Attached files

| file | filename |

|---|---|

| EX-31.2 - EXHIBIT 31.2 - HQ Global Education Inc. | v242958_ex31-2.htm |

| EX-32.1 - EXHIBIT 32.1 - HQ Global Education Inc. | v242958_ex32-1.htm |

| EX-32.2 - EXHIBIT 32.2 - HQ Global Education Inc. | v242958_ex32-2.htm |

| EX-31.1 - EXHIBIT 31.1 - HQ Global Education Inc. | v242958_ex31-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended August 31, 2011

¨ TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from [ ] to [ ]

Commission file number 333-150385

HQ GLOBAL EDUCATION INC.

(Exact name of registrant as specified in its charter)

|

Delaware

|

26-1806348

|

|

(State or other jurisdiction of

|

(I.R.S. Employer

|

|

incorporation or organization)

|

Identification No.)

|

27th Floor, BOBO Fortune Center, No.368, South Furong Road,

|

Changsha City, Hunan Province, PRC

|

410007

|

|

(Address of principal executive offices)

|

(Zip Code)

|

Registrant's telephone number, including area code: (86) 731-87828601

Securities registered pursuant to Section 12(b) of the Act:

N/A

(Title of class)

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, $0.0001 par value

(Title of class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ¨ Yes x No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. ¨ Yes x No

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the last 90 days.) x Yes ¨ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-K (ss.229.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). ¨ Yes ¨ No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (ss.229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definition of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer ¨

|

Accelerated filer ¨

|

|

Non-accelerated filer ¨

|

Smaller reporting company x

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The aggregate market value of Common Stock held by non-affiliates of the Registrant on February 28, 2011, the last business day of the Company's second fiscal quarter, was $31,375,000 (12,500,000 shares of common stock held by non-affiliates) based upon the closing price of $2.51 as quoted by OTC Bulletin Board on such date. Shares of common stock held by each director, each officer and each person who owns 10% or more of the outstanding common stock have been excluded from this calculation in that such persons may be deemed to be affiliates. The determination of affiliate status is not necessarily conclusive.

33,000,000 shares of common stock, $0.0001 par value, issued and outstanding as of November 30, 2011.

TABLE OF CONTENTS

|

Item 1.

|

Business

|

4

|

|

Item 1A.

|

Risk Factors

|

19 |

|

Item 1B.

|

Unresolved Staff Comments

|

19 |

|

Item 2.

|

Properties

|

19 |

|

Item 3.

|

Legal Proceedings

|

21 |

|

Item 4.

|

[Removed and Reserved]

|

21 |

|

Item 5.

|

Market for Common Equity and Related Stockholder Matters

|

21 |

|

Item 6.

|

Selected Financial Data

|

22 |

|

Item 7.

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

22 |

|

Item 7A.

|

Quantitative and Qualitative Disclosures About Market Risk

|

31 |

|

Item 8.

|

Financial Statements and Supplementary Data

|

31 |

|

Item 9.

|

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

|

32 |

|

Item 9A.

|

Controls and Procedures

|

32 |

|

Item 9B.

|

Other Information

|

34 |

|

Item 10.

|

Directors, Executive Officers and Corporate Governance

|

35 |

|

Item 11.

|

Executive Compensation

|

37 |

|

Item 12.

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

|

38 |

|

Item 13.

|

Certain Relationships and Related Transactions, and Director Independence

|

39 |

|

Item 14.

|

Principal Accountants Fees and Services

|

40 |

|

Item 15.

|

Exhibits, Financial Statement Schedules

|

41 |

2

FORWARD LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, and Section 21E of the Securities Exchange Act of 1934. These statements relate to future events or our future financial performance. We have attempted to identify forward-looking statements by terminology including "anticipates", "believes", "expects", "can", "continue", "could", "estimates", "expects", "intends", "may", "plans", "potential", "predict", "should" or "will" or the negative of these terms or other comparable terminology. These statements are only predictions. Uncertainties and other factors may cause our actual results, levels of activity, performance or achievements to be materially different from any future results, levels or activity, performance or achievements expressed or implied by these forward-looking statements.

Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Our expectations are as of the date this Form 10-K is filed, and we do not intend to update any of the forward-looking statements after the filing date to conform these statements to actual results, unless required by law.

3

PART I

In this annual report, unless otherwise specified, all dollar amounts are expressed in United States Dollars. As used in this annual report, the terms "we", "us", "our company", mean HQ Global Education Inc., a Delaware corporation. In addition, references to our "financial statements" are to our consolidated financial statements except as the context otherwise requires.

Except as otherwise indicated by the context, the abbreviations used in this report have the following meanings:

|

|

*

|

"Green Star" refers to Green Star Mining Corp., a Delaware corporation;

|

|

|

*

|

"Risetime" refers to Risetime Group Limited, a British Virgin Islands corporation that is wholly-owned by Green Star;

|

|

|

*

|

"Global Education" refers to Global Education International Limited, a Hong Kong corporation that is wholly-owned by Risetime;

|

|

|

*

|

"WFOE" refers to Xiangtan Nicestar Business Administration Co., Ltd, our wholly-owned Chinese subsidiary;

|

|

|

*

|

"Oya" refers to Hunan Oya Education Technology Co., Ltd;

|

|

|

*

|

"Nicestar" refers to Nicestar International Limited, a British Virgin Islands corporation that was the former shareholder of Risetime prior to the reverse acquisition;

|

|

|

*

|

"Securities Act" means the Securities Act of 1933, as amended;

|

|

|

*

|

"Exchange Act" means the Securities Exchange Act of 1934, as amended;

|

|

|

*

|

"RMB" means Renminbi, the legal currency of China;

|

|

|

*

|

"U.S. dollar", "$" and "US$" mean the legal currency of the United States;

|

|

|

*

|

"China" and "PRC" refer to "People's Republic of China".

|

OVERVIEW

HQ Global Education Inc. (the "Company", "we", "us" or "our") is a Delaware corporation incorporated on January 22, 2008. We are headquartered in Hunan Province, China. Currently, the Company's common stock is trading on the Over-the Counter Bulletin Board under the ticker HQGE.OB.

We provide vocational education and vocational training services to a varied student population throughout China. We generate revenue from tuition, school logistics services, and off-campus internship management fees. Our services are developed with many target employers to provide them with the skilled workers they require. As a consequence, 100% of our graduates obtain jobs with our cooperative companies. We offer a wide range of educational programs and services through vocational schools, consisting primarily of "Customized Education" programs for various vocational skills and school logistic services and have a 100% graduation rate. We provide educational services under our "HQ" brand. We believe our "HQ" brand is a famous brand in China's private vocational education sector, as evidenced by awards we received from many government authorities and semi-government entities, including the title of "State-level Key Secondary Vocational Schools" granted by the Ministry of Education of the People's Republic of China, and the title of "Famous Non-government Funded School" and the "Entity with Outstanding Contributions" granted by the Chinese People's Political Consultative Conference (the "CPPCC").

Since we started operations in 1994, we have had approximately 115,270 cumulative student enrollments. For the twelve months ended August 31, 2011, we had 15,118 newly-enrolled students. We deliver our educational programs to students through eleven schools and have approximately 3,070 faculty members as of August 31, 2011.

We have experienced significant growth in our business in recent years. For the year ended August 31, 2011, our total revenue was $55,572,631, representing an increase of $8,517,325 or 18.1% as compared with $47,055,306 for the year ended August 31, 2010. Our gross profit for the year ended August 31, 2011 was $21,283,067, representing an increase of $3,351,280 or 18.7% as compared with $17,931,787 for the prior year. For the years ended August 31, 2011 and 2010, net revenues from our "Customized Education" accounted for 15.5% and 13.0%, respectively. Our net income increased from $13,569,003 for the year ended August 31, 2010 as compared to $16,763,394 for the year ended August 31, 2011, demonstrating an annual growth rate of 23.5%.

