Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - FARMER BROTHERS CO | d271295d8k.htm |

| EX-99.1 - PRESS RELEASE - FARMER BROTHERS CO | d271295dex991.htm |

Exhibit 99.2

FARMER BROS. CO.

2011 Annual Stockholders Meeting

December 8, 2011

State of the Company Address (edited)

State of the Company Presentation by

Jeffrey A. Wahba, Interim Co-Chief Executive Officer, Chief Financial Officer and Treasurer

Patrick G. Criteser, Interim Co-Chief Executive Officer; President and Chief Executive Officer of Coffee Bean International, Inc.

1

2011 ANNUAL

PRESENTATION DECEMBER 8, 2011 |

Jeffrey Wahba: Welcome, everybody! Welcome to the Farmer Brothers’ Annual Meeting of Stockholders as we begin our 100th year. It’s hard to imagine that we’re here today to celebrate the 100th year of Farmer Brothers, which started in 1912, as well as conduct our 58th Annual Meeting of Stockholders.

My name is Jeff Wahba. I am an Interim Co-CEO of the Company along with Patrick Criteser, who is sitting right here. And I will chair the meeting this morning.

At this time, Patrick and I would like to discuss the Company related to our performance in FY ’11 and how we see the Company going forward. I’m pleased to welcome Patrick to the podium.

Patrick Criteser: Good Morning everyone! There’s no question that the Company has struggled over the last couple of years in terms of its financial performance. As we entered calendar year 2011, the Company was facing some significant challenges continuing with the integration of the acquisition of the Sara Lee Direct Store Delivery (DSD) Coffee Business as well as the significantly increased cost of our main raw material, coffee. The Company was facing a CEO transition and other challenges at that time. And certainly the Company’s financial performance was not meeting anyone’s expectations, and it was necessary for us to make some difficult choices with regard to cost cutting at that period in time.

The good news coming into fiscal 2011 was that the Company still had the fantastic products and services that it had had for decades and the strong customer relationships with over 60,000 customers. Most importantly, the Company’s more than 1,800 employees were as committed, dedicated and talented as ever. Those employees included many long-term Farmer Brothers’ employees as well as many that had come on board with the acquisitions that the Company had made, and some that had joined the Company more recently.

As we got together with the leadership team early in calendar year 2011, we worked with them to identify those key initiatives that we thought were going to make the most difference at the Company. The entire Company, all employees, have been working hard over the last year to bring the Company back to where they would like it to be. The good news is that although we have a lot of hard work left to do, we are starting to see that progress, and we’re going to talk about some of that.

So, what Jeff and I would like to do is to do an overview of the Company. We’ll talk a little bit about the market in which we’re competing, and we’ll also talk about the Company’s recent performance and how we’ve performed in relation to some of those initiatives that we laid out. Then we’ll take questions.

2

CAUTIONARY

STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

2

Certain

statements

contained

in

this

presentation,

including,

but

not

limited

to,

statements

regarding

the

development

and

growth

of

our

business,

our

intent,

belief

or

current

expectations,

primarily

with

respect

to

future

operating

performance

and

the

products

and

services

we

expect

to

offer

and

other

statements

contained

herein

regarding

matters

that

are

not

historical

facts

are

“forward-looking

statements”

within

the

meaning

of

federal

securities

laws

and

regulations.

These

statements

are

based

on

management’s

current

expectations,

assumptions,

estimates

and

observations

of

future

events

and

include

any

statements

that

do

not

directly

relate

to

any

historical

or

current

fact.

These

forward-looking

statements

can

be

identified

by

the

use

of

words

like

“anticipates,”

“feels,”

“estimates,”

“projects,”

“expects,”

“plans,”

“believes,”

“intends,”

“will,”

“assumes”

and

other

words

of

similar

meaning.

Owing

to

the

uncertainties

inherent

in

forward-looking

statements,

actual

results

could

differ

materially

from

those

set

forth

in

forward-looking

statements.

