & ROS $810 20%

$800 Asia 18% Pacific North 16% America $608 $618 Europe $600 $551 14%

$513 12% South America 9.5% 9.0% 10% $400 11.1% ROS %

SALES (US$ Millions) 10.1% 9.7% 8% 6% $200

4% Refrigeration Equipment

2% Energy & Environmental

Display

Efficient

$0 0% Cases

Solutions

2007 2008 2009 2010 2011E*

* 2011 includes Kysor Warren acquisition

15

|

|

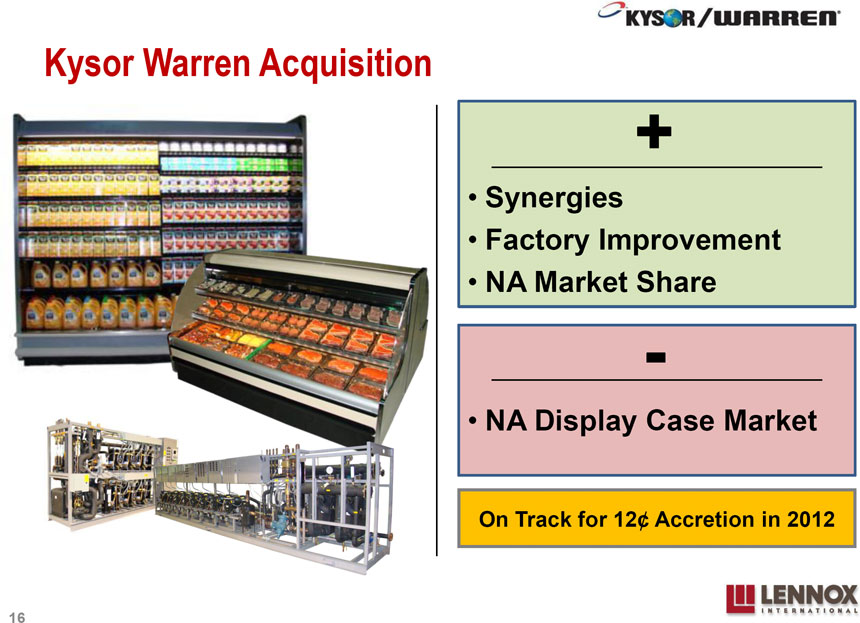

Kysor Warren Acquisition

Synergies

Factory Improvement

NA Market Share

NA Display Case Market

On Track for 12¢ Accretion in 2012

16

|

|

Who We Are

Update on Strategic Priorities 2011 Review & 2012 Guidance Questions & Answers

17

|

|

Strategic Priorities

1. Innovative Product and System Solutions

2. Manufacturing and Sourcing Excellence

3. Distribution Excellence

4. Geographic Expansion

5. Expense Reduction

VALUES

PEOPLE

18

|

|

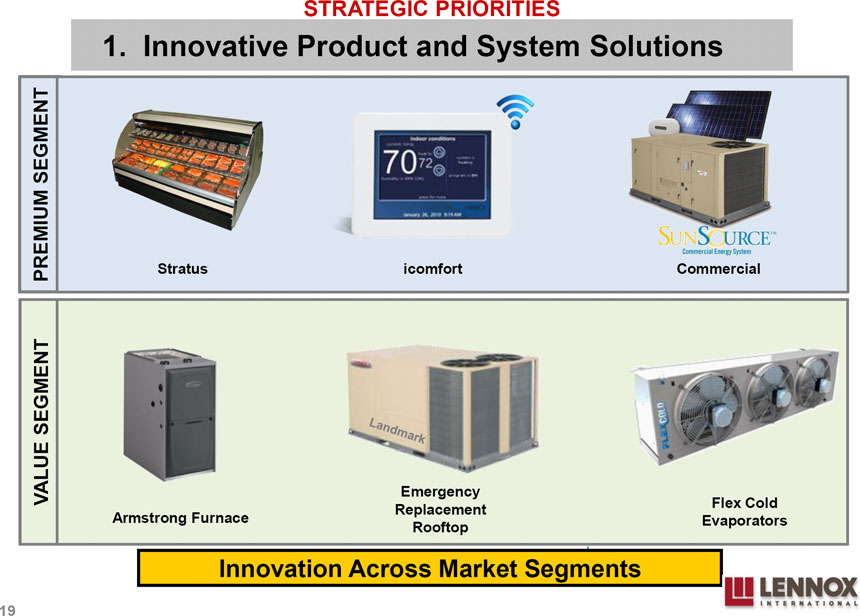

STRATEGIC PRIORITIES

1. Innovative Product and System Solutions

PREMIUM SEGMENT Stratus icomfort Commercial

VALUE SEGMENT Emergency

Flex Cold Replacement Armstrong Furnace Evaporators Rooftop

Innovation Across Market Segments

19

|

|

STRATEGIC PRIORITIES

1. Innovative Product and System Solutions

Lennox India Technology Center (LITC)