OUR CORPORATE HISTORY AND STRUCTURE

Mr. Guangwen He, our President and Chief Executive Officer, established Ningxiang Huanqiu Computer Training School (the predecessor of Changsha Huanqiu) in Ningxiang County, Changsha, China in August 1994 to offer computer training services. Since its inception, Changsha Huanqiu has grown rapidly and transformed itself from primarily a computer training school to a comprehensive provider of vocational education , skill training services, and a wide range of educational services and products to a variety of students throughout China. Mr. He established Shaoshan Huanqiu in Shaoshan City on May 15, 2006 to provide secondary vocational education and training services.

4

Risetime Group Limited ("Risetime") was incorporated in the British Virgin Islands on December 17, 2007. Global Education International Limited ("Global Education") was incorporated under the laws of Hong Kong on November 15, 2007. Global Education became the wholly owned subsidiary of Risetime on July 31, 2009. Global Education formed Xiangtan Nicestar Business Administration Co., Ltd. as a wholly foreign owned enterprise ("WFOE") under the laws of the PRC on September 30, 2009.

Hunan Oya Education Technology Co., Ltd ("Oya"), the operating company in the PRC, was organized under the laws of the PRC in November 20, 2008 and is directly owned by Mr. Guangwen He and Mrs. Yabin Zhong.

Under the laws of the PRC, a foreign (non-PRC) company cannot acquire Oya directly. As a result, WFOE entered into a series of contractual agreements with Oya, which we believe gives us effective control over Oya. These agreements are described in detail under the section "Contractual Arrangements between WFOE, Oya and its Shareholders".

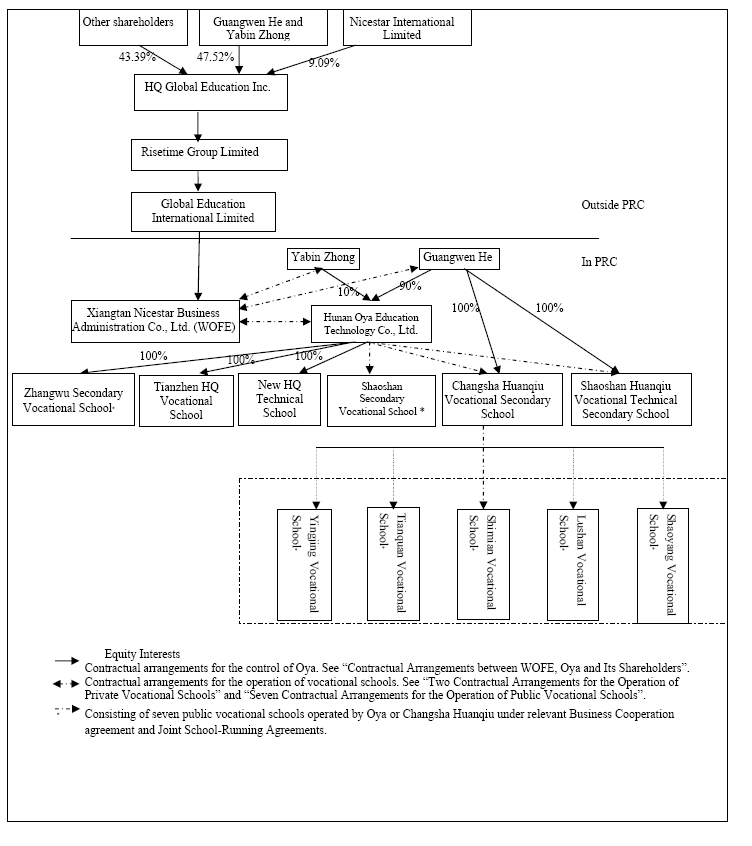

We operate four private secondary vocational schools (Changsha Huanqiu Vocational Secondary School (“Changsha Huanqiu”), Shaoshan Huanqiu Vocational Technical Secondary School (“Shaoshan Huanqiu”), New HQ Technical and Tianzhen Huanqiu Vocational Secondary School(“Tianzhen Huanqiu”)) and two public secondary vocational school (Shaoshan Vocational School, Zhangwu Vocational Secondary School ) in China through Oya. Changsha Huanqiu and Shaoshan Huanqiu are owned by Mr. Guangwen He. New HQ Technical, Tianzhen Huanqiu and Zhangwu are directly owned by Oya. Through Changsha Huanqiu, we operate five public secondary vocational schools, Yingjing Vocational School, Tianquan Vocational School, Shimian Vocational School, Lushan Vocational School and Shaoyang Vocational School. For a description of these arrangements, see " Two Contractual Arrangements for the Operation of Private Vocational Schools" and " Seven Contractual Arrangements for the Operation of Seven Public Vocational Schools".

REVERSE ACQUISITION

On February 8, 2010, Green Star entered into a Share Exchange Agreement with Risetime, and its sole shareholder, Nicestar International Limited ("Nicestar"), a British Virgin Islands company (the "Share Exchange Agreement"). Pursuant to the Share Exchange Agreement, Nicestar agreed to transfer all of its shares of the capital stock of Risetime, in exchange for 20,500,000 newly issued shares of Green Star's common stock that would, in the aggregate, constitute 62.12% of Green Star's issued and outstanding capital stock as of and immediately after the consummation of the transactions contemplated by the Share Exchange Agreement. Upon the consummation of the reverse acquisition, Nicestar becomes Green Star's controlling stockholder.

As a result of the reverse acquisition, Green Star acquired 100% of the capital stock of Risetime and consequently, control of the business and operations of Risetime and its affiliated entities. Prior to the reverse acquisition, Green Star was in the development stage engaged in the acquisition and exploration of mining properties and had not yet realized any revenues from operations. From and after the closing of the Share Exchange Agreement, Green Star's primary operations consist of the business and operations of Risetime, which are conducted by Oya and its affiliated entities.

Upon the closing of the reverse acquisition, On February 11, 2010, Green Star's sole director and officer, Mr. Yi Chen, submitted his resignation letter pursuant to which he resigned, effective immediately, from all offices of Green Star that he held and from his position as Green Star's director. Simultaneously, five new directors were appointed, including three independent directors. Mr. Guangwen He was appointed as our Chief Executive Officer and Chairman of the Board at the closing of the reverse acquisition.

The structure after the reverse acquisition is illustrated as below:

5

6

We changed our name from Green Star Mining Corp. to HQ Global Education Inc. pursuant to the Amended and Restated Certificate of Incorporation filed with the Secretary of State of State of Delaware on February 24, 2010, which has been approved by FINRA as of March 22, 2010. We have also been granted a new symbol ("HQGE") on the OTC Bulletin Board.

Effective March 22, 2010, we changed our fiscal year end to August 31 from our former fiscal year end of February 28.

Following the reverse acquisition, we, through our Chinese consolidated entities, provide vocational education and vocational skill training services to a variety of students throughout China. Our executive office is located at 27th Floor, BOBO Fortune Center, No.368, South Furong Road, Changsha City, Hunan Province, PRC, 410007, our telephone number is (86 731) 8887 3727, and our fax number is (86 731) 8871 9797. Our website is www.hq-education.com. Information on our website or any other website is not a part of this annual report.

CONTRACTUAL ARRANGEMENTS BETWEEN WFOE, OYA AND ITS SHAREHOLDERS

We have been and are expected to continue to be dependent on Oya to operate our education business until we qualify for direct ownership of an education business in China under PRC laws and regulations and acquire Oya as our direct, wholly-owned subsidiary. Through our Chinese subsidiary, WFOE, we have entered into a series of contractual arrangements with Oya and its shareholders which

enable us to:

|

*

|

exercise effective control over Oya;

|

|

*

|

receive a substantial portion of the economic benefits from Oya in consideration for the services provided by our wholly-owned subsidiary in China; and

|

|

*

|

have an exclusive option to purchase all or part of the equity interests in Oya when and to the extent permitted by PRC law.

|

EXCLUSIVE BUSINESS COOPERATION AGREEMENT. Through our wholly-owned Chinese subsidiary, WFOE, we have entered into an Exclusive Business Cooperation Agreement with Oya. The Exclusive Business Cooperation Agreement has an initial term of ten years and will be renewed upon WFOE's written consent. Under this agreement, WFOE provides comprehensive technical support, teaching support and relevant consulting services to Oya. As consideration for such services provided by WFOE, Oya will pay monthly service fee to WFOE equal to 100% of the monthly net income of Oya. Through the two parties' negotiation and with the prior written consent of WFOE, the monthly service fees may be adjusted based on the actual services provided by WFOE and the actual business demands of Oya.