A

forward-looking

statement

is

neither

a

prediction

nor

a

guarantee

of

future

events

or

circumstances,

and

those

future

events

or

circumstances

may

not

occur.

Stockholders

and

other

readers

should

not

place

undue

reliance

on

the

forward-

looking

statements,

which

speak

only

as

of

December

8,

2011.

The

Company

undertakes

no

obligation

to

update

or

alter

any

forward-looking

statements,

whether

as

a

result

of

new

information,

future

events

or

otherwise,

except

as

required

by

the

federal

securities

laws.

Factors

that

could

cause

actual

results

to

differ

materially

from

those

in

forward-looking

statements

include,

but

are

not

limited

to,

our

ability

to

successfully

integrate

the

CBI

and

DSD

Coffee

Business

acquisitions,

fluctuations

in

availability

and

cost

of

green

coffee,

competition,

organizational

changes,

the

impact

of

a

weaker

economy,

business

conditions

in

the

coffee

industry

and

food

industry

in

general,

our

continued

success

in

attracting

new

customers,

variances

from

budgeted

sales

mix

and

growth

rates,

weather

and

special

or

unusual

events,

and

changes

in

the

quality

or

dividend

stream

of

third

parties’

securities

and

other

investment

vehicles

in

which

we

have

invested

our

assets,

as

well

as

other

risks

described

from

time

to

time

in

our

filings

with

the

Securities

and

Exchange

Commission. |

So, these words with which most of you are familiar say that any forward-looking statements that we make today should not be used as investment advice.

3

MISSION

“We sell great coffee, tea and culinary

products and provide superior service –

one customer at a time.”

3

VISION

“We will be the preeminent roaster and

distributor of coffee, tea and culinary products

in every key market in the United States.”

AT A GLANCE

1.

The country’s largest direct-store-delivery coffee company ($470M in FY11

revenue) 2.

Leading manufacturer, wholesaler and distributor of coffee, tea and culinary products

3.

Founded in Los Angeles in 1912, celebrating our 100th year anniversary

4.

Headquartered

in

Torrance,

CA,

operating

three

manufacturing

facilities

–

Torrance,

Houston

and

Portland

–

each

possessing

unique

production

capabilities

that

allow

us

to

access multiple segments of the foodservice and retail channels

COMPANY OVERVIEW |

The Company’s mission has not changed over its long history of success: great coffee, tea and culinary products and superior service.

Today we have the shared mission of becoming the preeminent roaster and distributor of coffee, tea and culinary products in the United States, notably in every key market in the United States with the Company’s current capabilities; and those capabilities include being a leading manufacturer, distributor and wholesaler of coffee, tea, and culinary products, and notably our DSD capability, which is now nationwide.

4

COFFEE AND TEA

MARKETS CONTINUE TO GROW 4

•

The

Foodservice

Coffee

&

Tea

industry

is

estimated

at

$42

billion

1

•

Dollar

sales

are

growing

+6%,

driven

by

1

:

•

Specialty Coffee +15%

•

Iced Tea +8%

•

The cost of coffee has increased approximately 80% in 18 months

•

Combined in-home and out-of-home coffee consumption has

recently increased and is now holding steady

2

•

Since 2004, past day coffee consumption has gone from 48% to 58%

•

3.4 cups/coffee drinker

•

Coffee and tea are 2nd only to carbonated soft drinks in US

consumption, and growing

3

1.

Mintel Coffee & Tea (2010)

2.

National Coffee Association Trends Report (2011)

3.

New York Times (July 2011) |

I’ll just take a quick step back and talk about the markets in which we’re competing. The foodservice coffee and tea industry is about a $42 billion industry. Although the recession has certainly hit our industry hard, this industry continues to be very large and, in fact, a growing industry with dollar sales growing at about 6 percent per year, driven largely by specialty coffee and iced tea. But, as you know, those product categories that drive the growth tend to change from time to time.

One of the challenges that we’re facing, which I referred to earlier, is the increase in coffee cost. Coffee has increased – although it’s off its high now – about 80 percent from where it was 18 months ago. So you can imagine the challenges that coffee costs presented to our company as well as to the rest of the industry.