Chennai, India Key Benefits

Significant R&D Leverage

“Top Notch” Talent

Cycle Time Reduction

Areas of Focus

Communicating Controls

Value Engineering

Information Technology

Established in 2010 / 100+ Resources

CAD / CAE Analysis Accelerating New Product Development and Cost Reduction Programs

20

|

|

STRATEGIC PRIORITIES

2. Manufacturing and Sourcing Excellence

Saltillo Mexico Factory

Units Produced

(000s) 340

290 180 20 2008 2009 2010 2011E

Ramp Up in Mexico Continues

21

|

|

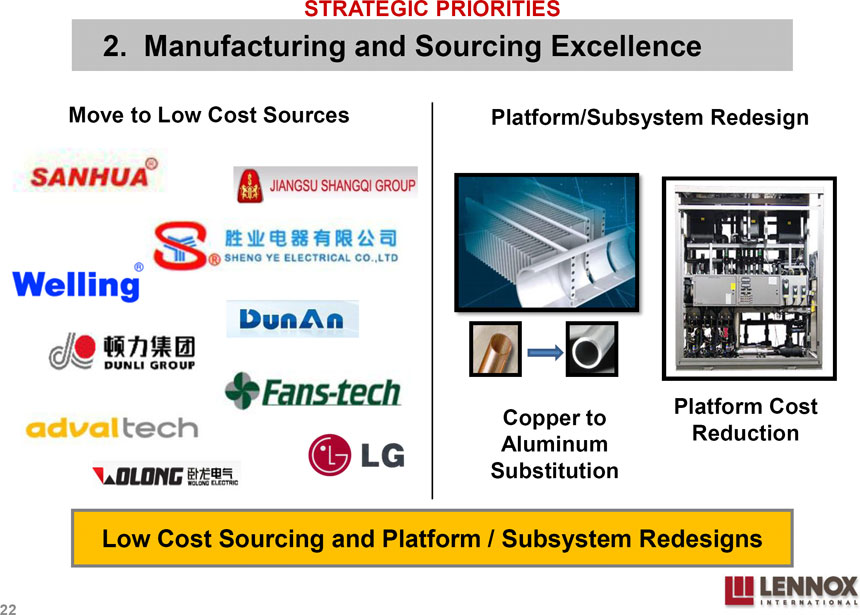

STRATEGIC PRIORITIES

2. Manufacturing and Sourcing Excellence

Move to Low Cost Sources Platform/Subsystem Redesign

Platform Cost Copper to Reduction Aluminum Substitution

Low Cost Sourcing and Platform / Subsystem Redesigns