LOAN AGREEMENTS. Under the Loan Agreements, WFOE will make loans in the aggregate principal amount of RMB 130 million (approximately $19 million) to the shareholders of Oya, each shareholder receiving a share of the loan proceeds proportional to its ownership percentage in Oya. WFOE agrees to grant loans to the shareholders of Oya within 20 days after receiving written drawdown notice from the shareholders. The terms of these loans are 10 years and may be extended with the consent of the parties. These loans do not bear interest.

PROXY LETTERS. On November 28, 2009, each of the shareholders of Oya executed a Proxy Letter. Under the Proxy Letters, Mr. Guangwen He and Ms. Yabin Zhong each irrevocably entrusted WFOE with the right to act as his/her proxy and vote all of his/her equity interests in Oya. Each of the Proxy Letters will remain effective as long as Mr. He or Ms. Zhong remains a shareholder of Oya.

EXCLUSIVE PURCHASE OPTION AGREEMENTS. Under the Exclusive Purchase Option Agreements dated November 28, 2009 among WFOE, Oya and the shareholders of Oya, the shareholders granted WFOE an irrevocable and exclusive right to purchase all or part of their equity interests in Oya. The purchase option may be exercised by WFOE in its sole discretion at any time that the exercise would be permissible under PRC laws, and the total purchase price for the WFOE's acquisition of the entitle equity interests of Oya is RMB (Y)20 (equivalent to $3.0), subject to necessary adjustment under applicable PRC laws at the time when such share transfer occurs. The terms of these agreements are 10 years and may be extended at the option of WFOE. The Exclusive Purchase Option Agreements contain agreements from Oya and its shareholders that they will refrain from taking some actions without the prior written consent of WFOE, such as amending the bylaws of Oya, increasing or reducing the registered capital of Oya, or declaring dividends of Oya.

EQUITY PLEDGE AGREEMENTS. Pursuant to the Equity Pledge Agreements dated November 28, 2009 between WFOE and the shareholders of Oya, each shareholder agreed to pledge his or her equity interest in Oya to WFOE to secure the performance of the shareholders' obligations under the Loan Agreements. Under the Equity Pledge Agreements, each of the shareholders has agreed not to transfer or create any encumbrance on his or her equity interest in Oya without the prior written consent of WFOE.

7

TWO CONTRACTUAL ARRANGEMENTS FOR THE OPERATION OF PRIVATE VOCATIONAL SCHOOLS

BUSINESS COOPERATION AGREEMENTS. On July 28, 2009, Oya entered into Business Cooperation Agreements with Changsha Huanqiu and Shaoshan Huanqiu respectively, which are our consolidated private schools owned by Mr. Guangwen He. Each Business Cooperation Agreement has a term of fifteen years, which may be extended with the written consent of the parties thereto. Under these agreements, Oya agreed to provide comprehensive and exclusive technical support, business support and relevant consulting services to the two private schools, including but not limited to making diversified investments, formulating student enrollment policies and financial policies, and authorizing the schools to use the "HQ" brand. Meanwhile, all revenues of these two schools belong to Oya; Oya has the right to distribute their profits, to appoint all their senior management and to dispose the net assets of these two private schools.

SEVEN CONTRACTUAL ARRANGEMENTS FOR THE OPERATION OF PUBLIC VOCATIONAL SCHOOLS

JOINT SCHOOL-RUNNING AGREEMENT WITH RESPECT TO SHAOSHAN VOCATIONAL SCHOOL. On March 30, 2009, Oya entered into a Joint School-Running Agreement with the People's Government of Shaoshan City for the joint operation of Shaoshan Vocational School. The term of the joint operation is 20 years, from April 8, 2009 to June 30, 2029. Under this agreement, Oya has the right to run and manage Shaoshan Vocational School, to appoint personnel, to accumulate working capital and to distribute profits during the term of the joint operation.

JOINT SCHOOL-RUNNING AGREEMENT WITH RESPECT TO YINGJING VOCATIONAL SCHOOL. On May 9, 2005, Changsha Huanqiu entered into a Joint School-Running Agreement with Yingjing Vocation School. The Education Bureau of Yingjing City is an intermediary to this agreement. The term of the joint operation is 15 years, from April 30, 2005 to April 30, 2020. During the term of the joint operation, Changsha Huanqiu has the right to run and manage Yingjing Vocational School and to accumulate working capital.

JOINT SCHOOL-RUNNING AGREEMENT WITH RESPECT TO TIANQUAN VOCATIONAL SCHOOL. On February 20, 2006, Changsha Huanqiu entered into a Joint School-Running Agreement with the Education Bureau of Tianquan County. The term of the joint operation is 15 years, from February 20, 2006 to July 15, 2021. During the term of the joint operation, Changsha Huanqiu has the right to run and manage Tianquan Vocational School, to accumulate working capital and to distribute profits.

JOINT SCHOOL-RUNNING AGREEMENT WITH RESPECT TO SHIMIAN VOCATIONAL SCHOOL. On January 23, 2006, Changsha Huanqiu entered into a Joint School-Running Agreement with the Education Bureau of Shimian County. The term of the joint operation is 15 years, from January 23, 2006 to July 30, 2021. During the term of the joint operation, Changsha Huangqiu has the right to run and manage Shimian Vocational School, to accumulate working capital and to distribute profits.

JOINT SCHOOL-RUNNING AGREEMENT WITH RESPECT TO LUSHAN VOCATIONAL SCHOOL. On May 18, 2006, Changsha Huanqiu entered into a Joint School-Running Agreement with the Education Bureau of Lushan County. The term of the joint operation is 15 years, from May 18, 2006 to July 30, 2021. During the term of the joint operation, Changsha Huanqiu has the right to run and manage Lushan Vocational School, to accumulate working capital and to distribute profits.

JOINT SCHOOL-RUNNING AGREEMENT WITH RESPECT TO SHAOYANG VOCATIONAL SCHOOL. On January 25, 2008, Changsha Huanqiu entered into a Joint School-Running Agreement with the People's Government of Shaoyang County. The term of the joint operation is 18 years, from January 25, 2008 to January 24, 2026. During the term of the joint operation, Changsha Huanqiu has the right to run and manage Shaoyang Vocational School, to appoint personnel, to accumulate working capital and to distribute profits.

JOINT SCHOOL-RUNNING AGREEMENT WITH RESPECT TO ZHANGWU SECONDARY VOCATIONAL SCHOOL. On July 13, 2011, Oya entered into a Joint School-Running Agreement with the People's Government of Zhangwu County. The term of the joint operation is 30 years, from July 20, 2011 to September 1, 2041. During the term of the joint operation, Oya has the right to run and manage Zhangwu Vocational Secondary School, to appoint personnel, to accumulate working capital and to distribute profits.

EDUCATION INDUSTRY AND MARKET OPPORTUNITY IN CHINA

Reflecting the magnitude of the overall population, the size of the education and training market in China is the largest in the world and growing rapidly. According to the World Bank Study which was issued on June 19, 2007, among China's approximately 1.3 billion population, around 260 million are students enrolled in basic, secondary and higher education programs and an additional 68 million adults are enrolled in a variety of other education and training programs. Education spending in China is expected to grow rapidly as demand for more skilled labor force grows and the participation rate in the educational system increases consequently. The growth in educational spending will likely be driven by several factors, including favorable demographic trends, growth in per capita and disposable income, the limited supply of educational resources and growing demand and government initiatives.