The good news is that combined in-home and out-of-home coffee consumption is up. It flattened a little bit recently, but since 2004, the percentage of consumers that say they consumed a cup of coffee yesterday has gone from 48 percent to 58 percent. So, we’re still in a good market and in a good position in that market. In fact, coffee and tea are second only to carbonated drinks.

5

5

5 POINTS OF DIFFERENTIATION

Our products include coffee and tea, along

with a diverse selection of culinary

products and other hot and cold beverages.

Nearly 3 million square miles of direct and

multi-channel distribution.

Deep, long lasting connections in coffee,

tea and spices, combined with strong co-

packing supplier partnerships in our other

categories.

We own and operate responsive

nationwide equipment service coverage

24/7/365.

Our high touch service model allows

63,000 foodservice customers to operate

their business more efficiently. |

So, here’s some context for the Company’s competitive environment. The Company today has lots of points of differentiation. Our coffee, tea and culinary products are of high quality and consistency, and have been for almost a hundred years. This is a key point of differentiation. Our delivery capability in virtually the entire United States today, as well as, our longstanding relationships in terms of coffee procurement, co-packers and tea procurement, are also key points of differentiation.

Equipment is an important part of our business. As many of you that have worked at the Company know, we provide not just coffee but a coffee service. And a key component of that coffee service is the equipment and the equipment service that goes along with that.

Most notably, in terms of our points of differentiation, our competitive advantage lies in our service. We have direct one-on-one relationships with customers throughout almost every local market in the United States today. And that is a huge competitive advantage for the Company.

6

BUSINESS

UNITS Farmer Brothers roasts and distributes coffee,

tea and culinary solutions such as spices, soup

bases and salad dressings through direct store

delivery and broad line distribution.

Coffee Bean International, an independent,

wholly-owned subsidiary of Farmer Brothers, is

one of the nation’s leading specialty coffee

roasters, focusing on private brand retail

programs.

Custom Coffee Plan is a division of

Farmer Bros. Co., an established leader in

coffee service supplying business and

hospitality venues within its operating regions.

Spice Products Company is an industrial spice

ingredients supplier which brings one of the highest

levels of quality and consistency to the foodservice

and industrial food manufacturing industries.

6 |

We operate four business units with various degrees of integration and with increasing integration over the last couple of years. The lion’s share of our revenues and most of our profits come from the Farmer Brothers’ DSD Business for coffee, tea and culinary products. We also have: Coffee Bean International (CBI), one of the nation’s leading specialty coffee roasters, that focuses primarily on private label grocery and foodservice customers, our Custom Coffee Plan business, which is an office coffee service that represents a significant opportunity for the Company going forward, and our Spice Products Company, which is an industrial spice business that matches nicely with the other Farmer Brothers businesses.

7

WHO WE ARE (IN

COFFEE) 7

TODAY

Traditional, Premium & Specialty Coffees

PRE 2007

Only Traditional Coffee

Three roasting facilities; DSD distribution in 48 states

West Coast primarily

Multiple brands:

–

Farmer Brothers

–

Superior

–

Coffee Bean International

–

Panache

One brand: Farmer Brothers

–

Prebica

–

Cain’s

–

Metropolitan

2010

Vendor

of

the

Year

for

both

Sheetz,

Inc.

&

Target

Corporation

Known primarily for supplying

small operators

Industry

leading

coffee

development

lab

and

green

coffee

purchasing

capabilities

Basic coffee resources

High Touch Customer Service Strategy Since 1912 |

Over the last four years, the Company has gone through tremendous changes, as anyone who has been a shareholder or is a former employee for that period of time knows. Before 2007, we were primarily a traditional coffee company. And today we’re able to do traditional, premium and specialty coffees to be able to provide our customers and prospective customers with exactly the right product that they need.

We were primarily a West Coast company. Today we have three roasting facilities and direct store delivery capabilities in 48 states. We were primarily one brand, Farmer Brothers. Now we have multiple brands at the Company, which we continue to look for ways to use to our competitive advantage.