22

|

|

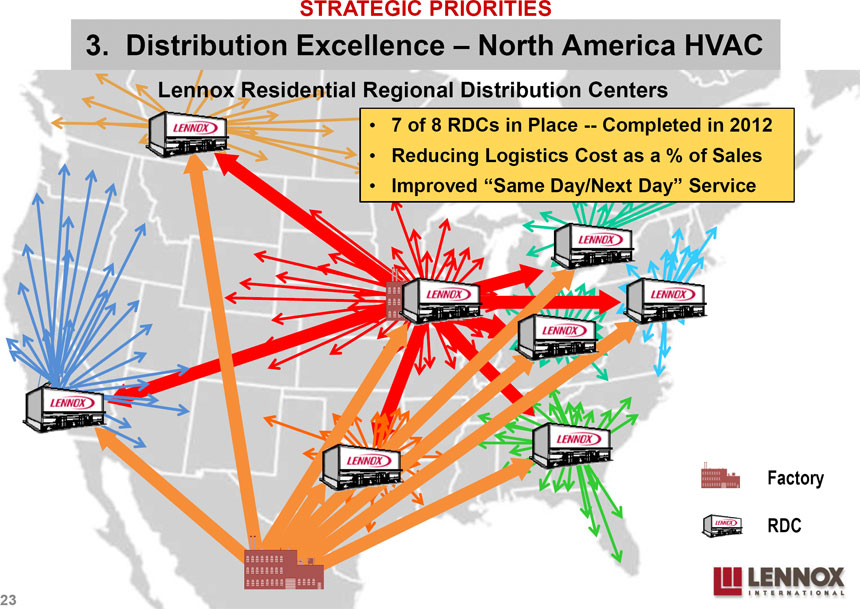

STRATEGIC PRIORITIES

3. Distribution Excellence North America HVAC

Lennox Residential Regional Distribution Centers

7 of 8 RDCs in Place -- Completed in 2012

Reducing Logistics Cost as a % of Sales

Improved “Same Day/Next Day” Service

Factory RDC 23

|

|

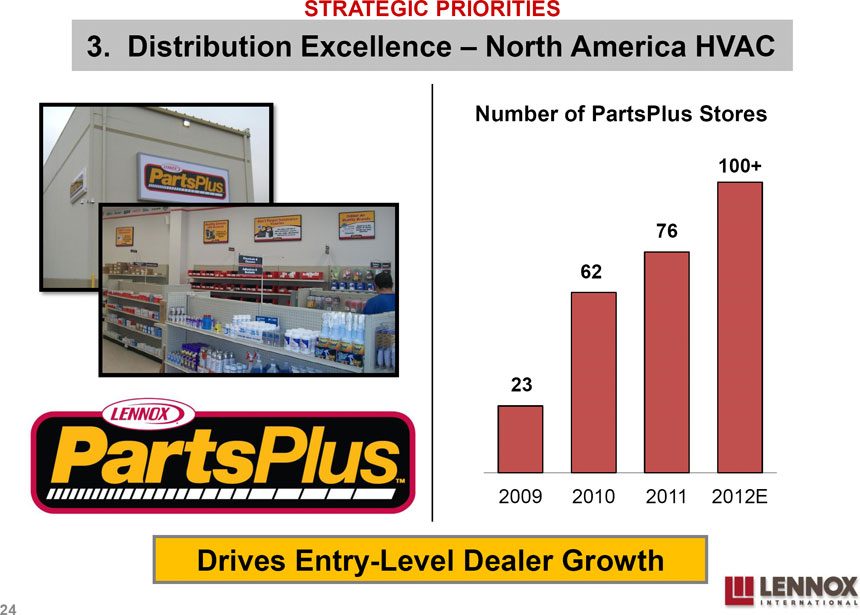

STRATEGIC PRIORITIES

3. Distribution Excellence North America HVAC

Number of PartsPlus Stores

100+ 76 62 23

2009 2010 2011 2012E Drives Entry-Level Dealer Growth

24

|

|

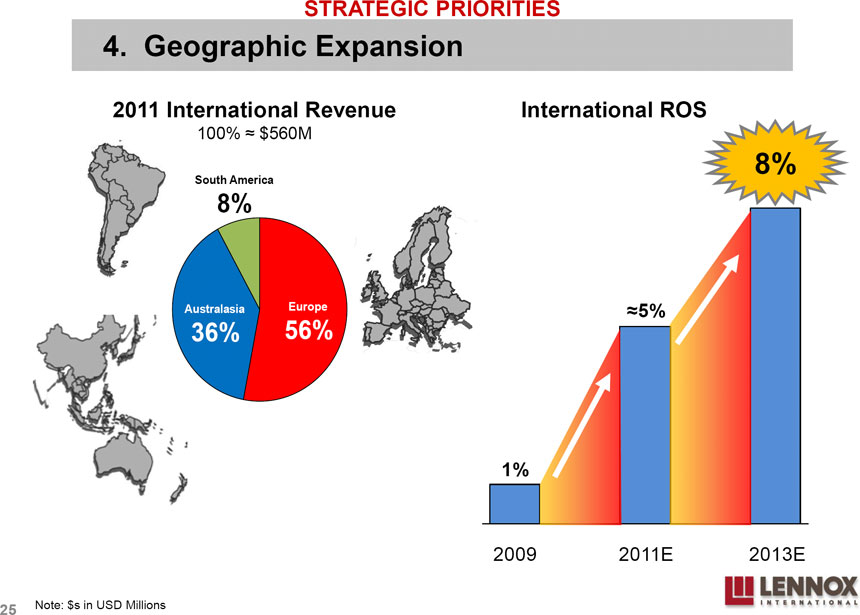

STRATEGIC PRIORITIES

4. Geographic Expansion

2011 International Revenue International ROS

100% $560M

8%

South America

8% Australasia Europe 5%