In 1986, the PRC government implemented a system of compulsory education that requires each child to have at least nine years of formal education. When students finish the nine-year compulsory education, they have two educational options: (a) high schools or (b) secondary vocational schools. High school graduates also have two educational options: (a) bachelor degree colleges and (b) higher vocational schools. Secondary vocational school students can be admitted to higher vocational schools if they pass the required tests. Higher vocational school students can be admitted to bachelor degree colleges if they pass the required tests.

8

China has one of the fastest growing economies in the world. As China's economy continues to expand, the demand for skilled workers will increase. There is a wide-spread shortage of senior blue collar workers in China. In the Yangtze River Delta, Pearl River Delta and some coastal areas, many enterprises operations suffer from a shortage of skilled workers. In some instances, factories have to be shut down due to the lack of qualified skilled workers.

Secondary vocational schools that train skilled workers have witnessed great booms and their graduates are in high demand. Many large companies establish cooperative relationship with vocational schools, paying a fee to schools to train their workers or rely heavily on these schools for recruitment of skill workers.

Vocational education has also gained support from the Chinese government. The Chinese government believes that there should be more vocational schools and graduates than degree colleges and graduates for the overall expansion of China's economy. All levels of government are required to speed up the development of vocational education system in their respective regions. In 2005, the State Council issued THE DECISION ON PROMOTING THE VOCATIONAL EDUCATION, which sets the state policy to speed up the development of secondary vocational education. Moreover, vocational education has been listed as one of major development objectives in the Eleventh Five-year Development Plan of China. More information is available at http://english.gov.cn/2005-10/11/content_76462.htm.

OUR STRENGTHS

We believe that the following competitive strengths contribute to our success and differentiate us from our competitors:

WELL RECOGNIZED VOCATIONAL EDUCATION BRAND IN CHINA. With a 17-year history, our"HQ" brand is a well-recognized brand in China. We have received numerous awards and recognitions. For example, Changsha Huanqiu has been granted the title of "State-level Key Secondary Vocational Schools" by the Ministry of Education of the People's Republic of China; Tianquan Vocational School and Shaoshan Vocational School have been awarded as "Provincial Key Schools" by the Department of Education of Sichuan Province and Hunan Province, respectively; Changsha Huanqiu has been granted the title of "Famous Non-government Funded School" and the "Entity with Outstanding Contributions" by the Chinese People's Political Consultative Conference (the "CPPCC"); and the title of "Outstanding School-running Entity" by Hunan Provincial Government. Furthermore, the achievements of the Company have been widely reported by news media, such as CCTV, the People's Daily, Guangming Daily, Hong Kong Wenhui Daily, and Gov.cn, the Chinese Central Government's Official Web Portal. We believe that our established "HQ" brand allows us to further expand our market share in existing markets and target new markets and areas of vocational education.

SUCCESSFUL ORDER-ORIENTED EDUCATION MODE. Order-oriented Education, or "Customized Education", is essential to the success of the Company. Order-oriented Education refers to the educational program that tailors vocational education and training via cooperation agreements between us and various enterprises. Under Order-oriented Education, we design and offer courses to meet the specific needs of target employers. We first try to understand the requirements of the industry, such as the specific skills and the number of potential employees that are needed, and sign cooperation contracts with the enterprises. "Order-oriented Education" reflects the resource sharing between schools and enterprises. It benefits our students in their job hunting endeavors after graduation. As a consequence, student recruitment witnessed a significant expansion in recent years for our eleven schools, and up to the twelve months ended August 31, 2011, the employment rate remained 100% for the students who graduated from our educational programs. We set up cooperative relationships with 128 enterprises as of August 31, 2011, to carry out the customized training program.

EXTENSIVE PROGRAM AND SERVICE OFFERINGS. We offer a wide range of educational programs and services to a varied student population with diverse career development needs. Our offerings primarily consist of various levels and types of vocational training programs for graduates from junior secondary schools, high schools and colleges, unemployed people and rural labor force, customized

pursuant to the need and requirement of our cooperating enterprises. As ofAugust 31, 2011, we had the following 17 categories of programs available forenrollment: Mould Design and Manufacture, Numerical Control Technology, Computerand Computer Application, Computer Information Management, Computer SoftwareEngineering, Computer-aided Design, Computer Repair and Maintenance, Computer Network Engineering, Apparel Design and Technique, Electronic Commerce, Accounting, Tour and Hotel

Management, Secretary, Electronic Technology Application, Electronic & Electrical, International Trade and Electromechanical Integration. These 17 categories include about sixty programs. We believe the breadth and the diversity of our programs and services increase our addressable markets and enhance our overall revenue stability.

9

BROAD NATIONAL SCALE AND NETWORK. We have a broad national scale and network as compared to other providers of vocational educational services in China. We deliver our educational programs and services through a physical network of eleven schools, located in Hunan Province, Sichuan Province and Shanxi Province, as of August 31, 2011. We typically locate our schools in and around selected area with large amount of labor force supply. We believe this strategy allows us to leverage the geographic difference of labor force supply and efficiently attract prospective students.

SUCCESSFUL TRACK RECORD. We were founded in 1994 by our Chairman and Chief Executive Officer, Guangwen He. Since then, we have developed ourselves from a single school to educational group providing a wide range of educational programs and services to a varied student population with diverse career development needs in China. We have demonstrated significant growth in our business since our inception, especially in recent years. Our school network increased from one schools in 1994 to eleven schools as of August 31, 2011. The number of students increased from 34,000 for the year ended August 31, 2005 when we operated one vocational school, to approximately 115,270 for the eleven schools we operated during the year ended August 31, 2011. Our total net income increased from $13,569,003 for the year ended August 31, 2010 as compared to $16,763,394 for the year ended August 31, 2011, representing an increase of $3,194,391 or 23.5%.

EXPERIENCED MANAGEMENT TEAM WITH A PASSION FOR EDUCATION. Our board members have an average of approximately 17 years of experience in the education industry. Our senior management team is committed to and passionate about education. They are familiar with the vocational education sector and relevant regulatory environment in China and continue to be actively involved in our management and strategic planning. In particular, Mr. Guangwen He, our Chairman and Chief Executive Officer, is a renowned expert in vocational education with over 17 years of experience in the education industry and is a leader in the vocational education community in China. He has served as director of the Association for Non-Government Education of China, vice president of Association for Non-Government Education of Hunan Province, vice president of Association for Non-Government Education of Changsha City, and vice president of the Education, Science, Culture and Health Board of 10th Changsha CPPCC. He has been selected as an Expert Enjoying Special Government Allowances of the State Council. We believe that our management team's passion for education and extensive experience in the vocational education sector and relevant regulatory environment in China have enabled us to successfully manage our operations and growth, promote our brand and achieve our goals.

OUR GROWTH STRATEGY

Our goal is to grow rapidly as a leading provider of vocational educational services in China. We intend to leverage our brand and national network to achieve our goal by pursuing the following strategies:

EXPAND CAPACITY OF OUR CURRENT CAMPUSES AND IMPROVE OUR QUALITY OF TEACHING. We expect to build new teaching facilities and purchase new equipments to make the full capacity of our existing schools with a growth rate of 30%. In the meanwhile, we will improve the professional skills of our faculty team via training programs and hiring more high quality teaching staff, to ensure the professional skills of our students can meet the requirement of our enterprise clients. We also expect to reinforce our internal control, especially our decision making process and cost control and performance assessment, to maximize our work efficiency.

STRENGTHEN OUR COOPERATION WITH ENTERPRISES. We will fully utilize our educational resources and try to keep 100% student employment rate. With the increase in student enrollment, more students will be arranged to work off-campus for our cooperative companies during winter and summer vacations. This will result in the increase in our revenue of such kind of service both for enterprises and our students. Our target is to increase the number of the enterprises which have cooperation relationships with us from 128 currently to 200 in the near future; especially the world top 500 enterprises are preferred.