We were known primarily for supplying small operators. At that point in time in the Company’s history, most of the business was from small operators. Today we have grown the national accounts business, including being selected as Vendor of the Year in 2010 for both Sheetz, Inc. and Target Corporation, two of the nation’s leading large retailers in different segments.

Prior to 2007, we had fairly basic coffee resources. And today, through acquisition and most notably through the development of our Green Coffee Team and coffee capabilities in the coffee lab here in Torrance, we have industry leading coffee development lab and green coffee purchasing capabilities.

8

QUALITY

EXECUTION AT ALL TIERS Using small batch, large batch and continuous roasting

processes,we achieve exceptional consistency and quality control over multiple

tiers. 8 |

So, the Company has come a long way in the last four years. In terms of the various tiers of product that we can provide, most of the coffee market is represented in this traditional category where we have traditionally been very strong, and so were the Sara Lee DSD Coffee Business assets that we purchased. We’re also able to meet the needs of our customers in the premium and the specialty segments with multiple different brands but also with private label capabilities in all of these areas.

9

PRODUCTION

CAPABILITIES TORRANCE

(1)

HOUSTON

PORTLAND

9

coffee, spices

coffee, tea

coffee

(1)

Headquarters |

Today our production capabilities include coffee and spices here in Torrance where, of course, the headquarters is; coffee and tea manufacturing in Houston; and coffee manufacturing in Portland. We now have these distributed manufacturing capabilities that we’re using to our advantage in the marketplace.

10

DISTRIBUTION

NETWORK 10

•

Total facility square footage exceeds 1.5 million square feet

•

6 distribution centers and 114 branch warehouses

•

Approximately 500 routes servicing 63,000 customers |

In terms of our distribution network, today we have six distribution centers and 114 branches. For those of you that can see this chart – I know it’s a little difficult to see – you see the distribution of blue dots, which are the branch warehouses. We have approximately 500 routes serving 63,000 customers.

The power of this distribution network is the key competitive advantage for the Company, and includes the ability to be present in local markets and have local, direct, one-on-one relationships, as well as the ability to provide DSD services to any nationwide customer that needs it from us.

11

WE SELL MORE

THAN JUST COFFEE Our broad array of products provide diverse menu solutions for our

customers 11 |

We, of course, sell a lot more than coffee. And our relationships with customers span multiple different categories. You see them here: creamer, salad dressing, iced tea, spices, iced coffee, all kinds of different products that the Company provides to its customers.

12

NATIONAL

ACCOUNT APPEAL 12

•

Broad selection of consistently high-quality products and service

•

Customization capabilities to support individual programs

•

National direct delivery distribution coverage

•

Responsive equipment service model with 24 hr support

•

Comprehensive partnership model, including:

•

Brand development / strategy

•

Coffee / tea market expertise and consumer insight trends

•

Strategic commodity cost management programs |

I’ve mentioned our national accounts business. National accounts business has grown significantly over the last couple of years. We offer a lot to a national restaurant operator, national hospitality operator, national grocery or foodservice operator – including a broad selection of high quality products, the ability to add value to their business, help them grow their business and serve as a coffee expert for these customers through our comprehensive partnership model, and our 24-hour service and support.

13

SIGNIFICANT

ACCOUNTS 13 |

Some of the significant national accounts that the Company has today you can see on this list of grocery and mass customers. You see large foodservice operators. You see convenience store chains, gaming, and specialty retailers. So, there’s a wide range of customers with whom we have good partnerships – national partnerships – today.

14

PRIVATE LABEL,

WITH ADDED VALUE 14 |

We also have – primarily through the CBI Division – a private label business that’s thriving. This has really put us in a position to take advantage of some of the trends in coffee. We’ve seen trends toward at-home consumption, trends in the retail market toward private brand, and overall trends toward specialty coffees. These private brand specialty programs have allowed us to take advantage of those trends in the marketplace and to provide some special value-added services. The one shown here is the direct trade program with Target Corporation.