36% 56% 1%

2009 2011E 2013E

25 Note: $s in USD Millions

|

|

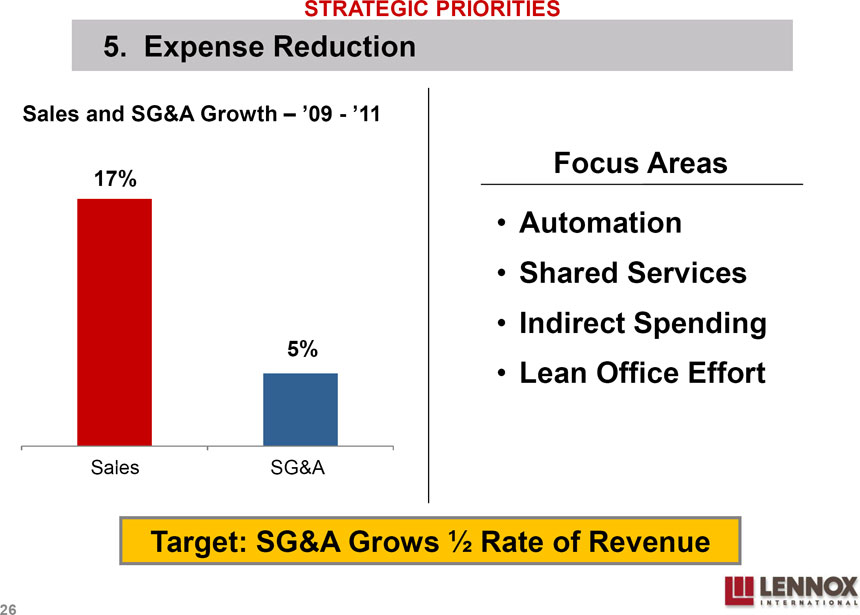

STRATEGIC PRIORITIES

5. Expense Reduction

Sales and SG&A Growth ’09 - ’11

Focus Areas

17% Automation

Shared Services

Indirect Spending

5%

Lean Office Effort

Sales1 SG&A 2

Target: SG&A Grows ½ Rate of Revenue

26

|

|

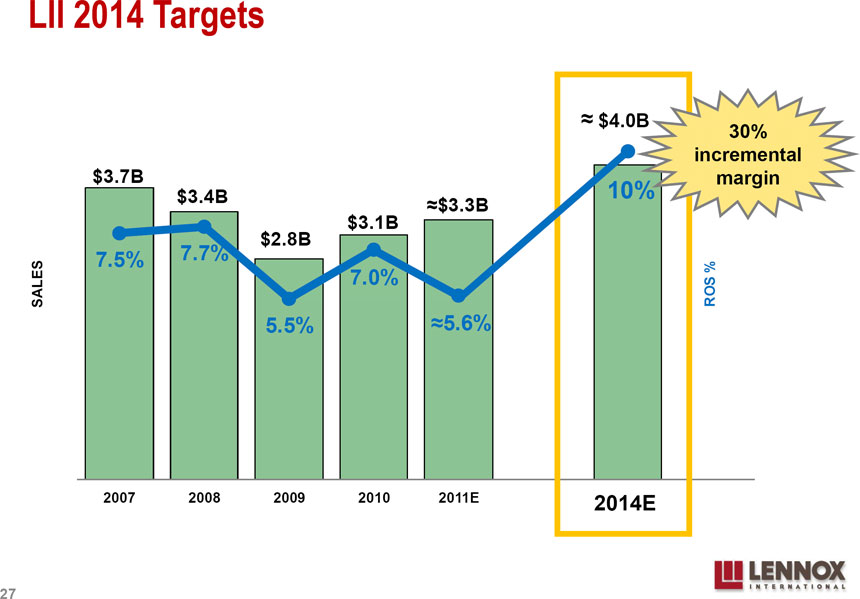

LII 2014 Targets

$5 12% $4.0B

30% incremental10%

$4 $3.7B margin $3.4B

$3.3B 10% $3.1B 8% $3 $2.8B

7.5% 7.7%

SALES 7.0% ROS % 6% $2 5.5% 5.6% 4% $1 2%

$0 0% 2007 2008 2009 2010 2011E 2014E

27

|

|

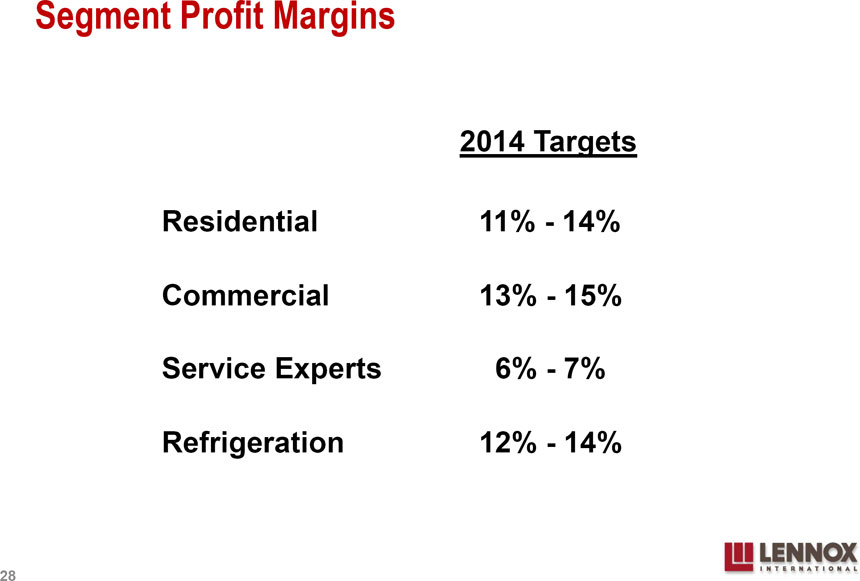

Segment Profit Margins

2014 Targets

Residential 11% - 14% Commercial 13% - 15% Service Experts 6% - 7% Refrigeration 12% - 14%