INTEGRATE EDUCATIONAL RESOURCES AND FORM TEN BUSINESS DIVISIONS. To achieve stable, sustainable and fast development, the Company has formed ten business divisions to integrate market educational resources by the end of fiscal year 2010. Each division has an experienced manager responsible for its operation and will complete its integration in the fiscal year 2012. We will start to assess the performance of these ten business divisions in the fiscal year 2012 and expect to see their great vitality in the reports for the fiscal year 2012. These business divisions are as follows: secondary vocational education division, remote network education division, vocational certification division, short-term training division, human resources division, pre-school education division, campus services division, teaching materials development and marketing division, continuing education division and order-oriented education division.

ENHANCE BRAND IMAGE BUILDING. To seek sustainable development, we will enhance image building of our brand and create distinctiveness of our brand. Management believes this is essential for a stable long-term growth. We will see continuous improvement in the core capacity of our management, marketing and auditing teams as well as in our overall business capability.

10

OUR NETWORK

As of August 31, 2011, we deliver our education programs and services to students through a network of eleven schools, five of which are in Hunan province, four are in Sichuan province, one is in Shanxi province and the other one is in Liaoning province and we have enrolled students in 25 provinces across China.

In addition, as we have had about 115,270 student enrollments since our inception, we have an extensive network of students and alumni. This network has been essential in promoting our brand and our programs, services and products by word-of-mouth referrals and through our students' and alumni's career achievements.

The following table sets forth information concerning our schools as of August 31, 2011.

|

Newly Enrolled Students during the

|

||||||

|

School

|

Location

|

year ended August 31, 2011

|

||||

|

Changsha Huanqiu and New HQ technical

|

Hunan Province

|

3,247 | ||||

|

Shaoshan Huanqiu

|

Hunan Province

|

2,238 | ||||

|

Shaoshan Vocational School

|

Hunan Province

|

580 | ||||

|

Shaoyang Vocational School

|

Hunan Province

|

713 | ||||

|

Tianquan Vocational School

|

Sichuan Province

|

966 | ||||

|

Shimian Vocational School

|

Sichuan Province

|

832 | ||||

|

Lushan Vocational School

|

Sichuan Province

|

630 | ||||

|

Yingjing Vocational School

|

Sichuan Province

|

785 | ||||

|

Tianzhen Huanqiu

|

Shanxi Province

|

5,127 | ||||

|

Zhangwu Vocational School

|

Liaoning Province

|

- | ||||

|

TOTAL

|

15,118

|

|||||

BUSINESS MODEL

ORDER-ORIENTED EDUCATION

Mr. Guangwen He is the founder and CEO of Oya, the principal of Changsha Huangqiu and Shaoshan Huanqiu. He has been engaged in vocational education since 1994. With 17 years' experience in education industry, Mr. He has become a renowned expert in vocational education. Since the publication of Mr. He's book on "order-oriented education" by Hunan Science and Technology Press in 2006, "Order-oriented Education" has become our main operation mode. Over the past years, we have witnessed a fast development through school-enterprise cooperation under our order-oriented education mode.

Order-oriented Education refers to the educational program that tailors vocational education and training via cooperation agreements between us and various enterprises. Under this model, we design and offer courses to meet the specific needs of target employers. We first try to understand the requirements of the industry, such as the specific skills and the number of potential employees that are needed and sign cooperation contracts with the companies. Our schools then customize the curriculum according to the specific requirements of target employers. At this stage, our revenue is derived from the students' tuition and is recognized proportionately within the semester.

In the winter and summer breaks, work-study programs, i.e. off-campus internships, are arranged for students. Our teachers work as the team leaders for these students who are sent to different companies in groups. Through such hands-on practice, students get familiar with the business requirements and the production process. They equip themselves with skills to meet the specific requirements of the target companies. As a result, students are competent for their future positions without further training once they graduate from our secondary schools.

For these kinds of internship arrangements, commissions are charged to the companies based on the number of students they receive, with a standard charge per student each time. We also obtain management fees from students with a fixed rate per student per month. Such revenue is recognized upon the completion of the internship arrangement. Upon graduation, eligible students are usually hired by the same companies for which they interned. In such instances, students will make a one-time payment to us for employment recommendations. Based on the majors we design and the number of students we offer, we collect commissions from recruiters for employment recommendation at different rates per person. We recognize such revenue upon the completion of all the services related to the employment.

To carry out the customized training program, we set up cooperative relationships with 128 enterprises including Fuji Xerox Technology (Shenzhen) Co., Ltd., Flextronics International (Zhuhai Doumen) Industrial Park, BYD Company Limited, Shenzhen Sanyo Huaqiang Laser Electronic Co., Ltd., Foxconn Technology Group, Olympus Shenzhen Industrial, Shenzhen Seg-Hitachi and NEC Wuxi Branch, among many others.

11

ORDER-ORIENTED EDUCATION FLOW CHART

|

Step I

|

Place Order

|

Employing enterprises sign an agreement on training with school (the "Training Order")

|

||

|

Step II

|

Set Tuition

|

The school applies to governmental pricing authority for approval of the tuition standard for new programs, if any, and to obtain tuition permission accordingly.

|

||

|

Step III

|

Establish Programs

|

The school establishes programs.

|

||

|

Step IV

|

Recruit students

|

The school recruits students independently, or Recruit Students via: (See Student Recruitment section for details) Government poverty relief offices Local Education authorities.

|

||

|

Step V

|

Students study in the school

|

Students take courses and receive trainings.

|

||

|

Step VI

|

Off-campus internships

|

Students are sent to various enterprises for internships, according to respective Training Order.

|

||

|

Step VII

|

Students return to school

|

Students return to school to take further professional courses, take the final exams and then graduate.

|

||

|

Step VIII

|

Students get employed

|

Enterprises choose graduates and sign employment agreements with them.

|

SCHOOL OPERATION

We operate schools in three basic modes described as follow:

AFFILIATED PRIVATE SCHOOLS. Oya operates four affiliated private vocational schools (Changsha Huanqiu, Shaoshan Huanqiu, New HQ Technical and Tianzhen Huanqiu) through contractual arrangements. For a description of these arrangements, see "Contractual Arrangements for the Operation of Two Private Vocational Schools".

JOINTLY-RUN PUBLIC SCHOOLS. Oya operates two public secondary vocational school (Shaoshan Vocational School and Zhangwu Secondary Vocational School) in China through contractual arrangements. Changsha Huanqiu operates five public secondary vocational schools, Yingjing Vocational School, Tianquan Vocational School, Shimian Vocational School, Lushan Vocational School and Shaoyang Vocational School through contractual arrangements. For a description of these arrangements, see "Two Contractual Arrangements for the Operation of Private Vocational Schools" and " Seven Contractual Arrangements for the Operation of Public Vocational Schools".

OTHER COOPERATIVE SCHOOLS. Changsha Huanqiu has contractual arrangements with several independent private or public schools. Through such arrangements, Changsha Huangqiu provides various services, typically including recruiting students, providing school facilities and providing faculty and management service. Changsha Huanqiu receives commissions from the cooperative schools. The current cooperative schools include Xiangtan Radio and Television University, Changsha University of Science and Technology, Hunan Normal University, Yiyang Radio and Television University.

OUR PROGRAMS AND SERVICES

We provide a wide variety of educational services intended to address the needs of employers and our students. We deliver education to our students both in traditional classroom settings and through field instruction.

MAIN TRAINING PROGRAMS

We offer a total of approximately 60 programs under 17 categories. Below is a list of our most-attractive key programs:

12

|

1.Mechanical Design and Manufacture

|

|

|

Length of Program: 3-4 years

Program objectives: To produce intermediate and senior technicians capable of computer-aided design, mechanical design and manufacture, equipment manufacture, maintenance, debugging and management.

Target Jobs: CAD/CAM design, production and equipment management in mechanical manufacture industry.

|

|

2. Mechanical Design and Automaton

|

|

|

Length of Program: 3-4 years

Training Objectives: To produce intermediate and senior technicians capable of modern mechanical manufacturing, basic automation theory, and design, manufacturing, control and management of modern mechanical equipment.