15

MAJOR WINS /

RECENT WINS 15 |

Major and recent national account wins include, again, hospitality customers, convenience store customers, foodservice customers and/or grocery retail customers. We continue to have success in all of these different segments.

I’m going to turn it over to Jeff to update us on where we are today.

Jeffrey Wahba: Thank you, Patrick! There is absolutely no question that the Company was very challenged as we entered FY ’11, as Patrick mentioned. We believe that a number of key accomplishments have occurred over the last several months.

16

KEY 2011

INITIATIVES & ACHIEVEMENTS 16

•

Aligned organization in response to current economic

environment needs

•

Grew National Account business by 20%

•

Significantly reduced operating expenses as a result of

integration efforts

•

Despite unfavorable external factors, increased top line revenue

by 3%

•

Increased product breadth, technical expertise and marketing

and

sales

capabilities

leading

to

substantial

increases

in

average

revenue per customer |

To get to a point where we can be profitable going forward we had to make a number of very painful decisions. We realigned our organization in the spring of last fiscal year. As we entered the new fiscal year in July 2011, we had about 200 less employees than we did a year earlier, about a 10 percent reduction.

We also had to make a very painful decision which we did not like to do. We froze our pension plan, which had been in place for many, many years. What we did replace it with – which is now prevalent in most of corporate America – is a 401(k) matching program.

These and other decisions, we felt, were necessary to get the Company to a means of profitability. We felt that taking all of those actions in a fairly short amount of time would get us restructured, and then, as we entered FY ’12, we would be well aligned to start making progress as we go forward.

What’s very important in terms of our strategy is that this Company succeeded in the last hundred years in terms of being the local provider and delivering service at the local level better than our competition. And our focus was to put the resources back into the local level to make sure that we could do the things that we do best.

Our focus has been to put programs to support our sales folks, align pricing, give them the kind of reporting and analysis they need, understand margins in a very coffee cost accelerated environment. And we believe some of those things are now beginning to pay off.

It is important to note that with the Sara Lee transaction we had a national footprint. And so, we are now able to go after national accounts, as Patrick mentioned. We grew our national accounts business by about 20 percent. We reduced operating expenses significantly, as I just mentioned.

Despite a number of challenges and with a continuing recessionary economy, revenue did grow three percent. As I mentioned, we’re now trying to focus on putting some of the resources back into the sales and marketing end of this business.

17

5 YEAR REVENUE

GROWTH TREND 17 |

As we look at our financial trends over the last five years, revenue certainly has grown. And it has grown, really, because we did two acquisitions. Revenue in itself doesn’t put profitability on the bottom line. But, it is important to understand where we stand today in terms of revenue. Five years ago we were at $216 million, and today we’re at $464 million.

18

FY11 ADJUSTED

EBITDAE RECONCILIATION 18

•

LIFO accounting impact of $40.3M in

FY11

•

Adjusted EBITDAE -

$18.0M; $21.1M

better than FY10

Description

FY09

FY10

FY11

(In millions)

EBITDAE

13.3

(4.1)

(22.3)

LIFO charge (credit)

(0.0)

1.0

40.3

Adj EBITDAE

13.3

(3.1)

18.0 |

Last year the Company recorded its worst net loss in its history. There’s no doubt about it. But, it is important to understand the underlying profitability of the Company. We had (see the right-hand side of the slide) an $18 million Adjusted EBITDAE. I won’t go through the various boxes on this chart, but two significant things, financial items, are important to understand when you look at our financials.

One is that we had almost $32 million of depreciation and amortization. And what that relates to is the very significant investments that the Company made in plant and equipment to integrate the two acquisitions that we made in the previous years — building a plant in Portland for CBI and going through the Sara Lee DSD Coffee Business acquisition. That depreciation is non-cash. As time goes by, especially as it relates to the plant that we built in Portland, that depreciation in the next couple of years will decrease significantly.