28

|

|

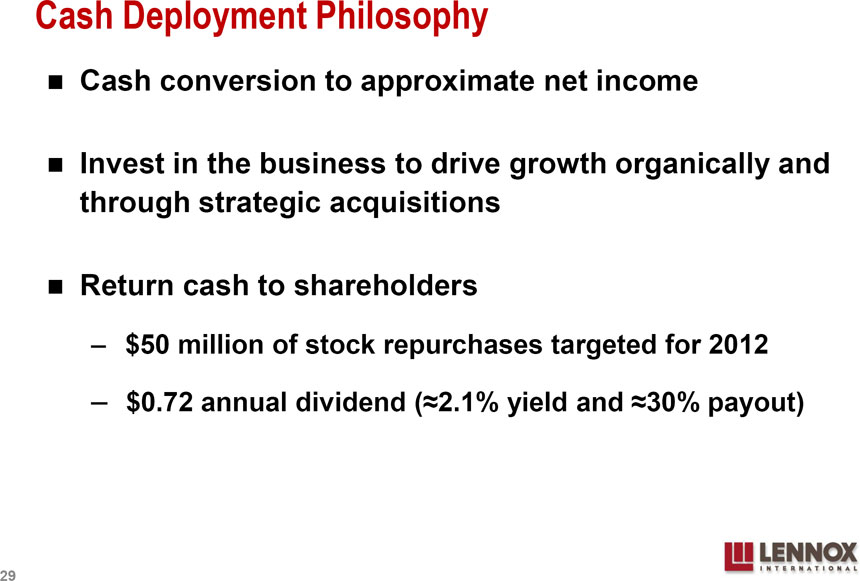

Cash Deployment Philosophy Cash conversion to approximate net income

Invest in the business to drive growth organically and through strategic acquisitions

Return cash to shareholders $50 million of stock repurchases targeted for 2012

$0.72 annual dividend ( 2.1% yield and 30% payout)