Target Jobs: Installation, debugging, maintenance and management of machinery for manufacturing enterprises, sale and manufacture of electromechanical equipment.

|

|

3.Numerical Control Technology

|

|

|

Length of Program: 3 years

Training Objectives: To produce senior technicians capable of NC principle, NC programming, NC processing, NC equipment operation, debugging, repair and technical management.

Target Jobs: NC programming, NC equipment operation, maintenance and technical management, NC design selling and after-sales service in manufacturing enterprises.

|

|

4.Mold Design And Manufacture

|

|

|

Length of Program: 3-4 years

Training Objectives: To produce senior technicians specializing in mold processing technique, mold fabrication and repair.

Target Jobs: Mold design, manufacture and repair, mold equipment installation, debugging, maintenance and management in industries of machinery, electronics, electric appliance, light industry and plastic.

|

13

|

5.Computer-aided Design And Manufacture

|

|

|

Length of Program: 2 years

Training Objectives: To produce senior technicians capable of CAD and CAM technologies.

Target Jobs: Computer-aided design and manufacturing of machinery, secondary development of mechanical CAD software and technical management.

|

|

6.Computer and Computer Application

|

|

|

Length of Program: 1-3 years

Training Objective: To produce technicians with a solid computer foundation and basic skills and specializing in computer repair and maintenance, network engineering, computer installation, debugging and software application on the front line of production and service.

Target Jobs: computer operation and management in enterprises and public service entities, and technicians in computer companies.

|

|

7.Electronic Technology Application

|

|

|

Length of Program: 1-3 years

Training Objectives: To produce technicians having a good command of fundamental theories and professional theories related to electronics and household electric appliances and having skills in electronic product application and repair.

Target Jobs: Technicians and technique designers of electronic product companies.

|

|

8.Electronic Commerce (Secretary)

|

|

|

Length of Program: 2 years

Training Objectives: To produce intermediate and senior technicians having a good command of office automation, secretarial skills and other professional skills.

Target Jobs: Secretaries in enterprises, public service entities, and financial institutions.

|

14

|

9.Apparel Design And Technique

|

|

|

Length of Program: 2 years

Training Objectives: To produce personnel specializing in clothing design, manufacturing and management.

Target Jobs: Apparel design, new product development, costume production technique and inspection in apparel enterprises.

|

MARKETING AND STUDENT RECRUITMENT

PROSPECTIVE STUDENTS

Our prospective students include graduates from junior secondary schools, high schools and colleges, unemployed people and the rural labor force. Currently, we have students coming from 25 provinces across China. Our students live in the dorms of the corresponding schools where they study. The average accommodation fee is RMB310 (approximately $47) per student each semester.

PROSPECTIVE EMPLOYERS FOR OUR GRADUATES

The prospective employers for our graduates include various types of enterprises, including both domestic companies and foreign companies in China, in the industries of electronics, computer, machinery, service, tourism and hotel management.

STUDENT RECRUITMENT

We believe prospective students are attracted to our schools due to our excellent brand name, the quality of our programs and the high employment rate of our graduates. We formulate our student recruitment plan based on the operation capacity of each school. We employ various marketing methods to attract students, including media advertisement, distribution of marketing materials and referrals of social celebrities, students, alumni and their parents and friends.

FACULTY

We believe that our faculty is critical to our success. As our teachers interact with our students on a daily basis, they are critical to maintaining the quality of our programs and services and to maintaining our brand and reputation. We seek to continue to hire teachers who have a strong command of the subject areas to be taught and meet our qualifications.

Our faculty members are required to undergo a job training period, during which they receive training in teaching skills and subject matter of relevant courses. We also provide various forms of continuing training, such as cross-subject training, expert seminar and practice in enterprises, so that our teachers can stay abreast of changes in industry requirements and student demands.

As of August 31, 2011, we have 3,070 faculty members in total, We engage 1,192 of the employees on a full-time basis and 1,778 on a part-time basis.

COMPETITION

The vocational education sector in China is rapidly evolving, highly fragmented and competitive, and we expect competition in this sector to persist and intensify. Most of our competitors focus on targeted markets, both in terms of the particular segments of students they aim to attract and the local markets in which they operate.

We compete with a number of PRC companies that sell educational services in the PRC. For example, we face nationwide competition for our computer courses from Xinhua Computer School, which offers computer-related courses in many cities in China. We face regional competition for our computer, electronic technique, and apparel-making programs from several competitors, such as Shandong Lanxiang Senior Technology School. We also face limited competition from many competitors that focus on providing vocational training courses in specific geographic markets in China.

We believe that the principal competitive factors in our markets include the following:

15

|

|

*

|

brand recognition;

|

|

|

*

|

employment rate for graduates;

|

|

|

*

|

overall student experience;

|

|

|

*

|

ability to effectively market programs, services and products to broad base of prospective students;

|

|

|

*

|

scope and quality of program, service and product offerings; and

|

|

|

*

|

alignment of programs, services and products catering to specific needs of students and employers.

|

We believe that our primary competitive advantages are our well-known "HQ" brand, our order-oriented education mode, our high employment rate of graduates, our close link with employers and the breadth and quality of our programs and services. However, some of our existing and potential competitors may have more resources than we do. These competitors may be able to devote greater resources to the development, promotion and sale of their programs, services and products of specific professional areas in specific geographic regions.

INTELLECTUAL PROPERTY

TRADEMARKS

We have registered two trademarks with the Trademark Bureau under the State of Administration for Industry & Commerce, PRC, as follows:

|

Trademarks

|

Registered Owner

|

Certificate No.

|

Valid Term

|

|||

|

Hunan Oya Education Technology Co., Ltd.

|

No.4025352

|

April 14, 2007 to April 13, 2017

|

|||

|

Hunan Oya Education Technology Co., Ltd.

|

No.3968713

|

April 28, 2007 to April 27,2017

|

DOMAIN NAMES

We have registered the following domain name: www.hq-education.com.

REPORTS TO SECURITY HOLDERS

We file annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to reports filed or furnished pursuant to Sections 13(a) and 15(d) of the Securities Exchange Act of 1934, as amended. You may read and copy any materials we file with the Commission at the SEC's website or by contacting the SEC's Public Reference Room at 100 F Street, NE., Washington, DC 20549, on official business days during the hours of 10 a.m. to 3 p.m. You may obtain information on the operation of the Public Reference Room by calling the Commission at 1-800-SEC-0330. In addition, the Commission maintains an Internet site that contains reports and other information regarding issuers that file electronically with the Commission and at HTTP://WWW.SEC.GOV. You may also obtain copies of reports filed with the SEC, free of charge, via a link included on our website at http://www.hq-education.com.

GOVERNMENT REGULATIONS

Because our principal operation is in the PRC, our business is regulated by the national and local laws of PRC. We believe our business is in compliance with existing PRC laws, rules and regulations.

We operate our business in China under a legal framework that consists of the State Council, which is the highest executive authority of the Chinese central government, and several ministries and agencies under its authority, including the Ministry of Education ("MOE"), the State Administration of Foreign Exchange ("SAFE"), the General Administration of Press and Publication ("GAPP"), the State Administration for Industry and Commerce ("SAIC"), the Ministry of Civil Affairs ("MCA"), and their respective authorized local counterparts.

REGULATIONS ON OPERATING PRIVATE SCHOOLS The PRC central government, through the Ministry of Education, manages education in the country at a macro level. The Ministry of Education is responsible for carrying out related laws, regulations, guidelines and policies of the central government; planning development of the education sector; integrating and coordinating nationwide educational initiatives and programs; and guiding education reform countrywide. Provincial governments are left to implement policies at the micro level on a day-to-day basis, by managing basic education through development of teaching plans to supplement the coursework required from the Ministry of Education and funding of basic education in poorer areas. Provincial level governments have the main responsibilities for implementing basic education on a day to day basis. Since 1978, the PRC government has promulgated a number of administrative regulations relating to education.