Number two is that we had a $40 million LIFO charge. Unlike nearly all of our competitors, we’re on LIFO, an inventory valuation methodology, which is last in, first out. When commodity costs accelerate as much as they did last year, we are recording through our P&L the most recently bought product cost rather than product cost that we may have paid six months ago. And so, we’re recording, from an accounting standpoint, a much higher cost for coffee than we would if we used a first-in, first-out (FIFO) inventory valuation methodology.

So, we had a $40 million LIFO charge in the year. And so, in the bottom right-hand corner when you look at what we call “Adjusted EBITDAE,” you can see that the Company actually improved its Adjusted EBITDAE while at the same time had a significant increase in net loss.

19

Q1 FINANCIAL

PERFORMANCE FY12 VS. FY11 19 |

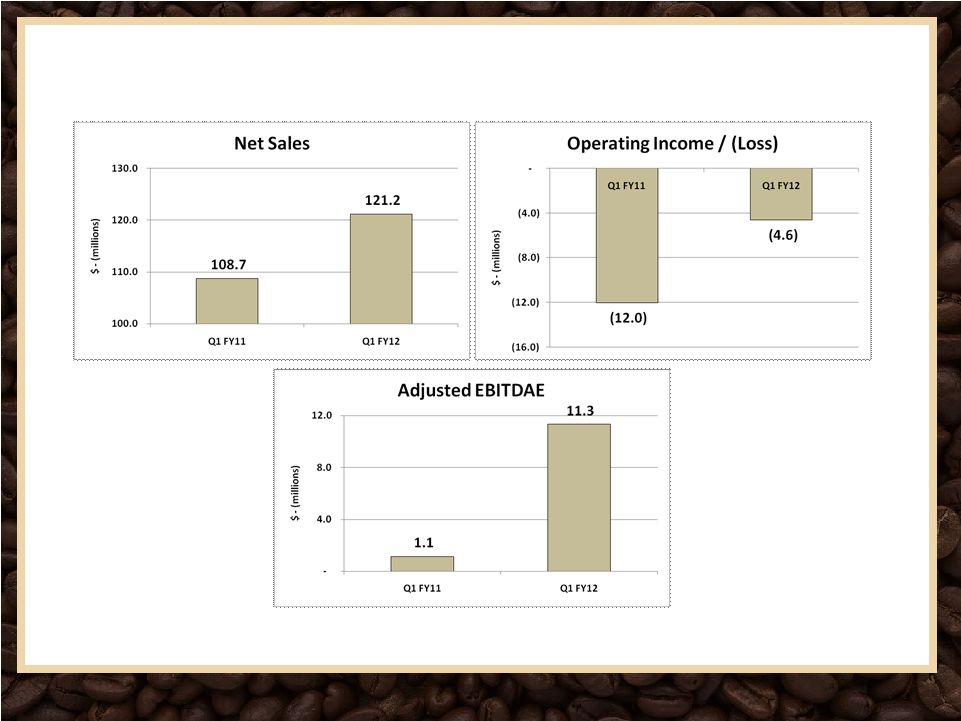

With that accounting overview, I will move on to what I believe is really most important on how we’re progressing going forward. This is a chart of our FY ’12 first quarter performance. Revenue in the first quarter, which ended September 30, 2011, versus the same quarter a year ago went up from $109 million to $121 million. Operating loss a year ago was $12 million and in this last quarter was $4.6 million. That’s about a $7.5 million improvement in operating income. And our Adjusted EBITDAE increased from $1.1 million to $11.3 million.

So, the takeaway from a financial perspective is that I believe the Company is on the right track to positive cash flow and increased profitability. The Company, as you may be aware, had significant bank borrowings over the last several years. I’m pleased that over the first five months of this fiscal year we’re actually a net provider of cash, which hasn’t happened since prior to either of the two acquisitions.