29

|

|

Who We Are

Update on Strategic Priorities 2011 Review & 2012 Guidance Questions & Answers

30

|

|

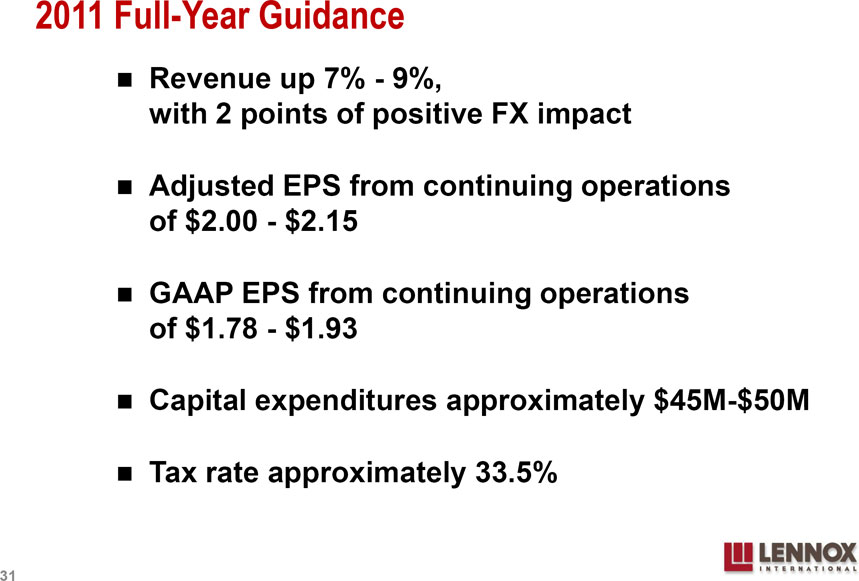

2011 Full-Year Guidance

Revenue up 7% - 9%, with 2 points of positive FX impact

Adjusted EPS from continuing operations of $2.00 - $2.15

GAAP EPS from continuing operations of $1.78 - $1.93

Capital expenditures approximately $45M-$50M

Tax rate approximately 33.5%

31

|

|

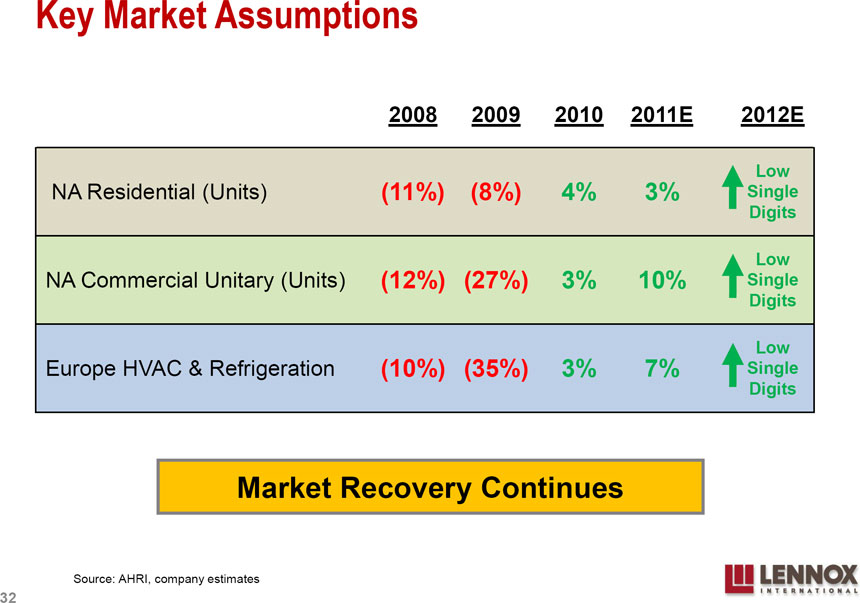

Key Market Assumptions

2008 2009 2010 2011E 2012E

Low

NA Residential (Units) (11%) (8%) 4% 3% Single

Digits Low

NA Commercial Unitary (Units) (12%) (27%) 3% 10% Single

Digits Low

Europe HVAC & Refrigeration (10%) (35%) 3% 7% Single

Digits

Market Recovery Continues

Source: AHRI, company estimates

32

|

|

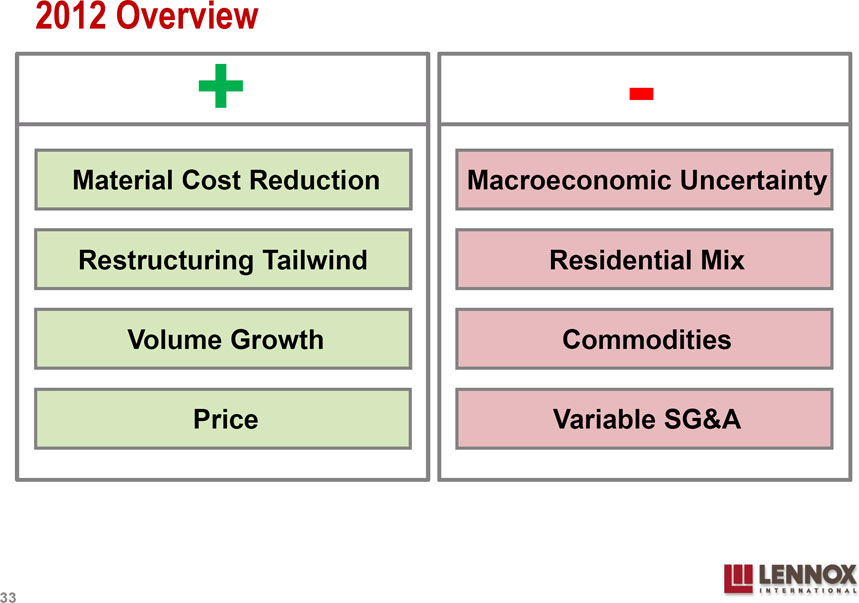

2012 Overview

+ -

Material Cost Reduction Macroeconomic Uncertainty Restructuring Tailwind Residential Mix Volume Growth Commodities Price Variable SG&A

33

|

|

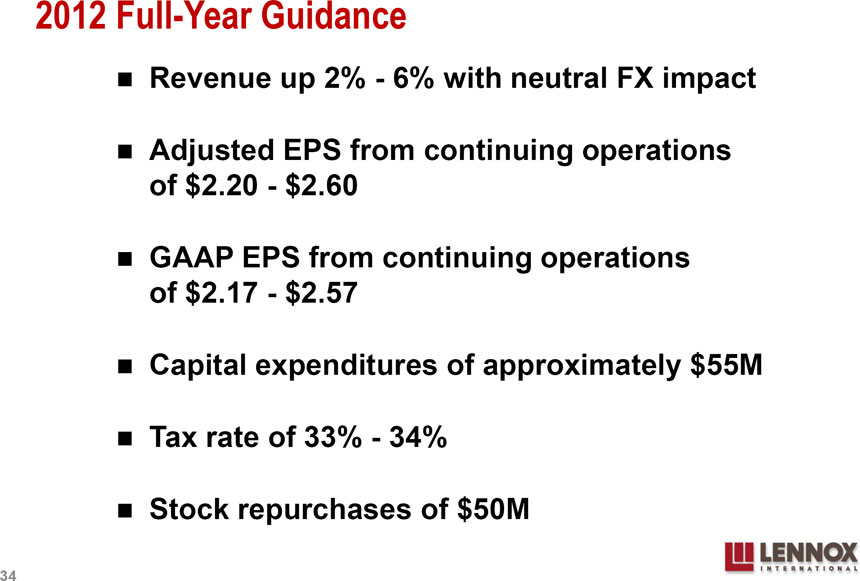

2012 Full-Year Guidance

Revenue up 2% - 6% with neutral FX impact

Adjusted EPS from continuing operations of $2.20 - $2.60

GAAP EPS from continuing operations of $2.17 - $2.57

Capital expenditures of approximately $55M Tax rate of 33% - 34% Stock repurchases of $50M