16

The principal regulations governing private education in China consist of the Education Law of China, the Vocational Education Law of China, the Law for Promoting Private Education (2003), the Implementation Rules for the Law for Promoting Private Education (2004) and the Regulations on Chinese-Foreign Cooperation in Operating Schools and the Implementing Rules for the Regulations on Operating Chinese-Foreign Schools. These regulations are summarized below.

EDUCATION LAW OF CHINA

The Education Law of China, or the Education Law, was enacted on March 18, 1995. The Education Law sets forth provisions relating to the fundamental education systems of China, including a system of pre-school education, primary education, secondary education and higher education, a system of nine-year compulsory education and a system of education certificates. The Education Law requires the government to formulate plans for the development of education and the establishment and operation of schools and other education institutions. In principle, enterprises, social organizations and individuals are encouraged to operate schools and other types of educational organizations in accordance with Chinese laws and regulations. Nevertheless, no school or any other educational institution may be established for profit-making purposes. However, private schools may be operated for "reasonable returns," as described in more detail below.

THE VOCATIONAL EDUCATION LAW

The Vocational Education Law of China, or the Vocational Education Law, was enacted on May 15, 1995. Under the Vocational Education Law, China encourages institutions, non-governmental organizations, other public organizations and individual citizens to establish vocational schools and vocational training institutions in accordance with relevant regulations. Measures for the establishment of vocational schools and vocational training institutions within Chinese territory by a foreign organization or individual shall be formulated by the State Council. The Vocational Education Law sets forth the basic conditions for the establishment of vocational schools and training institutions. The Vocational Education Law also sets forth provisions on the joint establishment and operation of vocational education schools and institutions. Our consolidated Chinese entity, Oya has entered into Joint School-Running Agreements with the People's Government of local cities for the joint operation of Shaoshan Vocational School and Zhangwu Secondary Vocational School. Changsha Huanqiu has entered into Joint School-Running Agreements with relevant government authorities for the joint operation of five public vocational schools, Yingjing Vocational School, Tianquan Vocational School, Shimian Vocational School, Lushan Vocational School and Shaoyang Vocational School.

THE LAW FOR PROMOTING PRIVATE EDUCATION (2003) AND THE IMPLEMENTATION RULES FOR THE LAW FOR PROMOTING PRIVATE EDUCATION (2004)

The Law for Promoting Private Education (2003) became effective on September 1, 2003, and its implementing regulations, the Implementation Rules for the Law for Promoting Private Education (2004), became effective on April 1, 2004. Under these regulations, "private schools" are defined as schools established by individuals or private social organizations using private funds. Private schools providing degree education, pre-school education, education for self-study aid and other academic education are subject to approval by the education authorities, while private schools engaging in occupational qualification training and occupational skill training are subject to approvals from the authorities in charge of labor and social welfare. An approved private school will be granted an operating permit, and it must be registered with the MCA or its local counterpart as a privately run non-enterprise legal person. Our private vocational schools, Changsha Huanqiu ,Shaoshan Huanqiu and Tianzhen Huanqiu, have obtained operating permits and have been registered with the relevant local office of the MCA.

The operation of private schools is highly regulated. For example, the types and amounts of fees charged by private schools offering certifications must be approved by the relevant governmental authority and be publicly disclosed, and the types and amounts of fees charged by private schools that do not offer certifications need only be filed with the relevant governmental authority and be publicly disclosed. Our consolidated private schools, Changsha Huanqiu, Shaoshan Huanqiu and Tianzhen Huanqiu, currently offer certifications to students, and the charged fees have been approved by the local price control administrations and publicly disclosed.

17

Private education is treated as a public welfare undertaking under the regulations. Nonetheless, investors in a private school may elect to require "reasonable returns" from the schools. Under the regulations, an election to establish a private school as one requiring reasonable returns must be made in the articles of association of the school. For schools that have made this election, the amount of reasonable return that can be distributed to investors each year is determined based on a percentage of the school's "operating surplus," which is equal to the school's annual net income less the aggregate amount of donations received, government subsidies, if any, the amount required to be reserved for the school's development fund and other expenses as required by the regulations. This percentage is determined by the school's board of directors, taking into consideration the following factors: (i) the school's tuition and other fees, (ii) the ratio of the school's expenses used for educational activities and improving the educational conditions to the total fees collected; and (iii) the school's admission standards and educational quality. Information relating to these factors must be publicly disclosed before the school's board determines the percentage of the school's annual net balance that can be distributed as reasonable returns. This disclosed information and the decision to distribute reasonable returns must also be filed with the approval authorities within 15 days from the decision made by the board. However, none of the current Chinese laws and regulations provides a formula or other guidelines for determining "reasonable returns." In addition, none of the current Chinese laws and regulations sets forth different requirements or restrictions on a private school's ability to operate its education business based on such school's status as a school that requires reasonable returns or a school that has not made this election.

At the end of each fiscal year, private schools are required to allocate a certain amount to their development fund for the construction and maintenance of the school and the procurement and upgrade of educational equipment. For private schools that require reasonable returns, this amount must be no less than 25% of the annual net income or the annual increase in the net assets of the school, while for other private schools, this amount must be no less than 25% of the annual increase in the net assets of the school, if any. Private schools that have not elected to require reasonable returns are entitled to the same preferential tax treatment as public schools. The regulations require that preferential tax treatment policies applicable to private schools requiring reasonable returns to be formulated by the finance authority, taxation authority and other authorities under the State Council, but to date no such regulations have been promulgated by the relevant authorities. Neither of our consolidated private schools is established as a school that requires reasonable returns. We may change the status of our consolidated private schools to schools requiring reasonable returns in future.

REGULATIONS ON CHINESE-FOREIGN COOPERATION IN OPERATING SCHOOLS Chinese-foreign cooperation in the operation of schools and training programs is specifically governed by the Regulations on Operating Chinese-Foreign Schools, issued by the State Council in 2003 and the Implementing Rules for the Regulations on Operating Chinese-Foreign Schools issued by the MOE in 2004 (the "Implementing Rules").

The Regulations on Operating Chinese-Foreign Schools and the Implementing Rules encourage substantive cooperation between overseas educational organizations with relevant qualifications and experience in providing high-quality education and Chinese educational organizations to jointly operate various types of schools in the PRC, with such cooperation in the areas of higher education and occupational education being encouraged. Chinese-foreign cooperative schools are not permitted, however, to engage in compulsory education and military, police, political and other kinds of education that are of a special nature in the PRC. Besides, foreign educational institutions, other organizations or individuals are prohibited from unilaterally establishing schools or other educational institutions providing education mainly to Chinese citizens within the territory

of China.

Permits for Chinese-foreign cooperation in operating schools must be obtained from the relevant education authorities or the authorities that regulate labor and social welfare in China. We have not applied for a permit for Chinese-foreign Cooperation in Operating Schools at this stage since all of our private schools are operated by Oya.

ENVIRONMENTAL REGULATIONS

Our operations are not subject to any environmental regulations.

EMPLOYEES

As of August 31, 2011, we employed a total of 3,070 employees. We engage 1,192 of the employees on a full-time basis and 1,778 on a part-time basis.

We consider our relations with our employees to be good. None of our employees is represented by a labor union.

Our employees in China participate in a state pension plan organized by Chinese municipal and provincial governments. We are required to make monthly contributions to the plan for each employee at the rate of 20% of his or her average monthly salary. In addition, we are required by Chinese law to cover employees in China with various types of social insurance. We believe that we are in compliance with the relevant PRC laws.

INSURANCE

Insurance companies in China offer limited business insurance products. While business interruption insurance is available to a limited extent in China, we have determined that the risks of interruption, cost of such insurance and the difficulties associated with acquiring such insurance on commercially reasonable terms make it impractical for us to have such insurance. As a result, we do not carry business interruption insurance.

18

As a "smaller reporting company", we are not required to provide the information required by this Item.

None.