20

STRONG BALANCE

SHEET WITH A FOCUS ON ASSET MANAGEMENT

20

•

Inventory -

includes LIFO reserve of $70.0 million

•

PP&E -

includes over 50 owned properties

(In millions)

June 30, 2011

Cash and Cash Equivalents

6.1

Short-Term Investments

24.9

Accounts and Notes Receivable

43.5

Inventories

79.8

Other Current Assets

3.2

Net PP&E

114.1

Other Assets

18.5

Total Assets

290.1

Total Liabilities excluding Credit Facility

130.6

Credit Facility

31.4

Stockholders' Equity

128.1

Total Liabilities and Stockholders' Equity

290.1

|

Furthermore, as we look at our balance sheet, Farmer Brothers has a very healthy and strong balance sheet. We have a stockholders’ equity of nearly $130 million at year-end. We have a LIFO reserve of $70 million, meaning that, on a FIFO basis, our inventory is actually worth $70 million more than it’s stated on our balance sheet. And we have over 50 pieces of real estate, all unencumbered or debt free.

As we look forward, I’m very encouraged from a financial standpoint. The coffee markets have certainly taken a toll on our gross margins. But, as we sit here today, coffee has come off its peak in May of 2011 of nearly $3.00 a pound, and the coffee markets today are in the $2.30 to $2.40 per pound range.

We – as we have historically done – buy coffee or commit to coffee in advance. So, we know that in the first six months of calendar year 2012, our coffee costs will be less than they were in the prior six months. If we can keep our operating expenses at the same level that they currently are, which is about a 20 percent decrease year-over-year from a year ago, I believe the Company is certainly on the road back to profitability.

21

LOOKING

AHEAD 21

•

Optimize cost structure by realizing more synergies from the

acquisitions

of

Coffee

Bean

International

and

Sara

Lee

DSD

(coffee

&Tea)

•

Grow all tiers of Foodservice business by leveraging our competitive

advantages:

•

Low cost producer with available roasting capacity

•

Unparalleled coffee and allied products distribution network

•

Customer

service

excellence

–

high

touch,

expert

capability

•

The most complete local, regional and national DSD network in the coffee

industry

•

Grow average order size and improve gross margin by focusing on

the following product categories:

•

Continue to grow private label coffee business by leveraging our

differentiated partnership model

•

Specialty coffee

•

Iced coffee

•

Iced tea

•

Cappuccino mix

•

Culinary products |

Just looking ahead, we’ve clearly started to optimize our cost structure, but there are still many more opportunities to integrate and to realize the synergies from Sara Lee DSD Coffee Business and the CBI acquisitions. In the last six months, we’ve done a number of things to take of the advantage of the premium coffee expertise and marketing expertise at CBI.

We want to continue to focus on leveraging our competitive advantages in the foodservice business. We continue to believe that we are a low cost producer and believe that we have the greatest and largest distribution network in the DSD arena. We continue to have superior customer service and excellence, and we are the local coffee company in 114 different branches across the country.

There are many opportunities to continue to increase our gross margins when it comes to penetration. Some of the areas such as, specialty coffee and iced tea, which have good margins, are areas where today we have less penetration than we would like and certainly a lot of opportunity to grow.

And finally, we’ve seen substantial growth at CBI and in the private label coffee market, and believe that will continue to go at double-digit growth over the next couple of years.

22

INVESTMENT

HIGHLIGHTS 22

A recognized leader in both premium and cost competitive

product offerings

Product Offering

Leading national direct delivery footprint

National

Coverage

Opportunities to continue to realize synergies from the recent

acquisitions

Acquisition

Synergies

State of the art development and production capabilities

Technical

Expertise

Leverage customer base of 63,000 and one of the most

experienced sales, marketing and operations teams in the industry

Market Position |

In summary, as we look at Farmer Brothers, I believe we remain a very attractive company. We have the leading national direct delivery footprint; our product offering is second to none in the DSD environment and in the coffee DSD environment; we have many synergies to realize from the two acquisitions that we made; we are the state-of-the-art coffee company in the DSD arena and a low cost producer; and we have 63,000 customers that we can continue to leverage with a broad base of product offerings.

So, with that, Patrick and I would be pleased to take questions from the audience.

23

NASDAQ:

FARM |