34

|

|

Lennox International

… is continuing to aggressively reduce its cost structure

… is continuing to make transformational investments in the business

… is participating in growth markets with significant pent-up demand

… is driving shareholder value with a disciplined use of free cash flow

35

|

|

36 |

|

GAAP / Non-GAAP Reconciliations

37

|

|

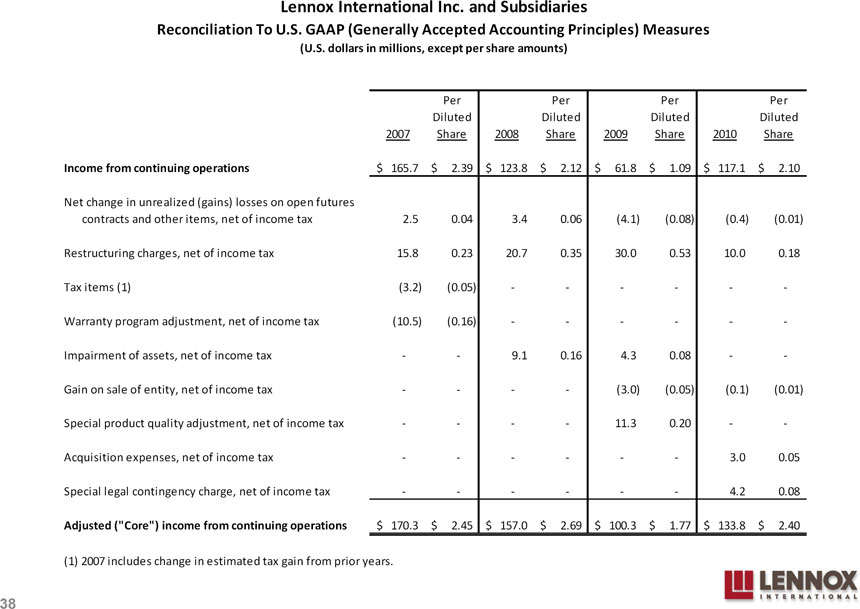

Lennox International Inc. and Subsidiaries

Reconciliation To U.S. GAAP (Generally Accepted Accounting Principles) Measures

(U.S. dollars in millions, except per share amounts)

Per Per Per Per Diluted Diluted Diluted Diluted 2007 Share 2008 Share 2009 Share 2010 Share

Income from continuing operations $ 165.7 $ 2.39 $ 123.8 $ 2.12 $ 61.8 $ 1.09 $ 117.1 $ 2.10

Net change in unrealized (gains) losses on open futures contracts and other items, net of income tax 2.5 0.04 3.4 0.06 (4.1) (0.08) (0.4) (0.01)

Restructuring charges, net of income tax 15.8 0.23 20.7 0.35 30.0 0.53 10.0 0.18 Tax items (1) (3.2) (0.05) - - - - - -Warranty program adjustment, net of income tax (10.5) (0.16) - - - - - -Impairment of assets, net of income tax - - 9.1 0.16 4.3 0.08 - -Gain on sale of entity, net of income tax - - - - (3.0) (0.05) (0.1) (0.01) Special product quality adjustment, net of income tax - - - - 11.3 0.20 - -Acquisition expenses, net of income tax - - - - - - 3.0 0.05 Special legal contingency charge, net of income tax - - - - - - 4.2 0.08 Adjusted (“Core”) income from continuing operations $ 170.3 $ 2.45 $ 157.0 $ 2.69 $ 100.3 $ 1.77 $ 133.8 $ 2.40 (1) 2007 includes change in estimated tax gain from prior years.