LAND USE RIGHT

All land in PRC is owned by the government and cannot be sold to any individual or entity. Instead, the government grants landholders a "land use right" after a purchase price for such land use right is paid to the government. The land use right allows the holder to use the land for a specific period of time and the holder enjoys all the benefits incidental to land ownership.

We have obtained land use right to the following plots of lands:

|

Form of

|

Expiration

|

||||||||||

|

No. Certificate No.

|

User of the Land

|

Area (m2)

|

Acquisition

|

Date

|

Encumbrances

|

||||||

|

1

|

Shao Guo Yong (2010)

|

Oya

|

27,283

|

By Transfer

|

5/25/2060

|

N/A

|

|||||

|

No. 10091

|

|||||||||||

|

2

|

Shao Guo Yong (2009)

|

Oya

|

15,807.9

|

By Transfer

|

5/13/2059

|

N/A

|

|||||

|

No. 09130

|

|||||||||||

|

3

|

Ning (1) Guo Yong (2000)

|

Changsha Huanqiu

|

2,053.975

|

By Transfer

|

6/17/2049

|

Pledged to Ningxiang

|

|||||

|

No. 0050

|

County Lijingpu Credit

|

||||||||||

|

Union. Pledge Period:

|

|||||||||||

|

11/13/2008 - 11/13/2011

|

|||||||||||

|

4

|

Ning (1) Guo Yong (2000)

|

Changsha Huanqiu

|

3,935

|

By Transfer

|

3/18/2050

|

N/A

|

|||||

|

No. 0051

|

|||||||||||

|

5

|

Ning (1) Guo Yong (2000)

|

Changsha Huanqiu

|

1,388.65

|

By Administrative

|

N/A

|

N/A

|

|||||

|

No. 0124

|

Grant

|

||||||||||

|

6

|

Ning (1) Guo Yong (2002)

|

Changsha Huanqiu

|

15,124.8

|

By Transfer

|

10/23/2051

|

N/A

|

|||||

|

No. 159

|

|||||||||||

|

7

|

Ning (2) Guo Yong (2003)

|

Yabin Zhong*

|

228

|

By Transfer

|

12/31/2070

|

N/A

|

|||||

|

No. 2142

|

|||||||||||

|

8

|

Ning (2) Guo Yong (2008)

|

Yabin Zhong*

|

494.8

|

By Transfer

|

12/22/2059

|

N/A

|

|||||

|

No. 1226

|

|||||||||||

|

9

|

Ning (2) Guo Yong (2002)

|

Guangwen He *

|

192

|

By Transfer

|

10/30/2070

|

N/A

|

|||||

|

No. 1245

|

|||||||||||

|

10

|

Ning (1) Guo Yong (2000)

|

Hunan Changsha

|

629

|

By Transfer

|

3/13/2065

|

N/A

|

|||||

|

No. 0039

|

Binshan Industry

|

||||||||||

|

Co. Ltd. *

|

|||||||||||

|

11

|

Ning (1) Guo Yong (2000)

|

Hunan Changsha

|

3,550.15

|

By Transfer

|

9/5/2050

|

N/A

|

|||||

|

No. 0104

|

Binshan Industry

|

||||||||||

|

Co. Ltd. *

|

|||||||||||

|

12

|

Ning (2) Guo Yong (2002)

|

Guangwen He *

|

3,991.7

|

By Transfer

|

7/25/2052

|

||||||

|

No. 01035

|

The land use right of the plot of land affiliated to the building (Certificate No: Ning Fang Quan Zheng Li Jing Pu Zi No.00037613) has been pledged to Ningxiang County Lijingpu Credit Union. Pledge Period: 11/13/2008 - 11/13/2011

|

||||||||||

|

13

|

Tian Guo Yong (2011)

|

Oya

|

1

|

21,319

|

By Transfer

|

2061

|

N/A

|

||||

|

No.0305003

|

|||||||||||

19

* These properties are held on behalf of Changsha Huanqiu under the name of Guangwen He, Yabin Zhong or Hunan Changsha Binshan Industry Co. Ltd. (the "Binshan Company"). Binshan Company is owned by Yabin Zhong. On March 1, 2004, Changsha Huanqiu signed the Entrustment Agreement on Land and Real Properties with Guangwen He, Yabin Zhong and Binshan Company. This agreement stipulates that Changsha Huanqiu will from time to time authorize Guangwen He, Yabin Zhong and Binshan Company to invest in lands and properties in their names using funds from Changsha Huanqiu for the interest of Changsha Huanqiu, that Changsha Huanqiu holds all the rights to these properties, that upon Changsha Huanqiu's request, Guangwen He, Yabin Zhong and Binshan Company shall cause relevant authorities to register these properties in the name of Changsha Huanqiu, and that Guangwen He, Yabin Zhong and Binshan Company shall have no right to dispose or encumber these properties.

BUILDING OWNERSHIP

We have ownership of the following buildings:

|

No.

|

Certificate No.

|

Owner

|

Area (m2)

|

Encumbrances

|

||||

|

1

|

Ning Fang Quan

|

Ningxiang Huanqiu

|

1,659.13

|

N/A

|

||||

|

Zheng Li Jing

|

Computer Training

|

|||||||

|

Pu Zi No.00010484

|

School**

|

|||||||

|

2

|

Ning Fang Quan

|

Ningxiang Huanqiu

|

1,231.51

|

N/A

|

||||

|

Zheng Li Jing

|

Computer Training

|

|||||||

|

Pu Zi No.00010482

|

School**

|

|||||||

|

3

|

Ning Fang Quan

|

Ningxiang Huanqiu

|

1,144.78

|

N/A

|

||||

|

Zheng Li Jing

|

Computer Training

|

|||||||

|

Pu Zi No.00010483

|

School**

|

|||||||

|

4

|

Ning Fang Quan

|

Yabin Zhong*

|

624.36

|

N/A

|

||||

|

Zheng Li Jing

|

||||||||

|

Pu Zi No.00037614

|

||||||||

|

5

|

Ning Fang Quan

|

Yabin Zhong*

|

1056.12

|

N/A

|

||||

|

Zheng Li Jing

|

||||||||

|

Pu Zi No.00015919

|

||||||||

|

6

|

Ning Fang Quan

|

Yabin Zhong*

|

614.41

|

N/A

|

||||

|

Zheng Li Jing

|

||||||||

|

Pu Zi No.00015918

|

||||||||

|

7

|

Ning Fang Quan

|

Guangwen He*

|

3203.95

|

Pledged to Ningxiang County Lijingpu Credit Union.

|

||||

|

Zheng Li Jing

|

Pledge Period 11/13/2008 - 11/13/2011

|

|||||||

|

Pu Zi No.00037613

|

||||||||

|

8

|

Ning Fang Quan

|

Guangwen He*

|

1166.2

|

N/A

|

||||

|

Zheng Li Jing

|

||||||||

|

Pu Zi No.00037611

|

||||||||

|

9

|

Ning Fang Quan

|

Hunan Changsha Binshan

|

3155.95

|

Pledged to Ningxiang County Lijingpu Credit Union.

|

||||

|

Zheng Yu Tan

|

Industry Co. Ltd. *

|

Pledge Period 12/28/2010 - 12/28/2012

|

||||||

|

Zi No.00015465

|

||||||||

|

10

|

Ning Fang Quan

|

Hunan Changsha Binshan

|

2911.5

|

Pledged to Ningxiang County Lijingpu Credit Union.

|

||||

|

Zheng Yu Tan

|

Industry Co. Ltd. *

|

Pledge Period: 11/13/2008 - 11/13/2011

|

||||||

|

Zi No.00015466

|

||||||||

|

11

|

Ning Fang Quan

|

Hunan Changsha Binshan

|

2252.53

|

N/A

|

||||

|

Zheng Yu Tan

|

Industry Co. Ltd. *

|

|||||||

|

Zi No.00015467

|

||||||||

|

12

|

Ning Fang Quan

|

Hunan Changsha Binshan

|

825.77

|

N/A

|

||||

|

Zheng Yu Tan

|

Industry Co. Ltd. *

|