38

|

|

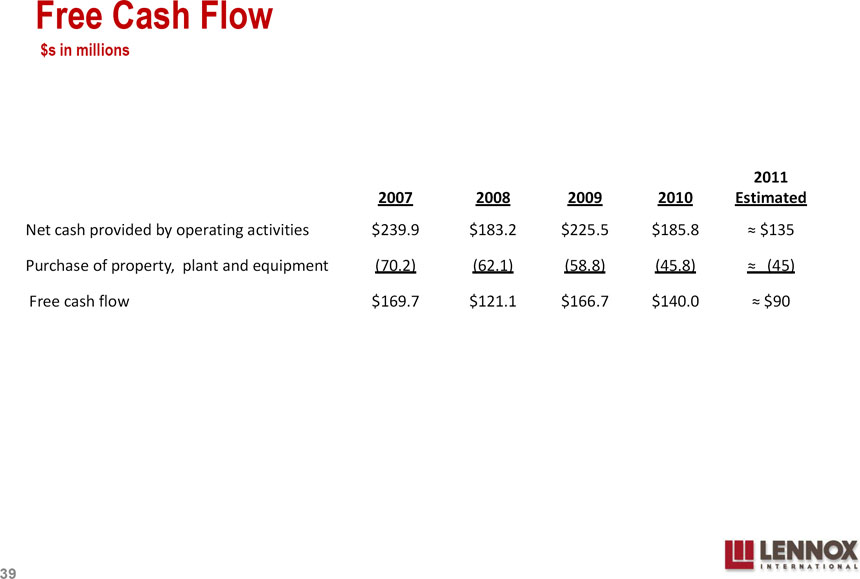

Free Cash Flow

$s in millions

2011 2007 2008 2009 2010 Estimated

Net cash provided by operating activities $239.9 $183.2 $225.5 $185.8 $135 Purchase of property, plant and equipment (70.2) (62.1) (58.8) (45.8) (45) Free cash flow $169.7 $121.1 $166.7 $140.0 $90

39

|

|

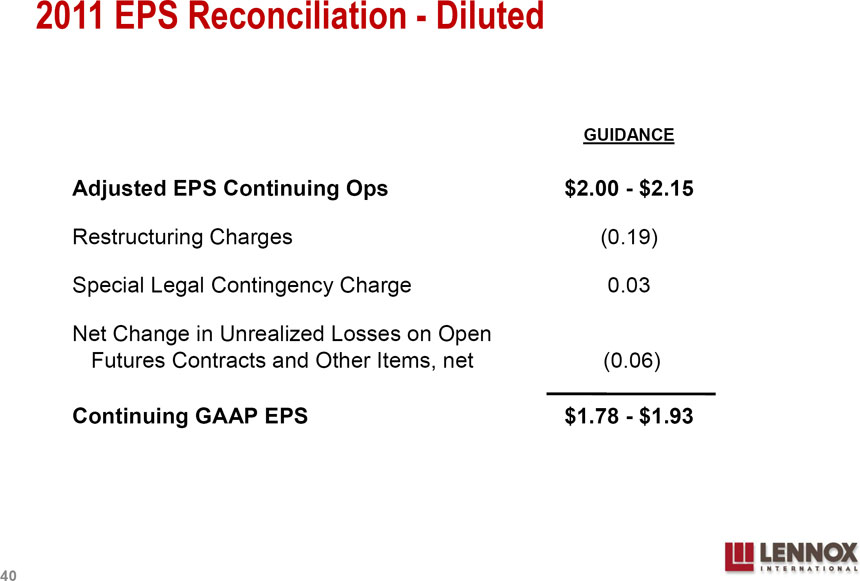

2011 EPS Reconciliation - Diluted

GUIDANCE

Adjusted EPS Continuing Ops $2.00 - $2.15

Restructuring Charges (0.19)

Special Legal Contingency Charge 0.03

Net Change in Unrealized Losses on Open Futures Contracts and Other Items, net (0.06)

Continuing GAAP EPS $1.78 - $1.93

40

|

|

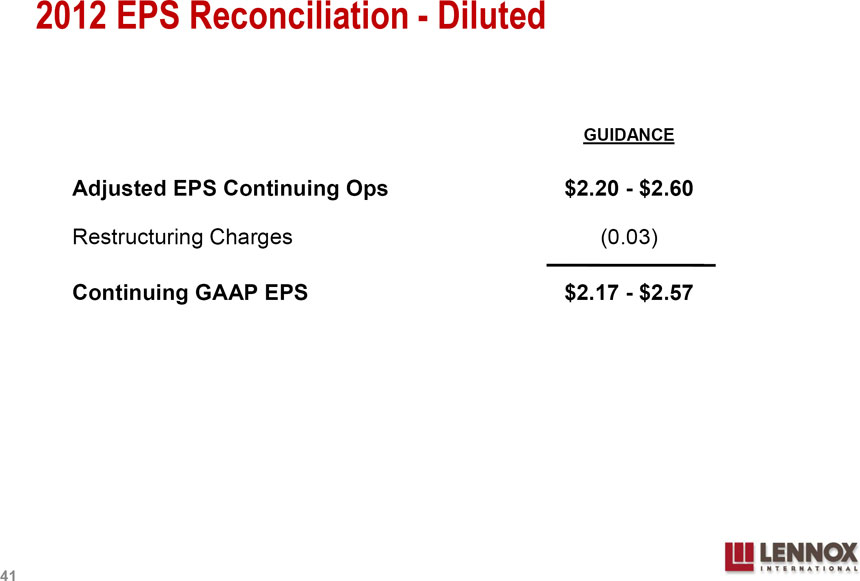

2012 EPS Reconciliation - Diluted

GUIDANCE

Adjusted EPS Continuing Ops $2.20 - $2.60

Restructuring Charges (0.03)

Continuing GAAP EPS $2.17 - $2.57

41

|